| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-228697-04 | ||

March 10, 2020

|

|

|

|

FREE WRITING PROSPECTUS

STRUCTURAL AND COLLATERAL TERM SHEET

$857,656,810

(Approximate Initial Mortgage Pool Balance)

$[_______]

(Approximate Offered Certificate Balance)

|

CF 2020-CF4 |

CCRE Commercial Mortgage Securities, L.P.

Depositor

Cantor Commercial Real Estate Lending, L.P.

KeyBank National Association

Societe Generale Financial Corporation

Starwood Mortgage Capital LLC

German American Capital Corporation

Sponsors and Mortgage Loan Sellers

| Cantor Fitzgerald & Co. | KeyBanc Capital Markets | Société Générale | Deutsche Bank Securities |

| Joint Bookrunning Managers and Co-Lead Managers | |||

| CastleOak Securities, L.P. | Drexel Hamilton | ||

| Co-Managers | |||

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com.

The securities offered by this structural and collateral term sheet (this “Term Sheet”) are described in greater detail in the preliminary prospectus included as part of our Registration Statement (SEC File No. 333-228697) (the “Preliminary Prospectus”) anticipated to be dated March [__] 2020. The Preliminary Prospectus contains material information that is not contained in this Term Sheet (including without limitation a detailed discussion of risks associated with an investment in the offered securities under the heading “Risk Factors” in the Preliminary Prospectus). The Preliminary Prospectus is available upon request from Cantor Fitzgerald & Co., Deutsche Bank Securities Inc., KeyBanc Capital Markets Inc., SG Americas Securities, LLC, CastleOak Securities, L.P. and Drexel Hamilton, LLC. This Term Sheet is subject to change.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

THE INFORMATION IN THIS PROSPECTUS IS PRELIMINARY AND MAY BE SUPPLEMENTED OR AMENDED PRIOR TO THE TIME OF SALE. IN ADDITION, THE OFFERED CERTIFICATES REFERRED TO IN THIS PROSPECTUS, AND THE ASSET POOL BACKING THEM, ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF OFFERED CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED) AT ANY TIME PRIOR TO ISSUANCE, AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS

The Securities May Not Be a Suitable Investment for You

The securities offered by this Term Sheet are not suitable investments for all investors. In particular, you should not purchase any class of securities unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with that class of securities. For those reasons and for the reasons set forth under the heading “Risk Factors” in the Preliminary Prospectus, the yield to maturity and the aggregate amount and timing of distributions on the offered securities are subject to material variability from period to period and give rise to the potential for significant loss over the life of those securities. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered securities involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the Mortgage Loans and the securities. Potential investors are advised and encouraged to review the Preliminary Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered securities described in this Term Sheet.

This Term Sheet is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this Term Sheet may not pertain to any securities that will actually be sold. The information contained in this Term Sheet may be based on assumptions regarding market conditions and other matters as reflected in this Term Sheet. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this Term Sheet should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this Term Sheet may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this Term Sheet or derivatives thereof (including options). Information contained in this Term Sheet is current as of the date appearing on this Term Sheet only. Information in this Term Sheet regarding the securities and the mortgage loans backing any securities discussed in this Term Sheet supersedes all prior information regarding such securities and mortgage loans. None of Cantor Fitzgerald & Co., Deutsche Bank Securities Inc., KeyBanc Capital Markets Inc., SG Americas Securities, LLC, CastleOak Securities, L.P. or Drexel Hamilton, LLC provides accounting, tax or legal advice.

The issuing entity will be relying upon an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—Other Risks Relating to the Certificates—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in the Preliminary Prospectus). See also “Legal Investment” in the Preliminary Prospectus.

Capitalized terms used but not otherwise defined in this Term Sheet have the respective meanings assigned to those terms in the Preliminary Prospectus.

2

CF 2020-CF4 Mortgage Trust

|

| TRANSACTION HIGHLIGHTS |

| Mortgage Loan Sellers | Number of Mortgage Loans | Number of Mortgaged Properties | Aggregate Cut-off Date Balance | % of Outstanding Pool Balance | ||||||||

| Cantor Commercial Real Estate Lending, L.P(1) | 12 | 13 | $216,103,686 | 25.2 | % | |||||||

| KeyBank National Association | 18 | 29 | 189,465,000 | 22.1 | ||||||||

| Societe Generale Financial Corporation | 8 | 11 | 176,500,624 | 20.6 | ||||||||

| Starwood Mortgage Capital LLC | 9 | 16 | 150,500,000 | 17.5 | ||||||||

| German American Capital Corporation | 3 | 3 | 85,087,500 | 9.9 | ||||||||

| Cantor Commercial Real Estate Lending, L.P and KeyBank National Association | 1 | 27 | 40,000,000 | 4.7 | ||||||||

| Total: | 51 | 99 | $857,656,810 | 100.0 | % | |||||||

| (1) | One of the mortgage loans being sold into the CF 2020-CF4 Mortgage Trust by CCRE have been or will be purchased by CCRE or an affiliate prior to the closing date for this securitization transaction from Deutsche Bank AG, acting through its New York Branch (“DBNY”) or its affiliate. One of the mortgage loans was co-originated by Citi Real Estate Funding Inc., Barclays Capital Real Estate Inc., BMO Harris Bank N.A., and Goldman Sachs Bank USA. One of the mortgage loans was originated by Citi Real Estate Funding Inc. and Barclays Capital Real Estate Inc. |

Mortgage Pool Characteristics: | |

| Initial Outstanding Pool Balance(1): | $857,656,810 |

| Number of Mortgage Loans: | 51 |

| Number of Mortgaged Properties: | 99 |

| Average Mortgage Loan Cut-off Date Balance: | $16,816,800 |

| Average Mortgaged Property Cut-off Date Balance: | $8,663,200 |

| Weighted Average Mortgage Rate: | 3.6546% |

| Weighted Average Mortgage Loan Original Term to Maturity or ARD (months): | 113 |

| Weighted Average Mortgage Loan Remaining Term to Maturity or ARD (months): | 112 |

| Weighted Average Mortgage Loan Seasoning (months): | 1 |

| % of Mortgage Loans Secured by Properties Leased to a Single Tenant: | 3.9% |

Credit Statistics(2): |

|

| Weighted Average Mortgage Loan U/W NCF DSCR: | 2.84x |

| Weighted Average Mortgage Loan Cut-off Date LTV(3): | 54.8% |

| Weighted Average Mortgage Loan Maturity Date or ARD LTV(3): | 51.3% |

| Weighted Average U/W NOI Debt Yield(3): | 11.6% |

Amortization Overview: |

|

| % Mortgage Loans with Amortization through Maturity or ARD: | 17.3% |

| % Mortgage Loans with Interest Only through Maturity or ARD: | 67.9% |

| % Mortgage Loans with Interest Only followed by Amortization through Maturity or ARD: | 14.8% |

| Weighted Average Remaining Amortization Term (months)(4): | 362 |

Property Type Composition: |

|

| % Mortgage Loans with Upfront or Ongoing Tax Reserves: | 71.6% |

| % Mortgage Loans with Upfront or Ongoing Replacement Reserves(5): | 82.7% |

| % Mortgage Loans with Upfront or Ongoing Insurance Reserves: | 40.9% |

| % Mortgage Loans with Upfront or Ongoing TI/LC Reserves(6): | 54.3% |

| % Mortgage Loans with Upfront Engineering Reserves: | 45.8% |

| % Mortgage Loans with Upfront or Ongoing Other Reserves: | 44.7% |

| % Mortgage Loans with In Place Hard Lockboxes: | 33.5% |

| % Mortgage Loans with Cash Traps Triggered at DSCR Levels ≥ 1.00x: | 75.4% |

| % Mortgage Loans with Defeasance Only after a Lockout Period and Prior to an Open Period: | 71.3% |

| % Mortgage Loans with Prepayment Only with a Yield Maintenance Charge after a Lockout Period and Prior to an Open Period: | 24.0% |

| % Mortgage Loans with Prepayment Only with a Yield Maintenance Charge Prior to an Open Period: | 4.7% |

| (1) | Subject to a permitted variance of plus or minus 5.0%. |

| (2) | The LTV, DSCR and Debt Yield calculations include any related Pari Passu Companion Loan(s) and exclude any related Subordinate Companion Loan(s) and/or mezzanine loan(s) unless otherwise specified. |

| (3) | Unless otherwise indicated in the definitions of “Appraised Value”, “Cut-off Date LTV Ratio” or “Maturity Date/ARD LTV Ratio” under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus, the related Cut-off Date LTV Ratio or Maturity Date or ARD LTV Ratio, as applicable, has been calculated using the “as-is” appraised value. However, with respect to three (3) mortgage loans (14.0%), the related Cut-off Date LTV and/or Maturity Date or ARD LTV have been calculated using “as-portfolio” value. With respect to one (1) mortgage loan (4.7%), the related Cut-off Date LTV and/or Maturity Date or ARD LTV have been calculated using “as is value inclusive of development rights” value. With respect to one (1) mortgage loan (4.7%), the related Cut-off Date LTV and/or Maturity Date or ARD LTV have been calculated using “hypothetical as is” value. With respect to one (1) mortgage loan (1.8%), the related Cut-off Date LTV and/or Maturity Date or ARD LTV have been calculated using “as complete” value. With respect to one (1) mortgage loan (1.4%), the related Cut-off Date LTV, Maturity Date or ARD LTV and U/W NOI Debt Yield has been calculated net of a related earnout or holdback reserve. |

| (4) | Excludes mortgage loans which are interest only for the full loan term. |

| (5) | Includes FF&E Reserves. |

| (6) | Represents the percent of the allocated initial outstanding principal balance of retail, office, industrial and mixed use properties only. |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

