graystone10q093011.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

|

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended September 30, 2011

or

|

|

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to .

Commission File Number: 000-54254

The Graystone Company, Inc.

(Exact name of registrant as specified in its charter)

|

DELAWARE

(State of Incorporation)

|

|

27-3051592

(I.R.S. Employer Identification No.)

|

| |

|

|

|

2620 Regatta Drive, Ste 102

Las Vegas, NV

(Address of principal executive offices)

|

|

89128

(Zip Code)

|

(702) 438-4100

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

|

Non-accelerated filer o

|

|

Accelerated filer o

|

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

Title of Each Class

|

|

Outstanding as of November 3, 2011

|

|

Class A Common stock, par value $0.0001 per share

Class B Common stock, par value $0.001 per share

|

|

186,050,000

1,400,000

|

THE GRAYSTONE COMPANY, INC.

FORM 10-Q

Septmeber 30, 2011

PART I-- FINANCIAL INFORMATION

|

Item 1.

|

|

3

|

|

Item 2.

|

|

12

|

|

Item 3.

|

|

18 |

|

Item 4T.

|

|

18 |

PART II-- OTHER INFORMATION

|

Item 1

|

|

19

|

|

Item 1A

|

|

19

|

|

Item 2.

|

|

19

|

|

Item 3.

|

|

19

|

|

Item 4.

|

|

19

|

|

Item 5.

|

|

20

|

|

Item 6.

|

|

20

|

Item 1. Financial Statements

THE GRAYSTONE COMPANY, INC.

CONDENSED AND CONSOLIDATED BALANCE SHEET

| |

|

Sep. 30, 2011

|

|

|

Dec. 31, 2010

|

|

| |

|

(Unaudited) |

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash or cash equivalents

|

|

$ |

623 |

|

|

$ |

5,522 |

|

|

Accounts receivable

|

|

|

18,268 |

|

|

|

11,644 |

|

|

Total current assets

|

|

|

18,891 |

|

|

|

17,166 |

|

| |

|

|

|

|

|

|

|

|

|

Fixed Assets

|

|

|

70,742 |

|

|

|

0 |

|

|

Long term securities

|

|

|

1,725,000 |

|

|

|

25,000 |

|

|

Acquired intangible assets

|

|

|

15,000 |

|

|

|

15,000 |

|

|

Total assets

|

|

$ |

1,829,633 |

|

|

$ |

57,166 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDER EQUITY

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts Payable

|

|

$ |

9,374 |

|

|

$ |

0 |

|

|

Note Payable for real estate

|

|

|

15,000 |

|

|

|

0 |

|

|

Current portion of long term liability

|

|

|

9,653 |

|

|

|

0 |

|

|

Accrued Tax Liability

|

|

|

607 |

|

|

|

2,815 |

|

|

Total current liabilities

|

|

|

34,634 |

|

|

|

2,815 |

|

| |

|

|

|

|

|

|

|

|

|

Long term liabilities:

|

|

|

|

|

|

|

|

|

|

Note payable to related party

|

|

|

75,976 |

|

|

|

0 |

|

|

Mine Acquisition Note Payable

|

|

|

181,007 |

|

|

|

0 |

|

|

Total long liabilities

|

|

|

256,983 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

$ |

291,617 |

|

|

$ |

2,815 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholder equity:

|

|

|

|

|

|

|

|

|

|

Class A Common Stock, Par Value $.0001 101,485,000 and 46,000,000 Issued and Outstanding, respectively

|

|

$ |

10,149 |

|

|

$ |

4,600 |

|

|

Additional Paid In Capital

|

|

|

2,183,976 |

|

|

|

10,500 |

|

|

Total Class A Common Stock

|

|

|

2,194,125 |

|

|

|

15,100 |

|

| |

|

|

|

|

|

|

|

|

|

Class B Common Stock, Par Value $.001 700,000 and 0 Issued and Outstanding, respectively

|

|

|

700 |

|

|

|

0 |

|

|

Additional Paid In Capital

|

|

|

13,300 |

|

|

|

0 |

|

|

Total Class B Common Stock

|

|

|

14,000 |

|

|

|

0 |

|

|

Dividend paid

|

|

|

(36,275 |

) |

|

|

(6,275 |

) |

|

Retained earning

|

|

|

45,526 |

|

|

|

45,526 |

|

|

Treasury Stock

|

|

|

0 |

|

|

|

0 |

|

|

Net income

|

|

|

(679,360 |

) |

|

|

0 |

|

|

Total shareholders' equity

|

|

|

1,538,016 |

|

|

|

54,351 |

|

|

Total liabilities and shareholders' equity

|

|

$ |

1,829,633 |

|

|

$ |

57,166 |

|

See accompanying notes to the financial statements

THE GRAYSTONE COMPANY, INC.

CONDENSED CONSOLIDATED

STATEMENT OF OPERATIONS

| |

|

3 Months Ended

|

|

|

9 Months Ended

|

|

| |

|

Sep. 30, 2011

|

|

|

Sep. 30, 2010

|

|

|

Sep. 30, 2011

|

|

|

Sep. 30, 2010

|

|

| |

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing Division

|

|

$ |

25,838 |

|

|

$ |

16,148 |

|

|

$ |

101,295 |

|

|

$ |

16,148 |

|

|

Mining Division (Gold Sales)

