Table of Contents

|

Defined terms |

1 |

|

Forward looking statements |

2 |

|

Key performance indicators (non-IFRS measures) |

4 |

|

Corporate structure |

5 |

|

General development of the business |

6 |

|

Description of the business |

7 |

|

Competition and industry outlook |

13 |

|

Environmental, social and governance policy |

15 |

|

Risk management |

16 |

|

Risk factors |

19 |

|

Dividends |

33 |

|

Capital structure |

34 |

|

Market for securities |

35 |

|

Escrowed securities |

37 |

|

Directors and executive officers |

38 |

|

Legal proceedings and regulatory actions |

40 |

|

Interest of management and others in material transactions |

41 |

|

Transfer agent and registrar |

42 |

|

Material contracts |

43 |

|

Audit and risk management committee information |

44 |

|

Interests of experts |

46 |

|

Additional information |

47 |

|

Appendix A - Audit and risk management committee mandate |

A-1 |

Defined terms

As used in this annual information form (“AIF”), unless the context indicates or requires otherwise, the following terms have the following meanings:

· “Corporation” or “Company” means Sprott Inc. and, where applicable, its subsidiaries and joint ventures.

· “Investment Products” means the Corporation’s investment funds (the “Funds”), discretionary managed accounts (the “Managed Accounts”), fixed term limited partnerships (the “Limited Partnerships”) and managed companies.

· “SAM” means Sprott Asset Management LP, a wholly-owned subsidiary of the Corporation, registered as a portfolio manager, an investment fund manager and an exempt market dealer.

· “SCP” means Sprott Capital Partners LP (formerly Sprott Private Wealth LP), a wholly-owned subsidiary of the Corporation, registered as an investment dealer and a member of the Investment Industry Regulatory Organization of Canada (“IIROC”).

· “Sprott U.S.” means Sprott U.S. Holdings Inc. (and its subsidiaries), a wholly-owned subsidiary of the Corporation through which the Corporation holds Rule Investment, Inc. (“RII”), Resource Capital Investment Corp. (“RCIC”), Sprott Global Resource Investments, Ltd. (“SGRIL”) and Sprott Asset Management USA Inc. (“SAM USA” and together with RII, RCIC and SGRIL, “Global”).

· “SRLC” or “Sprott Resource Lending” means Sprott Resource Lending Corp. (and its subsidiaries), a wholly-owned subsidiary of the Corporation which provides debt financing to companies in the resource sector and is the general partner of Sprott Private Resource Lending Fund (the “Lending Fund I”), Sprott Private Resource Lending Fund II (the “Lending Fund II”) and certain other lending vehicles (together with Lending Fund I and Lending Fund II, the “Lending Funds”).

· “SRSR” or “Sprott Streaming” means Sprott Resource Streaming and Royalty Corp., a wholly-owned subsidiary of the Corporation which provides specialized forms of capital on behalf of institutional investors to companies in the mining sector and is the general partner of Sprott Private Resource Streaming Fund (the “Streaming Funds”).

Effective January 1, 2020, the Corporation changed its presentation currency from Canadian dollars to United States dollars to better reflect the Corporation’s business. In this AIF, unless otherwise indicated, all dollar amounts are expressed in United States dollars. References to “$” are to United States dollars and references to “CAD$” are to Canadian dollars. All Canadian dollar amounts that are expressed in United States dollars in this AIF have been converted from Canadian dollars at the Bank of Canada daily exchange rate as at December 31, 2020 of CAD$1.2732 per $1.00. The information in this AIF is presented as at December 31, 2020 unless otherwise indicated.

Forward looking statements

Certain statements and information included in this AIF constitute forward-looking information and statements (collectively referred to herein as “Forward-Looking Statements”) within the meaning of applicable securities laws. Such statements are often accompanied by words such as “may”, “would”, “could”, “will”, “anticipate”, “believe”, “plan”, “expect”, “intend”, “estimate” and other similar expressions. All statements in this AIF, other than those relating to historical information or current conditions are forward looking statements, including, but not limited to:

· Intentions to grow the Corporation’s business, including by increasing Assets Under Management (“AUM”), and creating new investment products and businesses;

· The Corporation’s continued investment performance and industry-leading thought leadership;

· Maintenance of best-in-class precious metals and real asset strategies and the Corporation’s related approach to management and investing;

· Consideration of strategic acquisitions to build scale, improve profitability or enter new markets and investment categories;

· Ongoing growth and diversification of the Corporation’s merchant banking and advisory business.

· Expectations regarding continued consolidation of the asset management business, with bifurcation between large general managers and specialized boutique managers.

· Expectations regarding continued price compression in the asset management industry, particularly in the exchange traded funds segment as players compete for market share.

· Expected benefits from economic and demographic trends over the next decade.

· Commitment to being at the forefront of technological innovation in the sector.

· Future dividend distributions.

The Forward-Looking Statements herein are based upon the current internal expectations, estimates, projections, assumptions and beliefs of the Corporation as of the date of such information or statements, including, among other things, assumptions with respect to future growth, results of operations, performance and business prospects and opportunities. The reader is cautioned that the expectations, estimates, projections, assumptions and/or beliefs used in the preparation of such information may prove to be incorrect. The Forward-Looking Statements included in this AIF are not guarantees of future performance and should not be unduly relied upon. Such information and statements, including the assumptions made in respect thereof, involve known and unknown risks, uncertainties and other factors, which may cause actual results or events to differ materially from those anticipated in the Forward-Looking Statements. In addition, this AIF may contain Forward-Looking Statements attributed to third-party industry sources.

The Forward-Looking Statements contained in this AIF are expressly qualified by the cautionary statements provided for herein. The Corporation does not assume any obligation to publicly update or revise any of the included Forward-Looking Statements after the date of this AIF, whether as a result of new information, future events or otherwise, except as may be expressly required by applicable securities laws.

Although the Corporation believes the expectations, estimates, projections, assumptions and beliefs reflected in the Forward-Looking Statements are reasonable, undue reliance should not be placed on Forward-Looking Statements because the Corporation can give no assurance that such expectations, estimates, projections, assumptions and beliefs will prove to be correct. The Corporation cannot guarantee future results, levels of activity, performance or achievements. Consequently, there is no representation by the Corporation that actual results achieved will be the same in whole or in part as those set out in the Forward-Looking Statements. Some of the risks and other factors, some of which are beyond the control of the Corporation, that could cause results to differ materially from those expressed in the Forward-Looking Statements contained in this AIF, include, but are not limited to:

· Difficult market conditions.

· Poor investment performance.

· Failure to continue to retain and attract qualified staff.

· Employee errors or misconduct resulting in regulatory sanctions or reputational harm.

· Performance fee fluctuations.

· A business segment or another counterparty failing to pay its financial obligation.

· Failure of the Corporation to meet its demand for cash or fund obligations as they come due.

· Changes in the investment management industry.

· Failure to implement effective information security policies, procedures and capabilities.

· Lack of investment opportunities.

· Risks relating to regulatory compliance.

· Failure to deal appropriately with conflicts of interest.

· Competitive pressures.

· Corporate growth which may be difficult to sustain and may place significant demands on existing administrative, operational and financial resources.

· Failure to comply with privacy laws.

· Failure to execute the Corporation’s succession plan.

· Foreign exchange risk relating to the relative value of the U.S. dollar.

· Litigation risk.

· Risks related to maintaining minimum regulatory capital requirements.

· Failure to develop effective business resiliency plans.

· Failure to obtain or maintain sufficient insurance coverage on favourable economic terms.

· Historical financial information being not necessarily indicative of future performance.

· Risks related to the Corporation’s investment products.

