ANNUAL INFORMATION FORM

For the year ended December 31, 2017

Dated February 22, 2018

THIS PAGE INTENTIONALLY LEFT BLANK.

| Annual Information Form for the Year Ended December 31, 2017 | |

TABLE OF CONTENTS |

Overview of Tahoe's Business and Strategy | ||

81 | ||

Annual Information Form for the Year Ended December 31, 2017 | i |

82 | ||

INTERESTS OF EXPERTS | ||

87 | ||

ii | Tahoe Resources Inc. |

INTERPRETATION AND OTHER INFORMATION |

DEFINITIONS |

In this Annual Information Form (“AIF”), the words and phrases are defined below unless the context otherwise requires.

“Audit Committee” means the Audit Committee of the Board.

“BCA” means the Business Corporations Act (British Columbia), as amended, including all regulations promulgated thereunder.

“Bell Creek Mine” or “Bell Creek” means the underground gold mining operation encompassing the Bell Creek deposit located in the Timmins District of the province of Ontario in Canada, which produces ore that is processed at the Bell Creek Mill.

“Bell Creek Mill” means the gold processing plant, located in the Timmins District of the province of Ontario in Canada that processes ore from the Bell Creek Mine and the Timmins West Mine.

“Board” means the board of directors of the Company.

“Company” means Tahoe Resources Inc., together with all of its subsidiaries, unless the context indicates otherwise.

“Compensation Committee” means the Compensation Committee of the Board.

“CSA” means the Canadian Securities Administrators.

“Deferred Share Awards” means awards that will be issued upon the passage of time, continued employment of the recipient by the Company or upon such other terms and conditions as the Compensation Committee of the Company may determine in its discretion, pursuant to the Company’s Share Option and Incentive Share Plan, including any amendments thereto.

“Entre Mares” means Entre Mares de Guatemala, S.A.

“Escobal Acquisition” means the acquisition by the Company of the Escobal Mine Assets in accordance with the terms and conditions of the Transaction Agreement.

“Escobal Exploitation License” means the exploitation license (concession) on which the Escobal vein and Escobal Mine are located.

“Escobal Feasibility Study” means the independent technical report entitled “Escobal Mine Guatemala NI 43-101 Feasibility Study - Southeastern Guatemala” issued on November 5, 2014, with effective dates of January 23, 2014 for

the Escobal Mineral Resource and July 1, 2014 for the Escobal Mineral Reserve.

“Escobal License Suspension” means the temporary suspension of MSR’s Escobal mining license resulting from the May 2017 claim filed with the Supreme Court of Guatemala by an anti-mining organization.

“Escobal Mine” or “Escobal” means the mining project comprised of the Escobal Mine Assets.

“Escobal Vein” means the zone of mineralization on the Escobal Exploitation License that contains the Mineral Resources and Mineral Reserves for the Escobal Mine.

“Goldcorp” means Goldcorp Inc., a Canadian public company and where the context requires, includes affiliates of Goldcorp Inc.

“La Arena II” means the porphyry copper-gold project proximal to the existing La Arena Mine.

“La Arena Feasibility Study” means the NI 43-101 technical report for La Arena with an effective date of December 31, 2014. This report has been superseded by an updated NI 43-101 technical report with an effective date of January 1, 2018.

“La Arena Mine” or “La Arena” means the oxide open pit, heap leach gold mine located in northern Peru.

“Lake Shore” or “Tahoe Canada” means Lake Shore Gold Corporation (doing business as Tahoe Canada), a Canadian company which is a wholly-owned subsidiary of the Company and which holds mineral interests in Ontario, Canada.

“Lake Shore Arrangement” means the acquisition of all of the outstanding shares of Lake Shore on the terms and conditions set forth in the Lake Shore Arrangement Agreement.

“Lake Shore Arrangement Agreement” means the arrangement agreement entered into as of February 8, 2016, between the Company and Lake Shore relating to the acquisition by the Company of all of the outstanding shares of Lake Shore by way of Plan of Arrangement.

“MARN” means the Ministry of Environment and Natural Resources of Guatemala.

“MEM” means the Ministry of Energy and Mines of Guatemala and/or Peru, as specified when used.

Annual Information Form for the Year Ended December 31, 2017 | 1 |

“MSR” means Minera San Rafael, S.A., a Guatemala corporation that is owned by Escobal Resources Holdings Limited and the Company.

“MNDM” means Ministry of Northern Development and Mines of Ontario, Canada.

“NI 43-101” means National Instrument 43-101 - Standards of Disclosure for Mineral Projects, of the CSA.

“NI 52-110” means National Instrument 52-110 - Audit Committees, of the CSA.

“NYSE” means the New York Stock Exchange.

“Persons” includes an individual, partnership, association, body corporate, trustee, executor, administrator or legal representative.

“Restricted Share Awards” means awards that are issued but which will only be delivered to the holder of the award upon the passage of time, continued employment of the holder by the Company or upon such other terms and conditions as the Compensation Committee of the Company may determine in its discretion, pursuant to the Company’s Share Option and Incentive Share Plan, including any amendments thereto.

“Rio Alto” means Rio Alto Mining Limited, an Alberta company that was a party to the Rio Alto Arrangement Agreement and which was subsequently amalgamated into Tahoe Resources ULC, an Alberta company which is a wholly-owned subsidiary of the Company and which holds mineral interests in Peru.

“Rio Alto Arrangement” means the business combination between the Company and Rio Alto on the terms and conditions set forth in the Rio Alto Arrangement Agreement.

“Rio Alto Arrangement Agreement” means the arrangement agreement dated February 9, 2015 between the Company and Rio Alto with respect to the Rio Alto Arrangement.

“SEC” means the Securities and Exchange Commission of the United States of America.

“Secondary Offering” means the offering and sale of 58,051,692 common shares of the Company

beneficially held by Goldcorp that closed on June 30, 2015.

“SEDAR” means the System for Electronic Document Analysis and Retrieval, accessible through the internet at www.sedar.com.

“Shahuindo Prefeasibility Study” means the independent technical report entitled “Technical Report on the Shahuindo Mine, Cajabamba, Peru” dated January 25, 2016.

“Shahuindo Mine” or “Shahuindo” means the gold-silver open pit, heap leach mine located in northern Peru.

“Shares or Tahoe Shares” means common shares without par value of the Company.

“Share Option and Incentive Share Plan” means the Company’s Share Option and Incentive Share Plan, as amended and restated effective March 7, 2013.

“Tahoe” means Tahoe Resources Inc., together with all of its subsidiaries, unless the context indicates otherwise.

“Tahoe Resources Peru” or “Tahoe Peru” means Tahoe Resources Peru S.A.C. dba Tahoe Peru, a Peru entity which is a wholly owned subsidiary of the Company.

“Timmins Mines” means the Timmins West Mine, the Bell Creek Mine, and the Bell Creek Mill.

“Timmins West Mine” means the underground gold mining operation encompassing the Timmins, Thunder Creek and 144 Gap deposits located in the Timmins District of the province of Ontario, Canada. Ore from the Timmins West Mine is trucked to the Bell Creek Mill for processing.

“Transaction Agreement” means the definitive purchase and sale agreement made as of May 3, 2010, as amended on October 12, 2010, relating to the acquisition by the Company of the Escobal Mine Assets and including any amending agreement or instrument supplementary or auxiliary thereto.

“TSX” means the Toronto Stock Exchange.

