graystoneco10q063012.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

|

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended JUNE 30, 2012

or

|

|

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to .

Commission File Number: 000-54254

The Graystone Company, Inc.

(Exact name of registrant as specified in its charter)

|

DELAWARE

(State of Incorporation)

|

|

27-3051592

(I.R.S. Employer Identification No.)

|

| |

|

|

|

2620 Regatta Drive, Ste 102, Las Vegas, NV

(Address of principal executive offices)

|

|

89128

(Zip Code)

|

(702) 438-4100

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

|

Non-accelerated filer o

|

|

Accelerated filer o

|

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

Title of Each Class

|

|

Outstanding as of August 20, 2012

|

|

Class A Common stock, par value $0.0001 per share

Class B Common stock, par value $0.001 per share

|

|

179,241,320

5,000,000

|

THE GRAYSTONE COMPANY, INC.

FORM 10-Q

June 30, 2012

PART I-- FINANCIAL INFORMATION

|

Item 1.

|

|

3

|

|

Item 2.

|

|

16

|

|

Item 3.

|

|

22

|

|

Item 4.

|

|

22

|

PART II-- OTHER INFORMATION

|

Item 1.

|

|

24

|

|

Item 1A.

|

|

24

|

|

Item 2.

|

|

24

|

|

Item 3.

|

|

25

|

|

Item 4.

|

|

25

|

|

Item 5.

|

|

25

|

|

Item 6.

|

|

25

|

PART I FINANCIAL INFORMATION

ITEM 1 – FINANCIAL STATEMENTS

THE GRAYSTONE COMPANY, INC.

CONSOLIDATED BALANCE SHEET

| |

|

June 30,

|

|

|

December 31,

|

|

| |

|

2012

|

|

|

2011

|

|

| |

|

(unaudited)

|

|

|

(audited)

|

|

|

ASSETS

|

|

|

Current assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

46,018 |

|

|

$ |

793 |

|

|

Accounts receivable

|

|

|

21,930 |

|

|

|

17,120 |

|

|

Shareholders' subscription receivable

|

|

|

- |

|

|

|

350,000 |

|

|

Total current assets

|

|

|

67,948 |

|

|

|

367,913 |

|

| |

|

|

|

|

|

|

|

|

|

Plant, property & equipment (net of depreciation)

|

|

|

53,513 |

|

|

|

69,713 |

|

|

Acquired intangible assets (net of amortization)

|

|

|

13,500 |

|

|

|

14,000 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

134,961 |

|

|

$ |

451,626 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' (DEFICIT) EQUITY

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

18,232 |

|

|

$ |

10,495 |

|

|

Accrued expenses

|

|

|

6,978 |

|

|

|

1,637 |

|

|

Current portion of long term debts

|

|

|

83,465 |

|

|

|

12,713 |

|

|

Total current liabilities

|

|

|

108,675 |

|

|

|

24,845 |

|

| |

|

|

|

|

|

|

|

|

|

Long term debts

|

|

|

147,373 |

|

|

|

94,448 |

|

|

Total liabilities

|

|

|

256,048 |

|

|

|

119,293 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' (deficit) equity

|

|

|

|

|

|

|

|

|

|

Class A Common stock, $.0001 par value; 700,000,000 shares authorized, 76,174,556 and 19,056,000 shares issued and outstanding as of June 30, 2012 and December, 2011, respectively.

|

|

|

7,617 |

|

|

|

19,056 |

|

|

Class B Common stock, $.001 par value; 5,000,000 shares authorized, 5,000,000 and 700,000 shares issued and outstanding as of June 30, 2012 and December 31, 2011, respectively.

|

|

|

5,000 |

|

|

|

1,400 |

|

|

Additional paid-in capital

|

|

|

2,995,473 |

|

|

|

2,476,773 |

|

|

Dividend paid

|

|

|

- |

|

|

|

(46,764 |

) |

|

Accumulated deficits

|

|

|

(3,129,177 |

) |

|

|

(2,118,132 |

) |

|

Total stockholders' (deficit) equity

|

|

|

(121,087 |

) |

|

|

332,333 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' (deficit) equity

|

|

$ |

134,961 |

|

|

$ |

451,626 |

|

See accompanying notes to condensed consolidated financial statements

THE GRAYSTONE COMPANY, INC.

CONSOLIDATED STATEMENT OF OPERATIONS

| |

|

Six Months Ended June 30,

|

|

|

Three Months Ended June 30,

|

|

| |

|

2012

|

|

|

2011

|

|

|

2012

|

|

|

2011

|

|

| |

|

(unaudited)

|

|

|

(unaudited)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales, net

|

|

$ |

42,470 |

|

|

$ |

81,209 |

|

|

$ |

27,369 |

|

|

$ |

37,782 |

|

|

Cost of goods sold

|

|

|

14,279 |

|

|

|

30,079 |

|

|

|

8,938 |

|

|

|

14,330 |

|

|

Gross profit

|

|

$ |

28,191 |

|

|

$ |

51,130 |

|

|

$ |

18,431 |

|

|

$ |

23,452 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

302,434 |

|

|

|

23,694 |

|

|

|

270,487 |

|

|

|

21,288 |

|

|

Legal and professional

|

|

|

555,192 |

|

|

|

263,259 |

|

|

|

230,018 |

|

|

|

239,073 |

|

|

Research and development

|

|

|

45,035 |

|

|

|

170,545 |

|

|

|

10,996 |

|

|

|

170,545 |

|

|

Total operating expenses

|

|

|

902,661 |

|

|

|

457,498 |

|

|

|

511,501 |

|

|

|

430,906 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(874,470 |

) |

|

|

(406,368 |

) |

|

|

(493,070 |

) |

|

|

(407,454 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

- |

|

|

|

100 |

|

|

|

- |

|

|

|

0 |

|

|

Interest expense

|

|

|

(84,483 |

) |

|

|

- |

|

|

|

(27,642 |

) |

|

|

- |

|

|

Loss on sale of assets

|

|

|

(5,329 |

) |

|

|

- |

|

|

|

(5,329 |

) |

|

|

- |

|

|

Total other income (expense)

|

|

|

(89,812 |

) |

|

|

100 |

|

|

|

(32,971 |

) |

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes

|

|

|

(964,282 |

) |

|

|

(406,268 |

) |

|

|

(526,041 |

) |

|

|

(407,454 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(964,282 |

) |

|

$ |

(406,268 |

) |

|

$ |

(526,041 |

) |

|

$ |

(407,454 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share of common stock:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

(0.01 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding

|

|

|

115,660,875 |

|

|

|

58,759,063 |

|

|

|

231,494,808 |

|

|

|

96,059,066 |

|

See accompanying notes to condensed consolidated financial statements

THE GRAYSTONE COMPANY, INC.

