Registration No. 333-260073

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

To

FORM

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 7371 | ||||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification code number) |

(I.R.S. Employer Identification No.) |

(Address, including zip code, and telephone number, including area code, of principal executive offices)

Ajay Sikka

4205 SE 36th Street, Suite 100

Bellevue, WA 98006

(425) 818-0560

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Alan W. Becker, Esq. | Gregory Sichenzia, Esq. | |

| Bose McKinney & Evans LLP | Sichenzia Ross Ference LLP | |

| 110 Monument Circle, Suite 2700 | 1185 Avenue of the Americas, 31st Floor | |

| Indianapolis, Indiana 46204 | New York, New York 10036 | |

| (317) 684-5000 | (212) 930-9700 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non- accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “non-accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer ☐ | Accelerated filer ☐ |

| Smaller

reporting company | |

| Emerging

growth company |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED April 18, 2022 |

Shares

Common Stock

TraQiQ, Inc.

We are offering an aggregate of shares of our common stock, $0.0001 par value per share. We assume a public offering price of $ per share of our common stock which was the last reported sale price of our common stock on the OTCQB on , 2022.

Our common stock is presently quoted on the OTCQB marketplace under the symbol “TRIQ”. We have applied to have our common stock listed on the Nasdaq Capital Market under the symbol “TRIQ”. No assurance can be given that our application will be approved. If our application is not approved, we will not complete this offering. On , 2022, the last reported sale price for our common stock on the OTCQB market was $ per share. All share and per-share information, as well as all financial information, contained in this prospectus has been adjusted to give effect to the one-for-eight (1-for-8) reverse stock split effective March 21, 2022.

Our chief executive officer owns a majority of our common stock and controls matters submitted to a vote of shareholders.

The final public offering price per share will be determined through negotiation between us and the underwriter in this offering and will take into account the recent market price of our common stock, the general condition of the securities market at the time of this offering, the history of, and the prospects for, the industry in which we compete, and our past and present operations and our prospects for future revenues. The recent market price used throughout this prospectus may not be indicative of the public offering price per share. Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) | Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to the underwriters. See “Underwriting” for a description of compensation payable to the underwriters. |

We have granted a 45-day option to the representative of the underwriters to purchase up to additional shares of our common stock, solely to cover over-allotments, if any.

The underwriters expect to deliver our shares to purchasers in the offering on or about , 2022.

ThinkEquity

The date of this prospectus is , 2022

TABLE OF CONTENTS

You should rely only on information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus. We are not making an offer of these securities in any state or other jurisdiction where the offer is not permitted. The information in this prospectus may only be accurate as of the date on the front of this prospectus regardless of time of delivery of this prospectus or any sale of our securities.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the common stock hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy our common stock in any circumstance under which the offer or solicitation is unlawful. Neither the delivery of this prospectus nor any distribution of our common stock in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus.

Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

PROSPECTUS SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus. While this summary highlights what we consider to be important information about us, you should carefully read this entire prospectus before investing in our common stock, especially the risks and other information we discuss under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes beginning on page F-1. Our fiscal year end is December 31 and our fiscal years ended December 31, 2020, and 2021 are sometimes referred to herein as fiscal years 2020, and 2021, respectively. Some of the statements made in this prospectus discuss future events and developments, including our future strategy and our ability to generate revenue, income and cash flow. These forward-looking statements involve risks and uncertainties which could cause actual results to differ materially from those contemplated in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements”. Unless otherwise indicated or the context requires otherwise, the words “we,” “us,” “our”, the “Company” or “our Company” or TraQiQ” refer to TraQiQ, Inc., a California corporation, and our wholly owned subsidiaries, TraQiQ Solutions, Inc., TraQiQ Solutions, Pvt Ltd, Rohuma, LLC, Rohuma India Info Solutions Private Limited and Mimo-Technologies Pvt Ltd.

Except as otherwise indicated in this prospectus, all common stock and per share information and all exercise and conversion prices with respect to securities exercisable or convertible into our common stock reflect, on a retroactive basis, a 1-for-8 reverse stock split of our common stock, which became effective on March 21, 2022. This prospectus assumes the over-allotment option of the underwriters has not been exercised, unless otherwise indicated.

Overview of the Company

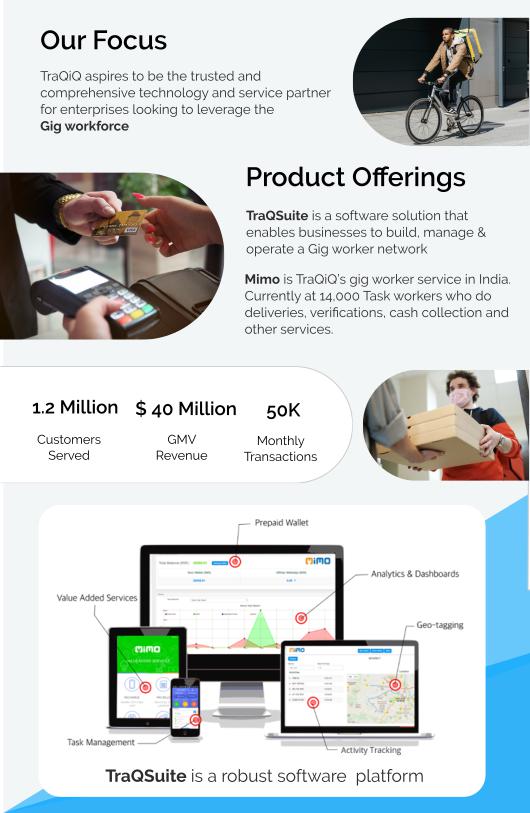

With operations concentrated in India, Southeast Asia and Latin America, we help businesses in emerging markets leverage the “gig” or task economy by providing both technology solutions and a network of workers required to fulfill those tasks. We provide software as a service that enables clients to build and manage a network of contract task workers. This platform can also be used by business clients to manage their employees who are performing services, such as PC repair or food delivery. In addition, our Mimo service operates a network of over 14,000 task workers in India who make deliveries, collect payments, do background verifications, and fulfill tasks across the supply chain, as needed by business clients to deliver their products and services to their respective markets and customers.

