UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM

(Amendment No. 1)

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

| For

the fiscal year ended | ||

| OR | ||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the transition period from to

| Commission

file number: |

|

||

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||

(Address of principal executive offices) |

(Zip Code) | ||

| Registrant’s

telephone number, including area code: ( | |||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Not Applicable | Not Applicable | Not Applicable |

Securities registered pursuant to section 12(g) of the Act: Common Shares, without par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

| ☒ | Smaller Reporting Company | ||

| Emerging Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐

At

December 31, 2021, the aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates

of the registrant was $

DOCUMENTS INCORPORATED BY REFERENCE

The registrant incorporates by reference in Part III hereof portions of its definitive proxy statement on Schedule 14A for its 2022 annual general meeting of shareholders.

EXPLANATORY NOTE

Background of Restatement

On October 18, 2022, the Audit Committee of the Board of Directors (the “Audit Committee”) of the Company, in consultation with the Company’s management, concluded that the Company’s previously issued consolidated financial statements with respect to the Affected Periods contained an error related to the accounting for the unamortized deferred financing costs and debt discounts upon extinguishments of debt related to debt conversions. As a result of this error, the Audit Committee determined that the Company’s consolidated financial statements for the Affected Periods should not be relied upon and should be restated by adjusting interest expense recognized in each of the Affected Periods. Any previously issued or filed reports, press releases, earnings releases and investor presentations or other communications describing the Company’s previously issued consolidated financial statements and other related financial information covering the Affected Periods should no longer be relied upon.

The identification of the need for the restatement arose out of the Company’s normal quarterly close and review procedures for the quarter ended September 30, 2022. Pursuant to these procedures, the Audit Committee, in consultation with the Company’s management, assessed the Company’s accounting policies, as well as the presentation and accounting for the amortization of debt discounts and deferred financing costs, and concluded that the Company should have expensed a proportionate amount of the debt discounts and deferred financing costs at the time of each conversion of the Company’s outstanding convertible debt security.

The change in the timing of expensing debt discounts and unamortized deferred financing costs upon extinguishments of debt related to debt conversions affects interest expense in the Company’s consolidated statements of operations and comprehensive loss.

This correction to the Company’s consolidated statements of operations and comprehensive loss also impacts the Company’s consolidated balance sheets, consolidated statements of shareholders’ equity, and certain notes to the consolidated financial statements, as well as management’s discussion and analysis of financial condition and results of operations included in the Company’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q covering the Affected Periods. This correction does not impact the consolidated statements of cash flows besides offsetting adjustments between net loss, accretion of convertible debt, and foreign exchange (gain) loss within the cash flows from operating activities section.

See Note 2 to the Consolidated Financial Statements in Part II, Item 8, “Financial Statements and Supplementary Data” for more information regarding this correction and the background of the Restatement.

Internal Control Considerations

The Company’s management has concluded that the Company had a material weakness in its internal control over financial reporting during the Affected Periods relating to the error described above. For a discussion of management’s considerations of the Company’s disclosures controls and procedures, internal control over financial reporting, and material weakness identified, refer to Part II, Item 9A., “Controls and Procedures.”

Items Amended in this Amendment

This Amendment sets forth the Original Form 10-K, as modified and superseded where necessary to reflect the Restatement and the related internal control considerations. Accordingly, the following items included in the Original Form 10-K have been amended, as appropriate, to reflect the Restatement and the related internal control considerations:

| ● | Part I, Item 1A, “Risk Factors”; |

| ● | Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; |

| ● | Part II, Item 8, “Financial Statements and Supplementary Data”; |

| ● | Part II, Item 9A, “Controls and Procedures”; and |

| ● | Part IV, Item 15, “Exhibits and Financial Statement Schedules.” |

Additionally, in accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended, the Company is including with this Amendment currently dated certifications from its Chief Executive Officer and Chief Financial Officer. These certifications are filed or furnished, as applicable, as Exhibits 31.1, 31.2, 32.1 and 32.2.

Except as described above, this Amendment does not amend, update or change any other disclosures in the Original Form 10-K. In addition, the information contained in this Amendment does not reflect events occurring after the Original Form 10-K was filed and does not modify or update the disclosures therein, except to reflect the effects of the Restatement. This Amendment should be read in conjunction with the Company’s other filings with the SEC.

TABLE OF CONTENTS

Contents

Glossary of Terms

| 0896800 | 0896800 B.C. Ltd., a wholly owned subsidiary of the Company and 100% owner of ECRC |

| 2019 NI 43-101 Elk Creek Technical Report | A CIM-compliant NI 43-101 technical report for the Elk Creek Project filed on SEDAR on May 29, 2019, with an effective date of April 16, 2019 |

| 2022 Elk Creek Feasibility Study | A feasibility study prepared by qualified persons, the results of which are summarized in the 2022 NI 43-101 Elk Creek Technical Report and the S-K 1300 Elk Creek Technical Report Summary. |

| 2022 NI 43-101 Elk Creek Technical Report | A CIM-compliant NI 43-101 technical report for the Elk Creek Project filed on SEDAR on June 28, 2022, with an effective date of June 28, 2022 |

| Air Permit | A State of Nebraska permit which describes all the prospective air emissions from a facility |

| CIM | Canadian Institute of Mining and Metallurgy |

| Common Shares | The Common Shares, without par value, in the capital stock of NioCorp as the same are constituted on the date hereof, as traded on the TSX |

| COVID-19 | The disease caused by a novel strain of coronavirus that the World Health Organization declared a global pandemic in March 2020 |

| deposit | A mineralized body which has been physically delineated by sufficient drilling, trenching, and/or underground work, and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures. Such a deposit does not qualify as a commercially mineable ore body or as containing reserves or ore, unless final legal, technical, and economic factors are resolved. |

| diamond drilling | A type of rotary drilling in which diamond bits are used as the rock-cutting tool to produce a recoverable drill core sample of rock for observation and analysis |

| Dodd-Frank Act | The United States Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 |

| ECRC | Elk Creek Resources Corp., a private Nebraska corporation and wholly owned subsidiary of 0896800 |

