Rule 497(k)

File No. 333-171759

|

First Trust

Exchange-Traded AlphaDEX® Fund II

|

SUMMARY PROSPECTUS

First Trust India NIFTY 50 Equal Weight ETF

|

Ticker Symbol:

|

NFTY

|

|

Exchange:

|

The Nasdaq Stock Market LLC

|

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s statutory prospectus and other information about the Fund, including the statement of additional information and most recent reports to shareholders, online at www.ftportfolios.com/retail/ETF/ETFfundnews.aspx?Ticker=NFTY. You can also get this information at no cost by calling (800) 621-1675 or by sending an e-mail request to info@ftportfolios.com. The Fund’s prospectus and statement of additional information, both dated May 1, 2023, are all incorporated by reference into this Summary Prospectus.

May 1, 2023

Investment Objective

The First Trust India NIFTY 50 Equal Weight ETF (the “Fund”) seeks investment results that correspond generally to the price and yield (before the Fund’s fees and expenses) of an equity index called the NIFTY 50 Equal Weight Index (the “Index”).

Fees and Expenses of the Fund

The following table describes the fees and expenses you may pay if you buy, hold and sell shares of the Fund. Investors may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example

below.

Shareholder Fees

(fees paid directly from your investment)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price)

|

None

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees

|

0.80%

|

|

Distribution and Service (12b-1) Fees

|

0.00%

|

|

Other Expenses

|

0.00%

|

|

Total Annual Fund Operating Expenses

|

0.80%

|

Example

The example below is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds.

The example assumes that you invest $10,000 in the Fund for the time periods indicated and then hold or sell all of your shares

at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain at current levels. Although your actual costs may be higher or lower, based on these assumptions your costs

would be:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

$82

|

$255

|

$444

|

$990

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable

account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 56% of the average value of its portfolio.

Principal Investment Strategies

The Fund will normally invest at least 90% of its net assets (including investment borrowings) in the securities that comprise

the Index. The Fund, using an indexing investment approach, attempts to replicate, before fees and expenses, the performance of the Index.

The Index is owned and is developed, maintained and sponsored by NSE Indices Limited (the “Index Provider”). The Index Provider makes all decisions on additions and deletions of companies comprising the Index.

According to the Index Provider, the Index is designed to track the performance of the 50 largest and most liquid Indian securities

listed on the National Stock Exchange of India (“NSE”) by investing in all of the components of the NIFTY 50 (the “Benchmark Index”). The Benchmark Index measures the equity performance of the top 50 companies (weighted by free float market capitalization)

whose equity securities trade in the Indian securities markets, and is designed to reflect the overall conditions of the Indian

equity market as well as the Indian economy. The Index includes the same 50 stocks included in the Benchmark Index but gives each an equal weight. According to the Index Provider, while the Index rebalances quarterly and reconstitutes semi-annually, throughout the year,

off-cycle rebalancing and reconstitution of the Index may be initiated in case any of the Index constituents ceases to form part of

the Benchmark Index due to suspension or delisting. The Index may be composed of emerging market companies, securities denominated in non-U.S.

currencies and companies with various market capitalizations.

The Index is rebalanced quarterly and reconstituted semi-annually and the Fund will make corresponding changes to its portfolio

shortly after the Index changes are made public. The Index’s quarterly rebalance schedule may cause the Fund to experience a higher rate of portfolio turnover. According to the Index Provider, an unscheduled Index reconstitution may be undertaken if an Index constituent

becomes subject to a merger, spin-off or delisting; or in specific cases of capital restructuring which may result in a change

in the stock price of a constituent company. An unscheduled Index reconstitution may also be undertaken, at the discretion of the Index

Provider, due to adverse regulatory findings or actions against a constituent company by the Indian securities markets or other regulatory

and/or

government agencies. The Fund will be concentrated in an industry or a group of industries to the extent that the Index is

so concentrated. As of March 31, 2023, the Index was composed of 50 securities and the Fund had significant investments in financial companies and Indian issuers, although this may change from time to time. The Fund’s investments will change as the Index changes and, as a result, the Fund may have significant investments in jurisdictions or investment sectors that it may not have had as of March 31,

2023. To the extent the Fund invests a significant portion of its assets in a given jurisdiction or investment sector, the Fund may

be exposed to the risks associated with that jurisdiction or investment sector.

