UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 1-K

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended November 30, 2022

| THE GRAYSTONE COMPANY, INC. |

| (Exact name of registrant as specified in its charter) |

| COLORADO |

| 86-2416093 |

| (State or other jurisdiction of incorporation) |

| (IRS Employer Identification No.) |

| 401 E. Las Olas Blvd #130-321 |

| Fort Lauderdale, FL 33301 |

| (Address of principal executive offices) |

| (City, State, ZIP Code) |

(954) 271-2704

(Registrant’s telephone number, including area code)

Common Stock, Class A

(Title of each class of securities issued pursuant to Regulation A)

In this Annual Report, the terms, ‘‘The Graystone Company,’’ “Graystone,” “the “Company,’’ ‘‘we,’’ “GYST,” ‘‘us,’’ and ‘‘our,’’ refer to The Graystone Company, Inc. and our wholly owned subsidiaries, NutraGyst, Inc., and Graystone Mining, Inc. (“Graystone Mining”) unless the context otherwise requires. Unless otherwise indicated, the term ‘‘fiscal year’’ refers to our fiscal year ending November 30. Unless otherwise indicated, the term ‘‘Shares” refers to shares of the Company’s Class A Common Stock. All dollar amounts refer to US dollars unless otherwise indicated.

This report contains certain forward-looking statements that are subject to various risks and uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “plan,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, or state other forward-looking information. Our ability to predict future events, actions, plans or strategies is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, actual outcomes could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could cause our forward-looking statements to differ from actual outcomes include, but are not limited to, those described under the heading “Risk Factors.” Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this report. Furthermore, except as required by law, we are under no duty to, and do not intend to, update any of our forward-looking statements after the date of this report, whether as a result of new information, future events or otherwise.

ITEM 1. BUSINESS

Overview

The Graystone Company business focuses on Bitcoin Mining - i.e. the process by which Bitcoins are created resulting in new blocks being added to the blockchain and new Bitcoins being issued to the miners. Miners engage in a set of prescribed complex mathematical calculations in order to add a block to the blockchain and thereby confirm cryptocurrency transactions included in that block’s data. Miners that are successful in adding a block to the blockchain are automatically awarded a fixed number of Bitcoins for their effort. All of the Company’s Bitcoin Mining activities will be conducted through our wholly-owned subsidiary Graystone Mining. The Company only mines Bitcoin.

The Company has purchased ASIC (application-specific integrated circuit) computers – these are computers are specifically designed for cryptocurrency mining - that will be used for Bitcoin Mining. We are hosting these Bitcoin Mining equipment with 3rd party datacenters or farms (often referred as a “Co-Location”) that will power and operate our Bitcoin Mining equipment for a fee – however, in the future, we intend to conduct our Bitcoin Mining operations from our own facilities.

We are currently generating revenues through receiving Bitcoin from our Bitcoin Mining equipment and the sale of bitcoin mining equipment.

We previously had a division that is focused on developing and marketing proprietary products in two categories: (i) Longevity and Wellness and (ii) Fertility. However, we have decided to focus on our bitcoin mining division and intend to use the profits generated from the bitcoin mining division to launch the Longevity and Wellness and Fertility products. In March 2023, the Company decided to shut down this division and focus solely on its bitcoin mining operations.

Our business is located at 401 E. Las Olas Blvd #130-321, Fort Lauderdale, FL 33301. Our telephone number is (954) 271-2704. Our E-Mail address is investors@thegraystonecompany.com. The address of our web site is www.thegraystonecompany.com. Information contained on, or accessible through, the website is not a part of, and is not incorporated by reference into, this Offering Circular.

| 2 |

Organizational History

The Graystone Company, Inc. was originally incorporated in the State of New York on May 27, 2010 under the name of Argentum Capital, Inc.,. The Company was reincorporated in Delaware on January 10, 2011 and subsequently changed its name to The Graystone Company, Inc. on January 14, 2011. The Company was reincorporated in Colorado on May 1, 2016. The Company is domiciled in the state of Florida, where it maintains its corporate headquarters in Fort Lauderdale, FL.

Reverse Merger

Pursuant to an Acquisition Agreement (the “Acquisition Agreement”) between the Company and NutraGyst Inc., dated November 6, 2020, the Company agreed to acquire 100% of the issued and outstanding shares of NutraGyst, Inc., a Colorado corporation (“NutraGyst”), in exchange for 46,000,000 shares of the Company’s Class B Common Stock (the “Reverse Merger”). The parties also agreed that, upon the closing of the transactions agreed upon in the Acquisition Agreement, new directors and officers of Graystone would be appointed by NutraGyst. The foregoing description of the Acquisition Agreement does not purport to be complete, and is qualified in its entirety by the full text of the Acquisition Agreement, which is attached hereto as Exhibit 6.1 and is incorporated herein by reference.

On November 6, 2020 (the “Effective Date”), the Company executed the Reverse Merger with NutraGyst, Inc. whereby the Company acquired 100% of NutraGyst, in exchange for 46,000,000 shares of the Company’s Class B Common stock. Immediately prior to the Reverse Merger, there were 146,391,521 shares of the Company’s Class A Common Stock outstanding and 5,000,000 shares of Class B Common Stock outstanding and 617 shares of Preferred shares outstanding, MT Soeparmo was the sole officer/director of the Company and Paul Howarth had 97% of the voting power of the Company. After the Reverse Merger, the Company had 146,391,521 shares of Class A Common Stock outstanding and 51,000,000 shares of Class B Common Stock outstanding and 617 shares of Preferred shares outstanding. Additionally, on November 10, 2020, MT Soeparmo resigned as officer and director and Anastasia Shishova was appointed as CEO and Director and Greg Tucker was appointed as Director.

Pursuant to the terms of the Acquisition Agreement, on the Effective Date, the Company issued 46,000,000 shares of its unregistered Class B Common Stock to the shareholder of NutraGyst, which was our CEO, in exchange for 1,000,000 shares of NutraGyst’s common stock, representing 100% of its issued and outstanding common stock and as a result of the Reverse Merger, NutraGyst became a wholly owned subsidiary of the Company. Each share of Class B Common Stock has voting rights equal to 2,500 votes per share compared to Class A Common Stock voting rights equal to 1 vote per share. As a result, our CEO Anastasia Shishova owned approximately 90% of the voting power of the Company after the Reverse Merger.

Prior to the Reverse Merger, the Company had no operations, assets or liabilities. As such, as a result of the Reverse Merger, the business of NutraGyst became the business of the Company going forward. Subsequently, the Company has added a Bitcoin Mining line of business operations, which will be conducted by Graystone Mining, our wholly-owned subsidiary.

