EXHIBIT 99.1

(An exploration company)

CONDENSED INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

FOR THE THREE MONTHS ENDED MARCH 31, 2024

| Fury Gold Mines Limited |

|

|

|

|

|

|

|

| ||||

| Condensed Interim Consolidated Statements of Financial Position | ||||||||||||

| (Expressed in thousands of Canadian dollars – Unaudited) | ||||||||||||

|

|

|

|

| At March 31 |

|

| At December 31 |

| ||||

|

|

| Note |

|

| 2024 |

|

| 2023 |

| |||

| Assets |

|

|

|

|

|

|

|

|

| |||

| Current assets: |

|

|

|

|

|

|

|

|

| |||

| Cash |

|

|

|

| $ | 5,731 |

|

| $ | 7,313 |

| |

| Marketable securities |

|

| 3 |

|

|

| 2,620 |

|

|

| 1,166 |

|

| Accounts receivable |

|

|

|

|

|

| 36 |

|

|

| 374 |

|

| Prepaid expenses and deposits |

|

|

|

|

|

| 594 |

|

|

| 592 |

|

|

|

|

|

|

|

|

| 8,981 |

|

|

| 9,445 |

|

| Non-current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Restricted cash |

|

|

|

|

|

| 144 |

|

|

| 144 |

|

| Prepaid expenses and deposits |

|

|

|

|

|

| 108 |

|

|

| 111 |

|

| Property and equipment |

|

|

|

|

|

| 503 |

|

|

| 588 |

|

| Mineral interests |

|

| 4 |

|

|

| 145,649 |

|

|

| 142,639 |

|

| Investments in associates |

|

| 5 |

|

|

| 32,638 |

|

|

| 36,248 |

|

|

|

|

|

|

|

|

| 179,042 |

|

|

| 179,730 |

|

| Total assets |

|

|

|

|

| $ | 188,023 |

|

| $ | 189,175 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

|

|

|

|

| $ | 696 |

|

| $ | 1,034 |

|

| Lease liability |

|

|

|

|

|

| 171 |

|

|

| 154 |

|

| Flow-through share premium liability |

|

| 6 |

|

|

| - |

|

|

| 544 |

|

|

|

|

|

|

|

|

| 867 |

|

|

| 1,732 |

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Lease liability |

|

|

|

|

|

| 20 |

|

|

| 74 |

|

| Flow-through share premium liability |

|

| 6 |

|

|

| 264 |

|

|

| - |

|

| Provision for site reclamation and closure |

|

|

|

|

|

| 4,516 |

|

|

| 4,495 |

|

| Total liabilities |

|

|

|

|

| $ | 5,667 |

|

| $ | 6,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

| Share capital |

|

| 8 |

|

| $ | 310,277 |

|

| $ | 310,277 |

|

| Share option and warrant reserve |

|

| 9 |

|

|

| 22,077 |

|

|

| 21,660 |

|

| Accumulated other comprehensive loss |

|

|

|

|

|

| (10 | ) |

|

| (9 | ) |

| Deficit |

|

|

|

|

|

| (149,988 | ) |

|

| (149,054 | ) |

| Total equity |

|

|

|

|

| $ | 182,356 |

|

| $ | 182,874 |

|

| Total liabilities and equity |

|

|

|

|

| $ | 188,023 |

|

| $ | 189,175 |

|

Commitments (notes 5c, 13)

Approved on behalf of the Board of Directors:

| “Forrester A. Clark” | “Steve Cook” |

| |

| Chief Executive Officer | Director |

|

The accompanying notes form an integral part of these condensed interim consolidated financial statements.

|

| |

| Fury Gold Mines Limited | 1 |

| Fury Gold Mines Limited | ||||||||||||

| Condensed Interim Consolidated Statements of Loss and Comprehensive Loss | ||||||||||||

| (Expressed in thousands of Canadian dollars, except per share amounts – Unaudited) | ||||||||||||

| Three months ended March 31 | ||||||||||||

|

|

| Note |

|

| 2024 |

|

| 2023 |

| |||

| Operating expenses: |

|

|

|

|

|

|

|

|

| |||

| Exploration and evaluation |

| 7 & 9 |

|

| $ | 791 |

|

| $ | 861 |

| |

| Fees, salaries, and other employee benefits |

| 9 & 10 |

|

|

| 482 |

|

|

| 880 |

| |

| Insurance |

|

|

|

|

| 148 |

|

|

| 168 |

| |

| Legal and professional |

|

|

|

|

| 144 |

|

|

| 103 |

| |

| Marketing and investor relations |

|

|

|

|

| 135 |

|

|

| 170 |

| |

| Office and administration |

|

|

|

|

| 94 |

|

|

| 81 |

| |

| Regulatory and compliance |

|

|

|

|

| 61 |

|

|

| 65 |

| |

|

|

|

|

|

|

| 1,855 |

|

|

| 2,328 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Other expense (income), net: |

|

|

|

|

|

|

|

|

|

|

| |

| Realized gain on disposal of investments |

|

| 5 |

|

|

| (537 | ) |

|

| - |

|

| Net gain on marketable securities |

|

| 3 |

|

|

| (398 | ) |

|

| (188 | ) |

| Net loss from associate |

|

| 5 |

|

|

| 327 |

|

|

| 582 |

|

| Amortization of flow-through share premium |

|

| 6 |

|

|

| (280 | ) |

|

| - |

|

| Accretion of provision for site reclamation and closure |

|

|

|

|

|

| 34 |

|

|

| 34 |

|

| Interest expense |

|

|

|

|

|

| 10 |

|

|

| 22 |

|

| Interest income |

|

|

|

|

|

| (82 | ) |

|

| (121 | ) |

| Foreign exchange loss |

|

|

|

|

|

| 5 |

|

|

| 4 |

|

|

|

|

|

|

|

|

| (921 | ) |

|

| 333 |

|

| Net loss |

|

|

|

|

| $ | 934 |

|

| $ | 2,661 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive loss, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized currency loss on translation of foreign operations |

|

|

|

|

|

| 1 |

|

|

| 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive loss |

|

|

|

|

| $ | 935 |

|

| $ | 2,662 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted loss per share |

|

| 12 |

|

| $ | 0.01 |

|

| $ | 0.02 |

|

The accompanying notes form an integral part of these condensed interim consolidated financial statements.

