Exhibit

99.1

FURY GOLD MINES LIMITED

|

|

ANNUAL INFORMATION FORM

|

|

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2020

DATED MARCH 31, 2021

|

TABLE OF CONTENTS

|

Preliminary Notes

|

3

|

|

Cautionary Note Regarding Forward-Looking Statements

|

3

|

|

Cautionary Note to United States Investors Regarding Presentation

of Mineral Reserve and Mineral Resource Estimates

|

5

|

|

Resource Category (Classification) Definitions

|

6

|

|

Corporate Structure

|

7

|

|

General Development of the Business

|

8

|

|

Business Description

|

13

|

|

Eau Claire Project

|

16

|

|

Committee Bay Project

|

27

|

|

Homestake Ridge Project

|

36

|

|

Risk Factors

|

52

|

|

Description of Capital Structure

|

63

|

|

Market for Securities

|

64

|

|

Directors and Executive Officers

|

65

|

|

Committees of the Board

|

68

|

|

Legal Proceedings and Regulatory Actions

|

70

|

|

Interest of Management and Others in Material

Transactions

|

70

|

|

Transfer Agent and Registrar

|

71

|

|

Auditor

|

71

|

|

Material Contracts

|

71

|

|

Interests of Experts

|

71

|

|

Additional Information

|

72

|

|

APPENDIX “A” – AUDIT COMMITTEE

CHARTER

|

A-1

|

-3-

In this

Annual Information Form (the “AIF”) the “Company”, “Fury Gold”,

“we”,

“us” or

“our” refers to

Fury Gold Mines Limited, together with, as the context requires,

its subsidiaries or its predecessors.

This

AIF is dated March 31, 2021. Except as otherwise indicated, all

information contained herein is as at December 31, 2020, unless

otherwise indicated.

In this AIF, unless otherwise indicated, all dollar amounts and

references to “C$” or “$” are to Canadian

dollars and references to “US$” are to U.S.

dollars. All dollar amounts are expressed in thousands of

Canadian dollars unless otherwise indicated.

Certain

statements made in this AIF contain forward-looking information

within the meaning of applicable Canadian and United States

securities laws (“forward-looking statements”).

These forward-looking statements are presented for the purpose of

assisting the Company’s securityholders and prospective

investors in understanding management’s views regarding those

future outcomes and may not be appropriate for other purposes. When

used in this AIF, the words “may”, “would”,

“could”, “will”, “intend”,

“plan”, “anticipate”,

“believe”, “seek”, “propose”,

“estimate”, “expect”, and similar

expressions, as they relate to the Company, are intended to

identify forward-looking statements. Specific forward-looking

statements in this AIF include, but are not limited to: issues

relating to the COVID-19 pandemic, including its impact on the

Company’s business and operations; the future price of

minerals, including gold and other metals; future capital

expenditures and requirements, and sources and timing of additional

financing; the success of exploration and development activities;

the Company’s mineral reserves and mineral resources;

permitting timelines; government regulation of mining operations;

environmental and climate-related risks; estimates of mineral

reserves and mineral resources; the realization of mineral resource

and mineral reserve estimates; the impairment of mining interests

and non-producing properties; any objectives, expectations,

intentions, plans, results, levels of activity, goals or

achievements; the timing and amount of estimated future production,

production guidance and net revenue expectations, anticipated cash

flows, costs of

production, capital

expenditures, costs and timing of development; reclamation

expenses; exchange rate fluctuations; realization of unused tax

benefits; cyclical or seasonal aspects of the Company’s

business; negotiations or regulatory investigations; limitations of

insurance coverage and the timing and possible outcome of

regulatory matters; labour relations, employee recruitment and

retention and pension funding; statements relating to the financial

condition, assets, liabilities (contingent or otherwise), business,

operations or prospects of the Company; the liquidity of the common

shares in the capital of the Company (the “Common Shares”); and other events

or conditions that may occur in the future.

The

forward-looking statements contained in this AIF represent the

Company’s views only as of the date such statements were

made. Forward-looking statements contained in this AIF are based on

management’s plans, estimates, projections, beliefs and

opinions as at the time such statements were made and the

assumptions related to these plans, estimates, projections, beliefs

and opinions may change. Such assumptions, which may prove to be

incorrect, include: the Company’s budget, including expected

costs and the assumptions regarding market conditions and other

factors upon which the Company has based its expenditure

expectations; the Company’s ability to raise additional

capital to proceed with its exploration, development and operations

plans; the Company’s ability to obtain or renew the licenses

and permits necessary for the operation and expansion of its

existing operations and for the development, construction and

commencement of new operations; financial markets will not in the

long term be adversely impacted by the COVID-19 pandemic;

production and cost estimates; the Company’s ability to

obtain all necessary regulatory approvals, permits and licenses for

its planned activities under governmental and other applicable

regulatory regimes; the Company’s ability to complete and

successfully integrate acquisitions; the effects of climate change,

extreme weather events, water scarcity, and seismic events, and the

effectiveness of strategies to deal with these issues; the

Company’s expectations regarding the demand for, and supply

and price of, precious metals; the Company’s ability to

recruit and retain qualified personnel; the Company’s mineral

reserve and resource estimates, and the assumptions upon which they

are based; the Company’s ability to comply with current and

future environmental, safety and other regulatory requirements and

to obtain and maintain required regulatory approvals.

-4-

Inherent

in the forward-looking statements are known and unknown risks,

uncertainties and other factors beyond the Company’s ability

to control or predict, that may cause the actual results,

performance or achievements of the Company, or developments in the

Company’s business or in its industry, to differ materially

from the anticipated results, performance, achievements or

developments expressed or implied by such forward-looking

statements. Some of the risks and other factors (some of which are

beyond the Company’s control) which could cause results to

differ materially from those expressed in the forward-looking

statements and information contained in this AIF include, but are

not limited to, risks related to: COVID-19 and other pandemics;

fluctuations in spot and forward markets for silver, gold, base

metals and certain other commodities (such as natural gas, fuel oil

and electricity); risks and hazards associated with the business of

mineral exploration, development and mining (including

environmental hazards, potential unintended releases of

contaminants, industrial accidents, unusual or unexpected

geological or structural formations, pressures, cave-ins and

flooding); the speculative nature of mineral exploration and

development; the estimation of mineral reserves and mineral

resources, including the realization of mineral reserve estimates;

the Company’s ability to obtain addition funding; global

financial conditions, including the market reaction to COVID-19;

competitive conditions in the exploration and mining industry;

environmental risks and remediation measures, including evolving

environmental regulations and legislation; inherent risks

associated with tailings facilities and heap leach operations,

including failure or leakages; the Company’s mineral

properties being subject to prior unregistered agreements,

transfers or claims and other defects in title; the effects of

climate change, extreme weather events, water scarcity, and seismic

events, and the effectiveness of strategies to deal with these

issues; health and safety regulations and legislation; changes in

laws and regulations; changes in national and local government

regulation of mining operations, tax rules and regulations, and

political and economic developments in jurisdictions in which the

Company operates; volatility in the price of the Common Shares, and

uncertainty and volatility related to stock market prices and

conditions; future dilution and fluctuation in the price of the

Common Shares; acquisitions, partnerships and joint ventures;

disputes as to the validity of mining or exploration titles or

claims or rights, which constitute most of our property holdings;

our management team and the specialized skill and knowledge

necessary to operate in the mining industry, including our

dependency on key personal and reliance on contractors and other

experts; the Company’s officers and directors becoming

associated with other natural resource companies, which may give

rise to conflicts of interest; legal and litigation risks;

statutory and regulatory compliance; insurance and uninsurable

risks; the Company’s limited business history and history of

losses, which may continue in the future; our dividend policy;

relations with and claims by local communities and non-governmental

organizations, including relations with and claims by indigenous

populations; the effectiveness of the Company’s internal

control over financial reporting; cybersecurity risks; risks

relating to the Company’s public perception; general

business, economic, competitive, political and social

uncertainties; and public health crises such as the COVID-19

pandemic and other uninsurable risks. This is not an exhaustive

list of the risk and other factors that may affect any of the

Company’s forward-looking statements. Some of these risks and

other factors are discussed in more detail in the section entitled

“Risk Factors”

in this AIF. Investors and others should carefully consider these

risks and other factors and not place undue reliance on the

forward-looking statements.

