UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22523

Destra Investment Trust II

(Exact name of registrant as specified in charter)

901 Warrenville Rd., Suite 15

Lisle, IL 60532

(Address of principal executive offices) (Zip code)

Nicholas Dalmaso

901 Warrenville Rd., Suite 15

Lisle, IL 60532

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-630-241-4200

Date of fiscal year end: September 30

Date of reporting period: March 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Destra Preferred and Income Securities Fund

Destra Focused Equity Fund

Semi-Annual Report

March 31, 2012

|

Table of Contents

|

|

|

Shareholder Letter

|

3

|

|

Discussion of Fund Performance

|

4

|

|

Fund Risks Disclosures

|

12

|

|

Shareholder Expense Examples

|

13

|

|

Portfolio of Investments

|

|

|

Destra Preferred and Income Securities Fund

|

14

|

|

Destra Focused Equity Fund

|

16

|

|

Statements of Assets and Liabilities

|

17

|

|

Statements of Operations

|

18

|

|

Statements of Changes in Net Assets

|

19

|

|

Financial Highlights

|

21

|

|

Notes to Financial Statements

|

23

|

|

Board of Trustees and Officers

|

28

|

|

General Information

|

31

|

2

Dear Shareholder,

Since the founding of Destra Capital, we have been focused on seeking out unique investment strategies and investment managers who seek to capture alpha in a responsible manner. Our approach has resulted in the development of core investment portfolios that seek to offer consistent returns.

Responsible Alpha – Our experience has taught us that protecting on the downside is paramount, because when you are able to keep more in down markets, the up markets don’t need to rise as much for you to outperform.

Unique Strategies – We look for managers who take a unique approach to asset management which provide financial advisors the resources for building durable investment portfolios.

Experience and Consistency – Our manager selection and oversight process is based on over 30 years of experience.

Over the past six months investors continued to shrug off geo-political and economic concerns and pushed markets to their highest levels since before the financial crisis. Overall, confidence in the markets grew as the eurozone backed away from the brink of collapse. The U.S. economy showed continued signs of life as central banks around the world pledged to step-in and support global economic growth. Investors began to move assets from relatively safe, but low-yielding bonds, into riskier instruments in the search of higher returns. Although Europe remains an open question, it is clear that sovereign governments are committed to taking action to control their debt. Investors on both sides of the pond responded positively to the news which helped to buoy investor sentiment. Domestically, as the Fed continues its low interest rate policy, increased consumer spending, small declines in jobless claims, and a decrease in the overall unemployment number added to the positive feel.

The question for the equity markets going forward is whether the bull market is over or still has some life left in it. There is considerable support to make a case for either scenario. Strong corporate profits, higher cash levels, dividend increases, share buybacks, low interest rates, modest economic growth and central bank easing make a good case for those who think the bull market has life. Eurozone debt worries, upcoming political elections, higher oil prices, disappointing job numbers and political instability around the world make a good case for those who think the equity market will not fare well going forward. The first two weeks of April showed that the market will not continue to go straight up. In fact, it is likely we may see the markets pause for a while before continuing an upward trend, although not as sharply as we saw over the past six months.

Interestingly, while the equity markets delivered strong returns, up almost 30% from the lows of October 2011, we wonder who really benefitted. Trading volumes were down substantially and equity mutual fund flows continued to be negative. Conversely, with interest rates at extremely low levels and probably nowhere to go but up, bond mutual fund flows were once again positive. We have seen this time and time again when retail investors become skittish they often exit the market just before the market goes up. They then enter the market after it has risen. A typical case of buy high and sell low. It is extremely difficult to time the markets. A much better approach is to develop a long-term strategic plan and stick to it. You have a much better opportunity to participate in market gains that way. The same is true for those who reduced their equity exposure and increased their bond exposure. If interest rates rise sharply, and bond prices fall, you will likely see those same investors take money out of bonds.

We thank you very much for your long-term approach to investing in your fund and hope that the semi-annual report provides you helpful insight into your specific strategy for the time period ending March 31, 2012. We value your support and confidence in Destra and look forward to serving your investment needs in the future.

Sincerely,

Peter Amendolair

Chief Investment Officer

Destra Capital Advisors LLC

3

Destra Preferred and Income Securities Fund

Semi Annual Report Shareholder Letter

Fund Snapshot

The Destra Preferred and Income Securities Fund seeks total return, with an emphasis on high current income by investing in a portfolio primarily of preferred and other income producing securities. Flaherty and Crumrine, the Fund’s investment manager, founded in 1983, is one of the oldest firms specializing in the management of preferred securities. Their experience, proprietary database and dedicated credit research capabilities have allowed them to unlock hidden value, in what the firm believes is an inefficient preferred securities market. The preferred market is an often-overlooked segment of the capital markets because it is relatively small and very complex. In an attempt to take advantage of inefficiency within the market Flaherty and Crumrine applies a combination of intensive credit research and quantitative analysis enabling them to seek out opportunities for the Fund.

|

·

|

Proprietary database with over 26 years of data, 1500 published issues, and 35-80 individual data points.

|

|

·

|

Portfolio managers work as traders allowing them to trade reactively in an inefficiently priced market.

|

|

·

|

In normal markets, the Fund will invest at least 80% of its assets in a portfolio of preferred and income- producing securities.

|

|

·

|

The Fund may invest up to 40% of its assets in securities of non-U.S. companies, and up to 15% of its assets in common stocks.

|

|

·

|

The Fund invests 25% or more of its assets in securities of financial service companies.

|

How did the Fund perform during the semi-annual time period October 1st – March 31, 2012?

During the semi-annual time period, the Fund’s investment portfolio had strong returns. The Class A shares had a total return of 9.19% at Net Asset Value, “NAV” (without load), while the Class I shares had a total return of 9.34% on NAV (without load). The Fund compared favorably to its benchmark index which had a total return of 9.03% during the time period. On November 1, 2011 the Fund launched Class C Shares. From its inception through March 31, 2012 the performance of the share class was 6.55%, at NAV.

What was the market environment like during the period?

U.S. economic growth continued to be restrained by household and financial deleveraging. In addition, elevated oil prices, fiscal uncertainty and the continuing European debt crisis also limited the recovery. While for several quarters we’ve seen signs of improvement in the U.S. economy, the pace of growth has been well short of robust.

However, beginning last December, U.S. investor confidence turned positive after several months of decline, the domestic labor picture showed improvement and the housing market appeared finally to have stabilized. In addition, Europe stepped back from the precipice of economic disaster (although concerns reemerged in April), as policy makers flooded the continent with liquidity. Interest rates around the globe hover near historical lows and are not expected to rise substantially anytime soon. This moderate growth environment allowed domestic companies to boost earnings and strengthen balance sheets, while at the same time the risks of recession and deflation diminished.

All of this stimulated demand for higher-yielding assets, especially preferred securities, contributed to excellent performance for preferreds. However, returns of this magnitude are rare – even in periods of above-average market volatility such as we’ve experienced over the past several years.

Regulatory Update

There is little new to report on regulatory matters. We expect new bank capital guidelines to be issued by the Fed very soon. With the new rules set to go into effect in January 2013, time is running out for the regulators. The new guidelines, when issued, will provide the final pieces of the regulatory capital overhaul which grew out of the financial crisis.

4

We’ve known for some time that most forms of trust preferred and hybrid preferred securities will eventually no longer count towards bank Tier 1 regulatory capital requirements. When they can and the economics make sense, banks are calling the higher-coupon of these trust preferreds under their regular call provisions, but we’re waiting to learn what can be used instead. Since we have been aware of this issue in the marketplace well before the Fund’s inception we have not invested in these high coupon preferreds so the Fund should not be impacted by these redemptions in the marketplace.