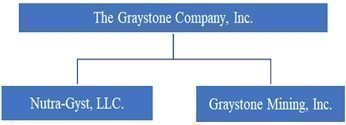

The corporate structure of the Company as of the date of this Offering Circular is as follows:

Our Class A Common Stock is quoted on the OTC Pink Current Tier of OTC Markets under the symbol, “GYST.” On March 8, 2023, the last reported sale price of our Class A Common Stock was $0.0036 per share.

| 3 |

Principal Products and Services

As described above, The Graystone Company business focuses on Bitcoin Mining - i.e. the process by which Bitcoins are created resulting in new blocks being added to the blockchain and new Bitcoins being issued to the miners. Miners engage in a set of prescribed complex mathematical calculations in order to add a block to the blockchain and thereby confirm cryptocurrency transactions included in that block’s data. Miners that are successful in adding a block to the blockchain are automatically awarded a fixed number of Bitcoins for their effort. All of the Company’s Bitcoin Mining activities will be conducted through our wholly-owned subsidiary Graystone Mining. The Company will only mine Bitcoin. We also have division that is focused on developing and marketing proprietary products in two categories: (i) Longevity and Wellness and (ii) Fertility. However, we have decided to focus on our bitcoin mining division and intend to use the profits generated from the bitcoin mining division to launch the Longevity and Wellness and Fertility products.

Bitcoin Mining Business (via Graystone Mining, Inc.)

The Company intends to use the proceeds from this offering to expand its Bitcoin Mining operations, through which the Company expects to generate revenues. The Company intends to earn revenues from Bitcoin Mining by providing transaction verification services within the digital currency network of Bitcoin. The Company satisfies its performance obligation at the point in time that the Company is awarded a unit of Bitcoin through its participation in the Bitcoin’s network and network participants benefit from the Company’s verification service. In consideration for these services, the Company receives Bitcoin, which is recorded as revenue using the closing U.S. Dollar price of the Bitcoin on the date of receipt. The Company will only mine Bitcoin. On April 13, 2021, the Company filed with the Secretary of State of Florida to form Graystone Mining, Inc. which will operate the Company’s Bitcoin Mining business.

Bitcoin Mining

A Bitcoin is one type of an intangible digital asset that is issued by, and transmitted through, an open source, math-based protocol platform using cryptographic security (the “Bitcoin Network”). The Bitcoin Network is an online, peer-to-peer user network that hosts the public transaction ledger, known as the “blockchain,” and the source code that comprises the basis for the cryptography and math-based protocols governing the Bitcoin Network. No single entity owns or operates the Bitcoin Network, the infrastructure of which is collectively maintained by a decentralized user base. Bitcoins can be used to pay for goods and services or can be converted to fiat currencies, such as the U.S. Dollar, at rates determined on Bitcoin exchanges or in individual end-user-to-end-user transactions under a barter system.

Bitcoins are “stored” or reflected on the blockchain. The blockchain records the transaction history of all Bitcoins in existence and, through the transparent reporting of transactions, allows the cryptocurrency network to verify the association of each Bitcoin with the digital wallet that owns them. The network and software programs can interpret the blockchain to determine the exact balance, if any, of any digital wallet listed in the blockchain as having taken part in a transaction on the cryptocurrency network.

Mining is the process by which Bitcoins are created resulting in new blocks being added to the blockchain and new Bitcoins being issued to the miners. Miners engage in a set of prescribed complex mathematical calculations in order to add a block to the blockchain and thereby confirm cryptocurrency transactions included in that block’s data. Miners that are successful in adding a block to the blockchain are automatically awarded a fixed number of Bitcoins for their effort. To begin mining, a user can download and run the network mining software, which turns the user’s computer into a node on the network that validates blocks.

All Bitcoin transactions are recorded in blocks added to the blockchain. Each block contains the details of some or all of the most recent transactions that are not memorialized in prior blocks, a reference to the most recent prior block, and a record of the award of Bitcoins to the miner who added the new block. Each unique block can only be solved and added to the blockchain by one miner; therefore, all individual miners and mining pools on the cryptocurrency network are engaged in a competitive process and are incentivized to increase their computing power to improve their likelihood of solving for new blocks.

The method for creating new Bitcoins is mathematically controlled in a manner so that the supply of Bitcoins grows at a limited rate pursuant to a pre-set schedule. Mining economics have also been much more pressured by the “Difficulty Rate” – a computation used by miners to determine the amount of computing power required to mine Bitcoin. The Difficulty Rate is directly influenced by the total size of the entire Bitcoin network. The Bitcoin network has grown 12-fold in the past year, resulting in a 12-fold increase in difficulty. Meanwhile, demand from miners also drove up hardware and power prices, the largest costs of production. This deliberately controlled rate of Bitcoin creation means that the number of Bitcoins in existence will never exceed 21 million and that Bitcoins cannot be devalued through excessive production unless the Bitcoin Network’s source code (and the underlying protocol for Bitcoin issuance) is altered.

| 4 |

Mining pools have developed in which multiple miners act cohesively and combine their processing power to solve blocks. When a pool solves a new block, the participating mining pool members split the resulting reward based on the processing power they each contributed to solve for such block. The mining pool operator provides a service that coordinates the workers. Fees are paid to the mining pool operator to cover the costs of maintaining the pool. The pool uses software that coordinates the pool members’ hashing power, identifies new block rewards, records how much work all the participants are doing, and assigns block rewards in-proportion to the participants’ efforts. While pool fees are not paid directly, pool fees (approximately 2% to 5%) are deducted from amounts we may otherwise earn. Participation in such pools is anticipated to be essential for our mining business.

Sale of Bitcoin Mining Equipment

In October 2021, the Company began offering turnkey mining solutions for companies or individuals looking to mine bitcoin but are unable to meet the minimum order quantities (MOQs) for equipment. The Company offers equipment for sale along with hosting services. We are able to provide hosting services by subleasing through current hosting provider.

Our Bitcoin Mining Operations

Our current operation consists of 2,100 TH/s that is currently operational and mining. The 2,100 TH/s was leased from SupplyBit, LLC for 3 years. The 3 year lease term is equivalent to the expected useful life of the equipment generating the TH/s.

Additionally, the Company has acquired 53 S19Proj (100 TH) units. These units are housed at a 3rd party datacenters or farms (often referred to as a “Co-Location”) that host, provide power, and maintain our equipment for a flat rate per Kilowatt of electricity used (between $0.075 to $0.085 per kilowatt). We have identified the Co-Location we intend to engage. The company has resold these units to 3rd parties.

Lease Terms of TH/s

The lease terms for the initial 2,100 TH/s is as follows:

|

| 1. | Term: 3 years |

|

| 2. | Uptime: 100% guaranteed uptime |

|

| 3. | Operational Costs: Approximately $3,600 per month ($1.69 per month per TH/s) |

|

| 4. | 15% management fee is charged by SupplyBit, LLC |

Under the terms of the lease, SupplyBit guarantees 100% uptime and in the event of our mining payout is lower than the expected payout, SupplyBit shall provide the Company a true up to equal to what the theoretical earnings of our 2,100 TH/s should have been. In the event, we received an amount higher than the theoretical earnings we do not have to repay any of the overage back to SupplyBit.

The Company pays SupplyBit $1.69 per TH/s per month. This is a all-in fee for power, repairs, maintenance and any other costs associated with the leased TH/s. AS such, the Company shall have no further capital expenditures related to the TH/s. The Company agreed to pause the mining units till June 2023 with SupplyBit in exchange for an extension of 12 months on the lease.

Holistic Health Products (via NutraGyst, Inc.)