Although

the Company believes that the assumptions and expectations

reflected in those forward-looking statements were reasonable at

the time such statements were made, there can be no assurance that

such assumptions and expectations will prove to be correct. The

Company cannot guarantee future results, levels of activity,

performance or achievements and actual results or developments may

differ materially from those contemplated by the forward-looking

statements. The Company does not undertake to update any

forward-looking statements, except to the extent required by

applicable securities laws.

In

addition, forward-looking financial information with respect to

potential outlook and future financial results contained in this

AIF is based on assumptions about future events, including economic

conditions and proposed courses of action, based on

management’s reasonable assessment of the relevant

information available as at the date of such forward-looking

financial information. Readers are cautioned that any such

forward-looking financial information should not be used for

purposes other than for which it is disclosed.

-5-

CAUTIONARY NOTE TO UNITED STATES INVESTORS REGARDING PRESENTATION

OF MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

This

AIF, uses the terms “mineral reserve”, “proven

mineral reserve”, “probable mineral reserve”,

“mineral resource”, “measured mineral

resource”, “indicated mineral resource” and

“inferred mineral resource”, which are Canadian mining

terms as defined in, and required to be disclosed in accordance

with, National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI

43-101”), which references the guidelines set out in

the Canadian Institute of Mining, Metallurgy and Petroleum (the

“CIM”) –

CIM Definition Standards on mineral resources and mineral reserves

(“CIM Definition

Standards”), adopted by the CIM Council, as amended.

However, these terms are not defined terms under SEC Industry Guide

7 (“SEC Industry Guide

7”) under the United States Securities Act of 1933, as

amended, and normally are not permitted to be used in reports and

registration statements filed with the Securities and Exchange

Commission (the “SEC”). The SEC has adopted

amendments to its disclosure rules to modernize the mineral

property disclosure requirements for issuers whose securities are

registered with the SEC under the United States Securities Exchange

Act of 1934, as amended (the “U.S. Exchange Act”). These

amendments became effective February 25, 2019 (the

“SEC Modernization

Rules”) with compliance required for the first fiscal

year beginning on or after January 1, 2021. The SEC Modernization

Rules replace the historical disclosure requirements for mining

registrants that were included in SEC Industry Guide 7. As a

foreign private issuer that files its annual report on Form 40-F

with the SEC pursuant to the multi-jurisdictional disclosure

system, the Company is not required to provide disclosure on its

mineral properties under the SEC Modernization Rules and will

continue to provide disclosure under NI 43-101 and the CIM

Definition Standards. If the Company ceases to be a foreign private

issuer or loses its eligibility to file its annual report on Form

40-F pursuant to the multi-jurisdictional disclosure system, then

the Company will be subject to the SEC Modernization Rules which

differ from the requirements of NI 43-101 and the CIM Definition

Standards.

United

States investors are cautioned that there are differences in the

definitions under the SEC Modernization Rules and the CIM

Definition Standards. There is no assurance any mineral resources

that the Company may report as “measured mineral

resources”, “indicated mineral resources” and

“inferred mineral resources” under NI 43- 101 would be

the same had the Company prepared the resource estimates under the

standards adopted under the SEC Modernization Rules. United States

investors are also cautioned that while the SEC will now recognize

“measured mineral resources”, “indicated mineral

resources” and “inferred mineral resources”, (i)

a “measured mineral resource” has a higher level of

confidence than that applying to either an “indicated mineral

resource” or an “inferred mineral resource”, it

may be converted to a “proven mineral reserve” or to a

“probable mineral reserve”, (ii) an “indicated

mineral resource” has a lower level of confidence than that

applying to a “measured mineral resource” and may only

be converted to a “probable mineral reserve”, and (iii)

an “inferred mineral resource” has a lower level of

confidence than that applying to an “indicated mineral

resource” and must not be converted to a “mineral

reserve”. Mineralization described using these terms has a

greater amount of uncertainty as to their existence and feasibility

than mineralization that has been characterized as reserves.

Accordingly, investors are cautioned not to assume that any

“measured mineral resources”, “indicated mineral

resources” or “inferred mineral resources” that

the Company reports are or will be economically or legally

mineable. Further, “inferred mineral resources” have a

greater amount of uncertainty as to their existence and as to

whether they can be mined legally or economically. Therefore,

United States investors are also cautioned not to assume that all

or any part of the “inferred mineral resources” exist.

In accordance with Canadian securities laws, estimates of

“inferred mineral resources” cannot form the basis of

feasibility or other economic studies, except in limited

circumstances where permitted under NI 43-101. In addition, the SEC

has amended its definitions of “proven mineral

reserves” and “probable mineral reserves” to be

“substantially similar” to the corresponding CIM

definitions. United States investors are cautioned that a

preliminary economic assessment cannot support an estimate of

either “proven mineral reserves” or “probable

mineral reserves” and that no feasibility studies have been

completed on the Company’s mineral properties.

Accordingly,

information contained in this AIF describing the Company’s

mineral deposits may not be comparable to similar information made

public by U.S. companies subject to the reporting and disclosure

requirements under the United States federal securities laws and

the rules and regulations thereunder.

See the

heading “Resource Category

(Classification)

Definitions” below

for a description of certain of the mining terms used in this

AIF.

-6-

RESOURCE CATEGORY (CLASSIFICATION) DEFINITIONS

The

discussion of mineral deposit classifications in this AIF adheres

to the CIM Definition Standards developed by the CIM. Estimated

mineral resources fall into two broad categories dependent on

whether the economic viability of them has been established and

these are “mineral resources” (potential for economic

viability) and “mineral reserves” (viable economic

production is feasible). Resources are sub-divided into categories

depending on the confidence level of the estimate based on level of

detail of sampling and geological understanding of the deposit. The

categories, from lowest confidence to highest confidence, are

inferred mineral resource, indicated mineral resource and measured

mineral resource. Reserves are similarly sub-divided by order of

confidence into probable (lowest) and proven (highest). The Company

at this time has not classified any of its mineral deposits as

mineral reserves. These classifications can be more particularly

described as follows:

A

“mineral

resource” is a concentration or occurrence of solid

material of economic interest in or on the Earth’s crust in

such form, grade or quality and quantity that there are reasonable

prospects for eventual economic extraction. The location, quantity,

grade or quality, continuity and other geological characteristics

of a mineral resource are known, estimated or interpreted from

specific geological evidence and knowledge, including

sampling.

An

“inferred

mineral resource” is that part of a mineral resource

for which quantity and grade or quality are estimated on the basis

of limited geological evidence and sampling. Geological evidence is

sufficient to imply but not verify geological and grade or quality

continuity. It has a lower level of confidence than that applying

to an indicated mineral resource and must not be converted to a

mineral reserve. It is reasonably expected that the majority of

inferred mineral resources could be upgraded to indicated mineral

resources with continued exploration.

