UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22523

Destra Investment Trust II

(Exact name of registrant as specified in charter)

901 Warrenville Rd., Suite 15

Lisle, IL 60532

(Address of principal executive offices) (Zip code)

Nicholas Dalmaso

901 Warrenville Rd., Suite 15

Lisle, IL 60532

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-630-241-4200

Date of fiscal year end: September 30

Date of reporting period: March 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Destra Preferred and Income Securities Fund

Destra Focused Equity Fund

Destra Focused Equity Fund

Semi-Annual Report

March 31, 2014

|

Table of Contents

|

|

|

Shareholder Letter

|

3

|

|

Destra Preferred and Income Securities Fund Discussion of Fund Performance

|

4

|

|

Destra Preferred and Income Securities Fund Portfolio Manager Letter

|

6

|

|

Destra Preferred and Income Securities Fund Risk Disclosures

|

9

|

|

Destra Focused Equity Fund Discussion of Fund Performance

|

11

|

|

Destra Focused Equity Fund Portfolio Manager Letter

|

13

|

|

Destra Focused Equity Fund Risk Disclosures

|

15

|

|

Overview of Fund Expenses

|

17

|

|

Portfolio of Investments

|

|

|

Destra Preferred and Income Securities Fund

|

18

|

|

Destra Focused Equity Fund

|

21

|

|

Statements of Assets and Liabilities

|

22

|

|

Statements of Operations

|

23

|

|

Statements of Changes in Net Assets

|

24

|

|

Financial Highlights

|

26

|

|

Notes to Financial Statements

|

30

|

|

Board Considerations Regarding the Approval of the Investment Management Agreement

|

|

|

and Investment Sub-Advisory Agreements

|

34

|

|

Board of Trustees and Officers

|

37

|

|

General Information

|

43

|

Not FDIC or Government Insured, No Bank Guarantee, May Lose Value

2

Dear Shareholder,

The six month period ended March 31, 2014 saw the US equity market, as measured by the S&P 500 Index, gain 12.51%. However, the road to that result was comprised of two distinctly different periods.

The fourth quarter 2013 saw the S&P 500 Index gain 10.51%, fueled by increased investor optimism and stronger economic data, including an increase in consumer spending and an improved labor market. The fourth quarter was also a period in which non-dividend paying and lower quality stocks outperformed dividend paying and higher quality stocks.

The Federal Reserve’s announcement that it would begin to taper its securities purchases, along with improving economic data, helped push interest rates up during the fourth quarter. The yield on the 30 year Treasury rose to just under 4%, while the yield on the 10 year Treasury rose to just over 3%.

The first quarter 2014 saw a reversal of the trends that dominated the fourth quarter 2013. Investor optimism faded on disappointing employment and spending data. Dividend paying and higher quality stocks outperformed non-dividend paying and lower quality stocks in the quarter. Severe winter weather also had an adverse impact on economic activity. Equity markets experienced increased trading volatility. The US equity markets sold off in January 2014, then recovered in February and March 2014 to post a modest gain of 1.81% for the quarter ended March 31, 2014.

In the first quarter of 2014 Treasury yields also experienced a reversal of trends that dominated the fourth quarter of 2013 as the yield on the 30 year Treasury fell to just under 2.75% and the yield on the 10 year Treasury fell to just over 3.50%. Investors seeking refuge from trading volatility in the equity markets paired with mixed economic data contributed to a rally in the 10 and 30 year Treasury in the first quarter of 2014.

The Destra mutual funds posted solid performance for the six month period ended March 31, 2014. Our investment managers continue to adhere to their investment strategy and focus on attempting to limit downside risk when markets are down while participating in the upside when markets go up. This semi-annual report should provide you with information on your Fund’s performance and other insights regarding the Fund’s investment strategy and management.

As always, we believe you have a better chance of achieving your investment goals if you adhere to a well thought out investment plan.

Thank you for choosing Destra Funds.

Sincerely,

Peter Amendolair

Chief Investment Officer

Destra Capital Advisors LLC

Index Definition

S&P 500 Index – a capitalization weighted index of 500 stocks. Indexes are unmanaged, do not reflect the deduction of fees or expenses and are not available for direct investment.

3

| DESTRA PREFERRED AND INCOME SECURITIES FUND |

| DISCUSSION OF FUND PERFORMANCE |

|

Destra Preferred and Income Securities Fund as of March 31, 2014

|

|||||||

|

Inception Date: April 12, 2011

|

Inception Date: November 1, 2011

|

||||||

|

Life

|

Life

|

||||||

|

Share Class

|

6 months

|

1 year

|

of Fund

|

Share Class

|

6 months

|

1 year

|

of Fund

|

|

A at NAV

|

7.33%

|

3.08%

|

27.05%

|

C at NAV

|

6.91%

|

2.29%

|

21.98%

|

|

A with Load

|

2.52%

|

-1.55%

|

21.31%

|

C with Load

|

5.91%

|

1.29%

|

21.98%

|

|

I at NAV

|

7.46%

|

3.40%

|

28.16%

|

||||

|

Preferred Benchmark

|

7.58%

|

3.25%

|

22.05%

|

Preferred Benchmark

|

7.58%

|

3.25%

|

22.18%

|

Performance shown is historical and may not be indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.destracapital.com or call 877.855.3434. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. Class A shares have a maximum sales charge of 4.50% and a 12b-1 fee of .25%. Class C shares have a maximum deferred sales charge of 1.00% and a 12b-1 fee of 1.00%.

The Fund’s total returns would have been lower if certain expenses had not been waived or reimbursed by the investment adviser. Returns for less than one year are not annualized. Returns over one year are cumulative. Fund returns include the reinvestment of dividends.

The Preferred and Income Securities Fund’s estimated total annual operating expense ratios, gross of any fee waiver or expense reimbursement, were anticipated to be 1.99% for Class A, 3.09% for Class C, and 1.55% for Class I shares. There is a voluntary fee waiver currently in place for this Fund through February 1, 2022, to the extent necessary to keep the Fund’s operating expense ratios from exceeding 1.50% for Class A, 2.25% for Class C, and 1.22% for Class I shares of average net assets per year. Some expenses fall outside of this cap and actual expenses may be higher than 1.50% for Class A, 2.25% for Class C, and 1.22% for Class I shares. Without this expense cap, actual returns would be lower.

The Preferred Benchmark is calculated as the sum of 50% of the monthly return on the BofA Merrill Lynch Hybrid Preferred Securities 8% Constrained Index and 50% of the monthly return on the BofA Merrill Lynch US Capital Securities US Issuers 8% Constrained Index. Index returns include investments of any distributions. It is not possible to invest directly in an index.

The BofA Merrill Lynch Hybrid Preferred Securities 8% Constrained Index includes taxable, fixed-rate, US dollar denominated investment-grade, preferred securities listed on a US exchange. The BofA Merrill Lynch US Capital Securities US Issuers 8% Constrained Index includes investment grade fixed rate or fixed-to-floating rate $1,000 par securities that receive some degree of equity credit from the rating agencies or their regulators. Unlike the portfolio returns,the index returns do not reflect any fees or expenses and do not include the effect of any cash reserves.