2 | Tahoe Resources Inc. |

GLOSSARY OF TECHNICAL TERMS | |

Ag: | Silver. |

Au: | Gold. |

Contained Ounces: | The troy ounces of metal in resources or reserves obtained by multiplying tonnage by grade. |

Cut-off Grade: | The grade below which mineralized material is considered uneconomic. |

Development: | The preparation of a mineable deposit. |

g/tonne or g/t: | Grams per metric tonne; 31.10348 grams is equal to one troy ounce. |

Indicated Mineral Resource(1): | That part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve. |

Inferred Mineral Resource(1): | That part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. |

IRR: | Internal Rate of Return. |

km: | Kilometre. |

km2: | Square Kilometre. |

Kv: | Kilovolt. |

Measured Mineral Resource(1): | That part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve. |

Mineral Reserve: | The economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility level as appropriate that include application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which Mineral Reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. The public disclosure of a Mineral Reserve must be demonstrated by a pre-feasibility study or feasibility study. |

Annual Information Form for the Year Ended December 31, 2017 | 3 |

GLOSSARY OF TECHNICAL TERMS | |

Mineral Resource: | A concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. The term Mineral Resource covers mineralization and natural material of intrinsic economic interest which has been identified and estimated through exploration and sampling and within which Mineral Reserves may subsequently be defined by the consideration and application of Modifying Factors. |

Modifying Factors: | Considerations used to convert Mineral Resources to Mineral Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors |

NPV: | Net Present Value. |

NSR: | Net Smelter Return; gross sales proceeds received from the sale of production obtained from a property, less the costs of insurance, smelting, refining (if applicable) and the cost of transportation of production from the mine or mill to the point of sale. For the purposes of taxes and royalties in Guatemala the cost of transportation is not deducted. |

Ore: | A metal or mineral or a combination of these of sufficient value as to quality and quantity to enable it to be mined and processed at a profit. |

Pb: | Lead. |

Probable Mineral Reserve(1): | The economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve. Probable Mineral Reserve estimates must be demonstrated to be economic, at the time of reporting, by at least a pre-feasibility study. |

Proven Mineral Reserve(1): | The economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors. The term should be restricted to that part of the deposit where production planning is taking place and for which any variation in the estimate would not significantly affect the potential economic viability of the deposit. Proven Mineral Reserve estimates must be demonstrated to be economic, at the time of reporting, by at least a pre-feasibility study. |

QA/QC: | Quality Assurance/Quality Control. |

Recovery Rate: | The percentage of metals or minerals which are recovered from ore during processing. |

Reserves: | Combined Proven and Probable Mineral Reserves. |

tpd: | Metric tonnes per day. |

Zn: | Zinc. |

(1) | The definitions of Proven and Probable Mineral Reserves, and Measured, Indicated and Inferred Mineral Resources are set forth in NI 43-101 which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects, as well as in the Canadian Institute of Mining, Metallurgy and Petroleum’s “CIM Definition Standards - For Mineral Resources and Reserves, Definitions and Guidelines” (CIM Standards) adopted by the CIM Council on December 2000 and modified in 2005, 2010 and 2014. A reader in the United States should be aware that the definition standards enunciated in NI 43-101 and in the CIM Standards differ significantly from those set forth in SEC Industry Guide 7, and resource information disclosed pursuant to NI 43-101 may not be comparable to similar information disclosed by US companies. See "Disclosure Standards - Cautionary Note to US Investors Regarding Reserves and Resources" for more information. |

4 | Tahoe Resources Inc. |

CURRENCY INFORMATION |

All currency amounts in this AIF are expressed in United States dollars (“US$”), unless otherwise noted. The following table reflects the low and high rates of exchange for one United States dollar, expressed in Canadian dollars, (“CAD$”) during the periods noted, the rates of exchange at the end of such periods and the average rates of exchange during such periods, based on the Bank of Canada noon spot rate of exchange for 2015 and 2016, and the daily exchange rate for 2017 and 2018.

One Month Ended | Years Ended December 31, | |||

Jan. 31, 2018 | 2017 | 2016 | 2015 | |

Low for the period | 1.2293 | 1.2128 | 1.2544 | 1.1749 |

High for the period | 1.2535 | 1.3743 | 1.4589 | 1.3965 |

Rate at the end of the period | 1.2293 | 1.2545 | 1.3427 | 1.3840 |

Average noon spot rate for the period | 1.2413 | 1.2986 | 1.3248 | 1.2875 |

On January 31, 2018, the Bank of Canada daily exchange rate was $1.00-CAD$1.2293.

FORWARD-LOOKING STATEMENTS |

This AIF contains “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the US Exchange Act, the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission, all as may be amended from time to time, and "forward-looking information" under the provisions of applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of the Company. All statements, other than statements of historical fact, are forward-looking statements. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects”, “is expected”, “guidance”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, or variations or comparable language of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, "should", “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

Forward-looking statements include, but are not limited to, statements related to the following: in regards to the status of the appeals to the Guatemalan Constitutional Court (i) of the decision by the Supreme Court of Guatemala ordering the Guatemalan Ministry of Energy and Mining (“MEM”) to conduct consultation with indigenous populations in certain designated locations in and around the Escobal Mine, (ii) of the decision by the Supreme Court of Guatemala reinstating the Company’s mining license in respect of the Escobal mine, and (iii) relating to Escobal’s export credential, the timing for such appeals to be decided and the likelihood of adverse decisions by the Constitutional Court; the timing and results of other court proceedings; the timing and likelihood of resolving the road blockage affecting the

Escobal Mine; the continuation of the expansion plans at Shahuindo and Bell Creek and the on-going review of all other capital and exploration expenditures; the timing and amount of estimated future production, costs of production, capital expenditures and requirements for additional capital; the expectation of meeting production targets; growing gold production to over one half million ounces in 2019; the timing and cost of the design, procurement, construction and commissioning of the 24,000 tpd crushing and agglomeration circuit at Shahuindo, as well as the expansion of the Shahuindo Mine to a production capacity of 36,000 tpd with commissioning in mid-year 2018 and achieving the full 36,000 tpd production rate by the end of 2018, providing an expected 80% ultimate gold recovery in line with the pre-feasibility study; the timing for commencement of production at Pad 2B in Q3 2018; the expectation of the capacity of the south waste rock dump at Shahuindo; the timing of completion of the Bell Creek shaft expansion project to double the Bell Creek Mine production to 80,000 ounces of gold per year in 2020, and the expected effect of decreasing operating costs at Bell Creek; the completion of construction of the Phase 5 tailings facility expansion at the Bell Creek Mill ready for operation in accordance with the life of mine plan; care and maintenance plans at Escobal; providing further updates to guidance when additional information regarding the Escobal license is available; the cost and timing of sustaining and project capital expenditures, corporate general and administration expenses, and exploration expenses; expected working capital requirements; the expected depreciation and depletion rates; exploration and review of prospective mineral acquisitions; the anticipated timing of updated Mineral Resource and Mineral Reserve estimates; and the timing, costs, results and impacts of purported class action lawsuits filed

Annual Information Form for the Year Ended December 31, 2017 | 5 |

against the Company and certain of its officers and directors.

Forward-looking statements are based on the reasonable assumptions, estimates, analyses and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Management believes that the assumptions and expectations reflected in such forward-looking statements are reasonable. Assumptions have been made regarding, among other things: the Company’s performance and ability to operate and implement operational improvements at the Escobal, La Arena, Shahuindo and Timmins Mines; studies and development efforts on the La Arena II deposit; the Company’s ability to carry on exploration and development activities, including land acquisition and construction; the availability and sufficiency of power and water for operations; the timely receipt of permits and other approvals; the successful outcomes of consultations with indigenous populations; the price of silver, gold and other metals; prices for key mining supplies, including labor costs and consumables, remaining consistent with the Company’s current expectations; production meeting expectations and being consistent with estimates; plant, equipment and processes operating as anticipated; there being no material variations in the current tax and regulatory environment; the Company’s ability to operate in a safe, efficient and effective manner; the exchange rates among the Canadian dollar, Guatemalan quetzal, Peruvian sol and the USD remaining consistent with current levels; the ability to resolve the protests and road blockages of the Escobal Mine; the timing and amount of foregone taxes and royalties; the timing and likelihood of further workforce reductions; the timing and ability of the Company to resume operations in the event suspension of the mining license to Minera San Rafael for the Escobal Mine is lifted and all licenses, permits and credentials affecting the operation of the Company’s mines, including the Escobal Mine, are renewed or re-issued and all roadblocks are resolved, and relationships with the Company’s partners, including employees, vendors and community populations are maintained or effectively managed; the Company’s ability to obtain financing as and when required and on reasonable terms; and the Company’s ability to continue to comply with the terms of the credit agreements with its lenders. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors

that may cause actual results to be materially different from those expressed or implied by such forward-looking statements. Such risks, uncertainties and other factors include but are not limited to; the fluctuation of the price of silver and gold; opposition to development and mining operations by one or more groups of indigenous people; actions that impede or prevent the operations of the Company’s mines; the inability to develop and operate the Company’s mines; social unrest and political or economic instability and uncertainties in the jurisdictions in which the Company operates; the timing and ability to maintain and, where necessary, obtain necessary permits and licenses; changes in national and local government legislation, taxation and controls or regulations; environmental and other governmental regulation compliance; un-appealable judicial decisions; the uncertainty in the estimation of Mineral Resources and Mineral Reserves; fluctuations in currency exchange rates; infrastructure risks, including access to roads, water and power; and the timing and possible outcome of pending or threatened litigation and the risk of unexpected litigation. For a more detailed discussion of risks relevant to the Company, see "Description of Tahoe’s Business - Risk Factors Relating to Tahoe’s Business", and "- Risk Factors Relating to Tahoe’s Shares" below.

