As filed with the Securities and Exchange Commission on April 29, 2022

1933 Act Registration No. 333-171759

1940 Act Registration No. 811-22519

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-1A

| Registration Statement Under the Securities Act of 1933 | [ ] |

| Pre-Effective Amendment No. __ | [ ] |

| Post-Effective Amendment No. 92 | [X] |

| and/or | |

| Registration Statement Under the Investment Company Act of 1940 | [ ] |

| Amendment No. 93 | [X] |

First Trust Exchange-Traded AlphaDEX® Fund II

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, Illinois 60187

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (800) 621-1675

W. Scott Jardine, Esq., Secretary

First Trust Exchange-Traded AlphaDEX® Fund

First Trust Advisors L.P.

120 East Liberty Drive, Suite 400

Wheaton, Illinois 60187

(Name and Address of Agent for Service)

Copy to:

Eric F. Fess, Esq.

Chapman and Cutler LLP

320 South Canal Street

Chicago, Illinois 60606

It is proposed that this filing will become effective (check appropriate box):

[ ] immediately upon filing pursuant to paragraph (b)

[X] on May 2, 2022 pursuant to paragraph (b)

[ ] 60 days after filing pursuant to paragraph (a)(1)

[ ] on (date) pursuant to paragraph (a)(1)

[ ] 75 days after filing pursuant to paragraph (a)(2)

[ ] on (date) pursuant to paragraph (a)(2) of Rule 485.

If appropriate, check the following box:

[ ] this post-effective amendment designates a new effective date for a previously filed post-effective amendment.

Contents of Post-Effective Amendment No. 92

This Post-Effective Amendment to the Registration Statement comprises the following papers and contents:

The Facing Sheet

Part A - Prospectus for First Trust Asia Pacific ex-Japan AlphaDEX® Fund, First Trust Brazil AlphaDEX® Fund, First Trust China AlphaDEX® Fund, First Trust Developed Markets ex-US AlphaDEX® Fund, First Trust Developed Markets ex-US Small Cap AlphaDEX® Fund, First Trust Emerging Markets AlphaDEX® Fund, First Trust Emerging Markets Small Cap AlphaDEX® Fund, First Trust Europe AlphaDEX® Fund, First Trust Eurozone AlphaDEX® ETF, First Trust Germany AlphaDEX® Fund, First Trust India NIFTY 50 Equal Weight ETF, First Trust Japan AlphaDEX® Fund, First Trust Latin America AlphaDEX® Fund, First Trust Switzerland AlphaDEX® Fund and First Trust United Kingdom AlphaDEX® Fund

Part B - Statement of Additional Information for First Trust Asia Pacific Ex-Japan AlphaDEX® Fund, First Trust Brazil AlphaDEX® Fund, First Trust China AlphaDEX® Fund, First Trust Developed Markets ex-US AlphaDEX® Fund, First Trust Developed Markets ex-US Small Cap AlphaDEX® Fund, First Trust Emerging Markets AlphaDEX® Fund, First Trust Emerging Markets Small Cap AlphaDEX® Fund, First Trust Europe AlphaDEX® Fund, First Trust Eurozone AlphaDEX® ETF, First Trust Germany AlphaDEX® Fund, First Trust India NIFTY 50 Equal Weight ETF, First Trust Japan AlphaDEX® Fund, First Trust Latin America AlphaDEX® Fund, First Trust Switzerland AlphaDEX® Fund and First Trust United Kingdom AlphaDEX® Fund

Part C - Other Information

Signatures

Index to Exhibits

Exhibits

|

First Trust

Exchange-Traded AlphaDEX® Fund II |

|

FUND NAME |

TICKER SYMBOL |

EXCHANGE |

|

First Trust Asia Pacific ex-Japan AlphaDEX® Fund |

FPA |

Nasdaq |

|

First Trust Brazil AlphaDEX® Fund |

FBZ |

Nasdaq |

|

First Trust China AlphaDEX® Fund |

FCA |

Nasdaq |

|

First Trust Developed Markets ex-US AlphaDEX® Fund |

FDT |

Nasdaq |

|

First Trust Developed Markets ex-US Small Cap AlphaDEX® Fund |

FDTS |

Nasdaq |

|

First Trust Emerging Markets AlphaDEX® Fund |

FEM |

Nasdaq |

|

First Trust Emerging Markets Small Cap AlphaDEX® Fund |

FEMS |

Nasdaq |

|

First Trust Europe AlphaDEX® Fund |

FEP |

Nasdaq |

|

First Trust Eurozone AlphaDEX® ETF |

FEUZ |

Nasdaq |

|

First Trust Germany AlphaDEX® Fund |

FGM |

Nasdaq |

|

First Trust India NIFTY 50 Equal Weight ETF |

NFTY |

Nasdaq |

|

First Trust Japan AlphaDEX® Fund |

FJP |

Nasdaq |

|

First Trust Latin America AlphaDEX® Fund |

FLN |

Nasdaq |

|

First Trust Switzerland AlphaDEX® Fund |

FSZ |

Nasdaq |

|

First Trust United Kingdom AlphaDEX® Fund |

FKU |

Nasdaq |

|

| |

|

3 | |

|

12 | |

|

21 | |

|

30 | |

|

39 | |

|

48 | |

|

58 | |

|

67 | |

|

75 | |

|

83 | |

|

91 | |

|

99 | |

|

108 | |

|

117 | |

|

126 | |

|

134 | |

|

136 | |

|

137 | |

|

150 | |

|

151 | |

|

152 | |

|

153 | |

|

153 | |

|

156 | |

|

157 | |

|

157 | |

|

157 | |

|

158 | |

|

159 | |

|

159 | |

|

165 | |

|

180 |

First Trust Asia Pacific ex-Japan AlphaDEX® Fund (FPA)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

