EXECUTION FORM

AGREEMENT AND PLAN OF REORGANIZATION

BY AND AMONG

TRIO MERGER CORP.,

TRIO MERGER SUB, INC.,

SAEXPLORATION HOLDINGS, INC.

AND

CLCH, LLC

DATED AS OF DECEMBER 10, 2012

AGREEMENT AND PLAN OF REORGANIZATION

THIS AGREEMENT AND

PLAN OF REORGANIZATION is made and entered into as of December 10, 2012, by and among Trio Merger Corp., a Delaware corporation

(“Parent”), Trio Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Parent (“Merger

Sub”), SAExploration Holdings, Inc., a Delaware corporation (“Company”), and CLCH, LLC, an Alaskan

limited liability company (“Stockholder”).

RECITALS

A. Upon

the terms and subject to the conditions of this Agreement (as defined in Section 1.1) and in accordance with the Delaware General

Corporation Law (the “DGCL”) and other applicable law, Parent and the Company intend to enter into a business

combination transaction by means of a merger of Company with and into Merger Sub, with Merger Sub being the surviving entity and

becoming a wholly owned subsidiary of Parent (the “Merger”).

B. The

board of directors of each of Parent and the Company has determined that the Merger is fair to, and in the best interests of, its

respective company and stockholders.

NOW, THEREFORE, in

consideration of the covenants, promises and representations set forth herein, and for other good and valuable consideration, the

receipt and sufficiency of which are hereby acknowledged, the parties agree as follows (defined terms used in this Agreement are

listed alphabetically in Article IX, together with the Section and, if applicable, paragraph number in which the definition of

each such term is located):

ARTICLE

I.

THE MERGER

1.1. The

Merger. At the Effective Time (as defined in Section 1.2) and subject to and upon the terms and conditions of this Agreement

and the applicable provisions of the DGCL, the Company shall be merged with and into Merger Sub, the separate corporate existence

of the Company shall cease and Merger Sub shall continue as the surviving corporation in the Merger (“Surviving Corp”).

The term “Agreement” as used herein refers to this Agreement and Plan of Reorganization, as the same may be

amended from time to time, and all exhibits and schedules hereto (including the Company Schedule and the Parent Schedule, as defined

in the preambles to Articles II and III hereof, respectively).

1.2. Effective

Time; Closing. Subject to the conditions of this Agreement, as soon as practicable on or after the Closing Date (as hereinafter

defined), the parties hereto shall cause the Merger to be consummated by filing a certificate of merger (the “Certificate

of Merger”) with the Secretary of State of the State of Delaware in accordance with the applicable provisions of the

DGCL (the time of such filing, or such later time as may be agreed in writing by the Company and Parent and specified in the Certificate

of Merger being the “Effective Time”). Unless this Agreement shall have been terminated pursuant to Section

8.1, the consummation of the transactions contemplated by this Agreement (the “Closing”), other than the filing

of the Certificate of Merger, shall take place at the offices of Graubard Miller, counsel to Parent, 405 Lexington Avenue, New

York, New York 10174 at a time and date to be specified by the parties, which shall be no later than the third (3rd)

business day after the satisfaction or waiver of the conditions set forth in Article VI, or at such other time, date and location

as the parties hereto agree in writing (the “Closing Date”). Closing signatures may be transmitted by facsimile

or by emailed PDF file.

1.3. Effect

of the Merger. At the Effective Time, the effect of the Merger shall be as provided in this Agreement and the applicable

provisions of the DGCL and other applicable provisions of law (collectively, the “Applicable Law”). Without

limiting the generality of the foregoing, and subject thereto, at the Effective Time all outstanding shares of common stock, par

value $0.0001, of the Company (“Company Common Stock”) and Series A Preferred Stock, par value $0.0001, of

the Company (“Series A Preferred”) shall be canceled and all the property, rights, privileges, powers and franchises

of the Company shall vest in Surviving Corp, and all debts, liabilities and duties of the Company shall become the debts, liabilities

and duties of Surviving Corp.

1.4. Governing

Documents. At the Effective Time,

(a) the

Certificate of Incorporation of Merger Sub shall become the Certificate of Incorporation of Surviving Corp; and

(b) the

Bylaws of Merger Sub shall become the Bylaws of Surviving Corp.

1.5. Merger

Consideration; Effect on Capital Stock.

(a) Merger

Consideration. The aggregate consideration to be paid to the holders of the capital stock of the Company in exchange for the

cancelation of their capital stock and their rights as such holders (“Merger Consideration”), of which the

portions of the Merger Consideration described in Subsections 1.5(a)(i)(A) and 1.5(a)(i)(D) shall be paid directly to such holders

and the portions of the Merger Consideration described in Subsections 1.5(a (i)(B), 1.5(a)(i)(C) and 1.5(a)(ii) shall be paid

to the Representative (as defined in Section 1.12(b) on behalf of such holders, is:

(i) to

the holders of the shares of Company Common Stock issued and outstanding immediately prior to the Effective Time:

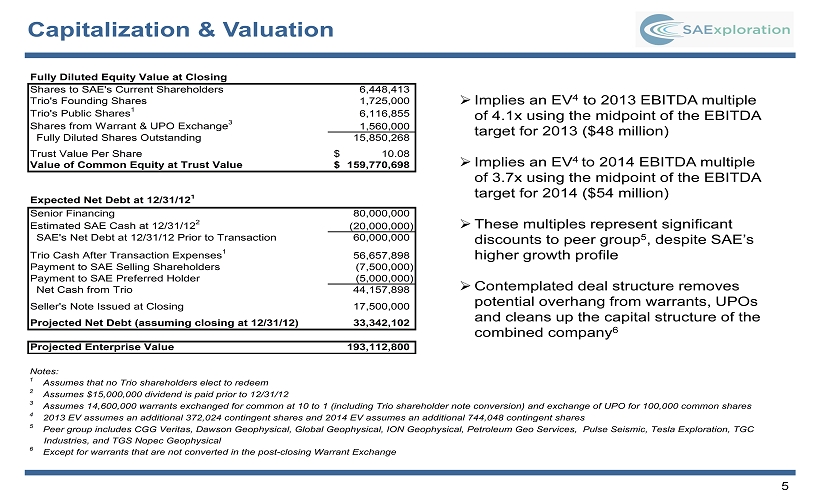

(A) 6,448,413

shares of common stock, par value $0.0001, of Parent (“Parent Common Stock”) to be issued at the Closing;

(B) $7,500,000

cash to be paid at the Closing;

(C) $17,500,000

represented by the note in the form of Exhibit A annexed hereto (“Seller Note”) to be issued by Parent

at the Closing; and

(D) those

numbers of EBIDTA Shares (as defined in Section 1.16(d)) to be issued in accordance with Section 1.16; and

(ii) to

the holders of Series A Preferred issued and outstanding immediately prior to the Effective Time, $5,000,000 in cash to be paid

at the Closing.

(b) Conversion

of Company Stock. Subject to the terms and conditions of this Agreement, at the Effective Time, by virtue of the Merger and

this Agreement and without any action on the part of Parent or the Company, each share of Company Common Stock issued and outstanding

immediately prior to the Effective Time will be canceled and the rights pertaining thereto will be automatically converted (subject

to Sections 1.5(f) and 1.5(g)) into the following portions of the Merger Consideration:

(i) the

number of shares of Parent Common Stock equal to (A) 6,448,413 divided by (B) the Outstanding Common Stock Number; plus

(ii) the

amount of cash equal to $7,500,000 divided by the Outstanding Common Stock Number; plus

(iii) a

Seller Note in the amount equal to $17,500,000 divided by the Outstanding Common Stock Number; plus

(iv) the

right pursuant to Section 1.16 to receive that number of EBITDA Shares for each year with respect to which EBITDA Shares are issuable

equal to (A) the number of EBITDA Shares issuable with respect to such year divided by (B) the Outstanding Common Stock Number.

(v) As

used herein, “Outstanding Common Stock Number” means the number of shares of Company Common Stock outstanding

immediately prior to the Effective Time, excluding treasury shares and Company Common Stock held by Parent or owned by the Company

or any direct or indirect wholly owned subsidiary of Parent of the Company immediately prior to the Effective Time. For purposes

of determining the Outstanding Common Stock Number, all shares of Company Common Stock issuable pursuant to the derivative securities

listed on Schedule 6.3(i) and all shares of restricted stock issued pursuant to the SAE Holdings 2012 Stock Compensation

Plan shall be deemed to be outstanding.

