QuickLinks -- Click here to rapidly navigate through this document

As filed with the Securities and Exchange Commission on June 23, 2015

Registration No. 333-204956

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO THE

FORM F-10

REGISTRATION STATEMENT

Under the Securities Act of 1933

TAHOE RESOURCES INC.

(Exact name of Registrant as specified in its charter)

British Columbia, Canada |

1040 (Primary Standard Industrial Classification) Code Number (if applicable)) |

27-1840120 (I.R.S. Employer Identification Number (if applicable)) |

5310 Kietzke Lane, Suite 200, Reno, Nevada 89511

(775) 448-5800

(Address and telephone number of the Registrant's principal executive offices)

Tahoe Resources USA Inc.

5310 Kietzke Lane, Suite 200, Reno, Nevada 89511

(775) 448-5800

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Copies to:

| Edie Hofmeister Tahoe Resources Inc. 5310 Kietzke Lane, Suite 200, Reno, Nevada 89511 (775) 448-5800 |

Michael Taylor Amandeep Sandhu McMillan LLP 1055 W Georgia St. Vancouver, BC, Canada V6E 3P3 (604) 691-7410 |

Mark Mandel Brett Nadritch Milbank, Tweed, Hadley & McCloy LLP 28 Liberty Street New York, NY 10005 (212) 530-5026 |

Riccardo A. Leofanti Skadden, Arps, Slate, Meagher & Flom LLP 222 Bay Street Suite 1750, P.O. Box 258 Toronto, ON, Canada M5K 1J5 (416) 777-4700 |

Maurice Swan Stikeman Elliott LLP Commerce Court West 199 Bay Street Toronto, ON, Canada M5L 1B9 (416) 869-5517 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after effectiveness of this Registration Statement.

Province of British Columbia, Canada

(Principal jurisdiction regulating this offering (if applicable))

It is proposed that this filing shall become effective (check appropriate box):

A. |

ý | Upon the filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada) | ||

B. |

o | At some future date (check the appropriate box below): | ||

|

1.o Pursuant to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing) | |||

|

2.o Pursuant to Rule 467(b) on (date) at (time) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on (date). | |||

|

3.o Pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority or the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. | |||

|

4.o After the filing of the next amendment to this Form (if preliminary material is being filed). |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check the following box. o

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

I-1

Secondary Offering |

June 23, 2015 |

TAHOE RESOURCES INC.

$998,489,102

58,051,692 Common Shares

This short form prospectus is being filed to qualify the distribution (the "Offering") of 58,051,692 common shares (the "Offered Shares") of Tahoe Resources Inc. ("we", "us", "our", "Tahoe" or the "Company") at a price of $17.20 per Offered Share (the "Offering Price") owned, beneficially and of record, by Les Mines Opinaca Ltée. (the "Selling Shareholder"), a wholly-owned subsidiary of Goldcorp Inc. ("Goldcorp"). The Company will not receive any part of the proceeds from the sale of the Offered Shares by the Selling Shareholder. The Selling Shareholder currently owns an aggregate of approximately 25.6% of the outstanding common shares (the "Common Shares") of the Company. Following completion of the Offering, neither Goldcorp nor the Selling Shareholder will own any of the outstanding Common Shares. See "Selling Shareholder" and "Plan of Distribution".

GMP Securities L.P., BMO Nesbitt Burns Inc., CIBC World Markets Inc., HSBC Securities (Canada) Inc., RBC Dominion Securities Inc., Scotia Capital Inc., TD Securities Inc., Citigroup Global Markets Canada Inc., Credit Suisse Securities (Canada), Inc., the Canadian broker-dealer affiliate of Goldman, Sachs & Co., Laurentian Bank Securities Inc., Merrill Lynch Canada Inc., Morgan Stanley Canada Ltd., Beacon Securities Limited, Canaccord Genuity Corp., Cormark Securities Inc., Dundee Securities Ltd., Macquarie Capital Markets Canada Ltd., Paradigm Capital Inc., and Raymond James Ltd. (together, the "Underwriters") have agreed to purchase the Offered Shares from the Selling Shareholder subject to the terms and conditions set forth in an underwriting agreement dated June 16, 2015 among the Selling Shareholder, Goldcorp, the Company and the Underwriters (the "Underwriting Agreement") more fully described under "Plan of Distribution". Subject to applicable laws and in connection with the Offering, the Underwriters may effect transactions that stabilize or maintain the market price of the Common Shares at levels other than those which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. See "Plan of Distribution".

The Offering is being made by a Canadian "foreign private issuer" that is permitted, under a multijurisdictional disclosure system adopted by the securities regulatory authorities in Canada and the United States, to prepare this short form prospectus in accordance with the disclosure requirements of Canada. Prospective investors in the United States should be aware that such requirements are different from those of the United States. The financial statements incorporated herein have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, are subject to Canadian auditing and auditor independence standards, and thus may not be comparable to financial statements of United States companies. These financial statements are subject to Canadian generally accepted auditing standards, the standards of the Public Company Accounting Oversight Board (United States), and Canadian auditor independence standards, in addition to the independence standards of the Public Company Accounting Oversight Board (United States) and the United States Securities and Exchange Commission (the "SEC").

Prospective investors should be aware that the acquisition of the securities described herein may have tax consequences both in the United States and in Canada, including the Canadian federal income tax consequences applicable to a foreign controlled Canadian corporation that acquires Offered Shares. Such consequences for investors who are resident in, or citizens of, the United States may not be described fully herein. Prospective investors should read the tax discussion contained herein and consult their own tax advisors with respect to their particular circumstances. See "Certain Canadian Federal Income Tax Considerations" and "Material United States Federal Income Tax Considerations".

The enforcement by investors of civil liabilities under the United States federal securities laws may be affected adversely by the fact that the Company is organized under the laws of British Columbia, Canada, that some or all of its officers and directors may be residents of a foreign country, that some or all of the experts named in this short form prospectus may be residents of a foreign country, and that a substantial portion of the assets of the Company and said persons may be located outside the United States.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC NOR ANY STATE OR CANADIAN SECURITIES COMMISSION NOR HAS THE SEC OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS SHORT FORM PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

The outstanding Common Shares are listed and posted for trading on the Toronto Stock Exchange (the "TSX") under the symbol "THO", on the New York Stock Exchange (the "NYSE") under the symbol "TAHO", and are provisionally listed on the Lima Stock Exchange ("BVL") under the symbol "THO". On June 22, 2015, the last trading day before the date of this short form prospectus, the closing price of the Common Shares on the TSX, on the NYSE and on the BVL was $16.57, US$13.44 and US$13.41, respectively.

Unless otherwise stated, references herein to "$" are to the Canadian dollar. References to "US$" are to the United States dollar.

Investing in the Common Shares involves risks. Prospective investors should consider the risk factors described under "Risk Factors" and in the documents incorporated by reference into this short form prospectus.