With respect the Company’s product development operations (through NutraGyst, Inc.), the Company has decided to discontinue its health product development to focus on the Company’s bitcoin mining operations.

| 5 |

Our Markets

Bitcoin Mining

The Digital Currency Markets

The value of Bitcoins is determined by the supply and demand of Bitcoins in the Bitcoin exchange market (and in private end-user-to-end-user transactions), as well as the number of merchants that accept them. However, merchant adoption is very low according to a Morgan Stanley note from the summer of 2018 and appears to continue to be low.

As Bitcoin transactions can be broadcast to the Bitcoin Network by any user’s Bitcoin software and Bitcoins can be transferred without the involvement of intermediaries or third parties, there are little or no transaction costs in direct peer-to-peer transactions on the Bitcoin Network. Third party service providers such as crypto currency exchanges and Bitcoin third party payment processing services may charge significant fees for processing transactions and for converting, or facilitating the conversion of, Bitcoins to or from fiat currency.

Under the peer-to-peer framework of the Bitcoin Network, transferors and recipients of Bitcoins are able to determine the value of the Bitcoins transferred by mutual agreement, the most common means of determining the value of a Bitcoin being by surveying one or more Bitcoin exchanges where Bitcoins are publicly bought, sold and traded, i.e., the Bitcoin Exchange Market (“Bitcoin Exchange”).

On each Bitcoin Exchange, Bitcoins are traded with publicly disclosed valuations for each transaction, measured by one or more fiat currencies. Bitcoin Exchanges report publicly on their site the valuation of each transaction and bid and ask prices for the purchase or sale of Bitcoins. Market participants can choose the Bitcoin Exchange on which to buy or sell Bitcoins. To date, the SEC has rejected the proposals for Bitcoin ETF’s, citing that lack of enough transparency in the cryptocurrency markets to be sure that prices are not being manipulated. The Wall Street Journal has recently reported on how bots are manipulating the prices of Bitcoin on the crypto exchanges. However, on November 8, 2018, the SEC announced in an order (the “Order”) that it had settled charges against Zachary Coburn, the founder of the digital token exchange EtherDelta, marking the first time that the SEC has brought an enforcement action against an online digital token platform for operating as an unregistered national securities exchange.

help in driving the growth of the wellness supplements market.

Competition

Bitcoin Mining

In cryptocurrency mining, companies, individuals and groups generate units of cryptocurrency through mining. Miners can range from individual enthusiasts to professional mining operations with dedicated data centers, with all of which we compete. Miners may organize themselves in mining pools, with which we would compete. The Company intends to participate in mining pools. At present, the information concerning the activities of these enterprises is not readily available as the vast majority of the participants in this sector do not publish information publicly or the information may be unreliable.

Marketing

Bitcoin Mining

Marketing does not factor into our Bitcoin Mining operations.

| 6 |

Bitcoin Equipment Sales

The Company is currently still testing its marketing methods for its turnkey bitcoin mining solution.

Distribution

Bitcoin Mining

Distribution does not factor into our Bitcoin Mining operations.

Bitcoin Equipment Sales

The Company is currently still testing its distribution methods for its turnkey bitcoin mining solution.

Suppliers

Bitcoin Mining

The Company has purchased ASIC computers from Blcokware Soluations. We will look to acquire mining equipment for $100-150 per terahash per second (or “TH/s”). Terahashes are the unit used to measure speed of the mining hardware mining cryptocurrencies, with a TH/s equaling one trillion hash calculations computed in one second.

The Company has engaged Blockware Soluations to host, provide power, and maintain our equipment for a flat rate per Kilowatt of electricity used (between $0.075 to $0.085 per kilowatt). The co-location we have engaged generates its power from nuclear power plant thereby allowing the Company’s equipment to be powered by a zero-emission clean energy source.

Bitcoin Equipment Sales

The Company has resales ASIC computers from cryptocurrency. However, the Company does not maintain inventory for resale purposes. When a client places an order for equipment, we add there order to orders we are placing. Thereby, the Company does not need to maintain inventory for its resell business.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with the consolidated financial statements and the notes to those statements that are included elsewhere in this Offering Circular. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under the Risk Factors, Cautionary Notice Regarding Forward-Looking Statements and Business sections in this Offering Circular. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements. Our future operating results, however, are impossible to predict and no guaranty or warranty is to be inferred from those forward-looking statements.

Overview

The Graystone Company business focuses on Bitcoin Mining - i.e. the process by which Bitcoins are created resulting in new blocks being added to the blockchain and new Bitcoins being issued to the miners. Miners engage in a set of prescribed complex mathematical calculations in order to add a block to the blockchain and thereby confirm cryptocurrency transactions included in that block’s data. Miners that are successful in adding a block to the blockchain are automatically awarded a fixed number of Bitcoins for their effort. All of the Company’s Bitcoin Mining activities will be conducted through our wholly-owned subsidiary Graystone Mining. The Company only mines Bitcoin.

The Graystone Company, Inc. was originally incorporated in the State of New York on May 27, 2010 under the name of Argentum Capital, Inc. The Company was reincorporated in Delaware on January 10, 2011 and subsequently changed its name to The Graystone Company, Inc. on January 14, 2011. The Company was reincorporated in Colorado on May 1, 2016. The Company is domiciled in the state of Florida, where it maintains its corporate headquarters in Fort Lauderdale, FL. On November 6, 2020 the Company effected a reverse merger with NutraGyst, Inc., a Colorado corporation, after which NutraGyst became a wholly owned subsidiary of the Company, and the business of NutraGyst became the business of the Company going forward. Subsequently, the Company has added a Bitcoin Mining line of business operations, which will be conducted by Graystone Mining, our wholly-owned subsidiary.

| 7 |

Our business is located at 401 E. Las Olas Blvd #130-321, Fort Lauderdale, FL 33301. Our telephone number is (954) 271-2704. Our E-Mail address is investors@thegraystonecompany.com. The address of our web site is www.thegraystonecompany.com. Information contained on, or accessible through, the website is not a part of, and is not incorporated by reference into this annual report.

Going Concern Matters

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which contemplates the Company’s continuation as a going concern. The Company has incurred operating losses of $(269,682)) during the period ended November 30, 2022 and has an accumulated deficit of $(403,328)) as of November 30, 2022.

There are no assurances that the Company will be able to either (1) achieve a level of revenues adequate to generate sufficient cash flow from operations; or (2) obtain additional financing through either private placement, public offerings and/or bank financing necessary to support its working capital requirements. To the extent that funds generated from operations and any private placements, public offerings and/or bank financing are insufficient, the Company will have to raise additional working capital. No assurance can be given that additional financing will be available, or if available, will be on terms acceptable to the Company. If adequate working capital is not available to the Company, it may be required to curtail or cease its operations.

Due to uncertainties related to these matters, a substantial doubt about the ability of the Company to continue as a going concern is raised. The accompanying consolidated financial statements do not include any adjustments related to the recoverability or classification of asset-carrying amounts or the amounts and classification of liabilities that may result should the Company be unable to continue as a going concern.

