UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________

FORM 10-K

____________________________________________

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2017

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 12 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-35952

____________________________________________

ARATANA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

____________________________________________

|

Delaware |

38-3826477 |

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

11400 Tomahawk Creek Parkway, Suite 340

Leawood, KS 66211

(913) 353-1000

(Address of principal executive offices, zip code and telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Name of Exchange on Which Registered |

|

|

Common Stock, par value $0.001 per share |

The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

____________________________________________

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933 Yes: ☐ No: ☒

Indicate by check if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes: ☐ No: ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 and 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes: ☒ No: ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes: ☒ No: ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

☐ |

Accelerated filer |

☒ |

|||

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|||

|

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes: ☐ No: ☒

The approximate aggregate market value of the common stock held by non-affiliates of the registrant based upon the closing price of the registrant’s common stock on the Nasdaq Global Market on June 30, 2017 was $225,560,521.

As of March 9, 2018, there were 45,854,403 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the registrant’s definitive proxy statement to be filed in connection with the registrant’s 2018 annual meeting of stockholders are incorporated by reference into Part III of this Form 10-K.

FORM 10-K

For the Year Ended December 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page |

|

|

|

|

2 | |

|

Item 1. |

|

|

2 | |

|

Item 1A. |

|

|

25 | |

|

Item 1B. |

|

|

46 | |

|

Item 2. |

|

|

46 | |

|

Item 3. |

|

|

46 | |

|

Item 4. |

|

|

46 | |

|

|

|

|

47 | |

|

Item 5. |

|

|

47 | |

|

Item 6. |

|

|

49 | |

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

51 |

|

Item 7A. |

|

|

67 | |

|

Item 8. |

|

|

67 | |

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

67 |

|

Item 9A. |

|

|

67 | |

|

Item 9B. |

|

|

68 | |

|

|

|

|

69 | |

|

Item 10. |

|

|

69 | |

|

Item 11. |

|

|

69 | |

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

69 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

69 |

|

Item 14. |

|

|

69 | |

|

|

|

|

70 | |

|

Item 15. |

|

|

70 | |

|

Item 16. |

|

|

72 | |

|

|

|

|

73 |

1

Aratana Therapeutics and our logo are two of our trademarks that are used in this filing. This filing also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this filing appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, the matters discussed in this Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (“2017 Annual Report”) are forward-looking statements that involve risks, uncertainties and assumptions that, if they never materialize or if they prove incorrect, could cause our consolidated results to differ materially from those expressed or implied by such forward-looking statements. The Company makes such forward-looking statements under the “Safe Harbor” section of the Private Securities Litigation Reform Act of 1995. Actual future results may vary materially from those projected, anticipated, or indicated in any forward-looking statements as a result of various important factors, including those set forth in Item 1A of this 2017 Annual Report under the heading “Risk Factors.” Readers should also carefully review the risk factors described in the other documents that we file from time to time with the SEC. In this 2017 Annual Report, the words “anticipates,” “believes,” “expects,” “intends,” “future,” “could,” “estimates,” “plans,” “would,” “should,” “potential,” “continues” and similar words or expressions (as well as other words or expressions referencing future events, conditions or circumstances) identify forward-looking statements. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements. The forward-looking statements contained in this 2017 Annual Report include, but are not limited to, statements related to: industry trends; market conditions; management’s plans, objectives and expectations regarding product development and commercialization; expectations regarding regulatory submissions and approvals, and anticipated timing thereof; the stockholder class action lawsuits and any additional litigation; customer trends and demand for our current or potential products; investments in research and development; business prospects; our collaboration partners and our relationships and arrangements therewith; anticipated achievement of milestones; anticipated financial performance, including future revenues; expected liquidity and capitalization; our ability to protect our intellectual property from third-party claims; changes in accounting principles; changes in actual or assumed tax liabilities; expectations regarding tax exposures; anticipated reinvestment of future earnings; ability to repay our indebtedness; and our intentions regarding the use of cash. All forward-looking statements included in this document are based on information available to us on the date hereof. We will not undertake and specifically decline any obligation to update any forward-looking statements, except as required under applicable law.

ARATANA THERAPEUTICS ®

Our Company

Aratana Therapeutics, Inc. is a pet therapeutics company focused on licensing, developing and commercializing innovative therapeutics for dogs and cats. As a pioneer in pet therapeutics, Aratana’s mission is to deliver safe and effective therapeutics that elevate the standard of care in veterinary medicine. We work with companion animal veterinarians to bring new therapeutics to market that support the needs of pets and their owners.

We were incorporated on December 1, 2010 under the laws of the State of Delaware. We have completed several licensing transactions and acquisitions to build our pipeline. The address of our principal executive offices is 11400 Tomahawk Creek Parkway, Suite 340, Leawood, Kansas 66211. Unless the context requires otherwise, references to “Aratana,” the “Company,” “we,” “us” or “our” in this 2017 Annual Report refer to Aratana Therapeutics, Inc., a Delaware corporation, and its subsidiaries.

We have three marketed therapeutics, including ENTYCE® (capromorelin oral solution) for appetite stimulation in dogs; NOCITA® (bupivacaine liposome injectable suspension) as a local post-operative analgesia for cranial cruciate ligament surgery in dogs; and GALLIPRANT® (grapiprant tablets) for the control of pain and inflammation associated with osteoarthritis in dogs, which we co-promote under an agreement with Elanco Animal Health, Inc., a division of Eli Lilly & Co. (“Elanco”). Our Canine Osteosarcoma Vaccine, Live Listeria Vector (AT-014) is conditionally licensed and is being made available at approximately two dozen study sites across the United States. Our pipeline has multiple therapeutic candidates in development for the potential treatment of pain, allergy, viral disease and cancer for dogs and cats.

2

Our Goal and Strategies

Our goal is to develop and commercialize therapeutics for unmet or underserved medical needs in pets. We plan to accomplish this by:

Deploying a management team with established experience in human pharmaceutical and animal health industries.

In order to successfully execute our plan, we have assembled an experienced management team consisting of veterinarians, physicians, scientists and other professionals. The members of our senior management team have nearly 300 years of combined experience in animal health and human pharmaceutical industries, as well as a strong track record of successfully developing and commercializing therapeutics for dogs and cats. Our senior management team is complemented by our seasoned staff members, most of whom are veterans in the animal health or human health industries.

Advancing our therapeutic candidates to achieve regulatory approval or licensure.

We received three United States Food and Drug Administration (“FDA”) approvals of our lead therapeutic candidates in 2016, several United States Department of Agriculture (“USDA”) licensures in the past few years and we maintain a portfolio of therapeutic candidates, including small molecule pharmaceuticals and biologics. These therapeutic candidates are in various stages of development for the treatment of cats or dogs, or both.

Continuing to grow our therapeutic pipeline by in-licensing additional therapeutic candidates.

We believe the pet therapeutics market is significantly underserved and have identified more than 20 therapeutic areas that overlap with areas of human pharmaceutical development. Pursuant to our corporate strategy, we seek to identify these candidates and when appropriate, to seek exclusive, worldwide rights to these compounds in animal health. Each of our current candidates is covered by patents and/or other intellectual property that provide for a multi-year period of market exclusivity. Additionally, we intend to seek opportunities to collaborate with companies where we can provide commercialization for their approved or close-to-approved pet therapeutics.

Using a direct sales organization, distributors, co-promotion, corporate sales and/or e-commerce to make therapeutics commercially available in the United States.

Our sales team includes approximately two dozen therapeutic specialists and a sales leadership team. Our marketing, sales operations and veterinary services teams round out our unique, therapeutic-focused commercial organization. We extend our reach through strategic distributor relationships and other corporate selling arrangements. In addition, we have an agreement with Elanco to co-promote GALLIPRANT in the United States. Veterinarians typically sell therapeutics to pet owners or administer in-clinic at a mark-up. We believe our sales efforts align with a veterinarian’s goal of improving the health and quality of life of pets, and generating revenue from sales of our therapeutics. In 2017, we directly marketed three FDA-approved therapeutics to veterinarians, including GALLIPRANT in collaboration with Elanco.

Executing on global initiatives.

We have licensed the rights to certain of our therapeutics in geographies outside the United States. We intend to seek regulatory approval for our pet therapeutics in Europe and potentially other countries over time. In April 2016, we announced a global collaboration agreement with Elanco and in 2018, we and Elanco received marketing authorization for GALLIPRANT in Europe for the treatment of pain associated with mild to moderate osteoarthritis in dogs. We believe there continues to be a desire from large animal health companies to collaborate on the commercialization of innovative pet therapeutics in countries outside the United States.