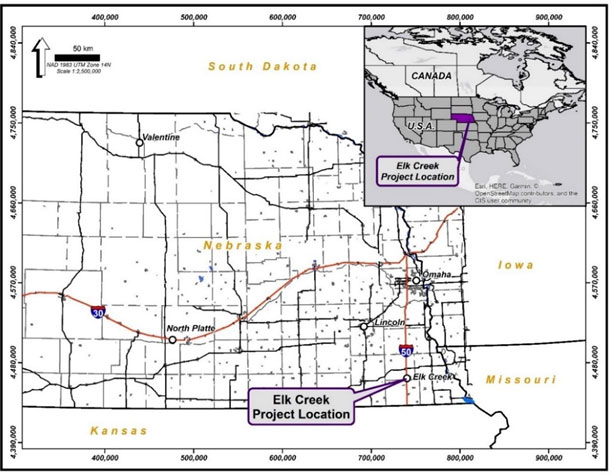

| Elk Creek Project | NioCorp’s niobium, scandium, and titanium project located on the Elk Creek Property |

| Elk Creek Property | NioCorp’s Carbonatite property located in Southeast Nebraska, USA on which the Elk Creek Project is located |

| EPA | The United States Environmental Protection Agency |

| Exchange Act | United States Securities Exchange Act of 1934, as amended |

| Ferroniobium or FeNb | An iron-niobium alloy, with a niobium content of 60-70% |

| grade | A particular quantity of metal or mineral, relative to other constituents, in a specified quantity of rock |

i

| HSLA steel | High-strength low-alloy steel |

| Lind III | Lind Global Asset Management III, LLC, an entity managed by The Lind Partners, a New York based asset management firm |

| Lind III Agreement | NioCorp’s definitive convertible security funding agreement with Lind III dated February 16, 2021 |

| Lind III Convertible Security | a convertible security dated as of February 16, 2021, issued to Lind III pursuant to the Lind III Agreement with a face value of $11,700,000 (representing $10,000,000 in funding plus an implied 8.5% interest rate per annum for the term of the Lind III Convertible Security) |

| Lind III Warrants | 8,558,000 Common Share purchase warrants, exercisable at a price per Common Share of C$0.97, expiring February 19, 2025, and issued on February 19, 2021, to Lind III pursuant to the Lind III Agreement |

| LoM | Life of Mine, the period from the beginning of construction to the end of mine life |

| Mark Smith | Chief Executive Officer, President, and Executive Chairman of NioCorp |

| NAAQS | The U.S. National Ambient Air Quality Standards limits on atmospheric concentration of six pollutants that cause smog, acid rain, and other health hazards, as established by the EPA |

| NDEE | Nebraska Department of Environment and Energy |

| NI 43-101 | National Instrument 43-101 of the Canadian Securities Administrators entitled “Standards of Disclosure for Mineral Projects” |

| niobium or Nb | The element niobium (atomic number 41), a transition metal primarily used in the production of HSLA steel |

| Nb2O5 | Niobium pentoxide, a commercial form of refined niobium |

| NioCorp, we, us, our or the Company | NioCorp Developments Ltd. |

| NSR | Net Smelter Return, the net revenue that the owner of a mining property receives from the sale of the mine's products less transportation and refining costs |

| Nordmin | The Nordmin Group of Companies |

| Nordmin Note | A convertible note in the principal amount of approximately $1,872,000 issued by the Company to Nordmin pursuant to a convertible note and warrant subscription agreement, dated as of December 18, 2020, between NioCorp and Nordmin |

| Offtake Agreement | An agreement between NioCorp and a third party for the purchase and sale of products to be produced from the Elk Creek Project |

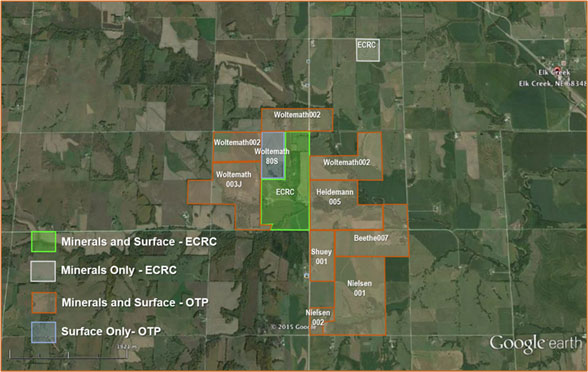

| OTP | An option to purchase agreement between NioCorp’s wholly owned subsidiary ECRC and an individual landowner relating to land and/or mineral rights |

ii

| Rare earth elements, rare earths or REEs | A group of 15 elements referred to as the lanthanide series in the periodic table of elements. Scandium and yttrium, while not true REEs, are also included in this categorization because they exhibit similar properties to the lanthanides and are found in the same ore bodies. Individual mineral deposits may not contain all REEs in economically recoverable quantities. |

| Rare earth products | Commercial rare earth products currently being examined for production by the Company, including neodymium-praseodymium oxide (sometimes referred to as didymium oxide), dysprosium oxide, and terbium oxide. These are the primary rare earths compounds used to manufacture the world’s most powerful permanent magnets. |

| scandium or Sc | The element scandium (atomic number 21), a transition metal used as an alloying agent with aluminum that provides high strength and lower weight for aerospace industry components and other applications that need lightweight metals. It also is used in the electrolyte layer of solid oxide fuel cells. |

| Sc2O3 | Scandium trioxide, the primary form of refined scandium |

| SEC | United States Securities and Exchange Commission |

| Securities Act | United States Securities Act of 1933, as amended |

| SEDAR | System for Electronic Document Analysis and Retrieval, the electronic filing system for the disclosure documents of issuers across Canada |

| S-K 1300 | Subpart 1300 of Regulation S-K promulgated by the SEC |

| S-K 1300 Elk Creek Technical Report Summary | A technical report summary for the Elk Creek Project that conforms to S-K 1300 reporting standards and filed as Exhibit 96.1 to this Annual Report on Form 10-K |

| Smith Credit Agreement | A non-revolving credit facility agreement with Mark Smith, dated January 16, 2017, as amended, of which $2.0 million is outstanding at June 30, 2022 and $0.7 million remains available for borrowing. |

| titanium or Ti | The element titanium (atomic number 22), a transition metal which in its oxide form is a common pigment in paper, paint, and plastic. In its metallic form, titanium is used in aerospace applications, armor, chemical processing applications, marine hardware applications, medical implants, power generation, and in sporting goods. |

| TiO2 | Titanium dioxide, a commercial form of refined titanium |

| TSF | An engineered and lined tailings storage facility constructed as a permanent repository for wastes produced from mining and production of niobium, scandium and titanium products |

| TSX | The Toronto Stock Exchange |

| U.S. | The United States of America |

| USACE | The United States Army Corps of Engineers |

| U.S. GAAP | United States generally accepted accounting principles |

| USGS | The United States Geological Service |

iii

S-K 1300 Definitions

| cut-off grade | The grade (i.e., the concentration of metal or mineral in rock) that determines the destination of the material during mining. For purposes of establishing “prospects of economic extraction,” the cut-off grade is the grade that distinguishes material deemed to have no economic value (it will not be mined in underground mining or if mined in surface mining, its destination will be the waste dump) from material deemed to have economic value (its ultimate destination during mining will be a processing facility). Other terms used in similar fashion as cut-off grade include net smelter return, pay limit, and break-even stripping ratio. |

| development stage issuer | An issuer that is engaged in the preparation of mineral reserves for extraction on at least one material property |

| development stage property | A property that has mineral reserves disclosed, pursuant to Regulation S-K 1300, but no material extraction |

| economically viable | When used in the context of mineral reserve determination, means that the qualified person has determined, using a discounted cash flow analysis, or has otherwise analytically determined, that extraction of the mineral reserve is economically viable under reasonable investment and market assumptions |

| feasibility study | A comprehensive technical and economic study of the selected development option for a mineral project, which includes detailed assessments of all applicable modifying factors, as defined under S-K 1300, together with any other relevant operational factors, and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is economically viable. The results of the study may serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project.