|

|

|

0 |

|

|

|

0 |

|

|

|

4,990 |

|

|

|

0 |

|

|

Consulting Division

|

|

|

5,300 |

|

|

|

0 |

|

|

|

5,800 |

|

|

|

0 |

|

|

Real Estate Division

|

|

|

450 |

|

|

|

0 |

|

|

|

1,640 |

|

|

|

0 |

|

|

Total Income

|

|

|

31,588 |

|

|

|

16,148 |

|

|

|

113,725 |

|

|

|

16,148 |

|

|

Refunds/Discount

|

|

|

(165 |

) |

|

|

(1,615 |

) |

|

|

(1,093 |

) |

|

|

(1,615 |

) |

|

Net Income

|

|

|

31,423 |

|

|

|

14,533 |

|

|

|

112,631 |

|

|

|

14,533 |

|

|

Cost of Goods Sold

|

|

|

12,255 |

|

|

|

2,354 |

|

|

|

42,334 |

|

|

|

2,354 |

|

|

Gross Profit

|

|

|

19,168 |

|

|

|

12,179 |

|

|

|

70,298 |

|

|

|

12,179 |

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mining Operations

|

|

|

23,362 |

|

|

|

0 |

|

|

|

182,945 |

|

|

|

0 |

|

|

G&A

|

|

|

31,169 |

|

|

|

250 |

|

|

|

79,555 |

|

|

|

250 |

|

|

Compensation

|

|

|

237,500 |

|

|

|

0 |

|

|

|

487,000 |

|

|

|

0 |

|

|

Total Operating Expenses

|

|

|

292,031 |

|

|

|

250 |

|

|

|

749,500 |

|

|

|

250 |

|

|

Operating Income

|

|

|

(272,863 |

) |

|

|

11,929 |

|

|

|

(679,202 |

) |

|

|

11,929 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

0 |

|

|

|

0 |

|

|

|

100 |

|

|

|

0 |

|

|

Total other income

|

|

|

0 |

|

|

|

0 |

|

|

|

100 |

|

|

|

0 |

|

|

Other expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

229 |

|

|

|

0 |

|

|

|

258 |

|

|

|

0 |

|

|

Total other expenses

|

|

|

229 |

|

|

|

0 |

|

|

|

258 |

|

|

|

0 |

|

|

Net Other Income

|

|

|

(229 |

) |

|

|

0 |

|

|

|

(158 |

) |

|

|

0 |

|

|

Provisions for Income Tax

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

Net Income

|

|

|

(273,092 |

) |

|

|

11,929 |

|

|

|

(679,360 |

) |

|

|

11,929 |

|

|

Earnings Per Share, Basic

|

|

$ |

(0.003 |

) |

|

$ |

0.001 |

|

|

$ |

(0.007 |

) |

|

$ |

0.001 |

|

|

Earnings Per Share, Diluted

|

|

$ |

(0.003 |

) |

|

$ |

|

|

|

$ |

(0.007 |

) |

|

$ |

|

|

See accompanying notes to the financial statements.

THE GRAYSTONE COMPANY, INC.

STATEMENT OF CASH FLOWS

| |

|

9 Months Ended

|

|

| |

|

Sep. 30, 2011

|

|

|

Sep. 30, 2010

|

|

| |

|

(Unaudited)

|

|

|

(Unaudited)

|

|

| |

|

|

|

|

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

Net Income

|

|

$ |

(679,360 |

) |

|

$ |

11,929 |

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Accounts Receivable

|

|

|

(6,624 |

) |

|

|

(6,922 |

) |

|

Accounts Payable

|

|

|

9,374 |

|

|

|

0 |

|

|

Prepaid rent

|

|

|

0 |

|

|

|

0 |

|

|

Accrued Income Taxes

|

|

|

(2,208 |

) |

|

|

0 |

|

|

Note payable for real estate

|

|

|

15,000 |

|

|

|

0 |

|

|

Current portion of long term liability

|

|

|

9,653 |

|

|

|

0 |

|

|

Stock received for services

|

|

|

0 |

|

|

|

0 |

|

|

Net cash provided (used) by operating activities

|

|

|

(654,165 |

) |

|

|

5,007 |

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

|

|

Intangible Assets

|

|

|

0 |

|

|

|

(15,000 |

) |

|

Boat (Peru)

|

|

|

(11,800 |

) |

|

|

0 |

|

|

Mining Properties

|

|

|

(44,000 |

) |

|

|

0 |

|

|

Real estate owned

|

|

|

(14,942 |

) |

|

|

0 |

|

|

Minority interest of entity

|

|

|

(1,700,000 |

) |

|

|

0 |

|

|

Net cash provided by investing activities

|

|

|

(1,770,742 |

) |

|

|

(15,000 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

|

|

Notes payable

|

|

|

181,007 |

|

|

|

0 |

|

|

Notes payable (related party)

|

|

|

75,976 |

|

|

|

0 |

|

|

Common Stock Issued , cash and services

|

|

|

2,193,025 |

|

|

|

15,100 |

|

|

Treasury Stock

|

|

|

0 |

|

|

|

0 |

|

|

Dividends Paid

|

|

|

(30,000 |

) |

|

|

0 |

|

|

Net cash provided by financing activities

|

|

|

2,420,008 |

|

|

|

15,100 |

|

| |

|

|

|

|

|

|

|

|

|

Cash balance, beginning of periods

|

|

|

5,522 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

Cash balance, end of periods

|

|

$ |

623 |

|

|

$ |

5,107 |

|

| |

|

|

|

|

|

|

|

|

|

Supplementary information:

|

|

|

|

|

|

|

|

|

|

Cash paid for:

|

|

|

|

|

|

|

|

|

|

Interest

|

|

|

-- |

|

|

|

-- |

|

|

Accrued income taxes

|

|

|

-- |

|

|

|

-- |

|

See accompanying notes to the financial statements

THE GRAYSTONE COMPANY, INC.

CONDENSED NOTES TO FINANCIAL STATEMENTS

AS OF September 30, 2011

(UNAUDITED)

Note 1 – Nature of Operations

The Graystone Company, Inc. (“Graystone”, “we”, “us”, “our”, the "Company" or the "Registrant") was originally incorporated in the State of New York on May 27, 2010 under the name of Argentum Capital, Inc. Graystone was reincorporated in Delaware on January 10, 2011 and subsequently to The Graystone Company, Inc on January 14, 2011. Graystone is domiciled in the state of Delaware, and its corporate headquarters are located in Las Vegas, Nevada. The Company selected December 31 as its fiscal year end.

Going Concern

The accompanying financial statements have been prepared on a basis which assumes that the Company will continue as a going concern and which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. Management feels the limited history of the Company and its future cash needs to implement its business plan raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Management's plans with respect to alleviating the adverse financial conditions that caused shareholders to express substantial doubt about the Company’s ability to continue as a going concern are as follows:

The Company’s current assets are not deemed to be sufficient to fund ongoing expenses related to the planned expansion of operations. In order to implement its entire business plan, the Company will need to raise additional capital through equity or debt financings or through loans from shareholders or others. The ability of the Company to continue as a going concern is dependent upon its ability to successfully raise additional capital and eventually attain profitable operations. There can be no assurance that the Company will be able to raise additional capital or execute its business strategy.