Results of Operations

There is limited historical financial information about us upon which to base an evaluation of our performance. We have generated revenues of $401,477 for the period of November 30, 2022, compares to $176,926 for the period of November 30, 2021. The revenue for November 30, 2022, breaks out as $128,676 in bitcoin mining revenue, $23,801 In hosting revenue and $249,000 in the sale of bitcoin mining equipment. This increase in revenue is contributed to the company beginning operations and launching of its bitcoin mining division and beginning to resale equipment.

The Company has also incurred operating losses of $(269,682) during period ended November 30, 2022 compared to $(132,406) in operating losses during the period ended November 30, 2021. This increase in operating loses is contributed to: (1) deprecation and loses in bitcoin being held, (2) legal and auditing expenses, and (3) the company beginning operations.

We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including the financial risks associated with the limited capital resources currently available to us for the implementation of our business strategies. (See “Risk Factors”). To become profitable and competitive, we must develop our business plan and execute the plan. Our management will attempt to secure financing through various means including borrowing and investment from institutions and private individuals.

Liquidity and Capital Resources

As of November 30, 2022, the Company had $67,413 in cash and bitcoin on hand. Anastasia Shishova, our Chief Executive Officer, during the period ended November 30, 2022, loaned the Company for payments and expenses paid on behalf of the Company. As of November 30, 2022, the Company had a balance owed to our CEO of $8,677. As of November 30, 2021, the Company recorded a note payable of $8,677. The note payable is not evidenced by a written note, is unsecured and bears no interest and is due upon demand. No officer or director, however, is under any obligation to advance us any funds and there are no third-parties that have committed to investing in, or funding the Company. The Company also had $7,334 in accounts payable.

| 8 |

During the period ended November 30, 2021, the Company issued 10,625,000 shares of Class A Common Stock in exchange for $255,000 in cash pursuant to its Regulation A offering.

Plan of Operations

The Graystone Company business focuses on Bitcoin Mining - i.e. the process by which Bitcoins are created resulting in new blocks being added to the blockchain and new Bitcoins being issued to the miners. Miners engage in a set of prescribed complex mathematical calculations in order to add a block to the blockchain and thereby confirm cryptocurrency transactions included in that block’s data. Miners that are successful in adding a block to the blockchain are automatically awarded a fixed number of Bitcoins for their effort. All of the Company’s Bitcoin Mining activities will be conducted through our wholly-owned subsidiary Graystone Mining. The Company will only mine Bitcoin.

Covid-19 Effects

If the current outbreak of the coronavirus continues to grow, the effects of such a widespread infectious disease and epidemic may inhibit our ability to conduct our business and operations and could materially harm our Company. The coronavirus may cause us to have to reduce operations as a result of various lock-down procedures enacted by the local, state or federal government, which could restrict our ability to conduct our business operations, including our Bitcoin Mining operations. The coronavirus may also cause a decrease in spending on the types of products that we plan to offer, as a result of the economic turmoil resulting from the spread of the coronavirus and thereby having a negative effect on our ability to generate revenue from the sales of our products. The continued coronavirus outbreak may also restrict our ability to raise funding when needed and may also cause an overall decline in the economy as a whole, which may reduce the value of the Bitcoin we intend to mine. The specific and actual effects of the spread of coronavirus are difficult to assess at this time as the actual effects will depend on many factors beyond the control and knowledge of the Company. However, the spread of the coronavirus, if it continues, may cause an overall decline in the economy as a whole and also may materially harm our Company.

Trends Information

The core elements of our growth strategy include developing a product line with a strong brand awareness. We plan to invest significant resources product development and marketing, and we anticipate that our operating expenses will continue to increase for the foreseeable future, particularly marketing costs and research and development of new products. These investments are intended to contribute to our long-term growth; however, they may affect our short-term profitability.

Our Company plans to raise funds from this Offering, to use to commence operations, and as of the date of this Offering Circular we have not begun production or selling any products. All our operations to date have been developing our business plan, developing our product line and analysis the specific need of our targeted customers for these products. Accordingly, we have not experienced any recognizable trends in the last fiscal year.

For our Bitcoin Mining business, the Company intends to capitalize on the growing value of cryptocurrencies – specifically Bitcoin – as well as recent enthusiasm for cryptocurrency mining operations in certain areas which the Company believes provides opportunity.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Critical Accounting Policies

Our financial statements are affected by the accounting policies used and the estimates and assumptions made by management during their preparation. We have identified below the critical accounting policies which are assumptions made by management about matters that are highly uncertain and that are of critical importance and have a material impact on our financial statements. Management believes that the critical accounting policies and estimates discussed below involve the most complex management judgments due to the sensitivity of the methods and assumptions necessary in determining the related asset, liability, revenue and expense amounts. Specific risks associated with these critical accounting policies are discussed throughout this MD&A, where such policies have a material effect on reported and expected financial results.

| 9 |

A complete listing of our significant policies is included in Note 2 to our financial statements for the year ended November 30, 2022.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (GAAP) requires management to make estimates and assumptions that affect the amounts reported in the financial statements. Estimates are based on historical experience, management expectations for future performance, and other assumptions as appropriate. We re-evaluate estimates on an ongoing basis; therefore, actual results may vary from those estimates.

Financial Instruments

The Company’s balance sheet includes certain financial instruments. The carrying amounts of current assets and current liabilities approximate their fair value because of the relatively short period of time between the origination of these instruments and their expected realization.

ITEM 3. DIRECTORS, EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES

The table below sets forth our directors and executive officers of as of the date of this filing.

| Name (1) |

| Position |

| Age |

| Term of Office |

|

|

|

|

|

|

|

|

| Anastasia Shishova | President, Chief Executive Officer (principal executive, financial and accounting officer) | 34 | Since November 10, 2020 - Present |

Anastasia Shishova, Chief Executive Officer and Director.

Ms. Shishova was appointed as our Chief Executive Officer and director on November 10, 2020. From 2015 through 2020, Ms. Shishova had been the CEO of Buscar Company, which currently trades on the OTC Markets Pink Tier under the symbol CGLD. Ms. Shishova resigned from Buscar Company in June 2020. From 2015 through 2020, Ms. Shishova was the CEO of Buscar Stables, which until June 2020 was a wholly owned subsidiary of Buscar Company, and ceased operations in June 2020. From June 2010 through 2014, Ms. Shishova has worked as an independent marketing consultant for various businesses. Ms. Shishova has a Master’s Degree in Marketing and a Bachelors Degree from Samara State University in Samara, Russia.

Family Relationships

None.