(1) A feasibility study is more comprehensive, and with a higher degree of accuracy, than a pre-feasibility study. It must contain mining, infrastructure, and process designs completed with sufficient rigor to serve as the basis for an investment decision or to support project financing.

(2) The confidence level in the results of a feasibility study is higher than the confidence level in the results of a pre-feasibility study. Terms such as full, final, comprehensive, bankable, or definitive feasibility study are equivalent to feasibility study.

|

| indicated mineral resource | That part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated mineral resource has a lower level of confidence than the level of confidence of a measured mineral resource, an indicated mineral resource may only be converted to a probable mineral reserve. |

| inferred mineral resource | That part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred mineral resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a mineral reserve. |

iv

| measured mineral resource | That part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured mineral resource is sufficient to allow a qualified person to apply modifying factors, as defined in this section, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured mineral resource has a higher level of confidence than the level of confidence of either an indicated mineral resource or an inferred mineral resource, a measured mineral resource may be converted to a proven mineral reserve or to a probable mineral reserve. |

| mineral reserve | An estimate of tonnage and grade or quality of indicated and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. |

| mineral resource | A concentration or occurrence of material of economic interest in or on the Earth's crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled. |

| modifying factors | The factors that a qualified person must apply to indicated and measured mineral resources and then evaluate in order to establish the economic viability of mineral reserves. A qualified person must apply and evaluate modifying factors to convert measured and indicated mineral resources to proven and probable mineral reserves. These factors include, but are not restricted to: mining; processing; metallurgical; infrastructure; economic; marketing; legal; environmental compliance; plans, negotiations, or agreements with local individuals or groups; and governmental factors. The number, type and specific characteristics of the modifying factors applied will necessarily be a function of and depend upon the mineral, mine, property, or project. |

| probable mineral reserve | The economically mineable part of an indicated and, in some cases, a measured mineral resource |

| production stage issuer | An issuer that is engaged in material extraction of mineral reserves on at least one material property |

| production stage property | A property with material extraction of mineral reserves |

| proven mineral reserve | The economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource |

v

| qualified person | An individual who is:

(1) A mineral industry professional with at least five years of relevant experience in the type of mineralization and type of deposit under consideration and in the specific type of activity that person is undertaking on behalf of the registrant; and

(2) An eligible member or licensee in good standing of a recognized professional organization at the time the technical report is prepared. For an organization to be a recognized professional organization, it must:

(i) Be either:

(A) An organization recognized within the mining industry as a reputable professional association; or

(B) A board authorized by U.S. federal, state or foreign statute to regulate professionals in the mining, geoscience or related field;

(ii) Admit eligible members primarily on the basis of their academic qualifications and experience;

(iii) Establish and require compliance with professional standards of competence and ethics;

(iv) Require or encourage continuing professional development;

(v) Have and apply disciplinary powers, including the power to suspend or expel a member regardless of where the member practices or resides; and

(vi) Provide a public list of members in good standing.

|

| relevant experience | For purposes of determining whether a party is a qualified person, that the party has experience in the specific type of activity that the person is undertaking on behalf of the registrant. If the qualified person is preparing or supervising the preparation of a technical report concerning exploration results, the relevant experience must be in exploration. If the qualified person is estimating, or supervising the estimation of mineral resources, the relevant experience must be in the estimation, assessment and evaluation of mineral resources and associated technical and economic factors likely to influence the prospect of economic extraction. If the qualified person is estimating, or supervising the estimation of mineral reserves, the relevant experience must be in engineering and other disciplines required for the estimation, assessment, evaluation and economic extraction of mineral reserves.

(1) Relevant experience also means, for purposes of determining whether a party is a qualified person, that the party has experience evaluating the specific type of mineral deposit under consideration (e.g., coal, metal, base metal, industrial mineral, or mineral brine). The type of experience necessary to qualify as relevant is a facts and circumstances determination. For example, experience in a high-nugget, vein-type mineralization such as tin or tungsten would likely be relevant experience for estimating mineral resources for vein-gold mineralization, whereas experience in a low grade disseminated gold deposit likely would not be relevant.

Note 1 to Paragraph (1) of the Definition of Relevant Experience: It is not always necessary for a person to have five years’ experience in each and every type of deposit in order to be an eligible qualified person if that person has relevant experience in similar deposit types. For example, a person with 20 years' experience in estimating mineral resources for a variety of metalliferous hard-rock deposit types may not require as much as five years of specific experience in porphyry-copper deposits to act as a qualified person. Relevant experience in the other deposit types could count towards the experience in relation to porphyry-copper deposits. |

vi

(2) For a qualified person providing a technical report for exploration results or mineral resource estimates, relevant experience also requires, in addition to experience in the type of mineralization, sufficient experience with the sampling and analytical techniques, as well as extraction and processing techniques, relevant to the mineral deposit under consideration. Sufficient experience means that level of experience necessary to be able to identify, with substantial confidence, problems that could affect the reliability of data and issues associated with processing.

(3) For a qualified person applying the modifying factors, as defined by this section, to convert mineral resources to mineral reserves, relevant experience also requires:

(i) Sufficient knowledge and experience in the application of these factors to the mineral deposit under consideration; and

(ii) Experience with the geology, geostatistics, mining, extraction and processing that is applicable to the type of mineral and mining under consideration. |

Metric Equivalents

For ease of reference, the following factors for converting Imperial measurements into metric equivalents are provided:

To convert from Imperial |

To metric |

Multiply by |

| Acres | Hectares | 0.4047 |

| Feet (“ft”) | Meters (“m”) | 0.3048 |

| Miles | Kilometers (“km”) | 1.6093 |

| Tons | Tonnes (“t”) | 0.9072 |

| 1 mile = 1.6093 kilometers |

| 1 acre = 0.4047 hectares |

| 2,204.62 pounds = 1 metric tonne = 1 tonne |

| 2000 pounds (1 short ton) = 0.9072 tonnes |

Mineral Reserves and Resources

Information concerning our mining property in this Annual Report on Form 10-K has been prepared in accordance with the requirements of S-K 1300, which first became applicable to us for the fiscal year ended June 30, 2022. All mineral resource and mineral reserve estimates included in this Annual Report on Form 10-K have been prepared in accordance with S-K 1300. Previously, we prepared our estimates of mineral resources and mineral reserves following only NI 43-101 and CIM. The 2022 NI 43-101 Elk Creek Technical Report and S-K 1300 Elk Creek Technical Report Summary, filed as Exhibit 96.1 to this Annual Report on Form 10-K, are based on the 2022 Elk Creek Feasibility Study and are substantively identical to one another except for internal references to the regulations under which the report is made, and certain organizational differences. In addition, S-K 1300 requires us to disclose our mineral resources, in addition to our mineral reserves, as of the end of our most recently completed fiscal year. You are cautioned that mineral resources are subject to further exploration and development and are subject to additional risks and no assurance can be given that they will eventually convert to future reserves. Inferred resources, in particular, have a great amount of uncertainty as to their existence and their economic and legal feasibility. Investors are cautioned not to assume that any part or all of the inferred resource exists or is economically or legally mineable. See Item 1A, Risk Factors.

vii

Currency and Exchange Rates

All dollar amounts in this Annual Report on Form 10-K are expressed in U.S. dollars unless otherwise indicated. The Company’s accounts are maintained in U.S. dollars and the Company’s financial statements are prepared in accordance with U.S. GAAP. Some of the Company’s material agreements use Canadian dollars and the Company’s Common Shares, as traded on the TSX, are traded in Canadian dollars. As used herein, “C$” represents Canadian dollars.