3

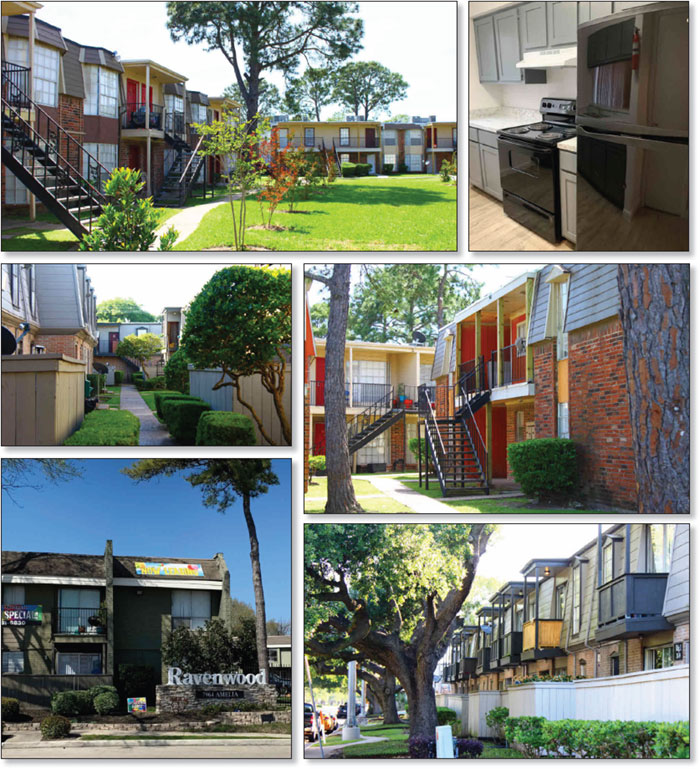

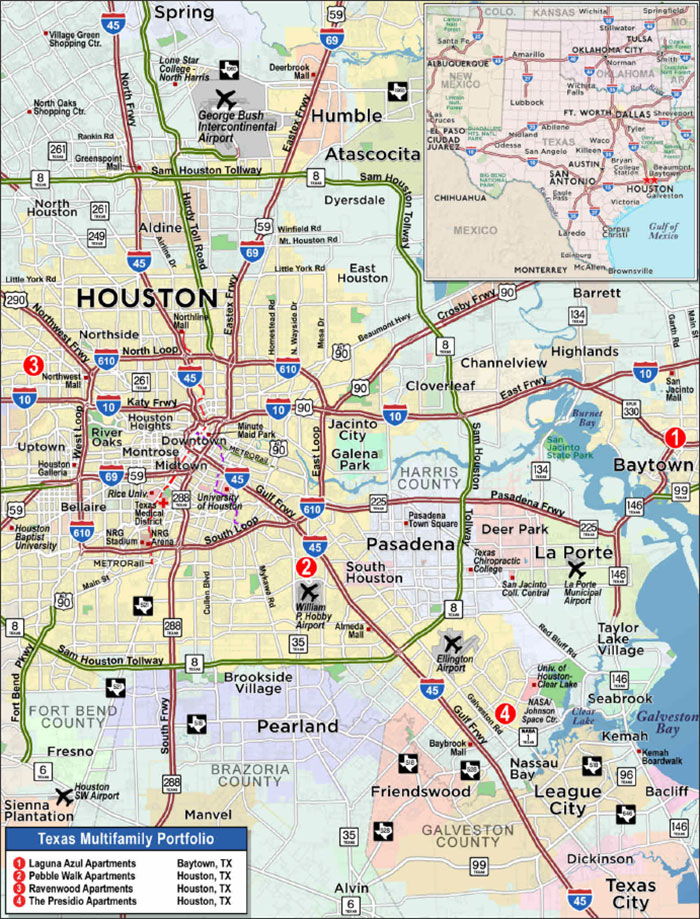

Various Various, TX |

Collateral Asset Summary – Loan No. 1 Texas Multifamily Portfolio |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$53,300,000 64.8% 1.43x 8.8% |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

4

Various Various, TX |

Collateral Asset Summary – Loan No. 1 Texas Multifamily Portfolio |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$53,300,000 64.8% 1.43x 8.8% |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

5

Various Various, TX |

Collateral Asset Summary – Loan No. 1 Texas Multifamily Portfolio |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$53,300,000 64.8% 1.43x 8.8% |

| Mortgage Loan Information | |

| Loan Seller: | SMC |

| Loan Purpose: | Refinance |

| Borrower Sponsor: | Gary W. Gates, Jr. |

| Borrowers: | APTRW, LLC; APTLA, LLC; |

| APTPW, LLC; APTTP, LLC | |

| Original Balance: | $53,300,000 |

| Cut-off Date Balance: | $53,300,000 |

| % by Initial UPB: | 6.2% |

| Interest Rate: | 4.0300% |

| Payment Date: | 6th of each month |

| First Payment Date: | April 6, 2020 |

| Maturity Date: | March 6, 2030 |

| Amortization: | Amortizing Balloon |

| Additional Debt: | None |

| Call Protection: | LO(24);YM1(92);O(4) |

| Lockbox / Cash Management: | Springing Soft / Springing |

| Reserves(1) | ||

| Initial | Monthly | |

| Taxes: | $351,713 | $117,238 |

| Insurance: | $69,172 | $18,339 |

| Replacement: | $0 | $25,900 |

| Deferred Maintenance: | $1,123,550 | $0 |

| Financial Information | |||

| Cut-off Date Balance / Unit: | $51,448 | ||

| Balloon Balance / Unit: | $40,913 | ||

| Cut-off Date LTV(2): | 64.8% | ||

| Balloon LTV(2): | 51.5% | ||

| Underwritten NOI DSCR: | 1.54x | ||

| Underwritten NCF DSCR: | 1.43x | ||

| Underwritten NOI Debt Yield: | 8.8% | ||

| Underwritten NCF Debt Yield: | 8.2% | ||

| Property Information | |

| Single Asset / Portfolio: | Portfolio of 4 properties |

| Property Type: | Multifamily - Garden |

| Collateral: | Fee Simple |

| Location: | Various, TX |

| Year Built / Renovated: | Various / Various |

| Total Units: | 1,036 |

| Property Management: | Gatesco, Inc. |

| Underwritten NOI: | $4,705,572 |

| Underwritten NCF: | $4,394,772 |

| Appraised Value(2): | $82,250,000 |

| Appraisal Date: | February 14, 2020 |

| Historical NOI | |

| Most Recent NOI: | $4,779,398 (December 31, 2019) |

| 2018 NOI(3): | $3,172,745 (December 31, 2018) |

| 2017 NOI(3): | $2,616,958 (December 31, 2017) |

| 2016 NOI(3): | $2,253,997 (December 31, 2016) |

| Historical Occupancy | |

| Most Recent Occupancy: | 91.5% (January 31, 2020) |

| 2018 Occupancy: | 91.6% (December 31, 2018 |

| 2017 Occupancy(4): | 87.6% (December 31, 2017) |

| 2016 Occupancy(4): | 91.2% (December 31, 2016) |

| (1) | See “Initial Reserves and Ongoing Reserves” below. |

| (2) | The “as-is portfolio” Appraised Value of $82.25 million for the Texas Multifamily Portfolio Properties (as defined below) as a whole reflects a 3.0% premium to the aggregate appraised value of the individual properties. The aggregate “as-is” appraised value for the individual properties as of February 14, 2020 is $79.8 million, which results in a Cut-off Date LTV of 66.8% and a Balloon LTV of 53.1%. |

| (3) | The Ravenwood Apartments property was acquired by the borrower sponsor in October 2018 and therefore full year operating history for 2017 and 2018 is not available. The 2018 NOI includes three months of operations from the Ravenwood Apartments property. Additionally, the Laguna Azul Apartments property was acquired by the borrower sponsor in May 2017 and therefore full year operating history for 2017 is not available. The 2017 NOI includes eight months of operations from the Laguna Azul Apartments property. The 2016 NOI includes operations from The Presidio Apartments and Pebble Walk Apartments properties only. |

| (4) | The Ravenwood Apartments property was acquired by the borrower sponsor in October 2018. The Laguna Azul Apartments property was acquired by the borrower sponsor in May 2017. Therefore 2017 Occupancy is based on the weighted average occupancies of The Presidio Apartments, Pebble Walk Apartments and Laguna Azul Apartments properties, while 2016 Occupancy is based on the weighted average occupancies of The Presidio Apartments and Pebble Walk Apartments properties. |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

6

Various Various, TX |

Collateral Asset Summary – Loan No. 1 Texas Multifamily Portfolio |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$53,300,000 64.8% 1.43x 8.8% |

The Loan. The Texas Multifamily Portfolio mortgage loan (the “Texas Multifamily Portfolio Loan”) is a fixed rate loan secured by the borrowers’ fee simple interest in four multifamily properties located in Houston and Baytown, Texas (collectively the “Texas Multifamily Portfolio Properties”) with an original and Cut-off Date principal balance of $53.3 million. The Texas Multifamily Portfolio Loan is structured with a 10-year term and amortizes on a 30-year amortization schedule. The Texas Multifamily Portfolio Loan accrues interest at a fixed rate equal to 4.0300%.