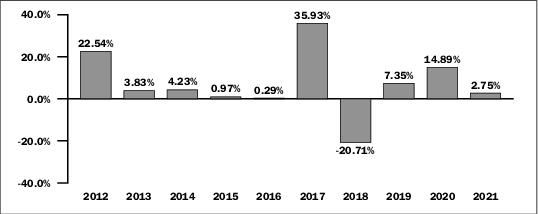

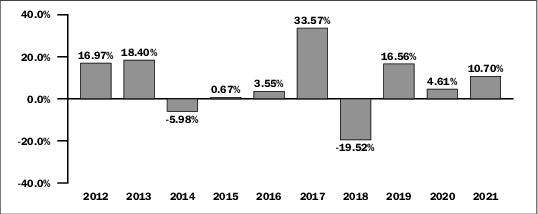

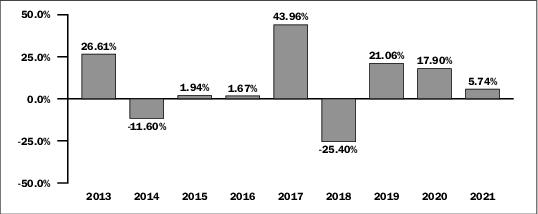

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Asia Pacific Ex-Japan Index(1)

(reflects no deduction for fees, expenses or taxes) |

|

|

|

|

|

|

Nasdaq DM Asia Pacific Ex-Japan Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

MSCI Pacific ex-Japan Index (reflects no deduction

for fees, expenses or taxes) |

|

|

|

|

|

First Trust Brazil AlphaDEX® Fund (FBZ)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

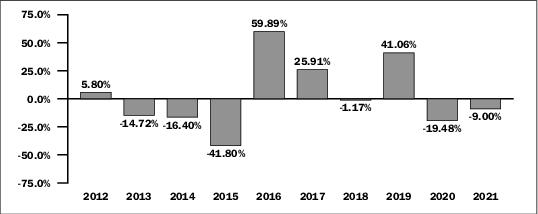

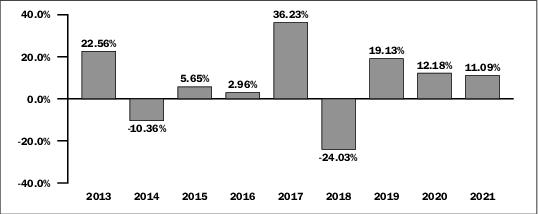

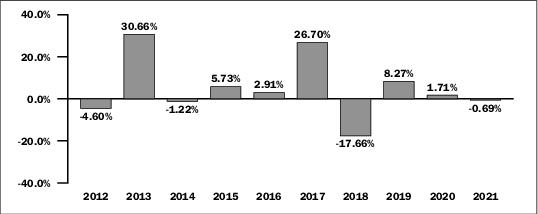

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

- |

|

- |

- |

|

|

Return After Taxes on Distributions |

- |

|

- |

- |

|

|

Return After Taxes on Distributions and Sale of

Fund Shares |

- |

|

- |

- |

|

|

Nasdaq AlphaDEX® Brazil Index(1) (reflects no

deduction for fees, expenses or taxes) |

- |

|

|

|

|

|

Nasdaq Brazil Index(1) (reflects no deduction for

fees, expenses or taxes) |

- |

|

|

|

|

|

MSCI Brazil Index (reflects no deduction for fees,

expenses or taxes) |

- |

|

- |

- |

|

First Trust China AlphaDEX® Fund (FCA)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

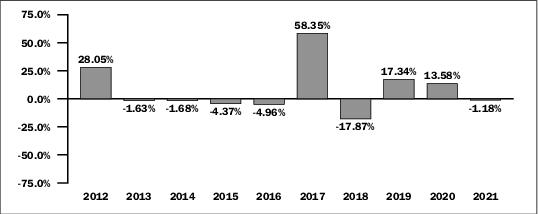

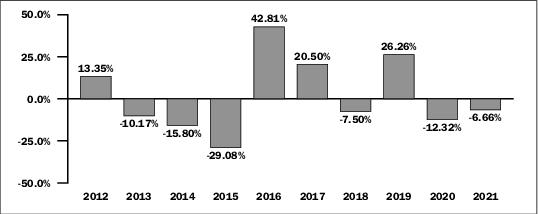

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

- |

|

|

|

|

|

Return After Taxes on Distributions |

- |

|

|

|

|

|

Return After Taxes on Distributions and Sale of

Fund Shares |

- |

|

|

|

|

|

Nasdaq AlphaDEX® China Index(1) (reflects no

deduction for fees, expenses or taxes) |

- |

|

|

|

|

|

Nasdaq China Index(1) (reflects no deduction for

fees, expenses or taxes) |

- |

|

|

|

|

|

MSCI China Index (reflects no deduction for fees,

expenses or taxes) |

- |

|

|

|

|

First Trust Developed Markets ex-US AlphaDEX® Fund (FDT)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of

Fund Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Developed Markets Ex-US

Index(1) (reflects no deduction for fees, expenses

or taxes) |

|

|

|

|

|

|

Nasdaq Developed Markets Ex-US Index(1) (reflects

no deduction for fees, expenses or taxes) |

|

|

|

|

|

|

MSCI World ex USA Index (reflects no deduction for

fees, expenses or taxes) |

|

|

|

|

|

First Trust Developed Markets ex-US Small Cap AlphaDEX® Fund (FDTS)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

|

|

Nasdaq AlphaDEX® Developed Markets Ex-US Small Cap Index(1)

(reflects no deduction for fees, expenses or taxes) |

|

|

|

|

|

Nasdaq Developed Markets Ex-US Small Cap Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

MSCI World ex-USA Small Cap Index (reflects no deduction for

fees, expenses or taxes) |

|

|

|

|

First Trust Emerging Markets AlphaDEX® Fund (FEM)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