Even without clear guidelines from regulators, a handful of banks recently have issued new preferred stock with terms expected to conform to the new rules. These securities are all perpetual, non-cumulative preferred stock, which we and the market presume will qualify as Tier 1 capital whenever the new bank capital rules are promulgated.

How did the Fund adjust to the market during this period?

While we have seen some preemptive redemption and issuance from stronger U.S. banks, to a large degree the preferred market is in a holding pattern awaiting new bank capital guidelines from the Federal Reserve. Once the rules are known, we don’t think the transition will be immediate; nor is it likely that all of the older “non-qualifying” capital will be replaced with newer “good” Tier 1 capital. However, we have tried to anticipate the shift by selling or avoiding securities, which may be called in the near future on unattractive terms. This type of proactive management has always been part of our investment approach as we constantly evaluate the risk/return profile of each holding. We anticipate a substantial pickup in bank trust preferred calls and preferred stock issuance after the rules are released.

Which holdings contributed to the Fund’s performance?

Even though the Fund is underweight banks, the Fund’s selection of banks was the primary reason for the Fund’s outperformance of the benchmark. During this period, European banks performed especially well for the portfolio, as the ECB stabilized funding issues in Europe for the time being. As such HSBC Holdings PLC, (1.27% of Total Assets), Barclays Bank PLC, (1.66% of Total Assets), and ING Groep N.V., (1.05% of Total Assets), were among the best performing banks in the Fund.

Which holdings detracted from the Fund’s performance?

Every security in the portfolio contributed positively to the Fund’s performance in the period. Although past performance is no guarantee of future success.

What is the portfolio manager’s outlook for the next six months/year?

Overall we remain moderately optimistic on U.S. economic growth this year, with restricted real GDP growth both this year and next. This moderate growth environment should allow companies to continue to boost earnings and further strengthen their balance sheets. That, along with improving lending performance, rising household savings and accommodative monetary policy, should contribute to good performance for preferred securities. At the same time, a number of risks are visible on the horizon, most notably (but not exclusively) the sovereign debt crisis in Europe.

At the end of the day, we believe long-term investors will continue to earn attractive returns on preferred securities, although there may be some bumps along the way. We will continue to manage the Fund as we have managed preferred portfolios for over 25 years – in quiet times and in crisis – with a disciplined eye on credit fundamentals, relative value and risk management.

5

| Preferred & Income Securities Fund | |||

|

3 Months

|

1 Year

|

Life of Fund

|

|

|

Ending

|

Ending

|

Ending

|

|

|

3/31/2012

|

3/31/2012

|

3/31/2012

|

|

|

Share Class

|

Return

|

Return

|

Return

|

|

A at NAV

|

6.44

|

9.35

|

|

|

A with Load

|

1.62

|

4.41

|

|

|

C at NAV

|

6.19

|

6.55

|

|

|

C with Load

|

5.19

|

5.55

|

|

|

I at NAV

|

6.49

|

9.59

|

|

|

Market Benchmark

|

6.49

|

6.23

|

Performance shown is historical and may not be indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.destracapital.com or call 877.855.3434. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares.

Class A share performance reflects the maximum 4.50% sales charge, and Class C shares reflects the applicable contingent deferred sales charge (CDSC) for the period invested. The CDSC on Class C Shares is 1% for the first year after purchase. Class I shares do not have a front-end sales charge or CDSC; therefore performance is at net asset value. The performance of the Fund’s share classes will differ primarily due to the different sales charge structures and class expenses.

The total annual Fund operating expense ratio set forth in the most recent Fund prospectus as of the date of this report for Class A, Class C, and Class I was 1.52%, 2.27% and 1.24% respectively. The expense ratio presented above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered in this report.

The Fund’s total returns would have been lower if certain expenses had not been waived or reimbursed by the investment adviser. Returns for less than 1 year are not annualized. Fund returns include the reinvestment of dividends and capital gains.

The Market Benchmark is rebalanced monthly as an equally weighted average of the performance of the BofA Merrill Lynch 8% Capped Hybrid Preferred Securities IndexSM and the BofA Merrill Lynch 8% Constrained Corporate U.S. Capital Securities IndexSM. It is not necessarily a comprehensive reflection of the preferred securities held by portfolios in the Composite

A direct investment cannot be made into the index. Unless otherwise indicated, index results include reinvested dividends and do not reflect any sales charges. Performance of the Fund may deviate significantly from the performance of the index.

Credit Quality

|

Moody’s

|

Standard & Poors

|

|||||

|

A2

|

2%

|

A-

|

0%

|

|||

|

A3

|

3%

|

BBB+

|

14%

|

|||

|

Baa1

|

7%

|

BBB

|

28%

|

|||

|

Baa2

|

21%

|

BBB-

|

9%

|

|||

|

Baa3

|

36%

|

BB+

|

34%

|

|||

|

Ba1

|

19%

|

BB

|

8%

|

|||

|

Ba2

|

5%

|

BB

|

2%

|

|||

|

Ba3

|

2%

|

Cash

|

5%

|

|||

|

Cash

|

5%

|

6

|

Top 10 Issuers

|

% of Total Investments

|

|

Met Life

|

4.5%

|

|

JPMorgan Chase

|

4.0%

|

|

Nexen

|

3.9%

|

|

Wells Fargo

|

3.9%

|

|

Axis Capital

|

3.9%

|

|

HSBC PLC

|

3.5%

|

|

Bank of America

|

3.5%

|

|

Citigroup

|

3.2%

|

|

Entergy Louisiana

|

3.2%

|

|

First Niagara Financial Group

|

3.1%

|

|

Industry Sectors

|

Weight

|

|

Bank

|

38%

|

|

Finance

|

4%

|

|

Insurance

|

27%

|

|

Utility

|

10%

|

|

REIT

|

9%

|

|

Energy

|

7%

|

|

Cash

|

5%

|

|

Security Types

|

Weight

|

|

Taxable (Flat) - Preferred

|

45%

|

|

Taxable (Flat) Debt

|

6%

|

|

Perpetual

|

15%

|

|

Corporate Bond

|

3%

|

|

Taxable Hybrid

|

19%

|

|

Convertible Preferred

|

3%

|

|

DRD Capital Security

|

4%

|

|

Cash

|

5%

|

Growth of $10,000 Investment

Since Inception At Offering Price

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

7

Destra Focused Equity Fund Manager Discussion and Analysis

Fund Snapshot

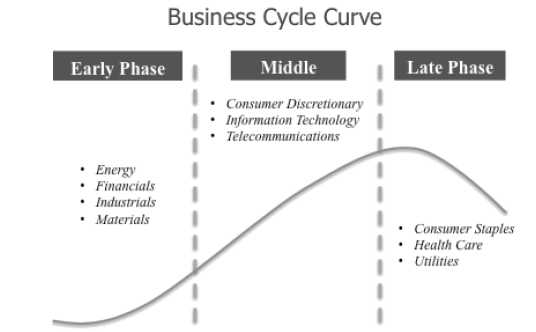

The Destra Focused Equity Fund, (the “Fund”) seeks long term capital appreciation by utilizing an investment approach guided by the belief that sector and industry performance is highly correlated with particular stages of the business cycle. With that in mind, the Fund’s investment manager, WestEnd Advisors, screens the S&P 500 for high-quality, clean balance sheet businesses that they believe are positioned to have the greatest appreciation in the current phase of the business cycle. WestEnd Advisors works to identify where we are in a business cycle by monitoring and evaluating approximately 120 economic and business indicators. This research also directs them to where they think the business cycle is moving.