Our TraQSuite software platform powers the last mile distribution network, allowing business users to target customers, facilitate and validate transactions, track and manage task workers, manage funds and run a distribution network. Key features of the TraQSuite software include:

| ● | Last Mile delivery: TraQSuite’s Last-Mile software module enables a business to manage thousands of task workers across multiple geographies to deliver products and services to the users. The software platform, operating through mobile apps, allows for data sharing, delivery validation, geo-tagging and know-your-customer (KYC) requirements and can even measure customer satisfaction. | |

| ● | Transact: TraQSuite enables task workers to facilitate transactions by meeting the end customers. They can collect payments via credit cards, smart-phone swipes, SMS messages or cash. Both banked and unbanked users can buy products and services and pay with their mobile devices. | |

| ● | Target: TraQSuite enables customer transactions to be rewarded with loyalty credits, tokens or points that can be redeemed by the customer for free products, discounts and benefits. The software analyzes these transactions and purchase behaviors by using leading AI models and can deliver real time, automated and targeted offers and recommendations for additional purchases and customer retention. |

The Mimo delivery and task service in India runs on the TraQSuite platform and performs deliveries and fulfills tasks for some of the largest businesses in India. Mimo provides delivery and pickup services for the banking and insurance industry, performing verifications, field investigations for loan requests, business verification, employment verification, collection of documents and customer data and assistance in filling out forms for banks. Mimo works with microfinance institutions to collect cash, such as loan payments, convert cash to digital forms such as debit cards, and conduct data collection and surveys. For consumer goods companies, Mimo does promotional marketing, last mile (hyper-local) delivery, merchant onboarding or activation, store audits, and route optimization for delivery.

| 1 |

Growth Strategy. Our strategy is to grow our business through a combination of organic growth and strategic investments that bring new functionality and revenue streams to the company. We plan to enhance the functionality of our existing products, increase sales in the Indian market and entry into new emerging markets. In addition to our significant presence in India, Southeast Asia and Latin America, we have recently added new customers in Australia, New Zealand and parts of Africa.

Risks Associated with our Business

An investment in our securities involves a high degree of risk. You should carefully consider the risks summarized below. The risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include, but are not limited to, the following:

| ● | We have a limited operating history and are subject to the risks encountered by early-stage companies. | |

| ● | A majority of our common stock is owned by our chief executive officer, who is in a position to control matters submitted to a vote of shareholders, including the election of directors. | |

| ● | Our operating losses and working capital deficiency raise substantial doubt about our ability to continue as a going concern. | |

| ● | If we are unable to integrate our acquisitions or manage the growth of those companies effectively, our business could be adversely affected. | |

| ● | Increasing competition within our emerging industry could have an impact on our business prospects. | |

| ● | Our current and future operations are subject to certain risks that are unique to operating in a foreign country. | |

| ● | Exchange rates may cause future losses in our international operations. | |

| ● | We may not be able to adequately protect our proprietary technology, and our competitors may be able to offer similar products and services, which would harm our competitive position. | |

| ● | If third parties claim that we infringe their intellectual property, it may result in costly litigation. | |

| ● | Pandemics including COVID-19 may adversely affect our business, especially in view of our foreign operations. |

Corporate History

We were incorporated as a shell company in the State of California in 2009 under the name Thunderclap Entertainment, Inc. In 2017, Thunderclap Entertainment, Inc. changed its name to TraQiQ, Inc. and since 2017 we have acquired two Indian companies and four United States companies (with one Indian subsidiary) in exchange for stock and assumption of debt.

The Company’s headquarters are located at 14205 SE 36th Street, Suite 100, Bellevue, WA 98006, and its main telephone number is (425) 818-0560. Our website address is traqiq.com. Information on our website is not part of this prospectus.

| 2 |

THE OFFERING

| Shares Offered (1) | shares of our common stock ( shares if the underwriters exercise their over-allotment option in full). | |

| Common stock outstanding before | ||

| the offering | 4,171,638 shares of common stock. | |

| Common stock to be outstanding | ||

| after this offering (2) | shares of common stock. | |

| Option to purchase additional shares | We have granted the underwriters a 45-day option to purchase up to additional shares of our common stock to cover allotments, if any. | |

| Use of proceeds | We intend to use the net proceeds of this offering for research and development activities, sales and marketing, engineering activities, repayment of outstanding debt and accounts payable and for general working capital purposes and possibly acquisitions of other companies, products or technologies, though no such acquisitions are currently contemplated. See “Use of Proceeds” on page 12. | |

| Risk factors | Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 6 before deciding to invest in our securities. | |

| Trading symbols | Our common stock is currently quoted on the OTCQB marketplace under the trading symbol “TRIQ”. We have applied to The Nasdaq Capital Market to list our common stock under the symbol “TRIQ”. | |

| Lock-ups | We and our directors and officers and stockholders who beneficially own five percent or more of our outstanding common stock have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of 180 days after the date of this prospectus with respect to our officers and directors, and 90 days with respect to us and stockholders who beneficially own five percent or more of our outstanding common stock. See “Underwriting” section on page 41. |

| (1) | Based on the assumed public offering price of $ per share, based on the closing price on , 2022. The actual number of shares we will offer will be determined based on the actual public offering price. |

| (2) | The shares of common stock to be outstanding after this offering is based on 4,171,638 shares outstanding as of the date of this prospectus. |

Nasdaq listing requirements include, among other things, a stock price threshold. As a result, on December 20, 2021 we filed Articles of Amendment to our Articles of Incorporation to effectuate a 1-for-8 reverse stock split. On March 21, 2022, the reverse stock split was effected on the OTCQB.

The shares of common stock to be outstanding after this offering excludes the following:

| ● | 196,250 shares remaining for issuance pursuant to the 2020 Equity Incentive Plan; |

| 3 |

| ● | 491,250 shares issuable upon exercise of outstanding options with a weighted average exercise price of $0.0416; | |

| ● | 228,310 shares issuable upon exercise of outstanding warrants with a weighted average exercise price of $0.008 which were issued in connection with acquisitions, of which 202,669 are currently exercisable and 25,641 are contingent upon achievement of 2022 revenue targets; | |

| ● | 124,138 shares issuable upon exercise of outstanding warrants which were issued in connection with a financing, and 9,931 shares issuable upon exercise of warrants issued to the placement agent as a part of that financing, all at an exercise price of $11.60; | |

| ● | 216,243 shares issuable in connection with a completed acquisition contingent upon achievement of future revenue targets; | |

| ● | 124,138 shares of common stock issuable upon conversion of convertible notes at a conversion price of $11.60 that were issued as a part of a financing; and | |

| ● | shares of common stock issuable upon conversion of outstanding convertible notes with a weighted average conversion price of $ , based on the company’s average quoted share price on the OTC markets immediately prior to and assuming a conversion date of , 2022. |

Unless we indicate otherwise, all information in this prospectus:

| ● | Assumes no exercise by the underwriters of their option to purchase up to an additional shares of common stock to cover over-allotments, if any; and | |

| ● | Excludes shares of common stock underlying the warrants to be issued to the underwriters in connection with this offering. |

| 4 |

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

The following summary consolidated statements of operations data for the fiscal years ended December 31, 2020, and 2021 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated balance sheet data as of December 31, 2021 are derived from our audited consolidated financial statements that are included elsewhere in this prospectus. The pro forma consolidated balance sheet data gives effect to the sale of shares in this offering after deducting underwriting discounts and commissions and offering expenses payable by us. The historical financial data presented below is not necessarily indicative of our financial results in future periods. You should read the summary consolidated financial data in conjunction with those financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles, or U.S. GAAP. Our consolidated financial statements have been prepared on a basis consistent with our audited financial statements and include all adjustments, consisting of normal and recurring adjustments that we consider necessary for a fair presentation of the financial position and results of operations as of and for such periods.