Although management has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. Forward-looking statements are made as of the date hereof and, accordingly, are subject to change after such date. Except as otherwise indicated by the Company, these statements do not reflect the potential impact of any non-recurring or other special items or of any disposition, monetization, merger, acquisition, other business combination or other transaction that may be announced or that may occur after the date hereof. Forward-looking statements are provided for the purpose of providing information about management’s current expectations and plans and allowing investors and others to get a better understanding of the Company’s operating environment. The Company does not intend or undertake to publicly update any forward-looking statements that are included in this document, whether as a result of new information, future events or otherwise, except as, and to the extent required by, applicable securities laws.

6 | Tahoe Resources Inc. |

DISCLOSURE STANDARDS |

Technical Disclosure

Charles Muerhoff, Vice President Technical Services and Qualified Person as defined in NI 43-101 has reviewed and approved the scientific and technical information contained in this AIF.

The basis of the Mineral Resource and Mineral Reserve estimates for the Escobal Mine is from Escobal Mine Guatemala NI 43-101 Feasibility Study dated November 5, 2014. Mineral Resources at January 1, 2018 were reported using a silver-equivalent cut-off grade of 100 g/t using metal prices of $20/oz silver, $1,300/oz gold, $1.00/lb lead and $1.10/lb zinc. Mineral Reserves at January 1, 2018 were reported using a cut-off grade calculated from the net smelter return value minus production costs using metal prices of $20/oz silver, $1,300/oz gold, $1.00/lb lead and $1.10/lb zinc. Mineral Resources and Mineral Reserves reported at January 1, 2018 were calculated by subtracting mine depletion volumes from the Mineral Resource and Mineral Reserve estimates stated in the aforementioned technical report. Mineral Reserves are included in Mineral Resources.

The basis of the Mineral Resource and Mineral Reserve estimates for the La Arena Mine and for La Arena II is from Technical Report on the La Arena Project, Peru, dated February 20, 2018 with an effective date of January 1, 2018. Oxide Mineral Resources for the La Arena Mine at January 1, 2018 were reported at a gold cut-off grade of 0.10 g/t within a $1,400/oz gold pit shell. Oxide Mineral Reserves for the La Arena Mine are reported using gold cut-off grades of 0.10 g/t within a pit designed from a $1,200/oz gold pit shell. The La Arena Mine Mineral Resources and Mineral Reserves reported at January 1, 2018 were calculated by applying the mine topographic surface at January 1, 2018 to an updated Mineral Resource estimate effective July 1, 2018. La Arena II oxide Mineral Resources are reported at a gold cut-off grade of 0.10 g/t and sulfide Mineral Resources are reported at a copper-equivalent cut-off grade of 0.18% within a $4.00/lb copper and $1,500/oz gold pit shell. Mineral Reserves are included in Mineral Resources.

The basis of the Mineral Resource and Mineral Reserve estimates for the Shahuindo Mine is from the Technical Report on the Shahuindo Mine, Cajabamba, Peru dated January 25, 2016. Oxide Mineral Resources at January 1, 2018 are reported at a gold cut-off grade of 0.15 g/t within a $1,400/oz gold pit shell. Sulfide Mineral Resources are reported in situ at a gold-equivalent cut-off grade of 0.5 g/t using a gold-to-silver ratio of 80. Oxide Mineral Reserves at January 1, 2018 are reported at a gold cut-off grade 0.18 g/t within a pit designed from a $1,200/oz gold pit shell. Oxide

Mineral Resources and Mineral Reserves at January 1, 2018 were calculated by applying the mine topographic surface at January 1, 2018 to an updated Mineral Resource estimate effective July 1, 2017. There are no sulfide Mineral Resources at Shahuindo. Mineral Reserves are included in Mineral Resources.

The basis of the Timmins West Mine Mineral Resources and Mineral Reserves is from National Instrument 43-101 Technical Report, Timmins West Mine, Timmins, Ontario, Canada, dated September 20, 2017 with an effective date of May 15, 2017. Mineral Resources are reported using a gold cut-off grade of 1.5 g/t. Mineral Reserves are reported using a gold cut-off grade of 2.0 g/t and a gold price of $1,250/oz. Mineral Resources and Mineral Reserves at January 1, 2018 were calculated by subtracting mine depletion volumes through December 31, 2017 from the Mineral Resource and Mineral Reserve estimates stated in the aforementioned technical report. Mineral Reserves are included in Mineral Resources.

The basis of the Mineral Resource and Mineral Reserve estimates for the Bell Creek Mine is from NI 43-101 Technical Report, Updated Mineral Reserve Estimate for Bell Creek Mine, Hoyle Township, Timmins, Ontario, Canada dated March 27, 2015. Mineral Resources at January 1, 2018 was reported at a gold cut-off grade of 2.2 g/t. Mineral Reserves at January 1, 2018 are reported using a gold cut-off grade of 2.3 g/t and a gold price of $1,250/oz. Mineral Resources and Mineral Reserves at January 1, 2017 were calculated by mine depletion volumes November 2017 and forecasted production for December 2017 from an updated Mineral Resource estimate effective June 1, 2016. Mineral Reserves are included in Mineral Resources.

The basis of the Whitney Mineral Resources is from Technical Report and Resource Estimate on the Upper Hallnor, C-Zone, and Broulan Reef Deposits, Whitney Gold Property, Timmins Area, Ontario, Canada, dated February 26, 2014. Mineral Resources were reported using a gold cut-off grade of 3.0 g/t.

The Mineral Resource estimate for the Fenn-Gib project is from Fenn-Gib Resource Estimate Technical Report, Timmins Canada dated November 17, 2011 for Lake Shore Gold Corp. The effective date of the Mineral Resource estimate was November 17, 2011. Indicated Mineral Resources reported used a gold cut-off grade of 0.5 g/t within an optimized $1,190/oz gold pit shell. Inferred Mineral Resources within an optimized $1,190/oz gold pit shell reported used a gold cut-off grade of 0.5 g/t; Inferred Mineral Resources

Annual Information Form for the Year Ended December 31, 2017 | 7 |

outside of the optimized pit shell reported using a gold cut-off grade of 1.5 g/t.

The Mineral Resource estimate for the Juby project is from Technical Report on the Updated Mineral Resource Estimate for the Juby Gold Project, Tyrrell Township, Shining Tree Area, Ontario dated February 24, 2014. The effective date of the Mineral Resource estimate was February 24, 2014. Mineral Resources reported used a gold cut-off grade of 0.4 g/t.

The Mineral Resource estimate for the Gold River project is from Technical Report on the Update of Mineral Resource Estimate for the Gold River Property, Thorneloe Township, Timmins, Ontario, Canada dated April 5, 2012 with an effective date of January 17, 2012. Mineral Resources reported used a gold cut-off grade of 2.0 g/t.

The Mineral Resource estimate for the Marlhill deposit is from Technical Report on the Marhill Project, Hoyle Township, Timmins, Ontario, Canada, with an effective date of March 1, 2011. Mineral Resources are reported using a gold cut-off grade of 2.9 g/t.

The Mineral Resource estimate for the Vogel/Schumacher deposit is from Technical Report on the Initial Mineral Resource Estimate for the Vogel/Schumacher Deposit, Bell Creek Complex, Hoyle Township, Timmins, Ontario, Canada, with an effective date of June 14, 2011. Mineral Resources are reported using a cut-off grade of 0.63 g/t inside an optimized pit shell using a gold price of US$1,150/oz. Additional Mineral Resources which occur below the pit shell are reported using a gold cut-off grade of 2.9 g/t.

Cautionary Note to US Investors Regarding Reserves and Resources

The Mineral Resource and Mineral Reserve estimates contained in this AIF have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws and use terms that are not recognized by the United States Securities and Exchange Commission (“SEC”). Canadian reporting requirements for disclosure of mineral properties are governed by NI 43-101. The definitions used in NI 43-101 are incorporated by reference from the CIM Definition Standards adopted by CIM Council on May 10, 2014 (the “CIM Definition Standards”). U.S. reporting requirements are governed by the SEC Industry Guide 7 (“Industry Guide 7”) under the United States Securities Act of 1933, as amended. These reporting standards have similar goals in

terms of conveying an appropriate level of confidence in the disclosures being reported, but embody difference approaches and definitions.

For example, the terms “Mineral Reserve”, “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms as defined in in NI 43-101, and these definitions differ from the definitions in Industry Guide 7. Under Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. Further, under Industry Guide 7, mineralization may not be classified as “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made.