Loan proceeds were used to retire existing debt of approximately $48.6 million on the Texas Multifamily Portfolio Properties, pay closing costs, fund reserves and return approximately $2.7 million of equity to the borrower sponsors. Based on the “as-is portfolio” appraised value of approximately $82.3 million as of February 14, 2020, the Cut-off Date LTV is 64.8%.

| Sources and Uses | ||||||

| Sources | Proceeds | % of Total | Uses | Proceeds | % of Total | |

| Mortgage Loan Amount | $53,300,000 | 100.0% | Loan Payoff | $48,644,607 | 91.3% | |

| Return of Equity | 2,746,827 | 5.2 | ||||

| Upfront Reserves | 1,544,435 | 2.9 | ||||

| Closing Costs | 364,132 | 0.7 | ||||

| Total Sources | $53,300,000 | 100.0% | Total Uses | $53,300,000 | 100.0% | |

The Borrowers / Borrower Sponsor. The borrowers are APTRW, LLC, APTLA, LLC, APTPW, LLC, APTTP, LLC (together, the “Texas Multifamily Portfolio Borrowers”), each a Texas limited liability company structured to be bankruptcy-remote with two independent directors at the managing member level.

The borrower sponsor and nonrecourse carve-out guarantor for the Texas Multifamily Portfolio Loan is Gary W. Gates, Jr. The borrower sponsor has more than 35 years of commercial real estate experience in the management of multifamily properties throughout Texas. Mr. Gates currently owns and manages 32 multifamily properties totaling 7,489 units throughout the greater Houston area. The borrower sponsor acquired the Texas Multifamily Portfolio Properties between 1999 and 2018, and has a total cost basis of approximately $65.7 million.

The Properties. The Texas Multifamily Portfolio Properties are comprised of four multifamily properties located in Houston and Baytown, Texas, collectively totaling 1,036 units with a weighted average occupancy of 91.5% as of January 31, 2020.

The following table presents detailed information with respect to each of the Texas Multifamily Portfolio Properties.

| Texas Multifamily Portfolio Properties Summary | |||||||||

| Property Name / Location | Property

Type |

Year

Built/ Renovated |

Units | Occupancy(1) | Allocated Loan Amount (“ALA”)(2) | %

of ALA |

Appraised Value(3) | UW NOI | % of UW NOI |

| The

Presidio Apartments 16201 El Camino Real Houston, TX |

Multifamily | 1967 / 2018 | 313 | 95.2% | $18,968,922 | 35.6% | $28,400,000 | $1,499,265 | 31.9% |

| Ravenwood

Apartments 7964 Amelia Road Houston, TX |

Multifamily | 1969 / 2019 | 236 | 87.7% | $15,428,947 | 28.9% | $23,100,000 | $1,411,810 | 30.0% |

| Laguna

Azul Apartments 1200 Northwood Street Baytown, TX |

Multifamily | 1976 / 2018 | 259 | 87.6% | $10,018,797 | 18.8% | $15,000,000 | $887,831 | 18.9% |

| Pebble

Walk Apartments 8500 Broadway Street Houston, TX |

Multifamily | 1974 / 2018 | 228 | 94.7% | $8,883,333 | 16.7% | $13,300,000 | $906,668 | 19.3% |

| Total / Wtd. Avg. | 1,036 | 91.5% | $53,300,000 | 100.0% | $79,800,000 | $4,705,572 | 100.0% | ||

| Total Portfolio Premium | $82,250,000 | ||||||||

| (1) | Based on the borrowers’ rent rolls dated January 31, 2020. |

| (2) | Allocated Loan Amounts are based on appraised values. The Texas Multifamily Portfolio Loan documents do not permit partial releases. |

| (3) | The “as-is portfolio” Appraised Value of $82.25 million for the Texas Multifamily Portfolio Properties as a whole reflects a 3.1% premium to the aggregate appraised value of the individual properties. The aggregate “as-is” appraised value for the individual properties as of February 14, 2020 is $79.8 million. |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

7

Various Various, TX |

Collateral Asset Summary – Loan No. 1 Texas Multifamily Portfolio |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$53,300,000 64.8% 1.43x 8.8% |

The Presidio Apartments (313 Units, 35.6% ALA). The Presidio Apartments property is comprised of 313 units (153 one-bedroom, 117 two-bedroom and 43 three-bedroom units). The 8.54-acre parcel is improved with 24 two-story apartment buildings. The improvements are of wood-frame construction with brick veneer and wood siding exteriors. The Presidio Apartments property features one, two and three-bedroom layouts ranging in size from 490 to 1,754 sq. ft. Asking rents range from $700 to $1,555 per month with an average asking rent of $945 and an average unit size of 879 sq. ft. Community amenities include a club house, pool, playground and on-site laundry. Unit features include high speed internet access, washer/dryer hookups, tub/shower, walk-in closets and balconies. The borrower sponsor acquired The Presidio Apartments property in December 2015 for a purchase price of approximately $14.5 million. Since January 2018, the borrower sponsor has spent approximately $1.6 million on capital improvements, which included unit upgrades, roof replacement, plumbing and electrical repairs, new HVAC units, exterior siding replacement and fresh paint, porch repairs, new appliances and ceramic tile.

The following table presents detailed information with respect to the units at The Presidio Apartments property:

| The Presidio Apartments Summary | ||||||||

| Unit Type | No. of Units(1) | % of Total | Average Unit Size (Sq. Ft.)(1) | Average Monthly Rental Rate(1) | Average Monthly Rental Rate per Sq. Ft.(1) |

Average Monthly Market Rental Rate(2) | Average Monthly Market Rental Rate per Sq. Ft.(2) | |

| 1 BR / 1 BA | 14 | 4.5 | % | 490 | $673 | $1.37 | $700 | $1.43 |

| 1 BR / 1 BA | 43 | 13.7 | 575 | $705 | $1.23 | $730 | $1.27 | |

| 1 BR / 1 BA | 16 | 5.1 | 630 | $743 | $1.18 | $765 | $1.21 | |

| 1 BR / 1 BA | 30 | 9.6 | 650 | $749 | $1.15 | $775 | $1.19 | |

| 1 BR / 1 BA | 47 | 15.0 | 675 | $762 | $1.13 | $790 | $1.17 | |

| 1 BR / 1 BA | 3 | 1.0 | 720 | $778 | $1.08 | $865 | $1.20 | |

| 2 BR / 1 BA | 3 | 1.0 | 730 | $860 | $1.18 | $875 | $1.20 | |

| 2 BR / 1 BA | 19 | 6.1 | 775 | $833 | $1.07 | $890 | $1.15 | |

| 2 BR / 1 BA | 2 | 0.6 | 800 | $895 | $1.12 | $910 | $1.14 | |

| 2 BR / 1 BA | 8 | 2.6 | 880 | $887 | $1.01 | $915 | $1.04 | |

| 2 BR / 1 BA | 8 | 2.6 | 905 | $887 | $0.98 | $925 | $1.02 | |

| 2 BR / 1 BA | 8 | 2.6 | 920 | $903 | $0.98 | $925 | $1.01 | |

| 2 BR / 1 BA Townhouse | 2 | 0.6 | 1,024 | $1,078 | $1.05 | $1,085 | $1.06 | |

| 2 BR / 1 BA Townhouse | 15 | 4.8 | 1,088 | $1,032 | $0.95 | $1,085 | $1.00 | |

| 2 BR / 1 BA Townhouse | 17 | 5.4 | 1,134 | $1,066 | $0.94 | $1,115 | $0.98 | |

| 2 BR / 1 BA Townhouse | 3 | 1.0 | 1,137 | $1,049 | $0.92 | $1,115 | $0.98 | |

| 2 BR / 1 BA Townhouse | 8 | 2.6 | 1,332 | $1,148 | $0.86 | $1,265 | $0.95 | |

| 2 BR / 2 BA | 24 | 7.7 | 1,060 | $1,032 | $0.97 | $1,070 | $1.01 | |

| 3 BR / 2 BA | 14 | 4.5 | 1,290 | $1,185 | $0.92 | $1,245 | $0.97 | |

| 3 BR / 2 BA | 2 | 0.6 | 1,402 | $1,215 | $0.87 | $1,315 | $0.94 | |

| 3 BR / 2.5 BA Townhouse | 2 | 0.6 | 1,425 | $1,348 | $0.95 | $1,415 | $0.99 | |

| 3 BR / 2.5 BA Townhouse | 4 | 1.3 | 1,444 | $1,242 | $0.86 | $1,415 | $0.98 | |

| 3 BR / 2.5 BA Townhouse | 2 | 0.6 | 1,480 | $1,263 | $0.85 | $1,440 | $0.97 | |

| 3 BR / 2.5 BA Townhouse | 4 | 1.3 | 1,532 | $1,371 | $0.90 | $1,450 | $0.95 | |

| 3 BR / 2.5 BA Townhouse | 8 | 2.6 | 1,554 | $1,329 | $0.86 | $1,465 | $0.94 | |

| 3 BR / 2.5 BA Townhouse | 3 | 1.0 | 1,596 | $1,345 | $0.84 | $1,490 | $0.93 | |

| 3 BR / 2.5 BA Townhouse | 2 | 0.6 | 1,675 | $1,255 | $0.75 | $1,490 | $0.89 | |

| 3 BR / 2.5 BA Townhouse | 2 | 0.6 | 1,754 | $1,408 | $0.80 | $1,555 | $0.89 | |

| Total/Wtd. Avg. | 313 | 100.0 | % | 879 | $899 | $1.07 | $945 | $1.12 |

| (1) | Based on the borrower rent rolls dated January 31, 2020. |

| (2) | Based on the appraisal. |

Ravenwood Apartments (236 Units, 28.9% ALA). The Ravenwood Apartments property is comprised of 236 units (40 one-bedroom, 156 two-bedroom and 40 three-bedroom units). The 13.47-acre parcel is improved with 33 two-story apartment buildings. The improvements are constructed with brick masonry. The Presidio Apartments property features one, two and three-bedroom layouts ranging in size from 740 to 1,215 sq. ft. Asking rents range from $800 to $1,200 per month with an average asking rent of $941 and an average unit size of 1,126 sq. ft. Community amenities include a playground, free wi-fi areas and on-site laundry. Unit features include high speed internet access, washer/dryer hookups, tub/shower, walk-in closets and balconies. The borrower sponsor acquired the Ravenwood Apartments property in October 2018 for a purchase price of approximately $21.9 million. Since October 2018, the borrower sponsor has spent