Note 2 – Significant Accounting Policies

Basis of Presentation

The accompanying condensed consolidated financial statements have been prepared by in accordance with accounting principles general accepted in the United States of America.

Principles of Consolidation

The condensed consolidated financial statements of the Company include majority and wholly-owned subsidiaries under its control. All of the material intercompany balances and transactions have been eliminated.

Unaudited interim financial information

The accompanying interim condensed consolidated financial statements and related notes of the Company for the nine months ended September 30, 2011, are unaudited. The unaudited interim condensed consolidated financial information has been prepared with the rules and regulations of the United States Securities and Exchange Commission (“SEC”) for interim financial information. Accordingly, they do not include all of the information and footnote required by GAAP for complete financial statements. These financial statements should be read in conjunction with the audited consolidated financial statements and the accompanying notes for the year ended December 31, 2010 contained in the final prospectus filed by the Company with the SEC on March 23, 2011 related to the Company’s Registration Statement on Form S-1/A (File No. 333-171893). The unaudited interim condensed consolidated financial statements have been prepared on the same basis as the annual consolidated financial statements and in the opinion of management reflects all adjustments, consisting of normal recurring adjustments, necessary to present fairly the results of operations of the Company for the nine months ended September 30, 2011, the results of cash flows of the Company for the nine months ended September 31, 2011, and the financial position of the Company as of September 31, 2011. Interim results are not necessarily indicative of the results to be expected for an entire year or any other future year or interim period.

Accounting Method

The Company's financial statements are prepared using the accrual method of accounting. The Company has elected a fiscal year ending on December 31.

(Note 2 – Continued)

Property and Equipment

Property and equipment are stated at cost and are depreciated over their estimated useful lives, which differ by asset category. Leasehold improvements are depreciated over the shorter of the lease term or the estimated useful lives of the assets:

|

|

Five Years, 150% Double Declining

|

|

|

Ten Years, 150% Double Declining

|

|

|

Five Years, 200% Double Declining

|

|

|

Five Years, 200% Double Declining

|

|

|

Five Years, Straight-line

|

Expenditures associated with upgrades and enhancements that improve, add functionality, or otherwise extend the life of a respective asset are capitalized, while expenditures that do not, such as repairs and maintenance, are expensed as incurred. The residual value of property and equipment is estimated to be equal to 10% of the original cost, except for no residual value for leasehold improvements. Upon disposal, the assets and related accumulated depreciation are removed from the Company’s accounts, and the resulting gains or losses are reflected in the statements of operations.

Property and equipment to be held and used are reviewed for impairment whenever events or changes in circumstances indicate that the carrying value of the assets may not be recoverable. Determination of recoverability is based on the lowest level of identifiable estimated undiscounted future cash flows resulting from the use of the asset and its eventual disposition. Measurement of any impairment loss for long-lived assets that management expects to hold and use is based on the excess of the carrying value of the asset over its fair value. No impairments of such assets were identified during any of the periods presented.

Use of estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

If the Company is successful in raising funds and becoming a business development company, its principal estimates will involve the determination of the value of its portfolio companies.

The net asset value per share of our outstanding shares of Class A Common Stock will be determined quarterly, as soon as practicable after, and as of the end of, each calendar quarter, by dividing the value of total assets minus total liabilities by the number of shares outstanding at the date as of which such determination is made.

In calculating the value of our total assets, we will value securities that are publicly traded at the closing price on the valuation date for exchange traded and NASDAQ listed securities or the average of the bid and asked prices for other securities. Debt and equity securities that are not publicly traded will be valued at fair value as determined in good faith by the valuation committee of our board of directors based on the recommendation by our investment adviser and under valuation guidelines adopted by our board of directors, and then approved by our entire board of directors. Initially, the fair value of these securities will be their original cost. Debt securities valued at cost would be revalued for significant events affecting the issuer's performance and equity securities valued at cost would be revalued if significant developments or other factors affecting the investment provide a basis for valuing the security at a price other than cost, such as results of subsequent financing, the availability of market quotations, the portfolio company's operations and changes in market conditions.

Debt securities with remaining maturities of 60 days or less at the time of purchase will be valued at amortized cost. Debt securities which are publicly traded will be valued by using market quotations obtained from pricing services or dealers. Our valuation guidelines are subject to periodic review by our board of directors and may be revised in light of our experience, regulatory developments or otherwise.

Determination of fair values involves subjective judgment and estimates not susceptible to substantiation by auditing procedures. Accordingly, under current auditing standards, the notes to our financial statements will refer to the uncertainty with respect to the possible effect of such valuations, and any change in such valuations, on our financial statements.

Cash equivalents

The Company considers all highly liquid investments with maturities of three months or less at the time of purchase to be cash equivalents.

(Note 2 – Continued)

Goodwill and Indefinite-Lived Intangible Assets

Goodwill and other intangible assets are tested for impairment annually and more frequently if facts and circumstances indicate goodwill carrying values exceed estimated reporting unit fair values and if indefinite useful lives are no longer appropriate for the Company’s trademarks. Based on the impairment tests performed, there was no impairment of goodwill or other intangible assets in fiscal 2010. Definite-lived intangibles are amortized over their estimated useful lives. For further information on goodwill and other intangible assets, see Note 4.

Basic and diluted net loss per share

Basic loss per share is computed using the weighted average number of shares of Class A Common Stock outstanding during each period. Diluted loss per share includes the dilutive effects of Class A Common Stock equivalents on an “as if converted” basis. Basic and diluted loss per share is the same due to the absence of Class A Common Stock equivalents.

Income taxes

The Company accounts for income taxes under the Financial Accounting Standards Board (FASB) Statement No. 109, "Accounting for Income Taxes" "Statement 109"). Under Statement 109, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under Statement 109, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. There were no current or deferred income tax expenses or benefits due to the Company not having any material operations since inception.