| Year Ended December 31, | ||||||||

| 2021 | 2020 | |||||||

| Consolidated Statement of Operations Data: | ||||||||

| Revenue | $ | 2,712,300 | $ | 1,009,949 | ||||

| Cost of revenue | 2,203,770 | 546,569 | ||||||

| Gross profit (loss) | 508,530 | 463,380 | ||||||

| Operating expenses | 5,461,164 | 818,348 | ||||||

| Operating loss | (4,952,634 | ) | (354,968 | ) | ||||

| Other income (expense) | (1,410,979 | ) | (252,132 | ) | ||||

| Net loss before provision for income taxes | (6,363,613 | ) | (607,100 | ) | ||||

| Provision for income taxes | 89,750 | 809 | ||||||

| Net loss | $ | (6,453,363 | ) | $ | (607,909 | ) | ||

| Net loss attributable to non-controlling interest | 4,488 | — | ||||||

| Net loss attributable to controlling interest | (6,488,875 | ) | (607,909 | ) | ||||

| Foreign currency translations adjustment | 2,884 | 6,477 | ||||||

| Comprehensive loss | $ | (6,445,991 | ) | $ | (601,432 | ) | ||

| Net loss per share – basic and diluted | $ | (1.64 | ) | $ | (0.18 | ) | ||

| Weighted average common shares outstanding – basic and diluted | 3,930,807 | 3,412,245 | ||||||

| Pro Forma, | Pro Forma, as adjusted | |||||||||||

| December 31, 2021 | December 31, 2021 (1) | December 31, 2021 (2) | ||||||||||

| Consolidated Balance Sheet Data: | ||||||||||||

| Cash | $ | 56,329 | $ | $ | ||||||||

| Total current assets | 980,747 | |||||||||||

| Total assets | 8,552,595 | |||||||||||

| Total current liabilities | 10,825,016 | |||||||||||

| Total liabilities | 10,970,898 | |||||||||||

| Total stockholders’ (deficit) equity | (2,418,303 | ) | ||||||||||

| (1) | The pro forma consolidated balance sheet data gives effect to the conversion of $2,000,000 in aggregate principal amount of related party notes with the CEO (who has agreed to convert this amount into common shares prior to the closing of this offering) into shares of common stock, using a conversion price of 80% of the public offering price. |

| (2) | The pro forma, as adjusted consolidated balance sheet data gives effect to the conversion of $2,000,000 in aggregate principal amount of related party notes with the CEO (who has agreed to convert this amount into common shares prior to the closing of this offering) into shares of common stock, using a conversion price of 80% of the public offering price, and the sale of shares in this offering after deducting underwriting discounts and commissions and offering expenses payable by us. |

| 5 |

RISK FACTORS

Investing in our securities includes a high degree of risk. Prior to making a decision about investing in our securities, you should consider carefully the risk factors discussed below, together with all of the other information contained in this prospectus. Our business, financial condition, results of operations and prospects could be materially and adversely affected by these risks.

General Risks Relating to Our Business, Operations of Financial Condition

We have a limited operating history and are subject to the risks encountered by early-stage companies.

Our company has a limited operating history, and you should consider and evaluate our operating prospects in light of the risks and uncertainties frequently encountered by early-stage companies in rapidly evolving markets. For us, these risks include:

| ● | risks that we may not have sufficient capital to achieve our growth strategy; | |

| ● | risks that we may not develop our product and service offerings in a manner that enables us to be profitable and meet our customers’ requirements; | |

| ● | risks that our growth strategy may not be successful; and | |

| ● | risks that fluctuations in our operating results will be significant relative to our revenues. |

These risks are described in more detail below. Our future growth will depend substantially on our ability to address these and the other risks described in this section. If we do not successfully address these risks, we will be unable to sustain our business growth to date and you could lose your investment.

Our operating losses and working capital deficiency raise substantial doubt about our ability to continue as a going concern. If we do not continue as a going concern, investors could lose their entire investment.

Our operating losses and working capital deficiency raise substantial doubt about our ability to continue as a going concern. We have an accumulated deficit of $8,953,768 as of December 31, 2021. We may never achieve profitability. If we do not generate sufficient revenues, do not achieve profitability and do not have other sources of financing for our business, we may have to curtail or cease our development plans and operations, which could cause investors to lose the entire amount of their investment.

If we are unable to integrate our acquisitions or manage the growth of those companies effectively, our business could be adversely affected.

Our business has grown mostly through acquisition of other companies, both in the United States and in India. These companies, particularly in India, are currently expanding rapidly. Our future operating results depend to a large extent on our ability to manage this expansion and growth successfully. For us to continue to manage such growth, we must put in place legal and accounting systems, and implement human resource management and other tools. We may be unable to successfully manage this anticipated rapid growth. A failure to manage our growth effectively could materially and adversely affect our business.

Increasing competition within our emerging industry could have an impact on our business prospects.

The artificial intelligence, mobile payment and “gig” worker markets are emerging industries where new competitors are entering the market frequently. These competing companies may have significantly greater financial and other resources than we have and may have been developing their products and services longer than we have been developing ours, and we may be unable to successfully compete.

| 6 |

Our current and future operations are subject to certain risks that are unique to operating in a foreign country.

We currently have international operations in India, Latin America, and Africa, among other places, and have a large concentration of employees and task workers in India. Therefore, we are exposed to risks inherent in international business operations. The risks of doing business in foreign countries include the following:

| ● | changing regulatory or taxation policies, including changes in tax policies that have been proposed by the current United States administration that may affect the taxation of foreign earnings; | |

| ● | currency exchange risks; | |

| ● | changes in diplomatic relations or hostility from local populations; | |

| ● | seizure of our property by the government or restrictions on our ability to transfer our property or earnings out of the foreign country; | |

| ● | potential instability of foreign governments, which might result in losses against which we are not insured; | |

| ● | difficulty in protecting our intellectual property from infringement in certain foreign countries; and | |

| ● | difficulty of enforcing agreements and collecting receivables through some foreign legal systems. |

Exchange rates may cause future losses in our international operations.

Because we own assets in foreign countries and derive revenue from our international operations, we may incur currency translation losses due to changes in the values of foreign currencies and in the value of the United States dollar. We cannot predict the effect of exchange rate fluctuations upon future operating results.

We may not be able to adequately protect our proprietary technology, and our competitors may be able to offer similar products and services, which would harm our competitive position.

