UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22527

FEG ABSOLUTE ACCESS FUND I LLC

(Exact name of registrant as specified in charter)

201 EAST FIFTH STREET, SUITE 1600

CINCINNATI, OHIO 45202

(Address of principal executive offices) (Zip code)

KEVIN CONROY

201 EAST FIFTH STREET, SUITE 1600

CINCINNATI, OHIO 45202

(Name and address of agent for service)

Registrant's telephone number, including area code: 888-268-0333

Date of fiscal year end: March 31

Date of reporting period: March 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| FINANCIAL STATEMENTS | |

| FEG Absolute Access Fund I LLC | |

| Year Ended March 31, 2018 | |

| With Report of Independent Registered | |

| Public Accounting Firm |

FEG Absolute Access Fund I LLC

Financial Statements

Year Ended March 31, 2018

Contents

Report of Independent Registered Public Accounting Firm |

1 |

Statement of Assets and Liabilities |

2 |

Statement of Operations |

3 |

Statements of Changes in Net Assets |

4 |

Statement of Cash Flows |

5 |

Financial Highlights |

6 |

Notes to Financial Statements |

7 |

Other Information (Unaudited) |

|

Company Management |

13 |

Other Information |

15 |

Privacy Policy |

18 |

Financial Statements of FEG Absolute Access Fund LLC

FEG Absolute Access Fund I LLC

Report of Independent Registered Public Accounting Firm

March 31, 2018

To the Members and Board of Directors of

FEG Absolute Access Fund I LLC

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of FEG Absolute Access Fund I LLC (the “Fund”) as of March 31, 2018, and the related statements of operations, cash flows and changes in net assets, and the financial highlights for the year then ended, including the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2018, the results of its operations, its cash flows, the changes in its net assets and the financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

The Fund’s financial statements and financial highlights for the years ended March 31, 2017 and prior, were audited by other auditors whose report dated June 22, 2017, expressed an unqualified opinion on those financial statements and financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audit includes performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and confirmation of securities owned as of March 31, 2018, correspondence with the portfolio fund manager. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2017.

COHEN & COMPANY, LTD.

Cleveland, Ohio

May 30, 2018

1

FEG Absolute Access Fund I LLC

Statement of Assets and Liabilities

March 31, 2018

| Assets | ||||

| Cash | $ | 5,862,225 | ||

| Investment in FEG Absolute Access Fund LLC, at fair value | 310,189,861 | |||

| Prepaid expenses and other assets | 63,087 | |||

| Total assets | 316,115,173 | |||

| Liabilities | ||||

| Capital redemptions payable | 5,862,225 | |||

| Professional fees payable | 100,574 | |||

| Accounting and administration fees payable | 29,900 | |||

| Directors fees payable | 6,000 | |||

| Other liabilities | 29,864 | |||

| Total liabilities | 6,028,563 | |||

| Net Assets | $ | 310,086,610 | ||

| Net assets consist of: | ||||

| Paid-in capital | $ | 320,500,557 | ||

| Accumulated net investment loss | (25,251,391 | ) | ||

| Accumulated net realized gain on investments | 16,763,348 | |||

| Accumulated net unrealized depreciation on investments | (1,925,904 | ) | ||

| Net assets | $ | 310,086,610 | ||

| Units issued and outstanding (unlimited units authorized) | 269,225 | |||

| Net Asset Value per unit | $ | 1,151.77 | ||

See accompanying notes and financial statements of FEG Absolute Access Fund LLC.

2

FEG Absolute Access Fund I LLC

Statement of Operations

Year Ended March 31, 2018

| Investment income/(loss) allocated from FEG Absolute Access Fund LLC | ||||

| Dividend income | $ | 259,422 | ||

| Expenses | (3,514,827 | ) | ||

| Net investment loss allocated from FEG Absolute Access Fund LLC | (3,255,405 | ) | ||

| Fund investment income | ||||

| Withholding tax rebate | 452 | |||

| Fund expenses | ||||

| Professional fees | 304,675 | |||

| Withholding tax | 129,151 | |||

| Compliance monitoring fees | 106,313 | |||

| Accounting and administration fees | 100,125 | |||

| Custodian fees | 36,851 | |||

| Directors fees | 24,000 | |||

| Other expenses | 65,100 | |||

| Total Fund expenses | 766,215 | |||

| Net investment loss | (4,021,168 | ) | ||

| Realized and unrealized gain (loss) on investments allocated from FEG Absolute Access Fund LLC | ||||

| Net realized gain on investments | 12,800,712 | |||

| Net change in unrealized appreciation/depreciation on investments | (6,297,351 | ) | ||

| Net realized and unrealized gain on investments allocated from FEG Absolute Access Fund LLC | 6,503,361 | |||

| Net increase in net assets resulting from operations | $ | 2,482,193 | ||

See accompanying notes and financial statements of FEG Absolute Access Fund LLC.

3

FEG Absolute Access Fund I LLC

Statements of Changes in Net Assets

| Year Ended March 31, 2018 | Year Ended March 31, 2017 | |||||||

| Operations | ||||||||

| Net investment loss | $ | (4,021,168 | ) | $ | (4,008,312 | ) | ||

| Net realized gain on investments | 12,800,712 | 5,304,716 | ||||||

| Net change in unrealized appreciation/depreciation on investments | (6,297,351 | ) | 14,115,620 | |||||

| Net increase in net assets resulting from operations | 2,482,193 | 15,412,024 | ||||||

| Distributions | ||||||||

| From net investment income | (10,137,527 | ) | (2,509,060 | ) | ||||

| Capital transactions | ||||||||

| Capital subscriptions | 44,360,778 | 25,457,110 | (1) | |||||

| Capital reinvestments of distribution | 8,649,770 | 2,345,654 | ||||||

Capital redemptions(2) | (70,188,415 | ) | (39,301,470 | ) | ||||

| Net change in net assets resulting from capital transactions | (17,177,867 | ) | (11,498,706 | ) | ||||

| Net change in net assets | (24,833,201 | ) | 1,404,258 | |||||

| Net assets at beginning of year | 334,919,811 | 333,515,553 | ||||||

| Net assets at end of year | $ | 310,086,610 | $ | 334,919,811 | ||||

| Accumulated net investment loss | $ | (25,251,391 | ) | $ | (13,170,139 | ) | ||

| Units transactions | ||||||||

| Units sold | 37,814 | 21,750 | ||||||

| Units reinvested | 7,491 | 2,004 | ||||||

| Units redeemed | (60,221 | ) | (33,903 | ) | ||||

| Net change in units | (14,916 | ) | (10,149 | ) | ||||

| (1) | Includes a $10 subscription from FEG Investors, LLC (the Investment Manager) for Class II Units, which was the only activity for Class II Units during the year ended March 31, 2017. |

| (2) | Net of early repurchase fees in the amount of $0 and $1,433, respectively. |

See accompanying notes and financial statements of FEG Absolute Access Fund LLC.

4

FEG Absolute Access Fund I LLC

Statement of Cash Flows

Year Ended March 31, 2018

| Operating activities | ||||

| Net increase in net assets resulting from operations | $ | 2,482,193 | ||

| Adjustments to reconcile net increase in net assets resulting from | ||||

| operations to net cash provided by operating activities: | ||||

| Purchases of investments | (44,360,779 | ) | ||

| Proceeds from sales of investments | 72,395,559 | |||

| Net investment loss allocated from FEG Absolute Access Fund LLC | 3,255,405 | |||

| Net realized gain on investments allocated from FEG Absolute Access Fund LLC | (12,800,712 | ) | ||

| Net change in unrealized appreciation/depreciation on investments allocated from FEG Absolute Access Fund LLC | 6,297,351 | |||

| Changes in operating assets and liabilities: | ||||

| Prepaid expenses and other assets | (1,837 | ) | ||

| Accounting and administration fees payable | (9,057 | ) | ||

| Professional fees payable | 30,035 | |||

| Other liabilities | 27,236 | |||

| Net cash provided by operating activities | 27,315,394 | |||

| Financing activities | ||||

| Proceeds from capital subscriptions | 43,823,778 | |||

| Dividends paid to shareholders, net of reinvestments | (1,487,757 | ) | ||

| Payments for capital redemptions, net of redemptions payable | (67,342,639 | ) | ||

| Net cash used in financing activities | (25,006,618 | ) | ||

| Net change in cash | 2,308,776 | |||

| Cash at beginning of year | 3,553,449 | |||

| Cash at end of year | $ | 5,862,225 | ||

| Supplemental Disclosure of cash flow information | ||||

| Non-cash distribution fully reinvested | $ | 8,649,770 | ||

See accompanying notes and financial statements of FEG Absolute Access Fund LLC.