The following table sets forth the rate of exchange for the Canadian dollar, expressed in U.S. dollars in effect at the end of the periods indicated, the average of exchange rates in effect during such periods, and the high and low exchange rates during such periods based on the daily rate of exchange as reported by the Bank of Canada for conversion of Canadian dollars into U.S. dollars.

Fiscal Year Ended June 30, | |||

2022 |

2021 |

2020 | |

| Canadian Dollars to U.S. Dollars | |||

| Rate at end of period | 0.7760 | 0.8068 | 0.7338 |

| Average rate for period | 0.7900 | 0.7807 | 0.7453 |

| High for period | 0.8111 | 0.8306 | 0.7710 |

| Low for period | 0.7669 | 0.7344 | 0.6898 |

viii

PART I

| ITEM 1. | BUSINESS |

Introduction

NioCorp was incorporated under the laws of the Province of British Columbia under the Business Corporations Act (British Columbia) on February 27, 1987, under the name “IPC International Prospector Corp.” On May 22, 1991, we changed our name to “Kingston Resources Ltd.” On June 29, 2001, we changed our name to “Butler Developments Corp.” On February 12, 2009, we changed our name to “Butler Resource Corp.” On March 4, 2010, we changed our name to “Quantum Rare Earth Developments Corp.” On March 4, 2013, we changed our name to “NioCorp Developments Ltd.”

NioCorp is a reporting issuer in British Columbia, Alberta, Saskatchewan, Ontario, and New Brunswick. Our registered and records office is located at 595 Burrard Street, Suite 2600, Vancouver, British Columbia V7X 1L3 (ATTN: Blake, Cassels & Graydon LLP). Our principal executive office is located at 7000 South Yosemite Street, Suite 115, Centennial, Colorado 80112.

Historical Development of the Business

During 2009 and 2010, the Company commenced mineral exploration activities in the Elk Creek, Nebraska area, including negotiations with local landowners for land access agreements. The acquisition of the Elk Creek Property was closed in December 2010 and involved the purchase of all of the issued and outstanding common shares of 0859404 BC Ltd., a private British Columbia company, which in turn held 100% of the issued and outstanding shares of ECRC and was signatory to the option agreements covering the Elk Creek Property area. A new Canadian company, 0886338 BC Ltd. was formed to merge with 0859404 BC Ltd., and this merged entity was subsequently amalgamated into 0896800.

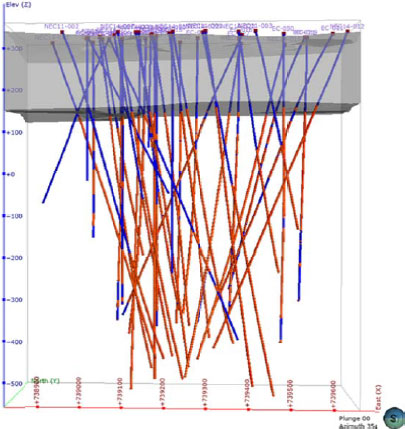

The Company commenced a field exploration program in 2011, which included verification of previous work which was completed on the Elk Creek Property in the 1970s and 1980s, re-assaying of historic drill core, an airborne geophysical survey and the completion of five new diamond drillholes. The available data for the Elk Creek Property was compiled into an updated NI 43-101 resource estimate for the Elk Creek Project, which was issued in April 2012. Additional drilling and NI 43-101 technical reports, including resource updates and preliminary economic assessments, were completed and issued by the Company in 2014 and 2015.

During fiscal years 2016 and 2017, the Company focused on feasibility study development, and on June 30, 2017, we announced the completion of a NI 43-101 technical report for the Elk Creek Project (the “2017 NI 43-101 Elk Creek Technical Report”). In connection with a review by the Ontario Securities and Exchange Commission, on December 15, 2017, the Company filed a revised 2017 NI 43-101 Elk Creek Technical Report. This revised report contained no changes to any previously reported numbers or forecasted economic returns of the Elk Creek Project from those contained in the originally filed 2017 NI 43-101 Elk Creek Technical Report.

During fiscal year 2019, we received a new mine design based on detailed underground engineering conducted by Nordmin. On April 16, 2019, we announced the results of the updated underground mine design and supporting infrastructure, the results of an update to the Elk Creek Project, and the 2019 NI 43-101 Elk Creek Technical Report based on the new mine design. During fiscal year 2020, the Company focused efforts on advancing detailed engineering of the surface and underground facilities and negotiating the follow-on contracts associated with the planned construction of the surface and underground features of the project, as well as obtaining the Air Permit. The Air Permit required the completion of an air quality model that demonstrates compliance with the NAAQS. The final Air Permit was issued by the State of Nebraska on June 2, 2020, for the Elk Creek Project.

During fiscal year 2021, we obtained funding which allowed us to purchase land and mineral rights at the Elk Creek Property and continue early project execution activities. With the acquisition of the land and mineral rights, the Company now owns the surface land on which the Elk Creek Project’s mine infrastructure and supporting operations will be located once sufficient project financing is obtained, along with ownership of the mineral rights to more than 90% of the Elk Creek Project’s mineral resources and mineral reserves.

1

During fiscal year 2022, we focused efforts towards refining our Elk Creek Project mineral resource and mineral reserve estimates. This work included additional assays of historical drill core to fill data gaps in the existing resource database and re-modeling of the Elk Creek Project to include REEs. Based on this re-interpretation of the geologic data, an update to the mine plan was also completed. Accordingly of this work, we issued the 2022 NI 43-101 Elk Creek Technical Report on June 28, 2022. Finally, to comply with the regulations under S-K 1300, we are filing the S-K 1300 Elk Creek Technical Report Summary as an exhibit to this Annual Report on Form 10-K.

During fiscal year 2022 we also advanced our efforts to optimize our process design to contemplate the recovery and production of REEs, including completion of bench and pilot scale testing on elements of the current metallurgical flowsheet as well as illustrating that NioCorp can recover and produce high purity, fully separated magnetic rare earth products, such as neodymium-praseodymium oxide, dysprosium oxide, and terbium oxide in addition to the niobium, scandium, and titanium products already planned for production by the Company, once Project financing is secured and additional work has been completed on the technical and economic feasibility of adding REEs to the Elk Creek Projects’ existing planned product suite. Following the success of this testing, the Company advanced the construction of a demonstration-scale test plant (the “Demonstration Plant”) located in Trois-Rivières, Quebec. Construction of the Demonstration Plant encountered supply chain delays which negatively impacted our estimation of the completion date; however, as of September 6, 2022, construction of the Demonstration Plant was substantially completed, and commissioning has been initiated. The Demonstration Plant is expected to confirm the results of the bench and pilot scale testing noted above, as well as provide updated recovery percentages for the niobium, scandium, titanium and REEs we intend to produce. The Demonstration Plant results would then be used to finalize the design of the optimized production plant for the Elk Creek Project along with demonstrating potential metallurgical recoveries for the prospective magnetic rare earth products.