While the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be disclosed by NI 43-101, these terms are not defined terms under Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. United States readers are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. In addition, “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. A significant amount of exploration must be completed in order to determine whether an Inferred Mineral Resource may be upgraded to a higher category. Under Canadian regulations, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. United States readers are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations if such disclosure includes the grade or quality and the quantity for each category of Mineral Resource and Mineral Reserve; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, information contained in this AIF containing descriptions of Tahoe’s mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

8 | Tahoe Resources Inc. |

CORPORATE STRUCTURE |

INCORPORATION AND OFFICES |

The Company was incorporated under the BCA on November 10, 2009 under the name “CKM Resources Inc.,” which was changed to “Tahoe Resources Inc.” on January 13, 2010. The Company’s head office is located at 5310 Kietzke Lane, Suite 200, Reno, Nevada, United States 89511. The Company’s registered and records office is located at 1055 West Georgia Street, Suite 1500, Vancouver, British Columbia, Canada, V6E 4N7.

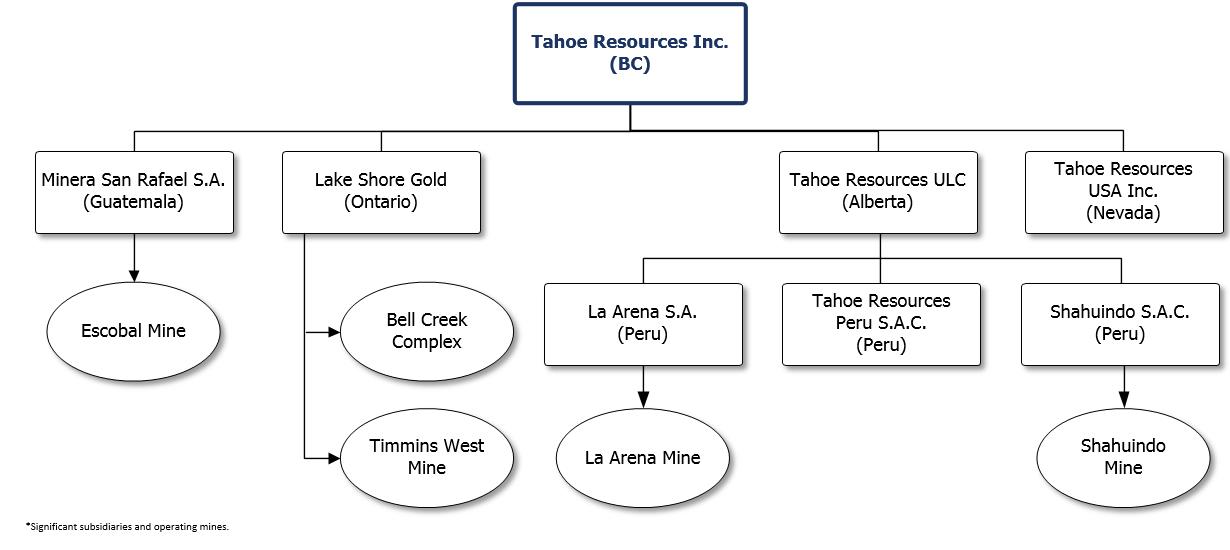

Tahoe currently has seven significant wholly-owned subsidiaries: La Arena S.A., a company incorporated under the laws of Peru; Lake Shore Gold Corp., a company incorporated under the laws of Canada; Minera San Rafael, S.A., a company incorporated under the laws of Guatemala; Tahoe Resources Peru S.A.C., incorporated under the laws of Peru; Shahuindo S.A.C., a company incorporated under the laws of Peru; Tahoe Resources ULC, a company incorporated under the laws of Alberta; and Tahoe Resources USA Inc., a company incorporated under the laws of Nevada. See "General Development of Tahoe’s Business - Inter-Corporate Relationships".

GENERAL DEVELOPMENT OF TAHOE'S BUSINESS |

DEVELOPMENT OF TAHOE'S BUSINESS |

OVERVIEW

Since incorporation in November 2009 and initial public offering in 2010, Tahoe has developed the Escobal Mine in Guatemala and acquired mining interests in Peru and Canada.

ESCOBAL MINE

The Company acquired the Escobal Mine assets located in Guatemala on June 8, 2010 pursuant to the terms of the Transaction Agreement with affiliates of Goldcorp. The Escobal Acquisition was completed contemporaneously with the Company’s initial public offering. The Escobal Mine achieved commercial production in January 2014. Mining operations are currently suspended while a suspension of the exploitation license is litigated and until the export credential is renewed and a roadblock affecting delivery of materials in and out of the Escobal Mine can be resolved. See "General Development of Tahoe’s Business - Legal - Escobal License Suspension", "- Escobal Export Credential", and "- Guatemala Roadblock".

LA ARENA MINE

The Company acquired the La Arena Mine assets located in northwestern Peru on April 1, 2015 pursuant to the terms of the Rio Alto Arrangement. Commercial operations at La Arena began in 2011. The La Arena Mine assets include, but are not limited to, the mineral and land concessions associated with the open pit gold mine at La Arena and La Arena II.

SHAHUINDO MINE

The Company acquired the Shahuindo Mine assets located in northwestern Peru on April 1, 2015 pursuant to the terms of the Rio Alto Arrangement. The Shahuindo Mine Assets include, but are not limited to, the mineral and land concessions associated with the open pit gold mine at Shahuindo. Commercial production began at Shahuindo in May 2016.

TIMMINS MINES

The Company acquired the Timmins Mines located in Timmins, Ontario on April 1, 2016 pursuant to the terms of the Lake Shore Arrangement. The Timmins Mines consist of two mining operations: Bell Creek Mine and Timmins West Mine, which both feed the Bell Creek Mill. Lake Shore began commercial operations at Bell Creek Mine in 2012 and at Timmins West Mine in 2011. Additional assets acquired pursuant to the Lake Shore Arrangement included, but were not limited to, the Fenn-Gib Project, the Juby Project, the Vogel Project, and the Gold River Project, as well as ownership in the Whitney Joint Venture and other mineral and land concessions previously held by Temex Resources Corp., which was amalgamated with Lake Shore effective January 1, 2018.

Annual Information Form for the Year Ended December 31, 2017 | 9 |

2018 DEVELOPMENTS |

LA ARENA II

La Arena II is a large-tonnage copper-gold porphyry deposit located in close proximity to the currently producing La Arena oxide gold mine in Peru. After completing an internal scoping study on La Arena II in early 2017, which showed encouraging results, the Company commissioned a new NI 43-101 technical report for the La Arena property which included a Preliminary Economic Assessment (“PEA”) of the La Arena II project, which was completed in February 2018.

Highlights of the La Arena II PEA include:

• | Total Measured and Indicated Mineral Resources of 5.8 billion pounds of copper and 5.6 million ounces of gold. Inferred Mineral Resources total 349 million pounds of copper and 683 thousand ounces of gold. |

• | Mineral Resources within the mine plan total 5.2 billion pounds of copper and 5.4 million ounces of gold. |

• | Annual metal recovered averages 207 million pounds of copper and 149 thousand ounces of gold over a 21 year mine life, plus an additional 115 million pounds of copper and 226 thousand ounces of gold recovered over a two year pre-production period. Total copper and gold recovered to concentrate and doré over the life of the project is estimated to be 4.5 billion pounds of copper and 3.4 million ounces of gold. |

• | Capital costs estimated at US$1.36 billion for project/initial capital and US$1.09 billion for sustaining capital over the life of the project. |

• | Average annual after-tax cash flow of US$273 million from the commencement of commercial production. |

• | Average co-product cost of $600 per ounce gold and $1.55 per pound copper. |

• | Average annual cash operating cost of $395 million. Total operating cost is $12.87 per tonne processed. |

• | After tax net present value at an 8% discount rate of US$824 million and an internal rate of return of 14.7% with a payback period of 4.6 years at the base case metal prices. |

Long-term base case metal prices used for the La Arena II PEA were US$3.30 per pound copper and US$1,300 per ounce gold.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The La Arena II PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the Preliminary Economic Assessment will be realized.

Tahoe expects to continue its evaluation of the La Arena II project with the intent of advancing the project to the prefeasibility or feasibility stage at the appropriate time. The timeline and estimated capital required to progress the project to the next stage are under review and no decisions have been made at this time. The project will be evaluated in the context of existing operations and pipeline opportunities. Tahoe is open to all financial and strategic options available in order to progress the project responsibly and to maximize value for its shareholders.

An expanded discussion of the La Arena II project is included in the La Arena technical discussion contained in this AIF.