(vi) If

shares of Company Common Stock issuable pursuant to the derivative securities listed on Schedule 6.3(i) are not issued and

outstanding immediately prior to the Effective Time, the Merger Consideration that would have been paid with respect to such shares

of Company Common Stock had they been issued and outstanding shall not be issued at the Closing but shall be reserved for issuance

upon exercise or exchange of such derivative securities and shall be paid upon such exercise or exchange upon cancelation of such

derivative securities.

(vii) If

any shares of Company Common Stock that are restricted stock issued pursuant to the SAE Holdings 2012 Stock Compensation Plan are

not fully vested immediately prior to the Effective Time, the Merger consideration that would have been paid with respect to such

shares of Company Common Stock pursuant to Subsections 1.5(a)(i)(B) and 1.5(a)(i)(C) that would have been paid with respect to

such shares of Company Common Stock had they been issued and outstanding shall not be issued at the Closing but shall be reserved

for issuance until such shares become fully vested and shall be paid upon such upon such vesting and the certificates representing

such shares shall bear an appropriate legend to such effect.

(viii) The

numbers of shares of Parent Common Stock, amounts of cash, Seller Note and rights to receive EBITDA Shares that would otherwise

be issuable pursuant to this Section 1.5(b) to Persons who hold Dissenting Shares (as defined in Section 1.14(b)) and

exercise their dissenters’ rights pursuant to Applicable Law shall not be issued to such Persons and shall be canceled.

(c) Conversion

of Preferred Stock. Subject to the terms and conditions of this Agreement, at the Effective Time, by virtue of the Merger and

this Agreement and without any action on the part of Parent or the Company, each share of Series A Preferred Stock issued and outstanding

immediately prior to the Effective Time will be canceled and the rights pertaining thereto will be automatically be converted into

the right to receive $5,000,000 divided by the number of shares of Series A Preferred outstanding immediately prior to the Effective

Time.

(d) Exceptions.

The conversions contemplated by Sections 1.5(b) and 1.5(c) shall not apply to or occur with respect to any shares of Company Common

Stock or Series A Preferred to be canceled pursuant to Section 1.5(f) or the Dissenting Shares.

(e) Surrender

of Company Certificates. Subject to Section 1.11, the Merger Consideration shall be issued or paid to the holders of certificates

representing the shares of Company Common Stock and Series A Preferred (the “Company Certificates”) upon surrender

of their respective Company Certificates in the manner provided in Section 1.6 (or in the case of a lost, stolen or destroyed certificate,

upon delivery of an affidavit (and indemnity, if required) in the manner provided in Section 1.8).

(f) Cancellation

of Treasury and Parent-Owned Stock. Each share of Company Common Stock and Series A Preferred held by Parent or owned by the

Company or any direct or indirect wholly owned subsidiary of Parent or the Company immediately prior to the Effective Time shall

be canceled and extinguished without any conversion or payment in respect thereof.

(g) Adjustments

to Exchange Ratios. The number of shares of Parent Common Stock that the holders of Company Common Stock are entitled

to receive as a result of the Merger shall be equitably adjusted to reflect appropriately the effect of any stock split, reverse

stock split, stock dividend (including any dividend or distribution of securities convertible into Company Common Stock, Company

Preferred Stock (as defined in Section 2.3) or Parent Common Stock), cash dividends, reorganization, recapitalization, reclassification,

combination, exchange of shares or other like change with respect to the Company Common Stock, Company Preferred Stock or Parent

Common Stock occurring on or after the date hereof and prior to the Effective Time; provided there shall not be any adjustment

with respect to the Company Dividend.

(h) No

Fractional Shares. No fraction of a share of Parent Common Stock will be issued by virtue of the Merger or the transactions

contemplated hereby, and each Person who would otherwise be entitled to a fraction of a share of Parent Common Stock (after aggregating

all fractional shares of Parent Common Stock that otherwise would be received by such holder) shall receive, in lieu of such fractional

share, one (1) share of Parent Common Stock.

(i) No

Further Ownership Rights in Company Stock. All the shares of Parent Common Stock and other Merger Consideration issued to the

holders of Company Common Stock and Series A Preferred upon consummation of the Merger or, in the case of the EBITDA Shares, thereafter

issuable, shall be deemed to have been issued in full satisfaction of all rights pertaining to the outstanding Company Common Stock

and Series A Preferred and there shall be no further registration of transfers on the records of Surviving Corp of the shares of

Company Common Stock or Series A Preferred that were outstanding immediately prior to the Effective Time.

(j) Required

Withholding. Parent shall be entitled to deduct and withhold from any consideration payable or otherwise deliverable pursuant

to this Agreement to any Person such amounts as are required to be deducted or withheld therefrom under the Internal Revenue Code

of 1986, as amended (the “Code”), or under any provision of state, local or foreign tax law or under any other

applicable Legal Requirement. To the extent such amounts are so deducted or withheld, such amounts shall be treated for all purposes

under this Agreement as having been paid to the person to whom such amounts would otherwise have been paid.

1.6. Exchange

Procedures.

(a) Prior

to the Effective Time, Parent shall appoint a reputable bank or trust company designated by Parent and reasonably satisfactory

to the Company to act as exchange agent (the “Exchange Agent”) for the issuance of the Merger Consideration

to be issued in the Merger. It is hereby acknowledged and agreed by the Company that Continental Stock Transfer & Trust Company

(“Continental”) is acceptable as Exchange Agent.

(b) Parent

and Company shall make all computations contemplated by Section 1.5 and any such computation shall be conclusive and binding

on the holders of shares of Company Common Stock and Series A Preferred, except for manifest mathematical error. Parent and the

Company shall deliver such computations to the Exchange Agent and all information and instructions necessary to fully effect the

issuances and payments required under Section 1.5.

(c) Promptly

after the Effective Time, the Exchange Agent shall deliver to each holder of Company Common Stock and Series A Preferred a letter

of transmittal in form and substance reasonably satisfactory to Parent and the Company (“Letter of Transmittal”),

together with such other documentation as Parent may direct, including, but not limited to the Lock-Up Agreement (as defined in

Section 1.17), with respect to the surrender and delivery by each such holder of his, her or its Company Certificates in exchange

for shares of Parent Common Stock and other Merger Consideration as contemplated by Section 1.5. Upon delivery to the Exchange

Agent of a validly executed and delivered Letter of Transmittal (the forms of which, among other things, shall contain an acknowledgment

that the Representative has received the Seller Note on its behalf and representations and other provisions required for compliance

with exemptions from registration under Regulation D or Regulation S promulgated under the Securities Act (as defined in Section

1.13(b)(iii)), as appropriate for each such holder based upon its country of residence), a Lock-Up Agreement and such other documentation

as may reasonably be required pursuant to the Letter of Transmittal, the Exchange Agent shall issue to the corresponding recipient

the number of shares of Parent Common Stock (less the applicable Escrow Shares (as defined in Section 1.11)) and other Merger Consideration,

and the Company Certificates shall forthwith be cancelled. Until so surrendered, outstanding Company Certificates will be deemed,

from and after the Effective Time, to evidence only the right to receive the applicable shares of Parent Common Stock and other

Merger Consideration pursuant to Section 1.5. Separate certificates shall be issued for each recipient’s Escrow Shares and

for the balance of the shares of Parent Common Stock to which such recipient is entitled.

(d) At

or prior to the Effective Time, Parent shall deposit in trust with the Exchange Agent, the aggregate number of shares of Parent

Common Stock (less the Escrow Shares), cash and Seller Note to be issued in the Merger.

(e) If

payment is to be made to a recipient other than the Person in whose name a surrendered Company Certificate is registered, it shall

be a condition of payment that the Company Certificate so surrendered must be properly endorsed or otherwise be in proper form

for transfer, and the Person who surrenders the Company Certificate must provide funds for payment of any transfer or other Taxes

required by reason of the payment to a Person other than the registered holder of the surrendered Company Certificate or establish

to the satisfaction of Parent that the Tax has been paid or is not applicable.

(f) At

any time that is more than 180 days after the Effective Time, Parent shall be entitled to require the Exchange Agent to deliver

to it any shares of Parent Common Stock and other Merger Consideration deposited with the Exchange Agent and not disbursed in accordance

with Article I of the Agreement, and after the shares and other Merger Consideration have been delivered to Parent, Persons

entitled to shares of Parent Common Stock and other Merger Consideration in accordance with Article I shall be entitled to look

solely to Parent (subject to abandoned property, escheat or other similar Laws) for issuance thereof upon surrender of the Company

Certificates held by them. Any shares of Parent Common Stock and other Merger Consideration remaining unclaimed as of a date which

is immediately prior to such time as such shares and other Merger Consideration would otherwise escheat to or become property of

any government entity shall, to the extent permitted by Applicable Law, become the property of Parent free and clear of any claims

or interest of any Person previously entitled thereto. Neither Parent nor the Exchange Agent will be liable to any Person entitled

to payment under Article I for any Merger Consideration that is delivered to a public official pursuant to any abandoned property,

escheat or similar Law.