Involvement in Certain Legal Proceedings

No executive officer, member of the board of directors or control person of our Company has been involved in any legal proceeding listed in Item 401(f) of Regulation S-K in the past 10 years.

| 10 |

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

| Name |

| Capacities in which Compensation was Received |

| Cash Compensation (1) |

| Other Compensation |

| Total Compensation | |

|

|

|

|

|

|

|

|

| ||

| Anastasia Shishova(2) |

| Chief Executive Officer and Director |

| 2022: $43,000 2021: $0 |

| 2022: $0 2020: $0 |

| 2022: $43,000 2020: $0 | |

______________

| 1 | We have not paid any compensation to any of our officers or directors during the time periods specified above. Anastasia Shishova has entered into an employment with the Company that is effective January 1, 2022. The new employment agreement pays Ms. Shishova an annual salary of $240,000 and bonus of 20% of the net operating proceeds from our bitcoin mining operation. However, Ms. Shishova has agreed to defer her salary and bonus above the $43,000 that she was compensated. We do not compensate our directors for attendance at meetings. We have no long-term incentive plans. |

|

|

|

| 2 | Anastasia Shishova was appointed to their positions with the Company on November 10, 2020. |

ITEM 4. SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITYHOLDERS

The following table sets forth information regarding beneficial ownership of our Class A and Class B Common Stock as of date of this Report and as adjusted to reflect the sale of shares of our Class A Common Stock offered by this Offering Circular, by:

|

| · | Each of our Directors and the named Executive Officers;

|

|

| · | All of our Directors and Executive Officers as a group; and

|

|

| · | Each person or group of affiliated persons known by us to be the beneficial owner of more than 10% of our outstanding shares of Common Stock

|

|

| · | All other shareholders as a group

|

Beneficial ownership and percentage ownership are determined in accordance with the rules of the Securities and Exchange Commission and includes voting or investment power with respect to shares of stock. This information does not necessarily indicate beneficial ownership for any other purpose.

Unless otherwise indicated and subject to applicable community property laws, to our knowledge, each stockholder named in the following table possesses sole voting and investment power over their shares of common stock, except for those jointly owned with that person’s spouse. Percentage of beneficial ownership before the offering is based on 153,541,521 shares of Class A Common Stock and 51,000,000 shares of Class B Common Stock outstanding as of November 30, 2021. Unless otherwise noted below, the address of each person listed on the table is c/o The Graystone Company, Inc. 401 E. Las Olas Blvd #130-321, Fort Lauderdale, FL 33301.

|

|

| Class A Common Shares Beneficially Owned |

| Class B Common Stock Beneficially Owned (1) |

| Voting Power | |||||||||

| of Beneficial Owner |

| Number |

|

| Percent |

| Number |

|

| Percent |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

| Officers/Directors |

|

|

|

|

|

|

|

|

|

|

|

| |||

| Anastasia Shishova(3) |

|

| 0 |

|

| 0% |

|

| 46,000,000 |

|

| 90.2 % |

| 90.08% | |

| 10% Shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Paul Howarth(2) |

|

| 81,112,502 |

|

| 55.41% |

|

| 5,000,000 |

|

| 9.8 % |

| 9.79% | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Officers and Directors as a Group (2 persons) |

|

| 0 |

|

| 0% |

|

| 46,000,000 |

|

| 90.2 % |

| 99.87% | |

____________

| (1) | The Class A and Class B Common Stock vote together as a single class except as otherwise required by law. Each share of Class B Common shares has voting rights of 2,500 votes per share while each share of Class A Common stock has 1 vote per share.

|

| (2) | Mr. Howarth is the control person of Renard Properties, LLC, which holds 65,620,001 shares of the Company’s Class A Common Stock, of which Mr. Howarth has voting and dispositive control. Mr. Howarth also holds 15,492,501 shares of the Company’s Class A Common Stock in his own name. Paul Howarth also holds 5,000,000 shares of the Company’s Class B Common Stock in his own name.

|

| (3) | Anastasia Shishova was appointed to their positions with the Company on November 10, 2020. Mr. Tucker’s position expired November 30, 2021 and was not reelected as an director. |

| 11 |

ITEM 5. INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS

Related Party Transactions

Voting control of the Company is held by Anastasia Shishova, our Chief Executive Officer, who owns approximately 90% of the voting power of the Company because she currently owns 46,000,000 shares of Class B Common Stock, which carries 2,500 votes per share, giving her voting control of the Company. Because of this voting control, she will be in a position to significantly influence membership of our board of directors, as well as all other matters requiring stockholder approval. The interests of our Chief Executive Officer may differ from the interests of other stockholders with respect to the issuance of shares, business transactions with or sales to other companies, selection of other officers and directors and other business decisions. The minority stockholders will have no way of overriding decisions made by our Chief Executive Officer.

Our CEO has the ability to control the Company and will have the ability to control all matters submitted to stockholders for approval, including, but not limited to:

|

| · | Election of the Board of Directors

|

|

| · | Removal of any Directors

|

|

| · | Amendments to the Company’s Articles of Incorporation or bylaws;

|

|

| · | Adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination. |

Our CEO will thus have control over the Company’s management and affairs. Accordingly, this ownership may have the effect of impeding a merger, consolidation, takeover or other business combination, or discouraging a potential acquirer from making a tender offer.

Due to Related Party

During the period ended November 30, 2022, the Company borrowed funds from our CEO. As of November 30, 2022, the Company recorded a note payable of $8,677. The note payable is not evidenced by a written note, is unsecured and bears no interest and is due upon demand.

Employment Agreements

Effective January 1, 2022, Anastasia Shishova has entered into an employment with the Company that is effective January 1, 2022. The new employment agreement pays Ms. Shishova an annual salary of $240,000 and bonus of 20% of the net operating proceeds from our bitcoin mining operation. However, Ms. Shisova was compensated $43,000 and agreed to cancel the remaining amounts of her salary and bonus for 2022.

| 12 |

Equity Transactions

On November 6, 2020, pursuant to the Reverse Merger, the Company issued to Anastasia Shishova a total of 46,000,000 shares of Class B Common Stock in exchange for her 100% interest in Nutra-Gyst, Inc.

Review, Approval and Ratification of Related Party Transactions

Given our small size and limited financial resources, we have not adopted formal policies and procedures for the review, approval or ratification of transactions, such as those described above, with our executive officer(s), Director(s) and significant stockholders. We intend to establish formal policies and procedures in the future, once we have sufficient resources and have appointed additional Directors, so that such transactions will be subject to the review, approval or ratification of our Board of Directors, or an appropriate committee thereof. On a moving forward basis, our Directors will continue to approve any related party transactions.

Conflict of Interest Policies

Our governing instruments do not restrict any of our directors, officers, stockholders or affiliates from having a pecuniary interest in an investment or transaction in which we have an interest or from conducting, for their own account, business activities of the type we conduct. However, we plan that our policies will be designed to eliminate or minimize potential conflicts of interest. A “conflict of interest” occurs when a director’s, officer’s or employee’s private interest interferes in any way, or appears to interfere, with the interests of the Company as a whole. We plan to adopt a policy that discloses personal conflicts of interest. This policy will provide that any situation that involves, or may reasonably be expected to involve, a conflict of interest must be disclosed immediately to our directors and subsequently to our shareholders in our next semi-annual or annual report. These policies may not be successful in eliminating the influence of conflicts of interest. If they are not successful, decisions could be made that might fail to reflect fully the interests of all stockholders.

ITEM 6. OTHER INFORMATION

Not applicable.

| 13 |

ITEM 7. FINANCIAL STATEMENTS

THE GRAYSTONE COMPANY, INC.

