Exhibit 99.1

|

|

| ANNUAL INFORMATION FORM |

| Financial Year Ended November 30, 2019 |

|

|

|

February 24, 2020

|

BASIS OF PRESENTATION

In this Annual Information Form, or AIF:

| · | references to “Theratechnologies”, the “Company”, the “Corporation”, “we”, “our” and “us” or similar terms refer to Theratechnologies Inc. and its subsidiaries on a consolidated basis, unless otherwise indicated or unless the context requires otherwise; |

| · | EGRIFTA® (tesamorelin for injection) and EGRIFTA SV™ refer to tesamorelin for the reduction of excess abdominal fat in HIV-infected patients with lipodystrophy. EGRIFTA is our registered trademark in the United States and in Canada and it is used in those countries to commercialize tesamorelin for the reduction of excess abdominal fat in HIV-infected patients with lipodystrophy. |

| · | tesamorelin refers to the use of our tesamorelin compound for the potential treatment of non-alcoholic steatohepatitis, or NASH, in HIV-infected patients and for other diseases; |

| · | Trogarzo® (Ibalizumab-uiyk) refers to the humanized monoclonal antibody ibalizumab for the treatment of multidrug-resistant HIV-1 infection; Trogarzo® is a registered trademark of TaiMed Biologics, Inc. and is under licence to us for use in the United States, Canada and the European Union. |

| · | THERA Patient Support® is our registered trademark in the United States and it refers to our patients and physicians service desk providing support to these people in connection with our commercialized products. |

| · | References to “$” and “US$” are to U.S. dollars and references to “CA$” or “CAD” are to Canadian dollars; |

| · | all information is provided as of February 24, 2020, except where otherwise stated. |

FORWARD-LOOKING STATEMENTS

This AIF contains forward-looking statements and forward-looking information within the meaning of applicable securities laws that are based on our management’s belief and assumptions and on information currently available to our management, collectively, “forward-looking statements”. In some cases, you can identify forward-looking statements by terms such as “may”, “will”, “should”, “could”, “would”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “project”, “predict”, “intend”, “potential”, “continue” and similar expressions intended to identify forward-looking statements. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| · | our expectations regarding the commercialization of EGRIFTA®, EGRIFTA SV™ and Trogarzo®; |

| · | our ability and capacity to grow the sales of EGRIFTA®, EGRIFTA SV™ and Trogarzo® successfully in the United States; |

| · | our capacity to meet supply and demand for our products; |

| · | the market acceptance of EGRIFTA SV™ in the United States; |

| · | the continuation of our collaborations and other significant agreements with our existing commercial partners and third-party suppliers and our ability to establish and maintain additional collaboration agreements; |

| · | our success in continuing to seek and in maintaining reimbursement for EGRIFTA®, EGRIFTA SV™ and Trogarzo® by third-party payors in the United States; |

| · | the success and pricing of other competing drugs or therapies that are or may become available; |

| · | our ability to protect and maintain our intellectual property rights in EGRIFTA®, EGRIFTA SV™ and tesamorelin; |

| · | our success in obtaining reimbursement for Trogarzo® in countries of the European Union; |

| · | our ability and capacity to launch Trogarzo® in countries of the European Union; |

| · | our capacity to develop a new formulation of tesamorelin; |

| · | our capacity to conduct a phase III clinical trial using tesamorelin for the treatment of NASH in the HIV-patient population and in the non-HIV population; |

| · | our capacity to develop our oncology peptides and obtain positive results from our research and development activities using those peptides; |

| · | our capacity to acquire or in-licence new products and/or compounds; |

| · | our expectations regarding our financial performance, including revenues, expenses, gross margins, profitability, liquidity, capital expenditures and income taxes; and |

| · | our estimates regarding our capital requirements. |

Such statements reflect our current views with respect to future events and are subject to certain risks, uncertainties and assumptions which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed in or implied by the forward-looking statements. Certain assumptions made in preparing the forward-looking statements include that:

| · | sales of EGRIFTA®, EGRIFTA SV™ and Trogarzo® in the United States will increase over time; |

| · | our commercial practices in the United States, Canada and the countries of the European Union will not be found to be in violation of applicable laws; |

| · | the long-term use of EGRIFTA®, EGRIFTA SV™ and Trogarzo® will not change their respective current safety profile; |

| · | no recall or market withdrawal of EGRIFTA®, EGRIFTA SV™ and Trogarzo® will occur; |

| · | no laws, regulation, order, decree or judgment will be passed or issued by a governmental body negatively affecting the marketing, promotion or sale of EGRIFTA®, EGRIFTA SV™ and Trogarzo® in the United States; |

| · | the categorization of tesamorelin as a biologic will not have a material adverse effect on us; |

| · | continuous supply of EGRIFTA®, EGRIFTA SV™ and Trogarzo® will be available; |

| · | our relations with third-party suppliers of EGRIFTA®, EGRIFTA SV™ and Trogarzo® will be conflict-free and such third-party suppliers will have the capacity to manufacture and supply EGRIFTA®, EGRIFTA SV™ and Trogarzo® to meet market demand on a timely basis; |

| · | no generic or biosimilar version of EGRIFTA® or EGRIFTA SV™ will be approved by the United States Food and Drug Administration, or FDA; |

| · | our intellectual property will prevent companies from commercializing generic or biosimilar versions of EGRIFTA® and EGRIFTA SV™ in the United States; |

| · | Trogarzo® will be added to the list of reimbursed drugs by countries of the European Union; |

| · | the FDA will approve a new formulation of tesamorelin; |

| · | we will obtain positive feedback from the FDA regarding our proposed phase III clinical trial to develop tesamorelin for the treatment of NASH in the HIV-patient population; |

| · | we will succeed in conducting our phase III clinical trial to develop tesamorelin for the treatment of NASH in the HIV-patient population; |

| · | our research and development activities using peptides derived from our oncology platform will yield positive results; |

| · | the data obtained from our market research on the potential market for Trogarzo® in the United States and in the European Union are accurate; |

| · | our European infrastructure is adequate to launch Trogarzo® in key European countries; and |

| · | our business plan will not be substantially modified. |

Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these risks and uncertainties, the forward-looking statements and circumstances discussed in this AIF may not occur, and you should not place undue reliance on these forward-looking statements. We discuss many of our risks in greater detail under “Item 3 - Risk Factors” (below) but additional risks and uncertainties, including those that we do not know about or that we currently believe are immaterial, may also adversely affect the forward-looking statements, our business, financial condition and prospects. Also, these forward-looking statements represent our estimates and assumptions only as of the date of this AIF. We undertake no obligation and do not intend to update or revise these forward-looking statements, unless required by law. We qualify all of the information presented in this AIF, and particularly our forward-looking statements, with these cautionary statements.