Principal Risks

You could lose money by investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or

guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. There can be no assurance that the Fund’s investment objective will be achieved. The order of the below risk factors does not indicate the significance of any particular risk

factor.

AUTHORIZED PARTICIPANT CONCENTRATION RISK. Only an authorized participant may engage in creation or redemption transactions directly with the Fund. A limited number of institutions act as authorized participants for the Fund. To the

extent that these institutions exit the business or are unable to proceed with creation and/or redemption orders and no other authorized

participant steps forward to create or redeem, the Fund’s shares may trade at a premium or discount (the difference between the market price of the Fund's shares and the Fund's net asset value) and possibly face delisting and the bid/ask spread (the difference between

the price that someone is willing to pay for shares of the Fund at a specific point in time versus the price at which someone

is willing to sell) on the Fund’s shares may widen.

CASH TRANSACTIONS RISK. The Fund will effect some or all of its creations and redemptions for cash rather than in-kind. As a result, an investment in the Fund may be less tax-efficient than an investment in an ETF that effects all of its creations and redemptions

in-kind. Because the Fund may effect redemptions for cash, it may be required to sell portfolio securities in order to obtain the cash

needed to distribute redemption proceeds. A sale of portfolio securities may result in capital gains or losses and may also result

in higher brokerage costs.

CURRENCY RISK. Changes in currency exchange rates affect the value of investments denominated in a foreign currency, and therefore the value of such investments in the Fund’s portfolio. The Fund’s net asset value could decline if a currency to which the Fund has exposure depreciates against the U.S. dollar or if there are delays or limits on repatriation of such currency. Currency exchange

rates can be very volatile and can change quickly and unpredictably. As a result, the value of an investment in the Fund may change

quickly and without warning.

CYBER SECURITY RISK. The Fund is susceptible to operational risks through breaches in cyber security. A breach in cyber security refers to both intentional and unintentional events that may cause the Fund to lose proprietary information, suffer data corruption

or lose operational capacity. Such events could cause the Fund to incur regulatory penalties, reputational damage, additional

compliance costs associated with corrective measures and/or financial loss. Cyber security breaches may involve unauthorized access to the Fund’s digital information systems through “hacking” or malicious software coding but may also result from outside attacks such as denial-of-service attacks through efforts to make network services unavailable to intended users. In addition, cyber security

breaches of the issuers of securities in which the Fund invests or the Fund’s third-party service providers, such as its administrator, transfer agent, custodian, or sub-advisor, as applicable, can also subject the Fund to many of the same risks associated with direct

cyber security breaches. Although the Fund has established risk management systems designed to reduce the risks associated with cyber security,

there is no guarantee that such efforts will succeed, especially because the Fund does not directly control the cyber security

systems of issuers or third-party service providers.

EMERGING MARKETS RISK. Investments in securities issued by governments and companies operating in emerging market countries involve additional risks relating to political, economic, or regulatory conditions not associated with investments in securities

and instruments issued by U.S. companies or by companies operating in other developed market countries. Investments in emerging

markets securities are generally considered speculative in nature and are subject to the following heightened risks: smaller market

capitalization of securities markets which may suffer periods of relative illiquidity; significant price volatility; restrictions on foreign

investment; possible repatriation of investment income and capital; rapid inflation; and currency convertibility issues. Emerging market countries

also often have less uniformity in accounting, auditing and reporting requirements, unsettled securities laws, unreliable securities

valuation and greater risk associated with custody of securities. Financial and other reporting by companies and government entities also

may be less reliable in emerging market countries. Shareholder claims that are available in the U.S., as well as regulatory oversight

and authority that is common in the U.S., including for claims based on fraud, may be difficult or impossible for shareholders of securities

in emerging market countries or for U.S. authorities to pursue. For funds that track an index or are managed based upon a benchmark, the

index may not weight the securities in emerging market countries on the basis of investor protection limitations, financial reporting

quality or available oversight mechanisms. Furthermore, investors may be required to register the proceeds of sales and future economic

or political crises could lead to price controls, forced mergers, expropriation or confiscatory taxation, seizure, nationalization

or creation of government monopolies.