5

FEG Absolute Access Fund I LLC

Financial Highlights

| Year Ended March 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

Per unit operating performances:(1) | ||||||||||||||||||||

| Net asset value per unit, beginning of year | $ | 1,178.71 | $ | 1,133.29 | $ | 1,189.27 | $ | 1,135.93 | $ | 1,062.22 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment loss | (18.45 | ) | (14.62 | ) | (13.72 | ) | (6.07 | ) | (5.98 | ) | ||||||||||

| Net realized and unrealized gain (loss) on investments | 28.22 | 68.75 | (37.63 | ) | 59.41 | 79.69 | ||||||||||||||

| Total change in per unit value from investment operations | 9.77 | 54.13 | (51.35 | ) | 53.34 | 73.71 | ||||||||||||||

| Distributions paid from: | ||||||||||||||||||||

| Net investment income | (36.71 | ) | (8.71 | ) | (2.35 | ) | — | — | ||||||||||||

| Net realized gains | — | — | (2.28 | ) | — | — | ||||||||||||||

| Total distributions to shareholders | (36.71 | ) | (8.71 | ) | (4.63 | ) | — | — | ||||||||||||

| Net asset value per unit, end of year | $ | 1,151.77 | $ | 1,178.71 | $ | 1,133.29 | $ | 1,189.27 | $ | 1,135.93 | ||||||||||

Ratios to average net assets:(2) | ||||||||||||||||||||

| Total expenses | 1.35 | %(3) | 1.23 | % | 1.27 | % | 1.34 | % | 1.56 | % | ||||||||||

| Net investment loss | (1.27 | )%(4) | (1.22 | )% | (1.27 | )% | (1.34 | )% | (1.56 | )% | ||||||||||

| Total return | 0.82 | % | 4.78 | % | (4.32 | )% | 4.70 | % | 6.94 | % | ||||||||||

| Portfolio turnover | 25.84 | % | 6.43 | % | 12.33 | % | 28.75 | % | 17.93 | % | ||||||||||

| Net assets end of year (000's) | $ | 310,087 | $ | 334,920 | $ | 333,516 | $ | 321,325 | $ | 239,771 | ||||||||||

| (1) | Selected data is for a single unit outstanding throughout the year. |

| (2) | The ratios include the Fund’s proportionate share of income and expenses allocated from FEG Absolute Access Fund LLC. |

| (3) | Includes state withholding tax from business activity of the portfolio funds of FEG Absolute Access Fund. If the expense was removed, total expenses would be 1.34%. |

| (4) | Includes state withholding tax from business activity of the portfolio funds of FEG Absolute Access Fund. If the expense was removed, net investment loss would be (1.25)%. |

See accompanying notes and financial statements of FEG Absolute Access Fund LLC.

6

FEG Absolute Access Fund I LLC

Notes to Financial Statements

Year Ended March 31, 2018

1. Organization

FEG Absolute Access Fund I LLC (the “Fund”) was organized as a limited liability company under the laws of the State of Delaware on January 20, 2011 and commenced operations on April 1, 2011. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. The business and operations of the Fund are managed and supervised under the direction of the Board of Directors (the “Board”). The objective of the Fund is to achieve capital appreciation in both rising and falling markets, although there can be no assurance that the Fund will achieve this objective. Effective January 1, 2015, the Fund attempts to achieve its investment objective by investing all or substantially all of its assets directly in FEG Absolute Access Fund LLC (“FEG Absolute Access Fund”), a limited liability company organized under the laws of the State of Delaware and registered under the 1940 Act. The Fund and FEG Absolute Access Fund are managed by FEG Investors, LLC (the “Investment Manager”), an investment manager registered under the Investment Advisers Act of 1940, as amended. FEG Absolute Access Fund’s Board of Directors (the “FEG Absolute Access Fund Board”) has overall responsibility for the management and supervision of FEG Absolute Access Fund’s operations. To the extent permitted by applicable law, the FEG Absolute Access Fund Board may delegate any of its respective rights, powers and authority to, among others, the officers of FEG Absolute Access Fund, any committee of the FEG Absolute Access Fund Board, or the Investment Manager.

Units of limited liability company interest (“Units”) of the Fund are offered only to investors (“Members”) that represent that they are an “accredited investor” within the meaning of Rule 501 under the Securities Act of 1933, as amended (the “1933 Act”).

The Second Amended and Restated Limited Liability Company Operating Agreement (as it may be further amended, the “Operating Agreement”) for the Fund was approved by the Board at a meeting held on August 18, 2014, and by Members at a meeting held on December 12, 2014. The Operating Agreement: (a) allows the Fund to elect to be classified, for purposes of U.S. federal income tax, as a corporation that intends to elect to be treated as a regulated investment company (“RIC”) under Subchapter M of Subtitle A, Chapter 1, of the Internal Revenue Code of 1986, as amended (the “Code”); and (b) permits the creation of multiple classes of Units of the Fund. The SEC granted the Fund an Exemptive Order on September 9, 2015 permitting the Fund to offer multiple classes of Units. The Fund’s registration statement permits it to offer two additional classes of Units. There have been no transactions involving Class II Units during the year ended March 31, 2018. Class II Units are expected to commence operations at an appropriate time in the future when additional subscriptions are available. When Class II Units commence operations, it is expected that the existing units of the Fund will be designated as Class I Units. As of March 31, 2018, no additional classes of units had commenced operations or had activity.

UMB Fund Services, Inc., a subsidiary of UMB Financial Corporation, serves as the Fund’s administrator (the “Administrator”). The Fund has entered into an agreement with the Administrator to perform general administrative tasks for the Fund, including but not limited to maintenance of the books and records of the Fund and the capital accounts of the Members of the Fund.

2. Significant Accounting Policies

The Fund is an investment company, and as such, these financial statements have applied the guidance set forth in Accounting Standards Codification (“ASC”) 946, Financial Services—Investment Companies. The following is a summary of significant accounting and reporting policies used in preparing the financial statements.

Use of Estimates

The financial statements have been prepared in accordance with accounting principles generally accepted in The United States of America (“U.S. GAAP”). The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in partners’ capital from operations during the reporting period. Actual results could differ from such estimates.

Cash is held at a major financial institution and is subject to credit risk to the extent those balances exceed Federal Deposit Insurance Corporation (FDIC) limitations.

7

FEG Absolute Access Fund I LLC

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

Calculation of Net Assets and Net Asset Value per Unit

The Fund calculates its net assets as of the close of business on the last business day of each calendar month and the last day of each fiscal period. In determining its net assets, the Fund values its investments as of such month-end or as of the end of such fiscal period, as applicable. The net assets of the Fund equals the value of the total assets of the Fund less liabilities, including accrued fees and expenses, each determined as of the date the Fund’s net assets is calculated. The Net Asset Value per Unit equals net assets divided by Units outstanding.