1.7. No

Distributions Until Surrender of Company Certificates. No dividends or other distributions declared or made after the date

of this Agreement with respect to Parent Common Stock with a record date after the Effective Time will be paid to the holders of

any Company Certificates that have not yet been surrendered with respect to the shares of Parent Common Stock to be issued upon

surrender thereof until the holders of record of such Company Certificates shall surrender such certificates. Subject to applicable

law, following surrender of any such Company Certificates, Parent shall promptly deliver to the record holders thereof, without

interest, the certificates representing the shares of Parent Common Stock issued in exchange therefor and the amount of any such

dividends or other distributions with a record date after the Effective Time theretofore paid with respect to such shares of Parent

Common Stock.

1.8. Lost,

Stolen or Destroyed Certificates. In the event that any Company Certificates shall have been lost, stolen or destroyed,

Parent shall issue in exchange for such lost, stolen or destroyed Company Certificates, upon the making of an affidavit of that

fact by the holder thereof, the certificates representing the shares of Parent Common Stock and cash and other Merger Consideration

that the shares of Company Common Stock or Series A Preferred formerly represented by such Company Certificates were converted

into and any dividends or distributions payable pursuant to Section 1.7; provided, however, that, as a condition precedent to the

issuance of such certificates representing shares of Parent Common Stock and cash and other Merger Consideration and other

distributions, the owner of such lost, stolen or destroyed Company Certificates shall indemnify Parent against any claim that may

be made against Parent or Surviving Corp with respect to the Company Certificates alleged to have been lost, stolen or destroyed.

1.9. Tax

Consequences. It is intended by the parties hereto that the Merger shall constitute a reorganization within the meaning

of Section 368 of the Code. The parties hereto adopt this Agreement as a “plan of reorganization” within the meaning

of Sections 1.368-2(g) and 1.368-3(a) of the United States Income Tax Regulations.

1.10. Taking

of Necessary Action; Further Action. If, at any time after the Effective Time, any further action is necessary or desirable

to carry out the purposes of this Agreement and to vest Surviving Corp with full right, title and possession to all assets, property,

rights, privileges, powers and franchises of the Company, the then current officers and directors of Parent and Merger Sub and

the officers and directors of the Company shall take all such lawful and necessary action.

1.11. Escrow.

(a) As

the sole remedy for the indemnification obligations set forth in Article VII of this Agreement, 545,635 of the shares of

Parent Common Stock issuable upon the Closing of the Merger (the “Escrow Shares”) shall be deposited in escrow

(the “Escrow Account”), which shall be allocated among the recipients in the same proportion as their proportionate

share of the total Company Common Stock outstanding immediately prior to the Effective Time, all in accordance with the terms and

conditions of the escrow agreement to be entered into at the Closing between Parent, the Representative, the Committee and Continental

(or such other Person as may be agreed by Parent and the Representative), as escrow agent (“Escrow Agent”),

substantially in the form of Exhibit B hereto (the “Escrow Agreement”). On the date (the “Basic

Indemnity Escrow Termination Date”) that is the later of the first anniversary of the Closing Date or thirty (30) days

after the date on which Parent has filed its Annual Report on Form 10-K pursuant to the Securities Exchange Act of 1934, as amended

(“Exchange Act”), for its 2013 fiscal year, the Escrow Agent shall release 272,818 of the original number of

Escrow Shares, less that number of Escrow Shares applied in satisfaction of or reserved with respect to indemnification claims

that are not Tax Indemnification Claims and Environmental Indemnification Claims (each as hereinafter defined) made prior to such

date, to the stockholders in the same proportions as originally deposited into escrow, except that, if the number of Escrow Shares

applied in satisfaction of or reserved with respect to Tax Indemnification Claims and Environmental Indemnification Claims made

prior to such date is in excess of 272,817, the amount of Escrow Shares to be released shall also be reduced by the amount of such

excess. The remaining Escrow Shares (the “T/E Indemnity Shares”) shall be available for indemnification only

with respect to Tax Indemnification Claims and Environmental Indemnification Claims. On the date (the “T/E Indemnity Escrow

Termination Date”) that is thirty (30) days after Parent has filed its Annual Report on Form 10-K for its 2015 fiscal

year, the Escrow Agent shall deliver the T/E Indemnity Shares, less any of such shares applied in satisfaction of a Tax Indemnification

Claim or an Environmental Indemnification Claim and any of such shares related to a Tax Indemnification Claim or an Environmental

Indemnification Claim that is then unresolved, to each recipient in the same proportions as initially deposited in escrow. Any

Escrow Shares held with respect to any unresolved claim for indemnification and not applied as indemnification with respect to

such claim upon its resolution shall be delivered to such Persons promptly upon such resolution. “Tax Indemnification

Claim” means a claim for indemnification pursuant to Article VII with respect to (x) a breach of the representations

and warranties set forth in Section 2.15 and (y) the matters referred to in Section 2.15 of the Company Schedule. “Environmental

Indemnification Claim” means a claim for indemnification pursuant to Article VII with respect to a breach of the

representations and warranties set forth in Section 2.16.

1.12. Committee

and Representative.

(a) Parent

Committee. Prior to the Closing, the Board of Directors of Parent shall appoint a committee consisting of one or more of its

then members to act on behalf of Parent to take all necessary actions and make all decisions pursuant to the Escrow Agreement.

In the event of a vacancy in such committee, the board of directors of Parent shall appoint as a successor a Person who was a director

of Parent prior to the Closing Date or, in the event of an inability to appoint same, another Person who would qualify as an “independent”

director of Parent and who has not had any material relationship with the Company or the Stockholder prior to the Closing. Such

committee is intended to be the “Committee” referred to in Article VII and elsewhere hereof and the Escrow Agreement.

(b) Representative.

The Stockholder is hereby appointed by the Company (and by execution of this Agreement hereby accepts such appointment) as the

representative of the recipients of the Merger Consideration (the “Representative”) to (i) receive that portion

of the Merger Consideration set forth in Section 1.5(a) herein on behalf of the holders of the Company Common Stock, and (ii) take

any and all actions and make any decisions required or permitted to be taken by such recipients under this Agreement or the Escrow

Agreement. Execution of the Letter of Transmittal and acceptance by a holder of Company Certificates of the Merger Consideration

to which such holder is entitled shall be deemed acceptance by such holder of the appointment of the Representative to act in such

holder’s behalf. Should the Representative resign or be unable to serve, a new Representative will be selected jointly by

a vote of the recipients who, at Closing, received a majority of the shares of Parent Common Stock in the Merger, whose appointment

shall be effective upon execution by such successor of a joinder agreement providing for such successor to become a party to the

Escrow Agreement and this Agreement as the Representative, in which case such successor shall for all purposes of this Agreement

and the Escrow Agreement be the Representative (and the prior acts taken by the succeeded Representative shall remain valid for

purposes of this Agreement and the Escrow Agreement). If such recipients are unable to appoint a Person to serve in the capacity

of Representative within 30 days of the date that the former Representative resigned or became unable to serve, a new Representative

shall be selected by majority vote of those Persons on Parent’s board of directors who served on the board of directors of

the Company immediately prior to the Effective Time. The Representative shall not be liable to recipients of the Merger Consideration

for any liability, loss, damage, penalty, fine, cost or expense incurred without gross negligence or willful misconduct by the

Representative while acting in good faith and arising out of or in connection with the acceptance or administration of its duties

hereunder (it being understood that any act done or omitted pursuant to the advice of counsel shall be conclusive evidence of such

good faith). From and after the Effective Time, a decision, act, consent or instruction of the Representative shall be final, binding

and conclusive and not subject to challenge by any recipient. Parent and Surviving Corp are hereby relieved from any liability

to any person for any acts done by Representative and any acts done by Parent or Surviving Corp in accordance with any such decision,

act, consent or instruction of the Representative. Parent, Surviving Corp and each of their respective Affiliates shall be entitled

to rely upon, and shall be fully protected in relying upon, the power and authority of the Representative without independent investigation.

1.13. Stockholder

Matters.

