Document

PRODUCTION SHARING CONTRACT

BETWEEN

THE REPUBLIC OF

EQUATORIAL GUINEA

AND

GUINEA ECUATORIAL DE PETROLEOS

AND

PANORO EG EXPLORATION LIMITED

AND

KOSMOS ENERGY EQUATORIAL GUINEA

FOR

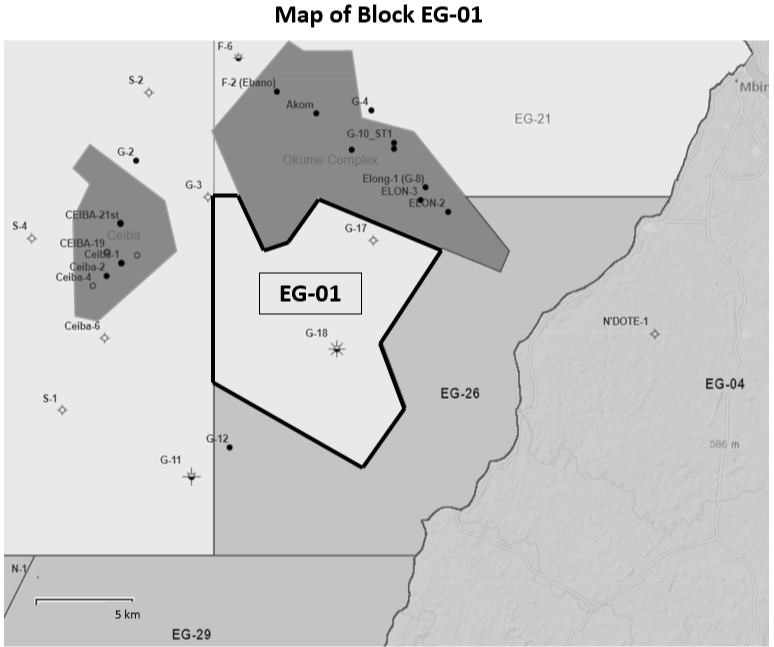

EG-01

CONTENTS

Page

THIS PRODUCTION SHARING CONTRACT is dated the____ of ____________, 2022.

BETWEEN:

(1) THE REPUBLIC OF EQUATORIAL GUINEA (hereinafter referred to as the "State"), represented for the purposes of this Contract by the Ministry of Mines and Hydrocarbons (hereinafter referred to as the "Ministry"), represented for purposes of its execution by His Excellency Gabriel Mbaga OBIANG LIMA, in his capacity as Minister of Mines and Hydrocarbons;

(2) GUINEA ECUATORIAL DE PETRÓLEOS (hereinafter referred to as the "National Company"), acting in exercise of its authority and in its own name for the purposes of this Contract and represented for purposes of its execution by Antonio OBURU ONDO, in his capacity as Director General

(3) PANORO EG EXPLORATION LIMITED (hereinafter referred to as "Panoro"), a company organized and existing under the laws of England with registered number 14403158 and having its registered office at 78 Brook Street, W1K 5EF London England; and

(4) KOSMOS ENERGY EQUATORIAL GUINEA (hereinafter referred to as “KEEG”), a company organized and existing under the laws of the Cayman Islands, under company registration number WT-269135, with its registered office at c/o Circumference (Cayman), P.I. Box 32322, 4th Floor, Century Yard, Cricket Square, Elgin Avenue, George Town, Grand Cayman, KY1-1209, Cayman Islands.

The State, Panoro, KEEG and the National Company, including their transferees as approved under the Hydrocarbons Law and this Contract, may be referred to individually as "Party" and collectively as "Parties."

PREAMBLE

(A) WHEREAS, all Hydrocarbons existing within the territory of the Republic of Equatorial Guinea, as stated in the Hydrocarbons Law, are national resources owned exclusively by the State;

(B) WHEREAS, the State wishes to promote the development of Hydrocarbon deposits within the Contract Area and the Contractor desires to associate itself with the State with a view to accelerating the Development and Production of Hydrocarbons within the Contract Area;

(C) WHEREAS, the Contractor has the technical and financial ability, as well as the professional skills necessary to carry out Petroleum Operations in accordance with this Contract and generally accepted good practices of the international petroleum industry; and

(D) WHEREAS the Parties wish to enter into this Contract in accordance with the Hydrocarbons Law, which allows for agreements to be entered into between the State and foreign investors in the form of a production sharing contract, through direct negotiation or by international public bidding,

NOW THEREFORE, in consideration of the commitments and mutual agreements expressed in this document, the Parties agree as follows:

ARTICLE 1

SCOPE AND DEFINITIONS

1.1 Definitions

Except where the context dictates another meaning, or as defined in the Hydrocarbons Law or Petroleum Regulations, the following words and expressions will have the following meanings:

1.1.1 Joint Operating Agreement (JOA) means the joint operating agreement that rules the internal relations of the parties making up the Contractor in carrying out Petroleum Operations in the Contract Area.

1.1.2 Calendar Year or Year means a period of twelve (12) months beginning 1 January and ending 31 December of the same year according to the Gregorian Calendar.

1.1.3 Contract Year means a period of twelve (12) consecutive months according to the Gregorian Calendar from the Effective Date of this Contract or from the anniversary of the Effective Date.

1.1.4 Contract Area means the geographic area within the territory of Equatorial Guinea, which is the object of this Contract. This Contract Area will be described in Annex A and illustrated in Annex B, as it may be changed by relinquishments of the Contractor in accordance with this Contract.

1.1.5 Development and Production Area means an area within the Contract Area encompassing the geographical extent of a Commercial Discovery that is subject to a Development and Production Plan and corresponding budget in accordance with Article 5.5.

1.1.6 Appraisal Area means an area within the Contract Area encompassing the geographical extent of a Discovery subject to an Appraisal work program and corresponding budget in accordance with Article 5.2.

1.1.7 Barrel means a quantity or unit of measure of Crude Oil equal to 158.9874 liters (forty-two (42) United States gallons) at a temperature of fifteen point five six degrees (15.56°) Centigrade (sixty degrees (60°) Fahrenheit) and at one (1) atmosphere of pressure.

1.1.8 BEAC means the Bank of Central African States.

1.1.9 Change in the Law means, with respect to Article 25, any change in the laws, decrees, regulations, or standards of Equatorial Guinea and any Relevant Authority Law in force on the Effective Date, including those pertaining to any fiscal matters, taxes, customs, or currency control, any change in the interpretation or application of, or in the customs and practices related to these laws (the stipulations of this Contract are considered to conform with such interpretation and application from the Effective Date ), decrees, regulations, or standards of Equatorial Guinea and excludes those laws, decrees, regulations, or standards that are (i) related to health, safety, work, and the environment, (ii) consistent with international petroleum industry standards and practices, and (iii) applied in a non-discriminatory manner.

1.1.10 Field means a Discovery or set of Discoveries established as a Field in accordance with Article 5 and can be developed commercially, taking into account all pertinent operational, economic and financial information collected in carrying out the Appraisal work program or otherwise, in accordance with generally accepted good practices of the international petroleum industry. A Field may consist of a Hydrocarbon deposit or multiple Hydrocarbon deposits grouped in or related to the same individual geological structural or stratigraphic conditions, or unrelated deposits that are developed using a Development and Production Plan. All deposits superimposed, adjacent to, or underlying a Field in the Contract Area will form part of that Field.

1.1.11 CIF has the meaning established in the publication of the International Chamber of Commerce, INCOTERMS 2020.

1.1.12 Affiliated Company or Affiliate of any specific Person means any other Person directly or indirectly Controlling or Controlled by or under the direct or indirect common Control of such Person.

1.1.13 The National Company, for the purposes of this Contract, means Guinea Ecuatorial de Petróleos (GEPetrol), as the national petroleum company of Equatorial Guinea, or whatever successor state company.

1.1.14 Contractor means Panoro, KEEG, and the National Company and will include the entities to which a Participation Interest under the Contract is legitimately transferred.

