UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

For the quarterly period ended

OR

For the transition period from __________ to __________

COMMISSION FILE NUMBER:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of | (IRS Employer |

(Address of principal executive offices)

+

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ |

Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act.

Yes

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which |

N/A |

| N/A |

| N/A |

As of March 31, 2022, there were

TABLE OF CONTENTS

| 5 | |||

5 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 27 | |||

30 | ||||

31 | ||||

32 | ||||

32 | ||||

32 | ||||

32 | ||||

32 | ||||

32 | ||||

32 | ||||

33 | ||||

34 |

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievement expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described under Part 1 Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference in this report, or that we filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

3

OTHER PERTINENT INFORMATION

References in this quarterly report to “we,” “us,” “our” and the “Company” refer to China United Insurance Service, Inc., its subsidiaries and variable interest entities.

References to China or the PRC refer to the People’s Republic of China (excluding Hong Kong, Macao and Taiwan). References to Taiwan refer to Republic of China.

Unless context indicates otherwise, reference to the “Company” in this quarterly report refers to China United Insurance Service, Inc. and its subsidiaries. Reference to “AHFL” refers to the combined operations of Action Holdings Financial Limited and its Taiwan Subsidiaries (as defined below). Reference to “Anhou” refers to the combined operations of Law Anhou Insurance Agency Co., Ltd. and its subsidiaries.

Our business is conducted in Taiwan and China using New Taiwanese Dollars (“NT$” or “NTD”), the currency of Taiwan, Hong Kong Dollars (“HK$” or “HKD”), the currency of Hong Kong, and RMB, the currency of China, respectively, and our financial statements are presented in United States dollars (“USD”, “US$” or “$”). In this quarterly report, we refer to assets, obligations, commitments and liabilities in our financial statements in U.S. dollars. These dollar references are based on the exchange rate of NT$, HK$ and RMB to USD, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of U.S. dollars which may result in an increase or decrease in the amount of our obligations (expressed in USD) and the value of our assets, including accounts receivable (expressed in USD).

4

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

March 31, | December 31, | |||||

(Amount in USD) |

| 2022 |

| 2021 | ||

ASSETS | ||||||

Current assets | ||||||

Cash and cash equivalents | $ | | $ | | ||

Time deposits |

| |

| | ||

Accounts receivable |

| |

| | ||

Contract assets | | — | ||||

Marketable securities | | — | ||||

Other current assets |

| |

| | ||

Total current assets |

| |

| | ||

| ||||||

Right-of-use assets under operating leases | ||||||

Property and equipment, net |

| |

| | ||

Intangible assets, net |

| |

| | ||

Long-term investments |

| |

| | ||

Restricted cash – noncurrent |

| |

| | ||

Deferred tax assets | | | ||||

Other assets |

| |

| | ||

TOTAL ASSETS | $ | | $ | | ||

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| ||

Current liabilities |

|

|

|

| ||

Commission payable to sales professionals | $ | | $ | | ||

Short-term loans | | | ||||

Income tax payable - current |

| |

| | ||

Operating lease liabilities - current | | | ||||

Due to related parties |

| |

| | ||

Other current liabilities |

| |

| | ||

Total current liabilities |

| |

| | ||

Income tax payable - noncurrent |

| |

| | ||

Operating lease liabilities - noncurrent | | | ||||

Net defined benefit liabilities - noncurrent | | | ||||

Other liabilities |

| |

| | ||

TOTAL LIABILITIES |

| |

| | ||

|

| |||||

COMMITMENTS AND CONTINGENCIES |

|

|

|

| ||

|

| |||||

STOCKHOLDERS’ EQUITY |

|

|

|

| ||

Preferred stock, par value $ |

| |

| | ||

Common stock, par value $ |

| |

| | ||

Additional paid-in capital |

| |

| | ||

Statutory reserves | |

| | |||

Retained earnings |

| |

| | ||

Accumulated other comprehensive income |

| |

| | ||

Total stockholders’ equity attributable to China United’s shareholders |

| |

| | ||

Noncontrolling interests |

| |

| | ||

TOTAL STOCKHOLDERS’ EQUITY |

| |

| | ||

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | | $ | | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

Three Months Ended | ||||||

March 31, | ||||||

(Amount in USD) |

| 2022 |

| 2021 | ||

Revenue | $ | | $ | | ||

Cost of revenue |

| |

| | ||

| ||||||

Gross profit |

| |

| | ||

Operating expenses: |

|

|

| |||

Selling |

| |

| | ||

General and administrative |

| |

| | ||

Total operating expense |

| |

| | ||

Income from operations |

| |

| | ||

|

| |||||

Other income (expenses): |

|

|

|

| ||

Interest income |

| |

| | ||

Interest expenses |

| ( |

| ( | ||

Foreign currency exchange gains |

| |

| | ||

Other - net |

| |

| | ||

Total other income, net |

| |

| | ||

Income before income taxes |

| |

| | ||

Income tax expense |

| ( |

| ( | ||

Net income |

| |

| | ||

Less: net income attributable to noncontrolling interests |

| ( |

| ( | ||

Net income attributable to China United’s shareholders |

| |

| | ||

Other comprehensive items, net of tax: |

|

| ||||

Foreign currency translation loss |

| ( |

| ( | ||

Other |

| |

| | ||

Total other comprehensive loss | ( | ( | ||||

Comprehensive income | | |||||

Less: comprehensive income attributable to noncontrolling interests | ( | ( | ||||

Comprehensive income attributable to China United’s shareholders | $ | | $ | | ||

Weighted average shares outstanding: |

|

| ||||

Basic and diluted |

| |

| | ||

Earnings per share attributable to common stockholders of China United: |

|

| ||||

Basic and diluted | | | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

6

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

Accumulated | ||||||||||||||||||||||||||||||||

Additional | Other | |||||||||||||||||||||||||||||||

Common | Preferred | Paid-in | Statutory | Comprehensive | Retained | Noncontrolling | Total | |||||||||||||||||||||||||

(Amount in USD) |

| Stock |

| Amount |

| Stock |

| Amount |

| Capital |

| Reserves |

| Income |

| Earnings |

| Total |

| Interests |

| Equity | ||||||||||

Balance December 31, 2021 |

| | $ | | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | |||||||||||

Foreign currency translation loss |

| — |

| — |

| — |

| — |

| — |

| — |

| ( |

| — |

| ( |

| ( |

| ( | ||||||||||

Other comprehensive income |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — | ||||||||||

Net income |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| |

| |

| |

| | ||||||||||

Balance March 31, 2022 |

| | $ | | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | |||||||||||

Accumulated | ||||||||||||||||||||||||||||||||

Additional | Other | |||||||||||||||||||||||||||||||

Common | Preferred | Paid-in | Statutory | Comprehensive | Retained | Noncontrolling | Total | |||||||||||||||||||||||||

(Amount in USD) |

| Stock |

| Amount |

| Stock |

| Amount |

| Capital |

| Reserves |

| Income |

| Earnings |

| Total |

| Interests |

| Equity | ||||||||||

Balance December 31, 2020 |

| | $ | | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | |||||||||||

Foreign currency translation loss |

| — |

| — |

| — |

| — |

| — |

| — |

| ( |

| — |

| ( |

| ( |

| ( | ||||||||||

Other comprehensive income |

| — |

| — |

| — |

| — |

| — |

| — |

| |

| — |

| |

| |

| | ||||||||||

Net income |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| |

| |

| |

| | ||||||||||

Balance March 31, 2021 |

| | $ | | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | |||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

