Exhibit 99.1

Auryn resources inc.

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2017

DATED AS OF March 27, 2018

600 – 1199 WEST HASTINGS STREET

VANCOUVER, BRITISH COLUMBIA

V6E 3T5

TABLE OF CONTENTS

| PRELIMINARY NOTES | 4 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 4 |

| Material Risks and Assumptions: | 5 |

| Resource Category (Classification) Definitions | 6 |

| CORPORATE STRUCTURE | 8 |

| Name, Address and Incorporation | 8 |

| Inter-corporate Relationships | 8 |

| GENERAL DEVELOPMENT OF THE BUSINESS | 9 |

| Three Year History | 9 |

| Peru Portfolio | 12 |

| Gibson MacQuoid Project | 13 |

| BUSINESS DESCRIPTION | 13 |

| General | 13 |

| Risk Factors | 14 |

| COMMITTEE BAY PROJECT | 22 |

| Amended and Restated Technical Report | 22 |

| Project Description and Location | 22 |

| Land Tenure | 22 |

| Accessibility | 22 |

| Climate | 23 |

| Local Resources | 23 |

| Existing Infrastructure | 24 |

| History | 24 |

| Past Production | 25 |

| Geology and Mineralization | 25 |

| Exploration Status | 25 |

| Committee Bay RAB Drilling QA/QC Disclosure | 26 |

| Mineral Resources | 26 |

| Mineral Reserves | 26 |

| Adjacent Properties | 26 |

| Conclusions | 27 |

| Recommendations | 27 |

| HOMESTAKE RIDGE PROJECT | 29 |

| Technical Report | 29 |

| Project Description and Location | 29 |

| Land Tenure | 30 |

| Accessibility | 30 |

| Climate | 30 |

| Local Resources | 30 |

| Existing Infrastructure | 31 |

| History | 31 |

| Past Production | 32 |

| Geology and Mineralization | 32 |

| Exploration Status | 33 |

| Homestake Ridge Drilling QA/QC Disclosure | 33 |

| Mineral Resources | 33 |

| - 2 - |

| Mineral Reserves | 34 |

| Adjacent Properties | 34 |

| Conclusions | 35 |

| Recommendations | 35 |

| PERUVIAN EXPLORATION PORTFOLIO | 37 |

| Technical Report | 37 |

| Project Description and Location | 37 |

| Land Tenure | 37 |

| Accessiblity | 38 |

| Climate | 39 |

| Local Resources and Infrastructure | 39 |

| History | 39 |

| Geology and Mineralization | 40 |

| Exploration | 41 |

| Mineral Resources | 41 |

| Adjacent Properties | 41 |

| Recommendations and Conclusions | 41 |

| Project Description, Location and Mineral Tenure | 44 |

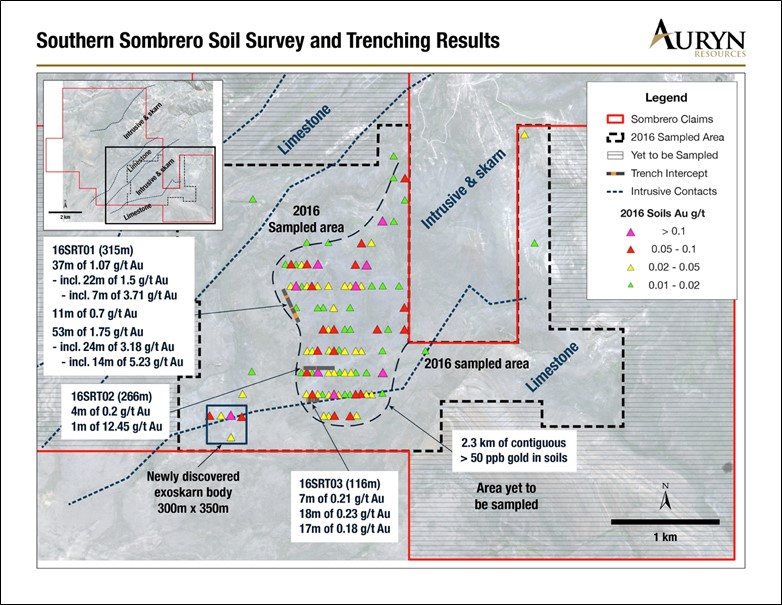

| 2016 Exploration | 44 |

| Quality Assurance/Quality Control & Sample Preparation, Analysis and Data Verification | 46 |

| Project Description, Location and Mineral Tenure | 47 |

| Exploration | 47 |

| DESCRIPTION OF CAPITAL STRUCTURE | 48 |

| Common Shares | 48 |

| Preferred Shares | 48 |

| Stock Options | 48 |

| Share Purchase Warrants | 49 |

| Broker Warrants | 49 |

| Homestake Warrants | 49 |

| MARKET FOR SECURITIES | 49 |

| Trading Price and Volume | 49 |

| Prior Sales | 50 |

| DIRECTORS AND EXECUTIVE OFFICERS | 50 |

| Name, Occupation and Security Holding | 50 |

| Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 53 |

| Conflicts of Interest | 53 |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 54 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 54 |

| TRANSFER AGENT AND REGISTRAR | 54 |

| Auditor | 54 |

| MATERIAL CONTRACTS | 54 |

| INTERESTS OF EXPERTS | 54 |

| Audit committee information | 55 |

| Audit Committee Charter | 55 |

| Composition of the Audit Committee | 56 |

| Relevant education and Experience | 56 |

| Pre-Approval Policies and Procedures | 56 |

| - 3 - |

| External Auditor Service Fees | 56 |

| ADDITIONAL INFORMATION | 57 |

TABLES

| TABLE 1 | Summary of Auryn Drilling (Committee Bay Project) | 9 | ||||

| TABLE 2 | Climatic Data (Committee Bay Project | 23 | ||||

| TABLE 3 | Proposed Budget – Phase 1 (Committee Bay Project | 28 | ||||

| TABLE 4 | Proposed Budget – Phase 2 (Committee Bay Project) | 28 | ||||

| TABLE 5 | Mineral Resource Statement as at Sept. 1, 2017 (Homestake Ridge Project) | 34 | ||||

| TABLE 6 | Proposed Budget – Phase 1 (Homestake Ridge Project) | 36 | ||||

| TABLE 7 | Proposed Budget – Phase 2 (Homestake Ridge Project) | 37 | ||||

| TABLE 8 | Huilacollo Option Expenditures And Cash Payments | 38 | ||||

| TABLE 9 | Phase 1 Recommended Exploration and Budget (Peru) | 42 | ||||

| TABLE 10 | Phase 2 Recommended Exploration and Budget (Peru) | 43 | ||||

| TABLE 11 | Baños Del Indio Work Expeditures And Cash Payments | 47 | ||||

| TABLE 12 | Outstanding Stock Options | 48 | ||||

| TABLE 13 | Outstanding Warrants | 49 | ||||

| TABLE 14 | Trading Price and Volume on TSX | 50 | ||||

| TABLE 15 | Directors and Executive Officers | 51 | ||||

| TABLE 16 | Audit Fees | 57 |

FIGURES

| FIGURE 1 | Consolidated Organizational Chart | 9 | ||||

| FIGURE 2 | Southern Sombrero Soil Survey and Trenching Results | 46 |

| - 4 - |

PRELIMINARY NOTES

In this Annual Information Form (the “AIF”) Auryn Resources Inc. is referred to as the “Company” or “Auryn”. All information in this AIF is at March 27, 2018, unless otherwise indicated.

All dollar amounts are expressed in Canadian dollars unless otherwise indicated.

Common shares of the Company are referred to as “Common Shares”, the “Shares” or “Auryn Shares”.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Auryn cautions readers regarding forward-looking statements found in this document and in any other statement made by, or on the behalf of the Company. Such statements may constitute “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information involves statements that are not based on historical information but rather relate to future operations, strategies, financial results or other developments. Forward-looking information is necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond Auryn’s control and many of which, regarding future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by or on the Company’s behalf. Although Auryn has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. All factors should be considered carefully and readers should not place undue reliance on Auryn’s forward-looking information. Examples of such forward-looking information within this AIF include statements relating to: the future price of minerals, future capital expenditures, success of exploration activities, mining or processing issues, government regulation of mining operations and environmental risks. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “estimates”, “anticipates”, or variations of such words and phrases (including negative and grammatical variations) or statements that certain actions, events or results “may”, “could”, “might” or “occur”. Forward-looking information is made based on management’s beliefs, estimates and opinions and are given only as of the date of this AIF. The Company undertakes no obligation to update forward-looking information if these beliefs, estimates and opinions or other circumstances should change, except as may be required by applicable law.