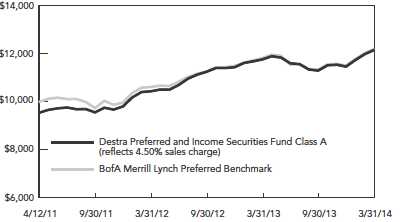

Growth of $10,000 Investment

Since Inception At Offering Price

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund. Class A Shares have a maximum sales charge of 4.50% imposed on purchases. Indexes are unmanaged and do not take into account fees, expenses or other costs. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

4

| DESTRA PREFERRED AND INCOME SECURITIES FUND | |

|

DISCUSSION OF FUND PERFORMANCE, CONTINUED

|

|

|

As of March 31, 2014

|

|

Credit Quality

|

|||

|

Moody’s

|

Standard & Poor’s

|

||

|

Aa3

|

AA-

|

2.7%

|

|

|

A1

|

A+

|

||

|

A2

|

A

|

||

|

A3

|

1.9%

|

A-

|

|

|

Baa1

|

3.9%

|

BBB+

|

10.3%

|

|

Baa2

|

21.6%

|

BBB

|

30.4%

|

|

Baa3

|

16.7%

|

BBB-

|

22.8%

|

|

Ba1

|

29.5%

|

BB+

|

21.6%

|

|

Ba2

|

9.8%

|

BB

|

8.2%

|

|

Ba3

|

5.8%

|

BB-

|

2.2%

|

|

<Ba

|

3.5%

|

<BB

|

0.3%

|

|

Not Rated

|

6.6%

|

Not Rated

|

0.8%

|

|

Cash

|

0.7%

|

Cash

|

0.7%

|

|

Top 10 Issuers

|

% of Total Investments

|

|

HSBC PLC

|

4.8%

|

|

ING Groep NV

|

4.4%

|

|

Citigroup

|

4.3%

|

|

JPMorgan Chase

|

4.0%

|

|

XL Group PLC

|

3.8%

|

|

MetLife

|

3.8%

|

|

First Republic Bank

|

3.6%

|

|

Barclays Bank PLC

|

3.6%

|

|

Axis Capital Holdings Ltd.

|

3.3%

|

|

General Electric Capital Corp.

|

2.7%

|

|

Portfolio Characteristics

|

Fund

|

|

|

Number of Issues

|

73

|

|

|

QDI Eligibility

|

63.3%

|

|

|

Geographic Concentration Domestic/International

|

71%/29%

|

|

Qualified Dividend Income (QDI) meets specific criteria to be taxed at lower long-term capital gains tax rates rather than at an individual’s ordinary income rate.

Holdings, sectors and security types are subject to change without notice. There is no assurance that the investment process will lead to successful investing.

The credit quality of the investments in the portfolio does not apply to the stability or safety of the Fund. Credit quality ratings are subject to change and pertain to the underlying holdings of the Fund and not the Fund itself.

5

|

DESTRA PREFERRED AND INCOME SECURITIES FUND

|

|

DESTRA PREFERRED AND INCOME SECURITIES FUND PORTFOLIO MANAGER LETTER

|

Fund Snapshot

The Destra Preferred and Income Securities Fund (the “Fund”) is sub-advised by investment manager Flaherty & Crumrine Incorporated (“Flaherty & Crumrine”). The Fund’s investment objective is to seek total return, with an emphasis on high current income.

Flaherty & Crumrine was founded in 1983 and is one of the oldest preferred securities managers in the industry. Through the years it has built a proprietary database with information on over 1500 separate issues of preferred securities. Flaherty & Crumrine then leverages its experience and database seeking to unlock hidden value, in what it believes is an inefficient preferred securities market. To accomplish this goal the Fund will, in normal markets, invest at least 80% of its net assets in a portfolio of preferred and income producing securities. The securities in which the Fund may invest include traditional preferred stock, trust preferred securities, hybrid securities, convertible securities, contingent-capital securities, subordinated debt, and senior debt securities of other open-end, closed-end or exchange-traded funds that invest primarily in the same types of securities. The Fund may invest up to 40% of its assets in securities of non-U.S. companies and up to 15% of its assets in common stocks. In addition, under normal market conditions, the Fund invests more than 25% of its total assets in companies principally engaged in financial services.

The Fund will principally invest in (i) investment grade quality securities or (ii) below investment grade quality preferred or subordinated securities of companies with investment grade senior debt outstanding, in either case determined at the time of purchase. Securities that are rated below investment grade are commonly referred to as “high yield” or “junk bonds.” However, some of the Fund’s total assets may be invested in securities rated (or issued by companies rated) below investment grade at the time of purchase. Preferred and debt securities of below investment grade quality are regarded as having predominantly speculative characteristics with respect to capacity to pay dividends and interest and repayment of principal. Due to the risks involved in investing in preferred and debt securities of below investment grade quality, an investment in the Fund should be considered speculative. The maturities of preferred and debt securities in which the Fund will invest generally will be longer-term (perpetual, in the case of some preferred securities, and ten years or more for other preferred and debt securities); however, in light of changing market conditions and interest rates, the Fund may also invest in shorter-term securities.

The following report is Flaherty & Crumrine’s review of the Fund’s performance over the six months comprising the semi-annual reporting period and outlook for the markets the Fund invests in going forward.

How did the Fund perform during the period of October 1, 2013—March 31, 2014?

During the six-months ended March 31, 2014, the Fund’s Class A shares had a total return of 7.33% based on Net Asset Value (“NAV”), the Class I shares had a total return of 7.46% on NAV and the Class C shares had a total return of 6.91% on NAV. During the period surveyed, the Fund’s benchmark (50%/50% blend of the BofA Merrill Lynch 8% Constrained Hybrid Preferred Securities Index and the BofA Merrill Lynch US Capital Securities US Issuers 8% Constrained Index) had a total return of 7.58%.

Two important factors to consider when surveying fund returns – first, the returns include reinvestment of all distributions, and second, it is not possible to invest directly in an index. All of the Fund’s share classes have the same investment objective — total return with an emphasis on high current income.

Preferred Benchmark is a 50/50 blend of the BofA/ML 8% Constrained Hybrid Preferred Securities Index, a subset of the BofA Merrill Lynch Fixed Rate Preferred Securities IndexSM that contains all subordinated constituents of the fixed rate index with a payment deferral feature and with issuer concentration capped at a maximum of 8% (the fixed-rate index includes investment grade DRD eligible and non-DRD eligible preferred stock and senior debt); and the BofA/ML US Capital Securities US Issuers 8% Constrained Index, a subset of the BofA Merrill Lynch Corporate All Capital Securities IndexSM that contains securities issued by US corporations (the index includes investment grade fixed-rate or fixed-to-floating rate $1,000 par securities that receive some degree of equity credit from the rating agencies or their regulators and with issuer concentration capped at a maximum of 8%). Indexes are unmanaged, do not reflect the deduction of fees or expenses and are not available for direct investment.

What were the significant events affecting the economy and market environment during the period surveyed?

After a difficult stretch during the second half of 2013, the preferred securities market seemed ripe for recovery, and it didn’t disappoint. One probably would not have arrived at that conclusion in December 2013, however, when long-term interest rates rose to their highest levels of the year (nearly 4% for the 30-year Treasury bond) after the Federal Reserve

6

|

DESTRA PREFERRED AND INCOME SECURITIES FUND

|

|

DESTRA PREFERRED AND INCOME SECURITIES FUND PORTFOLIO MANAGER LETTER, CONTINUED

|

began to taper its securities purchases. Many holders of preferred securities – particularly $25-par issues – sold them to book tax losses before year-end. Such selling pressure hurt prices even more. Preferred securities’ prices ended 2013 at or near their lows for the year.