Our strategy is to in-license proprietary technology from human pharmaceutical companies, academia or animal health companies that is applicable to dogs and cats with the intention to develop innovative pet therapeutics to solve unmet or underserved medical needs in companion pets. We seek to identify human therapeutic candidates that have demonstrated proof of safety in the target species, proof of efficacy in at least two mammalian species and a well-defined manufacturing process for the active pharmaceutical ingredients (“API”). We also seek to identify therapeutics already in development or being made commercially available for pets in an effort to license or acquire these products.

In addition, the Company entered into a collaboration, license, development and commercialization agreement (the “Collaboration Agreement”) and co-promotion agreement (the “Co-Promotion Agreement,” and together with the Collaboration Agreement, the “Elanco Agreements”) with Elanco, in April 2016, granting Elanco exclusive rights globally outside the United States to develop, manufacture, market and commercialize our products based on licensed grapiprant rights and technology, including GALLIPRANT (collectively, “Grapiprant Products”), and co-promotion rights in the United States with regards to such products.

To date, we have in-licensed, are further developing pharmaceutical compounds and/or have collaboration agreements with the following companies: Advaxis, Inc. (“Advaxis”), Atopix Therapeutics Ltd. acquired by Chiesi Farmaceutici Spa in November 2016 (“Atopix”), Elanco, Pacira Pharmaceuticals, Inc. (“Pacira”), RaQualia Pharma Inc. (“RaQualia”), Ajinomoto Pharmaceuticals Co., Ltd. (“Ajinomoto”), AskAt Inc. (“AskAt”), and Katholieke University Leuven Research and Development (“KU-Leuven”).

3

Key Developments

During 2017, Aratana had significant achievements that affected the business, including newly marketed therapeutics, progress with therapeutic candidates and other corporate updates.

|

|

|

|

entyce (capromorelin oral solution) |

In October 2017, Aratana made ENTYCE commercially available for appetite stimulation in dogs through distribution and direct purchase. As of December 31, 2017, approximately two months after the ENTYCE launch, Aratana had recorded $1.3 million in ENTYCE net product sales, which were primarily stocking orders to distribution. Initial uptake in the fourth quarter of 2017 exceeded Aratana’s original objective of placement in 1,800 clinics during the quarter by more than double. The Company plans to continue to focus on growing the number of accounts, driving re-orders and increasing days of use. |

|

nocita (bupivacaine liposome injectable suspension) |

In the full year 2017, NOCITA net product sales were $2.8 million as compared to $147 thousand in the fourth quarter and full year 2016 when the therapeutic was launched, and as of December 31, 2017, net product sales have increased sequentially in each quarter since launch. The Company believes the sequential increase in sales is primarily a result of steady, incremental growth of new accounts and strong re-order rates, including a re-order rate of approximately 65% in 2017 and more than 30% of revenues stemming from corporate accounts. |