Forward-looking information reflects Auryn’s current views with respect to expectations, beliefs, assumptions, estimates and forecasts about the Company’s business and the industry and markets in which the Company operates. Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions, which are difficult to predict. Assumptions underlying the Company’s expectations regarding forward-looking statements or information contained in this AIF include, among others, the Company’s ability to comply with applicable governmental regulations and standards, the Company’s success in implementing its strategies, achieving the Company’s business objectives, the Company’s ability to raise sufficient funds from equity financings in the future to support its operations, and general business and economic conditions. The foregoing list of assumptions is not exhaustive.

Persons reading this AIF are cautioned that forward-looking statements are only predictions, and that the Company’s actual future results or performance are subject to certain risks and uncertainties including:

| · | risks related to the Company’s mineral properties being subject to prior unregistered agreements, transfers or claims and other defects in title; |

| · | risks related to the Company’s history of losses, which may continue in the future; |

| - 5 - |

| · | risks related to increased competition and uncertainty related to additional financing that could adversely affect the Company’s ability to attract necessary capital funding or obtain suitable properties for mineral exploration in the future; |

| · | risks related to the Company’s officers and directors becoming associated with other natural resource companies, which may give rise to conflicts of interest; |

| · | uncertainty and volatility related to stock market prices and conditions; |

| · | further equity financing(s), which may substantially dilute the interests of the Company’s shareholders; |

| · | dependence on general economic, market or business conditions; |

| · | changes in business strategies; |

| · | changes in laws and regulations; and |

| · | other factors described under the heading “Risk Factors” in this AIF. |

Material Risks and Assumptions:

The forward-looking information in this AIF reflects our current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by us, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking information contained in this AIF and documents incorporated by reference, and we have made assumptions based on or related to many of these factors.

Such factors include, without limitation:

| · | fluctuations in spot and forward markets for silver, gold, base metals and certain other commodities (such as natural gas, fuel oil and electricity) |

| · | restrictions on mining in the jurisdictions in which we operate; |

| · | laws and regulations governing our operation, exploration and development activities; |

| · | our ability to obtain or renew the licenses and permits necessary for the operation and expansion of our existing operations and for the development, construction and commencement of new operations; |

| · | risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, potential unintended releases of contaminants, industrial accidents, unusual or unexpected geological or structural formations, pressures, cave-ins and flooding); |

| · | inherent risks associated with tailings facilities and heap leach operations, including failure or leakages; |

| · | the speculative nature of mineral exploration and development; |

| · | the inability to determine, with certainty, production and cost estimates; |

| · | inadequate or unreliable infrastructure (such as roads, bridges, power sources and water supplies); |

| · | environmental regulations and legislation; |

| - 6 - |

| · | the effects of climate change, extreme weather events, water scarcity, and seismic events, and the effectiveness of strategies to deal with these issues; |

| · | risks relating to our exploration operations in Peru; |

| · | fluctuations in currency markets (such as the Peruvian nuevo sol versus the Canadian dollar); |

| · | the volatility of the metals markets, and its potential to impact our ability to meet our financial obligations; |

| · | the inability to recruit and retain qualified personnel; |

| · | employee relations; |

| · | disputes as to the validity of mining or exploration titles or claims or rights, which constitute most of our property holdings; |

| · | our ability to complete and successfully integrate acquisitions; |

| · | increased competition in the mining industry for properties and equipment; |

| · | limited supply of materials and supply chain disruptions; |

| · | relations with and claims by indigenous populations; |

| · | relations with and claims by local communities and non-governmental organizations; |

| · | the effectiveness of our internal control over financial reporting; |

| · | claims and legal proceedings arising in the ordinary course of business activities; and |

| · | those factors identified under the caption “Risks Factors” in this AIF and the documents incorporated by reference herein, if any. |

You should not attribute undue certainty to forward-looking information. Although we have attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as described. We do not intend to update forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such information, other than as required by applicable law.

Resource Category (Classification) Definitions

The discussion of mineral deposit classifications in this AIF adheres to the mineral resource and mineral reserve definitions and classification criteria developed by the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") 2005. Estimated mineral resources fall into two broad categories dependent on whether the economic viability of them has been established and these are namely "resources" (potential for economic viability) and ore "reserves" (viable economic production is feasible). Resources are sub-divided into categories depending on the confidence level of the estimate based on level of detail of sampling and geological understanding of the deposit. The categories, from lowest confidence to highest confidence, are inferred mineral resource, indicated mineral resource and measured mineral resource. Reserves are similarly sub-divided by order of confidence into probable (lowest) and proven (highest). The Company at this time has not classified any of its mineral deposits as Mineral Reserves. These classifications can be more particularly described as follows:

| - 7 - |

A "Mineral Resource" is a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling.

An "Inferred Mineral Resource" is that part of a Mineral Resource for which quantity and grade or quality are

estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological

and grade or quality continuity. It has a lower level of confidence than that applying to an Indicated Mineral Resource and must

not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded

to Indicated Mineral Resources with continued exploration.

An "Indicated Mineral Resource" is that part of a Mineral Resource for which quantity, grade or quality, densities,

shape and physical characteristics are estimated with sufficient confidence to allow the application of modifying factors in sufficient

detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately

detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity

between points of observation. It has a lower level of confidence than that applying to a Measured Mineral Resource and may only

be converted to a Probable Mineral Reserve.

A "Measured Mineral Resource" is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of modifying factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. It has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve.

A "Mineral Reserve" is the economically mineable part of a Measured and/or Indicated Mineral Resource. It includes

diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies

at Pre-Feasibility or Feasibility level as appropriate that include application of modifying factors, which are considerations

used to convert Mineral Resources to Mineral Reserves and include, but are not restricted to, mining, processing, metallurgical,

infrastructure, economic, marketing, legal, environmental, social and governmental factors. Such studies demonstrate that, at the

time of reporting, extraction could reasonably be justified. The reference point at which Mineral Reserves are defined, usually

the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the

reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully

informed as to what is being reported. The public disclosure of a Mineral Reserve must be demonstrated by a Pre-Feasibility Study

or

Feasibility Study.

A "Probable Mineral Reserve" is the economically mineable part of an Indicated, and in some circumstances, a Measured

Mineral Resource. The confidence in the modifying factors applying to a Probable Mineral Reserve is lower than that applying to

a Proven Mineral Reserve.

A "Proven Mineral Reserve" is the economically mineable part of a Measured Mineral Resource. A Proven Mineral

Reserve implies a high degree of confidence in the modifying factors.

| - 8 - |

CORPORATE STRUCTURE

Name, Address and Incorporation

Auryn was incorporated under the name “Georgetown Capital Corp.” under the Business Corporations

Act (British Columbia) on June 9, 2008. The Company was a Capital Pool Company under the policies of the TSX Venture Exchange

(the “TSXV”). Auryn completed a qualifying transaction with Full Metal Minerals USA Inc. in February 2011. On

October 15, 2013, the Company changed its name to “Auryn Resources Inc.” Auryn’s registered and records

office is located at 1500 Royal Centre, 1055 West Georgia Street, P.O. Box 11117, Vancouver, British Columbia, V6E 4N7.

Auryn’s head office is located at Suite 600-1199 West Hastings Street, Vancouver, British Columbia, V6E 3T5. Auryn

is a reporting issuer in the provinces of British Columbia, Alberta and Ontario.

Effective October 31, 2016, the Company’s common shares ceased trading on the TSXV,and effective November 1, 2016, the Company’s common shares became listed on the Toronto Stock Exchange (the “TSX”). As a result, the Company ceased to be a “venture issuer” as defined under National Instrument 51-102 Continuous Disclosure Requirements on November 1, 2016, and its shares trade under the symbol AUG.