Our success depends in part upon our proprietary technology. We rely primarily on national and local statutory and common law rights in the jurisdictions in which we operate, as well as contractual restrictions, to establish and protect our proprietary rights, but to date we have not sought or obtained any patents on our proprietary technology or registered any of our trademarks. Despite the precautions we have taken, third parties could copy or otherwise obtain and use our technology without authorization or develop similar technology independently. The protection of our proprietary rights may be inadequate or our competitors may independently develop similar technology, duplicate our products and services or design around any intellectual property rights we hold.

If third parties claim that we infringe their intellectual property, it may result in costly litigation.

Third parties may claim our current or future products infringe their intellectual property rights. Any such claims, with or without merit, could cause costly litigation that could consume significant management time. As the number of product and services offerings in the artificial intelligence, mobile payments and task worker markets increases and functionalities increasingly overlap, we may become increasingly subject to infringement claims. Such claims also might require us to enter into royalty or license agreements. If required, we may not be able to enter into such royalty or license agreements or obtain them on terms acceptable to us.

Pandemics including COVID-19 may adversely affect our business.

The unprecedented events related to COVID-19, the disease caused by the novel coronavirus (SARS-CoV-2), have had significant health, economic, and market impacts and may have short-term and long-term adverse effects on our business that we cannot predict as the global pandemic continues to evolve. The extent and effectiveness of responses by governments and other organizations also cannot be predicted. During 2021 and 2020, COVID-19 forced us to suspend Last Mile deliveries and other task worker activities for a period of time, and we shifted some of those activities to a virtual, remote-service model until in-person activities could resume safely. The effects of the pandemic may have a particular effect on our business as a result of our extensive operations in India and other emerging markets, where vaccines are less available. While we continue to have the option to shift to virtual activities if necessary, it is unclear whether and to what extent future impacts of COVID-19 or other pandemics will have an adverse effect on our profitability and growth strategy.

| 7 |

We may need additional financing. Any limitation on our ability to obtain such additional financing could have a material adverse effect on our business, financial condition and results of operations.

We may need to raise additional capital, which we may be unable to obtain on favorable or reasonable terms, or at all. If we raise additional capital, it could result in dilution to our stockholders. Any limitation on our ability to obtain additional capital as and when needed could have a material adverse effect on our business, financial condition and results of operations.

If we fail to maintain proper and effective internal controls, our ability to produce accurate and timely financial statements could be impaired, which could harm our operating results, our ability to operate our business and investors’ views of us.

Ensuring that we have adequate internal financial and accounting controls and procedures in place so that we can produce accurate financial statements on a timely basis is a costly and time-consuming effort. Section 404 of the Sarbanes-Oxley Act requires public companies to conduct an annual review and evaluation of their internal controls. The Company’s internal control over financial reporting was ineffective as of December 31, 2021, and our disclosure controls and procedures were ineffective as of December 31, 2021. Our failure to maintain the effectiveness of our internal controls in accordance with the requirements of the Sarbanes-Oxley Act could have a material adverse effect on our business. We could lose investor confidence in the accuracy and completeness of our financial reports, which could have an adverse effect on the price of our common stock. In addition, if our efforts to comply with new or changed laws, regulations, and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, regulatory authorities may initiate legal proceedings against us and our business may be harmed.

Our revenue is currently concentrated in a small number of customers.

Although our strategy is to expand our business operations and customer base through our 2021 acquisitions of Rohuma and Mimo, most of our revenue has come historically from a few customers. For the year ended December 31, 2021, we had two major customers comprising 50% of our revenues, and at December 31, 2021 and five customers represented 93% of our accounts receivable. For the year ended December 31, 2020 and at the end of that year, these customers accounted for 85% of our revenues and our accounts receivable, respectively. A loss of the business from these customers or any difficulty collecting our accounts receivable from them could have a material adverse effect on our business, financial condition and results of operations.

Risks Relating to our Common Stock

One shareholder controls a majority of the voting power of our common stock, and his interest may conflict with those of investors.

Our Chairman of the Board of Directors, Chief Executive Officer and President, Ajay Sikka, beneficially owns shares representing a majority of our common stock. He therefore is in a position to exercise substantial influence over the outcome of all matters submitted to a vote of our shareholders, including the election of directors.

| 8 |

Our common stock may cease to be listed on the Nasdaq Stock Market.

We have applied to have our common stock listed on the Nasdaq Capital Market under the symbol “TRIQ.” Our application has not yet been approved, and there can be no assurance that it will be approved. If it is approved and our common stock is listed, we may not be able to meet the continued listing requirements of the Nasdaq Stock Market, which require, among other things, a minimum closing price of our common stock and a minimum market capitalization. If we are unable to satisfy the requirements of the Nasdaq Capital Market for continued listing, our common stock would be subject to delisting from that market, and we might or might not be eligible to list our shares on another Nasdaq market. A delisting of our common stock from the Nasdaq Capital Market, particularly if we did not qualify to be listed on another Nasdaq market, could negatively impact us by, among other things, reducing the liquidity and market price of our common stock.

The difficulties associated with any attempt to gain control of our company could adversely affect the price of our common stock.

Ajay Sikka has substantial influence over the decision as to whether a change in control will occur for our company. There are also provisions contained in our articles of incorporation, by-laws and California law that could make it more difficult for a third party to acquire control of TraQiQ. These restrictions and limitations could adversely affect the trading price of our common stock.

There is currently not an active liquid trading market for the Company’s common stock.

Our common stock is quoted on the OTC Markets QB tier under the symbol “TRIQ”. However, there is currently no regular active trading market in our common stock. Although there are periodic volume spikes from time to time, a consistent, active trading market may not develop. Further, in the event this offering is completed, and our common stock is listed on the Nasdaq Capital Market, there is no assurance an active trading market for our common stock will develop or be sustained or that we will remain eligible for continued listing on the Nasdaq Capital Market. If an active market for our common stock develops, there is a significant risk that our stock price may fluctuate in the future in response to any of the following factors, some of which are beyond our control:

| ● | variations in our quarterly operating results; | |

| ● | announcements that our revenue or income are below analysts’ expectations; | |

| ● | general economic downturns; | |

| ● | sales of large blocks of our common stock; or | |

| ● | announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments. |

You may experience dilution of your ownership interest due to future issuance of our securities.

We are currently authorized to issue 300,000,000 shares of common stock and 10,000,000 shares of preferred stock. We may issue additional shares of common stock or other securities that are convertible into or exercisable for common stock in future public offerings or private placements for capital raising purposes or for other business purposes, or upon conversion or exercise of outstanding options, warrants, or preferred stock. The future issuance of a substantial amount of common stock, or the perception that such an issuance could occur, could adversely affect the prevailing market price of our common shares. A decline in the price of our common stock could make it more difficult to raise funds through future offerings of our common stock or securities convertible into common stock.