CONSOLIDATED STATEMENT OF CASH FLOWS

| |

|

Six Months Ended June 30, |

|

| |

|

2012 |

|

|

2011 |

|

| |

|

(unaudited) |

|

| Cash flows from operating activities |

|

|

|

|

|

|

|

Net Income(loss)

|

|

$ |

(964,282 |

) |

|

$ |

(406,268 |

) |

|

Adjustments to reconcile net income to net cash used by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciations on fixed assets

|

|

|

1,258 |

|

|

|

- |

|

|

Amortizations on intangible assets

|

|

|

500 |

|

|

|

- |

|

|

Interest BCF

|

|

|

81,089 |

|

|

|

- |

|

|

Loss on sale of plant, property & equipment

|

|

|

5,329 |

|

|

|

- |

|

|

Common stock issuances for services contributed

|

|

|

623,585 |

|

|

|

404,500 |

|

|

Notes issued for legal services contributed

|

|

|

31,250 |

|

|

|

- |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(4,810 |

) |

|

|

(3,743 |

) |

|

Accounts payable

|

|

|

7,728 |

|

|

|

15,000 |

|

|

Accrued expenses

|

|

|

5,341 |

|

|

|

(2,114 |

) |

|

Net cash used by operating activities

|

|

|

(213,012 |

) |

|

|

7,375 |

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

|

|

Purchase of plant, property & equipment

|

|

|

- |

|

|

|

(70,971 |

) |

|

Purchase of minority interest of entity

|

|

|

- |

|

|

|

(1,700,000 |

) |

|

Sale of plant, property & equipment

|

|

|

9,613 |

|

|

|

- |

|

|

Net cash provided (used) by investing activities

|

|

|

9,613 |

|

|

|

(1,770,971 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

|

|

Proceeds from notes payable

|

|

|

189,064 |

|

|

|

254,725 |

|

|

Proceeds from stock issuances

|

|

|

86,950 |

|

|

|

1,541,506 |

|

|

Repayment from notes payable

|

|

|

(27,390 |

) |

|

|

- |

|

|

Cash dividend paid

|

|

|

- |

|

|

|

(30,000 |

) |

|

Net cash provided by financing activities

|

|

|

248,624 |

|

|

|

1,766,231 |

|

| |

|

|

|

|

|

|

|

|

|

Net change in cash and cash equivalent

|

|

|

45,225 |

|

|

|

2,636 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalent at the beginning of year

|

|

|

793 |

|

|

|

5,522 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalent at the end of year

|

|

$ |

46,018 |

|

|

$ |

8,158 |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow Information:

|

|

|

|

|

|

|

|

|

|

Cash paid during the period for:

|

|

|

|

|

|

|

|

|

|

Interest

|

|

$ |

- |

|

|

$ |

- |

|

|

Income taxes

|

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental non-cash investing and financing activities:

|

|

|

|

|

|

|

|

|

|

Issuance of common stock for services contributed

|

|

$ |

623,585 |

|

|

$ |

- |

|

|

Issuance of notes for services contributed

|

|

$ |

31,250 |

|

|

$ |

- |

|

|

BCF note discount

|

|

$ |

80,000 |

|

|

$ |

- |

|

|

BCF note that converted to class A common stock

|

|

$ |

13,400 |

|

|

$ |

- |

|

|

Common stocks cancelled with subscription receivable

|

|

$ |

(218,200 |

) |

|

$ |

- |

|

|

Subscription receivable compensated with professional service contributed

|

|

$ |

131,800 |

|

|

$ |

- |

|

See accompanying notes to condensed consolidated financial statements

THE GRAYSTONE COMPANY, INC.

CONDENSED NOTES TO FINANCIAL STATEMENTS

Note 1 – Nature of Operations

The Graystone Company, Inc. (“Graystone”, “we”, “us”, “our”, the "Company" or the "Registrant") was originally incorporated in the State of New York on May 27, 2010 under the name of Argentum Capital, Inc. Graystone was reincorporated in Delaware on January 10, 2011 and subsequently we changed our name to The Graystone Company, Inc on January 14, 2011. Graystone is domiciled in the state of Delaware, and its corporate headquarters are located in Las Vegas, Nevada.

The Graystone Company, Inc. is a holding company whose primary operating activities involve acquiring and developing mining properties amenable to low cost production. In January 2012, the Company launched a new division that sells gold, silver and other precious metals to retail buyers. The Company also operates other divisions that include a marketing division, real estate division, and consulting division.

The Graystone Company, Inc. has two dormant subsidiaries as indicated below,

|

•

|

Grupo Minero Inca S.A., - a Peru Corporation with equity interest of 100%

|

|

•

|

Graystone Mining Company – a Nevada Corporation with equity interest of 100%

|

Going Concern

The Company's financial statements are prepared using accounting principles generally accepted in the United States of America or GAAP applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, the Company does not have significant cash or other current assets, nor does it have an established source of revenues sufficient to cover its operating costs and to allow it to continue as a going concern.

Under the going concern assumption, an entity is ordinarily viewed as continuing in business for the foreseeable future with neither the intention nor the necessity of liquidation, ceasing trading, or seeking protection from creditors pursuant to laws or regulations. Accordingly, assets and liabilities are recorded on the basis that the entity will be able to realize its assets and discharge its liabilities in the normal course of business.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plan described in the preceding paragraph and eventually attain profitable operations. The accompanying financial statements do not include any adjustments that may be necessary if the Company is unable to continue as a going concern.

In the coming year, the Company’s foreseeable cash requirements will relate to continual development of the operations of its business, maintaining its good standing and making the requisite filings with the Securities and Exchange Commission, and the payment of expenses associated with operations and business developments. The Company may experience a cash shortfall and be required to raise additional capital.

Historically, it has mostly relied upon internally generated funds such as shareholder loans and advances to finance its operations and growth. Management may raise additional capital by retaining net earnings or through future public or private offerings of the Company’s stock or through loans from private investors, although there can be no assurance that it will be able to obtain such financing. The Company’s failure to do so could have a material and adverse affect upon it and its shareholders.

Note 2 – Significant Accounting Policies

Accounting Method

The Company's financial statements are prepared using the accrual method of accounting. The Company has elected a fiscal year ending on December 31.