(a) By

its execution of this Agreement, the Stockholder, in its capacity as a stockholder of the Company, hereby approves and adopts this

Agreement and authorizes the Company and its directors and officers to take all actions necessary for the consummation of the Merger

and the other transactions contemplated hereby pursuant to the terms of this Agreement and its exhibits. Such execution shall be

deemed to be action taken by the irrevocable written consent of the Stockholder for purposes of the relevant provisions of the

DGCL and other Applicable Law.

(b) The

Stockholder has all necessary power and authority to execute and deliver this Agreement and to perform its obligations hereunder

and, to consummate the transactions contemplated hereby. The execution and delivery of this Agreement and the consummation by the

Stockholder of the transactions contemplated hereby (including the Merger) have been duly and validly authorized by all necessary

action on the part of the Stockholder and no other proceedings on the part of the Stockholder are necessary to authorize this Agreement

or to consummate the transactions contemplated hereby pursuant to Applicable Law and the terms and conditions of this Agreement.

This Agreement has been duly and validly executed and delivered by the Stockholder and, assuming the due authorization, execution

and delivery thereof by the other parties hereto, constitutes the legal and binding obligation of the Stockholder, enforceable

against the Stockholder in accordance with its terms, except as may be limited by bankruptcy, insolvency, reorganization or other

similar laws affecting the enforcement of creditors’ rights generally and by general principles of equity.

(c) The

Stockholder for itself only, represents and warrants as follows:

(i) it

has had both the opportunity to ask questions and receive answers from the officers and directors of Parent and all persons acting

on Parent’s behalf concerning the business and operations of Parent and to obtain any additional information to the extent

Parent possesses or may possess such information or can acquire it without unreasonable effort or expense necessary to verify the

accuracy of such information;

(ii) it

has had access to the Parent SEC Reports (as defined in Section 3.7) filed prior to the date of this Agreement;

(iii) that

its execution and delivery of this Agreement does not, and the performance of its obligations hereunder will not, require any consent,

approval, authorization or permit of, or filing with or notification to, any court, administrative agency,

commission, governmental or regulatory authority, domestic or foreign (a “Governmental Entity”), except

(1) for applicable requirements, if any, of the Securities Act of 1933, as amended (“Securities Act”), the Exchange

Act, state securities laws (“Blue Sky Laws”), and the rules and regulations thereunder, and (2) where the failure

to obtain such consents, approvals, authorizations or permits, or to make such filings or notifications, would not, individually

or in the aggregate, reasonably be expected to have a Material Adverse Effect (as defined in Section 10.2(a)) on itself or the

Company or, after the Closing, Parent, or prevent consummation of the Merger or otherwise prevent the parties hereto from performing

their material obligations under this Agreement;

(iv) it

understands that the shares of Parent Common Stock to be issued in the Merger are not registered under the Securities Act, that

the issuance of the shares of Parent Common Stock is intended to be exempt from registration under the Securities Act pursuant

to Section 4(2) thereof, and that Parent’s reliance on such exemption is predicated on its representations set forth herein;

(v) it

is an “accredited investor” as that term is defined in Rule 501(a) of Regulation D under the Securities Act (“Accredited

Investor”), it can bear the economic risk of its investment in the shares of Parent Common Stock and it possesses such knowledge

and experience in financial and business matters that it is capable of evaluating the merits and risks of the investment in the

shares of Parent Common Stock;

(vi) it

understands that the shares of Parent Common Stock may not be sold, transferred, or otherwise disposed of without registration

under the Securities Act or an exemption therefrom, and that in the absence of an effective registration statement covering the

shares of Parent Common Stock or any available exemption from registration under the Securities Act, the shares of Parent Common

Stock may have to be held indefinitely; and

(vii) it

owns the shares of Company Common Stock and Series A Preferred listed on Schedule 2.3(a) as being owned by it free and clear

of all Liens, acknowledges that the Merger Consideration to be received by it is adequate consideration therefor and has not granted

to any other person or entity any options or other rights to buy such securities, nor has it granted

any interest in such securities to any person of any nature, nor will the sale and transfer of such securities pursuant to this

Agreement give any person a legal right or cause of action against such securities or Parent.

1.14. Shares

Subject to Appraisal Rights.

(a) Notwithstanding

Section 1.5 hereof, Dissenting Shares (as defined in Section 1.14(b)) shall not be converted into a right to receive Merger Consideration.

The holders thereof shall be entitled only to such rights as are granted by the DGCL. Each holder of Dissenting Shares who becomes

entitled to payment for his Dissenting Shares pursuant to the DGCL shall receive payment therefor from Parent in accordance with

the DGCL, provided, however, that (i) if any stockholder of the Company who asserts appraisal rights in connection with

the Merger (a “Dissenter”) shall have failed to establish his entitlement to such rights as provided in the

DGCL, or (ii) if any such Dissenter shall have effectively withdrawn his demand for payment for his Dissenting Shares or waived

or lost his right to payment for his Dissenting Shares under the appraisal rights process under the DGCL, the shares of Company

Common Stock held by such Dissenter shall be treated as if they had been converted, as of the Effective Time, into a right to receive

Merger Consideration as provided in Section 1.5. The Company shall give Parent prompt notice of any demands for payment received

by the Company from a person asserting appraisal rights, and Parent shall have the right to participate in all negotiations and

proceedings with respect to such demands. The Company shall not, except with the prior written consent of Parent, make any payment

with respect to, or settle or offer to settle, any such demands or negotiate or enter into any agreement with respect thereto.

(b) As

used herein, “Dissenting Shares” means any shares of Company Common Stock held by Persons who are entitled to

appraisal rights under the DGCL, and who have properly exercised, perfected and not subsequently withdrawn or lost or waived their

rights to demand payment with respect to those shares in accordance with the DGCL.

1.15. Treatment

of the Company Derivative Securities. The Company shall arrange that the holders of all outstanding Company Stock

Options (as defined in Section 2.3) and other Company Derivative Securities (as defined in Section 2.3) shall exercise or exchange

such securities prior to the Effective Time without the payment of any consideration therefor by the Company other than the issuance

of shares of Company Common Stock. Such exercise or exchange may be made contingent upon the occurrence of the Closing.

1.16. EBITDA

Shares.

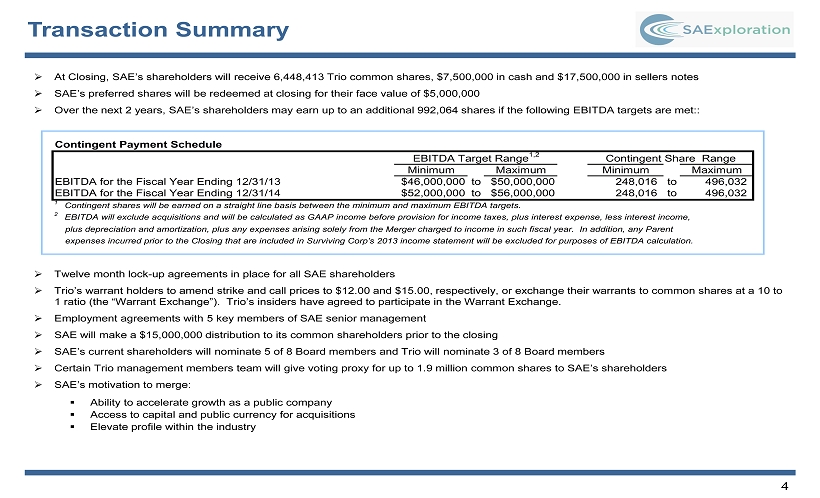

(a) If,

for the fiscal year of Parent ending December 31, 2013, Parent has EBITDA equal to or greater than $46,000,000, Parent shall

issue to the holders of Company Common Stock outstanding immediately prior to the Effective Time, in the aggregate, that number

of shares of Parent Common Stock equal to (i) 248,016 shares plus (ii) an amount equal to 248,016 shares multiplied by the fraction

the numerator of which is the actual EBITDA for such fiscal year, but not more than $50,000,000, less $46,000,000, and the denominator

of which is $4,000,000.

(b) If,

for the fiscal year of Parent ending December 31, 2014, Parent has EBITDA equal to or greater than $52,000,000, Parent shall

issue to the holders of Company Common Stock outstanding immediately prior to the Effective Time, in the aggregate, that number

of shares of Parent Common Stock equal to (i) 248,016 shares plus (ii) an amount equal to 248,016 shares multiplied by the fraction

the numerator of which is the actual EBITDA for such fiscal year, but not more than $56,000,000, less $52,000,000, and the denominator

of which is $4,000,000.