· Risks related to the Corporation’s short-term investments.

· Risks relating to the Corporation’s lending segment.

· Risks relating to the Corporation’s brokerage segment.

· Risks related to the Corporation’s organization, corporate structure and its common shares (the “Common Shares”).

· Risks related to compliance with dual-listing requirements.

· Risks relating to being a foreign private issuer under the U.S. Exchange Act.

· Risks relating to COVID-19

· The other risk factors disclosed in this AIF.

The foregoing list of factors should not be considered exhaustive. See also “Risk Factors”. Should one or more of the risks or uncertainties listed above or in “Risk Factors” in this AIF materialize, or should the expectations, estimates, projections, assumptions and/or beliefs underlying the Forward-Looking Statements prove incorrect, future results, levels of activity, performance or achievements could vary materially from those expressed or implied by Forward-Looking Statements contained in this AIF. With respect to Forward-Looking Statements contained in this AIF, the Corporation has made the following assumptions, among others: (i) the impact of increasing competition in each business in which the Corporation operates will not be material; (ii) quality management will be available; and (iii) the effects of regulation and tax laws of governmental agencies will be consistent with the current environment.

The above summary of assumptions and risks related to forward looking statements has been provided in this AIF in order to provide readers with a more complete perspective on the future operations of the Corporation. Readers are cautioned that such forward looking statements may not be appropriate for other purposes.

Key performance indicators (non-IFRS financial measures)

The Company measures the success of its business using a number of key performance indicators that are not measurements in accordance with International Financial Reporting Standards (“IFRS”) and should not be considered as an alternative to net income (loss) or any other measure of performance under IFRS. Non-IFRS financial measures do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. Our key performance indicators are discussed below:

Assets under management

Assets under management refers to the total net assets managed by the Company through its various investment product offerings, managed accounts and managed companies.

Net inflows

Net inflows (consisting of net sales, capital calls and fee earning capital commitments) result in changes to AUM and are described individually below:

Net sales

Fund sales (net of redemptions), including ‘at-the-market’ transactions and secondary offerings of our physical trusts and new ‘creations’ of ETF units, are a key performance indicator as new assets being managed will lead to higher management fees and can potentially lead to increased carried interest and performance fee generation (as applicable) given that AUM is also the basis upon which carried interest and performance fees are calculated.

Capital calls and commitments

Capital calls into our lending LPs are a key source of AUM creation, and ultimately, earnings for the Company. Once capital is called into our lending LPs, it is included within the AUM of the Company as it will now earn a management fee (NOTE: it is possible for some forms of committed capital to earn a commitment fee despite being uncalled, in which case, it will also be included in AUM at that time). Conversely, once loans in our lending LPs are repaid, capital may be returned to investors in the form of a distribution, thereby reducing our AUM (“capital distributions”).

Net fees

Management fees (net of trailer and sub-advisor fees) and carried interest and performance fees (net of carried interest and performance fee payouts) are key revenue indicators as they represent the net revenue contribution after directly associated costs that we generate from our AUM.

Net commissions

Commissions, net of commission expenses, arise primarily from the transaction based service offerings of our brokerage segment.

Net compensation

Net Compensation excludes commissions, carried interest and performance fee payouts, which are presented net of their related revenues in the management’s discussion and analysis of the Company for the year ended December 31, 2020, and severance and new hire accruals which are non-recurring.

Total shareholder return

Total Shareholder Return is the financial gain (loss) that results from the change in the Company’s share price, plus any dividends paid over the period.

Return on capital

Return on capital is calculated as adjusted base EBITDA, plus gain (loss) on investments divided by capital stock plus outstanding loan facility.

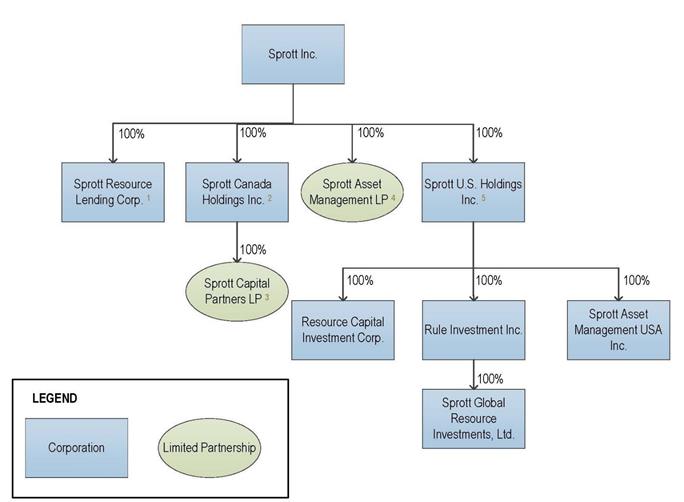

Corporate structure

Sprott Inc. was incorporated under the Business Corporations Act (Ontario) (the “OBCA”) by Articles of Incorporation dated February 13, 2008. The Corporation’s registered and head office is located at Royal Bank Plaza, South Tower, 200 Bay Street, Suite 2600, Toronto, Ontario, M5J 2J1.

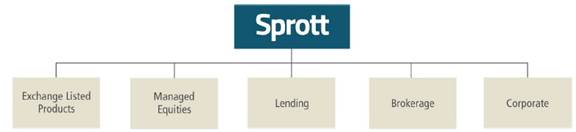

The corporate structure of the Corporation and its material subsidiaries are as indicated in the following chart:

(1) Sprott Resource Lending, which is incorporated under the federal laws of Canada, is the general partner of the Lending Funds.

(2) Sprott Canada Holdings Inc. is incorporated under the OBCA.

(3) Sprott Capital Partners GP Inc., which is incorporated under the OBCA, is the general partner of SCP.

(4) Sprott Asset Management GP Inc. which is incorporated under the OBCA, is the general partner of SAM.

(5) Sprott U.S. Holdings Inc., SAM USA and RCIC. Sprott U.S. Holdings Inc. exists under the laws of the State of Delaware. RII, SGRIL and SAM USA exists under the laws of the State of California. RCIC exists under the laws of the State of Nevada.

General development of the business

On January 16, 2018, the Corporation completed its acquisition of Central Fund of Canada Limited (“CFCL”) and the right to manage administer and manage physical gold and silver bullion assets that were transferred to a newly formed trust, Sprott Physical Gold and Silver Trust (“CEF”), for an aggregate purchase price consisting of CAD$105 million in cash and 699,739 Common Shares, plus a cash earnout payment (the “CFCL Transaction”). At the time of closing, the CFCL Transaction, doubled the size of the Corporation’s exchange-listed products franchise and increased the Corporation’s AUM to more than CAD$11.5 billion. CEF is managed by SAM and trades on the NYSE Arca and the TSX.

On January 29, 2019, Whitney George was appointed President of the Corporation in addition to his roles as Chairman of Sprott. U.S. and Chief Investment Officer (“CIO”) of SAM.

On November 7, 2019, the Board approved a normal course issuer bid (“NCIB”), pursuant to which the Corporation was permitted to repurchase up to 2.5% of its common shares over a one-year period commencing on November 15, 2019 and ending on November 14, 2020. On February 25, 2021 a renewed NCIB for the purchase of up to 2.5% of the Common Shares was approved by the Board. Purchases under the renewed NCIB are expected to occur for a one year period commencing on or about March 3, 2021 and will be subject to acceptance by the Toronto Stock Exchange.