As 2014 began, preferred security valuations recovered. Unusually cold temperatures and heavy snowfall blanketed much of the United States from December through February, dampening economic activity. Job growth sputtered, personal spending eased and housing activity slowed. The 30-year Treasury bond yield drifted back down to finish the Fund’s fiscal quarter at 3.58%, 23 bp lower than where it started in December. Meanwhile, fundamental credit conditions – profits, balance sheets and loan performance, among others – continued to improve for most preferred issuers.

As fears of sharply higher interest rates faded and tax-loss selling ran its course, preferred investors returned to the market. And they had company! Some investors who typically focus on other fixed-income markets, such as corporate or high-yield bonds, also bought preferred securities, attracted by their higher yields in an otherwise low-yield environment. Those other fixed-income markets dwarf the preferred market in size, so even a small reallocation to preferreds inside a bond portfolio can translate into a lot of dollars being invested in preferreds. Demand for preferred securities picked up noticeably.

Among major issuers, financial companies, especially banks, are adapting to new rules and regulations implemented since the financial crisis. Regular readers of our commentary will recall many discussions about Basel III and other regulatory pronouncements. These regulations are intended to strengthen balance sheets and improve transparency –positives for preferred investors. In almost every case in the U.S. and abroad, preferred securities are, or will be, an integral component of capital. As a result, we have seen, and will continue to see, a steady supply of new preferred issues. However, new issuance has been modest in size and readily absorbed by investors; and spreads on these and secondary-market issues have gradually compressed.

How did the aforementioned events affect the Fund?

The Fund tracked the performance of the overall preferred market – with its portfolio (that is, the Fund’s NAV, gross of expenses) underperforming the 50/50 weighted benchmark in the fourth quarter of 2013 and outperforming the benchmark in the first quarter of 2014. This was largely a story about retail preferreds.

Given its smaller portfolio size, the Fund is currently overweight exchange-listed preferreds (approximately 72% of the portfolio compared to 32% of the weighted benchmark). During the fourth quarter, these securities performed significantly worse than unlisted preferreds structured for institutional investors. Retail preferreds reacted with more volatility over fears of rising interest rates and were impacted by year-end tax loss selling and redemption of preferred exchange traded funds. However, in early 2014, concerns over interest rates seem to have moderated with the decline in longer-term interest rates and as seasonal tax-loss selling ended. Retail preferreds bounced back strongly during the first quarter. As a result, the Fund’s overweight to this sector paid off.

Which holdings contributed to the Fund’s performance during the period surveyed?

The Fund’s selection of bank holdings contributed the most positively to performance over the past six months. Banks comprise the largest industry sector in the Fund and they were among its highest yielding and best performing securities. Among the top performers were U.S. regional banks — First Republic Bank (3.58% of Net Assets), Texas Capital Bancshares, Inc. (2.30% of Net Assets) and Astoria Financial Corp. (2.36% of Net Assets) — as well as U.S. money center banks - Citigroup, Inc. (4.24% of Net Assets) and Goldman Sachs Group, Inc. (0.95% of Net Assets). Furthermore, banks in the Fund performed much better than their counterparts in the benchmark, which were only average performers.

Which holdings detracted from the Fund’s performance during the period surveyed?

Insurance companies were the best performing industry sector in the benchmark over the past six months. As a result, the Fund’s underweight to insurance companies (27% of the portfolio compared to 50% of the benchmark) was a drag on performance. Furthermore, the Fund’s insurance holdings were less sensitive to changes in long-term interest rates than those in the benchmark. During a period where interest rates declined, the Fund’s insurance companies didn’t benefit as much from the decrease in rates as their counterparts in the benchmark.

7

|

DESTRA PREFERRED AND INCOME SECURITIES FUND

|

|

DESTRA PREFERRED AND INCOME SECURITIES FUND PORTFOLIO MANAGER LETTER, CONTINUED

|

What is your outlook for the preferred securities marketplace?

Although interest-rate fears have receded recently, we know many fund and other preferred investors remain concerned about the possibility of rising interest rates. Three observations. First, although preferred security prices tend to move with intermediate and long-term Treasury yields, their correlation is not perfect. Yields on preferred securities are high relative to those of Treasuries and corporate bonds, and preferreds should be able to absorb some increase in Treasury yields while still generating positive total returns. We think improving credit fundamentals support that view.

Second, as the Fund’s experience in 2013’s third fiscal quarter demonstrated, prices of preferred securities can fall when interest rates increase significantly. However, preferred securities have paid dividends year-in and year-out. If we have picked our credits correctly, over time, those dividends have the potential to turn modest principal losses into positive total returns. Shareholders probably will have to live through some quarter-to-quarter volatility, but we think prospective returns on preferred securities remain attractive for long-term investors.

Third, there are a number of ways we can manage interest-rate risk in a portfolio of preferred securities. In particular, so-called “fixed-to floating-rate” preferred securities can offer attractive yields with only intermediate duration or interest-rate risk. A typical such security starts with a coupon rate that is fixed for five or 10 years and then floats at a margin over an index (usually 3-month LIBOR). These preferred securities have credit risk similar to fixed-rate issues, but they can have much less interest-rate risk. Of course, not all fixed-to floating-rate preferred securities are the same and none are riskless. Investors need to evaluate each issue’s creditworthiness, terms and conditions carefully, something we spend a lot of time doing. As of March 31, 2014, roughly 36% of the Fund’s portfolio was comprised of fixed-to-floating rate issues and they fit well with our market outlook.

We expect economic growth to improve in the second quarter as weather effects fade. We don’t think weather was the whole story behind sluggish first-quarter growth, but it was an important factor, and one that inevitably will thaw come Spring. Stronger growth may push interest rates higher once again. However, for 2014 as a whole, we foresee modest economic growth, improving credit conditions and continued accommodative monetary policy. That should translate into gradually (if erratically) rising Treasury rates along with narrower yield spreads on preferred securities. Investors should be prepared for some volatility over coming quarters, but we think “coupon” or “coupon minus a bit” returns on preferred securities should remain attractive for long-term investors.

8

| DESTRA PREFERRED AND INCOME SECURITIES FUND | |

| FUND RISK DISCLOSURES – DESTRA PREFERRED AND INCOME SECURITIES FUND |

This document may contain forward-looking statements representing Destra’s, the portfolio managers’ or sub-adviser’s beliefs concerning futures operations, strategies, financial results or other developments. Investors are cautioned that such forward-looking statements involve risks and uncertainties. Because these forward-looking statements are based on estimates and assumptions that are subject to significant business, economic and competitive uncertainties, many of which are beyond Destra’s, the portfolio managers’ or sub-adviser’s control or are subject to change, actual results could be materially different. There is no guarantee that such forward-looking statements will come to pass.

Some important risks of the Destra Preferred and Income Securities Fund are:

PRINCIPAL RISKS

Risk is inherent in all investing. The value of your investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments. The following is a summary description of certain risks of investing in the Fund.

Active Management Risk—The Fund is an actively managed portfolio and its success depends upon the investment skills and analytical abilities of the Fund’s sub-adviser to develop and effectively implement strategies that achieve the Fund’s investment objective. Subjective decisions made by the investment sub-adviser may cause the Fund to incur losses or to miss profit opportunities on which it may otherwise have capitalized.

Concentration Risk—The Fund intends to invest 25% or more of its total assets in securities of financial services companies. This policy makes the Fund more susceptible to adverse economic or regulatory occurrences affecting financial services companies.