1.1.15 Contract means this production sharing contract, including its Preamble and Annexes.

1.1.16 Material Contract means a contract having a value over five hundred thousand Dollars ($500,000) with respect to Exploration Operations, or one million Dollars ($1M) with respect to Development and Production Operations with (i) an Affiliate of the Operator, when the contract has not previously and specifically been approved in an Annual Budget as a contract that should be carried out by such an Affiliate, or (ii) a non-Affiliate of the Operator. If law or regulation establishes a greater limit than that stipulated in this definition for the supervision of contracts by the State, this definition will be amended to reflect that limit.

1.1.17 Control, when used with respect to a specified Person, means the power to direct, administer, and dictate the policies of such Person through ownership of a percentage of such Person's equity sufficient to hold a majority of voting rights in an ordinary shareholders meeting. The terms Controller and Controlled have meanings that correlate to the foregoing.

1.1.18 Development and Production Costs means all costs, expenses, and obligations incurred by the Contractor in connection with Development and Production Operations in a Development and Production Area, excluding all Exploration Costs incurred in the Development and Production Area before any Field is established, and that are determined to be in accordance with this Contract and the Hydrocarbons Law.

1.1.19 Exploration Costs means all costs, expenses, and other obligations incurred by the Contractor in connection with Exploration Operations in the Contract Area, including those identified in the Accounting Procedure, and that are determined to be in accordance with this Contract and the Hydrocarbons Law.

1.1.20 Petroleum Operations Costs means Exploration Costs and/or Development and Production Costs (depending on the context) incurred by the Contractor in carrying out Petroleum Operations, as determined in accordance with this Contract and the Accounting Procedure.

1.1.21 Argus Crude Report means the report published by the Argus company from time to time on the international crude oil market, including evaluation of the Crude Oil deposit located in the Contract Area.

1.1.22 Discovery means a finding of Hydrocarbons by the Contractor whose existence within the Contract Area was unknown prior to the Effective Date, or Hydrocarbons within the Contract Area that had not been declared a Commercial Discovery prior to the Effective Date and that are measurable by generally accepted good practices of the international petroleum industry.

1.1.23 Commercial Discovery means a Discovery that the Contractor considers economically viable and in the interest of which submits for the approval of the Ministry a Development and Production Plan of the Discovery.

1.1.24 Day means a day on which the offices of the Ministry are open to the public.

1.1.25 Working Day means a day on which the banks of Malabo, Equatorial Guinea, London, England and New York, USA, generally conduct commercial activities.

1.1.26 Dollar or $ means the legal tender of the United States of America.

1.1.27 Member State of CEMAC means the country is a member of the Economic and Monetary Community of Central Africa.

1.1.28 Member State of OHADA means the country is a member of the Organization for the Harmonization of Business Law in Africa.

1.1.29 Effective Date means the date the Contractor receives ratification of this Contract, totally signed by the State, in accordance with the provisions of Article 31.

1.1.30 Dated Brent means a quote published daily in Platts Bulletin that reflects the price of a North Sea Brent crude oil blend charged over a given period.

1.1.31 FOB has the meaning stipulated in the publication of the International Chamber of Commerce, INCOTERMS 2020.

1.1.32 Reserve Fund has the meaning attributed to it by Article 24.3

1.1.33 Natural Gas means those Hydrocarbons that at atmospheric conditions of temperature and pressure, are in a gaseous state, including dry gas, wet gas, and residual gas remaining after extraction, treatment, processing, or separation of liquid Hydrocarbons from wet gas, as well as gas or gases produced in association with liquid or gaseous Hydrocarbons.

1.1.34 Associated Natural Gas means all Natural Gas produced from a deposit the predominant content of which is Crude Oil and that has been separated from Crude Oil in accordance with generally accepted good practices of the international petroleum industry, including free gas cap, but excluding any liquid Hydrocarbons extracted from such gas either by normal field separation, dehydration, or in a gas plant

1.1.35 Net Natural Gas has the meaning attributed to it by Article 13.3.5.

1.1.36 Non-Associated Natural Gas means all gaseous Hydrocarbons extracted from Natural Gas deposits, and includes wet gas, dry gas, and residual gas remaining after the extraction of liquid Hydrocarbons from wet gas.

1.1.37 Equatorial Guinea or State means the Republic of Equatorial Guinea.

1.1.38 Hydrocarbons means all natural organic substances composed of carbon and hydrogen, including Crude Oil and Natural Gas that may be found and produced, or otherwise extracted and saved from the Contract Area.

1.1.39 Income Tax means that tax levied on the each of the Parties making up the Contractor and all other pertinent Persons in accordance with the Tax Law.

1.1.40 Gross Revenues means total income from sales of Total Disposable Production plus the equivalent monetary value of any other disposal of Total Disposable Production from the Contract Area during any Calendar Year.

1.1.41 Participation Interest means for each Party constituting the Contractor, the undivided percentage share of such Party in the rights and obligations under this Contract, as specified in Article 1.3.

1.1.42 Participation Interest of the National Company means the Participation Interest of the National Company as established in Article 1.3.

1.1.43 Hydrocarbons Law means Law No. 8/2006 dated 3 November 2006 of Equatorial Guinea.

1.1.44 Relevant Authority Law means any laws, codes, decrees, instruments or subordinate legislation, by-laws, regulations, declarations, rules, orders, statute, ordinances, normative acts and administrative acts of:

(a) the Organisation for the Harmonization of African Business Law (OHADA);

(b) the Inter-African Conference of Insurance Markets (CIMA);

(c) the Central African Banking Commission (COBAC);

(d) BEAC;

(e) the Economic and Monetary Community of Central Africa (CEMAC); and

(f) any other regional laws, codes, decrees, instruments or subordinate legislation, by-laws, regulations, declarations, rules, orders, statute, ordinances, normative acts and administrative acts (whether current or future and excluding Equatoguinean Law) applicable to the Parties in relation to the activities, including Petroleum Operations, to be undertaken under this Contract,

and shall also include the OHADA Accounting System.

1.1.45 Environmental Law means Law No. 7/2003 of 27 November of Equatorial Guinea and any law that amends or replaces it, including the International Treaties signed and ratified by the Republic of Equatorial Guinea.

1.1.46 Tax Law means Law No. 4/2004 of 28 October 2004 of Equatorial Guinea, and any law that amends it or replaces it.

1.1.47 Book Value means the value at which the asset is carried on the balance sheet prepared in accordance with generally accepted accounting practices used in the international petroleum industry.

1.1.48 Ministry means the Ministry of Mines and Hydrocarbons of Equatorial Guinea, the entity defined in Article 9 of the Hydrocarbons Law.

1.1.49 Negligence means any act or omission of an act by a Person (acting alone, together with another, or simultaneously) with the intention of causing harmful consequences, or with reckless imprudence or indifference to the harmful consequences that such Person knew or should have known would result for the safety, property, or interests of another Person from such an act or failure. Provided they satisfy the above parameters, such acts or omissions can include substantial deviations from the standards of behavior of a reasonable man, or of a prudent operator in the international petroleum industry, guided by generally accepted good practices of the international petroleum industry and by those considerations that normally rule the conduct of human affairs, acting in the circumstances of the presumed bad behavior.

1.1.50 Dispute Notification has the meaning attributed to it in Article 26.1.1.

1.1.51 Notification of Exploration Well according to the approved Work Programme, Contractor will notify the Ministry in writing of its intention to drill an Exploration Well.

1.1.52 Development and Production Operations means all operations, other than Exploration Operations that are engaged in to facilitate the Development and Production of Hydrocarbons from the Contract Area to the Delivery Point.

1.1.53 Exploration Operations include geological and geophysical studies, aerial mapping, investigations relating to subsurface geology, stratigraphic test drilling, Exploration Wells, Appraisal Wells and related activities such as drill site preparation, surveying and all connected work carried out in relation to the Exploration for Hydrocarbon deposits in the Contract Area and their Appraisal until the Ministry approves a Development and Production Plan.

1.1.54 Petroleum Operations means all operations related to Exploration, Appraisal, Development, Production, transportation, storage, conservation, dismantling, sale and/or other disposal of Hydrocarbons from the Contract Area to the Delivery Point and any other work or activities necessary or complementary to such operations; these operations and activities will be carried out in accordance with this Contract and the Hydrocarbons Law and will not include transport outside Equatorial Guinea.