On January 17, 2020, the Corporation completed the acquisition of Tocqueville Asset Management’s (“Tocqueville”) gold strategies for total consideration of up to $50 million, comprised of a payment at closing of $12.5 million in cash, as well as common shares valued at $2.5 million. The acquisition resulted in the Corporation managing and sub-advising the Tocqueville gold strategies, including the Tocqueville Gold Fund and certain other institutional accounts and, at closing of the acquisition, increased the AUM of the Corporation’s managed equities platform by approximately $1.7 billion. Subsequent to the year ended December 31, 2020, the Corporation successfully negotiated an amendment to the original terms of the purchase agreement. In lieu of any contingent consideration entitlement for the 2020 and 2021 fiscal years, the vendor accepted a final payment from the Corporation of $30 million ($27 million in cash and $3 million in common shares of the Corporation). This enabled the Corporation to lock-in the total acquisition price and return on investment economics going into 2021 and further enabled the Corporation to retain the full benefits of any additional increase in AUM expected over 2021.

On May 28, 2020, the Corporation completed a 10-for-1 consolidation of its common shares. All information pertaining to common shares and per-share amounts in this AIF for the period before May 28, 2020 reflects retrospective treatment of this consolidation.

On June 29, 2020, the common shares began trading on the New York Stock Exchange (“NYSE”) under the ticker symbol “SII”.

On September 21, 2020, the Corporation’s common shares were added by Dow Jones Canadian Index Services to the S&P/TSX Composite Index. The TSX also added the Corporation to the TSX30 as the Corporation ranked among the 30 top-performing TSX stocks over a three-year period based on dividend adjusted share price appreciation.

Description of the business

The Corporation’s operating segments are as follows:

Exchange listed products

· The Corporation’s closed-end physical trusts and exchange traded funds (“ETFs”).

Managed equities

· The Company’s alternative investment strategies managed in-house and on a sub-advised basis.

Lending

· The Company’s lending and streaming activities occur through limited partnership vehicles (“lending LPs”).

Brokerage

· The Company’s regulated broker-dealer activities (equity origination, corporate advisory, sales and trading).

Corporate

· Provides the Company’s operating segments with capital, balance sheet management and other shared services.

All other segments

· Contains all non-reportable segments as per IFRS 8, Operating Segments (“IFRS 8”). See Note 14 of the annual financial statements for further details.

The Corporation’s brand

The Sprott brand is recognized internationally for expertise in resource investing, particularly in the precious metals area. The importance of this brand recognition resides primarily in the role it plays in attracting new investors and employees to the Corporation. Protection of this brand by delivering investment performance and industry-leading thought leadership is important to the continued success of the Corporation’s business.

Summary of AUM

|

(In millions $) |

|

AUM |

|

AUM |

|

Blended |

|

|

Exchange listed products |

|

|

|

|

|

|

|

|

- Physical trusts |

|

6,579 |

|

11,851 |

|

0.39 |

% |

|

- ETFs |

|

252 |

|

382 |

|

0.35 |

% |

|

|

|

6,831 |

|

12,233 |

|

0.39 |

% |

|

Managed Equities |

|

|

|

|

|

|

|

|

- Precious metals strategies |

|

601 |

|

2,479 |

|

0.79 |

% |

|

- Other (2) |

|

350 |

|

352 |

|

0.92 |

% |

|

|

|

951 |

|

2,831 |

|

0.81 |

% |

|

Lending (3) |

|

783 |

|

999 |

|

1.05 |

% |

|

Other (4) |

|

688 |

|

1,327 |

|

0.79 |

% |

|

Total (5) |

|

9,253 |

|

17,390 |

|

0.53 |

% |

(1) Management fee rate represents the net amount received by the Company.

(2) Includes institutional managed accounts.

(3) $1.1 billion of committed capital remains uncalled, of which $0.4 billion earns a commitment fee (AUM), and $0.7 billion does not (future AUM).

(4) Includes Sprott Korea Corp., private equity strategy in Sprott Asia and high net worth discretionary managed accounts in the U.S.

(5) No performance fees are earned on exchange listed products. Performance fees are earned on all precious metals strategies (other than bullion funds) based on returns above relevant benchmarks. Other managed equities strategies primarily earn performance fees on flow-through products. Lending funds earn carried interest calculated as a pre-determined net profit over a preferred return.

The Corporation’s revenues

The Corporation derives its revenues principally from management fees earned from the management of its Investment Products and from performance fees earned from the investment of the AUM of its Investment Products. Accordingly, growth in the Corporation’s management fees is based on growth in AUM while growth in its carried interest and performance fees is based on both the growth in AUM and the absolute or relative return, as applicable, earned by its Investment Products. In addition, the Corporation derives revenues from commissions earned on placement and advisory fees and finance income from co-investments in lending funds The Corporation manages and reports across the five reporting segments.

For the year ended December 31, 2020, the Corporation’s total revenue was $121.8 million compared to $73.5 million for the fiscal year ended December 31, 2019.

The Corporation’s employees

As at December 31, 2020, the Corporation had 157 employees, across its operating segments as follows:

|

|

|

Exchange listed |

|

Lending |

|

Brokerage |

|

Corporate |

|

Other |

|

Total |

|

|

Number of employees |

|

36 |

|

13 |

|

63 |

|

22 |

|

23 |

|

157 |

|

Exchange listed products and managed equities

Sprott Asset Management LP (SAM)

SAM is the manager of Sprott’s exchange-traded products, alternative investment strategies and managed accounts. SAM is registered as a portfolio manager and an exempt market dealer in Ontario, British Columbia, Alberta, Saskatchewan, Manitoba, New Brunswick, Nova Scotia, and Newfoundland and Labrador and as an investment fund manager in Ontario, Quebec, and Newfoundland and Labrador. SAM is also registered as an exempt market dealer in Quebec and as a Commodity Trading Manager in Ontario. SAM is registered as a Registered Investment Advisor with the U.S. Securities and Exchange Commission (“SEC”). The majority of the Corporation’s revenues are generated through SAM in the form of management fees and performance fees earned through the management of funds and Managed Accounts.

SAM offers investors access to best-in-class precious metals and real asset strategies. SAM’s team of portfolio managers have a deep understanding of precious metals and natural resource investments and a long track record investing in the sector. By taking a consistent, disciplined approach to investing, based on sound fundamental analysis and independent research, SAM’s investment management team carefully assembles a portfolio of holdings to meet its investment objectives. SAM takes a team-based approach to its investment decision-making process. Themes and opportunities are discussed daily among its investment team.

SAM’s offerings include unique physical bullion trusts, mining ETFs and actively managed equity strategies. SAM managed funds had approximately $14.8 billion in AUM as at December 31, 2020.

During the year ended December 31, 2020, SAM managed or sub-advised the following funds:

|

Exchange listed products |

|

Precious metal strategies |

|

Sprott Physical Gold and Silver Trust (CEF) |

|

Sprott Gold Equity Fund |

|

Sprott Physical Gold Trust (PHYS) |

|

Sprott Hathaway Special Situations Fund |

|

Sprott Physical Silver Trust (PSLV) |

|

Bullion Funds (1), (2) |

|

Sprott Physical Platinum and Palladium Trust (SPPP) |

|

Gold and Precious Minerals Fund(1) |

|

Sprott Gold Miner’s ETF |

|

Flow-through LPs (1), (3) |

|

Sprott Jr. Gold Miner’s ETF |

|

Corporate Class Funds (1), (4) |

|

|

|

Institutional Accounts |

(1) Fund is managed by Ninepoint Partners LP and SAM acts as sub-advisor

(2) Includes: (1) Ninepoint Gold Bullion Fund; and (2) Ninepoint Silver Bullion Fund

(3) Includes: (1) Ninepoint 2018 Flow-Through LP (closed on February 28, 2020), (2) Ninepoint 2018-II Flow-Through LP (closed on February 28, 2020), (3) Ninepoint 2019 Flow- Through LP, (4) Ninepoint 2019 Short Duration Flow-Through LP, (5) Ninepoint 2020 Flow-through LP; and (6), Ninepoint 2020 Short Duration Flow-through LP

(4) Includes: (1) Ninepoint Silver Equities Class; and (2) Ninepoint Resource Class

SAM’s revenues

Except as detailed below, all of SAM’s products (including those sub-advised by SAM) have a fee structure that consists of both a management fee component and a performance fee component. SAM collects management fees calculated as a percentage of AUM, and may earn performance fees calculated, depending on the fund or managed account, as a percentage of: (i) excess performance over the relevant benchmark; (ii) the increase in net asset value over a predetermined hurdle, if any; or (iii) the net profit over the performance period.