EQUITY SECURITIES RISK. The value of the Fund’s shares will fluctuate with changes in the value of the equity securities in which it invests. Equity securities prices fluctuate for several reasons, including changes in investors’ perceptions of the financial condition of an issuer or the general condition of the relevant equity market, such as market volatility, or when political or economic

events affecting

an issuer occur. Common stock prices may be particularly sensitive to rising interest rates, as the cost of capital rises

and borrowing costs increase. Equity securities may decline significantly in price over short or extended periods of time, and such declines

may occur in the equity market as a whole, or they may occur in only a particular country, company, industry or sector of the market.

FINANCIAL COMPANIES RISK. Financial companies, such as retail and commercial banks, insurance companies and financial services companies, are especially subject to the adverse effects of economic recession, currency exchange rates, extensive government

regulation, decreases in the availability of capital, volatile interest rates, portfolio concentrations in geographic markets,

industries or products (such as commercial and residential real estate loans), competition from new entrants and blurred distinctions

in their fields of business.

INDEX CONCENTRATION RISK. The Fund will be concentrated in an industry or a group of industries to the extent that the Index is so concentrated. To the extent that the Fund invests a significant percentage of its assets in a single asset class or the

securities of issuers within the same country, state, region, industry or sector, an adverse economic, business or political development

may affect the value of the Fund’s investments more than if the Fund were more broadly diversified. A significant exposure makes the Fund more susceptible to any single occurrence and may subject the Fund to greater market risk than a fund that is more broadly diversified.

There may be instances in which the Index, for a variety of reasons including changes in the prices of individual securities

held by the Fund, has a larger exposure to a small number of stocks or a single stock relative to the rest of the stocks in the Index.

Under such circumstances, the Fund will not deviate from the Index except in rare circumstances or in an immaterial way and therefore the Fund’s returns would be more greatly influenced by the returns of the stock(s) with the larger exposure.

INDEX OR MODEL CONSTITUENT RISK. The Fund may be a constituent of one or more indices or ETF models. As a result, the Fund may be included in one or more index-tracking exchange-traded funds or mutual funds. Being a component security of such a

vehicle could greatly affect the trading activity involving the Fund’s shares, the size of the Fund and the market volatility of the Fund. Inclusion in an index could increase demand for the Fund and removal from an index could result in outsized selling activity in a relatively

short period of time. As a result, the Fund’s net asset value could be negatively impacted and the Fund’s market price may be below the Fund’s net asset value during certain periods. In addition, index rebalances may potentially result in increased trading activity in the Fund's shares.

INDEX PROVIDER RISK. There is no assurance that the Index Provider, or any agents that act on its behalf, will compile the Index accurately, or that the Index will be determined, maintained, constructed, reconstituted, rebalanced, composed, calculated

or disseminated accurately. The Index Provider and its agents do not provide any representation or warranty in relation to the

quality, accuracy or completeness of data in the Index, and do not guarantee that the Index will be calculated in accordance with its

stated methodology. The Advisor’s mandate as described in this prospectus is to manage the Fund consistently with the Index provided by the Index Provider. The Advisor relies upon the Index provider and its agents to accurately compile, maintain, construct,

reconstitute, rebalance, compose, calculate and disseminate the Index accurately. Therefore, losses or costs associated with any Index Provider

or agent errors generally will be borne by the Fund and its shareholders. To correct any such error, the Index Provider or its

agents may carry out an unscheduled rebalance of the Index or other modification of Index constituents or weightings. When the Fund in

turn rebalances its portfolio, any transaction costs and market exposure arising from such portfolio rebalancing will be borne

by the Fund and its shareholders. Unscheduled rebalances also expose the Fund to additional tracking error risk. Errors in respect of

the quality, accuracy and completeness of the data used to compile the Index may occur from time to time and may not be identified and

corrected by the Index Provider for a period of time or at all, particularly where the Index is less commonly used as a benchmark by

funds or advisors. For example, during a period where the Index contains incorrect constituents, the Fund tracking the Index would