Net profit/loss per common share

Net profit/loss per common share is computed pursuant to section 260-10-45 of the FASB Accounting Standards Codification. Basic net loss per share is computed by dividing net loss by the weighted average number of shares of Class A Common Stock outstanding during the period. Diluted net loss per share is computed by dividing net loss by the weighted average number of shares of Class A Common Stock and potentially outstanding shares of Class A Common Stock during each period. As of September 30, 2011, there were options that have vested equal to 1,100,000 shares of Class A Common Stock.

Recently issued accounting standards

Management does not believe that any recently issued, but not yet effective accounting pronouncements, if adopted, would have a material effect on the accompanying financial statements.

Recently Issued Accounting Pronouncements - In January 2010, the FASB issued ASC Update No. 2010-06 “Fair Value Measurements and Disclosures (Topic 820): Improving Disclosures about Fair Value Measurements” which updated guidance to amend the disclosure requirements related to recurring and nonrecurring fair value measurements. This update requires new disclosures on significant transfers of assets and liabilities between Level 1 and Level 2 of the fair value hierarchy (including the reasons for these transfers) and the reasons for any transfers in or out of Level 3. This update also requires a reconciliation of recurring Level 3 measurements about purchases, sales, issuances and settlements on a gross basis. In addition to these new disclosure requirements, this update clarifies certain existing disclosure requirements. For example, this update clarifies that reporting entities are required to provide fair value measurement disclosures for each class of assets and liabilities rather than each major category of assets and liabilities. This update also clarifies the requirement for entities to disclose information about both the valuation techniques and inputs used in estimating Level 2 and Level 3 fair value measurements. This update will become effective for the Company with the interim and annual reporting period beginning January 1, 2010, except for the requirement to provide the Level 3 activity of purchases, sales, issuances, and settlements on a gross basis, which will become effective for the Company with the interim and annual reporting period beginning January 1, 2011. The Company will not be required to provide the amended disclosures for any previous periods presented for comparative purposes. Other than requiring additional disclosures, adoption of this update will not have a material effect on the Company's financial statements.

There are several other new accounting pronouncements issued or proposed by the FASB. Each of these pronouncements, as applicable, has been or will be adopted by the Company. Management does not believe any of these accounting pronouncements has had or will have a material impact on the Company’s financial position or operating results.

Note 3 – Related Party Transaction

On January 25, 2011, the Company issued 350,000 restricted shares of our Class B Common Stock to Paul Howarth in exchange of $7,000 in dividend payments.

On January 25, 2011, the Company issued 350,000 restricted shares of our Class B Common Stock to Joseph Mezey in exchange of $7,000 in dividend payments.

On March 23, 2011, the Company acquired real estate previously owned by Paul Howarth and Joseph Mezey for $15,000 in a note payable. The note payable is due in full in 12 months and carries an interest rate equal to 0.00%

On March 27, 2011, the Company entered into an agreement to purchase 5% of Grupo Minero Inca in exchange for 3,000,000 shares of our Class A Common Stock from Paul Howarh and Joseph Mezey. Which was approved by the shareholders at the annual shareholder's meeting held on April 9, 2011.

On March 27, 2011, the Company issued 1,000,000 restricted shares of our Class A Common Stock to Paul Howarth for services rendered. The price per shares was $.006 for $6,000 in services rendered.

On March 27, 2011, the Company issued 1,000,000 restricted shares of our Class A Common Stock to Joseph Mezey for services rendered. The price per shares was $.006 for $6,000 in services rendered.

On March 31, 2011, the Company issued 1,500,000 free trading shares of our Class A Common (from the Company’s S-1) Stock to Paul Howarth pursuant to the acquisition of Grupo Minero Inca. The price per shares was $.05 for $75,000. Which was approved by the shareholders at the annual shareholder's meeting held on April 9, 2011.

On March 31, 2011, the Company issued 1,500,000 free trading shares of our Class A Common (from the Company’s S-1) Stock to J.W. Mezey pursuant to the acquisition of Grupo Minero Inca. The price per shares was $.05 for $75,000. Which was approved by the shareholders at the annual shareholder's meeting held on April 9, 2011.

On March 31, 2011, the Company has entered into an agreement with Grupo Minero Inca (“GMI”) to provide the gold extraction services and the overall management for the Companies properties. GMI will be responsible for the day to day operations of the mining sites while Graystone will be responsible for the acquisition of the mining properties, the equipment necessary to extract the ore and building of a camp for the workers. GMI will also provide exploration services and locate additional mining properties for Graystone. Pursuant to the Agreement, Graystone will retain 45% of the gross revenue from the gold extracted from its properties. Additionally, GMI has agreed that it will not claim any mining proprieties in its own name. Paul Howarth owns 37.5% of GMI and Joseph Mezey owns 37.5% of GMI as well. Which was approved by the shareholders at the annual shareholder's meeting held on April 9, 2011.

On April 12, 2011, the Company issued 2,375,000 shares of our Class A Common Stock to Joseph Mezey for services rendered. The price per shares was $.05 for $118,750 in services rendered.

On April 12, 2011, the Company issued 2,375,000 shares of our Class A Common Stock to Paul Howarth for services rendered. The price per shares was $.05 for $118,750 in services rendered.

On August 15, 2011, the Company issued 2,375,000 shares of our Class A Common Stock to Joseph Mezey for services rendered. The price per shares was $.05 for $118,750 in services rendered.

On August 15, 2011, the Company issued 2,375,000 shares of our Class A Common Stock to Paul Howarth for services rendered. The price per shares was $.05 for $118,750 in services rendered.

In October 2011, the Company completed the acquisition of GMI. this was accomplished by acquiring the remaining 37.5% owned by each Mr. Howarth and Mr. Mezey for $1.00. As a result, the agreement entered into GMI and the Company on March 31, 2011 has been cancelled.

During the Nine Months ending September 30, 2011, the Company received loans from Renard Properties, LLC of $85,639 which funds were used to acquire the Company's mining property for $44,000 and various other expenses related to the Company's mining operations.

Note 4 – Other Intangible Assets and Goodwill

Other intangible assets: Consist of trade secrets and technology cost pending further validation.