|

Galliprant (grapiprant tablets) |

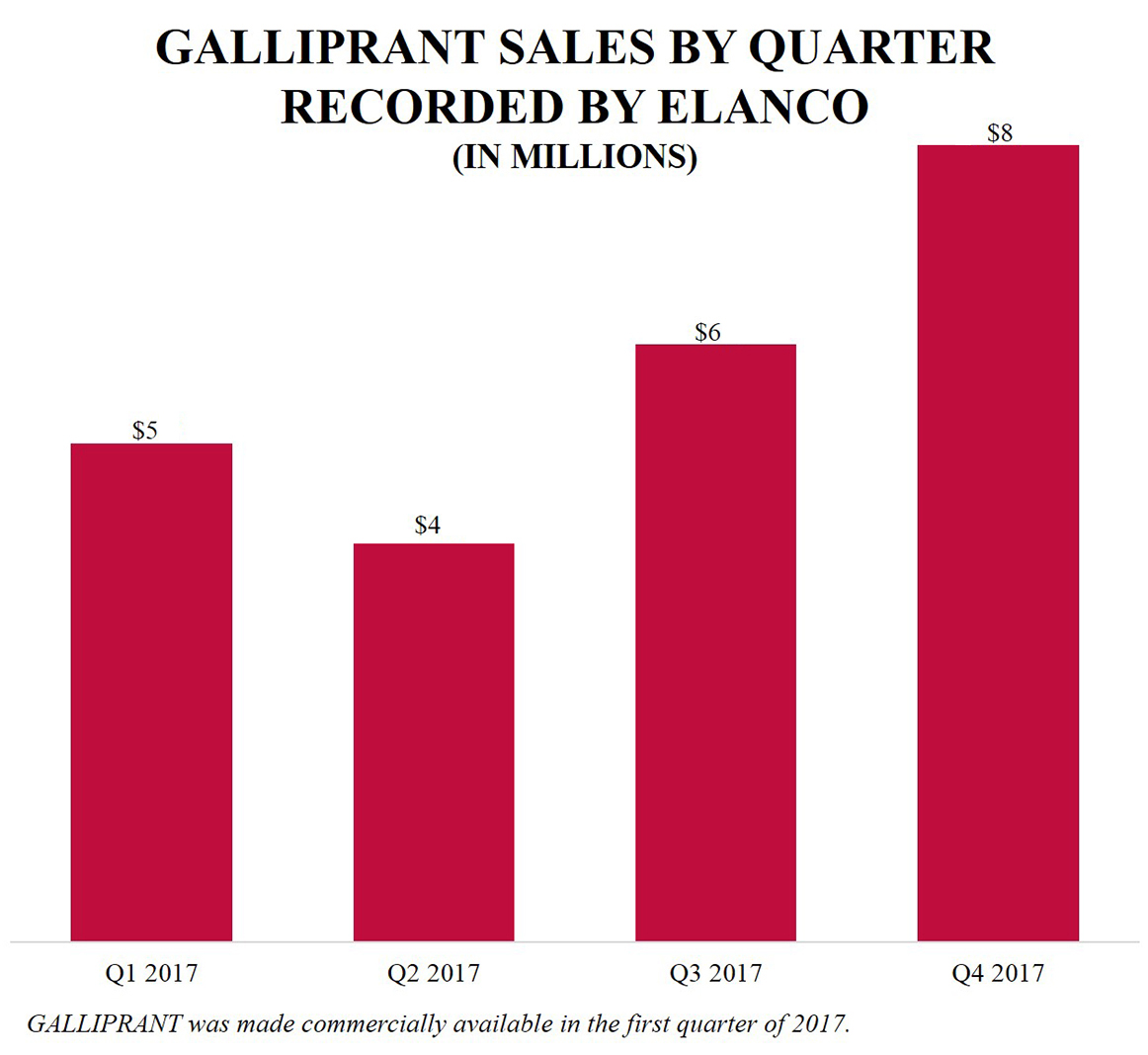

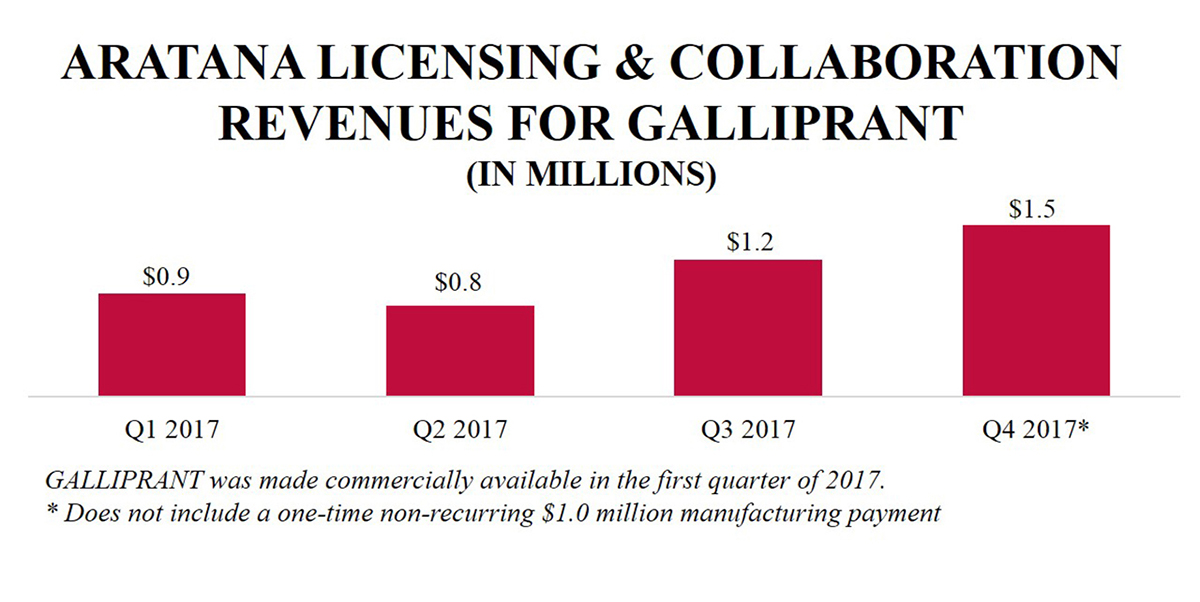

In the first quarter of 2017, in collaboration with Elanco, Aratana made GALLIPRANT commercially available for the control of pain and inflammation in dogs with osteoarthritis. In December 2017, Elanco and Aratana announced the European Medicine Agency's (“EMA”) Committee for Medicinal Products for Veterinary Use (“CVMP”) adopted a positive opinion to recommend the marketing authorization of GALLIPRANT in the European Union (“EU”) and in January 2018, the EMA granted marketing authorization. In the full year 2017, Aratana recorded $20.9 million in total revenues related to GALLIPRANT, which included $4.4 million in licensing and collaboration revenue from Elanco, a one-time non-recurring $1.0 million manufacturing payment and $15.5 million in product sales of finished goods prior to the assumption of manufacturing responsibility by Elanco in the third quarter of 2017. |

Canine Osteosarcoma Vaccine, Live Listeria Vector (AT-014). In December 2017, the USDA Center for Veterinary Biologics (“CVB”) granted Aratana conditional licensure for Canine Osteosarcoma Vaccine, Live Listeria Vector for the treatment of dogs diagnosed with osteosarcoma, one year of age or older. As required by USDA to progress from conditional licensure to full licensure, Aratana is conducting an extended field study, which started enrolling at approximately two dozen veterinary oncology practice groups across the United States in the first quarter of 2018.

AT-003 (bupivacaine liposome injectable suspension) for post-operative pain in cats. In the second quarter of 2017, the Company submitted results from the pivotal safety study to the FDA’s Center for Veterinary Medicine (“CVM”) for AT-003 in cats with post-operative pain. In December 2017, the Company received the target animal safety technical section complete letter for AT-003 from CVM. In the third quarter of 2017, Aratana announced positive results of a pivotal field effectiveness study evaluating AT-003 in client-owned cats undergoing an elective onychectomy. The Company submitted results from the pivotal efficacy study to CVM for AT-003, which if approved, would support the filing of a supplemental New Animal Drug Application (“NADA”) anticipated in the second quarter of 2018 to expand the NOCITA label to include cats.

Corporate Recognition and Awards. In the first quarter of 2017, Aratana was named Animal Pharm's Best Company in North America 2016 based on the FDA approvals of GALLIPRANT, ENTYCE and NOCITA, respectively, as well as the Company's evolution to a fully integrated commercial company. In the second quarter of 2017, the Kansas City Business Journal listed Aratana as the fastest growing Kansas City metro company in 2016 based on annual revenue growth, which was driven by the Elanco collaboration agreement upfront payment in 2016. In November 2017, Deloitte released its 2017 North America Technology Fast-500 and ranked Aratana fourth in revenue growth when measuring the rate of growth from 2013 to 2016.

Registered Direct Offering. In the second quarter of 2017, Aratana entered into a securities purchase agreement with several institutional investors providing for the issuance and sale of an aggregate of 5,000,000 shares of its common stock at a price of $5.25 per share in a registered direct offering.

4

Sales and Marketing

Our mission is to deliver safe and effective therapeutics that elevate the standard of care in veterinary medicine by working with companion animal veterinarians to bring new therapeutics to market that support pets and their owners. We reach companion animal veterinarians by utilizing a variety of tactics depending on the specific business situation for a particular therapeutic. We can market to companion animal veterinarians directly, which includes utilizing a sales force, telesales, e-commerce and selling to key accounts. Key accounts include corporate veterinary entities and group purchasing organizations. Our therapeutics also reach companion animal veterinarians indirectly, which entails selling our therapeutics to national or regional distributors, as well as via commercial collaboration partners who in turn sell to companion animal veterinarians. Typically, direct selling and indirect selling are complementary efforts aimed at raising awareness of the product, generating customer interest and supporting a good customer experience. In certain circumstances, for instance, where a therapeutic would require broad geographic sales coverage or faces established competition, we may choose to co-promote with one of the larger incumbent animal health companies.

In 2017, we gained significant sales experience with three FDA-approved therapeutics, ENTYCE, NOCITA and GALLIPRANT, and we recorded our first significant revenues from the commercialization of our therapeutics. We reported $9.5 million in net revenues in 2017 related to ENTYCE sales, NOCITA sales, GALLIPRANT licensing and collaboration (including a one-time $1.0 million manufacturing payment from Elanco) and other therapeutic sales. In addition, we reported $15.5 million in GALLIPRANT product sales to Elanco of finished goods prior to the assumption of manufacturing responsibility by Elanco in the third quarter of 2017. This compares to 2016 revenues, when NOCITA and other net product sales totaled $0.3 million and licensing and collaboration revenue was $38.2 million (almost all of which, $38.0 million, was related to the one-time upfront payment from Elanco), and to 2015, which had $0.7 million in net product sales.

|

|

|

|

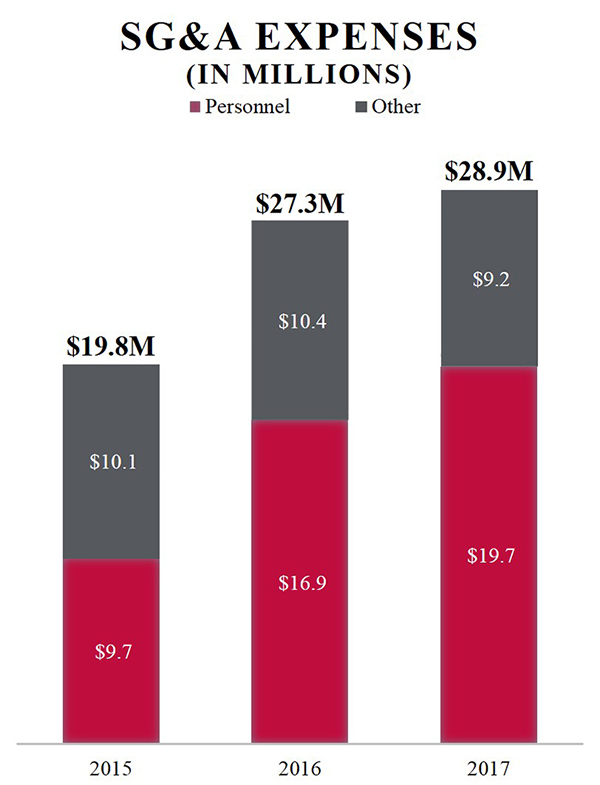

Our selling, general and administrative expenses were $28.9 million, $27.3 million and $19.8 million for the years ended December 31, 2017, 2016 and 2015, respectively. The focus of our current commercial activities is the United States, and we generally attempt to out-license the commercial rights outside the United States. According to independent market research commissioned by us, there are approximately 25,000 to 30,000 veterinary clinics in the United States. We believe we have direct access to approximately 50% of the revenue opportunity for our pet therapeutics through our sales organization of approximately 35 field sales team members detailing the top-40 metropolitan statistical areas (“MSAs”), including sales leadership and our veterinary medical liaisons. We will continue to review opportunities for incremental expansion of the sales organization where growth is expected to be significantly funded by sales. In addition, we believe we have indirect access to the remainder of the revenue opportunity through our relationships with distributors, corporate accounts and as in the case of GALLIPRANT, through a co-promotion arrangement. In 2018, we intend to remain focused on marketing our three FDA-approved therapeutics as we work to expand our product portfolio through business development and collaboration relationships. |

SG&A EXPENSES (IN MILLIONS) Personnel Other 2015 $9.7 $10.1 $19.8M 2016 $16.9 $10.4 $27.3M 2017 $19.7 $9.2 $28.9M |

5

ENTYCE® (capromorelin oral solution)

|

|

|

|

ENTYCE is the first FDA-approved appetite stimulant for dogs. It was made commercially available to veterinarians in the United States in October 2017 through our direct sales organization and our network of national and regional distributors. We currently market ENTYCE in three bottle sizes, 10mL, 15mL and 30mL. ENTYCE is administered as a flavored oral solution at a dose of 3 mg/kg body weight once daily. The cost per dose depends on the weight of the dog and as an example, the 15mL size bottle contains approximately ten doses for a 30 lbs. dog. |