have market exposure to such constituents and would be underexposed to the Index’s other constituents. Such errors may negatively impact the Fund and its shareholders. The Index Provider and its agents rely on various sources of information to assess the criteria

of issuers included in the Index, including information that may be based on assumptions and estimates. Neither the Fund nor the Advisor

can offer assurances that the Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers. Unusual market conditions may cause the Index Provider to postpone a scheduled rebalance, which could cause the Index

to vary from its normal or expected composition. The postponement of a scheduled rebalance in a time of market volatility could

mean that constituents that would otherwise be removed at rebalance due to changes in market capitalizations, issuer credit ratings,

or other reasons may remain, causing the performance and constituents of the Index to vary from those expected under normal conditions.

Apart from scheduled rebalances, the Index Provider or its agents may carry out additional ad hoc rebalances to the Index

due to unusual market conditions or in order, for example, to correct an error in the selection of index constituents.

INDIA REGULATORY RISK. The Fund is registered in India as a Foreign Portfolio Investor (“FPI”) with the Securities and Exchange Board of India (“SEBI”). Only while maintaining FPI registration would the Fund be able to buy, sell or deal in Indian securities. Investment by FPIs in Indian securities are subject to certain limits and restrictions under the applicable law, and the applications

of such limits and restrictions could adversely impact the ability of the Fund to make investments in India.

INDIA RISK. The Fund is subject to certain risks specifically associated with investments in the securities of Indian issuers. India

is an emerging market and demonstrates significantly higher volatility from time to time in comparison to developed markets. Shareholder

claims that are available in the U.S., as well as regulatory oversight and authority that is common in the U.S., including

for claims based on fraud, may be difficult or impossible for shareholders of securities in India or for U.S. authorities to pursue. Investment

in Indian securities involves risks in addition to those associated with investments in securities of issuers in more developed countries,

which

may adversely affect the value of the Fund’s assets. Such heightened risks include, among others, political and legal uncertainty, greater government control over the economy, currency fluctuations or blockage and the risk of nationalization or expropriation of

assets. In addition, religious and border disputes persist in India. Moreover, India has experienced civil unrest and hostilities with

neighboring countries, including Pakistan, and the Indian government has confronted separatist movements in several Indian states. The

securities market of India is considered an emerging market that is characterized by a large number of listed companies that have significantly

smaller market capitalizations, greater price volatility, greater delays and possibility of disruptions in settlement transactions,

greater political uncertainties and greater dependence on international trade or development assistance and substantially less liquidity

than companies in more developed markets. These factors, coupled with restrictions on foreign investment and other factors, limit

the supply of securities available for investment by the Fund. This will affect the rate at which the Fund is able to invest in

the securities of Indian companies, the purchase and sale prices for such securities and the timing of purchases and sales. Certain restrictions

on foreign investments may decrease the liquidity of the Fund’s portfolio, subject the Fund to higher transaction costs, or inhibit the Fund’s ability to track the Index. Investments in Indian securities may also be limited or prevented, at times, due to the limits

on foreign ownership imposed by the Reserve Bank of India (“RBI”) or the Securities and Exchange Board of India ("SEBI"). In addition, a natural or other disaster could occur in India that could affect the Indian economy or operations of the Fund, causing an adverse

impact on the Fund.

INFLATION RISK. Inflation risk is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the present value of the Fund’s assets and distributions may decline.

LARGE CAPITALIZATION COMPANIES RISK. Large capitalization companies may grow at a slower rate and be less able to adapt to changing market conditions than smaller capitalization companies. Thus, the return on investment in securities of large capitalization

companies may be less than the return on investment in securities of small and/or mid capitalization companies. The performance

of large capitalization companies also tends to trail the overall market during different market cycles.

MARKET MAKER RISK. The Fund faces numerous market trading risks, including the potential lack of an active market for Fund shares due to a limited number of market markers. Decisions by market makers or authorized participants to reduce their role or step

away from these activities in times of market stress could inhibit the effectiveness of the arbitrage process in maintaining the

relationship between the underlying values of the Fund’s portfolio securities and the Fund’s market price. The Fund may rely on a small number of third-party market makers to provide a market for the purchase and sale of shares. Any trading halt or other problem relating

to the trading activity of these market makers could result in a dramatic change in the spread between the Fund’s net asset value and the price at which the Fund’s shares are trading on the Exchange, which could result in a decrease in value of the Fund’s shares. This reduced effectiveness could result in Fund shares trading at a discount to net asset value and also in greater than normal

intraday bid-ask spreads for Fund shares.