Price $17.20 per Offered Share

| |

Price to the Public(1) |

Underwriters' Commission(2) |

Net Proceeds to the Selling Shareholder(3) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Per Offered Share |

$17.20 | $0.688 | $16.512 | |||||||

Total |

$998,489,102 | $39,939,564 | $958,549,538 | |||||||

Notes:

- (1)

- The

price at which the Offered Shares are being offered hereunder was determined by negotiation between Goldcorp, the Selling Shareholder and the

Underwriters with reference to the market price of the Common Shares.

- (2)

- Pursuant

to the terms of the Underwriting Agreement, the Underwriters will receive a commission (the "Underwriters' Commission") equal to 4.00% of

the gross proceeds of the Offering paid by the Selling Shareholder.

- (3)

- After deducting the Underwriters' Commission but before deducting expenses of the Offering, estimated at $2.5 million. Expenses of the Offering include all reasonable expenses of the Company and the Underwriters and all expenses of the Selling Shareholder, of which the Underwriters have agreed to pay $2.5 million on account of the expenses of the Offering. Any expenses in excess of this amount will be borne by the Selling Shareholder. The Company will not receive any proceeds from the Offering.

Prospective purchasers should rely only on the information contained or incorporated by reference in this short form prospectus. The Company, Goldcorp, the Selling Shareholder and the Underwriters have not authorized anyone to provide prospective purchasers with additional or different information from that contained or incorporated by reference in this short form prospectus. The Offered Shares are being offered only in jurisdictions where, and to persons to whom, offers and sales are lawfully permitted.

The Underwriters, as principals, conditionally offer the Offered Shares, subject to prior sale, if, as and when sold and delivered by the Selling Shareholder and accepted by the Underwriters in accordance with the conditions contained in the Underwriting Agreement referred to under "Plan of Distribution" and subject to the approval of certain legal matters on behalf of the Company by McMillan LLP with respect to Canadian legal matters and Milbank, Tweed, Hadley & McCloy LLP with respect to United States legal matters, on behalf of Goldcorp and the Selling Shareholder by Cassels Brock & Blackwell LLP with respect to Canadian legal matters and Neal Gerber & Eisenberg LLP with respect to United States legal matters, and on behalf of the Underwriters by Stikeman Elliott LLP with respect to Canadian legal matters and Skadden, Arps, Slate, Meagher & Flom LLP with respect to United States legal matters.

Certain of the Underwriters, (BMO Nesbitt Burns Inc., Scotia Capital Inc., CIBC World Markets Inc., HSBC Securities (Canada) Inc., RBC Dominion Securities Inc., TD Securities Inc., Merrill Lynch Canada Inc., Citigroup Global Markets Canada Inc., Credit Suisse Securities (Canada), Inc., Goldman Sachs Canada Inc. and Morgan Stanley Canada Ltd.), are directly or indirectly, wholly-owned subsidiaries of Canadian chartered banks or affiliates of other institutional lenders which are part of a syndicate of lenders to Goldcorp, the parent company of the Selling Shareholder, and its subsidiaries. Consequently, the Selling Shareholder may be considered to be a "connected issuer" of BMO Nesbitt Burns Inc., Scotia Capital Inc., CIBC World Markets Inc., HSBC Securities (Canada) Inc., RBC Dominion Securities Inc., TD Securities Inc., Merrill Lynch Canada Inc., Citigroup Global Markets Canada Inc., Credit Suisse Securities (Canada), Inc., Goldman Sachs Canada Inc. and Morgan Stanley Canada Ltd. for the purposes of Canadian securities legislation in certain jurisdictions. See "Relationship Between Selling Shareholder and Underwriters (Conflicts of Interest)".

Subscriptions will be received subject to rejection in whole or in part and the right is reserved to close the subscription books at any time without notice. The Offering will be conducted under the book-based system. A purchaser of the Offered Shares will generally receive only a customer confirmation from the registered dealer from or through which the Offered Shares are purchased and who is a CDS Clearing and Depository Services Inc. ("CDS") depository service participant. No certificates will be issued to purchasers (except in certain limited circumstances), and registration will be made in the depository service of CDS. The closing of the Offering is expected to take place on or about June 30, 2015, or such other date as may be agreed upon by the Company, the Selling Shareholder and the Underwriters. After the Underwriters have made reasonable efforts to sell all of the Offered Shares at the Offering Price, the Underwriters may offer the Offered Shares at a price lower than the Offering Price. See "Plan of Distribution".

Our head office is located at 5310 Kietzke Lane, Suite 200, Reno, Nevada, United States 89511. The registered office of the Company is located at Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia, V6E 4N7.

Certain of our directors and officers, Messrs. Alex Black, Kevin McArthur, Dan Rovig, James Voorhees, Drago Kisic and Mark Sadler, reside outside of Canada. Messrs. Black, McArthur, Rovig, Voorhees, Kisic and Sadler have appointed McMillan LLP as agent for service of process at the following address: 1500 – 1055 West Georgia Street, Vancouver, British Columbia V6E 4N7. Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if such person or company has appointed an agent for service of process.

| |

Page | |

|---|---|---|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

1 | |

GLOSSARY OF TECHNICAL TERMS |

4 | |

CAUTIONARY NOTE TO UNITED STATES INVESTORS |

6 | |

DOCUMENTS INCORPORATED BY REFERENCE |

7 | |

MARKETING MATERIALS |

8 | |

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT |

8 | |

AVAILABLE INFORMATION |

8 | |

ENFORCEMENT OF LEGAL RIGHTS |

9 | |

CURRENCY AND EXCHANGE RATE INFORMATION |

10 | |

THE COMPANY |

10 | |

RISK FACTORS |

13 | |

USE OF PROCEEDS |

27 | |

PLAN OF DISTRIBUTION |

28 | |

DESCRIPTION OF SECURITIES BEING DISTRIBUTED |

30 | |

CONSOLIDATED CAPITALIZATION |

30 | |

PRIOR SALES |

30 | |

TRADING PRICE AND VOLUME |

33 | |

SELLING SHAREHOLDER |

34 | |

RELATIONSHIP BETWEEN SELLING SHAREHOLDER AND UNDERWRITERS (CONFLICTS OF INTEREST) |

34 | |

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS |

35 | |

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS |

37 | |

LEGAL MATTERS |

40 | |

INTEREST OF EXPERTS |

41 | |

INDEPENDENT AUDITOR, TRANSFER AGENT AND REGISTRAR |

41 |

Unless the context requires otherwise, all references in this short form prospectus to "we", "us", "Tahoe", or the "Company" refer to Tahoe Resources Inc. and its subsidiaries.

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This short form prospectus and the documents incorporated by reference herein contain "forward-looking statements" and "forward-looking information" under the provisions of Canadian provincial securities laws and the United States Private Securities Litigation Reform Act of 1995. When used in this short form prospectus or the documents incorporated by reference herein, words such as "believe", "intend", "may", "will", "should", "plans", "anticipates", "believes", "potential", "intends", "expects", "estimates", "forecasts", "likely", "goal" and similar expressions are intended to identify such forward-looking statements. Forward-looking statements reflect our current expectations and assumptions, and are subject to a number of known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any anticipated future results, performance or achievements expressed or implied by the forward-looking statements.