Effective July 17, 2017, the Company’s common shares commenced trading on the NYSE American under the US symbol “AUG”.

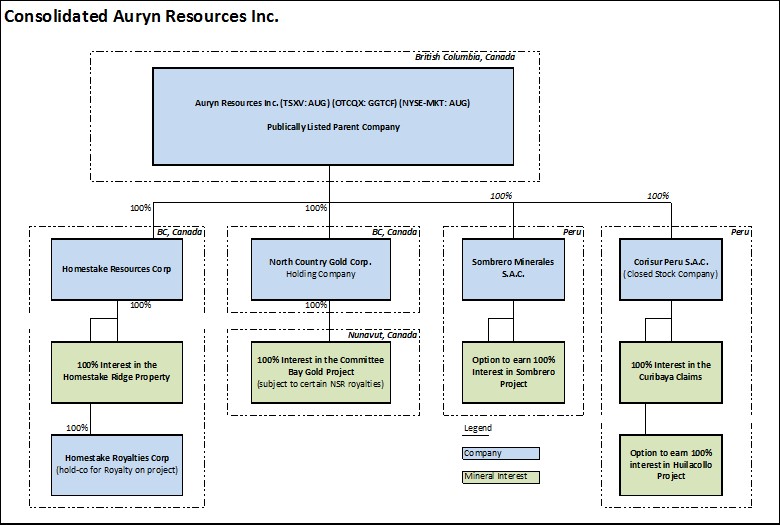

Inter-corporate Relationships

Auryn has the following wholly-owned subsidiaries:

| Subsidiary | Place of incorporation | Functional Currency |

Beneficial Interest |

| North Country Gold Corp. (“North Country”) | BC, Canada | CAD | 100% |

| Homestake Resource Corporation (“Homestake”) | BC, Canada | CAD | 100% |

| Corisur Peru, S.A.C. (“Corisur”) | Peru | USD | 100% |

| Sombrero Minerales, S.A.C. (“Sombrero”) | Peru | USD | 100% |

| Homestake Royalty Corporation (inactive) | BC, Canada | CAD | 100% |

Notes:

| (i) | The Company holds its 100% interest in Corisur through an option agreement with a private Peruvian individual. This option can be exercised upon Corisur receiving the required authorization from the Peruvian government to allow foreign ownership within the special economic boarder zone. |

Intercompany relationships are described as follows:

(Remainder of page intentionally left blank)

| - 9 - |

Figure 1 – Consolidated Organizational Chart

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

Private Placements

On December 11, 2014, Auryn completed a non-brokered private placement for gross proceeds of $7,313,000. The placement consisted of 11,251,230 Common Shares at a price of $0.65 per Common Share. In relation to this issuance, Auryn incurred cash costs in the amount of $96,423.

On September 16, 2015, Auryn completed a non-brokered private placement for gross proceeds of $5,802,000. The placement consisted of 4,835,000 units at a price of $1.20 per unit. Each unit consisted of one Common Share and one common share purchase warrant. Each common share purchase warrant is exercisable into a Common Share of the Company at a price of $1.70 per Common Share for a period of 24 months. Related to this share issuance, Auryn incurred costs in the amount of $163,820, which included a cash commission of $119,520 and other legal and regulatory costs of $44,300.

On January 24, 2017, the Company completed a strategic equity placement with Goldcorp Inc. (“Goldcorp”) as well as an equity placement of flow-through shares for total gross proceeds of $41,172,311.

| - 10 - |

The Company issued 9,542,402 common shares, of which an aggregate of 4,590,818 shares were issued as flow-through common shares sold by a syndicate of agents led by Beacon Securities Limited and including Echelon Wealth Partners Inc., Haywood Securities Inc. and PI Financial Corp. Of the shares ultimately purchased by Goldcorp, 4,590,818 were first issued to third party investors as flow-through shares at a price $5.01 per share and the remaining 4,951,584 common shares were purchased directly by Goldcorp at a price of $3.67 per share. Goldcorp’s total investment in the Company amounted to $35,020,615 and with this Goldcorp had acquired 12.5% interest in the outstanding common shares of the Company. Goldcorp has the right to maintain this percentage interest subject to certain obligations in an Investor Rights and Obligations Agreement.

May 2016 Prospectus Offering

On May 4, 2016, the Company completed a short form prospectus offering of 4,285,714 Common Shares at the price of $1.40 per share and 4,732,700 flow-through common shares (“Flow-Through Shares”) at the price of $1.89 per share including shares issued upon full exercise of the over-allotment option, for gross proceeds of $14,944,802.60 (the “Offering”). In connection with the Offering, the Company granted to the underwriters under the Offering an over-allotment option (the “Over-Allotment Option”) which, if exercised in full, would result in the issuance of an additional 559,006 Common Shares and 617,309 Flow-Through Shares and aggregate gross proceeds of $14,944,802.22. Beacon Securities Limited, PI Financial Corp, Canaccord Genuity Corp. and Echelon Wealth Partners Inc. (the “Underwriters”) acted as underwriters for the offering.

The proceeds received by the Company from the sale of the Flow-Through Shares were used to incur Canadian exploration expenditures that were “flow-through mining expenditures” (as such terms are defined in the Income Tax Act (Canada)) on the Company’s mineral concessions, which were renounced to the subscribers with an effective date no later than December 31, 2016, in the aggregate amount of not less than the total amount of the gross proceeds raised from the issue of Flow-Through Shares. The proceeds received by the Company from the sale of the Common Shares were used by the Company for general corporate and working capital purposes.

Under the Offering, the Underwriters received a total cash commission equal to 6% of the gross proceeds raised, being $896,688.13, and 541,104 broker warrants (the “Broker Warrants”). The Broker Warrants entitle the Underwriters to purchase, within 24 months after closing of the Offering, Common Shares at $1.40 per share.

Joint Exploration Agreement with North Country

On March 16, 2015, Auryn entered into the Joint Exploration Agreement with North Country whereby Auryn was able to earn a 51% interest in the Committee Bay Gold Project (the “Committee Bay Project”) in Nunavut, Canada (the “NC Option”). As a condition of the Joint Exploration Agreement, Auryn purchased 10,000,000 North Country common shares at a price of $0.05 per share for a total cost of $500,000. Under the terms of the NC Option, Auryn was required to complete $6,000,000 in exploration expenditures within a 30-month period, with $500,000 committed within the first 12 months. If Auryn elects to exercise the NC Option, the two parties would then form a customary joint venture to advance the Committee Bay project.

Change of Year-End

Effective June 4, 2015, the Company changed its financial year-end from June 30 to December 31 for years commencing on or after July 1, 2015.

Acquisition of North Country Gold Corp.

On September 25, 2015 pursuant to a plan of arrangement (the “Arrangement”), the Company completed the acquisition of 100% of the issued and outstanding shares of North Country by issuing a total of 13,838,894 Common Shares. North Country was an exploration company focused on the discovery of precious metals in Northern Canada. Prior to the Arrangement, the Company and North Country were party to a joint exploration agreement where Auryn was to earn a 51% interest in the Committee Bay Project as described above. The completion of the acquisition resulted in Auryn owning 100% of the Committee Bay Project. The Committee Bay Project is the Company’s material property and focus of its resources, as more fully described under the heading “Committee Bay Project”.

| - 11 - |

Pursuant to the Arrangement, each outstanding share of North Country was exchanged for 0.1 of a Common Share of Auryn. For this transaction the Company issued a total of 13,838,894 Common Shares from treasury with a fair value of $1.22 per Common Share and 840,000 replacement options with a weighted average fair value of $0.61 per option. The fair value of the Common Shares was determined using the last closing market price of the Company’s shares on the day of the acquisition.

The North Country acquisition was accounted for as an asset acquisition and transaction costs associated with the acquisition totalling $161,383 are capitalized and included in the cost of the net assets acquired. North Country’s operations have been included in the Company’s results of operations from the acquisition date.

