UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22535

ARES DYNAMIC CREDIT ALLOCATION FUND, INC.

(Exact name of registrant as specified in charter)

2000 AVENUE OF THE STARS

12TH FLOOR

LOS ANGELES, CALIFORNIA 90067

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: | |

| Ian Fitzgerald 2000 Avenue of the Stars, 12th Floor Los Angeles, California 90067 |

P. Jay Spinola, Esq. Willkie Farr & Gallagher LLP 787 Seventh Avenue New York, New York 10019 |

Registrant’s telephone number, including area code: (310) 201-4100

Date of fiscal year end: December 31

Date of reporting period: June 30, 2020

Item 1. Report to Stockholders.

Ares Dynamic Credit Allocation Fund, Inc.

(NYSE: ARDC)

Semi-Annual Report

June 30, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically at any time by (i) calling 877-855-3434 toll-free or by sending an e-mail request to Ares Dynamic Credit Allocation Fund, Inc. Investor Relations Department at ARDCInvestorRelations@aresmgmt.com, if you invest directly with the Fund, or (ii) contacting your financial intermediary (such as a broker-dealer or bank), if you invest through your financial intermediary. You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by (i) calling 877-855-3434 toll-free or by sending an e-mail request to Ares Dynamic Credit Allocation Fund, Inc. Investor Relations Department at ARDCInvestorRelations@aresmgmt.com, if you invest directly with the Fund, or (ii) contacting your financial intermediary. Your election to receive reports in paper will apply to all funds held in your account, if you invest through your financial intermediary, or all funds held with the fund complex if you invest directly with the Fund.

Ares Dynamic Credit Allocation Fund, Inc.

Contents

|

Letter to Shareholders |

1 |

||||||

|

Fund Profile & Financial Data |

4 |

||||||

|

Schedule of Investments |

5 |

||||||

|

Statement of Assets and Liabilities |

14 |

||||||

|

Statement of Operations |

15 |

||||||

|

Statements of Changes in Net Assets |

16 |

||||||

|

Statement of Cash Flows |

17 |

||||||

|

Financial Highlights |

18 |

||||||

|

Notes to Financial Statements |

19 |

||||||

|

Proxy & Portfolio Information |

34 |

||||||

|

Dividend Reinvestment Plan |

35 |

||||||

|

Corporate Information |

36 |

||||||

|

Privacy Notice |

37 |

||||||

|

Directors and Officers |

38 |

||||||

Semi-Annual Report 2020

Ares Dynamic Credit Allocation Fund, Inc.

Letter to Shareholders

As of June 30, 2020 (Unaudited)

Dear Shareholders,

We thank you for your support of the Ares Dynamic Credit Allocation Fund, Inc. ("ARDC" or the "Fund") and recognize the trust and confidence that you have demonstrated in Ares through your investment in ARDC.

Economic Conditions and Leveraged Finance Market Update

In the first half of 2020, the liquid credit markets experienced a broad sell off in reaction to the impact of the coronavirus (COVID-19) pandemic and then partially recovered due to central bank intervention, fiscal stimulus and prospects of reopening the economy. As cases of COVID-19 spread globally, investor sentiment deteriorated and the financial fallout of the COVID-19 pandemic escalated drastically as high yield default expectations tripled1 and credit spreads increased to levels last seen during the Global Financial Crisis. Investor sentiment was further exacerbated by the onset of the Saudi- Russian oil price war, which left investors scrambling to manage the ensuing unprecedented volatility, and March marked one the most tumultuous months in financial markets in decades. The S&P 500, high yield bond and leveraged loan indices ended the first calendar quarter with negative returns of -19.60%, -13.12%2 and -13.19%,3 respectively. As a result, the world's major central banks moved with unexpected pace to enact economic and financial stimulus plans as they effectively pledged support without limits. This included a Federal Reserve interest rate cut of 50bps to safeguard the U.S. economy from the economic damage caused by the virus.

The second calendar quarter of 2020 marked a turning point for financial markets as investor sentiment was boosted by unprecedented levels of financial stimulus being pumped into the economy, the expansion of eligibility of the Federal Reserve's credit facilities and plans to begin to reopen the global economy. Despite concerns surrounding escalating social unrest, tense U.S.-China relations and the possibility of a second wave of COVID-19 infections, credit spreads tightened across almost all liquid asset classes. Within the high yield market, the combination of robust inflows and the Federal Reserve's direct support led to material spread tightening while the market was able to digest heavy new issuance. Amid this broad-based rally, the leveraged loan market demonstrated stronger secondary market prices as well, supported by incremental demand from opportunistic institutional investors and renewed demand from CLO managers. Against this backdrop, high yield bond and leveraged loan indices posted strong returns of 9.61%2 and 9.71%,3 respectively, for the second calendar quarter, ending the first half down just -4.78%2 and -4.76%.3

CLOs exhibited many of the same trends seen in the leveraged loan market during the first half of the year. CLO prices fell materially during the peak of the market dislocation with BB-rated tranches ending the first calendar quarter down — 32.7%, according to a leading CLO data source.4 Although CLO securities generally lagged the price recovery in underlying loans, CLO spreads rallied to levels that supported new CLO formation during the second quarter,5 a positive sign of investor demand for both the CLO and leveraged loan markets. As a result, CLO prices rallied throughout the second quarter and recovered a significant portion of the first quarter valuation declines. By the end of the first half of 2020, BB- rated tranches of CLOs were down just -8.2% for the year, according to the same source.4

Looking ahead, we continue to closely monitor the pandemic and its impact on the global economy and monitor additional sources of volatility such as the upcoming U.S. presidential election. Given the uncertain backdrop, we expect volatility to persist and will continue to utilize the full depth and breadth of our platform as we seek to actively rotate exposures and generate attractive risk-adjusted returns.

Portfolio Performance and Positioning

ARDC has not been immune to the dislocation caused by the COVID-19 pandemic. Over the six months ended June 30, 2020, ARDC has generated net investment returns of -12.5% and market price-based returns of -18.3%,6 reflecting the uncertainty around economic growth and the lag in the price recovery of the CLO market discussed above. While there is no single established benchmark that reasonably compares to ARDC as a whole, ARDC's loan and high yield segments of the portfolio have outperformed their respective benchmarks by 180 bps and 9 bps, respectively, during the first half of the year.7

With respect to CLOs, we continue to actively manage our positions and remain constructive on this asset class due to its structural protections, such as overcollateralization cushions and capacity to either withstand downgrades or redirect investment cash flows to de-lever. Even though CLOs have lagged the broader loan market in the recovery, they have historically experienced fewer defaults in comparison with leveraged loans and we believe continue to have less exposure to the weakest credits than other types of loan funds.8 In addition, the reinvestment periods of many of our positions may enable us to capture incremental return. To that end, ARDC's CLO portfolio has already begun to recover, returning 32.0%

Semi-Annual Report 2020

1

Ares Dynamic Credit Allocation Fund, Inc.

Letter to Shareholders (continued)

As of June 30, 2020 (Unaudited)

over the past three months,9 which has supported the overall recovery in ARDC's net investment returns (+20.9%) and market price-based returns (+13.4%) during the second calendar quarter.

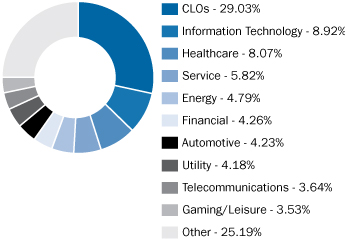

Across our portfolio, we employed a thoughtful and disciplined approach to navigating unprecedented market conditions. The share of our investments rated B, BB or BBB10 increased 240 bps to 78.6% as of June 30, 2020, and we continued to favor defensive sectors with ARDC's top three industries being information technology, healthcare and services.11 In addition, the portfolio remains well diversified across 201 issuers with an average position size of 0.50% and the largest position representing only 1.4%.12

We continue to have strong conviction in the quality of the ARDC portfolio and believe that the Fund continues to be well positioned to take advantage of buying opportunities in both the new issue and secondary markets. We continue to believe that the ability to dynamically allocate is critical to successfully navigating an evolving market environment with headline risk and interest rate driven volatility. The increasing importance of credit selection has become the primary driver of generating alpha. Looking ahead, we will remain focused on performing solid fundamental credit analysis and in-depth due diligence as we seek attractive risk adjusted returns for our investors. We thank you again for your continued support in ARDC.

Best Regards,

Ares Capital Management II LLC

Ares Dynamic Credit Allocation Fund, Inc.

ARDC is a closed-end fund that trades on the New York Stock Exchange under the symbol "ARDC" and is externally managed by Ares Capital Management II LLC (the "Adviser"), a subsidiary of Ares Management Corporation. ARDC's investment objective is to provide an attractive level of total return, primarily through current income and, secondarily, through capital appreciation by investing in a broad, dynamically-managed portfolio of (i) senior secured loans made primarily to companies whose debt is rated below investment grade; (ii) corporate bonds that are primarily high yield issues rated below investment grade; (iii) other fixed-income instruments of a similar nature that may be represented by derivatives; and (iv) securities of collateralized loan obligations (CLOs).

On November 6, 2015, the Board of Directors (the "Board") of ARDC authorized the repurchase of shares of common stock of the Fund (the "Common Shares") on the open market when the Common Shares are trading on the New York Stock Exchange at a discount of 10% or more (or such other percentage as the Board may determine from time to time) from the net asset value ("NAV") of the Common Shares. The Fund may repurchase its outstanding Common Shares in open-market transactions at the Fund management's discretion. The Fund is not required to effect share repurchases. Any future purchases of Common Shares may not materially impact the discount of the market price of the Common Shares relative to their NAV and any narrowing of this discount that does result may not be maintained. Since the inception of the program through June 30, 2020, we have repurchased 566,217 shares at an average price of $13.17, representing an average discount of -15.3%.