LA ARENA DEEP OXIDE PIT EXPANSION

The Company experienced a considerable positive reconciliation between production and the Mineral Resource and Mineral Reserve model, for both ore tonnes and gold grade, at the La Arena Mine in 2017. As the pit deepens, it has become evident that the frequency and continuity of the higher-grade Tilsa-style structures and associated fracture system is more extensive than previously modeled. Tahoe initiated a diamond drill program in December 2017 to better define and characterize the oxide mineralization below the current life-of-mine pit with the target of increasing reserves and extending the oxide mine life. Drilling is anticipated to conclude at the end of Q1 2018 with Mineral Resource and Mineral Reserve modeling updates to follow.

SHAHUINDO CRUSHING AND AGGLOMERATION CIRCUIT

Tahoe initiated a review of the crushing, size distribution, geotechnical and material handling characteristics of ore at Shahuindo in the second half of 2016. The review supported the achievement of throughput and recovery rates for agglomerated ores contained in the Shahuindo Prefeasibility Study. The review also identified opportunities to slightly reduce capital expenditures and operating costs at the mine through revisions to the

10 | Tahoe Resources Inc. |

crushing and agglomeration circuit. The Company completed the permitting process and began construction of the 12,000 tpd crushing and agglomeration circuit in Q1 2017. The 12,000 tonne per day crushing-agglomeration-conveyance circuit is in the final stages of commissioning and has been placed into operation. Commissioning of the expanded crushing and agglomeration circuit to 36,000 tonnes per day is expected to commence in mid-2018. Once in full operation, the Company expects an 80% ultimate gold recovery, in line with the pre-feasibility study.

BELL CREEK SHAFT EXPANSION

Work on the Bell Creek shaft expansion project began in the second quarter of 2016, with key positions hired and underground shaft access development commenced in June 2016. Shaft engineering work was completed in 2016, and shaft expansion work continued in 2017. Excavation of the first two pilot raises is complete, and excavation of the third and final pilot raise was initiated at the bottom level of 1,040 meters. Shaft rehabilitation and furnishing is complete down to a depth of 433 meters with new sets, guides and services installed. On the surface, demolition of the historical hoisting plant was completed in Q2 2017, and foundation work for the new hoist and headframe is now complete. The new administration building is complete and occupied and construction of the new security building is in progress. The expansion project is expected to be essentially complete by mid-2018. The project is expected to double production at Bell Creek to approximately 80,000 ounces per year in 2020 and significantly extend mine life.

SHAHUINDO PAD 2B

Detailed engineering of the foundation platform for Pad 2B was completed in June 2017 and construction began in the third quarter. Pad 2B is scheduled to be placed into production in Q3 2018.

JUBY

Juby is a large near-surface deposit located in the Shining Tree Area of Northern Ontario, near the town of Gowganda, approximately 100 kilometres south of Timmins. A 2014 Mineral Resource estimate contained 26.6 million tonnes at an average gold grade of 1.28 grams per tonne for 1.1 million ounces of gold in the Indicated category and 96.2 million tonnes at an average gold grade of 0.94 grams per tonne for 2.9 million ounces of gold in the Inferred category. Field activity during Q3 of 2017 included geochemical soil sampling, bedrock mapping and prospecting which identified a number of mineralized zones peripheral to the main Juby zone. Data compilation and refinement of the geologic and resource models continues with drilling expected to begin in Q2 of 2018 assuming timely receipt of permits.

REVOLVING CREDIT FACILITY

On February 16, 2018, the Company closed its revised revolving credit facility ("the Second Amended and Restated Credit Facility") with its bank syndicate, providing the Company with full access to a $175 million revolving credit facility, which includes a $25 million accordion feature, for total access of $200 million in capital. The Second Amended and Restated Credit Facility matures on July 19, 2021. This facility is structured on the strength of Tahoe’s gold business alone, and access to the facility does not rely on the operation of the Escobal Mine. See "General Development of Tahoe’s Business - Indebtedness - Revolving Credit Facility".

2017 DEVELOPMENTS |

ESCOBAL LICENSE SUSPENSION

On May 24, 2017, an anti-mining organization (“Plaintiff”) filed a claim in the Supreme Court of Guatemala against MEM alleging that MEM violated the Xinka indigenous communities’ right of consultation in advance of granting the Escobal mining license to Tahoe’s Guatemalan subsidiary, Minera San Rafael ("MSR"). On July 5, 2017, the Company was notified that the Supreme Court of Guatemala issued a provisional decision in respect of the action against MEM that suspended the Escobal mining license of MSR until the underlying civil claim was fully heard on the merits. The Company filed a procedural challenge with the Constitutional Court, the highest court in Guatemala, regarding the assignment of judges of the Supreme Court and also asked for the Supreme Court to reconsider its provisional ruling. On September 10, 2017, the Supreme Court issued a definitive decision on the merits of Plaintiff’s claim and reinstated Escobal’s mining license. The ruling also ordered MEM to consult with the Xinka indigenous communities within certain municipalities in the region of the Escobal mine within 12 months. Plaintiff and other interested parties appealed the Supreme Court’s decision reinstating the Escobal license to the Constitutional Court which heard the matter on October 25, 2017. The parties are awaiting a final ruling from the Constitutional Court on the definitive decision of the Supreme Court reinstating the license. For full details regarding this claim, see "General Development of Tahoe’s Business - Legal - Escobal License Suspension".

Annual Information Form for the Year Ended December 31, 2017 | 11 |

ESCOBAL EXPORT CREDENTIAL

In June 2017, the Company filed its annual request to renew the export credential with MEM. However, MEM did not renew the credential because its renewal had become contingent on the Supreme Court's reinstatement of the Escobal mining license. The credential therefore expired in August 2017. For full details regarding the status of Escobal’s export credential, see "General Development of Tahoe’s Business - Legal - Escobal Export Credential".

GUATEMALA ROADBLOCK

Since June 7, 2017, a group of protesters near the town of Casillas has blocked the primary highway that connects Guatemala City to San Rafael Las Flores and the Escobal mine. Operations were reduced between June 8 and June 19, 2017 to conserve fuel, and on July 5th were ultimately ceased following the Supreme Court’s provisional decision to suspend the Escobal mining license while the case against MEM was heard on the merits. MSR representatives have been pursuing engagement with community leaders, government agencies, and international mediation experts to develop a dialogue process aimed at resolving the protracted dispute and reaching a peaceful and expeditious conclusion to the roadblock. For full details regarding the status of the Guatemala roadblock, see "General Development of Tahoe’s Business - Legal - Guatemala Roadblock".

CLASS ACTION LAWSUITS

On July 7, 2017, the Company learned that three purported class action lawsuits were filed against Tahoe, and certain of its current and former officers and directors under Section 10(b) and Section 20(a) of the US Securities Exchange Act of 1934, as amended (the "US Exchange Act"), and Rule 10b-5, thereunder. The lawsuits were filed following the issuance of the provisional decision by the Guatemalan Supreme Court described above. See "General Development of Tahoe’s Business - Legal - Class Action Lawsuits".

ESCOBAL UNDERGROUND DEWATERING WELLS AND PUMP STATION

The construction of underground dewatering wells at Escobal on the 1190 level, currently the lowest production level in the mine, continued to advance in the first and second quarters of 2017. A total of seven dewatering wells were drilled. The first component of the newly constructed primary underground pump station, designed to handle clean water pumped from the underground dewatering wells, was commissioned in March 2017. The second component of the pump station will handle water impacted by mining operations. The pump station design and piping scheme maintains separation of clean water from impacted water to minimize the need for water treatment prior to discharge and to provide additional clean make-up water for operations as needed. The underground dewatering and pump station project was placed on hold during the third quarter of 2017.

SHAHUINDO PHASE 1 SOUTH WASTE ROCK DUMP

In the third quarter of 2017, the Company received Phase I permits for the operation of the Shahuindo Mine’s south waste rock dump which is now in use. The south waste rock dump has sufficient capacity to accommodate waste rock material mined from the Shahuindo pit through the end of 2018.

FENN-GIB

The Fenn-Gib deposit is an advanced stage exploration project located 80 kms east of Timmins. A 2011 Mineral Resource estimate contained 1.3 million ounces of gold (40.8 million tonnes at 0.99 g/t Au) in the Indicated category and 0.75 million ounces of gold (24.5 million tonnes at 0.95 g/t Au) in the Inferred category. During 2017, a total of 32,000 meters of surface infill drilling was completed in an effort to upgrade Inferred resources to the Indicated category and provide samples for metallurgical test work. Drilling largely confirmed previous geological interpretations and will be included in a new resource model in 2018. An additional 5,700 metres of surface drilling tested strike extensions up to 500 meters east and west of the current Fenn-Gib resource. The drilling encountered gold mineralization in both directions; however, additional drilling is required to determine the continuity of these mineralized zones. Due to the ongoing suspension of the mining operations in Guatemala, the Company curtailed much of the planned expenditures at Fenn-Gib, including work to establish a Preliminary Economic Assessment of the project.