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

8

Various Various, TX |

Collateral Asset Summary – Loan No. 1 Texas Multifamily Portfolio |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$53,300,000 64.8% 1.43x 8.8% |

approximately $971,007 on capital improvements, which included unit upgrades, roof replacement, plumbing and electrical repairs, new appliances and ceramic tile.

The following table presents detailed information with respect to the units at Ravenwood Apartments property:

| Ravenwood Apartments Summary | |||||||

| Unit Type | No. of Units(1) | % of Total | Average Unit Size (Sq. Ft.)(1) | Average Monthly Rental Rate(1) | Average Monthly Rental Rate per Sq. Ft.(1) | Average Monthly Market Rental Rate(2) | Average Monthly Market Rental Rate per Sq. Ft.(2) |

| 1 BR / 1 BA | 40 | 16.9% | 740 | $749 | $1.01 | $775 | $1.05 |

| 2 BR / 2 BA | 140 | 59.3 | 1,200 | $953 | $0.79 | $960 | $0.80 |

| 2 BR / 2.5 BA Townhouse | 16 | 6.8 | 1,215 | $996 | $0.82 | $1,000 | $0.82 |

| 3 BR / 2 BA | 40 | 16.9 | 1,215 | $1,038 | $0.85 | $1,070 | $0.88 |

| Total/Wtd. Avg. | 236 | 100.0% | 1,126 | $936 | $0.84 | $950 | $0.86 |

| (1) | Based on the borrower rent rolls dated January 31, 2020. |

| (2) | Based on the appraisal. |

Laguna Azul Apartments (259 Units, 18.8% ALA). The Laguna Azul Apartments property is comprised of 259 units (103 one-bedroom, 125 two-bedroom and 31 three-bedroom units). The 20.21-acre parcel is improved with 30 two-story apartment buildings. The improvements are of wood-frame construction with brick veneer and wood siding exteriors. The Laguna Azul Apartments property features one, two and three-bedroom layouts ranging in size from 564 to 1,328 sq. ft. Asking rents range from $500 to $875 per month with an average asking rent of $653 and an average unit size of 916 sq. ft. Community amenities include a playground, pool, volleyball court, clubhouse and on-site laundry. Unit features include high speed internet access, washer/dryer hookups, tub/shower, fireplace, walk-in closets and balconies. The borrower sponsor acquired the Laguna Azul Apartments property in May 2017 for a purchase price of approximately $11.6 million. Since January 2018, the borrower sponsor has spent approximately $3.2 million on capital improvements, which included unit upgrades, roof replacement, plumbing and electrical repairs, new HVAC units, exterior siding replacement and fresh paint, porch repairs, new appliances and ceramic tile.

The following table presents detailed information with respect to the units at Laguna Azul Apartments property:

| Laguna Azul Apartments Summary | |||||||

| Unit Type | No. of Units(1) | % of Total | Average Unit Size (Sq. Ft.)(1) | Average Monthly Rental Rate(1) | Average Monthly Rental Rate per Sq. Ft.(1) | Average Monthly Market Rental Rate(2) | Average Monthly Market Rental Rate per Sq. Ft.(2) |

| 1 BR / 1 BA | 6 | 2.3% | 564 | $505 | $0.90 | $500 | $0.89 |

| 1 BR / 1 BA | 97 | 37.5 | 690 | $504 | $0.73 | $535 | $0.78 |

| 2 BR / 1 BA | 15 | 5.8 | 798 | $614 | $0.77 | $625 | $0.78 |

| 2 BR / 1.5 BA | 86 | 33.2 | 1,026 | $652 | $0.64 | $700 | $0.68 |

| 2 BR / 2 BA | 24 | 9.3 | 1,078 | $665 | $0.62 | $750 | $0.70 |

| 3 BR / 2 BA | 10 | 3.9 | 1,301 | $764 | $0.59 | $825 | $0.63 |

| 3 BR / 2.5 BA Townhouse | 21 | 8.1 | 1,328 | $790 | $0.60 | $875 | $0.66 |

| Total/Wtd. Avg. | 259 | 100.0% | 916 | $608 | $0.68 | $653 | $0.73 |

| (1) | Based on the borrower rent rolls dated January 31, 2020. |

| (2) | Based on the appraisal. |

Pebble Walk Apartments (228 Units, 16.7% ALA). The Pebble Walk Apartments property is comprised of 228 units (144 one-bedroom and 84 two-bedroom units). The 6.05-acre parcel is improved with 19 two-story apartment buildings. The improvements are of wood-frame construction. The Pebble Walk Apartments property features one and two-bedroom layouts ranging in size from 543 to 912 sq. ft. Asking rents range from $500 to $700 per month with an average asking rent of $602 and an average unit size of 714 sq. ft. Community amenities include a playground, free wi-fi areas and on-site laundry. Unit features include high speed internet access, washer/dryer hookups, tub/shower, walk-in closets and balconies. The borrower sponsor acquired the Pebble Walk Apartments property in February 1999 for a purchase price of approximately $3.0 million. Since January 2018, the borrower sponsor has spent approximately $896,644 on capital improvements, which included unit upgrades, roof replacement, plumbing and electrical repairs, new HVAC units, exterior siding replacement and fresh paint, porch repairs, new appliances and ceramic tile.

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

9

Various Various, TX |

Collateral Asset Summary – Loan No. 1 Texas Multifamily Portfolio |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$53,300,000 64.8% 1.43x 8.8% |

The following table presents detailed information with respect to the units at Pebble Walk Apartments property:

| Pebble Walk Apartments Summary | |||||||

| Unit Type | No. of Units(1) | % of Total | Average Unit Size (Sq. Ft.)(1) | Average Monthly Rental Rate(1) | Average Monthly Rental Rate per Sq. Ft.(1) | Average Monthly Market Rental Rate(2) | Average Monthly Market Rental Rate per Sq. Ft.(2) |

| 1 BR / 1 BA | 64 | 28.1% | 543 | $547 | $1.01 | $565 | $1.04 |

| 1 BR / 1 BA | 40 | 17.5 | 630 | $562 | $0.89 | $585 | $0.93 |

| 1 BR / 1 BA | 40 | 17.5 | 655 | $564 | $0.86 | $585 | $0.89 |

| 2 BR / 1 BA | 84 | 36.8 | 912 | $695 | $0.76 | $725 | $0.79 |

| Total/Wtd. Avg. | 228 | 100.0% | 714 | $607 | $0.87 | $631 | $0.90 |

| (1) | Based on the borrower rent rolls dated January 31, 2020. |

| (2) | Based on the appraisal. |

Environmental Matters. According to the Phase I environmental reports, dated February 26, 2020 and February 27, 2020, there were no recognized environmental conditions or recommendations for further action at the Texas Multifamily Portfolio Properties.

The Markets. The Presidio Apartments property is located at 16201 El Camino Real, approximately 24 miles south of downtown Houston. According to the appraisal, The Presidio Apartments property is located in the Clear Lake/Webster/League City multifamily submarket. The Presidio Apartments property is located near Loop 610 which provides access to the Texas Medical Center and Houston central business district (“CBD”) (approximately a 20 minute drive), as well as the Galleria/Uptown area (approximately a 40 minute drive), Houston’s three largest employment centers. The Presidio Apartments property is also approximately 15 miles from Hobby Airport, Houston’s regional airport and home of the local operations for Southwest Airlines. According to the appraisal, the Clear Lake/Webster/League City multifamily submarket has a vacancy rate of 8.9% and average asking rents of $1,085 per unit as of February 2020. Within a one-, three- and five-mile radius of the of The Presidio Apartments property, the estimated 2019 population is 16,768, 77,249 and 172,670, respectively. Within the same radii, the estimated 2019 average household income is $75,466, $97,251 and $104,788, respectively.

The Ravenwood Apartments property is located at 7964 Amelia Road, approximately 12 miles northwest of downtown Houston. According to the appraisal, the Ravenwood Apartments property is located in the Memorial/Spring Branch multifamily submarket. The Ravenwood Apartments property is located just north of Interstate 10 and near the Loop 610. According to the appraisal, the Memorial/Spring Branch multifamily submarket has a vacancy rate of 11.5% and average asking rents of $998 per unit as of February 2020. Within a one-, three- and five-mile radius of the of the Ravenwood Apartments property, the estimated 2019 population is 22,211, 144,402 and 376,953, respectively. Within the same radii, the estimated 2019 average household income is $60,409, $89,329 and $108,885, respectively.