Thank you again for your continued support of ARDC. If you have any questions about the Fund, please call 1-877-855-3434, or visit the Fund's website at www.arespublicfunds.com.

Note: The opinions of the Adviser expressed herein are subject to change without notice. Information contained herein has been obtained from sources believed to be reliable, but is not guaranteed. This information should not be considered investment advice or an offer of any security for sale. This material may contain "forward-looking" information that is not purely historical in nature. No representations are made as to the accuracy of such information or that such information will be realized. Actual events or conditions are unlikely to be consistent with, and may differ materially from, those assumed. Past performance is not indicative of future results. Ares does not undertake any obligation to publicly update or review any forward-looking information, whether as a result of new information, future developments or otherwise, except as required by law.

The recent outbreak of a novel and highly contagious form of coronavirus ("COVID-19"), which the World Health Organization has declared to constitute a pandemic, has resulted in numerous deaths, adversely impacted global commercial activity and contributed to significant volatility in certain equity and debt markets. The global impact of the outbreak is rapidly evolving, and many countries have reacted by instituting quarantines, prohibitions on travel and the closure of offices, businesses, schools, retail stores and other public venues. Businesses are also implementing similar precautionary measures. Such measures, as well as the general uncertainty surrounding the dangers and impact of COVID- 19, are creating significant disruption in supply chains and economic activity and are having a particularly adverse impact on energy, transportation, hospitality, tourism, entertainment and other industries. The impact of COVID-19 has led to significant volatility and declines in the global financial markets and oil prices and it is uncertain how long this volatility will continue. As COVID-19 continues to spread, the potential impacts, including a global, regional or other economic recession, are increasingly uncertain and difficult to assess. Any public health emergency, including any outbreak of COVID-19 or other existing or new epidemic diseases, or the threat thereof, and the resulting financial and economic market uncertainty could have a significant adverse impact on the Fund, the value of its investments and its portfolio companies. The performance and portfolio company information herein is as of June 30, 2020, and the effects, directly and indirectly, resulting from COVID-19 are not reflected in such information.

Semi-Annual Report 2020

2

Ares Dynamic Credit Allocation Fund, Inc.

Letter to Shareholders (continued)

As of June 30, 2020 (Unaudited)

Indices are provided for illustrative purposes only and not indicative of any investment. They have not been selected to represent appropriate benchmarks or targets for ARDC. Rather, the indices shown are provided solely to illustrate the performance of well-known and widely recognized indices. Any comparisons herein of the investment performance of ARDC to an index are qualified as follows: (i) the volatility of such index will likely be materially different from that of ARDC; (ii) such index will, in many cases, employ different investment guidelines and criteria than ARDC and, therefore, holdings in ARDC will differ significantly from holdings of the securities that comprise such index and ARDC may invest in different asset classes altogether from the illustrative index, which may materially impact the performance of ARDC relative to the index; and (iii) the performance of such index is disclosed solely to allow for comparison on ARDC's performance to that of a well-known index. Comparisons to indices have limitations because indices have risk profiles, volatility, asset composition and other material characteristics that will differ from ARDC. The indices do not reflect the deduction of fees or expenses. You cannot invest directly in an index. No representation is being made as to the risk profile of any benchmark or index relative to the risk profile of ARDC. There can be no assurance that the future performance of any specific investment, or product will be profitable, equal any corresponding indicated historical performance, or be suitable for a portfolio.

This may contain information sourced from Bank of America, used with permission. Bank of America's Global Research division's fixed income index platform is licensing the ICE BofA Indices and related data "as is," makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or any data included in, related to, or derived therefrom, assumes no liability in connection with their use and does not sponsor, endorse, or recommend Ares Management, or any of its products or services.

The ICE BofA US High Yield Index ("H0A0") tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody's, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one- year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $100 million. Index constituents are capitalization-weighted based on their current amount outstanding times the market price plus accrued interest. Accrued interest is calculated assuming next-day settlement. Cash flows from bond payments that are received during the month are retained in the index until the end of the month and then are removed as part of the rebalancing. Cash does not earn any reinvestment income while it is held in the index. The index is rebalanced on the last calendar day of the month, based on information available up to and including the third business day before the last business day of the month. No changes are made to constituent holdings other than on month end rebalancing dates. Inception date: August 31, 1986.

The Credit Suisse Leveraged Loan Index ("CSLLI") is designed to mirror the investable universe of the $US-denominated leveraged loan market. The index inception is January 1992. The index frequency is daily, weekly and monthly. New loans are added to the index on their effective date if they qualify according to the following criteria: 1) loan facilities must be rated "5B" or lower; 2) only fully-funded term loan facilities are included; 3) the tenor must be at least one year; and 4) issuers must be domiciled in developed countries.

REF: TC- 01650

1 S&P Global Ratings Research, March 20, 2020.

2 ICE BofA High Yield Master II Index as of March 31, 2020 or June 30, 2020 as noted.

3 Credit Suisse Leveraged Loan Index as of March 31, 2020 or June 30, 2020 as noted.

4 J.P. Morgan, CLOIE Monitor, as of March 31, 2020 or June 30, 2020 as noted.

5 Wells Fargo, CLO Monthly Market Overview, as of June 30, 2020.

6 Past performance is not indicative of future results. Index provided for comparison purposes only.

7 Reflects the gross unlevered returns of ARDC's respective loan and high yield portfolios in comparison with the Credit Suisse Leveraged Loan Index and ICE BofA High Yield Master II Index.

8 Based on information from Ares INsight database, S&P LCD and Ares market observations as of June 9, 2020.

9 Reflects the gross unlevered returns of ARDC's CLO portfolio.

10 Based on S&P and/or Moody's rating. Credit quality is an assessment of the credit worthiness of an issuer of a security. AAA is the highest rating, meaning the obligor's capacity to meet its financial commitments is strong. As ratings decrease, the obligor is considered more speculative by market participants. Credit ratings apply only to the bonds and preferred securities in the portfolio and not to the shares of the fund which are not rated and will fluctuate in value.

11 Based on Credit Suisse industry classifications.

12 Diversification does not assure profit or protect against loss.

Semi-Annual Report 2020

3

Ares Dynamic Credit Allocation Fund, Inc.

Fund Profile & Financial Data

June 30, 2020 (Unaudited)

Portfolio Characteristics as of 6.30.20

|

Weighted Average Floating Coupon1 |

5.57 |

% |

|||||

|

Weighted Average Bond Coupon2 |

7.56 |

% |

|||||

|

Current Distribution Rate3 |

9.81 |

% |

|||||

|

Monthly Dividend Per Share4 |

$ |

0.0975 |

|||||

1 The weighted-average gross interest rate on the pool of loans as of June 30, 2020.

2 The weighted-average gross interest rate on the pool of bonds at the time the securities were issued.

3 Dividend per share annualized and divided by the June 30, 2020 market price per share. The distribution rate alone is not indicative of Fund performance.

4 Represents the Fund's June 2020 dividend of $0.0975 per share, which was comprised of net investment income. To the extent that any portion of the current distributions were estimated to be sourced from something other than income, such as return of capital, the source would have been disclosed in a Section 19(a) Notice located under the "Investor Documents" section of the Fund's website. Please note that distribution classifications are preliminary and certain distributions may be re-classified at year end. Please refer to year-end tax documents for the final classifications of the Fund's distributions for a given year.

Top 10 Holdings5 as of 6.30.20

|

Tegna |

1.44 |

% |

|||||

|

CenturyLink Inc |

1.42 |

% |

|||||

|

Williams Cos Inc/The |

1.33 |

% |

|||||

|

NRG Energy Inc |

1.30 |

% |

|||||

|

Iceland Topco Ltd |

1.29 |

% |

|||||

|

EchoStar Corp |

1.27 |

% |

|||||

|

Avantor, Inc. |

1.21 |

% |

|||||

|

Numericable |

1.19 |

% |

|||||

|

Eldorado Resorts |

1.16 |

% |

|||||

|

Altice USA |

1.16 |

% |

|||||

5 Market value percentage may represent multiple instruments by the named issuer and/or multiple issuers being consolidated to the extent they are owned by the same parent company. These values may be different than the issuer concentrations in certain regulatory filings.

Performance as of 6.30.20

|

Market |

NAV |

||||||||||

| 1 Month |

2.19 |

% |

6.43 |

% |

|||||||

|

Year to Date |

-18.33 |

% |

-12.50 |

% |

|||||||

|

3 Years (annualized) |

-1.96 |

% |

0.17 |

% |

|||||||

|

5 Years (annualized) |

3.75 |

% |

3.13 |

% |

|||||||

|

Since Inception** |

1.54 |

% |

3.66 |

% |

|||||||

*Since Inception of fund (11/27/2012) and annualized. Source: Ares

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. The NAV total return takes into account the Fund's total annual expenses and does not reflect transaction charges. If transaction charges were reflected, NAV total return would be reduced. Since Inception returns assume a purchase of common shares at the initial offering price of $20.00 per share for market price returns or initial net asset value (NAV) of $19.10 per share for NAV returns. Returns for periods of less than one year are not annualized. All distributions are assumed to be reinvested either in accordance with the dividend reinvestment plan (DRIP) for market price returns or NAV for NAV returns.

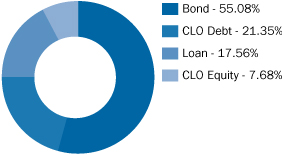

Portfolio Composition as of 6.30.20

This data is subject to change on a daily basis. As of 6.30.20, the Fund held a negative traded cash balance of -1.67%.