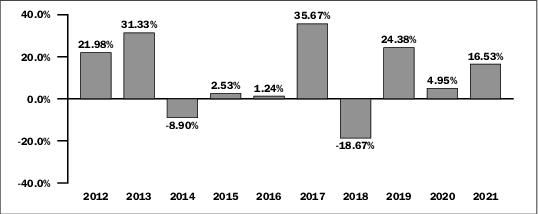

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Emerging Markets Index(1)

(reflects no deduction for fees, expenses or

taxes) |

|

|

|

|

|

|

Nasdaq Emerging Markets Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

MSCI Emerging Markets Index (reflects no

deduction for fees, expenses or taxes) |

- |

|

|

|

|

First Trust Emerging Markets Small Cap AlphaDEX® Fund (FEMS)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

|

|

Nasdaq AlphaDEX® Emerging Markets Small Cap Index(1)

(reflects no deduction for fees, expenses or taxes) |

|

|

|

|

|

Nasdaq Emerging Markets Small Cap Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

MSCI Emerging Markets Small Cap Index (reflects no deduction

for fees, expenses or taxes) |

|

|

|

|

First Trust Europe AlphaDEX® Fund (FEP)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of

Fund Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Europe Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

Nasdaq DM Europe Index(1) (reflects no deduction

for fees, expenses or taxes) |

|

|

|

|

|

|

MSCI Europe Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

First Trust Eurozone AlphaDEX® ETF (FEUZ)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

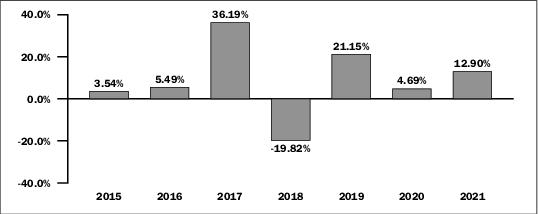

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

|

|

Nasdaq AlphaDEX® Eurozone Index (reflects no deduction for

fees, expenses or taxes) |

|

|

|

|

|

Nasdaq Eurozone Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

MSCI EMU Index (reflects no deduction for fees, expenses or

taxes) |

|

|

|

|

First Trust Germany AlphaDEX® Fund (FGM)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

|

|

Nasdaq AlphaDEX® Germany Index(1) (reflects no deduction for

fees, expenses or taxes) |

|

|

|

|

|

Nasdaq Germany Index(1) (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

MSCI Germany Index (reflects no deduction for fees, expenses or

taxes) |

|

|

|

|

First Trust India NIFTY 50 Equal Weight ETF (NFTY)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

|

|

NIFTY 50 Equal Weight Index(1) (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

NIFTY 50 Index (reflects no deduction for fees, expenses or

taxes) |

|

|

|

|

First Trust Japan AlphaDEX® Fund (FJP)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

- |

|

|

|

|

|

Return After Taxes on Distributions |

- |

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

- |

|

|

|

|

|

Nasdaq AlphaDEX® Japan Index(1) (reflects no

deduction for fees, expenses or taxes) |

- |

|

|

|

|

|

Nasdaq Japan Index(1) (reflects no deduction for

fees, expenses or taxes) |

|

|

|

|

|

|

MSCI Japan Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

First Trust Latin America AlphaDEX® Fund (FLN)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

- |

|

|

- |

|

|

Return After Taxes on Distributions |

- |

|

- |

- |

|

|

Return After Taxes on Distributions and Sale of

Fund Shares |

- |

|

- |

- |

|

|

Nasdaq AlphaDEX® Latin America Index (1)

(reflects no deduction for fees, expenses or

taxes) |

- |

|

|

|

|

|

Nasdaq Latin America Index (1) (reflects no

deduction for fees, expenses or taxes) |

- |

|

|

|

|

|

MSCI EM Latin America Index (reflects no

deduction for fees, expenses or taxes) |

- |

|

- |

- |

|

First Trust Switzerland AlphaDEX® Fund (FSZ)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

|

|

Nasdaq AlphaDEX® Switzerland Index(1) (reflects no deduction

for fees, expenses or taxes) |

|

|

|

|

|

Nasdaq Switzerland Index(1) (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

MSCI Switzerland Index (reflects no deduction for fees, expenses

or taxes) |

|

|

|

|

First Trust United Kingdom AlphaDEX® Fund (FKU)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

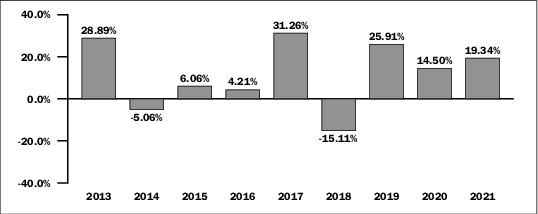

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

|

|

Nasdaq AlphaDEX® United Kingdom Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

Nasdaq United Kingdom Index(1) (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

MSCI United Kingdom Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(4/18/2011) |