1.1.55 Operator will be Panoro, as approved by the Ministry and so designated in the Joint Operation Agreement.

1.1.56 Party or Parties means the party or parties to this Contract, as the context dictates.

1.1.57 Paying Party or Parties will have the significance attributed to it (them) in Article 8.2.1.

1.1.58 Carried Participation of the National Company means the Participation Interest of twenty percent (20%) of the National Company that will be carried forward by the Contractor during the Exploration Period(s) until the End Point of the Carry-Forward.

1.1.59 Development and Production Period means the period defined in Article 5.10.

1.1.60 Initial Exploration Period means a period of five (5) Contract Years from the Effective Date, subdivided into two sub-periods of three (3) and two (2) Contract Years respectively.

1.1.61 Extension Period means the First Extension Period and the Second Extension Period, separately or together, as the context dictates. Each of these Extension Periods will be for a period of one (1) Contract Year.

1.1.62 Exploration Periods means the Initial Exploration Period, any Extension Period, and any further extensions of them.

1.1.63 Person means any individual, firm, company, corporation, society, trust, foundation, government, state or state agency, or any association or grouping (whether or not having a separate legal personality) or two or more of these.

1.1.64 Crude Oil means Hydrocarbons produced at the wellhead in a liquid state at atmospheric pressure including asphalt and ozokerites, and the liquid Hydrocarbons known as condensates and/or Natural Gas liquids obtained from Natural Gas by condensation or extraction through field separation units.

1.1.65 Net Crude Oil has the meaning attributed to it by Article 7.3.

1.1.66 Cost Recovery Oil has the meaning attributed to it in Article 7.2.1.

1.1.67 Development and Production Plan has the meaning attributed to it in Article 5.5.1.

1.1.68 Platts Bulletin means Platts Crude Oil Marketwire, or if Platts Crude Oil Marketwire ceases to be published then another similar daily international publication that lists benchmark crude oil prices and which is agreed at the time between the Parties..

1.1.69 Well means any opening in the ground or seabed made or being made by drilling or boring, or in any other manner, for the purpose of exploring and/or discovering, evaluating, or producing Crude Oil or Natural Gas, or for the injection of any fluid or gas into an underground formation other than a seismic hole.

1.1.70 Development Well means a Well, other than an Exploration Well or an Appraisal Well, drilled with the purpose of producing or improving the Production of Hydrocarbons, including Exploration Wells and Appraisal Wells completed as production or injection Wells.

1.1.71 Appraisal Well means a Well drilled after a Discovery, with the objective of delimiting and mapping the deposit, as well as to estimate the quantity of recoverable Hydrocarbons.

1.1.72 Exploration Well means any Well whose sole objective is to verify the existence of Hydrocarbons or to study all the necessary elements that could lead to a Discovery.

1.1.73 Market Price means the FOB price for Crude Oil calculated in accordance with Article 10.

1.1.74 Annual Budget means the Contractor's approved expenditures with respect to an Annual Work Program.

1.1.75 First Extension Period means the period of one (1) Contract Year beginning immediately after the conclusion of the First Exploration Sub-Period

1.1.76 First Exploration Sub-Period means the first three (3) Contract Years of the Initial Exploration Period.

1.1.77 Accounting Procedure means the accounting procedure contained in Annex C.

1.1.78 Total Disposable Production means all Hydrocarbons produced and saved from a Development and Production Area minus the quantities used for fuel and transport in Petroleum Operations under Article 6.10.

1.1.79 Annual Work Program means an itemized statement of the Petroleum Operations to be carried out in the Contract Area during a Calendar Year.

1.1.80 End Point of the Carry-Forward is the date of approval by the Ministry of the Development and Production Plan.

1.1.81 Delivery Point means the point located within the jurisdiction of Equatorial Guinea at which Hydrocarbons reach (i) the inlet flange at the FOB export vessel, (ii) the loading facility metering station of a pipeline, or (iii) any other point within the jurisdiction of Equatorial Guinea as may be agreed to by the Parties.

1.1.82 Royalties means a right of the State to Hydrocarbons extracted and saved from the Contract Area, and not utilized in Petroleum Operations for fuel or transport, in accordance with Article 6.10, based on percentages calculated as a function of the daily rate of the Total Disposable Production in accordance with Article 7.1.

1.1.83 Petroleum Regulations means all regulations promulgated by the Ministry observing and in accordance with the Hydrocarbons Law under Ministerial Order 4/2013 of 20 June 2013, and any regulations that may amend or replace them.

1.1.84 Second Extension Period means the period of one (1) Contract Year beginning immediately after the end of the Second Exploration Sub-Period.

1.1.85 Second Exploration Sub-Period means the final two (2) Contract Year(s) of the Initial Exploration Period.

1.1.86 Maximum Efficient Production Rate means the maximum efficient production rate of Hydrocarbons from a Field that does not damage deposit formations and does not cause excessive decline or loss of deposit pressure in accordance with good practices of the international oil industry, and as agreed in accordance with Article 6.4.

1.1.87 Tax and Taxes means the coercive pecuniary contributions stipulated by Tax Law, that the State, local entities and other public entities levy in exercise of their sovereign power.

1.1.88 Quarter means a period of three (3) consecutive months beginning 1 January, 1 April, 1 July, or 1 October and ending 31 March, 30 June, 30 September, or 31 December, respectively.

1.2 Scope

1.2.1 This Contract is a production sharing contract awarded pursuant to Chapter IV of the Hydrocarbons Law. In accordance with the provisions of this Contract and the Hydrocarbons Law, the Ministry will be responsible for supervising Petroleum Operations in the Contract Area.

1.2.2 The State grants the Contractor the sole and exclusive right to carry out all Petroleum Operations in the Contract Area during the term of this Contract. In consideration of the above, the Contractor commits itself to:

(a) be responsible to the State, in the capacity of independent contractor, for execution of the Petroleum Operations in accordance with this Contract, the Hydrocarbons Law, and the Petroleum Regulations;

(b) provide all funds, machinery, equipment, technology, and personnel that are prudent and necessary to execute the Petroleum Operations; and

(c) diligently, with due attention to generally accepted good practices of the international petroleum industry execute at its exclusive responsibility and risk, all investments and contractual obligations necessary for carrying out the Petroleum Operations in accordance with this Contract.

1.2.3 All costs of the Petroleum Operations will be recoverable and/or deductible for tax purposes in the manner established in this Contract and the Hydrocarbon Law.

1.2.4 During the term of this Contract, all Production obtained as a consequence of the Petroleum Operations will be shared between the parties in accordance with Article 7.

1.2.5 During the term of this Contract, the Parties shall comply with the laws of Equatorial Guinea, including the Environmental Law.

1.3 Participation Interests

1.3.1 On the Effective Date, the Participation Interests of the Parties making up the Contractor are as follows:

The National Company 20% (the “Carried Participation of the National Company")

Panoro 56%

KEEG 24%

Total 100%

The Participation Interest of the National Company is for compliance with Chapter XVIII of the Hydrocarbon Law. The abovementioned Carried Participation of the National Company of twenty percent (20%) will be carried by the Contractor (with the exception of the National Company) until the End Point of the Carry-Forward. The Carried Participation of the National Company will remain subject to all the responsibilities and obligations of the Contractor. The costs attributable to the Carried Participation of the National Company will be paid, subject to Article 8.2, by the Contractor (with the exception of the National Company), and recoverable as specified in Articles 8.2.2 and 8.2.3.

1.3.2 The National Company will have the option of acquiring an additional Participation Interest of ten percent (10%) if there is a Commercial Discovery in the Contract Area.

ARTICLE 2

PERIOD OF EXPLORATION AND RELINQUISHMENTS OF AREAS

2.1 Initial Exploration Period

From the Effective Date, the Contractor will be authorized to carry out Exploration Operations in the Contract Area during the Initial Exploration Period. Within sixty (60) days from the Effective Date, the Contractor will initiate study and evaluation work.

