Table of Contents

As filed with the United States Securities and Exchange Commission on July 22, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Loyalty Alliance Enterprise Corporation

(Exact name of Registrant as specified in its charter)

| Cayman Islands | 7380 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Loyalty Alliance Enterprise Corporation

Suite 6005, 60/F, Central Plaza

18 Harbour Road, Wanchai, Hong Kong

Attn: Frederick Sum, Chief Executive Officer

(852) 2511-0386

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

CT Corporation System

111 8th Avenue, 13th Floor

New York, New York 10011

(212) 894-8940

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||||||

| Carmen Chang, Esq. Nathaniel P. Gallon, Esq. Wilson Sonsini Goodrich & Rosati Professional Corporation 650 Page Mill Road Palo Alto, CA 94304 (650) 493-9300 |

Jeffrey Cannon, Esq. Wilson Sonsini Goodrich & Rosati Professional Corporation 38th Floor, Jin Mao Tower 88 Century Boulevard Pudong, Shanghai 200121 People’s Republic of China (8621) 6165-1700 |

Alan D. Seem, Esq. Shearman & Sterling LLP 12th Floor East Tower Twin Towers B-12 Jianguomenwai Dajie Beijing, 100022 People’s Republic of China (8610) 5922 8000 |

Shuang Zhao, Esq. Shearman & Sterling LLP c/o 12th Floor Gloucester Tower The Landmark 15 Queen’s Road Central Hong Kong (852) 2978-8000 | |||

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||

| Ordinary shares, par value $0.0001 per share(3) |

$92,588,800 | $10,750 | ||

| (1) | Estimated solely for the purpose of determining the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes (a) ordinary shares that may be purchased by the underwriters pursuant to an over-allotment option, and (b) ordinary shares initially offered and sold outside the United States that may be resold from time to time in the United States either as part of their distribution or within 40 days after the later of the effective date of this registration statement and the date the shares are first bona fide offered to the public. These ordinary shares are not being registered for the purpose of sales outside the United States. |

| (3) | American depositary shares issuable upon deposit of the ordinary shares registered hereby will be registered under a separate registration statement on Form F-6. Each American depositary share represents 15 ordinary shares. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a) may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PROSPECTUS (Subject to Completion) | Dated July 22, 2011 |

Loyalty Alliance Enterprise Corporation

5,032,000 American Depositary Shares

Representing 75,480,000 Ordinary Shares

This is the initial public offering of our American depositary shares, or ADSs.

We are offering 5,032,000 ADSs. Each ADS represents 15 ordinary shares, par value $0.0001 per share. The ADSs may be evidenced by American depositary receipts, or ADRs.

We expect that the public offering price will be between $14.00 and $16.00 per ADS. We have been approved to list the ADSs on the Nasdaq Global Market under the symbol “LAEC.”

Our business and an investment in our ADSs involves significant risks. Among other risks, we have historically relied on China Unicom Limited for substantially all of our net revenues. Upon the completion of this offering, our executive officers, directors, and our principal shareholders identified on page 123 together with their respective affiliates will own 63,236,344 ordinary shares and will continue to have significant influence over any corporate actions. See “Risk Factors” beginning on page 15 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| PER ADS | TOTAL | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

||||||||

| Proceeds, before expenses, to us |

||||||||

The underwriters may also purchase up to an additional 754,800 ADSs from us at the public offering price, less the underwriting discount, within 30 days from the date of the prospectus to cover over-allotments.

The underwriters expect to deliver the ADSs against payment in U.S. dollars in New York, New York on or about , 2011.

| Macquarie Capital | ||||

, 2011

Table of Contents

Table of Contents

You should rely only on the information contained in this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission in connection with this offering. We have not authorized anyone to provide you with information that is different from that contained in this prospectus or in any filed free writing prospectus. We are offering to sell, and seeking offers to buy, the ADSs only in jurisdictions where offers and sales are permitted. The information contained in this prospectus or in any filed free writing prospectus is accurate only as of its date, regardless of the time of its delivery or of any sale of the ADSs.

We have not undertaken any efforts to qualify this offering for offers to individual investors in any jurisdiction outside the United States. Therefore, individual investors located outside the United States should not expect to be eligible to participate in this offering.

Until , 2011 (25 days after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to unsold allotments or subscriptions.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus. You should read the following summary together with the more detailed information appearing in this prospectus, including our consolidated financial statements and related notes, and our risk factors beginning on page 15, before deciding whether to purchase our ADSs.

Loyalty Alliance Enterprise Corporation

Overview

We are a leading provider of data-driven multi-channel direct marketing and customer loyalty solutions in the mobile telecommunications sector in the high-growth China market in terms of the breadth and depth of the services offered, according to a market research report by CCID Consulting Company Limited, or CCID Consulting, that we sponsored. The Chinese mobile telecommunications sector was the first sector that we targeted and successfully penetrated. We currently provide our services mainly to China Unicom Limited, or China Unicom, and China Telecom Limited, or China Telecom. Net revenues from China Unicom represented an aggregate of 98.1% of our total net revenues in 2008, 81.1% of our total net revenues in 2009, 73.3% of our total net revenues in 2010 and 51.9% of our total net revenues for the three months ended March 31, 2011. Net revenues from China Telecom represented an aggregate of 0.5% of our total net revenues in 2008, 2.5% of our total net revenues in 2009, 3.9% of our total net revenues in 2010 and 3.3% of our total net revenues for the three months ended March 31, 2011.

We also have a growing predictive data analytics business that we launched in the first quarter of 2010. We have developed and continue to maintain a dynamic proprietary database of highly localized and valuable demographic and behavioral attributes of approximately 30 million consumers in affluent regions of China. With our proprietary database, technology and data analytics capabilities, we develop, implement and manage programs that help our clients identify, acquire and retain loyal and high value customers. We facilitate and manage interactions between our clients and their customers through a variety of marketing and customer-retention channels. Through these customer interactions, we capture important demographic and behavioral attributes about these customers that allow us to continuously build and improve our proprietary database and the efficacy of our solutions.

We use our analytics capabilities to help our clients become more customer-focused by developing direct marketing and customer loyalty programs tailored to each client’s unique needs as these clients address the rapid growth and increasingly discerning preferences of Chinese consumers. Our services allow our clients to analyze customer behaviors, create customized products and services, and develop compelling marketing programs to effectively attract new customers and keep existing customers engaged. Our data-driven technology service platform allows us to provide the following direct marketing, customer loyalty and predictive data analytics services:

| • | Direct Marketing Services: Our direct marketing services, which constituted 98.1%, 81.4%, 82.9% and 90.3% of our total net revenues in 2008, 2009 and 2010 and for the three months ended March 31, 2011, consist of customer acquisition, customer retention and marketing and promotion consulting services. Our direct marketing services revenues for the years ended December 31, 2009 and 2010 and for the three months ended March 31, 2011 were $10.2 million and $14.7 million and $5.5 million, respectively. |

| • | Customer Acquisition Services: Leveraging our local knowledge and execution expertise, we collaborate with our clients to design data-driven multi-channel marketing programs by |