The Laguna Azul Apartments property is located at 1200 Northwood Street, approximately 26 miles east of downtown Houston. According to the appraisal, the Laguna Azul Apartments property is located in the Baytown multifamily submarket. Baytown is home to several of ExxonMobil’s integrated sites, including the Baytown Refinery, Baytown Chemical Plant and Americas Area Engineering Office. The ExxonMobil Baytown Area is the largest petroleum and petrochemical complex in the United States. Additionally, the Laguna Azul Apartments property is located just south of Interstate 10 and approximately two minutes from Houston Methodist Baytown Hospital. According to the appraisal, the Baytown multifamily submarket has a vacancy rate of 11.3% and average asking rents of $891 per unit as of February 2020. Within a one-, three- and five-mile radius of the of the Laguna Azul Apartments property, the estimated 2019 population is 10,469, 65,616 and 96,767, respectively. Within the same radii, the estimated 2019 average household income is $49,153, $63,262 and $72,250, respectively.

The Pebble Walk Apartments property is located at 8500 Broadway Street, approximately 10 miles south of downtown Houston. According to the appraisal, the Pebble Walk Apartments property is located in the U of H/I-45 South multifamily submarket. The Pebble Walk Apartments property is located near Loop 610 which provides access to the Texas Medical Center (approximately a 10 minute drive), the Houston CBD (approximately a 15 minute drive) and the Galleria/Uptown area (approximately a 20 minute drive), Houston’s three largest employment centers. Pebble Walk is also a five-minute drive from Hobby Airport, Houston’s regional airport and home of the local operations for Southwest Airlines. According to the appraisal, the U of H/I-45 South multifamily submarket has a vacancy rate of 9.9% and average asking rents of $765 per unit as of February 2020. Within a one-, three- and five-mile radius of the of the Pebble Walk Apartments property, the estimated 2019 population is 23,235, 126,580 and 335,045, respectively. Within the same radii, the estimated 2019 average household income is $50,300, $52,952 and $53,133, respectively.

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

10

Various Various, TX |

Collateral Asset Summary – Loan No. 1 Texas Multifamily Portfolio |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$53,300,000 64.8% 1.43x 8.8% |

Cash Flow Analysis.

| Cash Flow Analysis | |||||||

| 2016(1) | 2017(1) | 2018(1) | 2019 | U/W | U/W per Unit | ||

| Base Rent | $4,105,596 | $5,120,642 | $6,549,287 | $8,685,819 | $8,685,819 | $8,384 | |

| Value of Vacant Space | 0 | 0 | 0 | 0 | 838,490 | $809 | |

| Gross Potential Rent | $4,105,596 | $5,120,642 | $6,549,287 | $8,685,819 | $9,524,309 | $9,193 | |

| Total Recoveries | 0 | 0 | 0 | 0 | 0 | $0 | |

| Other Income | 123,166 | 150,013 | 164,531 | 258,877 | 258,877 | $250 | |

| Less: Vacancy | 0 | 0 | 0 | 0 | (838,490) | ($809) | |

| Effective Gross Income | $4,228,763 | $5,270,655 | $6,713,817 | 8,944,696 | $8,944,696 | $8,634 | |

| Total Operating Expenses | 1,974,765 | 2,653,697 | 3,541,072 | 4,165,298 | 4,239,124 | $4,092 | |

| Net Operating Income | $2,253,997 | $2,616,958 | $3,172,745 | $4,779,398 | $4,705,572 | $4,542 | |

| TI/LC | 0 | 0 | 0 | 0 | 0 | $0 | |

| Capital Expenditures | 0 | 0 | 0 | 0 | 310,800 | $300 | |

| Net Cash Flow | $2,253,997 | $2,616,958 | $3,172,745 | $4,779,398 | $4,394,772 | $4,242 | |

| (1) | The Ravenwood Apartments property was acquired by the borrower sponsor in October 2018 and therefore full year operating history for 2017 and 2018 is not available. The 2018 financials includes three months of operations from the Ravenwood Apartments property. Additionally, the Laguna Azul Apartments property was acquired by the borrower sponsor in May 2017 and therefore full year operating history for 2017 is not available. The 2017 financials include eight months of operations from the Laguna Azul Apartments property. The 2016 financials include operations from The Presidio Apartments and Pebble Walk Apartments properties only. |

Property Management. The Texas Multifamily Portfolio Properties are managed by Gatesco, Inc., an affiliate of the Texas Multifamily Portfolio Borrowers.

Lockbox / Cash Management. The Texas Multifamily Portfolio Loan documents require a springing soft lockbox with springing cash management upon the occurrence of a Trigger Event (as defined below). After the occurrence of a Trigger Event, the Texas Multifamily Portfolio Borrowers are required to establish a lockbox account and the Texas Multifamily Portfolio Borrowers or property manager, as applicable, are required to direct tenants to pay all rents directly into the lockbox account within one business day. Upon the occurrence and during the continuance of a Trigger Event, all funds in the lockbox account are required to be swept daily to a cash management account under the control of the lender.

A “Trigger Event” will be in effect upon:

| (i) | the occurrence and continuance of an event of default under the Texas Multifamily Portfolio Loan until cured; or |

| (ii) | the date on which the debt service coverage ratio based on the trailing 12-month period is less than 1.15x until the date that the debt service coverage ratio based on the trailing 12-month period is at least 1.20x for two consecutive calendar quarters. |

Initial Reserves and Ongoing Reserves. At loan origination, the Texas Multifamily Portfolio Borrowers deposited (i) $351,713 for tax reserves, (ii) $69,172 for insurance reserves and (iii) $1,123,550 for deferred maintenance.

Tax Reserve. On a monthly basis, the Texas Multifamily Portfolio Borrowers are required to deposit into a real estate tax reserve, on a monthly basis, 1/12 of the estimated annual real estate taxes (currently estimated to be $117,238).

Insurance Reserve. On a monthly basis, the Texas Multifamily Portfolio Borrowers are required to deposit into an insurance reserve, on a monthly basis, 1/12 of estimated insurance premiums (currently estimated to be $18,339).

Replacement Reserve. On a monthly basis, the Texas Multifamily Portfolio Borrowers are required to deposit $25,900 (approximately $300 per unit per annum) into a replacement reserve account.

Current Mezzanine or Subordinate Indebtedness. None.

Future Mezzanine or Subordinate Indebtedness Permitted. None.

Partial Release. None.

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

11

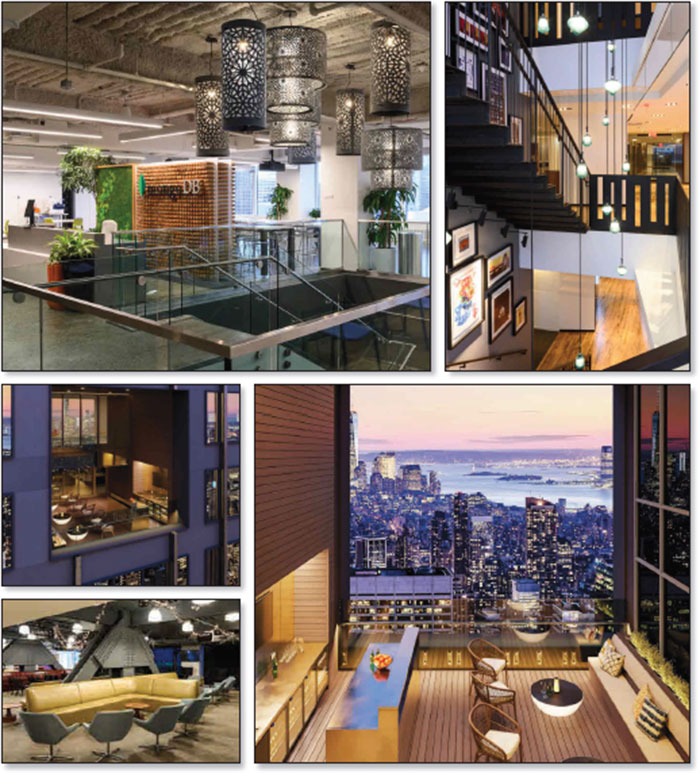

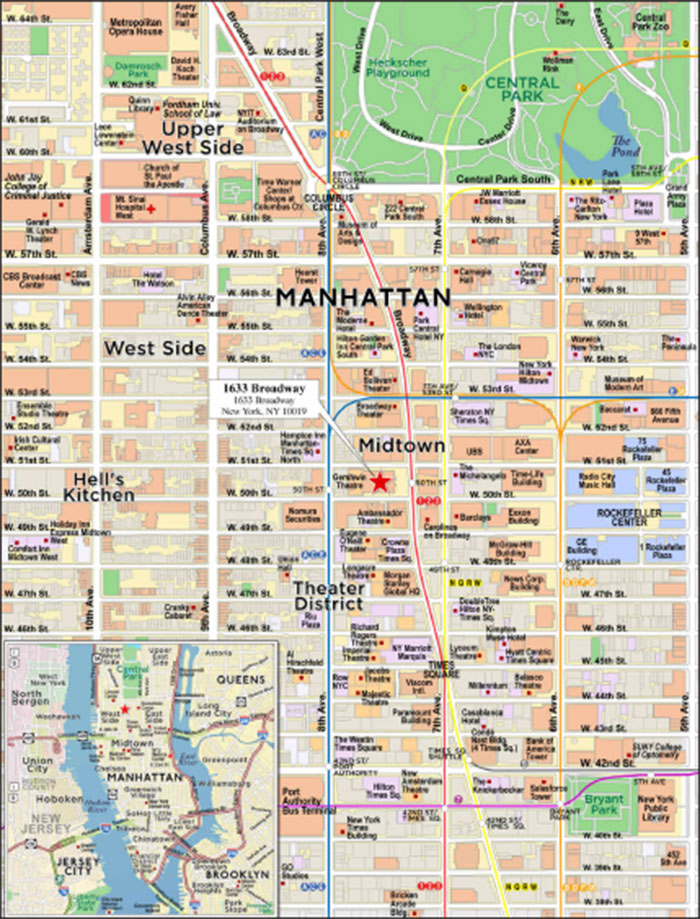

1633 Broadway New York, NY 10019 |

Collateral Asset Summary – Loan No. 2 1633 Broadway |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$45,000,000 41.7% 3.84x 11.9% |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

