As filed with the Securities and Exchange Commission on July 17 , 2014

Registration No. 333- 197304

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM F-10

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PRETIUM RESOURCES INC.

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant’s name into English (if applicable))

| British Columbia | 1040 | Not applicable | ||

| (Province or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number (if applicable)) | (I.R.S. Employer Identification Number (if applicable)) |

570 Granville Street, Suite 1600

Vancouver, British Columbia, Canada V6C 3P1

(604) 558-1784

(Address and telephone number of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

(302) 738-6680

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Copies to:

|

Bob J. Wooder

Blake, Cassels & Graydon LLP

595 Burrard Street, Suite 2600

Three Bentall Centre

Vancouver, British Columbia

Canada V7X 1L3

(604) 631-3330

|

Joseph J. Ovsenek

Pretium Resources Inc.

570 Granville Street, Suite 1600

Vancouver, British Columbia

Canada V6C 3P1

(604) 558-1784

|

Edwin S. Maynard

Paul, Weiss, Rifkind,

Wharton & Garrison LLP

1285 Avenue of the Americas

New York, New York 10019-6064

(212) 373-3000

|

Approximate date of commencement of proposed sale of the securities to the public: From time to time after the effective date of this Registration Statement.

Province of British Columbia

(Principal jurisdiction regulating this offering (if applicable))

1

It is proposed that this filing shall become effective (check appropriate box below):

|

A.

|

þ

|

upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada).

|

|

B.

|

o

|

at some future date (check appropriate box below)

|

|

1.

|

¨

|

pursuant to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing).

|

|

|

2.

|

¨

|

pursuant to Rule 467(b) on (date) at (time) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on (date).

|

|

|

3.

|

¨

|

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto.

|

|

|

4.

|

o

|

after the filing of the next amendment to this Form (if preliminary material is being filed).

|

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check the following box. þ

2

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

3

SHORT FORM BASE SHELF PROSPECTUS

| New Issue and Secondary Offering | July 16 , 2014 |

U.S.$600,000,000

Common Shares

Preferred Shares

Debt Securities

Subscription Receipts

Units

Warrants

This prospectus relates to the offering for sale from time to time, during the 25-month period that this prospectus, including any amendments hereto, remains effective, of the securities of Pretium Resources Inc. (“Pretium” or the “Company”) listed above in one or more series or issuances, with a total offering price of such securities, in the aggregate, of up to U.S.$600,000,000. The securities may be offered by us or by certain of our securityholders to be named in a prospectus supplement hereto. The securities may be offered separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of the sale and set forth in an accompanying prospectus supplement.

Our common shares are listed on the Toronto Stock Exchange (“TSX”) and on the New York Stock Exchange (“NYSE”), in each case, under the symbol “PVG”. On July 15 , 2014, the last trading day before the date hereof, the closing price per share of our common shares was C$8.70 on the TSX and U.S.$8.09 on the NYSE. Unless otherwise specified in an applicable prospectus supplement, our preferred shares, debt securities, subscription receipts, units and warrants will not be listed on any securities or stock exchange or on any automated dealer quotation system. There is currently no market through which our securities, other than our common shares, may be sold and purchasers may not be able to resell such securities purchased under this prospectus. This may affect the pricing of our securities, other than our common shares, in the secondary market, the transparency and availability of trading prices, the liquidity of these securities and the extent of issuer regulation. See “Risk Factors”.

We are permitted under a multijurisdictional disclosure system adopted by the securities regulatory authorities in Canada and the United States to prepare this prospectus in accordance with the disclosure requirements of Canada. Prospective investors in the United States should be aware that such requirements are different from those of the United States. Financial statements incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, and are subject to Canadian auditing and auditor independence standards, and thus may not be comparable to financial statements of United States companies.

Owning our securities may subject you to tax consequences both in Canada and the United States. Such tax consequences, including for investors who are resident in, or citizens of, the United States and Canada, are not described in this prospectus and may not be fully described in any applicable prospectus supplement. You should read the tax discussion in any prospectus supplement with respect to a particular offering and consult your own tax advisor with respect to your own particular circumstances.

Your ability to enforce civil liabilities under the U.S. federal securities laws may be affected adversely because we are incorporated under the federal laws of Canada, most of our officers and directors and the experts named in this prospectus are, and the underwriters, dealers or agents named in any prospectus supplement may be, residents of a country other than the United States, and a substantial portion of our assets and the assets of those officers, directors and experts are located outside of the United States.

Neither the U.S. Securities and Exchange Commission (the “SEC”), nor any state securities regulator has approved or disapproved the securities offered hereby or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offence.

No underwriter has been involved in the preparation of this prospectus or performed any review of the contents of this prospectus.

All applicable information permitted under securities legislation to be omitted from this prospectus that has been so omitted will be contained in one or more prospectus supplements that will be delivered to purchasers together with this prospectus. Each prospectus supplement will be incorporated by reference into this prospectus for the purposes of securities legislation as of the date of the prospectus supplement and only for the purposes of the distribution of the securities to which the prospectus supplement pertains. You should read this prospectus and any applicable prospectus supplement carefully before you invest in any securities issued pursuant to this prospectus. Our securities may be sold pursuant to this prospectus through underwriters or dealers or directly or through agents designated from time to time at amounts and prices and other terms determined by us or any selling securityholders. In connection with any underwritten offering of securities, the underwriters may over-allot or effect transactions which stabilize or maintain the market price of the securities offered. Such transactions, if commenced, may discontinue at any time. See “Plan of Distribution”. A prospectus supplement will set out the names of any underwriters, dealers, agents or selling securityholders involved in the sale of our securities, the amounts, if any, to be purchased by underwriters, the plan of distribution for such securities, including the net proceeds we expect to receive from the sale of such securities, if any, the amounts and prices at which such securities are sold and the compensation of such underwriters, dealers or agents.