WestEnd Advisors’ research has shown that historically, different sectors of the S&P 500 have been highly correlated with certain phases of the business cycle. By identifying where we are in a business cycle, WestEnd determines which sectors of the S&P 500 the Fund should own, as well as which sectors to avoid.

There are ten sectors in the S&P 500 (using Global Industry Classification Standard “GIC” sector and industry classifications), and over the course of a full business cycle the Fund should invest in each sector. In the early stages, the Fund will tend to own more economically sensitive sectors: energy, materials, industrials and financials. As the business cycle matures, the Fund will gravitate towards information technology, consumer discretionary and telecommunications. Ultimately when the economy slows down into what WestEnd Advisors calls a cycle-ending recession, the portfolio will become defensive and the Fund’s stock allocations will shift into sectors such as utilities, health care and consumer staples. WestEnd Advisor’s investment philosophy results is an investment process that shifts portfolio sector and style emphasis as the business cycle moves, seeking to keep the Fund’s portfolio properly oriented and timely over a full economic and market cycle. Since the Fund’s inception, financial markets have witnessed a historic high level of volatility, however the Fund’s strategy has generally served shareholders well over the past 11 months by limiting losses when the markets struggle and participating in rising markets. This is a concept we at Destra Capital Advisors, call, Responsible Alpha™.

How did the Fund perform from October 1, 2011 to March 31, 2012?

The Destra Focused Equity Fund’s Class A shares provided a total return of 24.77%, at net asset value from October 1, 2011 through March 31, 2012, the Fund’s semi-annual reporting period. The Fund’s Class I shares provided a total return of 25.08%, at net asset value over the same period. This compares with a return of 25.9% for the Fund’s benchmark, the S&P 500 Index. On November 1, 2011 the Fund launched Class C Shares. From their inception through March 31, 2012, the performance of the share class was 12.67%, at net asset value (“NAV”).

8

A Tale of Two Periods

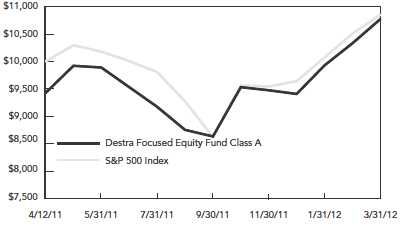

Markets rallied sharply during the period from October, 2011 to March, 2012. Given the Fund’s investment strategy we are not surprised by the Fund’s modest underperformance during the reporting period, compared to its benchmark, the S&P 500 Index. However, taken in the context of both up and down markets, as experienced since the Fund’s inception on April 12, 2011 through March 30, 2012, WestEnd’s investment process provided an overall market beating total return. In the Down Market period the Fund outperformed the S&P 500 by 4.67%. Conversely during the Up Market it participated in market performance but trailed the S&P 500 by 1.02%. However, over the combined period the Fund had a total return of 14.30% beating the S&P 500 Index by 4.90%, as the chart below illustrates. This concept of outperformance when markets struggle and near market returns when they rally significantly is a hallmark of what Destra looks for in Responsible Alpha™ management.

|

Down Market

|

Up Market

|

Combined Period

|

||||||||||

|

4/12/11-

|

10/1/11-

|

4/12/11-

|

||||||||||

|

9/30/11

|

3/31/12

|

3/31/12

|

||||||||||

|

S&P 500 Index*

|

-13.07 | % | 25.92 | % | 9.40 | % | ||||||

|

Destra Focused Equity Fund Class A Shares,

|

||||||||||||

|

at net asset value

|

-8.40 | % | 24.90 | % | 14.30 | % | ||||||

|

Fund Performance Difference

|

4.67 | % | -1.02 | % | 4.90 | % | ||||||

Past performance is no guarantee of future results.

|

*

|

The S&P 500 Index is a commonly recognized market-capitalization-weighted index of 500 widely held equity securities, designed to measure broad U.S. equity performance.

|

What was the economic and market environment like during this period?

During the six months ended March 31, 2012, the U.S. economy continued to grow despite investors’ worries that the U.S. was headed for another recession. Investors welcomed improved economic data, which included a pickup in consumer spending, solid business investment and better labor market statistics. In addition, an increased number of investors started to accept the idea that economic conditions in Europe and China do not necessarily dictate the strength or direction of the U.S. economy. The positive economic data, along with less emphasis on potential risks from outside the U.S., fueled the stock market rally during the six month period ended March 31, 2012.

Which holdings contributed to the Fund’s performance?

Today, WestEnd Advisors believes we are in the later middle stages of the business cycle that started at the end of the recession in 2002. Their research leads them to favor technology and consumer discretionary companies, followed by firms in the health care, telecommunications and consumer staples arenas. The largest contributor to performance of the Fund for the six months ended March 31, 2012, was the overweighting (relative to the S&P 500 Index) of the Information Technology sector. The Information Technology sector was the second best performing sector in the S&P 500 over the six month period. Stock selection in the Information Technology sector also contributed to the Fund’s positive performance during the period as Autodesk (4.59% of Total Assets), Qualcomm (4.59% of Total Assets), and Adobe Systems Inc. (4.57% of Total Assets), had impressive gains. Also contributing to the Fund’s performance during the time period was the overweighting of the Consumer Discretionary sector. The Consumer Discretionary sector was the third best performing sector in the S&P 500 over the six month period. Lowe’s (4.58% of Total Assets), Coach (4.60% of Total Assets), and Nike (4.63% of Total Assets) all added to strong performance within that sector.

Which holdings detracted from the Fund’s performance?

All of the Fund’s holdings had a positive return for the six months ended March 31, 2012. Most securities had double-digit returns with the exception of Verizon (4.61% of Total Assets), which lagged during the time period.

The largest negative contributor to the performance of the Fund for the six months ended March 31, 2012, was the underweight to the Financials sector, which was the best performing sector in the S&P 500 over the six month period. WestEnd Advisors’ research confirms their belief that we are in the late middle stages of the business cycle, which is why the Fund was underweight in this sector during the period. WestEnd continues to believe that financial companies in general will underperform in this economic environment and the Fund remains underweighted to this sector.

9

What is your outlook for the Fund?

We believe certain consumer-focused companies and technology companies are well positioned for the moderate growth environment we anticipate throughout 2012. Employee raises, increased hours worked and hiring have all contributed to personal income gains. Diminished concerns about layoffs along with higher incomes indicate consumer spending should continue to be a driver of U.S. growth. The Fund’s manager also sees business investment, especially in enterprise technology, as another area of economic strength. Spending on technology should remain strong as corporations look for ways to offset slower productivity gains and boost earnings growth. A low likelihood of additional security purchases by the Federal Reserve (QE3) points to a strong U.S. dollar in the period ahead. The strength in the dollar, together with moderate economic growth, should act as a headwind for the stocks of commodity-oriented companies in the Materials, Industrials and Energy sectors. We feel the Fund is positioned to benefit from these trends with significant allocations to the Consumer Discretionary and Information Technology sectors.

| Focused Equity Fund | |||

|

3 Months

|

1 Year

|

Life of Fund

|

|

|

Ending

|

Ending

|

Ending

|

|

|

3/31/2012

|

3/31/2012

|

3/31/2012

|

|

|

Share Class

|

Return

|

Return

|

Return

|

|

A at NAV

|

14.50

|

14.29

|

|

|

A with Load

|

7.93

|

7.69

|

|

|

C at NAV

|

14.34

|

12.67

|

|

|

C with Load

|

13.34

|

11.67

|

|

|

I at NAV

|

14.63

|

14.74

|

|

|

S&P 500 Index

|

12.59

|

11.77

|

Performance shown is historical and may not be indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.destracapital.com or call 877.855.3434. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares.