TABLE OF CONTENTS

| SELECTED EVENTS IN FISCAL YEAR 2019 AND OUTLOOK |

6 | |||||

| ITEM 1 |

CORPORATE STRUCTURE |

8 | ||||

| 1.1 |

NAME, ADDRESS AND INCORPORATION |

8 | ||||

| 1.2 |

SUBSIDIARIES |

8 | ||||

| ITEM 2 |

OUR BUSINESS |

9 | ||||

| 2.1 |

OVERVIEW |

9 | ||||

| 2.2 |

THREE-YEAR HISTORY |

10 | ||||

| 2.3 |

OUR 2020 STRATEGY AND OBJECTIVES |

14 | ||||

| 2.4 |

PRODUCTS |

15 | ||||

| 2.5 |

COMMERCIALIZATION ACTIVITIES |

17 | ||||

| 2.6 |

RESEARCH AND DEVELOPMENT ACTIVITIES |

23 | ||||

| 2.7 |

COMPETITION |

28 | ||||

| 2.8 |

GOVERNMENT REGULATION |

28 | ||||

| 2.9 |

PHARMACEUTICAL PRICING AND REIMBURSEMENT |

32 | ||||

| 2.10 |

CHANGES TO REGULATION – UNITED STATES |

34 | ||||

| 2.11 |

INTELLECTUAL PROPERTY |

35 | ||||

| 2.12 |

EMPLOYEES |

37 | ||||

| 2.13 |

FACILITIES |

37 | ||||

| 2.14 |

ENVIRONMENT |

38 | ||||

| ITEM 3 |

RISK FACTORS |

39 | ||||

| 3.1 |

RISKS RELATED TO THE COMMERCIALIZATION OF OUR PRODUCTS |

39 | ||||

| 3.2 |

RISKS RELATED TO RESEARCH AND DEVELOPMENT ACTIVITIES |

44 | ||||

| 3.3 |

RISKS RELATED TO OUR INTELLECTUAL PROPERTY |

45 | ||||

| 3.4 |

REGULATORY RISKS |

47 | ||||

| 3.5 |

LITIGATION RISKS |

49 | ||||

| 3.6 |

GEO-POLITICAL RISKS |

50 | ||||

| 3.7 |

OTHER RISKS RELATED TO OUR BUSINESS |

51 | ||||

| 3.8 |

RISKS RELATED TO OUR COMMON SHARES |

54 | ||||

| ITEM 4 |

DIRECTORS AND EXECUTIVE OFFICERS |

57 | ||||

| 4.1 |

DIRECTORS |

57 | ||||

| 4.2 |

AUDIT COMMITTEE |

63 | ||||

| 4.3 |

EXECUTIVE OFFICERS |

64 | ||||

| 4.4 |

CEASE TRADE ORDERS, BANKRUPTCIES, PENALTIES OR SANCTIONS |

66 | ||||

| 4.5 |

SECURITIES HELD BY THE DIRECTORS AND EXECUTIVE OFFICERS |

67 | ||||

| ITEM 5 |

INTERESTS OF EXPERTS |

68 | ||||

| ITEM 6 |

SECURITIES OF THE COMPANY |

69 | ||||

| 6.1 |

AUTHORIZED SHARE CAPITAL |

69 | ||||

| 6.2 |

DIVIDEND POLICY |

69 | ||||

| 6.3 |

TRANSFER AGENT AND REGISTRAR |

69 | ||||

| ITEM 7 |

MARKET FOR SECURITIES |

70 | ||||

| 7.1 |

PRICE RANGE AND TRADING VOLUME |

70 | ||||

| 7.2 |

PRIOR SALES |

71 | ||||

| ITEM 8 |

LEGAL PROCEEDINGS |

72 | ||||

| ITEM 9 |

MATERIAL CONTRACTS |

73 | ||||

| ITEM 10 |

ADDITIONAL INFORMATION |

78 | ||||

| APPENDIX A – AUDIT COMMITTEE CHARTER |

79 | |||||

SELECTED EVENTS IN FISCAL YEAR 2019 AND OUTLOOK

The following summary highlights selected events that occurred in the fiscal year 2019 and our business objectives described elsewhere in this AIF for the fiscal year 2020. This summary does not contain all of the information about us and you should carefully read the entire AIF, including the section entitled “Risk Factors”.

Commercial Events

| · | EGRIFTA SV™ became commercially available in the United States in November 2019; |

| · | We listed our common shares on the U.S. NASDAQ stock market in October 2019; |

| · | We terminated all of our distribution and licensing agreements with third parties regarding the distribution of EGRIFTA® and regained all of our worldwide distribution rights for this product from our commercial partners; |

| · | We acquired a targeted oncology technology platform through the acquisition of Katana Biopharma Inc. in February 2019; and |

| · | We appointed a general manager, Conor Walshe, to head our wholly owned subsidiary, Theratechnologies Europe Limited, based in Dublin, Ireland, and began recruiting and hiring employees to fill key positions. |

Regulatory Events

| · | In September 2019, the European Medicines Agency, or EMA, approved Trogarzo® for adults infected with multidrug-resistant HIV-1 for whom it is otherwise not possible to construct a suppressive antiviral regimen. |

Research and Development Events

| · | We received positive feedback from the FDA with respect to the development of our investigational peptide-conjugates, TH-1902 and TH-1904, and we aim to initiate one phase I clinical trial with TH-1902 by the end of 2020; |

| · | In vitro and in vivo experiments demonstrated that TH-1902 improved efficacy and tolerability compared to docetaxel alone; |

| · | In June 2019, we announced that we would pursue the development of tesamorelin for the treatment of NASH in people living with HIV. |

| · | In April 2019, based on a study conducted by the Massachusetts General Hospital, or MGH,, we announced that tesamorelin reduced liver fat in HIV patients with non-alcoholic fatty liver disease. |

2020 Business Objectives

| · | We intend to successfully continue growing our revenues in the United States from sales of EGRIFTA®, EGRIFTA SV™ and Trogarzo®; |

| · | We intend to successfully obtain reimbursement for Trogarzo® in key European countries; |

| · | We intend to develop a new formulation of tesamorelin; |

- 6 -

| · | We intend to initiate a phase III clinical trial using tesamorelin for the potential treatment of NASH in the HIV-patient population; |

| · | We intend to pursue the development of our oncology platform and initiate a phase I clinical trial using TH-1902 in patients suffering from cancer by the end of 2020; and |

| · | We intend to continue pursuing potential product acquisitions, in-licensing transactions complementary to our infrastructure, or other opportunities. |

- 7 -

ITEM 1 CORPORATE STRUCTURE

1.1 NAME, ADDRESS AND INCORPORATION

We were incorporated under Part IA of the Companies Act (Québec), or CAQ, on October 19, 1993 under the name Theratechnologies Inc. We amended our articles on October 20, 1993 by repealing the restrictions applicable to private companies. On December 6, 1993, we again amended our articles to increase the number of directors and to modify our share capital. On March 26, 1997, we further modified our share capital to consist of an unlimited number of common shares and an unlimited number of preferred shares. Finally, on June 21, 2011, we amended our articles to give the power to our directors to appoint a number of additional directors equal to 33.33% of the number of directors elected at the last shareholders meeting preceding any appointment.

On February 14, 2011, the CAQ was abrogated and replaced by the Business Corporations Act (Québec), or BCA, and companies governed by Part IA of the CAQ such as us became business corporations governed by the BCA. Accordingly, we did not have to file articles of continuation or amend our existing corporate articles. The BCA was applicable immediately without having to complete any formalities.

Our common shares are listed on the Toronto Stock Exchange, or TSX, under the symbol “TH” and on the U.S. NASDAQ stock market, or NASDAQ, under the symbol “THTX”. See Item 6.1 for a complete description of our authorized share capital.

Our head office and principal place of business are located at 2015 Peel Street, 11th Floor, Montreal, Québec, Canada H3A 1T8. Our phone number is (514) 336-7800. Our website is www.theratech.com. The information contained on our website is not part of this AIF.

1.2 SUBSIDIARIES

As at February 24, 2020, Theratechnologies had the following five wholly owned subsidiaries:

| · | Theratechnologies Europe Limited, a company governed by the Companies Act 2014 (Ireland). Theratechnologies Europe Limited is responsible to commercialize Trogarzo® in Europe; |

| · | Theratechnologies U.S., Inc., a company governed by the Delaware General Corporation Law (Delaware), provides the services of personnel to Theratechnologies Inc. for its activities in the United States; |

| · | Theratechnologies Intercontinental Inc.1, a company governed by the Business Corporations Act (Québec). Theratechnologies Intercontinental Inc., formerly Theratechnologies ME Inc., used to control the worldwide rights to commercialize EGRIFTA®, except in the United States, Europe, Russia, South Korea, Taiwan, Thailand and certain central Asian countries, and Canada; |

| · | Theratechnologies Europe Inc.1, a company governed by the Business Corporations Act (Québec). Theratechnologies Europe Inc., formerly 9176-5057 Québec Inc., used to control the rights to commercialize EGRIFTA® in Europe, Russia, South Korea, Taiwan, Thailand and certain central Asian countries; and |

| · | Pharma-G Inc.1, a company governed by the Business Corporations Act (Québec). Pharma-G Inc. is no longer an active subsidiary. |

1 We plan on winding-up those wholly owned subsidiaries into Theratechnologies Inc. in 2020.

- 8 -

ITEM 2 OUR BUSINESS

2.1 OVERVIEW

We are a commercial-stage biopharmaceutical company addressing unmet medical needs by bringing to market specialized therapies for people with orphan medical conditions, including those living with HIV.

Our vision is to grow our business to become a significant player in the pharma industry by making a difference in the lives of patients with special medical needs.

Our business strategy is to grow revenues from our existing and future assets in North America and Europe and to develop a portfolio of complementary products, compatible with our expertise in drug development and our commercialization know-how.

We currently commercialize three products: EGRIFTA®, EGRIFTA SV™ and Trogarzo®.

EGRIFTA® (tesamorelin for injection) was approved by the FDA in November 2010 and was launched in the United States in January 2011. EGRIFTA® was also approved by Health Canada in its 1 mg/vial presentation in March 2015 and was launched in Canada in June 2015. COFEPRIS, Mexico’s health agency, also approved EGRIFTA® in its 1 mg/vial presentation in March 2016. EGRIFTA® is not commercialized in Mexico since it is not reimbursed. As of this date, we do not intend to commercialize EGRIFTA® in Mexico by ourselves.

EGRIFTA® is currently the only approved therapy in the United States for the reduction of excess abdominal fat in HIV-infected patients with lipodystrophy and our organization has been commercializing this product in this country since May1st, 2014.