Forward-looking statements in this short form prospectus and the documents incorporated by reference herein include those that relate to:

- •

- the Company's liquidity position and expected sufficiency of cash from operations to fund repayment of

outstanding debt;

- •

- the expected working capital requirements and the ability to generate cash flows that exceed capital requirements;

- •

- capital expenditures and costs, including forecasted cash costs;

- •

- the sufficiency of capital resources and the possibility of considering alternative financing arrangements to meet

strategic needs;

- •

- the Company's ability to complete future financings to raise additional capital for exploration, development and

operational activities and for acquisitions;

- •

- the Company's 2015 operations outlook and production guidance, including estimated unit costs per ounce of silver and gold

and estimated capital costs;

- •

- the assessment of future reclamation obligations;

- •

- exploration and review of prospective mineral acquisitions;

- •

- the ability of the Company to identify appropriate acquisition opportunities or, if an opportunity is identified, to

conclude a transaction on satisfactory terms;

- •

- the statements regarding changes in Guatemalan and Peruvian mining laws and regulations;

- •

- the timing and results of court proceedings;

- •

- the expected increases in mill operations at the Escobal Mine (as defined herein);

- •

- the timing for optimizing the paste backfill plant, fourth filter press and second primary ventilation fan at the

Escobal Mine;

- •

- the estimation of Mineral Reserves (as defined under "Glossary of Technical Terms") and Mineral Resources

(as defined under "Glossary of Technical Terms") and the realization of Mineral Reserve and Mineral Resource estimates (including all assumptions);

- •

- expected benefits of the acquisition (the "Rio Alto Acquisition") of Rio Alto Mining Limited

("Rio Alto");

- •

- future exploration and development activities and the expected results of exploration activities;

- •

- the ability to identify new Mineral Resources and convert Mineral Resources into Mineral Reserves;

- •

- the impact of new estimation methodologies on mine and production planning;

- •

- the timing and receipt of approvals, consents and permits under applicable legislation in connection with the continued

operation and development of the Escobal Mine, the La Arena Mine (as defined herein), and the Shahuindo Project (as defined herein);

- •

- alternatives to two-stage crushing and agglomeration at the Shahuindo Project;

- •

- the anticipated timing of the updated Mineral Resource and Mineral Reserve estimates and the commencement of commercial

operations at the Shahuindo Project;

- •

- the ability of the Company to comply with environmental, safety and other regulatory requirements;

- •

- expectations regarding currency fluctuations; and

- •

- any statement as to future dividends.

1

Such forward-looking information is necessarily based upon numerous factors and assumptions that, while considered reasonable by the Company as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The assumptions made by the Company in preparing the forward-looking information contained in this short form prospectus and the documents incorporated by reference, which may prove to be incorrect, include, but are not limited to:

- •

- the specific assumptions set forth in this short form prospectus and the documents incorporated by reference;

- •

- the expectations and beliefs of management;

- •

- assumptions relating to the existence of companies that may wish to dispose of producing or near-term producing precious

metals assets;

- •

- the Company's ability to carry on exploration and development activities, including construction;

- •

- successful integration of Rio Alto and realization of anticipated benefits;

- •

- the timely receipt of required approvals;

- •

- the price of silver, gold and other metals remains consistent with the Company's expectations;

- •

- prices for key mining supplies, including labour costs and consumables, remaining consistent with the Company's current

expectations;

- •

- production meeting expectations and being consistent with estimates;

- •

- plant, equipment and processes operating as anticipated;

- •

- that there are no significant disruptions affecting operations, whether due to labour disruptions, supply disruptions,

damage to or loss of equipment, whether as a result of natural occurrences including flooding, political changes, title issues, intervention by local landowners, loss of permits, or environmental

concerns or otherwise;

- •

- there being no material variations in the current tax and regulatory environment;

- •

- the Company's ability to operate in a safe, efficient and effective manner;

- •

- the exchange rates among the Canadian dollar, the Guatemalan quetzal, the Peruvian nuevo sol and the United States

dollar remaining consistent with current levels;

- •

- that the Company will be able to obtain and maintain government approvals or permits in connection with the continued

operation and development of the Escobal Mine, the La Arena Mine and the Shahuindo Project; and

- •

- the Company's ability to obtain financing as and when required and on reasonable terms.

Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. No assurance can be given that these assumptions will prove to be correct. These assumptions should be considered carefully by readers. Readers are cautioned not to place undue reliance on the forward-looking information and statements or the assumptions on which the Company's forward-looking information and statements are based.

Forward-looking information is subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual results, performance or achievements to differ from those reflected in the forward-looking statements. Such risks, uncertainties and other factors include, but are not limited to:

- •

- the Company's dependence on the Escobal Mine and La Arena Mine;

- •

- risks associated with operations in Guatemala;

- •

- risks associated with operations in Peru;

- •

- other risks associated with foreign operations;

- •

- risks related to commodity price fluctuations;

- •

- the timing and ability to maintain and, where necessary, obtain necessary permits and licenses;

2

- •

- the Company's limited operating and production history;

- •

- projected cash costs of production and capital expenditures may be greater than anticipated;

- •

- failure to achieve anticipated production levels;

- •

- risks related to the Company's indebtedness;

- •

- the availability of additional funding as and when required;

- •

- land title risks;

- •

- changes in national and local government legislation, taxation and controls or regulations and changes in the

administration of governmental regulation, policies and practices;

- •

- mining risks which delay operations or prevent extraction of material;

- •

- uncertainty of future production, delays in completion of the mill expansion, exploration and development plans;

- •

- insurance and uninsured risks;

- •

- risks associated with illegal mining activities by unauthorized individuals on the Company's mining or exploration

properties;

- •

- risks related to the transportation of concentrate;

- •

- environmental risks and hazards, including cost of environmental expenditures and potential environmental liabilities;

- •

- the speculative nature of mineral exploration and development;

- •

- exploration potential, mineral grades and mineral recovery estimates;

- •

- the uncertainty in geologic, hydrological, metallurgical and geotechnical studies and opinions;

- •

- the uncertainty in the estimation of Mineral Resources and Mineral Reserves and ability to convert its Mineral Resources

into Mineral Reserves;

- •

- infrastructure risks, including access to water and power;

- •

- dependence on key management personnel and executives;

- •

- the impact of global economic conditions;

- •

- risks associated with competition;

- •

- risks associated with currency fluctuations;

- •

- risks related to the Company's interactions with indigenous communities;

- •

- risks related to community actions and protests;

- •

- the timing and possible outcome of pending or threatened litigation;

- •

- the risk of unanticipated litigation;

- •

- risks associated with effecting service of process and enforcing judgments;

- •

- potential conflicts of interest;

- •

- risks associated with the repatriation of earnings;

- •

- compliance with anti-bribery and anti-corruption requirements;

- •

- our ability to maintain effective controls and procedures;

- •

- risks associated with dilution;

- •

- potential changes to the Company's dividend policy;

- •

- potentially unknown risks and liabilities associated with the Rio Alto Acquisition; and

- •

- the integration of finances and operations of Rio Alto.