Use of estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Fair Value of Financial Instruments

The Company’s financial instruments consist principally of cash and cash equivalents, accounts receivable and accounts payable. The Company believes that the recorded values of all of its other financial instruments approximate their fair values because of their nature and respective maturity dates or durations. The fair value of our long-term debt is determined by using estimated market prices. Assets and liabilities measured at fair value are categorized based on whether or not the inputs are observable in the market and the degree that the inputs are observable. The categorization of financial instruments within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement. The hierarchy is prioritized into three levels (with Level 3 being the lowest) defined as follows:

Level 1: Inputs are based on quoted market prices for identical assets or liabilities in active markets at the measurement date.

Level 2: Inputs include quoted prices for similar assets or liabilities in active markets and/or quoted prices for identical or similar assets or liabilities in markets that are not active near the measurement date.

Level 3: Inputs include management’s best estimate of what market participants would use in pricing the asset or liability at the measurement date. The inputs are unobservable in the market and significant to the instrument’s valuation.

The fair value of the majority of our cash equivalents was determined based on “Level 1” inputs. The Company does not have any marketable securities in the “Level 2” and “Level 3” category. The Company believes that the recorded values of all our other financial instruments approximate their current fair values because of their nature and respective relatively short maturity dates or durations.

The carrying value of financial assets and liabilities recorded at fair value is measured on a recurring or nonrecurring basis. Financial assets and liabilities measured on a non-recurring basis are those that are adjusted to fair value when a significant event occurs. The Company had no financial assets or liabilities carried and measured on a nonrecurring basis during the reporting periods. Financial assets and liabilities measured on a recurring basis are those that are adjusted to fair value each time a financial statement is prepared. The Company does not have financial assets as an investment carried at fair value on a recurring basis as of December 31, 2011 and 2010.

The availability of inputs observable in the market varies from instrument to instrument and depends on a variety of factors including the type of instrument, whether the instrument is actively traded, and other characteristics particular to the transaction. For many financial instruments, pricing inputs are readily observable in the market, the valuation methodology used is widely accepted by market participants, and the valuation does not require significant management discretion. For other financial instruments, pricing inputs are less observable in the market and may require management judgment. As of December 31, 2011 and 2010, the Company has assets and liabilities in cash, various receivables, property and equipments, and various payables. Management believes that they are being presented at their fair market value.

Note 2 – Significant Accounting Policies (Continued)

Income Taxes

In accordance with Accounting Standards Codification (“ASC”) Topic 740, “Income Taxes” (“ASC 740”), the Company accounts for income taxes using an asset and liability approach, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been recognized in the Company’s Consolidated Financial Statements, but have not been reflected in the Company's taxable income. A valuation allowance has been established to reduce deferred tax assets to their estimated realizable value. Therefore, the Company provides a valuation allowance to the extent that the Company does not believe it is more likely than not that it will generate sufficient taxable income in future periods to realize the benefit of its deferred tax assets. The Company recognizes interest and penalties related to unrecognized tax benefits in income tax expense.

Cash and Cash Equivalents

The Company considers all highly liquid investments with maturities of three months or less at the time of purchase to be cash equivalents. Cash and cash equivalents may at times exceed Federally-insured limits. To minimize this risk, the Company places its cash and cash equivalents with high credit quality institutions.

Accounts Receivable

Accounts receivable, if any, is carried at the expected net realizable value. The allowance for doubtful accounts, when determined, will be based on management’s assessment of the collectability of specific customer accounts and the aging of the accounts receivables. If there were a deterioration of a major customer’s creditworthiness, or actual defaults were higher than historical experience, our estimates of the recoverability of the amounts due to us could be overstated, which could have a negative impact on operations. As of June 30, 2012 and December 2011, the balances of accounts receivable were $21,930 and $17,120, respectively.

Notes Payable

Notes payable is classified as current if the maturity date is within 12 months after June 30, 2012, and otherwise it is classified as non-current.

Revenue Recognition

The Company has four different divisions. The revenue recognition methods for each division are indicated below.

Natural Resources Division - This division began operating in January 2011and operates the Company’s wholly owned subsidiary Graystone Mining, Inc., a Nevada Company. This Division is engaged in the business of acquiring gold, silver, precious metal and gems and other mineral properties with proven and/or probable reserves. The Company has currently begun mining operations in Peru. The Company's Natural Resources Division is a mine processing entity whereby we locate and extract mineral deposits for refining. Revenue is recognized when products are shipped or delivered if not shipped.

Marketing Division - This division operates under d/b/a paypercallexchange.com. This division began operating in July 2010. The division serves as an advertising and customer acquisition firm for 3rd party entities. The Company places generic interactive advertisements through our proprietary process and technologies, in numerous mediums, e.g. print, web, Skype and mobile. Revenue is recognized when the call is generated and transferred to one of the clients.

Consulting Division - This division operates under d/b/a Graystone Ventures. Graystone Ventures began operating in November 2010. This division is a strategic, financial and operational consulting entity, which allows clients to outsource aspects of their business. This division focuses primarily on early staged companies and public companies in the nano-cap and micro-cap but also assists growth and mature companies as well. This division provides services in the areas of marketing, sales and operations. Revenue is recognized when consulting services are provided to clients.

Real Estate Division - This division began operations in January 2011 and acquired its initial property on March 30, 2011. On March 30, 2011, the Company retained the services of a consultant to manage its properties and locate additional properties in the Fort Wayne, Indiana area. Revenue is recognized when management services are provided to clients.

Note 2 – Significant Accounting Policies (Continued)

Equity Warrants

The Company has issued warrants to purchase shares of its common stock in connection with convertible notes. In accordance with ASC 470-20, Debt with conversions and other options, the proceeds from the notes were allocated based on the relative fair values of the notes without the warrants issued in conjunction with the notes and of the warrants themselves at the time of issuance. The Company records the fair value of the warrants at the time of issuance as additional paid in capital and as a debt discount to the notes. The Company amortizes this debt discount as interest expense over the life of the note. Additionally, as a result of issuing the warrants with the convertible notes, a beneficial conversion option is recorded as a debt discount reflecting the incremental conversion option intrinsic value of the conversion option provided to the holders of the notes. Company also amortizes this debt discount as interest expense over the life of the notes. The intrinsic value of each conversion option was calculated as the difference between the effective conversion price and the fair value of the common stock, multiplied by the number of shares into which the note is convertible.