Class A share performance reflects the maximum 5.75% sales charge, and Class C shares reflect the applicable contingent deferred sales charge (CDSC) for the period invested. The CDSC on Class C Shares is 1% for the first year after purchase. Class I shares do not have a front-end sales charge or CDSC; therefore performance is at net asset value. The performance of the Fund’s share classes will differ primarily due to the different sales charge structures and class expenses.

The total annual Fund operating expense ratio set forth in the most recent Fund prospectus as of the date of this report for Class A, Class C, and Class I was 1.61%, 2.36% and 1.33% respectively. The expense ratio presented above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered in this report.

The Fund’s total returns would have been lower if certain expenses had not been waived or reimbursed by the investment adviser. Returns for less than 1 year are not annualized. Fund returns include the reinvestment of dividends and capital gains.

The S&P 500 Index is an unmanaged index considered representative of the U.S. stock market.

A direct investment cannot be made into the index. Unless otherwise indicated, index results include reinvested dividends and do not reflect any sales charges. Performance of the Fund may deviate significantly from the performance of the index.

10

|

Top Five Holdings

|

Ticker

|

% of Fund

|

|

|

EMC Corp.

|

EMC

|

4.8%

|

|

|

Nordstrom, Inc.

|

JWN

|

4.8%

|

|

|

American Tower Corp.

|

AMT

|

4.8%

|

|

|

Autodesk, INC.

|

ADSK

|

4.8%

|

|

|

Oracle Corporation

|

ORCL

|

4.8%

|

|

|

Key Characteristics

|

Focused Equity Fund

|

S&P 500

|

|

|

AUM (millions)

|

$14.8

|

||

|

# of Positions

|

21

|

500

|

|

|

Avg. Market Cap ($B)

|

$59.8

|

$55.1

|

|

|

Trailing Price/Earnings Ratio

|

20.8

|

15.2

|

|

|

Trailing Price to Book

|

3.7

|

2.2

|

|

|

Industry Sectors

|

Weight

|

||

|

Consumer Discretionary

|

30%

|

||

|

Consumer Staples

|

15%

|

||

|

Energy

|

0%

|

||

|

Financials

|

0%

|

||

|

Health Care

|

10%

|

||

|

Industrials

|

0%

|

||

|

Information Technology

|

35%

|

||

|

Materials

|

0%

|

||

|

Telecommunication Services

|

10%

|

||

|

Utilities

|

0%

|

||

|

Other

|

0%

|

|

Growth of $10,000 Investment

|

|||

|

Since Inception At Offering Price

|

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

11

DESTRA FUND RISKS DISCLOSURES

Destra Funds Risk Disclosures

This document may contain forward-looking statements representing Destra’s or the portfolio manager or sub-adviser’s beliefs concerning future operations, strategies, financial results or other developments. Investors are cautioned that such forward-looking statement involve risks and uncertainties. Because these forward-looking statement are based on estimates and assumptions that are subject to significant business, economic and competitive uncertainties, many of which are beyond Destra’s or the portfolio manager or sub-adviser’s control or are subject to change, actual results could be materially different. There is no guarantee that such forward-looking statements will come to pass.

Destra Focused Equity Fund

Some important risks of the Focused Equity Fund are: Market Risk: The market values of securities owned by the Fund may decline, at times sharply and unpredictably, due to drops in the stock or other financial markets and therefore the value of Fund shares will fluctuate. Securities Selection Risk: Securities selected by the sub-advisor for the Fund may not perform to expectations. Sector Focus Risk: The Fund will typically focus its investments on companies within particular economic sectors. Developments affecting companies in those sectors will have a magnified effect on the Fund’s net asset value and total return. Non-Diversification/Limited Holdings Risk: The Fund is non-diversified, which means that it may invest in the securities of fewer issuers than a diversified fund. The Fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility, and be highly concentrated in certain issues. Furthermore, because the Fund has a relatively small number of issuers, the Fund has greater susceptibility to adverse development in one issuer or group of issuers. Investment Strategy Risk: The Fund invests in common stocks of companies that the sub-advisor believes will perform well in certain phases of the economic business cycle. The sub-advisor’s investment approach may be out of favor at times, causing the Fund to underperform funds that also seek capital appreciation but use different approaches to the stock selection and portfolio construction process. Investment Risk: When you sell your shares of the Fund, they could be worth less than what you paid for them. Therefore, as with any mutual fund investment, you may lose some or all of your investment by investing in the Fund. See the prospectus for a complete listing of the principal risks.

Destra Preferred and Income Securities Fund

Some important risks of the Preferred and Income Securities Fund are: Market Risk: The market values of securities owned by the Fund may decline, at times sharply and unpredictably, and therefore the value of Fund shares will fluctuate. Preferred and Subordinated Security Risk: Preferred and other subordinated securities rank lower than bonds and other debt instruments in a company’s capital structure and therefore will be subject to a greater credit risk than those debt instruments. Distributions on some types of these securities may also be skipped or deferred by issuers without causing a default. Credit Risk: Credit risk is the risk that an issuer of a security will be unable or unwilling to make a dividend, interest, or principal payment when due and the related risk that the value of a security may decline because of an issuer’s ability to make such payments. Credit risk may be heightened for the Fund because the Fund may invest in “high yield” or “high risk” securities, which involve greater risk, including the possibility of default or bankruptcy, and are regarded as predominantly speculative with respect to the issuer’s capacity to pay dividends and interest and repay principal. Although the Fund intends to principally invest in investment-grade securities at the time of investment, there is no limit on the amount of below-investment-grade securities that the Fund may invest in. Therefore an investment in the Fund should be considered speculative. Interest Rate Risk: If interest rates rise — long-term rates in particular — the prices of fixed-rate securities held by the Fund will fall. Liquidity Risk: The fund is limited to investing up to 15% of its net assets in illiquid securities. These types of securities may have limited marketability and may be difficult to sell at favorable prices. Non-U.S. Investment Risk: Non-U.S. companies or U.S. companies with significant non-U.S. operations may be subject to risks in addition to those of companies that principally operate in the United States. This increased risk is a result of, among other things, regulatory, political, social, and economic developments abroad, different legal, regulatory, and tax environments, less liquidity and greater volatility, and a lack of uniform accounting, auditing, and financial reporting standards. Currency Risk: Changes in currency exchange rates may adversely affect the Fund’s net asset value, the value of dividends and interest earned, and gains and losses realized on the sale of securities. Non-Diversification Risk: The Fund is non-diversified, which means that it may invest in the securities of fewer issuers than a diversified fund. As a result, it may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, may experience increased volatility, and may be highly concentrated in certain securities. Securities Selection Risk: Securities selected by the Fund’s portfolio manager may not perform to expectations. This could result in the Fund’s underperformance compared to other funds with similar investment objectives. Investment Risk: When you sell your shares of the Fund, they could be worth more or less than what you paid for them. You may lose some or all of your investment in this Fund. Issuer Concentration in Industries with Regulated Capital Structure: Over 80% of preferred securities are issued by regulated companies in the banking, financial services, insurance, and utility industries, with the regulatory structure potentially providing insulation against credit default. In normal market conditions, the Fund will invest at least 25% of its assets in securities of companies principally engaged in the financial services industry. This policy makes the Fund more susceptible to adverse economic or regulatory occurrences affecting financial services companies, including the adverse effects of economic recession, currency exchange rates, government regulation, decreases in the availability of capital, volatile interest rates, and portfolio concentration in geographic markets and commercial and residential real estate loans.