Investment in the securities being offered is highly speculative and involves significant risks that you should consider before purchasing such securities. You should carefully review the risks outlined in this prospectus (including any prospectus supplement) and in the documents incorporated by reference as well as the information under the heading “Cautionary Note Regarding Forward-Looking Statements” and consider such risks and information in connection with an investment in the securities. See “Risk Factors”.

Our head office is located at Suite 1600 – 570 Granville Street, Vancouver, British Columbia, V6C 3P1 and our registered office is located at Suite 2900 – 550 Burrard Street, Vancouver, British Columbia, V6C 0A3, Canada.

Certain of the Company’s directors reside outside of Canada and have appointed an agent for service of process in Canada. See “Agent for Service of Process”.

Investors should rely only on the information contained in or incorporated by reference into this prospectus and any applicable prospectus supplement. We have not authorized anyone to provide investors with different information. Information contained on our website shall not be deemed to be a part of this prospectus (including any applicable prospectus supplement) or incorporated by reference and should not be relied upon by prospective investors for the purpose of determining whether to invest in the securities. We will not make an offer of these securities in any jurisdiction where the offer or sale is not permitted. Investors should not assume that the information contained in this prospectus is accurate as of any date other than the date on the face page of this prospectus, the date of any applicable prospectus supplement, or the date of any documents incorporated by reference herein.

TABLE OF CONTENTS

|

ABOUT THIS PROSPECTUS

|

i

|

|

CAUTIONARY NOTE FOR UNITED STATES INVESTORS

|

i

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

i

|

|

DOCUMENTS INCORPORATED BY REFERENCE

|

iii

|

|

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

|

iv

|

|

EXCHANGE RATE INFORMATION

|

v

|

|

THE COMPANY

|

1

|

|

THE BRUCEJACK PROJECT

|

2

|

|

RISK FACTORS

|

18

|

|

USE OF PROCEEDS

|

30

|

|

PRIOR SALES

|

31

|

|

MARKET FOR SECURITIES

|

31

|

|

EARNINGS COVERAGE

|

31

|

|

CONSOLIDATED CAPITALIZATION

|

31

|

|

DESCRIPTION OF SHARE CAPITAL

|

31

|

|

DESCRIPTION OF DEBT SECURITIES

|

31

|

|

DESCRIPTION OF WARRANTS

|

39

|

|

DESCRIPTION OF UNITS

|

41

|

|

DESCRIPTION OF SUBSCRIPTION RECEIPTS

|

41

|

|

CERTAIN INCOME TAX CONSIDERATIONS

|

43

|

|

SELLING SECURITYHOLDERS

|

43

|

|

PLAN OF DISTRIBUTION

|

43

|

|

AUDITORS, TRANSFER AGENT AND REGISTRAR

|

45

|

|

SCIENTIFIC AND TECHNICAL INFORMATION

|

46

|

|

INTEREST OF EXPERTS

|

46

|

|

AGENT FOR SERVICE OF PROCESS

|

46

|

|

LEGAL MATTERS

|

47

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

47

|

|

ENFORCEABILITY OF CIVIL LIABILITIES

|

47

|

ABOUT THIS PROSPECTUS

You should rely only on the information contained or incorporated by reference in this prospectus or any applicable prospectus supplement and on the other information included in the registration statement of which this prospectus forms a part. We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. We are not making an offer to sell or seeking an offer to buy the securities offered pursuant to this prospectus in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus or any applicable prospectus supplement is accurate only as of the date on the front of those documents and that information contained in any document incorporated by reference is accurate only as of the date of that document, regardless of the time of delivery of this prospectus or any applicable prospectus supplement or of any sale of our securities pursuant thereto. Our business, financial condition, results of operations and prospects may have changed since those dates.

Market data and certain industry forecasts used in this prospectus or any applicable prospectus supplement and the documents incorporated by reference in this prospectus or any applicable prospectus supplement were obtained from market research, publicly available information and industry publications. We believe that these sources are generally reliable, but the accuracy and completeness of this information is not guaranteed. We have not independently verified such information, and we do not make any representation as to the accuracy of such information.

In this prospectus and any prospectus supplement, unless otherwise indicated, all dollar amounts and references to “U.S.$” are to U.S. dollars and references to “C$” or “$” are to Canadian dollars. This prospectus and the documents incorporated by reference contain translations of some Canadian dollar amounts into U.S. dollars solely for your convenience. See “Exchange Rate Information”.

In this prospectus and in any prospectus supplement, unless the context otherwise requires, references to “we”, “us”, “our” or similar terms, as well as references to “Pretium” or the “Company”, refer to Pretium Resources Inc. together with our subsidiaries.

CAUTIONARY NOTE FOR UNITED STATES INVESTORS

We are permitted under a multi-jurisdictional disclosure system adopted by the securities regulatory authorities in Canada and the United States to prepare this prospectus, including the documents incorporated by reference and any prospectus supplement, in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws.

Technical disclosure regarding our properties included herein and in the documents incorporated herein by reference has not been prepared in accordance with the requirements of U.S. securities laws. Without limiting the foregoing, such technical disclosure uses terms that comply with reporting standards in Canada and certain estimates are made in accordance with National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all mineral reserve and mineral resource estimates contained in the technical disclosure have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System.

Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC, and mineral reserve and resource information contained or incorporated by reference in this prospectus and any prospectus supplement may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term "resource" does not equate to the term “reserves”. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made and volumes that are not “reserves’ should not be disclosed. Among other things, all necessary permits would be required to be in hand or issuance imminent in order to classify mineralized material as reserves under the SEC standards. Accordingly, mineral reserves estimates included herein and in the documents incorporated herein by reference may not qualify as “reserves” under SEC standards. The SEC's disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute "reserves" by U.S. standards in documents filed with the SEC.

U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. In addition, the definitions of “proven mineral reserves” and “probable mineral reserves” under reporting standards in Canada differ in certain respects from the standards of the SEC. Accordingly, information concerning mineral deposits set forth herein and in the documents incorporated herein by reference may not be comparable with information made public by companies that report in accordance with U.S. standards.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, and the documents incorporated by reference herein, contain “forward-looking information” and “forward looking statements” within the meaning of applicable Canadian and United States securities legislation (collectively herein referred to as “forward-looking statements”), including the “safe harbour” provisions of provincial securities legislation and the U.S. Private Securities Litigation Reform Act of 1995, Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 27A of the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”). Forward-looking statements may include, but are not limited to, information with respect to our planned exploration and development activities, the adequacy of our financial resources, the estimation of mineral resources, realization of mineral resource estimates, timing of development of the Brucejack Project (as defined below), costs and timing of future exploration, results of future exploration and drilling, production and processing estimates, capital and operating cost estimates, timelines and similar statements relating to the economic viability of the Brucejack Project, timing and receipt of approvals, consents and permits under applicable legislation, our executive compensation approach and practice, and adequacy of financial resources. Wherever possible, words such as “plans”, “expects”, “projects”, “assumes”, “budgeted”, “strategy”, “scheduled”, “estimates”, “forecasts”, “anticipates”, “believes”, “intends” “modelled” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative forms of any of these terms and similar expressions, have been used to identify forward-looking statements.

i

Statements concerning mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the property is developed. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation, risks related to:

|

|

·

|

uncertainty as to the outcome of legal proceedings including certain class action proceedings in the U.S. and Canada;

|

|

|

·

|

the exploration, development and operation of a mine or mine property, including the potential for undisclosed liabilities on our mineral projects;

|

|

|

·

|

the fact that we are a relatively new company with no mineral properties in production or development and no history of production or revenue;

|

|

|

·

|

our ability to obtain adequate financing for our planned exploration and development activities and to complete further exploration programs;

|

|

|

·

|

dependency on the Brucejack Project for our future operating revenue;

|

|

|

·

|

our mineral resource estimates, including accuracy thereof and our ability to upgrade such mineral resource estimates and establish mineral reserve estimates;

|

|

|

·

|

uncertainties relating to the interpretation of drill results and the geology, grade and continuity of our mineral deposits;

|

|

|

·

|

commodity price fluctuations, including gold price volatility;

|

|

|

·

|

our history of negative operating cash flow, incurred losses and accumulated deficit;

|

|

|

·

|

market events and general economic conditions;

|

|

|

·

|

the inherent risk in the mining industry;

|

|

|

·

|

the commercial viability of our current and any acquired mineral rights;

|

|

|

·

|

availability of suitable infrastructure or damage to existing infrastructure;

|

|

|

·

|

governmental regulations, including environmental regulations;

|

|

|

·

|

delay in obtaining or failure to obtain required permits, or non-compliance with permits that are obtained;

|

|

|

·

|

increased costs and restrictions on operations due to compliance with environmental laws and regulations;

|

|

|

·

|

compliance with emerging climate change regulation;

|

|

|

·

|

adequate internal control over financial reporting;

|

|

|

·

|

increased costs of complying with the Dodd-Frank Act;

|

|

|

·

|

potential opposition from non-governmental organizations;

|

|

|

·

|

uncertainty regarding unsettled First Nations rights and title in British Columbia;

|

|

|

·

|

uncertainties related to title to our mineral properties and surface rights;

|

|

|

·

|

land reclamation requirements;

|

|

|

·

|

our ability to identify and successfully integrate any material properties we acquire;

|

|

|

·

|

currency fluctuations;

|

|

|

·

|

increased costs affecting the mining industry;

|

|

|

·

|

increased competition in the mining industry for properties, qualified personnel and management;

|

|

|

·

|

our ability to attract and retain qualified management;

|

|

|

·

|

some of our directors’ and officers’ involvement with other natural resource companies;

|

|

|

·

|

potential inability to attract development partners or our ability to identify attractive acquisitions;

|

|

|

·

|

potential liabilities associated with our acquisition of material properties;

|

|

|

·

|

our ability to comply with foreign corrupt practices regulations and anti-bribery laws;

|

|

|

·

|

changes to relevant legislation, accounting practices or increasing insurance costs;

|

|

|

·

|

our anti-takeover provisions could discourage potentially beneficial third party takeover offers;

|

|

|

·

|

significant growth could place a strain on our management systems;

|

|

|

·

|

share ownership by our significant shareholders, their ability to influence our governance and possible market overhang;

|

|

|

·

|

there is no market for our securities other than our common shares;

|

ii

|

|

·

|

the trading price of our common shares is subject volatility due to market conditions;

|

|

|

·

|

future sales or issuances of our equity securities;

|

|

|

·

|

certain actions under U.S. federal securities laws may be unenforceable;

|

|

|

·

|

if we raise debt securities, they will be unsecured and will rank equally with other unsecured debt;

|

|

|

·

|

our broad discretion relating to the use of any proceeds raised hereunder;

|

|

|

·

|

we do not intend to pay dividends in the near future; and

|

|

|

·

|

our being treated as a passive foreign investment company for U.S. federal income tax purposes.