In Canada, EGRIFTA® is also the only approved drug for the treatment of excess visceral adipose tissue, as assessed by waist circumference ³ 95 cm for men and ³ 94 cm for women, and confirmed by a visceral adipose tissue level of > 130 cm2 by CT scan, in treatment-experienced adult HIV-infected patients. EGRIFTA® is marketed exclusively by us in this country but sales of EGRIFTA® are not material to our business.

EGRIFTA SV™ is a new formulation of EGRIFTA® and was approved by the FDA in November 2018 and launched in the United States in November 2019. EGRIFTA SV™ can be kept at room temperature, comes in a single vial and has a higher concentration resulting in a smaller volume of administration.

Trogarzo® (ibalizumab-uiyk) injection was approved by the FDA in March 2018 and was made commercially available in the United States in April 2018. Trogarzo® was also approved by the EMA in September 2019 and is not yet commercially available in Europe, except through early access programs. Trogarzo® is under licence to us following our entering into an amended and restated distribution and marketing agreement, or TaiMed Agreement, with TaiMed Biologics, Inc., or TaiMed, pursuant to which we acquired the exclusive right to distribute and commercialize ibalizumab in Canada, in the United States, in Europe and in certain other countries.

In addition to the sale of our products, we are conducting research and development activities in the oncology field further to our acquisition of our oncology platform in February 2019. We are completing the pre-clinical work on two (2) peptide-conjugates, namely TH-1902 and TH-1904, which, amongst other things, are aimed at treating triple negative breast cancer and ovarian cancer. We plan on initiating a phase I clinical trial withTH-1902 by the end of 2020.

Research and development work is also being carried out to improve the current formulation of tesamorelin.

- 9 -

Finally, pending feedback from the FDA, we plan on beginning a phase III clinical trial using tesamorelin for the potential treatment of NASH in people living with HIV by the end of 2020 using a new formulation of tesamorelin currently under development.

2.2 THREE-YEAR HISTORY

2019

| · | Preliminary Revenue Estimates for Fiscal 2019 and Revenue Guidance for Fiscal 2020. On December 19, 2019, we issued preliminary consolidated revenue estimates of $63.3 million for the fiscal year ended November 30, 2019 and consolidated revenue guidance ranging between $83 and $87 million for the fiscal year to end on November 30, 2020. |

| · | In Vitro and In Vivo Data on our Investigational Oncology Peptide-Conjugates Presented at Scientific Conference. On December 13, 2019, we announced the results from in vitro and in vivo experiments using TH-1902, our proprietary peptide-conjugate, currently in pre-clinical development at the San Antonio Breast Cancer Symposium. Results showed that treatment using TH-1902, in combination with docetaxel, improved efficacy and has better tolerability over treatment with docetaxel alone. In addition, we also announced that we were aiming at initiating a phase I clinical trial using TH-1902 before the end of 2020. |

| · | Commercialization of EGRIFTA SVTM in the United States. On November 25, 2019, we announced that EGRIFTA SVTM was commercially available in the United States. |

| · | Publication of NASH Study Results in The Lancet HIV Journal. On October 11, 2019, we announced that results from a clinical trial conducted at the Massachusetts General Hospital on the effects of tesamorelin on non-alcoholic fatty liver disease, or NAFLD, in HIV-patients had been published in The Lancet HIV Journal. |

| · | Common Shares Listed on U.S. NASDAQ Stock Market. On October 10, 2019, we announced that our common shares began trading on the U.S. NASDAQ stock market under the symbol “THTX”. The application to list on NASDAQ was filed on August 12, 2019. |

| · | Trogarzo® Approved by the EMA. On September 26, 2019, we announced that the EMA approved Trogarzo® for commercialization in European Union countries. |

| · | Worldwide Distribution Rights of EGRIFTA® Regained. On August 8, 2019, we announced the termination of all of our distribution and licensing agreements with our international commercial partners regarding their rights to distribute EGRIFTA® and, as a result, we regained all worldwide distribution rights to EGRIFTA®. |

| · | Change to our Board of Directors. On August 7, 2019, we announced that Mr. Jean-Denis Talon retired from our board of directors after 18 years of directorship. |

| · | Tesamorelin to be Developed for the Treatment of NASH in HIV Patient Population. On June 17, 2019, we announced that we would pursue the development of tesamorelin for the potential treatment of NASH |

- 10 -

| in people living with HIV. Our intent is to use a new formulation of tesamorelin currently under development. |

| · | Appointment of New Director. On March 29, 2019, we announced the appointment of Ms. Sheila Frame as a new independent member to our board of directors. |

| · | EMA Issues Good Manufacturing Practice Certificates to WuXi. On March 20, 2019, we announced that the EMA issued good manufacturing practice certificates to WuXi Apptec for its manufacturing sites of Trogarzo® in Wuxi City, China, and in Shanghai, China. |

| · | FDA Authorizes Study for a New Mode of Administration of Trogarzo®. On March 4, 2019, we announced that we were informed by TaiMed that the FDA authorized a study protocol to evaluate an intravenous slow-push formulation of Trogarzo®. |

| · | Acquisition of Oncology Platform. On February 25, 2019, we announced the acquisition of all of the issued and outstanding common shares of Katana BioPharma Inc., or Katana. Katana had exclusive worldwide rights through a licence agreement entered into with Transfer Plus L.P. to the development and commercialization of a targeted oncology technology platform. The technology platform uses peptides as a vehicle to deliver existing cytotoxic agents to sortilin receptors which are overexpressed in cancer cells. |

| · | Appointment of General Manager for our European Subsidiary. On February 11, 2019, we announced the appointment of Mr. Conor Walshe as the general manager of our wholly owned subsidiary Theratechnologies Europe Limited (formerly Theratechnologies International Limited). |

| · | Appointment of New Chief Commercial Officer. On December 3, 2019, we announced the appointment of Mr. Jovan Antunovic as our new Chief Commercial Officer further to the retirement of Ms. Lyne Fortin. |

2018

| · | FDA Approves F4 Formulation for EGRIFTA®. On November 5, 2018, we announced that the FDA approved the supplemental new drug application, or sNDA, filed for the new single vial formulation, or F4 Formulation, of EGRIFTA®. The sNDA was filed in July 2018. The F4 Formulation is four times more concentrated than the 1mg/vial formulation currently being commercialized, thereby reducing the volume of injection, and is also stable at room temperature. |

| · | Trogarzo® Included in Treatment Issued by DHHS. On October 29, 2018, we announced that Trogarzo® had been included in the most recent version of the treatment guidelines issued by the United States Department of Health and Human Services, or DHHS. |

| · | New Board Member at Theratechnologies. On October 15, 2018, we announced that Mr. Gary Littlejohn was appointed as a new independent member to our board of directors. |

| · | Filing of MAA for Trogarzo® with EMA. On August 28, 2018, we announced the filing of a marketing authorization application, or MAA, with the EMA to seek marketing approval of Trogarzo® in the European Union. Prior to filing the MAA, we obtained a decision from the EMA allowing us to defer the conduct of a pediatric investigation plan for Trogarzo® after the filing of the MAA. Prior to filing the MAA, we also obtained a decision from the Committee for Medicinal Products for Human Use, or CHMP, of the EMA that the MAA was eligible to be processed through the accelerated assessment procedure. The MAA is currently under review through the accelerated assessment procedure with a timeframe of |