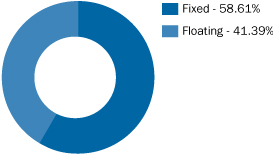

Fixed vs. Floating Rate as of 6.30.20

Excludes Equity and CLO Equity

Industry Allocation6 as of 6.30.20

6 Credit Suisse industry classifications weighted by market value. These values may be different than industry classifications in certain regulatory filings.

Semi-Annual Report 2020

4

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments

June 30, 2020 (Unaudited)

Senior Loans 24.6%(b)(c)(d)

|

Principal Amount |

Value(a) |

||||||||||

|

Aerospace & Defense 0.5% |

|||||||||||

|

JetBlue Airways Corp., 1st Lien Term Loan, 3M LIBOR + 5.25%, 6.25%, 06/17/2024 |

$ |

1,599,634 |

$ |

1,563,643 |

|||||||

|

Automotive 0.3% |

|||||||||||

|

Navistar, Inc., Tranche 1st Lien Term Loan B, 1M LIBOR + 3.50%, 3.70%, 11/06/2024 |

1,000,000 |

944,580 |

|||||||||

|

Banking, Finance, Insurance & Real Estate 3.6% |

|||||||||||

|

Asurion, LLC, 2nd Lien Term Loan B-2, 1M LIBOR + 6.50%, 6.68%, 08/04/2025(e) |

4,499,695 |

4,465,948 |

|||||||||

|

Boels Rental Ltd., EUR 1st Lien Term Loan B, (Netherlands), 02/09/2027(e) |

€ |

2,205,882 |

2,377,535 |

||||||||

|

Financiere CEP, 1st Lien Term Loan, (France), 06/03/2027(e) |

2,250,000 |

2,480,368 |

|||||||||

|

GBT U.S., LLC, 1st Lien Delayed Draw Term Loan, 02/27/2027(e)(f) |

$ |

1,196,357 |

1,076,721 |

||||||||

|

GBT U.S., LLC, 1st Lien Term Loan, 02/27/2027(e)(f) |

1,428,659 |

1,285,793 |

|||||||||

|

11,686,365 |

|||||||||||

|

Chemicals, Plastics & Rubber 0.6% |

|||||||||||

|

DCG Acquisition Corp., Initial 1st Lien Term Loan, 1M LIBOR + 4.50%, 4.69%, 09/30/2026(f) |

2,123,738 |

1,890,127 |

|||||||||

|

Consumer Goods: Durable 1.2% |

|||||||||||

|

AI Aqua Merger Sub, Inc., 1st Lien 5th Amendment Incremental Term Loan, 3M LIBOR + 4.25%, 5.34%, 12/13/2023(f) |

1,990,000 |

1,940,250 |

|||||||||

|

Kronos Acquisition Intermediate, Inc., Initial 1st Lien Term Loan, 1M LIBOR + 4.00%, 5.00%, 05/15/2023(e) |

2,250,000 |

2,137,792 |

|||||||||

|

4,078,042 |

|||||||||||

|

Healthcare & Pharmaceuticals 4.4% |

|||||||||||

|

Albany Molecular Research, Inc., 2nd Lien Term Loan, 3M LIBOR + 7.00%, 8.00%, 08/30/2025 |

1,000,000 |

950,500 |

|||||||||

|

Albany Molecular Research, Inc., Initial 1st Lien Term Loan, 3M LIBOR + 3.25%, 4.25%, 08/30/2024(e) |

999,172 |

963,702 |

|||||||||

|

Cambrex Corp., Initial 1st Lien Term Loan, 1M LIBOR + 5.00%, 6.00%, 12/04/2026(f) |

3,980,000 |

3,900,400 |

|||||||||

Senior Loans(b)(c)(d) (continued)

|

Principal Amount |

Value(a) |

||||||||||

|

CPI Holdco, LLC, 1st Lien Term Loan, 1M LIBOR + 4.25%, 4.43%, 11/04/2026 |

$ |

1,317,123 |

$ |

1,264,438 |

|||||||

|

Hanger, Inc., 1st Lien Term Loan, 1M LIBOR + 3.50%, 3.68%, 03/06/2025 |

1,803,041 |

1,715,900 |

|||||||||

|

Ortho-Clinical Diagnostics, Inc., 1st Lien Term Loan B, 1M LIBOR + 3.25%, 3.43%, 06/30/2025 |

1,978,397 |

1,846,101 |

|||||||||

|

Sotera Health Holdings, LLC, Initial 1st Lien Term Loan, 1M LIBOR + 4.50%, 5.50%, 12/11/2026 |

3,990,000 |

3,889,412 |

|||||||||

|

14,530,453 |

|||||||||||

|

High Tech Industries 4.5% |

|||||||||||

|

Applied Systems, Inc., 2nd Lien Term Loan, 3M LIBOR + 7.00%, 8.00%, 09/19/2025 |

2,500,000 |

2,487,500 |

|||||||||

|

eResearch Technology, Inc., Initial 1st Lien Term Loan, 1M LIBOR + 4.50%, 5.50%, 02/04/2027 |

3,084,839 |

3,016,201 |

|||||||||

|

GlobalFoundries, Inc., Initial 1st Lien Term Loan, 3M LIBOR + 4.75%, 5.06%, 06/05/2026(f) |

1,550,107 |

1,488,103 |

|||||||||

|

Huskies Parent, Inc., 1st Lien Closing Date Term Loan, 1M LIBOR + 4.00%, 4.18%, 07/31/2026(f) |

2,034,820 |

1,983,949 |

|||||||||

|

Hyland Software, Inc., 2nd Lien Term Loan, 1M LIBOR + 7.00%, 7.75%, 07/07/2025 |

1,750,000 |

1,720,828 |

|||||||||

|

Informatica, LLC, Initial 2nd Lien Term Loan, 7.13%, 02/25/2025 |

1,290,878 |

1,289,264 |

|||||||||

|

MA FinanceCo., LLC, Tranche 1st Lien Term Loan B-4, 3M LIBOR + 4.25%, 5.25%, 06/05/2025 |

1,660,000 |

1,615,728 |

|||||||||

|

Sophia, LP, 1st Lien Term Loan B, 3M LIBOR + 3.25%, 4.25%, 09/30/2022 |

1,000,000 |

975,000 |

|||||||||

|

14,576,573 |

|||||||||||

|

Hotel, Gaming & Leisure 0.7% |

|||||||||||

|

Equinox Holdings, Inc., 1st Lien Term Loan B-2, 3M LIBOR + 9.00%, 10.00%, 03/08/2024(f) |

2,500,000 |

2,462,500 |

|||||||||

|

Media: Diversified & Production 0.6% |

|||||||||||

|

Formula One Management, Ltd., Facility 1st Lien Term Loan B-3, (Great Britain), 1M LIBOR + 2.50%, 3.50%, 02/01/2024 |

2,000,000 |

1,898,760 |

|||||||||

Semi-Annual Report 2020

5

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Senior Loans(b)(c)(d) (continued)

|

Principal Amount |

Value(a) |

||||||||||

|

Retail 0.6% |

|||||||||||

|

Bass Pro Group, LLC, 1st Lien Term Loan B, 6M LIBOR + 5.00%, 6.07%, 09/25/2024(e) |

$ |

590 |

$ |

571 |

|||||||

|

GOBP Holdings, Inc., 1st Lien Term Loan, 6M LIBOR + 2.75%, 3.74%, 10/22/2025 |

2,000,000 |

1,917,500 |

|||||||||

|

1,918,071 |

|||||||||||

|

Services: Business 2.7% |

|||||||||||

|

AVSC Holding Corp., Initial 2nd Lien Term Loan, 6M LIBOR + 7.25%, 8.25%, 09/01/2025 |

1,250,000 |

746,875 |

|||||||||

|

Casmar Holdings, Ltd., Initial 1st Lien Term Loan, (Australia), 3M LIBOR + 4.50%, 5.50%, 12/20/2023 |

3,342,921 |

2,340,044 |

|||||||||

|

Dun & Bradstreet Corp., Initial 1st Lien Term Loan, 1M LIBOR + 4.00%, 4.18%, 02/06/2026 |

1,995,000 |

1,940,137 |

|||||||||

|

Kronos, Inc., Initial 2nd Lien Term Loan, 1M LIBOR + 8.25%, 9.25%, 11/01/2024 |

1,525,000 |

1,524,055 |

|||||||||

|

Packers Holdings, LLC, Initial 1st Lien Term Loan, 1M LIBOR + 3.00%, 4.00%, 12/04/2024 |

2,386,076 |

2,279,896 |

|||||||||

|

8,831,007 |

|||||||||||

|

Services: Consumer 3.7% |

|||||||||||

|

Diebold Nixdorf, Inc., 1st Lien Term Loan A-1, 1M LIBOR + 9.25%, 9.44%, 08/31/2022 |

4,111,390 |

4,080,555 |

|||||||||

|

Gems Menasas Cayman, Ltd., Facility 1st Lien Term Loan B, (Cayman Islands), 6M LIBOR + 5.00%, 6.00%, 07/31/2026 |

2,861,091 |

2,700,154 |

|||||||||

|

Learning Care Group (US) No. 2 Inc., 1st Lien Term Loan B, 6M LIBOR + 3.25%, 4.25%, 03/13/2025 |

1,994,898 |

1,746,154 |

|||||||||

|

St. George's University Scholastic Services, LLC, 1st Lien Term Loan, 1M LIBOR + 3.25%, 3.43%, 07/17/2025(f) |