Information regarding the Elk Creek Project is discussed below under Item 2., “Properties.”

Emerging Growth Company Status

Prior to June 30, 2022, we qualified as an “emerging growth company” as defined in Section 101 of the United States Jumpstart Our Business Startups Act of 2012. We lost our status as an emerging growth company as of June 30, 2022, and are now subject to Section 14A(a) and (b) of the Exchange Act beginning with our fiscal year starting July 1, 2022. However, notwithstanding the loss of our status as an emerging growth company, we will continue to be exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002 for so long as we are neither a “large accelerated filer” nor an “accelerated filer” as those terms are defined in Rule 12b-2 under the Exchange Act.

Corporate Structure

The Company’s business operations are conducted primarily through ECRC. The table below provides an overview of the Company’s current subsidiaries and their activities.

Name | State/Province of Formation | Ownership | Business | |||

| 0896800 B.C. Ltd. | British Columbia | 100% by the Company | The only business of 0896800 is to hold the shares of ECRC | |||

| Elk Creek Resources Corp. | Nebraska | 100% by 0896800 | The business of ECRC is the development of the Elk Creek Project |

Business Operations

NioCorp is a mineral exploration company engaged in the acquisition, exploration, and development of mineral properties. NioCorp, through ECRC, is developing a superalloy materials project that, if and when developed, will produce niobium, scandium, and titanium products. Known as the “Elk Creek Project,” it is located near Elk Creek, Nebraska, in the southeast portion of the state.

| ● | Niobium is used to produce various superalloys that are extensively used in high performance aircraft and jet turbines. It also is used in HSLA steel, a stronger steel used in automobiles, bridges, structural systems, buildings, pipelines, and other applications that generally enables those applications to be stronger and lighter in mass. This “lightweighting” benefit often results in environmental benefits, including reduced fuel consumption and material usage, which can result in fewer air emissions. |

2

| ● | Scandium can be combined with aluminum to make super-high-performance alloys with increased strength and improved corrosion resistance. Scandium also is a critical component of advanced solid oxide fuel cells, an environmentally preferred technology for high-reliability, distributed electricity generation. |

| ● | Titanium is a component of various superalloys and other applications that are used for aerospace applications, weapons systems, protective armor, medical implants and many others. It also is used in pigments for paper, paint, and plastics. |

During fiscal year 2022, the Company also advanced work on the determination of the economic potential of expanding its currently planned product suite from the Elk Creek Project to include REEs.

Our primary business strategy is to advance our Elk Creek Project to commercial production. We are focused on obtaining additional funds to carry out our near-term planned work programs associated with securing the project financing necessary to complete mine development and construction of the Elk Creek Project.

Competitive Business Conditions

There is aggressive competition within the minerals industry to discover and acquire mineral properties considered to have commercial potential. We compete for the opportunity to participate in promising exploration projects with other entities. In addition, we compete with others in efforts to obtain financing to acquire and explore mineral properties, acquire and utilize mineral exploration equipment, and hire qualified mineral exploration personnel. We may compete with other mining companies for mining claims in regions adjacent to our existing claims, or in other parts of the world should we dedicate resources to doing so in the future. These companies may be better capitalized than us and we may have difficulty in expanding our holdings through the staking or acquisition of additional mining claims or other mineral tenures.

In competing for qualified mineral exploration personnel, we may be required to pay compensation or benefits relatively higher than those paid in the past, and the availability of qualified personnel may be limited in high-demand mining periods, such as was the case in past years when the price of gold and other metals was higher than it is now.

Cycles

The mining business is subject to mineral price cycles. The marketability of minerals and mineral concentrates is also affected by worldwide economic cycles. At the present time, strong demand for some minerals in many countries is lifting commodity prices, although it is difficult to assess how long such trends may continue. Fluctuations in supply and demand in various regions throughout the world are common.

The following table sets forth commodity prices for the last five calendar years for the ferroniobium, scandium trioxide and titanium dioxide products the Company anticipates extracting from its Elk Creek Project. These pricing surveys may not be representative of the pricing that the Company anticipates achieving for its products once commercial production begins from its Elk Creek Project.

Year | Ferroniobium | Sc2O3 | TiO2 | |||

| 2021 | $44 | $2,200 | $1.50 | |||

| 2020 | 37 | 3,800 | 1.18 | |||

| 2019 | 39 | 3,900 | 1.13 | |||

| 2018 | 38 | 4,600 | 1.03 | |||

| 2017 | 37 | 4,600 | 0.74 |

| (1) | Source: Argus Metal Prices, average annual ending price, 2021. Ferroniobium 65% niobium content, FOB U.S. warehouse. |

| (2) | Source: USGS Mineral Commodity Summary, 2022. Sc2O3, 99.99% purity, 5-kilogram (“kg”) lot size. |

| (3) | Source: USGS Mineral Commodity Summary, 2022. Rutile mineral concentrate, bulk, minimum 95% TiO2, f.o.b. Australia. |

3

As NioCorp is a development stage issuer and has not yet generated any revenue from the operation of the Elk Creek Project, it is not currently significantly affected by changes in commodity demand and prices, except to the extent that same impact the availability of capital for mineral exploration and development projects. As it does not carry on production activities, NioCorp’s ability to fund ongoing exploration is affected by the availability of financing, which is, in turn, affected by the strength of the economy and other general economic factors.

Economic Dependence

Other than land and mineral right option agreements and the offtake agreements, NioCorp’s business is not substantially dependent on any contract such as a contract to sell the major part of its product or services or to purchase the major part of its requirements for goods, services or its raw materials, or any franchise or license or other agreement to use a patent, formula, trade secret, process or trade name upon which its business depends.

Government Regulation

The exploration and development of a mining prospect is subject to regulation by a number of federal and state government authorities. These include the EPA and the USACE as well as the various state and local environmental protection agencies. The regulations address many environmental issues relating to air, soil, and water contamination, and apply to many mining related activities including exploration, mine construction, mineral extraction, ore milling, water use, waste disposal, and use of toxic substances. In addition, we are subject to regulations relating to labor standards, occupational health and safety, mine safety, general land use, export of minerals, and taxation. Many of the regulations require permits or licenses to be obtained, the absence of which and/or inability to obtain such permits or licenses will adversely affect our ability to conduct our exploration, development, and operation activities. The failure to comply with the regulations and terms of permits and licenses may result in fines or other penalties or in revocation of a permit or license or loss of a prospect.