5 Years |

10 Years |

Inception

(4/18/2011) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

2.75% |

6.43% |

6.25% |

3.43% |

36.58% |

83.43% |

43.47% |

|

Market Price |

2.34% |

6.01% |

6.05% |

3.31% |

33.92% |

79.93% |

41.63% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Asia Pacific Ex-Japan

Index(1) |

3.68% |

7.39% |

N/A |

N/A |

42.83% |

N/A |

N/A |

|

Nasdaq DM Asia Pacific Ex-Japan Index(1) |

1.91% |

9.56% |

N/A |

N/A |

57.88% |

N/A |

N/A |

|

MSCI Pacific ex-Japan Index |

4.68% |

8.31% |

6.77% |

4.49% |

49.07% |

92.46% |

60.01% |

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(4/18/2011) |

5 Years |

10 Years |

Inception

(4/18/2011) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-9.00% |

5.16% |

-1.02% |

-3.16% |

28.62% |

-9.72% |

-29.06% |

|

Market Price |

-9.08% |

5.44% |

-1.07% |

-3.17% |

30.33% |

-10.19% |

-29.14% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Brazil Index(1) |

-7.86% |

7.43% |

N/A |

N/A |

43.12% |

N/A |

N/A |

|

Nasdaq Brazil Index(1) |

-21.39% |

0.70% |

N/A |

N/A |

3.55% |

N/A |

N/A |

|

MSCI Brazil Index |

-17.40% |

0.85% |

-3.04% |

-4.98% |

4.34% |

-26.57% |

-42.09% |

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(4/18/2011) |

5 Years |

10 Years |

Inception

(4/18/2011) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-1.18% |

11.36% |

6.78% |

2.41% |

71.29% |

92.80% |

29.03% |

|

Market Price |

-0.42% |

11.66% |

6.76% |

2.35% |

73.57% |

92.31% |

28.27% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® China Index(1) |

-2.00% |

12.38% |

N/A |

N/A |

79.22% |

N/A |

N/A |

|

Nasdaq China Index(1) |

-21.14% |

6.37% |

N/A |

N/A |

36.14% |

N/A |

N/A |

|

MSCI China Index |

-21.72% |

9.36% |

7.17% |

4.17% |

56.42% |

99.80% |

54.77% |

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(4/18/2011) |

5 Years |

10 Years |

Inception

(4/18/2011) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

10.70% |

7.73% |

7.01% |

4.23% |

45.10% |

96.94% |

55.74% |

|

Market Price |

11.35% |

7.77% |

6.83% |

4.22% |

45.40% |

93.67% |

55.73% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Developed Markets

Ex-US Index(1) |

11.52% |

8.58% |

N/A |

N/A |

50.89% |

N/A |

N/A |

|

Nasdaq Developed Markets Ex-US Index(1) |

11.05% |

9.54% |

N/A |

N/A |

57.74% |

N/A |

N/A |

|

MSCI World ex USA Index |

12.62% |

9.63% |

7.84% |

5.74% |

58.37% |

112.68% |

81.74% |

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||

|

|

1 Year |

5 Years |

Inception

(2/15/2012) |

5 Years |

Inception

(2/15/2012) |

|

Fund Performance |

|

|

|

|

|

|

Net Asset Value |

11.09% |

8.97% |

6.72% |

53.65% |

90.09% |

|

Market Price |

11.87% |

9.13% |

6.68% |

54.76% |

89.33% |

|

Index Performance |

|

|

|

|

|

|

Nasdaq AlphaDEX® Developed Markets Ex-US Small

Cap Index(1) |

12.24% |

9.88% |

N/A |

60.18% |

N/A |

|

Nasdaq Developed Markets Ex-US Small Cap Index(1) |

8.32% |

8.63% |

N/A |

51.27% |

N/A |

|

MSCI World ex-USA Small Cap Index |

11.14% |

11.03% |

8.92% |

68.76% |

132.51% |

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(4/18/2011) |

5 Years |

10 Years |

Inception

(4/18/2011) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

7.90% |

8.58% |

4.81% |

1.93% |

50.95% |

59.90% |

22.77% |

|

Market Price |

7.31% |

8.58% |

4.60% |

1.88% |

50.94% |

56.85% |

22.04% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Emerging Markets

Index(1) |

8.99% |

9.94% |

N/A |

N/A |

60.63% |

N/A |

N/A |

|

Nasdaq Emerging Markets Index(1) |

0.22% |

9.22% |

N/A |

N/A |

55.44% |

N/A |

N/A |

|

MSCI Emerging Markets Index |

-2.54% |

9.87% |

5.49% |

3.00% |

60.14% |

70.62% |

37.22% |

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||

|

|

1 Year |

5 Years |