3,541,619 |

3,417,662 |

|||||||||

|

11,944,525 |

|||||||||||

|

Transportation: Consumer 0.4% |

|||||||||||

|

Mileage Plus Holdings, LLC, Term Loan B, 3M LIBOR + 5.25%, 6.25%, 06/25/2027 |

1,452,327 |

1,440,825 |

|||||||||

Senior Loans(b)(c)(d) (continued)

|

Principal Amount |

Value(a) |

||||||||||

|

Utilities: Electric 0.8% |

|||||||||||

|

PG&E Corporation, 1st Lien Term Loan, 3M LIBOR + 4.50%, 5.50%, 06/23/2025 |

$ |

2,750,000 |

$ |

2,698,437 |

|||||||

|

Total Senior Loans (Cost: $82,776,539) |

80,463,908 |

||||||||||

Corporate Bonds 75.3%

|

Aerospace & Defense 3.3% |

|||||||||||

|

Bombardier, Inc., (Canada), 8.75%, 12/01/2021(d) |

2,000,000 |

1,625,000 |

|||||||||

|

Howmet Aerospace, Inc., 6.88%, 05/01/2025 |

2,000,000 |

2,169,722 |

|||||||||

|

Leidos, Inc. (fka Leidos Innovations Corp.), 7.13%, 07/01/2032 |

2,500,000 |

3,155,650 |

|||||||||

|

TransDigm, Inc., 8.00%, 12/15/2025(d) |

3,500,000 |

3,678,465 |

|||||||||

|

10,628,837 |

|||||||||||

|

Automotive 4.5% |

|||||||||||

|

Clarios Global, LP, 8.50%, 05/15/2027(d) |

1,375,000 |

1,381,806 |

|||||||||

|

Clarios Global, LP, (Canada), 6.75%, 05/15/2025(d) |

668,000 |

694,720 |

|||||||||

|

Dana, Inc., 5.38%, 11/15/2027 |

525,000 |

524,008 |

|||||||||

|

Dana, Inc., 5.63%, 06/15/2028 |

725,000 |

719,707 |

|||||||||

|

Fiat Chrysler Automobiles N.V., 4.50%, 07/07/2028(f)(g) |

€ |

500,000 |

564,534 |

||||||||

|

Ford Motor Co., 8.50%, 04/21/2023 |

$ |

1,920,000 |

2,030,400 |

||||||||

|

Ford Motor Co., 9.00%, 04/22/2025 |

1,625,000 |

1,758,575 |

|||||||||

|

Goodyear Tire & Rubber Co. (The), 8.75%, 08/15/2020 |

2,522,000 |

2,536,628 |

|||||||||

|

Meritor, Inc., 6.25%, 06/01/2025(d) |

2,500,000 |

2,525,000 |

|||||||||

|

Navistar International Corp., 9.50%, 05/01/2025(d) |

1,750,000 |

1,875,212 |

|||||||||

|

14,610,590 |

|||||||||||

|

Banking, Finance, Insurance & Real Estate 4.3% |

|||||||||||

|

Acrisure, LLC, 10.13%, 08/01/2026(d) |

1,023,000 |

1,099,725 |

|||||||||

|

Acrisure, LLC, 8.13%, 02/15/2024(d) |

750,000 |

779,775 |

|||||||||

|

Ford Motor Credit Co, LLC, 5.13%, 06/16/2025 |

2,025,000 |

2,025,810 |

|||||||||

|

HAT Holdings I, LLC, 6.00%, 04/15/2025(d) |

2,500,000 |

2,618,750 |

|||||||||

|

NFP Corp., 7.00%, 05/15/2025(d) |

1,366,000 |

1,434,300 |

|||||||||

Semi-Annual Report 2020

6

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Corporate Bonds (continued)

|

Principal Amount |

Value(a) |

||||||||||

|

NMI Holdings, Inc., 7.38%, 06/01/2025(d) |

$ |

1,140,000 |

$ |

1,192,873 |

|||||||

|

Refinitiv U.S. Holdings, Inc., 8.25%, 11/15/2026(d) |

4,500,000 |

4,873,365 |

|||||||||

|

14,024,598 |

|||||||||||

|

Beverage, Food & Tobacco 2.1% |

|||||||||||

|

Albertsons Cos, Inc., 6.63%, 06/15/2024 |

2,000,000 |

2,050,000 |

|||||||||

|

Chobani, LLC, 7.50%, 04/15/2025(d) |

1,000,000 |

965,000 |

|||||||||

|

IRB Holding Corp., 7.00%, 06/15/2025(d) |

3,742,000 |

3,856,879 |

|||||||||

|

6,871,879 |

|||||||||||

|

Capital Equipment 2.7% |

|||||||||||

|

Avantor, Inc., 9.00%, 10/01/2025(d) |

5,000,000 |

5,375,000 |

|||||||||

|

Clark Equipment Co., 5.88%, 06/01/2025(d) |

2,205,000 |

2,254,613 |

|||||||||

|

Vertical Holdco GmbH, (Germany), 7.63%, 07/15/2028(d)(g) |

650,000 |

650,000 |

|||||||||

|

Vertical U.S. Newco, Inc., 5.25%, 07/15/2027(d)(g) |

667,000 |

667,000 |

|||||||||

|

8,946,613 |

|||||||||||

|

Chemicals, Plastics & Rubber 4.8% |

|||||||||||

|

Aruba Investments, Inc., 8.75%, 02/15/2023(d) |

3,750,000 |

3,768,750 |

|||||||||

|

Blue Cube Spinco, Inc., 9.75%, 10/15/2023 |

4,750,000 |

4,892,500 |

|||||||||

|

OCI NV, (Netherlands), 5.25%, 11/01/2024(d) |

2,000,000 |

1,920,000 |

|||||||||

|

Trident TPI Holdings, Inc., 9.25%, 08/01/2024(d) |

2,500,000 |

2,562,500 |

|||||||||

|

Tronox, Inc., 6.50%, 05/01/2025(d) |

1,747,000 |

1,764,470 |

|||||||||

|

Tronox, Inc., 6.50%, 04/15/2026(d) |

1,000,000 |

935,000 |

|||||||||

|

15,843,220 |

|||||||||||

|

Construction & Building 1.5% |

|||||||||||

|

PowerTeam Services, LLC, 9.03%, 12/04/2025(d) |

4,770,000 |

4,865,400 |

|||||||||

|

Consumer Goods: Durable 1.9% |

|||||||||||

|

CD&R Smokey Buyer, Inc., 6.75%, 07/15/2025(d)(g) |

2,500,000 |

2,599,250 |

|||||||||

|

Core & Main Holdings, LP, 8.63%, 09/15/2024(d) |

2,500,000 |

2,504,000 |

|||||||||

Corporate Bonds (continued)

|

Principal Amount |

Value(a) |

||||||||||

|

Kronos Acquisition Holdings, Inc., 9.00%, 08/15/2023(d) |

$ |

1,250,000 |

$ |

1,190,625 |

|||||||

|

6,293,875 |

|||||||||||

|

Consumer Goods: Non-Durable 2.1% |

|||||||||||

|

Adient US, LLC, 9.00%, 04/15/2025(d) |

1,175,000 |

1,265,710 |

|||||||||

|

Iceland Bondco, PLC, (Great Britain), 4.63%, 03/15/2025(d) |

£ |

2,000,000 |

2,209,835 |

||||||||

|

Iceland Bondco, PLC, (Great Britain), 6.75%, 07/15/2024(d) |

3,000,000 |

3,529,735 |

|||||||||

|

7,005,280 |

|||||||||||

|

Containers, Packaging & Glass 2.9% |

|||||||||||

|

Boise Cascade Co., 5.63%, 09/01/2024(d) |

$ |

1,750,000 |

1,763,125 |

||||||||

|

Crown Cork & Seal Co., Inc., 7.38%, 12/15/2026 |

4,350,000 |

5,089,500 |

|||||||||

|

Owens-Brockway Glass Container, Inc., 6.38%, 08/15/2025(d) |

1,750,000 |

1,850,625 |

|||||||||

|

Owens-Brockway Glass Container, Inc., 6.63%, 05/13/2027(d) |

672,000 |

698,880 |

|||||||||

|

9,402,130 |

|||||||||||

|

Energy: Electricity 0.7% |

|||||||||||

|

Enviva Partners, LP, 6.50%, 01/15/2026(d)(g) |

2,140,000 |

2,225,600 |

|||||||||

|

Energy: Oil & Gas 5.8% |

|||||||||||

|

Comstock Resources, Inc., 9.75%, 08/15/2026 |

500,000 |

466,250 |

|||||||||

|

EQT Corp., 7.00%, 02/01/2030 |

4,000,000 |

4,120,120 |

|||||||||

|

EQT Midstream Partners, LP, 6.00%, 07/01/2025(d) |

1,250,000 |

1,266,150 |

|||||||||

|

EQT Midstream Partners, LP, 6.50%, 07/01/2027(d) |

1,250,000 |

1,280,275 |

|||||||||

|

Exterran Energy Solutions, LP, 8.13%, 05/01/2025 |

3,000,000 |

2,482,500 |

|||||||||

|

Hilcorp Energy I, LP, 6.25%, 11/01/2028(d) |

1,200,000 |

963,000 |

|||||||||

|

Laredo Petroleum, Inc., 9.50%, 01/15/2025 |

2,500,000 |

1,728,125 |

|||||||||

|

Laredo Petroleum, Inc., 10.13%, 01/15/2028 |

1,250,000 |

862,500 |

|||||||||

|

Williams Cos., Inc., 8.75%, 03/15/2032 |

4,000,000 |

5,931,393 |

|||||||||

|

19,100,313 |

|||||||||||

Semi-Annual Report 2020

7

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Corporate Bonds (continued)