1

Table of Contents

| customizing our clients’ products and services. We execute direct marketing programs through a comprehensive suite of channels, including telephone, Internet, direct mail (pamphlet and brochure), location-based marketing (e.g., SMS), in-person and event hosting (in stores, in communities, and for products). We use our dynamic, proprietary database of valuable demographic and behavioral information on Chinese consumers to help our clients capture value through targeted marketing. |

| • | Customer Retention Services: To enhance the stickiness of our clients’ customers and to increase the value of their customer transactions, we offer a variety of ongoing customer support services on a subscription basis to those customers we helped our clients acquire over the term of the customer contract, which typically ranges from two to three years. These services typically include customer call support, technical support, store teach-ins and demonstrations, and post-sales customer follow-ups. These value-added services enhance customers’ experience with our clients and also increase the value and frequency with which customers transact business with our clients. |

| • | Marketing and Promotion Consulting Services: In 2010, we began offering marketing and promotion consulting services to third-party direct marketing companies whereby we help these companies establish their own direct marketing operations to provide direct marketing services to affiliates of China Unicom Limited, or China Unicom, in geographical locations where we currently do not have a direct marketing presence. We earn a fixed fee for assisting these companies in establishing themselves as direct marketing representatives and providing training to their employees. |

Our direct marketing services net revenues increased 43.3% for the year ended December 31, 2010 compared to the same period in 2009 and 55.9% for the three months ended March 31, 2011 compared to the same period in 2010. A substantial portion of our net revenues from our direct marketing business during 2008, 2009 and 2010 and for the three months ended March 31, 2011 was derived from providing direct marketing services to regional subsidiaries, branches and affiliates of China Unicom.

| • | Customer Loyalty Services: We manage and maintain open-loop customer loyalty programs (e.g., on-line, off-line and mobile coupons, gifts, discounts and privileges), or CLP, that allow our clients’ customers to accumulate reward points that can be redeemed for products and services at any one of over 3,000 reputable merchants within our network. In an open-loop customer loyalty program, customers can redeem reward points and enjoy promotional privileges across any participating merchant. Our key services include nationwide merchant acquisition and management, gift sourcing, and loyalty points transaction processing. In addition, we have designed and implemented a number of innovative and effective customer loyalty channels, such as credit cards with loyalty points and discount privileges for high value customers and kiosks in shopping malls. These channels supplement our open-loop program and further enhance customers’ experiences to promote customer loyalty for our clients. For the year ended December 31, 2010 and the three months ended March 31, 2011, we derived 10.2% and 8.7%, respectively, of our total net revenues from our customer loyalty services. Our customer loyalty services net revenues for the year ended December 31, 2010 was $1.8 million and was $0.5 million for the three months ended March 31, 2011. Our customer loyalty services net revenues in 2009 was $2.3 million, which included one-time net revenues of $1.8 million for providing a loyalty program software and membership system to a related party. We derive a significant portion of our net revenues from our customer loyalty business by providing customer loyalty services to regional subsidiaries, branches and affiliates of China Telecom on a fixed fee basis. We also provide customer loyalty services to China Unicom on a fixed fee basis. We also sold customer loyalty program software to two clients in 2010. |

| • | Predictive Data Analytics Services: In the first quarter of 2010, we began to offer customer database consulting and data-driven marketing advisory services to help our clients increase market share and |

2

Table of Contents

| penetrate new market segments by leveraging our dynamic database and our data analytics capabilities. We recognized $1.2 million in net revenues from our predictive data analytics services during 2010 and $0.1 million for the three months ended March 31, 2011. |

We currently provide services to China Telecom and China Unicom, two of the three mobile telecommunications service providers in China, in addition to several merchants in other sectors outside of the mobile telecommunications sector. As we continue to strategically expand our services across more sectors and geographic regions in China, we believe that our customer database will continue to improve in scale and information quality, making it more difficult to replicate and further allowing us to leverage our database to generate cross-selling opportunities for our clients.

Our total net revenues have grown from $12.6 million in 2009 to $17.7 million in 2010, representing a growth rate of 40.8% and our total net revenues for the three months ended March 31, 2011 amounted to $6.0 million. We incurred a net loss of $10.8 million in 2008 and a net loss of $0.8 million in 2009. We generated a net profit of $0.8 million in 2010 and $1.5 million for the three months ended March 31, 2011. Our net profit in 2010 and for the three months ended March 31, 2011 was negatively impacted by $2.5 million and $0.3 million of share-based compensation expense, respectively.

Our Industry

China’s disposable income has grown rapidly in recent years. According to the statistics released by the National Bureau of Statistics of China available in 2011, urban residents in China have experienced a 13.1% compound annual growth in disposable income between 2005 and 2009, while rural residents have experienced 12.2% compound annual growth over the same time period. While this growth in disposable income has helped increase consumer demand for goods and services in recent years, consumer consumption rates in China still have potential for significant future growth. According to Global Insight’s statistics released in the fourth quarter of 2010, private consumption as a percentage of gross domestic product, or GDP, in China was 34.3% in 2009, well below the 71.1% level in the United States. However, private consumption in China is expected to outpace GDP growth, with Global Insight estimating a compound annual growth rate, or CAGR, of 15.2% for private consumption in China between 2009 and 2012.

Further evidence of rising disposable incomes in China can be seen in the historical and projected trends of the Chinese middle class. According to “The Value of China’s Emerging Middle Class” published by McKinsey Global Institute in 2006, China’s middle class, defined as urban households with annual income between RMB25,000 and RMB100,000, grew from 7.6 million in 1995 to 42.0 million in 2005, representing a CAGR of 18.6%. This middle class, according to the same study, is expected to expand to 295.4 million by 2025, representing a CAGR of over 10.2% from 2005 to 2025 and accounting for 79.2% of the urban households by 2025. It is our belief that this growing, powerful socio-economic group is likely to be a driver of consumer consumption and presents an opportunity for retailers looking to enter and grow within the Chinese market.

We believe the retail sector in China will continue to benefit from the significant growth in the size of China’s middle class and the overall growth in private consumption. According to a 2011 Euromonitor International report, retail sales of consumer goods in China are expected to grow from RMB6.9 trillion in 2009 to RMB9.1 trillion in 2012, equivalent to a CAGR of 9.4%. This presents a substantial opportunity for companies like ours that are well positioned to aid retailers in capitalizing on such a rapidly growing economy.

However, despite rising disposable income for Chinese households and increasing consumption of more expensive retail products and services, there remains a significant information asymmetry between the retail and consumer companies and the Chinese consumers primarily due to the lack of a reliable and centralized consumer credit and profile system. Currently, consumer data, credit information and track record are dispersed and

3

Table of Contents

generally unavailable, as evidenced by a credit card penetration ratio of less than 5% in China according to “China’s Card Market: Primed for Rapid Evolution” published by McKinsey Global Institute in September 2009. Therefore, it is difficult for domestic and international companies to effectively market and sell their products and services to the potential consumers in China. These structural hurdles and the growth opportunities presented in China offer unique opportunities for third party providers like us to help clients develop more targeted marketing and sales strategies to reach specific subsectors of the Chinese consumer base more effectively.