Convertible Securities Risk—The market value of a convertible security often performs like that of a regular debt security; that is, if market interest rates rise, the value of a convertible security usually falls. In addition, convertible securities are subject to the risk that the issuer will not be able to pay interest or dividends when due, and their market value may change based on changes in the issuer’s credit rating or the market’s perception of the issuer’s creditworthiness. Since it derives a portion of its value from the common stock into which it may be converted, a convertible security is also subject to the same types of market and issuer risks that apply to the underlying common stock.

Credit Risk—Credit risk is the risk that an issuer of a security will be unable or unwilling to make dividend, interest and principal payments when due and the related risk that the value of a security may decline because of concerns about the issuer’s ability to make such payments. Credit risk may be heightened for the Fund because the Fund may invest in “high yield” or “high risk” securities; such securities, while generally offering higher yields than investment grade securities with similar maturities, involve greater risks, including the possibility of default or bankruptcy, and are regarded as predominantly speculative with respect to the issuer’s capacity to pay dividends and interest and repay principal.

Currency Risk—Since a portion of the Fund’s assets may be invested in securities denominated foreign currencies, changes in currency exchange rates may adversely affect the Fund’s NAV, the value of dividends and income earned, and gains and losses realized on the sale of securities.

Financial Services Companies Risk—Financial services companies are especially subject to the adverse effects of economic recession, currency exchange rates, government regulation, decreases in the availability of capital, volatile interest rates, portfolio concentrations in geographic markets and in commercial and residential real estate loans, and competition from new entrants in their fields of business.

Foreign Investment Risk—Because the Fund can invest its assets in foreign instruments, the value of Fund shares can be adversely affected by changes in currency exchange rates and political and economic developments abroad. Foreign markets may be smaller, less liquid and more volatile than the major markets in the United States, and as a result, Fund share values may be more volatile. Trading in foreign markets typically involves higher expense than trading in the United States. The Fund may have difficulties enforcing its legal or contractual rights in a foreign country. In addition, the European financial markets have recently experienced volatility and adverse trends due to concerns about economic

9

|

DESTRA PREFERRED AND INCOME SECURITIES FUND

|

|

FUND RISK DISCLOSURES – DESTRA PREFERRED AND INCOME SECURITIES FUND, CONTINUED

|

downturns in, or rising government debt levels of several European countries. These events may spread to other countries in Europe, including countries that do not use the Euro. These events may affect the value and liquidity of certain of the Fund’s investments.

General Fund Investing Risks—The Fund is not a complete investment program and you may lose money by investing in the Fund. All investments carry a certain amount of risk and there is no guarantee that the Fund will be able to achieve its investment objective. In general, the annual fund operating expenses expressed as a percentage of the Fund’s average daily net assets will change as Fund assets increase and decrease, and the Fund’s annual fund operating expenses may differ in the future. Purchase and redemption activities by Fund shareholders may impact the management of the Fund and its ability to achieve its objective. Investors in the Fund should have long-term investment perspective and be able to tolerate potentially sharp declines in value. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, entity or person.

High Yield Securities Risk—High yield securities generally are less liquid, have more volatile prices, and have greater credit risk than investment grade securities.

Income Risk—The income earned from the Fund’s portfolio may decline because of falling market interest rates. This can result when the Fund invests the proceeds from new share sales, or from matured or called preferred or debt securities, at market interest rates that are below the portfolio’s current earnings rate.

Interest Rate Risk—If interest rates rise, in particular, if long-term interest rates rise, the prices of fixed-rate securities held by the Fund will fall.

Investment Companies Risk—As with other investments, investments in other investment companies are subject to market and selection risk. In addition, if the Fund acquires shares of investment companies, including ones affiliated with the Fund, shareholders bear both their proportionate share of expenses in the Fund (including management and advisory fees) and, indirectly, the expenses of the investment companies. To the extent the Fund is held by an affiliated fund, the ability of the Fund itself to hold other investment companies may be limited.

Liquidity Risk—This Fund, like all open-end funds, is limited to investing up to 15% of its net assets in illiquid securities. From time to time, certain securities held by the Fund may have limited marketability and may be difficult to sell at favorable times or prices. It is possible that certain securities held by the Fund will not be able to be sold in sufficient amounts or in a sufficiently timely manner to raise the cash necessary to meet any potentially large redemption requests by fund shareholders.

Market Risk and Selection Risk—Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money.

Non-Diversification/Limited Holding Risk—The Fund is non-diversified, which means that it may invest in the securities of fewer issuers than a diversified fund. As a result, it may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, may experience increased volatility and may be highly concentrated in certain securities. Furthermore, because the Fund has a relatively small number of issuers, the Fund has greater susceptibility to adverse developments in one issuer or group of issuers.

Preferred Security Risk—Preferred and other subordinated securities rank lower than bonds and other debt instruments in a company’s capital structure and therefore will be subject to greater credit risk than those debt instruments. Distributions on some types of these securities may also be skipped or deferred by issuers without causing a default. Finally, some of these securities typically have special redemption rights that allow the issuer to redeem the security at par earlier than scheduled.

Investors should consider the investment objective and policies, risk considerations, charges and ongoing expenses of an investment carefully before investing. The prospectus contains this and other information relevant to an investment in the Fund. Please read the prospectus carefully before investing. To obtain a prospectus, please contact your investment representative or Destra Capital Investments LLC at 877-855-3434 or access our website at destracapital.com.

10

| DESTRA FOCUSED EQUITY FUND |

|

DISCUSSION OF FUND PERFORMANCE

|

|

Destra Focused Equity Fund as of March 31, 2014

|

|||||||

| Inception Date: April 12, 2011 |

Inception Date: November 1, 2011

|

||||||

|

Share Class

|

6 months

|

1 year

|

Life

of Fund |

Share Class

|

6 months

|

1 year

|

Life

of Fund |

|

A at NAV

|

7.39%

|

16.73%

|

41.97%

|

C at NAV

|

6.99%

|

15.86%

|

37.80%

|

|

A with Load

|

1.24%

|

10.01%

|

33.76%

|

C with Load

|

5.99%

|

14.86%

|

37.80%

|

|

I at NAV

|

7.58%

|

17.09%

|

43.42%

|

||||

|

S&P 500 Index

|

12.51%

|

21.86%

|

50.80%

|

S&P 500 Index

|

12.51%

|

21.86%

|

57.60%

|

Performance shown is historical and may not be indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.destracapital.com or call 877.855.3434. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. Class A shares have a maximum sales charge of 5.75% and a 12b-1 fee of .25%. Class C shares have a maximum deferred sales charge of 1.00% and a 12b-1 fee of 1.00%.

The Fund’s total returns would have been lower if certain expenses had not been waived or reimbursed by the investment adviser. Returns for less than one year are not annualized. Returns over one year are cumulative. Fund returns include the reinvestment of distributions.

The Focused Equity Fund’s estimated total annual operating expense ratios, gross of any fee waiver or expense reimbursement, were anticipated to be 1.90% for Class A, 3.45% for Class C, and 1.54% for Class I shares. There is a voluntary fee waiver currently in place for this Fund through February 1, 2022, to the extent necessary to keep the Fund’s operating expense ratios from exceeding 1.60% for Class A, 2.35% for Class C, and 1.32% for Class I shares of average net assets per year. Some expenses fall outside of this cap and actual expenses may be higher than 1.60% for Class A, 2.35% for Class C, and 1.32% for Class I shares. Without this expense cap, actual returns would be lower.

S&P 500 Index – a capitalization weighted index of 500 stocks. Indexes are unmanaged, do not reflect the deduction of fees or expenses and are not available for direct investment.