WHITNEY

The Whitney project is a joint venture with Goldcorp for which the Company is the operator. The project comprises the Hallnor, Bonetal, C Zone and Broulan Reef zones covering approximately 8.9km2 south approximately 4 km south of the Bell Creek Complex. Surface drilling at Whitney during 2017 concentrated on delineating and expanding the near surface resource as well as collecting material for metallurgical studies.

12 | Tahoe Resources Inc. |

In addition, drilling targeted the deeper #19 and #20 veins west of the historic Hallnor mine workings. This program succeeded in extending previously recognized veins 140 meters west and 200 metres to depth. An update to the Whitney model is currently underway. Future mine planning will consider open pit and underground mine alternatives.

DIVIDENDS DISTRIBUTIONS AND REINVESTMENT PLAN

The Company announced the cessation of the dividend and its dividend reinvestment plan, beginning August 8, 2017, due to the Escobal License Suspension. The dividend cessation is intended to protect the health of the Company’s balance sheet and to ensure the Company has financial flexibility.

2016 DEVELOPMENTS |

LAKE SHORE ACQUISITION

On April 1, 2016, the Company completed the acquisition of Lake Shore pursuant to the Lake Shore Arrangement Agreement dated February 8, 2016. The Lake Shore Arrangement was approved by shareholders of the Company and the shareholders of Lake Shore on March 31, 2016 and received final court approval on April 1, 2016.

Pursuant to the terms of the Lake Shore Arrangement Agreement, Lake Shore became a wholly-owned subsidiary of the Company on April 1, 2016 and all of the issued and outstanding common shares of Lake Shore (each a “Lake Shore Share”) were transferred to the Company in consideration for the issuance by the Company of 0.1467 of a Tahoe Share for each Lake Shore Share. The Company filed a Business Acquisition Report in respect of the Lake Shore Arrangement on SEDAR on April 29, 2016.

REDEMPTION OF LAKE SHORE CONVERTIBLE DEBENTURES

Lake Shore had outstanding a class of 6.25% convertible unsecured debentures (the “Debentures”), which were governed by an indenture dated September 7, 2012, as supplemented effective April 1, 2016 (the “Indenture”). As a result of the Lake Shore Arrangement and in accordance with the terms of the Indenture, on conversion of the Debentures each debenture holder was entitled to receive Tahoe Shares (in lieu of Lake Shore Shares). Tahoe and Lake Shore entered into a supplement to the Indenture with Computershare Trust Company of Canada, as trustee, to, among other things, evidence Tahoe’s agreement to issue Tahoe Shares to any debenture holder upon conversion of the Debentures. An aggregate of 10,611,411 Tahoe Shares were issued pursuant to the exercise of conversion rights available to holders of the Debentures.

SHAHUINDO PREFEASIBILITY STUDY

The Company completed the Shahuindo Prefeasibility Study dated January 25, 2016. The Shahuindo Mine reached commercial production on May 1, 2016.

BELL CREEK ROYALTY

On July 5, 2016, the Company acquired from Goldcorp for $12.5 million in cash Goldcorp’s 2% net smelter return royalty related to production at the Bell Creek Mine.

2015 DEVELOPMENTS |

RIO ALTO ACQUISITION

On April 1, 2015, the Company completed the acquisition of Rio Alto pursuant to the Rio Alto Arrangement Agreement dated February 9, 2015. The Rio Alto Arrangement was approved by shareholders of Rio Alto and received final court approval on March 30, 2015.

Pursuant to the terms of the Rio Alto Arrangement Agreement, Rio Alto became a wholly-owned subsidiary of the Company on April 1, 2015, as the Company acquired all of the issued and outstanding common shares of Rio Alto (each a “Rio Alto Share”) in exchange for 0.227 Tahoe Shares and the payment of CAD$0.001 for each Rio Alto Share. Additionally, outstanding options of Rio Alto were deemed to have been exchanged under the Rio Alto Arrangement, and the holders of Rio Alto options received options to purchase Tahoe Shares. In accordance with the terms of the outstanding warrants to purchase Rio Alto Shares, each holder was entitled to receive upon exercise, 0.227 Tahoe Shares and CAD$0.001 in cash in lieu of one Rio Alto Share. The Company filed a Business Acquisition Report in respect of the Rio Alto Arrangement on SEDAR on June 11, 2015.

Annual Information Form for the Year Ended December 31, 2017 | 13 |

SECONDARY OFFERING

On June 30, 2015, Goldcorp closed a secondary offering of 58,051,692 Tahoe Shares it beneficially held at an offering price of CAD$17.20 per share for gross proceeds of approximately CAD$1 billion. The Secondary Offering was completed through a syndicate of underwriters led by GMP Securities L.P. and BMO Nesbitt Burns Inc. The secondary offering resulted in the termination of Goldcorp’s rights under the shareholders’ agreement among the Company and affiliates of Goldcorp, which was last amended and restated on February 9, 2015.

INDEBTEDNESS |

REVOLVING CREDIT FACILITY

On February 16, 2018, the Company closed its Second Amended and Restated Credit Facility with its bank syndicate providing the Company with full access to a $175 million revolving credit facility, which includes a $25 million accordion feature, for total access of $200 million in capital. The revised facility matures on July 19, 2021. This facility is structured on the strength of Tahoe’s gold business alone, and access to the facility does not rely on the operation of the Escobal Mine. The Bank of Nova Scotia and HSBC Securities (USA) Inc. are the co-leads for the facility, with The Bank of Nova Scotia acting as the administrative agent. The facility bears interest on a sliding scale of LIBOR plus between 2.25% to 3.25% or a base rate plus 1.25% to 2.25%, which is determined based upon the Company's consolidated net leverage ratio. Standby fees for the undrawn portion of the facility are also on a similar sliding scale basis of between 0.5063% and 0.7313%. The Second Amended and Restated Credit Facility superseded the $150 million revolving credit facility that the Company initially entered on August 10, 2015, and amended on July 18, 2017, with a syndicate of lenders.

CREDIT AGREEMENT LOAN

The Company’s 2016 credit agreement with an international bank in the aggregate amount of $35 million bore interest at LIBOR plus 2.25% on the portion drawn. The LIBOR rate was reset on July 10, 2017. The Facility had a two-year term with a maturity date of April 9, 2018. As a condition of closing the Second Amended and Restated Credit Facility, this credit agreement was terminated on February 20, 2018 with all amounts repaid from operating cash flows.

INTER-CORPORATE RELATIONSHIPS |

Tahoe’s corporate structure as of the date of this AIF is as follows:

LEGAL |

ESCOBAL LICENSE SUSPENSION

On May 24, 2017, an anti-mining organization (“Plaintiff”) filed a claim in the Supreme Court of Guatemala against MEM alleging that MEM violated the Xinka indigenous communities’ right of consultation in advance of granting the Escobal mining license to Tahoe’s Guatemalan subsidiary, Minera San Rafael ("MSR").

14 | Tahoe Resources Inc. |

On July 5, 2017, the Company was notified that the Supreme Court of Guatemala issued a provisional decision in respect of the action against MEM that suspended the Escobal mining license of MSR until the underlying civil claim was fully heard on the merits.

On July 14, 2017, the Company filed a legal action against the Guatemalan Supreme Court challenging jurisdiction and the irregular process that the Supreme Court followed in rendering its decision, both of which the court denied.

The Company filed a procedural challenge with the Constitutional Court, the highest court in Guatemala, regarding the assignment of judges of the Supreme Court and also asked for the Supreme Court to reconsider its provisional ruling. On July 28, 2017, the Supreme Court denied the Company’s motion for reconsideration and on August 29, 2017 the Constitutional Court issued a resolution denying the Company's appeal regarding the provisional ruling.

On September 10, 2017, the Supreme Court issued a definitive decision on the merits of Plaintiff’s claim and reinstated Escobal’s mining license. The ruling also ordered MEM to consult with the Xinka indigenous communities within certain municipalities in the region of the Escobal mine within 12 months, namely Casillas, Nueva Santa Rosa, Mataquescuintla and San Rafael Las Flores. In addition, the ruling allowed Escobal to restart operations immediately and to continue to operate during consultation. In response to a motion for clarification filed by MSR on August 26, 2017, the Supreme Court declined to review the Company’s request to order MEM to issue the annual renewal of Escobal’s export credential, which expired on August 8, 2017 due to the pending appeal with the Constitutional Court of the Supreme Court’s decision on September 10, 2017. Although Tahoe believes that MEM complied with ILO Convention 169 before it issued the Escobal license, it will fully support MEM in any of its future indigenous engagement to the extent it is permitted.