An

“indicated mineral

resource” is that part of a mineral resource

for which quantity, grade or quality, densities, shape and physical

characteristics are estimated with sufficient confidence to allow

the application of modifying factors in sufficient detail to

support mine planning and evaluation of the economic viability of

the deposit. Geological evidence is derived from adequately

detailed and reliable exploration, sampling and testing and is

sufficient to assume geological and grade or quality continuity

between points of observation. It has a lower level of confidence

than that applying to a measured mineral resource and may only be

converted to a probable mineral reserve.

A

“measured

mineral resource” is that part of a mineral resource

for which quantity, grade or quality, densities, shape, and

physical characteristics are estimated with confidence sufficient

to allow the application of modifying factors to support detailed

mine planning and final evaluation of the economic viability of the

deposit. Geological evidence is derived from detailed and reliable

exploration, sampling and testing and is sufficient to confirm

geological and grade or quality continuity between points of

observation. It has a higher level of confidence than that applying

to either an indicated mineral resource or an inferred mineral

resource. It may be converted to a proven mineral reserve or to a

probable mineral reserve.

A

“mineral

reserve” is the economically mineable part

of a measured and/or indicated mineral resource. It includes

diluting materials and allowances for losses, which may occur when

the material is mined or extracted and is defined by studies at

Pre-Feasibility or Feasibility level as appropriate that include

application of modifying factors, which are considerations used to

convert mineral resources to mineral reserves and include, but are

not restricted to, mining, processing, metallurgical,

infrastructure, economic, marketing, legal, environmental, social

and governmental factors. Such studies demonstrate that, at the

time of reporting, extraction could reasonably be justified. The

reference point at which mineral reserves are defined, usually the

point where the ore is delivered to the processing plant, must be

stated. It is important that, in all situations where the reference

point is different, such as for a saleable product, a clarifying

statement is included to ensure that the reader is fully informed

as to what is being reported. The public disclosure of a mineral

reserve must be demonstrated by a pre-feasibility study or

feasibility study.

A

“probable

mineral reserve” is the economically mineable part

of an indicated, and in some circumstances, a measured mineral

resource. The confidence in the modifying factors applying to a

probable mineral reserve is lower than that applying to a proven

mineral reserve.

A

“proven

mineral reserve” is the economically mineable part

of a measured mineral resource. A proven mineral reserve implies a

high degree of confidence in the modifying factors.

-7-

CORPORATE STRUCTURE

Name,

Address and Incorporation

The

Company was incorporated under the Business Corporations Act (British

Columbia) (the “BCBCA”) on June 9, 2008, under the

name Georgetown Capital Corp. The Company was a Capital Pool

Company under the policies of the TSX Venture Exchange (the

“TSXV”) and,

accordingly, on February 23, 2011, the Company completed a

qualifying transaction (the “Qualifying

Transaction”) with Full Metal Minerals USA Inc.,

a wholly owned subsidiary of Full Metals Minerals Ltd. Pursuant to

the Qualifying Transaction, the Common Shares began trading on the

TSXV. On October 15, 2013, the Company changed its name to Auryn

Resources Inc. On November 1, 2016, the Company completed its

graduation to the TSX and the Common Shares began trading on the

TSX. In connection with the Company’s graduation to the TSX,

the Common Shares were voluntarily delisted from the TSXV. On July

17, 2017, the Common Shares commenced trading on the NYSE

American.

On

October 9, 2020, the Company acquired all of the then issued and

outstanding shares of Eastmain Resources Inc. (“Eastmain”) in accordance with the

terms and conditions of the arrangement agreement dated August 10,

2020 (the “Arrangement

Agreement”). On October 5, 2020, the Transaction (as

defined herein) received the approval of both the Company’s

and Eastmain’s shareholders, and on October 7, 2020, the

British Columbia Supreme Court and the Ontario Superior Court of

Justice approved the Reorganization Arrangement and the Eastmain

Arrangement, respectively, and both courts issued final orders

approving the Transaction (as such terms are defined herein). In

accordance with the terms of the Arrangement Agreement, the Company

changed its name to “Fury Gold Mines Limited” pursuant

to a certificate of change of name dated October 8,

2020.

Immediately

following the closing of the Transaction, the Company’s

ticker symbol for the Common Shares was changed to

“FURY” effective October 12, 2020 on the NYSE American

and October 13, 2020 on the TSX. Eastmain’s shares were

delisted form the TSX and removed from the OTCQB after the end of

trading on October 9, 2020. Immediately following the closing of

the Eastmain Arrangement, Eastmain became a wholly-owned subsidiary

of Fury Gold.

Fury

Gold is a reporting issuer in the provinces of British Columbia,

Alberta, Ontario and Quebec. In addition, the Common Shares are

registered under Section 12(b) of the U.S. Exchange Act by virtue

of being listed on the NYSE American. The Company’s

registered and records office is 595 Burrard Street, Suite 2600,

Vancouver, British Columbia, V7X 1L3 and its head office is located

at 34 King Street East, Suite 601, Toronto, Ontario, M5C

2X8.

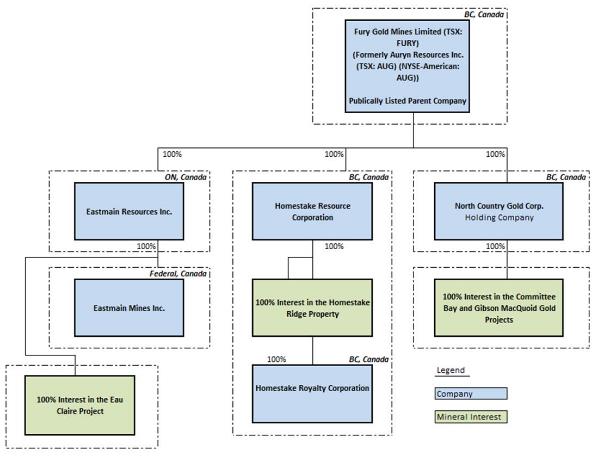

Inter-corporate Relationships

Fury

Gold conducts its business through a number of wholly-owned

subsidiaries. The following diagram depicts the Company’s

corporate structure and its subsidiaries, including the name,

jurisdiction of incorporate and proportion of ownership in

each:

-8-

Business

of Fury Gold

Fury

Gold is a Canadian-focused exploration and development company with

active projects in three prolific gold mining regions and a focus

on finding and advancing globally significant precious metal

deposits. Fury Gold has a portfolio of mineral properties including

three flagship properties in Canada: the Eau Claire property

located in the Eeyou Istchee James Bay Region of Northern Quebec

(the “Eau Claire

Project”), the Committee Bay gold project located in

the Kitikmeot Region of Nunavut (the “Committee Bay Project”) and the

Homestake Ridge project located within the Iskut-Stewart-Kitsault

belt in northwestern British Columbia (the “Homestake Ridge

Project”).

Three Year History

2018

Equity

Offerings

On

March 23, 2018, the Company closed a public prospectus offering

(the “March 2018 Public

Offering”), under which the Company issued 6,015,385

Common Shares at a price of US$1.30 per Common Share for aggregate

gross proceeds of approximately US$7.8 million. Concurrently with

the March 2018 Public Offering, the Company closed a private

placement offering (the “March 2018 Private Placement”, and

together with the March 2018 Public Offering, the

“March 2018

Offering”) of 1,091,826 flow-through Common Shares

(each, a “Flow-Through

Share”) at a price of US$1.82 per Flow-Through Share

for aggregate gross proceeds of approximately US$2.0 million. The

proceeds of the March 2018 Offering were used exclusively for

exploration purposes on the Committee Bay Project.

-9-

On

August 16, 2018, the Company closed a non-brokered private

placement (the “August 2018

Offering”) of 2,084,375 Flow-Through Shares at an

issue price of $1.60 per Flow-Through Share, 1,215,000 Flow-Through

Shares at an issue price of $1.75 per Flow-Through Share, and

1,000,000 Flow-Through Shares at an issue price of $1.87 per

Flow-Through Share for aggregate gross proceeds of approximately

$7.3 million. The proceeds from the August 2018 Offering were used

for exploration purposes on the Committee Bay Project, the

Homestake Ridge Project and the Gibson MacQuoid Project (as defined

herein).