(c) In

the event that Parent meets one EBITDA target but fails to meet the other EBITDA target as described in Sections 1.16(a) or 1.16(b)

but has cumulative EBITDA for the period January 1, 2013 to December 31, 2014 of at least $98,000,000, Parent shall issue to the

holders of Company Common Stock, in the aggregate, that number of shares of Parent Common Stock equal to (i) 496,032 shares plus

(ii) an amount equal to 496,032 shares multiplied by the fraction the numerator of which is the actual aggregate EBITDA for such

two fiscal years, but not more than $106,000,000, less $98,000,000, and the denominator of which is $8,000,000, less (iii) the

number of EBITDA shares issued with respect to the fiscal year for which the target was met.

(d) As

used herein,

(i) “EBITDA”

means for the applicable fiscal year, using results and expenses taken from the audited financial statements of Parent, but excluding

any results attributable to businesses acquired after the date of this Agreement, the following calculation: income before provision

for income taxes, plus interest expense, less interest income, plus depreciation and amortization, plus any expenses arising solely

from the Merger charged to income in such fiscal year. In addition, any Parent expenses incurred prior to the Closing that

are included in Surviving Corp’s 2013 income statement will be excluded for purposes of EBITDA calculation.

(ii) “EBITDA

Shares” means shares of Parent Common Stock issuable pursuant to this Section 1.16.

(e) Not

later than 120 days after the fiscal year with respect to which EBITDA is calculated, Parent shall deliver to the Committee its

EBITDA calculation (the “EBITDA Calculation”), which shall be conclusive and binding

upon the parties unless the Committee, within ten Business Days after its receipt of the EBITDA Calculation, notifies Parent in

writing that the Committee disputes any of the amounts set forth therein, specifying the nature of the dispute and the basis therefore.

The parties shall in good faith attempt to resolve any dispute and, if the parties so resolve all disputes, the EBITDA Calculation,

as amended to the extent necessary to reflect the resolution of the dispute, shall be conclusive and binding on the parties. If

the parties do not reach agreement in resolving the dispute within ten Business Days after notice is given to Parent by the Committee,

the parties shall submit the dispute to an independent accounting firm which is mutually agreeable to the parties (the “Accounting

Arbiter”). Within thirty 30 days of such submission, the Accounting Arbiter shall determine (it being understood that

in making such determination, the Accounting Arbiter shall be functioning as an expert and not as an arbitrator), based solely

on written submissions by Parent and the Committee, and not by independent review, only those issues in dispute and shall render

a written report as to the resolution of the dispute and the resulting EBITDA Calculation which shall be conclusive and binding

on the parties. In resolving any disputed item, the Accounting Arbiter (x) shall be bound by the provisions of this Section

and (y) may not assign a value to any item greater than the greatest value for such items claimed by either party or less

than the smallest value for such items claimed by either party. The fees, costs and expenses of the Accounting Arbiter shall be

borne by Parent. The Committee shall be entitled to engage a firm of independent accountants to advise it with respect to the EBITDA

Calculation, with the reasonable fees and expenses of such firm to be paid by the Committee.

(f) EBITDA

Shares shall be issued to the Persons entitled to them no later than ten (10) days after the date the EBITDA Calculation with respect

to which such EBITDA Shares are earned becomes conclusive and binding on the parties.

1.17. Sale

Restriction. No public market sales of shares of Parent Common Stock issued as a result of the Merger, including EBITDA

Shares, shall be made for a period of twelve months following the Closing Date. No private sales of shares of Parent Common Stock

issued as a result of the Merger shall be made unless the purchaser acknowledges and agrees to the restriction stated in the preceding

sentence by delivery to Parent of a written document to such effect. Such restrictions will be evidenced by a Lock-Up Agreement

in the form of Exhibit C hereto to be executed and delivered to Parent by the holders of the Company Common Stock in connection

with the exchange procedure set forth in Section 1.6 herein. Certificates representing shares of Parent Common Stock issued as

a result of the Merger shall bear a prominent legend to such effect.

ARTICLE

II.

REPRESENTATIONS AND WARRANTIES REGARDING THE COMPANY

Subject to the exceptions

set forth in Schedule 2 attached hereto (the “Company Schedule”), the Company hereby represents

and warrants to, and covenant with, Parent as follows:

2.1. Organization

and Qualification.

(a) The

Company is a corporation duly incorporated, validly existing and in good standing under the laws of the State of Delaware and has

the requisite corporate power and authority to own, lease and operate its assets and properties and to carry on its business as

it is now being conducted. The Company is in possession of all franchises, grants, authorizations, licenses, permits, easements,

consents, certificates, approvals and orders (“Approvals”) necessary to own, lease and operate the properties

it purports to own, operate or lease and to carry on its business as it is now being conducted, except where the failure to have

such Approvals could not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect on the Company

and its Subsidiaries taken as a whole. Complete and correct copies of the certificate of incorporation and bylaws (or other comparable

governing instruments with different names) (collectively referred to herein as “Charter Documents”) of the

Company, as amended and currently in effect, have been heretofore made available to Parent or Parent’s counsel. The Company

is not in violation of any of the provisions of the Company’s Charter Documents.

(b) The

Company is duly qualified or licensed to do business as a foreign corporation and is in good standing in each jurisdiction where

the character of the properties owned, leased or operated by it or the nature of its activities makes such qualification or licensing

necessary, except for such failures to be so duly qualified or licensed and in good standing that could not, individually or in

the aggregate, reasonably be expected to have a Material Adverse Effect on the Company and its Subsidiaries taken as a whole. Each

jurisdiction in which the Company is so qualified or licensed is listed in Schedule 2.1.

(c) The

minute books of the Company contain true, complete and accurate records of all written minutes for meetings and written consents

in lieu of meetings of its Board of Directors (and any committees thereof), similar governing bodies and stockholders (“Corporate

Records”) since the time of the Company’s organization. Copies of such Corporate Records of the Company have been

made available to Parent or Parent’s counsel.

(d) The

stock transfer, warrant and option transfer and ownership records of the Company contain true, complete and accurate records of

the securities ownership as of the date of such records and the transfers involving the capital stock and other securities of the

Company since the time of the Company’s incorporation. Copies of such records of the Company have been made available to

Parent or Parent’s counsel.

2.2. Subsidiaries.

(a) The

Company has no direct or indirect subsidiaries or participations in joint ventures or other entities other than those listed in

Schedule 2.2 (the “Subsidiaries”). Except as set forth in Schedule 2.2, the Company

owns all of the outstanding equity securities of the Subsidiaries, free and clear of all Liens (as defined in Section 10.2(e)).

Except for the Subsidiaries, the Company does not own, directly or indirectly, any ownership, equity, profits or voting interest

in any Person or has any agreement or commitment to purchase any such interest, and has not agreed and is not obligated to make

nor is bound by any written, oral or other agreement, contract, subcontract, lease, binding understanding, instrument, note, option,

warranty, purchase order, license, sublicense, insurance policy, benefit plan, commitment or undertaking of any nature, as of the

date hereof or as may hereafter be in effect under which it becomes obligated to make, any future investment in or capital contribution

to any other entity.

(b) Each

Subsidiary that is a corporation is duly incorporated, validly existing and in good standing under the laws of its state of incorporation

(as listed in Schedule 2.2) and has the requisite corporate power and authority to own, lease and operate its assets

and properties and to carry on its business as it is now being conducted. Each Subsidiary that is a limited liability company is

duly organized or formed, validly existing and in good standing under the laws of its state of organization or formation (as listed

in Schedule 2.2) and has the requisite power and authority to own, lease and operate its assets and properties and

to carry on its business as it is now being conducted. Each Subsidiary is in possession of all Approvals necessary to own, lease

and operate the properties it purports to own, operate or lease and to carry on its business as it is now being conducted, except

where the failure to have such Approvals could not, individually or in the aggregate, reasonably be expected to have a Material

Adverse Effect on the Company and its Subsidiaries taken as a whole. Complete and correct copies of the Charter Documents of each

Subsidiary, as amended and currently in effect, have been heretofore delivered to Parent or Parent’s counsel. No Subsidiary

is in violation of any of the provisions of its Charter Documents.

(c) Each

Subsidiary is duly qualified or licensed to do business as a foreign corporation or foreign limited liability company and is in

good standing in each jurisdiction where the character of the properties owned, leased or operated by it or the nature of its activities

makes such qualification or licensing necessary, except for such failures to be so duly qualified or licensed and in good standing

that could not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect on the Company and its

Subsidiaries taken as a whole. Each jurisdiction in which each Subsidiary is so qualified or licensed is listed in Schedule 2.2.

(d) The

minute books of each Subsidiary contain true, complete and accurate records of all written minutes for meetings and written consents

in lieu of meetings of its Board of Directors (and any committees thereof), similar governing bodies and stockholders and other

equity holders. Copies of the Corporate Records of each Subsidiary have been heretofore made available to Parent or Parent’s

counsel.