|

| |

| Fury Gold Mines Limited | 2 |

| Fury Gold Mines Limited Condensed Interim Consolidated Statements of Equity (Expressed in thousands of Canadian dollars, except share amounts – Unaudited) | ||||||||||||||||||||||||

|

|

| Number of common shares |

|

| Share capital |

|

| Share option and warrant reserve |

|

| Accumulated other comprehensive loss |

|

| Deficit |

|

| Total |

| ||||||

| Balance at December 31, 2022 |

|

| 139,470,950 |

|

| $ | 306,328 |

|

| $ | 20,309 |

|

| $ | (3 | ) |

| $ | (131,841 | ) |

| $ | 194,793 |

|

| Total comprehensive loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| (1 | ) |

|

| (2,661 | ) |

|

| (2,662 | ) |

| Shares issued pursuant to offering, net of share issue costs and flow-through liability |

|

| 6,076,500 |

|

|

| 3,949 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 3,949 |

|

| Share-based compensation |

|

| - |

|

|

| - |

|

|

| 686 |

|

|

| - |

|

|

| - |

|

|

| 686 |

|

| Balance at March 31, 2023 |

|

| 145,547,450 |

|

| $ | 310,277 |

|

| $ | 20,995 |

|

| $ | (4 | ) |

| $ | (134,502 | ) |

| $ | 196,766 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2023 |

|

| 145,744,795 |

|

| $ | 310,277 |

|

| $ | 21,660 |

|

| $ | (9 | ) |

| $ | (149,054 | ) |

| $ | 182,874 |

|

| Total comprehensive loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| (1 | ) |

|

| (934 | ) |

|

| (935 | ) |

| Share-based compensation (note 9(a)) |

|

| 332,308 |

|

|

| - |

|

|

| 417 |

|

|

| - |

|

|

| - |

|

|

| 417 |

|

| Balance at March 31, 2024 |

|

| 146,077,103 |

|

| $ | 310,277 |

|

| $ | 22,077 |

|

| $ | (10 | ) |

| $ | (149,988 | ) |

| $ | 182,356 |

|

The accompanying notes form an integral part of these condensed interim consolidated financial statements.

|

| |

| Fury Gold Mines Limited | 3 |

| Fury Gold Mines Limited |

|

|

|

|

|

| ||||||

| Condensed Interim Consolidated Statements of Cash Flows | ||||||||||||

| (Expressed in thousands of Canadian dollars – Unaudited) | ||||||||||||

|

|

|

| Three months ended March 31 |

| ||||||||

|

|

| Note |

|

| 2024 |

|

| 2023 |

| |||

| Operating activities: |

|

|

|

|

|

|

|

|

| |||

| Net (loss) |

|

|

|

| $ | (934 | ) |

| $ | (2,661 | ) | |

| Adjusted for: |

|

|

|

|

|

|

|

|

|

|

| |

| Interest income |

|

|

|

|

| (82 | ) |

|

| (121 | ) | |

| Items not involving cash: |

|

|

|

|

|

|

|

|

|

|

| |

| Depreciation |

|

|

|

|

| 84 |

|

|

| 87 |

| |

| Realized gain on disposal of investments |

|

| 5 |

|

|

| (537 | ) |

|

| - |

|

| Net gain on marketable securities |

|

| 3 |

|

|

| (398 | ) |

|

| (188 | ) |

| Net loss from associates |

|

| 5 |

|

|

| 327 |

|

|

| 582 |

|

| Amortization of flow-through share premium |

|

| 6 |

|

|

| (280 | ) |

|

| - |

|

| Accretion expense |

|

|

|

|

|

| 34 |

|

|

| 34 |

|

| Share-based compensation |

|

| 9a |

|

| 253 |

|

|

| 686 |

| |

| Interest expense |

|

|

|

|

|

| 10 |

|

|

| 22 |

|

| Changes in non-cash working capital |

|

| 11 |

|

|

| 165 |

|

|

| (242 | ) |

| Cash used in operating activities |

|

|

|

|

|

| (1,358 | ) |

|

| (1,801 | ) |

| Investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest received |

|

|

|

|

|

| 82 |

|

|

| 121 |

|

| Acquisition of mineral interests, inclusive of transaction fees |

|

| 4 |

|

|

| (3,022 | ) |

|

| - |

|

| Proceeds from disposition of investment in associate, net of transaction costs |

|

| 5a |

|

| 3,820 |

|

|

| - |

| |

| Acquisition of marketable securities |

|

|

|

|

|

| (1,300 | ) |

|

| - |

|

| Proceeds from disposal of marketable securities |

|

|

|

|

|

| 244 |

|

|

| - |

|

| Option payment received |

|

|

|

|

|

| - |

|

|

| 50 |

|

| Cash (used in) provided by investing activities |

|

|

|

|

|

| (176 | ) |

|

| 171 |

|

| Financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from issuance of flow-through shares, net of costs |

|

| 8 |

|

|

| - |

|

|

| 7,926 |

|

| Lease payments |

|

|

|

|

|

| (47 | ) |

|

| (63 | ) |

| Cash (used in) provided by financing activities |

|

|

|

|

|

| (47 | ) |

|

| 7,863 |

|

| Effect of foreign exchange on cash |

|

|

|

|

|

| (1 | ) |

|

| (1 | ) |

| (Decrease) increase in cash |

|

|

|

|

|

| (1,582 | ) |

|

| 6,232 |

|

| Cash, beginning of the period |

|

|

|

|

|

| 7,313 |

|

|

| 10,309 |

|

| Cash, end of the period |

|

|

|

|

| $ | 5,731 |

|

| $ | 16,541 |

|

Supplemental cash flow information (note 11)

The accompanying notes form an integral part of these condensed interim consolidated financial statements.

|

| |

| Fury Gold Mines Limited | 4 |

| Note 1: Nature of operations |

|

|

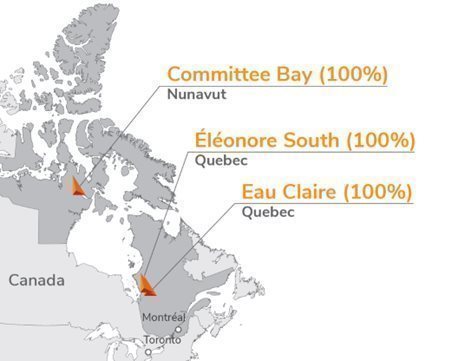

Fury Gold Mines Limited (the “Company” or “Fury Gold”) was incorporated on June 9, 2008, under the Business Corporations Act (British Columbia) and is listed on the Toronto Stock Exchange and the NYSE-American, with its common shares trading under the symbol FURY. The Company’s registered and records office is at 1500-1055 West Georgia Street Vancouver, BC, V6E 4N7 and the mailing address is 1630-1177 West Hastings Street, Vancouver, BC, V6E 2K3.