|

This list is not exhaustive of the factors that may affect any of our forward-looking statements. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Forward-looking statements involve statements about the future and is inherently uncertain, and our actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in this prospectus under the heading “Risk Factors” and elsewhere in this prospectus. Our forward-looking statements are based on the beliefs, expectations and opinions of management on the date the statements are made. In connection with the forward-looking statements contained in this prospectus, we have made certain assumptions about our business, including about our planned exploration and development activities; the accuracy of our mineral resource estimates; capital and operating cost estimates; production and processing estimates; the results, costs and timing of future exploration and drilling; timelines and similar statements relating to the economic viability of the Brucejack Project; timing and receipt of approvals, consents and permits under applicable legislation; and the adequacy of our financial resources. We have also assumed that no significant events will occur outside of our normal course of business. Although we believe that the assumptions inherent in the forward-looking statements are reasonable as of the date of this prospectus, forward-looking statements are not guarantees of future performance due to the inherent uncertainty therein. We do not assume any obligation to update forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by applicable law. For the reasons set forth above, prospective investors should not place undue reliance on forward-looking statements.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this prospectus from documents filed with securities commissions or similar authorities in Canada and with the SEC in the United States. Copies of the documents incorporated by reference in this prospectus and not delivered with this prospectus may be obtained on request without charge from the Corporate Secretary of Pretium Resources Inc. at Suite 1600 – 570 Granville Street, Vancouver, British Columbia, V6C 3P1, Canada, telephone: (604) 558-1784 or by accessing the disclosure documents through the Internet on the Canadian System for Electronic Document Analysis and Retrieval, or SEDAR, at www.sedar.com. Documents filed with, or furnished to, the SEC are available through the SEC’s Electronic Data Gathering and Retrieval System, or EDGAR, at www.sec.gov.

The following documents, filed with the securities commissions or similar regulatory authorities in certain provinces and territories of Canada and filed with, or furnished to, the SEC are specifically incorporated by reference into, and form an integral part of, this prospectus:

|

|

·

|

our annual information form for the fiscal year ended December 31, 2013, dated as of March 31, 2014;

|

|

|

·

|

our audited annual consolidated financial statements for the fiscal years ended December 31, 2013 and 2012, together with the notes thereto and the auditor’s reports thereon (the “Audited Financial Statements”);

|

|

|

·

|

our management’s discussion and analysis of our financial condition and results of operations for the years ended December 31, 2013 and 2012;

|

|

|

·

|

our unaudited condensed consolidated interim financial statements as at and for the three month periods ended March 31, 2014 and 2013;

|

|

|

·

|

our management’s discussion and analysis of our financial condition and results of operations for the three month period ended March 31, 2014;

|

|

|

·

|

our management information circular dated April 10, 2014, distributed in connection with our annual general meeting of shareholders held on May 14, 2014;

|

|

|

·

|

our material change report dated February 21, 2014 announcing a private placement equity offering of 568,182 “investment tax credit” flow-through common shares (the “ITC Flow-Through Shares”) and 1,863,455 “Canadian exploration expenses” flow-through common shares (the “CEE Flow-Through Shares” and together with the ITC Flow-Through Shares, the “Flow-Through Shares”) for aggregate gross proceeds to us of approximately C$20 million (the “2014 Private Placement”);

|

|

|

·

|

our material change report dated March 13, 2014 announcing highlights from the fourth quarter of 2013 and providing an update on our Brucejack Project;

|

|

|

·

|

our material change report dated March 14, 2014 announcing our adoption of an advance notice policy;

|

|

|

·

|

our material change report dated March 14, 2014 announcing the closing of the 2014 Private Placement;

|

iii

|

|

·

|

our material change report dated March 20, 2014 announcing that Mr. James A. Currie was appointed as Chief Operating Officer and Mr. Joseph J. Ovsenek, our Chief Development Officer, was promoted to Executive Vice President;

|

|

|

·

|

our material change report dated March 20, 2014 announcing that the agent’s had exercised their option in respect of the 2014 Private Placement resulting in the issuance of an additional 869,566 CEE flow-through common shares for aggregate gross proceeds to us of approximately C$7 million;

|

|

|

·

|

our material change report dated May 14, 2014 announcing highlights from the first quarter of 2014 and providing an update on our Brucejack Project;

|

|

|

·

|

our material change report dated May 16, 2014 announcing that Mr. Peter Birkey was elected to our Board of Directors at our annual general meeting of shareholders held on May 14, 2014;

|

|

|

·

|

our material change report dated June 20, 2014, announcing the results of an updated NI 43-101 compliant feasibility study for the Brucejack Project; and

|

|

|

·

|

our NI 43-101 feasibility study on the Brucejack Project entitled “Feasibility Study and Technical Report Update on the BruceJack Project, Stewart, BC” with an effective date of June 19, 2014, which was prepared for us by Tetra Tech and co-authored by Snowden Mining Industry Consultants Inc. (“Snowden”), AMC Mining Consultants (Canada) Ltd. (“AMC”), ERM Rescan, BGC Engineering Inc. (“BGC”), Alpine Solutions Avalanche Services (“Alpine Solutions”) and Valard Construction (“Valard”) (the “Brucejack Technical Report”).

|

Any documents of the type described in Section 11.1 of Form 44-101F1 Short Form Prospectuses filed by the Company with a securities commission or similar authority in any province of Canada subsequent to the date of this short form prospectus and prior to the expiry of this prospectus, or the completion of the issuance of securities pursuant hereto, will be deemed to be incorporated by reference into this prospectus.

