Exhibit 99.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 1, 2015

CAPITOL ACQUISITION CORP. II

(Exact Name of Registrant as Specified in Charter)

| Delaware | 001-35898 | 27-4749725 | ||

| (State or other jurisdiction

of incorporation) |

(Commission File Number) | (IRS Employer Identification Number) |

| 509 7th Street, N.W., Washington, D.C. | 20004 | |

| (Address of Principal Executive Offices) | (Zip Code) |

(202) 654-7060

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☒ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c))

CAPITOL ACQUISITION CORP. II (“CAPITOL”) INTENDS TO HOLD PRESENTATIONS FOR CERTAIN OF ITS STOCKHOLDERS, AS WELL AS OTHER PERSONS WHO MIGHT BE INTERESTED IN PURCHASING CAPITOL’S SECURITIES, IN CONNECTION WITH THE PROPOSED TRANSACTION WITH LINDBLAD EXPEDITIONS, INC. (“LINDBLAD”), AS DESCRIBED IN THE CURRENT REPORT ON FORM 8-K FILED BY CAPITOL ON MARCH 10, 2015. THE EXHIBIT INCLUDED IN THIS CURRENT REPORT ON FORM 8-K MAY BE DISTRIBUTED TO PARTICIPANTS AT SUCH PRESENTATIONS.

CAPITOL HAS FILED A PRELIMINARY PROXY STATEMENT WITH THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) IN CONNECTION WITH THE PROPOSED TRANSACTION. STOCKHOLDERS OF CAPITOL AND OTHER INTERESTED PERSONS ARE ADVISED TO READ THE PRELIMINARY PROXY STATEMENT AND, WHEN AVAILABLE, THE DEFINITIVE PROXY STATEMENT IN CONNECTION WITH CAPITOL’S SOLICITATION OF PROXIES FOR THE SPECIAL MEETING BECAUSE THESE PROXY STATEMENTS WILL CONTAIN IMPORTANT INFORMATION. SUCH PERSONS CAN ALSO READ CAPITOL’S FINAL PROSPECTUS, DATED MAY 10, 2013, AND CAPITOL’S ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014 FOR A DESCRIPTION OF THE SECURITY HOLDINGS OF THE CAPITOL OFFICERS AND DIRECTORS AND THEIR INTERESTS AS SECURITY HOLDERS IN THE SUCCESSFUL CONSUMMATION OF THE PROPOSED TRANSACTION. THE DEFINITIVE PROXY STATEMENT WILL BE MAILED TO SECURITYHOLDERS OF CAPITOL AS OF A RECORD DATE TO BE ESTABLISHED FOR VOTING ON THE PROPOSED TRANSACTION. SECURITYHOLDERS WILL ALSO BE ABLE TO OBTAIN A COPY OF THE DEFINITIVE PROXY STATEMENT, WITHOUT CHARGE, BY DIRECTING A REQUEST TO: CAPITOL ACQUISITION CORP. II, 509 7th STREET, N.W., WASHINGTON, D.C 20004. THE PRELIMINARY PROXY STATEMENT AND THE DEFINITIVE PROXY STATEMENT, ONCE AVAILABLE, AND THE FINAL PROSPECTUS AND ANNUAL REPORT ON FORM 10-K CAN ALSO BE OBTAINED, WITHOUT CHARGE, AT THE SECURITIES AND EXCHANGE COMMISSION’S INTERNET SITE (http://www.sec.gov).