The Company’s principal business activity is the acquisition and exploration of resource projects in Canada. At March 31, 2024, the Company had two principal projects: Eau Claire in Quebec and Committee Bay in Nunavut. Additionally, the Company holds an 18.99% common share interest in Dolly Varden Silver Corporation (“Dolly Varden”), which owns the Kitsault project in British Columbia and a 25% interest in Universal Mineral Services Limited (“UMS”), a private shared-services provider (note 5).

| Note 2: Basis of presentation |

|

|

Statement of compliance

These unaudited condensed interim consolidated financial statements (the “interim financial statements”) have been prepared in accordance with International Accounting Standard 34 – Interim Financial Reporting (“IAS 34”) as issued by the International Accounting Standards Board (“IASB”). Certain disclosures included in the Company’s annual consolidated financial statements (the “consolidated financial statements”) prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the IASB and interpretations issued by the IFRS Interpretations Committee (“IFRICs”) have been condensed or omitted herein. Accordingly, these unaudited interim financial statements should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2023. These interim financial statements were approved and authorized for issuance by the Board of Directors of the Company on May 14, 2024.

Basis of preparation and consolidation

These interim financial statements incorporate the financial statements of the Company and entities controlled by the Company (its subsidiaries). Control exists when the Company has power over an investee, exposure or rights to variable returns from its involvement with the investee, and the ability to use its power over the investee to affect the amount of the Company’s returns. The Company’s interim results are not necessarily indicative of its results for a full year.

The subsidiaries (with a beneficial interest of 100%) of the Company at March 31, 2024 were as follows:

| Subsidiary | Place of incorporation | Functional currency |

| Eastmain Mines Inc. (a) | Canada | CAD |

| Eastmain Resources Inc. | ON, Canada | CAD |

| Fury Gold USA Limited (b) | Delaware, U.S.A. | USD |

| North Country Gold Corp. | BC, Canada | CAD |

(a) Company incorporated federally in Canada.

(b) Fury USA provides certain administrative services with respect to employee benefits for US resident personnel.

Investments in associates and joint arrangements

These interim financial statements also include the following joint arrangement and investments in associates:

| Associates and joint arrangement | Ownership interest | Location | Classification and accounting method |

| Dolly Varden | 18.99% | BC, Canada | Associate; equity method |

| UMS | 25.00% | BC, Canada | Associate; equity method |

|

| |

| Fury Gold Mines Limited Notes to Q1 2024 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 5 |

These interim financial statements have been prepared on a historical cost basis except for certain financial instruments that have been measured at fair value (note 13). All amounts are expressed in thousands of Canadian dollars unless otherwise noted. Reference to US$ are to United States dollars. All intercompany balances and transactions have been eliminated.

Segmented information

The Company’s operating segments are reviewed by the key decision maker to make decisions about resources to be allocated to the segments and to assess their performance. The Company operates in one reportable operating segment, being the acquisition, exploration, and development of mineral resource properties, and in one geographical location, Canada.

Critical accounting estimates, judgements, and policies

The preparation of financial statements in accordance with IFRS requires management to select accounting policies and make estimates and judgments that may have a significant impact on consolidated financial statements. Estimates are continuously evaluated and are based on management’s experience and expectations of future events that are believed to be reasonable under the circumstances. Actual outcomes may differ from these estimates.

In preparing the Company’s interim financial statements for the three months ended March 31, 2024, the Company applied the material accounting policy information and critical accounting estimates and judgements disclosed in notes 3 and 5, respectively, of its consolidated financial statements for the year ended December 31, 2023.

Application of new and revised accounting standards:

On October 31, 2021, the IASB issued Non-current Liabilities with Covenants (Amendments to IAS 1). The amendments to IAS 1 affect only the presentation of liabilities as current or non-current in the statement of financial position and not the amount or timing of recognition of any asset, liability, income or expenses, or the information disclosed about those items. The adoption of the new standard did not impact the financial statements of the Company.

On May 25, 2023, the IASB issued the final amendments to IAS 7 and IFRS 7 which address the disclosure requirements to enhance the transparency of supplier finance arrangements and their effects on a company’s liabilities, cash flows and exposure to liquidity risk. The amendments to IAS 7 are effective for annual periods beginning on or after January 1, 2024 with earlier application permitted. The adoption of the new standard did not impact the financial statements of the Company.

On September 22, 2022, the IASB issued "Lease Liability in a Sale and Leaseback (Amendments to IFRS 16)" with amendments that clarify how a seller-lessee subsequently measures sale and leaseback transactions that satisfy the requirements in IFRS 15 to be accounted for as a sale. The amendments are effective for annual reporting periods beginning on or after January 1, 2024 and earlier application is permitted. The adoption of the new standard did not impact the financial statements of the Company.

| Note 3: Marketable securities |

|

|

The marketable securities held by the Company were as follows:

|

|

| Total |

| |

| Balance at December 31, 2022 |

| $ | 582 |

|

| Additions |

|

| 1,619 |

|

| Proceeds from disposal of marketable securities |

|

| (381 | ) |

| Realized gain on disposition |

|

| 293 |

|

| Unrealized net loss |

|

| (947 | ) |

| Balance at December 31, 2023 |

| $ | 1,166 |

|

| Additions |

|

| 1,300 |

|

| Proceeds from disposal of marketable securities |

|

| (244 | ) |

| Realized loss on disposition |

|

| (14 | ) |

| Unrealized net gain |

|

| 412 |

|

| Balance at March 31, 2024 |

| $ | 2,620 |

|

|

| |

| Fury Gold Mines Limited Notes to Q1 2024 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 6 |