ENTYCE NET SALES BY QUARTER (IN MILLIONS) Q4 2017 $1.3 ENTYCE was made commercially available in the fourth quarter of 2017. |

As of December 31, 2017, approximately two months after its launch, we had recorded $1.3 million in ENTYCE net product sales, which was approximately evenly split between initial stocking orders to distribution and subsequent move-out from distribution representing product moving into the clinics to satisfy orders. ENTYCE had strong uptake in the fourth quarter by exceeding our original objective (placement in 1,800 clinics) by more than double. Placement in clinics continues to grow as of early 2018. And as of the date of the filing of this 2017 Annual Report, we continue to see subsequent move-out of ENTYCE from distribution into the clinics at approximately the same rate as what we saw in the first few months of the launch. As we get further into 2018, we anticipate that inventory levels across the sales channel will stabilize and we believe we will see sequential growth and a tighter correlation between shipments to distributors and move-out to veterinary clinics. Our confidence is bolstered by the rate at which we have been able to access clinics for their initial orders and the anecdotal reports that we are getting from the field. We are focused on growing the number of accounts, driving re-orders, increasing the days of use and succeeding in both acute and chronic inappetence. We believe that initial orders will be smaller as veterinarians gain trial experience and become familiar with the product. We believe that the long-term success of ENTYCE will be driven by veterinarians becoming increasingly comfortable with its use. We anticipate that as the therapeutic establishes itself in clinical practice, we will see a shift towards chronic use and larger orders at the clinic level. Currently, all package sizes are being ordered consistently, however we anticipate a shift toward the larger sizes if veterinarians’ dispensing patterns shift as expected.

Medical need. The control of hunger and satiety involves a complex system in mammals. In many acute and chronic disease states, as well as with aging, lack of appetite is a problem and can fuel a downward spiral. Malnutrition and decreased muscle mass can result from inadequate food intake regardless of the underlying condition. Until ENTYCE veterinarians did not have an FDA approved therapeutic specifically designed to treat inappetence in dogs, a frustrating clinical situation for the veterinarian and pet owner. In a survey of veterinarians 81% believed that stimulation of appetite and weight gain in dogs represented a significant unmet need and 68% of veterinarians reported they were unsatisfied with products being used to treat inappetence prior to ENTYCE. There are numerous chronic and acute conditions that can cause inappetence, some of which include: behavioral or environmental changes; gastroenteritis; psychological; medications; pain; post-surgery; aging; cancer; and various diseases, including autoimmune, endocrine, gastrointestinal, heart, infectious, nasal, neurological and respiratory.

Mechanism of Action. ENTYCE is a first-in-class ghrelin receptor agonist that works by mimicking the effect of ghrelin, the hunger hormone. Like naturally occurring ghrelin, ENTYCE binds to specific receptors in the hypothalamus and causes the feeling of hunger.

Efficacy & Safety. The FDA approved ENTYCE based on a pivotal clinical field study that demonstrated a significantly higher proportion of inappetent dogs receiving ENTYCE had increased appetite in the single question assessment and owner appetite assessment as compared to dogs receiving placebo. ENTYCE-treated dogs in the study also demonstrated an increase in body weight. A 12-month laboratory safety study demonstrated capromorelin was well-tolerated in dogs at daily doses up to 40 mg/kg (17.5x labeled dose).

Treatment options. One of the first goals of therapy for inappetence is to correct the underlying cause. Often veterinarians will begin treatment of inappetence by recommending a change to a highly palatable diet such as tuna for cats and chicken or beef for dogs. Depending on the severity of the condition, the animal may be supported with fluids and electrolytes until the diagnosis of the underlying condition is made and effective treatment is initiated where possible. Prolonged or severe inappetence may require hospitalization and feeding tube placement. Drug therapy to address inappetence has focused primarily on human drugs affecting the central nervous system such as benzodiazepines, cyproheptadine and mirtazapine. However, these drugs are not approved for veterinary use, are believed to have limited effectiveness in pets and are contraindicated for cats with hepatic lipidosis. We believe some veterinarians use Cerenia (maropitant), which is indicated for the control of vomiting, to determine whether the dog is inappetent due to nausea. We believe a significant number of veterinarians are not prescribing these various therapies due to their limited safety and efficacy.

Market opportunity. We believe there is a significant market opportunity for a therapeutic that can safely and effectively stimulate appetite in pets. Almost any disease can manifest or develop decreased appetite (hyporexia), complete lack of appetite (anorexia) or changes in appetite (dysrexia). Inappetence can be the first sign, and may be the only sign, that a dog is sick or has an underlying health condition. Prolonged inappetence, if left untreated, can become even more detrimental to the patient than the underlying primary disease. In addition to being detrimental to the pet, this can cause distress to pet owners and can be perceived as suffering or decreased quality of life. According to market research, approximately 9.8 million dogs in the United States are inappetent each year and approximately 4.1 million of such dogs are treated for the condition (2.3 million dogs are being treated for acute inappetence and 1.8 million dogs are being treated for chronic inappetence). The large majority of veterinarians (87%) we surveyed stated that they are

6

extremely likely or very likely to use ENTYCE in chronic conditions, which is 40 days of therapy per year on average, assuming competitive pricing. By contrast 63% of veterinarians surveyed said they would use the product in acute conditions, which is 4 days of therapy per year, assuming competitive pricing.

NOCITA® (bupivacaine liposome injectable suspension)

|

|

|

|

NOCITA is a long-acting local post-operative anesthetic providing 72 hours of post-operative pain relief for dogs undergoing cranial cruciate ligament surgery in one dose at closure. NOCITA was made commercially available to veterinarians in the United States in October 2016 through our direct sales organization. In 2017, we recorded approximately $2.8 million in NOCITA net product sales as compared to approximately $0.1 million in 2016, and as of December 31, 2017, net product sales have increased sequentially in each quarter since launch. |

NOCITA NET SALES BY QUARTER (IN MILLIONS) Q4 2016 $0.1 Q1 2017 $0.3 Q2 2017 $0.6 Q3 2017 $0.7 Q4 2017 $1.1 NOCITA was made commercially available in the fourth quarter of 2016. |

We believe the quarterly sequential increase in sales is primarily a result of steady, incremental growth of new accounts each month and strong re-order rates, including a re-order rate of approximately 65% in 2017 and more than 30% of revenues stemming from corporate accounts. In 2017, we had more than 13,000 interactions with veterinary customers and accounts, suppliers, and/or vendors to educate and discuss NOCITA. Based on third party market research, we have garnered more than 90% aided awareness about the therapeutic among surgeon targets. In 2018, we look to continue to market NOCITA as the standard of care for cranial cruciate ligament surgeries, and anticipate a supplemental NADA in 2018 to expand the NOCITA label to include cats. We are also exploring potentially making NOCITA available in smaller vial sizes, which we believe would increase the target addressable market.

Medical need. Veterinarians perform approximately 20 million dog surgeries each year. Approximately 50% of dog surgeries are spays and neuters, while other common surgeries include cruciate repairs, fracture repairs and cancer surgery. There is not one established protocol for the use of pain medications in these surgeries and pain management practices have traditionally been based on the veterinarian’s views on the level of pain associated with a specific surgical procedure and the perceived pain tolerance of the pets. Pain management has become more important to pet owners and they have begun requesting analgesia for their pets’ painful conditions. Furthermore, animal research demonstrates that pain can have a detrimental effect on healing, and pain experts in academia and specialty practices are advocating more use of local anesthesia for pain control.

Mechanism of Action. NOCITA is a long-acting, local anesthetic that lasts up to 72 hours post-surgery by releasing bupivacaine over time from multi-vesicular liposomes deposited in the tissue. The therapeutic is administered as a single dose by tissue infiltration during closure of cranial cruciate ligament surgery in dogs. This potentially prevents analgesia gaps up to the first 72 hours post-surgery and provides consistent pain control after the patient is discharged.

Efficacy & Safety. FDA approval was based on a pivotal clinical field study in dogs undergoing knee surgery and measured pain using the Glasgow Composite Measure Pain Scale-Short Form (“CMPS-SF”). NOCITA-treated dogs had statistically significant reduction in pain scores compared to placebo at 24, 48 and 72 hours following surgical closure. A four-week laboratory study at up to five times the labeled dose demonstrated there were no clinically relevant treatment-related effects.