CEF, PHYS, PSLV, SPPP, Sprott Gold Miners ETF, Sprott Junior Gold Miners ETF, Sprott Gold Equity Fund, certain institutional accounts and the Bullion Funds only charge a management fee.

SAM selling and distribution

The Corporation focuses its distribution primarily in the United States through its family of exchange traded products. Exchange traded products also provide broader distribution to investors in many countries including Canada, the United Kingdom, as well as countries in Europe and Asia.

The Corporation actively promotes its offerings through its sales team, public and investor relations, marketing, social and traditional media platforms and conferences.

Resource Capital Investment Corp. (RCIC)

RCIC manages assets for limited partnership investment vehicles that invest in natural resource companies. These investment vehicles include: (1) closed-ended pooled investment vehicles with remaining durations between one to four years; and (2) open-ended limited partnerships.

As at December 31, 2020, these investment vehicles had an aggregate AUM of approximately $251 million.

RCIC revenues

RCIC earns revenue in the form of management fees and carried interest and performance fees through the management of the limited partnerships. Management fees are calculated as a percentage of AUM, and may earn carried interest and performance fees depending on the excess performance over the predetermined hurdle.

For the year ended December 31, 2020, exchange listed products and managed equities had total revenue of $79 million compared to $38.6 million for the year ended December 31, 2019.

Lending

Sprott Resource Lending is focused on providing financing to companies within the natural resource sector, primarily through the Lending Funds.

SRLC is the general partner and RCIC is the manager of Lending Fund I. Pursuant to a sub-management agreement, RCIC has delegated to Sprott Resource Lending Partnership (“SRLP”) all aspects of the management of investments of lending fund I, including investigating, analyzing, structuring and negotiating potential investments, monitoring the performance of loan investments and portfolio companies and making determinations as to disposition and other opportunities in respect of the investments of lending fund I.

SRLC is the general partner and SRLP is the manager of lending fund II. SRLP provides certain administrative services to, and manages the investments of, Lending Fund II, including investigating, analyzing, structuring and negotiating potential investments, monitoring the performance of loan investments and portfolio companies and making determinations as to disposition and other opportunities in respect of the investments of lending fund II.

The lending funds have been established to primarily provide loan facilities to, and invest in, debt instruments (“Loan Investments”) of companies in the mining, agricultural mineral, resource infrastructure, resource service and energy production sectors on a global basis. Loan investments may include a committed or revolving credit facility that has not yet been drawn down by the relevant borrower and any loan, note, bond debenture or other debt instruments. The lending funds may also invest in, receive rights in respect of or otherwise acquire shares, options, warrants, commodity price appreciation rights, royalties and other contingent purchase rights, including upon the exercise of any such right or as a result of the conversion of debt. The lending funds are subject to certain investment restrictions, including limits on investments in any one portfolio company based on a specified percentage of capital commitments, limits on non-senior debt or other investments, or other restrictions, without approval of the lending funds’ respective limited partners or advisory committee, as the case may be.

In addition to the loan investments made through the lending funds, the Corporation may provide certain direct financing to companies within the natural resource sector, primarily through credit facilities.

SRSR is focused on specialized forms of capital to the mining sector on behalf of institutional investors through its streaming fund. SRSR, through the streaming fund, invests primarily in royalties and streams, which share in a project’s metal production in return for an up-front payment providing investors with long duration exposure to commodity prices and mine life extensions and expansions.

As at December 31, 2020, AUM in the lending and streaming funds stood at $1 billion. This was due to $260 million of new capital calls into our lending funds, net of $85 million of capital distributions during the year. In addition, $1.1 billion of committed capital remains uncalled, of which $0.4 billion earns a commitment fee (AUM), and $0.7 billion does not (future AUM)

Lending revenues

Both Sprott Resource Lending, through SRLP, and Sprott Streaming and Royalty, through SRSR earns revenue in the form of management fees, calculated as a percentage of the funds’ aggregate capital commitments used to fund investments that have not been fully realized and may earn carried interest calculated as a percentage of cumulative net realized profits.

With respect to co-investment in the lending and streaming funds and direct financing, Sprott Resource Lending and Sprott Resource Streaming and Royalty earns revenue in the form of finance income.

On direct financing, SRLC may earn other fees on its lending activities as well as realizing on the upside potential of bonus arrangements with resource borrowers which are generally tied to the revenue or the value of the common shares of the borrower. SRLC’s revenues are subject to the return it is able to generate on its capital, its ability to reinvest funds as financings mature and are repaid, the nature and credit quality of its loan portfolio, including the quality of the collateral security and the overall resource and commodity markets.

For the year ended December 31, 2020, Lending had total revenue of $15.5 million compared to $14.7 million for the fiscal year ended December 31, 2019.

Brokerage

Canadian brokerage

Merchant banking

Through the merchant banking division of SCP, the Corporation generates investment ideas within the Corporation’s core areas of expertise and provides focused advice and capital raising services to corporate clients. The Merchant Banking Division is led by a team of seasoned resource banking professionals and benefits from the Corporation’s deal-flow and brand recognition in the natural resource sector. While the merchant banking division’s area of focus is currently in the natural resource sector, it may diversify sector coverage in the future.

Advisory services

Through the advisory services division of SCP (the “Advisory Services Division”), the Corporation provides investment management and administrative services to high net worth individuals and institutions. The Advisory services division focuses on providing a high level of service to its direct private clients. Whether dealing with high net worth individuals or institutional investors, the advisory services division attempts to inform its clients of the Corporation’s market outlook as well as each investment professional’s approach to allocating capital within their respective fund strategies. The advisory services division provides investors with monthly reports, email updates and web postings. Clients also have the ability to contact an informed customer service representative. As at December 31, 2020, the advisory services division’s private client base represented approximately $141.7 million of client assets.

SCP is a member of IIROC and the Canadian Investor Protection Fund. SCP is registered as an investment dealer in Ontario, British Columbia, Alberta, Saskatchewan, Manitoba, Quebec, Prince Edward Island, New Brunswick, Nova Scotia, and Newfoundland and Labrador.

SCP’s revenues

The merchant banking division’s primary revenue streams are commissions earned on capital raising services and fees earned on advisory deals.

The advisory services division has revenue streams including: (1) structured fees from charity flow-through transactions, (2) commissions from trading, private placements and underwriting; and (3) finance income from retail accounts.

US brokerage

SGRIL

SGRIL is a full service U.S. brokerage firm providing personalized brokerage services to investors in the natural resource sector. SGRIL is a broker-dealer regulated by the Financial Industry National Regulatory Authority (“FINRA”). Many of SGRIL’s financial advisors worked in various natural resource industries before they began their financial services career, enabling them to provide specialized advice. As at December 31, 2020, SGRIL has approximately 4,172 client accounts and had approximately $1.4 billion of assets under administration.