During the three months ended March 31, 2024, the Company acquired a 10.9% common share ownership of Sirios Resources Inc (“Sirios”) for $1,300, as part of another transaction (note 4) to consolidate its Éléonore South project ownership. The 30,392,372 Sirios common shares have been acquired for investment purposes and the Company will evaluate its investment in Sirios on an ongoing basis with respect to any possible additional purchases or dispositions, whereupon any such marketable securities transactions are accounted for as of the trade date. During the first quarter of 2024, Fury Gold sold an aggregate of 1,514,000 Sirios common shares, lowering its holdings to 10.4% as at March 31, 2024.

| Note 4: Mineral interests |

|

|

The Company’s resource properties are located in Canada. A summary of the carrying amounts is as follows:

|

|

| Quebec |

|

| Nunavut |

|

| Total |

| |||

| Balance at December 31, 2022 |

| $ | 125,656 |

|

| $ | 19,534 |

|

| $ | 145,190 |

|

| Option payment received |

|

| (880 | ) |

|

| - |

|

|

| (880 | ) |

| Disposition |

|

| (1,746 | ) |

|

| - |

|

|

| (1,746 | ) |

| Change in estimate of provision for site reclamation and closure |

|

| (52 | ) |

|

| 127 |

|

|

| 75 |

|

| Option payment received |

|

| (880 | ) |

|

| - |

|

|

| (880 | ) |

| Balance at December 31, 2023 |

| $ | 122,978 |

|

| $ | 19,661 |

|

| $ | 142,639 |

|

| Additions (1) |

|

| 3,022 |

|

|

| - |

|

|

| 3,022 |

|

| Change in estimate of provision for site reclamation and closure |

|

| 4 |

|

|

| (16 | ) |

|

| (12 | ) |

| Balance at March 31, 2024 |

| $ | 126,004 |

|

| $ | 19,645 |

|

| $ | 145,649 |

|

(1) On February 29, 2024, the Company, and its joint operation partner Newmont Corporation (“Newmont”), through their respective subsidiaries, closed a transaction whereby the Company acquired 100% control of the joint operation interests, the Éléonore South project, consolidating these properties into the Company’s portfolio at which time the joint venture operation was dissolved. The 49.978% that Newmont held was acquired by the Company for $3,000 while incurring $22 in transaction costs. As part of the same transaction, the Company also acquired a 10.9% interest in Sirios, as disclosed in note 3.

| Note 5: Investments in Associates |

|

|

| (a) | Acquisition of investments in associates |

|

| (i) | On February 25, 2022, the Company completed the sale of Homestake Resources Corporation to Dolly Varden for cash proceeds of $5,000 and 76,504,590 common shares of Dolly Varden. The Company’s resulting interest in Dolly Varden represented approximately 35.3% of the issued and outstanding common shares of Dolly Varden on February 25, 2022, which has been accounted for using the equity method. The Company recognized a gain of $48,390, net of transaction costs of $589, on the date of disposition. On October 13, 2022, the Company completed the sale of 17,000,000 common shares of Dolly Varden for total gross proceeds of $6,800. On March 13, 2024 the Company sold a further 5,450,000 common shares of Dolly Varden for gross proceeds of $4,006 to decrease its holdings to 18.99% as at March 31, 2024, recognizing a gain of $537 and incurring $185 in costs to complete the transaction. |

|

|

|

|

|

| (ii) | On April 1, 2022, the Company purchased a 25% share interest in UMS, a private shared-services provider for nominal consideration. The Company funded, in addition to its nominal investment in UMS, a cash deposit of $150,000 which is held by UMS for the purposes of general working capital, and which will be returned to the Company upon termination of the UMS Canada arrangement, net of any residual unfulfilled obligations. UMS is the private company through which its shareholders, including Fury Gold, share geological, financial, and transactional advisory services as well as administrative services on a full, cost recovery basis. |

|

| |

| Fury Gold Mines Limited Notes to Q1 2024 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 7 |

| (b) | Summarized financial information of the Company’s investments in associates: |

The carrying amounts of the Company’s investments in associates as at March 31, 2024, were as follows:

|

|

| Dolly Varden |

|

| UMS |

|

| Total |

| |||

| Carrying amount at December 31, 2022 |

| $ | 42,303 |

|

| $ | 127 |

|

| $ | 42,430 |

|

| Company’s share of net loss of associates |

|

| (6,177 | ) |

|

| (5 | ) |

|

| (6,182 | ) |

| Carrying amount at December 31, 2023 |

| $ | 36,126 |

|

| $ | 122 |

|

| $ | 36,248 |

|

| Company’s share of net loss of associates |

|

| (326 | ) |

|

| (1 | ) |

|

| (327 | ) |

| Disposition(1) |

|

| (3,283 | ) |

|

| - |

|

|

| (3,283 | ) |

| Carrying amount at March 31, 2024 |

| $ | 32,517 |

|

| $ | 121 |

|

| $ | 32,638 |

|

(1) Included in the disposition number is $26 which was the Company’s portion of its loss until disposition.

The fair market value of the Company’s equity interest in Dolly Varden at March 31, 2024 was $45,406, based on the closing share price on the TSX Venture Exchange on that date.

For the three months ended March 31, 2024 and 2023, the Company’s equity share of net losses of the Company’s associates on a 100% basis were as follows:

| Three months ended March 31, 2024 |

| Dolly Varden |

|

| UMS |

|

| Total |

| |||

| Cost recoveries |

| $ | - |

|

| $ | (953 | ) |

| $ | (953 | ) |

| Exploration and evaluation |

|

| 436 |

|

|

| 331 |

|

|

| 767 |

|

| Marketing |

|

| 284 |

|

|

| 82 |

|

|

| 366 |

|

| Share-based compensation |

|

| 349 |

|

|

| - |

|

|

| 349 |

|

| Administrative and other |

|

| 563 |

|

|

| 544 |

|

|

| 1,107 |

|

| Net loss of associate, 100% |

|

| 1,632 |

|

|

| 4 |

|

|

| 1,636 |

|

| Average equity interest for the period |

|

| 21.56 | % |

|

| 25 | % |

|

|

|

|

| Company’s share of net loss of associates |

| $ | 352 |

|

| $ | 1 |

|

| $ | 353 |

|

| Three months ended March 31, 2023 |

| Dolly Varden |

|

| UMS |

|

| Total |

| |||

| Cost recoveries |

| $ | - |

|

| $ | (1,556 | ) |

| $ | (1,556 | ) |

| Exploration and evaluation |

|

| 799 |

|

|

| 491 |

|

|

| 1,290 |

|

| Marketing |

|

| 408 |

|

|

| 128 |

|

|

| 536 |

|

| Share-based compensation |

|

| 420 |

|

|

| - |

|

|

| 420 |

|

| Administrative and other |

|

| 811 |

|

|

| 974 |

|

|

| 1,785 |

|

| Net loss of associate, 100% |

|

| 2,438 |

|

|

| 37 |

|

|

| 2,475 |

|

| Average equity interest for the period |

|

| 23.5 | % |

|

| 25 | % |

|

|

|

|

| Company’s share of net loss of associates |

| $ | 573 |

|

| $ | 9 |

|

| $ | 582 |

|

The Company’s equity share of net assets of associates at March 31, 2024, is as follows:

|

|

| Dolly Varden |

|

| UMS |

| ||

| Current assets |

| $ | 23,907 |

|

| $ | 825 |

|

| Non-current assets |

|

| 151,928 |

|

|

| 2,391 |

|

| Current liabilities |

|

| (4,598 | ) |

|

| (1,428 | ) |

| Non-current liabilities |

|

| - |

|

|

| (1,304 | ) |

| Net assets, 100% |

|

| 171,237 |

|

|

| 484 |

|

| Company’s equity share of net assets of associate |

| $ | 32,517 |

|

| $ | 121 |

|

|

| |

| Fury Gold Mines Limited Notes to Q1 2024 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 8 |

| (c) | Services rendered and balances with UMS |

|

|

| Three months ended March 31 |

| |||||

|

|

| 2024 |

|

| 2023 |

| ||

| Exploration and evaluation costs |

| $ | 58 |

|

| $ | 296 |

|

| General, marketing and administration |

|

| 73 |

|

|

| 241 |

|

| Total transactions for the period |

| $ | 131 |

|

| $ | 537 |

|

The outstanding balance owing at March 31, 2024, was $38 (December 31, 2023 – $103) which is included in accounts payable and accrued liabilities.

As part of the UMS arrangement, the Company is contractually obliged to pay certain rental expenses in respect of a ten-year office lease entered into by UMS on July 1, 2021. As at March 31, 2024, the Company expects to incur approximately $216 in respect of its share of future rental expense of UMS for the remaining 7 years.

The Company issues share options to certain UMS employees, including key management personnel of the Company (note 10). The Company recognized a share-based compensation reversal of $4 for the three months ended March 31, 2024 in respect of share options issued to UMS employees (March 31, 2023 expense - $224).

| Note 6: Flow-through share premium liability |

|

|

Flow-through shares are issued at a premium, calculated as the difference between the price of a flow-through share and the price of a common share at that date. Tax deductions generated by eligible expenditures are passed through to the shareholders of the flow-through shares once the eligible expenditures are incurred and renounced.

| Quebec |

| Flow-through funding and expenditures |

|

| Flow-through Premium liability |

| ||

| Balance at December 31, 2022 |

| $ | - |

|

| $ | - |

|

| Flow-through funds raised |

|

| 8,750 |

|

|

| 3,889 |

|

| Flow-through eligible expenditures |

|

| (7,527 | ) |

|

| (3,345 | ) |

| Balance at December 31, 2023 |

| $ | 1,223 |

|

| $ | 544 |

|

| Flow-through eligible expenditures |

|

| 631 |

|

|

| 280 |

|

| Balance at March 31, 2024 |

| $ | 592 |

|

| $ | 264 |

|

On March 23, 2023, the Company completed an offering (note 8) and raised $8,750 through the issuance of 6,076,500 common shares designated as flow-through shares. The flow-through proceeds will be used for mineral exploration in Quebec. The Company is committed to incur the full exploration expenditures of $8,750 before December 31, 2024.

|

| |

| Fury Gold Mines Limited Notes to Q1 2024 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 9 |

| Note 7: Exploration and evaluation costs |

|

|

For the three months ended March 31, 2024 and 2023, the Company’s exploration and evaluation costs were as follows:

| Quebec |

|

| Nunavut |

|

| Total |

| |||||

| Assaying |

| $ | 73 |

|

| $ | 8 |

|

| $ | 81 |

|

| Exploration drilling |

|

| 83 |

|

|

| - |

|

|

| 83 |

|

| Camp cost, equipment, and field supplies |

|

| 92 |

|

|

| 48 |

|

|

| 140 |

|

| Geological consulting services |

|

| 6 |

|

|

| 4 |

|

|

| 10 |

|

| Permitting, environmental and community costs |

|

| 16 |

|

|

| 43 |

|

|

| 59 |

|

| Salaries and wages |

|

| 325 |

|

|

| 4 |

|

|

| 329 |

|

| Fuel and consumables |

|

| 35 |

|

|

| - |

|

|

| 35 |

|

| Aircraft and travel |

|

| 12 |

|

|

| - |

|

|

| 12 |

|

| Share-based compensation |

|

| 41 |

|

|

| 1 |

|

|

| 42 |

|

| Three months ended March 31, 2024 |

| $ | 683 |

|

| $ | 108 |

|

| $ | 791 |

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

|

| Quebec |

|

| Nunavut |

|

|

| Total |

| ||

| Assaying |

| $ | 27 |

|

| $ | 11 |

|

| $ | 38 |

|

| Exploration drilling |

|

| 16 |

|

|

| - |

|

|

| 16 |

|

| Camp cost, equipment, and field supplies |

|

| 66 |

|

|

| 48 |

|

|

| 114 |

|

| Geological consulting services |

|

| 7 |

|

|

| 3 |

|

|

| 10 |

|

| Permitting, environmental and community costs |

|

| 50 |

|

|

| 44 |

|

|

| 94 |

|

| Salaries and wages |

|

| 353 |

|

|

| 6 |

|

|

| 359 |

|

| Fuel and consumables |

|

| 13 |

|

|

| - |

|

|

| 13 |

|

| Aircraft and travel |

|

| 17 |

|

|

| - |

|

|

| 17 |

|

| Share-based compensation |

|

| 196 |

|

|

| 4 |

|

|

| 200 |

|

| Three months ended March 31, 2023 |

| $ | 745 |

|

| $ | 116 |

|

| $ | 861 |

|

| Note 8: Share capital |

|

|

Authorized

Unlimited common shares without par value.