Treatment options. We believe the most widely used drugs approved for treatment of post-operative pain are COX-inhibiting nonsteroidal anti-inflammatory drugs (“NSAIDs”) and opioids in dogs. In 2017, the United States Drug Enforcement Administration implemented its initiative to reduce opioids manufactured in the United States by 25%, including opioids sold to veterinarians. We believe this may lead to a decrease in the availability of opioids and, as a result, in surgeries associated with the most severe post-operative pain there may be a shift to using non-opioids. Currently, fentanyl is commonly used (dispensed as a patch), but is not FDA-approved in dogs, and pets are often kept in the hospital while receiving the narcotic. We believe that there are unmet needs in pets undergoing these more painful surgeries, especially if effective and extended pain relief could be achieved with a non-narcotic medicine. COX-inhibiting NSAIDs are used as part of the pain protocol and have demonstrated significant side effects that result in prescribed monitoring of dog health during their use due to concerns with effects on the liver, gastrointestinal system and kidneys.

Market opportunity. We believe that there is a significant market opportunity for the treatment of post-operative pain in dogs. According to market research, approximately 20 million dogs in the United States undergo surgery per year and of such dogs, approximately 5.8 million have very painful expensive surgeries, including cranial cruciate ligament knee surgery. Our initial product indication covered in the product label for NOCITA is for post-operative analgesia for cranial cruciate ligament surgery. In 2017, we made submissions with CVM with the intention of advancing our efforts to expand the label to include cats.

7

GALLIPRANT® (grapiprant tablets)

As part of our Collaboration Agreement with Elanco on Grapiprant Products, Elanco has the lead responsibility for all commercial activities globally. We believe that our commercial organization will continue to participate in the commercial activities in the United States via our Co-Promotion Agreement, which is effective through 2028. We recorded revenues related to our supply arrangement with Elanco in 2017 and we will continue to record certain co-promotion fees, royalties and, if achieved, regulatory, manufacturing and commercial milestones. Hence, the commercial success of Grapiprant Products is very meaningful to us. See “GALLIPRANT Collaboration, License, Development and Commercialization and Co-Promotion Agreements with Elanco” for additional information.

Canine Osteosarcoma Vaccine, Live Listeria Vector (AT-014) for dogs.

In December 2017, the USDA’s CVB granted Aratana conditional licensure for Canine Osteosarcoma Vaccine, Live Listeria Vector for the treatment of dogs diagnosed with osteosarcoma, one year of age or older. The therapeutic expresses a tumor-associated antigen and directs the T-cells to fight cancer cells, even after the bacteria are cleared. Thus, the therapeutic capitalizes on the dog's immune system and its ability to attack bacterial infections, redirecting it to fight cancer cells. As of the first quarter of 2018, we made the therapeutic initially available for purchase to approximately two dozen veterinary oncology practice groups participating in an extended field study across the United States. The goal is to gain more experience with the therapeutic and enroll dogs in the extended field study that is required by USDA to progress from conditional licensure to full licensure. The therapeutic is commercially available to those veterinarians participating in the clinical study. While the study is on-going, any product purchased for use in the clinical study will offset R&D expenses.

8

Competition

The development and commercialization of new animal health medicines is highly competitive, and we expect considerable competition from major pharmaceutical, biotechnology and specialty animal health medicines companies. As a result, there are, and likely will continue to be, extensive research and substantial financial resources invested in the discovery and development of new animal health medicines. Our potential competitors include large animal health companies, such as Zoetis; Merck Animal Health, the animal health division of Merck & Co., Inc.; Elanco; Bayer Animal Health, the animal health division of Bayer AG; Boehringer Ingelheim Animal Health, the animal health division of Boehringer Ingelheim GmbH; Virbac Group; Ceva Animal Health; Vetoquinol and Dechra Pharmaceuticals PLC. We are also aware of several smaller early stage animal health companies, such as Nexvet (acquired in 2017 by Zoetis); Kindred Biosciences; Zomedica Pharmaceuticals; Parnell Pharmaceuticals; and VetDC that are developing products for use in the pet therapeutics market.

Osteoarthritis is a competitive marketplace and Elanco has taken the lead on commercial activities for Grapiprant Products. ENTYCE entered a new market where it is the only product approved for veterinary use to stimulate appetite in dogs. However, we are aware that some veterinarians utilize mirtazapine, a human generic antidepressant with known side effects and limited effectiveness, to treat inappetence, and we are aware that a company is pursuing FDA approval of mirtazapine for weight gain in cats. NOCITA competes primarily with existing analgesics that are part of multi-modal pain protocols, including local anesthetics, opioids and cox-inhibiting NSAIDs. Regarding AT-014, we are aware that veterinarians often utilize off-label chemotherapy to treat this disease and we are aware of a variety of investigational candidates for osteosarcoma.

We are an emerging commercial company with a limited history of operations and many of our competitors have substantially more resources than we do, including both financial and technical resources. In addition, many of our competitors have more experience than we have in the development, manufacture, regulation and worldwide commercialization of animal health medicines. We are also competing with academic institutions, governmental agencies and private organizations that are conducting research in the field of animal health medicines.

Our competitive position will be determined in part by the potential indications for which our products are developed and ultimately approved by regulatory authorities. Additionally, the timing of market introduction of some of our potential products or of competitors’ products may be an important competitive factor. Accordingly, the speed with which we can develop our compounds, complete target animal studies and approval processes, and supply commercial quantities to market are expected to be important competitive factors. We expect that competition among products approved for sale will be based on various factors, including product efficacy, safety, reliability, availability, price and patent position.

|

|

|

|

Research and Development Our drug development programs focus on the development of novel compounds with the intention of capturing opportunities that will raise the standard of care for dogs and cats. We are building a development pipeline, both through the application of early-stage in-licensed therapeutic candidates and through strategic agreements. Our development approach provides access to promising therapeutic development opportunities within our focus areas. Even after a therapeutic is commercially available, we may conduct additional clinical studies for life cycle management purposes (supplemental indications) or for scientific exchange. Our current therapeutic candidates are animal pharmaceuticals regulated by the FDA and immune-mediated biologics, including cancer vaccines, regulated by the USDA. We are focused on our core strengths of clinical development and navigating the regulatory environment with respect to our in-licensed therapeutic candidates. We continue to prioritize our development and commercial efforts with a primary focus on the United States. We have incurred and will continue to incur research and development expense as we develop our business. Our research and development expenses were $15.1 million, $30.5 million and $25.0 million for the years ended December 31, 2017, 2016 and 2015, respectively. |

R&D EXPENSES (IN MILLIONS) Personnel Milestones Contract Development Costs Other 2015 $5.7 $0.7 $16.9 $1.7 $25.0M 2016 $4.5 $7.0 $18.3 $0.7 $30.5M 2017 $3.3 $0.3 $11.1 $0.4 $15.1M |

9

Development Programs at the FDA and USDA

FDA: To begin the development process for our product candidates in the United States, we establish an Investigational New Animal Drug (“INAD”) file with the CVM. We then hold a pre-development meeting with the CVM to reach a general agreement on the plans for providing the data necessary to fulfill requirements for a NADA. During development, we submit pivotal protocols to the CVM for review and concurrence prior to conducting the required studies. We gather and submit data on manufacturing, safety and effectiveness to the CVM for review, and this review is conducted according to timelines specified in the Animal Drug User Fee Act (“ADUFA”). Once all data have been submitted and reviewed for each technical section – safety, effectiveness and Chemistry, Manufacturing and Controls (“CMC”) – the CVM issues us a technical section complete letter as each section review is completed, and when the three letters have been issued, we compile a draft of the Freedom of Information Summary, the proposed labeling, and all other relevant information, and submit these as an administrative NADA for CVM review. Generally, if there are no deficiencies in the submission, the NADA is issued within 60 days after submission of the administrative NADA, as was the case with all three of our therapeutics that received FDA approval in 2016. A separate approval either as an original or supplemental NADA is required for each species. In addition, additional indications and additional formulations to extend the lifecycle of our product candidates require separate approvals. By exploring new uses and methods, we may potentially be able to extend the patent life of our product candidates and achieve further differentiation in the marketplace.