Our Competitive Strengths

We believe the following strengths contribute to our success and differentiate us from our competitors:

| • | A large, dynamic and growing consumer information database; |

| • | Proprietary predictive data analytics capabilities; |

| • | A leading provider of data-driven multi-channel direct marketing and customer loyalty solutions in China with a growing predictive data analytics business; |

| • | Market-driven and customer-focused solutions; |

| • | Scalable business model to support growth and profitability; |

| • | Significant barriers to entry; and |

| • | Experienced management team with a multi-national and multi-cultural perspective. |

Our Strategies

Our goal is to become the dominant provider of data-driven multi-channel direct marketing, customer loyalty and predictive data analytics solutions in the high-growth China market. We plan to achieve our goal through the following key strategies:

| • | Continue to improve the depth, quality and size of our consumer information database; |

| • | Enhance our data analytics capabilities to better understand Chinese consumer behavior; |

| • | Expand our services to other selected growth sectors in China; |

| • | Broaden our merchant network to increase the attractiveness of our open-loop loyalty programs; |

| • | Expand the geographic reach of our operations in China; and |

| • | Pursue strategic acquisitions that complement our leadership position. |

Our Challenges

Our ability to achieve our goal and execute our strategies is subject to risks and uncertainties, including the following:

| • | We generated 98.1%, 81.1%, 73.3% and 51.9% of our total net revenues for 2008, 2009 and 2010 and for the three months ended March 31, 2011, respectively, from China Unicom. Any loss or deterioration of our relationship with China Unicom would result in the loss of significant net revenues and would harm our business. In addition, significant changes in policies or guidelines of China Unicom could materially and adversely impact our business operations and financial condition; |

| • | We generated 98.1%, 81.4%, 82.9% and 90.3% of our total net revenues for 2008, 2009 and 2010 and for the three months ended March 31, 2011, respectively, from our direct marketing services. If we are unable to successfully grow our customer loyalty services and predictive data analytics applications, we may not be able to execute on our strategy; |

| • | China Unicom or China Telecom may claim that we do not own a portion of the content in our database, which could limit our ability to provide our predictive data analytics solutions to other clients; |

4

Table of Contents

| • | If we fail to increase the number of clients who use our services, we may not be able to maintain or increase total net revenues or to enhance our proprietary database; |

| • | Our growth prospects may be adversely affected if the market for our services and the sectors we serve fail to grow; |

| • | Our executive officers and all of the members of our board of directors serve in similar capacities with PayEase Corp., or PayEase. This overlap may result in conflicts of interest or the diversion of management’s attention from our business; |

| • | If we are not able to manage our growth, we may not be able to maintain profitability and our business would be materially and adversely affected; and |

| • | We may not be able to compete successfully against our existing or future competitors. |

Please see “Risk Factors” for a discussion of these and other risks and uncertainties we face.

Corporate Information

Our principal executive offices are located at Suite 6005, 60/F, Central Plaza, 18 Harbour Road, Wanchai, Hong Kong. Our telephone number at this address is +852-2511-0386. Our registered office in the Cayman Islands is located at Maples Corporate Services Limited, P.O. Box 309, Ugland House, South Church Street, George Town, Grand Cayman KY1-1104, Cayman Islands. Our telephone number at this address is +1 (345) 949-8066. We also have offices in China, including in the cities of Chengdu, Dongguan, Foshan, Guangzhou, Hangzhou, Huizhou, Shenzhen, Wuhan, Zhanjiang and Zhaoqing, and in the United States in Santa Clara, California.

Our website is www.loyalty-alliance.com. The information contained on this website is not a part of this prospectus. Our agent for service of process in the United States is CT Corporation System, located at 111 8th Avenue, 13th Floor, New York, New York 10011.

Recent Developments

Our consolidated financial data for the three months ended June 30, 2011 discussed below are preliminary, based upon information available to date and management estimates, and subject to completion of our normal quarter-end closing procedures. We believe the estimates set forth below are reasonable and we expect our final operating results for the three months ended June 30, 2011 to be within the ranges set forth below. Although we have not completed our normal quarter-end closing procedures, in preparing the estimates set forth below, we prepared and recorded closing entries and compared information from our financial records and worksheets to closing information. We followed our revenue recognition policies during the quarter when recording revenue and reflected our expenses in accordance with our normal procedures during the quarter or, for expenses where we have not yet finalized such information, we made estimates of expenses based both on historical activities and known factors. Some of the normal quarter-end procedures that need to be performed include obtaining a valuation report for the fair value of our ordinary shares from an independent valuation firm, preparing an analysis on revenue recognition, preparing a full set of financial statements with footnote disclosure and having our independent registered public accounting firm perform a review of those financial statements. We expect that our closing procedures for the three months ended March 31, 2011 will be completed by September 2011. Our independent registered public accounting firm, Ernst & Young Hua Ming, has not audited, reviewed, compiled or performed any procedures on this preliminary financial data, and accordingly, does not express an opinion or other form of assurance with respect to this preliminary financial data. For additional information regarding the various risks and uncertainties inherent in estimates of this type, see “Special Note Regarding Forward-Looking Statements.”

Total Net Revenues

We estimate total net revenues for the three months ended June 30, 2011 to be between approximately $6.9 million and $7.3 million as compared to $3.5 million for the three months ended June 30, 2010 and $6.0 million for the three months ended March 31, 2011. The increase in total net revenues was primarily due to increases in each of our direct marketing services and predictive data analytics services revenues in the three months ended June 30, 2010 over the three months ended March 31, 2011.

5

Table of Contents

In the fourth quarter of 2010 we began working with third party direct marketing entities in regions of China where we do not currently have a direct marketing presence. We do so through marketing and promotion agreements where we assist these third parties in establishing their own direct marketing operations to support China Unicom in those regions. The increase in our direct marketing services revenues for the three months ended June 30, 2011 was primarily attributable to increased revenue from these marketing and promotion service agreements.

The increase in our predictive data analytics revenue resulted from providing more predictive data analytics services and database marketing for our existing customers as well as the acquisition of one new predictive data analytics customer in the second quarter of 2011.

Net Profit

We estimate net profit for the quarter ended June 30, 2011 to be between approximately $2.2 million and $2.5 million as compared to $50,000 for the quarter ended June 30, 2010 and $1.5 million for the quarter ended March 31, 2011. The estimated net profit for the quarter ended June 30, 2011 reflected less than $50,000 in estimated share-based compensation expense. The increase in net profit is primarily attributable to our increase in total net revenues while maintaining our expense levels.

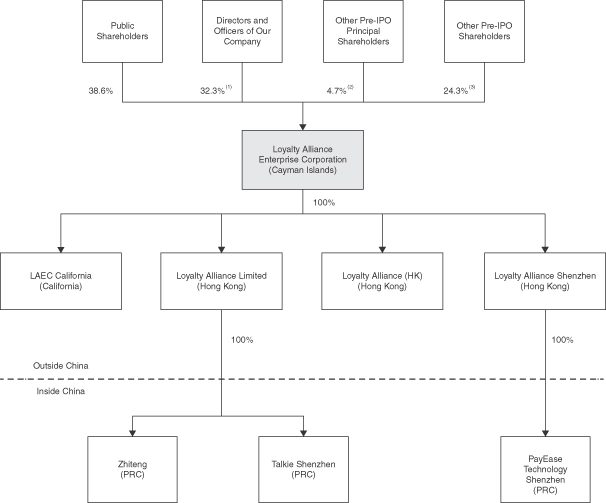

Corporate Structure

We are a holding company incorporated in the Cayman Islands. We conduct our operations primarily through our wholly-owned subsidiaries in the PRC.