2.2 Extension periods

2.2.1 The Contractor may ask for up to two (2) extensions: the first is an extension of one (1) year to the First Exploration Sub-Period, that is, the First Extension Period, and the second is an

extension of one (1) year to the Second Exploration Sub-Period, that is, the Second Extension Period.

2.2.2 For each Extension Period, the Contractor will present a request to the Ministry at least two (2) months before the expiration of the First Exploration Sub-Period, or as the case may be, the Second Exploration Sub-Period. The Ministry will not unreasonably deny or delay the granting of this extension, provided the Contractor has complied with all of its obligations in the First Exploration Sub-Period, the First Extension Period and the Second Exploration Sub-Period, as the case may be, and is in no way noncompliant with this Contract.

2.2.3 A map will be attached to each request for an extension, if appropriate, delineating the Contract Area the Contractor proposes to retain, as well as a report that specifies the work realized in the areas proposed for relinquishment since the Effective Date, and the results obtained from them.

2.2.4 If on the expiration of the Initial Exploration Period or any Extension Period, an Appraisal work program is under way, the Contractor will be entitled to the grant of an additional extension of the current exploration period necessary to complete the work in progress. Additionally, if Appraisal work has not been completed by the Contractor at the time a relinquishment comes due, as stipulated in Article 2.4, the obligation to relinquish will be suspended until the Contractor has completed the work, the commerciality is decided, and if applicable, establishment of a Field has been approved or denied. Any additional extension granted in accordance with this Article will not exceed one (1) Contract Year or a longer period that may be approved by the Ministry, plus the necessary period of time established under Article 5 for the evaluation of a Development and Production Plan and the Ministry's response.

2.2.5 In the previous case, the Contractor will ask the Ministry for an additional extension at least two (2) months before expiration of the Initial Exploration Period or the Extension Period in force at the time, as applicable.

2.3 Termination

If the Contractor decides:

(a) not to enter the Second Exploration Sub-Period;

(b) not to extend the Initial Exploration Period and no Field has been established during that period;

(c) to extend the Initial Exploration Period and no Field has been established during the Extension Period or any extension of it; or

(d) to relinquish all its rights with respect to the entire Contract Area in accordance with what is established in Article 2.5,

this Contract will be automatically terminated.

2.4 Obligatory relinquishments

2.4.1 Given the size of the Contract Area the Contractor shall have no obligation to relinquish to the State any part of the initial surface area of the Contract Area during the Exploration Period.

2.4.2 On expiration of the final applicable extension period stipulated in accordance with Article 2.2, and subject to the provisions of Article 2.2.4, the Contractor will relinquish the Contract Area, with the exception of:

(a) Development and Production Areas;

(b) areas for which approval of a Development and Production Plan is pending, until a final decision is made;

(c) the area of any Field, including those Fields that may be subject to unitization in accordance with Article 22; and

(d) any area reserved for a possible Unassociated Natural Gas Appraisal with respect to which the Contractor is negotiating with the Ministry in accordance with the terms of Article 13.1.

2.5 Voluntary relinquishments

2.5.1 Subject to the Contractor's obligations established in Article 24 and the Hydrocarbons Law, the Contractor may at any time notify the Ministry with three (3) months' advance notice that it relinquishes all of its rights over all or any part of the Contract Area.

2.5.2 In no event will voluntary relinquishment of rights over all or any part of the Contract Area reduce the Contractor's obligations of Exploration established in Article 3.

2.6 Involuntary relinquishments

2.6.1 If the Contractor, during the First Exploration Sub-Period, fails to perform the minimum work programme defined in Article 3, the Contractor will then relinquish all of its rights over the entire Contract Area at the end of the First Exploration Sub-Period.

2.6.2 If the Contractor, during the Second Exploration Sub-Period fails to perform the minimum work programme defined in Article 3, the Contractor will then relinquish all of its rights over the entire Contract Area at the end of the Second Exploration Sub-Period

2.6.3 This involuntary relinquishment will in no way exempt the Contractor from any of the obligations it may have under Article 24 or the Hydrocarbons Law.

2.7 Relinquishments in General

2.7.1 No relinquishment made by virtue of Articles 2.4 or 2.5 will relieve the Contractor of its obligation to pay accrued surface rentals, or to make due and payable payments incurred during Petroleum Operations executed up to the date of the relinquishment.

2.7.2 The Contractor will, in accordance with generally accepted good practices of the international petroleum industry, put forward the geographical location of the part of the Contract Area that it proposes to retain. This area will have one or more continuous geometric forms that extend North to South and East to West and will be delimited at a minimum by one (1) minute of latitude or longitude or natural boundaries; moreover, this area will also be subject to the Ministry's approval.

ARTICLE 3

EXPLORATION WORK OBLIGATIONS

3.1 Minimum Work Program

During the Exploration Period, the Contractor commits itself to executing the following program of minimum work:

| | | | | | | | |

First Exploration Sub-Period

36 Calendar Months |

Studies / Data (specify) | Acquisition of all existing data on the block from the MMH database at a cost of $1.9MM, $1MM payable within thirty (30) days of the Effective Date and $0.9MM payable within thirty (30) days of the Contractor deciding to enter int the Second Exploration Sub-Period |

| Re-processing of 250 sq km of 3D seismic data |

| Geological and geophysical studies |

| | |

| Total Cost First Exploration Sub-Period | $3.0MM |

| | |

Second Exploration Sub-Period

24 Calendar Months |

Exploration well(s) | Number: 1 |

| Depth (mss): 2,500 |

| Stratigraphic Target: Albian |

| Cost ($ per well) 20MM |

| |

| Total Cost Second Exploration Sub-Period | $20MM |

3.1.1 If the Contractor completely fulfils all the obligations of the First Exploration Sub-Period, then it may, at its sole discretion, by notice in writing to the Ministry, elect to enter into a Second Exploration Sub-Period.

3.1.2 If the Contractor has drilled more than the minimum number of Exploration Wells demanded in the minimum work programme, then the surplus that exceeds the obligatory amount at the end of the period in question will be transferred and considered part of the obligations of the next guaranteed period(s).

3.2 Minimum Depth of the Exploration Wells

3.2.1 Each of the Exploration Wells must be drilled to the minimum depth specified above or to a lesser depth if the Ministry so authorizes in accordance with this Article, or if interrupting drilling is justified by one of the following reasons:

(a) the economic basement is reached at a lesser depth than the minimum depth specified in this Contract;

(b) further drilling is clearly dangerous because of abnormal pressure in the formation or for another reason;

(c) rocky formations are encountered whose hardness makes it impracticable to continue drilling with appropriate equipment; or

(d) hydrocarbon-bearing formations are encountered that require the installation of casings that exclude reaching the minimum contractual depth.

3.2.2 For purposes of Article 3.2.1(a), economic basement in and beneath which the geological structure or the physical sequence of the rocks do not have the necessary properties to accumulate hydrocarbons in commercial quantities and that moreover, reflects the maximum depth at which accumulations of this type can reasonably be expected to occur.

3.3 Commencement and Cessation of drilling

The Contractor shall give to the Ministry a Notification of Exploration Well at least twenty-one (21) days prior to the commencement of drilling an Exploration Well.

With respect to Article 3.2.1(b), and to the extent practicable, if a prudent operator would immediately cease drilling operations, the Contractor will notify the Ministry immediately of its decision and obtain the Ministry's approval before removing any drilling platform from the area. The Ministry will respond to this request for approval as soon as practicable. Approval may not be unreasonably denied or delayed without reasonable justification, provided that the Ministry has sufficient information to make an informed decision.

3.4 Substitute Wells

If any obligatory Exploration Well is abandoned due to insurmountable technical problems as set out in Article 3.2.1, items (b), (c) and (d) and, at the time of abandonment, the Exploration Costs for that Well equal or exceed fifteen million Dollars ($15MM), for all purposes of this Contract, the Contractor will be considered to have fulfilled its minimum work obligations for the period in question. If any obligatory Exploration Well is abandoned due to insurmountable technical problems and if, at the time of abandonment, the Exploration Costs for that Well are less than fifteen million Dollars ($15MM), the Contractor will choose between the following options:

(a) drill a substitute Exploration Well in the same or a different site to be agreed on with the Ministry: or

(b) pay the Ministry an amount equal to the difference between fifteen million dollars ($15MM) and the amount of Exploration Costs effectively spent in connection with this Exploration Well, which will be treated as if it were the finalization of the well, thus fulfilling the minimum work obligations with this Well.