12

Overview of Fund Expenses — As of March 31, 2012 (unaudited)

As a shareholder of the Destra Investment Trust II, you incur advisory fees and other Fund expenses. The expense examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period 9/30/11 to 3/31/12” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing cost of investing in a Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or contingent deferred sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

Annualized

|

||||||||||||||||

|

Expense

|

Expenses

|

|||||||||||||||

|

Ratios

|

Paid

|

|||||||||||||||

|

Beginning

|

Ending

|

During the

|

During the

|

|||||||||||||

|

Account

|

Account

|

Period

|

Period

|

|||||||||||||

|

Value

|

Value

|

9/30/11

|

9/30/11

|

|||||||||||||

|

9/30/11

|

3/31/2012

|

to 3/31/12

|

to 3/31/12†

|

|||||||||||||

|

Destra Preferred and Income Securities Fund Class A

|

||||||||||||||||

|

Actual

|

$ | 1,000.00 | $ | 1,091.88 | 1.50 | % | $ | 7.84 | ||||||||

|

Hypothetical (5% return before expenses)

|

1,000.00 | 1,017.50 | 1.50 | % | 7.57 | |||||||||||

|

Destra Preferred and Income Securities Fund Class C*

|

||||||||||||||||

|

Actual

|

1,000.00 | 1,065.50 | 2.25 | % | 9.65 | †† | ||||||||||

|

Hypothetical (5% return before expenses)

|

1,000.00 | 1,013.75 | 2.25 | % | 11.33 | |||||||||||

|

Destra Preferred and Income Securities Fund Class I

|

||||||||||||||||

|

Actual

|

1,000.00 | 1,093.40 | 1.22 | % | 6.38 | |||||||||||

|

Hypothetical (5% return before expenses)

|

1,000.00 | 1,018.90 | 1.22 | % | 6.16 | |||||||||||

|

Destra Focused Equity Fund Class A

|

||||||||||||||||

|

Actual

|

1,000.00 | 1,247.70 | 1.60 | % | 8.99 | |||||||||||

|

Hypothetical (5% return before expenses)

|

1,000.00 | 1,017.00 | 1.60 | % | 8.07 | |||||||||||

|

Destra Focused Equity Fund Class C*

|

||||||||||||||||

|

Actual

|

1,000.00 | 1,126.70 | 2.35 | % | 10.38 | †† | ||||||||||

|

Hypothetical (5% return before expenses)

|

1,000.00 | 1,013.25 | 2.35 | % | 11.83 | |||||||||||

|

Destra Focused Equity Fund Class I

|

||||||||||||||||

|

Actual

|

1,000.00 | 1,250.77 | 1.32 | % | 7.43 | |||||||||||

|

Hypothetical (5% return before expenses)

|

1,000.00 | 1,018.40 | 1.32 | % | 6.66 | |||||||||||

|

*

|

Data is provided for the period November 1, 2011 (commencement of operations) to March 31, 2012.

|

|

†

|

Expenses are calculated using the Fund’s annualized expense ratio, which includes waived fees or reimbursed expenses, multiplied by the average account value for the period, multiplied by 183/366 (to reflect the six-month period). Hypothetical expenses assume the Fund was outstanding for a full six-month period and not the shorter actual period shown above.

|

|

††

|

Expenses are calculated using each Fund’s annualized expense ratio, which includes waived fees or reimbursed expenses, multiplied by the average account value for the period, multiplied by 152/366 (to reflect commencement of operations).

|

13

DESTRA PREFERRED AND INCOME SECURITIES FUND

PORTFOLIO OF INVESTMENTS

March 31, 2012 (unaudited)

|

Number

|

||||

|

of

|

Moody‘s

|

|||

|

Shares

|

Description

|

Ratings

|

Fair Value

|

|

|

Long-Term Investments - 101.2%

|

||||

|

Preferred Securities - 72.3%

|

||||

|

Banks - 25.5%

|

||||

|

Barclays Bank PLC, PFD

|

||||

|

2,000

|

8.125%, Series 5 (a)

|

Baa3

|

$ 50,880

|

|

|

4,169

|

7.750%, Series 4 (a)

|

Baa3

|

105,059

|

|

|

7,555

|

Countrywide Capital V, PFD

|

|||

|

7.000% 11/01/36

|

Ba1

|

180,338

|

||

|

1,400

|

Deutsche Bank Contingent Capital

|

|||

|

Trust III, PFD 7.600% (a)

|

Baa2

|

35,924

|

||

|

1,477

|

Deutsche Bank Contingent Capital

|

|||

|

Trust V, PFD 8.050% (a)

|

Baa2

|

39,643

|

||

|

1,500

|

Fifth Third Capital Trust V, PFD

|

|||

|

7.250% 08/15/67

|

Baa3

|

37,920

|

||

|

6,675

|

Fifth Third Capital Trust VI, PFD

|

|||

|

7.250% 11/15/67

|

Baa3

|

168,610

|

||

|

10,250

|

First Niagara Financial Group, Inc.,

|

|||

|

PFD 8.625%, Series B (a)

|

Ba2

|

282,592

|

||

|

5,925

|

First Republic Bank, PFD 6.700%,

|

|||

|

Series A (a)

|

Baa3

|

149,962

|

||

|

4,225

|

HSBC Finance Corp., PFD 6.360%,

|

|||

|

Series B (a)

|

Baa2

|

104,949

|

||

|

4,364

|

HSBC Holdings PLC, PFD 8.000%,

|

|||

|

Series 2 (a)

|

A3

|

119,181

|

||

|

3,900

|

HSBC USA, Inc., PFD 6.500%,

|

|||

|

Series H (a)

|

Baa1

|

97,617

|

||

|

3,665

|

KeyCorp Capital X, PFD 8.000%

|

|||

|

03/15/68

|

Baa3

|

93,457

|

||

|

3,175

|

Regions Financing Trust III, PFD

|

|||

|

8.875% 06/15/78

|

B2

|

81,121

|

||

|

5,523

|

Santander Finance Preferred SA

|

|||

|

Unipersonal, PFD 10.500%,

|

||||

|

Series 10 (a)

|

Baa2

|

147,409

|

||

|

1,120

|

SunTrust Capital IX, PFD 7.875%

|

|||

|

03/15/68

|

Baa3

|

28,538

|

||

|

3,600

|

US Bancorp, PFD 6.500%,

|

|||

|

Series F (a)

|

A3

|

97,884

|

||

|

250

|

Wells Fargo & Co., PFD 7.500%,

|

|||

|

Series L (a)

|

Baa3

|

279,175

|

||

|

2,500

|

Wells Fargo & Co., PFD 8.000%,

|

|||

|

Series J (a)

|

Baa3

|

72,650

|

||

|

2,172,909

|

||||

|

Diversified Financials - 8.1%

|

||||

|

3,610

|

Bank of America Corp., PFD 8.625%,

|

|||

|

Series 8 (a)

|

Ba3

|

92,560

|

||

|

5,800

|

Citigroup Capital VIII, PFD 6.950%

|

|||

|

09/15/31

|

Baa3

|

145,000

|

||

|

5,176

|

Citigroup Capital XII, PFD 8.500%

|

|||

|

03/30/40

|

Baa3

|

132,506

|

||

|

542

|

Citigroup Capital XIII, PFD 7.875%

|

|||

|

10/30/40

|

Baa3

|

14,742

|

||

|

5,473

|

Morgan Stanley Capital Trust III,

|

|||

|

PFD 6.250% 03/01/33

|

Baa2

|

132,228

|

||

|

6,550

|

Raymond James Financial, Inc.,

|

|||

|

PFD 6.900% 03/15/42

|

Baa2

|

170,169

|

||

|

687,205

|

||||

|

Number

|

||||

|

of

|

Moody‘s

|

|||

|

Shares

|

Description

|

Ratings

|

Fair Value

|

|

|

Energy - 4.2%

|

||||

|

14,130

|

Nexen, Inc., PFD 7.350%

|

|||

|

11/01/43

|

Ba1

|

$ 357,489

|

||

|

Insurance - 20.8%

|

||||

|

9,650

|

Arch Capital Group Ltd., PFD

|

|||

|

6.750% (a)