|

Principal Amount |

Value(a) |

||||||||||

|

Environmental Industries 2.1% |

|||||||||||

|

Core & Main, LP, 6.13%, 08/15/2025(d) |

$ |

1,000,000 |

$ |

996,650 |

|||||||

|

Covanta Holding Corp., 5.88%, 03/01/2024 |

1,000,000 |

1,008,750 |

|||||||||

|

Covanta Holding Corp., 5.88%, 07/01/2025 |

1,328,000 |

1,344,600 |

|||||||||

|

Covanta Holding Corp., 6.00%, 01/01/2027 |

925,000 |

936,655 |

|||||||||

|

GFL Environmental, Inc., (Canada), 8.50%, 05/01/2027(d) |

2,374,000 |

2,581,725 |

|||||||||

|

6,868,380 |

|||||||||||

|

Healthcare & Pharmaceuticals 4.0% |

|||||||||||

|

Bausch Health Cos., Inc., (Canada), 7.00%, 03/15/2024(d) |

2,250,000 |

2,334,375 |

|||||||||

|

Centene Corp., 5.25%, 04/01/2025(d) |

1,000,000 |

1,029,670 |

|||||||||

|

HCA, Inc., 7.69%, 06/15/2025 |

3,500,000 |

3,990,000 |

|||||||||

|

Immucor, Inc., 11.13%, 02/15/2022(d) |

3,000,000 |

2,677,500 |

|||||||||

|

Ortho-Clinical Diagnostics, Inc., 7.38%, 06/01/2025(d) |

1,250,000 |

1,271,875 |

|||||||||

|

RegionalCare Hospital Partners Holdings, Inc., 9.75%, 12/01/2026(d) |

1,633,000 |

1,681,990 |

|||||||||

|

12,985,410 |

|||||||||||

|

High Tech Industries 4.2% |

|||||||||||

|

Dell International, LLC, 6.02%, 06/15/2026(d) |

2,350,000 |

2,694,217 |

|||||||||

|

Dell International, LLC, 6.10%, 07/15/2027(d) |

1,500,000 |

1,732,881 |

|||||||||

|

Genesys Telecommunications Laboratories, Inc., 10.00%, 11/30/2024(d) |

4,000,000 |

4,160,000 |

|||||||||

|

Sophia, LP, 9.00%, 09/30/2023(d) |

2,250,000 |

2,272,500 |

|||||||||

|

Uber Technologies, Inc., 7.50%, 05/15/2025(d) |

3,000,000 |

3,022,500 |

|||||||||

|

13,882,098 |

|||||||||||

|

Hotel, Gaming & Leisure 4.0% |

|||||||||||

|

Colt Merger Sub, Inc., 6.25%, 07/01/2025(d)(g) |

2,500,000 |

2,484,375 |

|||||||||

|

Colt Merger Sub, Inc., 8.13%, 07/01/2027(d)(g) |

1,275,000 |

1,231,969 |

|||||||||

|

Eldorado Resorts, Inc., 7.00%, 08/01/2023 |

5,000,000 |

5,162,500 |

|||||||||

Corporate Bonds (continued)

|

Principal Amount |

Value(a) |

||||||||||

|

Golden Nugget, Inc., 8.75%, 10/01/2025(d)(f) |

$ |

1,500,000 |

$ |

877,500 |

|||||||

|

MGM Resorts International, 6.75%, 05/01/2025 |

3,000,000 |

2,970,240 |

|||||||||

|

MGM Resorts International, 7.75%, 03/15/2022 |

500,000 |

510,000 |

|||||||||

|

13,236,584 |

|||||||||||

|

Media: Broadcasting & Subscription 7.4% |

|||||||||||

|

Belo Corp., 7.25%, 09/15/2027 |

6,000,000 |

6,390,000 |

|||||||||

|

CSC Holdings, LLC, 7.50%, 04/01/2028(d) |

1,750,000 |

1,909,687 |

|||||||||

|

CSC Holdings, LLC, 10.88%, 10/15/2025(d) |

3,010,000 |

3,235,750 |

|||||||||

|

Cumulus Media New Holdings, Inc., 6.75%, 07/01/2026(d) |

1,316,000 |

1,215,655 |

|||||||||

|

Diamond Sports Group, LLC, 6.63%, 08/15/2027(d) |

2,973,000 |

1,583,123 |

|||||||||

|

Gray Television, Inc., 7.00%, 05/15/2027(d) |

2,000,000 |

2,050,000 |

|||||||||

|

Hughes Satellite Systems Corp., 7.63%, 06/15/2021 |

5,500,000 |

5,665,000 |

|||||||||

|

Quebecor Media, Inc., (Canada), 5.75%, 01/15/2023 |

2,000,000 |

2,095,000 |

|||||||||

|

24,144,215 |

|||||||||||

|

Metals & Mining 0.2% |

|||||||||||

|

Constellium SE, (France), 5.63%, 06/15/2028(d) |

597,000 |

585,060 |

|||||||||

|

Retail 2.4% |

|||||||||||

|

Burlington Coat Factory Warehouse Corp., 6.25%, 04/15/2025(d) |

1,778,000 |

1,858,010 |

|||||||||

|

L Brands, Inc., 5.63%, 02/15/2022 |

350,000 |

342,125 |

|||||||||

|

L Brands, Inc., 6.88%, 07/01/2025(d) |

1,250,000 |

1,290,625 |

|||||||||

|

L Brands, Inc., 9.38%, 07/01/2025(d) |

2,000,000 |

2,002,400 |

|||||||||

|

PetSmart, Inc., 7.13%, 03/15/2023(d) |

2,500,000 |

2,464,700 |

|||||||||

|

7,957,860 |

|||||||||||

|

Services: Business 2.2% |

|||||||||||

|

Aramark Services, Inc., 6.38%, 05/01/2025(d) |

1,500,000 |

1,548,945 |

|||||||||

|

Iron Mountain, Inc., 5.25%, 07/15/2030(d) |

2,000,000 |

1,970,000 |

|||||||||

Semi-Annual Report 2020

8

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Corporate Bonds (continued)

|

Principal Amount |

Value(a) |

||||||||||

|

Iron Mountain, Inc., 5.63%, 07/15/2032(d) |

$ |

1,500,000 |

$ |

1,496,850 |

|||||||

|

Solera, LLC, 10.50%, 03/01/2024(d) |

2,000,000 |

2,035,000 |

|||||||||

|

7,050,795 |

|||||||||||

|

Services: Consumer 1.0% |

|||||||||||

|

Dole Food Co., Inc., 7.25%, 06/15/2025(d) |

2,250,000 |

2,154,375 |

|||||||||

|

Gems Menasa Cayman, Ltd., (Cayman Islands), 7.13%, 07/31/2026(d) |

1,000,000 |

950,000 |

|||||||||

|

3,104,375 |

|||||||||||

|

Telecommunications 5.5% |

|||||||||||

|

Altice Financing S.A., (Luxembourg), 7.50%, 05/15/2026(d) |

500,000 |

523,750 |

|||||||||

|

Altice Finco S.A., (Luxembourg), 7.63%, 02/15/2025(d) |

500,000 |

519,065 |

|||||||||

|

Altice France Holding S.A., (Luxembourg), 10.50%, 05/15/2027(d) |

1,000,000 |

1,101,550 |

|||||||||

|

Altice France S.A., (France), 7.38%, 05/01/2026(d) |

3,235,000 |

3,373,458 |

|||||||||

|

Altice France S.A., (France), 8.13%, 02/01/2027(d) |

769,000 |

841,094 |

|||||||||

|

Embarq Corp., 8.00%, 06/01/2036 |

4,000,000 |

4,492,000 |

|||||||||

|

Qwest Corp., 6.75%, 12/01/2021 |

1,750,000 |

1,849,411 |

|||||||||

|

Sprint Corp., 7.63%, 03/01/2026 |

1,425,000 |

1,682,027 |

|||||||||

|

T-Mobile USA, Inc., 6.38%, 03/01/2025 |

1,885,000 |

1,936,838 |

|||||||||

|

T-Mobile USA, Inc., 6.50%, 01/15/2026 |

1,500,000 |

1,567,665 |

|||||||||

|

17,886,858 |

|||||||||||

|

Transportation: Cargo 2.0% |

|||||||||||

|

Watco Cos., LLC, 6.50%, 06/15/2027(d) |

3,280,000 |

3,360,622 |

|||||||||

|

XPO Logistics, Inc., 6.25%, 05/01/2025(d) |

500,000 |

523,750 |

|||||||||

|

XPO Logistics, Inc., 6.75%, 08/15/2024(d) |

2,500,000 |

2,619,000 |

|||||||||

|

6,503,372 |

|||||||||||

|

Transportation: Consumer 1.0% |

|||||||||||

|

Delta Air Lines, Inc., 7.00%, 05/01/2025(d) |

2,250,000 |

2,322,603 |

|||||||||

Corporate Bonds (continued)

|

Principal Amount |

Value(a) |

||||||||||

|

Mileage Plus Holdings, LLC, 6.50%, 06/20/2027(d)(g) |

$ |

1,053,000 |

$ |

1,055,633 |

|||||||

|

3,378,236 |

|||||||||||

|

Utilities: Electric 2.7% |

|||||||||||

|

NRG Energy, Inc., 7.25%, 05/15/2026 |

5,500,000 |

5,802,500 |

|||||||||

|

NSG Holdings, LLC, 7.75%, 12/15/2025(d) |

2,503,568 |

2,528,604 |

|||||||||

|

PG&E Corp., 5.25%, 07/01/2030 |

335,000 |

336,909 |

|||||||||

|

8,668,013 |

|||||||||||

|

Total Corporate Bonds (Cost: $245,309,892) |

246,069,591 |

||||||||||

Collateralized Loan Obligations 39.5%(d)(f)

|

Collateralized Loan Obligations — Debt 29.1%(c) |

|||||||||||

|

AMMC CLO XI, Ltd., (Cayman Islands), 3M LIBOR + 5.80%, 6.56%, 04/30/2031 |

2,000,000 |

1,567,716 |

|||||||||

|

AMMC CLO XI, Ltd., (Cayman Islands), 3M LIBOR + 7.95%, 8.71%, 04/30/2031 |

500,000 |

304,147 |

|||||||||

|

AMMC CLO XIV, Ltd., (Cayman Islands), 3M LIBOR + 7.35%, 8.34%, 07/25/2029 |

1,250,000 |

1,101,543 |

|||||||||

|

AMMC CLO XXII, Ltd., (Cayman Islands), 3M LIBOR + 5.50%, 6.49%, 04/25/2031 |

3,000,000 |

2,519,628 |

|||||||||

|

Apidos CLO XX, Ltd., (Cayman Islands), 3M LIBOR + 8.70%, 9.88%, 07/16/2031 |

850,000 |

545,813 |

|||||||||

|

Atlas Senior Loan Fund VII, Ltd., (Cayman Islands), 3M LIBOR + 8.05%, 8.42%, 11/27/2031 |