- 11 -

| 150 review days, which does not include the time required to answer questions which might be asked by the EMA. We received questions from the EMA on December 14, 2018 and submitted our answers on January 25, 2019. We expect a decision from the EMA in the second half of 2019. |

| · | Trogarzo® Included in Treatment Guidelines Issued by IAS. On July 25, 2018, we announced that Trogarzo® was included in the most recent version of the treatment guidelines issued by the International Antiviral Society-USA Panel, or IAS. These guidelines state, among other things, that Trogarzo® may be useful as a fully active agent for patients with multi class-resistant virus. The full guidelines are available in the Journal of the American Medical Association, 2018; 320(4): 379-396. |

| · | US$57.5 Million Notes Offering. On May 30, 2018, we announced that we had entered into an underwriting agreement with a syndicate of underwriters pursuant to which those underwriters agreed to purchase US$50 million aggregate principal amount of 5.75% convertible unsecured senior notes due June 30, 2023, or Notes, at a price of US$1,000 per Note, or Offering. We also granted the underwriters an option to purchase up to an additional US$7,500,000 aggregate principal amount of Notes. The closing of the Offering of the Notes occurred on June 19, 2018, and resulted in gross proceeds to us of US$57,500,000. |

| · | Repayment of Long-Term Obligation to EMD Serono. On May 30, 2018, we announced the entering into of an amendment to a termination and transfer agreement, or the EMD Serono Termination Agreement, with EMD Serono Inc., or EMD Serono, to repay our long-term obligations, then totaling US$28.2 million in consideration of one lump sum payment of US$23.8 million. The payment of US$23.8 million was sourced from the Offering. |

| · | EGRIFTA® to be Studied in NAFLD-NASH Independent Study. On May 11, 2018, we announced that the National Institutes of Health, or NIH, in the United States awarded a grant to the Massachusetts General Hospital to conduct a study using EGRIFTA® in non-HIV patients suffering from Non-Alcoholic Liver Disease and Non-Alcoholic Steatosis Hepatosis, or NAFLD-NASH. |

| · | Release by FDA From Post-Approval Studies for EGRIFTA®. On May 1, 2018, we announced that the FDA released us from the conduct of a long-term observational safety study and a phase IV clinical trial to assess whether EGRIFTA® increased the incidence or progression of diabetic retinopathy in diabetic HIV-infected patients with lipodystrophy and excess abdominal fat. These two studies were mandated by the FDA upon the approval of EGRIFTA® in November 2010; |

| · | Ibalizumab Approved by FDA. On March 6, 2018, we announced that the FDA approved ibalizumab for the treatment of human immunodeficiency virus type 1, or HIV-1, infection in heavily treatment-experienced adults with multidrug-resistant HIV-1 infection failing their current antiretroviral regimen. Ibalizumab is commercialized in the United States under the tradename “Trogarzo” and was made commercially available on April 30, 2018. |

2017

| · | Ibalizumab Efficacy and Safety Results Presented at IDWeek 2017. On October 4, 2017, we announced that an oral presentation regarding the 48-week efficacy and safety results for ibalizumab in patients infected with MDR HIV-1 would be presented. The 27 patients who completed the 24-week treatment period using ibalizumab during the phase III trial in the United States entered the expanded access program study where they continued to receive ibalizumab at 800 mg every two 2 weeks for up to 48 weeks. The viral suppression observed at week 24 was sustained through week 48; median viral load reduction from baseline was 2.5 log10 at weeks 24 and 48. In the expanded access program study, 15 patients having an undetectable viral load at week 24 maintained suppression to week 48. In the |

- 12 -

| expanded access program, ibalizumab plus optimized background regimen was well tolerated. The most common adverse reactions noted with respect to the use of ibalizumab in the expanded access program were diarrhea, dizziness, nausea and rash. |

| · | FDA Inspection of Ibalizumab Manufacturing Facility. On August 2, 2017, we announced that we had been notified by our partner, TaiMed, that the FDA completed the pre-licence inspection of WuXi AppTec Biopharmaceuticals Co., Ltd.’s facility, or WuXi, where ibalizumab is manufactured. The inspection was carried out from July 17, 2017 until August 2, 2017. We were informed by TaiMed that the FDA completed the inspection with no critical findings, although a series of observations were made requiring corrections by WuXi. |

| · | Results Presented at 9th IAS Conference on HIV Science. On July 24, 2017, we announced that results on HIV susceptibility to ibalizumab and new findings for EGRIFTA® would be presented during poster sessions at the 9th IAS Conference on HIV Science in Paris, France. The data for ibalizumab showed no significant difference in susceptibility (measured by maximum percent inhibition or ICHALF MAX Fold Change) in patients HIV isolated that were either sensitive or resistant to other antiretroviral agents. With respect to EGRIFTA®, in a retrospective analysis of datasets from two, multicenter, randomized placebo-controlled trials using EGRIFTA® among HIV-infected adults with lipodystrophy, fat in trunk muscles decreased and trunk muscle area increased over 26 weeks in patients with excess visceral adipose tissue who showed a clinical response to EGRIFTA®. |

| · | Priority Review for Ibalizumab. On June 30, 2017, we announced that we had been notified by our partner, TaiMed, that the FDA had accepted for review the BLA filed by TaiMed for ibalizumab as a treatment for MDR HIV-1 and that the FDA had granted priority review status for this BLA. |

| · | New Board Member at Theratechnologies. On May 16, 2017, we announced that Ms. Dale Weil was elected as a new independent member to our board of directors. |

| · | BLA Filed for Ibalizumab. On May 3, 2017, we announced that our partner, TaiMed, had completed the filing of the BLA to the FDA for ibalizumab seeking the treatment of MDR HIV-1. |

| · | European Commercialization Rights Acquired by Us. On March 6, 2017, we announced that we had reached an agreement with TaiMed for the acquisition of the commercial rights to ibalizumab in the European Union countries as well as for Albania, Iceland, Israel Liechtenstein, Norway, Russia, Switzerland and Turkey. These territories are in addition to the territories of Canada and the United States of America for which we have the exclusive commercialization rights to ibalizumab as well. |

| · | Holding of Investment Community Meeting. On March 1st, 2017, we announced that we had hosted a webcast meeting for the investment community, the purpose of which was to provide the investment community with our corporate strategy for the years to come and an updated guidance for the fiscal year 2017. |

| · | Additional Secondary Efficacy and Safety Endpoint Results for Ibalizumab. On February 14, 2017, we announced that additional secondary efficacy and safety endpoint results from the 24-week ibalizumab phase III trial were presented at a late-breaker session at the 2017 Conference on Retroviruses and Opportunistic Infections. The new data showed that patients with MDR-HIV-1 infection experienced a mean increase in CD4+ T cell of 48 cells/µL after 24 weeks of treatment with ibalizumab plus an optimized background regimen. These data supplemented previously reported findings, where 83% of patients achieved a ³ 0.5 log10 decrease in viral load from baseline seven days after the single loading dose of 2000 mg of ibalizumab (primary endpoint) and a mean reduction in viral load of 1.6 log10 over the 24 week treatment period with more than 48% of patients experiencing a viral load reduction of more than 2.0 |

- 13 -

| log10. Patients enrolled in this phase III trial experienced a significant decrease in viral load after receiving a single loading dose of ibalizumab 2,000 mg intravenously in addition to their failing antiretroviral therapy (or no therapy). Viral load decreases were maintained during the 24-week trial. At the end of the treatment period, the proportion of study participants with undetectable viral load (HIV-1 <50 copies/mL) was 43% (mean viral load reduction of 3.1 log10) and 50% of patients had a viral load lower than 200 copies/ml. The safety results in this phase III trial were consistent with the ones previously observed in the phase IIb trial. Other than for one case of immune reconstitution inflammatory syndrome, an inflammatory response in HIV-infected patients that may be triggered after changing to more active antiretroviral therapy, no serious adverse events were considered to be related to ibalizumab. Most treatment-emergent adverse events reported were mild to moderate in severity. No notable trends in laboratory abnormalities were observed. Additionally, no anti-ibalizumab antibodies were detected in blood samples from patients. |

2.3 OUR 2020 STRATEGY AND OBJECTIVES

Our strategy for value creation in 2020 is focused on: increasing sales of EGRIFTA®, EGRIFTA SV™ and Trogarzo® in the United States; developing a new formulation of tesamorelin which could be used for the treatment of lipodystrophy and for the potential treatment of NAFLD/NASH in patients living with HIV; beginning a phase III clinical trial for the potential treatment of NAFLD/NASH in patients living with HIV; and initiating a phase I clinical trial with our investigational peptide-conjugate TH-1902.

We will also continue to seek reimbursement for Trogarzo® in key European countries. Finally, we will continue to assess the market for potential product acquisitions or in-licensing transactions that would be complementary to our infrastructure.

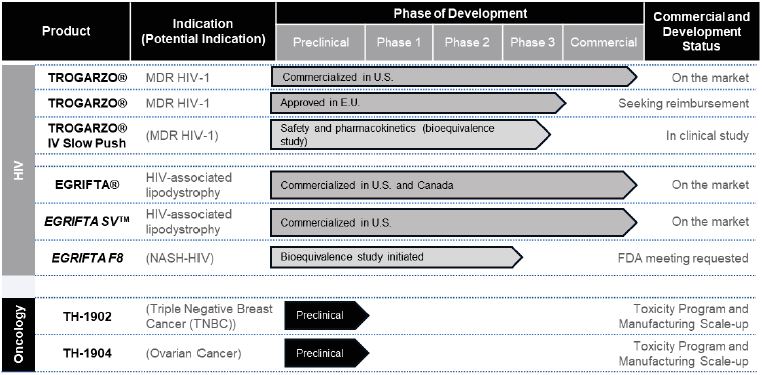

Below is a table detailing our approved products and our pipeline.