Inception

(2/15/2012) |

5 Years |

Inception

(2/15/2012) |

|

Fund Performance |

|

|

|

|

|

|

Net Asset Value |

3.68% |

10.50% |

6.61% |

64.76% |

88.11% |

|

Market Price |

4.01% |

10.67% |

6.59% |

66.05% |

87.80% |

|

Index Performance |

|

|

|

|

|

|

Nasdaq AlphaDEX® Emerging Markets Small Cap

Index(1) |

4.87% |

12.22% |

N/A |

78.01% |

N/A |

|

Nasdaq Emerging Markets Small Cap Index(1) |

14.91% |

10.75% |

N/A |

66.65% |

N/A |

|

MSCI Emerging Markets Small Cap Index |

18.75% |

11.47% |

5.67% |

72.10% |

72.32% |

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(4/18/2011) |

5 Years |

10 Years |

Inception

(4/18/2011) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

16.53% |

10.91% |

9.78% |

6.27% |

67.85% |

154.29% |

91.91% |

|

Market Price |

16.76% |

10.87% |

9.57% |

6.22% |

67.54% |

149.35% |

90.69% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Europe Index(1) |

17.14% |

11.57% |

N/A |

N/A |

72.89% |

N/A |

N/A |

|

Nasdaq DM Europe Index(1) |

15.88% |

10.17% |

N/A |

N/A |

62.33% |

N/A |

N/A |

|

MSCI Europe Index |

16.30% |

10.14% |

8.18% |

5.90% |

62.08% |

119.52% |

84.79% |

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||

|

|

1 Year |

5 Years |

Inception

(10/21/2014) |

5 Years |

Inception

(10/21/2014) |

|

Fund Performance |

|

|

|

|

|

|

Net Asset Value |

12.90% |

9.35% |

7.89% |

56.38% |

72.74% |

|

Market Price |

13.44% |

9.31% |

7.80% |

56.04% |

71.63% |

|

Index Performance |

|

|

|

|

|

|

Nasdaq AlphaDEX® Eurozone Index |

13.22% |

9.86% |

8.49% |

60.01% |

79.71% |

|

Nasdaq Eurozone Index |

13.31% |

9.73% |

7.10% |

59.11% |

63.75% |

|

MSCI EMU Index |

13.54% |

9.94% |

6.99% |

60.62% |

62.55% |

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||

|

|

1 Year |

5 Years |

Inception

(2/14/2012) |

5 Years |

Inception

(2/14/2012) |

|

Fund Performance |

|

|

|

|

|

|

Net Asset Value |

5.74% |

10.14% |

7.94% |

62.08% |

112.63% |

|

Market Price |

6.71% |

10.16% |

7.93% |

62.21% |

112.58% |

|

Index Performance |

|

|

|

|

|

|

Nasdaq AlphaDEX® Germany Index(1) |

5.92% |

10.50% |

N/A |

64.75% |

N/A |

|

Nasdaq Germany Index(1) |

4.28% |

6.64% |

N/A |

37.92% |

N/A |

|

MSCI Germany Index |

5.34% |

7.12% |

6.71% |

41.04% |

89.88% |

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||

|

|

1 Year |

5 Years |

Inception

(2/14/2012) |

5 Years |

Inception

(2/14/2012) |

|

Fund Performance |

|

|

|

|

|

|

Net Asset Value |

26.15% |

10.88% |

6.94% |

67.63% |

94.08% |

|

Market Price |

26.81% |

11.16% |

6.96% |

69.72% |

94.37% |

|

Index Performance |

|

|

|

|

|

|

NIFTY 50 Equal Weight Index(1) |

32.70% |

N/A |

N/A |

N/A |

N/A |

|

NIFTY 50 Index |

23.48% |

15.59% |

9.29% |

106.33% |

140.46% |

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(4/18/2011) |

5 Years |

10 Years |

Inception

(4/18/2011) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-0.69% |

2.67% |

4.33% |

3.58% |

14.09% |

52.85% |

45.73% |

|

Market Price |

-1.02% |

2.69% |

4.31% |

3.58% |

14.20% |

52.47% |

45.67% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Japan Index(1) |

-0.23% |

3.33% |

N/A |

N/A |

17.82% |

N/A |

N/A |

|

Nasdaq Japan Index(1) |

1.08% |

7.83% |

N/A |

N/A |

45.75% |

N/A |

N/A |

|

MSCI Japan Index |

1.71% |

8.51% |

8.34% |

7.02% |

50.44% |

122.81% |

106.73% |

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(4/18/2011) |

5 Years |

10 Years |

Inception

(4/18/2011) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-6.66% |

2.87% |

0.00% |

-1.66% |

15.18% |

0.02% |

-16.39% |

|

Market Price |

-7.13% |

2.95% |

-0.12% |

-1.71% |

15.65% |

-1.15% |

-16.88% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Latin America Index(1) |