USDA: There are many parallels between the requirements to receive FDA approval for a veterinary pharmaceutical candidate and certain veterinary biologics candidates. The terminology differs, but the three main components are consistent, including efficacy, manufacturing and safety. USDA regulations are designed to ensure that veterinary biologics are pure, safe, potent and effective. The differences compared to FDA regulations are based on the immunological nature of the mode of action in biologics and the manufacturing process involving living organisms. In cases of emergencies, which means there is no licensed option available, the USDA will issue a time-limited conditional license after the manufacturing and safety requirements have been substantially fulfilled and a reasonable expectation of efficacy has been established. The applicant is expected to continue the pivotal efficacy study and the testing of the validation of the therapeutic. The conditional license can be extended if reasonable progress toward full licensure can be demonstrated. A unique requirement for veterinary biologics in the United States is that manufacturers must hold a United States Veterinary Biologics Establishment License to produce licensed veterinary biologics. An establishment license will only be issued if at least one biologic qualifies for a license. Applications for veterinary biologics establishments include: articles of incorporation for the applicant; qualifications of veterinary biologics personnel for key employees; water quality statement; facility blueprints; plot plans; and legends.

We are developing the following therapeutic candidates under FDA regulations:

|

Pilot Studies |

Pivotal Studies |

Phased Submission |

Commercial |

||||

|

AT-003 (bupivacaine liposome injectable suspension) for post-operative pain in cats |

|

|

|||||

|

AT-002 (capromorelin) for the management of weight loss in CKD cats |

|

|

|

||||

|

AT-018 (timapiprant) for dogs |

|

|

|

|

|||

|

AT-006 for cats |

|

|

|

|

|||

We are developing the following therapeutic candidates under USDA regulations:

|

|

|

|

|

|

|

Field Safety & Efficacy |

Conditional and/or Full Licensure |

Commercial |

||

|

Canine Osteosarcoma Vaccine, Live Listeria Vector (AT-014) for dogs |

|

|

||

|

AT-017 for dogs |

|

|

|

|

10

The following summarizes our regulatory and development advances in 2017 and early 2018 for therapeutic candidates being developed under FDA and USDA regulations:

ENTYCE® (capromorelin oral solution) for dogs.

ENTYCE was approved by the FDA for appetite stimulation in dogs in 2016. In October 2017, we announced that we received CVM approval of the prior-approval supplement (“PAS”) submission for the transfer and scale-up of manufacturing of ENTYCE, which allowed us to introduce the product into the market in late-2017.

AT-003 (bupivacaine liposome injectable suspension) for cats.

In June 2017, we submitted results from the pivotal safety study showing the therapeutic candidate was well-tolerated for the safety technical section filing with CVM for AT-003 (in-licensed from Pacira) in cats. In December 2017, we received the target animal safety technical section complete letter for AT-003 from CVM. In July 2017, we announced positive results of a pivotal field effectiveness study evaluating AT-003 in 200 client-owned cats undergoing an elective onychectomy. Data showed AT-003 met protocol-defined efficacy success criteria, which were statistically significant (p < 0.05), and the data were submitted to CVM in October. We have submitted all major technical sections to CVM and if we receive a technical section complete letter for efficacy, we plan to file a supplemental NADA with CVM to expand the NOCITA label to include cats in 2018.

AT-002 (capromorelin) for cats.

AT-002 (in-licensed from RaQualia) is a cat-specific formulation of capromorelin with a flavor that differs from the therapeutic approved for use in dogs. In 2017, we completed pivotal target animal safety study under FDA-concurred protocol. Currently, AT-002 is being evaluated in an ongoing, FDA-concurred field effectiveness study for weight management in cats with chronic kidney disease. The study is anticipated to complete enrollment in late-2018 and we anticipate that results will be available in 2019.

AT-018 (timapiprant) for dogs.

AT-018, which we in-licensed from Atopix following an option period between the parties, is an oral CRTH2 antagonist for the potential treatment of atopic dermatitis in dogs. In April 2017, we initiated a pilot study evaluating timapiprant for the prevention of clinical signs of atopic dermatitis in at-risk dogs and anticipate completing enrollment of the study in 2018.

AT-006 (eprociclovir) for cats.

AT-006 is an anti-viral for the treatment of feline herpes virus-induced ophthalmic conditions in-licensed from Ajinomoto. We plan to procure supply to be prepared to initiate a pilot study in 2018.

Canine Osteosarcoma Vaccine, Live Listeria Vector (AT-014) for dogs.

Canine Osteosarcoma Vaccine is a novel immunotherapy developed by us using a listeria based antigen delivery system in-licensed from Advaxis and is a lyophilized formulation of a modified live, attenuated strain of listeria that activates cytotoxic T-cells. In 2017, we submitted pivotal field safety study data and in December 2017, the USDA granted Aratana conditional licensure for the treatment of dogs diagnosed with osteosarcoma, one year of age or older. As required by USDA to progress from conditional licensure to full licensure, Aratana has initiated an extended field study. Initially, the therapeutic will be made available for purchase at the approximately two dozen veterinary oncology practice groups across the United States which participate in the study.

AT-017 for dogs.

AT-017 is an investigational therapeutic using a listeria based antigen delivery system in-licensed from Advaxis with potential in canine lymphoma. In 2018, we anticipate initiating a laboratory safety study.

AT-016 (allogeneic adipose-derived stem cells) for dogs.

In December 2017, our license partner responsible for the development of AT-016, VetStem BioPharma (“VetStem”), shared results of a pivotal study, that did not achieve protocol-defined efficacy success criteria. We do not anticipate committing future resources to the program and in January 2018, we exercised our right to terminate the license agreement with VetStem effective as of mid-April 2018.

AT-019.

In February 2018, we licensed exclusive, worldwide rights to develop and commercialize AT-019 from AskAt. AT-019 is a potent and innovative EP4 receptor antagonist therapeutic candidate with potential in pain, inflammation and other indications. We intend to start development work in 2018.

11

Regulatory and development advances in 2017 and early 2018 for therapeutic candidates outside the United States:

Grapiprant Products.

Under the Collaboration Agreement, Elanco has exclusive rights to Grapiprant Products globally outside the United States for development, manufacturing, marketing and commercialization in additional species and/or indications. Aratana was responsible under the Collaboration Agreement for all development activities required to obtain the first regulatory approval for grapiprant for use in dogs in the EU and Elanco is responsible for all other development activities going forward. In February 2016, we filed a marketing authorization application with the EMA for grapiprant in dogs in the EU. In cooperation with Elanco, in October 2017, we submitted additional information to the EMA. In November 2017, Elanco and Aratana announced the EMA’s CVMP adopted a positive opinion to recommend the marketing authorization of GALLIPRANT in the EU. In January 2018, Elanco and Aratana announced that the European Commission had adopted the decision to grant marketing authorization of GALLIPRANT in the EU.

AT-008 (rabacfosadine) for dogs in Europe.

AT-008 is a potential therapeutic candidate for canine lymphoma we sub-licensed from KU-Leuven and we have rights to develop and market the therapeutic candidate outside North America. VetDC has rights to the therapeutic candidate in North America, and it was conditionally approved by the FDA as Tanovea®-CA1 in late-2016. As Tanovea®-CA1 is established in the United States, we continue to evaluate if and how to move the therapeutic forward in Europe.

Other therapeutics for dogs and cats in Europe.

We have started to develop a dossier for EMA regulatory authorities on bupivacaine liposome injectable suspension in Europe. Separately, based on conversations with the EMA, we believe the path forward for capromorelin may be informed by studies investigating weight gain in cats.

12

Manufacturing and Supply Chain

We manage third-party manufacturers to supply API, drug product and packaged product for the development and commercialization of our small molecule product candidates. To ensure dependable and high-quality supply, we have chosen to rely on Current Good Manufacturing Practices (“cGMP”) compliant contract manufacturer organizations (“CMO”) rather than devote capital and manpower toward developing or acquiring internal manufacturing facilities. We utilize CMOs that have established track records of quality product supply and significant experience with regulatory requirements of both CVM and EMA. We believe we have or will have sufficient supply to conduct each of our currently contemplated studies and for the continued commercial supply of our products.