Exploration

and Drilling Highlights

Material Properties

For a

summary of the Company’s 2018 exploration and drilling

highlights and updated resource estimates at certain of the

Company’s material properties see “Committee Bay Project – Exploration

Status – 2018 Exploration” and

“Eau Claire Project –

Mineral Resource Estimate – 2018 Eau Claire Resource

Update” in

this AIF for further information.

Gibson MacQuoid Project

In

2017, the Company acquired a number of prospecting permits and

mineral claims along the Gibson MacQuoid greenstone belt in

Nunavut, Canada (the “Gibson

MacQuoid Project”). The Gibson MacQuoid Project is an

early-stage gold exploration project situated between the Meliadine

deposit and the Meadowbank mine in Nunavut, Canada. The 19

prospecting permits and the 57 mineral claims that make up the

project encompass approximately 120 kilometres (“kms”) of strike length of the

prospective greenstone bel and total 375,000 hectares

collectively.

During

2018, the Company collected approximately 3,000 tightly spaced till

samples and 193 rock samples from boulders and exposed outcrop as a

follow-up to the Company’s 2017 geochemical survey on the

Gibson MacQuoid Project which had identified eight high priority

gold in-till anomalies. The focus of the 2018 exploration program

at the Gibson MacQuoid Project was on delineating these anomalies

into distinct drill-ready gold prospectus.

2019

Equity

Offerings

On

March 27, 2019, the Company closed a non-brokered private placement

of 3,284,375 Common Shares at a price of $1.60 per Common Share for

aggregate gross proceeds of approximately $5.3

million.

On July

11, 2019, the Company closed a non-brokered private placement (the

“July 2019

Offering”) of 633,334 Flow-Through Shares at a price

of $3.00 per Flow-Through Share for aggregate gross proceeds of

approximately $1.9 million. The proceeds from the July 2019

Offering were used exclusively for exploration purposes on the

Committee Bay Project.

Bridge

Loan

On

September 12, 2019, the Company entered a bridge loan facility (the

“Bridge

Loan”) for

up to $6.0 million with a private lender (the “Lender”). The Bridge Loan consists of two

tranches of up to $3.0 million each, with the first tranche having

been advanced and the second tranche being conditional upon the

mutual agreement of the parties. The Bridge Loan bears interest at

10%, payable annually or on repayment of the principal, and has a

term of one year from the date of advancement; however, the Bridge

Loan can be repaid without penalty at any time after 90 days of

advancement at the discretion of the Company. The Bridge Loan is

secured by a first charge general security agreement over all of

the Company’s present and future assets.

In

connection with the Bridge Loan, the Company issued 337,813 common

share purchase warrants (each, a “Warrant”) to the Lender. Each

Warrant is exercisable to acquire one Common Share at a price of

$2.96 per Common Share from September 12, 2020 until September 12,

2022.

-10-

Exploration

and Drilling Highlights

Material Properties

For a

summary of the Company’s 2019 exploration and drilling

highlights and updated resource estimates at certain of the

Company’s material properties see “Committee Bay Project – Exploration

Status – 2019 Exploration”, “Homestake Ridge Project – Mineral

Resource Estimate” and “Eau Claire Project – Exploration Status

– 2019 Eau Claire Exploration

Program” in this AIF for further

information.

Gibson MacQuoid Project

During

2019, the Company staked 36 additional claims at the Gibson

MacQuoid Project, totalling 42,640.7 hectares, which overlapped the

Company’s prospecting claims that expired in February 2020,

to maintain a contiguous land package over the Company’s

current areas of interest. The Gibson MacQuoid Project currently

comprises 66 mineral claims, which are located between the

Meliadine deposit and Meadowbank mine, covering approximately 120

km of strike length of the prospective greenstone belt and total

74,000 hectares collectively.

2020

Equity Offerings

In

February 2020, the Company closed a non-brokered private placement

(the “February 2020

Offering”) of 9,375,000 Common Shares, in two

tranches, at a price of $1.60 per Common Share for aggregate gross

proceeds of approximately $15.0 million. The proceeds from the February 2020

Offering were used for exploration purposes on Peruvian properties

which were spun out to the SpinCos (as defined below) in connection

with the Reorganization Arrangement.

On

February 6, 2020, and concurrent with the closing of the first

tranche of the February 2020 Offering, the Company amended the

Bridge Loan to provide mutual conversion rights to the Lender and

the Company, and also to reduce the annual interest rate from 10%

to 5% from the date of amendment (the “Loan Amendment”). Under the terms

of the Loan Amendment, the Lender obtained the right to convert the

$3.0 million of principal and approximately $0.1 million of accrued

interest, into Common Shares at the price of $1.60 per Common

Share, while the Company obtained the right to require conversion

if the Common Shares trade on the TSX at a price of $2.50 per

Common Share or more for any five consecutive trading days prior to

the maturity date of the Bridge Loan.

On July

7, 2020, the Company announced that the Bridge Loan had been

converted into Common Shares. In accordance with the Loan

Amendment, a total of 1,952,084 Common Shares were issued to the

Lender at a price of $1.60 per Common Share. From the total,

1,875,000 Shares were issued on conversion of the $3.0 million

principal loan and 77,084 Shares were issued on conversion of

approximately $0.1 million of interest that had accrued at a rate

of 10% per annum up to the date of the Loan Amendment. The balance

of the interest on the loan, which had accrued at a rate of 5% per

annum from the date of the Loan Amendment, was paid to the Lender

in cash.

Plan of Arrangement

On

October 9, 2020, the Company acquired all of the then issued and

outstanding shares of Eastmain in accordance with the terms and

conditions of the Arrangement Agreement among the Company,

Eastmain, 1258618 B.C. Ltd. (“SpinCo Sombrero”) and 1258620 B.C.

Ltd. (“SpinCo

Curibaya”, and together with SpinCo Sombrero, the

“SpinCos”), by

way of court-approved plan of arrangement under the Business Corporations Act (Ontario)

(the “Eastmain

Arrangement”). The Eastmain Arrangement closed

immediately following the spin out of the Company’s Peruvian

projects to shareholders of the Company, by way of court-approved

plan of arrangement between the Company and the SpinCos, under the

BCBCA (the “Reorganization

Arrangement”), and the completion of a concurrent

subscription receipt financing (the “Subscription Receipt Financing”,

and, together with the Eastmain Arrangement and the Reorganization

Arrangement, the “Transaction”). Upon the completion

of the Eastmain Arrangement, Eastmain shareholders received

approximately 0.116685115 of a post-consolidation Common Share for

each Eastmain common share held. On October 5, 2020, the

Transaction received the approval of both the Company’s and

Eastmain’s shareholders, and on October 7, 2020, the British

Columbia Supreme Court and the Ontario Superior Court of Justice

issued final orders approving the Reorganization Arrangement and

the Eastmain Arrangement, respectively. In accordance with the

terms of the Arrangement Agreement, the Company changed its name to

“Fury Gold Mines Limited” pursuant to a certificate of

change of name dated October 8, 2020.