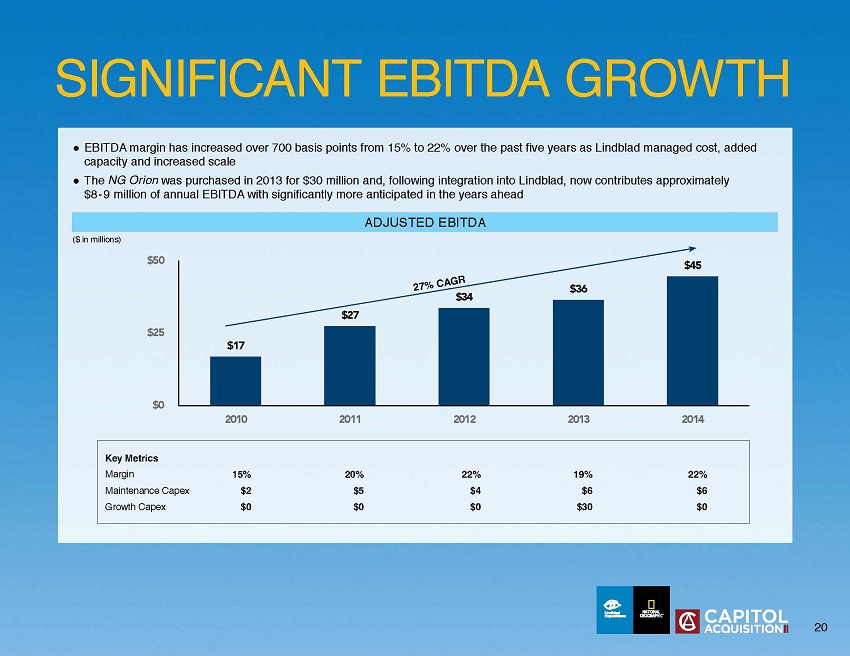

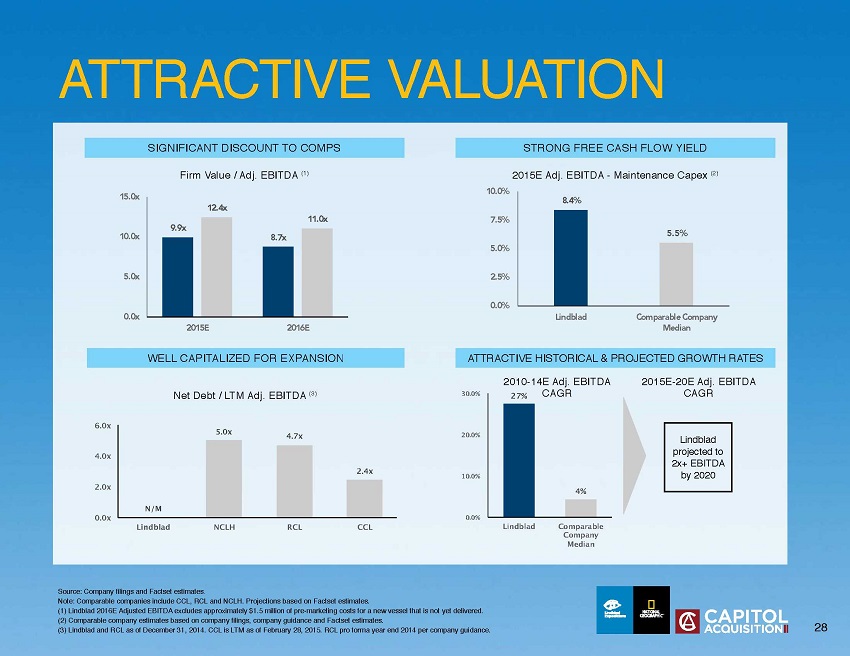

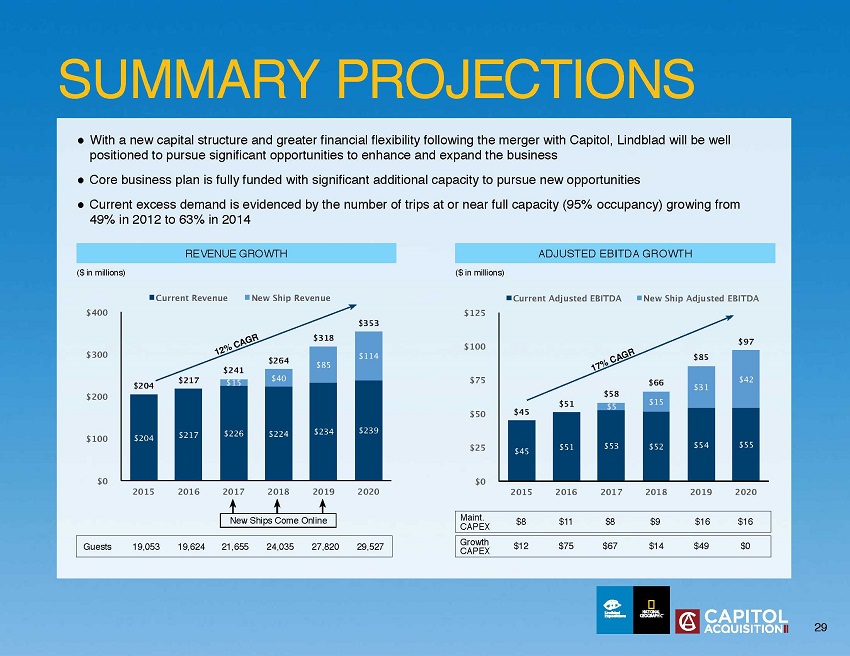

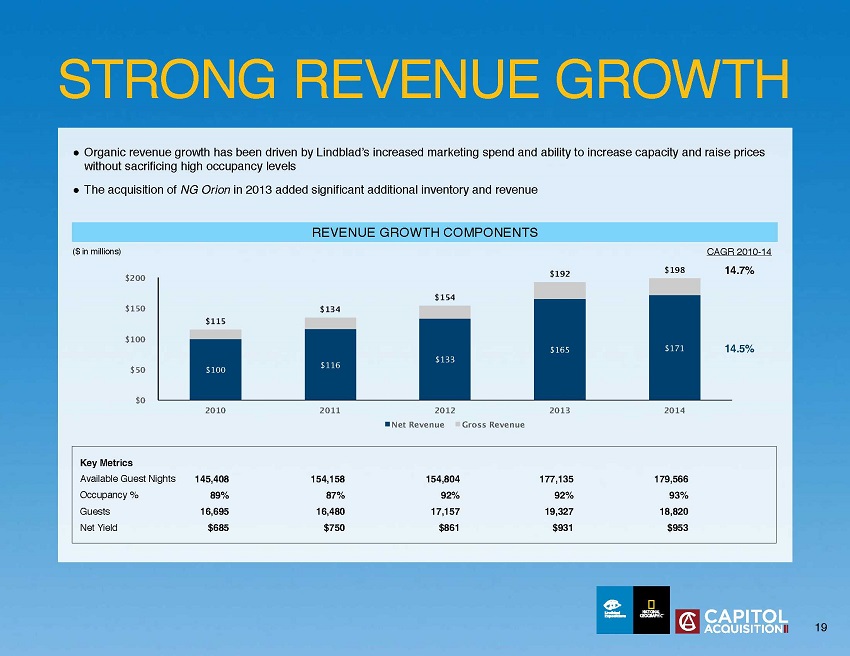

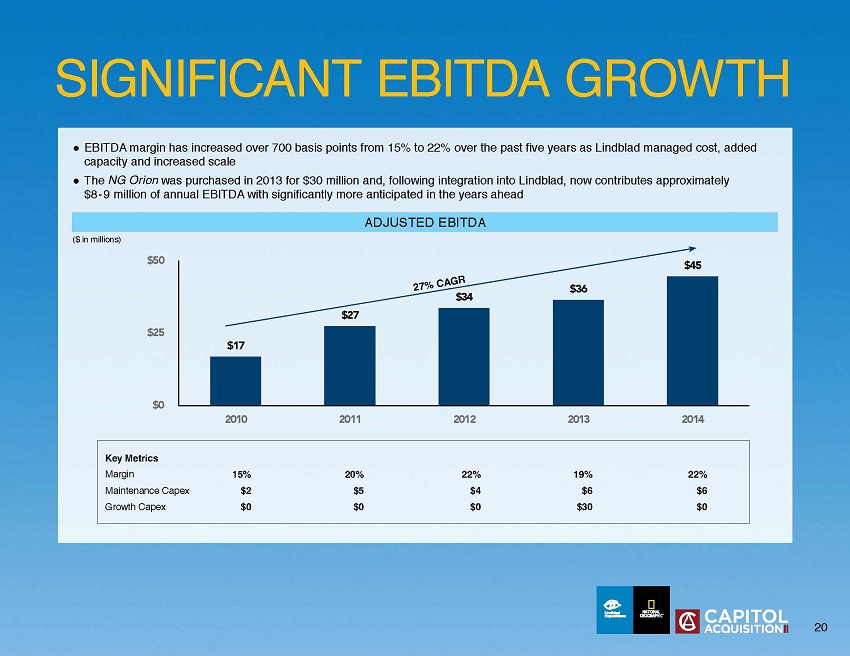

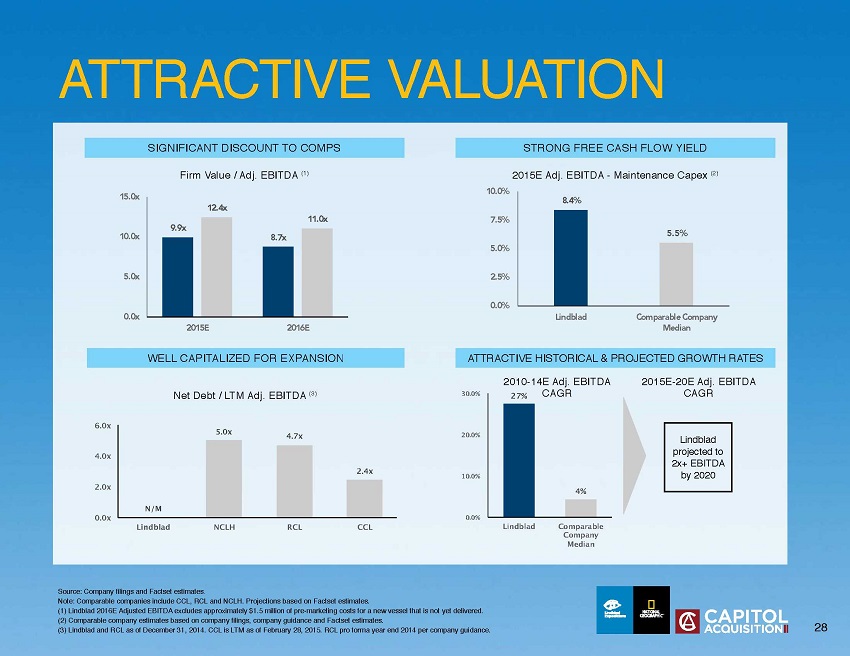

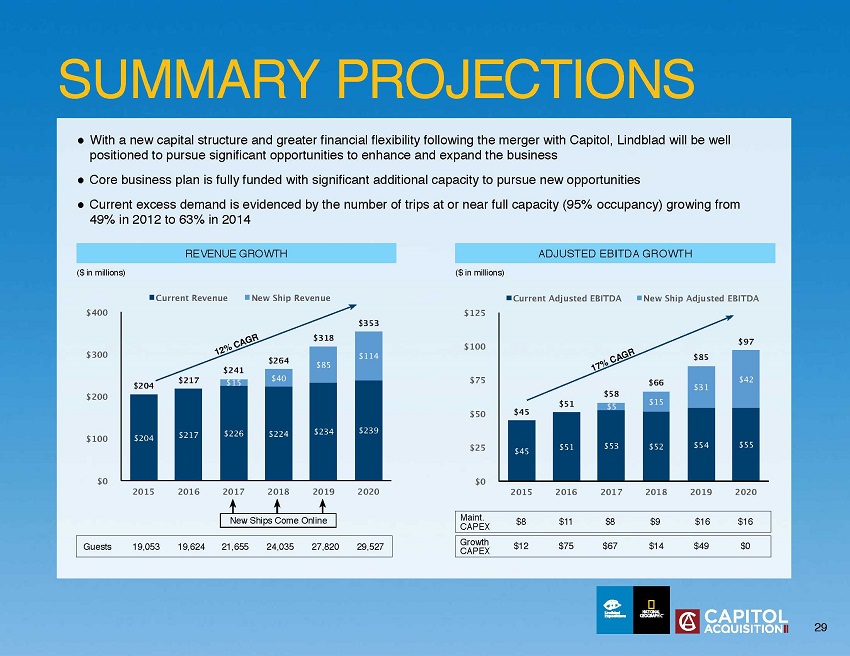

SOME OF LINDBLAD’S FINANCIAL INFORMATION AND DATA CONTAINED IN THE EXHIBIT HERETO DOES NOT CONFORM TO SEC REGULATION S-X IN THAT IT CONTAINES CERTAIN FINANCIAL INFORMATION (EBITDA) NOT DERIVED IN ACCORDANCE WITH UNITED STATES GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (“GAAP”). ACCORDINGLY, SUCH INFORMATION AND DATA WILL BE ADJUSTED AND PRESENTED DIFFERENTLY IN CAPITOL’S PROXY STATEMENT TO SOLICIT STOCKHOLDER APPROVAL OF THE PROPOSED TRANSACTION. CAPITOL AND LINDBLAD BELIEVE THAT THE PRESENTATION OF NON-GAAP MEASURES PROVIDES INFORMATION THAT IS USEFUL TO INVESTORS AS IT INDICATES MORE CLEARLY THE ABILITY OF LINDBLAD TO MEET CAPITAL EXPENDITURES AND WORKING CAPITAL REQUIREMENTS AND OTHERWISE MEET ITS OBLIGATIONS AS THEY BECOME DUE.

ADDITIONAL INFORMATION AND FORWARD-LOOKING STATEMENTS

This report and the exhibit hereto are not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of CAPITOL or LINDBLAD, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction.