3.5 Provision of Guarantees

3.5.1 On or before the Effective Date, each of the Parties making up the Contractor (other than the National Company) will provide to the State a guarantee in the form stipulated in Annex D from an Affiliate Company in up to the amount of one million Dollars ($1MM), which corresponds to the minimum expenditure obligations of the Contractor under this Contract for the First Exploration Sub-Period, and which will remain valid until the Contractor has

complied with this obligation of minimum expenditures. In any case, the amount of the guarantee will be reduced as a function of sums expended that are related to the work obligations carried out to the degree that they are complete. If the Parties that make up the Contractor (except the National Company) do not provide the Ministry with the guarantee by the date established under this Article 3.5.1, this Contract will be considered null and void, if the Contractor does not succeed in remediating the noncompliance within thirty (30) days of being notified of it.

3.5.2 Thirty (30) days before initiating drilling of the Exploration Well demandable in the Second Exploration Sub-Period, the Contractor (other than the National Company) will provide the State a guarantee in the form stipulated in Annex D from an Affiliate Company in an amount up to the amount of fifteen million Dollars ($15MM), which corresponds to fifty percent (50%) of the minimum expenditure obligations of the Contractor under this Contract for the Second Exploration Sub-Period, and which will remain valid until the Contractor has complied with this obligation of minimum expenditures. In any case, the amount of the guarantee will be reduced as a function of sums expended that are related to the work obligations carried out to the degree that they are completed. If the Parties that make up the Contractor (except the National Company) do not provide the Ministry with the guarantee by the date established under this Article 3.5.2, this Contract will be considered null and void, if the Contractor does not succeed in remediating the noncompliance within thirty (30) days of being notified of it.

ARTICLE 4

ANNUAL WORK PROGRAMS AND BUDGETS

4.1 Presentation of Annual Work Program

No later than ninety (90) days before the beginning of each Calendar Year, or for the first Calendar Year, no later than sixty (60) days after the Effective Date, the Contractor will prepare and present for approval by the Ministry a detailed Annual Work Program divided into Quarters, together with the corresponding Annual Budget for the Contract Area explaining the Petroleum Operations the Contractor proposes to carry out during the Calendar Year. The Annual Budget will be presented in the Ministry's official format.

4.2 Form and Approval of the Annual Work Program

Each Annual Work Program and corresponding Annual Budget will be broken down into the various Exploration Operations and, as applicable, according to the appraisal operations for each Appraisal Area, and the Development and Production Operations for each Development and Production Area. If no response is received within ninety (90) days of the reception of the Annual Work Program and corresponding Annual Budget, these will be considered approved. The Ministry may propose amendments or modifications to the Annual Work Program and corresponding Annual Budget, by giving notice to the Contractor and including reasons for the amendments or modifications, within sixty (60) days of receiving the Annual Work Program and Annual Budget. In such event, the Ministry and the Contractor will meet as soon as possible to review the amendments or modifications proposed by the Ministry and establish the Annual Work Program and corresponding Annual Budget by mutual agreement. The parts of the Annual Work Program for which the Ministry does not require amendment or modification will be considered approved and the Contractor must implement them within the stated time period, provided they can be undertaken on an individual basis, or with respect to an approved activity that depends technically or financially on an activity that is not approved. With respect to the parts of the Annual Work Program for which the Ministry proposes any amendment or modification, the date of approval of the Annual Work Program and corresponding Annual Budget will be the date on which the Ministry and the Contractor reach mutual agreement on them. If the Ministry and the Contractor do not reach an agreement about the amendments and modifications proposed by the Ministry before the end of the Calendar Year in which the Annual Work Plan and corresponding Annual Budget are submitted, the Contractor will continue operating in accordance with the most recent Annual Work Plan and corresponding Annual Budget approved by the Ministry until agreement is reached.

4.3 Execution of Petroleum Operations

The Contractor will perform each operation included in an approved Annual Work Program correctly and diligently, in accordance with the terms of this Contract, the Hydrocarbons Law, and the generally accepted good practices of the international petroleum industry.

4.4 Unbudgeted expenses

4.4.1 The Ministry and the Contractor recognize that the technical results acquired as work progresses, or certain unforeseen changes in circumstances, may justify modifying the approved Annual Work Program and corresponding Annual Budget. In such circumstances, the Contractor will promptly notify the Ministry of the proposed modifications. The Ministry will study these modifications and decide whether to approve them within a period of sixty (60) days of receiving the notification. If the Ministry neither approves nor rejects the proposed modifications within this sixty (60) day period, the proposed modifications will be considered approved. Notwithstanding the foregoing, the Contractor will not in any case incur any expenditure that exceeds the approved Annual Budget by more than five percent (5%) without the prior approval of the Ministry. Expenditures exceeding the five percent (5%) tolerance will not be recoverable as a Petroleum Operations Cost or deductible for tax purposes. Where such approval is requested in connection with ongoing operations, the date of any approval will be considered to be prior to expenditure if the Ministry is aware of the excess and the continuation of operations after the time of that cost is verbally approved by the Ministry. In relation to emergencies or accidents, Articles 78.3 and 79 of the Petroleum Regulations will apply.

4.4.2 At the time the Contractor reasonably believes that the limits of the Annual Budget will be exceeded, the Contractor will promptly notify the Ministry and provide the Ministry with full details of such excess expenditures, including the reasons for them.

4.4.3 The limitations stipulated in Article 4.4 will not affect the Contractor’s right to make expenditures in the event of an emergency or accident requiring urgent action in accordance with what is stipulated in Article 4.5.

4.4.4 Except as otherwise provided in Article 4.5, if the Contractor incurs any expenditure whose program and budget has not been approved within an Annual Work Program and corresponding Annual Budget or any amendment to them approved by the Ministry, then this expenditure will not be recoverable by the Contractor as a Petroleum Operations Cost.

4.5 Emergency or Accident

4.5.1 In the event of an emergency or accident requiring urgent action, the Contractor will follow all steps and take the measures as may be prudent and necessary in accordance with generally accepted good practices of the international petroleum industry to protect its interests and those of the State and the property, life, and health of other Persons, the environment, and the safety of the Petroleum Operations. The Contractor will promptly inform the Ministry of such emergency or accident.

4.5.2 All of the related costs incurred by the Contractor in accordance with Article 4.5 will be recoverable as Petroleum Operations Costs and deductible for tax purposes. Nevertheless, costs incurred by the Contractor in cleaning up pollution or damage to the environment, if caused by the Negligence of the Contractor, its subcontractors or any Person acting on its or their behalf, will not be recoverable as a Petroleum Operations Costs or deductible for tax purposes.

ARTICLE 5

EVALUATION OF A DISCOVERY AND PRODUCTION PERIOD

5.1 Notification of Discovery

If the Contractor discovers Hydrocarbons in the Contract Area it will notify the Ministry as soon as possible, but not later than thirty (30) days after the date of the Discovery. This notice will include all relevant information in accordance with the generally accepted good practices of the international petroleum industry, including the details of any production testing program that the Contractor has carried out or proposes to carry out during drilling operations

5.2 Appraisal Work Program

5.2.1 If the Contractor considers that the Discovery merits Appraisal it will diligently submit to the Ministry a detailed appraisal work program and corresponding budget no later than six (6) months following the date on which the Discovery was reported in accordance with Article 5.1 The appraisal work program, corresponding budget and designated Appraisal Area are subject to the review and approval of the Ministry in accordance with the procedures established in Article 4.

5.2.2 The rough draft of the appraisal work program will specify the estimated size of the Hydrocarbon reserves of the Discovery, the area to be designated as the Appraisal Area and will include all seismic, drilling, testing and appraisal operations necessary to carry out an appropriate appraisal of the Discovery. The Contractor will diligently undertake the approved appraisal work program, it being understood that the provisions of Article 4.4 will apply to the program.