-11-

Pursuant

to the Transaction and in accordance with the terms of the

Arrangement Agreement: (i) Fury Gold spun out its Peruvian assets

into two new separate entities owned by the shareholders of the

Company, SpinCo Curibaya and SpinCo Sombrero, with each holder of

Common Shares at the effective time of the Reorganization

Arrangement receiving one common share in each of SpinCo Curibaya

and SpinCo Sombrero for each pre-consolidation Common Share held by

such holder; (ii) Fury Gold consolidated the Common Shares at

a ratio of approximately 10 pre-consolidation Common Shares for

each 6.76 post-consolidation Common Shares, such that the

then-outstanding 111,340,434 Common Shares were consolidated into

75,900,000 Common Shares; and (iii) the Subscription Receipts were

exchanged for 7,750,000 post-consolidation Common Shares and the

net proceeds of the Subscription Receipt Financing were released

from escrow.

Immediately

following the closing of the Transaction there were 117,750,000

Common Shares issued and outstanding. The ticker symbol for the

Common Shares was changed to “FURY” effective October

12, 2020 on the NYSE American and October 13, 2020 on the TSX.

Eastmain’s common shares were delisted form the TSX and

removed from the OTCQB after the end of trading on October 9, 2020.

Upon closing of the Eastmain Arrangement, Eastmain became a

wholly-owned subsidiary of Fury Gold.

Changes in Management

In accordance with the terms of the Arrangement Agreement and

immediately following the closing of the Transaction, Mike

Timmins was appointed President and

Chief Executive Officer of the Company and joined the board of

directors of the Company (the "Board").

On November 9, 2020, Dr. Lynsey Sherry was appointed Chief

Financial Officer of the Company. Dr. Sherry, formerly the

Vice President, Controller of Goldcorp

Inc. (now Newmont Corporation), took over from Elizabeth Senez who

had been Interim Chief Financial Officer.

Eau Claire Exploration Program

In November 2020, Fury Gold commenced its 50,000 metre

(“m”) drill program at the Eau Claire project.

The drill program consists of an infill phase focused on upgrading

and expanding the current resource and an exploration phase

designed to test a one-km down plunge extension of the resource.

The program is expected to focus on several highly prospective,

untested gold targets within the 7-km deposit

trend.

The infill drill program at the Eau Claire deposit is expected to

consist of approximately 25,000 m on the southeast margin of the

existing inferred mineral resource, which is currently defined by

200,000 ounces at 12.2 g/t gold (using a 3.5g/t gold cut-off

grade). This portion of the drill program is designed to

add ounces between defined resource blocks as well as upgrade the

resource category from inferred to indicated in this

location.

The exploration phase aims to significantly expand the Eau Claire

deposit with a focused 10,000 m to 12,000 m drill program that

targets a one-kilometer down plunge extension. The potential for

high-grade gold mineralization to continue down plunge is strongly

supported by newly acquired gradient array IP chargeability data

where the intersection of primary and secondary shear zones has

been imaged approximately 600 m to 800 m to the east of limits of

drilling at the Eau Claire deposit. This newly imaged structural

pattern is defined by the intersection of the mineralized Snake

Lake structure and the projected continuation of the Eau Claire

deposit structure. This structural geometry is consistent with that

observed at the Eau Claire deposit and in part forms the basis of

the down plunge targets.

The exploration drilling is focused on three target

areas:

●

Target A is

situated 100 m to 300 m down plunge from the limit of the current

resource. The planned drill array represents a 200 m to 500 m down

dip extension from the target area where historical drilling above

the target area hosts intercepts of 1.0 m of 12.6 g/t gold, 2.5 m

of 4.4 g/t gold and 2.0 m of 4.8 g/t gold. Collectively, these

historical results are associated with both quartz-tourmaline veins

and secondary shear zone alteration and are interpreted to be

vertically situated above the projected down plunge extension of

the deposit but demonstrate the continuity of mineralized system to

the east of the current resource. Results are pending for three holes in Target

A.

-12-

●

Target B is

situated 500 to 700 m down plunge from the limit of the current

resource. The planned drill array represents a 400 m to 700 m down

dip extension from historical drilling above the target area where

there is a 20 m wide zone of alteration that is similar to that

observed with secondary shear zones at the Eau Claire deposit.

Importantly, newly acquired gradient array IP chargeability data

images the intersection of the primary shear zone and secondary

shear zones that are associated with the extension of the Eau

Claire deposit structure and the mineralized Snake Lake structure,

respectively. Similar structural intersections at the Eau Claire

deposit are associated with high-grade gold mineralization. Fury

completed four drill holes into Target B for a total of 4,434m.

Results from these first holes were very encouraging and include

1.0m of 5.3 g/t Au from 21EC-007; 1.5m of 8.8 g/t Au from 21EC-010

and 3.0m of 2.59 g/t Au from 20EC-006 (refer to news releases dated

January 25th, 2021 and March 30,

2021). Further targeting along Target B is underway.

●

Target C is

situated 800 m to 1,000 m down plunge from the limit of the current

resource. The planned drill array represents a 700 m to 900 m down

dip extension from the historical drilling above the target area.

This target is also situated along the same structural intersection

of the Snake Lake and Eau Claire structures that in part defines

Target B. Results are pending for two drill holes into target

C

●

The Snake Lake

target is located 1.2km to the east of the Eau Claire deposit and

has seen limited drilling. The Company is planning an initial drill

test aimed at offsetting shallow historical intercepts of 2.65m of

13.24 g/t Au; 1.5m of 12.2 g/t Au and 2.0m of 6.62g/t Au with 150

– 300m offsets down plunge to the west. A deep intersection

in 21EC-010, 1.5m of 6.43 g/t Au is located in the same structural

and stratigraphic position as the Snake Lake mineralization. The

intercept in 21EC-010 is approximately 1,100m down plunge of the

nearest Snake Lake drilling and has significantly opened up the

exploration potential along this structural corridor.

Committee Bay Project Drill and Exploration Plans

On

September 29, 2020, the Company announced 12 refined targets across

the Committee Bay Project gold belt that aim to leverage the

targeting breakthrough along the Kalulik – Aiviq structural

corridor and the Anuri target area, as well as expand upon the

Three Bluffs deposit. The targets are within known gold-bearing

systems and were derived using the technical team’s critical

new understanding of high-grade (+5 g/t gold) systems across the

belt based on geophysical conductivity data collected since Fury

Gold has worked on the project. The 2019 targeting breakthrough

enabled Fury Gold to empirically determine the system drivers that

define high-grade across the belt.

Recent Developments – 2021 Year-to-Date

Homestake Ridge Project Drill Plan

On

February 2, 2021, the Company announced a 25,000 m drill program at

the Homestake Ridge Project, which is subject to the availability

of funds, with the primary goal of expanding the resource and

testing high quality gold-silver targets along the deposit trend.

Fury Gold intends, subject to the availability of funds, to conduct

approximately 15,000 m of exploration drilling to extend the

deposit to depth and along strike. The deposit extension targets

are based upon expanding zones of high-grade mineralization, which

are defined by intense silicification, continuous breccia bodies

and vein sets that are based on a relog and the recently completed

geological model of the deposit. Planned step-outs from these

high-grade breccia bodies and vein sets range from 100 m to 350 m

and have the potential to significantly expand the

resource.

The

Company also intends, subject to the availability of funds, to

conduct approximately 10,000 m of infill drilling at Homestake

Silver Zone (“HS

Zone”). The goal of this program is to upgrade a

portion of the resource from inferred to indicated category and to

demonstrate the geologic continuity of mineralization based on all

recently completed geological data sets and models

to-date.

Committee Bay Project Drill and Exploration Plans

On

February 17, 2021, the Company announced its exploration plans for

the Committee Bay Project, which are subject to the availability of

funding. Fury Gold plans, subject to the availability of funds, to

drill between 5,000 m and 10,000 m, with the goals of: (i) drilling

the underexplored Raven high-grade vein target, which sits along an

8 km shear zone; (ii) expanding the Three Bluffs deposit through

the drilling of a major conductor down dip from a high-grade

portion of the resource; and (iii) advancing the

previous geological work on targets along the Aiviq-Kalulik

corridor to advance them to drill stage.