-5.52% |

4.38% |

N/A |

N/A |

23.89% |

N/A |

N/A |

|

Nasdaq Latin America Index(1) |

-12.28% |

0.96% |

N/A |

N/A |

4.88% |

N/A |

N/A |

|

MSCI EM Latin America Index |

-8.09% |

1.47% |

-2.17% |

-3.79% |

7.59% |

-19.72% |

-33.88% |

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||

|

|

1 Year |

5 Years |

Inception

(2/14/2012) |

5 Years |

Inception

(2/14/2012) |

|

Fund Performance |

|

|

|

|

|

|

Net Asset Value |

19.34% |

13.90% |

11.20% |

91.69% |

185.31% |

|

Market Price |

19.72% |

13.86% |

11.17% |

91.39% |

184.52% |

|

Index Performance |

|

|

|

|

|

|

Nasdaq AlphaDEX® Switzerland Index(1) |

20.05% |

14.43% |

N/A |

96.22% |

N/A |

|

Nasdaq Switzerland Index(1) |

18.78% |

13.99% |

N/A |

92.49% |

N/A |

|

MSCI Switzerland Index |

19.29% |

14.44% |

10.57% |

96.30% |

169.84% |

Total Returns as of December 31, 2021

|

|

|

Average Annual |

Cumulative | ||

|

|

1 Year |

5 Years |

Inception

(2/14/2012) |

5 Years |

Inception

(2/14/2012) |

|

Fund Performance |

|

|

|

|

|

|

Net Asset Value |

19.10% |

9.47% |

7.08% |

57.20% |

96.45% |

|

Market Price |

20.78% |

9.69% |

7.13% |

58.79% |

97.45% |

|

Index Performance |

|

|

|

|

|

|

Nasdaq AlphaDEX® United Kingdom Index(1) |

20.45% |

10.54% |

N/A |

65.01% |

N/A |

|

Nasdaq United Kingdom Index(1) |

17.13% |

6.78% |

N/A |

38.81% |

N/A |

|

MSCI United Kingdom Index |

18.50% |

6.16% |

4.43% |

34.83% |

53.40% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$32.25 |

$28.57 |

$27.65 |

$35.73 |

$27.16 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

1.28 |

0.58 |

0.63 |

0.40 |

0.93 |

|

Net realized and unrealized gain (loss) |

(0.37) |

3.61 |

1.40 |

(7.72) |

8.76 |

|

Total from investment operations |

0.91 |

4.19 |

2.03 |

(7.32) |

9.69 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(1.59) |

(0.51) |

(1.09) |

(0.69) |

(1.12) |

|

Return of capital |

— |

— |

(0.02) |

(0.07) |

— |

|

Total distributions |

(1.59) |

(0.51) |

(1.11) |

(0.76) |

(1.12) |

|

Net asset value, end of period |

$31.57 |

$32.25 |

$28.57 |

$27.65 |

$35.73 |

|

Total Return(a) |

2.75% |

14.89% |

7.35% |

(20.71)% |

35.93% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$25,258 |

$17,736 |

$19,997 |

$30,419 |

$58,959 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.80% |

|

Ratio of net investment income (loss) to average net assets |

4.03% |

2.33% |

2.64% |

1.68% |

2.95% |

|

Portfolio turnover rate(b) |

102% |

103% |

101% |

88% |

94% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$13.39 |

$17.24 |

$13.38 |

$15.51 |

$13.93 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

0.94 |

0.09 |

0.35 |

0.55 |

2.46 |

|

Net realized and unrealized gain (loss) |

(2.08) |

(3.60) |

5.08 |

(0.97) |

1.06 |

|

Total from investment operations |

(1.14) |

(3.51) |

5.43 |

(0.42) |

3.52 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(0.78) |

(0.28) |

(1.57) |

(0.54) |

(1.77) |

|

Net realized gain |

— |

— |

— |

(1.17) |

(0.17) |

|

Return of capital |

— |

(0.06) |

— |

— |

— |

|

Total distributions |

(0.78) |

(0.34) |

(1.57) |

(1.71) |

(1.94) |

|

Net asset value, end of period |

$11.47 |

$13.39 |

$17.24 |

$13.38 |

$15.51 |

|

Total Return(a) |

(9.00)% |

(19.48)% |

41.06% |

(1.17)% |

25.91% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$12,039 |

$9,373 |

$116,374 |

$129,081 |

$9,308 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.84%(b) |

|

Ratio of net investment income (loss) to average net assets |

7.36% |

0.72% |

2.15% |

6.84% |

3.19% |

|

Portfolio turnover rate(c) |

225% |

154% |

90% |

128% |

159% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$29.16 |

$26.87 |

$23.81 |

$29.77 |

$19.28 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

1.22 |

1.22 |

1.03 |

0.84 |

0.47 |

|

Net realized and unrealized gain (loss) |

(1.47) |

2.26 |

3.03 |

(6.07) |

10.70 |

|

Total from investment operations |

(0.25) |

3.48 |

4.06 |

(5.23) |

11.17 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(1.34) |

(1.19) |

(1.00) |

(0.73) |

(0.68) |

|

Net asset value, end of period |

$27.57 |

$29.16 |

$26.87 |

$23.81 |

$29.77 |

|

Total Return(a) |

(1.18)% |

13.58% |

17.34% |

(17.87)% |

58.35% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$9,649 |

$13,121 |

$9,403 |

$7,142 |

$7,443 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.80% |

|

Ratio of net investment income (loss) to average net assets |

3.66% |

5.16% |

4.21% |

2.90% |

1.69% |

|

Portfolio turnover rate(b) |

166% |

83% |

111% |

97% |

69% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$56.88 |

$55.79 |

$49.24 |

$62.31 |

$47.43 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

1.52 |

0.68 |

1.19 |

1.04 |

0.88 |

|

Net realized and unrealized gain (loss) |

4.55 |

1.78 |

6.91 |

(13.06) |

14.98 |

|

Total from investment operations |

6.07 |

2.46 |

8.10 |

(12.02) |

15.86 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(2.31) |

(1.37) |

(1.55) |

(1.01) |

(0.98) |

|

Return of capital |

— |

— |

— |

(0.04) |

— |

|

Total distributions |

(2.31) |

(1.37) |

(1.55) |

(1.05) |

(0.98) |

|

Net asset value, end of period |

$60.64 |

$56.88 |

$55.79 |

$49.24 |

$62.31 |

|

Total Return(a) |

10.70% |

4.61% |

16.56% |

(19.52)% |

33.57% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$414,579 |

$360,418 |

$691,886 |

$940,633 |

$810,194 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.80% |

|

Ratio of net investment income (loss) to average net assets |

2.42% |

1.39% |

2.13% |

1.76% |

1.85% |

|

Portfolio turnover rate(b) |

111% |

117% |

107% |

109% |

104% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$42.72 |

$39.03 |

$33.54 |

$44.89 |

$33.70 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

0.74 |

0.46 |

0.61 |

0.58 |

0.71 |

|

Net realized and unrealized gain (loss) |

3.99 |

4.09 |

5.77 |

(11.28) |

11.41 |

|

Total from investment operations |

4.73 |

4.55 |

6.38 |

(10.70) |

12.12 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(1.39) |