1,587,540 |

794,276 |

|||||||||

|

Bain Capital Credit CLO 2020-1, (Cayman Islands), 3M LIBOR + 8.25%, 9.52%, 04/18/2033 |

3,000,000 |

2,939,106 |

|||||||||

|

Bain Capital Credit CLO, Ltd. 2016-2, (Cayman Islands), 3M LIBOR + 7.04%, 8.26%, 01/15/2029 |

2,000,000 |

1,679,334 |

|||||||||

|

Canyon Capital CLO, Ltd. 2018-1, (Cayman Islands), 3M LIBOR + 5.75%, 6.97%, 07/15/2031 |

750,000 |

607,500 |

|||||||||

|

Carlyle Global Market Strategies CLO, Ltd. 2017-1, (Cayman Islands), 3M LIBOR + 6.00%, 7.14%, 04/20/2031 |

3,000,000 |

2,346,735 |

|||||||||

Semi-Annual Report 2020

9

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Collateralized Loan Obligations(d)(f) (continued)

|

Principal Amount |

Value(a) |

||||||||||

|

CBAM, Ltd. 2017-3, (Cayman Islands), 3M LIBOR + 6.50%, 7.64%, 10/17/2029 |

$ |

1,615,385 |

$ |

1,409,767 |

|||||||

|

Cedar Funding CLO VIII, Ltd., (Cayman Islands), 3M LIBOR + 6.35%, 7.49%, 10/17/2030 |

2,000,000 |

1,755,942 |

|||||||||

|

CIFC Funding 2015-2A, Ltd., (Cayman Islands), 3M LIBOR + 6.81%, 8.03%, 04/15/2030 |

1,500,000 |

1,393,866 |

|||||||||

|

Crestline Denali CLO XIV, Ltd., (Cayman Islands), 3M LIBOR + 6.35%, 7.39%, 10/23/2031 |

2,000,000 |

1,415,584 |

|||||||||

|

Crestline Denali CLO XV, Ltd., (Cayman Islands), 3M LIBOR + 7.35%, 8.49%, 04/20/2030 |

3,875,000 |

2,758,182 |

|||||||||

|

Denali Capital CLO XII, Ltd., (Cayman Islands), 3M LIBOR + 5.90%, 7.12%, 04/15/2031 |

5,000,000 |

3,448,285 |

|||||||||

|

Dryden 26 Senior Loan Fund, (Cayman Islands), 3M LIBOR + 5.54%, 6.76%, 04/15/2029 |

2,000,000 |

1,720,000 |

|||||||||

|

Dryden 40 Senior Loan Fund, (Cayman Islands), 3M LIBOR + 5.75%, 6.14%, 08/15/2031 |

3,000,000 |

2,584,146 |

|||||||||

|

Dryden 45 Senior Loan Fund, (Cayman Islands), 3M LIBOR + 5.85%, 7.07%, 10/15/2030 |

3,000,000 |

2,551,647 |

|||||||||

|

Dryden 68 Senior Loan Fund, (Cayman Islands), 3M LIBOR + 6.75%, 7.97%, 07/15/2032 |

1,250,000 |

1,126,183 |

|||||||||

|

Highbridge Loan Management, Ltd. 2013-2, (Cayman Islands), 3M LIBOR + 8.25%, 9.39%, 10/20/2029 |

2,306,639 |

1,466,130 |

|||||||||

|

Highbridge Loan Management, Ltd. 2014-4, (Cayman Islands), 3M LIBOR + 7.36%, 8.25%, 01/28/2030 |

2,046,286 |

1,301,194 |

|||||||||

|

ICG U.S. CLO, Ltd. 2018-2, (Cayman Islands), 3M LIBOR + 5.75%, 6.85%, 07/22/2031 |

1,200,000 |

947,015 |

|||||||||

|

INGIM, Ltd. 2013-3, (Cayman Islands), 3M LIBOR + 5.90%, 7.04%, 10/18/2031 |

2,750,000 |

2,132,779 |

|||||||||

|

KKR CLO 15, Ltd., (Cayman Islands), 3M LIBOR + 6.44%, 7.58%, 01/18/2032 |

3,000,000 |

2,296,470 |

|||||||||

|

LCM 30, Ltd., (Cayman Islands), 3M LIBOR + 6.95%, 8.09%, 04/20/2031 |

1,200,000 |

1,126,393 |

|||||||||

Collateralized Loan Obligations(d)(f) (continued)

|

Principal Amount |

Value(a) |

||||||||||

|

LCM XVII, LP, (Cayman Islands), 3M LIBOR + 6.00%, 7.22%, 10/15/2031 |

$ |

3,750,000 |

$ |

2,872,616 |

|||||||

|

LCM XXIII, LP, (Cayman Islands), 3M LIBOR + 7.05%, 8.19%, 10/20/2029 |

3,000,000 |

2,371,629 |

|||||||||

|

Madison Park Funding XIV, Ltd., (Cayman Islands), 3M LIBOR + 7.77%, 8.87%, 10/22/2030 |

2,500,000 |

1,528,877 |

|||||||||

|

Madison Park Funding XXVI, Ltd., (Cayman Islands), 3M LIBOR + 6.50%, 7.34%, 07/29/2030 |

1,500,000 |

1,364,984 |

|||||||||

|

Madison Park Funding XXXII, Ltd., (Cayman Islands), 3M LIBOR + 7.10%, 8.20%, 01/22/2031 |

3,000,000 |

2,855,130 |

|||||||||

|

Mariner CLO, LLC 2019 1A, (Cayman Islands), 3M LIBOR + 6.89%, 7.65%, 04/30/2032 |

1,000,000 |

938,303 |

|||||||||

|

Northwoods Capital XII-B, Ltd., (Cayman Islands), 3M LIBOR + 5.79%, 6.10%, 06/15/2031 |

2,000,000 |

1,291,680 |

|||||||||

|

Oaktree CLO, Ltd. 2014-1, (Cayman Islands), 3M LIBOR + 6.30%, 6.73%, 05/13/2029 |

5,100,091 |

3,556,604 |

|||||||||

|

Oaktree CLO, Ltd. 2019-2, (Cayman Islands), 3M LIBOR + 6.77%, 7.99%, 04/15/2031 |

2,000,000 |

1,426,022 |

|||||||||

|

Oaktree CLO, Ltd. 2019-4, (Cayman Islands), 3M LIBOR + 7.23%, 8.37%, 10/20/2032 |

1,500,000 |

1,406,807 |

|||||||||

|

OHA Credit Partners VII, Ltd., (Cayman Islands), 3M LIBOR + 7.50%, 7.88%, 11/20/2027 |

2,850,000 |

2,817,678 |

|||||||||

|

OHA Credit Partners XI, Ltd., (Cayman Islands), 3M LIBOR + 7.90%, 9.04%, 01/20/2032 |

2,750,000 |

1,805,059 |

|||||||||

|

OHA Credit Partners XII, Ltd., (Cayman Islands), 3M LIBOR + 5.45%, 6.49%, 07/23/2030 |

1,500,000 |

1,286,094 |

|||||||||

|

OZLM XI, Ltd. 2015-11A, (Cayman Islands), 3M LIBOR + 7.00%, 7.76%, 10/30/2030 |

2,750,000 |

2,349,333 |

|||||||||

|

Silver Creek CLO, Ltd., (Cayman Islands), 3M LIBOR + 6.40%, 7.54%, 07/20/2030 |

1,000,000 |

866,569 |

|||||||||

|

Steele Creek CLO, Ltd. 2015-1, (Cayman Islands), 3M LIBOR + 8.85%, 9.22%, 05/21/2029 |

3,000,000 |

1,729,881 |

|||||||||

Semi-Annual Report 2020

10

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Collateralized Loan Obligations(d)(f) (continued)

|

Principal Amount |

Value(a) |

||||||||||

|

Steele Creek CLO, Ltd. 2016-1, (Cayman Islands), 3M LIBOR + 5.75%, 6.06%, 06/15/2031 |

$ |

3,000,000 |

$ |

2,010,474 |

|||||||

|

TCI-Flatiron CLO, Ltd. 2018-1, (Cayman Islands), 3M LIBOR + 6.60%, 7.44%, 01/29/2032 |

3,000,000 |

2,771,757 |

|||||||||

|

TCI-Symphony CLO, Ltd. 2017-1, (Cayman Islands), 3M LIBOR + 6.45%, 7.67%, 07/15/2030 |