We own all of the share capital of our four direct subsidiaries:

| • | Loyalty Alliance Limited (formerly known as PayEase Shenzhen (HK) Ltd.) |

| • | Loyalty Alliance (HK) Limited, or Loyalty Alliance (HK) |

| • | Loyalty Alliance Shenzhen (HK) Limited, or Loyalty Alliance Shenzhen |

| • | LAEC Enterprise Corporation, or LAEC California |

Loyalty Alliance Limited is a holding company that owns all of the share capital of Zhiteng Infotech (Shenzhen) Co., Ltd., or Zhiteng, and Talkie Technology (Shenzhen) Co., Ltd., or Talkie Shenzhen, two of our operating subsidiaries in the PRC.

Talkie Shenzhen provides direct marketing and customer loyalty services. Our customer loyalty services are also provided by Zhiteng and through our nominee agreement with PayEase Beijing (HK) Limited, or PayEase Beijing, which was assumed by a former subsidiary of PayEase, PayEase Technology (Beijing) Co., Ltd., or PayEase Technology Beijing.

Our predictive data analytics services are provided by Loyalty Alliance (HK).

Loyalty Alliance Shenzhen is a holding company that owns all of the share capital of PayEase Technology (Shenzhen) Co., Ltd., or PayEase Technology Shenzhen, one of our subsidiaries in the PRC that was formed in December 2010 that we may use in the future to provide direct marketing and customer loyalty services.

As of the date of this prospectus, we were not conducting operations through LAEC California.

Prior to our incorporation in September 2009, we conducted our business as a business unit of PayEase. In September 2009, PayEase transferred to us all of the share capital of Loyalty Alliance Limited. In February 2010, PayEase distributed all of our share capital that it owned, representing all of our issued share capital at that time, to its stockholders in a pro rata distribution.

Our direct marketing services originated from acquisitions made by PayEase in 2007 through a series of control agreements. On March 12, 2007, PayEase completed its acquisition of Dongguan Talkie Telecom Co., Limited and Shenzhen Talkie Telecom Co., Limited, or Talkie. On August 13, 2007, PayEase completed its acquisition of Guangzhou Vispac Telecom Company Limited, or Vispac, Foshan Pickatelly Communication Company Limited and Wuhan Pickatelly Communication Company Limited. Prior to their respective acquisitions by PayEase, these companies provided direct marketing services to the regional affiliates of China Unicom. These control agreements were terminated on December 30, 2008. See note 4 to our financial

6

Table of Contents

statements included elsewhere in this prospectus. On December 1, 2008, PayEase and Talkie Shenzhen entered into a sales and purchase agreement with Justin International Limited, pursuant to which PayEase and Talkie Shenzhen purchased the contract between Justin International Limited and China Unicom relating to providing direct marketing services to China Unicom, or the Justin Contract.

The following diagram illustrates our corporate structure immediately after the offering, assuming that the underwriters do not exercise the over-allotment option:

| (1) | Representing the aggregate percentage of our ordinary shares owned or controlled by our directors and officers and their respective affiliates immediately after the offering. See “Principal Shareholders” for more detailed information. |

| (2) | Representing the aggregate percentage of our ordinary shares owned or controlled by our pre-IPO shareholders, other than our directors and officers and their respective affiliates, each of whom owned more than 5% of our ordinary shares immediately prior to the offering. See “Principal Shareholders” for more detailed information. |

| (3) | Representing the aggregate percentage of our ordinary shares owned or controlled by our pre-IPO shareholders, other than our directors and officers and our pre-IPO holders of more than 5% of our ordinary shares. See “Principal Shareholders” for more detailed information. |

7

Table of Contents

Our Directors and Executive Officers

After this offering, our directors, executive officers, principal shareholders and their affiliated entities will own approximately 37.1% of our outstanding ordinary shares (assuming no exercise of the over-allotment option). These shareholders, acting individually or as a group, will be able to exert substantial influence over matters such as electing directors and approving mergers or other business combination transactions. See “Risk Factors—Risks Related to Our ADSs and This Offering—Our corporate actions are substantially controlled by our principal shareholders and affiliated entities” and “Principal Shareholders.”

All of the members of our board of directors are also on the board of directors of PayEase. In addition, each of our chairman, president and chief executive officer, and chief financial officer and general counsel serve in similar capacities with PayEase and are currently employed by PayEase and not by us. These officers are not contractually obligated to devote a minimum portion of their time to our business, and they may in the future devote a larger proportion of their time to the business of PayEase. For these and other reasons, their attention may be diverted from our business, which may cause us to miss business opportunities that we would not otherwise have missed, or cause our relationships with our clients to deteriorate, any of which could adversely affect our business, financial condition and operating results. See “Risk Factors—Risks Related to Our Business and Industry—Our chairman, president and chief executive officer, chief financial officer and general counsel and executive vice president, technology and development, also serve as executive officers in similar capacities with PayEase. The members of our board of directors also serve on the board of directors of PayEase. This executive officer and board of directors overlap may result in conflicts of interest or the diversion of management’s attention from our business. ”

8

Table of Contents

The Offering

| Issuer |

Loyalty Alliance Enterprise Corporation |

| Price per ADS |

We currently estimate that the initial public offering price will be between $14.00 and $16.00 per ADS. |

| ADSs offered by us |

5,032,000 ADSs |

| Ordinary shares outstanding immediately after this offering |

195,504,097 ordinary shares (or 206,826,097 ordinary shares if the underwriters exercise their over-allotment option in full). |

| Over-allotment option |

We have granted a 30-day option (commencing from the date of this prospectus) to the underwriters to purchase up to an additional 754,800 ADSs to cover over-allotments. |

| The ADSs |

Each ADS represents 15 ordinary shares, par value $0.0001 per ordinary share. The ADSs may be evidenced by American depositary receipts, or ADRs. |

| The depositary will be the holder of the ordinary shares underlying the ADSs and you will have the rights of an ADR holder as provided in the deposit agreement among us, the depositary and beneficial owners of ADSs from time to time. |

| Subject to the terms of the deposit agreement, you may surrender your ADSs to the depositary to withdraw the ordinary shares underlying your ADSs. The depositary will charge you a fee for such an exchange. |

| To better understand the terms of the ADSs, you should carefully read the section in this prospectus entitled “Description of American Depositary Shares.” We also encourage you to read the deposit agreement, which is an exhibit to the registration statement that includes this prospectus. |

| Use of proceeds |

We estimate that we will receive net proceeds of approximately $66.9 million from this offering (or $77.4 million if the underwriters exercise their over-allotment option in full), assuming an initial offering price of $15.00 per ADS, the midpoint of the estimated range of the initial public offering price listed on the cover page of this prospectus. We intend to use the net proceeds from this offering for geographic expansion, including through acquisitions, to develop new technologies and products and for other general corporate purposes, including working capital needs. See “Use of Proceeds” for more information. |

9

Table of Contents

| Risk factors |

See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our ADSs. |

| Listing |

We have been approved to list our ADSs on the Nasdaq Global Market. Our ordinary shares will not be listed on any exchange or quoted for trading on any over-the-counter trading system. |

| Nasdaq Global Market symbol |

LAEC |

| Depositary |

Citibank, N.A. |

| Lock-up |

We, our directors, executive officers and a substantial majority of our other existing shareholders have agreed, subject to certain exceptions, not to transfer or dispose of, directly or indirectly, any of our ADSs or ordinary shares or securities convertible into or exercisable or exchangeable for ordinary shares or ADSs for a period of 180 days after the date of this prospectus. See “Underwriting.” |

The number of our ordinary shares indicated above to be outstanding following this offering is based on 120,024,097 ordinary shares outstanding as of the date of this prospectus, which includes an aggregate of 6,920,517 ordinary shares issued between January 1, 2011 and the date of this prospectus upon the exercise of options, assuming the automatic conversion of all of our outstanding preferred shares into 73,212,100 ordinary shares immediately prior to the closing of this offering, and the issuance of 1,078,710 ordinary shares to Justin International Limited or its nominee following this offering, and excludes 21,444,741 ordinary shares reserved for issuance under our equity incentive plans.