General

While none of the lands on which the Elk Creek Project is proposed to be built are owned by the U.S. Government, mining rights are governed by the General Mining Law of 1872, as amended, which allows for the location of mining claims on certain federal lands upon the discovery of a valuable mineral deposit and compliance with location requirements. The exploration of mining properties and development and operation of mines is governed by both federal and state laws. Federal laws that govern mining claim location and maintenance and mining operations on federal lands are generally administered by the Bureau of Land Management. Additional federal laws, governing mine safety and health, also apply. State laws also require various permits and approvals before exploration, development or production operations can begin. Among other things, a reclamation plan must typically be prepared and approved, with financial assurance provided in the amount of projected reclamation costs. The financial assurance is used to ensure that proper reclamation takes place and will not be released until that time. Local jurisdictions may also impose permitting requirements, such as conditional use permits or zoning approvals.

Environmental Regulation

Our mineral projects are subject to various federal, state and local laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive. The development, operation, closure, and reclamation of mining projects in the U.S. requires numerous notifications, permits, authorizations, and public agency decisions. Compliance with environmental and related laws and regulations requires us to obtain permits issued by regulatory agencies and to file various reports and keep records of our operations. Certain of these permits require periodic renewal or review of their conditions and may be subject to a public review process during which opposition to our proposed operations may be encountered. We are currently operating under various permits for activities connected to mineral exploration, reclamation, and environmental considerations. Our policy is to conduct business in a way that safeguards public health and the environment. We believe that our operations are conducted in material compliance with applicable laws and regulations.

Changes to current local, state, or federal laws and regulations in the jurisdictions where we operate could require additional capital expenditures and increased operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could impact the economics of our projects.

4

Environmental Regulation - U.S. Federal Laws

The Comprehensive Environmental, Response, Compensation, and Liability Act (“CERCLA”), and comparable state statutes, impose strict, joint, and several liability on current and former owners and operators of sites and on persons who disposed of or arranged for the disposal of hazardous substances found at such sites. It is not uncommon for the government to file claims requiring clean-up actions and/or demands for reimbursement for government-incurred clean-up costs or natural resource damages. It is also not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances released into the environment. The Resource Conservation and Recovery Act (“RCRA”), and comparable state statutes, govern the disposal of solid waste and hazardous waste and authorize the imposition of substantial fines and penalties for noncompliance, as well as requirements for corrective actions. CERCLA, RCRA, and comparable state statutes can impose liability for clean-up of sites and disposal of substances found on exploration, mining and processing sites long after activities on such sites have been completed.

The Clean Air Act, as amended (“CAA”), restricts the emission of air pollutants from many sources, including mining and processing activities. Any future mining operations by the Company may produce air emissions, including fugitive dust and other air pollutants from stationary equipment, storage facilities, and the use of mobile sources such as trucks and heavy construction equipment, which are subject to review, monitoring and/or control requirements under the CAA and state air quality laws. New facilities may be required to obtain permits before work can begin, and existing facilities may be required to incur capital costs in order to remain in compliance. In addition, permitting rules may impose limitations on our production levels or result in additional capital expenditures in order to comply with the rules.

The National Environmental Policy Act (“NEPA”) requires federal agencies to integrate environmental considerations into their decision-making processes by evaluating the environmental impacts of their proposed actions, including issuance of permits to mining facilities and assessing alternatives to those actions. If a proposed action could significantly affect the environment, the agency must prepare either a detailed statement known as an Environmental Impact Statement (“EIS”), or a less detailed statement known as an Environmental Assessment (“EA”). The EPA, other federal agencies, and any interested third parties can review and comment on the scope of the EIS or EA and the adequacy of any findings set forth in the draft and final EIS or EA. This process can cause delays in issuance of required permits or result in changes to a project to mitigate its potential environmental impacts, which can in turn impact the economic feasibility of a proposed project.

The Clean Water Act (“CWA”), and comparable state statutes, impose restrictions and controls on the discharge of pollutants into waters of the U.S. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. The CWA regulates storm water from mining facilities and requires a storm water discharge permit or Stormwater Pollution Prevention Plan for certain activities. Such a permit requires the regulated facility to monitor and sample storm water run-off from its operations. The CWA and regulations implemented thereunder also prohibit discharges of dredged and fill material in wetlands and other waters of the U.S. unless authorized by an appropriately issued permit. The CWA and comparable state statutes provide for civil, criminal, and administrative penalties for unauthorized discharges of pollutants, and impose liability on parties responsible for those discharges for the costs of cleaning up any environmental damage caused by the release and for natural resource damages resulting from the release.

The Safe Drinking Water Act (“SDWA”) and the Underground Injection Control (“UIC”) program promulgated thereunder, regulate the drilling and operation of subsurface injection wells. The EPA directly administers the UIC program in some states and in others the responsibility for the program has been delegated to the state. The program requires that a permit be obtained before drilling a disposal or injection well. Violation of these regulations and/or contamination of groundwater by mining-related activities may result in fines, penalties, and remediation costs, among other sanctions and liabilities under the SDWA and state laws. In addition, third-party claims may be filed by landowners and other parties claiming damages for alternative water supplies, property damages, and bodily injury.

5

Environmental Regulation − Nebraska

Nebraska has a well-developed set of environmental regulations and responsible agencies but does not have clearly defined regulations with respect to permitting mines. As such, review of the project and the issuance of permits by Nebraska agencies and regulatory bodies could potentially impact the total time to market for our Elk Creek Project. Other Nebraska regulations govern operating and design standards for the construction and operation of any source of air emissions and landfill operations. Any changes to these laws and regulations could have an adverse impact on our financial performance and results of operations by, for example, requiring changes to operating conditions, technical criteria, fees, or surety requirements. The most stringent permit related to air quality is known as a Prevention of Significant Deterioration (“PSD”) Permit, which requires the applicant to demonstrate compliance with NAAQS and Best Available Control Technology (“BACT”) for the control of air emissions. If the facility exceeds the potential to emit thresholds for such a permit and is thus subject to PSD requirements, permanent construction at the project site may not begin until the responsible agency issues the PSD Permit. For facilities in Nebraska with potential emissions below PSD thresholds, a state air construction permit is needed. The state permit also requires a demonstration of compliance with NAAQS but does not require a BACT demonstration and further allows construction at a subject facility to proceed ahead of permit issuance through an established variance process.

Human Capital

The Company’s ability to continue to progress the Elk Creek Project will depend on its ability to attract and retain individuals with (among other skills) financial, administrative, engineering, geological and mining skills, and knowledge of our industry and targeted markets. Much of the necessary specialized skills and knowledge required by the Company as a mineral exploration company are available from the Company’s current management team and Board of Directors. The Company retains outside consultants if additional specialized skills and knowledge are required.

As of June 30, 2022, we had eight full-time employees as well as one contract employee. In addition, we use consultants with specific skills to assist with various aspects of our corporate affairs, project evaluation, due diligence, corporate governance and property management.