As our products move from development-stage to commercial-stage, we work with the relevant CMOs to make changes in the manufacturing process as required to complete process validation, scale-up capacity and to implement process improvements. Depending on the nature of the changes, we make supplemental manufacturing filings to obtain the required approval to manufacture and sell products. As has been the case with each of our commercialized small molecule products, such transition and supplemental approval process can cause delays in making the first commercial sale following the initial approval.

|

|

|

|

entyce (capromorelin oral solution) |

In February 2017, we announced the FDA requested additional information on our PAS to transfer the manufacturing of the API of ENTYCE to a different vendor than included on our original NADA in order to produce ENTYCE at commercial scale. We met with the FDA in April 2017 and in late-June 2017, we re-submitted the PAS with the FDA’s CVM. Subsequent to the re-submission of the PAS, we resumed manufacturing additional commercial inventory of ENTYCE, including API from the manufacturer for which we were seeking approval from CVM. In October 2017, we received approval of our PAS from CVM for the transfer and commercial scale-up of the API of ENTYCE, and we made ENTYCE commercially available in late-October 2017. With the alternate API vendor in place, we believe that we can maintain sufficient inventory to continuously supply ENTYCE to the market. In addition, we are investing to establish redundant commercial supply such that we can continue to improve our costs of goods and mitigate any potential supply issues. |

|

nocita (bupivacaine liposome injetable suspension) |

For NOCITA, Pacira is our exclusive supplier and under our December 2012 supply agreement, Pacira is responsible for supplying us with finished drug product in vials. We are responsible for the labeling, packaging and shipping of NOCITA. We must submit rolling forecasts to Pacira with a portion of each forecast constituting a binding commitment. The term of the supply agreement extends for as long as the license agreement with Pacira continues in force. The license agreement has a term of fifteen years, until December 5, 2027, after which we have the option to renew the term for an additional five years. Pacira may terminate the supply agreement if we fail to make an undisputed payment, if we breach a material provision of the agreement, or if Pacira ceases manufacture of the drug product. Pacira also has the unilateral right to change its manufacturing process for the drug product. In this case, if we cannot reach agreement on the terms of continued supply of NOCITA meeting current specifications and Pacira decides that it is no longer commercially reasonable to supply us with drug product meeting such specifications, then Pacira may terminate the supply agreement. Our NOCITA supply is labeled with a 12-month shelf life. In 2018, we anticipate investigating opportunities with Pacira for making the therapeutic available in additional vial sizes. |

|

Galliprant (grapiprant tablets) |

GALLIPRANT has been available to customers since January 2017, and as part of the Collaboration Agreement, we agreed to provide commercial supply of GALLIPRANT to Elanco for a specified period. In July 2017, Elanco provided us with notice of its intent to assume responsibility for manufacturing of the Grapiprant Products and its intent to assume the regulatory approvals pursuant to the Collaboration Agreement. As of September 2017, Elanco assumed ownership of the NADA and manufacturing responsibility for GALLIPRANT. Prior to Elanco assuming manufacturing responsibility, we charged Elanco for bulk API at a fixed price that was above or below the actual API costs that we incurred in manufacturing the product. Hence, in aggregate we captured a modest manufacturing margin. Elanco is also working on a technology transfer at its expense to secure redundant supply and capture process improvements. Upon the successful establishment of this alternate supply source, we are eligible for a $4.0 million milestone payment from Elanco. GALLIPRANT is currently available in 20 mg and 60 mg tablets in a variety of packaging configurations. The 100 mg tablets of GALLIPRANT remain on backorder to resolve isolated reports of 100 mg tablets breaking in the bottle. With the transfer of manufacturing responsibility, Elanco is responsible for the timing and availability of the 100 mg tablets. |

13

Canine Osteosarcoma Vaccine. Regarding AT-014, we transferred the manufacturing from Advaxis to a third-party USDA-licensed CMO. We have the ability to expand the relationship with the CMO, subject to our needs and growth of current and/or future biologic therapeutics.

BLONTRESS (canine lymphoma monoclonal antibody, B-cell) and TACTRESS (canine lymphoma monoclonal antibody, T-cell).

As previously announced, we determined in the third quarter of 2017 that customer demand did not justify manufacturing additional BLONTRESS or TACTRESS and therefore, we discontinued the therapeutics in November 2017. We also closed our USDA-licensed research and manufacturing facility in San Diego by the year ended 2017, which resulted in us no longer holding a USDA establishment license and voiding the BLONTRESS and TACTRESS licenses with the USDA.

Intellectual Property and License Agreements

We seek to protect our products and technologies through a combination of patents, regulatory exclusivity, and proprietary know-how. Our goal is to obtain, maintain and enforce patent protection for our products, formulations, processes, methods and other proprietary technologies, preserve our trade secrets, and operate without infringing on the proprietary rights of other parties, both in the United States and in other countries. Our policy is to actively seek to obtain, where appropriate, the broadest intellectual property protection possible for our current compounds and any future compounds for development, proprietary information and proprietary technology through a combination of contractual arrangements and patents, both in the United States and abroad. However, even patent protection may not always afford us with complete protection against competitors who seek to circumvent our patents.

We depend upon the skills, knowledge and experience of our scientific and technical personnel, as well as that of our advisors, consultants and other contractors, none of which is patentable. To help protect our proprietary know-how, which is not patentable, and inventions for which patents may be difficult to obtain or enforce, we rely on trade secret protection and confidentiality agreements to protect our interests. To this end, we generally require all of our employees, consultants, advisors and other contractors to enter into confidentiality agreements that prohibit the disclosure of confidential information and, where applicable, require disclosure and assignment to us of the ideas, developments, discoveries and inventions important to our business.

Exclusive License Agreements with RaQualia

In December 2010, we entered into two agreements with RaQualia pursuant to which we exclusively licensed intellectual property rights relating to AT-001 and AT-002 in the animal health field. Pursuant to these agreements we obtained the rights to certain patents in the United States and other jurisdictions. The patents relating to AT-001 include composition of matter claims as well as claims to methods of use of AT-001. The patent rights relating to the use of AT-001 further include methods of preparing the compounds of interest and salts, polymorphs and intermediates thereof, as well as certain combination therapies. Additionally, we licensed from RaQualia additional patent rights relating to AT-002 that include composition of matter claims as well as claims to methods of use of AT-002. Under these agreements, we were granted exclusive, worldwide licenses to develop, manufacture and commercialize AT-001 and AT-002 in the field of animal health, except that we cannot develop, manufacture or commercialize injectable AT-001 products in Japan, South Korea, China or Taiwan. We have the right to grant sublicenses to third parties under these agreements. Under our agreement with RaQualia, we are responsible for using commercially reasonable efforts to develop and commercialize AT-001 and AT-002. The patent that we believe covers the crystalline form of the AT-001 compound expires on February 21, 2027 and is expected to be eligible for a patent term extension to August 2029. Certain of the AT-002 patents and applications licensed under the agreement are expected to extend out to 2034. In addition, the use of AT-002 in companion animals is protected by an Aratana patent, which expires in January 2036.

We are responsible for contingent milestone payments upon achievement of development and regulatory milestones and royalties on net sales of licensed products, subject to certain potential offsets and deductions, under each of the AT-001 and AT-002 agreements, and the royalty percentage is in the mid-single digits. We must also pay to RaQualia a portion of royalties we receive from any sublicensees, subject to a minimum royalty on net sales by such sublicensees. Our royalty obligations apply on a country-by-country and licensed product-by-licensed product basis, and end upon the expiration or abandonment of all patents with valid claims covering a licensed product in a given country.

Each of the AT-001 and AT-002 agreements continues until terminated. RaQualia may terminate the AT-001 agreement or the AT-002 agreement if we fail to pay any undisputed fee under the relevant agreement and do not cure such failure within 60 days after RaQualia notifies us of such failure. We may terminate the AT-001 agreement or the AT-002 agreement, or any license granted under either agreement, on a patent-by-patent and country-by-country basis at will, upon 30 days’ prior written notice to RaQualia. Once all of the patents licensed under the AT-001 agreement or the AT-002 agreement have expired or been abandoned, the licenses granted under the relevant agreement become fully-paid and irrevocable.

GALLIPRANT Collaboration, License, Development and Commercialization and Co-Promotion Agreements with Elanco

On April 22, 2016, we entered into a Collaboration Agreement with Elanco that granted Elanco rights to develop, manufacture and commercialize Grapiprant Products, an FDA-approved therapeutic for the control of pain and inflammation associated with osteoarthritis in dogs. Elanco will have exclusive rights globally outside the United States and co-promotion rights with us in the United States during the term of the Collaboration Agreement.

14

Elanco paid us an upfront payment of $45.0 million. Elanco has also agreed to pay us a $4.0 million milestone related to European approval of a Grapiprant Product for the treatment of pain and inflammation, a $4.0 million milestone related to the manufacturing of a Grapiprant Product from an alternate supply source and up to $75.0 million upon the achievement of certain sales milestones. The sales milestone payments are subject to a one third reduction for each year the occurrence of the milestone is not achieved beyond December 31, 2021, with any non-occurrence beyond December 31, 2023, cancelling out the applicable milestone payment obligation entirely.