(0.86) |

(0.89) |

(0.62) |

(0.93) |

|

Return of capital |

— |

— |

— |

(0.03) |

— |

|

Total distributions |

(1.39) |

(0.86) |

(0.89) |

(0.65) |

(0.93) |

|

Net asset value, end of period |

$46.06 |

$42.72 |

$39.03 |

$33.54 |

$44.89 |

|

Total Return(a) |

11.09% |

12.18% |

19.13% |

(24.03)% |

36.23% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$13,817 |

$8,544 |

$9,758 |

$10,063 |

$8,977 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.80% |

|

Ratio of net investment income (loss) to average net assets |

1.46% |

1.35% |

1.66% |

1.30% |

1.80% |

|

Portfolio turnover rate(b) |

116% |

127% |

119% |

142% |

111% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$25.31 |

$26.36 |

$22.80 |

$27.84 |

$20.50 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

1.11 |

0.63 |

0.88 |

0.88 |

0.59 |

|

Net realized and unrealized gain (loss) |

0.90 |

(1.00) |

3.56 |

(5.12) |

7.43 |

|

Total from investment operations |

2.01 |

(0.37) |

4.44 |

(4.24) |

8.02 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(1.08) |

(0.68) |

(0.88) |

(0.80) |

(0.68) |

|

Net asset value, end of period |

$26.24 |

$25.31 |

$26.36 |

$22.80 |

$27.84 |

|

Total Return(a) |

7.90% |

(0.92)% |

19.81% |

(15.48)% |

39.43% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$436,915 |

$441,711 |

$644,615 |

$452,607 |

$449,663 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.80% |

|

Ratio of net investment income (loss) to average net assets |

4.03% |

2.53% |

3.61% |

3.37% |

2.69% |

|

Portfolio turnover rate(b) |

119% |

111% |

122% |

103% |

101% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$41.24 |

$39.28 |

$32.44 |

$43.02 |

$30.42 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

1.57 |

0.74 |

1.11 |

1.19 |

1.11 |

|

Net realized and unrealized gain (loss) |

(0.01) |

2.41 |

7.46 |

(10.26) |

12.96 |

|

Total from investment operations |

1.56 |

3.15 |

8.57 |

(9.07) |

14.07 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(2.51) |

(1.19) |

(1.73) |

(1.44) |

(1.26) |

|

Net realized gain |

— |

— |

— |

(0.07) |

(0.21) |

|

Total distributions |

(2.51) |

(1.19) |

(1.73) |

(1.51) |

(1.47) |

|

Net asset value, end of period |

$40.29 |

$41.24 |

$39.28 |

$32.44 |

$43.02 |

|

Total Return(a) |

3.68% |

8.73% |

26.90% |

(21.42)% |

46.57% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$143,030 |

$152,581 |

$163,004 |

$157,326 |

$271,055 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.80% |

|

Ratio of net investment income (loss) to average net assets |

3.65% |

2.38% |

2.88% |

3.02% |

3.26% |

|

Portfolio turnover rate(b) |

127% |

123% |

127% |

126% |

113% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$38.50 |

$37.64 |

$31.11 |

$39.07 |

$29.32 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

1.05 |

0.42 |

0.87 |

0.84 |

0.49 |

|

Net realized and unrealized gain (loss) |

5.26 |

1.32 |

6.65 |

(7.99) |

9.90 |

|

Total from investment operations |

6.31 |

1.74 |

7.52 |

(7.15) |

10.39 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(1.50) |

(0.88) |

(0.99) |

(0.81) |

(0.64) |

|

Net asset value, end of period |

$43.31 |

$38.50 |

$37.64 |

$31.11 |

$39.07 |

|

Total Return(a) |

16.53% |

4.95% |

24.38% |

(18.67)% |

35.67% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$573,909 |

$442,765 |

$511,890 |

$592,586 |

$707,087 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.80% |

|

Ratio of net investment income (loss) to average net assets |

2.33% |

1.32% |

2.49% |

2.30% |

1.39% |

|

Portfolio turnover rate(b) |

105% |

109% |

102% |

99% |

100% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$42.10 |

$40.88 |

$34.43 |

$43.81 |

$32.64 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

1.10 |

0.50 |

0.73 |

0.80 |

0.47 |

|

Net realized and unrealized gain (loss) |

4.32 |

1.34 |

6.51 |

(9.34) |

11.26 |

|

Total from investment operations |

5.42 |

1.84 |

7.24 |

(8.54) |

11.73 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(1.16) |

(0.62) |

(0.79) |

(0.84) |

(0.56) |

|

Net asset value, end of period |

$46.36 |

$42.10 |

$40.88 |

$34.43 |

$43.81 |

|

Total Return(a) |

12.90% |

4.69% |

21.15% |

(19.82)% |

36.19% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$81,135 |

$27,363 |

$53,145 |

$49,925 |

$39,425 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.80% |

|

Ratio of net investment income (loss) to average net assets |

2.27% |

1.26% |

1.96% |

2.10% |

0.96% |

|

Portfolio turnover rate(b) |

59% |

93% |

87% |

90% |

77% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$51.56 |

$44.39 |

$37.57 |

$51.26 |

$36.47 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

0.91 |

0.68 |

1.02 |

0.72 |

1.00 |

|

Net realized and unrealized gain (loss) |

2.08 |

7.17 |

6.82 |

(13.59) |

14.87 |

|

Total from investment operations |

2.99 |

7.85 |

7.84 |

(12.87) |

15.87 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(0.77) |

(0.68) |

(1.02) |

(0.82) |

(1.08) |

|

Net asset value, end of period |

$53.78 |

$51.56 |

$44.39 |

$37.57 |

$51.26 |

|

Total Return(a) |

5.74% |

17.90% |

21.06% |

(25.40)% |

43.96% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$99,497 |

$95,381 |

$144,261 |

$139,022 |

$258,845 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.80% |

|

Ratio of net investment income (loss) to average net assets |

1.67% |

1.40% |

2.48% |

1.66% |

2.38% |

|

Portfolio turnover rate(b) |

80% |

106% |

99% |

81% |

82% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$38.83 |

$35.26 |

$35.35 |

$36.33 |

$30.87 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

0.48 |

0.30 |

0.26 |

0.23 |

0.87 |

|

Net realized and unrealized gain (loss) |

9.65 |

3.50 |

(0.01) |

(1.21) |

6.06 |

|

Total from investment operations |

10.13 |

3.80 |

0.25 |

(0.98) |

6.93 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(0.73) |

(0.23) |

(0.27) |

— |

(1.47) |

|

Return of capital |

— |

— |

(0.07) |

— |

— |

|

Total distributions |