Unless otherwise indicated, for calculating our number of ordinary shares outstanding immediately after this offering, this prospectus reflects and assumes the following:

| • | the automatic conversion of all outstanding preferred shares into 73,212,100 ordinary shares immediately prior to the closing of the offering; |

| • | the issuance of 1,078,710 ordinary shares to Justin International Limited or its nominee following this offering pursuant to a sales and purchase agreement; and |

| • | no exercise by the underwriters of their over-allotment option. |

10

Table of Contents

Summary Consolidated Financial Data

The following summary consolidated financial data should be read in conjunction with, and are qualified in their entirety by reference to, our consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. The summary consolidated statement of operations and cash flow data for the years ended December 31, 2008, 2009 and 2010 and consolidated balance sheet data as of December 31, 2010 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary unaudited consolidated statement of operations and cash flow data for the three months ended March 31, 2010 and 2011, and the summary unaudited consolidated balance sheet data as of March 31, 2011, are derived from our unaudited interim condensed consolidated financial statements included elsewhere in this prospectus.

Our consolidated financial statements include allocations of certain PayEase expenses, including centralized legal, tax, treasury, employee benefits and other PayEase corporate services and infrastructure costs. These expense allocations have been determined on bases that we and PayEase consider to be reasonable reflections of the use of services provided or the benefit received by us. The financial information included in this discussion and in our consolidated financial statements may not be indicative of our consolidated financial position and operating results in the future, or what they would have been had we been a separate stand-alone entity throughout the periods presented. See note 1 of the notes to our consolidated financial statements for additional information on our relationship with PayEase.

Our consolidated financial statements are prepared and presented in accordance with the United States generally accepted accounting principles, or U.S. GAAP.

11

Table of Contents

| For the Year Ended December 31, | For the Three Months Ended March 31, |

|||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| (unaudited) |

||||||||||||||||||||

| Summary Consolidated Statement of Operations Data: |

||||||||||||||||||||

| Total net revenues: |

||||||||||||||||||||

| Direct marketing services |

$ | 11,082 | $ | 10,241 | $ | 14,678 | $ | 3,496 | $ | 5,452 | ||||||||||

| Customer loyalty services |

220 | 2,342 | 1,808 | 198 | 525 | |||||||||||||||

| Predictive data analytics services |

— | — | 1,229 | — | 60 | |||||||||||||||

| Total net revenues |

$ | 11,302 | $ | 12,583 | $ | 17,715 | $ | 3,694 | $ | 6,037 | ||||||||||

| Total cost of revenues |

$ | 9,952 | $ | 8,596 | $ | 8,192 | $ | 1,956 | $ | 1,831 | ||||||||||

| Gross profit |

1,350 | 3,987 | 9,523 | 1,738 | 4,206 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Selling and marketing |

906 | 974 | 862 | 196 | 187 | |||||||||||||||

| General and administrative(1) |

4,219 | 3,404 | 6,625 | 2,274 | 2,294 | |||||||||||||||

| Loss on termination of control agreements with Talkie and Vispac |

6,732 | — | — | — | — | |||||||||||||||

| Gain on modification of payable for business acquisition |

— | — | — | — | (277 | ) | ||||||||||||||

| Operating profit (loss) |

(10,507 | ) | (391 | ) | 2,036 | (732 | ) | 2,002 | ||||||||||||

| Interest expense (income), net |

(33 | ) | 59 | 19 | 14 | (19 | ) | |||||||||||||

| Profit (loss) before income tax |

(10,474 | ) | (450 | ) | 2,017 | (746 | ) | 2,021 | ||||||||||||

| Income tax expense |

363 | 386 | 1,193 | 184 | 529 | |||||||||||||||

| Net profit (loss) |

$ | (10,837 | ) | $ | (836 | ) | $ | 824 | $ | (930 | ) | $ | 1,492 | |||||||

| Cumulative dividends of contingently redeemable convertible preferred shares |

$ | — | $ | — | $ | 1,854 | $ | 336 | $ | 506 | ||||||||||

| Accretion of contingently redeemable convertible preferred shares to redemption value |

— | — | 12,762 | 12,762 | — | |||||||||||||||

| Net profit (loss) attributable to ordinary shareholders |

$ | (10,837 | ) | $ | (836 | ) | $ | (13,792 | ) | $ | (14,028 | ) | $ | 986 | ||||||

| Earnings (loss) per ordinary share—basic and diluted |

$ | (0.60 | ) | $ | (0.04 | ) | $ | (0.37 | ) | $ | (0.43 | ) | $ | 0.01 | ||||||

| Weighted average number of ordinary shares used in calculating earnings (loss) per ordinary share: |

||||||||||||||||||||

| Basic |

18,037 | 21,245 | 37,033 | 32,554 | 39,283 | |||||||||||||||

| Diluted |

18,037 | 21,245 | 37,033 | 32,554 | 42,126 | |||||||||||||||

| Unaudited pro forma earnings per ordinary share(2): |

||||||||||||||||||||

| Basic |

$ | 0.01 | ||||||||||||||||||

| Diluted |

$ | 0.01 | ||||||||||||||||||

| Weighted average shares used in calculating unaudited pro forma earnings per share(2): |

||||||||||||||||||||

| Basic |

104,299 | |||||||||||||||||||

| Diluted |

107,143 | |||||||||||||||||||

| Summary Non-GAAP Financial Measures: |

||||||||||||||||||||

| Non-GAAP net profit (loss) |

$ | (4,074 | ) | $ | (809 | ) | $ | 3,331 | $ | 529 | $ | 1,839 | ||||||||

| (1) | Share-based compensation expense is included in the following financial statements line items: |

| For the Year Ended December 31, | For the Three Months Ended March 31, |

|||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| Share-based compensation expense included in general and administrative |

$ | 31 | $ | 27 | $ | 2,507 | $ | 1,459 | $ | 347 | ||||||||||

| (2) | The unaudited pro forma earnings per share data and weighted average shares used in calculating unaudited pro forma earnings per share data reflects the automatic conversion of our outstanding preferred shares as of March 31, 2011 into 65,016,438 ordinary shares. It does not reflect the issuance and sale of 8,195,662 Series G preferred shares in May 2011, the issuance of 3,665,517 ordinary shares upon the exercise of options after March 31, 2011 or the issuance of 1,078,710 ordinary shares to Justin International Limited or its nominees following this offering. |