3

Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results, performance or achievements may vary materially from those described in the forward-looking statements.

Readers are advised to carefully review and consider the risk factors identified in this short form prospectus under the heading "Risk Factors", the AIF and the Rio Alto AIF (each as defined under "Documents Incorporated by Reference") for a discussion of the factors that could cause the Company's actual results, performance and achievements to be materially different from any anticipated future results, performance or achievements expressed or implied by the forward-looking statements. Readers are further cautioned that the foregoing list of assumptions and risk factors is not exhaustive and it is recommended that prospective investors consult the more complete discussion of the Company's business, financial condition and prospects that is included in this short form prospectus and the documents incorporated by reference. The forward-looking information and statements contained in this short form prospectus and the documents incorporated by reference are made as of the date hereof or thereof, as the case may be, and, accordingly, are subject to change after such date. The Company does not undertake to update any forward-looking information, except as, and to the extent, required by applicable securities laws. The forward-looking statements contained herein and in the documents incorporated by reference are expressly qualified by this cautionary note.

In this short form prospectus:

g/t |

means grams per tonne; |

|

Indicated Mineral Resource |

means that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve; |

|

Inferred Mineral Resource |

means that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration; |

|

Measured Mineral Resource |

means that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve; |

4

Mineral Reserves |

means the economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility level as appropriate that include application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which Mineral Reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. The public disclosure of a Mineral Reserve must be demonstrated by a pre-feasibility study or feasibility study; |

|

Mineral Resources |

means a concentration or occurrence of solid material of economic interest in or on the Earth's crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. The term Mineral Resource covers mineralization and natural material of intrinsic economic interest which has been identified and estimated through exploration and sampling and within which Mineral Reserves may subsequently be defined by the consideration and application of Modifying Factors; |

|

Modifying Factors |

means considerations used to convert Mineral Resources to Mineral Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors; |

|

NI 43-101 |

means Canadian Securities Administrators' National Instrument 43-101 Standards of Disclosure for Mineral Projects; |

|

ounce |

means troy ounce; |

|

Probable Mineral Reserve |

means the economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve. Probable Mineral Reserve estimates must be demonstrated to be economic, at the time of reporting, by at least a pre-feasibility study; |

|

Proven Mineral Reserve |

means the economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors. The term should be restricted to that part of the deposit where production planning is taking place and for which any variation in the estimate would not significantly affect the potential economic viability of the deposit. Proven Mineral Reserve estimates must be demonstrated to be economic, at the time of reporting, by at least a pre-feasibility study; and |

|

tonne |

means metric tonne, equalling 1,000 kilograms. |

Note: See "Cautionary Note to United States Investors" below.

5

CAUTIONARY NOTE TO UNITED STATES INVESTORS

Technical disclosure regarding our properties included herein and in the documents incorporated herein by reference has not been prepared in accordance with the requirements of U.S. securities laws. The disclosure in this short form prospectus, and certain of the documents incorporated by reference in this short form prospectus, uses terms that comply with reporting standards in Canada and certain estimates are made in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all reserve and resource estimates contained in or incorporated by reference in this short form prospectus have been prepared in accordance with NI 43-101. These standards differ significantly from the disclosure requirements of the SEC, and reserve and resource information contained and incorporated by reference herein may not be comparable to similar information disclosed by U.S. companies in accordance with the rules and regulations promulgated by the SEC.

In particular, this short form prospectus includes estimates of Mineral Reserves that have been calculated in accordance with NI 43-101, as required by Canadian securities regulatory authorities. For United States reporting purposes, SEC Industry Guide 7 (under the United States Securities Act of 1933, as amended (the "U.S. Securities Act")), as interpreted by Staff of the SEC, applies different standards in order to classify mineralization as a reserve. As a result, the definition of Probable Mineral Reserves used in NI 43-101 differs from the definition in SEC Industry Guide 7. Under SEC standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or issued imminently in order to classify mineralized material as reserves under the SEC standards. Accordingly, Mineral Reserve estimates contained in this short form prospectus may not qualify as "reserves" under SEC standards.

In addition, this short form prospectus uses the terms "Measured Mineral Resources", "Indicated Mineral Resources" and "Inferred Mineral Resources" to comply with the reporting standards in Canada. We advise U.S. investors that, while those terms are recognized and required by Canadian regulations, the SEC's Industry Guide 7 does not permit the inclusion of information concerning "Measured Mineral Resources", "Indicated Mineral Resources" and "Inferred Mineral Resources" or other descriptions of the amount of mineralization in mineral deposits that do not constitute "reserves" by United States standards in documents they file with the SEC. United States investors are specifically cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into mineral reserves, as defined by the SEC.

Further, "Inferred Mineral Resources" have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, investors are also cautioned not to assume that all or any part of the "Inferred Mineral Resources" exist. In accordance with Canadian securities laws, estimates of "Inferred Mineral Resources" cannot form the basis of feasibility, pre-feasibility or other economic studies, other than in certain limited circumstances.

It cannot be assumed that all or any part of "Measured Mineral Resources", "Indicated Mineral Resources" or "Inferred Mineral Resources" will ever be upgraded to a higher category. Investors are cautioned not to assume that any part of the reported "Measured Mineral Resources" or "Indicated Mineral Resources", other than that portion of such resources included in Proven Mineral Reserves or Probable Mineral Reserves, or "Inferred Mineral Resources" in this short form prospectus or the documents incorporated herein by reference is economically or legally mineable.

NI 43-101 also permits the inclusion of disclosure regarding the potential quantity and grade, expressed as ranges, of a target for further exploration provided that the disclosure (i) states with equal prominence that the potential quantity and grade is conceptual in nature, that there has been insufficient exploration to define a mineral resource and that it is uncertain if further exploration will result in the target being delineated as a Mineral Resource, and (ii) states the basis on which the disclosed potential quantity and grade has been determined. Disclosure regarding exploration potential has been included in the Company's annual information form and management's discussion and analysis that are incorporated by reference into this short form prospectus. United States investors are cautioned that disclosure of such exploration potential is conceptual in

6

nature by definition and there is no assurance that exploration of the mineral potential identified will result in any category of NI 43-101 Mineral Resources being identified.

In addition, disclosure of resources using "contained ounces" is permitted under Canadian regulations; however, the SEC only permits issuers to report mineralization that does not qualify as a reserve as in place tonnage and grade without reference to unit measures.

For the above reasons, information contained in this short form prospectus may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder. See "Risk Factors — We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to United States domestic public companies".