Investment in FEG Absolute Access Fund LLC

The Fund records its investment in FEG Absolute Access Fund at fair value which is represented by the Fund’s units held in FEG Absolute Access Fund valued at their per unit net asset value. Valuation of investment funds and other investments held by FEG Absolute Access Fund is discussed in the notes to FEG Absolute Access Fund’s financial statements. The Fund records its allocated portion of income, expense, realized gains and losses and unrealized appreciation and depreciation from FEG Absolute Access Fund. The performance of the Fund is directly affected by the performance of FEG Absolute Access Fund. The financial statements of FEG Absolute Access Fund, which accompany this report, are an integral part of these financial statements. Refer to the accounting policies disclosed in the financial statements of FEG Absolute Access Fund for additional information regarding significant accounting policies that affect the Fund. As of March 31, 2018, the Fund owned 90.64% of the units of FEG Absolute Access Fund.

Taxation and Distributions to Members

For periods prior to January 1, 2015, the Fund, as a limited liability company, was classified as a partnership for federal tax purposes. Accordingly, no provision for federal income taxes was required. Components of net assets reflected in the Statement of Assets and Liabilities are reported on a tax basis, removing historical information prior to January 1, 2015.

Effective January 1, 2015, the Fund elected to be treated as a corporation for federal income tax purposes, and it further intends to elect to be treated, and expects each year to qualify, as a RIC under Subchapter M of the Code. For each taxable year that the Fund so qualifies, the Fund will not be subject to federal income tax on that part of its taxable income that it distributes to its investors. Taxable income consists generally of net investment income and net capital gains. The Fund intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains, resulting in no provision requirements for federal income or excise taxes.

Management has analyzed the Fund’s tax positions for all open tax years, which include the years ended December 31, 2014 through December 31, 2017, and has concluded that as of March 31, 2018, no provision for income taxes is required in the financial statements. Therefore, no additional tax expense, including any interest and penalties, was recorded in the current year and no adjustments were made to prior periods. To the extent the Fund recognizes interest and penalties, they are included in interest expense and other expenses, respectively, in the Statement of Operations.

The character of distributions made during the year from net investment income or net realized gain may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense, and gain/(loss) items for financial statement and tax purposes. Where appropriate, reclassifications between net asset accounts are made for such differences that are permanent in nature.

8

FEG Absolute Access Fund I LLC

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

Additionally, U.S. GAAP requires certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. Permanent differences between book and tax basis are attributable to distribution reclassifications, partnerships and Passive Foreign Investment Companies (PFIC’s). These reclassifications have no effect on net assets or Net Asset Value per Unit. For the tax year ended December 31, 2017, the following amounts were reclassified:

| Paid-in capital | $ | 1,653 | ||

| Accumulated net investment income (loss) | 2,077,443 | |||

| Accumulated net realized gain (loss) on investments | (2,079,096 | ) |

As of March 31, 2018, the federal tax cost of investments and unrealized appreciation/(depreciation) were as follows:

| Gross unrealized appreciation | $ | 29,795,541 | ||

| Gross unrealized depreciation | (3,300,988 | ) | ||

| Net unrealized appreciation | $ | 26,494,553 | ||

| Cost of investments | $ | 283,695,308 |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in investment transactions.

Post-October capital losses incurred after October 31 and within the taxable year are deemed to arise on the first business day of the Funds’ next taxable year. As of December 31, 2017, the Fund had $167,678 in short-term post-October capital-losses.

The Fund utilized $3,257,580 of its capital loss carryforward during the year ended December 31, 2017.

The tax character of distributions paid during the tax year ended December 31, 2017 was as follows:

| 2017 | 2016 | |||||||

| Distributions paid from: | ||||||||

| Ordinary income | $ | 7,501,701 | $ | 2,509,060 | ||||

| Net long term capital gains | 2,635,826 | — | ||||||

| Total taxable distributions | 10,137,527 | 2,509,060 | ||||||

| Total distributions paid | $ | 10,137,527 | $ | 2,509,060 | ||||

3. Related Party Transactions

The Investment Manager receives from FEG Absolute Access Fund a monthly management fee (the “Management Fee”) equal to 1/12 of 0.85% of FEG Absolute Access Fund’s month-end members’ capital balances. The Fund indirectly incurs the Management Fee as a member of FEG Absolute Access Fund.

On September 15, 2017, Fund Evaluation Group Employee Stock Ownership Trust (“FEG Trust”), a voting trust administered by Argent Trust Company as trustee, acquired Fund Evaluation Group 2017, Inc. (“Fund Evaluation Group”), the indirect parent company of the Investment Manager (the “transaction”) from Fund Evaluation Group’s eighteen individual owners. The transaction will allow employees of the Investment Manager to indirectly own the Investment Manager through an employee stock ownership plan. While the transaction represented a change in the legal ownership of the Investment Manager, it is not a change in the management of the Fund or FEG Absolute Access Fund. The Investment Manager, through its employees, has continued and will continue in its role in providing day-to-day investment management services to FEG Absolute Access Fund.

9

FEG Absolute Access Fund I LLC

Notes to Financial Statements (continued)

3. Related Party Transactions (continued)

The transaction resulted in an “assignment” under the 1940 Act of the then-existing investment management agreement of FEG Absolute Access Fund (the “Prior Management Agreement”) that resulted in the termination of the Prior Management Agreement. The Prior Management Agreement was replaced by an interim and then a new investment management agreement between FEG Absolute Access Fund and the Investment Manager that was approved by FEG Absolute Access Fund’s members at a special meeting of members held on November 28, 2017.

Each member of the Board who is not an “interested person” of the Fund (the “Independent Directors”), as defined by the 1940 Act, receives a quarterly retainer of $3,000. In addition, all Independent Directors are reimbursed by the Fund for all reasonable out-of-pocket expenses incurred by them in performing their duties. The Independent Directors’ fees totaled $24,000 for the year ended March 31, 2018, of which $6,000 was payable as of March 31, 2018.

As of March 31, 2018, Members who are affiliated with the Investment Manager owned $912,494 (0.29% of net assets) of the Fund.

4. Capital

Members may be admitted when permitted by the Board. Generally, Members will only be admitted as of the beginning of a calendar month but may be admitted at any other time in the discretion of the Board. The minimum initial investment is $50,000, and additional contributions from existing Members may be made in a minimum amount of $25,000, although the Board may waive such minimums in certain cases.

No Member will have the right to require the Fund to redeem its Units. Rather, the Board may, from time to time and in its complete and absolute discretion, cause the Fund to offer to repurchase Units from Members pursuant to written requests by Members on such terms and conditions as it may determine. However, because all or substantially all of the Fund’s assets will be invested in FEG Absolute Access Fund, the Fund generally will find it necessary to liquidate a portion of its FEG Absolute Access Fund units in order to satisfy repurchase requests. Because FEG Absolute Access Fund’s units may not be transferred, the Fund may withdraw a portion of its FEG Absolute Access Fund units only pursuant to repurchase offers by FEG Absolute Access Fund. Therefore, the Fund does not expect to conduct a repurchase offer for Units unless FEG Absolute Access Fund contemporaneously conducts a repurchase offer for FEG Absolute Access Fund units.

Capital subscriptions received in advance are comprised of cash received on or prior to March 31, 2018 for which Units are issued April 1, 2018. Capital subscriptions received in advance do not participate in the earnings of the Fund until such Units are issued. Capital redemptions payable are comprised of requests for redemptions that were effective on March 31, 2018 but were paid subsequent to fiscal year-end.

In determining whether the Fund should offer to repurchase Units from Members pursuant to written requests, the Board will consider, among other things, the recommendation of the Investment Manager. The Investment Manager expects that it will recommend to the FEG Absolute Access Fund Board that FEG Absolute Access Fund repurchases FEG Absolute Access Fund units from members twice a year, effective as of June 30th and December 31st each year. The repurchase amount will be determined by the FEG Absolute Access Fund Board in its complete and absolute discretion, but is expected to be no more than approximately 25% of FEG Absolute Access Fund’s outstanding units.

FEG Absolute Access Fund will make repurchase offers, if any, to all holders of FEG Absolute Access Fund units, including the Fund. The Fund does not expect to make a repurchase offer that is larger than the portion of FEG Absolute Access Fund’s corresponding repurchase offer expected to be available for acceptance by the Fund. Consequently, the Fund will conduct repurchase offers on a schedule and in amounts that will depend on FEG Absolute Access Fund’s repurchase offers.