Our compensation programs are designed to align compensation of our employees with the Company’s performance and to provide the proper incentives to attract, retain and motivate employees to achieve superior results. The structure of our compensation programs balances competitive wages and benefits and incentive earnings for both short-term and long-term performance.

Our priority to maintain a culture of ethical performance as a core value is reflected in the Company’s Code of Conduct (as defined below) and other related policies. Oversight is provided by the Company’s Board of Directors and, for specific areas of performance, by committees of the Board of Directors. Employees are required to review the Code of Conduct on a periodic basis. Our compensation programs also include consideration of ethical performance in determining incentive awards.

The Company also provides a robust suite of benefits to our employees, including 401(k) participation, medical-insurance options, and programs to encourage and support the whole person.

Forward-Looking Statements

This Annual Report on Form 10-K and the exhibits attached hereto contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and “forward-looking information” within the meaning of applicable Canadian securities legislation (collectively, “forward-looking statements”). Such forward-looking statements concern our anticipated results and developments in the operations of the Company in future periods, planned exploration activities, the adequacy of the Company’s financial resources, and other events or conditions that may occur in the future.

6

Forward-looking statements have been based upon our current business and operating plans, as approved by the Company’s Board of Directors; our cash and other funding requirements and timing and sources thereof; results of feasibility studies; the accuracy of mineral resource and reserve estimates and assumptions on which they are based; the results of economic assessments and exploration activities; and current market conditions and project development plans. The material assumptions used to develop the forward-looking statements and forward-looking information included in this Annual Report on Form 10-K include: our expectations of mineral prices; our forecasts and expected cash flows; our projected capital and operating costs; accuracy of mineral resource estimates and resource modeling and feasibility study results; expectations regarding mining and metallurgical recoveries; timing and reliability of sampling and assay data; anticipated political and social conditions; expected national and local government policies, including legal reforms; successful advancement of the Company’s required permitting processes; and the ability to successfully raise additional capital.

Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” and similar expressions, or statements that events, conditions, or results “will,” “may,” “could,” or “should” (or the negative and grammatical variations of any of these terms) occur or be achieved. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect,” “is expected,” “anticipates” or “does not anticipate,” “plans,” “estimates,” or “intends,” or stating that certain actions, events, or results “may,” “could,” “would,” “might,” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Such forward-looking statements reflect the Company’s current views with respect to future events and are subject to certain known and unknown risks, uncertainties, and assumptions. Many factors could cause actual results, performance, or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements, including, among others, risks related to the following:

Risks Related to Our Business:

| ● | risks related to our ability to operate as a going concern; |

| ● | risks related to our requirement of significant additional capital; |

| ● | risks related to our limited operating history; |

| ● | risks related to our history of losses; |

| ● | risks related to cost increases for our exploration and, if warranted, development projects; |

| ● | risks related to a disruption in, or failure of, our information technology (“IT”) systems, including those related to cybersecurity; | |

| ● | risks related to equipment and supply shortages; | |

| ● | risks related to current and future offtake agreements, joint ventures, and partnerships; | |

| ● | risks related to our ability to attract qualified management; | |

| ● | risks related to the effects of the COVID-19 pandemic or other global health crises on our business plans, financial condition and liquidity; and | |

| ● | risks related to the ability to enforce judgment against certain of our directors. |

Risks Related to Mining and Exploration:

| ● | risks related to estimates of mineral resources and reserves; |

| ● | risks related to mineral exploration and production activities; |

| ● | risks related to our lack of mineral production from our properties; |

| ● | risks related to the results of our metallurgical testing; |

| ● | risks related to the price volatility of commodities; | |

| ● | risks related to the establishment of a reserve and resource for REEs and the development of a viable recovery process for REEs; | |

| ● | risks related to the estimation of mineral resources and mineral reserves; |

| ● | risks related to changes in mineral resource and reserve estimates; |

| ● | risks related to competition in the mining industry; | |

| ● | risks related to the management of the water balance at our Elk Creek Project; | |

| ● | risks related to claims on the title to our properties; | |

| ● | risks related to potential future litigation; and | |

| ● | risks related to our lack of insurance covering all our operations. |

7

Risks Related to Government Regulations:

| ● | risks related to our ability to obtain or renew permits and licenses for production; |

| ● | risks related to government and environmental regulations that may increase our costs of doing business or restrict our operations; | |

| ● | risks related to changes in federal and/or state laws that may significantly affect the mining industry; | |

| ● | risks related to the impacts of climate change, as well as actions taken or required by governments related to strengthening resilience in the face of potential impacts from climate change; and |

| ● | risks related to land reclamation requirements. |

Risks Related to Our Debt:

| ● | risks related to covenants contained in agreements with our secured creditors that may affect our assets; and |

| ● | risks related to the extent to which our level of indebtedness may impair our ability to obtain additional financing. |

Risks Related to Our Common Shares:

| ● | risks related to qualifying as a “passive foreign investment company” under the U.S. Internal Revenue Code of 1986, as amended; and |

| ● | risks related to our Common Shares, including price volatility, lack of dividend payments, dilution and penny stock rules. |

New Risks in this Form 10-K/A

| ● | risks related to the restatement of our consolidated financial statements with respect to the Affected Periods and the impact of such restatement on our future financial statements and other financial measures; and |

| ● | risks related to the material weakness in our internal control over financial reporting, our efforts to remediate such material weakness and the timing of remediation. |

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the Item 1A., – “Risk Factors,” below. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated, or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law.

Available Information

We maintain a website at http://www.niocorp.com. Our Common Shares are currently registered under Section 12(g) of the Exchange Act, and we are currently required to file reports on Forms 10-K, 10-Q or 8-K. Our Annual Report on Form 10-K (which includes our audited financial statements), Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Exchange Act, are available on our website, free of charge, as soon as reasonably practicable after we electronically file such reports with, or furnish those reports to, the SEC. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC (http://www.sec.gov). We do not intend to send security holders a printed version of our Annual Report as it will be available online.

8

We maintain a Code of Business Conduct and Ethics for Directors, Officers and Employees (“Code of Conduct”). A copy of our Code of Conduct may be found on our website in the “About Us” section under the main title “Corporate Governance.” Our Code of Conduct contains information regarding whistleblower procedures.

We are not including the information contained on or accessible through our website or the SEC’s website as a part of, or incorporating it by reference into, this Annual Report on Form 10-K.

| ITEM 1A. | RISK FACTORS |

Our business activities are subject to significant risks, including those described below. You should carefully consider these risks. If any of the described risks actually occurs, our business, financial position and results of operations could be materially adversely affected. Such risks are not the only ones we face, and additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business. This report contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of a number of factors, including the risks described below. See “Forward-Looking Statements” under Item 1., “Business.”

Risks Related to Our Business

Our ability to operate as a going concern is in doubt.

The notes that accompany our financial statements for the year ended June 30, 2022, disclose that substantial doubt exists as to our ability to continue as a going concern. The financial statements included in this Annual Report on Form 10-K have been prepared under the assumption that we will continue as a going concern. We are a development stage issuer and we have incurred losses since our inception.