2.3. Capitalization.

(a) The

authorized capital stock of the Company consists of 1,250,000 shares of Company Common Stock, of which 1,060,441 shares are issued

and outstanding as of the date of this Agreement, and 5,000,000 shares of preferred stock (“Company Preferred Stock”),

of which 5,000,000 shares are designated as Series A Preferred and are issued and outstanding as of the date of this Agreement,

all of which shares are validly issued, fully paid and nonassessable. Other than Company Common Stock and Company Preferred Stock,

the Company has no class or series of securities authorized by its Charter Documents. Schedule 2.3(a) hereto contains

a list of all of the stockholders of the Company, the number of shares of Company Common Stock and Company Preferred Stock owned,

or to be owned at the time of the Closing, by each shareholder and each shareholder’s state or province of residence. Except

as set forth in Schedule 2.3(a) hereto, as of the date of this Agreement, no shares of Company Common Stock are reserved

for issuance upon the exercise of outstanding options to purchase Company Common Stock granted to employees of Company or other

parties (“Company Stock Options”). Except as set forth in Schedule 2.3(a), no shares of Company Common

Stock are reserved for issuance upon the exercise of outstanding warrants or other rights or derivative securities (other than

Company Stock Options) to purchase Company Common Stock (“Company Derivative Securities”). All shares of Company

Common Stock subject to issuance as aforesaid, upon issuance on the terms and conditions specified in the instrument pursuant to

which they are issuable, will be duly authorized, validly issued, fully paid and nonassessable. There are no commitments or agreements

of any character to which Company is bound obligating Company to accelerate the vesting of any Company Stock Option as a result

of the Merger. All outstanding shares of Company Common Stock and all outstanding Company Stock Options have been issued and granted

in compliance with (x) all applicable securities laws and (in all material respects) other applicable laws and regulations, and

(y) all requirements set forth in any applicable Company Contracts (as defined in Section 2.19). The Company has heretofore

delivered to Parent or Parent’s counsel true and accurate copies of the forms of documents used for the issuance of Company

Stock Options and a true and complete list of the holders thereof, including their names and the numbers of shares of Company Common

Stock underlying such holders’ Company Stock Options.

(b) Except

as set forth in Schedule 2.3(b) hereto or as set forth in Section 2.3(a) hereof, there are no subscriptions, options,

warrants, equity securities, partnership interests or similar ownership interests, calls, rights (including preemptive rights),

commitments or agreements of any character to which the Company is a party or by which it is bound obligating the Company to issue,

deliver or sell, or cause to be issued, delivered or sold, or repurchase, redeem or otherwise acquire, or cause the repurchase,

redemption or acquisition of, any shares of capital stock, partnership interests or similar ownership interests of the Company

or obligating the Company to grant, extend, accelerate the vesting of or enter into any such subscription, option, warrant, equity

security, call, right, commitment or agreement.

(c) Except

as contemplated by this Agreement and except as set forth in Schedule 2.3(c) hereto, there are no registration rights,

and there is no voting trust, proxy, rights plan, antitakeover plan or other agreement or understanding to which the Company is

a party or by which the Company is bound with respect to any equity security of any class of the Company.

(d) Except

as set forth in Schedule 2.3(d), no outstanding shares of Company Common Stock are unvested or subjected to a repurchase

option, risk of forfeiture or other condition under any applicable agreement with the Company.

(e) The

authorized and outstanding capital stock or membership interests of each Subsidiary are set forth in Schedule 2.3(e)

hereto. Except as set forth in Schedule 2.3(e), the Company owns all of the outstanding equity securities of each Subsidiary,

free and clear of all Liens, either directly or indirectly through one or more other Subsidiaries. There are no outstanding options,

warrants or other rights to purchase securities of any Subsidiary.

2.4. Authority

Relative to this Agreement. The Company has all necessary corporate power and authority to execute and deliver this Agreement

and to perform its obligations hereunder and to consummate the transactions contemplated hereby (including the Merger). The execution

and delivery of this Agreement and the consummation by the Company of the transactions contemplated hereby (including the Merger)

have been duly and validly authorized by all necessary corporate action on the part of the Company (including the approval by its

Board of Directors and stockholders, subject in all cases to the satisfaction of the terms and conditions of this Agreement, including

the conditions set forth in Article VI), and no other corporate proceedings on the part of the Company or its stockholders

are necessary to authorize this Agreement or to consummate the transactions contemplated hereby pursuant to Applicable Law and

the terms and conditions of this Agreement. This Agreement has been duly and validly executed and delivered by the Company and,

assuming the due authorization, execution and delivery thereof by the other parties hereto, constitutes the legal and binding obligation

of the Company, enforceable against the Company in accordance with its terms, except as may be limited by bankruptcy, insolvency,

reorganization or other similar laws affecting the enforcement of creditors’ rights generally and by general principles of

equity.

2.5. No

Conflict; Required Filings and Consents. Except as set forth in Schedule 2.5 hereto:

(a) The

execution and delivery of this Agreement by the Company does not, and the performance of this Agreement by the Company shall not,

(i) conflict with or violate the Company’s Charter Documents, (ii) subject to obtaining the adoption of this Agreement and

the Merger by the stockholders of the Company, conflict with or violate any Legal Requirements (as defined in Section 10.2(b)),

(iii) result in any breach of or constitute a default (or an event that with notice or lapse of time or both would become a default)

under, or materially impair the Company’s rights or alter the rights or obligations of any third party under, or give to

others any rights of termination, amendment, acceleration or cancellation of, or result in the creation of a lien or encumbrance

on any of the properties or assets of the Company pursuant to, any Company Contracts or (iv) result in the triggering, acceleration

or increase of any payment to any Person pursuant to any Company Contract, including any “change in control” or similar

provision of any Company Contract, except, with respect to clauses (ii), (iii) or (iv), for any such conflicts, violations, breaches,

defaults, triggerings, accelerations, increases or other occurrences that would not, individually and in the aggregate, have a

Material Adverse Effect on the Company and its Subsidiaries taken as a whole.

(b) The

execution and delivery of this Agreement by the Company does not, and the performance of its obligations hereunder will not, require

any consent, approval, authorization or permit of, or filing with or notification to, any Governmental Entity or other third party

(including, without limitation, lenders and lessors), except (i) for applicable requirements, if any, of the Securities Act, the

Exchange Act or Blue Sky Laws, and the rules and regulations thereunder, and appropriate documents received from or filed with

the relevant authorities of other jurisdictions in which the Company is licensed or qualified to do business, (ii) for the filing

of any notifications required under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”),

if required upon advice of counsel, and the expiration or early termination of the required waiting period thereunder, (iii) the

consents, approvals, authorizations and permits described in Schedule 2.5, and (iv) where the failure to obtain such

consents, approvals, authorizations or permits, or to make such filings or notifications, would not, individually or in the aggregate,

reasonably be expected to have a Material Adverse Effect on the Company and its Subsidiaries taken as a whole or, after the Closing,

Parent or Surviving Corp, or prevent consummation of the Merger or otherwise prevent the parties hereto from performing their obligations

under this Agreement.

2.6. Compliance.

Except as disclosed in Schedule 2.6, since its inception the Company and its Subsidiaries have complied with and is not

in violation of any Legal Requirements with respect to the conduct of its business, or the ownership or operation of its business,

except for failures to comply or violations which, individually or in the aggregate, have not had and are not reasonably likely

to have a Material Adverse Effect on the Company and its Subsidiaries taken as a whole. The businesses and activities of the Company

and its Subsidiaries have not been and are not being conducted in violation of any Legal Requirements. The Company and its Subsidiaries

are not in default or violation of any term, condition or provision of any applicable Charter Documents. Except as set forth in

Schedule 2.6, since the inception of the Company and its Subsidiaries, no written notice of non-compliance with any

Legal Requirements has been received by the Company or its Subsidiaries (and the Company and its Subsidiaries have no knowledge

of any such notice delivered to any other Person). The Company and its Subsidiaries are not in violation of any term of any Company

Contract, except for failures to comply or violations which, individually or in the aggregate, have not had and are not reasonably

likely to have a Material Adverse Effect on the Company and its Subsidiaries taken as a whole.

2.7. Financial

Statements.