MARKET RISK. Market risk is the risk that a particular security, or shares of the Fund in general, may fall in value. Securities are subject

to market fluctuations caused by such factors as economic, political, regulatory or market developments, changes in interest

rates and perceived trends in securities prices. Shares of the Fund could decline in value or underperform other investments. In

addition, local, regional or global events such as war, acts of terrorism, spread of infectious diseases or other public health issues,

recessions, natural disasters, or other events could have a significant negative impact on the Fund and its investments. For example,

the coronavirus disease 2019 (COVID-19) global pandemic and the ensuing policies enacted by governments and central banks have caused and

may continue to cause significant volatility and uncertainty in global financial markets, negatively impacting global growth prospects.

While vaccines have been developed, there is no guarantee that vaccines will be effective against future variants of the disease.

As this global pandemic illustrated, such events may affect certain geographic regions, countries, sectors and industries more significantly

than others. Recent and potential future bank failures could result in disruption to the broader banking industry or markets generally

and reduce confidence in financial institutions and the economy as a whole, which may also heighten market volatility and reduce liquidity.

These events also adversely affect the prices and liquidity of the Fund’s portfolio securities or other instruments and could result in disruptions in the trading markets. Any of such circumstances could have a materially negative impact on the value of the Fund’s shares and result in increased market volatility. During any such events, the Fund’s shares may trade at increased premiums or discounts to their net asset value and the bid/ask spread on the Fund’s shares may widen.

NON-CORRELATION RISK. The Fund’s return may not match the return of the Index for a number of reasons. The Fund incurs operating expenses not applicable to the Index, and may incur costs in buying and selling securities, especially when rebalancing the Fund’s portfolio holdings to reflect changes in the composition of the Index. In addition, the Fund’s portfolio holdings may not exactly replicate the securities included in the Index or the ratios between the securities included in the Index. Additionally, in order to comply

with its investment strategies and policies, the Fund portfolio may deviate from the composition of the Index. Accordingly, the Fund's

return may underperform the return of the Index.

NON-U.S. SECURITIES RISK. Non-U.S. securities are subject to higher volatility than securities of domestic issuers due to possible adverse political, social or economic developments, restrictions on foreign investment or exchange of securities, capital

controls, lack of liquidity, currency exchange rates, excessive taxation, government seizure of assets, the imposition of sanctions by foreign

governments, different legal or accounting standards, and less government supervision and regulation of securities exchanges

in foreign countries.

OPERATIONAL RISK. The Fund is subject to risks arising from various operational factors, including, but not limited to, human error, processing and communication errors, errors of the Fund’s service providers, counterparties or other third-parties, failed or inadequate processes and technology or systems failures. The Fund relies on third-parties for a range of services, including custody.

Any delay or failure relating to engaging or maintaining such service providers may affect the Fund’s ability to meet its investment objective. Although the Fund and the Fund's investment advisor seek to reduce these operational risks through controls and procedures, there is

no way to completely protect against such risks.

PASSIVE INVESTMENT RISK. The Fund is not actively managed. The Fund invests in securities included in or representative of the Index regardless of investment merit. The Fund generally will not attempt to take defensive positions in declining markets.

In the event that the Index is no longer calculated, the Index license is terminated or the identity or character of the Index is materially

changed, the Fund will seek to engage a replacement index.

PORTFOLIO TURNOVER RISK. High portfolio turnover may result in the Fund paying higher levels of transaction costs and may generate greater tax liabilities for shareholders. Portfolio turnover risk may cause the Fund’s performance to be less than expected.