12

1633 Broadway New York, NY 10019 |

Collateral Asset Summary – Loan No. 2 1633 Broadway |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$45,000,000 41.7% 3.84x 11.9% |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

13

1633 Broadway New York, NY 10019 |

Collateral Asset Summary – Loan No. 2 1633 Broadway |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$45,000,000 41.7% 3.84x 11.9% |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

14

1633 Broadway New York, NY 10019 |

Collateral Asset Summary – Loan No. 2 1633 Broadway |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$45,000,000 41.7% 3.84x 11.9% |

| Mortgage Loan Information | |

| Loan Seller(1): | GACC |

| Loan Purpose: | Refinance |

| Credit Assessment KBRA/Fitch/S&P: | A / BBB-sf / TBD |

| Borrower Sponsor: | Paramount Group Operating Partnership LP |

| Borrowers: | PGREF I 1633 Broadway Tower, L.P.; PGREF I 1633 Broadway Land, L.P. |

| Original Balance(2): | $45,000,000 |

| Cut-off Date Balance(2): | $45,000,000 |

| % by Initial UPB: | 5.2% |

| Interest Rate: | 2.9900% |

| Payment Date: | 6th of each month |

| First Payment Date: | January 6, 2020 |

| Maturity Date: | December 6, 2029 |

| Amortization: | Interest Only |

| Additional Debt(2): | $956,000,000 Pari Passu Debt $249,000,000 Subordinate Debt |

| Call Protection(3): | LO(27);DEF(86);O(7) |

| Lockbox / Cash Management: | Hard / Springing |

| Reserves(4) | ||

| Initial | Monthly | |

| Taxes: | $0 | Springing |

| Insurance: | $0 | Springing |

| Replacement: | $0 | Springing |

| TI/LC: | $0 | Springing |

| Unfunded TI Obligations: | $36,389,727 | $0 |

| Financial Information(2) | ||

| Senior Notes | Whole Loan | |

| Cut-off Date Balance / Sq. Ft.: | $391 | $488 |

| Balloon Balance / Sq. Ft.: | $391 | $488 |

| Cut-off Date LTV: | 41.7% | 52.1% |

| Balloon LTV: | 41.7% | 52.1% |

| Underwritten NOI DSCR: | 3.93x | 3.14x |

| Underwritten NCF DSCR: | 3.84x | 3.08x |

| Underwritten NOI Debt Yield: | 11.9% | 9.5% |

| Underwritten NCF Debt Yield: | 11.7% | 9.3% |

| Property Information | |

| Single Asset / Portfolio: | Single Asset |

| Property Type: | Office - CBD |

| Collateral: | Fee Simple |

| Location: | New York, NY |

| Year Built / Renovated: | 1972 / 2013 |

| Total Sq. Ft.: | 2,561,512 |

| Property Management: | Paramount Group Property-Asset Management LLC |

| Underwritten NOI: | $119,150,163 |

| Underwritten NCF: | $116,677,727 |

| Appraised Value: | $2,400,000,000 |

| Appraisal Date: | October 24, 2019 |

| Historical NOI | |

| Most Recent NOI: | $110,809,315 (T-12 September 30, 2019) |

| 2018 NOI: | $109,098,450 (December 31, 2018) |

| 2017 NOI: | $94,190,007 (December 31, 2017) |

| 2016 NOI: | $93,821,386 (December 31, 2016) |

| Historical Occupancy | |

| Most Recent Occupancy: | 98.4% (October 31, 2019) |

| 2018 Occupancy: | 95.4% (December 31, 2018) |

| 2017 Occupancy: | 95.4% (December 31, 2017) |

| 2016 Occupancy: | 86.3% (December 31, 2016) |

| (1) | The 1633 Broadway Whole Loan (as defined below) was co-originated by DBR Investments Co. Limited (“DBRI”), JPMorgan Chase Bank, National Association (“JPMCB”), Goldman Sachs Bank USA (“GS Bank”), and Wells Fargo Bank, National Association (“WFB”). GACC subsequently acquired from DBRI, and is selling Note A-2-C-4. |

| (2) | The 1633 Broadway Loan (as defined below) consists of the non-controlling Note A-2-C-3-A and A-2-C-7 with an aggregate original principal balance and aggregate outstanding principal balance as of the Cut-off Date of $45.0 million. The 1633 Broadway Loan is part the 1633 Broadway Whole Loan evidenced by 35 senior pari passu notes and four pari passu subordinate notes, with an aggregate outstanding principal balance as of the Cut-off Date of $1.25 billion. For additional information, see “The Loan” herein. |

| (3) | The lockout period will be at least 27 payments beginning with and including January 6, 2020. The borrowers have the option to defease the 1633 Broadway Whole Loan in full after the earlier to occur of (i) two years after the closing date of the securitization that includes the last note to be securitized and (ii) November 25, 2022. |

| (4) | See “Initial Reserves and Ongoing Reserves” herein. |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

15

1633 Broadway New York, NY 10019 |

Collateral Asset Summary – Loan No. 2 1633 Broadway |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$45,000,000 41.7% 3.93x 11.9% |

The Loan. The 1633 Broadway mortgage loan (the “1633 Broadway Loan”) is part of a whole loan (the “1633 Broadway Whole Loan”) consisting of 35 pari passu senior notes with an outstanding aggregate principal balance as of the Cut-off Date of $1,001,000,000 (collectively, the “1633 Broadway Senior Notes”) and four pari passu subordinate notes with an aggregate outstanding principal balance as of the Cut-of Date of $249,000,000 (collectively, the “1633 Broadway Subordinate Notes”). The 1633 Broadway Whole Loan is secured by a first mortgage encumbering the borrowers’ fee simple interest in an office building in New York, New York (the “1633 Broadway Property”). The 1633 Broadway Loan, which is evidenced by the non-controlling Note A-2-C-3-A and Note A-2-C-7 has an aggregate original principal balance and outstanding principal balance as of the Cut-off Date of $45,000,000.

The relationship between the holders of the 1633 Broadway Whole Loan will be governed by a co-lender agreement as described under “Description of the Mortgage Pool—The Whole Loans—The 1633 Broadway Pari Passu-AB Whole Loan” in the Preliminary Prospectus.

| Whole Loan Summary | ||||

| Original Balance | Cut-off Date Balance | Note Holder | Controlling Note | |

| 1633 Broadway Loan | ||||

| Note A-2-C-3-A, Note A-2-C-7 | $45,000,000 | $45,000,000 | CF 2020-CF4 | No |

| 1633 Broadway Pari Passu Senior Notes | ||||

| Note A-1-S-1, Note A-2-S-1, Note A-3-S-1, Note A-4-S-1 | $1,000,000 | $1,000,000 | BWAY 2019-1633 | No |

| Note A-1-C-1, Note A-1-C-5, Note A-2-C-1-A | $110,000,000 | $110,000,000 | CGCMT 2020-GC46 | No(1) |

| Note A-1-C-3, Note A-1-C-4, Note A-1-C-6, Note A-1-C-7 | $122,500,000 | $122,500,000 | GS Bank(2) | No |

| Note A-1-C-2, Note A-2-C-5 | $60,000,000 | $60,000,000 | GSMS 2020-GC45 | No |

| Note A-2-C-1-B, Note A-3-C-1-B | $45,000,000 | $45,000,000 | Benchmark 2020-B16 | No |

| Note A-2-C-3-B, Note A-3-C-2 | $64,650,000 | $64,650,000 | Benchmark 2020-IG1 | No |

| Note A-3-C-5, Note A-3-C-6 | $50,000,000 | $50,000,000 | Benchmark 2020-B17(3) | No |

| Note A-2-C-2, Note A-2-C-4, Note A-2-C-6 | $125,000,000 | $125,000,000 | DBRI(2) | No |

| Note A-3-C-1-A, Note A-3-C-3, Note A-3-C-4, Note A-3-C-7 | $127,850,000 | $137,850,000 | JPMCB(2) | No |

| Note A-4-C-1, Note A-4-C-2 | $100,000,000 | $100,000,000 | BANK 2020-BNK25 | No |

| Note A-4-C-4, Note A-4-C-5 | $70,000,000 | $70,000,000 | WFCM 2020-C55 | No |

| Note A-4-C-3, Note A-4-C-6, Note A-4-C-7 | $80,000,000 | $80,000,000 | WFB(2) | No |

| 1633 Broadway Junior Notes | ||||

| Note B-1, Note B-2, Note B-3 | $249,000,000 | $249,000,000 | BWAY 2019-1633 | Yes(1) |

| 1633 Broadway Whole Loan | $1,250,000,000 | $1,250,000,000 | ||

| (1) | During the continuance of a control appraisal relating to the BWAY 2019-1633 securitization transaction (i.e., when the most senior class of certificates in such transaction have been control appraised out), Note A-1-C-1 will be the controlling note. See “Description of the Mortgage Pool—The Whole Loans—The 1633 Broadway Pari Passu-AB Whole Loan” in the Preliminary Prospectus. |

| (2) | The related notes are currently held by the Note Holder identified in the table above and are expected to be contributed to one or more future securitization transactions. |

| (3) | The Benchmark 2020-B17 transaction is expected to close on or about March 24, 2020. |