In addition, to the extent that any document or information incorporated by reference into this prospectus is filed with, or furnished to, the SEC pursuant to the Exchange Act after the date of this prospectus, such document or information will be deemed to be incorporated by reference as an exhibit to the registration statement of which this prospectus forms a part (in the case of a report on Form 6-K, if and to the extent expressly provided therein).

A prospectus supplement containing the specific terms of any offering of our securities will be delivered to purchasers of our securities together with this prospectus and will be deemed to be incorporated by reference in this prospectus as of the date of the prospectus supplement and only for the purposes of the offering of our securities to which that prospectus supplement pertains.

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein, in any prospectus supplement hereto or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement is not to be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of material fact or an omission to state a material fact that is required to be stated or is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

Upon our filing of a new annual information form and the related annual financial statements and management’s discussion and analysis with applicable securities regulatory authorities during the currency of this prospectus, the previous annual information form, the previous annual financial statements and management’s discussion and analysis and all interim financial statements, supplemental information, material change reports and information circulars filed prior to the commencement of our financial year in which the new annual information form is filed will be deemed no longer to be incorporated into this prospectus for purposes of future offers and sales of our securities under this prospectus. Upon interim consolidated financial statements and the accompanying management’s discussion and analysis and material change report being filed by us with the applicable securities regulatory authorities during the duration of this prospectus, all interim consolidated financial statements and the accompanying management’s discussion and analysis and material change report filed prior to the new interim consolidated financial statements shall be deemed no longer to be incorporated into this prospectus for purposes of future offers and sales of securities under this prospectus.

References to our website in any documents that are incorporated by reference into this prospectus do not incorporate by reference the information on such website into this prospectus, and we disclaim any such incorporation by reference.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been or will be filed or furnished with the SEC as part of the registration statement of which this prospectus forms a part: (i) the documents listed under the heading “Documents Incorporated by Reference”; (ii) powers of attorney from our directors and officers, as applicable; (iii) the consent of PricewaterhouseCoopers LLP; (iv) the consent of each “qualified person” for the purposes of NI 43-101 listed on the Exhibit Index of the registration statement ; and (v) the form of indenture relating to the debt securities that may be issued under this prospectus.

iv

EXCHANGE RATE INFORMATION

The following table sets forth for each period indicated: (i) the noon exchange rates in effect at the end of the period; (ii) the high and low noon exchange rates during such period; and (iii) the average noon exchange rates for such period, for one Canadian dollar, expressed in U.S. dollars, as quoted by the Bank of Canada.

|

Year Ended December 31

|

|||||||||

|

2013

|

2012

|

2011

|

|||||||

|

U.S.$

|

U.S.$

|

U.S.$

|

|||||||

|

Closing

|

0.9402 | 1.0051 | 0.9833 | ||||||

|

High

|

1.0164 | 1.0299 | 1.0583 | ||||||

|

Low

|

0.9348 | 0.9599 | 0.9430 | ||||||

|

Average

|

0.9710 | 1.0004 | 1.0111 | ||||||

|

Three Months Ended March 31

|

|||||||||

|

2014

|

2013

|

2012

|

|||||||

|

U.S.$

|

U.S.$

|

U.S.$

|

|||||||

|

Closing

|

0.9047

|

0.9846

|

1.0009

|

||||||

|

High

|

0.9422

|

1.0164

|

1.0153

|

||||||

|

Low

|

0.8888

|

0.9696

|

0.9735

|

||||||

|

Average

|

0.9064

|

0.9917

|

0.9989

|

||||||

On July 15 , 2014, the noon exchange rate as quoted by the Bank of Canada was U.S.$1.00 = C$1.0766 .

v

THE COMPANY

The Company was incorporated under the Business Corporations Act (British Columbia) (the “BCBCA”) on October 22, 2010. We currently have two wholly-owned subsidiaries, Pretium Exploration Inc. and 0890696 B.C. Ltd, which hold our interests in the Brucejack Project and the assets related thereto, both of which were incorporated under the BCBCA. Pretium is authorized to issue an unlimited number of common shares and an unlimited number of preferred shares, each without par value. Our common shares commenced trading on the TSX on December 21, 2010 and on the NYSE on January 12, 2012.

Our registered office is located at Suite 2900 – 550 Burrard Street, Vancouver, British Columbia, V6C 0A3, Canada and our head office and principal place of business are located at 1600 – 570 Granville Street, Vancouver, British Columbia, V6C 3P1.

Our Business

We are an exploration and development company that was formed for the acquisition, exploration and development of precious metal resource properties in the Americas. Our only material mineral project for the purposes of National Instrument 43-101 – Standard of Disclosure for Mineral Projects (“NI 43-101”) is the Brucejack Project, an advanced stage exploration project located in north-western British Columbia (the “Brucejack Project”). We also have a 100% interest in the Snowfield Project (the “Snowfield Project”), which borders the Brucejack Project to the north.

We intend to focus our exploration and development efforts on the Brucejack Project and, in particular, on expanding, and increasing the quality of our mineral resources and on advancing engineering studies on the higher grade underground opportunities at the Brucejack Project.

Our strategy is to grow our business through the exploration and acquisition of quality precious metals projects. The Brucejack Project is our only material project and we intend to continue exploration of the Brucejack Project as described herein. We believe Snowfield Project represents a longer term gold opportunity. Although we currently do not have a development plan for the Snowfield Project, we intend to continue to explore the area and have budgeted for additional environmental studies which we believe will benefit both the Brucejack and Snowfield Projects.