7

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amount in USD) | Three Months Ended March 31, | |||||

| 2022 |

| 2021 | |||

Cash flows from operating activities: | ||||||

Net income | $ | | $ | |||

Adjustments to reconcile net income to net cash provided by operating activities |

|

| ||||

Depreciation and amortization |

| |

| |||

Amortization of right-of-use assets | | |||||

Amortization of bond premium |

| — |

| | ||

Gain on sales of financial assets |

| — | ( | |||

Loss on valuation of financial assets |

| | | |||

Loss on disposals of equipment | | | ||||

Deferred income tax |

| |

| | ||

Unrealized foreign currency exchange (gains) | ( | — | ||||

Net changes in operating assets and liabilities: |

|

| ||||

Accounts receivable |

| |

| | ||

Contract assets | ( | ( | ||||

Other current assets |

| ( |

| | ||

Other assets |

| |

| ( | ||

Commission payable to sales professionals |

| ( |

| ( | ||

Income tax payable |

| |

| | ||

Other current liabilities |

| ( |

|

| ( | |

Other liabilities |

| — |

| ( | ||

Lease liabilities | ( | ( | ||||

Net cash provided by operating activities |

| |

|

| | |

Cash flows from investing activities: |

|

| ||||

Purchases of marketable securities | ( | — | ||||

Purchases of time deposits |

| ( |

| ( | ||

Proceeds from maturities of time deposits |

| |

| |||

Proceeds from receipts in advance of disposal of a subsidiary |

| |

| — | ||

Proceeds from sales of marketable securities | — | | ||||

Purchase of equipment |

| ( |

| ( | ||

Purchase of intangible assets | ( | ( | ||||

Net cash (used in) provided by investing activities |

| ( |

| | ||

Cash flows from financing activities: |

|

|

|

| ||

Proceeds from short-term loans |

| |

| |||

Repayment of short-term loans |

| ( |

| ( | ||

Repayment of related party borrowings |

| ( |

| ( | ||

Net cash provided by financing activities | |

| | |||

| ||||||

Foreign currency translation |

| ( |

| ( | ||

Net increase in cash, cash equivalents and restricted cash |

| |

| | ||

| ||||||

Cash, cash equivalents and restricted cash, beginning balance |

| |

| | ||

Cash, cash equivalents and restricted cash, ending balance | $ | | $ | | ||

| ||||||

SUPPLEMENTARY DISCLOSURE: |

| |||||

Interest paid | $ | | $ | | ||

Income tax paid | $ | — | $ | — | ||

SUPPLEMENTARY DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES: | ||||||

Lease liabilities arising from new right-of-use assets | $ | | $ | | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

8

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amount in USD)

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES

China United Insurance Service, Inc. (“China United” or “CUII”), its subsidiaries and variable-interest entity and its subsidiaries (collectively referred to herein as the “Company”) primarily engage in insurance brokerage and insurance agency services. The Company markets and sells to customers two broad categories of insurance products: life insurance products and property and casualty insurance products, both focused on meeting the particular insurance needs of individuals. The insurance products are underwritten by some of the leading insurance companies in Taiwan and China. The Company manages its business through aggregating them into three geographic operating segments, Taiwan, the PRC, and Hong Kong. The Company’s common stock currently trades over the counter under the ticker symbol “CUII” on the OTCQB.

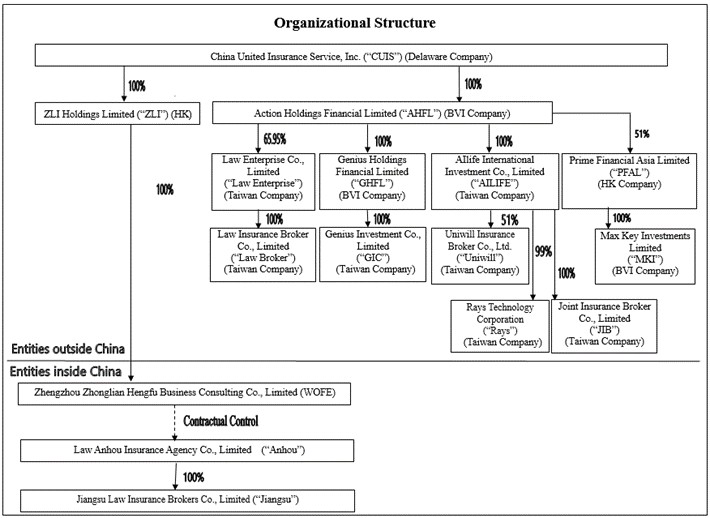

The corporate structure as of March 31, 2022 is as follows:

On January 31, 2022, Genius Investment Consultant Co., Ltd (“GIC”), a subsidiary entity of CUII entered into a stock transfer agreement with AIlife International Investment Co., Ltd. (“AIlife”), pursuant to which GIC sold and transferred to AIlife

9

therefore, they were accounted for at the carrying amount of the equity interests transferred and there was no impact on consolidated financial statements as of and for the three months ended March 31, 2022.

On February 25, 2022, Law Anhou Insurance Agency Co., Ltd. (“Law Anhou”), a contractually controlled entity of CUII entered into a Share Purchase Agreement with Jiangsu Law Insurance Brokerage Co., Ltd. (“Jiangsu Law”) and third-party buyers, pursuant to which Law Anhou shall sell and transfer

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The unaudited condensed consolidated financial statements include the accounts of China United, its subsidiaries and variable interest entity and its subsidiaries as shown in the corporate structure in Note 1. All significant intercompany transactions and balances have been eliminated in consolidation. Certain reclassifications have been made to the consolidated financial statements for prior year to the current year’s presentation. Such reclassifications have no effect on net income and the cash flow statements operating activities as previously reported.

Basis of Presentation

The unaudited condensed consolidated financial statements presented herein have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and in accordance with the instructions to Form 10-Q and Regulation S-X. Accordingly, the financial statements do not include all of the information and notes required by GAAP for complete financial statements. In the opinion of management, all adjustments, including normal recurring adjustments, considered necessary for a fair statement of the financial statements have been included. Operating results for the three months ended March 31, 2022 are not necessarily indicative of the results that may be expected for the year ending December 31, 2022.

These unaudited condensed consolidated financial statements and notes thereto should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto for the year ended December 31, 2021, which were included in the Company’s 2021 Annual Report on Form 10-K (“2021 Form 10-K”). The accompanying consolidated balance sheet as of December 31, 2021, has been derived from the Company’s audited consolidated financial statements as of that date.

Use of Estimates

The preparation of the Company’s unaudited condensed consolidated financial statements in conformity with GAAP requires management to make estimates, judgments and assumptions that affect the amounts reported in the consolidated financial statements and footnotes thereto. Actual results may differ from those estimates and assumptions.

Variable Interest Entities

Due to the legal restrictions on foreign ownership and investment in insurance agency and brokerage businesses in China, especially those on qualifications as well as capital requirement of the investors, China United, through its subsidiary, Zhengzhou Zhonglian Hengfu Business Consulting Co., Limited (“WFOE”), entered into Exclusive Business Cooperation Agreement (the “EBCA”), Power of Attorney, Option Agreement, and Share Pledge Agreement (collectively, the First VIE Agreements) on January 17, 2011 with Anhou and Anhou original shareholders so as to operate and conduct the insurance agency and brokerage business in the PRC.