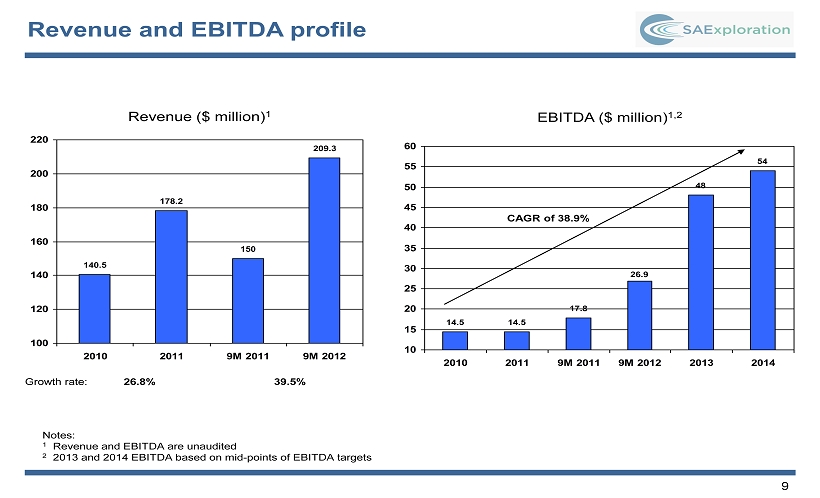

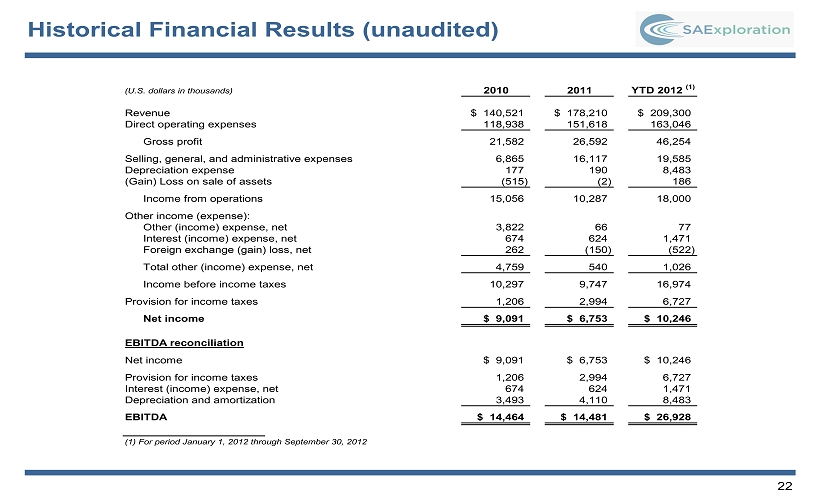

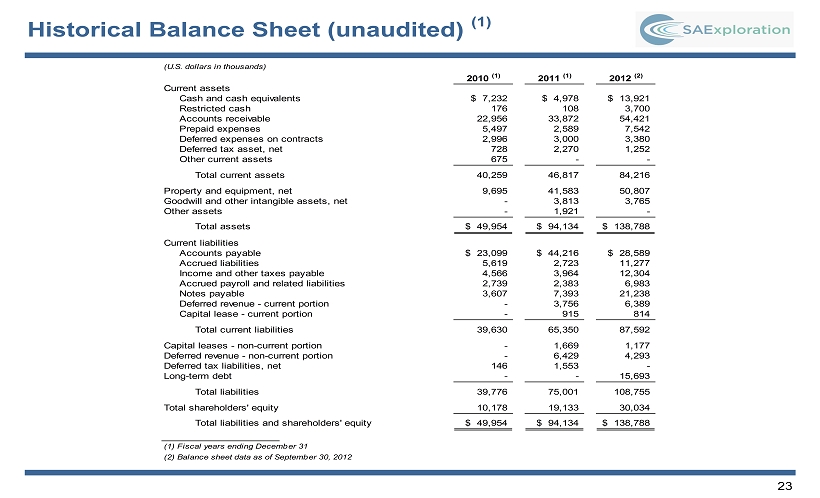

(a) The

Company has provided to Parent a correct and complete copy of the audited consolidated financial statements (including any related

notes thereto) of the Company for the fiscal years ended December 31, 2011 and December 31, 2010 (the “Audited Financial

Statements”). The Audited Financial Statements were prepared in accordance with generally accepted accounting principles

of the United States (“U.S. GAAP”) applied on a consistent basis throughout the periods involved (except as

may be indicated in the notes thereto), and each fairly presents in all material respects the financial position of the Company

at the respective dates thereof and the results of its operations and cash flows for the periods indicated.

(b) The

Company has provided to Parent a correct and complete copy of the unaudited consolidated financial statements of the Company for

the nine month period ended September 30, 2012 (including any notes related thereto) (the “Unaudited Financial Statements”).

The Unaudited Financial Statements comply as to form in all material respects, and were prepared in accordance with U.S. GAAP applied

on a consistent basis throughout the periods involved and in a manner consistent with the preparation of the Audited Financial

Statements, and fairly present in all material respects the financial position of the Company at the date thereof and the results

of its operations and cash flows for the period indicated, except that such statements need not contain notes and are subject to

normal audit adjustments that are not expected to have a Material Adverse Effect on the Company and its Subsidiaries taken as a

whole.

(c) The

books of account, minute books, stock certificate books and stock transfer ledgers and other similar books and records of the Company

have been maintained in accordance with good business practice, are complete and correct in all material respects and there have

been no material transactions that are required to be set forth therein and which have not been so set forth.

(d) Except

as otherwise noted in the Audited Financial Statements or the Unaudited Financial Statements, the accounts and notes receivable

of the Company reflected on the balance sheets included in the Audited Financial Statements and the Unaudited Financial Statements:

(i) arose from bona fide sales transactions in the ordinary course of business and are payable on ordinary trade terms, (ii) to

the knowledge of the Company, are legal, valid and binding obligations of the respective debtors enforceable in accordance with

their terms, except as such may be limited by bankruptcy, insolvency, reorganization, or other similar laws affecting creditors’

rights generally, and by general equitable principles, (iii) to the knowledge of the Company, are not subject to any valid set-off

or counterclaim except to the extent set forth in such balance sheet contained therein other than possible back charges which,

to the Company’s knowledge, do not exist at this time, which back charges, to the Company’s knowledge, either individually

or in the aggregate, would not reasonably be expected to have a Material Adverse Effect upon the Company and its Subsidiaries taken

as a whole, (iv) are collectible in the ordinary course of business consistent with past practice in the aggregate recorded amounts

thereof, net of any applicable reserve reflected in such balance sheet referenced above, and (v) are not the subject of any actions

or proceedings brought by or on behalf of the Company.

2.8. No

Undisclosed Liabilities. Except as set forth in Schedule 2.8 hereto, the Company and its Subsidiaries have

no liabilities (absolute, accrued, contingent or otherwise) of a nature required to be disclosed on a balance sheet or in the related

notes to financial statements that are, individually or in the aggregate, material to the business, results of operations or financial

condition of the Company and its Subsidiaries, except: (i) liabilities provided for in or otherwise disclosed in the interim balance

sheet included in the Unaudited Financial Statements, and (ii) such liabilities arising in the ordinary course of the Company’s

business since September 30, 2012, none of which, individually or in the aggregate, would have a Material Adverse Effect on the

Company and its Subsidiaries taken as a whole.

2.9. Absence

of Certain Changes or Events. Except as set forth in Schedule 2.9 hereto, since September 30, 2012, there has

not been: (i) any Material Adverse Effect on the Company and its Subsidiaries taken as a whole, (ii) any declaration, setting aside

or payment of any dividend on, or other distribution (whether in cash, stock or property) in respect of, any of the Company’s

stock, or any purchase, redemption or other acquisition by the Company of any of the Company’s capital stock or any other

securities of the Company or any options, warrants, calls or rights to acquire any such shares or other securities, (iii) any split,

combination or reclassification of any of the Company’s capital stock, (iv) any granting by the Company or its Subsidiaries

of any increase in compensation or fringe benefits, except for normal increases of cash compensation in the ordinary course of

business consistent with past practice, or any payment by the Company or any of its Subsidiaries of any bonus, except for bonuses

made in the ordinary course of business consistent with past practice, or any granting by the Company or any of its Subsidiaries

of any increase in severance or termination pay or any entry by the Company or any of its Subsidiaries into any currently effective

employment, severance, termination or indemnification agreement or any agreement the benefits of which are contingent or the terms

of which are materially altered upon the occurrence of a transaction involving the Company of the nature contemplated hereby, (v)

any material change by the Company or any of its Subsidiaries in its accounting methods, principles or practices, (vi) any change

in the auditors of the Company, (vii) any issuance of capital stock of the Company, (viii) any revaluation by the Company of any

of its assets, including, without limitation, writing down the value of capitalized inventory or writing off notes or accounts

receivable or any sale of assets of the Company other than in the ordinary course of business, (ix) any incurrence of debt by the

Company other than trade debt in the ordinary course of business or (x) any agreement, whether written or oral, to do any of the

foregoing.