- 14 -

2.4 PRODUCTS

Our Approved Products

EGRIFTA® (tesamorelin for injection)

EGRIFTA® (tesamorelin for injection) induces the release of growth hormone which causes a reduction in excess abdominal fat (lipohypertrophy) in HIV-infected patients without reducing or interfering with subcutaneous fat, and, as such, has no clinically significant effect on undesired loss of subcutaneous fat (lipoatrophy).

EGRIFTA® is currently available in the United States as a once-daily two-unit dose (two vials, each containing 1 mg of tesamorelin) of sterilized lyophilized powder to be reconstituted with sterile water for injection. To administer EGRIFTA®, 1 ml is retrieved from each vial into one syringe to prepare a single 2 ml patient self-administered subcutaneous injection. EGRIFTA® is injected under the skin into the abdomen once a day.

EGRIFTA SVTM was approved by the FDA in November 2018 and was launched in the United States in November 2019. EGRIFTA SVTM is a new formulation of EGRIFTA®. EGRIFTA SVTM comes in a single vial, has a higher concentration, can be stored at room temperature and results in a smaller volume of administration.

Lipodystrophy

Lipodystrophy is characterized by abnormalities in the production and storage of fat. It has two components: lipohypertrophy, abnormal and excessive fat accumulation, and lipoatrophy, the noticeable, localized loss of fat tissue under the skin. In patients with lipohypertrophy, fat accumulation occurs mostly around the waist and may also occur in other regions, including breast tissue and in dorsocervical tissues in the neck, resulting in a “buffalo hump”. Excess fat also appears as lipomas, or benign tumors composed of fat cells. In patients with lipoatrophy, the loss of fat tissue generally occurs in the limbs and facial area.

In HIV-infected patients, lipodystrophy may be caused by the viral infection itself, the use of antiretroviral therapy (not class-specific), or both. Recent data suggest that different pathophysiological mechanisms are involved in the development of lipohypertrophy and lipoatrophy. The most common statistically significant independent risk factors identified for lipohypertrophy are duration of antiretroviral therapy and markers of disease severity, including higher pre-antiretroviral treatment viral load. Other factors include age, genetics, and gender.

Tesamorelin

Tesamorelin is the active peptide comprising EGRIFTA® and EGRIFTA SV™. Tesamorelin is a stabilized 44 amino acid human GRF analogue, which was synthesized in our laboratories in 1995 using our long-acting peptide method. Although natural peptides have significant therapeutic potential, they are subject to enzymatic degradation which severely limits their effectiveness in clinical use. Our long-acting peptide method is a peptide stabilization process which increases the target protein’s resistance to enzymatic degradation, while maintaining its natural specificity. This usually results in a more stable and efficient compound, which can thus prolong its duration of action. tesamorelin induces growth hormone secretion in a natural and pulsatile way. The clinical results obtained to date using tesamorelin suggest a therapeutic potential in both anabolic and lipolytic indications.

- 15 -

Mechanism of Action

In vitro, tesamorelin binds and stimulates human GRF receptors with similar potency as the endogenous GRF. GRF is a hypothalamic peptide that acts on the pituitary somatotroph cells to stimulate the synthesis and pulsatile release of endogenous growth hormone, which is both anabolic and lipolytic. Growth hormone exerts its effects by interacting with specific receptors on a variety of target cells, including chondrocytes, osteoblasts, myocytes, hepatocytes, and adipocytes, resulting in a host of pharmacodynamic effects. Some, but not all these effects, are primarily mediated by insulin-like growth factor one, IGF-1, produced in the liver and in peripheral tissues.

The effects of recombinant human growth hormone, or rhGH, and tesamorelin have been the subject of several clinical trials in the area of HIV-associated lipodystrophy. Based on these clinical trials, the safety profiles of rhGH and tesamorelin appear to be very different. The natural synthesis of growth hormone is regulated by a feedback mechanism preventing its overproduction. tesamorelin induces optimal activity of the somatotrope function and retains the natural rhythm (pulsatility) of the physiological secretion of growth hormone without interfering with the feedback mechanism mentioned above. With the exogenous administration of rhGH, the feedback mechanisms are short-circuited, which gives rise to higher levels of growth hormone. The side effects associated with rhGH include nerve, muscle or joint pain, swelling due to fluid retention (edema), carpal tunnel syndrome, numbness and tingling of skin and increased risk of diabetes. These side effects are particularly frequent among older people. In addition, rhGH can cause hyperglycemia which makes it contraindicated for patients with diabetes or pre-diabetic conditions.

Trogarzo® (ibalizumab-uiyk) Injection

Trogarzo® is a CD-4 directed post-attachment HIV-1 inhibitor. Trogarzo® was approved by the FDA on March 6, 2018 and was made commercially available to patients in the United States on April 30, 2018. In the United States, Trogarzo® is indicated for the treatment of HIV-1 infection in heavily treatment-experienced adults with multidrug-resistant HIV-1 infection failing their current antiretroviral regimen. Since its approval, Trogarzo® was included in the treatment guidelines issued by the IAS and the treatment guidelines issued by the DHHS. In addition, effective January 1, 2019, in order to facilitate the reimbursement of Trogarzo® for physicians, the Centers for Medicare and Medicaid Services assigned a specific J-Code to Trogarzo®: J-1746.

Trogarzo® is available in the United States as a single dose, 2 mg/vial containing 200 mg of ibalizumab-uiyk. Trogarzo® is administered intravenously after diluting the appropriate number of vials in 250 ml of 0.9% Sodium Chloride Injection, USP. Patients receive a single loading dose of 2,000 mg followed by a maintenance dose of 800 mg every two weeks.

Trogarzo® was also approved by the EMA on September 26, 2019. In Europe, Trogarzo® is indicated for the treatment of adults infected with multi-drug resistant HIV-1 infection for whom it is otherwise not possible to construct a suppressive antiviral regimen.

Trogarzo® is currently not commercially available in Europe, except through early access programs in a few countries, as we work on obtaining reimbursement in key European countries. We anticipate launching Trogarzo® sequentially in countries where the product will be reimbursed.

Trogarzo® was developed by TaiMed and is under licence to us. See “TaiMed Agreement” below.

Mechanism of Action

Unlike other antiretroviral agents, Trogarzo® binds primarily to the second extracellular domain of the CD4 receptor, away from major histocompatibility complex II molecule binding sites. It potentially prevents the HIV virus from infecting CD4+ immune cells while preserving normal immunological function. Trogarzo® is active

- 16 -

across all major HIV clades and irrespective of tropism. No drug-drug interactions and no cross-resistance with other antiretroviral therapies, or ART, were noted during the clinical trials.

2.5 COMMERCIALIZATION ACTIVITIES

EGRIFTA® and EGRIFTA SV™ - United States

General

Since May 1, 2014, we are responsible for the commercialization of EGRIFTA® (tesamorelin for injection) in the United States after regaining our commercialization rights to EGRIFTA® pursuant to the EMD Serono Termination Agreement.

EGRIFTA SV™ was made commercially available in the United States in November 2019. Since the launch of EGRIFTA SV™, physicians and patients are encouraged to use this new formulation.

Manufacturing

We do not own or operate commercial scale manufacturing facilities for the production of EGRIFTA® and EGRIFTA SV™, nor do we have plans to develop our own manufacturing operations in the foreseeable future. We currently depend on third-party service providers, Bachem Americas, Inc., or Bachem, and Jubilant HollisterStier, General Partnership, or Jubilant, for all of our required raw materials, drug substance and finished product for commercial sale and clinical trials, if any, and we have entered into supply agreements with those two third-party service providers.

We currently manufacture EGRIFTA® in a 1 mg/vial formulation and EGRIFTA SV™ in a 2 mg/vial formulation. Two vials of EGRIFTA® are required to administer the recommended dose of 2 mg; whereas EGRIFTA SV™ only requires one vial to administer a bioequivalent dose of 1.4 mg. Given its higher concentration, EGRIFTA SV™ results in a lower volume of administration.

Active Pharmaceutical Ingredient

We have an agreement with Bachem, an American subsidiary of Swiss-based Bachem AG, providing for the manufacture and supply of the active pharmaceutical ingredient of tesamorelin, or API, for EGRIFTA® and EGRIFTA SV™ for commercial sale in the United States and in Canada (EGRIFTA® only) as well as for clinical programs. Bachem is our only validated supplier of raw materials. The price of tesamorelin manufactured by Bachem has been set under our agreement and is not subject to volatility. See “Item 9 - Material Contracts” below.

Finished Product

We have an agreement with Jubilant providing for the manufacture and supply of the finished form of EGRIFTA® and EGRIFTA SV™ for commercial sale in the United States and in Canada (EGRIFTA® only) and for tesamorelin in connection with clinical programs. Under our agreement, Jubilant must fill vials with tesamorelin, lyophilize it, label and package those vials and deliver them to locations in accordance with our instructions. See “Item 9 - Material Contracts” below.