Pursuant to the EBCA, (a) WFOE has the right to provide Anhou with complete technical support, business support and related consulting services during the term of the EBCA; (b) Anhou agrees to accept all the consultations and services provided by WFOE. Anhou further agrees that unless with WFOE’s prior written consent, during the term of the EBCA, Anhou shall not directly or indirectly accept the same or any similar consultations and/or services provided by any third party and shall not establish similar cooperation relationship with any third party regarding the matters contemplated by the EBCA; (c) within 90 days after the end of each fiscal year Anhou shall pay an amount to WFOE equal to the shortfall, if any, of the aggregate net income of Anhou for such fiscal; (d) WFOE retains all exclusive and proprietary rights and interests in all rights, ownership, interests and intellectual properties arising out of or

10

created during the performance of the EBCA; and (e) the shareholders of Anhou have pledged all of their equity interests in Anhou to WFOE to guarantee Anhou’s performance of its obligations under the EBCA. The term of the EBCA is 10 years and may be extended and determined by WFOE prior to the expiration thereof, and Anhou shall accept such extended term unconditionally.

On March 23, 2022, Anhou and WFOE entered into an amendment to the EBCA, pursuant to which the EBCA shall be automatic renewed for successive terms unless WFOE gives a

To extend the business within the PRC, Anhou intended to increase its registered capital to RMB

As a result of the Second VIE Agreements, WFOE is considered the primary beneficiary of Anhou and has effective control over Anhou. Accordingly, the results of operations, assets and liabilities of Anhou and its subsidiaries (collectively, the “Consolidated Affiliated Entities” or the “CAE”) are consolidated from the earliest period presented. The Company reviews the VIE’s status on an annual basis and determine if any events have occurred that could cause its primary beneficiary status to change, which include (a) the legal entity’s governing documents or contractual arrangements are changed in a manner that changes the characteristics or adequacy of the legal entity’s equity investment at risk; (b) the equity investment or some part thereof is returned to the equity investors, and other interests become exposed to expected losses of the legal entity; (c) the legal entity undertakes additional activities or acquires additional assets, beyond those anticipated at the later of the inception of the entity or the latest reconsideration event, that increase the entity’s expected losses; and (d) the legal entity receives an additional equity investment that is at risk, or the legal entity curtails or modifies its activities in a way that decreases its expected losses. For the three months ended March 31, 2022 and 2021, no event taken place that would change the Company’s primary beneficiary status.

Marketable Securities

The Company invests part of its excessive cash in equity securities and money market funds. Marketable securities represent trading securities bought and held primarily for sale in the near-term to generate income on short-term price differences and are stated at fair value. Realized and unrealized gains and losses are recorded in other income (expense).

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable includes commission receivables stated at net realizable values. The Company reviews its accounts receivable regularly to determine if a bad debt allowance is necessary at each quarter-end. Management reviews the composition of accounts receivable and analyzes the age of receivables outstanding, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the necessity of making such allowance. No allowance was deemed necessary as of March 31, 2022 and December 31, 2021.

Revenue Recognition

The Company’s revenue is derived from insurance agency and brokerage services with respect to life insurance and property and casualty insurance products. The Company, through its subsidiaries and variable interest entities, sells insurance products provided by insurance companies to individuals, and is compensated in the form of commissions from the respective insurance companies, according to the terms of each service agreement made by and between the Company and the insurance companies. The core revenue recognition principle under ASC 606, the Company considers the contracts with insurance companies contain one performance obligation and consideration should be recorded when performance obligation is satisfied at point in time. The sale of an insurance product by the Company is considered complete when initial insurance premium is paid by an individual and the insurance policy is approved by the respective insurance company. When a policy is effective, the insurance company is obligated to pay the agreed-upon commission to the Company under the terms of its service agreement with the Company and such commission is recognized as revenue.

For the first year commission (FYC), the Company recognizes the revenue when the individuals’ policies are effective. The Company makes the estimation amount to be entitled for annual performance and operating bonus which is based on the FYC. The Company

11

makes an estimation on performance and operation bonus which are based on the accumulated FYC on quarterly basis, and make reconciliation between actual and estimation amount on annual basis. For the three months ended March 31, 2022 and 2021, the estimated revenue was approximately $

Others includes the contingent commissions for subsequent years, the bonus based on persistency ratio bonus, and service allowances, are considered highly susceptible to factors outside the company's influence and depend on the actions of third parties (i.e., the subsequent premiums paid by individual policyholders), and the uncertainty can be extended for many years. Considering the high uncertainties, the contingent commissions for subsequent years, the bonus based on persistency ratio, and service allowances will be recognized as revenue based on the actual amount received from the insurance companies after the uncertain event is resolved.

For property and casualty insurance products, the Company recognizes the revenue when the individuals’ policies are effective. The revenue from property and casualty insurance products were

The Company is obligated to pay commissions to its sales professionals when an insurance policy becomes effective. The Company recognizes commission revenue granted from insurance companies on a gross basis, and the commissions paid to its sales professionals are recognized as cost of revenue.

The Company enters into service agreements with insurance companies, which may give rise to contract assets and contract liabilities. When the timing of revenue recognition differs from the timing of payments made by insurance companies, the Company recognizes either contract assets (its performance precedes the billing date) or contract liabilities (customer payment is received in advance of performance).

Foreign Currency Transactions

China United’s financial statements are presented in U.S. dollars ($), which is the China United’s reporting and functional currency. The functional currencies of the China United’s subsidiaries are New Taiwan dollar (“NTD”), China yuan (“RMB”) and Hong Kong dollar (“HKD”). Each subsidiary maintains its financial records in its own functional currency. Transactions denominated in foreign currencies are measured at the exchange rates prevailing on the transaction dates. Monetary assets and liabilities denominated in foreign currencies are remeasured at the exchange rates prevailing at the balance sheet date. Non-monetary items that are measured in terms of historical cost in foreign currency are remeasured using the exchange rates at the dates of the initial transactions. Exchange gains and losses are included in the consolidated statements of operations and other comprehensive income (loss).

The Company translates the assets and liabilities into U.S. dollars using the rate of exchange prevailing at the balance sheet date and the statements of operations and cash flows are translated at an average rate during the reporting period. Adjustments resulting from the translation from NTD, RMB and HKD into U.S. dollars are recorded in stockholders’ equity as part of accumulated other comprehensive income. The exchange rates used for unaudited condensed consolidated financial statements are as follows:

Average Rate for the three months ended | ||||||

March 31, | ||||||

| 2022 |

| 2021 | |||

(unaudited) | (unaudited) | |||||

Taiwan dollar (NTD) | NTD | |

| NTD | | |

China yuan (RMB) | RMB | |

| RMB | | |

Hong Kong dollar (HKD) | HKD | |

| HKD | | |

United States dollar ($) | $ | |

| $ | | |

Exchange Rate at | ||||||

| March 31, 2022 |

| ||||

(unaudited) | December 31, 2021 | |||||

Taiwan dollar (NTD) | NTD | |

| NTD | | |

China yuan (RMB) | RMB | |

| RMB | | |

Hong Kong dollar (HKD) | HKD | |

| HKD | | |

United States dollar ($) | $ | | $ | | ||

12

Earnings Per Share

Basic earnings per common share (“EPS”) is computed by dividing net income attributable to the common shareholders of the Company by the weighted-average number of common shares outstanding. Diluted EPS is computed in the same manner as basic EPS, except the number of shares includes additional common shares that would have been outstanding if potential common shares with a dilutive effect had been issued.

As the holders of preferred stock of the Company are entitled to share equally with the holders of common stock, on a per share basis, in such dividends and other distributions of cash, property or shares of stock of the Company as may be declared by the board of directors, the preferred stock is treated as a participating security. When calculating the basic earnings per common share, the two-class method is used to allocate earnings to common stock and participating security as required by FASB ASC Topic 260, “Earnings Per Share.” As of March 31, 2022 and 2021, the Company does not have any potentially dilutive instrument.