SAM USA

SAM USA is a registered investment advisor that provides segregated managed accounts for institutional and high-net worth clients looking for distinctive and personalized wealth management. SAM USA offers clients the option of investing through its model portfolios, which include (1) Sprott Global Diversified Resource Strategy, (2) Sprott Rule Managed Accounts, (3) Sprott Global Gold Separately Managed Account; and (4) Sprott Real Asset Value+ Strategy.). As at December 31, 2020, SAM USA’s AUM was approximately $530 million.

US brokerage revenues

SGRIL earns commissions and other fees from the sale and purchase of stocks by its clients, from new and follow-on offerings of limited partnerships managed by RCIC and from the sale of private placements to its clients. SAM USA earns revenue in the form of management fees and performance fees from the management of managed accounts.

For the year ended December 31, 2020, brokerage has total revenue was $30.7 million compared to $21.2 million for the fiscal year ended December 31, 2019.

Corporate

The Corporate operating segment provides capital, balance sheet management and shared services to the Corporation’s subsidiaries.

COMPETITION AND INDUSTRY OUTLOOK

The Corporation is fairly unique as an alternative asset management organization in terms of the breadth of its various investing platforms. However, each business line operates in a very competitive environment where there is significant competition for investors’ assets.

Exchange listed products and managed equities

The North American asset management industry is highly competitive and is dominated by a small number of larger players. As at December 31, 2020, SAM managed approximately $14.8 billion of AUM, concentrated mainly in its physical bullion trusts, Gold Equity fund, as well as sub-advisory agreements for actively-managed resource funds. SAM has historically been a manager of specialized, focused funds where the Corporation believes that (i) it has a competitive advantage due to its investment management expertise; and (ii) it is able to add value as compared to a benchmark or index.

SAM’s primary focus is in the precious metals and mining sectors. Most competitors in these sectors are larger and more diversified asset managers that do not focus exclusively in these areas. SAM’s focus provides an advantage, allowing it to compete with larger organizations. SAM also has developed world-renown expertise and brand equity in precious metals and mining which allows it to promote its offerings to a variety of investors.

The Corporation expects that the asset management business will continue to consolidate, with the industry bifurcating between large general managers and specialized boutique managers. The Corporation also expects that price compression will continue in the asset management industry, particularly in the ETF segment as players compete for market share. As a result, the Corporation believes that asset managers without differentiated offerings and access to distribution and capital will be at a disadvantage.

With the completion of the CFCL Transaction in 2018, the Corporation became the third largest bullion manager in North America. The exchange listed products platform is highly scalable, with approximately 150,000 clients, and has significant leverage to precious metals prices and is well-positioned to add complementary strategies.

The Corporation’s acquisition of Tocqueville Asset Management’s gold strategies in January 2020 increased the Corporation’s AUM by approximately $1.7 billion and added meaningful scale to our managed equities platform.

SAM will continue to consider strategic acquisitions which will allow it to build scale, improve profitability or enter new markets and investment categories.

Lending

Sprott Resource Lending and Sprott Resource Streaming operate in the specialized lending industry, carrying out lending activities on a global basis. SRLC and SRSR’s competition includes other unconventional lenders, bank loans, high yield note offerings, investment funds and money managers, and public and private equity financings carried out by those institutions. As markets in the resource sector improve, potential borrowers may opt for equity or bank loans for their financing needs rather than SRLC’s or SRSR’s product offering.

Brokerage

Merchant banking

SCP’s merchant banking division competes with large domestic and international securities firms, securities subsidiaries of major chartered banks, major regional firms, smaller niche-oriented companies as well as institutional and strategic investors. The Corporation believes that the expertise of the merchant banking division’s team, their extensive background in natural resources and their access to the deal flow and expertise of the broader Sprott group network provides SCP’s merchant banking division with a competitive advantage within its operating niche.

Advisory Services

SCP’s advisory services division is focused on providing private client solutions to clients interested in natural resource investment opportunities. The Corporation believes that the advisory services division can be competitive in this segment through its access to private placement opportunities generated by the merchant banking division as well as resource-focused investment products managed by the SAM investment team.

U.S Brokerage

The U.S. asset management industry - both broker-dealers and asset managers - is highly competitive but fragmented. Both SGRIL and SAM USA operate specialized “niche” businesses. SGRIL provides brokerage services to clients focused on small capitalization stocks in the natural resource sector. SAM USA offers a managed account program for investors seeking a personalized wealth management program focused on investments in natural resources.

The Corporation believes that the specialized focus that both SGRIL and SAM USA offer to clients is a distinct competitive advantage for both SGRIL and SAM USA. Each of these companies seeks to increase its client base through expanded marketing and sales efforts across selected geographic markets in the U.S.

Corporate

The Corporate segment provides treasury and shared services to the Corporation’s subsidiaries.

Environmental, social and governance policy

The Corporation has implemented an Environmental, Social and Governance (“ESG”) Policy.

The Corporation believes it is part of its corporate responsibility to deliver returns by being a responsible investor and that integrating ESG matters into its investment decision-making process and active ownership practices are key tenets to being a responsible investor.

ESG principles

The United Nations Principles for Responsible Investment (“UNPRI”) was launched in 2006 with the aim of ensuring that ESG matters are considered during the investment process and subsequent management of investments. The UNPRI framework has become the standard for global best practice in responsible investing. Although the UNPRI framework is voluntary, the Corporation has committed to incorporating ESG matters into its investment decision making and active ownership practices.

The Corporation will endeavour to observe the following UNPRI principles:

· The Corporation will incorporate ESG issues into investment analysis and decision-making processes.

· The Corporation will be an active owner and incorporate ESG issues into its ownership policies and procedures.

· The Corporation will seek appropriate disclosure on ESG issues by the entities in which it invests.

· The Corporation will promote acceptance and implementation of the principles within the investment industry.

· The Corporation will work to enhance its effectiveness in implementing the principles.

· The Corporation will report on its activities and progress towards implementing the principles.

2020 highlights

Our accomplishments during 2020 towards ESG included the following:

Environmental

· Donation to American Australian Association’s Bush Fire Relief Fund

· Closed on the acquisition of U.S clean energy fund assets (Brookfield Renewable Partners: 50.1%; Sprott Korea led consortium: 49.9%)

Social

· Women and BIPOC make up 30%+ of board and senior leadership

· Signed 2020 BlackNorth initiative (along with over 200 public and private companies) to address workplace injustice against BIPOC in Canada

· Donation to various COVID-19 relief projects (including Toronto General Hospital and YMCA)

· Launched Sprott scholarship for women in finance at Carlton University

· Launched mandatory company-wide unconscious bias training

Governance

· Engaged Global Governance Advisors for a 2021 project to assist in further enhancing our governance practices as we grow and expand our reach into international regulatory environments in the U.S, Europe and Asia

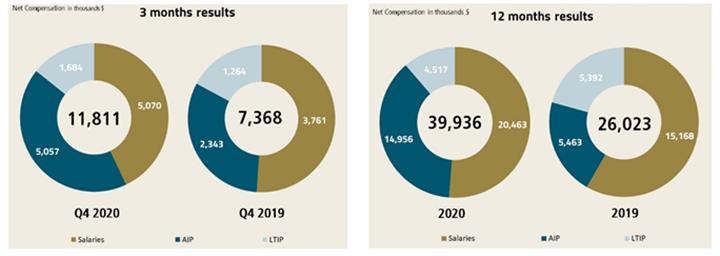

· Our compensation practices continue to produce a mix of pay reflecting the objectives of our shareholders that management be compensated more towards variable at-risk pay (AIP) and long-term stock incentives (LTIP)

· Hired an independent audit firm to conduct a 2021 review of our cybersecurity framework against the best practices noted in the National Institute of Standards & Technology Cybersecurity Framework (“NIST Framework”)

Risk management

The Corporation monitors, evaluates and manages the principal risks associated with the conduct of its business. These risks include external market risks to which all investors are subject and internal risks resulting from the nature of the Corporation’s business.