Indefinite-lived intangibles

|

|

|

|

|

|

|

|

|

Definite-lived intangibles

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Definite-lived intangibles, net

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Total other intangible assets

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Definite-lived intangibles approximate remaining weighted average useful life in years

|

|

|

|

|

|

|

|

|

Note 5 – Equity

The Company is authorized to issue 700,000,000 shares of Class A Common Stock, Class A, with a par value of $0.001. As of November 3, 2011 there were 186,050,000 shares of Class A Common Stock outstanding and 189,650,000 shares of Class A Common Stock Issued. The Company has 3,600,000 in Treasury Stock that we may re-issue. On October 3, 2011, the Company issued a dividend to its shareholders. The dividend was paid in Class A Common Stock which equaled one (1) share issued for each shares owned.

The Company is authorized to issue 5,000,000 shares of Class B Common Stock, Par Value with a par value of $0.001. The Class B shares do not have the right to convert into Series A. Additionally , the Series B votes with the Common A shareholders, unless prohibited by law, and have voting rights equal to 100 votes for each share of Class B Common Stock. As of November 3, 2011, there were 1,400,000 shares of Class B Common Stock outstanding.

Note 6 – Dividends

For the Three Months Ending September 30, 2011

For the Three Months ending September 30, 2011, the Company issued dividends of $0.

For the Nine Months Ending September 30, 2011.

For the Six Months ending June 30, 2011, the Company issued dividends of $36,275.

Note 7 – Mining Properties

Our property interests located in Peru are in the exploration stage and we refer to these properties as the "Gorilla Property." Our property interests located in Peru are in the exploration stage and we refer to these properties as the "Peru Property."

|

Name

|

Area (hectares)

|

Dept

|

Province

|

District

|

|

Gorilla

Graystone II

|

400

800

|

Loreto

Loreto

|

Datem del Maranon

Datem del Maranon

|

Manseriche

Manseriche

|

Exploration Program

Shortly after our initial acquisition of the property interests in Peru, we commenced the initial stages of our exploration and development program and carried out the following activities:

|

·

|

Completed an initial social base line study to document all surface rights owners and people resident in the project area;

|

|

·

|

Implemented a community relations program to inform local communities of the project and what potential opportunities that may exist for community involvement in the implementation phases of the development program;

|

|

·

|

Acquired equipment for further evaluation and development of resources;

|

|

·

|

Set-up an operational base in the project area to continuously review the exploration program and prior experiences gained operating in this difficult terrain;

|

|

·

|

Began bulk sampling of the site to assist in mapping the property

|

|

·

|

Commissioned a preliminary master plan which indicated the size and scope of our projected operations and areas where more information is required.

|

The principle objective of our planned exploration and development program is to bring a dredge and appropriately matched floating plant onto the property to assist us in conducting trial mining tests which requires that we undertake the following actions:

|

·

|

Drill an area on the property where known mineralization;

|

|

·

|

Extend the resource though a wider-spaced program of reconnaissance drilling so as to indicate the potential size of the deposit;

|

|

·

|

Perform additional geotechnical and metallurgical studies to complement existing information in order to prepare the optimum processing route to be adopted in the exploitation phase; and

|

|

·

|

Prepare scoping, prefeasibility, and full feasibility studies.

|

Bulk Sampling

From May 20 through July 5, 2011, the Company spent 23 days engaged in bulk sampling which the resulted in the following data:

Gravel Mined: 135 m3 (apprx. 165 tons)

Raw Gold Produced: 122 grams

Raw Gold Grade: .90g/ m3

Raw Gold Value: $34.74 per m3

No proven (measured) or probable (indicated) reserves have been established with respect to the Gorilla project. Any references to estimated, potential and/or “inferred” reserves or resources, and any estimated values of such reserves, contained in the geological report, or set forth in any other communication (i) do not represent proven (measured) or probable (indicated) reserves within the meaning of Item 102 of Regulation S-K and the Commission’s Securities Act Industry Guide 7, and (ii) should not be relied upon by any person in evaluating the Company’s prospects at the Gorilla project.

Note 8 – Treasury Stock

As of November 3, 2011, the Company has 3,600,000 shares of Class A Common Stock held as treasury stock. These shares reflect an issuance of 3,600,000 shares from the Company's effective S-1 to a 3rd party for services to be rendered that was subsequently rescinded. The Company decided to retained the shares to be re-issuable in lieu of cancelling the shares.

Note 9 – Fixed Assets

The Company's Fixed Assets are comprised as follows:

Mining Property: $44,000

Mining Equipment: $11,800

Real Estate Owned: $14,942

Note 10 – Long Term Securities

The Company's Long Term Securities are comprised as follows:

$25,000 worth of stock in Avarus which the Company received for services rendered in 2010.

$1,750,000 in stock of Groupo Mineria Inca (GMI) which the Company acquired a 20% stake through a stock issuance to 3rd party individuals and 5% of GMI from Mr. Howarth and Mr. Mezey. The remaining 75% of GMI is owned by Joseph Mezey and Paul Howarth. This transaction was approved by the shareholders at the annual shareholder's meeting held on April 9, 2011. During the month October 2011, the Company completed acquiring 100% of GMI from Mr. Howarth and Mr. Mezey for $1.00.

Note 11 – Long Term Liabilities

Various liabilities with 0% interest rates $247,330

Less: Current Portion : $ 9,653

Total Long Term Debt $256,983

Note 12 – Subsequent Events

None.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Our Company

The Graystone Company, Inc. (“Graystone”, “we”, “us”, “our”, the "Company" or the "Registrant") was originally incorporated in the State of New York on May 27, 2010 under the name of Argentum Capital, Inc. Graystone was reincorporated in Delaware on January 10, 2011 and subsequently renamed the Company to The Graystone Company, Inc on January 14, 2011. Graystone is domiciled in the state of Delaware, and its corporate headquarters are located in New York, New York. The Company selected December 31 as its fiscal year end.

Business of Registrant

The Graystone Company, Inc. is a holding company operating various divisions engaged in a number of diverse business activities. The Company began operating in July 2010 under the d/b/a paypercallexchange.com. In November 2010, the Company began operating separate division to provide consulting services. In January 2011, the Company began to operate a real estate division and natural resources division.