Plaintiff and other interested parties appealed the Supreme Court’s decision reinstating the Escobal license to the Constitutional Court which heard the matter on October 25, 2017. The parties are awaiting a final ruling from the Constitutional Court on the definitive decision of the Supreme Court reinstating the license.

Due to the delay of a decision from the Constitutional Court and inability of the Company to resume mining operations, the Company terminated 250 MSR employees on January 15, 2018. If the Constitutional Court issues a favorable ruling reinstating the Escobal mining license and Escobal resumes operation, Tahoe will seek to restore its workforce.

For additional details, refer to the press releases dated September 26, 2017, September 10, 2017, August 24, 2017 and July 5, 2017 available on SEDAR at www.sedar.com, on EDGAR at www.sec.gov or on the Company’s website at www.tahoeresources.com.

ESCOBAL EXPORT CREDENTIAL

In June 2017, the Company filed its annual request to renew the export credential with MEM. However, MEM did not renew the credential because its renewal had become contingent on the Supreme Court's reinstatement of the Escobal mining license. The credential therefore expired in August 2017. After the Supreme Court reinstated the mining license in September 2017, MEM publicly stated to local press that the export credential could be legally renewed. However, contrary to such public declaration, in December MEM indicated in a written communication to MSR that it will not renew the credential given the pending ruling from the Constitutional Court. The Company expects that MEM will renew the export credential in the event of a positive ruling of the Constitutional Court on the appeal reinstating the license.

GUATEMALA ROADBLOCK

Since June 7, 2017, a group of protesters near the town of Casillas has blocked the primary highway that connects Guatemala City to San Rafael Las Flores and the Escobal mine. Operations were reduced between June 8 and June 19, 2017 to conserve fuel, and on July 5th were ultimately ceased following the Supreme Court’s provisional decision to suspend the Escobal mining license while the case against MEM was heard on the merits. While some of the protestors are residents of Casillas, which is 16 kilometers from the mine, many more are from outside the municipality. The Company has reason to believe that the blockade is politically motivated and is being substantially funded by anti-mining groups. As the roadblock continued, some protestors became increasingly violent. Following the September 10, 2017 court ruling that reinstated the Escobal mining license, the Company attempted to transport supplies to the mine site. Protesters blocked the passage of company vehicles and attacked the truck drivers and trucks. On a separate occasion, a helicopter attempting to deliver fuel to the mine was shot at from the ground.

MSR representatives have continued to engage with community leaders, government agencies, and international mediation experts aimed at resolving the protracted dispute and reaching a peaceful and expeditious conclusion to the roadblock, and have made significant headway in recent weeks.

Annual Information Form for the Year Ended December 31, 2017 | 15 |

CLASS ACTION LAWSUITS

On July 7, 2017, the Company learned that three purported class action lawsuits were filed against Tahoe, and certain of its current and former officers and directors under Section 10(b) and Section 20(a) of the US Securities Exchange Act of 1934, as amended (the "US Exchange Act"), and Rule 10b-5, thereunder. The lawsuits were filed in three different federal courts and all generally allege that the Company made untrue statements of material facts or omitted to state material facts or engaged in acts that operated as a fraud upon the purchasers of the Company's stock. The lawsuits were filed following the issuance of the provisional decision by the Guatemalan Supreme Court described above. The suits allege compensatory damages, interest, fees and costs. The Company expects the cases to be transferred to one court so that they can be consolidated and a lead plaintiff can be appointed to represent the purported class members. The Company disputes the allegations raised and will vigorously defend the lawsuits, the outcome of which is not determinable at this time.

MEM’S HEARING OF WRITTEN OPPOSITIONS

On July 23, 2013, the Court of Appeals in Guatemala (the “Appeals Court”) held that MEM should have conducted a hearing of a written opposition to the Escobal Mine Exploitation License (“Opposition”) during the permitting application process. The Appeals Court did not rule on the substance or validity of the license but stated that MEM was obligated to hold an administrative hearing addressing the substance of the Opposition under the 1997 Mining Law. MEM issued a press release on July 24, 2013 stating that the ruling had no impact on the status of the Company’s exploitation license. On July 25, 2013, MEM and the Company appealed the Appeals Court’s decision to the Constitutional Court and the Constitutional Court upheld the Appeals Court’s decision, compelling MEM to conduct a hearing on the Opposition that MEM already found to be without merit. The claimants subsequently requested a clarification from the Constitutional Court, which the Constitutional Court denied in early May 2016.

In June 2016, MEM commenced the hearing process and then suspended it indefinitely as a result of an administrative file issue. In August 2016, claimant presented a request to the Appeals Court to suspend the exploitation license. The Appeals Court denied claimant’s request. Claimant appealed that ruling to the Constitutional Court, which was denied. The administrative issue has now been resolved and there do not appear to be remaining impediments to the hearing process proceeding. The Opposition involves dated claims of prospective environmental harm (no such harm has materialized since production at Escobal began three years ago) and new claims of inadequate consultation.

GARCIA ET AL. V. TAHOE

On June 18, 2014, seven plaintiffs filed an action against the Company in the Supreme Court of British Columbia alleging battery and negligence regarding a security incident that occurred at the Escobal Mine on April 27, 2013. The plaintiffs seek compensatory and punitive damages.

Tahoe challenged the claim in June 2014 based on jurisdictional issues, and the Court issued a judgment in Tahoe’s favor in November 2015 ruling the case should be heard in Guatemala. The plaintiffs appealed the decision to the Court of Appeal for British Columbia, which reversed the decision in January 2017, allowing the legal claims filed by the Guatemalan plaintiffs to be heard in British Columbia. Tahoe filed an application for leave to appeal the issue to the Supreme Court of Canada, which was dismissed on June 8, 2017. In April 2017, three of the seven plaintiffs settled with the Company. The case of the four remaining plaintiffs will now be heard in the Supreme Court of British Columbia.

DESCRIPTION OF TAHOE'S BUSINESS |

OVERVIEW OF TAHOE'S BUSINESS AND STRATEGY |

Tahoe’s strategy is to responsibly and profitably operate the Escobal, La Arena, Shahuindo, Bell Creek and Timmins West Mines to international standards and develop and operate high quality precious metals assets in the Americas. We are committed to sustainable development and to providing significant long-term benefits from our operations to our host communities and governments. Tahoe’s principal objectives at this time are to secure the operating license in Guatemala and resume production, optimize the Company’s current operations and continue expanding the Mineral Resource and Mineral Reserve base through exploration and development of the Escobal, La Arena, Shahuindo, Bell Creek and Timmins West ore bodies and other mineral deposits identified in those regions.

Tahoe will continue to identify, investigate and, where appropriate, acquire interests in mineral properties in the Americas through direct application to government authorities, joint venture activities or acquisition from existing holders. As part of this process, the Company will undertake early-stage exploration activities to ensure

16 | Tahoe Resources Inc. |

an orderly and steady development of exploration targets. For details on La Arena II, see "General Development of Tahoe’s Business - Development of Tahoe’s Business - 2018 Developments - La Arena II".

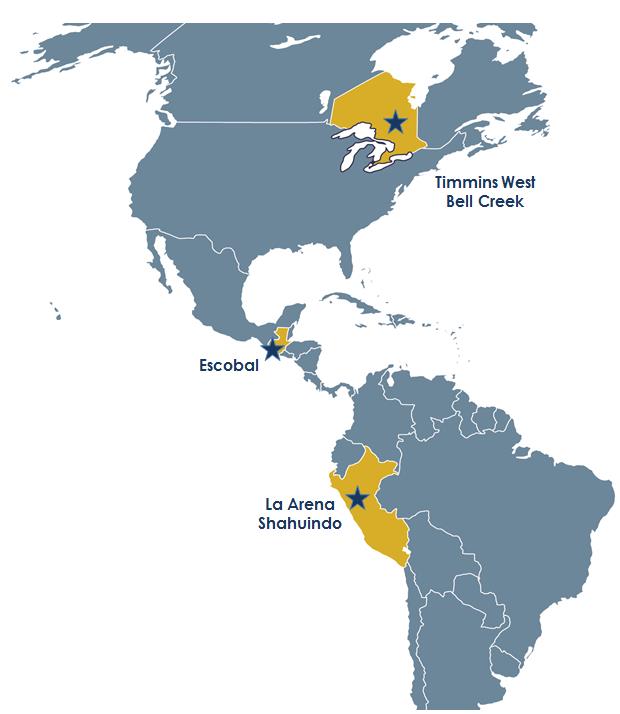

The following map shows the locations of Tahoe’s producing mineral properties.