Injection Tool Kit

In connection with the sale of EGRIFTA® and EGRIFTA SV™, we decided to provide patients with the necessary devices to administer EGRIFTA® and EGRIFTA SV™. These devices are comprised of syringes, needles and water for injection. We have entered into supply agreements with third parties for the supply of syringes, hypodermic

- 17 -

needles and sterile water for injection. The packaging of those devices is done through third-party service providers.

Distribution

In connection with the commercialization of EGRIFTA® and EGRIFTA SV™ in the United States, we have entered into various agreements with third-party service providers to distribute our products to patients. The distribution of EGRIFTA® and EGRIFTA SV™ is tightly controlled and is only available through certain selected pharmacies. Below is a summary of our agreements entered into with our third-party service providers forming part of the supply chain of EGRIFTA® and EGRIFTA SV™.

Logistic Service Provider and Distributor

On November 1st, 2017, we entered into an amended and restated master services agreement with RxC Acquisition Company, LLC, or RxCrossroads, along with two amended and restated statements of work, or RxCrossroads Agreements. Under the terms of the RxCrossroads Agreements, RxCrossroads acts as our exclusive third-party logistic service provider for all of our products in the United States and as such, provides us with warehousing and logistical support services, including inventory control, account management, customers support, product return management and fulfillment of orders.

Under the RxCrossroads Agreements, RxCrossroads also acts as our exclusive third-party distributor of our products in the United States. In such role, RxCrossroads purchases products from us and takes title thereto. RxCrossroads’ purchases of our products are triggered by its expectations of market demand for them over a certain period of time. RxCrossroads fulfills orders received from authorized wholesalers and, with respect to EGRIFTA® and EGRIFTA SV™, delivers it directly to that authorized wholesaler’s client, namely a specialty pharmacy forming part of our network of specialty pharmacies. See “Item 9 - Material Contracts” below.

Wholesalers

Our supply chain of EGRIFTA® and EGRIFTA SV™ in the United States is comprised of a limited number of wholesalers through which specialty pharmacies we have contracted with can order EGRIFTA® and EGRIFTA SV™. These wholesalers accept purchase orders from those specialty pharmacies, purchase EGRIFTA® or EGRIFTA SV™ from RxCrossroads and resell any of those two products to these specialty pharmacies. Our wholesalers do not handle the physical delivery of EGRIFTA® and EGRIFTA SV™. The shipping and delivery of EGRIFTA® and EGRIFTA SV™ to those specialty pharmacies is handled by RxCrossroads. To date, we have agreements in place with the following wholesalers for EGRIFTA®: H.D. Smith, LLC., Cardinal Health, McKesson Corporation, Morris & Dickson Co., LLC, and Cesar Castillo, Inc. We are currently amending some of those agreements to include EGRIFTA SV™. For a description of these agreements, see “Item 9 - Material Contracts” below.

Specialty Pharmacies

We have entered into agreements with various specialty pharmacies across the United States providing them with the right to order EGRIFTA® and EGRIFTA SV™ from our authorized wholesalers and distribute EGRIFTA® and EGRIFTA SV™ to patients in the United States through their networks of local pharmacies.

In addition, a limited number of those specialty pharmacies are allowed to purchase EGRIFTA® and EGRIFTA SV™ directly from RxCrossroads for redistribution within their own retail specialty pharmacy stores.

- 18 -

EGRIFTA® - Canada

General

EGRIFTA® was approved for commercialization in Canada on April 30, 2014 in its 2 mg/vial presentation and, on March 30, 2015, in its 1 mg/vial presentation. No filing has been made in Canada to seek the approval of EGRIFTA SV™.

We have been commercializing EGRIFTA® in Canada since June 2015 using our internal team.

EGRIFTA® is not reimbursed in any of the provinces of Canada. However, EGRIFTA® is available in Canada to cash-paying patients and those with certain types of private insurance plans.

The supply chain and commercialization process of EGRIFTA® in Canada is described below.

Manufacturing

The manufacturing components of EGRIFTA® for commercialization in Canada are made by Bachem and Jubilant under the same agreements as those of the United States. The sterile water for injection is purchased off-the-shelf from a distributor. Since sterile water for injection is easily available in Canada, no formal agreement has been entered into with a third-party supplier.

On March 30, 2015, we entered into a packaging agreement with a third party supplier. Under this agreement, such supplier is responsible to label the vials of EGRIFTA® and place them in boxes ready for shipping and to package syringes, needles, sterile water for injection and patients inserts in the boxes ready for shipping. The agreement was scheduled to terminate on March 30, 2018 and has since been renewed for one-year terms. This agreement renews automatically for one-year terms unless a party gives the other party written notice of its intent not to renew the agreement. Such written notice must be given to the other party at least 90 days prior to the expiration of the agreement. To date, we have not issued nor received any such notice.

Distribution

The distribution of EGRIFTA® in Canada is made through McKesson Specialized Distribution Inc., or McKesson Distribution, an affiliate of McKesson Canada Corporation, or McKesson Canada. McKesson Distribution purchases EGRIFTA® from us, resells and distributes it to Canadian pharmacies which form part of its network. McKesson Canada provides us with various other services related to the commercialization of EGRIFTA® in Canada.

EGRIFTA® - Other Territories

EGRIFTA® is approved in Mexico but is not commercialized in such country since it is not reimbursed. In 2019, we have terminated all of our distribution and licensing agreements with third parties granting those third parties the exclusive right to commercialize EGRIFTA® in various territories of the world, including Latin America, Africa, the Middle East, the European Union countries and South Korea. As a result, we currently own all of the worldwide rights to EGRIFTA®. The termination of those agreements was part of our strategy to ensure that we would have all of the worldwide rights to commercialize EGRIFTA® if we develop tesamorelin for the potential treatment of NASH in the HIV-patient population.

- 19 -

Trogarzo®

General

On March 18, 2016, we entered into a distribution and marketing agreement with TaiMed and, on March 6, 2017, we amended and restated the TaiMed Agreement, as further amended on November 6, 2018. Pursuant to the terms of the TaiMed Agreement, we have the exclusive rights to commercialize Trogarzo® in the United States, in Canada, in the European Union countries as well as in Albania, Iceland, Israel, Liechtenstein, Norway, Russia, Switzerland and Turkey, or, collectively, European Territory.

Effective November 5, 2019, we re-amended the TaiMed Agreement to set forth some of the obligations of the parties in connection with the payment of expenses and the delivery terms of Trogarzo® in the European Territory.

Under the TaiMed Agreement, TaiMed is responsible for all development activities regarding ibalizumab. TaiMed is also responsible to manufacture and supply Trogarzo® to us for each territory/country covered by the TaiMed Agreement. Since TaiMed has no manufacturing facility, TaiMed has subcontracted the manufacture of Trogarzo® to WuXi Apptec Biologics, Inc., or WuXi. However, TaiMed has indicated to us that it began the construction of its own manufacturing facility with the aim of manufacturing Trogarzo®.

The TaiMed Agreement will expire on a country-by-country basis 12 years after marketing approval for ibalizumab has been obtained in each country, unless earlier terminated. The TaiMed Agreement contains customary representations and warranties, indemnification provisions and other provisions customarily found in agreements of this nature. In the last fiscal year, we met the minimum sales requirement under the TaiMed Agreement and there exists no more minimum sales requirement under the TaiMed Agreement.

North American Territory – Terms and Conditions

In Canada, we are responsible, but under no obligation, to seek the approval of Trogarzo® from Health Canada. No filing seeking the approval of Trogarzo® has been made in Canada and no decision has been taken yet regarding a filing in Canada.

In the United States, Trogarzo® was approved by the FDA on March 6, 2018.

We are responsible for all regulatory activities, regulatory filings and communications with Health Canada, if any, and with the FDA, in addition to all commercialization activities in the North American Territory.

The transfer price for sales of Trogarzo® in Canada and in the United States has been determined at 52% of its net selling price.

Under the terms of the TaiMed Agreement, we agreed to make the following payments to TaiMed in consideration of the rights granted to us in the North American Territory:

| - | a cash payment of US$1,000,000, which cash payment was made on the execution of the TaiMed Agreement in March 2016; and |

| - | a payment of US$4,000,000 through the issuance of common shares and such payment was made after the first commercial sale of Trogarzo® in the United States. |

The US$4,000,000 payment was made on May 15, 2018, and resulted in the issuance of 1,463,505 common shares to TaiMed.