PREMIUM/DISCOUNT RISK. The market price of the Fund’s shares will generally fluctuate in accordance with changes in the Fund’s net asset value as well as the relative supply of and demand for shares on the Exchange. The Fund’s investment advisor cannot predict whether shares will trade below, at or above their net asset value because the shares trade on the Exchange at market prices

and not at net asset value. Price differences may be due, in large part, to the fact that supply and demand forces at work in the

secondary trading market for shares will be closely related, but not identical, to the same forces influencing the prices of the holdings

of the Fund trading individually or in the aggregate at any point in time. However, given that shares can only be purchased and redeemed

in Creation Units, and only to and from broker-dealers and large institutional investors that have entered into participation agreements

(unlike shares of closed-end funds, which frequently trade at appreciable discounts from, and sometimes at premiums to, their net

asset value), the Fund’s investment advisor believes that large discounts or premiums to the net asset value of shares should not be sustained. During stressed market conditions, the market for the Fund’s shares may become less liquid in response to deteriorating liquidity in the market for the Fund’s underlying portfolio holdings, which could in turn lead to differences between the market price of the Fund’s shares and their net asset value and the bid/ask spread on the Fund’s shares may widen.

SMALLER COMPANIES RISK. Small and/or mid capitalization companies may be more vulnerable to adverse general market or economic developments, and their securities may be less liquid and may experience greater price volatility than larger, more established

companies as a result of several factors, including limited trading volumes, fewer products or financial resources, management inexperience

and less publicly available information. Accordingly, such companies are generally subject to greater market risk than larger,

more established companies.

TAX RISK. The Fund will be subject to tax in India on the purchase and sale of Indian securities held by the Fund, which will reduce

the Fund’s returns. For more information regarding the tax implications of investing in Indian securities, please see the section entitled “Federal Tax Matters.”

TRADING ISSUES RISK. Trading in Fund shares on the Exchange may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in shares inadvisable. In addition, trading in Fund shares on the Exchange is subject to

trading halts caused by extraordinary market volatility pursuant to the Exchange’s “circuit breaker” rules. There can be no assurance that the requirements of the Exchange necessary to maintain the listing of the Fund will continue to be met or will remain unchanged.

The Fund may have difficulty maintaining its listing on the Exchange in the event the Fund’s assets are small, the Fund does not have enough shareholders, or if the Fund is unable to proceed with creation and/or redemption orders.

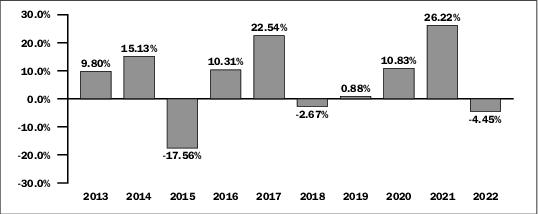

Annual Total Return

The bar chart and table below illustrate the annual calendar year returns of the Fund based on net asset value as well as

the average annual Fund and Index returns. The bar chart and table provide an indication of the risks of investing in the Fund by showing

changes in the Fund’s performance from year-to-year and by showing how the Fund’s average annual total returns based on net asset value compared to those of the Index and two market indices. See “Total Return Information” for additional performance information regarding the Fund. The Fund’s performance information is accessible on the Fund’s website at www.ftportfolios.com.

On April 17, 2018 the Fund’s underlying index changed from the Nasdaq AlphaDEX® Taiwan Index to the NIFTY 50 Equal Weight Index. Therefore, the Fund’s performance and historical returns shown below are not necessarily indicative of the performance that the Fund, based on the Index, would have generated. Returns for an underlying index are only disclosed for those periods in which the

index was in existence for the whole period.

First Trust India NIFTY 50 Equal Weight ETF

Calendar Year Total Returns as of 12/31

Calendar Year Total Returns as of 12/31

During the periods shown in the chart above:

|

Best Quarter

|

|

Worst Quarter

|

|

|

25.70%

|

December 31, 2020

|

-35.46%

|

March 31, 2020

|

The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

All after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not

reflect the impact of any state or local tax. Returns after taxes on distributions reflect the taxed return on the payment of dividends and capital

gains. Returns after taxes on distributions and sale of shares assume you sold your shares at period end, and, therefore, are also

adjusted for any capital gains or losses incurred. Returns for the market indices do not include expenses, which are deducted from

Fund returns, or taxes.