Changes to Management and the Board

On

January 6, 2021, the Company announced that Salisha Ilyas had been

appointed to the newly formed role of Vice President, Investor

Relations.

On

March 16, 2021, the Company announced that Tim Clark has been

appointed a director of the Company, replacing Mr. Blair Schultz,

who had resigned as a director. The Company also announced the

appointment of Jeffrey Mason as lead director.

-13-

BUSINESS DESCRIPTION

General

Fury Gold is a Canadian-focused

exploration and development company with active projects in three

prolific gold mining regions and a focus on finding and advancing

globally significant precious metal deposits. Fury Gold has a

portfolio of mineral properties including three flagship properties

in Canada: the Eau Claire Project, the Committee Bay Project and

the Homestake Ridge Project.

Since

2016, the Company has been actively exploring its mineral projects

with the goal of identifying new areas of significant

mineralization. As discussed in Committee Bay Project, Homestake

Ridge Project and Eau Claire Project sections below, the majority

of this work has taken place away from the known deposit areas in

the form of regional exploration and prospect drilling at satellite

targets. Though this work has yet to lead to the discovery of any

new material mineral deposits, it has strengthened the

Company’s understanding of the geological systems and

provided new evidence with respect to the projects continued

perspectivity. The Company expects to continue its exploration on

the Eau Claire Project through 2021 as discussed above under the

heading “General Development

of the Business – Recent

Developments”.

The

Company has not yet determined whether any of its mineral property

interests contain economically recoverable mineral

reserves. The

Company’s continuing operations and the underlying value of

the Company’s mineral property interests are entirely

dependent upon the existence of economically recoverable mineral

reserves, the ability of the Company to obtain the necessary

financing to complete the exploration of its mineral property

interests, obtaining the necessary mining permits, and on future

profitable production or the proceeds from the disposition of the

exploration and evaluation assets. See “Risk Factors” for further

information.

Specialized Skill and Knowledge

All

aspects of the Company’s business require specialized skills

and knowledge. Such skills and knowledge include the areas of

geology, mining, metallurgy, engineering, environment issues,

permitting, social issues, and accounting. While competition in the

resource mining industry can make it difficult to locate and retain

competent employees in such fields, the Company has been successful

in finding and retaining personnel for the majority of its key

processes. See “Risk Factors

– Specialized Skill and Knowledge”.

In

addition, Fury Gold’s technical and management teams have a

track record of successfully monetizing assets for all stakeholders

and local communities in which it operates. Fury Gold conducts

itself to the highest standards of corporate governance and

sustainability.

Competitive Conditions

The

mineral exploration industry is competitive and Fury Gold will be

required to compete for the acquisition of mineral permits, claims,

leases and other mineral interests for operations, exploration and

development projects. As a result of this competition Fury Gold may

not be able to acquire or retain prospective development projects,

technical experts that can find, develop and mine such mineral

properties and interests, workers to operate its mineral

properties, and capital to finance exploration, development and

future operations. The Company competes with other mining

companies, some of which have greater financial resources and

technical facilities, for the acquisition of mineral property

interests, the recruitment and retention of qualified employees and

for investment capital with which to fund its operations and

projects. See “Risk Factors

– Competitive Conditions”.

Cycles

The

Company’s mineral exploration activities may be subject to

seasonality due to adverse weather conditions including, without

limitation, incremental weather, frozen ground and restricted

access due to snow, ice or other weather-related factors. Further,

the mining business, and particularly the precious metals industry,

including the gold industry, is subject to metal price cycles.

Moreover, the mining and mineral exploration business is subject to

global economic cycles effecting, among other things, the

marketability and price of gold products in the global marketplace.

See “Risk Factors –

Commodity Price Fluctuations and Cycles”.

-14-

Intangible Properties

The

Company’s intangible property, including its mineral and

surface rights, is described elsewhere in this AIF. The

Company’s business is not materially affected by intangibles

such as business or commercial licenses, patents and

trademarks.

Environmental Protection

The

Company is currently engaged in exploration activities on all its

material properties and such activities are subject to various

environmental laws and regulations. Compliance with such laws and

regulations increases the costs of and delays planning, designing,

drilling and developing the Company’s properties. To the best

of management’s knowledge, the Company is in compliance in

all material respects with all environmental laws and regulations

applicable to its exploration and drilling activities. Fury Gold is

committed to meeting or surpassing all applicable environmental

legislation, regulations, permit and license requirements, and to

continuously improving its environmental performance and

practices. The Company

embraces safe, socially and environmentally responsible and

sustainable work practices during all activities. Fury Gold is

proud to utilize innovative technologies and techniques to reduce

its environmental footprint across all of the Company’s

projects. This includes awarding drill contracts to an EcoLogo

certified contractor at Eau Claire, the use of Rotary Air Blast

(RAB) drilling at the Committee Bay Project, which reduces water

usage, footprint and time on the ground, and the use of drone

imagery to allow targeted ground-based follow up of outcrop.

Current costs associated with compliance are considered to be

normal. See “Risk

Factors –

Environmental Regulatory, Health & Safety

Risks and

“Risk Factors

– Environmental

Protection”.

Employees

As at

December 31, 2020, the Company had approximately 15 full-time

employees at its offices in Vancouver, Edmonton and Toronto, as

well as based at the Eau Claire camp, including full-time employees

seconded from Universal Mineral Services Ltd. The Company also

relies on consultants and contractors to carry on many of its

business activities and, in particular, to supervise and carry out

mineral exploration and drilling on its mineral properties. No

management functions of Fury Gold are performed to any substantial

degree by a person other than the directors or executive officers

of Fury Gold.

Social and Environmental Policies

Building

and maintaining good corporate citizenship is an important

component of Fury Gold’s business practices. The Company has

adopted several social and environmental policies and codes of

conduct that are essential to its operations. The Company’s

operating practices are governed by the principles set out in its

Code of Business Conduct and Ethics, Gender Diversity Policy,

Insider Trading Policy, Disclosure Policy and Whistle-Blower

Policy.

Fury

Gold endeavors to contribute to the communities in which it

operates by focusing on activities that can make a meaningful,

positive and lasting difference to the lives of those affected by

its presence. Fury Gold

prioritizes creating mutually beneficial and long-term partnerships

with the communities where it operates, respecting their interests

as our own. Fury Gold establishes constructive local partnerships

to contribute to local priorities and interests and to have

communities benefit both socially and economically from its

activities. The Company seeks opportunities to maximize employment

and procurement for local communities through the provision of

suitable training opportunities and resources.

Fury Gold engages in open and transparent dialogue with

governments, communities, Indigenous peoples, organizations and

individuals on the basis of respect, fairness and meaningful

consultation and participation.

Further information regarding Fury Gold’s corporate

governance policies and charters can be found on its website

at

www.furygoldmines.com/corporate/corporate-governance.

-15-

Indigenous and Local Community Engagement

Fury Gold respects and engages meaningfully with Indigenous and

local communities at all of its operations. The Company is

committed to working constructively with local communities,

government agencies and Indigenous groups to ensure that

exploration work is conducted in a culturally and environmentally

sensitive manner. The Company’s engagement with Indigenous

and local communities is governed by the principles set out in its

Indigenous and Community Relations Committee Charter. Moreover,

Fury Gold is committed to:

●

sharing information about its projects and operations, providing

meaningful opportunities for input and dialogue and involving local

and Indigenous communities in archaeological work, environmental

assessments and related studies;

●

making meaningful efforts to reach agreements with local and

Indigenous groups on the preferred method of participation and

engagement processes;

●

exploring opportunities for local and Indigenous communities to

benefit from its projects and activities, which may include

employment, contracting, training, community benefits and

agreements, as appropriate to the type and stage of activity being

undertaken; and

●

engaging in candid and respectful dialogue with a view to resolving

or minimizing any disagreements and ensuring full communication in

respect of any unresolved issues.