The Corporation conducts an enterprise risk assessment on all of its major operating business units at least annually. Through the risk assessment process, the Corporation identifies the significant risk factors present in each business unit, and subjectively determines the likelihood of the risk occurring and the financial and/or non-financial impact to such business if the risk occurs. The Board and/or the management of each business unit monitors the significant risk factors identified by the Corporation and, where deemed necessary, adopts an appropriate risk optimization strategy.

The Corporation has internal control policies related to its business conduct. Such polices are intended to ensure conformity with the rules and regulations of the Canadian Securities Administrators, IIROC, the Ontario Securities Commission, the SEC, FINRA and any other regulator, as applicable. The policies focus on multiple areas, including employee code of ethics, conflict of interest management, as well as, compliance and risk monitoring of all business processes. Each policy has a defined control objective and applicable procedures to ensure adherence to sound business practices, regulatory requirements and high ethical standards, including capital adequacy, insurance, segregation of clients’ securities, safeguarding of securities and cash, and pricing of securities.

The Corporation has also established a number of policies with respect to its employees’ personal trading. Employees may not trade any of the securities held or being considered for investment by any of the Funds without prior approval. All of the Corporation’s employees must comply with the Corporation’s written policies and procedures, including the Corporation’s Code of Business Conduct and Ethics, which establish strict rules for professional conduct and management of conflicts of interest, and the Corporation’s Insider Trading Policy, which fosters and facilitates compliance with applicable laws, including applicable securities laws.

The Corporation believes that confidentiality is essential to the success of its business and, as such, strives to consistently maintain the highest standards of trust, integrity and professionalism. Account information is kept under strict control in compliance with all applicable laws, and physical, procedural, and electronic safeguards are maintained in order to protect this information from access by unauthorized parties. The Corporation keeps the affairs of its investors/clients confidential and does not disclose the identities of its investors/clients (absent express investor/client consent to do so). If a prospective client or investor requests a reference, the Corporation will not furnish the name of an existing client or investor before receiving permission from such client or investor to reveal their business relationship with the Corporation. See “Risk Management - Privacy Policy”.

Enterprise risk management

The Corporation’s risk appetite and its enterprise risk management program (“ERM”) is primarily based on specific regulatory and legal environment considerations; general environmental social and governance responsibilities; the need for sound capital adequacy and treasury management processes; the preservation of its positive reputation among current and future stakeholders; the natural expectation of its shareholders that it takes appropriate and reasonable levels of risk in its various business segments to maximize shareholder returns; and its overall desire to be good corporate citizens as part of its organizational culture and core values. The aforementioned considerations formed the basis for the Corporation’s risk appetite statements noted below:

· Regardless of loss probability, the Corporation will only accept inherent or residual risks that it has a proven, demonstrable ability to understand, diligently manage on an ongoing basis and thoroughly consider and balance relative to the outcomes; and

· The Corporation’s risk appetite is low around any actions or inactions that could materially jeopardize the Corporation’s reputation, core values or commitment to its stakeholders.

The ERM process involves a comprehensive drill down through the organization to its constituent parts to identify all salient risks and evaluate them through the lens of the Corporation’s risk appetite. The following is a summary of the ERM steps used to filter organizational risks through the Corporation’s risk appetite:

· Identify all major processes within each business segment (and enterprise shared services function supporting them);

· Identify materially relevant inherent risks (both quantitative and qualitative), that may arise in each major process area;

· Rate each inherent risk (in the absence of internal controls), based on the degree of event probability and impact to the organization;

· Determine our risk tolerance for each inherent risk previously identified and rated;

· Identify internal controls in place (or needed) to mitigate the inherent risks down to the appropriate “residual level” (i.e. determine the post-controls risk rating and compare it to our predetermined risk tolerance level). NOTE: we stratify our internal controls universe using the “three lines of defense” approach recommended by the Institute of Internal Auditors prior to evaluating the effectiveness of internal controls;

· Compare all residual risk ratings to their corresponding risk tolerance level to ensure the risk is being appropriately managed (i.e. there are a sufficient number of, and appropriate types of, internal controls in place to manage the risk in light of our risk tolerance), and if not, take further action;

· Test, document and report on the effectiveness of the ERM program in managing risks within the boundaries of our risk appetite.

Regulatory matters

SCP is registered as an investment dealer in Ontario, British Columbia, Alberta, Saskatchewan, Manitoba, Quebec, Prince Edward Island, New Brunswick, Nova Scotia, and Newfoundland and Labrador. SCP is also a member of IIROC. SAM is registered as a portfolio manager in Ontario, British Columbia, Alberta, Saskatchewan, Manitoba, New Brunswick, Nova Scotia and Newfoundland and Labrador and as an investment fund manager in Ontario, Quebec and Newfoundland and Labrador.

The Corporation is subject to extensive regulation in Canada. As a matter of public policy, regulatory bodies in Canada are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of investors participating in those markets. The Corporation’s operations are subject to the securities legislation of nine Canadian provinces, the Universal Market Integrity Rules, and the rules, regulations and by-laws of IIROC. The distribution of the Funds is also subject to regulations under the securities legislation of those jurisdictions where its Funds are sold.

Securities brokerage, trading, advisory and investment banking activities are conducted in SGRIL, a U.S.-registered broker-dealer affiliate. The SEC, state securities regulators and FINRA regulate this broker-dealer affiliate.

SAM and SAM USA are involved in the business of investment management in the U.S. or to U.S. persons. These activities require that SAM and SAM USA be registered with the SEC as investment advisers under the U.S. Investment Advisers Act of 1940 (the “Advisers Act”). The Advisers Act and related rules regulate the registration and activities of investment advisers.

The Corporation is subject to regulations that cover all aspects of the securities business, including sales methods, trading practices among investment dealers, use and safekeeping of funds and securities, capital structure, record-keeping, conflicts of interest and the conduct of directors, officers and employees. The various government agencies and self-regulatory organizations having jurisdiction over registrants are empowered to conduct administrative proceedings that can result in censure, fine, the issuance of cease-and-desist orders or the suspension or expulsion of a registrant or its directors, officers or employees. A registrant is subject to rules respecting the maintenance of minimum regulatory capital. Compliance with regulatory capital requirements can limit a registrant’s operations and also restrict its ability to withdraw capital from its regulated affiliates, which in turn can limit its ability to repay debt or pay dividends on its shares.

Since the Corporation’s ability to carry on its business is dependent upon its continued registration under applicable laws, the Corporation regularly reviews its policies, practices and procedures to ensure that they comply with current regulatory requirements and employees are routinely updated on relevant legal requirements. In addition, external legal advice is obtained, as required, to ensure that the Corporation is informed of new regulatory requirements that may be applicable. All of the Corporation’s registrations are in good standing. SCP has retained National Bank Independent Network (“NBIN”) under a written introducing/carrying broker agreement to provide certain record-keeping and operational services in respect of its client accounts which may include execution and settlement of securities transactions, custody of securities and cash balances, and extension of credit on margin transactions. The fees payable to NBIN as carrying broker are not considered material to the Corporation or NBIN.