We acquired the Brucejack Project, along with the Snowfield Project and other associated assets (together, the “Project Assets”), pursuant to an acquisition agreement dated October 28, 2010, as amended (the “Acquisition Agreement”), with Silver Standard Resources Inc. (“Silver Standard”), for an aggregate acquisition price of $450 million, consisting of a cash payment of $233,020,000 and the issuance of a total of 36,163,333 of our common shares (the “Acquisition”). We financed the cash portion of the Acquisition with part of the proceeds from our initial public offering, which closed concurrently with the acquisition of the Project Assets in December 2010.

We entered into an investor rights agreement dated December 21, 2010 (the “Investor Rights Agreement”) with Silver Standard that provides that, as long as Silver Standard and its affiliates hold at least 10% of our issued and outstanding common shares:

|

|

·

|

Silver Standard is entitled to nominate to serve as members of our board of directors (the “Board”) the number of nominees equal to the lesser of (i) one less than the number which constitutes a majority of the Board and (ii) the percentage of issued and outstanding common shares and securities convertible or exchangeable into common shares held by Silver Standard multiplied by the number of directors comprising the Board (rounded to the nearest whole number);

|

|

|

·

|

Silver Standard and its affiliates have the right to maintain their proportionate ownership of our common shares by participating pro rata in issuances of common shares (save in respect of equity compensation plans); and

|

|

|

·

|

Silver Standard and its affiliates have the right to sell common shares by participating pro rata in prospectus offerings by us (to a maximum of 20% of any such offering).

|

Recent Developments

Updated Technical Report for the Brucejack Project

On June 30, 2014, we filed the Brucejack Technical Report. For more details regarding the Brucejack Technical Report or the Brucejack Project generally, see “The Brucejack Project” below.

Management Changes & Corporate Update

On March 10, 2014, we announced the appointment of Mr. James A. Currie as our Chief Operating Officer with the intent that he will lead the development of the Brucejack Project into production as an underground mine. Joseph J. Ovsenek, Chief Development Officer, was concurrently promoted to Executive Vice President. Mr. Ovsenek joined Pretium in January 2011 as Chief Development Officer and Director, and oversees a broad scope of our strategic corporate functions including financing and project permitting.

1

Subsequently, we also announced the adoption of an advance notice policy to provide our shareholders, directors and management with a clear framework for nominating persons for election as directors of the Company. Among other things, the advance notice policy sets a deadline by which holders of record of our common shares must submit director nominations to the Company prior to any annual or special meeting of shareholders and sets forth the specific information that a shareholder must include in the written notice for an effective nomination to occur. No person will be eligible for election as a director of the Company unless nominated in accordance with the provisions of the advance notice policy.

On May 16, 2014, we announced that Mr. Peter Birkey was elected to the Board at our annual general meeting of shareholders held on May 14, 2014. Mr. Birkey, who was nominated by Liberty Metals & Mining Holding, LLC (“Liberty”) under the terms of the April 22, 2013 subscription agreement between Pretium and Liberty, will serve on the Board’s Audit committee. Pursuant to the April 22, 2013 subscription agreement, for so long as Liberty and their affiliates hold at least 4.75% of our issued and outstanding common shares, Liberty is entitled to nominate one individual to serve on our Board and Liberty has the right to maintain its and its affiliates proportionate ownership of our common shares by participating pro rata in issuances of our common shares (subject to certain exceptions). As of March 23, 2014, Liberty and its affiliates held approximately 6.3% of our issued and outstanding common shares.

2014 Private Placement

On March 6, 2014, we closed the 2014 Private Placement and on March 20, 2014, we closed the final tranche of the agents’ option in respect of the 2014 Private Placement. Pursuant to the 2014 Private Placement, we issued the ITC Flow-Through Shares at a price of $8.80 per share and the CEE Flow-Through Shares at a price of $8.05. A total of 3,425,327 Flow-Through Shares were issued under the offering, for aggregate gross proceeds to us of approximately $28.0 million.

THE BRUCEJACK PROJECT

Unless stated otherwise, the information in this section is solely derived from, and in some instances is an extract from, the Brucejack Technical Report. The Brucejack Technical Report is incorporated by reference herein and, for full technical details, reference should be made to the full text of the Brucejack Technical Report, which is available electronically on the SEDAR website at www.sedar.com under our SEDAR profile, as the Brucejack Technical Report contains additional assumptions, qualifications, references, reliances and procedures which are not fully described herein.

The “Resource Estimate” in the Brucejack Technical Report has been prepared in compliance with NI 43-101 and Form 43-101F1 which require that all estimates be prepared in accordance with the “CIM Definition Standards on Mineral Resources and Mineral Reserves as prepared by the CIM Standing Committee on Reserve Definitions” and in effect as of the effective date of the Brucejack Technical Report. The quantity and grade of reported inferred resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred resources as an indicated or measured mineral resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured mineral resource category. Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