- 20 -

Furthermore, we agreed to make the following one-time milestone payments to TaiMed based on the net sales of Trogarzo® in the North American Territory:

| - | US$7,000,000 in two annual equal installments once net sales reached an aggregate amount of US$20,000,000 over four consecutive Theratechnologies’s financial quarters. The first installment of US$3,500,000 was paid in July 2019; |

| - | US$10,000,000 once annual net sales will have reached US$200,000,000 in any of our financial year; |

| - | US$40,000,000 once annual net sales will have reached US$500,000,000 in any of our financial year; and |

| - | US$100,000,000 once annual net sales will have reached US$1,000,000,000 in any of our financial year. |

We also agreed to pay TaiMed a development milestone of US$3,000,000 upon the first commercial sale in the North American Territory of a bi-weekly intramuscular, subcutaneous or intravenous-push (either fast or slow) injection formulation. This milestone will be payable in two annual equal installments of US$1,500,000 each, with the first one being paid 30 days after the first sale of such new formulation in the North American Territory, while the second one will be paid 12 months thereafter.

We also agreed to pay TaiMed an additional development milestone as a result of the potential conduct by TaiMed of a phase III trial using Trogarzo® with a once every four-week intramuscular, subcutaneous or intravenous-push (either fast or slow) injection formulation. This development milestone would be equal to 50% of all costs associated with the development and approval of such new formulation, subject, however, to a maximum of US$50,000,000. We need to agree with TaiMed on the amount of the milestone after taking into consideration the size of the market for this new formulation of Trogarzo® and the market exclusivity related thereto. The TaiMed Agreement contains a provision dealing with a disagreement between the parties on the determination of the amount of this development milestone. This development milestone would be paid quarterly, based on a percentage of net sales then generated by the sale of Trogarzo® using this new formulation, and would include a payment of interest on the principal.

Distribution

We began the distribution of Trogarzo® at the end of April 2018.

Logistic Service Provider and Distributor

RxCrossroads acts as our exclusive third-party logistic service provider and exclusive third-party distributor in the United States under the RxCrossroads Agreements.

Specialty Pharmacies

We have entered into agreements with specialty pharmacies and infusion therapy providers that had a large U.S. network capable of handling drug products whose administration is made intravenously. These specialty pharmacies have the capacity to deliver Trogarzo® to patients, physicians or infusion centers. Each of those specialty pharmacies purchase Trogarzo® from RxCrossroads and deliver it to infusion centers, physicians or patients for home-infusion. Patients are administered Trogarzo® at infusion centers, at physicians’ offices or at home with the assistance of nurses.

To provide these services to patients, we entered into agreements with Accredo Health Group, Inc., or Accredo, Option Care Enterprises, Inc., or Option Care, Priority Healthcare Distribution, Inc., or Curascript, and Walgreen Co., or Walgreen. For a description of these agreements, see “Item 9 -Material Contracts” below.

- 21 -

Accredo and Option Care are specialty pharmacies that provide home-infusion services. Curascript is a specialty pharmacy that can deliver Trogarzo® to physicians and Walgreen is a specialty pharmacy.

European Territory – Terms and Conditions

In the European Territory, Trogarzo® was approved by the EMA on September 26, 2019. We are responsible for all regulatory activities, including regulatory filings and communications with the EMA, in addition to all commercialization activities.

The transfer price for sales occurring in a country forming part of the European Territory is set at (i) 52% of the net selling price of Trogarzo® in such country on annual net sales in such country up to, or equal to, US$50,000,000 and (ii) an amount equal to 57% of the net selling price of Trogarzo® in such country on the portion of annual net sales of Trogarzo® in the European Territory that exceeds annual net sales of Trogarzo® in the European Territory of US$50,000,000.

Under the terms of the TaiMed Agreement, we agreed to issue to TaiMed 906,077 common shares in consideration of the rights granted to us in the European Territory. The common shares were issued on March 17, 2017.

Furthermore, we agreed to make the following one-time milestone payments to TaiMed based on the net sales of Trogarzo® in the European Territory:

| - | US$10,000,000 to be paid in two annual equal installments upon the date of the first commercial sale of Trogarzo® in the European Territory. The first installment of US$5,000,000 is payable twelve (12) months after the first commercial sale of Trogarzo® in the European Territory, whereas the second installment of US$5,000,000 is payable twelve (12) months after first achieving aggregate net sales of US$50,000,000 in the European Territory over four (4) consecutive Theratechnologies’ financial quarters; |

| - | US$10,000,000 upon achieving aggregate net sales of Trogarzo® of US$150,000,000 over four consecutive financial quarters (based on our fiscal year); |

| - | US$20,000,000 upon achieving aggregate net sales of Trogarzo® of US$500,000,000 over four consecutive financial quarters (based on our fiscal year); and |

| - | US$50,000,000 upon achieving aggregate net sales of Trogarzo® of US$1,000,000,000 over four consecutive financial quarters (based on our fiscal year). |

Distribution

We will be responsible for the importation of Trogarzo® into the European Territory and its distribution will be made through third parties. Trogarzo® will be supplied to us by TaiMed in brite stock form. We will be responsible for quality testing and release of the Product to the market and for its packaging and labeling. We intend to follow the North American Territory distribution model in the European Territory in that we will sell Trogarzo® to one distributor that will resell it to end-users. We are currently finalizing the negotiations of commercial agreements with our proposed third-party suppliers in relation to the distribution of Trogarzo® in the European Territory.

Marketing and Sales of Our Products

North American Territory

Our marketing and sales activities in the United States for EGRIFTA®, EGRIFTA SVTM and Trogarzo® are conducted from our head office in Montreal, Québec, Canada. We have also retained the services of Syneos Health, or Syneos, to assist us with sales activities in the United States. Syneos is a recognized provider of

- 22 -

commercial, clinical and consulting services around the globe. We have renewed our agreement with Syneos and we entered into an amendment to our amended and restated master service agreement in this respect as of February 3, 2020, or Syneos Agreement, pursuant to which Syneos will continue providing us with various services in connection with the commercialization of EGRIFTA®, EGRIFTA SVTM and Trogarzo® in the United States. In addition, we sometimes retain Syneos and other third parties for certain marketing activities.

The services currently provided by Syneos comprise a sales force team fully dedicated to EGRIFTA®, EGRIFTA SVTM and Trogarzo®, a medical science liaison team solely assigned to our medical activities, a managed market team solely dedicated to the reimbursement of our products with both public and private payors.

The Syneos Agreement contains customary representations and warranties, indemnification, confidentiality, intellectual property and termination provisions. The Syneos Agreement is scheduled to expire on November 30, 2021, unless earlier terminated.

Last year, we have contracted with Asembia, LLC, or Asembia, for the provision of services related to a call center. The call center, THERA Patient Support®, guides physicians and patients through the process of initiating treatment under reimbursement. This process, which can be complex and time-consuming, begins with a referral and concludes with the final reimbursement decision. THERA Patient Support® also helps patients adhering to their treatment and answering questions about our products. See “Item 9 – Material Contracts” below

In Canada, the commercialization of EGRIFTA® is conducted internally. Trogarzo® is not approved in Canada since no filing has been made with Health Canada to seek its approval.

In addition, McKesson Canada provides the services of a call center, EGRIFTA Support®, which guides physicians and patients through the process of initiating treatment with EGRIFTA®, which answers questions patients may have regarding EGRIFTA® and which helps patients with the reimbursement process with their private insurance providers.

European Territory

EGRIFTA® and EGRIFTA SVTM

EGRIFTA® and EGRIFTA SVTM are not approved in Europe.

Trogarzo®

Thera International has focused its efforts on obtaining reimbursement for Trogarzo® in key European countries and it is anticipated that Trogarzo® will be launched sequentially as public reimbursement is obtained in individual countries.

Thera International has also retained the services of Syneos who provide medical science liaison personnel for Italy, France and Germany.

2.6 RESEARCH AND DEVELOPMENT ACTIVITIES

EGRIFTA® and Tesamorelin

F8 Formulation

We are currently working on the development of a new formulation of EGRIFTA®, or F8 Formulation. The F8 Formulation would be eight times more concentrated than the current EGRIFTA® formulation and twice as

- 23 -

concentrated as the EGRIFTA SVTM formulation. The F8 Formulation would have a number of advantages for the patients over the previous EGRIFTA® formulations: (1) it would be presented in a multidose vial that would be reconstituted once per week; (2) it would be stable at room temperature, even once reconstituted; and (3) the volume of administration is expected to be smaller, approximately 0.2 ml. We initiated the conduct of a bioequivalence study to further the development of this new formulation. If the development of the F8 Formulation is successful and if approved by regulatory authorities, the F8 Formulation could be used for the treatment of HIV-associated lipodystrophy in territories where EGRIFTA® has already been approved.