5.2.3 The duration of the appraisal work program will not exceed twenty-four (24) months for Crude Oil and in the case of Natural Gas, the duration of the appraisal work program will be determined in accordance with the provisions of Article 13, unless otherwise approved by the Ministry. The Ministry's approval of the request will not be denied or delayed without reasonable justification.

5.3 Presentation of the Appraisal Report

5.3.1 Within six (6) months following completion of the appraisal work program and in any case, no later than thirty (30) days before expiration of the Initial Exploration Period, or the First Extension Period or the Second Extension Period, including all additional extensions in accordance with the provisions of Article 2.2, as the case may be, the Contractor will present a detailed report to the Ministry giving all the technical and economic information associated with the appraised Discovery and that confirms, in the Contractor's judgment, whether such Discovery is a Commercial Discovery.

5.3.2 This report will include geological and petrophysical characteristics of the Discovery, estimated geographical extent of the Discovery, results of the production tests obtained from the formation, and a preliminary economic study with respect to exploitation of the Discovery.

5.4 Determination of Commerciality

For the purposes of Article 5.3, the Contractor will determine whether it considers that a Discovery or set of Discoveries can be developed commercially. The commercial viability of the Discovery or set of Discoveries will be determined after consideration of all operating, economic, and financial information gathered during performance of the appraisal work program and other sources, including recoverable reserves of Crude Oil and Natural Gas, sustainable Production levels and all other relevant economic factors, according to the generally accepted good practices of the international petroleum industry.

5.5 Presentation and Approval of the Development and Production Plan

5.5.1 If the Contractor considers the Discovery or set of Discoveries to be a Field, it will submit for the approval of the Ministry a development and production plan (the "Development and Production Plan") for that Discovery or set of Discoveries within twelve (12) months following delivery of the report referred to in Article 5.3

5.5.2 The Ministry may propose amendments or modifications to the aforementioned Development and Production Plan, and also to the Development and Production Area that is the object of this Development and Production Plan, giving notice to the Contractor within ninety (90) days following receipt of the plan. Such notification will explain the reasons for the amendments or modifications proposed by the Ministry. In such case, the Ministry and the Contractor will meet as soon as possible to review the proposed amendments or modifications of the Ministry and establish the Development and Production Plan by mutual agreement.

5.5.3 If the Contractor and the Ministry do not reach a written agreement within one hundred eighty (180) days following the submission of amendments and modifications by the Ministry, or the Ministry notifies the Contractor that it does not approve the establishment of a Field, the Field will not be established and any extension granted under Article 2.2.4 with respect to the Discovery or set of Discoveries in question will be deliberated and decided by an internationally recognized expert named by the International Chamber of Commerce in accordance with its Rules for Expertise (ICC Expertise Rules). The decision of the expert will be restricted to whether the rejection by the Ministry of the establishment of a Field or the amendments and modifications to the Development and Production Plan by the Ministry are reasonable and customary and prudent in accordance with generally accepted good practices of the international petroleum industry. The decision of the expert will be final and binding on the Parties, and if it cannot be enforced in accordance with the law of Equatorial Guinea, the only recourse will be to arbitration under Article 26 to arrive at a definitive and binding decision. The expert will determine the above within twenty (20) days from the date of his designation. The costs and expenses of the expert will be paid by the Contractor parties pro-rata to their respective Participation Interests.

5.6 Modifications to the Development and Production Plan

5.6.1 When the results obtained during Development and Production Operations require certain modifications to the Development and Production Plan, the plan may be modified using the same procedure provided for its initial approval. Subject to the provisions of Article 4.4, the Contractor may not incur any expenditure that exceeds the approved Development and Production Plan without prior approval of the Ministry; if prior approval is not obtained, such excess expenditures will not be recoverable by the Contractor as Petroleum Operations Costs or deductible for tax purposes.

5.6.2 During the Development and Production Period, the Contractor may propose to the Ministry revisions to the Development and Production Plan at any time that additional Development and Production Operations are under consideration. Such revisions will be submitted for the Ministry’s approval using the same procedure provided for the initial approval.

5.7 Number of Fields

If the Contractor discovers more than one (1) Field in the Contract Area that are not overlying, adjacent to, or underlying an existing Field, each will be the object of a separate Development and Production Plan, unless the Ministry agrees that the Fields would be better developed with a single Development and Production Plan.

5.8 Extension of the Field beyond the Contract Area

5.8.1 If, during work performed after approval of a Development and Production Plan, it appears that the geographical extent of a Field is larger than the Development and Production Area designated in accordance with Article 5.5, this will be so reported to the Ministry for enlargement of the Field by the Contractor to the additional area, provided that it is included in the Contract Area in effect at that time, and provided that the Contractor provides supporting evidence of the existence of the additional area for which it is applying.

5.8.2 If a Field extends beyond the boundaries of the Contract Area as delimited at any particular time, the Ministry may require the Contractor to exploit such Field in association with the contractor of the adjacent area in accordance with the Hydrocarbons Law and generally accepted good practices of the international petroleum industry.

5.8.3 When the area proposed to be unitized is not subject to any production sharing contract, such area will be the subject of new negotiations between the Parties to achieve an amendment to this Contract, it being understood that any award of an additional area must be in accordance with the Hydrocarbons Law.

5.9 Commencement and Execution of Development and Production Operations

5.9.1 The Contractor will commence Development and Production Operations within six (6) months of the approval date of the Development and Production Plan and will conduct these operations diligently.

5.9.2 The Contractor commits itself to conducting all Development and Production Operations in accordance with generally accepted good practices of the international petroleum industry, this Contract, and the Hydrocarbons Law.

5.10 Duration of the Development and Production Operations

5.10 The duration of the Development and Production Period during which the Contractor is authorized to exploit a Field is twenty-five (25) Years from the date of approval of the Development and Production Plan for the Field.

5.10.2 The Development and Production Period may be extended for an additional period of five (5) Years with prior approval of the Ministry.

5.11 The Contractor's Expenses and Financial Risks

The Contractor commits itself to assuming the expenses and financial risks of all Petroleum Operations required to bring a Field into Production in accordance with the approved Development and Production Plan.

5.12 Mandatory Relinquishment

During the Initial Exploration Period, the Extension Periods, and any additional extensions, the Ministry may, provided it gives at least six (6) months’ notice, require the Contractor to promptly relinquish, without any compensation or indemnification, all of its rights to the area encompassing a Discovery, including any rights to Hydrocarbons that may be produced from such Discovery, if the Contractor:

(a) has not presented, in accordance with Article 5.2, an appraisal work program and corresponding budget with respect to the Discovery within six (6) months of the date on which the Discovery has been reported to the Ministry; or

(b) subject to the provisions of Article 13.1 with respect to Unassociated Natural Gas, does not establish the Discovery as a Field within one (1) Year after completion of appraisal work with respect to the Discovery.

5.13 Future Operations

In the event of a relinquishment under Article 5.12, the Ministry may perform or cause to be performed any Petroleum Operations with respect to any Discovery so relinquished without any compensation or indemnification to the Contractor, provided, however, that it will not interfere with the Petroleum Operations undertaken by the Contractor in the part of the Contract Area retained by the Contractor, if any. The Ministry will be permitted to use (free of charge) all facilities and equipment of the Contractor that are not used for continuing Petroleum Operations. If so requested by the Ministry, the Contractor will take charge of all continuing operations on terms and for a fee to be agreed between the Ministry and the Contractor.

ARTICLE 6

CONDUCT OF PETROLEUM OPERATIONS

6.1 Obligations of the Contractor

In accordance with the generally accepted good practices of the international petroleum industry and the Hydrocarbons Law, the Contractor will provide all funds necessary to manage Petroleum Operations in the Contract Area, including buying or leasing all facilities, equipment, materials, and other goods required to carry out such Petroleum Operations. It will also supply all technical and operational expertise, including the use of foreign and national personnel required to implement Annual Work Programs. The Contractor will be responsible for the preparation and implementation of all Annual Work Programs, which will be carried out in accordance with this Contract, the Hydrocarbons Law and generally accepted good practices of the international petroleum industry.