The 1633 Broadway Whole Loan has a 10-year interest-only term and accrues interest at a rate of 2.9900% per annum. The 1633 Broadway Whole Loan was primarily used to repay the existing loan, fund upfront reserves, pay closing costs and return approximately $139.9 million to the borrower sponsor. Based on the “As Is” appraised value of $2.4 billion as of October 24, 2019 and the Cut-off Date balance of the 1633 Broadway Senior Notes, the Cut-off Date LTV Ratio is 41.7%.

| Sources and Uses | ||||||

| Sources | Proceeds | % of Total | Uses | Proceeds | % of Total | |

| Senior Notes: | $1,001,000,000 | 80.1% | Refinance Existing Debt | $1,052,884,467 | 84.2% | |

| Subordinate Debt: | 249,000,000 | 19.9 | Return of Equity | 139,885,652 | 11.2 | |

| Upfront Reserves | 36,389,727 | 2.9 | ||||

| Closing Costs | 20,840,154 | 1.7 | ||||

| Total Sources | $1,250,000,000 | 100.0% | Total Uses | $1,250,000,000 | 100.0% | |

The Borrowers / Borrower Sponsor. The borrowers are PGREF I 1633 Broadway Tower, L.P. and PGREF I 1633 Broadway Land, L.P., each a Delaware limited partnership (collectively, the “1633 Broadway Borrowers”). PGREF I 1633 Broadway Land, L.P. owns the 1633 Broadway Property entirely in fee and also ground leases the 1633 Broadway Property to PGREF I 1633 Broadway Tower, L.P. (i.e., both landlord and tenant interests in the ground lease are pledged as collateral, in addition to the fee interest in the 1633 Broadway Property). Legal counsel to the borrowers delivered a non-consolidation opinion in connection with the origination of the 1633 Broadway Whole Loan. There is no non-recourse carveout guarantor or separate environmental indemnitor with respect to the 1633 Broadway Whole Loan.

The borrower sponsor is Paramount Group Operating Partnership LP (the “1633 Broadway Borrower Sponsor”), which indirectly owns and controls the 1633 Broadway Borrowers. Paramount Group, Inc. (NYSE: PGRE), an approximately 91.0% general partner of the borrower sponsor, is a real estate investment trust that currently owns and/or manages a 13.4 million sq. ft. portfolio of 18 Class A office

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

16

1633 Broadway New York, NY 10019 |

Collateral Asset Summary – Loan No. 2 1633 Broadway |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$45,000,000 41.7% 3.93x 11.9% |

and retail buildings in New York, Washington, D.C., and San Francisco. Paramount Group, Inc. has a New York portfolio that includes: 1633 Broadway, 1301 Avenue of the Americas, 1325 Avenue of the Americas, 31 West 52nd Street, 900 Third Avenue, 712 Fifth Avenue, 60 Wall Street, 745 Fifth Avenue, 718 Fifth Avenue, and 0 Bond Street.

The Property. The 1633 Broadway Property is an approximately 2.6 million sq. ft., 48-story office tower that is situated with a full block of Broadway frontage between 50th and 51st Streets in Midtown Manhattan. The 1633 Broadway Property contains views of the Hudson River, Central Park, and Midtown from above the 36th floor. In addition to the office space, the 1633 Broadway Property includes retail space (anchored by Equinox), a parking garage across three levels below grade, two theaters comprising a total of 145,192 sq. ft. (the Gershwin Theatre and Circle in the Square Theatre) and storage space comprising 18,384 sq. ft.

The 1633 Broadway Property is located on a 90,400 sq. ft. parcel comprising the entire western block front of Broadway between West 50th and West 51st Streets within the Westside office submarket of Midtown. The 1633 Broadway Property was constructed in 1972 and was most recently renovated in 2013. Since 2010, the borrower sponsor has invested a total of approximately $41.6 million in lobby renovations, plaza redevelopment, and retail renovations. In addition, the borrower sponsor has invested approximately $230 million in tenant improvements and leasing commissions since 2010. Going forward, the borrower sponsor provided a 10-year renovation budget which totals approximately $55.98 million; the renovation budget is anticipated to be utilized for items including a roof replacement, structural upgrades, fire alarm system upgrades, Gershwin Theatre upgrades, completion of the terrace on the 47th and 48th floors, and development of the Retail Cube. Such renovations are not required by the 1633 Broadway Whole Loan documents, and have not been reserved for. We cannot assure you that such renovation will proceed as expected or at all.

The 1633 Broadway Property comprises 2,561,512 sq. ft. and was 98.4% leased as of October 31, 2019. The 1633 Broadway Property benefits from a strong office component, which is currently 100.0% leased to 17 tenants. The retail space within the 1633 Broadway Property totals approximately 80,000 sq. ft. of net rentable area and is anchored by Equinox (25,458 sq. ft.) through February 2040. Approximately 94.3% of the underwritten rent is from office tenants.

The 1633 Broadway Property features two theatres that comprise 5.7% of the total net rentable area and account for 1.2% of the underwritten rental revenue. The larger of the two theatres is the U. T. Associates of the Gershwin Theatre (“Gershwin Theatre”), which is notable for hosting Wicked since 2003. The Gershwin Theatre contains three, five-year renewal options that could potentially extend the term through May 2042. The 1633 Broadway Property contains an additional theatre known as the Circle in the Square, which comprises approximately 800 seats and 34,570 sq. ft. and currently hosts the show OKLAHOMA! The 1633 Broadway Property also houses the Circle in the Square Theatre School, the only accredited training conservatory associated with a Broadway theatre, which offers two, two-year training programs, in acting and musical theatre. The tenant currently pays a total contract rent of $864,250 or $25.00 PSF through September 2021.

The parking component within the 1633 Broadway Property consists of 250-space parking garage across three levels below grade and comprises 64,158 sq. ft. The parking area is currently leased to ABM Parking Services, Inc., a parking garage operator, which is expected to occupy the space through July 2026. The parking garage operator is responsible for a contract rent of approximately $2.39 million, or $10,167 per space, which will increase by 1.50% per annum throughout the remainder of its lease.

Major Tenants.

Allianz Asset Management of America L.P. (“Allianz”) (320,911 sq. ft., 12.5% of NRA, 15.7% of U/W Base Rent) is an asset manager with over 800 investment professionals in 25 offices worldwide and manages assets for individuals, families and institutions. The 1633 Broadway Property serves as the United States headquarters for Allianz. Allianz occupies six suites with leases expiring in January 2031.

Morgan Stanley & Co (“Morgan Stanley”) (260,829 sq. ft., 10.2% of NRA; 11.1% of U/W Base Rent) is a financial holding company, that provides various financial products and services to corporations, governments, financial institutions and individuals in the Americas, Europe, the Middle East, Africa and Asia. Morgan Stanley operates through three segments: Institutional Securities, Wealth Management and Investment Management. Morgan Stanley occupies five suites with leases expiring in March 2032.

WMG Acquisition Corp (“Warner Music Group”) (293,888 sq. ft., 11.5% of NRA; 10.4% of U/W Base Rent) is an American multinational entertainment and record label conglomerate. It is one of the “Big Three” recording companies and the third largest in the global music industry, next to Universal Music Group and Sony Music Entertainment. Warner Music Group is headquartered at the 1633 Broadway Property.