Our board of directors may issue and fix the terms of shares of our preferred stock without stockholder approval, which could adversely affect the voting power of holders of our common stock or any change in control of our company.

Our articles of incorporation authorize the issuance of up to 10,000,000 shares of “blank check” preferred stock, with such designation rights and preferences as may be determined from time to time by the board of directors. Of these authorized shares, 50,000 shares have been designated Series A Preferred Stock but none of them are currently outstanding (see “Description of Capital Stock”). Our board of directors is empowered, without shareholder approval, to create additional series and issue additional shares of preferred stock with dividend, liquidation, conversion, voting or other rights which could adversely affect the voting power or other rights of the holders of our common stock. In the event of such issuances, the preferred stock could be used, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of our company.

| 9 |

We do not expect to pay dividends and investors should not buy our common stock expecting to receive dividends.

We do not anticipate that we will declare or pay any dividends in the foreseeable future. Consequently, you will only realize an economic gain on your investment in our common stock if the price appreciates, which may not occur. You should not purchase our common stock expecting to receive cash dividends. Since we do not pay dividends, and if an active trading market for our shares does not develop, you may not have any manner to liquidate or receive any payment on your investment. Therefore, our failure to pay dividends may cause you to not see any return on your investment even if we are successful in our business operations. In addition, because we do not pay dividends we may have trouble raising additional funds which could affect our ability to expand our business operations.

Risks Related to the Offering

Investors in this offering will experience immediate and substantial dilution in net tangible book value.

The public offering price will be substantially higher than the net tangible book value per share of our outstanding shares of common stock. As a result, investors in this offering will incur immediate dilution of $ per share, based on the assumed public offering price of $ per share of common stock and the closing price of our common stock on , 2022. See “Dilution” for a more complete description of how the value of your investment will be diluted upon the completion of this offering.

In addition, during 2021 we agreed to issue up to an additional 216,243 shares of common stock without additional consideration to the former owners of Rohuma contingent on the financial performance of Rohuma and issued warrants to the former owners of Mimo for the purchase of up to 170,942 shares of our common stock at an exercise price of $0.008 per share (of which warrants for 145,301 shares are currently earned and warrants for the other 25,641 shares are contingent on the 2022 performance of the Mimo business). If these shares are all issued, investors in this offering will incur additional dilution of $ per share, based on the assumed public offering price of $ per share of common stock and the closing price of our common stock on , 2022.

Our common stock is subject to the “penny stock” rules of the SEC and the trading market in the securities is limited, which makes transactions in the stock cumbersome and may reduce the value of an investment in the stock.

Our common stock is subject to the “penny stock” rules of the SEC because it has historically had a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| ● | that a broker or dealer approve a person’s account for transactions in penny stocks after compliance with various information collection rules and a suitability evaluation; | |

| ● | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased; and | |

| ● | the broker or dealer deliver a disclosure schedule prescribed by the SEC. |

If we are successful in our application to list our stock for trading on the Nasdaq Stock Market and we are able to maintain that listing, our stock will cease to be a penny stock. However, if we cease to obtain and maintain that listing, we may again be subject to the penny stock rules. Generally, brokers may be less willing to execute transactions in securities subject to the penny stock rules. In addition, according to the SEC, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. These factors may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our common stock if it were to become subject to the penny stock rules.

| 10 |

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds of this offering, including for any of the purposes described in the section of this prospectus entitled “Use of Proceeds.” You will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the net proceeds are being used appropriately. The failure by our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business and cause the price of our securities to decline. Pending the application of these funds, we may invest the net proceeds from this offering in a manner that does not produce income or that loses value.

Risks Related to Our Reverse Stock Split

Although on March 21, 2022 we implemented a 1 for 8 reverse stock split, we cannot assure you that we will be able to continue to comply with the minimum bid price requirement of the Nasdaq Stock Market tier on which we are listed.

We cannot assure you that the market price of our common stock following the reverse stock split will remain at the level required for continuing compliance with the minimum bid price for the Nasdaq market tier on which our common stock is listed or the minimum for listing on any other Nasdaq market. It is not uncommon for the market price of a company’s common stock to decline in the period following a reverse stock split. If the market price of our common stock declines following the completion of the reverse stock split, the percentage decline may be greater than would occur in the absence of the reverse stock split. In any event, other factors unrelated to the number of shares of our common stock outstanding, such as negative financial or operational results, could adversely affect the market price of our common stock and jeopardize our ability to meet or maintain Nasdaq’s minimum bid price requirement for its Capital market tier. In addition to specific listing and maintenance standards, Nasdaq has broad discretionary authority over the initial and continued listing of securities, which it could exercise with respect to the listing of our common stock.

The reverse stock split may decrease the liquidity of the shares of our common stock.

The liquidity of the shares of our common stock may be affected adversely by the reverse stock split given the reduced number of shares that are outstanding following the reverse stock split. In addition, the reverse stock split increased the number of stockholders who own odd lots (less than 100 shares) of our common stock, creating the potential for such stockholders to experience an increase in the cost of selling their shares and greater difficulty effecting such sales.

Following the reverse stock split, the resulting market price of our common stock may not attract new investors, including institutional investors, and may not satisfy the investing requirements of those investors. Consequently, the trading liquidity of our common stock may not improve.

Although we believe that a higher market price of our common stock may help generate greater or broader investor interest, there can be no assurance that the reverse stock split will result in a share price that will attract new investors, including institutional investors. In addition, there can be no assurance that the market price of our common stock will satisfy the investing requirements of those investors. As a result, the trading liquidity of our common stock may not improve.

| 11 |

USE OF PROCEEDS

We estimate that the net proceeds from the sale of the common stock in the offering will be approximately $ , after deducting the underwriting discounts and commissions and estimated offering expenses, or approximately $ if the underwriters exercise their over-allotment option in full.

We currently expect to use the net proceeds of this offering primarily for the following purposes:

| ● | Approximately $8,500,000 to fund sales and marketing activities; | |

| ● | Approximately $4,000,000 for acquisitions of other companies, products or technologies involving software similar to that offered by TraQiQ or task worker services, although we have not currently entered into agreements or letters of intent for any such acquisitions; | |

| ● | Approximately $2,000,000 to fund engineering activities; | |

| ● | Approximately $2,000,000 to pay outstanding invoices and to repay approximately $ in outstanding debt with a weighted average interest rate of % and maturities ranging from to ; | |

| ● | Approximately $500,000 for working capital; and | |

| ● | The remainder for other general corporate purposes. |

We believe that the expected net proceeds from this offering and our existing cash and cash equivalents, together with interest thereon, will be sufficient to fund our operations for at least the next 12 months, although we cannot assure you that this will occur.