Natural Resources Division. This division began operating in January 2011and operates the Company’s wholly owned subsidiary Graystone Mining, Inc., a Nevada Company. This Division is engaged in the business of acquiring gold, silver, precious metal and gems and other mineral properties with proven and/or probable reserves. The Company has currently begun mining operations in Peru. The Company's Natural Resources Division is a mine processing entity whereby we locate and extract mineral deposits for refining. The Company does not engage in general exploration activities. Exploration involves the prospecting, sampling, mapping, drilling and other work involved in searching for ore on properties. Exploration is time consuming and costly as it requires an evaluation of the land's geology, analyst of the geochemistry of soil sediment and water, and drilling of numerous test holes and testing these for the presence of minerals. The Company instead focuses on acquiring or entering into joint ventures with entities that have already found, through exploration, proven or probable mineral ore reserves. This allows the Company to focus its attention on processing mineral resources instead of having to also have exploration activities to locate new sites that may have mineral ore deposits. Thereby, the Company can more efficiently explore the properties that it acquires, or has a joint venture with, that have proven or probable reserves and deploy the Company's resources and machinery; thereby, allowing the Company to generate revenue quicker since its properties will already have a map of possible ore locations.

Graystone Mining focuses on acquiring properties that require a lower capital investment to begin mining operations. This approach may reduce the size of the deposits that the Company can acquire. However, by generating revenue from smaller mining ventures, the Company can build a solid foundation and the needed infrastructure to undertake larger and more costly ventures, such as hard rock projects. Thereby the Company is focusing initially on alluvial mining (surface mining) projects, the Company can begin generating a positive cash flow for a smaller capital investment.

The Company currently owns 400 hectares and is in the process of completing the acquisition of another 800 hectares. One hectares equals 2.47 acres. The Company expects to acquire 10,000 hectares by the end of 2012. The Company anticipates that its cost of acquiring properties with proven or probable reserves will cost between 20% and 25% of the total amount that is extracted from these properties. Additionally, the acquisition cost of the machinery needed to perform the extraction is expected to be between $50,000 and $500,000. The staffing costs related to the extraction of the mineral ore will be between 25% and 30% of the total amount that is extracted from these sites. Thereby, the Company anticipates the cost of property and equipment acquisition and the labor and mining operations related to extracting gold on its properties to be approximately 55% of the gross value of the gold extracted from its properties. The company currently has eight (8) employees in Peru.

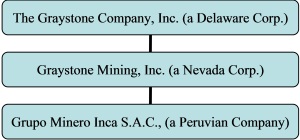

The Company has finalized the purchase of 100% of Grupo Minero Inca S.A.C., a Peruvian Company (“GMI”). GMI is now a wholly owned subsidiary of the Company. GMI provides the Company a local Peruvian entity. Acting through GMI, the Company can acquire concessions in its own name and directly hire employees and staff in Peru instead of using third parties for these purposes. The Company will coordinate all of its activities in Peru through GMI. The corporate structure of this division is as follows:

Mining Project: Gorilla

The Company's initial mining site consist of 400 hectares and is referred to Gorilla. The Company completed its initial bulk sampling activities on Gorilla. From May 20 through July 5, 2011, the company completed 23 days of bulk sampling. The Company expects to begin full scale mapping and environmental impact study once the Company obtains the necessary capital of approximately $50,000. Once the Company has mapped the property, we will need to raise $500,000 to acquire the necessary equipment to begin larger bulk sampling operations on this property.

Marketing Division. This division operates under d/b/a paypercallexchange.com. This division began operating in July 2010. The division serves as an advertising and customer acquisition firm for 3rd party entities. The Company places generic interactive advertisements, through our proprietary process and technologies, in numerous mediums, e.g. print, web, skype and mobile. These generic advertisements are placed for different services and products, e.g. cable & satellite services, mortgage refinancing, credit repair, travel agent services, auto insurance, substance abuse rehabilitation, 24-hour locksmith, website development, cosmetic surgery, timeshares, cruises and legal services. Each of these advertisements have a unique phone number for individuals interested in the products or services to call for more information. When an individual calls that specific phone number, the call is automatically forward to one of our clients, which we refer to as a lead. The software tracks the time and date of the phone call, the duration of the phone call, the caller id, city and state of the caller, repeat calls from the same number, the number the call was transferred to and the advertisement that generated the call. The Company charges its clients for each call that is transferred to them in which the duration is over an agreed upon length (usually 15 seconds).

Our proprietary process and software includes the knowledge of how to generate the maximum number of calls at the lowest cost possible, the type of advertisements placed, the days and hours of such advertisement placement, the medium such advertisements should be placed, the ability to track the advertisement's efficiency and to track the results of each advertisement placed. Through the use of these proprietary methods, the company provides lead sources to our clients at competitive pricing. The Company generated 4,428 leads during the third quarter of 2011 and 14,822 during the nine-months ending September 30, 2011.

Consulting Division. This division operates under d/b/a Graystone Ventures. Graystone Ventures began operating in November 2010. This division is a strategic, financial and operational consulting entity, which allows clients to outsource aspects of their business. This division focuses primarily on early staged companies and public companies in the nano-cap an micro-cap but also assists growth and mature companies as well. This division provides services in the areas of marketing, sales and operations. We strive to create and manage combined cost-reduction/expansion strategies for our clients. The Company refers to nano-cap companies as those with a market capitalization if under $10 Million and micro-cap companies as those with a market capitalization if under $100 Million. The Company believes that these entities cannot afford internal staff to handle the services that we provide and therefore are looking for cost effective alternatives.

Operational Consulting: We assist companies in implementing strategies to achieve their business and corporate objectives through business and management consulting services, organizational transformation, and business communications. Clients can outsource certain aspects of their business to us such as review of staffing needs, plans for staff reduction or recruitment, coordinating with outside counsel, accountants (or auditors if the company is publicly traded) and other professionals. These activities may include assisting clients in creating and following budgets, expansion plans, acquisition plans, staff reduction plans, staff retention efforts, and coordinating communication with its clients, investors, and/or shareholders. This allows the client's management to focus on its business and the implementation of its business plan.