The allocation of purchase price, based on management’s estimate of the relative fair value of assets acquired and liabilities assumed is as follows:

| Total purchase price: | ||||

| Fair value of common shares issued for acquisition | $ | 16,883,451 | ||

| Fair value of investment in shares of North Country | 1,200,000 | |||

| Fair value of stock options issued on acquisition | 133,541 | |||

| Transaction costs associated with the acquisition | 161,383 | |||

| Total purchase price to allocate | $ | 18,378,375 | ||

| Cost of assets acquired and liabilities assumed: | ||||

| Cash and cash equivalents | $ | 138,249 | ||

| Amounts receivable and prepaid expenses | 666,298 | |||

| Equipment | 1,858,001 | |||

| Mineral properties | 17,999,192 | |||

| Accounts payable and accrued liabilities | (1,189,492 | ) | ||

| Asset retirement obligation | (1,093,873 | ) | ||

| $ | 18,378,375 | |||

The fair value of stock options issued to North Country’s employees and others providing similar services on acquisition has been estimated using the Black-Scholes option valuation model with the following assumptions:

| Risk-free interest rate | 0.81% |

| Expected dividend yield | nil |

| Stock price volatility | 104% |

| Expected life (in years - weighted average) | 0.54 |

The fair value of the Company’s investment in North Country shares prior to the Arrangement was determined based on the closing share price for North Country on the TSXV immediately prior to the acquisition.

The Company considers this a “significant acquisition” pursuant to Part 8 of National Instrument 51-102 - Continuous Disclosure Obligations and filed a Business Acquisition Report on Form 51-102F4 dated November 5, 2015 in connection with its acquisition of North Country.

| - 12 - |

Acquisition of Homestake Resources

On September 7, 2016 the Company completed the acquisition of 100% of the issued and outstanding shares of Homestake pursuant to a plan of arrangement (the “Homestake Arrangement”). Under the terms of the Homestake Arrangement, Homestake shareholders received one Auryn common share for each seventeen (17) Homestake common shares held, resulting in the issuance of a total of 4,068,124 Common Shares with a fair value of $13,262,084. In addition to the Common Shares issued to Homestake shareholders, 97,786 replacement stock options with a weighted average fair value of $1.10 per option were granted to former Homestake employees and consultants and 286,167 replacement share purchase warrants were granted to former Homestake warrant holders at a weighted average fair value of $2.42 per warrant.

The acquisition of Homestake was accounted for as an asset acquisition and transaction costs associated with the acquisition, totalling $1,044,098, were included in the calculation of the purchase price. Transaction costs included the fair value of $725,686 related to 222,603 common shares issued as finders’ fees ($3.26 per common share), as well as $318,411 in professional fees, regulatory fees and other costs incurred in connection with the transaction. Homestake’s operations have been included in the Company’s results of operations from the acquisition date.

The allocation of the purchase price, based on the relative fair value of assets acquired and liabilities assumed is as follows:

| Total purchase price: | ||||

| Fair value of common shares issued on acquisition | $ | 13,262,084 | ||

| Fair value of investment in shares of Homestake (note 7) | 285,000 | |||

| Fair value of stock options issued on acquisition | 107,185 | |||

| Fair value of warrants issued on acquisition | 692,005 | |||

| Transaction costs associated with the acquisition | 1,044,097 | |||

| Total purchase price to allocate | $ | 15,390,371 | ||

| Cost of assets acquired and liabilities assumed: | ||||

| Cash and cash equivalents | $ | 799 | ||

| Amounts receivable and prepaid expenses | 37,037 | |||

| Marketable securities | 770,821 | |||

| Reclamation bond | 55,001 | |||

| Mineral properties | 16,060,125 | |||

| Accounts payable and accrued liabilities | (1,533,412 | ) | ||

| $ | 15,390,371 | |||

The fair value of the replacement stock options and warrants issued on acquisition to Homestake employees and warrant holders, respectively, has been estimated using the Black-Scholes option valuation model with the following assumptions:

| Stock options | Warrants | |

| Risk-free interest rate | 0.54% | 0.54% |

| Expected dividend yield | nil | nil |

| Stock price volatility | 63% | 62% |

| Expected life (in years - weighted average) | 0.25 | 0.92 |

| - 13 - |

Peru Portfolio

Auryn has acquired the rights to the Huilacollo and Curibaya in the Tacna province of Southern Peru. Together these projects encompass a total of 38,500 hectares within the prolific Pliocene Au/Ag epithermal and Miocene Cu/Au porphyry belts respectively. The epithermal belt in this region of Peru is host to four multi-million ounce gold discoveries since the year 2000 and the porphyry belt is host to four of the largest porphyry deposits in Peru.

The Company has also entered into an option agreement to acquire the 4,600 hectare, copper-gold Sombrero property mining concessions located 340 kilometers SE of Lima in southern Peru.

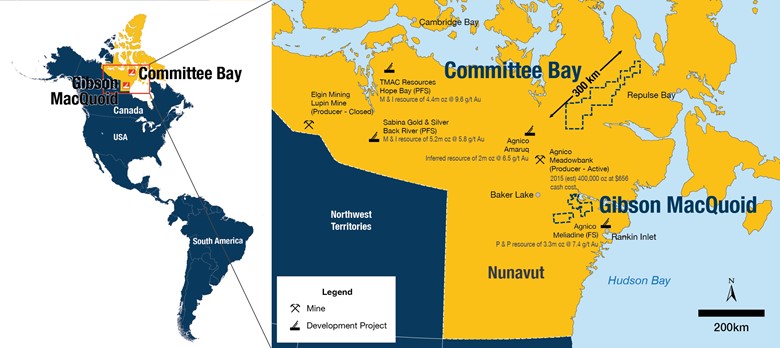

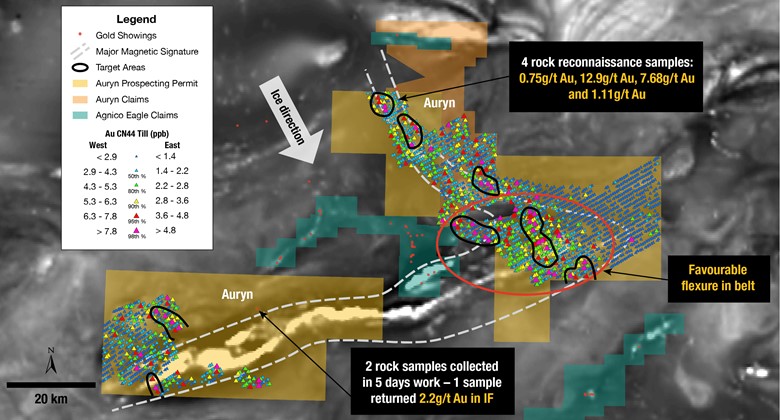

Gibson MacQuoid Project

In early 2017, the Company acquired several prospecting permits along the Gibson MacQuoid greenstone belt in Nunavut, Canada (the “Gibson MacQuoid Project”). These permits are located between the Meliadine deposit and Meadowbank mine. The 19 prospecting permits and an additional 57 mineral claims staked in 2017 encompass approximately 120 km of strike length of the prospective greenstone belt and total 375,000 hectares collectively.

In August 2017, the Company commenced its 2017 exploration program at the Gibson MacQuoid Project. During the course of the program, the Company conducted a belt-wide geochemical survey in order to identify centers of gold mineralization beneath the till cover. As at the date of this AIF, the survey has been completed with all results from this program pending.

BUSINESS DESCRIPTION

General

Auryn is a technically driven, capital efficient exploration company focused on delivering shareholder value through accretive project acquisition and discovery. The Company’s management team is highly experienced with a record of success in the discovery, advancement and monetization of exploration assets.

Auryn has an extensive multidisciplinary technical team, a premier gold exploration portfolio and is focused on scalable high-grade gold deposits in established favourable mining jurisdictions.

The Company is an exploration company focused on the acquisition, exploration and development of mineral resource properties. Auryn’s principal mineral properties are the Committee Bay gold project located in Nunavut, Canada and the Homestake Ridge Project located within the Iskut-Stewart-Kitsault belt, in northwestern British Columbia. The Company also holds a substantial project portfolio in Peru.

The Company has also secured rights to various mining concessions in southern and central Peru.

As at December 31, 2017 the Company had approximately 22 full-time employees at its office in Vancouver, Canada.