10

FEG Absolute Access Fund I LLC

Notes to Financial Statements (continued)

4. Capital (continued)

Subject to the considerations described above, the aggregate value of Units to be repurchased at any time will be determined by the Board in its sole discretion, and such amount may be stated as a percentage of the value of the Fund’s outstanding Units. Therefore, the Fund may determine not to conduct a repurchase offer at a time that FEG Absolute Access Fund conducts a repurchase offer.

The Board also will consider the following factors, among others, in making such determination: (i) whether FEG Absolute Access Fund is making a contemporaneous repurchase offer for FEG Absolute Access Fund units, and the aggregate value of FEG Absolute Access Fund units that FEG Absolute Access Fund is offering to repurchase; (ii) the liquidity of the assets of the applicable fund; (iii) the investment plans and working capital requirements of the applicable fund; (iv) the relative economies of scale with respect to the size of the applicable fund; (v) the history of the applicable fund in repurchasing Units; (vi) the conditions in the securities markets and economic conditions generally; and (vii) the anticipated tax consequences of any proposed repurchases of Units.

The Operating Agreement and the FEG Absolute Access Fund operating agreement each provides that the respective entity will be dissolved if any Member that has submitted a written request, in accordance with the terms of the applicable Operating Agreement, to tender all of such Member’s Units or FEG Absolute Access Fund’s units, as applicable, for repurchase by the applicable fund has not been given the opportunity to so tender within a period of two (2) years after the request (whether in a single repurchase offer or multiple consecutive offers within the two-year period). Such a dissolution of FEG Absolute Access Fund would likely result in a determination to dissolve the Fund.

When the Board determines that the Fund will offer to repurchase Units (or portions of Units), written notice will be provided to Members that describes the commencement date of the repurchase offer, and specifies the date on which repurchase requests must be received by the Fund (the “Repurchase Request Deadline”).

For Members tendering all of their Units in the Fund, Units will be valued for purposes of determining their repurchase price as of a date approximately 95 days after the Repurchase Request Deadline (the “Full Repurchase Valuation Date”). The amount that a Member who is tendering all of its Units in the Fund may expect to receive on the repurchase of such Member’s Units will be the value of the Member’s capital account determined on the Full Repurchase Valuation Date, and the Fund will generally not make any adjustments for final valuations based on adjustments received from FEG Absolute Access Fund, and the withdrawing Member (if such valuations are adjusted upwards) or the remaining Members (if such valuations are adjusted downwards) will bear the risk of change of any such valuations.

Members who tender a portion of their Units in the Fund (defined as a specific dollar value in their repurchase request), and which portion is accepted for repurchase by the Fund, will receive such specified dollar amount. Within five days of the Repurchase Request Deadline, each Member whose Units have been accepted for repurchase will be given a non-interest bearing, non-transferable promissory note by the Fund entitling the Member to be paid an amount equal to 100% of the unaudited net asset value of such Member’s capital account (or portion thereof) being repurchased, determined as of the Full Repurchase Valuation Date (after giving effect to all allocations to be made as of that date to such Member’s capital account). The note will entitle the Member to be paid within 30 days after the Full Repurchase Valuation Date, or ten business days after the Fund has received at least 90% of the aggregate amount withdrawn by the Fund from its investment in FEG Absolute Access Fund), whichever is later (either such date, a “Payment Date”). Notwithstanding the foregoing, if a Member has requested the repurchase of 90% or more of the Units held by such Member, such Member shall receive (i) a non-interest bearing, non-transferable promissory note, in an amount equal to 90% of the estimated unaudited net asset value of such Member’s capital account (or portion thereof) being repurchased, determined as of the Full Repurchase Valuation Date (after giving effect to all allocations to be made as of that date to such Member’s capital account) (the “Initial Payment”), which will be paid on or prior to the Payment Date; and (ii) a promissory note entitling the holder thereof to the balance of the proceeds, to be paid within 30 days following the completion of the Fund’s next annual audit, which is expected to be completed within 60 days after the end of the Fund’s fiscal year. The note will be held by the Administrator on the Member’s behalf. Upon written request by a Member to the Administrator, the Administrator will mail the note to the Member at the address of the Member as maintained in the books and records of the Fund.

11

FEG Absolute Access Fund I LLC

Notes to Financial Statements (continued)

4. Capital (continued)

The Fund does not intend to impose any charges on the repurchase of Units.

If Members request that the Fund repurchase a greater number of Units than the repurchase offer amount as of the Repurchase Request Deadline, as determined by the Board in its complete and absolute discretion, the Fund shall repurchase the Units pursuant to repurchase requests on a pro rata basis, disregarding fractions, according to the portion of the Units requested by each Member to be repurchased as of the Repurchase Request Deadline.

A Member who tenders some but not all of the Member’s Units for repurchase will be required to maintain a minimum capital account balance of $50,000. The Fund reserves the right to reduce the amount to be repurchased from a Member so that the required capital account balance is maintained.

5. Indemnifications

The Fund enters into contracts that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is not known. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

6. Subsequent Events

The Investment Manager evaluated subsequent events through the date the financial statements were issued, and concluded that there were no recognized or unrecognized subsequent events that required disclosure in or adjustment to the Fund’s financial statements.

12

FEG Absolute Access Fund I LLC

Company Management

(unaudited)

The identity of the Board Members and brief biographical information as of March 31, 2018 is set forth below. The Fund’s Statement of Additional Information includes additional information about the Board Members and is available, without charge, by calling 1-888-268-0333.

INDEPENDENT DIRECTORS |

||||

Name, Date Of Birth, |

Position(s) Held With The Fund |

Term Of Office And Length Of Time Served |

Principal Occupation(s) |

Number Of Portfolios In Fund Complex Overseen By Director |

David Clark Hyland |

Director; Chairman of Audit Committee |

Indefinite; Since Inception |

Associate Professor of Finance, Xavier University since 2008; Board of Advisors, Sterling Valuation Group, 2006-present. |

2 |

Gregory James Hahn |

Director; Audit Committee Member |

Indefinite; Since Inception |

Chief Investment Officer, Portfolio Manager, Investment Strategy, Winthrop Capital Management, LLC since 2007; Trustee, Indiana Public Employee Retirement Fund, 2010-present; Trustee, Indiana State Teachers’ Retirement Fund, 2008-present. |

2 |

INTERESTED DIRECTORS AND OFFICERS |

||||

Name, Date Of Birth, |

Position(s) Held With The Fund |

Term Of Office And Length Of Time Served |

Principal Occupation(s) Other Directorships Held By Director or Officer |

Number Of Portfolios In Fund Complex Overseen By Director Or Officer |

Kevin J. Conroy |

President; Secretary |

Indefinite; Since February 20, 2018 |

Vice President of Hedged Strategies and Assistant Portfolio Manager since 2014, Senior Analyst of Hedged Strategies, 2012-2014, Analyst of Hedged Strategies, 2011-2012, Fund Evaluation Group, LLC. |

2 |

Mary T. Bascom |

Treasurer |

Indefinite; Since Inception |

Chief Financial Officer, Fund Evaluation Group, LLC since 1999. |

2 |

13

FEG Absolute Access Fund I LLC

Company Management (continued)

(unaudited)

INTERESTED DIRECTORS AND OFFICERS (continued) |

||||

Name, Date Of Birth, |

Position(s) Held With The Fund |

Term Of Office And Length Of Time Served |

Principal Occupation(s) Other Directorships Held By Director or Officer |

Number Of Portfolios In Fund Complex Overseen By Director Or Officer |

Julie T. Thomas |

Chief Compliance Officer |

Indefinite; Since December 2016 |

Chief Compliance Officer, Fund Evaluation Group, LLC, since November 2015; Vice President, Deputy Chief Compliance Officer, The Ohio National Life Insurance Company, January 2015-November 2015; Chief Compliance Officer, 2013-2015, Director, Fund Compliance, 2012-2013, Fund Compliance Officer, 2011-2012; Suffolk Capital Management LLC, Fiduciary Capital Management, LLC, Ohio National Investments, Inc., and Ohio National Fund. |