The amount and timing of our actual expenditures will depend on numerous factors, including the status of our development efforts, sales and marketing activities and the amount of cash generated or used by our operations. We may find it necessary or advisable to use portions of the proceeds for other purposes, and we will have broad discretion and flexibility in the application of the net proceeds. Pending these uses, we will invest the proceeds in short-term bank deposits.

| 12 |

MARKET FOR OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

TraQiQ’s common stock is traded on the OTCQB Market under the symbol “TRIQ.” Because the company’s common stock is not listed on a securities exchange and its quotations on OTCQB are limited and sporadic, there is currently no established public trading market for the common stock. TraQiQ has applied to The Nasdaq Capital Market to list its common stock under the symbol “TRIQ”.

On March 21, 2022, we completed a 1-for-8 reverse split of our common stock. All share and per share information gives effect, retroactively, to the reverse stock split.

As of , 2022, there were approximately registered holders of record of our common stock, and the last reported sale price of our common stock on the OTCQB was $ per share on , 2022.

Any over-the-counter market quotations of our common stock reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

Dividends

The company has never declared or paid any cash dividends on its common stock. The company currently intends to retain future earnings, if any, to finance the expansion of its business. As a result, the company does not anticipate paying any cash dividends in the foreseeable future.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table gives information about our common stock that may be issued upon the exercise of options, warrants and rights under our 2020 Equity Incentive Plan as of December 31, 2021. Our shareholders have approved this plan.

| Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders | 491,250 | 0.0416 | 196,250 | |||||||||

| Equity compensation plans not approved by security holders | ||||||||||||

| Total | 491,250 | 0.0416 | 196,250 | |||||||||

| 13 |

CAPITALIZATION

The following table sets forth our consolidated cash and cash equivalents and capitalization as of December 31, 2021. Such information is set forth on the following basis:

| ● | an actual basis (giving effect, on a retroactive basis, to a 1-for-8 reverse stock split which was consummated on March 21, 2022); | |

| ● | a pro forma basis to give effect to (i) the conversion of $2,000,000 in aggregate principal amount of related party notes with the CEO (who has agreed to convert this amount into common shares prior to the closing of this offering) into shares of common stock, using a conversion price of 80% of the public offering price, and (iii) an additional $190,640 in debt from financings completed in January and February, 2022; and | |

| ● | a pro forma as adjusted basis, giving effect to the pro forma adjustments above as well as the sale of the shares in this offering at the assumed public offering price of $ per share which was the last reported sale price of our common stock on the OTCQB on , 2022, after deducting underwriting discounts and commissions and other estimated offering expenses payable by us. |

The as adjusted information below is illustrative only and our capitalization following the completion of this offering will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. You should read this table together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited and unaudited consolidated financial statements and the related notes appearing elsewhere in this prospectus.

| As of December 31, 2021 | ||||||||||||

| Actual | Pro Forma | Pro Forma As Adjusted(1) | ||||||||||

| Consolidated Balance Sheet Data: | ||||||||||||

| Cash | $ | 56,329 | $ | $ | ||||||||

| Total other assets | 8,496,266 | |||||||||||

| Total liabilities | 10,970,898 | |||||||||||

| Preferred stock, par value, $0.0001, 10,000,000 shares authorized, Series A Convertible Preferred, 50,000 shares issued and outstanding, actual, 0 shares issued and outstanding, pro forma and pro forma as adjusted | — | — | — | |||||||||

| Common stock, par value, $0.0001, 300,000,000 shares authorized, 4,171,638 shares issued and outstanding, actual, shares issued and outstanding, pro forma, shares issued and outstanding, pro forma as adjusted | 417 | |||||||||||

| Additional paid-in capital | 6,508,931 | |||||||||||

| Accumulated deficit | (8,953,768 | ) | ||||||||||

| Accumulated other comprehensive income | 30,605 | |||||||||||

| Total stockholders’ (deficit) equity before non-controlling interest | (2,413,815 | ) | ||||||||||

| Non-controlling interest | (4,488 | ) | ||||||||||

| Total stockholders’ (deficit) equity | (2,418,303 | ) | ||||||||||

| Capitalization | 8,552,595 | |||||||||||

| (1) | A $1.00 increase or decrease in the assumed public offering price per share would increase or decrease our pro forma as adjusted cash, additional paid-in capital, total stockholders’ equity and total capitalization by approximately $ assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the underwriter discount and estimated offering expenses payable by us. |

| 14 |

DILUTION

Our pro forma net tangible book value (deficit) as of December 31, 2021 was approximately $(7,488,327), or $(1.55) per share of common stock based upon 4,821,638 shares of common stock outstanding on that date after giving pro forma effect to the conversion of $2,000,000 in aggregate principal amount of related party notes with the CEO (who has agreed to convert this amount into common shares prior to the closing of this offering) into shares of common stock, using a conversion price of 80% of the public offering price (estimated to be 650,000 shares). Pro forma net tangible book value per share represents the amount of our total pro forma tangible assets reduced by the amount of our total pro forma liabilities, divided by the total number of shares of common stock outstanding on a pro forma basis, after giving effect to the same conversions and issuances.

Our pro forma as adjusted net tangible book value will be $ or $ per share. Pro forma as adjusted net tangible book value per share represents pro forma as adjusted net tangible book value divided by the total number of shares outstanding on a pro forma basis after giving effect to the sale of the shares in this offering at the assumed public offering price of $ per share, after deducting underwriting discounts and commissions and other estimated offering expenses payable by us. This represents an immediate increase in pro forma as adjusted net tangible book value of $ per share to existing stockholders and an immediate dilution of $ per share to investors purchasing shares of common stock in this offering at the assumed public offering price.

The following table illustrates this dilution on a per share basis to new investors:

| Assumed public offering price per share | $ | |||||||

| Pro forma net tangible book value per share as of December 31, 2021 | $ | |||||||

| Increase in net tangible book value per share attributable to new investors | $ | |||||||

| Pro forma as adjusted net tangible book value per share after giving effect to this offering | $ | |||||||

| Dilution in net tangible book value per share to new investors | $ |

The information above is pro forma as of December 31, 2021 and excludes as of such date the following:

| ● | outstanding options to purchase an aggregate of 491,250 shares of common stock at a weighted average exercise price of $0.0416 under our equity compensation plan; | |

| ● | 228,310 shares issuable upon exercise of outstanding warrants which were issued in connection with the Mann and MIMO acquisitions, of which 202,669 are currently exercisable and 25,641 are contingent upon achievement of 2022 revenue targets; | |

| ● | 124,138 shares issuable upon exercise of outstanding warrants which were issued in connection with the September 2021 and October 2021 financing, and 9,931 shares issuable upon exercise of warrants issued to the placement agent as a part of that financing, all at an exercise price of $11.60 | |

| ● | 216,243 shares issuable in connection with the Rohuma acquisition contingent upon achievement of future revenue targets, and 43,750 shares issuable to a director for services rendered that are accruing over a three-year period; | |

| ● | 124,138 shares of common stock issuable upon conversion of convertible notes at a conversion price of $11.60 that were issued as a part of the September 2021 and October 2021 financing; | |

| ● | shares of common stock underlying the warrants to be issued to the underwriters in connection with this offering ( shares if the over-allotment is exercised in full); and | |

| ● | shares of common stock issuable upon the exercise of the underwriters’ over-allotment option. |

If the underwriters exercise their overallotment option, our pro forma as adjusted net tangible book value following the offering will be $ per share, and the dilution to new investors in the offering will be $ per share.