|

Baa2

|

245,171

|

||

|

Axis Capital Holdings Ltd., PFD

|

||||

|

10,000

|

6.875%, Series C (a)

|

Baa3

|

260,000

|

|

|

3,605

|

7.250%, Series A (a)

|

Baa3

|

90,558

|

|

|

4,250

|

Berkley W.R. Capital Trust II, PFD

|

|||

|

6.750% 07/26/45

|

Baa3

|

107,100

|

||

|

10,848

|

Delphi Financial Group, Inc.,

|

|||

|

PFD 7.376% 05/15/37

|

Ba1

|

268,488

|

||

|

3,000

|

Endurance Specialty Holdings Ltd.,

|

|||

|

3,000

|

PFD 7.500%, Series B (a)

|

Baa3

|

77,460

|

|

|

3,681

|

PFD 7.750%, Series A (a)

|

Baa3

|

96,553

|

|

|

4,223

|

ING Groep NV, PFD 7.050%(a)

|

Ba1

|

98,691

|

|

|

8,096

|

Partnerre Ltd., PFD 7.250%,

|

|||

|

Series E (a)

|

Baa2

|

211,305

|

||

|

3,953

|

Principal Financial Group, Inc.,

|

|||

|

PFD 6.518%, Series B (a)

|

Baa3

|

101,157

|

||

|

8,650

|

Renaissancere Holdings Ltd.,

|

|||

|

PFD 6.600%, Series D (a)

|

Baa2

|

216,769

|

||

|

1,773,252

|

||||

|

Real Estate - 7.3%

|

||||

|

751

|

Commonwealth REIT, PFD

|

|||

|

7.500% 11/15/19

|

Baa2

|

16,710

|

||

|

6,930

|

Cubesmart, PFD 7.750%,

|

|||

|

Series A (a)

|

Ba2

|

175,953

|

||

|

4,598

|

Duke Realty Corp., PFD 6.600%,

|

|||

|

Series L (a)

|

Baa3

|

115,824

|

||

|

PS Business Parks, Inc., PFD

|

||||

|

4,448

|

6.875%, Series R (a)

|

Baa3

|

114,936

|

|

|

1,000

|

7.000%, Series H (a)

|

Baa3

|

25,220

|

|

|

6,900

|

Realty Income Corp., PFD 6.625%,

|

|||

|

Series F (a)

|

Baa2

|

175,605

|

||

|

624,248

|

||||

|

Utilities - 6.4%

|

||||

|

6,280

|

Constellation Energy Group, Inc.,

|

|||

|

PFD 8.625% 06/15/63,

|

||||

|

Series A

|

Baa3

|

170,502

|

||

|

2,900

|

Entergy Louisiana LLC, PFD

|

|||

|

6.950% (a)

|

Ba1

|

290,906

|

||

|

3,440

|

PPL Electric Utilities Corp., PFD

|

|||

|

6.250% (a)

|

Ba1

|

86,645

|

||

|

548,053

|

||||

|

Total Preferred Securities

|

||||

|

(Cost $6,019,500)

|

6,163,156

|

|||

The accompanying notes are an integral part of these financial statements.

14

DESTRA PREFERRED AND INCOME SECURITIES FUND

PORTFOLIO OF INVESTMENTS, CONTINUED

March 31, 2012 (unaudited)

|

Moody‘s

|

||||

| Par Value |

Description

|

Ratings

|

Fair Value

|

|

|

Capital Securities - 21.9%

|

||||

|

Diversified Financials - 8.3%

|

||||

|

40,000

|

BankAmerica Capital II 8.000%

|

|||

|

12/15/26, Series 2

|

Ba1

|

$ 40,600

|

||

|

212,000

|

Capital One Capital III 7.686%

|

|||

|

08/15/36

|

Baa3

|

214,120

|

||

|

100,000

|

Goldman Sachs Capital I 6.345%

|

|||

|

02/15/34

|

A3

|

93,579

|

||

|

330,000

|

JPMorgan Chase & Co. 7.900% (a)

|

Baa1

|

362,776

|

|

|

711,075

|

||||

|

Energy - 3.0%

|

||||

|

230,000

|

Enterprise Products Operating LLC

|

|||

|

8.375% 08/01/66

|

Baa3

|

250,928

|

||

|

Insurance - 7.6%

|

||||

|

100,000

|

ACE Capital Trust II 9.700%

|

|||

|

04/01/30

|

Baa1

|

136,731

|

||

|

100,000

|

Lincoln National Corp. 7.000%

|

|||

|

05/17/66

|

Ba1

|

97,750

|

||

|

300,000

|

MetLife, Inc. 10.750% 08/01/39

|

Baa2

|

412,801

|

|

|

647,282

|

||||

|

Utilities - 3.0%

|

||||

|

125,000

|

PPL Capital Funding, Inc. 6.700%

|

|||

|

03/30/67

|

Ba1

|

125,131

|

||

|

130,000

|

Puget Sound Energy, Inc. 6.974%

|

|||

|

06/01/67, Series A

|

Baa3

|

133,423

|

||

|

258,554

|

||||

|

Total Capital Securities

|

||||

|

(Cost $1,832,062)

|

1,867,839

|

|||

|

Corporate Bonds - 7.0%

|

||||

|

Diversified Financials - 1.8%

|

||||

|

160,000

|

Goldman Sachs Group, Inc.

|

|||

|

6.750% 10/01/37

|

A2

|

156,799

|

||

|

Insurance - 2.4%

|

||||

|

240,000

|

XL Group PLC 6.500%,

|

|||

|

Series E (a)

|

Ba1

|

204,600

|

||

|

Real Estate - 1.7%

|

||||

|

5,925

|

Commonwealth REIT, PFD 7.250%,

|

|||

|

Series E (a)

|

Baa3

|

149,014

|

||

|

Utilities - 1.1%

|

||||

|

75,000

|

Southern Union Co. 8.250%

|

|||

|

11/15/29

|

Baa3

|

89,809

|

||

|

Total Corporate Bonds

|

||||

|

(Cost $589,119)

|

600,222

|

|||

|

Total Long-Term Investments - 101.2%

|

||||

|

(Cost $8,440,681)

|

8,631,217

|

|||

|

Money Market Mutual Funds - 5.2%

|

||||

|

445,616

|

Fidelity Institutional Money

|

|||

|

Market Prime, 0.14% (b)

|

||||

|

(Cost $445,616)

|

445,616

|

|||

|

Moody‘s

|

||||

| Par Value |

Description

|

Ratings

|

Fair Value

|

|

|

Total Investments - 106.4%

|

||||

|

(Cost $8,886,297)

|

$ 9,076,833

|

|||

|

Liabilities in excess of other

|

||||

|

Assets - (6.4%)

|

(549,241)