2 |

14

FEG Absolute Access Fund I LLC

Other Information

(unaudited)

Change of Independent Registered Public Accounting Firm

Ernst & Young LLP (“EY”) resigned as the independent registered public accounting firm to the Fund effective October 3, 2017. EY’s reports on the Fund financial statements for the fiscal years ended March 31, 2016 and March 31, 2017 contained no adverse opinion or disclaimer of opinion nor were they qualified or modified as to uncertainty, audit scope or accounting principles. During the Fund’s fiscal years ended March 31, 2017 and March 31, 2016, (i) there were no disagreements with EY on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of EY, would have caused it to make reference to the subject matter of the disagreements in connection with its reports on the Fund’s financial statements for such fiscal years, and (ii) there were no “reportable events” of the kind described in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

On November 13, 2017, the Fund by action of the Board upon the recommendation of the Fund’s Audit Committee engaged Cohen & Company as the independent registered public accounting firm to audit the Fund’s financial statements for the fiscal year ending March 31, 2018. During the Fund’s fiscal years ended March 31, 2017 and March 31, 2016, neither the Fund nor anyone on their behalf has consulted with Cohen & Company on items which (i) concerned the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Fund’s financial statements; or (ii) concerned the subject of a disagreement (as defined in paragraph (a)(1)(iv) of Item 304 of Regulation S-K) or reportable events (as described in paragraph (a)(1)(v) of said Item 304).

15

FEG Absolute Access Fund I LLC

Other Information (continued)

(unaudited)

2017 Proxy Results

A Special Meeting of Members was held on November 28, 2017 to consider the proposal noted below. The proposal was approved. The results of the voting at the Special Meeting were as follows:

The Proposal: To obtain voting instructions regarding the Master Fund Proposal to approve the investment management agreement attached hereto as Appendix A between FEG Investors, LLC and FEG Absolute Access Fund LLC.

Number of Votes |

|

For: |

155,533 |

Against: |

0 |

Abstain: |

118,437 |

16

FEG Absolute Access Fund I LLC

Other Information (continued)

(unaudited)

Information on Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-888-268-0333. It is also available on the SEC’s website at http://www.sec.gov.

Information regarding how the Company voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, by calling 1-888-268-0333, and on the SEC’s website at http://www.sec.gov.

Availability of Quarterly Report Schedule

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Company’s Forms N-Q are available on the SEC’s website at http://www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

17

FEG Absolute Access Fund I LLC

Privacy Policy

(unaudited)

In the course of doing business with shareholders, the Fund collects nonpublic personal information about shareholders. “Nonpublic personal information” is personally identifiable financial information about shareholders. For example, it includes shareholders’ social security number, account balance, bank account information, and purchase and redemption history.

The Fund collects this information from the following sources:

|

● |

Information it receives from shareholders on applications or other forms; |

|

● |

Information about shareholder transactions with the Fund and its service providers, or others; |

|

● |

Information it receives from consumer reporting agencies (including credit bureaus). |

What information does the Fund disclose and to whom does the Fund disclose information?

The Fund only discloses nonpublic personal information collected about shareholders as permitted by law. For example, the Fund may disclose nonpublic personal information about shareholders:

|

● |

To government entities, in response to subpoenas or to comply with laws or regulations. |

|

● |

When shareholders direct the Fund to do so or consent to the disclosure. |

|

● |

To companies that perform necessary services for the Fund, such as data processing companies that the Fund uses to process shareholders transactions or maintain shareholder accounts. |

|

● |

To protect against fraud, or to collect unpaid debts. |

|

● |

Information about former shareholders. |

If a shareholder closes its account, the Fund will adhere to the privacy policies and practices described in this notice.

How the Fund safeguards information

Within the Fund, access to nonpublic personal information about shareholders is limited to employees and in some cases to third parties (for example, the service providers described above), as permitted by law. The Fund and its service providers maintain physical, electronic, and procedural safeguards that comply with federal standards to guard shareholder nonpublic personal information.

18

| FINANCIAL STATEMENTS | |

| FEG Absolute Access Fund LLC | |

| Year Ended March 31, 2018 | |

| With Report of Independent Registered | |

| Public Accounting Firm |

FEG Absolute Access Fund LLC

Financial Statements

Year Ended March 31, 2018

Contents

Report of Independent Registered Public Accounting Firm |

1 |

Statement of Assets, Liabilities and Members’ Capital |

2 |

Schedule of Investments |

3 |

Statement of Operations |

6 |

Statements of Changes in Members’ Capital |

7 |

Statement of Cash Flows |

8 |

Financial Highlights |

9 |

Notes to Financial Statements |

10 |

Other Information (Unaudited) |

|

Company Management |

18 |

Other Information |

20 |

Privacy Policy |

23 |

FEG Absolute Access Fund LLC

Report of Independent Registered Public Accounting Firm

March 31, 2018

To the Members and Board of Directors of

FEG Absolute Access Fund LLC

Opinion on the Financial Statements

We have audited the accompanying statement of assets, liabilities and members’ capital, including the schedule of investments, of FEG Absolute Access Fund LLC (the “Fund”) as of March 31, 2018, and the related statements of operations, cash flows and changes in members’ capital and the financial highlights for the year then ended, including the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2018, the results of its operations, its cash flows, the changes in its members’ capital and the financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

The Fund’s financial statements and financial highlights for the years ended March 31, 2017 and prior, were audited by other auditors whose report dated June 22, 2017, expressed an unqualified opinion on those financial statements and financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audit includes performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and confirmation of securities owned as of March 31, 2018, by correspondence with the custodian and underlying fund management, or by other appropriate auditing procedures where replies from underlying fund management were not received. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2017.

COHEN & COMPANY, LTD.

Cleveland, Ohio

May 30, 2018

1

FEG Absolute Access Fund LLC

Statement of Assets, Liabilities and Members’ Capital

March 31, 2018

| Assets | ||||

| Cash | $ | 2,063,704 | ||

| Short-term investments (cost $2,086,155) | 2,086,155 | |||

| Investments in Portfolio Funds, at fair value (cost $280,299,745) | 317,353,136 | |||

| Receivable for Portfolio Funds sold | 22,457,635 | |||

| Prepaid expenses and other assets | 13,531 | |||

| Total assets | $ | 343,974,161 | ||

| Liabilities and members’ capital | ||||

| Capital withdrawals payable | $ | 1,008,790 | ||

| Management fee payable | 483,919 | |||

| Professional fees payable | 124,651 | |||

| Accounting and administration fees payable | 76,872 | |||

| Line of credit fees payable | 7,778 | |||

| Directors fees payable | 6,000 | |||

| Other liabilities | 47,482 | |||

| Total liabilities | 1,755,492 | |||

| Members’ capital | 342,218,669 | |||

Total liabilities and members’ capital | $ | 343,974,161 | ||

| Components of members’ capital | ||||

| Paid-in capital | $ | 272,493,592 | ||

| Accumulated net investment loss | (25,662,950 | ) | ||

| Accumulated net realized gain on investments | 58,334,636 | |||

| Accumulated net unrealized appreciation on investments | 37,053,391 | |||

| Members’ capital | $ | 342,218,669 | ||

| Units issued and outstanding (unlimited units authorized) | 261,433 | |||

| Net Asset Value per unit | $ | 1,309.01 | ||

See accompanying notes.