Introduction

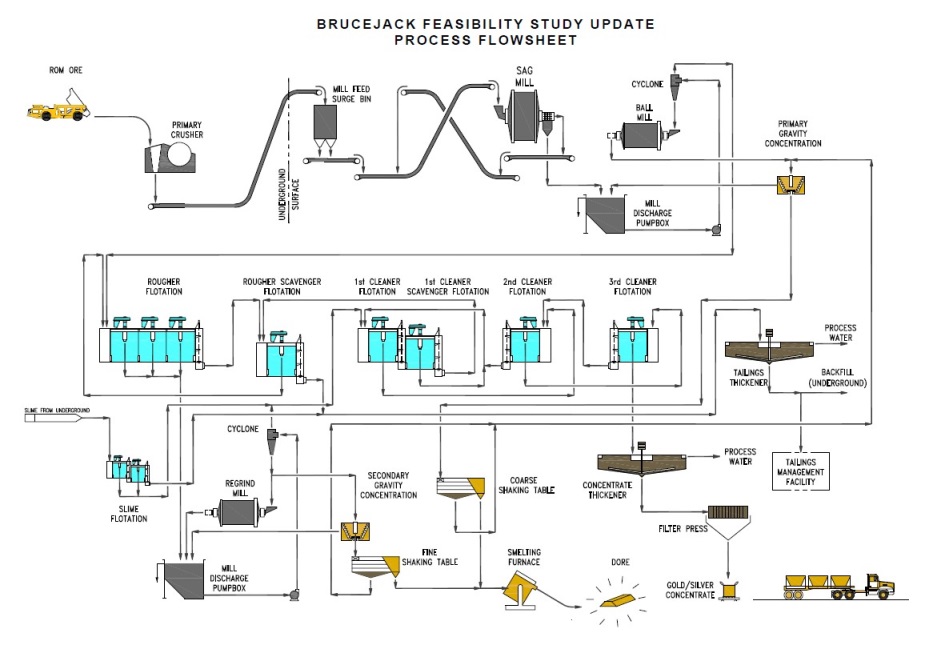

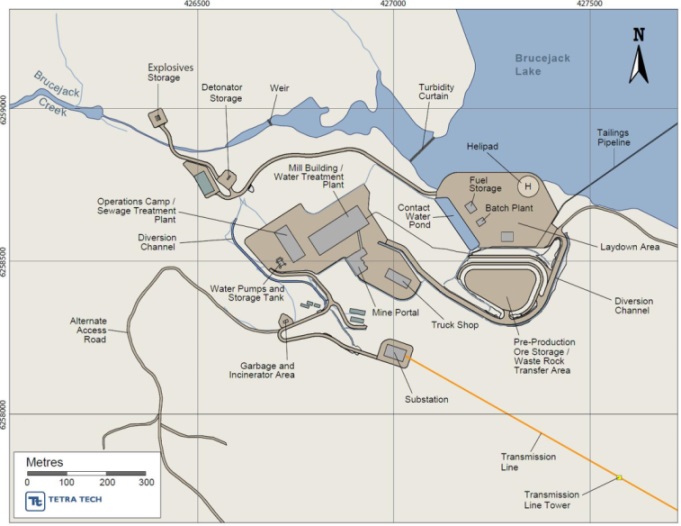

The Brucejack Project, located in northwestern British Columbia, will be a 2,700 t/d underground mining operation over a 18-year life-of-mine (“LOM”). Ore will be processed using a combination of conventional sulphide flotation and gravity concentration to recover gold and silver. The Brucejack Project is 100% owned by Pretium.

In 2014, Pretium commissioned a team of consultants to complete a feasibility study update in accordance with NI 43-101 for the Brucejack Project. The following consultants were commissioned to complete the component studies for the purpose of the feasibility study update:

|

|

·

|

Tetra Tech: overall project management; mineral processing and metallurgical testing; recovery methods; access infrastructure; internal site roads and pad areas; grading and drainage; ancillary facilities; water supply and distribution; water treatment plant; communications; power supply and distribution; fuel supply and distribution; off-site infrastructure; market studies and contracts; capital cost estimate; processing operating cost estimate; financial analysis; and project execution plan;

|

|

|

·

|

Snowden: property description and location; accessibility, climate, and physiology; history; geological setting and mineralization; deposit types; exploration; drilling; sample preparation; data verification; adjacent properties; and mineral resource estimates;

|

|

|

·

|

AMC: mining, including mine capital and operating cost estimates; and mineral reserve estimates;

|

|

|

·

|

ERM Rescan: environmental studies, permits, and social or community impacts; and tailings delivery system;

|

2

|

|

·

|

BGC: geotechnical design; mine hydrogeological/groundwater; waste disposal; environmental water management and water quality, acid rock drainage and metal leaching;

|

|

|

·

|

Alpine Solutions: avalanche hazard assessment; and

|

|

|

·

|

Valard: transmission line.