12

Table of Contents

The following table presents a summary of our balance sheet data as of December 31, 2008, 2009 and 2010 on an actual basis and as of March 31, 2011:

| • | on an actual basis; |

| • | on a pro forma basis to reflect (i) the automatic conversion of all of our outstanding preferred shares into 73,212,100 ordinary shares immediately prior to the closing of this offering, as if it had occurred on March 31, 2011, (ii) the proceeds received from the issuance and sale of 8,195,662 Series G preference shares in May 2011, as if it had occurred on March 31, 2011, and (iii) the issuance and sale of 3,665,517 ordinary shares upon the exercise of options between April 1, 2011 and the date of this prospectus; and |

| • | on a pro forma as adjusted basis to further reflect (i) the issuance and sale of 75,480,000 ordinary shares in the form of ADSs by us in this offering and our receipt of the estimated net proceeds from this offering, each based on an assumed initial offering price of $15.00 per ADS (which is the midpoint of the estimated public offering price range), after deducting underwriting discounts and commissions and estimated offering expenses payable by us and (ii) the issuance of 1,078,710 ordinary shares to Justin International Limited or its nominee following this offering pursuant to a sales and purchase agreement. |

| As of December 31, | As of March 31, 2011 | |||||||||||||||||||||||

| 2008 | 2009 | 2010 | Actual | Pro Forma |

Pro Forma As Adjusted |

|||||||||||||||||||

| (in thousands) |

||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Summary Consolidated Balance Sheet Data: |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 2,339 | $ | 2,851 | $ | 11,061 | $ | 16,238 | $ | 17,974 | $ | 84,873 | ||||||||||||

| Working capital (deficit) |

(2,837 | ) | (2,691 | ) | 5,151 | (3,184 | ) | 14,543 | 81,442 | |||||||||||||||

| Total assets |

29,044 | 33,333 | 43,831 | 61,174 | 63,262 | 130,161 | ||||||||||||||||||

| Total liabilities |

11,170 | 13,116 | 12,909 | 28,411 | 12,772 | 10,767 | ||||||||||||||||||

| Contingently redeemable convertible preferred shares |

20,947 | 20,947 | 35,607 | 36,113 | — | — | ||||||||||||||||||

| Convertible preferred shares |

229 | 229 | 229 | 229 | — | — | ||||||||||||||||||

| Total shareholders’ equity (deficit) |

(3,073 | ) | (730 | ) | (4,685 | ) | (3,350 | ) | 50,490 | 119,394 | ||||||||||||||

The following table presents a summary of our cash flow data for the years ended December 31, 2008, 2009 and 2010 and for the three months ended March 31, 2010 and 2011.

| For the Year Ended December 31, | For the Three Months Ended March 31, |

|||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| Summary Consolidated Cash Flow Data: |

||||||||||||||||||||

| Net cash generated from (used in) operating activities |

$ | 1,923 | $ | 847 | $ | 6,213 | $ | 1,727 | $ | (230 | ) | |||||||||

| Net cash used in investing activities |

(7,701 | ) | (2,053 | ) | (7,422 | ) | (2,510 | ) | (8,114 | ) | ||||||||||

| Net cash from financing activities |

3,993 | 1,720 | 9,488 | 7,334 | 13,485 | |||||||||||||||

| Net (decrease) increase in cash and cash equivalents |

(1,980 | ) | 512 | 8,210 | 6,536 | 5,177 | ||||||||||||||

Non-GAAP Financial Measures

We define non-GAAP net profit (loss) as net profit (loss) excluding share-based compensation expenses and loss on termination of control agreements with Talkie and Vispac. We utilize non-GAAP net profit (loss) to

13

Table of Contents

obtain a better understanding of our operating performance. We also believe it is useful supplemental information for investors and analysts to assess our operating performance without the effects of share-based compensation expense and the impact of the termination of control agreements with Talkie and Vispac.

While we will continue to incur share-based compensation expense in the future, the expense reflected in the March 31, 2011 statement of operations is the result of changes in fair value for ordinary share options and Series D preferred share options held by employees of PayEase that require liability classification. The underlying option grants pertaining to these awards were made in 2005 and 2006, and the ongoing expense is a result of their required liability classification.

One of the limitations of using non-GAAP net profit (loss) is that it does not include all items that impact our net profit (loss) for the period. In addition, because non-GAAP net profit (loss) is not calculated in the same manner by all companies, it may not be comparable to other similar titled measures used by other companies. In light of the foregoing limitations, you should not consider non-GAAP net profit (loss) in isolation or an alternative to net profit (loss) prepared in accordance with GAAP. We encourage investors and others to review our financial information in its entirety and not rely on a single financial measure.

| For the Year Ended December 31, | For the Three Months Ended March 31, |

|||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||

| Net profit (loss) |

$ | (10,837 | ) | $ | (836 | ) | $ | 824 | $ | (930 | ) | $ | 1,492 | |||||||

| Add back: share-based compensation expense |

31 | 27 | 2,507 | 1,459 | 347 | |||||||||||||||

| Add back: loss on termination of control agreements with Talkie and Vispac |

6,732 | — | — | — | — | |||||||||||||||

| Non-GAAP net profit (loss) |

(4,074 | ) | (809 | ) | 3,331 | 529 | 1,839 | |||||||||||||

14

Table of Contents

Investing in our ADSs involves a high degree of risk. You should consider carefully all of the information in this prospectus, including the risks and uncertainties described below, before making an investment in our ADSs. Any of the following risks could have a material adverse effect on our business, financial condition and results of operations. In any such case, the trading price of our ADSs could decline, and you may lose all or part of your investment.

This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements due to the material risks that we face described below.

Risks Related to Our Business and Industry

We generated 98.1%, 81.1%, 73.3% and 51.9% of our total net revenues for 2008, 2009 and 2010 and for the three months ended March 31, 2011, respectively, from China Unicom, one of the three mobile telecommunications services providers in China. Any loss or deterioration of our relationship with China Unicom would result in the loss of significant net revenues and would harm our ability to expand our customer database and grow our business. In addition, significant changes in policies or guidelines of China Unicom could materially and adversely impact our business operations and financial condition.

Total net revenues we received from China Unicom constituted 98.1%, 81.1%, 73.3% and 51.9%, of our total net revenues for 2008, 2009 and 2010 and for the three months ended March 31, 2011, respectively. We derived these net revenues from one-time commissions that we generated from sales of China Unicom network cards with calling plans on behalf of regional affiliates of China Unicom. Subsequent to our acquiring a new customer for China Unicom, we provide customer retention services to these customers. In return, we receive various commissions based on certain percentages of wireless communication charges incurred by end customers acquired by us. We also derive other net revenues from China Unicom, for example, through incentive rewards that we receive from regional affiliates of China Unicom for achieving certain customer acquisition targets. As a result, our net revenues depend substantially on our relationship with China Unicom.

We do not have a long-term strategic cooperation agreement with China Unicom. We enter into agreements with regional affiliates of China Unicom with varying provisions and terms typically ranging from one to three years. In 2010, the Company had approximately 40 contracts with 16 different local affiliates of China Unicom. The contracting China Unicom regional affiliate may have the right to terminate the agreement prior to the expiration of its term under specified circumstances. In addition, China Unicom is not under any legal obligation to renew these agreements upon their expiration.

If we fail to retain a significant amount of business from China Unicom due to our failure to meet service level expectations, failure to renew existing agreements or any loss or deterioration of our relationships with any of China Unicom’s regional affiliates, we would lose significant net revenues and our results of operations and financial condition would be materially and adversely affected. Moreover, a significant portion of our direct sales efforts are based on customer lists provided by China Unicom and a significant portion of our sales of China Unicom mobile phone packages are made to customers on these lists. If China Unicom ceases to provide us with customer lists for our direct marketing activities, to allow us to use information about its customers for our direct marketing activities or to allow us to sell airtime packages to customers, our ability to generate net revenues and our ability to expand and leverage our customer database would suffer, and our business would be adversely affected.