DOCUMENTS INCORPORATED BY REFERENCE

The following documents filed with the securities commission or similar regulatory authority in each of the provinces and territories of Canada are specifically incorporated by reference into, and form an integral part of, this short form prospectus:

- (a)

- the

audited consolidated financial statements of the Company as at and for the years ended December 31, 2014 and December 31, 2013 and the

notes thereto, together with the report of the independent registered public accounting firm thereon and management's discussion and analysis of financial condition and results of operations for the

year ended December 31, 2014;

- (b)

- the

unaudited condensed interim consolidated financial statements of the Company for the three months ended March 31, 2015 and 2014 and the notes

thereto, and management's discussion and analysis of financial condition and results of operations for the three months ended March 31, 2015;

- (c)

- the

annual information form of the Company for the year ended December 31, 2014 filed on March 11, 2015 (the "AIF");

- (d)

- the

annual information form of Rio Alto for the year ended December 31, 2014 filed on March 16, 2015 (the "Rio Alto AIF"), which

incorporation by reference is limited to the incorporation of only the following selected information: "Description of the Business — Competitive Conditions";

"Description of the Business — Employees"; "Principal Properties — La Arena Project"; "Principal

Properties — Shahuindo Project"; "Risk Factors"; "Directors and Officers"; "Legal Proceedings and Regulatory Actions"; "Interest of Management and Others in

Material Transactions"; "Material Contracts"; and "Interests of Experts". The technical reports incorporated by reference in the Rio Alto AIF are specifically excluded and are not incorporated by

reference herein;

- (e)

- the

business acquisition report of the Company dated June 12, 2015 prepared in connection with the completion of the Rio Alto Acquisition

(the "Business Acquisition Report");

- (f)

- the

management information circular of the Company dated April 7, 2015 prepared in connection with the annual general meeting of shareholders held on

May 8, 2015;

- (g)

- the

material change report filed on April 10, 2015 related to the Company's April 1, 2015 announcement of the completion of the Rio Alto

Acquisition;

- (h)

- the

material change report filed on February 18, 2015 related to the Company's February 9, 2015 announcement of the entering into of the

arrangement agreement with Rio Alto;

- (i)

- the

term sheet dated June 15, 2015 relating to the Offering; and

- (j)

- the corporate presentation dated June 2015, used in connection with the Offering (the items in subsections (i) and (j) together referred to herein as the "marketing materials").

Copies of the documents incorporated herein by reference may be obtained on request without charge from the Secretary of Tahoe Resources Inc. at 5310 Kietzke Lane, Suite 200, Reno, Nevada, United States 89511 (Telephone 775-448-5800), and are also available electronically at www.sedar.com or in the United States through EDGAR at the website of the SEC at www.sec.gov.

7

Any document of the type referred to above or as set forth in Section 11.1 of Form 44-101F1 of National Instrument 44-101 — Short Form Prospectus Distributions (excluding confidential material change reports) filed by the Company with a securities commission or similar regulatory authority in Canada after the date of this short form prospectus and before termination of the distribution of securities being qualified hereunder, will be deemed to be incorporated by reference into this short form prospectus. In addition, any document filed by the Company with, or furnished by the Company to, the SEC pursuant to the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act"), subsequent to the date of this short form prospectus and prior to the termination of the distribution of the Offered Shares, will be deemed to be incorporated by reference into the registration statement of which this short form prospectus forms a part (in the case of any report on Form 6-K, if and only to the extent expressly provided in such report).

Any statement contained in a document incorporated or deemed to be incorporated by reference herein will be deemed to be modified or superseded for the purposes of this short form prospectus to the extent that a statement contained in this short form prospectus or in any subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded will not constitute a part of this short form prospectus, except as so modified or superseded. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of such a modifying or superseding statement will not be deemed an admission for any purpose that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

References to the Company's website in any documents that are incorporated by reference into this short form prospectus do not incorporate by reference the information on such website into this short form prospectus, and the Company explicitly disclaims any such incorporation by reference.

Any "template version" of "marketing materials" (as such terms are defined in National Instrument 41-101 — General Prospectus Requirements) will be incorporated by reference in the final short form prospectus. However, such "template version" of "marketing materials" will not form part of the final short form prospectus to the extent that the contents of the "template version" of "marketing materials" are modified or superseded by a statement contained in the final short form prospectus. Any "template version" of "marketing materials" filed on SEDAR after the date of the final short form prospectus and before the termination of the distribution under the Offering will be deemed to be incorporated into the final short form prospectus.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been, or will be, filed with the SEC as part of the Registration Statement (as defined below) of which this short form prospectus forms a part: (1) the Underwriting Agreement; (2) the documents listed under "Documents Incorporated by Reference"; (3) the consent of Deloitte LLP; (4) the consent of Grant Thornton LLP; (5) powers of attorney from certain of the Company's directors and officers (included on the signature page to the Registration Statement); and (6) the consents of the "qualified persons" referred to under "Interest of Experts".

Additional information related to the Company may be found on SEDAR at www.sedar.com or in the United States through EDGAR at the website of the SEC at www.sec.gov. In the alternative, copies may be obtained from the Company, upon written request.

The Company is subject to the informational requirements of the Exchange Act and applicable Canadian requirements and, in accordance therewith, files reports and other information with the SEC and with securities regulatory authorities in Canada. Under the multijurisdictional disclosure system adopted by the United States and Canada, such reports and other information may be prepared in accordance with the disclosure

8

requirements of Canada, which requirements are different from those of the United States. As a foreign private issuer, the Company is exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements, and the Company's officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. Reports and other information filed by the Company with, or furnished to, the SEC may be inspected and copied at the public reference facilities maintained by the SEC in the SEC's public reference room at 100 F Street, N.E., Washington, D.C., 20549 by paying a fee. Prospective investors may call the SEC at 1-800-SEC-0330 or access its website at www.sec.gov for further information regarding the public reference facilities. The SEC also maintains a website that contains reports and other information regarding registrants that file electronically with the SEC. The address of the website is www.sec.gov.

The Company has filed with the SEC a registration statement (the "Registration Statement") on Form F-10 under the U.S. Securities Act with respect to the Offering. This short form prospectus, including the documents incorporated by reference herein, which forms a part of the Registration Statement, does not contain all of the information set forth in the Registration Statement, certain parts of which are contained in the exhibits to the Registration Statement as permitted by the rules and regulations of the SEC. For further information with respect to the Company, the Offering and the Offered Shares, reference is made to the Registration Statement and the exhibits thereto. Statements contained in this short form prospectus, including the documents incorporated by reference herein, as to the contents of certain documents are not necessarily complete and, in each instance, reference is made to the copy of the document filed as an exhibit to the Registration Statement. Each such statement is qualified in its entirety by such reference. The Registration Statement can be found on EDGAR at the SEC's website: www.sec.gov.

Certain of the Company's directors and officers, Messrs. Alex Black, Kevin McArthur, Dan Rovig, James Voorhees, Drago Kisic and Mark Sadler, reside outside of Canada. Messrs. Black, McArthur, Rovig, Voorhees, Kisic and Sadler have appointed McMillan LLP as agent for service of process at the following address: 1500 — 1055 West Georgia Street, Vancouver, British Columbia V6E 4N7.

In addition, the following experts named in this short form prospectus, Conrad E. Huss, Thomas L. Drielick, Daniel Roth, Paul Tietz, Matthew Blattman, Charles Muerhoff, Enrique Garay, Ian Dreyer, Tim Williams, Greg Lane, Scott Elfen, Fernando Angeles, Carl E. Defilippi and Thomas L. Dyer, reside outside of Canada.

Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organised under the laws of a foreign jurisdiction or resides outside of Canada, even if such person or company has appointed an agent for service of process.

The Company is a corporation existing under the Business Corporations Act (British Columbia). Certain of the officers and directors of the Company and other experts named in this short form prospectus are resident outside of the United States and a substantial portion of its assets and the assets of such persons are located outside of the United States. The Company has appointed an agent for service of process in the United States, but it may be difficult for holders of Common Shares who reside in the United States to effect service within the United States upon those directors, officers and experts who are not residents of the United States. It may also be difficult for holders of Common Shares who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon the Company's civil liability and the civil liability of its directors, officers and experts under the United States federal securities laws. Investors should not assume that Canadian courts would enforce judgments of United States courts obtained in actions against the Company or such persons predicated on the civil liability provisions of the United States federal securities laws or the securities or "blue sky" laws of any state within the United States or would enforce, in original actions, liabilities against the Company or such persons predicated on the United States federal securities or any such state securities or "blue sky" laws.

The Company filed with the SEC, concurrently with the Registration Statement on Form F-10 of which this short form prospectus is a part, an appointment of agent for service of process on Form F-X. Under the

9

Form F-X, the Company appointed Tahoe Resources USA Inc. as its agent for service of process in the United States in connection with any investigation or administrative proceeding conducted by the SEC, and any civil suit or action brought against or involving the Company in a United States court, arising out of or related to or concerning the Offering of securities under this short form prospectus.

CURRENCY AND EXCHANGE RATE INFORMATION

Unless otherwise stated, references herein to "$" are to the Canadian dollar. References to "US$" are to the United States dollar. The following table reflects the low and high rates of exchange for one United States dollar, expressed in Canadian dollars, during the years noted, the rates of exchange at the end of such years and the average rates of exchange during such years, based on the Bank of Canada noon spot rate of exchange.

| |

|

|

Year ended December 31, | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Three months ended March 31, 2015 |

Three months ended March 31, 2014 |

||||||||||||||

| |

2014 | 2013 | 2012 | |||||||||||||

Low for the period |

$ | 1.1728 | $ | 1.0614 | $ | 1.0614 | $ | 0.9839 | $ | 0.9710 | ||||||

High for the period |

1.2803 | 1.1251 | 1.1643 | 1.0697 | 1.0418 | |||||||||||

Rate at the end of the period |

1.2683 | 1.1053 | 1.1601 | 1.0636 | 0.9949 | |||||||||||

Average noon spot rate for the period |

1.2412 | 1.1033 | 1.1045 | 1.0299 | 0.9996 | |||||||||||

On June 22, 2015, the Bank of Canada noon spot rate of exchange was US$1.00 = $1.2288.

Overview

We are incorporated under the Business Corporations Act (British Columbia) and our head office is located at 5310 Kietzke Lane, Suite 200, Reno, Nevada, United States 89511. Our outstanding Common Shares are listed and posted for trading on the TSX and on the NYSE and are provisionally listed on the BVL.

We are a precious metals producer with operations in Guatemala and Peru. We are focused on becoming a leading intermediate precious metals producer by building a portfolio of high quality, low cost precious metals assets in the Americas. We currently have two producing properties: (i) the Escobal mine (the "Escobal Mine"), located in southeast Guatemala; and (ii) the La Arena mine (the "La Arena Mine") which is located northern Peru. We also have one development property, the Shahuindo project (the "Shahuindo Project") located in northern Peru. The La Arena Mine and the Shahuindo Project were both acquired as a result of the Rio Alto Acquisition, which was completed on April 1, 2015.

With the expansion of our mineral property holdings through the recent acquisition of the La Arena Mine and the Shahuindo Project, we have begun the process of creating a diversified, high growth, low-cost precious metals producer in Guatemala and Peru. These acquisitions have diversified us from a single asset company to a multi-mine producer and enable us to deliver on our strategy of long-term sustainable growth through several value-enhancing growth opportunities in the Americas.

10

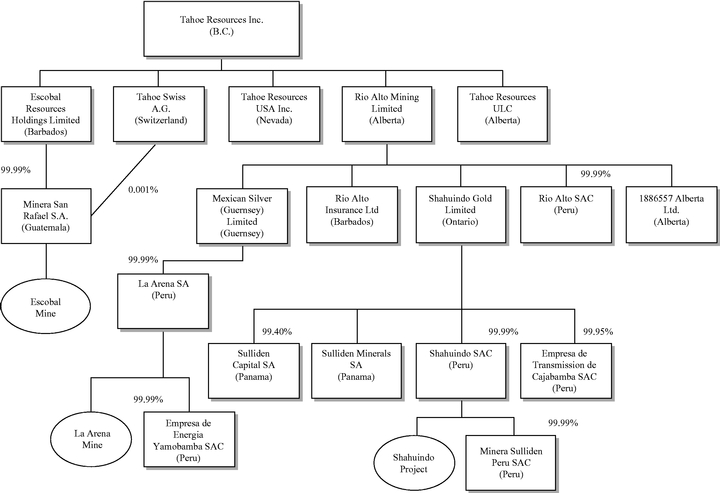

Corporate Organizational Chart

Recent Developments

Rio Alto Acquisition

The Rio Alto Acquisition was completed on April 1, 2015. We acquired all of the issued and outstanding common shares of Rio Alto ("Rio Alto Shares") by way of a statutory plan of arrangement under the Business Corporations Act (Alberta). Pursuant to the Rio Alto Acquisition, shareholders of Rio Alto received 0.227 of a Common Share (the "Rio Alto Exchange Ratio") and $0.001 in cash for each Rio Alto Share held.

All outstanding options to purchase Rio Alto Shares were exchanged for options to purchase Common Shares based upon the Rio Alto Exchange Ratio plus that portion of a Common Share that, immediately prior to the effective time of the Rio Alto Acquisition, had a fair market value equal to $0.001 cash. Following completion of the Rio Alto Acquisition, each outstanding warrant to purchase a Rio Alto Share became exercisable to purchase 0.227 of a Common Share of plus $0.001 in cash in lieu of one Rio Alto Share. All such outstanding warrants have been exercised and a total of 2,011,244 Common Shares were issued in lieu of Rio Alto Shares.

11

Selected Tahoe Pro Forma Consolidated Financial Information

The selected pro forma consolidated financial information set forth below are extracted from and should be read in conjunction with Tahoe's pro forma consolidated financial statements and the accompanying notes thereto which are included in the Business Acquisition Report incorporated by reference in this short form prospectus.

The summary pro forma consolidated financial information is not intended to be indicative of the results that would actually have occurred, or the results expected in future periods, had the events reflected therein occurred on the dates indicated. No attempt has been made to calculate or estimate potential synergies between Tahoe and Rio Alto.