2,100,000 |

1,922,008 |

|||||||||

|

Venture XXIV CLO, Ltd., (Cayman Islands), 3M LIBOR + 6.72%, 7.86%, 10/20/2028 |

700,000 |

559,806 |

|||||||||

|

Venture XXVI CLO, Ltd., (Cayman Islands), 3M LIBOR + 6.80%, 7.94%, 01/20/2029 |

1,000,000 |

683,363 |

|||||||||

|

Venture XXVII CLO, Ltd., (Cayman Islands), 3M LIBOR + 6.35%, 7.49%, 07/20/2030 |

2,025,000 |

1,613,903 |

|||||||||

|

Venture XXVIII CLO, Ltd., (Cayman Islands), 3M LIBOR + 6.16%, 7.30%, 10/20/2029 |

4,000,000 |

3,252,480 |

|||||||||

|

Venture XXXVI CLO, Ltd., (Cayman Islands), 3M LIBOR + 6.92%, 8.06%, 04/20/2032 |

2,000,000 |

1,539,754 |

|||||||||

|

Vibrant CLO X, Ltd., (Cayman Islands), 3M LIBOR + 6.19%, 7.33%, 10/20/2031 |

3,000,000 |

2,297,856 |

|||||||||

|

Voya CLO, Ltd. 2015-3, (Cayman Islands), 3M LIBOR + 6.20%, 7.34%, 10/20/2031 |

3,000,000 |

2,447,541 |

|||||||||

|

Wellfleet CLO, Ltd. 2017-2, (Cayman Islands), 3M LIBOR + 6.75%, 7.89%, 10/20/2029 |

2,000,000 |

1,610,060 |

|||||||||

|

95,015,649 |

|||||||||||

|

Collateralized Loan Obligations — Equity 10.4% |

|||||||||||

|

Allegro CLO, Ltd. 2017-1A, (Cayman Islands), 1.15%, 10/16/2030 |

2,000,000 |

963,556 |

|||||||||

|

Allegro CLO, Ltd. 2018-2A, (Cayman Islands), 15.50%, 07/15/2031 |

3,500,000 |

2,067,142 |

|||||||||

|

AMMC CLO XXI, Ltd., (Cayman Islands), 6.55%, 11/02/2030 |

500,000 |

276,595 |

|||||||||

|

Atlas Senior Loan Fund I, Ltd., (Cayman Islands), 6.76%, 11/17/2027 |

1,800,000 |

221,632 |

|||||||||

|

Canyon Capital CLO, Ltd. 2019-1, (Cayman Islands), 10.83%, 04/15/2032 |

1,000,000 |

625,775 |

|||||||||

Collateralized Loan Obligations(d)(f) (continued)

|

Principal Amount |

Value(a) |

||||||||||

|

Carlyle Global Market Strategies CLO, Ltd. 2013-4, (Cayman Islands), 18.29%, 01/15/2031 |

$ |

1,259,000 |

$ |

424,526 |

|||||||

|

Carlyle Global Market Strategies CLO, Ltd. 2017-3, (Cayman Islands), 2.49%, 07/20/2029 |

1,750,000 |

393,507 |

|||||||||

|

Carlyle Global Market Strategies CLO, Ltd. 2018-3, (Cayman Islands), 13.43%, 10/15/2030 |

3,222,500 |

1,573,276 |

|||||||||

|

Cedar Funding CLO IV, Ltd., (Cayman Islands), 28.14%, 07/23/2030 |

2,500,000 |

1,260,940 |

|||||||||

|

Cedar Funding CLO V, Ltd., (Cayman Islands), 15.33%, 07/17/2031 |

2,546,000 |

1,553,620 |

|||||||||

|

Cedar Funding CLO VI, Ltd., (Cayman Islands), 24.27%, 10/20/2028 |

2,000,000 |

1,117,198 |

|||||||||

|

Cedar Funding CLO VIII, Ltd., (Cayman Islands), 12.84%, 10/17/2030 |

2,000,000 |

1,034,670 |

|||||||||

|

Crestline Denali CLO XVI, Ltd., (Cayman Islands), 12.27%, 01/20/2030 |

2,000,000 |

1,055,032 |

|||||||||

|

Dryden 57 Senior Loan Fund, (Cayman Islands), 15.92%, 05/15/2031 |

573,500 |

426,272 |

|||||||||

|

Eaton Vance CLO 2018-1, Ltd., (Cayman Islands), 13.92%, 10/15/2030 |

2,430,000 |

1,406,571 |

|||||||||

|

Halcyon Loan Advisors Funding, Ltd. 2017-1, (Cayman Islands), 7.27%, 06/25/2029 |

1,750,000 |

537,201 |

|||||||||

|

ICG U.S. CLO, Ltd. 2018-2, (Cayman Islands), 25.06%, 07/22/2031 |

3,500,000 |

2,598,953 |

|||||||||

|

LCM XIII, LP, (Cayman Islands), 16.39%, 07/19/2027 |

2,175,000 |

425,882 |

|||||||||

|

LCM XV, LP, (Cayman Islands), 27.59%, 07/20/2030 |

5,875,000 |

1,280,538 |

|||||||||

|

LCM XXIII, LP, (Cayman Islands), 13.18%, 10/20/2029 |

3,100,000 |

904,304 |

|||||||||

|

Madison Park Funding XII, Ltd., (Cayman Islands), 07/20/2026 |

4,000,000 |

632,412 |

|||||||||

|

Madison Park Funding XXXI, Ltd., (Cayman Islands), 15.62%, 01/23/2048 |

2,000,000 |

1,345,942 |

|||||||||

|

Mariner CLO, Ltd. 2018-5A, (Cayman Islands), 14.72%, 04/25/2031 |

2,567,500 |

1,617,746 |

|||||||||

Semi-Annual Report 2020

11

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Collateralized Loan Obligations(d)(f) (continued)

|

Principal Amount |

Value(a) |

||||||||||

|

Oaktree CLO, Ltd. 2015-1, (Cayman Islands), 11.61%, 10/20/2027 |

$ |

4,000,000 |

$ |

1,193,448 |

|||||||

|

Oaktree CLO, Ltd. 2018-1, (Cayman Islands), 5.62%, 10/20/2030 |

4,250,000 |

2,782,313 |

|||||||||

|

OHA Credit Partners VII, Ltd., (Cayman Islands), 7.42%, 11/20/2027 |

2,000,000 |

505,828 |

|||||||||

|

OZLM XIX, Ltd. 2017-19A, (Cayman Islands), 10.71%, 11/22/2030 |

2,440,000 |

1,009,199 |

|||||||||

|

OZLM XXI, Ltd. 2017-21A, (Cayman Islands), 12.00%, 01/20/2031 |

1,750,000 |

887,938 |

|||||||||

|

Venture XXX CLO, Ltd., (Cayman Islands), 16.63%, 01/15/2031 |

2,100,000 |

1,113,918 |

|||||||||

|

Vibrant CLO VI, Ltd., (Cayman Islands), 7.92%, 06/20/2029 |

1,500,000 |

463,022 |

|||||||||

|

Voya CLO, Ltd. 2017-2, (Cayman Islands), 8.76%, 06/07/2030 |

1,000,000 |

418,765 |

|||||||||

|

Wellfleet CLO, Ltd. 2018-3, (Cayman Islands), 20.92%, 01/20/2032 |

3,000,000 |

1,926,840 |

|||||||||

|

West CLO, Ltd. 2013-1, (Cayman Islands), 11/07/2025 |

500,000 |

25,766 |

|||||||||

|

34,070,327 |

|||||||||||

|

Total Collateralized Loan Obligations (Cost: $171,071,935) |

129,085,976 |

||||||||||

Common Stock 0.0%(d)(f)(h)(i)

|

Shares |

Value(a) |

||||||||||

|

Energy: Oil & Gas 0.0% |

|||||||||||

|

TE Holdcorp, LLC, Class A Common Equity |

145,457 |

$ |

— |

||||||||

|

Total Common Stocks (Cost: $5,396,473) |

— |

||||||||||

Preferred Stocks 0.0%(d)(f)(h)(i)

|

Energy: Oil & Gas 0.0% |

|||||||||||

|

TE Holdcorp, LLC, Class A Preferred Equity |

254,588 |

— |

|||||||||

|

Total Preferred Stocks (Cost: $2,210,246) |

— |

||||||||||

Warrants 0.0%(d)(f)(h)(i)

|

Media: Advertising, Printing & Publishing 0.0% |

|||||||||||

|

Affinion Holdings, (Common) |

7,874 |

— |

|||||||||

|

Total Warrants (Cost: $3,922,355) |

— |

||||||||||

|

Total Investments — 139.4% (Cost: $510,687,440) |

$ |

455,619,475 |

|||||||||

|

Liabilities in Excess of Other Assets — (39.4%) |

(128,706,725 |

) |

|||||||||

|

Net Assets — 100.0% |

$ |

326,912,750 |

|||||||||

Semi-Annual Report 2020

12

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Footnotes:

(a) Investment holdings in foreign currencies are converted to U.S. Dollars using period end spot rates. All investments are in United States enterprises unless otherwise noted.

(b) Variable rate loans bear interest at a rate that may be determined by reference to the London Interbank Offered Rate ("LIBOR"). Stated interest rates in this schedule represents the "all-in" rate as of June 30, 2020.

(c) Variable rate coupon rate shown as of June 30, 2020.

(d) All of Ares Dynamic Credit Allocation Fund, Inc. (the "Fund") Senior Loans, Collateralized Loan Obligations, Common Stock, Preferred Stocks, Warrants and Corporate Bonds exempt from registration under Rule 144A, which as of June 30, 2020 represented 111.5% of the Fund's net assets or 75.4% of the Fund's total assets, are subject to legal restrictions on sales.

(e) This loan or a portion of this loan represents an unsettled loan purchase. The interest rate will be determined at the time of settlement and will be based upon a spread plus the applicable reference rate determined at the time of purchase.