CONSOLIDATED FINANCIAL STATEMENTS

NOVEMBER 30, 2022 and 2021

Together with Independent Auditors’ Report

|

| PAGE | ||

|

| |||

|

| F-2 | ||

|

| |||

|

| F-3 | ||

|

| |||

| CONSOLIDATED STATEMENT OF OPERATIONS FOR THE YEARS’ ENDED NOVEMBER 30, 2021 and 2020 |

| F-4 | |

|

| |||

|

| F-5 | ||

|

| |||

| CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEARS’ ENDED NOVEMBER 30, 2021 and 2020 |

| F-6 | |

|

| |||

|

| F-7 |

| F-1 |

| Table of Contents |

Report of Independent Registered Public Accounting Firm

To the shareholders and the board of directors of The Graystone Company, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of The Graystone Company, Inc. as of November 30, 2022 and 2021, the related statements of operations, stockholders' equity (deficit), and cash flows for the years then ended, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of November 30, 2022 and 2021, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States.

Substantial Doubt about the Company’s Ability to Continue as a Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered recurring losses from operations and has a significant accumulated deficit. In addition, the Company continues to experience negative cash flows from operations. These factors raise substantial doubt about the Company's ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/S/ BF Borgers CPA PC

BF Borgers CPA PC (PCAOB ID 5041)

We have served as the Company's auditor since 2021

Lakewood, CO

March 30, 2023

| F-2 |

| Table of Contents |

The Graystone Company, Inc.

|

|

| November 30, |

|

| November 30, |

| ||

|

|

| 2022 |

|

| 2021 |

| ||

| ASSETS |

|

|

|

|

|

| ||

| Current Assets |

|

|

|

|

|

| ||

| Cash and cash equivalents |

| $ | 34 |

|

| $ | 57,333 |

|

| Ditigital currency (Bitcoin) |

|

| 67,378 |

|

|

| 52,013 |

|

| Total Current Assets |

|

| 67,413 |

|

|

| 109,346 |

|

|

|

|

|

|

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

|

|

| Mining proceeds receivable |

|

| - |

|

|

| 6,226 |

|

| Bitcoin mining equipment |

|

| 238,428 |

|

|

| 202,300 |

|

| Leased bitcoin mining equipment |

|

| 61,442 |

|

|

| 94,574 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

| $ | 367,283 |

|

| $ | 412,445 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

|

| 7,334 |

|

|

| 3,549 |

|

| Due to related parties |

|

| 8,677 |

|

|

| 42,942 |

|

| Total Current Liabilities |

|

| 16,011 |

|

|

| 46,491 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES |

|

| 16,011 |

|

|

| 46,491 |

|

|

|

|

|

|

|

|

|

|

|

| Stockholders' Deficit |

|

|

|

|

|

|

|

|

| Preferred stock: 4,000,000 shares authorized; $0.0001 par value |

|

|

|

|

|

|

|

|

| Series B preferred stock, 2,000 shares designated, $0.0001 par value: 617 shares issued and outstanding |

|

| 1 |

|

|

| 1 |

|

| Class A Common stock, $.0001 par value; 500,000,000 shares authorized, 175,541,521 and 164,916,521 shares issued and outstanding as of November 30, 2022 and 2021, respectively) |

|

| 17,554 |

|

|

| 16,492 |

|

| Class B Common stock, $.001 par value; 51,000,000 shares authorized, 51,000,000 shares issued and outstanding as of November 30, 2022 and 2021, respectively |

|

| 51,000 |

|

|

| 51,000 |

|

| Additional paid in capital |

|

| 686,045 |

|

|

| 432,108 |

|

| Accumulated deficit |

|

| (403,328 | ) |

|

| (132,406 | ) |

| Total Stockholders' Equity (Deficit) |

|

| 351,272 |

|

|

| 367,194 |

|

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) |

| $ | 367,283 |

|

| $ | 413,685 |

|

The accompanying notes are an integral part of these consolidated financial statements.

| F-3 |

| Table of Contents |

The Graystone Company, Inc.

Consolidated Statement of Operations

|

|

| Years Ending |

| |||||

|

|

| November 30, |

|

| November 30, |

| ||

|

|

| 2022 |

|

| 2021 |

| ||

|

|

|

|

|

|

|

| ||

| Revenues |

|

|

|

|

|

| ||

| Bitcoin mining revenue |

| $ | 128,676 |

|

| $ | 38,126 |

|

| Hosting revenue |

|

| 23,801 |

|

|

| - |

|

| Sale of bitcoin mining equipment |

|

| 249,000 |

|

|

| 138,800 |

|

| Total Revenue |

|

| 401,477 |

|

|

| 176,926 |

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

| 290,586 |

|

|

| 120,844 |

|

| Gross profit (loss) |

|

| 110,891 |

|

|

| 56,083 |

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

|

| General and administration |

|

| 196,081 |

|

|

| 190,453 |

|

| Total operating expenses |

|

| 196,081 |

|

|

| 190,453 |

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

| (85,190 | ) |

|

| (134,371 | ) |

|

|

|

|

|

|

|

|

|

|

| Other income (expenses) |

|

|

|

|

|

|

|

|

| Unrealized gain (loss) on bitcoin held |

|

| (83,238 | ) |

|

| 6,785 |

|

| Depreciation |

|

| (101,254 | ) |

|

| (4,821 | ) |

| Total other income (expense) |

|

| (184,492 | ) |

|

| 1,964 |

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

| $ | (269,682 | ) |

| $ | (132,406 | ) |

|

|

|

|

|

|

|

|

|

|

| Net loss per common share, Basic and Diluted |

| $ | (0.002 | ) |

| $ | (0.001 | ) |

|

|

|

|

|

|

|

|

|

|

| Weighted average number of Class A Common Stock outstanding, Basic and Diluted |

|

| 175,279,535 |

|

|

| 152,577,206 |

|

The accompanying notes are an integral part of these consolidated financial statements.

| F-4 |

| Table of Contents |

The Graystone Company, Inc.