We currently have no historical recurring source of revenue and our ability to continue as a going concern is dependent on our ability to raise capital to fund our future exploration and working capital requirements or our ability to profitably execute our business plan. Our plans for the long-term return to and continuation as a going concern include financing our future operations through sales of our Common Shares and/or debt and the potential profitable exploitation of our Elk Creek Project. Additionally, capital markets and general economic conditions in the U.S. and Canada may impose significant obstacles to raising the required funds. As discussed further below, while we have been successful in doing so in the past, there can be no assurance we will be able to raise funds in the future. These factors raise substantial doubt about our ability to continue as a going concern.

We will require significant additional capital to fund our business plan.

We will be required to expend significant funds to develop our existing properties and to identify and acquire additional properties to diversify our property portfolio. We anticipate that we will be required to make substantial capital expenditures for the development of our Elk Creek Project.

As of June 30, 2022, the Company had cash of $5.3 million and working capital of $0.6 million, compared to cash of $7.3 million and working capital of $3.4 million on June 30, 2021.

As of June 30, 2022, the Company’s current planned operational needs are approximately $9.5 million through the end of fiscal 2023. From the date of this Annual Report on Form 10-K, the Company anticipates that it does not have sufficient cash to continue to fund basic operations for the next twelve months. This includes general overhead costs, expected costs relating to securing financing necessary for the Elk Creek Project, satisfying outstanding accounts payable, and potential retirement of our short-term debt obligations. Access to additional funds will be utilized to fund basic operations as well as to further advance the Elk Creek Project through substantive near-term milestones.

We are actively pursuing such additional sources of debt and equity financing, and while we have been successful in doing so in the past, there can be no assurance we will be able to do so in the future.

Our ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including the status of the national and worldwide economy and the price of the products we intend to produce. We may not be successful in obtaining the required financing or, if we can obtain such financing, such financing may not be on terms that are favorable to us.

9

Our inability to access sufficient capital for our operations could have a material adverse effect on our financial condition, results of operations, or prospects. Sales of substantial amounts of securities may have a highly dilutive effect on our ownership or share structure. Sales of a large number of Common Shares in the public markets, or the potential for such sales, could decrease the trading price of the Common Shares and could impair our ability to raise capital through future sales of Common Shares. We have not yet commenced commercial production at any of our properties and, as such, have not generated positive cash flows to date and have no reasonable prospects of doing so unless successful commercial production can be achieved at our Elk Creek Project. We expect to continue to incur negative investing and operating cash flows until such time as we enter into successful commercial production. This will require us to deploy our working capital to fund such negative cash flow and to seek additional sources of financing. There is no assurance that any such financing sources will be available or sufficient to meet our requirements. There is no assurance that we will be able to continue to raise equity capital or to secure additional debt financing, or that we will not continue to incur losses.

We have a limited operating history on which to base an evaluation of our business and prospects.

Since our inception, we have had no revenue from operations. We have no history of producing products from any of our properties. Our Elk Creek Project is a development stage property. Advancing our Elk Creek Project from a development stage property to a production stage property will require significant capital and time, and successful commercial production from the Elk Creek Property will be subject to permitting and construction of the mine, processing plants, roads, and other related works and infrastructure. As a result, we are subject to all of the risks associated with developing and establishing new mining operations and business enterprises including:

| ● | the timing and cost, which can be considerable, of further exploration, preparing feasibility studies, permitting, engineering and construction of infrastructure, mining, and processing facilities; |

| ● | the availability and costs of drilling equipment, exploration personnel, skilled labor, and mining and processing equipment, if required; |

| ● | the availability and cost of appropriate smelting and/or refining arrangements, if required; |

| ● | compliance with environmental and other governmental approval and permit requirements; |

| ● | the availability of funds to finance exploration, development, permitting, and construction activities, as warranted; |

| ● | potential opposition from non-governmental organizations, local groups, or local residents that may delay or prevent development activities; |

| ● | potential increases in exploration, construction, and operating costs due to changes in the cost of fuel, power, materials, and supplies; and |

| ● | potential shortages of mining, mineral processing, hydrometallurgical, pyrometallurgical, construction, and other facilities-related supplies. |

The costs, timing, and complexities of exploration, development, engineering and construction activities may be increased by the location of our properties and competition from other mineral exploration and mining companies. It is common for exploration companies to experience unexpected problems and delays during development, if commenced, including engineering, procurement, construction, commissioning and ramp-up. Accordingly, our activities may not result in profitable operations and we may not succeed in establishing operations or profitably producing products at any of our current or future properties, including our Elk Creek Project.

We have a history of losses and expect to continue to incur losses in the future.

We have incurred losses since inception, have negative cash flow from operating activities, and expect to continue to incur losses in the future. We incurred the following losses from operations during each of the following periods:

| ● | $10,887 for the year ended June 30, 2022; |

| ● | $4,824 for the year ended June 30, 2021; and |

| ● | $4,001 for the year ended June 30, 2020. |

10

We expect to continue to incur losses unless and until such time as one of our properties enters into commercial production and generates sufficient revenues to fund continuing operations. We recognize that if we are unable to generate significant revenues from operations and dispositions of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses, and difficulties frequently encountered by companies at the start-up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition.

Increased costs could affect our financial condition.

We anticipate that costs at our projects that we may explore or develop will frequently be subject to variation from one year to the next due to a number of factors, such as changing ore grade, metallurgical performance, and revisions to mine plans, if any, in response to the physical shape and location of the ore body. In addition, costs are affected by the price of commodities such as fuel, steel, aluminum, iron, chemicals, natural gas, fresh water, electricity, and government actions such as tariffs. Such commodities are at times subject to volatile price movements, including increases that could make production at certain operations less profitable or not profitable at all. A material increase in costs at any significant location could have a significant effect on our profitability.

A disruption in, or failure of our third-party service providers’ IT systems, including those related to cybersecurity, could adversely affect our business operations and financial performance.

We rely on the accuracy, capacity and security of our third-party service providers’ IT systems for the operations of many of our business processes and to comply with regulatory, legal and tax requirements. We are dependent on third parties to provide important IT services relating to, among other things, operational technology at our facilities, human resources, electronic communications and certain finance functions. Despite the security measures that our third-party service providers have implemented, including those related to cybersecurity, their systems could be breached or damaged by computer viruses, natural or man-made incidents or disasters, or unauthorized physical or electronic access. Though our third-party service providers have controls in place, we cannot provide assurance that a cyber-attack will not occur. Furthermore, we may have little or no oversight with respect to security measures employed by third-party service providers, which may ultimately prove to be ineffective at countering threats. Failures of our third-party service providers’ IT systems, whether caused maliciously or inadvertently, may result in the disruption of our business processes, or in the unauthorized release of sensitive, confidential or otherwise protected information or result in the corruption of data, which could adversely affect our business operations and financial performance. In addition, we may be required to incur significant costs to protect against and, if required, remediate the damage caused by such disruptions or system failures in the future.

A shortage of equipment and supplies could adversely affect our ability to operate our business.