6.2 Joint Operating Agreement

The Contractor will provide the Ministry with a copy of the draft Joint Operating Agreement (JOA) no later than ninety (90) days after the Effective Date, linking the entities making up the Contractor group, and naming the entity designated as the Operator.

6.3 Management of Petroleum Operations

The Contractor will diligently manage Petroleum Operations in accordance with this Contract, the Hydrocarbons Law and the generally accepted good practices of the international petroleum industry.

6.4 Maximum Efficient Production Rate

The Contractor and the Ministry will agree on the Production programs before Production begins in any Field and establish at that time the Maximum Efficient Production Rate for the Field, and will decide the dates on which the levels will be re-examined and potentially revised.

6.5 Working conditions

The Contractor will provide acceptable working conditions and access to medical attention and nursing care for all of its local and international personnel and those of its subcontractors that are working offshore and on land during Petroleum Operations. The Contractor will also provide living quarters for national or international personnel based on offshore installations and an additional housing allowance in the remuneration of land-based personnel.

6.6 Discovery of other minerals

The Contractor will promptly notify the Ministry of the discovery of other minerals or substances in the Contract Area. If any Persons are granted a permit or license within the Contract Area for the exploration and exploitation of any minerals or substances other than Hydrocarbons, the Ministry will take all reasonable measures to ensure that the operations of such Persons do not obstruct the Contractor's Petroleum Operations. The Contractor will use all reasonable efforts to avoid obstructing the operations of such permit holders or licensees.

6.7 Awarding of Contracts

6.7.1 The Contractor will award all contracts in accordance with the National Content Regulation promulgated by the Ministry in Ministerial Order No. 1/2014 of 26 September 2014, to the best qualified subcontractor or other Person, including Affiliates of the Contractor, as determined by cost and ability to comply with the provisions of the contract, provided the Contractor complies with Article 23.1.

In all Material Contracts, the Contractor will:

(a) call for bidding on the contract;

(b) give preference to national companies the Contractor considers qualified;

(c) before awarding a contract, send a notification to the Ministry reporting that the Contractor intends to present an offer for the contract;

(d) include the national companies on a list supplied by the Ministry and that the Contractor considers competent, on the list of bidders for the contract;

(e) add any Persons to the list so requested by the Ministry;

(f) complete the bidding process within a reasonable time;

(g) consider and analyze the details of the bids received;

(h) prepare a competitive bid analysis and present to the Ministry stating the Contractor’s recommendation as to the Person to whom the contract should be awarded, the reasons, and the technical, commercial, and contractual terms to be agreed upon;

(i) obtain the approval of the Ministry that will be considered as conceded if there is no response to a request for approval thirty (30) Days after receipt of a written request; and

(j) provide the Ministry with a copy of the final executed contract.

All amendments and/or variations to a Material Contract will require the prior approval of the Ministry, approval that will be considered as conceded if there is no response to a request for approval thirty (30) Days after receipt of a written request.

6.7.2 To the extent that the Contractor imports and/or uses any services, materials, equipment, consumables, and other goods from outside Equatorial Guinea in conscious contravention of this Article or Article 23.1, or otherwise enters into a contract in contravention of these Articles, the costs will not be Petroleum Operations Costs and will not be costs that the Contractor can recover.

6.7.3 Together with the Annual Work Program, the Contractor will submit to the Ministry a list of the types of contracts or agreements for services that the Contractor foresees entering into during that Year, as well as details of those entered into in the previous Year. This list will include the value of those contracts, as well as the corporate names, addresses, and telephone numbers where all the subcontractors of the Contractor and other Persons who have entered into these contracts. In addition, the Contractor will present to the Ministry Quarterly a detailed list, including the corporate names, addresses, and telephone contacts of the Contractor’s subcontractors and other Persons who have provided goods or services to the Contractor for the conduct of Petroleum Operations during the relevant Quarter.

6.8 Inspection of Petroleum Operations

6.8.1 All Petroleum Operations may be inspected and audited by the Ministry at such intervals as the Ministry considers necessary; nevertheless, only in exceptional cases will this be done outside regular working hours. The duly commissioned representatives of the Ministry will have the right, among others, to monitor Petroleum Operations and inspect all equipment,

facilities, and materials relating to Petroleum Operations, provided that any such inspection will not unduly delay or impede Petroleum Operations, nor demand the use of housing necessary for operating personnel. The representatives of the Ministry inspecting and monitoring Petroleum Operations will comply with the safety standards of the Contractor, and whenever possible, will do so without incurring extra expenses for the Contractor.

6.8.2 For purposes of allowing exercise of the rights mentioned in the paragraph above, the Contractor will provide reasonable assistance to the representatives of the Ministry, including transportation and accommodation, when these are under the control of the Contractor. The Ministry will pay all expenses of transportation and housing of third parties, with the exception of what is established in Article 6.8.3,

6.8.3 In accordance with the Petroleum Regulations, all reasonable costs directly related to the technical inspection, verification, and audit of Petroleum Operations, or related to the exercise of the Ministry's rights under this Contract or the performance of the Contractor's obligations will be at the expense of the Contractor Payments under this Article 6.8.3 will be made to the State and are recoverable as Petroleum Operations Costs in accordance with this Contract, including:

(a) outbound and return travel expenses for trips outside Equatorial Guinea;

(b) local public transportation, when transportation in accordance with Article 6.8.2 is not available;

(c) housing, when this is necessary to carry out official tasks and is not supplied under Article 6.8.2; and

(d) per diems, which will be adjusted in accordance with the amounts assigned to the classification of each agent of the Ministry as published in the general budget law of the State approved each Calendar Year, applicable to all companies in the Hydrocarbons extraction sector of Equatorial Guinea.

All travel expenses in (a) and (b) and accommodations in (c) above shall be arranged by Contractor and Contractor shall pay directly to the service providers such costs. As a consequence of the payment of the per diems noted above in (d), Contractor shall not make any payments to or on behalf of any Government of Equatorial Guinea travellers in relation to meals or other incidental or miscellaneous costs incurred by such travellers during such travel, and all such costs shall be for the sole account of such travellers.

6.9 Supply of information to the Ministry:

6.9.1 The Contractor will keep the Ministry fully informed of the performance and status of Petroleum Operations, supplying information at reasonable intervals and as required under this Contract, and about all accidents or emergencies that may have occurred during these operations. Furthermore, the Contractor will provide the Ministry with all documentation and information that is required to be provided under this Contract and the Hydrocarbons Law and that may be requested by the Ministry from time to time.

6.9.2 The Contractor will keep the Ministry informed on a daily basis of the volumes of Hydrocarbons produced in the Contract Area.

6.10 Production of energy for own use

If the national power grid is available to the Contractor for its onshore Petroleum Operations, the Contractor will connect to that network and will not produce any energy for its own use except to the extent that national production or transmission of energy is insufficient or not sufficiently reliable for the Contractor's needs to carry out Petroleum Operations. In such case, the energy produced will not be sold to any Person. The Contractor may utilize the

quantities of Crude Oil and/or Natural Gas as fuel in its offshore Petroleum Operations or for the transport of Hydrocarbons to an onshore location.

6.11 Equipment standards

The Contractor will ensure that all equipment, plants, installations, and materials it uses comply with the Hydrocarbons Law and generally accepted engineering standards, and that they have been duly constructed and are maintained in good condition.

6.12 Contractor's care and the environment

6.12.1 The Contractor will take all necessary and prudent steps in accordance with generally accepted good practices of the international petroleum industry, the Hydrocarbons Law, and this Contract to:

(a)prevent pollution and protect the environment and living resources;

(b)ensure that any Hydrocarbons discovered or produced in the Contract Area are handled in a safe manner for the environment;

(c)avoid causing damage to overlying, adjacent, and/or underlying formations that contain Hydrocarbon deposits;

(d)prevent the ingress of water via Wells into strata that contain Hydrocarbons that are not specified in an approved Development and Production Plan;

(e)avoid causing damage to overlying, adjacent, and/or underlying aquifers;

(f)ensure that Petroleum Operations are carried out in accordance with this Contract, the Hydrocarbons Law, and all other laws of Equatorial Guinea;

(g)take the precautions necessary to protect maritime transportation and the fishing industry, and to avoid contamination of the ocean and rivers;

(h)drill and exploit each Field in a manner consistent with the approved Development and Production Plan for protection of the interests of Equatorial Guinea; and

(i)ensure that damages caused by Petroleum Operations to Persons and property are promptly, fairly, and fully compensated.