Your own actual after-tax returns will depend on your specific tax situation and may differ from what is shown here. After-tax

returns are not relevant to investors who hold Fund shares in tax-deferred accounts such as individual retirement accounts (IRAs) or employee-sponsored retirement plans.

Average Annual Total Returns for the Periods Ended December 31, 2022

|

|

1 Year

|

5 Years

|

10 Years

|

Since

Inception

|

Inception

Date

|

|

Return Before Taxes

|

-4.45%

|

5.50%

|

6.30%

|

5.84%

|

2/14/2012

|

|

Return After Taxes on Distributions

|

-6.53%

|

4.83%

|

5.35%

|

4.89%

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares

|

-2.52%

|

4.03%

|

4.57%

|

4.20%

|

|

|

NIFTY 50 Equal Weight Index(1) (reflects no deduction for

fees, expenses or taxes)

|

-2.86%

|

N/A

|

N/A

|

N/A

|

|

|

NIFTY 50 Index (reflects no deduction for fees, expenses or

taxes)

|

-5.14%

|

7.25%

|

8.66%

|

7.88%

|

|

|

MSCI India Index (reflects no deduction for fees, expenses or

taxes)

|

-7.95%

|

6.01%

|

7.43%

|

6.77%

|

|

(1)

On April 17, 2018, the Fund's underlying index changed from the Nasdaq AlphaDEX® Taiwan Index to the NIFTY 50 Equal Weight Index. Therefore, the Fund’s performance and total returns shown for the periods prior to April 17, 2018, are not necessarily indicative of the performance that the Fund, based on the current index, would have generated. Since the Fund’s new underlying index had an inception date of September 29, 2017, it was not in existence for all the periods disclosed.

Management

Investment Advisor

First Trust Advisors L.P. (“First Trust” or the “Advisor”)

Portfolio Managers

The Fund’s portfolio is managed by a team (the “Investment Committee”) consisting of:

•

Daniel J. Lindquist, Chairman of the Investment Committee and Managing Director of First Trust

•

David G. McGarel, Chief Investment Officer, Chief Operating Officer and Managing Director of First Trust

•

Jon C. Erickson, Senior Vice President of First Trust

•

Roger F. Testin, Senior Vice President of First Trust

•

Stan Ueland, Senior Vice President of First Trust

•

Chris A. Peterson, Senior Vice President of First Trust

•

Erik Russo, Vice President of First Trust

The Investment Committee members are primarily and jointly responsible for the day-to-day management of the Fund. Each Investment Committee member has served as a part of the portfolio management team of the Fund since 2012, except for Chris A. Peterson and Erik Russo who have served as part of the portfolio management team of the Fund since 2016 and 2020, respectively.

Purchase and Sale of Fund Shares

The Fund issues and redeems shares on a continuous basis, at net asset value, only in large blocks of shares called “Creation Units.” Individual shares of the Fund may only be purchased and sold on the secondary market through a broker-dealer. Since shares

of the Fund trade on securities exchanges in the secondary market at their market price rather than their net asset value, the Fund’s shares may trade at a price greater than (premium) or less than (discount) the Fund’s net asset value. An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares of the Fund (bid) and the lowest

price a seller is willing to accept for shares of the Fund (ask) when buying or selling shares in the secondary market (the “bid-ask spread”). Recent information, including the Fund’s net asset value, market price, premiums and discounts, bid-ask spreads and the median bid-ask spread for the Fund’s most recent fiscal year, is available online at https://www.ftportfolios.com/Retail/etf/home.aspx.

Tax Information

The Fund’s distributions are taxable and will generally be taxed as ordinary income or capital gains. Distributions on shares held in a tax-deferred account, while not immediately taxable, will be subject to tax when the shares are no longer held in a tax-deferred

account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer, registered investment adviser, bank or other financial intermediary

(collectively, “intermediaries”), First Trust and First Trust Portfolios L.P., the Fund’s distributor, may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or

other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial

intermediary’s website for more information.

You can find the Fund’s statutory prospectus and other information about the Fund, including the statement of additional information and most recent reports to shareholders, online at www.ftportfolios.com/retail/ETF/ETFfundnews.aspx?Ticker=NFTY.

NFTYSP050123