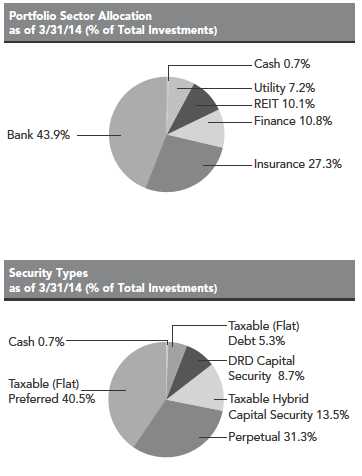

Growth of $10,000 Investment

Since Inception At Offering Price

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund. Class A shares have a maximum sales charge of 5.75% imposed on purchases. Indexes are unmanaged and do not take into account fees, expenses, or other costs. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

11

| DESTRA FOCUSED EQUITY FUND |

|

DISCUSSION OF FUND PERFORMANCE, CONTINUED

|

|

As of March 31, 2014

|

|

Top 10 Holdings

|

|

|

as of 3/31/14

|

% of Total Investments

|

|

Oracle Corp.

|

5.2%

|

|

The Walt Disney Co.

|

5.1%

|

|

Adobe Systems Inc.

|

5.1%

|

|

The TJX Cos., Inc.

|

5.1%

|

|

Johnson & Johnson

|

5.0%

|

|

Mondelez International, Inc.

|

5.0%

|

|

CVS Caremark Corp.

|

5.0%

|

|

Nordstrom, Inc.

|

5.0%

|

|

EMC Corp.

|

5.0%

|

|

Nike, Inc.

|

5.0%

|

|

Portfolio Characteristics

|

Fund

|

Index

|

|

Number of Holdings

|

21

|

500

|

|

Average Market Cap

|

$103.0 bil

|

$35.0 bil

|

|

Price to Earnings Ratio

|

21.2x

|

17.4x

|

|

Price to Book Ratio

|

5.1x

|

4.0x

|

Holdings sectors and security types are subject to change without notice. There is no assurance that the investment process will lead to successful investing.

Glossary

Number of Holdings: The total number of individual securities held by the Fund or covered in the index.

Price to Earnings Ratio: A valuation ratio of current share price compared to its per-share operating earnings over the previous four quarters.

Average Market Capitalization: The average of market capitalization (market price multiplied by the number of shares outstanding) of the stocks in the portfolio.

Price to Book: A ratio used to compare a stock’s market value to its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value per share.

12

| DESTRA FOCUSED EQUITY FUND | |

| DESTRA FOCUSED EQUITY FUND PORTFOLIO MANAGER LETTER |

Fund Snapshot

The Destra Focused Equity Fund (the “Fund”) is sub-advised by the investment manager WestEnd Advisors LLC (“WestEnd”). The Fund’s investment objective is to seek long-term capital appreciation.

Under normal market conditions, the Fund invests primarily (at least 80% of net assets, plus the amount of any borrowings for investment purposes) in equity securities. The Fund’s investment manager, WestEnd, believes that sector and industry performance is correlated with particular stages of the business cycle. The manager selects sectors it believes will experience economic tailwinds, and avoid sectors it sees as untimely. Through this process, it targets high-quality, market-leading companies within the favored sectors.

The following report is WestEnd’s review of the Fund’s performance over the six months comprising the semi-annual reporting period and an outlook for the markets the Fund invests in going forward.

How did the Fund perform during the period of October 1, 2013—March 31, 2014?

During the six-months ended March 31, 2014, the Fund’s Class A shares had a total return of 7.39% based on Net Asset Value (“NAV”), the Class I shares had a total return of 7.58% on NAV and the Class C shares had a total return of 6.99% on NAV. During the period surveyed, the Fund’s benchmark, the S&P 500 Index, returned 12.51%.

S&P 500 Index is a capitalization-weighted index of 500 stocks. Indexes are unmanaged, do not reflect the deduction of fees or expenses and are not available for direct investment.

What were the significant events affecting the economy and market environment during the period surveyed?

Market conditions for the six-month period ended March 31, 2014 were characterized by two distinct environments. In the last three months of 2013, there was stronger economic data, led by a pickup in consumer spending and inventory-boosted GDP readings. However, we believed that this data was similar to prior temporary periods of above-trend growth within a longer period of moderate growth. Nevertheless, investors were encouraged by the stronger data and stocks performed well late last year.

While investors were optimistic about the prospects for the U.S. economy and the equity markets going into 2014, questions began to rise soon after the new year began. The December employment report and December auto sales, both released early in the year, were a few of several pieces of disappointing economic data that contributed to the stock market selloff in January. The market bounced back in February, but uncertainty grew later in the month as Russia made clear its intentions to annex Ukraine’s Crimea region. The S&P 500 Index finished the quarter up modestly. However, the significant intra-quarter stock market swings signaled that investors had serious questions about the outlook for U.S. growth.

How did the aforementioned events affect the Fund?

Increased investor optimism led to a 10.51% return for the S&P 500 Index in the last three months of 2013. The fourth quarter gains were the culmination of a year when stock valuations increased as stock price appreciation substantially outpaced earnings increases. The S&P 500 Index, for instance, rose 32.39% in 2013, while earnings for the index’s constituents increased just 7.2%. The Focused Equity Fund participated in the stock market gains, but a challenge to performance was the relative outperformance of smaller capitalization companies within the S&P 500 Index. For example, for the six months ended March 31, 2014, stocks in S&P 500 Index with market capitalization (“market cap”) over $50 billion underperformed the broader market by approximately 1%, while stocks in the S&P 500 Index with a market cap of less than $50 billion outperformed the Index by more than 1%. The Focused Equity Fund holds high-quality, large-capitalization companies, with only one-third of the weight of the Focused Equity Fund invested in stocks with a market cap of less than $50 billion. WestEnd continues to believe that stocks of the high-quality, large-capitalization companies in the Fund will outperform the broad market through a variety of market environments.

The start of 2014 coincided with a shift in the market backdrop. Stocks sold off in January, but recovered those losses by the end of the quarter. The S&P 500 Index finished the first quarter of 2014 up a modest 1.81%. A headwind for the Fund’s relative performance, particularly in late March, was the underperformance of growth stocks, like those in the biotechnology industry. We believe the Focused Equity Fund’s biotech stocks have attractive valuations given our high degree of confidence in their significantly higher-than-market earnings growth in the quarters ahead.

13

|

DESTRA FOCUSED EQUITY FUND

|

|

DESTRA FOCUSED EQUITY FUND PORTFOLIO MANAGER LETTER, CONTINUED

|

Which holdings contributed to the Fund’s performance during the period surveyed?

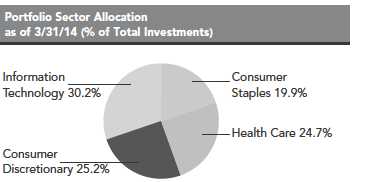

WestEnd continues to believe the economy is in a slow-to-moderate economic growth environment typical of the later stages of the middle phase of the business cycle. This research leads WestEnd to favor Consumer Discretionary, Consumer Staples, Health Care and Information Technology companies. The largest contributor to the absolute performance of the Fund over the six month period was its overweight of the Information Technology Sector (30.2% of Total Investments) which was the second best performing sector in the S&P 500 Index for the six months ended March 31, 2014. The largest contributor to relative performance of the Fund, was its avoidance of the Energy Sector. The Fund has a zero percent allocation to Energy, which was the third worst performing Sector in the S&P 500 Index over the six month period. Stock selection in the Information Technology Sector also contributed to the Fund’s positive performance during the time period as Adobe Systems, Inc. (4.98% of Net Assets) and Oracle Corp. (5.12% of Net Assets) added to gains.