The Company has not yet determined whether its mineral property interests contain economically recoverable mineral reserves. The Company's continuing operations and the underlying value of the Company’s mineral property interests are entirely dependent upon the existence of economically recoverable mineral reserves, the ability of the Company to obtain the necessary financing to complete the exploration of its mineral property interests, obtaining the necessary mining permits, and on future profitable production or the proceeds from the disposition of the exploration and evaluation assets.

| - 14 - |

Risk Factors

An investment in securities of Auryn involves significant risks, which should be carefully considered by prospective investors before purchasing such securities. Management of Auryn considers the following risks to be most significant for potential investors in Auryn, but such risks do not necessarily comprise all those associated with an investment in Auryn. Additional risks and uncertainties not currently known to management of Auryn may also have an adverse effect on Auryn’s business. If any of these risks actually occur, Auryn’s business, financial condition, capital resources, results of operations and/or future operations could be materially adversely affected.

In addition to the other information set forth elsewhere in this AIF, the following risk factors should be carefully considered when considering risks related to Auryn’s business.

Commodity Price Fluctuations and Cycles

Junior resource exploration is significantly linked to the outlook for commodities. When the price of commodities being explored declines investor interests subsides and capital markets become very difficult. The price of commodities varies on a daily basis and there is no proven methodology for determining future prices. Price volatility could have dramatic effects on the results of operations and the ability of Auryn to execute its business plan. The mining business is subject to mineral price cycles. The marketability of minerals and mineral concentrates is also affected by worldwide economic cycles. Fluctuations in supply and demand in various regions throughout the world are common. In recent years, mineral prices have fluctuated widely. Moreover, it is difficult to predict with any certainty future mineral prices. As Auryn’s business is in the exploration stage and as Auryn does not carry on production activities, its ability to fund ongoing exploration is affected by the availability of financing which is, in turn, affected by the strength of the economy and other general economic factors.

Gold prices specifically are historically subject to wide fluctuation and are influenced by a number of factors beyond the control or influence of the Company. Some factors that affect the price of gold include: industrial and jewellery demand; central bank lending or purchase or sales of gold bullion; forward or short sales of gold by producers and speculators; future level of gold productions; and rapid short-term changes in supply and demand due to speculative or hedging activities by producers, individuals or funds. Gold prices are also affected by macroeconomic factors including: confidence in the global monetary system; expectations of the future rate of inflation; the availability and attractiveness of alternative investment vehicles; the general level of interest rates; the strength of, and confidence in the U.S. dollar, the currency in which the price of gold is generally quoted, and other major currencies; global and regional political or economic events; and costs of production of other gold producing companies. All of the above factors can, through their interaction, affect the price of gold by increasing or decreasing the demand for or supply of gold.

Exploration Activities May Not be Successful

Exploration for, and development of, mineral properties involves significant financial risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenditures may be required to establish reserves by drilling, to complete a feasibility study and to construct mining and processing facilities at a site for extracting gold or other metals from ore. Auryn cannot ensure that its future exploration programs will result in profitable commercial mining operations.

Also, substantial expenses may be incurred on exploration projects that are subsequently abandoned due to poor exploration results or the inability to define reserves that can be mined economically. Development projects have no operating history upon which to base estimates of future cash flow. Estimates of proven and probable reserves and cash operating costs are, to a large extent, based upon detailed geological and engineering analysis. There have been no feasibility studies conducted in order to derive estimates of capital and operating costs including, among others, anticipated tonnage and grades of ore to be mined and processed, the configuration of the ore body, ground and mining conditions, expected recovery rates of the gold or copper from the ore, and anticipated environmental and regulatory compliance costs.

| - 15 - |

It is possible that actual costs and economic returns of future mining operations may differ materially from Auryn’s best estimates. It is not unusual in the mining industry for new mining operations to experience unexpected problems during the start-up phase and to require more capital than anticipated. These additional costs could have an adverse impact on Auryn’s future cash flows, earnings, results of operations and financial condition.

Exploration Stage Operations

The Company’s operations are subject to all of the risks normally incident to the exploration for and the development and operation of mineral properties. The Company has implemented safety and environmental measures designed to comply with or exceed government regulations and ensure safe, reliable and efficient operations in all phases of its operations. The Company maintains liability and property insurance, where reasonably available, in such amounts as it considers prudent. The Company may become subject to liability for hazards against which it cannot insure or which it may elect not to insure against because of high premium costs or other reasons.

The mineral exploration business is very speculative. All of the Company’s properties are at an early stage of exploration. Mineral exploration involves a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to avoid. Few properties that are explored are ultimately developed into producing mines. Unusual or unexpected formations, formation pressures, fires, power outages, labour disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain adequate machinery, equipment and/or labour are some of the risks involved in mineral exploration activities. The Company has relied on and may continue to rely on consultants and others for mineral exploration expertise. Substantial expenditures are required to establish mineral reserves and resources through drilling, to develop metallurgical processes to extract the metal from the material processed and to develop the mining and processing facilities and infrastructure at any site chosen for mining. There can be no assurance that commercial or any quantities of ore will be discovered. There is also no assurance that even if commercial quantities of ore are discovered, that the properties will be brought into commercial production or that the funds required to exploit any mineral reserves and resources discovered by the Company will be obtained on a timely basis or at all. The commercial viability of a mineral deposit once discovered is also dependent on a number of factors, some of which are the particular attributes of the deposit, such as size, grade and proximity to infrastructure, as well as gold prices. Most of the above factors are beyond the control of the Company. There can be no assurance that the Company’s mineral exploration activities will be successful. In the event that such commercial viability is never attained, the Company may seek to transfer its property interests or otherwise realize value or may even be required to abandon its business and fail as a “going concern”.

Calculation of Reserves, Resources and Precious Metal Recoveries

There is a degree of uncertainty attributable to the calculation and estimates of mineral reserves and mineral resources and the corresponding metal grades to be mined and recovered. Until reserves or resources are actually mined and processed, the quantities of mineralization and metal grades must be considered as estimates only. Any material change in the quantity of mineral reserves, mineral resources, grades and recoveries may affect the economic viability of the Company's properties. To date, the Company has not established mineral reserves on any of its mineral properties.

Additional Funding Requirements

As Auryn’s business is in the exploration stage and as Auryn does not carry on production activities, it will require additional financing to continue its operations. Its ability to secure additional financing and fund ongoing exploration is affected by the strength of the economy and other general economic factors. There can be no assurance that Auryn will be able to obtain adequate financing in the future, or that the terms of such financing will be favourable for further exploration and development of its projects. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration. Further, revenues, financings and profits, if any, will depend upon various factors, including the success, if any, of exploration programs and general market conditions for natural resources.

| - 16 - |

Specialized Skill and Knowledge

Various aspects of Auryn’s business require specialized skills and knowledge. Such skills and knowledge include the areas of permitting, geology, drilling, metallurgy, logistical planning and implementation of exploration programs as well as finance and accounting. Auryn’s management team and board of directors provide much of the specialized skill and knowledge. Auryn also retains outside consultants as additional specialized skills and knowledge are required. However, it is possible that delays and increased costs may be experienced by Auryn in locating and/or retaining skilled and knowledgeable employees and consultants in order to proceed with its planned exploration and development at its mineral properties.

Competitive Conditions

Auryn competes against other companies to identify suitable exploration properties. Competition in the mineral exploration business is intense, and there is a high degree of competition for desirable mineral leases, suitable prospects for drilling operations and necessary exploration equipment, as well as for access to funds. Auryn is competing with many other exploration companies possessing greater financial resources and technical facilities than that currently held by Auryn.

Environmental Protection

Auryn’s properties are subject to stringent laws and regulations governing environmental quality. Such laws and regulations can increase the cost of planning, designing, installing and operating facilities on our properties. However, it is anticipated that, absent the occurrence of an extraordinary event, compliance with existing laws and regulations governing the release of materials in the environment or otherwise relating to the protection of the environment, will not have a material effect upon Auryn’s current operations, capital expenditures, earnings or competitive position.

Property Commitments

Auryn’s mineral properties and/or interests may be subject to various land payments, royalties and/or work commitments. Failure by Auryn to meet its payment obligations or otherwise fulfill its commitments under these agreements could result in the loss of related property interests.