Consolidated Statement of Stockholders' Equity

|

|

| Class A Common Stock |

|

| Class B Common Stock |

|

| Series B Preferred Stock |

|

| Additional |

|

|

|

| Total |

| |||||||||||||||||||

|

|

| Number of Shares |

|

| Amount |

|

| Number of Shares |

|

| Amount |

|

| Number of Shares |

|

| Amount |

|

| Paid in Capital |

|

| Accumulated Deficit |

|

| Stockholders' Deficit |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

| Balance - November 6, 2020 (Inception) |

|

|

|

|

|

|

|

| - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

| ||

| Stock issued to founders |

|

| 0 |

|

|

| 0 |

|

|

| 46,000,000 |

|

|

| 46,000 |

|

|

| 0 |

|

|

| 0 |

|

|

| (45,900 | ) |

|

| - |

|

|

| 100 |

|

| Reverse merger adjustment |

|

| 146,391,521 |

|

|

| 14,639 |

|

|

| 5,000,000 |

|

|

| 5,000 |

|

|

| 617 |

|

|

| 1 |

|

|

| (19,640 | ) |

|

| - |

|

|

| - |

|

| Net loss |

|

| 0 |

|

|

|

|

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (1,240 | ) |

|

| (1,240 | ) |

| Balance - November 30, 2020 |

|

| 146,391,521 |

|

|

| 14,639 |

|

|

| 51,000,000 |

|

| $ | 51,000 |

|

|

| 617 |

|

| $ | 1 |

|

| $ | (65,540 | ) |

| $ | (1,240 | ) |

| $ | (1,140 | ) |

| Stock issued for cash |

|

| 18,525,000 |

|

|

| 1,853 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 497,648 |

|

|

| - |

|

|

| 499,500 |

|

| Net loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (132,406 | ) |

|

| (132,406 | ) |

| Balance - November 30, 2021 |

|

| 164,916,521 |

|

|

| 16,492 |

|

|

| 51,000,000 |

|

| $ | 51,000 |

|

|

| 617 |

|

| $ | 1 |

|

| $ | 432,108 |

|

| $ | (133,646 | ) |

| $ | 365,954 |

|

| Stock issued for cash |

|

| 10,625,000 |

|

|

| 1,063 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 253,938 |

|

|

| - |

|

|

| 255,000 |

|

| Net loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (269,682 | ) |

|

| (269,682 | ) |

| Balance - November 30, 2022 |

|

| 175,541,521 |

|

|

| 17,554 |

|

|

| 51,000,000 |

|

| $ | 51,000 |

|

|

| 617 |

|

| $ | 1 |

|

| $ | 686,045 |

|

| $ | (403,328 | ) |

| $ | 351,272 |

|

The accompanying notes are an integral part of these consolidated financial statements.

| F-5 |

| Table of Contents |

The Graystone Company, Inc.

Consolidated Statement of Cash Flows

|

|

| Years Ending |

| |||||

|

|

| November 30, |

|

| November 30, |

| ||

|

|

| 2022 |

|

| 2021 |

| ||

|

|

|

|

|

|

|

| ||

| CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

| ||

| Net loss |

| $ | (269,682 | ) |

| $ | (132,406 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

| 101,254 |

|

|

| 4,821 |

|

| Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

| 3,785 |

|

|

| 3,549 |

|

| Cost of mining equipment sold |

|

| 194,850 |

|

|

|

|

|

| Mining proceeds receivable |

|

| 6,226 |

|

|

| (6,226 | ) |

| Change in amount owed to officers |

|

| (34,265 | ) |

|

| 41,803 |

|

| Net Cash Used in Operating Activities |

|

| 2,168 |

|

|

| (88,459 | ) |

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Acquisition of leased bitcoin mining equipment |

|

| 0 |

|

|

| (99,395 | ) |

| Purchase of bitcoin mining equipment |

|

| (299,100 | ) |

|

| (202,300 | ) |

| Net Cash Provided By Financing Activities |

|

| (299,100 | ) |

|

| (301,695 | ) |

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Stock issued for cash |

|

| 255,000 |

|

|

| 499,500 |

|

| Net Cash Provided By Financing Activities |

|

| 255,000 |

|

|

| 499,500 |

|

|

|

|

|

|

|

|

|

|

|

| Net increase (decrease) in cash and cash equivalents |

|

| (41,932 | ) |

|

| 109,346 |

|

| Cash and cash equivalents, beginning of period |

|

| 109,346 |

|

|

| 0 |

|

| Cash and cash equivalents, end of period |

| $ | 67,413 |

|

| $ | 109,346 |

|

|

|

|

|

|

|

|

|

|

|

| Supplemental cash flow information |

|

|

|

|

|

|

|

|

| Cash paid for interest |

|

| - |

|

|

| - |

|

| Cash paid for taxes |

| $ | - |

|

| $ | - |

|

The accompanying notes are an integral part of these consolidated financial statements.

| F-6 |

| Table of Contents |

The Graystone Company, Inc.

Notes to the Consolidated Financial Statements

November 30, 2022

NOTE 1. ORGANIZATION AND BUSINESS

Organization and Operations

The Graystone Company, Inc. (“Graystone”, “we”, “us”, “our”, the “Company” or the “Registrant”) was originally incorporated in the State of New York on May 27, 2010 under the name of Argentum Capital, Inc. Graystone was reincorporated in Delaware on January 10, 2011 and subsequently changed our name to The Graystone Company, Inc on January 14, 2011. Graystone was reincorporated in Colorado on May 1, 2016. Graystone is domiciled in the state of Florida, and its corporate headquarters are in Florida and maintains it US executive office in Fort Lauderdale, FL for mailing purposes. The Company selected November 30 as its fiscal year end.

Our business and registered office is located at 401 E. Las Olas Blvd #130-321, Fort Lauderdale, FL 33301. Our telephone number is (954) 271-2704. Our E-Mail address is investors@thegraystonecompany.com.

The address of our web site is www.thegraystonecompany.com. The information at our web site is for general information and marketing purposes and is not part of this report for purposes of liability for disclosures under the federal securities laws.

The Graystone Company business focuses on Bitcoin Mining - i.e. the process by which Bitcoins are created resulting in new blocks being added to the blockchain and new Bitcoins being issued to the miners. Miners engage in a set of prescribed complex mathematical calculations in order to add a block to the blockchain and thereby confirm cryptocurrency transactions included in that block’s data. Miners that are successful in adding a block to the blockchain are automatically awarded a fixed number of Bitcoins for their effort. All of the Company’s Bitcoin Mining activities will be conducted through our wholly-owned subsidiary Graystone Mining. The Company only mines Bitcoin.

Change in Fiscal Year.

On November 7, 2020, our Board of Directors approved a change in our Fiscal Year from December 31 to November 30 in connection with our acquisition of NutraGyst. The change in fiscal year became effective for our 2020 fiscal year, which began on November 6, 2020 (date of inception of NutraGyst) and ended November 30, 2020. NutraGyst had a fiscal year of November 30. Due to the reverse acquisition with NutraGyst, all of the financial statements prior to the acquisition date are of NutraGyst and accordingly we have presented consolidated financial statements for the period of inception for NutraGyst, which began on November 6, 2020 and ended on November 30, 2020.

Share Exchange and Reorganization

On November 6, 2020, the Company executed a reverse merger with NutraGyst, Inc. whereby the Company acquired 1,000,000 shares of NutraGyst’s common stock representing 100% of NutraGyst’s outstanding stock, in exchange for 46,000,000 shares of The Graystone Company’s unregistered Class B Common stock. Immediately prior to the reverse merger, there were 146,391,521 shares of Class A Common Stock outstanding and 5,000,000 shares of Class B Common Stock outstanding and 617 shares of Preferred shares outstanding, MT Soeparmo was the sole officer/director and Paul Howarth had 97% of the voting power of the Company. After the reverse merger, the Company had 146,391,521 shares of Class A Common Stock outstanding and 51,000,000 shares of Class B Common Stock outstanding and 617 shares of Preferred shares outstanding. Additionally, MT Soeparmo resigned as officer and director and Anastasia Shishova was appointed as CEO and Director and Greg Tucker was appointed as Director. Additionally, Anastasia Shishova now owns 90% of the voting power of the Company.