Marketing/Sales Consulting: We assist companies in the development and implementation of marketing plans and budgets to increase awareness of its brands and increase sales while reducing the expense associated with these activities. Many companies cannot afford to hire a marketing coordinator; as such we serve as an outsourced option whereby we coordinate advertising buying, creative design, and expansion of its marketing plan into areas such as TV and radio advertising. Additionally, if our clients marketing plan have a pay per call component we can service these needs through our marketing division, paypercallexchange.com.

Real Estate Division. This division began operations in January 2011 and acquired its initial property on March 30, 2011. On March 30, 2011, the Company retained the services of a consultant to manage its properties and locate additional properties in the Fort Wayne, Indiana area.

The Real Estate Division focuses on the acquisition, development and management of single-family and mutli-family properties in the United States. Our real estate acquisitions are expected to include:

|

·

|

income-producing residential properties;

|

|

·

|

properties undervalued and/or in need of some repairs; and

|

|

·

|

new development properties.

|

We intend to seek potential property acquisitions meeting the above criteria and which are located throughout the United States. We believe the most important criteria for evaluating the markets in which we intend to purchase properties include:

|

·

|

historic and projected population growth;

|

|

·

|

historically high levels of tenant demand and lower historic investment volatility for the type of property being acquired;

|

|

·

|

markets with historic and growing numbers of a qualified and affordable workforce;

|

|

·

|

high historic and projected employment growth;

|

|

·

|

markets where demographics support need for senior living and healthcare related facilities;

|

|

·

|

markets with high levels of insured populations;

|

|

·

|

stable household income and general economic stability; and

|

|

·

|

sound real estate fundamentals, such as high occupancy rates and strong rent rate potential.

|

Portfolio of Properties

The Company acquired its initial property on March 30, 2011. The Company is continuing to identify additional possible real estate acquisition targets.

Property

Our principal executive office is located in Las Vegas, Nevada and satellite offices in the Los Angeles Metropolitan area of California and Lima Metropolitan area of Peru. Our office space is provided to us by the officers of the company.

|

Corporate Entity

|

Address

|

The Graystone Company, Inc.

|

2620 Regatta Drive, Suite 102, Las Vegas, Nevada

|

|

|

2620 Regatta Drive, Suite 102, Las Vegas, Nevada

|

Grupo Minero Inca, S.A.C..

|

Camino Real 348 Torre El Pilar, San Isidro, Lima, Peru

|

|

Corporate D/B/A

|

Address

|

|

|

2620 Regatta Drive, Suite 102, Las Vegas, Nevada

|

|

|

2620 Regatta Drive, Suite 102, Las Vegas, Nevada

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Revenue

For the Three Months Ending September 30, 2011

For the Three Months ending September 30, 2011, the Company generated net gross revenue of $31,588 with a net income of $31,423. The Company provided discounts of $165.

For the Nine Months Ending September 30, 2011

For the Nine Months ending September 30, 2011, the Company generated net gross revenue of $113,725 with a net income of $112,631. The Company provided discounts of $1,093.

Cost of Goods Sold

For the Three Months Ending September 30, 2011

For the Three Months ending September 30, 2011, the Company had $12,255 in Cost of Goods Sold (COGS). The COGS consist of the Company’s expenses related to the generating the leads it sells to clients to generate revenue for its marketing division paypercallexchange.com.

Media Purchased for Clients

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ending September 30, 2011

For the Nine Months ending September 30, 2011, the Company had $42,334 in Cost of Goods Sold (COGS). The COGS consist of the Company’s expenses related to the generating the leads it sells to clients to generate revenue for its marketing division paypercallexchange.com and its merchant fees.

Media Purchased for Clients

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Operating Expenses

For the Three Months Ending September 30, 2011

For the Three Months ending September 30, 2011the Company had $292,031 in Operating Expenses.

These expenses include a one-time expenses of $237,500 in compensation that was paid in stock to our officers, these expenses are not expected to be recurring expenses. Also, the Company issued stock for services rendered in the amount of $9,518.50. Of the $292,031 in operating expenses $247,018.50 was the result of stock that was issued for services rendered on behalf of the Company.

The Company spent a total of $23,362 in Peru which included $12,400 in direct mining expenses.

For the Nine Months Ending September 30, 2011

For the Nine Months ending September 30, 2011 the Company had $749,500 in Operating Expenses.

These expenses include a one-time expenses of $487,000 in compensation that was paid in stock to our officers, these expenses are not expected to be recurring expenses after September 30, 2011. Also, the Company issued stock for services rendered in the amount of $164,518.50. Of the $749,500 in operating expenses $651,518.50 was the result of stock that was issued for services rendered on behalf of the Company.

The Company spent a total of $193,906.83 in Peru. This included $7,211 in food and supplies for the Company's employees on the mining site and $7,689 in worker salaries. The Company also had $162,500 in exploration costs.

Net Profit

For the Three Months Ending September 30, 2011

For the Three Months ending September 30, 2011, the Company had Net Losses of $273,092. This was derived as follows:

For the Nine Months Ending September 30, 2011

For the Nine Months ending September 30, 2011, the Company had Net Losses of $679,360. This was derived as follows:

Dividends

For the Three Months Ending September 30, 2011

For the Three Months ending September 30, 2011, the Company issued dividends of $0.

For the Nine Months Ending September 30, 2011

For the Nine Months ending September 30, 2011, the Company issued dividends of $36,275.

Liquidity and Capital Resources

For the Period Ending September 30, 2011.

For the period ending September 30, 2011the Company had $623 in cash, $18,268 in Accounts Receivables $1,725,000 in Long Term Securities, $70,742 in fixed assets and $15,000 in intangible assets for a total of $1,829,633 in assets. In management’s opinion, the Company’s cash position is insufficient to maintain its operations at the current level for the next 12 months. Any expansion may cause the Company to require additional capital until such expansion began generating revenue. Our forecast for the period for which our financial resources will be adequate to support our operations involves risks and uncertainties and actual results could fail as a result of a number of factors.

Since the Company distributes it profits in the form of dividends to its shareholders, we are seeking to raise additional funds to meet our expansion needs. It is anticipated that the raise of additional funds will principally be through the sales of our securities. As of the date of this report, additional funding has not been secured and no assurance may be given that we will be able to raise additional funds.