There are certain regulatory restrictions on the ownership and holding of shares of investment dealers and their parent companies. Notably, the direct or indirect ownership or holding of an interest in an investment dealer by the public is subject to approval by IIROC, other self-regulatory organizations, stock exchanges and certain securities commissions. See “Risk Factors” and “Capital Structure”.

Privacy policy

The Corporation is also subject to Canadian federal and provincial privacy laws regarding the collection, use, disclosure and protection of client information. The Personal Information Protection and Electronic Documents Act (“PIPEDA”), the federal privacy legislation governing the private sector, requires that organizations only use personal information for purposes that a reasonable person would consider appropriate in the circumstances and for the purposes for which it is collected. The Corporation complies with the applicable requirements of PIPEDA and all applicable provincial personal information laws. The Corporation collects personal information directly from investors or through their financial advisor and/or dealer in order to provide such investor with services in connection with his or her investment, to meet legal and regulatory requirements and for any other purposes to which such investor may consent.

In addition, in the European Union, some of the Corporation’s operations are subject to the European Union’s General Data Protection Regulation (“GDPR”) which took effect on May 25, 2018. Despite the United Kingdom leaving the European Union as of December 31, 2020, the GDPR currently remains applicable alongside the UK Data Protection Act 2018. The GDPR sets out the requirements that companies must follow when processing personal data and provides for substantial penalties for non-compliance. Under the GDPR, companies who process personal data are required to comply with certain principles relating to the process of personal data (such as ensuring personal data is processed transparently, lawfully and for limited purposes) and report data breaches to data protection regulators. The GDPR also places companies under obligations relating to data transfers outside of the EU and the security of the personal data they possess. Another key aspect of the GDPR is that it provides data subjects with certain rights relating to their personal data (e.g. a right of access) that companies are required to comply with. The Corporation is aware of its obligations under the GDPR and is continuing to review and update its policies and procedures in light of those obligations.

The Corporation does not sell, lease, barter or otherwise deal with personal information collected by the Corporation with third parties. The Corporation carefully safeguards all personal information collected and retained by it and, to that end, restricts access to personal information to those employees and other persons who need to know the information to enable the Corporation to provide its services. The Corporation’s employees are responsible for ensuring the confidentiality of all personal information they may access. In addition to an employee’s obligation of confidentiality under the terms of their employment agreement, each of the Corporation’s employees is required to annually sign a code of conduct, which contains policies on the protection of confidential information.

The Corporation’s Privacy Policy is provided to every prospective client and sets out the Corporation’s commitment to the protection of the privacy of its clients.

Anti-money laundering laws

In order to comply with federal legislation aimed at the prevention of money laundering, the Corporation sometimes requires additional information concerning a purchaser of securities of any Investment Products. If, as a result of any information or other matter which comes to the attention of any of its directors, officers or employees, or its professional advisors, the Corporation knows or suspects that an investor is engaged in money laundering, it is required to report such information or other matter to the Financial Transactions and Reports Analysis Centre of Canada and such report shall not be treated as a breach of any restriction upon the disclosure of information imposed by law or otherwise.

Risk factors

An investment in the securities of the Corporation involves a number of risks. In addition to the other information contained in this AIF, investors should carefully consider the risks described below before making an investment decision. The Corporation’s business, financial condition, revenues and profitability could be materially adversely affected by any of these risks. The trading price of the common shares could decline due to any of these risks, and investors may lose all or part of their investment. The risks described below are not the only ones facing the Corporation and holders of common shares. Additional risks not currently known to the Corporation or that management currently considers immaterial may also impair the Corporation’s business operations should such risks arise or become material to the Corporation.

This AIF contains forward looking statements that involve significant known and unknown risks, uncertainties and assumptions. The Corporation’s actual results could differ materially from those expressed, anticipated or implied in these Forward-Looking Statements as a result of certain factors, including the risks faced by the Corporation described below and elsewhere in this AIF. See “Forward Looking Statements”.

Risks related to the business

Difficult market conditions

The success of the Corporation’s business lines is highly dependent upon conditions in the Canadian and global equity and financial markets and economic conditions throughout the world that are outside the Corporation’s control and difficult to predict. Factors such as interest rates, availability of credit, inflation rates, economic uncertainty, cyclical factors, changes in laws (including laws relating to taxation), trade barriers, commodity prices, currency exchange rates and controls, and national and international political circumstances (including wars, terrorist acts, security operations, demonstrations or protests), government policies, securities offerings and M&A activity, expenses associated with establishing and expanding new and existing business units and product offerings and performance of businesses and industry sectors can have a material negative impact on the Corporation’s revenues and profitability.

Unpredictable or unstable market conditions and adverse economic conditions may result in reduced opportunities to find suitable risk-adjusted investments to deploy capital and make it more difficult to exit and realize value from existing investments, which could materially adversely affect the Corporation’s ability to raise new funds and sustain profitability and growth.

The majority of the Corporation’s investment products are focused on precious metals and the natural resource industry. The natural resource industry is notoriously cyclical, and the Corporation’s performance is affected by the various stages in the resource investment cycle. In particular, investment performance, financial results and the ability to attract assets may be adversely affected by falling precious metals and commodity prices.

Poor investment performance

Management believes that investment performance is one of the most important factors explaining the historical growth of the Corporation’s AUM. Poor investment performance (relative to its competitors or otherwise) could impair revenues and growth as existing clients might withdraw funds in favour of better performing products and the ability of the Corporation to attract funds from existing and new clients would be reduced. All of the foregoing could result in lower AUM and could impact the Corporation’s ability to earn management fees. In addition, the ability to earn performance fees is directly related to investment performance and therefore poor investment performance may cause the Corporation to earn lower performance fees.

There is no assurance that the Corporation will be able to achieve or maintain any particular level of AUM, which may have a material negative impact on its ability to attract and retain clients, management fees and potential performance fees, and overall profitability. The Corporation’s investment products tend to be more volatile than general market indices as the Corporation’s investment team strives for exceptional performance and returns rather than attempting to mirror or follow the market indices. This volatility combined with negative or poor performance could combine to lead to a reduction in AUM and lower management fees and performance fees as a result. See “Risk Factors - Risks related to the Corporation’s investment products” regarding various risks to the performance of the Corporation’s investment products.

Key management and staff

The Corporation’s business is dependent on the highly skilled and often highly specialized individuals employed by the Corporation. The contribution of these individuals to the investment management, client service, sales, marketing, capital markets and operational teams is important to attracting and retaining clients. The Corporation aims to establish relationships with prospective clients in advance of any transaction, and to maintain such relationships over the long-term. Such relationships depend in part on the individual employees who represent the Corporation in its dealings with such clients. Management devotes considerable resources to recruiting, training and compensating these individuals. However, the competition in the market and the reliance on performance results have increased the demand for high quality professionals in the industries in which the Corporation operates.

Management has taken, and will continue to take, steps to retain key employees, including incentive programs such as the Corporation’s employee bonus pool, revenue share program, the Corporation’s stock option plan (the “Option Plan”), employee profit sharing plan (“EPSP”) and equity incentive plan (“EIP”). The Corporation has also entered into employment agreements with certain key employees. However, not all of the investment professionals have employment agreements or are subject to non-competition or non-solicitation restrictions. There can be no assurance that the steps taken to retain key individuals will be sufficient in light of the increasing competition for experienced professionals in the industry or that management will be able to recruit a sufficient number of new employees with the desired qualifications in a timely manner, if required. The failure to retain key employees and to recruit new employees could lead to a decline in revenues.