Fury Gold is committed to responsible mineral exploration. The

Company values forging strong, durable, and respectful

relationships with the Indigenous communities in which it

operates.

Fury Gold’s Indigenous and Community Relations Committee

Charter can be viewed on its website at

www.furygoldmines.com/corporate/corporate-governance.

Continuing Operations and Actual and Anticipated Impact of

COVID-19

The

effect of the COVID-19 pandemic on the Company’s operations

has been varied. At the Company’s Eau Claire Project, where

drilling activities recently commenced, the Company has implemented

COVID-19 screening for all site personnel prior to their arrival to

limit the risk of infection in the camp. Although commercial

flights between the Nemiscau Airport and Montreal have been halted

as a result of COVID-19, the ability of Company personnel to access

the Eau Claire Project has not been materially

impacted. Due

to travel restrictions into Nunavut as well as to respect the local

communities’ concerns over COVID-19, the Company informed

stakeholders in the Committee Bay Project that the Company would

not conduct field operations in 2020.

Across

Canada, public health officials have recommended precautions to

mitigate the spread of the ongoing COVID-19 pandemic, especially in

heavily populated areas, with provincial governments issuing orders

that at certain times have required the closure of non-essential

businesses and for people to remain at home. As a precaution, the

corporate offices were temporarily closed in 2020 and all employees

supported to work remotely.

The

situation in Canada with respect to the management of COVID-19

remains fluid and permitted activities are subject to change. The

Company is continually reviewing the situation along with

provincial and government guidelines and allowing work to be

undertaken once it is confident that it is safe for its employees

and stakeholders to do so. The Company continues to have full

access to its properties in Canada and has managed to adequately

stage its work sites for its planned programs. Additional measures

have been taken to enhance the safety of employees and contractors

at all active sites. These measures include limiting camp

occupancy, additional sanitation stations, social distancing and

mandatory mask usage. The Company to date has not experienced

problems with obtaining the supplies and staff needed for its

exploration work and other work programs. The Company has continued

to move forward with its planned exploration work, including

drilling at the Eau Claire Project. See “Eau Claire Project – Eau

Claire Exploration Program – 2020” for more information on the drill

program.

In

February 2021, the community vaccination program already underway

in Northern Québec was made available to any persons working

in Northern Québec. The Company’s employees currently

working at the Eau Claire Project have commenced voluntary

participation in the vaccination program and the Company

anticipates all Québec employees working at site to be

vaccinated in the near future.

All

reporting and expenditure requirements at the Committee Bay Project

and Gibson MacQuoid project were extended for one year under the

Nunavut COVID-19 relief program announced May 1, 2020. All

reporting and expenditure requirements at the Eau Claire Project

were extended for one year under Québec’s COVID-19

relief program. At the Homestake Ridge Project, all reporting and

expenditure requirements have been extended until December 31, 2021

under section 66 of the Mineral

Tenure Act (British Columbia).

The

Company anticipates that, in order to respect local

communities’ concerns, any access to the Committee Bay

Project during 2021 may be by way of direct charter from Churchill,

Manitoba, and may not involve travel through local communities. The

Company does not anticipate that such access will have a material

impact on its costs or timelines to achieving its goal of advancing

exploration at the Committee Bay Project.

While

the disruptions resulting from the COVID-19 pandemic have caused

some delays in the Company’s planned goals for 2020, mainly

related to its inability to conduct field programs in Canada once

movement restrictions were mandated, management was able to

continue with much of its planned activity. As the situation

surrounding COVID-19 continues to develop daily, the Company will

continue to monitor the situation closely and respond

appropriately. See “Risk

Factors –

COVID-19 and Other

Pandemics”.

-16-

EAU CLAIRE PROJECT

The following disclosure relating to the Eau Claire Project is

based on information derived from the NI 43-101 compliant technical

report on the Eau Claire Project entitled “Technical Report,

Updated Mineral Resource Estimate and Preliminary Economic

Assessment on the Eau Claire Gold Deposit, Clearwater Property,

Quebec, Canada”

with an effective

date of February 4, 2018. Reference should be made to the full text

of the Eau Claire Report, which is available electronically on the

SEDAR website at www.sedar.com under our SEDAR profile, as the Eau

Claire Report contains additional assumptions, qualifications,

references, reliances and procedures which are not fully described

herein. The Eau Claire Report is the only current NI 43-101

compliant technical report with respect to the Eau Claire Project

and supersedes all previous technical reports. All information of a

scientific or technical nature contained below and provided after

the date of the Eau Claire Report has been reviewed and approved by

David Frappier-Rivard, the Company’s Exploration Manager and

a qualified person for the purposes of NI

43-101.

Property Description and Location

Fury Gold owns a 100%-interest in the Eau Claire Project, host to

the Eau Claire gold deposit, one of five known gold deposits in the

James Bay region of Québec. The largest of these,

Newmont’s Éléonore mine, is located 57 km NNW of

the Eau Claire Project.

The Eau Claire Project is located immediately north of the Eastmain

reservoir, 10 km northeast of Hydro Quebec’s EM-1 hydroelectric power

facility, 80 km north of the town of Nemaska and approximately 320 km northeast of the

town of Matagami and 800 km north of Montreal in the

Eeyou Istchee James Bay Region of

Québec (UTM NAD 83, Zone

18: 444,000E; 5,785,000N). This property consists of map-designated

claims, (CDC’s) totaling approximately 233

km2.

These claims are held 100% by Fury Gold and are currently in good

standing. Permits are obtained annually for all surface

exploration, particularly trenching and drilling, undertaken on the

property.

Accessibility, Climate, Local Resources, Infrastructure and

Physiography

The property is located 80 km

north of a commercial airport at Nemiscau and less than 10 km northeast of

Hydro Québec’s EM-1

complex. The Eau Claire gold deposit is situated at the western end

of the property 2.5 km from Hydro Québec’s nearest service road.

The property is accessible by the all-weather Route du Nord from the town of Chibougamau

to Hydro Quebec’s

Eastmain One power generation complex (EM-1). Alternatively, the

property may be accessed from the town of Amos via Matagami and

the Route de la Baie James and

the Route du Nord. Under normal

operating conditions, the Nemiscau Airport has several commercial flights

per week from Montreal.

Road access reaches the southern boundary of the property, five km

east of Hydro

Québec’s principal EM-1 dam, located on the

Eastmain River. The base camp is

accessible by four-wheel drive truck, ATV or

snowmobile.

The area is well known for its extensive hydroelectric complex and

associated infrastructure. Hydro-Québec’s EM-1 Power Project currently includes a 100-person camp

with full amenities and medical support. The principal dam is

situated near the junction of the Eastmain and Eau Claire Rivers. The Eastmain reservoir for the

EM-1 hydroelectric power facility covers a large area immediately

south of the Eau Claire Project. Future development of the property

will require access and infrastructure improvements near EM-1

requiring consultation with Hydro Quebec.

The region and the property include many lakes and rivers. The

topography is gently rolling to flat-lying with local relief

ranging from 250m to 400m above sea-level. Outcrop exposure is

limited. Large, east-west trending outcrop ridges and coarse sand

eskers, flanked by lower troughs provide moderate drainage over

most of the area. There is an abundance of quaternary deposits and

swamps. The area is drained by the Eau Claire River, which in turn drains into

the Eastmain River and James

Bay. Vegetation includes large areas covered by sparse forest

(mainly spruce) and many smaller mostly swampy areas devoid of

trees.