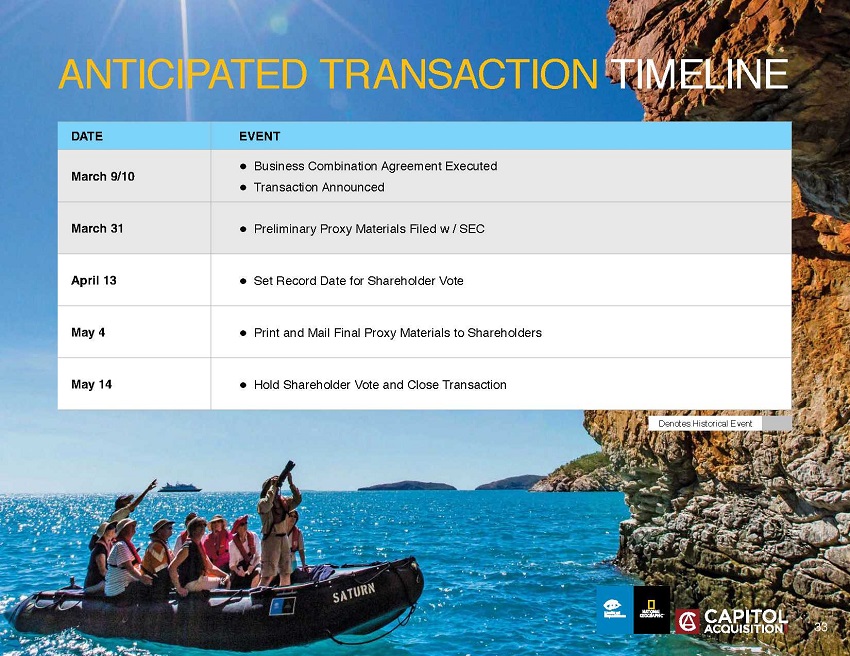

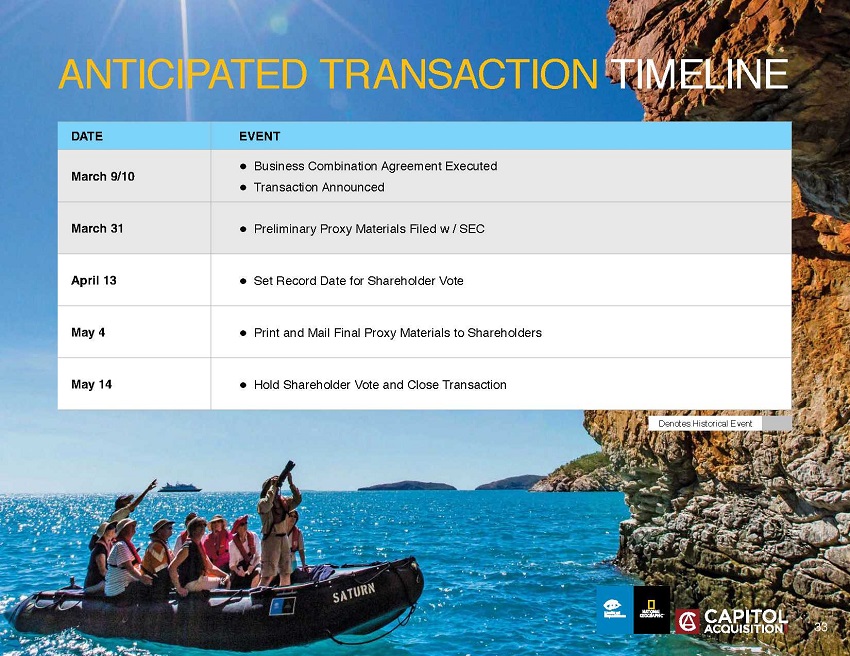

This report and the exhibit hereto include “forward-looking statements”. LINDBLAD’s actual results may differ from its expectations, estimates and projections and, consequently, you should not rely on these forward looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, CAPITOL’s and LINDBLAD’s expectations with respect to future performance, anticipated financial impacts of the PROPOSED TRANSACTION; approval of the PROPOSED transaction by security holders; the satisfaction of the closing conditions to the PROPOSED transaction; and the timing of the completion of the PROPOSED transaction.

These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the parties’ control and difficult to predict. Factors that may cause such differences include: business conditions; weather and natural disasters; changing interpretations of GAAP; outcomes of government reviews; inquiries and investigations and related litigation; continued compliance with government regulations; legislation or regulatory environments, requirements or changes adversely affecting the business in which LINDBLAD is engaged; fluctuations in customer demand; general economic conditions; and geopolitical events and regulatory changes. Other factors include the possibility that the PROPOSED TRANSACTION doES not close, including due to the failure to receive required security holder approvals, or the failure of other closing conditions.