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

17

1633 Broadway New York, NY 10019 |

Collateral Asset Summary – Loan No. 2 1633 Broadway |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$45,000,000 41.7% 3.93x 11.9% |

| Tenant Summary(1) | ||||||

| Tenant | Ratings (Moody’s/Fitch/S&P)(2) |

Net Rentable Area (Sq. Ft.) (3) |

% of Net Rentable Area |

U/W Base Rent PSF |

% of Total U/W

|

Lease Expiration |

| Allianz(4) | AA-/Aa3/AA | 320,911 | 12.5% | $82.66 | 15.7% | 1/31/2031 |

| Morgan Stanley(5) | A/A3/BBB+ | 260,829 | 10.2 | $71.61 | 11.1 | 3/31/2032 |

| WMG Acquisition Corp(6) | NR/NR/NR | 293,888 | 11.5 | $59.62 | 10.4 | 7/31/2029 |

| Showtime Networks Inc | BBB/Baa2/BBB | 261,196 | 10.2 | $55.28 | 8.6 | 1/31/2026 |

| Kasowitz Benson Torres(7) | NR/NR/NR | 203,394 | 7.9 | $68.00 | 8.2 | 3/31/2037 |

| New Mountain Capital, LLC(8) | NR/NR/NR | 108,374 | 4.2 | $86.00 | 5.5 | 10/15/2035 |

| Charter Communications Holding | NR/Ba2/BB+ | 106,176 | 4.1 | $84.00 | 5.3 | 12/15/2025 |

| MongoDB, Inc. | NR/NR/NR | 106,230 | 4.1 | $76.00 | 4.8 | 12/31/2029 |

| Travel Leaders Group, LLC | NR/NR/B+ | 107,205 | 4.2 | $74.58 | 4.7 | 12/31/2033 |

| Assured Guaranty Municipal | NR/NR/A | 103,838 | 4.1 | $69.88 | 4.3 | Various(9) |

| Subtotal / Wtd. Avg. | 1,872,041 | 73.1% | $70.81 | 78.5% | ||

| Remaining Tenants | 649,710 | 25.4 | $55.74 | 21.5 | ||

| Occupied Subtotal / Wtd. Avg. | 2,521,751 | 98.4% | $66.93 | 100.0% | ||

| Vacant | 39,761 | 1.6 | ||||

| Total / Wtd. Avg. | 2,561,512 | 100.0% | ||||

| (1) | Based on the underwritten rent roll dated October 31, 2019. |

| (2) | Certain ratings are those of the parent company whether or not the parent guarantees the lease. |

| (3) | Borrowers’ owned space. Does not include non-owned anchors or outparcels. |

| (4) | Allianz subleases 20,600 sq. ft. of suite 4600 (totaling 54,118 sq. ft.) to Triumph Hospitality at a base rent of $46.80 PSF through December 30, 2030. Triumph Hospitality further subleases 3,000 sq. ft. of suite 4600 to Stein Adler Dabah & Zelkowitz at a base rent of $41.33 PSF through July 31, 2022. U/W Base Rent is based on the contractual rent under the prime lease. |

| (5) | Morgan Stanley has the option to terminate its lease as to all or any portion (but not less than one full floor) of its space at any time after April 1, 2027, upon 18 months’ notice and payment of a termination fee. |

| (6) | WMG Acquisition Corp subleases 3,815 sq. ft. of suite 0400 (totaling 36,854 sq. ft.) to Cooper Investment Partners LLC at a base rent of $58.37 PSF on a month-to-month basis. U/W Base Rent is based on the contractual rent under the prime lease. |

| (7) | Kasowitz Benson Torres subleases a collective 32,487 sq. ft. of Suite 2200 (totaling 50,718 sq. ft.) to three tenants. Delcath Systems, Inc. subleases 6,877 sq. ft. and pays a rent of $68.50 PSF through February 28, 2021; Avalonbay Communities subleases 12,145 sq. ft. through October 31, 2026 and pays a current rent of $74.00 PSF; Cresa New York subleases 13,195 sq. ft. and pays a rent of $65.00 PSF through April 30, 2021. Kasowitz Benson Torres has the right to terminate all or a portion of one full floor of the premises located on the uppermost or lowermost floors (provided that the terminated space must be in a commercially reasonable configuration), effective as of March 31, 2024, upon notice by March 31, 2023. U/W Base Rent is based on the contractual rent under the prime lease and payment of a termination fee. |

| (8) | New Mountain Capital, LLC has executed a lease but has not yet taken occupancy or begun paying rent. We cannot assure you that they will take occupancy or begin paying rent as expected or at all. |

| (9) | Assured Guaranty Municipal has 103,492 sq. ft. expiring on 2/28/2032 and 346 sq. ft that is MTM. |

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-228697) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Cantor Fitzgerald & Co., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-212-915-1700 or by email to the following address: legal@ccre.com. This free writing prospectus is preliminary, subject to completion, and may be amended or supplemented prior to the time of sale.

18

1633 Broadway New York, NY 10019 |

Collateral Asset Summary – Loan No. 2 1633 Broadway |

Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: |

$45,000,000 41.7% 3.93x 11.9% |

| Lease Rollover Schedule(1)(2) | ||||||||

| Year | # of Leases Expiring |

Total Expiring Sq. Ft. |

% of Total Sq. Ft. Expiring |

Cumulative Sq. Ft. Expiring |

Cumulative % of Sq. Ft. Expiring |

Annual U/W

Base PSF |

% U/W Base Rent Rolling |

Cumulative % of U/W Base Rent |

| MTM | 10 | 9,482 | 0.4% | 9,482 | 0.4% | $67.30 | 0.4% | 0.4% |

| 2020 | 2 | 960 | 0.0 | 10,442 | 0.4% | 30.00 | 0.0 | 0.4% |

| 2021 | 3 | 86,460 | 3.4 | 96,902 | 3.8% | 55.01 | 2.8 | 3.2% |

| 2022 | 4 | 116,337 | 4.5 | 213,239 | 8.3% | 24.18 | 1.7 | 4.9% |

| 2023 | 2 | 38,550 | 1.5 | 251,789 | 9.8% | 33.72 | 0.8 | 5.7% |

| 2024 | 1 | 51,276 | 2.0 | 303,065 | 11.8% | 91.00 | 2.8 | 8.4% |

| 2025 | 1 | 106,176 | 4.1 | 409,241 | 16.0% | 84.00 | 5.3 | 13.7% |

| 2026 | 3 | 383,584 | 15.0 | 792,825 | 31.0% | 53.18 | 12.1 | 25.8% |

| 2027 | 2 | 55,247 | 2.2 | 848,072 | 33.1% | 82.98 | 2.7 | 28.5% |

| 2028 | 2 | 90,001 | 3.5 | 938,073 | 36.6% | 67.15 | 3.6 | 32.1% |

| 2029 | 3 | 399,717 | 15.6 | 1,337,790 | 52.2% | 63.99 | 15.2 | 47.2% |

| 2030 | 0 | 0 | 0.0 | 1,337,790 | 52.2% | 0.00 | 0.0 | 47.2% |

| Thereafter | 10 | 1,183,961 | 46.2 | 2,521,751 | 98.4% | 75.21 | 52.8 | 100.0% |

| Vacant | NAP | 39,761 | 1.6 | 2,561,512 | 100.0% | NAP | NAP | |

| Total / Wtd. Avg.(3) | 43 | 2,561,512 | 100.0% | $66.93 | 100.0% | |||

| (1) | Based on the underwritten rent roll dated October 31, 2019. |

| (2) | Certain tenants may have termination or contraction options (which may become exercisable prior to the originally stated expiration date of the tenant lease) that are not considered in the above Lease Rollover Schedule. |

| (3) | Total/Wtd. Avg. Average U/W Base Rent PSF excludes vacant space. |

Environmental Matters. According to a Phase I environmental report, dated October 30, 2019, there are no recognized environmental conditions or recommendations for further action at the 1633 Broadway Property, other than the development and implementation of an asbestos operations and maintenance program.

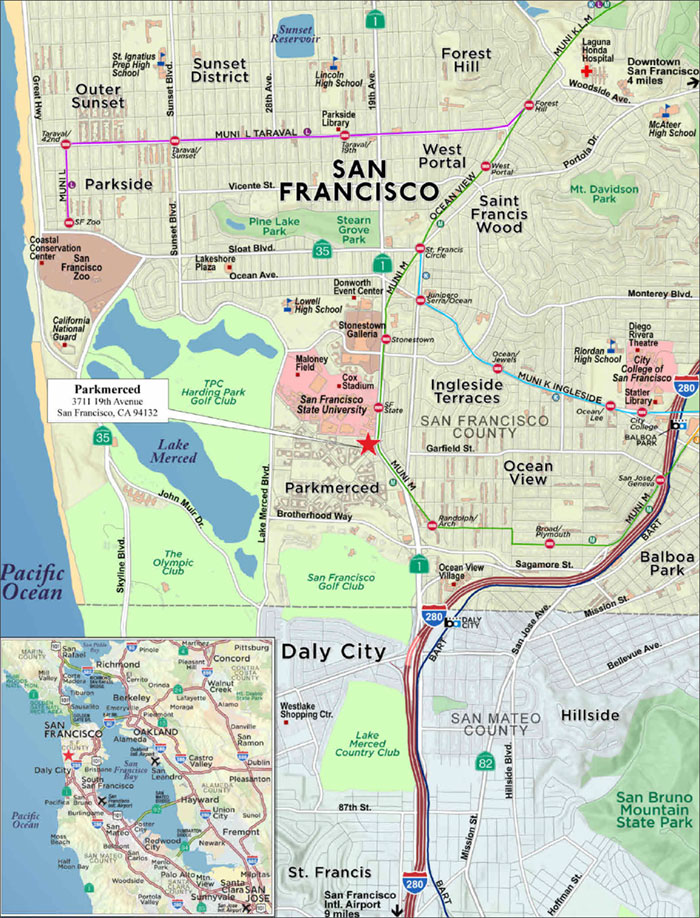

The Market. The 1633 Broadway Property is located in the Times Square neighborhood of Midtown Manhattan, a high traffic commercial corridor that produces 15% of New York City’s economic output. The neighborhood is bounded by 41st Street to the south and 52nd Street to the north between Avenue of the Americas and Eighth Avenue. The 1633 Broadway Property is located within one block of the 50th Street/Broadway, 50th Street and 49th Street subway stations, which serve the 1, 2, C, E, N, R and W lines.