In addition, our net revenues and profitability could be materially and adversely affected if China Unicom decides to change its policies or guidelines with respect to its product or services, such as lowering the prices or fees to maintain or increase its competitiveness. Any such change in policies or guidelines may result in lower net revenues or additional operating costs for us, and we cannot assure you that our financial condition and

15

Table of Contents

results of operation will not be materially and adversely affected by any policy or guideline change by China Unicom in the future.

We rely to a significant extent on China Unicom to calculate our monthly revenues from them.

According to our agreements with China Unicom, we are entitled to various fees for the customers that we acquire, such as upfront commissions, monthly phone bill commissions and sales incentives. We currently rely on China Unicom to track certain customer information, calculate our monthly revenues from that information and remit to us payments from merchants for services that we perform for the merchants. Our ability to undertake effective summary, differentiation, stratification and analysis to reconcile the revenues calculated by China Unicom is limited due to our limited access to the database operated by China Unicom. Any miscalculation by China Unicom or potential disputes between us and China Unicom in respect of such calculations may have a material and adverse effect on our business operations and financial results.

We generated 98.1%, 81.4%, 82.9% and 90.3% of our total net revenues for 2008, 2009, 2010 and for the three months ended March 31, 2011, respectively, from our direct marketing services. To achieve our goal of becoming the dominant provider of data-driven multi-channel direct marketing, customer loyalty and predictive data analytics solutions in China, we must significantly grow our customer loyalty services and predictive data analytics businesses. If we are unable to successfully grow these segments of our business, we may not be able to execute on our strategy and our business and results of operations could be materially and adversely impacted.

We operate and manage our business as three reportable segments: direct marketing services, customer loyalty services and predictive data analytics services. Net revenues we generated from our direct marketing services constituted 98.1%, 81.4%, 82.9% and 90.3%, for the years ended December 31, 2008, 2009, 2010 and for the three months ended March 31, 2011, respectively. Net revenues we generated from our customer loyalty services constituted 1.9%, 18.6%, 10.2% and 8.7% for the years ended December 31, 2008, 2009, 2010 and for the three months ended March 31, 2011, respectively. We recognized $1.2 million in net revenues from our predictive data analytics services, which we began to offer in the first quarter of 2010. We recognized $0.1 million of net revenues from our predictive data analytics services for the three months ended March 31, 2011. To achieve our goal of becoming the dominant provider of customer loyalty, data-driven multi-channel direct marketing and predictive data analytics services, we must significantly grow our customer loyalty services and predictive data analytics businesses. Growing our customer loyalty services and data analytics services revenues will require substantial management efforts and the dedication of additional resources. We cannot assure you that we will be able to successfully grow and expand our customer loyalty services and our predictive data analytics services. If we are not able to successfully grow our customer loyalty and predictive data analytics businesses and substantially increase the revenues that we generate from these segments, we may not be able to execute on our business plan, and our business and results of operations could be materially and adversely impacted.

We establish business relationships with major telecommunications service providers in China through different legal entities. Some of these contracts contain exclusivity provisions restricting the party to the contract from engaging in similar arrangements with other telecommunications companies. Although we establish business relationships with major telecommunications service providers in China through different legal entities and we believe we comply with the legal requirements of these exclusivity provisions, we cannot assure you that such telecommunications service providers will agree if they were unaware, and become aware, that we are providing similar services to other telecommunications service providers that may compete with them. If such telecommunications service providers take the position that we are in violation of these exclusivity provisions, they could choose not to renew their contracts with us or claim that we are in breach of our contracts with them, which could substantially harm our ability to grow our customer loyalty services and predictive data analytics programs. We expect to continue to rely upon our direct marketing services for a substantial portion of our revenues.

16

Table of Contents

China Unicom or China Telecom may claim that we do not own a portion of the content in our database, which could limit our ability to provide our predictive data analytics solutions to other clients.

We depend upon data from external sources, including data received from clients and customers, for information used in our database. For instance, we rely on China Unicom to provide us with call lists for our direct marketing activities as well as lists of merchants for the customer loyalty programs we develop, implement and manage on their behalf. We have two customer loyalty services agreements with affiliates of each of China Unicom and China Telecom and one direct marketing services agreement with a China Unicom affiliate that specifically restrict us from disclosing or using customer data and further providing that these clients own all the information, content and data related to the programs we develop under such agreements. While the data that we collect under these agreements are not commingled with data in our other databases, we cannot assure you that we will not inadvertently disclose or use this information, which could harm our client relationships.

In addition, certain of the direct marketing services agreements with regional affiliates of China Unicom and certain of the customer loyalty services agreements with China Telecom and China Unicom specify that we may not disclose any information provided by our clients to any third parties or use this information for any purpose not related to the services contemplated. Other than the limited data provided to us by China Unicom and China Telecom under these agreements, we believe that the other customer data, such as data regarding age, gender, income and spending patterns, which we collect with customer consent, is not collected for the purpose of performing services under these agreements and can be freely used by us. While we believe we can freely use the customer data we have accumulated, we cannot assure you that China Unicom or China Telecom will not challenge our usage of the additional information we have collected. Further, China Unicom and China Telecom may not be aware of the extent to which we collect and use such customer data. If either China Unicom or China Telecom were to challenge our usage of this information and we were unsuccessful, we could be precluded from further exploiting portions of our customer database to provide our services to other clients or be required to obtain a license from China Unicom or China Telecom to use such information and we may also be held liable for violating confidentiality provisions, which could materially and adversely affect our predictive data analytics services.

We rely on our nominee agreement with PayEase Beijing to conduct substantially all of our customer loyalty services business. If we were unable to continue to enjoy the economic benefits of this relationship under this agreement, our business, client and customer relationships could be materially harmed.

In 2008, 2009, 2010 and for the three months ended March 31, 2011, 100.0%, 98.7%, 53.0% and 43.1% of our customer loyalty services revenues, respectively, were derived from business contracts subject to the nominee agreement that we entered into with PayEase Beijing (HK) Limited, or PayEase Beijing, to enable us to receive the economic benefits under certain customer loyalty services contracts to which certain subsidiaries and controlled affiliates of PayEase Beijing are parties. These contracts relate to the customer loyalty services transferred to us in our separation from PayEase. Under the nominee agreement, the relevant subsidiaries and controlled affiliates of PayEase Beijing deal with the specified contracts as our nominee, and all economic benefits and obligations arising from these contracts belong to us. The obligations of PayEase Beijing under the nominee agreement have been assumed by the former PayEase subsidiary operating the online payment processing business in China, PayEase Technology Beijing. If we were unable to continue to enjoy the economic relationship benefits of this agreement, our business, client and customer relationships could be materially harmed. See “Related Party Transactions—Nominee Agreement (with PayEase Beijing (HK) Limited).”

If we fail to increase the number and types of clients who use our services, we may not be able to maintain or increase net revenues or enhance our proprietary database.