The climate is typical of Northern Canada (temperate to sub-arctic

climate) with average summer (June to September) temperatures

varying from 10oC

to 35°C during the day and 5°C to 15°C during the

night. Winters can be cold, ranging from -40°C to -10°C.

Precipitation varies during the year, reaching 2m annually, with

snow cover expected from November to May. However, exploration and

mining can generally be carried out year-round.

-17-

History

The area covered by the current Eau Claire Project was previously

explored from 1984 to 1990 in a joint venture between Eastmain and

Westmain Resources Ltd. Previous exploration included airborne and

ground geophysical surveys, geochemical surveys, geological

mapping, outcrop stripping, trenching and sampling, and diamond

drilling. The Eau Claire gold deposit was discovered in

1987.

In 1995, SOQUEM Inc. optioned the property from the joint venture

and initiated a multi-disciplinary exploration program, which

continued until May 2002, when Eastmain took over management of the

project. Eastmain acquired an option to earn SOQUEM’s remaining ownership in the Eau

Claire Project during fiscal 2004, in exchange for cash and

securities, thus giving Eastmain 100% ownership of the Eau Claire

Project. The property was subject to a 2% NSR in favour of SOQUEM

which was purchased by Eastmain in March of 2011. The Eau Claire

Project became the central focus of Eastmain in

2012.

Geology, Mineralization and Deposit Type

The Eeyou Istchee James Bay

region is mainly comprised of the La Grande and Opinaca sub-provinces. The Eau Claire Project is

underlain by typical Archean

greenstone assemblages of the Eastmain Greenstone Belt, which are

essentially composed of volcanic rocks of basaltic to rhyolitic

composition and of related clastic and chemical sedimentary rocks.

These rocks have been intruded by an assemblage of mafic to felsic

sills, stocks and dykes. Metamorphism ranges from upper greenschist

to amphibolite facies in the greenstone assemblages, while

higher-grade facies, up to granulite level, typically characterize

the Opinaca sub-province.

Archean-aged deformation affects all rocks on the property. Near

the Eau Claire deposit, the volcano-sedimentary assemblage has been

folded, forming a closed antiform plunging gently to the west.

Regional rock foliation and lithology are generally east-west in

strike with moderate to sub-vertical southerly dips in the vicinity

of the Eau Claire gold deposit.

A structural interpretation based on field evaluation and

interpretation of high-resolution airborne magnetic surveys flown

over the Eau Claire Project has defined three major deformation

events (D1, D2 and D3) on the property. Based on interpretation, a

crustal scale, east-west trending, D2 structural break (the Cannard

Deformation Zone (“CDZ”)) has been traced for more than 100 km

across the district. Gold mineralization, including that found in

the Eau Claire deposit, has been traced via rock and channel

sampling for a length exceeding 20 km immediately north and

parallel to the CDZ. The Eau Claire gold deposit is a structurally

controlled gold deposit, consisting of en-echelon sheeted

quartz-tourmaline (“QT”) veins and altered rock coinciding with a

mafic volcanic/felsic volcaniclastic contact, along the south limb

of an F2 anticlinal fold. At Eau Claire, gold-bearing QT veins and

alteration zones occur sub-parallel to the F2 fold axis and are

related to a D2 structural event. The deposit is situated

approximately one km north the CDZ.

Over 90% of the gold mineralization at Eau Claire occurs within

iron- and magnesium-rich

tholeiitic basalts. In the hanging wall to the deposit these

basalts are intruded by a quartz-feldspar porphyry

dyke swarm. A felsic

volcaniclastic unit is interpreted to represent the deposit

footwall. The Eau Claire deposit is comprised of two zones

(450 West and 850

West) which form a crescent-shaped

body extending for a length of 1.8 km. Portions of the 450 West and

850 West zones outcrop on topographic highs. For exploration

purposes the limits of the known deposit are defined by a 0.5 g/t

Au grade envelope. Along the 450 West zone, quartz-feldspar

porphyry dyke swarm occupies

the hanging wall to the mineralization and is believed to

contribute structurally to the development of the vein system while

at the 850 West zone QT veining crosscuts the porphyry

intrusions.

Exploration Status

Eau Claire Exploration Program

During calendar 2017, and as of December 31, 2017, Eastmain had

completed 62,772 m of drilling at Eau Claire including 54,264 m at

the 450 West zone and 5,313 m at the 850 West zone of the Eau

Claire Project deposit. The drilling total also included 3,195 m

which tested to the east of Eau Claire and at Snake Lake. During the drill campaign,

approximately 59,350 core samples were collected ranging in length

from 0.5 m to 1.5 m and 3,849 control samples for

Quality Assurance and Quality Control

purposes were inserted. Core samples obtained within the deposit in

2017 returned gold assays ranging from below detection (<5 ppb

Au) over individual intervals of 1.5 m to as high as 206 g/t Au

over 0.5 m. Mineralized veins and alteration identified in logging

form the basis of deposit interpretation and weighted averages of

gold assays within the mineralized intervals are incorporated into

the mineral resource

Estimate.

-18-

In the period from August to December 2017, 19 drill holes were

completed at the Eau Claire Project deposit to test and extend

mineralization at vertical depths of 600 m to 800 m. These holes

targeted depths extensions of QT and high-grade schist

(“HGS”) veins and were drilled to improve

understanding of these vein systems at that

depth.

In addition to Eastmain’s focus on resource drilling at Eau

Claire, trenching was completed in late 2017 at the Clovis,

Beluga and Rosemary targets. Fourteen

trenches totaling 1,575 m were excavated, mapped and sampled and

978 m of saw-cut channel samples were taken. 1,126 samples,

including 66 QA/QC samples, were submitted for

analysis.

2019 Eau Claire Exploration Program

At the Eau Claire Project, Eastmain announced the discovery of a

new gold mineralized zone at the Percival Prospect on November 13, 2018. The

Percival discovery is located 14 km

ESE of the Eau Claire Deposit

and represents a new and distinct style of mineralization on the

property. Initial drilling returned intervals of 1.46 g/t Au over

78.5 m (ER18-822), 4.46 g/t Au over 8.2 m and 2.35 g/t Au over 87.0

m (ER18-823), and 5.76 g/t Au over 6.0 m.

Eastmain mobilized in early February 2019 to commence a follow-up

drill program at Percival,

completing 5,116 m by April 2019. With the completion of this

drilling, the Percival geology

had been extended to over 400 m along a SSW-NNE strike

length.

During the 2019 summer field season, Eastmain commenced surface

geophysics, geological mapping, trenching and sampling over 5 km

strike of the KS Horizon.

Testing focused on the KS

Horizon beginning at the Knight

showing in the west and continuing through the Percival discovery to the

east.

Surface exposures from trenching confirm numerous geological

observations from discovery drill holes ER18-822 and ER18-823

including the relationship of gold mineralization to breccias

throughout the Percival area.

While breccias were initially identified in core as weakly to very

strongly silicified units of siltstone and mudstone, surface

exposures have identified that the main Percival breccia also includes altered and

silicified banded iron formation (BIF) and BIF slump breccias where

magnetite appears to be replaced by pyrrhotite. Remnant unaltered

BIF rafts and smaller blocks have been mapped in the new exposures

but were not intersected initially in core from this location. BIF

horizons are locally associated to thin layers of garnet

amphibolite rock which are part of the iron formation sequence and

interbedded with strongly silicified and sericitized schists

(altered argillites). Strong alteration is accompanied by sulphide

mineralization (1 to 10% pyrrhotite + pyrite) as both replacement

of BIF magnetite and as a later hydrothermal sulphide mineralizing

event. Highlight results from the 2019 channel sampling at

Percival were announced in August and