Stock-Based Compensation

The Company accounts for share-based payments, including grants of stock options to employees, consultants and non-employees; moreover, the Company issues warrants to the consultants and related parties. The Company is required to estimate the fair value of share-based awards and warrants on the date of grant. The value of the award is principally recognized as expense ratably over the requisite service periods. The Company has estimated the fair value of stock options and warrants as of the date of grant or assumption using the Black-Scholes option pricing model, which was developed for use in estimating the value of traded options that have no vesting restrictions and that are freely transferable. The Black-Scholes model requires the input of certain assumptions. Changes in the assumptions used in Black-Scholes model can materially affect the fair value estimates. The Company evaluates the assumptions used to value stock options on an annual basis. The expected term of stock options represents the weighted average period the stock options are expected to remain outstanding.

The expected term is based on the observed and expected time to exercise and post-vesting cancellations of options by employees. Upon the adoption of the accounting guidance, the Company continued to use historical volatility in deriving its expected volatility assumption as allowed under GAAP because it believes that future volatility over the expected term of the stock options is not likely to differ materially from the past. The risk-free interest rate assumption is based on 5-year U.S Treasury zero-coupon rates appropriate for the expected term of the stock options. The expected dividend assumption is based on the history and expectation of dividend payouts. The fair values generated by the Black-Scholes model may not be indicative of the actual fair values of the equity awards, as the Company does not consider other factors important to those awards to employees, such as continued employment, periodic vesting requirements and limited transferability.

Litigation and Settlement Costs

Legal costs are expensed as incurred. The Company records a charge equal to at least the minimum estimated liability for a loss contingency when both of the following conditions are met: (i) information available prior to issuance of the financial statements indicates that it is probable that an asset had been impaired or a liability had been incurred at the date of the financial statements and (ii) accrue the best estimate within a range of loss if there is a loss or, when there is no amount within a range that forms a better estimate, the Company will accrue the minimum amount in the range. The Company is not presently involved in any legal proceedings, litigation or other legal actions

Research and Development Costs

Costs associated with the development of the Company’s products are charged to expense as incurred. $45,035 and $170,545 were incurred in the period ended June 30, 2012 and 2011, respectively.

Recently issued accounting standards

In September 2011, the FASB issued ASU No. 2011-8, Intangibles—Goodwill and Other (Topic 350) - Testing Goodwill for Impairment, that provides guidance on testing goodwill for impairment. The new guidance provides an entity the option to first perform a qualitative assessment to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If an entity determines that this is the case, it is required to perform the currently prescribed two-step goodwill impairment test to identify potential goodwill impairment and measure the amount of goodwill impairment loss to be recognized for that reporting unit (if any). If an entity determines that the fair value of a reporting unit is greater than its carrying amount, the two-step goodwill impairment test is not required. The new guidance will be effective for us beginning January 1, 2012.

In June 2011, the Financial Accounting Standards Board, or FASB, issued guidance regarding the presentation of comprehensive income. The new standard requires the presentation of comprehensive income, the components of net income and the components of other comprehensive income either in a single continuous statement of comprehensive incomer in two separate but consecutive statements. The updated guidance is effective on a retrospective basis for financial statements issued for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2011. We adopted the provisions of this guidance effective January 1, 2012, as reflected in the unaudited condensed consolidated statements of comprehensive income herein.

Note 3 – Other Intangible Assets

Other intangible assets: Consist of trade secrets and technology cost pending further validation. Estimated useful lives are 15 years.

The Company reviews the carrying values of long-lived assets whenever events and circumstances, such as reductions in demand, lower projections of profitability, significant changes in the manner of our use of acquired assets, or significant negative industry or economic trends, indicate that the net book value of an asset may not be recovered through expected undiscounted future cash flows from its use and eventual disposition. If this review indicates that there is impairment, the impaired asset is written down to its fair value, which is typically calculated using: (i) quoted market prices and/or (ii) discounted expected future cash flows. The Company estimates regarding future anticipated revenue and cash flows, the remaining economic life of the products and technologies, or both, may differ from those used to assess the recoverability of assets. In that event, impairment charges or shortened useful lives of certain long-lived assets may be required, resulting in a reduction in net income or an increase to net loss in the period when such determinations are made. As of June 30, 2012 there was no trigger event which caused the Company to impair the intangible assets.

| |

|

2012

|

|

|

2011

|

|

| |

|

|

|

|

|

|

Definite-lived intangibles

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

Definite-lived intangibles, net

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Total other intangible assets

|

|

|

|

|

|

|

|

|

Definite-lived intangibles approximate remaining weighted average useful life in years.

Note 4 – Common Stock

The Company is authorized to issue 700,000,000 shares of Class A Common Stock, Class A, with a par value of $0.0001. The Company's board of directors and majority of its Class A Common Stock holders approved a reverse split of 400:1 for all shares issued and outstanding as of March 27, 2012. The reverse split will be effective at May 14, 2012. Therefore, in the period ended June 30, 2012, the company issued a total of 76,174,556 Class A Common Stock shares.

|

Date

|

|

Category(in exchange for)

|

|

Shares issued(canceled)

|

|

|

5/14/2012

|

|

Reverse

|

|

|

(190,874,048 |

) |

|

5/14/2012

|

|

Services

|

|

|

64,100,000 |

|

|

5/31/2012

|

|

Services

|

|

|

200,000 |

|

|

6/5/2012

|

|

Cash/Services

|

|

|

3,000,000 |

|

|

6/11/2012

|

|

Convertible Notes

|

|

|

3,181,818 |

|

|

6/14/2012

|

|

Services

|

|

|

250,000 |

|

|

6/19/2012

|

|

Cash/Services

|

|

|

1,750,000 |

|

|

6/21/2012

|

|

Convertible Notes

|

|

|

3,214,286 |

|

| |

|

Subtotal

|

|

|

-115,177,944 |

|

| |

|

|

|

|

|

|

| |

|

Shares issued in the beginning balance

|

|

|

191,352,500 |

|

| |

|

Total Class A Common Stock Shares Issued in first Quarter 2012

|

|

|

-115,177,944 |

|

| |

|

Shares issued as of June 30, 2012

|

|

|

76,174,556 |

|

The Company is authorized to issue 5,000,000 shares of Class B Common Stock, Par Value with a par value of $0.001. The Class B shares do not have the right to convert into Series A. Additionally , the Series B votes with the Common A shareholders, unless prohibited by law, and have voting rights equal to 100 votes for each share of Class B Common Stock. In the period ended June 30, 2012, the company issued a total of 3,600,000 Class B Common Stock shares.