Our future growth depends, in part, on our ability to provide our services to clients other than mobile services providers. We cannot assure you that we will be able to expand our services significantly beyond our current client base. We expect to invest substantial amounts to:

| • | expand our client and customer base, including through increased marketing and improved brand recognition; |

17

Table of Contents

| • | expand and enhance our services, including expanding existing and opening new operation centers; |

| • | develop and maintain close relationships with customers and merchants to preserve existing and establish new competitive products and services; |

| • | pursue strategic acquisitions and partnerships; |

| • | develop new client relationships and strengthen existing client relationships; |

| • | continue to augment our proprietary customer database and our predictive data analytics capabilities; and |

| • | expand our cross-selling operations on behalf of our clients. |

If we fail to successfully implement these programs or to substantially increase adoption of our services, we may not be able to expand our client base or increase the size of our database. In such an event, our net revenues growth would be adversely affected and our business would suffer. In addition, the future success of our business depends on our ability to continue to attract and retain existing clients and to offer value-added services to our clients by using information in our customer database. If we are unable to continually attract and retain a substantial number of new clients that use our services on a recurring basis, our ability to develop value-added services for our clients and our direct and cross-selling efforts may be harmed, we may not be able to maintain or increase our profitability, and our business would be materially and adversely affected.

Our limited operating history makes it difficult to evaluate our business and prospects.

Through our acquisitions of Talkie and Vispac in 2007, and our acquisition in 2008 of the contract between Justin International Limited and China Unicom, we began providing location-based marketing services to regional affiliates of China Unicom. We only began providing predictive data analytics services in the first quarter of 2010. As such, our limited operating history in our current business segments may not provide a meaningful basis for evaluating our business and prospects. We expect our service offerings to continue to evolve over time. You should consider our business and prospects in light of the risks and uncertainties experienced by early stage companies. Some of these risks and uncertainties relate to our ability to:

| • | develop, deliver and manage the introduction of new services successfully; |

| • | anticipate growth in the market and client and customer needs accurately; |

| • | manage our expanding operations, including the integration of any future acquisitions; |

| • | improve our brand recognition, maintain and enhance our reputation, and increase the size of and retain our client, customer and merchant base; |

| • | form and maintain close relationships with clients to maintain and develop competitive services; |

| • | respond to and manage costs or potential limitations on our business activities resulting from regulatory developments in our industry; |

| • | compete effectively and increase or maintain net revenues and market share; |

| • | control our costs and expenses; |

| • | raise sufficient capital to sustain and expand our business; and |

| • | attract, retain and motivate qualified personnel. |

If we are unsuccessful in addressing any of these risks and uncertainties, our business may be materially and adversely affected.

Our predictive data analytics services segment has only recently been introduced and, as a result, it may be difficult to evaluate its performance and prospects.

In the first quarter of 2010, we began to offer customer database consulting and data-driven marketing advisory services to help our clients increase market share and penetrate new market segments by leveraging our

18

Table of Contents

dynamic database and our data analytics capabilities. In 2010, we recognized $1.2 million in net revenues from our predictive data analytics services segment and for the three months ended March 31, 2011 we recognized $0.1 million in net revenues from this segment. Given our limited operating history in this segment, such results may not provide a meaningful basis for evaluating our performance and prospects with respect to our predictive data analytics services business. We may not be able to achieve similar results in future periods. Accordingly, you should not rely on our results of operations for any prior periods as an indication of the future performance or prospects of our predictive data analytics services segment. You should consider our prospects in this segment in light of the risks and uncertainties relating to our ability to:

| • | secure new or renew existing database consulting and data-driven marketing advisory service contracts; |

| • | develop and maintain client relationships, particularly as we do not have longstanding business relationships with current clients in our predictive data analytics services segment; |

| • | increase awareness of our predictive data analytics capabilities; |

| • | manage risks associated with intellectual property rights and database management; and |

| • | upgrade our technology and infrastructure to expand our predictive data analytics service offerings. |

If we are unsuccessful in addressing any of these risks and uncertainties, we may not be able to successfully grow our predictive data analytics services business.

Our growth prospects may be adversely affected if the market for our services and the industries we serve fail to grow.

Our growth and our ability to maintain profitability depend on acceptance of the services that we offer. Our clients may not continue to use our direct marketing, customer loyalty and predictive data analytics services. In addition, our services generate material recurring net revenues from China Unicom for airtime usage by customers that we acquired on their behalf. We also generate net revenues from the sale of China Unicom products and services, such as SIM cards and mobile phone sets, and through incentive rewards paid by China Unicom for achievement of customer acquisition targets. As a result, any decline in the growth of China’s mobile communications services sector, including any decline in demand for our clients such as China Unicom’s products and services, for reasons beyond our control, such as customer preference for a competing product or service or a reduction in our clients’ marketing efforts, could make it more difficult for us to successfully market China Unicom’s mobile services. Any decrease in the demand for our services could have a material adverse effect on our growth, net revenues and operating results.

If we are not able to manage our growth, we may not be able to maintain or increase profitability and our business would be materially and adversely affected.

Our total net revenues have grown from $12.6 million for the year ended December 31, 2009 to $17.7 million for the year ended December 31, 2010 and grew from $3.7 million for the three months ended March 31, 2010 to $6.0 million for the three months ended March 31, 2011. We intend to continue to grow our business in the near future organically, as well as potentially through business acquisitions. To support our growth plans, in particular our expansion into additional provinces in China, we may need to expand our existing management team, operational, financial and human resources, facilities, customer service capabilities and information systems and controls. All of these measures will require substantial management efforts and the dedication of additional resources. We cannot assure you that we will be able to implement these measures successfully or effectively manage our growth and expanding operations. If we are not able to successfully manage this growth, we may not be able to maintain or increase our profitability, and our business would be materially and adversely affected.

19

Table of Contents

We could lose our access to data from third parties, which could harm our ability to provide our solutions to clients and adversely affect our business.

Our sources of data, such as China Unicom, could stop providing us with this data, such as call lists, in the future, and we could also become subject to regulatory restrictions on the use of such data, in particular if such data is not collected in a way which allows us to legally use and/or process the data. If a substantial number of data sources, or certain key sources, were to stop providing or be unable to provide this data, or if we were to lose access to this data due to regulation, or if the cost of this data became too expensive, our ability to provide customer loyalty or direct marketing solutions to our clients could be impacted, which could materially and adversely affect our business, reputation, financial condition and operating results.

We may undertake acquisitions or investments to further expand our business and we may not realize the anticipated benefits of these acquisitions or investments.

As part of our growth strategy, we will continue to evaluate opportunities to acquire or invest in other businesses or in intellectual property or technologies that would complement our businesses, expand the scope of our sector and geographic coverage of markets we can address or enhance our capabilities. Any such acquisition or investment may require a significant amount of capital investment. Acquisitions and investments entail a number of risks that could materially and adversely affect our business, operating and financial results, including:

| • | problems integrating the acquired operations, technologies or products into our existing business; |

| • | diversion of management’s time and attention from our core business; |

| • | need for financial resources above our planned investment levels; |

| • | failure to realize anticipated synergies; |

| • | adverse effects on existing business relationships with clients; |

| • | difficulties in maintaining business relationships established by the acquired company; |

| • | risks associated with entering markets in which we lack experience; |

| • | potential loss of key employees of the acquired company; |

| • | deterioration in the quality of our services; |

| • | potential write-offs of acquired assets; and |

| • | potential expenses related to the amortization of intangible assets and goodwill impairment. |

In addition, if we use our equity securities to pay for acquisitions, our shareholders will experience dilution. If we borrow funds to finance acquisitions, such debt instruments may contain restrictive covenants that can, among other things, restrict us from distributing dividends. Our failure to address the risks associated with acquisition and investment activities may have a material adverse effect on our financial condition and results of operations.

An impairment in the carrying value of our goodwill or other intangible assets could adversely affect our financial condition and results of operations.