(in thousands of U.S. dollars)

|

Year ended December 31, 2014(1) |

|||

|---|---|---|---|---|

Statement of Operations Data: |

||||

Revenue |

$ | 620,673 | ||

Earnings from mine operations |

$ | 248,961 | ||

Total comprehensive income (loss) |

$ | 125,045 | ||

(in U.S. dollars)

|

||||

Per Tahoe Share data: |

||||

Basic earnings (loss) per share |

$ | 0.56 | ||

Diluted earnings (loss) per share |

$ | 0.56 | ||

(in thousands of U.S. dollars)

|

Three months ended March 31, 2015(2) |

|||

|---|---|---|---|---|

Statement of Operations Data: |

||||

Revenue |

$ | 153,044 | ||

Earnings from mine operations |

$ | 66,354 | ||

Total comprehensive income (loss) |

$ | 36,898 | ||

(in U.S. dollars)

|

||||

Per Tahoe Share data: |

||||

Basic earnings (loss) per share |

$ | 0.16 | ||

Diluted earnings (loss) per share |

$ | 0.16 | ||

(in thousands of U.S. dollars)

|

As at March 31, 2015(3) |

|||

|---|---|---|---|---|

Balance Sheet Data: |

||||

Total current assets |

$ | 290,169 | ||

Total assets |

$ | 2,226,702 | ||

Total current liabilities |

$ | 204,366 | ||

Total liabilities |

$ | 469,358 | ||

Total equity |

$ | 1,757,344 | ||

Notes:

- (1)

- The

pro forma consolidated statement of operations and comprehensive income for the year ended December 31, 2014 has been prepared from the

audited consolidated statement of operations and comprehensive income for the year ended December 31, 2014 of Tahoe, and the audited consolidated statement of net income and comprehensive

income for the year ended December 31, 2014 of Rio Alto. The pro forma consolidated statement of operations and comprehensive income gives pro forma effect to the Rio Alto

Acquisition as if it had occurred on January 1, 2014.

- (2)

- The

pro forma consolidated statement of operations and total comprehensive income for the three months ended March 31, 2015 has been prepared

from the March 31, 2015 unaudited interim consolidated statement of operation of Tahoe and the March 31, 2015 unaudited condensed interim consolidated statement of net income and

comprehensive income of Rio Alto. The pro forma consolidated statement of operations and comprehensive income gives pro forma effect to the Rio Alto Acquisition as if it had occurred on

January 1, 2014.

- (3)

- The pro forma consolidated statement of financial position has been prepared from the March 31, 2015 unaudited interim consolidated statement of financial position of Tahoe and the March 31, 2015 unaudited condensed interim consolidated statement of financial position of Rio Alto. The pro forma consolidated statement of financial position gives pro forma effect to the Rio Alto Acquisition as if it had occurred on March 31, 2015.

12

Directors and Officers of the Company

Our executive management and board of directors are currently comprised as follows:

Executive Management

C. Kevin McArthur |

Executive Chair | ||

Alex Black |

Chief Executive Officer | ||

Ronald W. Clayton |

President and Chief Operating Officer | ||

Mark Sadler |

Vice President and Chief Financial Officer | ||

Tim Williams |

Vice President Operations | ||

Brian Brodsky |

Vice President Exploration | ||

Edie Hofmeister |

Vice President Corporate Affairs |

Board of Directors

C. Kevin McArthur |

Executive Chair and Director | ||

Alex Black |

Director | ||

A. Dan Rovig |

Lead Director | ||

Tanya Jakusconek |

Director | ||

Paul B. Sweeney |

Director | ||

James S. Voorhees |

Director | ||

Drago Kisic Wagner |

Director | ||

Kenneth F. Williamson |

Director | ||

Dr. Klaus Zeitler |

Director |

An investment in the Common Shares is subject to certain risks that should be considered by prospective investors and their advisors. Prospective investors should consult with their own advisors and carefully consider the risk factors relating to the Common Shares set out in information contained in this short form prospectus and documents incorporated by reference herein (including, specifically, under the heading "Risk Factors" in the AIF and "Risk Factors" in the Rio Alto AIF). Such risk factors could materially affect the Company's future financial results and could cause actual results and events to differ materially from those described in forward-looking statements and forward-looking information relating to the Company or the business, property or financial results, any of which could cause investors to lose part or all of their investment in the Offered Shares.

Risks Relating to Our Business

We are dependent on the Escobal Mine and La Arena Mine, and any adverse development affecting these properties could materially affect our results of operations, cash flows and financial position.

The Escobal Mine and the La Arena Mine are currently the Company's only revenue producing operations. As a result, unless we acquire additional revenue producing operations or until the Shahuindo Project becomes a revenue producing operation, any adverse development affecting these properties could have a material adverse effect upon the Company and would materially and adversely affect the potential production of Mineral Reserves, revenue, profitability, financial performance, cash flows and results of operations of the Company. Ongoing development and operation of the Escobal Mine and the La Arena Mine depends upon our ability to consistently mine to design parameters and to process mined material at approximate design throughput rates. The long-term commercial viability of the Escobal Mine and the La Arena Mine is also dependent upon a number of factors, some of which relate to the particular attributes of the deposit (such as size, grade and proximity to infrastructure), metal prices and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection. Most of the above factors are beyond our control. As a result, there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Failure to do so will have a material adverse impact on our operations and potential future profitability.

13

Our Guatemalan operations are subject to political, economic, social and geographic risks of doing business in foreign countries.

The Escobal Mine is located in Guatemala which has a history of political unrest. Guatemala suffered an armed conflict for 36 years, which was finally resolved through a peace agreement reached with the country's internal revolutionary movement in 1996. The last political crisis in Guatemala occurred in 1983 and constitutional government was not restored until 1985. For nearly two decades Guatemala has made progress in restructuring its political institutions and establishing democratic processes. However, renewed political unrest or a political crisis in Guatemala could adversely affect our business and results of operations.

Guatemala suffers from social problems such as a high crime rate and uncertain land tenure for many indigenous people, which could adversely affect the Escobal Mine. Such adverse effects could result from the efforts of third parties to manipulate local populations into encroaching on the Escobal Mine land, challenging the boundaries of such land, impeding Escobal Mine activities through roadblocks or other public protests or attacks against Escobal Mine assets or personnel.

Our Peruvian operations are subject to political, economic, social and geographic risks of doing business in foreign countries.

The La Arena Mine and the Shahuindo Project are located in the Republic of Peru. For more than two decades Peru has made progress in restructuring its political institutions and revitalizing its economy. In previous decades Peru's history was one of political and economic instability during which governments intervened in the national economy and social structure, including periodically imposing various controls, the effects of which were to restrict the ability of both domestic and foreign companies to freely operate.

Local opposition to mine development projects occurs in Peru, and such opposition in the past has at times been violent. There is also the risk of political violence and increased social tension in Peru as a result of the increased civil unrest, crime and labour unrest. Roadblocks by members of local communities, unemployed people and unions can occur on local, national and provincial routes. There is no assurance that the Company's current existing positive relationships with the surrounding communities will continue in the future.

As in any jurisdiction, mineral exploration and mining activities in Peru may be affected in varying degrees by government regulations relating to the mining industry or political instability. Any changes in regulations or shifts in political conditions in Peru are beyond the control of the Company and may adversely affect our business. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, environmental legislation and mine safety. The status of Peru as a developing country may make it more difficult to obtain any required financing for projects. The effect of all of these factors cannot be accurately predicted.