2

FEG Absolute Access Fund LLC

Schedule of Investments

March 31, 2018

| Investment Name | Cost | Fair Value | Percentage of Members’ Capital | Withdrawals Permitted (1) | Redemption Notice | |||||||||||||

Investments in Portfolio Funds: (2) | ||||||||||||||||||

| United States: | ||||||||||||||||||

Multi-Strategy: (3) | ||||||||||||||||||

AG Super Fund, L.P.(4) | $ | 563,888 | $ | 823,394 | 0.2% | Quarterly (5) | 90 days | |||||||||||

| Canyon Balanced Fund, L.P. | 19,642,801 | 22,823,916 | 6.7 | Quarterly (6) | 30 days | |||||||||||||

| Claren Road Credit Partners, L.P. | 111,512 | 86,385 | 0.0 | Quarterly (5) | 45 days | |||||||||||||

CVI Global Value Fund A, L.P., Class H(4) | 437,661 | 1,299,007 | 0.4 | Quarterly (7) | 120 days | |||||||||||||

Eton Park Fund, L.P., Class B(4) | 1,027,742 | 1,204,840 | 0.3 | Quarterly | 65 days | |||||||||||||

Farallon Capital Partners, L.P.(4) | 18,060,570 | 25,441,115 | 7.4 | Annually (5) | 45 days | |||||||||||||

| Fir Tree Capital Opportunity Fund, L.P. | 17,791,631 | 23,117,972 | 6.7 | Annually (5) | 90 days | |||||||||||||

| Governors Lane Onshore Fund, L.P. | 14,000,000 | 14,925,084 | 4.4 | Quarterly (5) | 65 days | |||||||||||||

GSO Special Situations Fund, L.P.(4) | 12,094 | 54,269 | 0.0 | Semi-Annually (5) | 90 days | |||||||||||||

| HBK Multi-Strategy Fund, L.P., Class A | 13,497,263 | 19,722,534 | 5.8 | Quarterly | 90 days | |||||||||||||

Highfields Capital II, L.P.(4) | 48,467 | 49,447 | 0.0 | Annually (7) | 60 days | |||||||||||||

| Lion Point Associates, L.P. | 8,000,000 | 7,811,182 | 2.3 | Semi-Annually | 60 days | |||||||||||||

OZ Asia Domestic Partners, L.P.(4) | 812,511 | 1,241,245 | 0.4 | Quarterly (5)(9) | 30 days | |||||||||||||

| Pacific Grove Opportunities Fund I, L.P. | 10,000,000 | 10,621,295 | 3.1 | Quarterly (5)(6) | 65 Days | |||||||||||||

| Securis Event Fund (US), L.P. | 10,000,000 | 10,154,608 | 3.0 | Semi-Annually (5) | 180 days | |||||||||||||

Stark Investments, L.P. (4) | 824 | 218 | 0.0 | Quarterly | 90 days | |||||||||||||

Stark Investments, L.P., Class A (4) | 24,869 | 33,883 | 0.0 | Quarterly | 90 days | |||||||||||||

Stark Investments, L.P., Class B (4) | 3,294 | 3,687 | 0.0 | Quarterly | 90 days | |||||||||||||

| Total United States: | 114,035,127 | 139,414,081 | 40.7 | |||||||||||||||

| Cayman Islands: | ||||||||||||||||||

Multi-Strategy: (3) | ||||||||||||||||||

| Argentiere Fund, Ltd. | 8,000,000 | 8,021,606 | 2.3 | Quarterly | 55 days | |||||||||||||

| Autonomy Global Macro Fund Limited | 15,000,000 | 16,188,363 | 4.7 | Monthly (5) | 60 days | |||||||||||||

| Elliott International Limited | 25,928,845 | 32,819,968 | 9.6 | Quarterly (7) | 60 days | |||||||||||||

Eton Park Overseas Fund, Ltd.(4) | 621,242 | 539,047 | 0.2 | Annually (5) | 65 days | |||||||||||||

| Graham Global Investment Fund II SPC, Ltd. | 16,140,529 | 12,815,227 | 3.8 | Monthly | 3 days | |||||||||||||

| Graticule Asia Macro Fund, Ltd. | 15,000,000 | 14,927,732 | 4.4 | Monthly | 60 days | |||||||||||||

Highfields Capital, Ltd.(4) | 19,194,668 | 21,242,396 | 6.2 | Annually (7)(10) | 60 days | |||||||||||||

| Indaba Capital Partners (Cayman), L.P. | 23,000,000 | 27,804,495 | 8.1 | Quarterly | 90 days | |||||||||||||

| Kepos Alpha Fund, Ltd., Class A-30 Series 181 | 18,550,000 | 15,559,451 | 4.5 | Quarterly (8) | 65 days | |||||||||||||

| Myriad Opportunities US Fund Limited | 15,000,000 | 15,283,611 | 4.5 | Quarterly | 60 days | |||||||||||||

| Systematica Alternative Markets Fund Limited | 9,829,334 | 12,737,159 | 3.7 | Monthly (5) | 30 days | |||||||||||||

| Total Cayman Islands: | 166,264,618 | 177,939,055 | 52.0 | |||||||||||||||

| Total investments in Portfolio Funds | $ | 280,299,745 | $ | 317,353,136 | 92.7% | |||||||||||||

See accompanying notes.

3

FEG Absolute Access Fund LLC

Schedule of Investments (continued)

| Investment Name | Cost | Fair Value | Percentage of Members’ Capital | |||||||||

| Short-term investments: | ||||||||||||

| United States: | ||||||||||||

| Money market fund: | ||||||||||||

Fidelity Investments Money Market Treasury Funds Portfolio - Class I, 1.50% (11) | $ | 2,086,155 | $ | 2,086,155 | 0.6 | % | ||||||

| Total Short-term investments: | 2,086,155 | 2,086,155 | 0.6 | |||||||||

Total investments in Portfolio Funds and short-term investments | $ | 282,385,900 | 319,439,291 | 93.3 | ||||||||

| Other assets less liabilities | 22,779,378 | 6.7 | ||||||||||

| Members’ capital | $ | 342,218,669 | 100.0 | % | ||||||||

| (1) | Redemption frequency and redemption notice period reflect general redemption terms, and exclude liquidity restrictions. |

| (2) | Non-income producing. |

| (3) | Absolute return managers, while often investing in the same asset classes as traditional investment managers, do so in a market neutral framework that attempts to arbitrage pricing discrepancies or other anomalies that are unrelated to general market moves. Absolute return strategies are designed to reduce exposure to the market risks that define the broad asset classes and therefore should be viewed as a separate absolute return or diversifying strategy category for asset allocation purposes. An allocation to absolute return strategies can add a potentially valuable element of diversification to a portfolio of traditional investments and can be used by investors as a way to manage the total market risk of their portfolios. Examples of individual strategies that generally fall into this absolute return category include merger arbitrage, fixed income arbitrage, equity market neutral, convertible arbitrage, relative value arbitrage, and other event-driven strategies. |

| (4) | All or a portion of these investments are held in side-pockets. Such investments generally cannot be withdrawn until removed from the side-pocket, the timing of which cannot be determined. See Note 2 for a discussion of the Fund’s investments in side pockets. |

| (5) | Withdrawals from these Portfolio Funds are permitted after a one-year lockup period from the date of the initial investment. |

| (6) | Withdrawals from this Portfolio Fund are permitted on a quarterly basis, with 25%, 33 1/3%, 50%, and 100% of the total investment becoming eligible for redemption each successive quarter. |

| (7) | Withdrawals from these Portfolio Funds are permitted after a two-year lockup period from the date of the initial investment. |

| (8) | In addition to quarterly withdrawals, monthly withdrawals are also permitted from this Portfolio Fund at a limited amount of 33% of the net asset value held by a shareholder subject to a 0.20% redemption fee on the proceeds. |

| (9) | Withdrawals from this Portfolio Fund are permitted after a one-year and a quarter lockup period from the date of the initial investment. |

| (10) | In addition to annual withdrawals, semi-annual withdrawals are also permitted from this Portfolio Fund at a limited amount of 25% of the net asset value held by a shareholder. |

| (11) | The rate shown is the annualized 7-day yield as of March 31, 2018. |

See accompanying notes.