Elanco will also pay us royalty payments on a percentage of net sales in the mid-single to low-double digits. In addition, we and Elanco have agreed to pay 25% and 75%, respectively, of all third-party development fees and expenses through December 31, 2018, in connection with preclinical and clinical trials necessary for any registration or regulatory approval of the products (“Registration”), provided that our contribution to such development fees and expenses is capped at $7.0 million. We were responsible for all development activities required to obtain the first Registration for Grapiprant Products for use in dogs in each of the European Union and the United States, and Elanco is responsible for all other development activities.

The term of the collaboration will continue throughout the development and commercialization of the product candidates, on a product-by-product and country-by-country basis, until the latest of (i) the date on which no valid claim of certain issued or granted patents specified in the Collaboration Agreement in the respective country exists, (ii) the expiration of any regulatory exclusivity in such country covering such Grapiprant Product, and (iii) the tenth anniversary of the first commercial sale of such product in such country.

The Collaboration Agreement may be terminated by Elanco at any time upon 90 days’ written notice to us. The Collaboration Agreement may also be terminated by either party (i) for the other party’s material breach, where such breach is not cured within the timeframe specified by the agreement, (ii) upon the bankruptcy, insolvency or dissolution of the other party, or (iii) for certain activities involving the challenge of certain patents licensed by us to Elanco. Upon Elanco’s voluntary termination or termination for Elanco’s breach, among other things, (a) all licenses and rights granted to Elanco will terminate and revert to us, and (b) Elanco has agreed to assign to us all registrations and trademarks obtained in connection with the Grapiprant Products. Upon termination for our breach, among other things, Elanco may elect to retain its rights to the licenses granted by us under the Collaboration Agreement subject to specified payment obligations.

On April 22, 2016, in connection with the Collaboration Agreement, we entered into the Co-Promotion Agreement with Elanco to co-promote the Grapiprant Products in the United States.

Under the terms of the Co-Promotion Agreement, Elanco has agreed to pay us, as a fee for services performed and expenses incurred by us under the Co-Promotion Agreement, (i) 25% of the gross margin on net sales of Grapiprant Products sold in the United States under the Collaboration Agreement prior to December 31, 2018 (unless extended by mutual agreement), and (ii) a mid-single digit percentage of net sales of the Grapiprant Products in the United States after December 31, 2018 through 2028 (unless extended by mutual agreement).

The Co-Promotion Agreement expires on December 31, 2028, unless extended by mutual agreement. In addition, the Co-Promotion Agreement provides that it will automatically terminate if the Collaboration Agreement is terminated early.

Exclusive License Agreement with Pacira

In December 2012, we entered into an exclusive license agreement and related exclusive supply agreement with Pacira. Under the license agreement, we were granted an exclusive, worldwide license to develop and commercialize, but not to manufacture, AT-003 in the veterinary field. Pursuant to this agreement we obtained the rights to certain patent rights relating to AT-003 including composition of matter claims and methods of use thereof. Patents relating to the AT-003 formulation extend out to 2031.

We have the right to grant sublicenses to third parties outside the United States upon Pacira’s approval. Any sublicenses we wish to grant to third parties within the United States must be discussed with Pacira and approved by Pacira in its sole discretion and good faith reasonable business judgment. We are responsible for using commercially reasonable efforts to develop and commercialize AT-003, and for launching AT-003 within a specified time period following regulatory approval in certain countries.

We paid Pacira an upfront fee and are responsible for contingent milestone payments upon the achievement of certain development and commercial milestones and for royalties on net sales of AT-003 by us and our affiliates, with a tiered royalty percentage in the low- to mid-20s. We must pay Pacira a royalty on net sales of AT-003 by us and our affiliates, subject to certain reductions. We must also pay to Pacira a percentage of all payments we receive from any sublicensee, subject to certain offsets, and under certain circumstances, share a portion of Pacira’s royalty payment obligations to its third-party licensors. We are responsible for meeting minimum annual revenue requirements for AT-003 beginning the fifth year after the first commercial sale of AT-003. If we fail to meet these requirements, either we or Pacira may terminate the license agreement.

The term of the license agreement extends for 15 years, until December 5, 2027, after which we have the option to renew the term for an additional five years. Pacira may terminate the agreement in its entirety if we fail to pay any amount due within a specified time period, or on a country-by-country basis if we fail to achieve certain regulatory, clinical and commercial milestones within certain timeframes. We may terminate the agreement on a country-by-country basis either upon the entry of a generic competitor, or at will outside the United States or the European Union. Either we or Pacira may terminate the agreement if the other party materially breaches or files for bankruptcy and fails to cure such breach within a specified time period, or if we do not pay the minimum annual

15

revenue requirements referenced above. The agreement automatically terminates if Pacira terminates the related supply agreement and if certain circumstances involving a United States sublicensee occur and we do not meet certain financial obligations to Pacira.

Other

As part of our January 2014 acquisition of Okapi Sciences, we acquired certain patent rights that cover formulations of AT-006 and methods of making the active ingredient of AT-006. Issued patents relating to AT-006 expire in 2031 and 2032. There are also pending applications relating to the issued patents. We also have a license to certain patent rights that covers composition and methods of use of AT-008 outside of North America. These patent rights will expire between 2024 and 2027.

As part of our October 2013 acquisition of Vet Therapeutics, we acquired a patent family related to the speciesization of antibodies that cover all Vet Therapeutics products with an issued patent expiring in 2029. We also acquired a patent family related to antibody constant domain regions and uses thereof, which also covers all Vet Therapeutics products and has an issued United States patent expiring in 2032.

Regulatory

The development, approval and sale of animal health products are governed by the laws and regulations of each country in which we intend to sell our products. To comply with these regulatory requirements, we have established processes and resources to provide oversight of the development and launch of our products and their maintenance in the market.

Requirements for Approval of Veterinary Pharmaceuticals for Pets

As a condition to regulatory approval for sale of animal products, regulatory agencies worldwide require that a product to be used for pets be demonstrated to be safe for the intended use in the intended species; have substantial evidence of effectiveness for the intended use; have a defined manufacturing process that ensures that the product can be made with high quality consistency; and be safe for humans handling the product and for the environment.

Safety. To determine that a new veterinary drug is safe for use, regulatory bodies will require us to provide data from a safety study generated in laboratory cats and dogs tested at doses higher than the intended label dose, over a period of time determined by the intended length of dosing of the product. In the case of the CVM, the design and review of the safety study and the study protocol are completed prior to initiation of the study to help assure that the data generated will meet FDA requirements. These studies are conducted under rigorous quality control, including Good Laboratory Practice (“GLP”), to assure integrity of the data. They are designed to clearly define a safety margin, identify any potential safety concerns, and establish a safe dose for the product. This dose and effectiveness is evaluated in the pivotal field effectiveness study where the product is studied in the animal patient population in which the product is intended to be used. Field safety data, obtained in a variety of breeds and animals kept under various conditions, are evaluated to assure that the product will be safe in the target population. Safety studies are governed by regulations and regulatory pronouncements that provide the parameters of required safety studies and are utilized by regulatory bodies in the United States, the European Union, Japan and other countries.

Chemistry, Manufacturing and Controls. To assure that the product can be manufactured consistently, regulatory agencies will require us to provide documentation of the process by which the API is made and the controls applicable to that process that assure the API and the formulation of the final commercial product meet certain criteria, including purity and stability. For FDA and EMA approvals, both pharmaceutical API and commercial formulations are required to be manufactured at facilities that practice cGMP. After a product is approved, we will be required to communicate with the regulatory bodies any changes in the procedures or manufacturing site. For example, with regard to FDA-regulated products, different reporting requirements apply depending on the scope and extent of post-approval changes to the CMC. Generally, “major changes” (as defined in the FDA’s guidance documents) require a PAS filing, which has a 120-day review period by the FDA and must be approved by the FDA before distribution or sale of the product. “Moderate changes” (as defined in the FDA’s guidance documents) can be filed as a Supplement Changes Being Effected in 30 Days (“CBE30”) or as a Supplement Changes Being Effected (“CBE0”). Products manufactured involving changes filed as a CBE30 can be distributed and/or sold within 30 days of receipt of the CBE30 by the FDA or immediately if filed with the FDA as a CBE0. No affirmative approval is required by the FDA for those categories of changes. Finally, “minor changes” (as defined in the FDA’s guidance documents) are simply required to be provided to the FDA by companies in their annual reports on CMC application matters titled Minor Changes and Stability Reports.