Unlimited preferred shares – nil issued and outstanding.

Share issuances

In March 2023, the Company issued 6,076,500 flow-through shares for gross proceeds of $8,750 (“March 2023 Offering”). Share issue costs related to the March 2023 Offering totaled $912, which included $525 in commissions and $387 in other issuance costs. A reconciliation of the impact of the March 2023 Offering on share capital is as follows:

|

|

| Number of common shares |

|

| Impact on share capital |

| ||

| Flow-through shares issued at $1.44 per share |

|

| 6,076,500 |

|

| $ | 8,750 |

|

| Cash share issue costs |

|

| - |

|

|

| (912 | ) |

| Proceeds, net of share issue costs |

|

| 6,076,500 |

|

| $ | 7,838 |

|

| Less: flow-through share premium liability (note 6) |

|

| - |

|

|

| (3,889 | ) |

| Total allocated to share capital |

|

| 6,076,500 |

|

| $ | 3,949 |

|

|

| |

| Fury Gold Mines Limited Notes to Q1 2024 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 10 |

| Note 9: Share option, Restricted Share Units and warrant reserves |

|

|

| (a) | Share-based compensation expense |

The Company uses the fair value method of accounting for all share-based payments to directors, officers, employees, and other service providers. During the three months ended March 31, 2024 and 2023, the share-based compensation expense was as follows:

|

|

| Three months ended March 31 |

| |||||

|

|

| 2024 |

|

| 2023 |

| ||

| Recognized in net loss and included in: |

|

|

|

|

|

| ||

| Exploration and evaluation costs |

| $ | 42 |

|

| $ | 200 |

|

| Fees, salaries and other employee benefits |

|

| 211 |

|

|

| 486 |

|

| Total share-based compensation expense |

| $ | 253 |

|

| $ | 686 |

|

During the three months ended March 31, 2024, the Company granted 145,000 (March 31, 2023 – 2,893,800) share options to directors, officers, employees, and certain consultants who provide certain on-going services to the Company, representative of employee services.

Certain of the Company’s executive officer option grants issued in 2023 are subject to vesting restrictions, representing certain performance measures to be met. As at March 31, 2024, it is not considered probable that those performance measures will be achieved, therefore those options have been excluded from the share-based compensation expense recognized.

The weighted average fair value per option of these share options was calculated as $0.30 (March 31, 2023 - $0.48) using the Black-Scholes option valuation model at the grant date using the following weighted average assumptions:

|

|

| Three months ended March 31 |

| |||||

|

|

| 2024 |

|

| 2023 |

| ||

| Risk-free interest rate |

|

| 3.40 | % |

|

| 2.97 | % |

| Expected dividend yield |

| Nil |

|

| Nil |

| ||

| Share price volatility |

|

| 69 | % |

|

| 68 | % |

| Expected forfeiture rate |

|

| 4.4 | % |

|

| 2.7 | % |

| Expected life in years |

|

| 5.0 |

|

|

| 5.0 |

|

The risk-free interest rate assumption is based on the Government of Canada benchmark bond yields and treasury bills with a remaining term that approximates the expected life of the share-based options. The expected volatility assumption is based on the historical and implied volatility of the Company’s common shares. The expected forfeiture rate and the expected life in years are based on historical trends.

| (b) | Long-term incentive plan |

The Company currently has two equity compensation plans, its 2017 Incentive Option Plan (“2017 Plan”), and the LTI Plan which was approved by shareholders on June 29, 2023. The LTI Plan is a rolling plan pursuant to which Options and Restricted Share Units (“RSUs”), totalling to a maximum of 10% of the Common Shares issued and outstanding from time to time, are available for grant.

The Company may grant share options and RSUs, from time to time to its eligible directors, officers, employees, and other service providers.

The share options typically vest as to 25% on the date of the grant and 12.5% every three months thereafter for a total vesting period of 18 months.

The number of share options issued and outstanding and the weighted average exercise price were as follows:

|

|

| Number of share options |

|

| Weighted average exercise price ($/option) |

| ||

| Outstanding, December 31, 2022 |

|

| 8,880,324 |

|

| $ | 1.44 |

|

| Granted |

|

| 3,134,800 |

|

|

| 0.80 |

|

| Expired |

|

| (1,672,087 | ) |

|

| 1.58 |

|

| Forfeited |

|

| (391,435 | ) |

|

| 0.95 |

|

| Outstanding, December 31, 2023 |

|

| 9,951,602 |

|

| $ | 1.23 |

|

| Granted |

|

| 145,000 |

|

|

| 0.57 |

|

| Forfeited |

|

| (208,812 | ) |

|

| 1.73 |

|

| Outstanding, March 31, 2024 |

|

| 9,887,790 |

|

| $ | 1.20 |

|

|

| |

| Fury Gold Mines Limited Notes to Q1 2024 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 11 |

As at March 31, 2024, the number of share options outstanding was as follows:

|

|

|

| Options outstanding |

|

| Options exercisable |

| |||||||||||||||||||

| Exercise price ($/option) |

|

| Number of shares |

|

| Weighted average exercise price ($/option) |

|

| Weighted average remaining life (years) |

|

| Number of shares |

|

| Weighted average exercise price ($/option) |

|

| Weighted average remaining life (years) |

| |||||||

| $0.53 – $1.00 |

|

|

| 4,049,181 |

|

|

| 0.83 |

|

|

| 3.46 |

|

|

| 3,223,181 |

|

|

| 0.84 |

|

|

| 3.32 |

| |

| $1.00 – $1.95 |

|

|

| 3,853,609 |

|

|

| 1.18 |

|

|

| 2.48 |

|

|

| 3,853,609 |

|

|

| 1.18 |

|

|

| 2.48 |

| |

| $2.05 |

|

|

| 1,985,000 |

|

|

| 2.05 |

|

|

| 1.56 |

|

|

| 1,985,000 |

|

|

| 2.05 |

|

|

| 1.56 |

| |

|

|

|

|

| 9,887,790 |

|

|

| 1.21 |

|

|

| 2.70 |

|

|

| 9,061,790 |

|

|

| 1.25 |

|

|

| 2.58 |

| |

On January 9, 2024, the Company issued 1,318,623 RSU’s to directors, officers, and employees. The RSU’s were issued in accordance with the Company’s LTI plan, one third vesting annually on the anniversary and paid out as fully paid shares. The Company also approved 235,080 RSU’s to directors vesting quarterly in 2024. On March 5, 2024, 58,766 of the 235,080 RSU’s issued to directors, vested.