6.12.2 If the Contractor's actions result in any pollution or damage to the environment, any Person, living resources, property or other type of damage, the Contractor will immediately take all prudent and necessary measures to remedy such damages and its effects and/or those measures the Ministry may order. If the pollution or damage is caused as a result of the Negligence of the Contractor, its subcontractors, or any Persons acting on its or their behalf, all costs related to that pollution or damage will not be recoverable as Petroleum Operations Costs. If the Contractor does not act promptly to control or clean up any pollution or repair any damage caused, the Ministry may, after giving the Contractor reasonable notice in the circumstances, carry out the actions that are prudent or necessary in accordance with this Article and Article 4.5 and all reasonable costs and expenses of those measures will be at the expense of the Contractor and will not be recoverable as Petroleum Operations Costs.

6.12.3 If the Ministry determines that any works or installations built by the Contractor or any activity undertaken by the Contractor threatens the safety of any Persons or property or causes pollution or harm to the environment, the Ministry will promptly advise the Contractor of its determination, and may require the Contractor to take all appropriate mitigating measures, consistent with generally accepted good practices of the international petroleum industry, to repair any damage caused by the Contractor's conduct or activities. Furthermore, if the

Ministry considers it necessary, it may demand that the Contractor suspend the affected Petroleum Operations totally or partially until the Contractor has taken the appropriate mitigating measures or repaired any damage.

6.12.4 The Contractor will undertake comprehensive environmental impact assessment studies before, during, and after drilling operations. The Contractor will assume the costs of these studies and the costs will be recoverable This requirement is mandatory and the first study will be presented to the Ministry before drilling starts on the first Well in the Contract Area. However, an environmental impact assessment must also be completed before any seismic work in especially sensitive areas environmentally specified by the State.

6.13 Reinjection and Natural Gas Flaring

The Natural Gas that the Contractor does not develop in accordance with this Contract and the Hydrocarbons Law or use in its own operations within the Contract Area will be reinjected into the structure of the subsoil. All costs of the reinjection will be recoverable as Petroleum Operations Costs. Notwithstanding the foregoing, the Ministry may authorize the combustion of Natural Gas for short periods of time in accordance with the Hydrocarbons Law. The Contractor will compensate the State for unauthorized volumes of gas flared. All such Natural Gas not used in Petroleum Operations by the Contractor or not developed in accordance with this Contract and the Hydrocarbons Law will remain the sole property of the State.

6.14 Design and identification of Wells

6.14.1 The Contractor will conform to the good practices generally accepted in the international petroleum industry in the design and drilling of Wells, including their casing and cementation.

6.14.2 Each Well will be identified by a name or number agreed on with the Ministry, which will be indicated on all maps, plans and other similar records produced by or on behalf of the Contractor.

6.15 Vertical Projection Wells

No Well may be drilled to an objective outside the vertical projection of the boundaries of the Contract Area. Directional Wells drilled within the Contract Area from adjacent terrain not covered by this Contract will be considered for all purposes of this Contract as Wells drilled from territory included in the Contract Area, and whose drilling may only be undertaken with the prior approval of the Ministry, and on the terms and conditions the Ministry may establish. No part of this Article intends or may be interpreted as conceding a right of lease, license, servitude or any other right that the Contractor must obtain from the Ministry or other Persons.

6.16 Notification of Drilling Commencement

The Contractor will notify the Ministry at least ten (10) Working Days before drilling any Well established in an approved Annual Work Program and corresponding Annual Budget, or before resuming work on any Well where work has been suspended for more than six (6) months.

6.17 Construction of installations

The Contractor will build and maintain all installations necessary to properly comply with this Contract and carry out Petroleum Operations. The Contractor will request authorization from the Ministry and/or other applicable governmental authorities to occupy land necessary for the exercise of corresponding rights and obligations in accordance with this Contract. This authorization will be ruled by the provisions of Article 6.19, the Hydrocarbons Law, and other applicable laws of Equatorial Guinea. The Contractor will repair all damages caused by such circumstances.

6.18 Occupation of Land

6.18.1 In order to carry out Petroleum Operations, the Contractor will have the right to:

(a) subject to the provisions of Articles 6.17 and 6.18.2, occupy the land necessary to carry out Petroleum Operations and connected activities, as stipulated in items (b) and (c) of this Article, including housing of personnel;

(b) undertake or procure the undertaking of any infrastructure work necessary in normal technical and economic conditions for the carrying out of Petroleum Operations and associated activities such as transport, storage of equipment, materials and extracted substances, establishment of telecommunications equipment and communication lines necessary to carrying out Petroleum Operations at installations located both offshore and on land;

(c) realize or ensure realization of the work necessary to supply water for personnel and installations in accordance with water supply regulations; and

(d) extract and use or ensure the extraction and utilization of resources (other than Hydrocarbons) from the subsoil necessary for the activities stipulated in paragraphs (a), (b) and (c) above in accordance with applicable regulations.

6.18.2 Occupation of land as mentioned in Article 6.18.1 will become effective after the Ministry or other appropriate governmental authority approves the request submitted by the Contractor indicating and detailing the location of such land and how the Contractor plans to use it, taking the following into consideration:

(a) if the land belongs to the State, the State will grant it to the Contractor for occupation and to build its fixed or temporary installations during the term of this Contract for a

fee and on terms to be agreed and this amount will be considered a Petroleum Operations Cost;

(b) if the land is private property by traditional or local right according to the Property Registry of Equatorial Guinea, then (i) if the occupation is merely temporary or transitory, or for right of way, the Contractor will reach an agreement with the relevant property owner and the property owner will reach an agreement with any occupant, tenant, or possessor with respect to the rental to be paid, and the resulting amounts will be considered recoverable Petroleum Operations Costs, or (ii) if the occupation is permanent, the Contractor will reach an agreement on matters related to the property's acquisition with the owner in question, and such amounts will be considered Petroleum Operations Costs;

(c) if the Contractor and the relevant property owner or occupant, tenant, or possessor do not reach an agreement about the matters mentioned in paragraph (b) above, the Ministry will act as mediator between them, and if mediation fails to produce resolution of the case, the dispute will be resolved by the courts of Equatorial Guinea, unless recourse is had to the procedure described in paragraph (d) below;

(d) the State may expropriate the land, subject to prior publication of a decree of compulsory expropriation followed by a fair and reasonable appraisal of the land by an expert appraiser. In such event, the Contractor will compensate the expropriated property owner in accordance with the value determined by the expert appraiser if the State has not done so; such amounts will be considered recoverable Petroleum Operations Costs;

(e) relinquishment, in whole or in part, of the Contract Area, will not affect the Contractor’s rights under Article 6.18.1 to carry out building work and construction of installations, provided that such work and installations are directly related to other activities of the Contractor in the remainder of the Contract Area, as in the case of partial relinquishment, or covered by another production sharing contract.

6.19 Residence of personnel

No restrictions will be imposed on the entry, residence, free circulation, employment, and repatriation of the Contractor's personnel and those of its subcontractors, the family of such personnel, or the belongings of such personnel and their families, provided the Contractor and its subcontractors comply with all applicable laws, including, among others, the labor and social law of Equatorial Guinea. The State commits to expediting without delay the entry, work, or residence permits or other permits or authorizations that may be required by the personnel of the Contractor or any subcontractor in accordance with the Laws of Equatorial Guinea.

6.20 Collaboration of the Ministry

The Ministry will collaborate with the Contractor and its subcontractors in obtaining all administrative authorizations and licenses as may reasonably be necessary for proper execution of Petroleum Operations under this Contract.

6.21 Opening a branch.