THE GOLD INDUSTRY |

Demand for gold is primarily based on global investment demand, central bank holdings and jewelry. Saving and disposal play a larger role in the price of gold than does consumption. The metal is also used for coinage, and has been used as a standard for monetary systems in some countries.

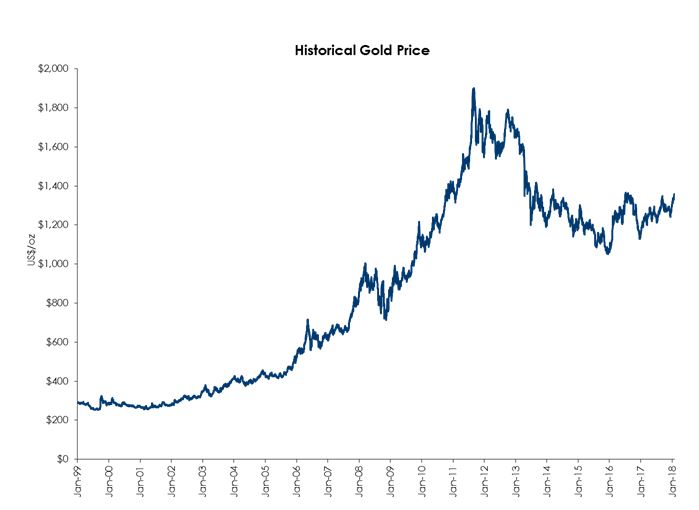

Gold prices will have a direct impact on Tahoe’s business. Declining prices can, for example, impact operations by requiring a re-assessment of the feasibility of a particular project. See "Description of Tahoe’s Business - Risk Factors Relating to Tahoe’s Business". A chart indicating gold prices since January 1, 1999, is set out below.

As of January 31, 2018, the London Fix price of gold was US$1,345.05.

Annual Information Form for the Year Ended December 31, 2017 | 17 |

THE SILVER INDUSTRY |

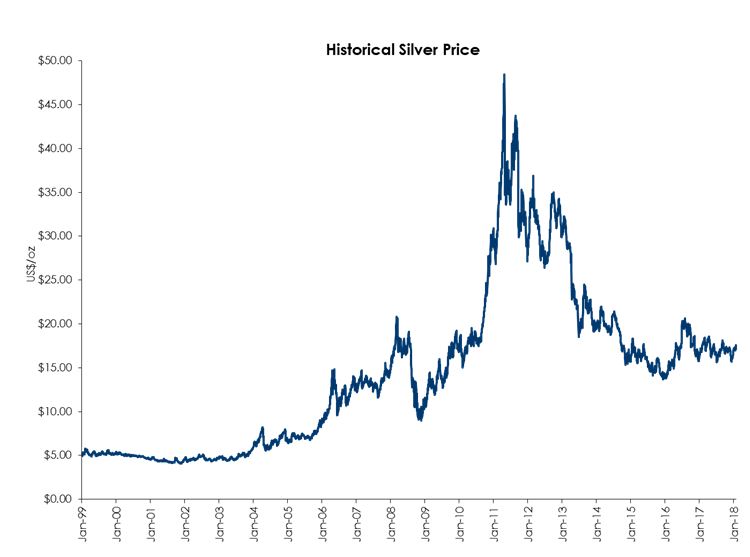

Demand for silver is based on investment demand, industrial and decorative uses, photography, jewelry and silverware. Together, these categories represent more than 90% of annual silver consumption.

Silver has a number of unique properties including its strength, malleability and ductility, its electrical and thermal conductivity, its sensitivity to and high reflectance of light, and its ability to endure extreme temperature ranges. Silver’s unique properties restrict its substitution in most applications.

Silver prices will have a direct impact on Tahoe’s business. Declining prices can, for example, impact operations by requiring a re-assessment of the feasibility of a particular project. See "Description of Tahoe’s Business - Risk Factors Relating to Tahoe’s Business". A chart indicating silver prices since January 1, 1999, is set out below.

As of January 31, 2018, the London Fix price of silver was US$17.23.

PRODUCT |

The Company produces metal-bearing concentrates and gold doré. At Escobal, silver, gold, lead and zinc are recovered by differential flotation, producing silver-rich lead concentrates and zinc concentrates which are sold to third-party smelters under concentrate sales arrangements. Silver sales at Escobal for the year ended December 31, 2017 totaled $170.5 million, and for the year ended 2016 totaled $316.8 million. No revenues from the sale of by-product metals (gold, lead, zinc) exceeded 15% of the total consolidated revenue. Gold doré is refined and sold to third parties (principally international bullion banks and traders) under refining, sales and purchase agreements. At La Arena, gold doré is produced through a cyanide leach solution and carbon absorption system. Gold sales at La Arena for the year ended December 31, 2017 totaled $233.3 million, and for the year ended 2016 totaled $244.4 million. At Shahuindo, a cyanide leach solution and carbon absorption system is used to pour gold doré, which first occurred in December 2015. Commercial production began at Shahuindo in the second quarter of 2016. Gold sales at Shahuindo for the year ended December 31, 2017 totaled $93.5 million, and for the year ended 2016 totaled $47.2 million (gold sold prior to declaration of commercial production was credited against construction capital). Ore from the Bell Creek and Timmins West Mines is processed at the Bell Creek Mill. Gold doré is produced using carbon-in-pulp and carbon-in-leach recovery systems. The loaded solution from the strip circuit is passed through two electro-winning cells in the refinery where gold doré is poured and then sold to third parties under refining, sales and purchase agreements. Sales from the Bell Creek and Timmins West Mines for the year ended December 31, 2017 totaled $211.7 million, and for the year ended 2016 totaled $137.1 million (sales for the Bell Creek and Timmins West Mines commenced April 1, 2016 following the acquisition of Lake Shore).

18 | Tahoe Resources Inc. |

SPECIALIZED SKILL AND KNOWLEDGE |

Most aspects of Tahoe’s business require specialized skills and knowledge in the areas of geology, engineering, exploration and development, environmental management, sustainability and accounting. Tahoe has a number of employees with extensive experience in mining, engineering, geology, exploration and development and sustainability in Guatemala, Peru and Canada, including C. Kevin McArthur, Executive Chair, Ronald W. Clayton, President and Chief Executive Officer, Brian Brodsky, Vice President Exploration, Charlie Muerhoff, Vice President Technical Services, Mark Sadler, Vice President Projects Development, Tom Fudge, Vice President Operations, Edie Hofmeister, Executive Vice President Corporate Affairs & General Counsel, Phil Dalke, Vice President Operations Peru, Dave Howe, Vice President Operations Guatemala and Peter Van Alphen, Vice President Operations Canada. In addition, Tahoe’s management team has extensive experience in accounting and finance, including Vice President and Chief Financial Officer Elizabeth McGregor and Vice President and Controller Ryan Snow.

Mr. McArthur is an experienced mining engineer with over 35 years of engineering, mine building and mine operations experience, including over six years as Chief Executive Officer of the Company, where he and the Company’s experienced executive team built, acquired and operated world class mines in the Americas. Mr. McArthur currently serves as the Company’s Executive Chair. Previously, he served eight years in the role of President and Chief Executive Officer of Glamis Gold Ltd. and two years in the role of President and Chief Executive Officer of Goldcorp. Mr. Clayton is a seasoned mining executive and mining engineer with more than 35 years of experience operating mines. He served as the Company’s first Chief Operations Officer beginning in 2010 and became the Company’s Chief Executive Officer in 2016. He was Senior Vice President, Operations, for Hecla Mining Company before joining the Company. Messrs. McArthur, Clayton, Brodsky, Muerhoff, Fudge, Dalke, Howe and Van Alphen have substantial underground and open pit mining experience, including significant Latin American and Canadian operating experience. Mr. Muerhoff is a Qualified Person as defined by NI 43-101 and has worked in the mining industry for over 25 years.

EMPLOYEES |

As of February 1, 2018, Tahoe Resources USA employed 29 people in Reno, Nevada, MSR employed 780 people in Guatemala, Tahoe Peru employed 1,200 people in Peru, and Tahoe Canada employed 675 people in Canada.

FOREIGN OPERATIONS |

The Escobal Mine is located in Guatemala and the La Arena and Shahuindo Mines are located in Peru. As such, these operations are exposed to various levels of political, economic and other risks and uncertainties associated with operating in a foreign jurisdiction. See "Description of Tahoe’s Business - Risk Factors Relating to Tahoe’s Business - Operations in Guatemala, Peru and Canada", "- Obtaining and Renewing Licenses and Permits", "- Licenses and Title to Assets", and "- Governmental Laws and Regulation".

COMPETITIVE CONDITIONS |