Tesamorelin for NASH in HIV-Patient Population

On June 17, 2019, we announced that we would move forward with the development of tesamorelin for the potential treatment of NASH in patients living with HIV using the F8 Formulation. This decision was made following the results of the study conducted by Dr. Steven Grinspoon of the Massachusetts General Hospital, or MGH, evaluating the safety and efficacy of tesamorelin in the treatment of HIV-infected patients suffering from NAFLD - NASH. The study sought to determine the effects of tesamorelin on liver fat, inflammation, fibrosis, and hepatocellular damage seen in conjunction with NASH.

The 12-month randomized, double-blind, placebo-controlled clinical trial enrolled a total of 61 men and women with HIV infection and hepatic fat fraction ³5%, assessed by magnetic resonance spectroscopy; 31 patients were randomized in the tesamorelin group while 30 patients were enrolled in the placebo group. At baseline, patients enrolled in the study had hepatic fat levels of 13.8%. In total, 43% of patients had fibrosis as assessed by liver biopsies.

The results of the study showed a statistically significant difference in the progression of fibrosis for patients in the tesamorelin arm. In the tesamorelin group, only 10.5% of patients experienced progression of liver fibrosis compared to 37.5% in patients receiving a placebo (p=0.04). Previously released data showed that in patients on tesamorelin, liver fat decreased by 32% while it increased by 5% in placebo patients, from baseline, (p=0.02), amounting to a 37% relative reduction in liver fat. Furthermore, 35% of patients in the tesamorelin group returned to liver fat values below 5% in comparison to only 4% of patients on placebo (p=0.007).

Exploratory analyses showed that the higher the baseline NASH score was, the more change was seen among the tesamorelin-treated individuals (r=-0.48, P=0.04), whereas a similar relationship was not observed in the placebo group (r=-0.14, P=0.52).

The results of the study were published in October 2019 in The Lancet HIV Journal.

NAFLD includes nonalcoholic fatty liver, or NAFL, NASH and NASH cirrhosis. NAFLD is the leading cause of liver diseases in the Western world (Central Europe and United States). As the global epidemic of obesity fuels NAFLD prevalence, NASH has become one of the most common liver disorders. In the absence of approved therapies, NASH remains widely untreated, and has become a critical public health concern with high unmet medical needs.

Without therapeutic intervention, NASH can cause the development of fibrosis, which is the accumulation of non-functional scar tissue, as the body tries to heal itself.

Because this build-up leads to tissue remodeling, development of fibrosis leads to progressive loss of liver function which may ultimately progress to life-threatening conditions such as cirrhosis, liver cancer and ultimately liver failure, a stage where patients have no other choice than undergoing a liver transplantation.

In addition to its deleterious effects on the liver, NASH multiplies the risk of a patient developing cardiovascular problems (myocardial infarction, stroke and peripheral vascular accident).

- 24 -

This contributes to higher mortality rates in NASH patients, and cardiovascular disease is the leading cause of death in NASH patients.

HIV-infected patients are at higher risk of NAFLD than the general population as a result of multiple cofactors, including lifelong use of antiretrovirals, HIV itself, host factors and highly prevalent metabolic comorbidities. The reported prevalence of NAFLD ranges from 13% to 65% in HIV-monoinfected patients. Moreover, NASH and significant liver fibrosis may be at least twice as frequent in HIV-monoinfected patients as in the general population.

On February 4, 2020, we entered into an amended and restated licence agreement with the MGH in order to benefit from the assistance and knowledge of the MGH for the development of tesamorelin for the potential treatment of NASH in the HIV population. Under the terms of the agreement, the MGH, through Dr. Steven Grinspoon, will provide services related to the study design, selection of optimal patient population, dosing, study duration and other safety matters and to participate, if need be, in regulatory meetings with the FDA or the EMA. In consideration, we agreed to make certain milestone payments to the MGH related to the development of tessamorelin and a low single-digit royalty payment on all sales of EGRIFTA® above a certain threshold amount. The payment of the royalty will begin upon approval by the FDA or the EMA (the first to occur) of an expanded label of tesamorelin for the treatment of NAFLD or NASH in the HIV population.

In addition, on that same date, we entered into a consulting agreement with the MGH pursuant to which Dr. Grinspoon became one of our scientific advisors. In such a role, Dr. Grinspoon will provide guidance about current developments in the HIV patient population, potential treatments, and the possible development of tesamorelin for treatment of additional diseases.

We have filed a demand for a Type C meeting with the FDA to discuss the opportunity for Theratechnologies to develop tesamorelin for the treatment of NASH with liver fibrosis in the HIV population. We expect a response form the FDA in the second quarter of 2020.

We have also filed a request for a CHMP Scientific Advice with the EMA in order to assess the development of tesamorelin for the treatment of NASH with liver fibrosis in the HIV population. We expect a decision from the CHMP in the first half of 2020.

Based on the feedback received from either of these regulatory agencies, assuming it is positive, we will then complete our protocol for our intended phase III clinical trial related to the development of tesamorelin for the treatment of NASH with liver fibrosis in the HIV population.

Oncology Platform

Acquisition of Oncology Platform

On February 25, 2019, we acquired all of the issued and outstanding common shares of Katana Biopharma Inc., or Katana, a company who had the exclusive worldwide rights, through a licence agreement, or Licence Agreement, with Transfert Plus, LP, or Transfert Plus, to a technology platform using peptides as a vehicle to specifically deliver cytotoxic agents to sortilin receptors, which are overexpressed on cancer cells. Katana was subsequently wound-up into Theratechnologies in May 2019.

The maximum purchase price, or Purchase Price, for all of the issued and outstanding common shares of Katana was set at CAD 7,980,000 and was payable as to a maximum of CAD 2,600,000 in cash and through the issuance of common shares on the closing date, or Up-Front Payment, subject to an upward adjustment aggregating CAD 1,080,000 upon obtaining a subsidy, or Subsidy, from a Québec-based governmental agency to pursue the research and development work on the oncology platform, and at later dates through the issuance of common

- 25 -

shares based on the attainment of two development milestones. The first development milestone of CAD 2,000,000, or Second Installment, is payable on the date that a phase I clinical trial is initiated using one of the peptides developed through the oncology platform and the second development milestone of up to CAD 3,000,000, or Third Installment, is payable upon our decision to pursue the development of the peptide studied in the phase I clinical trial if the results of such study warrant the pursuit of its development.

On the closing date, we paid to Katana’s shareholders the Up-Front Payment as to CAD 2,592,800 in cash and issued 900 common shares having an aggregate value of CAD 7,200. The Subsidy was subsequently obtained and, in October 2019, we paid an amount of CAD 500,000 in cash to the former Katana’s shareholders.

The balance of the payment resulting from the receipt of the Subsidy (CAD 580,000) will be paid through the issuance of common shares simultaneously to the payment of the Third Installment.

Description of Licence Agreement

Under the License Agreement, Katana (now Theratechnologies) obtained the exclusive worldwide rights to develop, make, have made, use, sell, offer to sell, distribute, commercialize and import the technology related to the technology platform that uses peptides as a vehicle to deliver existing cytotoxic agents to sortilin receptors which are overexpressed on cancer cells.

Annual maintenance fees amount to CAD 25,000 for the first five (5) years and CAD 100,000 thereafter, until royalties become payable beginning with the first commercial sale of a product developed using the licensed technology.

The royalties payable under the License Agreement vary between 1% and 2.5% on net sales of a product based on the licensed technology. If we enter into a sublicense agreement, we must then pay amounts varying between 5% and 15% of revenues received from such sublicense agreement. The percentage varies based on the timing of the entering into of such a sublicense agreement.

We must also pay Transfert Plus the following milestone payments upon the occurrence of the following development milestones for the first product developed in the field of oncology:

(i) first milestone payment: CAD 50,000 upon the successful enrolment of the first patient in the first phase I clinical trial;

(ii) second milestone payment: CAD 100,000 upon the successful enrolment of the first patient in the first phase II clinical trial;

(iii) third milestone payment: CAD 200,000 upon the successful enrolment of the first patient in the first phase III clinical trial.

Also, we must pay CAD 200,000 for each product upon receiving the first approval for such product by a regulatory authority. The approval shall entitle the holder thereof to commercialize the product in the territory in which the approval was obtained.

We must also pay Transfert Plus the same milestone payments upon the occurrence of any of those development milestones for the first product developed outside the field of oncology.

Research and Development Activities

To date, we are studying two proprietary compounds derived from our oncology platform, TH-1902 (conjugated with docetaxel) and TH-1904 (conjugated with doxorubicin), for the potential treatment of various types of cancer, including breast cancer, ovarian cancer and lung cancer.

- 26 -