Employee error or misconduct

Misconduct by employees could include binding the Corporation to transactions that exceed authorized limits or present unacceptable risks, or concealing from the Corporation unauthorized or unsuccessful activities, which, in either case, may result in unknown and unmanaged risks or losses. Employee misconduct could also involve the improper use of confidential information, which could result in regulatory enforcement proceedings, sanctions and serious reputational harm. The Corporation is also susceptible to loss as a result of employee error. While management proactively takes extensive measures to deter employee misconduct or prevent employee error, the precautions management takes to prevent and detect this activity may not be effective in all cases, which could materially adversely affect the business, financial condition or profitability of the Corporation.

Performance fee fluctuations

The Corporation is entitled to performance fees only if performance exceeds pre-specified performance hurdles. If these hurdles are not exceeded, performance fees will not be payable for the relevant period. Moreover, any failure to meet or exceed a performance hurdle is carried forward indefinitely until such time as such deficit is made up. Performance fees will vary from period to period in relation to, among other things, volatility in investment returns, causing revenues to be more volatile. The volatility in revenues may decrease the common share price. In addition, most of the investment products have a December 31 performance year end, at which time performance fees (other than crystallized performance fees) for that 12-month period are determined. The limited partnerships have a carried interest generally received upon certain monetizing events in the limited partnership. Performance fees are generally received only once per portfolio performance year and determined based on the difference between the net asset value of the particular Investment Product on the first day of its performance year and on the last day of its performance year. The performance fees could be significantly impacted by events or factors beyond the Corporation’s control that affect the net asset value on one of those days. For example, the markets generally could suffer a significant decline in value on or near the last day of a performance year as a result of a market or world event that could cause the Corporation to earn lower or no performance fees for that performance year despite a prior overall increase in the net asset value of those investment products over the course of the year.

Moreover, there may be increased volatility in the price of common shares during the period leading up to the announcement of performance fees and/or the declaration by the board of special dividends, if any.

Counterparty risk

The majority of the Corporation’s receivables are from management fees, carried interest and performance fees from the business segments and funds. A business segment or another counterparty failing to pay its financial obligation could cause a decline in revenues for the Corporation.

Liquidity risk

The Corporation has a risk that it cannot meet its demand for cash or fund obligations as they come due. This includes exposure to liquidity risk through its loan advances (both directly via balance sheet loans and indirectly via borrowers of the lending funds the Corporation co-invests with) and other financial liabilities. The Corporation manages its liquidity risk by maintaining sufficient levels of liquid assets to meet its obligations as they come due. Additionally, the Corporation has access to a $70 million committed line of credit with a major Canadian Schedule I chartered bank.

Industry changes

The historical growth of the financial services industry may not continue and adverse economic conditions and other factors, including a protracted or precipitous decline in the Canadian, international or global financial markets or a change in the acceptance of fees typically charged by industry participants, could affect the popularity of the Corporation’s services or result in clients withdrawing from the markets or decreasing their level and/or rate of investment. A decline in the growth of the industries in which the Corporation operates or other changes to the industries that discourage investors could affect the Corporation’s ability to attract clients or could lead to redemptions of the Investment Products, as applicable, for reasons that may be unrelated to their performance but would nonetheless result in a decline in revenues.

Information security policies

The Corporation is dependent on the effectiveness of its information security policies, procedures and capabilities to protect its computer and telecommunications systems, and the data that resides on or is transmitted through them. Although the Corporation takes protective measures and tries to modify them as circumstances warrant, computer systems, sensitive data, software and networks may be vulnerable to cyberattacks, unauthorized access, computer viruses or other malicious code and events that could have a security impact. If one or more of these events occur, this could potentially jeopardize the Corporation’s, or its clients’ or counterparties’ confidential and other personal information processed and stored in, and transmitted through, computer systems and networks, or otherwise cause interruptions or malfunctions in clients’, counterparties, or third parties’ operations. The Corporation may be required to expend significant additional resources to modify protective measures or to investigate and remediate vulnerabilities or other exposures. As a result, the Corporation may be subject to financial losses, litigation, fines and/or liability for failure to comply with privacy and data security laws and regulations as well as regulatory investigations and heightened regulatory scrutiny. These all may lead to reputational harm affecting client and investor confidence, which in turn could materially adversely affect the Corporation’s business, financial condition or profitability.

A cyberattack could also compromise any proprietary, confidential or sensitive information or systems that the Corporation maintains for the purpose of competitive advantage (e.g. confidential corporate finance deal details) and such a compromise could lead to lost revenues while the Corporation attempts to recover or replace the lost information or systems.

The increased use of smartphones and other mobile devices, as well as enabling employees to securely access the Corporation’s network remotely, may also heighten these risks.

Use of technology

The Corporation is dependent on the efficiency and effectiveness of the technologies it uses. Any failure or interruptions of the Corporation’s systems, or those of third parties such as service providers, clearing corporations and exchanges, could cause delays or other problems in the Corporation’s sales, trading, clearing, settlement and other client services. Improper functioning of any of the technologies could materially interrupt the Corporation’s business operations and cause material financial loss, regulatory actions, breach of client contracts, reputational harm or legal liability, which in turn, could materially adversely affect the business, financial condition or profitability of the Corporation. Although the Corporation has back-up procedures, duplicate systems and business continuity plans in place, there is no assurances that procedures and plans will be sufficient or adequate in the event of a failure or interruption.

Lack of investment opportunities

An important component of investment performance is the availability of appropriate investment opportunities for the Corporation, new clients and new client assets. If the Corporation is not able to find sufficient investments in a timely manner, investment performance could be materially adversely affected. Alternatively, if there are insufficient investment opportunities, management may elect to limit the Corporation’s growth and reduce the rate of intake of new clients and new client assets. Historically, depending on, among other factors, prevailing market conditions, the Corporation has taken opportunities to invest in smaller market capitalization companies and other more thinly traded securities in which relatively smaller investments are typically made. As the Corporation’s AUM increases, the Corporation may not be able to exploit the investment opportunities that have historically been available to the Corporation or find sufficient investment opportunities for producing the absolute returns targeted. If the Corporation is not able to identify sufficient appropriate investment opportunities for itself, new clients and new client assets, the Corporation’s investment performance and management’s decision to continue to grow may be materially adversely affected.

Regulatory compliance

The Corporation’s ability to carry on its business is dependent upon its compliance with and continued registration under securities legislation in the jurisdictions in which it carries on business. See “Risk management - regulatory matters”. The securities business is subject to extensive regulation under securities laws in Canada, the U.S. and elsewhere. Compliance with many of the regulations applicable to the Corporation involves a number of risks, particularly in areas where applicable regulations may be subject to interpretation. In the event of non-compliance with an applicable regulation, securities regulators, IIROC and FINRA may institute administrative or judicial proceedings that may result in censure, fine, civil penalties, issuance of cease-and-desist orders, deregistration or suspension of the non-compliant investment dealer or investment adviser, suspension or disqualification of the investment dealer’s officers or employees, or other adverse consequences. The imposition of any such penalties or orders on the Corporation regardless of duration or any subsequent appellate results could have a material adverse effect on the Corporation’s operating results and financial condition.

Additional regulation, changes in existing laws and rules, or changes in interpretations or enforcement of existing laws and rules often affect directly the method of operation and profitability of securities firms. It is not possible to predict with any certainty as to what effect any such changes might have on the Corporation’s business. Furthermore, its business may be materially affected not only by regulations applicable to the Corporation as a financial market intermediary, but also by regulations of general application. For example, returns on investments in a given time period could be affected by, among other things, existing and proposed tax legislation, competition policy and other governmental regulations and policies, including the interest rate policies of the Bank of Canada, the Federal Reserve or other global central banks and changes in interpretation or enforcement of existing laws and rules that affect the business and financial communities or industry-specific legislation or regulations.

Risk management