The following is a reconciliation of the income and share data used in the basic and diluted EPS computations for the three months ended March 31, 2022 and 2021 under the two-class method.

| Three Months Ended March 31, | |||||||||||

2022 | 2021 | |||||||||||

Numerator: |

| Common stock |

| Preferred stock |

| Common stock |

| Preferred stock | ||||

Allocation of net income attributable to the Company | $ | | $ | | $ | | $ | | ||||

Denominator: |

|

|

|

|

|

|

|

| ||||

Weighted average shares of the Company’s common/preferred stock outstanding - basic |

| |

| |

| |

| | ||||

Basic and diluted earnings per share | | | | | ||||||||

The participating rights (liquidation and dividend rights) of the holders of the Company’s common stock and preferred stock are identical, except with respect to voting right. As a result, and in accordance with ASC 260, the undistributed earnings for each year are allocated based on the contractual participation rights of the common stock and preferred stock as if the earnings for the year had been distributed. As the liquidation and dividend rights are identical, the undistributed earnings are allocated on a proportionate basis.

Fair Value of Financial Instruments

Fair value accounting establishes a framework for measuring fair value and expands disclosure about fair value measurements. Fair value, which is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. This framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels as follows:

- | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

-Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liabilities, either directly or indirectly, for substantially the full term of the financial instruments.

-Level 3 inputs to the valuation methodology are unobservable and significant to the fair value.

In determining the appropriate levels, the Company performs a detailed analysis of the assets and liabilities that are measured and reported on a fair value basis. At each reporting period, all assets and liabilities for which the fair value measurement is based on significant unobservable inputs are classified as Level 3.

13

The following table summarize financial assets and liabilities measured at fair value on a recurring basis as of March 31, 2022 and December 31, 2021:

March 31, 2022 | ||||||||||||

Fair Value | Carrying | |||||||||||

| Level 1 |

| Level 2 |

| Level 3 |

| Value | |||||

Assets | ||||||||||||

Marketable securities : |

|

| ||||||||||

Stock and mutual funds | $ | | $ | — | $ | — | $ | | ||||

Long-term investments: |

|

|

|

|

|

|

| |||||

REITs |

| |

| — |

| — |

| | ||||

Total assets measured at fair value | $ | | $ | — | $ | — | $ | | ||||

December 31, 2021 | ||||||||||||

Fair Value | Carrying | |||||||||||

| Level 1 |

| Level 2 |

| Level 3 |

| Value | |||||

Assets | ||||||||||||

Long-term investments: |

|

|

|

|

|

|

| |||||

REITs | $ | | $ | — | $ | — | $ | | ||||

Total assets measured at fair value | $ | | $ | — | $ | — | $ | | ||||

The carrying amounts of current financial assets and liabilities in the consolidated balance sheets for cash equivalents, time deposits, and restricted cash equivalents approximate fair value due to the short-term duration of those instruments, which are considered level 2 fair value measurement.

Marketable securities and long-term investments in REITs – The fair values of mutual funds and REITs were valued based on quoted market prices in active markets.

Concentration of Risk

The Company maintains cash with banks in the USA, People’s Republic of China (“PRC”), Hong Kong, and Taiwan. Should any bank holding the Company’s cash become insolvent, or if the Company is otherwise unable to withdraw funds, the Company would lose all or part of its cash deposit with that bank; however, the Company has not experienced any losses in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts. In Taiwan, a depositor has up to NTD

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and cash equivalents, time deposits, restricted cash, register capital deposit and accounts receivable. As of March 31, 2022 and December 31, 2021, approximately $

For the three months ended March 31, 2022 and 2021, the Company’s revenues from sale of insurance policies underwritten by these companies were:

Three Months Ended March 31, | |||||||||||

2022 | 2021 |

| |||||||||

(unaudited) | (unaudited) | ||||||||||

% of Total | % of Total |

| |||||||||

| Amount |

| Revenue |

| Amount |

| Revenue |

| |||

TransGlobe Life Insurance Inc. | $ | |

| | % | $ | |

| | % | |

Taiwan Life Insurance Co., Ltd. | |

| | % | |

| | % | |||

Farglory Life Insurance Co., Ltd. |

| |

| | % |

| |

| | % | |

14

As of March 31, 2022 and December 31, 2021, the Company’s accounts receivable from these companies were:

March 31, 2022 |

| ||||||||||

(unaudited) | December 31, 2021 |

| |||||||||

% of Total | % of Total |

| |||||||||

Accounts | Accounts |

| |||||||||

| Amount |

| Receivable |

| Amount |

| Receivable | ||||

TransGlobe Life Insurance Inc. | $ | | | % | $ | | | % | |||

Taiwan Life Insurance Co., Ltd | | | % | | | % | |||||

Farglory Life Insurance Co., Ltd. | | | % | | | % | |||||

The Company’s operations are in the PRC, Hong Kong and Taiwan. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic, foreign currency exchange and legal environments in the PRC, Hong Kong and Taiwan, and by the state of each economy. The Company’s results of operations may be adversely affected by changes in the political and social conditions in the PRC, Hong Kong and Taiwan, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, and rates and methods of taxation, among other things.

Income Taxes

The Company records income tax expense using the asset-and-liability method of accounting for deferred income taxes. Under this method, deferred taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each year-end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Deferred tax assets are reduced by a valuation allowance if, based on available evidence, it is more likely than not that the deferred tax assets will not be realized.

When tax returns are filed, it is likely some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than

New Accounting Pronouncements and Other Guidance

New accounting pronouncements not yet adopted

Credit Losses

In June 2016, the FASB issued ASU No. 2016-13, (FASB ASC Topic 326), Financial Instruments – Credit Losses: Measurement of Credit Losses on Financial Instruments which amends the current accounting guidance and requires the use of the new forward-looking “expected loss” model, rather than the “incurred loss” model, which requires all expected losses to be determined based on historical experience, current conditions and reasonable and supportable forecasts. This guidance amends the accounting for credit losses for most financial assets and certain other instruments including trade and other receivables, held-to-maturity debt securities, loans and other instruments.

In November 2019, the FASB issued ASU No. 2019-10 to postpone the effective date of ASU No. 2016-13 for public business entities eligible to be smaller reporting companies defined by the SEC to fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. The Company believes the adoption of ASU No. 2016-13 will not have a material impact on the Company’s consolidated financial statements.

15

Reference Rate Reform

In March 2020, the FASB issued ASU No. 2020–04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting. The pronouncement provides temporary optional expedients and exceptions to the current guidance on contract modifications and hedge accounting to ease the financial reporting burden related to the expected market transition from the London Interbank Offered Rate (“LIBOR”) and other interbank offered rates to alternative reference rates. The guidance was effective for all entities upon issuance and generally can be applied to applicable contract modifications through December 31, 2022. The Company is currently evaluating the effects of the guidance on the Company’s consolidated financial statements and related disclosures.

The management does not believe that other than disclosed above, accounting pronouncements the recently issued but not yet adopted will have a material impact on its financial position, results of operations or cash flows.

NOTE 3 – CASH, CASH EQUIVALENTS AND RESTRICTED CASH

Cash, cash equivalents and restricted cash consisted of the following as of March 31, 2022 and December 31, 2021:

March 31, 2022 |

| ||||||

| (unaudited) |

| December 31, 2021 | ||||

Cash and cash equivalents: | |||||||

Cash on hand and in banks | $ | | $ | | |||

Restricted cash – noncurrent |

| |

| | |||

Total cash, cash equivalents and restricted cash shown in the statements of cash flows | $ | | $ | | |||

Noncurrent restricted cash includes a mandatory deposit in the bank in conformity with Provisions of the Supervision and Administration of Specialized Insurance Agencies in PRC, which is not allowed to be withdrawn without the permission of the regulatory commission.