Which holdings detracted from the Fund’s performance during the period surveyed?

The largest negative contributor to the relative performance of the Fund for the six months ended March 31, 2013, was the overweight to the Consumer Staples Sector (19.90% of Total Investments), which underperformed the S&P 500 Index over the six month period. WestEnd’s research confirms the belief that we are in the later stages of the middle phase of the business cycle, which is why the Fund was overweight in this sector during the period. WestEnd continues to believe that the Fund’s stocks in the Consumer Staples Sector will outperform in this economic environment, and the Fund remains overweight in this sector.

Whole Food Market, Inc. (“Whole Foods”), which is no longer a holding in the Fund, was the worst performing stock in the Fund for the six months ended March 31, 2014. Whole Foods lagged the portfolio during the period surveyed due to a slowdown in earnings and same-store sales growth from previously reported levels, despite a healthy high-end consumer. The Fund’s position in Whole Foods was sold in Q1 2014 in an effort to deploy capital into opportunities with strong earnings growth potential trading at lower relative earnings multiples. Coach, Inc. (“Coach”) (2.44% of Net Assets) was the second worst performing stock in the Fund during the period surveyed. Coach lagged during the period surveyed due to a decline in earnings and same-store sales growth from previously reported levels as the company transitioned to a new line of high-end hand bag and accessory products. Half of the Fund’s position in Coach was sold in Q1 2014 in an effort to deploy capital into opportunities with strong earnings growth potential.

What is your outlook for the United States equity markets?

While the weather played a role in the softer than expected early 2014 data, other signs of slow growth were prevalent across the economy. We believe that when investors gain more clarity, as additional data is released over the next few months and quarters, investors will recognize that the U.S. is on a different path of growth in 2014 than they originally anticipated at the start of the year. The consensus view should move closer to our outlook for slow-to-moderate growth, rather than an acceleration in activity. The absence of a pickup in economic growth in our view leaves stocks in the most economically sensitive sectors of the market like Materials, Energy, Industrials and Financials vulnerable to a selloff. We continue to avoid these more vulnerable areas of the market as well as slow-growth companies that will likely see their stocks under pressure as interest rates rise. The Focused Equity Fund, in contrast, remains positioned to capitalize on healthy consumer spending and investment in technology as well as benefit from certain Health Care and Consumer Staples stocks with strong earnings growth prospects.

14

|

DESTRA FOCUSED EQUITY FUND

|

|

FUND RISK DISCLOSURES – DESTRA FOCUSED EQUITY FUND

|

This document may contain forward-looking statements representing Destra’s, the portfolio managers’ or sub-adviser’s beliefs concerning futures operations, strategies, financial results or other developments. Investors are cautioned that such forward-looking statements involve risks and uncertainties. Because these forward-looking statements are based on estimates and assumptions that are subject to significant business, economic and competitive uncertainties, many of which are beyond Destra’s, the portfolio managers’ or sub-adviser’s control or are subject to change, actual results could be materially different. There is no guarantee that such forward-looking statements will come to pass.

Some important risks of the Destra Focused Equity Fund are:

PRINCIPAL RISKS

Risk is inherent in all investing. The value of your investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments. The following is a summary description of certain risks of investing in the Fund.

Active Management Risk—The Fund is an actively managed portfolio and its success depends upon the investment skills and analytical abilities of the Fund’s sub-adviser to develop and effectively implement strategies that achieve the Fund’s investment objective. Subjective decisions made by the investment sub-adviser may cause the Fund to incur losses or to miss profit opportunities on which it may otherwise have capitalized.

Consumer Discretionary Companies Risk—Consumer discretionary companies manufacture products and provide discretionary services directly to the consumer, and the success of these companies is tied closely to the performance of the overall domestic and international economy, interest rates, competition and consumer confidence. The success of this sector depends heavily on disposable household income and consumer spending. Changes in demographics and consumer tastes can also affect the demand for, and success of, consumer discretionary products in the marketplace.

Consumer Staples Companies Risk—Consumer staples companies may be affected by the permissibility of using various product components and production methods, marketing campaigns and other factors affecting consumer demand. Tobacco companies, in particular, may be adversely affected by new laws, regulations and litigation. Consumer staples companies may also be adversely affected by changes or trends in commodity prices, which may be influenced or characterized by unpredictable factors.

Equity Securities Risk—Stock markets are volatile. The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions.

General Fund Investing Risks—The Fund is not a complete investment program and you may lose money by investing in the Fund. All investments carry a certain amount of risk and there is no guarantee that the Fund will be able to achieve its investment objective. In general, the annual fund operating expenses expressed as a percentage of the Fund’s average daily net assets will change as Fund assets increase and decrease, and the Fund’s annual fund operating expenses may differ in the future. Purchase and redemption activities by Fund shareholders may impact the management of the Fund and its ability to achieve its objective. Investors in the Fund should have long-term investment perspective and be able to tolerate potentially sharp declines in value. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, entity or person.

Health Care Companies Risk—The Fund invests in health care companies, including those that are involved in medical services or health care, including biotechnology research and production, drugs and pharmaceuticals and health care facilities and services, and are subject to extensive competition, generic drug sales or the loss of patent protection, product liability litigation and increased government regulation. Research and development costs of bringing new drugs to market are substantial, and there is no guarantee that the product will ever come to market. Health care facility operators may be affected by the demand for services, efforts by government or insurer to limit rates, restriction of government financial assistance and competition from other providers.

Information Technology Companies Risk—Information technology companies are generally subject to the risks of rapidly changing technologies, short product life cycles, fierce competition, aggressive pricing and reduced profit margins, loss of patent, copyright and trademark protections, cyclical market patterns, evolving industry standards and frequent new product introductions. Information technology companies may be smaller and less experienced companies, with limited product lines, markets or financial resources and fewer experienced management or marketing personnel. Information technology company stocks, particularly those involved with the Internet, have experienced extreme price and volume fluctuations that often have been unrelated to their operating performance.

15

| DESTRA FOCUSED EQUITY FUND |

| FUND RISK DISCLOSURES – DESTRA FOCUSED EQUITY FUND, CONTINUED |

Investment Strategy Risk—The Fund invests in common stocks of companies that the sub-adviser believes will perform well in certain phases of the business cycle. The sub-adviser’s investment approach may be out of favor at times, causing the Fund to underperform funds that also seek capital appreciation but use different approaches to the stock selection and portfolio construction process.

Market Risk and Selection Risk—Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money.

Non-Diversification/Limited Holdings Risk—The Fund is non-diversified, which means that it may invest in the securities of fewer issuers than a diversified fund. As a result, it may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, may experience increased volatility and may be highly concentrated in certain issues. Furthermore, because the Fund has a relatively small number of issuers, the Fund has greater susceptibility to adverse developments in one issuer or group of issuers.

Sector Focus Risk—The Fund will typically focus its investments on companies within particular economic sectors. To the extent that it does so, developments affecting companies in those sectors will have a magnified effect on the Fund’s NAV and total return.

Investors should consider the investment objective and policies, risk considerations, charges and ongoing expenses of an investment carefully before investing. The prospectus contains this and other information relevant to an investment in the Fund. Please read the prospectus carefully before investing. To obtain a prospectus, please contact your investment representative or Destra Capital Investments LLC at 877-855-3434 or access our website at destracapital.com.