(f) Investments whose values were determined using significant unobservable inputs (Level 3) (See Note 3 of the Notes to Financial Statements).

(g) When-Issued or delayed delivery security based on typical market settlement convention for such security.

(h) Security valued at fair value using methods determined in good faith by or under the direction of the board of trustees.

(i) Non-income producing security as of June 30, 2020.

As of June 30, 2020, the aggregate cost of securities for Federal income tax purposes was $511,166,694. Unrealized appreciation and depreciation on investments for Federal income tax purposes are as follows:

|

Gross unrealized appreciation |

$ |

6,520,217 |

|||||

|

Gross unrealized depreciation |

(62,067,436 |

) |

|||||

|

Net unrealized depreciation |

$ |

(55,547,219 |

) |

||||

Abbreviations:

144A Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid.

CLO Collateralized Loan Obligation

Currencies:

€ Euro Currency

£ British Pounds

$ U.S. Dollars

Semi-Annual Report 2020

13

Ares Dynamic Credit Allocation Fund, Inc.

Statement of Assets and Liabilities

June 30, 2020 (Unaudited)

|

Assets: |

|||||||

|

Investments, at value (cost $510,687,440) |

$455,619,475 |

||||||

|

Cash |

1,345,580 |

||||||

|

Cash denominated in foreign currency, at value (cost $5,400,996) |

5,444,878 |

||||||

|

Receivable for securities sold |

14,910,257 |

||||||

|

Interest and principal receivable |

5,817,090 |

||||||

|

Deferred debt issuance costs |

266,642 |

||||||

|

Other assets |

110,906 |

||||||

|

Total assets |

483,514,828 |

||||||

|

Liabilities: |

|||||||

|

Line of credit outstanding |

123,491,138 |

||||||

|

Payable for securities purchased |

32,241,695 |

||||||

|

Payable for investment advisory fees |

369,260 |

||||||

|

Payable for commitment fee |

103,329 |

||||||

|

Payable for administration and transfer agent fees |

30,025 |

||||||

|

Payable for interest expense |

26,625 |

||||||

|

Payable for investor support fees |

25,459 |

||||||

|

Accrued expenses and other payables |

314,547 |

||||||

|

Total liabilities |

156,602,078 |

||||||

|

Net assets |

$ |

326,912,750 |

|||||

|

Net assets consist of: |

|||||||

|

Paid-in capital |

$444,104,685 |

||||||

|

Distributable earnings accumulated loss |

(117,191,935) |

||||||

|

Net assets |

$ |

326,912,750 |

|||||

|

Common shares: |

|||||||

|

Net assets |

$326,912,750 |

||||||

|

Shares outstanding (authorized 1 billion shares of $0.001 par value) |

22,914,939 |

||||||

|

Net asset value per share |

$14.26 |

||||||

Semi-Annual Report 2020

14

Ares Dynamic Credit Allocation Fund, Inc.

Statement of Operations

For the six months ended June 30, 2020 (Unaudited)

|

Investment income: |

|||||||

|

Interest |

$ |

19,423,895 |

|||||

|

Expenses: |

|||||||

|

Investment advisory fees (Note 6) |

2,324,582 |

||||||

|

Interest expense (Note 5) |

1,298,595 |

||||||

|

Administrative services of the adviser (Note 6) |

245,113 |

||||||

|

Legal fees |

113,007 |

||||||

|

Investor support fees (Note 6) |

163,142 |

||||||

|

Administration, custodian and transfer agent fees (Note 6) |

186,862 |

||||||

|

Insurance expense |

79,113 |

||||||

|

Amortization of debt issuance cost (Note 5) |

89,220 |

||||||

|

Audit fees |

83,814 |

||||||

|

Directors fee expense |

79,692 |

||||||

|

Commitment fee expense (Note 5) |

59,738 |

||||||

|

Printing expense |

50,645 |

||||||

|

Tax expense |

61,964 |

||||||

|

Other expenses |

67,246 |

||||||

|

Total expenses |

4,902,733 |

||||||

|

Net investment income |

14,521,162 |

||||||

|

Net realized and unrealized gain/(loss) on investments and foreign currency |

|||||||

|

Net realized loss on investments |

(23,112,378 |

) |

|||||

|

Net realized gain on foreign currency |

64,315 |

||||||

|

Net unrealized loss on investments |

(40,544,903 |

) |

|||||

|

Net unrealized loss on foreign currency |

(19,210 |

) |

|||||

|

Net realized and unrealized loss on investments and foreign currency |

(63,612,176 |

) |

|||||

|

Total decrease in net assets resulting from operations |

$ |

(49,091,014 |

) |

||||

Semi-Annual Report 2020

15

Ares Dynamic Credit Allocation Fund, Inc.

Statements of Changes in Net Assets

|

Six Months Ended June 30, 2020 (Unaudited) |

For the Period Ended December 31, 2019(a) |

For the Year Ended October 31, 2019 |

|||||||||||||

|

Increase (decrease) in net assets from operations: |

|||||||||||||||

|

Net investment income |

$ |

14,521,162 |

$ |

3,937,469 |

$ |

31,771,646 |

|||||||||

|

Net realized loss on investments and foreign currency |

(23,048,063 |

) |

(285,432 |

) |

(9,491,193 |

) |

|||||||||

|

Net unrealized gain/(loss) on investments and foreign currency |

(40,564,113 |

) |

15,089,388 |

(17,716,274 |

) |

||||||||||

|

Net increase/(decrease) from operations |

(49,091,014 |

) |

18,741,425 |

4,564,179 |

|||||||||||

|

Distributions to shareholders from (Note 2): |

|||||||||||||||

|

Distributable earnings |

(14,092,688 |

) |

(4,926,712 |

) |

(29,565,391 |

) |

|||||||||

|

Increase (decrease) in net assets from operations and distributions |

(63,183,702 |

) |

13,814,713 |

(25,001,212 |

) |

||||||||||

|

Share transactions: |

|||||||||||||||

|

Cost of shares repurchased (Note 4) |

— |

— |

(673,460 |

) |

|||||||||||

|

Net increase (decrease) from share transactions |

— |

— |

(673,460 |

) |

|||||||||||

|

Total increase (decrease) in net assets |

(63,183,702 |

) |

13,814,713 |

(25,674,672 |

) |

||||||||||

|

Net Assets, beginning of period |

390,096,452 |

376,281,739 |

401,956,411 |

||||||||||||

|

Net Assets, end of period |

$ |

326,912,750 |

$ |

390,096,452 |

$ |

376,281,739 |

|||||||||

(a) For the two month period ended December 31, 2019. See Note 1 of Notes to Financial Statements.

Semi-Annual Report 2020

16

Ares Dynamic Credit Allocation Fund, Inc.

Statement of Cash Flows

For the six months ended June 30, 2020 (Unaudited)

|

Operating Activities: |

|||||||

|

Net decrease in net assets resulting from operations |

$ |

(49,091,014 |

) |

||||

|

Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities: |

|||||||

|

Purchases of investments |

(360,093,504 |

) |

|||||

|

Proceeds from the sale of investments |

392,860,273 |

||||||

|

Amortization and accretion of discounts and premiums, net |

789,897 |

||||||

|

Net realized (gain)/loss on investments |

23,112,378 |

||||||

|

Net unrealized (gain)/loss on investments |

40,544,903 |

||||||

|

Effect of exchange rate changes on line of credit |

(1,424 |

) |

|||||

|

Amortization of debt issuance cost |

(89,220 |

) |

|||||

|

Changes in operating assets and liabilities: |

|||||||

|

Receivable for securities sold |

(7,096,208 |

) |

|||||

|

Interest and principal receivable |

1,593,614 |

||||||

|

Prepaid expenses |

88,721 |

||||||

|

Payable for securities purchased |

14,423,205 |

||||||

|

Payable for investment advisory fees |

(89,026 |

) |

|||||

|

Payable for interest expense |

(299,766 |

) |

|||||

|

Payable for administration, custodian and transfer agent fees |

11,184 |

||||||

|

Payable for investor support fees |

(6,625 |

) |

|||||

|

Payable for commitment fees |

59,738 |

||||||

|

Accrued expenses and other fees |

(276,481 |

) |

|||||

|

Net cash provided by operating activities |

56,440,645 |

||||||

|

Financing Activities: |

|||||||

|

Borrowings on line of credit |

108,974,336 |

||||||

|

Paydowns on line of credit |

(148,798,093 |

) |

|||||

|

Deferred debt issuance costs |

15,937 |

||||||

|

Distributions paid to common shareholders |

(14,092,688 |

) |

|||||

|

Net cash used in financing activities |

(53,900,508 |

) |

|||||

|

Net increase in Cash |

2,540,137 |

||||||

|

Cash: |

|||||||

|

Beginning of period |

4,250,321 |

||||||

|

End of period |

$ |

6,790,458 |

|||||

|

Supplemental disclosure of cash flow information: |

|||||||

|

Cash paid for interest during the period |

$ |

1,598,361 |

|||||

Semi-Annual Report 2020

17

Ares Dynamic Credit Allocation Fund, Inc.

Financial Highlights

|

For the Six Months Ended June 30, 2020 (Unaudited) |

For the Period Ended December 31, 2019* |

For the Year Ended October 31, 2019 |

For the Year Ended October 31, 2018 |

For the Year Ended October 31, 2017 |

For the Year Ended October 31, 2016 |

For the Year Ended October 31, 2015 |

|||||||||||||||||||||||||

|

Per share data: |

|||||||||||||||||||||||||||||||

|

Net asset value, beginning of period |

$ |

17.02 |

$ |

16.42 |

$ |

17.50 |

$ |

18.00 |

$ |

17.04 |

$ |

16.95 |

$ |

18.72 |

|||||||||||||||||

|

Income from investment operations: |