As of September 30, 2011, our total liabilities were $291,617.

During fiscal 2011, we expect that the legal and accounting costs of being a public company will continue to impact our liquidity. Other than the anticipated increases in legal and accounting costs due to the reporting requirements of being a reporting company, we are not aware of any other known trends, events or uncertainties, which may affect our future liquidity.

In the opinion of management, available funds will not satisfy our growth requirements for the next twelve months. The Company expects that its current revenue will allow us to satisfy our current operations and our reporting requirement for the next twelve months. However, if our revenue decreases we may not able to support our current operations and reporting obligations without obtaining additional funds. We believe our currently available capital resources will allows us to begin operations within our natural resource division and maintain its operation over the course of the next 12 months; however, our other expansion plans would be put on hold until we could raise sufficient capital. However, this is dependent on whether we can finance the cost of the machinery, as described above. If we cannot obtain such financing, our officers, directors and principal shareholders have verbally committed to providing the Company with a line of credit, that has been secured by shares of the Company, to be used exclusively to acquire machinery and property with mineral reserves. This is the only amount and for that our officers, directors and principal shareholders have committed to.

Our forecast for the period for which our financial resources will be adequate to support our operations involves risks and uncertainties and actual results could fail as a result of a number of factors. In order to implement our business plan in the manner we envision, we will need to raise additional capital. We cannot guaranty that we will be able to raise additional funds. Moreover, in the event that we can raise additional funds, we cannot guaranty that additional funding will be available on favorable terms.

The Company believes it would need a minimum of $500,000 to expand it mining operations and be able to fully fund those operations and the company’s on-going reporting obligations as a public company over the next 12 months. This is broken down as follows:

|

Natural Resource Div.:

|

$450,000 for the acquisition extraction machinery for the company's properties.

|

|

Travel:

|

$25,000 for travel to and from Gold claims in Peru.

|

|

Working Capital:

|

$25,000 for general administrative purposes and the Company’s on-going reporting.

|

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

We have not had any disagreements with our auditors on any matters of accounting principles, practices, or financial statement disclosure.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

N/A

Item 4. Controls and Procedures.

Our principal executive and principal financial officers have evaluated the effectiveness of our disclosure controls and procedures, as defined in Rules 13a – 15(e) and 15d – 15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are designed to ensure that information required to be disclosed in our reports under the Exchange Act, is recorded, processed, summarized and reported within the time periods required under the SEC’s rules and forms and that the information is gathered and communicated to our management, including our principal executive officer and principal financial officer, as appropriate, to allow for timely decisions regarding required disclosure.

Our principal executive officer and principal financial officer evaluated the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)) as of the end of the period covered by this report. Based on this evaluation, our principal executive officer and principal financial officer concluded that our disclosure controls and procedures were not effective as of the end of the period covered by this report.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

We are not presently parties to any litigation, nor to our knowledge and belief is any litigation threatened or contemplated.

Not applicable because we are a smaller reporting company.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

On January 25, 2011, we issued 8,750,000 restricted shares of our Class A Common Stock to investors exchange for $52,500 cash. The cash raised will be used in our operations and for our natural resources division. The price per share was $.006.

On January 25, 2011, we issued 350,000 restricted shares of our Class B Common Stock to Renard Properties, LLC, in exchange for $3,500 in dividend payments at a price per share of $.01. We also issued 300,000 shares of our Class B Common Stock to WTL Group, Inc. and 50,000 shares of our Class B Common Stock to J.W. Mezey exchange for $3,500 in dividend payments at a price per share of $.01.

On March 27, 2011, the Company issued 1,100,000 restricted shares of our Class A Common Stock to investors exchange for $6,600 cash. The cash was used for general corporate purposes. The price per shares was $.006.

On March 27, 2011, the Company issued 375,000 restricted shares of our Class A Common Stock to consultants for services rendered. The price per shares was $.006 for $2,250 in services rendered.

On March 27, 2011, the Company issued 1,000,000 restricted shares of our Class A Common Stock to Paul Howarth for services rendered. The price per shares was $.006 for $6,000 in services rendered.

On March 27, 2011, the Company issued 1,000,000 restricted shares of our Class A Common Stock to Joseph Mezey for services rendered. The price per shares was $.006 for $6,000 in services rendered.

On April 12, 2011, the Company issued 2,375,000 shares of our Class A Common Stock to Joseph Mezey for services rendered. The price per shares was $.05 for $118,750 in services rendered.

On April 12, 2011, the Company issued 2,375,000 shares of our Class A Common Stock to Paul Howarth for services rendered. The price per shares was $.05 for $118,750 in services rendered.

On September 8, 2011, the Company issued 100,000 shares of Class A Common Stock to a consult for services provided to the Company for its exploration services. The price per share was $.05 for $5,000 in services rendered.

On October 3, 2011, the Company issued a dividend to its shareholders of record. The dividend was paid in stock at a ratio of 1 share issued for each share owned. The shares issued were restricted stock.

Item 3. Defaults Upon Senior Securities

None

Item 4. (Removed and Reserved.)

Item 5. Other Information

There was no other information during the quarter ended September 30, 2011 that was not previously disclosed in our filings during that period.

|

31.1

|

|

|

31.2

|

|

|

32.1

|

|

|

32.2

|

|

|

101.INS

|

XBRL Instance Document

|

|

101.SCH

|

XBRL Taxonomy Extension Schema

|

|

101.CAL

|

XBRL Taxonomy Extension Calculation Linkbase

|

|

101.DEF

|

XBRL Taxonomy Extension Definition Linkbase

|

|

101.LAB

|

XBRL Taxonomy Extension Label Linkbase

|

|

101.PRE

|

XBRL Taxonomy Extension Presentation Linkbase

|

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, there unto duly authorized.

| |

THE GRAYSTONE COMPANY, INC.

|

|

| |

|

|

|

Date: November 7, 2011

|

By: /s/ Paul Howarth

|

|

| |

Paul Howarth

|

|

| |

Chief Executive Officer

|

|

| |

|

|

|

Date: November 7, 2011

|

By: /s/ Joseph Mezey

|

|

| |

Joseph Mezey

Chief Financial and Accounting Officer

|

|