NOTE 4 – TIME DEPOSITS

March 31, 2022 | |||||||

| (unaudited) |

| December 31, 2021 | ||||

Total time deposits | $ | | $ | | |||

Less: Time deposits – with original maturities less than three months |

| ( |

| ( | |||

Time deposits – original maturities over three months but less than one year | $ | | $ | | |||

Time Deposits Pledged as Collateral

The Company had a total of $

NOTE 5 – LONG-TERM INVESTMENTS

As of March 31, 2022 and December 31, 2021, the Company’s long-term investments consisted of the following:

March 31, 2022 | ||||||

(unaudited) | December 31, 2021 | |||||

Equity investments under cost method | $ | | $ | | ||

REITs |

| |

| | ||

Total long-term investments | $ | | $ | | ||

16

Equity Investments under cost method using the measurement alternative

| March 31, 2022 |

| ||||||||

(unaudited) | December 31, 2021 | |||||||||

Investment | Investment | |||||||||

Investee | Ownership | Amount | Ownership | Amount | ||||||

% | $ | | % | $ | | |||||

| | % | |

| | % | | |||

On February 13, 2015, the Company and AHFL, a wholly owned subsidiary of the Company, entered into an acquisition agreement with Mr. Chwan Hau Li, the selling shareholder of GHFL. Subsequent to the acquisition, GHFL became a wholly-owned subsidiary of the Company which in turn holds approximately

The total paid-in capital with GIB changed from NTD

A new investee in the investment ownership was due to the Company’s investment in HAINAN in 2021. HAINAN operates projects for insurance platforms, which contain insurance product centralized procurement, share service platform of sub-hierarchy distribution channel, and IoT business requirement. The Company invested HAINAN for RMB

The change in carrying value of equity investment resulted from the fluctuation of exchange rates.

REITs

REITs are valued based on quoted market prices in the active market of Taiwan. The fair value of REITs as of March 31, 2022 and December 31, 2021 were $

Unrealized losses included in earnings for assets held at the end of the reporting periods were $

For the three months ended March 31, 2022 and 2021, no other-than temporary impairment were recorded related to the long-term investments.

17

NOTE 6 – SHORT-TERM LOANS

The Company’s short-term loans consisted of the following as of March 31, 2022 and December 31, 2021:

March 31, 2022 | ||||||||||||||

(unaudited) | December 31, 2021 | |||||||||||||

|

| Debt |

| Collateral |

| Debt |

| Collateral | ||||||

Line of Credit | Collateral | balance | value | balance | value | |||||||||

$ |

| Time deposits | $ | | $ | | $ | | $ | | ||||

$ |

| Time deposits |

| |

| |

| |

| | ||||

$ |

| Time deposits |

| |

| | |

| | |||||

$ |

| Time deposits |

| |

| |

| |

| | ||||

$ |

| Time deposits |

| |

| |

| |

| | ||||

$ |

| Time deposits | |

| |

| |

| | |||||

$ | Time deposits | | | — | | |||||||||

$ | Time deposits | | | — | — | |||||||||

$ | | $ | | $ | | $ | | |||||||

Borrowings under the revolving credit agreements are generally due 90 days or less. Total interest expenses for short-term loans incurred were $

NOTE 7 – COMMISSIONS PAYABLE TO SALES PROFESSIONALS

Commissions payable to sales professionals consisted of the following as of March 31, 2022 and December 31, 2021:

March 31, 2022 | |||||||

| (unaudited) |

| December 31, 2021 | ||||

Taiwan | $ | | $ | | |||

PRC |

| |

| | |||

Total commissions payable to sales professionals | $ | | $ | | |||

Commissions payable to sales professionals are usually settled within twelve months.

18

NOTE 8 – OTHER CURRENT LIABILITIES

Other current liabilities were as follows, as of March 31, 2022 and December 31, 2021:

March 31, 2022 | ||||||

| (unaudited) |

| December 31, 2021 | |||

Accrued bonus | $ | | $ | | ||

Payroll payable and other benefits | | | ||||

Accrued business tax and tax withholdings | | | ||||

Proceeds from receipts in advance of disposal of a subsidiary | | — | ||||

Execution fees payable – AIA(Note 10) | | | ||||

Other accrued liabilities | | | ||||

Total other current liabilities | $ | | $ | | ||

Accrued Bonus

The Company’s foreign subsidiaries have various bonus plans, which provide cash awards to employees based upon their performance, and had accrued bonus of $

The Company has other compensation plans solely provided by Law Broker to its officers. The compensation plans eligible to Law Broker’s officers include a surplus bonus based on a percentage of income after tax and other performance bonuses such as retention and non-competition. For the three months ended March 31, 2022 and 2021, the bonus expenses to Law Broker’s officers under the compensation plans were $

As of March 31, 2022 and December 31, 2021, the Company had accrued bonus of $

NOTE 9 – OTHER LIABILITIES

The Company’s other liabilities consisted of the following as of March 31, 2022 and December 31, 2021:

March 31, 2022 | |||||||

| (unaudited) |

| December 31, 2021 |

| |||

Due to previous shareholders of AHFL | $ | | $ | | |||

Total other liabilities | $ | | $ | | |||

Due to Previous Shareholders of AHFL

Due to previous shareholders of AHFL is the entire remaining balance payable of the acquisition cost. On March 27, 2019, the Company and the selling shareholders of AHFL entered into a sixth amendment to the acquisition agreement, pursuant to which, the Company will make the cash payment in the amount of NTD

NOTE 10 – CONTRACTS WITH CUSTOMERS

Information about accounts receivable and contract assets from contracts with customers is as follows:

March 31, 2022 | ||||||

| (unaudited) |

| December 31, 2021 | |||

Accounts receivable | $ | | $ | | ||

Contract assets | | — | ||||

19

Contract assets are the Company’s conditional rights to consideration for completed performance obligation and are in relation to the performance bonus to be rewarded based on the annual performance. The Company recognizes the contingent commission as a contract asset when the performance obligation is fulfilled, and the Company has not had the unconditional rights to the payment. As of March 31, 2022 and December 31, 2021, the Company had $

Contract with AIATW

On June 10, 2013, AHFL entered into a Strategic Alliance Agreement (the “Alliance Agreement”) with AIA International Limited Taiwan Branch (“AIATW”), the purpose of which is to promote life insurance products provided by AIATW within Taiwan by insurance agencies or brokerage companies affiliated with AHFL or China United. Pursuant to the terms of the Alliance Agreement, AIATW paid AHFL an execution fee, which was recorded as revenue upon fulfilling certain criteria over the original term of the Alliance Agreement from June 1, 2013 to May 31, 2018. From 2014 to 2017, AHFL has entered into three amendments to the Alliance Agreement with AIATW to further revise certain terms and conditions in the Alliance Agreement, including the extension of the expiration date from May 31, 2018 to December 31, 2021. Pursuant to the Third Amendment to the Alliance Agreement (the “Amendment 3”), both AHFL and AIATW agreed to adjust certain terms and conditions set forth in this amendment, some of which included (i) except the first contract year (April 15th, 2013 to September 30th, 2014), the sales target of the alliance between the parties shall be changed to (a) value of new business (“VONB”) and (b) the 13-month persistency ratio; and (ii) AIATW will calculate and recognize the VONB and 13-month persistency ratio each contract year and inform the Company the result; and (iii) the Company agrees to return the basic business promotion fees to AIATW within thirty (30) days of receipt of the notice sent by AIATW if the Company fails to meet the targets set forth in the Amendment 3, AIATW reserves the right to offset such amount against the amount payable by it to the Company; and (iv) upon the termination of the Alliance Agreement and its amendments pursuant to the Section 8.2 of the Alliance Agreement, both parties agreed to calculate the amount to be returned or repaid, as applicable, based on the past and current contract years. The Company shall return the basic business execution fees at NTD