A $1.00 increase or decrease in the assumed public offering price per share would increase or decrease our pro forma as adjusted net tangible book value after this offering by approximately $ , and dilution per share to new investors by approximately $ .

| 15 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements involve risks and uncertainties and include statements regarding, among other things, our projected revenue growth and profitability, our growth strategies and opportunity, anticipated trends in our market and our anticipated needs for working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plans,” “potential,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend” or the negative of these words or other variations on these words or comparable terminology. These statements may be found under the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as in this prospectus generally. In particular, these include statements relating to future actions, prospective products, market acceptance, future performance or results of current and anticipated products, sales efforts, expenses, and the outcome of contingencies such as legal proceedings and financial results.

Examples of forward-looking statements in this prospectus include, but are not limited to, our expectations regarding our business strategy, business prospects, operating results, operating expenses, working capital, liquidity and capital expenditure requirements. Important assumptions relating to the forward-looking statements include, among others, assumptions regarding demand for our products, the cost, terms and availability of components, pricing levels, the timing and cost of capital expenditures, competitive conditions and general economic conditions. These statements are based on our management’s expectations, beliefs and assumptions concerning future events affecting us, which in turn are based on currently available information. These assumptions could prove inaccurate. Although we believe that the estimates and projections reflected in the forward-looking statements are reasonable, our expectations may prove to be incorrect.

Important factors that could cause actual results to differ materially from the results and events anticipated or implied by such forward-looking statements include, but are not limited to:

| ● | changes in the market acceptance of our products; | |

| ● | increased levels of competition; | |

| ● | changes in political, economic or regulatory conditions generally and in the markets in which we operate; | |

| ● | our relationships with our key customers; | |

| ● | our ability to retain and attract senior management and other key employees; | |

| ● | our ability to quickly and effectively respond to new technological developments; | |

| ● | our ability to protect our trade secrets or other proprietary rights, operate without infringing upon the proprietary rights of others and prevent others from infringing on our proprietary rights; and | |

| ● | other risks, including those described in the “Risk Factors” discussion of this prospectus. |

We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all of those risks, nor can we assess the impact of all of those risks on our business or the extent to which any factor may cause actual results to differ materially from those contained in any forward-looking statement. The forward-looking statements in this prospectus are based on assumptions management believes are reasonable. However, due to the uncertainties associated with forward-looking statements, you should not place undue reliance on any forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and unless required by law, we expressly disclaim any obligation or undertaking to publicly update any of them in light of new information, future events, or otherwise.

| 16 |

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our financial statements and notes thereto appearing elsewhere in this Registration Statement on Form S-1.

Our financial statements are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). These accounting principles require us to make certain estimates, judgments and assumptions. We believe that the estimates, judgments and assumptions upon which we rely are reasonable based upon information available to us at the time that these estimates, judgments and assumptions are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities as of the date of the financial statements as well as the reported amounts of revenues and expenses during the periods presented. Our financial statements would be affected to the extent there are material differences between these estimates and actual results. In many cases, the accounting treatment of a particular transaction is specifically dictated by GAAP and does not require management’s judgment in its application. There are also areas in which management’s judgment in selecting any available alternative would not produce a materially different result.

Overview

TraQiQ was incorporated in the State of California on September 9, 2009 as Thunderclap Entertainment, Inc. On July 14, 2017, Thunderclap Entertainment, Inc. changed its name to TraQiQ, Inc. On July 19, 2017, the Company entered into a Share Exchange Agreement with the stockholders of OmniM2M, Inc. (“OmniM2M”) and TraQiQ Solutions, Inc. dba Ci2i Services, Inc. (formerly Ci2i Services, Inc. – amended November 6, 2019) (“Ci2i”) whereby the stockholders of OmniM2M and Ci2i agreed to exchange all of their respective shares, representing 100% ownership in OmniM2M and Ci2i in exchange for 1,500,000 shares of the Company’s common stock, respectively. The OmniM2M Shareholders and the Ci2i Shareholders were issued their respective 1,500,000 shares on a pro rata basis based on their respective holdings in OmniM2M and Ci2i in the Share Exchange Agreement. The Share Exchange was accounted for as a reverse merger whereas Ci2i is considered the accounting acquirer and TraQiQ, Inc. is considered the accounting acquiree. Accordingly, the consolidated financial statements included the accounts of Ci2i for all periods presented and the accounts of TraQiQ, Inc. and OmniM2M, which was acquired by the Company on July 19, 2017 since the date of acquisition. For accounting purposes, the acquisition of OmniM2M is recorded at historical cost in accordance with Accounting Standard Codification (“ASC”) 805-50-25-2 as this is considered an acquisition of entities under common control as the management of the Company and OmniM2M control the activities of the respective companies. Prior to the merger with Ci2i and acquisition of OmniM2M, the Company was considered a shell company under Rule 12b-2 of Exchange Act. On December 1, 2017, the Company entered into a Share Purchase Agreement with Ajay Sikka (“Sikka”), the sole shareholder of Transport IQ, Inc. whereby Sikka sold all of the shares in TransportIQ, Inc. (“TransportIQ”) in exchange for $18,109, in the form of cancellation of all of the debt of TransportIQ that was owed to the Company. The transaction became effective upon the execution of the agreement by Sikka and the Company; and Transport IQ, Inc, is now a wholly-owned subsidiary of the Company. Because TransportIQ was commonly controlled and owned, the transaction was recorded at the historical carrying value of TransportIQ’s assets and liabilities.

Ci2i is a services company founded in 1998 that develops and deploys intelligent technologies and products in order to meet the demand for sustainable, integrated solutions. Ci2i’s primary focus has been in the analytics and intelligence segments. The Company is investing significantly in building products in the area of supply chain and last mile delivery.