2.10. Litigation.

Except as disclosed in Schedule 2.10 hereto, there are no claims, suits, actions or proceedings pending or, to the

knowledge of the Company, threatened against the Company or any of its Subsidiaries before any court, governmental department,

commission, agency, instrumentality or authority, or any arbitrator.

2.11. Employee

Benefit Plans.

(a) Schedule 2.11(a)

lists all employee compensation, incentive, fringe or benefit plans, programs, policies, commitments or other arrangements (whether

or not set forth in a written document) covering any active or former employee, director or consultant of the Company or any of

its Subsidiaries, or any trade or business (whether or not incorporated) which is under common control with the Company or any

of its Subsidiaries, with respect to which the Company has liability (individually, a “Plan,” and, collectively,

the “Plans”). All Plans have been maintained and administered in all material respects in compliance with their

respective terms and with the requirements prescribed by any and all Applicable Law applicable to such Plans, and all liabilities

with respect to the Plans have been properly reflected in the financial statements and records of the Company or any of its Subsidiaries.

No suit, action or other litigation (excluding claims for benefits incurred in the ordinary course of Plan activities) has been

brought, or, to the knowledge of the Company, is threatened, against or with respect to any Plan. There are no audits, inquiries

or proceedings pending or, to the knowledge of the Company, threatened by any Governmental Entity with respect to any Plan. All

contributions, reserves or premium payments required to be made or accrued as of the date hereof to the Plans have been timely

made or accrued. The Company or any of its Subsidiaries do not have any plan or commitment to establish any new Plan, to modify

any Plan (except to the extent required by law or to conform any such Plan to the requirements of any Applicable Law, in each case

as previously disclosed to Parent in writing, or as required by this Agreement), or to enter into any new Plan. Except as disclosed

in Schedule 2.11(a), each Plan can be amended, terminated or otherwise discontinued after the Closing in accordance

with its terms, without liability to Parent, the Company or any of its Subsidiaries (other than ordinary administration expenses

and expenses for benefits accrued but not yet paid).

(b) Except

as disclosed in Schedule 2.11(b) hereto, neither the execution and delivery of this Agreement nor the consummation

of the transactions contemplated hereby will (i) result in any payment (including severance, unemployment compensation, golden

parachute, bonus or otherwise) becoming due to any stockholder, director or employee of the Company and its Subsidiaries under

any Plan or otherwise, (ii) materially increase any benefits otherwise payable under any Plan, or (iii) result in the acceleration

of the time of payment or vesting of any such benefits.

(c) No

material liability under Title IV of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”),

has been incurred by the Company or any of its Subsidiaries that has not been satisfied in full and no event has occurred and,

to the knowledge of the Company and its Subsidiaries, no condition exists that could reasonably be likely to result in the Company

or any of its Subsidiaries incurring a material liability under Title IV of ERISA. No Plan is a defined benefit pension plan or

is subject to Section 302 or Title IV of ERISA or Section 412 of the Code. No Plan is a multiemployer plan within the

meaning of Section 3(37) of ERISA or a multiple employer welfare arrangement as defined in Section 3(40) or ERISA.

2.12. Labor

Matters.

(a) Except

as set forth on Schedule 2.12, the Company and its Subsidiaries are not a party to any collective bargaining agreement

or other labor union contract applicable to persons employed by the Company and its Subsidiaries nor, to the Company’s knowledge,

are there any pending, or to the knowledge of the Company and its Subsidiaries, threatened, (i) activities or proceedings of any

labor union to organize any such employees or (ii) strikes, labor disputes, slowdowns or stoppages or union representation questions.

There are no pending grievance or similar proceedings involving the Company and its Subsidiaries and any of its employees subject

to a collective bargaining agreement or other labor union contract and there are no continuing obligations of the Company and its

Subsidiaries pursuant to the resolution of any such proceeding that is no longer pending.

(b) Except

as provided for in the collective bargaining agreements and labor union contracts set forth on Schedule 2.12, (i) each

employee and consultant of the Company and its Subsidiaries is terminable “at will” subject to applicable notice periods

as set forth by law or in an employment agreement, but in any event not more than ninety (90) days, and (ii) there are no agreements

or understandings between the Company and its Subsidiaries and any of their employees or consultants that their employment or services

will be for any particular period. The Company has no knowledge that any of its officers or key employees intends to terminate

his or her employment with the Company or any of its Subsidiaries. The Company and its Subsidiaries are in compliance in all material

respects and, to the Company’s knowledge, each of the Company’s and its Subsidiaries’ employees and consultants

is in compliance in all material respects, with the terms of the respective employment and consulting agreements between the Company

or its Subsidiaries and such individuals. Except as otherwise disclosed in Schedule 2.12, there are not, and there

have not been, any oral or informal arrangements, commitments or promises between the Company or its Subsidiaries and any employees

or consultants of the Company or its Subsidiaries that have not been documented as part of the formal written agreements between

any such individuals and the Company or its Subsidiaries that have been made available to Parent.

(c) The

Company and its Subsidiaries are in compliance in all material respects with all Legal Requirements applicable to its employees,

respecting employment, employment practices, terms and conditions of employment and wages and hours and is not liable for any arrears

of wages or penalties with respect thereto. The Company’s and its Subsidiaries’ obligations to provide statutory severance

pay to their employees are fully funded or accrued on the Unaudited Financial Statements and the Company has no knowledge of any

circumstance that could give rise to any valid claim by a current or former employee for compensation on termination of employment

(beyond the statutory severance pay to which employees are entitled). All amounts that the Company is legally or contractually

required either (x) to deduct from its employees’ salaries or to transfer to such employees’ pension or life insurance,

incapacity insurance, continuing education fund or other similar funds or (y) to withhold from its employees’ salaries and

benefits and to pay to any Governmental Entity as required by applicable Legal Requirements have, in each case, been duly deducted,

transferred, withheld and paid when required, and the Company and its Subsidiaries do not have any outstanding obligation to make

any such deduction, transfer, withholding or payment. Except as set forth in Schedule 2.12, there are no pending or, to

the Company’s knowledge, threatened claims or actions against the Company or any of its Subsidiaries by any employee in connection

with such employee’s employment or termination of employment by the Company or any of its Subsidiaries.

(d) No

employee or former employee of the Company or any of its Subsidiaries is owed any wages, benefits or other compensation for past

services (other than wages, benefits and compensation accrued in the ordinary course of business during the current pay period

and any accrued benefits for services, which by their terms or under applicable law, are payable in the future, such as accrued

vacation, recreation leave and severance pay).

(e) As

used in this Section 2.l2, knowledge of the Company encompasses knowledge of members of the human resources departments (or employees

with similar functions) of the Company and its Subsidiaries taken as a whole.

2.13. Restrictions

on Business Activities. Except as disclosed in Schedule 2.13 hereto, there is no agreement, commitment, judgment,

injunction, order or decree binding upon the Company or its Subsidiaries or their assets or to which the Company or its Subsidiaries

is a party which has or could reasonably be expected to have the effect of prohibiting or materially impairing any business practice

of the Company or its Subsidiaries, any acquisition of property by the Company or its Subsidiaries or the conduct of business by

the Company or its Subsidiaries as currently conducted other than such effects, individually or in the aggregate, that have not

had and could not reasonably be expected to have a Material Adverse Effect on the Company and its Subsidiaries taken as a whole.

2.14. Title

to Property.

(a) All

real property owned by the Company and its Subsidiaries (including improvements and fixtures thereon, easements and rights of way)

is shown or reflected on the balance sheet of the Company included in the Unaudited Financial Statements and is listed on Schedule

2.14(a) hereto. The Company and its Subsidiaries have good, valid and marketable fee simple title to the real property respectively

owned by each such entity, and except as set forth in the Audited Financial Statements or on Schedule 2.14(a) hereto,

all of such real property is held free and clear of (i) all leases, licenses and other rights to occupy or use such real property

and (ii) all Liens, rights of way, easements, restrictions, exceptions, variances, reservations, covenants or other title defects

or limitations of any kind, other than liens for taxes not yet due and payable and such liens or other imperfections of title,

if any, as do not materially detract from the value of or materially interfere with the present use of the property affected thereby.

Schedule 2.14(a) hereto also contains a list of all options or other contracts under which the Company and its Subsidiaries