On March 15, 2022, AHFL entered into the Fourth Amendment to the Alliance Agreement (the “Amendment 4”), which, among other things, extended the expiration date of the Alliance Agreement to December 31, 2031. Pursuant to Amendment 4, the sales targets for the remaining contract term under the Alliance Agreement shall be changed by reference to (i) the amount of VONB and (ii) the 13-month persistency ratio as set forth therein, provided that to the extent any underlying insurance contract is revoked, invalidated or terminated and premiums are refunded to such policyholder, the amount of the related VONB shall be correspondingly reduced. Amendment 4 provides that AIATW shall pay the strategic alliance business promotion fee of NTD

The Company recognized the revenue related to AIATW of $

20

NOTE 11 –LEASE

The Company has operating leases for its offices with lease terms ranging from one to five years. The Company recorded its operating lease cost of $

Operating lease right-of-use assets represent the Company’s right to use an underlying asset for the lease term and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. As of March 31, 2022 and December 31, 2021, operating lease right-of-use assets and lease liabilities were as follows:

| March 31, 2022 |

| ||||

| (unaudited) |

| December 31, 2021 | |||

Right-of-use assets under operating leases | $ | | $ | | ||

Operating lease liabilities – current |

| |

| | ||

Operating lease liabilities – noncurrent |

| |

| | ||

Lease term and discount rate

March 31, 2022 |

| ||||||

| (unaudited) |

| December 31, 2021 | ||||

Weighted average remaining lease term |

|

| |||||

Operating lease |

| years | years | ||||

Weighted average discount rate |

|

|

|

|

| ||

Operating lease |

| | % | | % | ||

Supplemental cash flow information related to leases

| Three Months Ended March 31, | |||||

2022(unaudited) | 2021(unaudited) | |||||

Cash paid for amounts included in the measurement of lease liabilities |

| |||||

Operating cash flows related to operating leases | $ | | $ | | ||

Amortization of right-of-use assets under operating leases | | | ||||

The minimum future lease payments as of March 31, 2022 are as follows:

| Amount | ||

2022 (remainder of year) | | ||

2023 |

| | |

2024 |

| | |

2025 |

| | |

2026 | | ||

Thereafter |

| | |

Total minimum lease payments | | ||

Less: Interest |

| ( | |

Present value of future minimum lease payments | $ | | |

21

NOTE 12 – NONCONTROLLING INTERESTS

Noncontrolling interests consisted of the following as of March 31, 2022 and December 31, 2021:

% of Non- | Other | March 31, | ||||||||||||

controlling | December 31, | Net Income | Comprehensive | 2022 | ||||||||||

Name of Entity |

| Interest |

| 2021 |

| (Loss) |

| (Loss) |

| (unaudited) | ||||

Law Enterprise |

| | % | $ | ( | $ | ( | $ | ( | ( | ||||

Law Broker |

| | % |

| | |

| ( |

| | ||||

Uniwill |

| | % |

| | |

| ( |

| | ||||

Rays | | % | ( | ( | — | ( | ||||||||

PFAL |

| | % |

| | |

| ( |

| | ||||

MKI |

| | % |

| ( | — |

| — |

| ( | ||||

Total | $ | | $ | | $ | ( | $ | | ||||||

% of Non- | Other | Impact from | |||||||||||||||

controlling | December 31, | Net Income | Comprehensive | Liquidation of | December 31, | ||||||||||||

Name of Entity |

| Interest |

| 2020 |

| (Loss) |

| Income (Loss) |

| PA Taiwan |

| 2021 | |||||

Law Enterprise |

| | % | $ | ( | $ | ( | $ | | $ | — | $ | ( | ||||

Law Broker |

| | % |

| |

| |

| | — |

| | |||||

Uniwill | | % | ( | | | — | | ||||||||||

Rays | | % | ( | ( | — | — | ( | ||||||||||

PFAL |

| | % |

| |

| ( |

| | — |

| | |||||

MKI |

| | % |

| ( |

| ( |

| — | ( |

| ( | |||||

PA Taiwan |

| | % |

| ( |

| |

| ( | |

| — | |||||

Total | $ | | $ | | $ | | $ | — | $ | | |||||||

NOTE 13 – INCOME TAX

The following table reconciles the Company’s statutory tax rates to effective tax rates for the three months ended March 31, 2022 and 2021:

Three Months Ended March 31, | |||||

2022 | 2021 | ||||

| (unaudited) |

| (unaudited) |

| |

US statutory rate |

| | % | | % |

Tax rate difference |

| ( | % | ( | % |

Change in valuation allowance |

| | % | | % |

Income tax on undistributed earnings | | % | | % | |

Utilization of deferred tax assets not previously recognized | ( | % | ( | % | |

Non-deductible and non-taxable items |

| — | % | | % |

True up of prior year income tax |

| — | % | ( | % |

Other | (4) | % | — | % | |

Effective tax rate |

| | % | | % |

The Company’s income tax expense is mainly generated by its subsidiaries in Taiwan. The Company’s subsidiaries in Taiwan are governed by the Income Tax Law of Taiwan and subject to a statutory tax rate on income reported in the statutory financial statements at

WFOE and the Consolidated Affiliated Entities (“CAE”) in the PRC are governed by the Income Tax Law of PRC concerning private-run enterprises, which are generally subject to tax at

22

The Company’s subsidiaries in Hong Kong are governed by the Inland Revenue Ordinance Tax Law and subject to two-tiered profits tax regime. The first HK$

The 2017 Tax Act was enacted into law on December 22, 2017 and imposed a mandatory one-time tax on accumulated earnings of foreign subsidiaries, introducing new tax regimes, and changing how foreign earnings are subject to U.S. tax. Based on the Company’s total post-1986 earnings and profits (“E&P”) that it previously deferred from U.S. income taxes, we recorded the one-time transition tax $

NOTE 14 – RELATED PARTY TRANSACTIONS

The following summarized the Company’s loans payable related parties as of March 31, 2022 and December 31, 2021:

March 31, 2022 | |||||||

| (unaudited) |

| December 31, 2021 | ||||

Due to Ms. Lu (A shareholder of Anhou) | $ | | $ | | |||

Others |

| |

| | |||

Total | $ | | $ | | |||

Amounts due to Ms. Lu were borrowings from Ms. Lu to support Anhou’s business operation. The amounts were non-interesting bearing and payable on demand.

Due to bonus to officer, please refer to Note 8; and due to AHFL previous shareholders, please refer to Note 9.

There was no other material related party transactions other than those disclosed above.

NOTE 15– COMMITMENTS AND CONTINGENCIES

Operating Leases

See future minimum annual lease payments in Note 11.

Time Deposits Pledged as Collateral

See time deposits pledged as collateral in Notes 4 and 6.