On May 16, 2019, the Company entered into a Share Exchange Agreement with TRAQIQ Solutions Private Limited (TraQ Pvt Ltd), formerly known as Mann-India Technologies Pvt Ltd. Pursuant to the agreement, the Company acquired 100% of the shares of TRAQ Pvt Ltd. and assumed certain net liabilities in exchange for warrants exercisable over five-years to purchase up to 166,159 shares of common stock of the Company valued at $268 at an exercise price of $0.0008. The warrants are exercisable as follows: (i) 12,596 warrants immediately upon closing; (ii) 107,494 warrants exercisable one-year after the date of closing; and (iii) 46,069 warrants exercisable two-years after the date of closing. This transaction is being recorded as a business combination under ASC 805.

| 17 |

The warrants that are exercisable in one-year and two-years were conditioned upon TRAQ Pvt Ltd. achieving certain revenue figures and pre-tax profit percentages. For the warrants to become exercisable, TRAQ Pvt Ltd. was required to achieve target revenue of $1.1 million and pre-tax profit of 25% in 2019 and 2020, respectively, with the amount of such warrants becoming exercisable reduced proportionally to the extent TRAQ Pvt Ltd. failed to achieve these targets. A total of 52,391 of these warrants were cancelled effective May 16, 2021 as a result of these criteria not being achieved. There were 56,400 of these warrants exercised during 2021 and 57,368 warrants remain outstanding as of December 31, 2021.

Effective December 31, 2020, Ci2i acquired the net assets of OmniM2M and TransportIQ, and then dissolved those entities in January 2021. The value of those transactions were for the assumed liabilities of Omni and TransportIQ, and no cash was exchanged.

On January 22, 2021, the Company entered into a Share Exchange Agreement with Rohuma, LLC, a Delaware limited liability company (“Rohuma”) and its members, whereby the Rohuma members agreed to exchange all of their respective membership interests in Rohuma in exchange for up to 536,528 shares of common stock, of which the first tranche of 320,285 shares was issued upon closing on March 1, 2021, with the remaining value reflected as contingent consideration until the shares vest at which time they will be issued. The Company issued _____ shares for the second tranche as a result of satisfying the revenue requirement for 2021, and the remaining shares would be issued upon satisfying the revenue requirement for 2022. The Company, as of March 31, 2022, determined that the criteria for vesting of the second tranche of shares were satisfied.

The transaction was valued at $3,433,776 ($6.40 per share). Rohuma has an Indian affiliate that is owned 99% by Rohuma and 1% by its founding member. Rohuma controls this entity and the 1% ownership by the member is now less than 1% upon acquisition by the Company. This amount is reflected as a non-controlling interest.

Rohuma dba Kringle.ai is a California based software solutions company that enables digital and mobile commerce by providing enterprise class applications that cover loyalty and rewards products, payments, online ordering, distribution logistics for retail and more. Kringle analyzes customers’ omni-channel behaviors and transactions. Using AI for digital commerce, Kringle is able to deliver real time, automated 1:1 recommendations and personalized content across all customer touch points.

On February 17, 2021, the Company entered into a Share Exchange Agreement with Mimo Technologies Private Ltd., an Indian corporation (“Mimo”), and its shareholders, whereby the Mimo shareholders exchanged all of their respective shares in Mimo for warrants to purchase up to 170,942 shares of the Company’s common stock. Of these warrants, 145,301 were earned through March 31, 2022, with the remaining 25,641 warrants to be earned subject to Mimo meeting certain revenue goals for 2022. The Company, as of March 31, 2022, determined that the criteria for vesting of the second tranche of warrants were satisfied.. The warrants have a term of three years and an exercise price of $0.008 and value in the amount of $1,640,447, of which $1,394,380 is reflected in additional paid in capital, with the remaining $246,067 reflected as contingent consideration as of March 31, 2022. In addition to the issuance of the warrants, TRAQ Pvt Ltd, wrote off $258,736 in amounts due from a note receivable, $123,778 in accounts receivable and $40,354 in a debenture from Mimo. In addition, the Company made a cash payment to one of the minority shareholders of Mimo in the amount of $22,338. The Company acquired over 99% of Mimo with the remaining percentage of less than 1% reflected as a non-controlling interest.

Mimo provides delivery and task worker solutions across India. Mimo works with Banking, Financial, Logistics and Distribution companies, to take their products and services to semi-urban and rural India. Mimo trains the agents in each Product or Service through an online and classroom training platform.

Going Concern

The Company has an accumulated deficit of $8,953,768 and a working capital deficit of $9,844,269 as of December 31, 2021, compared to a working capital deficit of $3,168,246 as of December 31, 2020. The Company’s continuation as a going concern is dependent on its ability to generate sufficient cash flows from operations to meet its obligations, which it has not been able to accomplish to date, and/or obtain additional financing from its stockholders and/or other third parties.

| 18 |

Our consolidated financial statements have been prepared on a going concern basis, which implies the Company will continue to meet its obligations and continue its operations for the next fiscal year. The continuation of the Company as a going concern is dependent upon the ability of the Company to obtain necessary equity or debt financing to continue operations, successfully locating and negotiating with other business entities for potential acquisition and /or acquiring new clients to generate revenues. The consolidated financial statements of the Company do not include any adjustments that may result from the outcome of the uncertainties.

In order to further implement its business plan and satisfy its working capital requirements, the Company will need to raise additional capital. There is no guarantee that the Company will be able to raise additional equity or debt financing at acceptable terms, if at all.

There is no assurance that the Company will ever be profitable. These consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result should the Company be unable to continue as a going concern.

Critical Accounting Policies and Estimates

Our significant accounting policies are more fully described in the notes to our consolidated financial statements. Those material accounting estimates that we believe are the most critical to an investor’s understanding of our financial results and condition are discussed immediately below and are particularly important to the portrayal of our financial position and results of operations and require the application of significant judgment by our management to determine the appropriate assumptions to be used in the determination of certain estimates.

Consolidation

The consolidated financial statements include the accounts of TraQiQ, Inc. and its wholly-owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

The Company applies the guidance of Topic 810 Consolidation of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) to determine whether and how to consolidate another entity. Pursuant to ASC paragraph 810-10-15-10, all majority-owned subsidiaries—all entities in which a parent has a controlling financial interest—are consolidated except when control does not rest with the parent.

Pursuant to ASC paragraph 810-10-15-8, the usual condition for a controlling financial interest is ownership of a majority voting interest, and, therefore, as a general rule ownership by one reporting entity, directly or indirectly, of more than 50 percent of the outstanding voting shares of another entity is a condition pointing toward consolidation. The power to control may also exist with a lesser percentage of ownership, for example, by contract, lease, agreement with other stockholders, or by court decree.

Noncontrolling Interests

In accordance with ASC 810-10-45 Noncontrolling Interests in Consolidated Financial Statements, the Company classifies noncontrolling interests as a component of equity within the consolidated balance sheet. In January 2021, the acquisition of Rohuma resulted in a less than 1% non-controlling interest of the Indian affiliate of that company. In February 2021, the acquisition of Mimo resulted in a less than 1% non-controlling interest of that company.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting periods. These estimates include, but are not limited to, management’s estimate of provisions required for non-collectible accounts receivable, depreciative lives of our assets, determination of technological feasibility, and valuation allowances of our deferred tax assets. Actual results could differ from those estimates.

| 19 |

Capitalized Software Costs