Note 5 – Dividends

The Company did not declare or issue any dividends in the quarter ending June 30, 2012.

Note 6 – Commitments and legal proceedings

Legal Proceedings

The Company is not presently involved in any legal proceedings and was not involved in any such legal proceedings during the year ended June 30, 2012.

Indemnification

Under the indemnification provisions of the Company’s customer agreements, the Company agrees to indemnify and defend its customers against infringement of any patent, trademark, or copyright of any country or the misappropriation of any trade secret, arising from the customers’ legal use of the Company’s services. Exposure to the Company under these indemnification provisions is generally limited to the total amount paid by the customers under pertinent agreements. However, certain indemnification provisions potentially expose the Company to losses in excess of the aggregate amount received from the customer. To date, there have been no claims against the Company or its customers pertaining to such indemnification provisions and no amounts have been recorded

Note 7 – Fair Value Measurements

Determination of fair value

Cash equivalents are classified within Level 1 of the fair value hierarchy because they are valued using quoted market prices.

Assets Measured at Fair Value on a Recurring Basis

As of June 30, 2012, none of the Company’s cash balances were invested in financial instruments. The following table presents the Company’s financial assets and liabilities that are measured at fair value on a recurring basis which were comprised of the following types of instruments as of June 30, 2012:

|

As of June 30, 2012

|

|

|

|

|

|

|

|

|

|

|

| |

Fair Value

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

Cash and cash equivalents:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

46,018 |

|

|

$ |

46,018 |

|

|

|

- |

|

|

|

- |

|

(1) Included in Cash and cash equivalents on the Company’s Condensed Consolidated Balance Sheets.

|

Cash equivalents are classified within Level 1 of the fair value hierarchy because they are valued using quoted market prices. The types of instruments valued based on quoted market prices in active markets include money market securities. The Company reviewed its financial and non-financial assets and liabilities for the year ended June 30, 2012 and concluded that there were no material impairment charges during each of these periods.

Note 8 – Convertible Notes Payable

Graystone Convertible Notes:

On November 29, 2011 the Company received a note in the amount of $42,500 from Asher Enterprises, Inc. The note bears a simple interest of 8% per annum from the date hereof (the “Issue Date”) until it becomes due and payable, whether at maturity date on September 5, 2012. The note is convertible into shares of Class A Common Stock, $0.0001 par value per share. As of June 30, 2012, the Company accrued $2,589 interest on the unsecured convertible loan.

On January 10, 2012 the Company received a note in the amount of $32,500 from Asher Enterprises, Inc. The note bears a simple interest of 8% per annum from the date hereof (the “Issue Date”) until it becomes due and payable, whether at maturity date on October 12, 2012. The note is convertible into shares of Class A Common Stock, $0.0001 par value per share. As of June 30, 2012, the Company accrued $1,592 interest on the unsecured convertible loan.

On February 28, 2012 the Company received a note in the amount of $32,500 from Asher Enterprises, Inc. The note bears a simple interest of 8% per annum from the date hereof (the “Issue Date”) until it becomes due and payable, whether at maturity date on November 30, 2012. The note is convertible into shares of Class A Common Stock, $0.0001 par value per share. As of June 30, 2012, the Company accrued $1,159 interest on the unsecured convertible loan.

On April 26, 2012 the Company received a note in the amount of $47,500 from Asher Enterprises, Inc. The note bears a simple interest of 8% per annum from the date hereof (the “Issue Date”) until it becomes due and payable, whether at maturity date on January 30, 2013. The note is convertible into shares of Class A Common Stock, $0.0001 par value per share. As of June 30, 2012, the Company accrued $885 interest on the unsecured convertible loan.

On June 21, 2012 the Company received a note in the amount of $32,500 from Asher Enterprises, Inc. The note bears a simple interest of 8% per annum from the date hereof (the “Issue Date”) until it becomes due and payable, whether at maturity date on March 25, 2013. The note is convertible into shares of Class A Common Stock, $0.0001 par value per share. As of June 30, 2012, the Company accrued $85 interest on the unsecured convertible loan.

Conversion Rights:

At any time on or prior to the Maturity Date, at the option of the Company in its sole discretion, all or any portion of the then outstanding Principal Amount and accrued but unpaid interest of this Note may be converted (the “Optional Conversion”) into a number of shares of the Company’s common stock (the “Optional Conversion Shares”) equal to the amount of the then outstanding Principal Among plus the then accrued but unpaid interest to be converted, divided by the Conversion Price which shall be a percentage of the market price as of June 30, 2012.

|

|

|

|

|

| |

|

|

minus discount of beneficial conversion feature,

|

|

|

|

|

|

The Company recorded interest expense in the amounts of $45,653 and $72,669 for the three months and six months ended June 30, 2012 and, respectively in connection with the five convertible notes from Asher Enterprises, Inc.

Note 9 – Segment Information

The Company has four (4) business segments: mining, paypercallexchange.com, consulting and real estate. The Company is currently winding down all of its operations in paypercallexchange.com, consulting and real estate and focusing its energy to its mining operations. The Company’s chief operating decision-maker is its Chief Executive Officer. The Company’s Chief Executive Officer reviews financial information presented on a consolidated basis for purposes of evaluating financial performance and allocating resources, accompanied by information about revenue by geographic regions. The Company’s assets are primarily located in the United States of America and Peru and not allocated to any specific region and it does not measure the performance of its geographic regions based upon asset-based metrics. Therefore, geographic information is presented only for revenue. Revenue by geographic region is based on the ship to address on the customer order

The following present total revenue by geographic region for the three period ended June 30, 2012.

|

Revenues:

|

|

|

|

| |

|

|

|

|

December 31,

2011

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The decrease in US Sales is attributable to the fact that Company is winding down its operations related to paypercallexchange.com, real estate division and consulting division and redeploying those assets to it mining operations.

The following present total cost of goods sold by geographic region for the three periods ended June 30, 2012.

| Sales by category |

|

|

|

| |

|

Three Months Ending June 30,

|

|

| |

|

2012

|

|

|

2011

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note 10 – Subsequent Events

The Company has evaluated events and transactions subsequent to June 30, 2012 to the date of issuance in accordance with ASC 855 “Subsequent Event”. We have had the following material subsequent event.