Appointment agreement

On December 21, 2018, Law Broker entered into an appointment agreement with Shu-Fen, Lee (“Ms. Lee”), pursuant to which, she served as the president of Law Broker from December 21, 2018 to December 20, 2021. Law Broker expects to extend Ms. Lee’s appointment agreement at the next meeting of the board of directors. Ms. Lee’s primary responsibilities included 1) overall business planning, 2) implementation of resolution of the shareholders' meeting or the board of directors, 3) the appointment and dismissal of the Law Broker’s employees and sales professionals, except for internal auditors, 4) financial management and application, 5) being the representative of Law Broker, 6) other matters assigned by the board of directors. According to the appointment agreement, Ms. Lee’s compensation plan included: 1) base salary, 2) managerial allowance, 3) surplus bonus based on

Engagement agreement

On December 23, 2021, Law Broker entered into a new engagement agreement with Hui-Hsien Chao (“Ms. Chao”), pursuant to which she shall have served as the general manager of Law Broker from December 23, 2021 to December 22, 2024. Ms. Chao’s primary responsibilities are to assist Law Broker in operating and managing insurance agency business. According to the engagement agreement, Ms. Chao’s Bonus plans shall include: 1) execution, 2) long-term service fees and 3) non-competition. The payment of such bonuses

23

will only occur upon satisfaction of certain conditions and subject to the terms in the engagement agreement. Ms. Chao has agreed to act as the general manager or equivalent position of Law Broker for a term of at least

NOTE 16 –VARIABLE INTEREST ENTITIES

The carrying amounts of the assets, liabilities and the results of operations of the VIE and its subsidiaries (i.e., Zhengzhou Zhonglia Hengfu Business Consulting Co., Limited and its subsidiaries) included in the Company’s consolidated balance sheets and statements of comprehensive loss after the elimination of intercompany balances and transactions among VIEs and their subsidiaries within the Company are as follows:

| March 31, 2022 |

| ||||

(Amount in USD) | (unaudited) | December 31, 2021 | ||||

ASSETS |

|

|

|

| ||

Current assets | ||||||

Cash and cash equivalents | $ | | $ | | ||

Accounts receivable and notes receivable |

| |

| | ||

Other current assets |

| |

| | ||

Total current assets |

| |

| | ||

Right-of-use assets under operating leases |

| |

| | ||

Property and equipment, net |

| |

| | ||

Prepaid expenses - intangible assets |

| |

| | ||

Long-term investments |

| |

| | ||

Restricted cash – noncurrent |

| |

| | ||

Registered capital deposits |

| |

| | ||

Deferred tax assets |

| — |

| | ||

Other assets |

| |

| | ||

TOTAL ASSETS | $ | | $ | | ||

LIABILITIES |

|

|

|

| ||

Current liabilities |

|

|

|

| ||

Commissions payable to sales professionals | $ | | $ | | ||

Other current liabilities |

| |

| | ||

Due to related parties - Ms. Lu (the shareholder of Law Anhou) |

| |

| | ||

Total current liabilities |

| |

| | ||

Operating lease liabilities - noncurrent |

| |

| | ||

TOTAL LIABILITIES | $ | | $ | | ||

| Three Months Ended March 31, | |||||

(Amount in USD) | 2022 | 2021 | ||||

Revenue | $ | | $ | | ||

Net loss |

| ( |

| ( | ||

Net cash used in operating activities |

| ( |

| ( | ||

Net cash provided by (used in) investing activities |

| |

| ( | ||

Net cash used in financing activities |

| ( |

| ( | ||

The VIEs contributed $

24

As of March 31, 2022, there was no pledge or collateralization of the VIEs’ assets that can only be used to settle obligations of the VIEs, other than the share pledge agreements, restricted cash and registered capital deposits. Other than the amounts due to the Company and its non-VIE subsidiaries (which are eliminated upon consolidation), the creditors of the VIEs’ third-party liabilities did not have recourse to the general credit of the Company in normal course of business. The Company did not provide or intend to provide financial or other supports not previously contractually required to the VIEs during the years presented.

NOTE 17 – SEGMENT REPORTING

The Company organizes and manages its business as

The geographical distributions of the Company’s financial information for the three months ended March 31, 2022 and 2021 were as follows:

Three Months Ended March 31, | ||||||

| (unaudited) |

| (unaudited) | |||

| 2022 |

| 2021 | |||

Geographical Areas | ||||||

Revenue | ||||||

Taiwan | $ | | $ | | ||

PRC |

| |

| | ||

Hong Kong |

| |

| | ||

Elimination adjustment |

| ( |

| ( | ||

Total revenue | $ | | $ | | ||

|

| |||||

Income (loss) from operations |

|

|

| |||

Taiwan | $ | | $ | | ||

PRC |

| ( |

| ( | ||

Hong Kong |

| |

| | ||

Elimination adjustment |

| |

| | ||

Total income from operations | $ | | $ | | ||

Non operating income (expense) | ||||||

Taiwan | $ | | $ | | ||

PRC |

| |

| | ||

Hong Kong |

| |

| ( | ||

Elimination adjustment |

| ( |

| ( | ||

Total non-operating income (expense) | $ | | $ | | ||

|

| |||||

Net income |

|

|

| |||

Taiwan | $ | | $ | | ||

PRC |

| |

| | ||

Hong Kong |

| |

| | ||

Elimination adjustment |

| |

| | ||

Total net income | $ | | $ | | ||

25

The geographical distribution of the Company’s financial information as of March 31, 2022 and December 31, 2021 were as follows:

March 31, 2022 | ||||||

| (unaudited) |

| December 31, 2021 | |||

Geographical Areas | ||||||

Reportable assets | ||||||

Taiwan | $ | | $ | | ||

PRC |

| |

| | ||

Hong Kong |

| |

| | ||

Elimination adjustment |

| ( |

| ( | ||

Total reportable assets | $ | | $ | | ||

|

| |||||

Long-lived assets |

|

|

| |||

Taiwan | $ | | $ | | ||

PRC |

| |

| | ||

Hong Kong |

| |

| | ||

Elimination adjustment |

| ( |

| ( | ||

Total long-lived assets | $ | | $ | | ||

|

|

| ||||

Capital investments (CAPEX cash flows) |

|

|

|

| ||

Taiwan | $ | | $ | | ||

PRC |

| |

| | ||

Hong Kong |

| — |

| | ||

Total capital investments | $ | | $ | | ||

NOTE 18 –RISKS AND UNCERTAINTIES

There has continued to be widespread impact from the coronavirus disease (“COVID-19”) pandemic including potentially more contagious strains of COVID-19 such as the Delta and Omicron variants. It has created significant volatility and uncertainty and economic disruption. The extent to which the pandemic impacts the Company’s business and operations will depend on numerous evolving factors, many of which are not within the Company’s control and which the Company may not be able to accurately predict, including its duration and scope; the ultimate availability, administration and effectiveness of vaccines around the world; governmental actions that have been and continue to be taken in response to the pandemic, including vaccine coverage; the impact of the pandemic on economic activity and actions taken in response; the ability of the Company’s customers to pay their insurance premiums which could impact the Company’s commission and fee revenues for the services provided; and the long-term impact of employees working from home, including increased technology costs.

NOTE 19 – SUBSEQUENT EVENTS

The Company has evaluated all other subsequent events through the date these consolidated financial statements were issued and determine that there were no subsequent events or transactions that require recognition or disclosures in the consolidated financial statements, except for the following:

As disclosed in Note 10, the Company failed to meet the targets set forth in the Amendment 3 of the Alliance Agreement with AIATW and shall refund the basic business execution fees of $

26

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS.

The following discussion of the results of operations and financial condition should be read in conjunction with our unaudited condensed consolidated financial statements and notes thereto included in Item 1 of this part. This report, including the information incorporated by reference, contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. The use of any of the words “believe,” “expect,” “anticipate,” “plan,” “estimate,” and similar expressions are intended to identify such statements. Forward-looking statements include statements concerning our possible or assumed future results. The actual results that we achieve may differ materially from those discussed in such forward-looking statements due to the risks and uncertainties described in the Risk Factors section of this report, in Management’s Discussion and Analysis of Financial Condition and Results of Operations, and in other sections of this report, as well as in our annual report on Form 10-K. We undertake no obligation to update any forward-looking statements.

Overview

The Company primarily provides two broad categories of insurance products, life insurance products and property and casualty insurance products, in Taiwan and People’s Republic of China (“PRC”). The Company also provides reinsurance brokerage services and insurance consulting services in Hong Kong and Taiwan. The percentage of reinsurance brokerage services and insurance consulting services is less than 1% of our total revenue. The insurance products that the Company’s subsidiaries sell are underwritten by some of the leading insurance companies in Taiwan and PRC, respectively.