|

|||

|

Net Assets - 100.0%

|

$ 8,527,592

|

|||

| % of | ||||||||

|

Summary by Country

|

Fair Value

|

Net Assets

|

||||||

|

Bermuda

|

$ | 1,197,815 | 14.0 | % | ||||

|

Britain

|

275,120 | 3.2 | ||||||

|

Canada

|

357,489 | 4.2 | ||||||

|

Ireland

|

204,600 | 2.4 | ||||||

|

Netherlands

|

98,691 | 1.2 | ||||||

|

Spain

|

147,409 | 1.7 | ||||||

|

United States

|

6,350,093 | 74.5 | ||||||

|

Money Market Mutual Funds

|

445,616 | 5.2 | ||||||

|

Total Investments

|

9,076,833 | 106.4 | ||||||

|

Liabilities in excess of

|

||||||||

|

other Assets

|

(549,241 | ) | (6.4 | ) | ||||

|

Net Assets

|

$ | 8,527,592 | 100.0 | % | ||||

|

LLC - Limited Liability Corporation

|

|

NV - Publicly Traded Company

|

|

PFD - Preferred Security

|

|

PLC - Public Limited Company

|

|

REIT - Real Estate Investment Trust

|

|

SA - Corporation

|

| (a) - Perpetual security. |

| (b) - Interest rate shown reflects yield as of March 31, 2012. |

The accompanying notes are an integral part of these financial statements.

15

DESTRA FOCUSED EQUITY FUND

PORTFOLIO OF INVESTMENTS

March 31, 2012 (unaudited)

|

Number

|

|||

|

of

|

|||

| Shares |

Description

|

Fair Value

|

|

|

Common Stocks - 96.6%

|

|||

|

Automobiles & Components - 4.9%

|

|||

|

22,227

|

Johnson Controls, Inc.

|

$ 721,933

|

|

|

Consumer Durables & Apparel - 9.7%

|

|||

|

9,263

|

Coach, Inc

|

715,845

|

|

|

6,647

|

NIKE, Inc. - Class B

|

720,801

|

|

|

1,436,646

|

|||

|

Food & Staples Retailing - 9.7%

|

|||

|

7,913

|

Costco Wholesale Corp

|

718,500

|

|

|

8,587

|

Whole Foods Market, Inc

|

714,438

|

|

|

1,432,938

|

|||

|

Pharmaceuticals, Biotechnology &

|

|||

|

Life Sciences - 9.6%

|

|||

|

10,591

|

Amgen, Inc

|

720,082

|

|

|

9,157

|

Celgene Corp. *

|

709,851

|

|

|

1,429,933

|

|||

|

Real Estate - 4.9%

|

|||

|

11,510

|

American Tower Corp

|

725,360

|

|

|

Retailing - 19.3%

|

|||

|

10,804

|

Bed Bath & Beyond, Inc. *

|

710,579

|

|

|

22,754

|

Lowe’s Cos., Inc

|

714,020

|

|

|

13,021

|

Nordstrom, Inc

|

725,530

|

|

|

12,295

|

Target Corp

|

716,430

|

|

|

2,866,559

|

|||

|

Semiconductors & Semiconductor

|

|||

|

Equipment - 4.8%

|

|||

|

25,497

|

Intel Corp

|

716,721

|

|

|

Software & Services - 19.2%

|

|||

|

20,728

|

Adobe Systems, Inc. *

|

711,178

|

|

|

16,911

|

Autodesk, Inc. *

|

715,673

|

|

|

3,416

|

International Business

|

||

|

Machines Corp

|

712,748

|

||

|

24,337

|

Oracle Corp

|

709,667

|

|

|

2,849,266

|

|||

|

Technology Hardware &

|

|||

|

Equipment - 9.7%

|

|||

|

24,362

|

EMC Corp. *

|

727,937

|

|

|

10,521

|

QUALCOMM, Inc

|

715,638

|

|

|

1,443,575

|

|||

|

Telecommunication Services - 4.8%

|

|||

|

18,794

|

Verizon Communications, Inc

|

718,495

|

|

|

Total Common Stocks

|

|||

|

(Cost $12,790,483)

|

14,341,426

|

||

|

Number

|

|||

|

of

|

|||

|

Shares

|

Description

|

Fair Value

|

|

|

Money Market Mutual Funds - 5.8%

|

|||

|

866,216

|

Fidelity Institutional Money

|

||

|

Market Prime, 0.14%(a)

|

|||

|

(Cost $866,216)

|

$ 866,216

|

||

|

Total Investments - 102.4%

|

|||

|

(Cost $13,656,699)

|

15,207,642

|

||

|

Liabilities in excess of

|

|||

|

other Assets - (2.4%)

|

(360,977)

|

||

|

Net Assets - 100.0%

|

$ 14,846,665

|

||

| * - Non-income producing security. |

| (a) - Interest rate shown reflects yield as of March 31, 2012. |

16

|

STATEMENTS OF ASSETS AND LIABILITIES

|

|

March 31, 2012 (unaudited)

|

|

Destra Preferred

|

Destra

|

|||||||

|

and Income

|

Focused

|

|||||||

|

Securities

|

Equity

|

|||||||

|

Fund

|

Fund

|

|||||||

|

Assets

|

||||||||

|

Investments:

|

||||||||

|

Investments at cost

|

$ | 8,886,297 | $ | 13,656,699 | ||||

|

Net unrealized appreciation

|

190,536 | 1,550,943 | ||||||

|

Total Investments at value

|

9,076,833 | 15,207,642 | ||||||

|

Receivables:

|

||||||||

|

Capital shares sold

|

51,591 | 263,282 | ||||||

|

Due from the advisor

|

68,818 | 58,101 | ||||||

|

Dividends and interest

|

48,823 | 7,331 | ||||||

|

Investments sold

|

99,742 | — | ||||||

|

Foreign tax reclaims

|

217 | — | ||||||

|

Prepaid expenses

|

40,755 | 40,761 | ||||||

|

Total assets

|

9,386,779 | 15,577,117 | ||||||

|

Liabilities

|

||||||||

|

Payables:

|

||||||||

|

Investments purchased

|

703,605 | 572,202 | ||||||

|

Transfer agent fees

|

41,802 | 42,272 | ||||||

|

Audit fees

|

10,003 | 10,003 | ||||||

|

Legal fees

|

25,009 | 25,009 | ||||||

|

Trustees’ fees

|

12,524 | 16,482 | ||||||

|

Organizational fees

|

10,793 | 10,793 | ||||||

|

Capital shares payable

|

5,393 | 223 | ||||||

|

Other expenses and payables

|

50,058 | 53,468 | ||||||

|

Total liabilities

|

859,187 | 730,452 | ||||||

|

Net Assets

|

$ | 8,527,592 | $ | 14,846,665 | ||||

|

Composition of Net Assets

|

||||||||

|

Paid-in capital ($0.001 par value common stock)

|

$ | 8,316,856 | $ | 13,376,280 | ||||

|

Undistributed net investment income (loss)

|

11,599 | (13,324 | ) | |||||

|

Accumulated net realized gain (loss) on investments

|

8,601 | (67,234 | ) | |||||

|

Net unrealized appreciation on investments

|

190,536 | 1,550,943 | ||||||

|

Net Assets

|

$ | 8,527,592 | $ | 14,846,665 | ||||

|

Net Assets

|

||||||||

|

Class A

|

$ | 5,543,894 | $ | 8,242,831 | ||||

|

Class C

|

$ | 920,193 | $ | 463,000 | ||||

|

Class I

|

$ | 2,063,505 | $ | 6,140,834 | ||||

|

Shares Outstanding

|

||||||||

|

Class A

|

350,762 | 480,765 | ||||||

|

Class C

|

58,039 | 27,401 | ||||||

|

Class I

|

131,316 | 357,904 | ||||||

|

Net Asset Value Per Share

|

||||||||

|

Class A

|

$ | 15.81 | $ | 17.15 | ||||

|

Class C

|

$ | 15.85 | $ | 16.90 | ||||

|

Class I

|

$ | 15.71 | $ | 17.16 | ||||

The accompanying notes are an integral part of financial statements.