Political, Economic and Social Risks and Uncertainties

Auryn’s operations at the Committee Bay Project are located in Nunavut and, as such, its operations are exposed to various levels of political, economic and other risks and uncertainties. Risks and uncertainties of operating in Nunavut vary from time to time, but are not limited to a limited local workforce, poor infrastructure, a complex regulatory regime and harsh weather.

Auryn’s operations in Peru are located within a special economic zone situated within 50km of the Peruvian border. Regardless of Peru’s progress in recent decades in restructuring its political institutions and revitalizing its economy, the country has a history of political and economic instability under both democratically elected and dictatorial governments, particularly through the 1980’s. The Company believes that the current conditions in Peru are stable and conducive to conducting business, however, the Company’s current and future mineral exploration, development and mining activities could be impacted by adverse political, social or economic developments. Adverse developments could include: widespread civil unrest and rebellion; the imposition of unfavourable government regulations on foreign investment, production and extraction, prices, exports, income taxes, environmental compliance or worker safety; or the expropriation of property.

| - 17 - |

Environmental Regulatory Risks

Auryn’s operations are subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation and regulation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain exploration industry operations, such as from tailings disposal areas, which would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner which means stricter standards, and enforcement, fines and penalties for non-compliance are more stringent. Future legislation and regulations could cause additional expenses, capital expenditures, restrictions, liabilities and delays in exploration of any of Auryn’s properties, the extent of which cannot be predicted. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations.

Changes in Government Regulation

Changes in government regulations or the application thereof and the presence of unknown environmental hazards on any of Auryn’s mineral properties may result in significant unanticipated compliance and reclamation costs. Government regulations relating to mineral rights tenure, permission to disturb areas and the right to operate can adversely affect Auryn.

Auryn may not be able to obtain all necessary licenses and permits that may be required to carry out exploration on any of its projects. Obtaining the necessary governmental permits is a complex, time consuming and costly process. The duration and success of efforts to obtain permits are contingent upon many variables not within our control. Obtaining environmental permits may increase costs and cause delays depending on the nature of the activity to be permitted and the interpretation of applicable requirements implemented by the permitting authority. There can be no assurance that all necessary approvals and permits will be obtained and, if obtained, that the costs involved will not exceed those that we previously estimated. It is possible that the costs and delays associated with the compliance with such standards and regulations could become such that we would not proceed with the development or operation.

Properties May be Subject to Defects in Title

Auryn has investigated its rights to explore and exploit its projects and, to the best of its knowledge, its rights are in good standing. However, no assurance can be given that such rights will not be revoked, or significantly altered, to Auryn’s detriment. There can also be no assurance that Auryn’s rights will not be challenged or impugned by third parties.

Some Auryn’ mineral claims may overlap with other mineral claims owned by third parties which may be considered senior in title to the Auryn mineral claims. The junior claim is only invalid in the areas where it overlaps a senior claim. Auryn has not determined which, if any, of the Auryn mineral claims is junior to a mineral claim held by a third party.

Although Auryn is not aware of any existing title uncertainties with respect to any of its projects, there is no assurance that such uncertainties will not result in future losses or additional expenditures, which could have an adverse impact on Auryn’s future cash flows, earnings, results of operations and financial condition.

| - 18 - |

Key Personnel

Auryn’s senior officers are critical to its success. In the event of the departure of a senior officer, Auryn believes that it will be successful in attracting and retaining qualified successors but there can be no assurance of such success. Recruiting qualified personnel as Auryn grows is critical to its success. The number of persons skilled in the acquisition, exploration of mining properties is limited and competition for such persons is intense. As Auryn’s business activity grows, it will require additional key financial, administrative, mining and exploration personnel, and potentially additional operations staff. If Auryn is not successful in attracting and training qualified personnel, the efficiency of its operations could be affected, which could have an adverse impact on future cash flows, earnings, results of operations and the financial condition of Auryn.

Legal and Litigation Risks

All industries, including the exploration industry, are subject to legal claims, with and without merit. Defense and settlement costs of legal claims can be substantial, even with respect to claims that have no merit. Due to the inherent uncertainty of the litigation process, the resolution of any particular legal proceeding to which Auryn may become subject could have a material adverse effect on Auryn’s business, prospects, financial condition, and operating results. Defense and settlement of costs of legal claims can be substantial.

Risks Relating to Statutory and Regulatory Compliance

Auryn’s current and future operations, from exploration through development activities and commercial production, if any, are and will be governed by applicable laws and regulations governing mineral claims acquisition, prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in exploration activities and in the development and operation of mines and related facilities, generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Auryn has received all necessary permits for the exploration work it is presently conducting; however, there can be no assurance that all permits which Auryn may require for future exploration, construction of mining facilities and conduct of mining operations, if any, will be obtainable on reasonable terms or on a timely basis or at all, or that such laws and regulations would not have an adverse effect on any project which Auryn may undertake.

Failure to comply with applicable laws, regulations and permits may result in enforcement actions thereunder, including the forfeiture of claims, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions. Auryn may be required to compensate those suffering loss or damage by reason of its mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits. Auryn is not currently covered by any form of environmental liability insurance. See “Risk Factor - Insurance Risk”, below.

Existing and possible future laws, regulations and permits governing operations and activities of exploration companies, or more stringent implementation thereof, could have a material adverse impact on Auryn and cause increases in capital expenditures or require abandonment or delays in exploration.

Insurance Risk

Auryn is subject to a number of operational risks and may not be adequately insured for certain risks, including: accidents or spills, industrial and transportation accidents, which may involve hazardous materials, labour disputes, catastrophic accidents, fires, blockades or other acts of social activism, changes in the regulatory environment, impact of non-compliance with laws and regulations, natural phenomena such as inclement weather conditions, floods, earthquakes, ground movements, cave-ins, and encountering unusual or unexpected geological conditions and technological failure of exploration methods.

| - 19 - |

There is no assurance that the foregoing risks and hazards will not result in damage to, or destruction of, the properties of Auryn, personal injury or death, environmental damage or, regarding the exploration activities of Auryn, increased costs, monetary losses and potential legal liability and adverse governmental action, all of which could have an adverse impact on Auryn’s future cash flows, earnings, results of operations and financial condition. The payment of any such liabilities would reduce the funds available to Auryn. If Auryn is unable to fully fund the cost of remedying an environmental problem, it might be required to suspend operations or enter into costly interim compliance measures pending completion of a permanent remedy.

No assurance can be given that insurance to cover the risks to which Auryn’s activities are subject will be available at all or at commercially reasonable premiums. Auryn is not currently covered by any form of environmental liability insurance, since insurance against environmental risks (including liability for pollution) or other hazards resulting from exploration activities is unavailable or prohibitively expensive. This lack of environmental liability insurance coverage could have an adverse impact on Auryn’s future cash flows, earnings, results of operations and financial condition.

Limited Business History and No History of Earnings

Auryn has only recently commenced operations and has no history of operating earnings. The likelihood of success of Auryn must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with the establishment of any business. Auryn has limited financial resources and there is no assurance that additional funding will be available to it for further operations or to fulfill its obligations under applicable agreements. There is no assurance that Auryn will ultimately generate revenues, operate profitably, or provide a return on investment, or that it will successfully implement its plans.

In addition, Auryn’s activities are focused primarily on the Committee Bay Project. Any adverse changes or developments affecting this project would have a material and adverse effect on Auryn’s business, financial condition, results of operations and prospects.

Claims by Investors Outside of Canada

Auryn is incorporated under the laws of British Columbia and its head office is located in Vancouver, British Columbia. The majority of Auryn’s directors and officers, and some of the experts named herein, are residents of Canada or otherwise reside outside of the United States, and all or a substantial portion of their assets, and a substantial portion of Auryn’s assets, are located outside of the United States. As a result, it may be difficult for investors in the United States or outside of Canada to bring an action against directors, officers or experts who are not resident in the United States. It may also be difficult for an investor to enforce a judgment obtained in a United States court or a court of another jurisdiction of residence predicated upon the civil liability provisions of United States federal securities laws or other laws of the United States or any state thereof or the equivalent laws of other jurisdictions outside of Canada against those persons or Auryn.