16

|

OVERVIEW OF FUND EXPENSES

|

|

As of March 31, 2014 (unaudited)

|

As a shareholder of the Destra Investment Trust II, you incur advisory fees and other fund expenses. The expense examples below (the “Example”) are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period 9/30/13 to 3/31/14” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing cost of investing in a Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or contingent deferred sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

Annualized

|

|||||||||||||||

|

Expense

|

|||||||||||||||

|

Ratios

|

Expenses

|

||||||||||||||

|

Beginning

|

Ending

|

During the

|

Paid During

|

||||||||||||

|

Account

|

Account

|

Period

|

the Period

|

||||||||||||

|

Value

|

Value

|

9/30/13

|

9/30/13 to

|

||||||||||||

|

9/30/13

|

3/31/14

|

to 3/31/14

|

3/31/14†

|

||||||||||||

|

Destra Preferred and Income Securities Fund Class A

|

|||||||||||||||

|

Actual

|

$ | 1,000.00 | $ | 1,073.30 | 1.50 | % | $ | 7.75 | |||||||

|

Hypothetical (5% return before expenses)

|

1,000.00 | 1,017.45 | 1.50 | % | 7.54 | ||||||||||

|

Destra Preferred and Income Securities Fund Class C

|

|||||||||||||||

|

Actual

|

1,000.00 | 1,069.05 | 2.25 | % | 11.61 | ||||||||||

|

Hypothetical (5% return before expenses)

|

1,000.00 | 1,013.71 | 2.25 | % | 11.30 | ||||||||||

|

Destra Preferred and Income Securities Fund Class I

|

|||||||||||||||

|

Actual

|

1,000.00 | 1,074.58 | 1.22 | % | 6.31 | ||||||||||

|

Hypothetical (5% return before expenses)

|

1,000.00 | 1,018.85 | 1.22 | % | 6.14 | ||||||||||

|

Destra Focused Equity Fund Class A

|

|||||||||||||||

|

Actual

|

1,000.00 | 1,073.95 | 1.60 | % | 8.27 | ||||||||||

|

Hypothetical (5% return before expenses)

|

1,000.00 | 1,016.95 | 1.60 | % | 8.05 | ||||||||||

|

Destra Focused Equity Fund Class C

|

|||||||||||||||

|

Actual

|

1,000.00 | 1,069.85 | 2.35 | % | 12.13 | ||||||||||

|

Hypothetical (5% return before expenses)

|

1,000.00 | 1,013.21 | 2.35 | % | 11.80 | ||||||||||

|

Destra Focused Equity Fund Class I

|

|||||||||||||||

|

Actual

|

1,000.00 | 1,075.77 | 1.32 | % | 6.83 | ||||||||||

|

Hypothetical (5% return before expenses)

|

1,000.00 | 1,018.35 | 1.32 | % | 6.64 | ||||||||||

|

†

|

Expenses are calculated using the Fund’s annualized expense ratio, which includes waived fees or reimbursed expenses, multiplied by the average account value for the period, multiplied by 182/365 (to reflect the six-month period). Hypothetical expenses assume each Fund was outstanding for a full six-month period.

|

17

|

DESTRA PREFERRED AND INCOME SECURITIES FUND

|

|

PORTFOLIO OF INVESTMENTS

|

|

March 31, 2014 (unaudited)

|

|

Number

|

||||

|

of

|

Moody’s

|

|||

|

Shares

|

Ratings

|

Fair Value

|

||

|

Long-Term Investments - 98.8%

|

||||

|

Preferred Stocks - 76.8%

|

||||

|

Banks - 39.5%

|

||||

|

33,810

|

Astoria Financial Corp., PFD

|

|||

|

6.500%, Series C (a)

|

Ba2

|

$ 803,326

|

||

|

Barclays Bank PLC, PFD

|

||||

|

23,500

|

7.100%, Series 3 (a)

|

Ba2

|

603,245

|

|

|

4,169

|

7.750%, Series 4 (a)

|

Ba2

|

108,144

|

|

|

19,000

|

8.125%, Series 5 (a)

|

Ba2

|

494,190

|

|

|

24,050

|

BB&T Corp., PFD

|

|||

|

5.625%, Series E (a)

|

Baa2

|

538,480

|

||

|

5,000

|

Capital One Financial Corp., PFD

|

|||

|

6.000%, Series B (a)

|

Ba1

|

117,300

|

||

|

Citigroup, Inc., PFD

|

||||

|

43,049

|

6.875%, Series K (a)

|

Ba3

|

1,122,288

|

|

|

12,150

|

7.125%, Series J (a)

|

Ba3

|

320,760

|

|

|

5,000

|

City National Corp., PFD

|

|||

|

5.500%, Series C (a)

|

Baa3

|

109,550

|

||

|

10,000

|

Countrywide Capital V, PFD

|

|||

|

7.000% 11/01/36

|

Ba1

|

255,000

|

||

|

5,000

|

First Horizon National Corp., PFD

|

|||

|

6.200%, Series A (a)

|

Ba3

|

118,450

|

||

|

30,000

|

First Niagara Financial Group, Inc.,

|

|||

|

PFD 8.625%, Series B (a)

|

B1

|

852,300

|

||

|

49,425

|

First Republic Bank, PFD

|

|||

|

6.200%, Series B (a)

|

Baa3

|

1,218,326

|

||

|

14,074

|

Goldman Sachs Group, Inc., PFD

|

|||

|

5.950%, Series I (a)

|

Ba2

|

324,406

|

||

|

21,364

|

HSBC Holdings PLC, PFD

|

|||

|

8.000%, Series 2 (a)

|

Baa2

|

576,187

|

||

|

ING Groep NV,

|

||||

|

300

|

PFD 6.375% (a)

|

Ba1

|

7,494

|

|

|

8,202

|

PFD 7.050% (a)

|

Ba1

|

211,858

|

|

|

5,000

|

PFD 7.200% (a)

|

Ba1

|

129,500

|

|

|

43,754

|

PFD 7.375% (a)

|

Ba1

|

1,117,039

|

|

|

5,000

|

JPMorgan Chase & Co., PFD

|

|||

|

6.700%, Series T (a)

|

Ba1

|

127,000

|

||

|

15,000

|

Morgan Stanley, PFD

|

|||

|

6.875%, Series F (a)

|

Ba3

|

388,800

|

||

|

14,000

|

Royal Bank of Scotland Group PLC,

|

|||

|

PFD 7.250%, Series T (a)

|

B2

|

348,880

|

||

|

25,523

|

Santander Finance Preferred

|

|||

|

SA Unipersonal, PFD

|

||||

|

10.500%, Series 10 (a)

|

Ba2

|

665,895

|

||

|

15,500

|

SunTrust Banks, Inc., PFD

|

|||

|

5.875%, Series E (a)

|

Ba1

|

348,130

|

||

|

33,219

|

Texas Capital Bancshares, Inc., PFD

|

|||

|

6.500% 09/21/42

|

Ba1

|

783,968

|

||

|

24,342

|

Webster Financial Corp., PFD

|

|||

|

6.400%, Series E (a)

|

Ba1

|

586,399

|

||

|

20,000

|

Wells Fargo & Co., PFD

|

|||

|

8.000%, Series J (a)

|

Baa3

|

582,800

|

||

|

Zions Bancorporation, PFD

|

||||

|

8,000

|

6.950% 09/15/28

|

BB+ (b)