4

FEG Absolute Access Fund LLC

Schedule of Investments (continued)

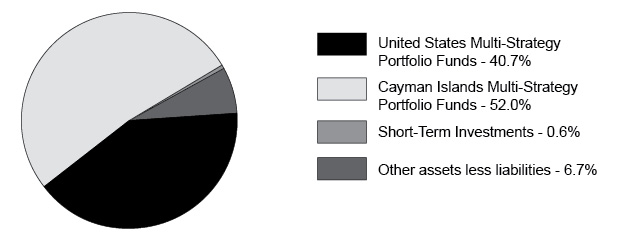

Type of Investment as a Percentage of Total Members’ Capital (Unaudited):

See accompanying notes.

5

FEG Absolute Access Fund LLC

Statement of Operations

Year Ended March 31, 2018

| Investment income | ||||

| Dividend income | $ | 290,257 | ||

| Expenses | ||||

| Management fees | 3,056,416 | |||

| Accounting and administration fees | 306,003 | |||

| Professional fees | 217,850 | |||

| Line of credit fees | 102,169 | |||

| Custodian fees | 39,469 | |||

| Line of credit interest expense | 35,365 | |||

| Compliance fees | 30,000 | |||

| Directors fees | 24,000 | |||

| Insurance expense | 16,170 | |||

| Other expenses | 109,169 | |||

| Total expenses | 3,936,611 | |||

| Net investment loss | (3,646,354 | ) | ||

| Realized and unrealized gain (loss) on investments | ||||

| Net realized gain on investments | 14,357,722 | |||

| Net change in unrealized appreciation/depreciation on investments | (7,063,327 | ) | ||

| Net realized and unrealized gain on investments | 7,294,395 | |||

| Net increase in members' capital resulting from operations | $ | 3,648,041 | ||

See accompanying notes.

6

FEG Absolute Access Fund LLC

Statements of Changes in Members’ Capital

| Year Ended March 31, 2018 | Year Ended March 31, 2017 | |||||||

| Operations | ||||||||

| Net investment loss | $ | (3,646,354 | ) | $ | (4,021,370 | ) | ||

| Net realized gain on investments | 14,357,722 | 6,129,817 | ||||||

| Net change in unrealized appreciation/depreciation on investments | (7,063,327 | ) | 16,311,181 | |||||

| Net increase in members' capital resulting from operations | 3,648,041 | 18,419,628 | ||||||

| Capital transactions | ||||||||

| Capital contributions | 44,373,024 | 27,289,847 | ||||||

| Capital withdrawals | (86,358,437 | ) | (50,629,729 | ) | ||||

| Net change in members' capital resulting from capital transactions | (41,985,413 | ) | (23,339,882 | ) | ||||

| Net change in members' capital | (38,337,372 | ) | (4,920,254 | ) | ||||

| Members' capital at beginning of year | 380,556,041 | 385,476,295 | ||||||

| Members' capital at end of year | $ | 342,218,669 | $ | 380,556,041 | ||||

| Accumulated net investment loss | $ | (25,662,950 | ) | $ | (22,016,596 | ) | ||

| Units transactions | ||||||||

| Units sold | 33,979 | 21,313 | ||||||

| Units redeemed | (66,353 | ) | (39,829 | ) | ||||

| Net change in units | (32,374 | ) | (18,516 | ) | ||||

See accompanying notes.

7

FEG Absolute Access Fund LLC

Statement of Cash Flows

Year Ended March 31, 2018

| Operating activities | ||||

| Net increase in members’ capital resulting from operations | $ | 3,648,041 | ||

| Adjustments to reconcile net increase in members' capital resulting from operations to net cash provided by operating activities: | ||||

| Purchases of investments in Portfolio Funds | (83,541,389 | ) | ||

| Proceeds from sales of investments in Portfolio Funds | 124,355,662 | |||

| Net realized gain on investments | (14,357,722 | ) | ||

| Net change in unrealized appreciation/depreciation on investments | 7,063,327 | |||

| Sales of short-term investments, net | 5,671,715 | |||

| Changes in operating assets and liabilities: | ||||

| Prepaid expenses and other assets | (805 | ) | ||

| Management fee payable | (56,373 | ) | ||

| Professional fees payable | (15,744 | ) | ||

| Accounting and administration fees payable | (13,269 | ) | ||

| Other liabilities | 9,429 | |||

| Net cash provided by operating activities | 42,762,872 | |||

| Financing activities | ||||

| Proceeds from line of credit | 16,500,000 | |||

| Payments for line of credit | (16,500,000 | ) | ||

| Line of credit fees payable | 3,334 | |||

| Proceeds from capital contributions | 44,373,024 | |||

| Payments for capital withdrawals, net of withdrawals payable | (86,307,347 | ) | ||

| Net cash used in financing activities | (41,930,989 | ) | ||

| Net change in cash | 831,883 | |||

| Cash at beginning of year | 1,231,821 | |||

| Cash at end of year | $ | 2,063,704 | ||

| Supplemental disclosure of interest paid | $ | 35,365 | ||

See accompanying notes.

8

FEG Absolute Access Fund LLC

Financial Highlights

| Year Ended March 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

Per unit operating performances: (1) | ||||||||||||||||||||

| Net asset value per unit, beginning of year | $ | 1,295.26 | $ | 1,234.22 | $ | 1,287.07 | $ | 1,225.97 | $ | 1,141.52 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment loss | (23.22 | ) | (17.32 | ) | (12.98 | ) | (4.81 | ) | (3.84 | ) | ||||||||||

| Net realized and unrealized gain (loss) on investments | 36.97 | 78.36 | (39.87 | ) | 65.91 | 88.29 | ||||||||||||||

| Total change in per unit value from investment operations | 13.75 | 61.04 | (52.85 | ) | 61.10 | 84.45 | ||||||||||||||

| Net asset value per unit, end of year | $ | 1,309.01 | $ | 1,295.26 | $ | 1,234.22 | $ | 1,287.07 | $ | 1,225.97 | ||||||||||

Ratios to average members' capital: (2) | ||||||||||||||||||||

| Total expenses | 1.11 | %(3) | 1.07 | % | 1.06 | % | 1.06 | % | 1.12 | % | ||||||||||

| Net investment loss | (1.03 | )%(4) | (1.05 | )% | (1.04 | )% | (1.06 | )% | (1.12 | )% | ||||||||||

| Total return | 1.06 | % | 4.95 | % | (4.11 | )% | 4.98 | % | 7.40 | % | ||||||||||

| Portfolio turnover | 25.84 | % | 6.43 | % | 12.33 | % | 28.75 | % | 17.93 | % | ||||||||||

| Members' capital end of year (000's) | $ | 342,219 | $ | 380,556 | $ | 385,476 | $ | 398,207 | $ | 314,170 | ||||||||||

| (1) | Selected data is for a single unit outstanding throughout the year. |

| (2) | The ratios do not include investment income, expenses or incentive allocations of the Portfolio Funds in which the Company invests. |

| (3) | Includes state withholding tax from business activity of the portfolio funds. If the expense was removed, total expenses would be 1.09%. |

| (4) | Includes state withholding tax from business activity of the portfolio funds. If the expense was removed, net investment loss would be (1.01)%. |

See accompanying notes.

9

FEG Absolute Access Fund LLC

Notes to Financial Statements

Year Ended March 31, 2018

1. Organization

FEG Absolute Access Fund LLC (the “Company”) was formed on January 18, 2008, and is a Delaware limited liability company that commenced operations on April 1, 2008. The Company registered with the U.S. Securities and Exchange Commission (the “SEC”) on August 16, 2010, under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. The Company’s Board of Directors (the “Board”) has overall responsibility for the management and supervision of the Company’s operations. To the extent permitted by applicable law, the Board may delegate any of its respective rights, powers, and authority to, among others, the officers of the Company, any committee of the Board, or the Investment Manager (as defined below). Under the supervision of the Board and pursuant to an investment management agreement, FEG Investors, LLC serves as the investment manager (the “Investment Manager”) to the Company. The Investment Manager is a registered investment adviser with the SEC under the Investment Advisers Act of 1940, as amended (the “Advisers Act”).