Changes in the Market Price of Common Shares may be Unrelated to Auryn’s Results of Operations and could have an Adverse Impact on Auryn

The Auryn Shares are listed on the TSX. The price of Auryn Shares is likely to be significantly affected by short-term changes in the gold price or in its financial condition or results of operations as reflected in its quarterly earnings reports. Other factors unrelated to Auryn’s performance that may have an effect on the price of Auryn Shares and may adversely affect an investors’ ability to liquidate an investment and consequently an investor’s interest in acquiring a significant stake in Auryn include: a reduction in analytical coverage by investment banks with research capabilities; a drop in trading volume and general market interest in Auryn’s securities; a failure to meet the reporting and other obligations under relevant securities laws or imposed by applicable stock exchanges could result in a delisting of Auryn Shares and a substantial decline in the price of the Auryn Shares that persists for a significant period of time.

| - 20 - |

As a result of any of these factors, the market price of Auryn Shares at any given point in time may not accurately reflect their long-term value. Securities class action litigation often has been brought against companies following periods of volatility in the market price of their securities. Auryn may in the future be the target of similar litigation. Securities litigation could result in substantial costs and damages and divert management’s attention and resources.

Price Volatility of Publicly Traded Securities

In recent years, the securities markets in the United States and Canada have experienced a high level of price and volume volatility, and the market prices of securities of many companies have experienced wide fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. There can be no assurance that continuing fluctuations in price will not occur.

Future Sales May Affect the Market Price of the Auryn Shares

In order to finance future operations, Auryn may raise funds through the issuance of additional Common Shares or the issuance of debt instruments or other securities convertible into Common Shares. Auryn cannot predict the size of future issuances of Common Shares or the issuance of debt instruments or other securities convertible into Common Shares or the dilutive effect, if any, that future issuances and sales of Auryn’s securities will have on the market price of the Common Shares.

Dividend Policy

No dividends on the Common Shares have been paid by Auryn to date. Payment of any future dividends, if any, will be at the discretion of the Auryn Board of directors (the “Board”) after taking into account many factors, including Auryn's operating results, financial condition, and current and anticipated cash needs.

| - 21 - |

No History of Earnings

The Company has no history of earnings and there is no assurance that its mineral properties will generate earnings, operate profitably or provide a return on investment in the near future. The Company has not paid dividends in the past and has no plans to pay dividends for the foreseeable future, if ever. Any future determination to pay dividends will be at the discretion of the board of directors and will depend upon the capital requirements of the Company, results of operations and such other factors as the board of directors considers relevant.

Risk of Foreign Operations

In Peru, the jurisdiction in which Auryn has mineral properties, such mineral properties are subject to various political, economic and other uncertainties, including, among other things, the risks of war and civil unrest, expropriation, nationalization, renegotiation or nullification of existing concessions, licenses, permits, approvals and contracts, taxation policies, foreign exchange and repatriation restrictions, changing political conditions, international monetary fluctuations, currency controls and foreign governmental regulations that favour or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction.

In addition, in the event of a dispute arising from foreign operations, Auryn may be subject to the exclusive jurisdiction of foreign courts or may not be successful in subjecting foreign persons to the jurisdiction of courts in the United States or Canada. Alturas also may be hindered or prevented from enforcing its rights with respect to a governmental instrumentality because of the doctrine of sovereign immunity. It is not possible for Auryn to accurately predict such developments or changes in laws or policy or to what extent any such developments or changes may have a material adverse effect on Auryn’s operations.

Peru is the world’s largest producer of silver, second largest producer of copper, third of zinc, fourth of lead and the sixth largest producer of gold. It also has the largest reserves of silver and the third largest copper and zinc reserves in the world. In 2017, mining provided a significant portion of Peru’s export revenues. Peru’s has enjoyed improvements in its GDP over the past decade, in a macroeconomic context of low inflation and declining poverty levels. On the downside, the economy is most vulnerable in the short term to a global growth shock that permeates through lower commodity prices.

(Remainder of page intentionally left blank)

| - 22 - |

COMMITTEE BAY PROJECT

Amended and Restated Technical Report

On June 16, 2017, the Company filed a technical report entitled “Technical Report on the Committee Bay Project, Nunavut Territory, Canada” with an effective date of May 31, 2017 with respect to its Committee Bay project (the “Original 2017 Committee Bay Technical Report”). On November 3, 2017, the Company filed an amended and restated technical report entitled “Technical Report on the Committee Bay Project, Nunavut Territory, Canada” dated October 23, 2017 with an effective date of May 31, 2017 with respect to its Committee Bay project (the “Amended 2017 Committee Bay Technical Report”). The Amended 2017 Committee Bay Technical Report amended the Original 2017 Committee Bay Technical Report to remove an incorrect reference to the previous 2013 mineral resource estimate being current and to confirm that the current mineral resource estimate in the Amended 2017 Committee Bay Technical Report, which is effective May 31, 2017, reflected updated metal price, exchange rate and operating cost assumptions.

The following information on the Committee Bay Project is a summary of the Amended 2017 Committee Bay Technical Report and is qualified by reference to the Amended 2017 Committee Bay Technical Report in its entirety. Readers are encouraged to review the Amended 2017 Committee Bay Technical Report under the Company’s profile at www.sedar.com.

Project Description and Location

The Committee Bay Project is located in the eastern part of the Kitikmeot Region of Nunavut, approximately 430 km northwest of the town of Rankin Inlet, Nunavut. The Committee Bay Project is only accessible by air, either from Rankin Inlet or Yellowknife, Northwest Territories. The Committee Bay Project is centered at approximately 7,400,000m N and 570,000m E (NAD 83, Zone 15N) in 1:250,000 scale map sheets 56J (Waker Lake), 56K (Laughland Lake), 56O (Arrowsmith River) and 56P (Ellice Hills).

Land Tenure

As of the effective date of the Amended 2017 Committee Bay Technical Report, the Committee Bay Project consists of three non-contiguous blocks totalling 44 crown leases, 274 claims and one sub-surface exploration agreement covering IOL totalling approximately 427,978 ha. Auryn reports that the leases, claims and the sub-surface exploration agreement are in good standing. Applications are pending for an additional 13 leases totalling approximately 13,714.5 ha.

On March 20, 2015, Auryn announced that it had entered into a definitive joint venture agreement with North Country whereby it could earn a 51% interest in North Country’s Committee Bay Project by incurring $6 million in expenditures over a 30 month period. Of that amount, $500,000 was a firm commitment to be spent within 12 months. Auryn also agreed to buy 10 million of North Country shares at a price of $0.05 each as part of a non-brokered private placement.

On June 30, 2015, Auryn announced that it had entered into a letter agreement with North Country whereby it would acquire all the North Country shares that it did not already own in exchange for 13.8 million shares of Auryn valued at approximately $20.4 million. The Auryn shares issued as part of the agreement constituted approximately 30.7% of Auryn’s outstanding shares. On September 25, 2015, Auryn announced that it had completed the agreement and that North Country had become a subsidiary of Auryn.

| - 23 - |

Accessibility

The Committee Bay Project is located 430 km northwest of Rankin Inlet, Nunavut. Access to Rankin Inlet is achieved via regularly scheduled commercial flights (Canadian North and/or First Air) from Yellowknife, Northwest Territories;Winnipeg, Manitoba; and Ottawa, Ontario. Rankin Inlet and Baker Lake are serviced seasonally by barge and ship. The hamlets of Baker Lake, Naujaat (Repulse Bay), Gjoa Haven, Taloyoak, and Kugaaruk (Pelly Bay) are accessible by scheduled commercial flights.

At the Three Bluffs camp site, Hayes Camp, an esker airstrip is accessible by Twin Otter fixedwing aircraft on oversized tires from June through early September. Parts of the Hayes River area are accessible to float-equipped fixed-wing aircraft by late June. Fixed-wing and helicopter charters may be arranged either from Rankin Inlet or from Yellowknife. In order to facilitate the mobilization of large quantities of equipment and supplies for exploration programs, a 5,000 ft airstrip (ice-strip) is constructed each spring on Sandspit Lake at Hayes Camp.