In July 2012, the Company closed on a Securities Purchase Agreement (“Purchase Agreement”) with Asher Enterprises, Inc., a Delaware corporation (“Asher”), relating to the issuance and sale to Asher of an unsecured convertible promissory note (the “Note”) in a private transaction (the “Transaction”) with a principal amount of $32,500. The Company received net proceeds of $30,000 from the Transaction, which will be used as general working capital. The Purchase Agreement includes customary representations, warranties and covenants. In connection with the Transaction, the Company issued Asher the Note. Interest on the Note accrues at a rate of 8% annually.The principal amount of the Note together with interest may be converted into shares of the Company's common stock, par value $0.0001 (“Common Stock”), at the option of the Asher at a conversion price equal to fifty-five percent (55%) of the Market Price (as defined in the Note) for the Common Stock during the ten trading days prior to the conversion.

On July, 5, 2012, the Company agreed to acquire the rights to 100 oil and gas leases from Avenill Ventures, LLC for $700,000. Avenhill is beneficially owned by Paul Howarth and Joseph Mezey, our officers and directors. The Company agreed to issue to $100,000 in Company stock at the closing market price on July 5, 2012 which was $0.002. As such on July 9, 2012.the Company issued 25,000,000 shares of its Class A Common Stock to Renard Properties, LLC (which is beneficially owned by Paul Howarth) and 25,000,000 shares of its Class A Common Stock to JW Group, Inc. (which is beneficially owned by Joseph Mezey). The remaining $600,000 is owed as a note in the amounts of: $200,000 Renard Properties, LLC, $200,000 to JW Group, Inc. and $200,000 to an unrelated 3rd party.

On July, 5, 2012, the Company agreed to acquire the rights to 100 oil and gas leases from Avenill Ventures, LLC for $700,000. Avenhill is beneficially owned by Paul Howarth and Joseph Mezey, our officers and directors. The

Company agreed to issue to $100,000 in Company stock at the closing market price on July 5, 2012 which was $0.002. As such on July 9, 2012.the Company issued 25,000,000 shares of its Class A Common Stock to Renard Properties, LLC (which is beneficially owned by Paul Howarth) and 25,000,000 shares of its Class A Common Stock to JW Group, Inc. (which is beneficially owned by Joseph Mezey). The remaining $600,000 is owed as a note in the amounts of: $200,000 Renard Properties, LLC, $200,000 to JW Group, Inc. and $200,000 to an unrelated 3rd party.

On July, 6, 2012, the Company issued 3,235,294 shares of Class A Common stock at an applicable conversion price of $0.00068. Asher Enterprises converted $2,200 of its note convertible in the amount of $42,500. As a result, the Company issued 3,235,294 shares of its Class A Common Stock to Asher Enterprises, Inc. The agreement with Asher allows them to convert their debt after six (6) months at a conversion price equal to the lowest closing bid price twenty trading days prior to the conversion date.

On July 19, 2012, the Company issued 3,235,294 shares of Class A Common stock at an applicable conversion price of $0.00068. Asher Enterprises converted $2,200 of its note convertible in the amount of $42,500. As a result, the Company issued 3,235,294 shares of its Class A Common Stock to Asher Enterprises, Inc. The agreement with Asher allows them to convert their debt after six (6) months at a conversion price equal to the lowest closing bid price twenty trading days prior to the conversion date.

On July 25, 2012, the Company issued 3,235,294 shares of Class A Common stock at an applicable conversion price of $0.00068. Asher Enterprises converted $2,200 of its note convertible in the amount of $42,500. As a result, the Company issued 3,235,294 shares of its Class A Common Stock to Asher Enterprises, Inc. The agreement with Asher allows them to convert their debt after six (6) months at a conversion price equal to the lowest closing bid price twenty trading days prior to the conversion date.

On August 1 2012, the Company issued 3,235,294 shares of Class A Common stock at an applicable conversion price of $0.00068. Asher Enterprises converted $2,200 of its note convertible in the amount of $42,500. As a result, the Company issued 3,235,294 shares of its Class A Common Stock to Asher Enterprises, Inc. The agreement with Asher allows them to convert their debt after six (6) months at a conversion price equal to the lowest closing bid price twenty trading days prior to the conversion date.

On August 7, 2012, the Company issued 3,263,158 shares of Class A Common stock at an applicable conversion price of $0.00068. Asher Enterprises converted $2,200 of its note convertible in the amount of $42,500. As a result, the Company issued 3,235,294 shares of its Class A Common Stock to Asher Enterprises, Inc. The agreement with Asher allows them to convert their debt after six (6) months at a conversion price equal to the lowest closing bid price twenty trading days prior to the conversion date.

Note 10 – Subsequent Events (Continued)

On August 9, 2012, the Company issued 3,000,000 shares of Class A Common stock to Renard Properties, LLC at a price of $.0049. The shares issued are restricted under Rule 144. Renard Properties is beneficially owned by Paul Howarth our CEO.

On August 9, 2012, the Company issued 3,000,000 shares of Class A Common stock to JW Group, Inc. at a price of $.0049. The shares issued are restricted under Rule 144. JW Group is beneficially owned by Joseph Mezey our CFO.

On August 10, 2012, the Company issued 2,000,000 shares of Class A Common stock to Renard Properties, LLC at a price of $.01. The shares issued are restricted under Rule 144. Renard Properties is beneficially owned by Paul Howarth our CEO.

On August 10, 2012, the Company issued 2,000,000 shares of Class A Common stock to JW Group, Inc. at a price of $.01. The shares issued are restricted under Rule 144. JW Group is beneficially owned by Joseph Mezey our CFO.

On August 14, 2012, the Company issued 1,000,000 shares of Class A Common stock to Renard Properties, LLC at a price of $.0195. The shares issued are restricted under Rule 144. Renard Properties is beneficially owned by Paul Howarth our CEO.

On August 14, 2012, the Company issued 1,000,000 shares of Class A Common stock to JW Group, Inc. at a price of $.0195. The shares issued are restricted under Rule 144. JW Group is beneficially owned by Joseph Mezey our CFO.

On August 20, 2012, The Company’s officers, Paul Howarth and Joseph Mezey, agreed to purchase on behalf of the company a sluice box. The officers agreed to pay the $150,000 for the equipment in exchange for the shares purchase on August 9-14, 2012 and a promissory note for the remaining amount.

On August 20, 2012, the Company closed on a Securities Purchase Agreement (“Purchase Agreement”) with Asher Enterprises, Inc., a Delaware corporation (“Asher”), relating to the issuance and sale to Asher of an unsecured convertible promissory note (the “Note”) in a private transaction (the “Transaction”) with a principal amount of $32,500. The Company received net proceeds of $30,000 from the Transaction

On August 19, 2012, the Company renewed its lease on the corporate apartment in Lima, Peru.