|

211,520

|

|

|

12,803

|

7.900%, Series F (a)

|

BB (b)

|

362,837

|

|

|

13,434,072

|

||||

|

Diversified Financials - 6.4%

|

||||

|

32,277

|

Affiliated Managers Group, Inc., PFD

|

|||

|

6.375% 08/15/42

|

BBB (b)

|

806,925

|

||

|

11,477

|

Deutsche Bank Contingent Capital

|

|||

|

Trust V, PFD 8.050% (a)

|

Ba2

|

315,273

|

||

|

41,912

|

HSBC Finance Corp., PFD

|

|||

|

6.360%, Series B (a)

|

Baa3

|

1,051,991

|

||

|

2,174,189

|

||||

|

Insurance - 14.9%

|

||||

|

16,050

|

Arch Capital Group Ltd., PFD

|

|||

|

6.750%, Series C (a)

|

Baa2

|

403,176

|

||

|

Aspen Insurance Holdings Ltd.,

|

||||

|

12,286

|

PFD 5.950% (a)

|

Ba1

|

304,815

|

|

|

2,714

|

PFD 7.250% (a)

|

Ba1

|

70,890

|

|

|

44,000

|

Axis Capital Holdings Ltd., PFD

|

|||

|

6.875%, Series C (a)

|

Baa3

|

1,108,800

|

||

|

34,501

|

Delphi Financial Group, Inc., PFD

|

|||

|

7.376% 05/15/37

|

BBB- (b)

|

861,449

|

||

|

Endurance Specialty Holdings Ltd.,

|

||||

|

18,000

|

PFD 7.500%, Series B (a)

|

Ba1

|

471,060

|

|

|

3,681

|

PFD 7.750%, Series A (a)

|

Ba1

|

96,516

|

|

|

PartnerRe Ltd.,

|

||||

|

11,922

|

PFD 5.875%, Series F (a)

|

Baa2

|

266,099

|

|

|

15,500

|

PFD 7.250%, Series E (a)

|

Baa2

|

410,905

|

|

|

28,387

|

Principal Financial Group, Inc., PFD

|

|||

|

6.518%, Series B (a)

|

Ba1

|

706,269

|

||

|

8,897

|

RenaissanceRe Holdings Ltd., PFD

|

|||

|

5.375%, Series E (a)

|

Baa2

|

182,033

|

||

|

8,223

|

WR Berkley Corp., PFD

|

|||

|

5.625% 04/30/53

|

Baa3

|

177,123

|

||

|

5,059,135

|

||||

|

Real Estate - 10.0%

|

||||

|

30,000

|

CommonWealth REIT, PFD

|

|||

|

7.250%, Series E (a)

|

Ba1

|

755,100

|

||

|

10,430

|

CubeSmart, PFD

|

|||

|

7.750%, Series A (a)

|

Ba1

|

268,468

|

||

|

16,667

|

Duke Realty Corp., PFD

|

|||

|

6.600%, Series L (a)

|

Baa3

|

404,008

|

||

|

Kimco Realty Corp., PFD

|

||||

|

1,500

|

5.500%, Series J (a)

|

Baa2

|

31,275

|

|

|

13,012

|

6.900%, Series H (a)

|

Baa2

|

335,319

|

|

|

National Retail Properties, Inc., PFD

|

||||

|

4,100

|

5.700%, Series E (a)

|

Baa2

|

85,854

|

|

|

4,230

|

6.625%, Series D (a)

|

Baa2

|

102,535

|

|

|

PS Business Parks, Inc., PFD

|

||||

|

26,100

|

5.750%, Series U (a)

|

Baa2

|

558,801

|

|

|

8,839

|

6.000%, Series T (a)

|

Baa2

|

198,877

|

|

|

4,448

|

6.875%, Series R (a)

|

Baa2

|

112,757

|

|

|

17,063

|

Realty Income Corp., PFD

|

|||

|

6.625%, Series F (a)

|

Baa2

|

429,817

|

||

|

5,560

|

Weingarten Realty Investors, PFD

|

|||

|

6.500%, Series F (a)

|

Baa3

|

137,221

|

||

|

3,420,032

|

||||

|

Utilities - 6.0%

|

||||

|

4,000

|

Dominion Resources, Inc., PFD

|

|||

|

8.375% 06/15/64, Series A

|

Baa3

|

102,000

|

The accompanying notes are an integral part of these financial statements.

18

| DESTRA PREFERRED AND INCOME SECURITIES FUND | |

| PORTFOLIO OF INVESTMENTS, CONTINUED | |

|

March 31, 2014 (unaudited)

|

|

Number

|

||||

|

of Shares/

|

Moody’s

|

|||

|

Par Value

|

Ratings

|

Fair Value

|

||

|

Utilities (continued)

|

||||

|

5,148

|

Entergy Louisiana LLC,

|

|||

|

PFD 6.950% (a)

|

Baa3

|

$ 517,857

|

||

|

8,000

|

Integrys Energy Group, Inc., PFD

|

|||

|

6.000% 08/01/73

|

Baa2

|

201,680

|

||

|

10,000

|

PPL Capital Funding, Inc., PFD

|

|||

|

5.900% 04/30/73, Series B

|

Ba1

|

233,000

|

||

|

21,825

|

SCANA Corp, PFD

|

|||

|

7.700% 01/30/65

|

Ba1

|

577,271

|

||

|

4,000

|

Southern California Edison Co., PFD

|

|||

|

6.500%, Series D (a)

|

Baa1

|

411,125

|

||

|

2,042,933

|

||||

|

Total Preferred Stocks

|

||||

|

(Cost $26,305,799)

|

26,130,361

|

|||

|

Capital Securities - 22.0%

|

||||

|

Banks - 4.2%

|

||||

|

1,071,000

|

JPMorgan Chase & Co.

|

|||

|

7.900%, Series 1 (a)

|

Ba1

|

1,215,585

|

||

|

215,000

|

PNC Financial Services Group, Inc.

|

|||

|

(The) 6.750%, Series O (a)

|

Baa3

|

235,409

|

||

|

1,450,994

|

||||

|

Diversified Financials - 4.3%

|

||||

|

500,000

|

Charles Schwab Corp. (The)

|

|||

|

7.000%, Series A (a)

|

Baa2

|

572,500

|

||

|

800,000

|

General Electric Capital Corp.

|

|||

|

7.125%, Series A (a)

|

Baa1

|

913,444

|

||

|

1,485,944

|

||||

|

Insurance - 12.3%

|

||||

|

500,000

|

AXA SA

|

|||

|

8.600% 12/15/30

|

A3

|

646,250

|

||

|

450,000

|

Everest Reinsurance Holdings, Inc.

|

|||

|

6.600% 05/15/37

|

Baa2

|

459,000

|

||

|

837,000

|

MetLife, Inc.

|

|||

|

10.750% 08/01/39

|

Baa2

|

1,272,240

|

||

|

500,000

|

Prudential Financial, Inc.

|

|||

|

5.625% 06/15/43

|

Baa2

|

512,500

|

||

|

1,300,000

|

XL Group PLC

|

|||

|

6.500%, Series E (a)

|

Ba1

|

1,285,375

|

||

|

4,175,365

|

||||

|

Utilities - 1.2%

|

||||

|

320,000

|

PPL Capital Funding, Inc.

|

|||

|

6.700% 03/30/67, Series A

|

Ba1

|

321,815

|

||

|

75,000

|

Puget Sound Energy, Inc.

|

|||

|

6.974% 06/01/67, Series A

|