The foregoing list of factors is not exclusive. Additional information concerning these and other risk factors WILL BE contained in CAPITOL’s filings with the SEC. All subsequent written and oral forward-looking statements concerning CAPITOL and LINDBLAD, the PROPOSED transaction or other matters and attributable to CAPITOL and LINDBLAD or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Neither CAPITOL nor LINDBLAD undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in their expectations or any change in events, conditions or circumstances on which any such statement is based, EXCEPT AS REQUIRED BY APPLICABLE LAW.

Item 7.01 Regulation FD Disclosure.

Attached as Exhibit 99.1 to this Report is the form of investor presentation to be used by Capitol in presentations to certain of its stockholders and other persons interested in purchasing Capitol common stock.

The information under this Item 7.01, including the exhibit attached hereto, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements, Pro Forma Financial Information and Exhibits.

(d) Exhibits:

| Exhibit | Description | |

| 99.1 | Investor Presentation. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: April 1, 2015

| CAPITOL ACQUISITION CORP. II | ||

| By: | /s/ Mark D. Ein | |

| Mark D. Ein Chief Executive Officer | ||

Exhibit 99.1

%_P"V

M)5QNN;Z^N#+(0,$G8Z*,^R@>PKJ<:4-)O7R,ZEC;ZS#S-+_@K+I]A!XP\$WD8A74KBRNX[K:P\PP

MI)$T.Y>N-SS`$]<,.<&OJ3X2?;$_9Z\*_;/.^W'PQ9&YW\MYOV./=D\\YSG'

M'/UKX;_9_DTO]KO]I:SN/BUXKFN)KPK':VCQ>3%J[!BR68DC"I!&6)X`W2&0

MJ#N?-?I%JEDC:3<;%C6/[,X`4!5&%(X`X`XZ#@=L5-63LDR*:YI.:V/S]_X)

M.!S\=M:$89BWAF08`Z_Z7:'^E?>TT