17

|

STATEMENTS OF OPERATIONS

|

|

For the six months ended March 31, 2012 (unaudited)

|

|

Destra Preferred

|

Destra

|

|||||||

|

and Income

|

Focused

|

|||||||

|

Securities

|

Equity

|

|||||||

|

Fund

|

Fund

|

|||||||

|

Investment Income

|

||||||||

|

Dividends

|

$ | 124,840 | $ | 42,590 | ||||

|

Less: foreign taxes withheld

|

(118 | ) | — | |||||

|

Interest income

|

31,016 | — | ||||||

|

Total Investment Income

|

155,738 | 42,590 | ||||||

|

Expenses

|

||||||||

|

Legal fees

|

33,369 | 28,269 | ||||||

|

Transfer agent fees

|

33,360 | 32,027 | ||||||

|

Shareholder reporting fees

|

26,804 | 26,589 | ||||||

|

Organizational fees

|

25,276 | 25,276 | ||||||

|

Administration and accounting fees

|

16,659 | 17,414 | ||||||

|

Advisory fees

|

16,485 | 29,611 | ||||||

|

Trustees’ fees and expenses

|

11,718 | 15,693 | ||||||

|

Audit fees

|

10,120 | 10,119 | ||||||

|

Insurance fees

|

4,508 | 4,941 | ||||||

|

Distribution fees Class A

|

3,486 | 4,631 | ||||||

|

Distribution fees Class C

|

1,629 | 693 | ||||||

|

Shareholder servicing fees

|

3,460 | 5,295 | ||||||

|

Custody fees

|

623 | 992 | ||||||

|

Other fees

|

20,552 | 20,624 | ||||||

|

Total expenses

|

208,049 | 222,174 | ||||||

|

Less: expense waivers and reimbursements

|

(175,653 | ) | (170,290 | ) | ||||

|

Net expenses

|

32,396 | 51,884 | ||||||

|

Net Investment Income (Loss)

|

$ | 123,342 | $ | (9,294 | ) | |||

|

Realized and Unrealized Gain (Loss)

|

||||||||

|

Net realized gain (loss) on investments in securities

|

$ | 8,601 | $ | (18,926 | ) | |||

|

Net change in unrealized appreciation on investments in securities

|

241,504 | 1,585,123 | ||||||

|

Net realized and unrealized gain on investments in securities

|

250,105 | 1,566,197 | ||||||

|

Net Increase in Net Assets Resulting from Operations

|

$ | 373,447 | $ | 1,556,903 | ||||

The accompanying notes are an integral part of financial statements.

18

STATEMENTS OF CHANGES IN NET ASSETS

|

Destra Preferred and

|

Destra Focused

|

|||||||||||||||

|

Income Securities Fund

|

Equity Fund

|

|||||||||||||||

|

For the

|

For the

|

For the

|

For the

|

|||||||||||||

|

six months

|

period

|

six months

|

period

|

|||||||||||||

|

ended

|

April 12,

|

ended

|

April 12,

|

|||||||||||||

|

March 31,

|

2011* to

|

March 31,

|

2011* to

|

|||||||||||||

|

2012

|

September 30,

|

2012

|

September 30,

|

|||||||||||||

|

(unaudited)

|

2011

|

(unaudited)

|

2011

|

|||||||||||||

|

Increase (Decrease) in Net Assets Resulting from Operations

|

||||||||||||||||

|

Net investment income (loss)

|

$ | 123,342 | $ | 50,693 | $ | (9,294 | ) | $ | (394 | ) | ||||||

|

Net realized gain (loss) on investments in securities

|

8,601 | (174 | ) | (18,926 | ) | (48,308 | ) | |||||||||

|

Net change in unrealized appreciation (depreciation) from

|

||||||||||||||||

|

investments in securities

|

241,504 | (50,968 | ) | 1,585,123 | (34,180 | ) | ||||||||||

|

Net increase (decrease) in net assets resulting from operations

|

373,447 | (449 | ) | 1,556,903 | (82,882 | ) | ||||||||||

|

Class A

|

||||||||||||||||

|

Distributions to Shareholders

|

||||||||||||||||

|

Net investment income

|

(78,216 | ) | (23,711 | ) | (491 | ) | — | |||||||||

|

Net realized gain

|

(386 | ) | — | — | — | |||||||||||

|

Total distributions to shareholders

|

(78,602 | ) | (23,711 | ) | (491 | ) | — | |||||||||

|

Class C

|

||||||||||||||||

|

Distributions to Shareholders

|

||||||||||||||||

|

Net investment income

|

(2,091 | ) | — | — | — | |||||||||||

|

Net realized gain

|

(16 | ) | — | — | — | |||||||||||

|

Total distributions to shareholders

|

(2,107 | ) | — | — | — | |||||||||||

|

Class I

|

||||||||||||||||

|

Distributions to Shareholders

|

||||||||||||||||

|

Net investment income

|

(42,620 | ) | (16,790 | ) | (4,789 | ) | — | |||||||||

|

Net realized gain

|

(195 | ) | — | — | — | |||||||||||

|

Total distributions to shareholders

|

(42,815 | ) | (16,790 | ) | (4,789 | ) | — | |||||||||

|

Class A

|

||||||||||||||||

|

Capital Share Transactions

|

||||||||||||||||

|

Proceeds from shares sold

|

3,839,760 | 1,730,906 | 6,851,025 | 983,639 | ||||||||||||

|

Dividends reinvested

|

62,789 | 19,551 | 338 | — | ||||||||||||

|

Cost of shares redeemed

|

(260,441 | ) | (4,074 | ) | (442,174 | ) | (5,045 | ) | ||||||||

|

Net increase from capital share transactions

|

3,642,108 | 1,746,383 | 6,409,189 | 978,594 | ||||||||||||

|

Class C

|

||||||||||||||||

|

Capital Share Transactions

|

||||||||||||||||

|

Proceeds from shares sold

|

891,425 | — | 448,660 | — | ||||||||||||

|

Dividends reinvested

|

1,542 | — | — | — | ||||||||||||

|

Cost of shares redeemed

|

— | — | (10,125 | ) | — | |||||||||||

|

Net increase from capital share transactions

|

892,967 | — | 438,535 | — | ||||||||||||

|

Class I

|

||||||||||||||||

|

Capital Share Transactions

|

||||||||||||||||

|

Proceeds from shares sold

|

935,943 | 1,000,065 | 4,559,347 | 1,000,005 | ||||||||||||

|

Dividends reinvested

|

34,821 | 16,380 | 4,230 | — | ||||||||||||

|

Cost of shares redeemed

|

— | (59 | ) | (63,245 | ) | — | ||||||||||

|

Redemption fees

|

1 | — | 1,259 | — | ||||||||||||

|

Net increase from capital share transactions

|

970,765 | 1,016,386 | 4,501,591 | 1,000,005 | ||||||||||||

|

Total increase in net assets

|

5,755,763 | 2,721,819 | 12,900,938 | 1,895,717 | ||||||||||||

|

Net Assets

|

||||||||||||||||

|

Beginning of period

|

2,771,829 | 50,010 | 1,945,727 | 50,010 | ||||||||||||

|

End of period

|

$ | 8,527,592 | $ | 2,771,829 | $ | 14,846,665 | $ | 1,945,727 | ||||||||

|