Climate

The Committee Bay Project is located in the Wager Bay Plateau Ecoregion of the Northern Arctic Ecozone (Marshall and Schutt, 1999). This ecoregion is classified as having a low arctic ecoclimate. Summers are short and cold, with mean daily temperatures above freezing only in July and August. Snow cover usually lasts from September to June, but it can fall during any month. Most of the lakes are icebound until approximately mid-July.

Precipitation is moderate throughout the year, but drifting of snow in the winter can result in considerable localized accumulations, particularly on the sides of hills. Fog is often a problem near the coast and at higher elevations particularly during the late spring to early summer and the fall months.

Table 2 illustrates the major climatic data for the three closest Environment Canada weather stations, Repulse Bay, Pelly Bay and Gjoa Haven, located approximately 235 km to the east, 220 km to the north, and 290 km to the northwest, respectively.

TABLE 2 – CLIMATIC DATA

Auryn Resources Inc. – Committee Bay Project

| Repulse Bay | Pelly Bay | Gjoa Haven | |

| Mean January temperature Mean July temperature Extreme maximum temperature Extreme minimum temperature Average annual precipitation Average annual rainfall Average annual snowfall |

-31.3°C 8.8°C 28.0°C -50.0°C 311.3 mm 123.8 mm 215.4 cm |

-33°5C 9.3°C 29.0°C -51.5°C 261.3 mm 116.6 mm 146.2 cm |

-33.8°C 11.6°C 33.6°C -50.6°C 272.5 mm 163.4 mm 126.5 cm |

| Source: Environment Canada |

| - 24 - |

Local Resources

Most services are available in Baker Lake, Kugaaruk, and Rankin Inlet, including: groceries; hotel accommodations; expediting services; and some camp supplies. Anything that is not locally available can be shipped in via daily scheduled air services.

The Rankin Inlet area is a hub of mining activity in the region. Exploration and mining suppliers and contractors are available from Manitoba and the Northwest Territories. General labour is readily available from the local communities.

Existing Infrastructure

There is no permanent infrastructure at the Committee Bay Project. Auryn maintains three camps to support seasonal exploration campaigns in various portions of the Committee Bay Project, namely the Hayes Camp (100 person capacity), the Bullion Camp (20 to 40 person capacity) and the Ingot Camp (10 person capacity). The Committee Bay Project also benefits from a 914 m, graded, esker airstrip at the Hayes Camp, a permitted, seasonally prepared 1,580 m winter ice airstrip, which is constructed on the adjacent Sandspit Lake, and 320m tundra airstrip at the Bullion Camp. A drill water system is maintained at the Three Bluffs site.

History

Key historical events are:

| · | 1961 and 1967: Mapping done in the area by the Geological Survey of Canada (GSC). |

| · | 1970: King Resources Company conducted reconnaissance geological mapping and sampling in the Laughland Lake and Ellice Hills areas. Follow-up work includes geophysics and detailed mapping, trenching, and sampling. |

| · | 1970, 1974, and 1976: Cominco Ltd. carried out reconnaissance and detailed geological mapping, ground geophysics, and sampling in the Hayes River area. |

| · | 1971: The Aquitaine Company conducted airborne electromagnetic (EM) and magnetometer surveys. |

| · | 1972 to 1977: Detailed re-mapping of the area was done by the GSC. |

| · | 1979: Urangesellschaft Canada Ltd. carried out reconnaissance airborne radiometric surveys and prospecting for uranium in the Laughland Lake area. |

| · | 1986: Wollex carried out geological mapping and rock sampling in the West Laughland Lake area. |

| · | 1992: GSC conducted geological re-assessment of the mineral potential of the Prince Albert Group. |

| · | 1994: Channel sampling carried out over the Three Bluffs area but the results were lost. |

| · | 1996: Terraquest Ltd. conducted a high-resolution airborne magnetometer survey. |

| - 25 - |

| · | 1997 to 1998: P.H. Thompson Geological Consulting Ltd. conducted regional geological mapping in the Three Bluffs area. |

| · | 1999 to 2002: GSC conducted a multi-disciplinary study of the Committee Bay Greenstone Belt. |

| · | 1992 to 2012: Apex Geoscience Ltd. (Apex) carried out prospecting, rock sampling, gridding, airborne and ground geophysics, geophysics, geological mapping, and reverse circulation and diamond drilling on several of the gold targets including Three Bluffs, Three Bluffs West, West Plains, Anuri, Inuk, Antler, and Hayes. |

Past Production

There has been no previous production from the Committee Bay Project.

Geology and Mineralization

The Committee Bay area, situated in the Churchill Structural Province, is underlain by Archean and Proterozoic rocks and extensively covered by Quaternary glacial drift. It comprises three distinct Archean sub-domains (Prince Albert Group, Northern Migmatite, and Walker Lake Intrusive Complex).

The Committee Bay Greenstone Belt (the “CBGB”), which hosts the gold occurrences discussed in the Amended 2017 Committee Bay Technical Report, is composed of Prince Albert Group rocks. These are bounded by the wide, northeast-striking Slave-Chantrey mylonite belt to the northwest and by the Amer and Wager Bay shear zones to the south. Two major fault systems, the northeast-striking Kellet fault and the northwest-striking Hayes River fault, intersect the central portion of the CBGB and cut the Prince Albert Group rocks. Gold occurrences in the CBGB appear to be spatially related to the major shear systems and their sub-structures indicating the potential for the re-mobilization of mineral-bearing fluids along these structures.

The regional strike of rock units in the West Laughland Lake area is generally north but shows a degree of variability. Units, generally vertically dipping in much of the CBGB, have a more moderate to shallow dip at Four Hills. Rocks generally strike northeast from Four Hills east to Committee Bay. In the Hayes River area, the east-striking Walker Lake shear zone is the dominant structure. Dips in the Hayes River area are generally sub-vertical and there is evidence of flexural shear and silicification along lithological contacts between iron formation and talc-actinolite schist (meta-komatiite). Rocks of the Curtis River area, approximately 120 km northeast of the Hayes River area, strike northeast and dip sub-vertically.

The iron formations that host the Three Bluffs, Antler, Hayes, and Ledge gold occurrences have unique lithological associations with their contact rocks and do not appear to be stratigraphically equivalent.

Three low, rounded, rusty outcrops, called West, Central, and East, comprise the Three Bluffs gold occurrence. Gold mineralization is hosted in gossanous, predominantly oxide, silicate, and sulphide facies iron formations. Iron formation thicknesses range from 25 m to 30 m at the West Bluff to 55 m at the Central Bluff. The Three Bluffs iron formation maintains a thickness of 10 m for a minimum strike length of 1.8 km and is at least 55 m thick for 700 m. The iron formations are poorly banded to massive with locally shared, quartz-veined intervals of up to three metres near lithological contacts. Chlorite and epidote alteration indicates either lower amphibolite grade metamorphism (epidote-amphibolite facies) or the result of retrograde greenschist facies metamorphism associated with gold deposition. Local mineralization, composed of disseminated pyrite and pyrrhotite, can occupy up to 50% of the rock volume.

| - 26 - |

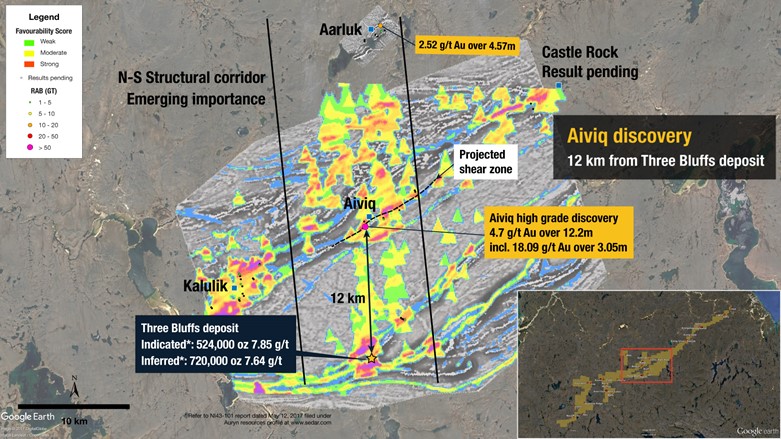

Exploration Status

The Three Bluffs deposit is at the Mineral Resource development stage. The remainder of the Property is at the early exploration stage.