On November 6, 2020 (the “Effective Date”), NutraGyst merged into The Graystone Company, Inc., and became a 100% subsidiary of Graystone Company. Furthermore, the Company entered into and closed on a share exchange agreement with Graystone and its shareholders. At the date of acquisition, The Graystone Company had no assets, liabilities or operations.

| F-7 |

| Table of Contents |

Each share of Class B Common Stock has voting rights equal to 2,500 votes per share compared to Class A Common Stock voting rights equal to 1 vote per share. As a result, Anastasia Shishova owned approximately 90% of the voting power of the Company after the reverse merger.

Recapitalization

For financial accounting purposes, this transaction was treated as a reverse acquisition by NutraGyst, and resulted in a recapitalization with NutraGyst being the accounting acquirer and Graystone Company as the acquired company. The consummation of this reverse acquisition resulted in a change of control. Accordingly, the historical financial statements prior to the acquisition are those of the accounting acquirer, NutraGyst and have been prepared to give retroactive effect to the reverse acquisition completed on November 6, 2020, and represent the operations of NutraGyst. The consolidated financial statements after the acquisition date, November 30, 2020 include the balance sheets of both companies at historical cost, the historical results of NutraGyst and the results of the Company from the acquisition date. All share and per share information in the accompanying consolidated financial statements and footnotes has been retroactively restated to reflect the recapitalization.

Going Concern Matters

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which contemplates the Company’s continuation as a going concern. The Company has incurred operating losses of $(269,682)) during the period ended November 30, 2022 and has an accumulated deficit of $(403,328)) as of November 30, 2022.

There are no assurances that the Company will be able to either (1) achieve a level of revenues adequate to generate sufficient cash flow from operations; or (2) obtain additional financing through either private placement, public offerings and/or bank financing necessary to support its working capital requirements. To the extent that funds generated from operations and any private placements, public offerings and/or bank financing are insufficient, the Company will have to raise additional working capital. No assurance can be given that additional financing will be available, or if available, will be on terms acceptable to the Company. If adequate working capital is not available to the Company, it may be required to curtail or cease its operations.

Due to uncertainties related to these matters, a substantial doubt about the ability of the Company to continue as a going concern is raised. The accompanying consolidated financial statements do not include any adjustments related to the recoverability or classification of asset-carrying amounts or the amounts and classification of liabilities that may result should the Company be unable to continue as a going concern.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

General principles

These consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“US GAAP”). The fiscal year end is November 30.

Digital Currencies

Digital currencies consist of Bitcoin, generally received for the Company’s own account as compensation for cryptocurrency mining services, and other digital currencies purchased for short-term investment and trading purposes. Given that there is limited precedent regarding the classification and measurement of cryptocurrencies under current Generally Accepted Accounting Principles (“GAAP”), the Company has determined to account for these digital currencies as indefinite-lived intangible assets in accordance with Accounting Standards Update (“ASU”) No. 350, Intangibles – Goodwill and Other, for the period covered by this report and in future reports unless and until further guidance is issued by the Financial Accounting Standards Board (“FASB”). An intangible asset with an indefinite useful life is not amortized but assessed for impairment annually, or more frequently, when events or changes in circumstances occur indicating that it is more likely than not that the indefinite-lived asset is impaired. Impairment exists when the carrying amount exceeds its fair value. In testing for impairment, the Company has the option to first perform a qualitative assessment to determine whether it is more likely than not than an impairment exists. If it is determined that it is more likely than not that an impairment exists, a quantitative impairment test is not necessary. If the Company concludes otherwise, it is required to perform a quantitative impairment test. To the extent an impairment loss is recognized, the loss establishes the new cost basis of the asset. Subsequent reversal of impairment losses is not permitted. Realized gains or losses on the sale of digital currencies, net of transaction costs, are included in other income (expense) in the statements of operations.

| F-8 |

| Table of Contents |

Leased bitcoin mining equipment

The Company has leased terrahash from SupplyBit, LLC. The company has 2 leases with SupplyBit:

|

| (1) | 1,100 TH/s which commenced mining on September 15, 2021 and the term of the lease will expire on September 14, 2024, and |

|

| (2) | 1,000 TH/s commenced mining on October 30, 2021 and the term of the lease will expire on October 29, 2024. |

The 3-year lease term is equivalent to the expected useful life of the equipment generating the TH/s.

The lease terms are as follows:

|

| 1. | Term: 3 years |

|

| 2. | Uptime: 100% guaranteed uptime |

|

| 3. | Operational Costs: Approximately $3,600 per month ($1.69 per month per TH/s) |

|

| 4. | 15% management fee is charged by SupplyBit, LLC |

Under the terms of the lease, SupplyBit guarantees 100% uptime and in the event of our mining payout is lower than the expected payout, SupplyBit shall provide the Company a true up to equal to what the theoretical earnings of our 2,100 TH/s should have been. In the event, we received an amount higher than the theoretical earnings we do not have to repay any of the overage back to SupplyBit.

The Company pays SupplyBit $1.69 per TH/s per month. This is a all-in fee for power, repairs, maintenance and any other costs associated with the leased TH/s.

Related Party Transactions

Transactions between related parties are considered to be related party transactions even though they may not be given accounting recognition. FASB ASC 850, Related Party Disclosures (“FASB ASC 850”) requires that transactions with related parties that would make a difference in decision making shall be disclosed so that users of the financial statements can evaluate their significance. Related party transactions typically occur within the context of the following relationships:

| · | Affiliates of the entity;

|

| · | Entities for which investments in their equity securities is typically accounted for under the equity method by the investing entity;

|

| · | Trusts for the benefit of employees;

|

| · | Principal owners of the entity and members of their immediate families;

|

| · | Management of the entity and members of their immediate families.

|

Other parties that can significantly influence the management or operating policies of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

Consolidation Policy

For November 30, 2021, the consolidated financial statements of the Company include the accounts of the Company and its wholly owned subsidiaries, NutraGyst and Graystone Mining. All significant intercompany balances and transactions have been eliminated in consolidation.

| F-9 |

| Table of Contents |

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash and cash equivalents

Cash equivalents are short-term highly liquid investments that are readily convertible to cash with original maturities of three months or less, at the date acquired.

Revenue recognition

Effective January 1, 2018, the Company adopted ASC 606 — Revenue from Contracts with Customers. Under ASC 606, the Company recognizes revenue from the commercial sales of products by: (1) identify the contract (if any) with a customer; (2) identify the performance obligations in the contract (if any); (3) determine the transaction price; (4) allocate the transaction price to each performance obligation in the contract (if any); and (5) recognize revenue when each performance obligation is satisfied. Under ASC 606, revenue is recognized when the following criteria are met: (1) persuasive evidence of an arrangement exists; (2) the performance of service has been rendered to a customer or delivery has occurred; (3) the amount of fee to be paid by a customer is fixed and determinable; and (4) the collectability of the fee is reasonably assured. Other than The Company has no outstanding contracts with any of its’ customers. The Company recognizes revenue when title, ownership, and risk of loss pass to the customer, all of which occurs upon shipment or delivery of the product and is based on the applicable shipping terms.