Changes in the market price of gold and silver, and other metals, which in the past have fluctuated widely, may affect our results of operations, cash flows and financial position.

The majority of our revenue is derived from the sale of gold and silver and, to a lesser degree, lead and zinc. Therefore, fluctuations in the prices of these commodities represent one of the most significant factors that we expect will affect our future operations and potential profitability. The price of gold and silver and other metals are affected by numerous factors beyond our control, including

- •

- levels of supply and demand,

- •

- global or regional consumptive patterns,

- •

- sales by government holders,

- •

- metal stock levels maintained by producers and others,

- •

- increased production due to new mine developments and improved mining and production methods,

- •

- speculative activities related to the sale of metals,

- •

- availability and costs of metal substitutes,

14

- •

- international and regional economic and political conditions,

- •

- interest rates, currency values, and inflation.

Declining market prices for these metals could materially adversely affect our future operations and profitability. In particular, the market prices of gold and silver have experienced recent volatility.

In addition to adversely affecting our Mineral Reserve and Mineral Resource estimates and our results of operations, cash flows and financial position, declining metal prices can impact operations by requiring a reassessment of the feasibility of a particular project. Even if a project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays and/or may interrupt operations until the reassessment can be completed, which may have a material adverse effect on our results of operations, cash flows and financial position.

We are required to obtain and maintain a number of licenses, permits and approvals from various governmental authorities, and any failure to obtain or loss of such licenses, permits or approvals could have a material adverse effect on our business.

In the ordinary course of business, we will be required to obtain and renew governmental licenses or permits for the operation and expansion of the Escobal Mine, the La Arena Mine and the Shahuindo Project or for the development, construction and commencement of mining at our existing properties or those we acquire in the future. Obtaining or renewing the necessary governmental licenses or permits is a complex and time-consuming process involving numerous jurisdictions and often involving public comment periods and costly undertakings on our part. The duration and success of our efforts to obtain and renew licenses or permits are contingent upon many variables not within our control, including local politics, legal challenges and the interpretation of applicable requirements implemented by the licensing authority. Any unexpected refusals of required licenses or permits or delays or costs associated with the licensing or permitting process could prevent or delay the development or impede the operation of a mine, which could adversely impact our operations, and profitability.

We have a limited history of operations and commercial production.

We have a limited history of operations and commercial production. As a newly producing company, we are subject to many risks common to such enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial and other resources. There is no assurance that we will be successful in achieving a return on shareholders' investment and the likelihood of our success must be considered in light of our early stage of production.

Any changes or increases in the Company's production costs, or failure to achieve anticipated production levels may impact its profitability and could materially affect our results of operations, cash flows and financial position.

Changes in the Company's production costs could have a major impact on its profitability. Its main production expenses are personnel and contractor costs, materials and energy. Changes in costs of the Company's mining and processing operations could occur as a result of unforeseen events, including international and local economic and political events, a change in commodity prices, increased costs (including oil, steel and diesel) and scarcity of labor, and could result in changes in profitability or Mineral Reserve estimates. Many of these factors may be beyond the Company's control.

The Company prepares estimates of future cash costs and capital costs for its operations and projects. There is no assurance that actual costs will not exceed such estimates. Exceeding cost estimates could have an adverse impact on the Company's future results of operations or financial condition.

Failure to achieve anticipated production levels would have a material adverse impact on the Company's cash flow and future profitability. Our failure to achieve profitability and positive operating cash flows could have a material adverse effect on our financial condition and results of operations.

15

Higher levels of indebtedness and increased debt service obligations will effectively reduce the amount of funds available for other business purposes and may adversely affect us.

As of the date of this short form prospectus, we had aggregate consolidated indebtedness of approximately US$55 million, consisting of a US$35 million credit facility at Rio Alto and a US$20 million capital lease obligation from a sale-leaseback transaction undertaken by Rio Alto. As a result of this indebtedness, the Company is required to use a portion of its cash flow to service principal and interest on its debt, which will limit the cash flow available for other business opportunities. The Company's ability to make scheduled principal payments, pay interest on or refinance its indebtedness depends on the Company's future performance, which is subject to economic, financial, competitive and other factors beyond its control. Unexpected delays in production or other operational problems could impact our ability to service the debt and make necessary capital expenditures. If the Company is unable to generate such cash flow to timely repay the debt, it may be required to adopt one or more alternatives, such as selling assets, restructuring debt or obtaining additional equity capital on terms that may be onerous or highly dilutive. The Company's ability to refinance its indebtedness will depend on the capital markets and its financial condition at such time. The Company may not be able to engage in any of these activities or engage in these activities on desirable terms, which could result in a default on its debt obligations.

Any changes to our current projections or any new development or acquisition activity may require substantial additional capital, which may not be available on commercially reasonable terms, if at all.

Any changes to our current projections or any new development or acquisition activity, whether at the Escobal Mine, the La Arena Mine, the Shahuindo Project or elsewhere, may require substantial additional capital. When such additional capital is required, we will need to pursue various financing transactions or arrangements, including joint venturing of projects, debt financing, equity financing or other means. Additional financing may not be available when needed or, if available, the terms of such financing might not be favourable to us and might involve substantial dilution to existing shareholders. We may not be successful in locating suitable financing transactions in the time period required or at all, and may not obtain the capital required by other means. A failure to raise capital when needed would have a material adverse effect on our business, financial condition and results of operations. Any future issuance of Common Shares to raise required capital will be dilutive to shareholders. In addition, debt and other mezzanine financing may involve a pledge of assets and may be senior to interests of equity holders. We may incur substantial costs in pursuing future capital requirements, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. The ability to obtain needed financing may be impaired by such factors as the capital markets (both generally and in the precious metals industry in particular), our status as an enterprise with a limited production history, the location of the Escobal Mine in Guatemala, the locations of the La Arena Mine and the Shahuindo Project in Peru, the price of silver, gold, lead and zinc on the commodities markets (which will impact the amount of asset-based financing available), and/or the loss of key management personnel. Further, if the price of silver and other metals on the commodities markets decreases, then revenues from the Escobal Mine and the La Arena Mine will likely decrease and such decreased revenues may increase the requirements for capital. Failure to obtain necessary capital on reasonable terms may materially adversely affect our future operations and profitability.

Title, mineral rights or surface rights to our properties could be challenged, and, if successful, such challenges could have a material adverse effect on our production, results of operations, cash flows and financial position.

The validity of the licenses related to the Escobal Mine, the La Arena Mine and the Shahuindo Project can be uncertain and may be contested. There is no assurance that applicable governmental bodies will not revoke or significantly alter the conditions of applicable licenses issued in respect of the Escobal Mine, the La Arena Mine or the Shahuindo Project. Changes to Guatemalan laws or Peruvian laws, including new mining legislation or adverse court rulings could materially and adversely impact our rights to exploration and exploitation licenses necessary for the Escobal Mine, La Arena Mine and Shahuindo Project.