On August 20, 2012, Paul Howarth, Graystone Company’s CEO, applied for the equivalent of a green card in Peru.

ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

This Form 10-Q may contain certain “forward-looking” statements as such term is defined in the private securities litigation reform act of 1995 and by the securities and exchange commission in its rules, regulations and releases, which represent the Company’s expectations or beliefs, including but not limited to, statements concerning the Company’s operations, economic performance, financial condition, growth and acquisition strategies, investments, and future operational plans. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may”, “will”, “expect”, “believe”, “anticipate”, “intent”, “could”, “estimate”, “might”, “Plan”, “predict” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, certain of which are beyond the Company’s control, and actual results may differ materially depending on a variety of important factors, including uncertainty related to acquisitions, governmental regulation, managing and maintaining growth, the operations of the company and its subsidiaries, volatility of stock price and any other factors discussed in this and other registrant filings with the securities and exchange commission. The company does not intend to undertake to update the information in this Form 10-Q if any forward-looking statement later turns out to be inaccurate.

The following discussion summarizes the results of our operations for the three month period ended March 31, 2012, and compares those results to the three months ended March 31, 2011. It also analyzes our financial condition at December 31, 2011. This discussion should be read in conjunction with the Management’s Discussion and Analysis, including the audited financial statements for the years ended December 31, 2011 and 2010 and Notes to the financial statements, in our Form 10-K for our fiscal year ended December 31, 2011.

Going Concern

Our financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has generated modest revenues since inception and has never paid any dividends and is unlikely to pay dividends. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations and to determine the existence, discovery and successful exploration of economically recoverable reserves in its resource properties, confirmation of the Company’s interests in the underlying properties, and the attainment of profitable operations. The Company has had very little operating history to date. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Overview

During our current Three Months Ended March 31, 2012, we generated sales of $15,101 and incurred a net loss of $401,275. We have received no substantial revenue ($2,203) from the production of gold or other metals, and historically relied on our other divisions and equity and debt financings to finance our ongoing operations. Our operations generated a net loss of $381,315 from for the Three Months Ending 31, 2012. In order to fund operations, we relied on proceeds received under the private placement sale in secured convertible debentures aggregating $65,000 from Asher Enterprises, and proceeds received from notes payable of $12,392 from our shareholders.

Corporate Background and Our Business

The Graystone Company, Inc. (“Graystone”, “we”, “us”, “our”, the "Company" or the "Registrant") was originally incorporated in the State of New York on May 27, 2010 under the name of Argentum Capital, Inc. Graystone was reincorporated in Delaware on January 10, 2011 and subsequently changed our name to The Graystone Company, Inc on January 14, 2011. Graystone is domiciled in the state of Delaware, and its corporate headquarters are located in Lima, Peru and maintains it US executive office in Las Vegas, Nevada for mailing purposes. The Company selected December 31 as its fiscal year end.

The Graystone Company, Inc. is a holding company whose primary operating activities involve acquiring and developing mining properties amenable to low cost production. In January 2012, the Company launched a new division that sells gold, silver and other precious metals to retail buyers. The Company also operates other divisions that include a marketing division, real estate division, and consulting division. Information about the Company, including a link to our most recent financial reports filed with the Securities and Exchange Commission (“SEC”), can be viewed on our website at www.graystone1.com.

Natural Resources Division. This division began operating in January 2011 and operates through the Company’s wholly owned subsidiary Graystone Mining, Inc., a Nevada Company. This Division is engaged in the business of acquiring gold, silver, precious metal and gems and other mineral properties with proven and/or probable reserves. The Company has currently begun mining operations in Peru.

Graystone Mining focuses on acquiring properties that require a lower capital investment to begin mining operations. This approach may reduce the size of the deposits that the Company can acquire. However, by generating revenue from smaller mining ventures, the Company can build a solid foundation and the needed infrastructure to undertake larger and more costly ventures, such as hard rock projects. Thereby the Company is focusing initially on alluvial mining (surface mining) projects, the Company can begin generating a positive cash flow for a smaller capital investment. As such, the Company does not engage in general exploration activities. Exploration involves the prospecting, sampling, mapping, drilling and other work involved in searching for ore on properties. Exploration is time consuming and costly as it requires an evaluation of the land's geology, analyst of the geochemistry of soil sediment and water, and drilling of numerous test holes and testing these for the presence of minerals. The Company instead focuses on acquiring or entering into joint ventures with entities that have already found, through exploration, proven or probable mineral ore reserves. This allows the Company to focus its attention on processing mineral resources instead of having to also have exploration activities to locate new sites that may have mineral ore deposits.

The Company currently owns the mining rights to 1,900 hectares. The Company is currently in the process of having the claims put in the name of the Company's subsidiary Grupo Minero Inca. One hectares equals 2.47 acres. The Company expects to acquire 10,000 hectares by the end of 2012. The Company anticipates that its cost of acquiring properties with proven or probable reserves will cost between 20% and 25% of the total amount that is extracted from these properties. Additionally, the acquisition cost of the machinery needed to perform the extraction is expected to be between $50,000 and $500,000. The staffing costs related to the extraction of the mineral ore will be between 25% and 30% of the total amount that is extracted from these sites. Thereby, the Company anticipates the cost of property and equipment acquisition and the labor and mining operations related to extracting gold on its properties to be approximately 55% of the gross value of the gold extracted from its properties.

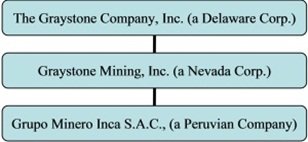

During 2011, the Company acquired Grupo Minero Inca S.A.C., a Peruvian Company (“GMI”). GMI is a wholly owned subsidiary of the Company. GMI provides the Company a local Peruvian entity. Acting through GMI, the Company can acquire concessions in its own name and directly hire employees and staff in Peru instead of using third parties for these purposes. The Company coordinates all of its activities in Peru through GMI. The corporate structure of this division is as follows:

Additionally, GMI provides the gold extraction services and the overall management for the Companies properties. GMI will be responsible for the day to day operations of the mining sites while Graystone will be responsible for financing the acquisition of the mining properties, the equipment necessary to extract the ore and building the camps for the workers.