(1) | Life Insurance Products |

Total revenue from Taiwan segment’s sales of life insurance products were 89.2% and 88.1% of total revenue for the three months ended March 31, 2022 and 2021, respectively. Total revenue from PRC segment’s sales of life insurance products were 3.6% and 6.0% of total revenue for the three months ended March 31, 2022 and 2021, respectively.

In addition to the periodic premium payment schedules, most of the individual life insurance products we distribute also allow the insured to choose to make a single, lump-sum premium payment at the beginning of the policy term. If a periodic payment schedule is adopted by the insured, a life insurance policy can generate periodic payment of fixed premiums to the insurance company for a specified period of time. This means that once the Company sells a life insurance policy with a periodic premium payment schedule, they will be able to derive commission and fee income from that policy for an extended period of time, sometimes up to 25 years. Because of this feature and the expected sustainable growth of life insurance sales in the PRC and Taiwan, we have focused significant resources ever since the incorporation of Anhou and Law Broker on developing our capability to distribute individual life insurance products with periodic payment schedules. We expect that sales of life insurance products will continuously be our primary source of revenue in the next several years.

(2) | Property and Casualty Insurance Products |

Total revenue from Taiwan segment’s sales of property and casualty insurance products were 6.3% and 5.2% of total revenue for the three months ended March 31, 2022 and 2021, respectively. Total revenue from PRC segment’s sales of property and casualty insurance products were 0.7% and 0.4% of total revenue for the three months ended March 31, 2022 and 2021, respectively.

As COVID-19 and its duration remain uncertain, we have been monitoring and will continue to measure and modify our business to protect our customers, sales professionals and employees. The extent of the COVID-19 impact to the Company will depend on numerous factors and developments. Consequently, any potential impacts of COVID-19 remain highly uncertain and cannot be predicted with confidence.

Critical Accounting Policies and Estimates

A critical accounting policy is one that is both important to the portrayal of our financial condition and results of operation and requires our management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. We have had no changes to our Critical Accounting Policies as described in our most recent Form 10-K for the year ended December 31, 2021 and believe that of our significant accounting and reporting policies, the more critical policies include our accounting for revenue recognition and estimate of income taxes. Our significant accounting policies are described

27

in Note 1 of “Summary of Significant Accounting Policies” included within our 2021 Annual Report on Form 10-K filed with the Securities and Exchange Commission.

Results of Operations- Three Months ended March 31, 2022 Compared to Three Months ended March 31, 2021

The following table shows the results of operations for the three months ended March 31, 2022 and 2021:

Three Months Ended March 31, |

| |||||||||||

2022 | 2021 |

| ||||||||||

| (Unaudited) |

| (Unaudited) |

| Change |

| Percent |

| ||||

Revenue | $ | 30,980,523 | $ | 30,530,117 | $ | 450,406 |

| 2 | % | |||

Cost of revenue |

| 19,009,519 |

| 18,973,432 |

| 36,087 |

| — | % | |||

Gross profit |

| 11,971,004 |

| 11,556,685 |

| 414,319 |

| 4 | % | |||

Gross profit margin |

| 38.6 | % |

| 37.9 | % |

| 0.7 | % | 2 | % | |

Operating expenses: |

|

|

|

|

|

|

|

| ||||

Selling |

| 684,150 |

| 579,777 |

| 104,373 |

| 18 | % | |||

General and administrative |

| 5,973,039 |

| 6,090,254 |

| (117,215) |

| (2) | % | |||

Total operating expenses |

| 6,657,189 |

| 6,670,031 |

| (12,842) |

| — | % | |||

Income from operations |

| 5,313,815 |

| 4,886,654 |

| 427,161 |

| 9 | % | |||

Other income (expenses): |

|

|

|

|

|

|

|

| ||||

Interest income |

| 104,977 |

| 83,998 |

| 20,979 |

| 25 | % | |||

Interest expenses |

| (52,335) |

| (42,470) |

| (9,865) |

| 23 | % | |||

Foreign currency exchange gains, net |

| 737,550 |

| 328,466 |

| 409,084 |

| 125 | % | |||

Other - net |

| 162,048 |

| 178,940 |

| (16,892) |

| (9) | % | |||

Total other income, net |

| 952,240 |

| 548,934 |

| 403,306 |

| 74 | % | |||

Income before income taxes |

| 6,266,055 |

| 5,435,588 |

| 830,467 |

| 15 | % | |||

Income tax expense |

| (1,581,897) |

| (1,398,806) |

| (183,091) |

| 13 | % | |||

Net income |

| 4,684,158 |

| 4,036,782 |

| 647,376 |

| 16 | % | |||

Net income attributable to the noncontrolling interests |

| (1,739,281) |

| (1,626,396) |

| (112,885) |

| 7 | % | |||

Net income attributable to China United’s shareholders | $ | 2,944,877 | $ | 2,410,386 | $ | 534,491 |

| 22 | % | |||

Revenue

As a distributor of insurance products, we derive our revenue primarily from commissions and fees paid by insurance companies, typically calculated as a percentage of premiums paid by our customers to the insurance companies in Taiwan, PRC and Hong Kong. We generate revenue primarily through our sales force, which consists of individual sales agents in our distribution and service network. For the three months ended March 31, 2022 and 2021, the revenues generated from Taiwan, PRC and Hong Kong were as follows:

Geographic Areas | Three Months Ended March 31, |

| ||||||||||

| 2022 |

| 2021 |

| Change |

| Percent |

| ||||

Revenue |

|

|

|

|

|

|

|

| ||||

Taiwan segment | $ | 29,549,885 | $ | 28,467,663 | $ | 1,082,222 |

| 3.8 | % | |||

Percentage of revenue |

| 95.4 | % |

| 93.2 | % |

|

|

|

| ||

PRC segment |

| 1,347,816 |

| 1,951,469 |

| (603,653) |

| (30.9) | % | |||

Percentage of revenue |

| 4.3 | % |

| 6.4 | % |

|

|

|

| ||

Hong Kong segment |

| 82,822 |

| 110,985 |

| (28,163) |

| (25.4) | % | |||

Percentage of revenue |

| 0.3 | % |

| 0.4 | % |

|

|

|

| ||

Total revenue | $ | 30,980,523 | $ | 30,530,117 | $ | 450,406 |

| 1.5 | % | |||

Revenue from our Taiwan segment increased by $1.0 million from $28.5 million for the three months ended March 31, 2021 to $29.5 million for the three months ended March 31, 2022. Increase in revenue was mainly due to the high performance of sales of investment-

28

type insurance policies, our continued growth in the sales of insurance products in the past years, and our continuance of receiving more persistency-rate-linked bonuses for the three months ended March 31, 2022 as compared to the three months ended March 31, 2021.

Revenue from our PRC segment decreased by $0.6 million from $1.9 million for the three months ended March 31, 2021 to $1.3 million for the three months ended March 31, 2022. The insurance premium of certain products were priced higher in the first quarter of 2022 than those in the first quarter of 2021 and therefore, customers in PRC were unwilling to buy the insurance products, which resulted in the decrease of revenue. In addition, the persistency-rate-linked bonuses in the PRC segment also decreased for the three months ended March 31, 2022 due to the termination of certain sales agreement with some of the PRC insurance companies.

Revenue from the Hong Kong Segment was primarily derived from reinsurance commission on sales of insurance products from other insurers to Taiwan Life Insurance Co., Ltd. (“Taiwan Life”) for risk management. Revenue from our Hong Kong segment for the three months ended March 31, 2022 remained consistent with that of the same period in 2021.

Cost of revenue and gross profit