(0.73) |

(0.23) |

(0.34) |

— |

(1.47) |

|

Net asset value, end of period |

$48.23 |

$38.83 |

$35.26 |

$35.35 |

$36.33 |

|

Total Return(a) |

26.15% |

10.66% |

0.71% |

(2.67)%(b) |

22.54% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$62,703 |

$3,883 |

$3,526 |

$3,535 |

$3,633 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.80% |

|

Ratio of net investment income (loss) to average net assets |

0.95% |

0.98% |

0.74% |

0.77% |

2.45% |

|

Portfolio turnover rate(c) |

57% |

38% |

24% |

156%(d) |

64% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$51.42 |

$51.10 |

$48.55 |

$59.80 |

$47.85 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

0.81 |

0.49 |

1.12 |

0.79 |

0.64 |

|

Net realized and unrealized gain (loss) |

(1.16) |

0.34 |

2.84 |

(11.30) |

12.08 |

|

Total from investment operations |

(0.35) |

0.83 |

3.96 |

(10.51) |

12.72 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(1.21) |

(0.51) |

(1.41) |

(0.74) |

(0.77) |

|

Net asset value, end of period |

$49.86 |

$51.42 |

$51.10 |

$48.55 |

$59.80 |

|

Total Return(a) |

(0.69)% |

1.71% |

8.27% |

(17.66)% |

26.70% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$34,901 |

$41,136 |

$76,647 |

$152,934 |

$83,718 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.80% |

|

Ratio of net investment income (loss) to average net assets |

1.53% |

1.13% |

1.90% |

1.34% |

1.22% |

|

Portfolio turnover rate(b) |

126% |

136% |

127% |

90% |

101% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$19.43 |

$22.67 |

$18.33 |

$20.43 |

$18.74 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

0.89 |

0.52 |

0.48 |

0.52 |

1.56 |

|

Net realized and unrealized gain (loss) |

(2.16) |

(3.44) |

4.29 |

(2.06) |

2.23 |

|

Total from investment operations |

(1.27) |

(2.92) |

4.77 |

(1.54) |

3.79 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(0.81) |

(0.20) |

(0.43) |

(0.51) |

(2.10) |

|

Return of capital |

— |

(0.12) |

— |

(0.05) |

— |

|

Total distributions |

(0.81) |

(0.32) |

(0.43) |

(0.56) |

(2.10) |

|

Net asset value, end of period |

$17.35 |

$19.43 |

$22.67 |

$18.33 |

$20.43 |

|

Total Return(a) |

(6.66)% |

(12.32)% |

26.26% |

(7.50)% |

20.50% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$7,805 |

$13,599 |

$131,463 |

$17,418 |

$17,363 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.82%(b) |

|

Ratio of net investment income (loss) to average net assets |

4.28% |

0.81% |

2.02% |

2.46% |

3.02% |

|

Portfolio turnover rate(c) |

91% |

34% |

165% |

158% |

187% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$60.85 |

$54.11 |

$43.89 |

$52.73 |

$40.82 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

0.78 |

0.88 |

1.07 |

0.82 |

0.66 |

|

Net realized and unrealized gain (loss) |

10.92 |

6.78 |

10.24 |

(8.66) |

12.03 |

|

Total from investment operations |

11.70 |

7.66 |

11.31 |

(7.84) |

12.69 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(1.16) |

(0.92) |

(1.09) |

(0.84) |

(0.78) |

|

Return of capital |

— |

— |

— |

(0.16) |

— |

|

Total distributions |

(1.16) |

(0.92) |

(1.09) |

(1.00) |

(0.78) |

|

Net asset value, end of period |

$71.39 |

$60.85 |

$54.11 |

$43.89 |

$52.73 |

|

Total Return(a) |

19.34% |

14.50% |

25.91% |

(15.11)% |

31.26% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$99,943 |

$97,354 |

$148,811 |

$151,409 |

$237,288 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.80% |

|

Ratio of net investment income (loss) to average net assets |

1.25% |

1.59% |

2.24% |

1.79% |

1.43% |

|

Portfolio turnover rate(b) |

66% |

86% |

77% |

65% |

50% |

For a share outstanding throughout each period

|

|

Year Ended December 31, | ||||

|

|

2021 |

2020 |

2019 |

2018 |

2017 |

|

Net asset value, beginning of period |

$38.06 |

$40.99 |

$32.11 |

$39.97 |

$32.85 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

1.29 |

0.58 |

1.34 |

1.13 |

1.15 |

|

Net realized and unrealized gain (loss) |

5.93 |

(2.95) |

8.91 |

(7.35) |

7.14 |

|

Total from investment operations |

7.22 |

(2.37) |

10.25 |

(6.22) |

8.29 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(1.31) |

(0.56) |

(1.37) |

(1.64) |

(1.17) |

|

Net asset value, end of period |

$43.97 |

$38.06 |

$40.99 |

$32.11 |

$39.97 |

|

Total Return(a) |

19.10% |

(5.25)% |

32.36% |

(16.16)% |

25.53% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$98,943 |

$19,030 |

$18,444 |

$9,632 |

$17,986 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.80% |

0.80% |

0.80% |

0.80% |

0.80% |

|

Ratio of net investment income (loss) to average net assets |

3.34% |

1.72% |

3.58% |

2.81% |

2.87% |

|

Portfolio turnover rate(b) |

45% |

109% |

73% |

107% |

98% |

|

First Trust

Exchange-Traded AlphaDEX® Fund II |

First Trust Asia Pacific ex-Japan AlphaDEX® Fund

First Trust Brazil AlphaDEX® Fund

First Trust China AlphaDEX® Fund

First Trust Developed Markets ex-US AlphaDEX® Fund

First Trust Developed Markets ex-US Small Cap AlphaDEX® Fund

First Trust Emerging Markets AlphaDEX® Fund

First Trust Emerging Markets Small Cap AlphaDEX® Fund

First Trust Europe AlphaDEX® Fund

First Trust Eurozone AlphaDEX® ETF

First Trust Germany AlphaDEX® Fund

First Trust India NIFTY 50 Equal Weight ETF

First Trust Japan AlphaDEX® Fund

First Trust Latin America AlphaDEX® Fund

First Trust Switzerland AlphaDEX® Fund

First Trust United Kingdom AlphaDEX® Fund

120 East Liberty Drive, Suite 400

Wheaton, Illinois 60187

(800) 621-1675

811-22519

|

FUND NAME |

TICKER SYMBOL |

EXCHANGE |

|

First Trust Asia Pacific ex-Japan AlphaDEX® Fund |

FPA |

Nasdaq |

|

First Trust Brazil AlphaDEX® Fund |

FBZ |

Nasdaq |

|

First Trust China AlphaDEX® Fund |

FCA |

Nasdaq |

|

First Trust Developed Markets ex-US AlphaDEX® Fund |

FDT |

Nasdaq |

|

First Trust Developed Markets ex-US Small Cap AlphaDEX® Fund |

FDTS |

Nasdaq |

|

First Trust Emerging Markets AlphaDEX® Fund |

FEM |

Nasdaq |

|

First Trust Emerging Markets Small Cap AlphaDEX® Fund |

FEMS |

Nasdaq |

|

First Trust Europe AlphaDEX® Fund |

FEP |

Nasdaq |