Marketing Division. This division operates under d/b/a paypercallexchange.com. This division began operating in July 2010. The division serves as an advertising and customer acquisition firm for 3rd party entities. The Company places generic interactive advertisements, through our proprietary process and technologies, in numerous mediums, e.g. print, web, skype and mobile. These generic advertisements are placed for different services and products, e.g. cable & satellite services, mortgage refinancing, credit repair, travel agent services, auto insurance, substance abuse rehabilitation, 24-hour locksmith, website development, cosmetic surgery, timeshares, cruises and legal services. Each of these advertisements have a unique phone number for individuals interested in the products or services to call for more information. When an individual calls that specific phone number, the call is automatically forward to one of our clients, which we refer to as a lead. The software tracks the time and date of the phone call, the duration of the phone call, the caller id, city and state of the caller, repeat calls from the same number, the number the call was transferred to and the advertisement that generated the call. The Company charges its clients for each call that is transferred to them in which the duration is over an agreed upon length (usually 15 seconds).

Our proprietary process and software includes the knowledge of how to generate the maximum number of calls at the lowest cost possible, the type of advertisements placed, the days and hours of such advertisement placement, the medium such advertisements should be placed, the ability to track the advertisement's efficiency and to track the results of each advertisement placed. Through the use of these proprietary methods, the company provides lead sources to our clients at competitive pricing. The Company generated 18,234 leads/calls during the fiscal year of 2011.

The Company expects to wind this division down during the fiscal year 2012. By winding down the division the Company can redeploy its assets to its main business of mining.

Consulting Division. The company discontinued operating the consulting division and redeployed its assets to the natural resources division.

Real Estate Division. The company has ceased operating this division. The company sold its sole property and has redeployed its assets to the natural resources division.

Going Concern

Our financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has generated modest revenues since inception and has never paid any dividends and is unlikely to pay dividends. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations and to determine the existence, discovery and successful exploration of economically recoverable reserves in its resource properties, confirmation of the Company’s interests in the underlying properties, and the attainment of profitable operations. The Company has had very little operating history to date. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. These factors raise substantial doubt regarding the ability of the Company to continue as a going concern.

We have experienced recurring net losses from operations which losses have caused an accumulated deficit of ($2,575,172) as of March 31, 2012. We had net losses of ($410,275) for the period ended March 31, 2012. These factors, among others, raise substantial doubt about our ability to continue as a going concern. If we are unable to generate profits and are unable to continue to obtain financing to meet our working capital requirements, we may have to curtail our business sharply or cease operations altogether. Our continuation as a going concern is dependent upon our ability to generate sufficient cash flow to meet our obligations on a timely basis to retain our current financing, to obtain additional financing, and, ultimately, to attain profitability. Should any of these events not occur, we will be adversely affected and we may have to cease operations.

The ongoing execution of our business plan is expected to result in operating losses over the next twelve months. Management believes it will need to raise capital through stock issuances in order to have enough cash to maintain its operations for the next twelve months. There are no assurances that we will be successful in achieving our goals of obtaining cash through stock issuances or increasing revenues and reaching profitability.

In view of these conditions, our ability to continue as a going concern is dependent upon our ability to meet our financing requirements, and to ultimately achieve profitable operations. Management believes that its current and future plans provide an opportunity to continue as a going concern. The accompanying financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that may be necessary in the event we cannot continue as a going concern.

Office Facilities

The Company's operating offices are located in Lima, Peru through its subsidiary Grupo Mineral Inca. The Company uses its Las Vegas, NV address as it Executive Office address for US mailing purposes.

|

Corporate Entity

|

|

Address

|

The Graystone Company, Inc.

|

|

2620 Regatta Drive, Suite 102, Las Vegas, Nevada

|

|

|

|

2620 Regatta Drive, Suite 102, Las Vegas, Nevada

|

Grupo Mineral Inca, S.A.C..

|

|

Camino Real 348 Torre El Pilar, San Isidro, Lima, Peru

|

Mining Properties

The Company currently owns 1,900 hectares and is in the process of completing the transfer of these properties into the Company’s wholly owned subsidiary in Peru. The properties include the following projects:

|

Name

|

|

Area (hectares)

|

|

Dept

|

|

Province

|

|

District

|

|

Gorilla

|

|

|

400 |

|

Loreto

|

|

Datem del Maranon

|

|

Manseriche

|

|

Graystone II

|

|

|

800 |

|

Loreto

|

|

Datem del Maranon

|

|

Manseriche

|

|

Graystone III

|

|

|

700 |

|

Amazonas

|

|

Condorcanqui

|

|

Rio Santiago

|

Results of Operations

For the Six Months Ended June 30, 2012 and 2011, the Company generated the following revenue:

| |

|

Six Month Ended June 31,

|

|

| |

|

2012

|

|

|

2011

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Sic Months Ended June 30, 2012 and 2011, the Company generated the following expenses:

| |

|

Six Month Ended June 30 31,

|

|

| |

|

2012

|

|

|

2011

|

|

| |

|

|

|

|

|

|

General and Administrative

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

The Company's research and development expenses are related to the Company's mining activities in Peru and include exploration on the Company's mining properties.

Liquidity and Capital Resources

The following is a summary of our balance sheet for the Six Months Ended June 30, 2012 and 2011:

| |

Six Months Ended June 30,

|

| |

2012

|

|

| |

|

|

|

|

|

$ |

46,018 |

|

|

|

|

|

21,930 |

|

|

|

|

|

57,013 |

|

| |

|

|

|

|

|

|

|

|

(121,087 |

) |

In the opinion of management, available funds will not satisfy our growth requirements for the next twelve months. The Company expects that its current revenue will allow us to satisfy our current operations and our reporting requirement for the next twelve months. However, if our revenue decreases we may not able to support our current operations and reporting obligations without obtaining additional funds. We believe our currently available capital resources will allows us to begin operations within our natural resource division and maintain its operation over the course of the next 12 months; however, our other expansion plans would be put on hold until we could raise sufficient capital. The Company expects that it needs to raise between $200,000 and $500,000 to acquire the necessary equipment to begin full mining operations in Peru. We cannot guaranty that we will be able to raise additional funds. Moreover, in the event that we can raise additional funds, we cannot guaranty that additional funding will be available on favorable terms.

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive exploration activities. For these reasons our auditors stated in their report that they have substantial doubt we will be able to continue as a going concern.

Accounting and Audit Plan

We expect are audit fees to be approximately $10,000 for the 10-K and $1,500 - $5,000 to review our 10-Q. In the next twelve months, we anticipate spending approximately $30,000 to pay for our accounting and audit requirements.

Off-balance sheet arrangements