On January 31, 2024, the Company issued 273,542 RSU’s to an officer. The RSU’s were issued in accordance with the Company’s LTI plan, which vested on the same day and paid out as fully paid shares.

The number of Restricted Share Units Issued and outstanding and the weighted average exercise price were as follows:

|

|

| Number of RSU’s |

|

| Weighted average vesting price ($/ share) |

| ||

| Outstanding, December 31, 2022 |

|

| - |

|

| $ | - |

|

| Granted |

|

| 197,345 |

|

|

| 0.60 |

|

| Settled |

|

| (197,345 | ) |

|

| (0.60 | ) |

| Outstanding, December 31, 2023 |

|

| - |

|

| $ | - |

|

| Granted |

|

| 1,827,245 |

|

|

| 0.72 |

|

| Settled |

|

| (332,308 | ) |

|

| (0.61 | ) |

| Outstanding, March 31, 2024 |

|

| 1,494,937 |

|

| $ | 0.75 |

|

| (c) | Share purchase warrants |

The number of share purchase warrants outstanding at March 31, 2024 was as follows:

|

|

| Warrants outstanding |

|

| Weighted average exercise price ($/share) |

| ||

| Outstanding at December 31, 2022 |

|

| 7,461,450 |

|

| $ | 1.20 |

|

| Outstanding at December 31, 2023 and March 31, 2024 |

|

| 7,461,450 |

|

| $ | 1.20 |

|

|

| |

| Fury Gold Mines Limited Notes to Q1 2024 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 12 |

The following table reflects the warrants issued and outstanding as of March 31, 2024:

| Expiry date |

| Warrants outstanding |

|

| Exercise price ($/share) |

| ||

| October 6, 2024 |

|

| 5,085,670 |

|

|

| 1.20 |

|

| October 12, 2024 |

|

| 2,375,780 |

|

|

| 1.20 |

|

| Total |

|

| 7,461,450 |

|

|

| 1.20 |

|

| Note 10: Key management personnel |

|

|

Key management personnel include Fury Gold’s board of directors and the executive officers of the Company, including the Chief Executive Officer and Chief Financial Officer.

The remuneration of the Company’s key management personnel was as follows:

|

|

| Three months ended March 31 |

| |||||

|

|

| 2024 |

|

| 2023 |

| ||

| Short-term benefits provided to executives (a) |

| $ | 215 |

|

| $ | 272 |

|

| Directors’ fees paid to non-executive directors |

|

| 35 |

|

|

| 65 |

|

| Share-based payments |

|

| 147 |

|

|

| 459 |

|

| Total |

| $ | 397 |

|

| $ | 796 |

|

(a) Short-term employee benefits include salaries, bonuses payable within twelve months of the date of the condensed interim consolidated statements of financial position, and other annual employee benefits.

| Note 11: Supplemental cash flow information |

|

|

The impact of changes in non-cash working capital was as follows:

|

|

| Three months ended March 31 |

| |||||

|

|

| 2024 |

|

| 2023 |

| ||

| Accounts receivable |

| $ | 338 |

|

| $ | 56 |

|

| Prepaid expenses and deposits |

|

| 1 |

|

|

| (39 | ) |

| Accounts payable and accrued liabilities |

|

| (174 | ) |

|

| (259 | ) |

| Change in non-cash working capital |

| $ | 165 |

|

| $ | (242 | ) |

| Note 12: Loss per share |

|

|

For the three months ended March 31, 2024, and 2023, the weighted average number of common shares outstanding and loss per share were as follows:

|

|

| Three months ended March 31 |

| |||||

|

|

| 2024 |

|

| 2023 |

| ||

| Net Loss |

| $ | 935 |

|

| $ | 2,662 |

|

| Weighted average basic number of shares outstanding |

|

| 145,941,943 |

|

|

| 140,011,083 |

|

| Basic loss per share |

| $ | 0.01 |

|

| $ | 0.02 |

|

| Weighted average diluted number of shares outstanding |

|

| 145,941,943 |

|

|

| 140,011,083 |

|

| Diluted loss per share |

| $ | 0.01 |

|

| $ | 0.02 |

|

All of the outstanding share options and share purchase warrants at March 31, 2024 were anti-dilutive for the periods then ended as the Company was in a loss position.

|

| |

| Fury Gold Mines Limited Notes to Q1 2024 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 13 |

| Note 13: Financial instruments |

|

|

The Company’s financial instruments as at March 31, 2024 consisted of cash, accounts receivable, marketable securities, deposits, and accounts payable and accrued liabilities. The fair values of these financial instruments approximate their carrying values, unless otherwise noted.

| (a) | Financial assets and liabilities by categories |

|

|

| At March 31, 2024 |

|

| At December 31, 2023 |

| ||||||||||||||||||

|

|

| Amortized Cost |

|

| FVTPL |

|

| Total |

|

| Amortized Cost |

|

| FVTPL |

|

| Total |

| ||||||

| Cash |

| $ | 5,731 |

|

| $ | - |

|

| $ | 5,731 |

|

| $ | 7,313 |

|

| $ | - |

|

| $ | 7,313 |

|

| Marketable securities |

|

| - |

|

|

| 2,620 |

|

|

| 2,620 |

|

|

| - |

|

|

| 1,166 |

|

|

| 1,166 |

|

| Deposits |

|

| 173 |

|

|

| - |

|

|

| 173 |

|

|

| 100 |

|

|

| - |

|

|

| 100 |

|

| Accounts receivable |

|

| 36 |

|

|

| - |

|

|

| 36 |

|

|

| 374 |

|

|

| - |

|

|

| 374 |

|

| Total financial assets |

|

| 5,940 |

|

|

| 2,620 |

|

|

| 8,560 |

|

|

| 7,787 |

|

|

| 1,166 |

|

|

| 8,953 |

|

| Accounts payable and accrued liabilities |

|

| 696 |

|

|

| - |

|

|

| 696 |

|

|

| 1,034 |

|

|

| - |

|

|

| 1,034 |

|

| Total financial liabilities |

| $ | 696 |

|

| $ | - |

|

| $ | 696 |

|

| $ | 1,034 |

|

| $ | - |

|

| $ | 1,034 |

|

| (b) | Financial assets and liabilities measured at fair value |

The categories of the fair value hierarchy that reflect the significance of inputs used in making fair value measurements are as follows:

Level 1 – fair values based on unadjusted quoted prices in active markets for identical assets or liabilities;

Level 2 – fair values based on inputs that are observable for the asset or liability, either directly or indirectly; and

Level 3 – fair values based on inputs for the asset or liability that are not based on observable market data.

The Company’s policy to determine when a transfer occurs between levels is to assess the impact at the date of the event or the change in circumstances that could result in a transfer. No transfers occurred between the levels during the period.

The Company’s financial instruments measured at fair value on a recurring basis were the Company’s marketable securities which were classified as Level 1 at March 31, 2024 (December 31, 2023 – Level 1).

During the three months ended March 31, 2024, there were no financial assets or financial liabilities measured and recognized in the condensed interim consolidated statements of financial position at fair value that would be categorized as level 2 or 3 in the fair value hierarchy.

| (c) | Financial instruments and related risks |

The Company’s financial instruments are exposed to liquidity risk, credit risk and market risks, which include currency risk and price risk. As at March 31, 2024, the primary risks were as follows:

Liquidity risk

Liquidity risk is the risk that the Company will encounter difficulty in meeting obligations associated with financial liabilities. The Company proactively manages its capital resources and has in place a budgeting and cash management process to help determine the funds required to ensure the Company has the appropriate liquidity to meet its current exploration plans and achieve its growth objectives. The Company ensures that there is sufficient liquidity available to meet its short-term business requirements, taking into account its anticipated cash outflows from exploration activities, and its holdings of cash and marketable securities. The Company monitors and adjusts, when required, these exploration programs as well as corporate administrative costs to ensure that adequate levels of working capital are maintained.

|

| |

| Fury Gold Mines Limited Notes to Q1 2024 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 14 |

As at March 31, 2024, the Company had unrestricted cash of $5,731 (December 31, 2023 – $7,313), working capital surplus of $8,114 (December 31, 2023 –$7,713), which the Company defines as current assets less current liabilities, and an accumulated deficit of $149,988 (December 31, 2023 – $149,054). The Company notes that the flow-through share premium liability, which reduced the Company’s working capital by $264 (December 31, 2023 – $544), is not settled through cash payment. Instead, the flow-through share premium liability will be drawn down as the Company incurs flow-through eligible exploration expenditures on its Quebec properties. During the three months ended March 31, 2024, Fury Gold recognized a net loss of $934 (three months ended March 31, 2023 –$2,661). The Company expects to incur future operating losses in relation to exploration activities. With no source of operating cash flow, there is no assurance that sufficient funding will be available to conduct further exploration and development of its mineral properties.

The Company’s contractual obligations are as follows:

|

|

| Within 1 year |

|

| 2 to 3 years |

|

| Over 3 years |

|

| At March 31 2024 |

|

| At December 31 2023 |

| |||||

| Accounts payable and accrued liabilities |

| $ | 696 |

|

| $ | - |

|

| $ | - |

|

| $ | 696 |

|

| $ | 1,034 |

|

| Quebec flow-through expenditure requirements |

|

| 592 |

|

|

| - |

|

|

| - |

|

|

| 592 |

|

|

| 1,223 |

|

| Undiscounted lease payments |

|

| 189 |

|

|

| 64 |

|

|

| - |

|

|

| 253 |

|

|

| 253 |

|

| Total |

| $ | 1,477 |

|

| $ | 64 |

|

| $ | - |

|

| $ | 1,541 |

|

| $ | 2,510 |

|

The Company also makes certain payments arising on mineral claims and leases on an annual or bi-annual basis to ensure all the Company’s properties remain in good standing. Cash payments of $43 were made during the three months ended March 31, 2024, in respect of these mineral claims.

During the three months ended March 31, 2024, the Company entered into a drilling services contract and has committed to an approximate 2,500 metre drilling program with the contractor, to be completed in April 2024.

Credit risk

The Company’s cash and accounts receivable are exposed to credit risk, which is the risk that the counterparties to the Company’s financial instruments will cause a loss to the Company by failing to pay their obligations. The amount of credit risk to which the Company is exposed is considered insignificant as the Company’s cash is held with highly rated financial institutions in interest-bearing accounts and the accounts receivable primarily consist of sales tax receivables and a receivable from a reputable supplier of services in Canada.

Market risk

This is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market prices. Significant market risks to which the Company is exposed are as follows:

| i. | Currency risk |

The Company is exposed to currency risk by having balances and transactions in currencies that are different from its functional currency (the Canadian dollar). The Company’s foreign currency exposure related to its financial assets and liabilities held in US dollars was as follows:

|

|

| At March 31 2024 |

|

| At December 31 2023 |

| ||

| Financial assets |

|

|

|

|

|

| ||

| US$ bank accounts |

| $ | 1 |

|

| $ | 1 |

|

| Financial liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

|

| (7 | ) |

|

| (7 | ) |

|

|

| $ | (6 | ) |

| $ | (6 | ) |

|

| |

| Fury Gold Mines Limited Notes to Q1 2024 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 15 |

A 10% increase or decrease in the US dollar to Canadian dollar exchange rate would not have a material impact on the Company’s net loss.

| ii. | Price risk |

The Company holds certain investments in marketable securities (note 3) which are measured at fair value, being the closing share price of each equity security at the date of the condensed interim consolidated statements of financial position. The Company is exposed to changes in share prices which would result in gains and losses being recognized in the earnings for the period. A 10% increase or decrease in the Company’s marketable securities’ share prices would not have a material impact on the Company’s net income.

|

| |

| Fury Gold Mines Limited Notes to Q1 2024 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 16 |