The Company’s investment objective is to achieve capital appreciation in both rising and falling markets, although there can be no assurance that the Company will achieve this objective. The Company was formed to capitalize on the experience of the Investment Manager’s principals by creating a fund-of-funds product, which offers professional portfolio fund manager due diligence, selection and monitoring, consolidated reporting, risk monitoring, and access to portfolio fund managers for a smaller minimum investment than would be required for direct investment. The Investment Manager manages the Company by allocating its capital among a number of independent general partners or investment managers (the “Portfolio Fund Managers”) acting through pooled investment vehicles and/or managed accounts (collectively, the “Portfolio Funds”).

Units of limited liability company interest (“Units”) of the Company are offered only to investors (“Members”) that represent that they are an “accredited investor” within the meaning of Rule 501 under the Securities Act of 1933, as amended (the “1933 Act”).

UMB Fund Services, Inc., a subsidiary of UMB Financial Corporation, serves as the Company’s administrator (the “Administrator”). The Company has entered into an agreement with the Administrator to perform general administrative tasks for the Company, including but not limited to maintenance of the books and records of the Company and the capital accounts of the Members of the Company.

2. Significant Accounting Policies

The Company is an investment company, and as such, these financial statements have applied the guidance set forth in Accounting Standards Codification (“ASC”) 946, Financial Services—Investment Companies. The following is a summary of significant accounting and reporting policies used in preparing the financial statements.

Use of Estimates

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in partners’ capital from operations during the reporting period. Actual results could differ from such estimates.

Cash is held at a major financial institution and is subject to credit risk to the extent those balances exceed Federal Deposit Insurance Corporation (FDIC) limitations.

10

FEG Absolute Access Fund LLC

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

Calculation of Members’ Capital and Net Asset Value per Unit

The Company calculates its Members’ capital as of the close of business on the last business day of each calendar month and the last day of each fiscal period. In determining its Members’ capital, the Company values its investments as of such month-end or as of the end of such fiscal period, as applicable. The Members’ capital of the Company equals the value of the total assets of the Company less liabilities, including accrued fees and expenses, each determined as of the date the Company’s Members’ capital is calculated. The net asset value per Unit equals Members’ capital divided by Units outstanding.

Investments in Portfolio Funds

The Company values its investments in Portfolio Funds at fair value, which generally represents the Company’s pro rata interest in the members’ capital of the Portfolio Funds, net of management fees and incentive allocations payable to Portfolio Fund Managers as reported by the underlying funds. The underlying investments held by the Portfolio Funds are valued at fair value in accordance with the policies established by the Portfolio Funds, as described in their respective financial statements and agreements. Due to the inherent uncertainty of less liquid investments, the value of certain investments held by the Portfolio Funds may differ from the values that would have been used if a ready market existed. The Portfolio Funds may hold investments for which market quotations are not readily available and are thus valued at their fair value, as determined in good faith by their respective Portfolio Fund Managers. Net realized and unrealized gains and losses from investments in Portfolio Funds are reflected in the Statement of Operations. Realized gains and losses from Portfolio Funds are recorded on the average cost basis.

For the year ended March 31, 2018, the aggregate cost of purchases and proceeds from sales of investments in Portfolio Funds were $83,541,389 and $143,579,516, respectively.

Certain of the Portfolio Funds may hold a portion of their assets as side-pocket investments (the “Side-Pockets”), which have restricted liquidity, potentially extending over a much longer period of time than the typical liquidity an investment in a Portfolio Fund may provide. Should the Company seek to liquidate its investments in the Side-Pockets, the Company might not be able to fully liquidate its investment without delay, and such delay could be considerable. In such cases, until the Company is permitted to fully liquidate its interest in the Side-Pockets, the value of its investment could fluctuate based on adjustments to the fair value of the Side-Pockets. As of March 31, 2018, 10 of the 29 Portfolio Funds in which the Company invested had all or a portion of their assets held as Side-Pockets. The fair value of these Side-Pockets as of March 31, 2018 was $3,959,258 and represented 1.16% of total Members’ capital.

Fair Value of Financial Instruments

Within U.S. GAAP, Fair Value Measurement, fair value is defined as the price that the Company would receive if it were to sell an investment or pay to transfer a liability in a timely transaction with an independent buyer in the principal market, or in the absence of a principal market, the most advantageous market for the investment or liability. U.S. GAAP establishes a three-tier hierarchy to distinguish between (1) inputs that reflect the assumptions that market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs), and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the fair value of the Company’s investments.

11

FEG Absolute Access Fund LLC

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

The inputs are summarized in the three broad levels listed below:

Level 1 – Inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2 – Inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets and inputs that are observable for the asset or liability, either directly or indirectly.

Level 3 – Inputs to the valuation methodology are unobservable and significant to the fair value measurement. This includes situations where there is little, if any, market activity for the asset or liability.

The inputs or methodology used for valuing investments are not necessarily an indication of the risk associated with investing in those investments.

Short-term investments represent an investment in a money market fund. Short-term investments are recorded at fair value, which is their published net asset value and are listed in the table below as a Level 1 investment.

Investments in Portfolio Funds are recorded at fair value, using the Portfolio Funds’ net asset value as a practical expedient.

The following table represents the investments carried at fair value on the Statement of Assets, Liabilities and Members’ Capital by level within the valuation hierarchy as of March 31, 2018:

| Investments | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Short-term investments | $ | 2,086,155 | $ | — | $ | — | $ | 2,086,155 | ||||||||

| Total | $ | 2,086,155 | $ | — | $ | — | $ | 2,086,155 | ||||||||

In accordance with ASC 820, investments in Portfolio Funds with a fair value of $317,353,136 are excluded from the fair value hierarchy as of March 31, 2018.

The Schedule of Investments categorizes the aggregate fair value of the Company’s investments in the Portfolio Funds by domicile, investment strategy, and liquidity.

The Company discloses transfers between levels based on valuations at the end of the reporting period. There were no transfers between Levels 1, 2, or 3 for the year ended March 31, 2018.

Investment Transactions and Investment Income

Investment transactions are recorded on a trade-date basis. Dividend income is recorded on the ex-dividend date. Capital gain distributions received are recorded as capital gains as soon as information is available. Realized gains and losses are determined on Pro Rata Depletion cost basis. Return of capital or security distributions received are accounted for as a reduction to cost.

Taxation

The Company is treated as a partnership for federal income tax purposes and therefore is not subject to U.S. federal income tax. For income tax purposes, the individual Members will be taxed upon their distributive share of each item of the Company’s profit and loss. The only taxes payable by the Company are withholding taxes applicable to certain investment income.

12

FEG Absolute Access Fund LLC

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

Management has analyzed the Company’s tax positions for all open tax years, which include the years ended December 31, 2014 through December 31, 2017, and has concluded that as of March 31, 2018, no provision for income taxes is required in the financial statements. Therefore, no additional tax expense, including any interest and penalties, was recorded in the current year and no adjustments were made to prior periods. To the extent the Company recognizes interest and penalties, they are included in interest expense and other expenses, respectively, in the Statement of Operations.

3. Investments in Portfolio Funds

The Investment Manager utilizes due diligence processes with respect to the Portfolio Funds and their Portfolio Fund Managers, which are intended to assist management in determining that financial information provided by the underlying Portfolio Fund Managers is reasonably reliable.

The Company has the ability to liquidate its investments in Portfolio Funds periodically in accordance with the provisions of the respective Portfolio Fund’s operating agreement; however, these withdrawal requests may be subject to certain lockup periods such as gates, suspensions, and the Side-Pockets, or other delays, fees, or restrictions in accordance with the provisions of the respective Portfolio Fund’s operating agreement.