|

Property Description and Location

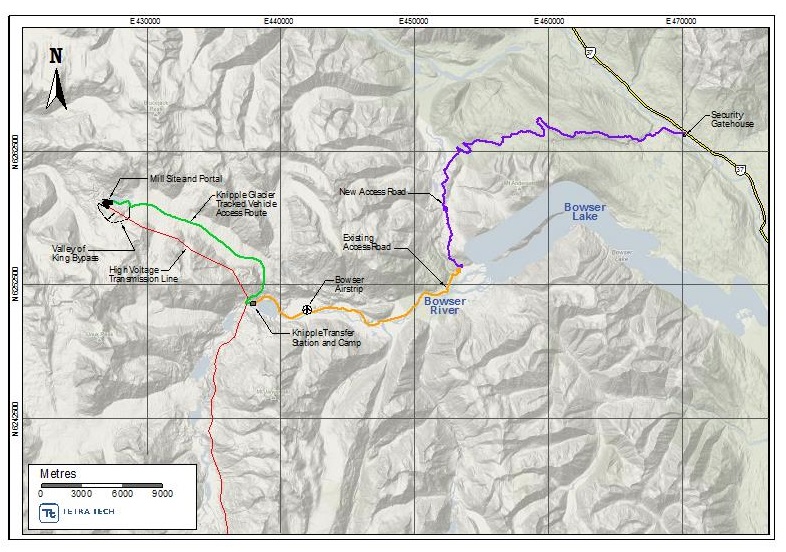

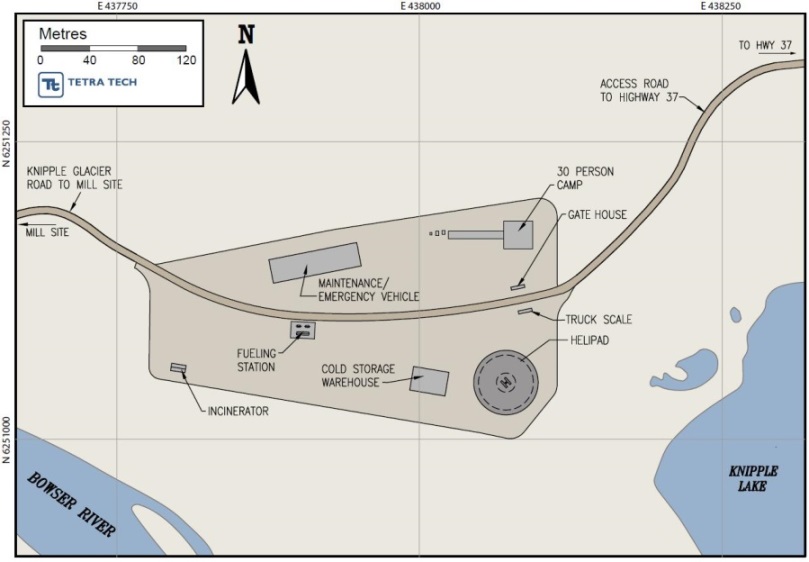

The Brucejack Project is situated approximately at 56°28′20″N Latitude by 130°11′31″W Longitude, a position approximately 950 km northwest of Vancouver, 65 km north-northwest of Stewart, and 21 km south-southeast of the Eskay Creek Mine in the Province of British Columbia. The Brucejack Project consists of six mineral claims totalling 3,199.28 ha in area and all claims are in good standing until January 31, 2025.

The Brucejack Project and the surrounding region have a history rich in exploration for precious and base metals dating back to the late 1800s. More recently in 2009 Silver Standard began work on the Brucejack Project. The 2009 program included drilling, rock-chip and channel sampling, and re-sampling of historical drill core. In 2010, pursuant to the Acquisition Agreement between Silver Standard (as the seller) and Pretium (as the buyer), Silver Standard sold to Pretium all of the issued shares of 0890693 BC Ltd., the owner of the Brucejack Project and the adjacent Snowfield Project.

Geology and Mineralization

The Brucejack Project is largely underlain by volcano-sedimentary rocks of the Lower Jurassic Hazelton Group. These rocks unconformably overlie volcanic arc sedimentary rocks of the Upper Triassic Stuhini Group along the westernmost part of the Brucejack Project.

Gold (± silver) mineralization is hosted in predominantly sub-vertical vein, vein stockwork, and subordinate vein breccia systems of variable intensity. The vein/stockwork systems display both parallel and discordant relationships to stratigraphy. These systems are relatively continuous along strike (several tens of metres to several hundreds of metres).

Several mineralization zones have been explored to varying degrees including (from south to north): Bridge Zone, Valley of the Kings (the “VOK” or “VOK Zone”), West Zone, Gossan Hill, Shore Zone, and SG Zone.

High-grade gold mineralization in the VOK, the current focus of the Brucejack Project, occurs in a series of west-northwest (and subordinate west-southwest) trending sub-vertical corridors of structurally reoriented vein stockworks and vein breccias. Stockwork mineralization displays both discordant and concordant relationships to the volcanic pile stratigraphy. Gold is typically present as gold-rich electrum within deformed quartz-carbonate (±adularia) vein stockworks, veins, and subordinate vein breccias.

Recent underground exploration carried out as a part of the bulk sample program confirmed the location of corridors of stockwork-style mineralization and the lithological contacts in this part of the deposit (within the VOK).

The VOK deposit is currently defined over 1,200 m in east-west extent, 600 m in north-south extent, and up to 650 m in depth below the topographic surface. The West Zone appears to form the northern limb of an anticline that links up with the VOK in the south, and the southern limb of a syncline that extends further to the north. This zone, which is currently defined over 590 m along its northwest strike, 560 m across strike, and down to 650 m in depth, is open to the northwest, southeast, and at depth to the northeast.

The Brucejack deposit is considered to be a transitional to intermediate sulphidation epithermal stockwork vein system-hosted gold-silver deposit that was developed in a dynamic extensional basin. It is likely associated with a deeper porphyry system that developed within an active island arc tectonic setting.

Mineral Resource Estimates

In August 2013, Snowden was engaged by Pretium to complete an update of the Mineral Resource estimate for the VOK Zone at the Brucejack Project in compliance with NI 43-101 and Form 43-101F1. In addition, the West Zone estimate created as part of the April 2012 Mineral Resource estimate has been documented in the Brucejack Technical Report for completeness. West Zone was not updated for the Brucejack Technical Report Mineral Resource estimate as there has been very little additional drilling in this area.

Drilling, Sampling, Assaying and Data Verification

The input data for the VOK Mineral Resource estimate comprised 932 drillholes totalling 218,238 m. The drilling consisted of:

|

|

·

|

9 historic drillholes (579 m);

|

|

|

·

|

490 surface drillholes drilled between 2009 and 2012 (173,619 m);

|

3

|

|

·

|

24 surface drillholes drilled in 2013 (5,200 m); and

|

|

|

·

|

409 underground drillholes drilled in 2013 (38,840 m).

|

The sample data for the West Zone estimate comprised 756 drillholes (63,208 m) including 439 underground drillholes (24,688 m), 269 historical surface drillholes (21,321 m) and 48 surface drillholes (17,199 m) completed since 2009.

Historical drill core sizes for surface drillholes were generally NQ (47.6 mm diameter) or BQ (36.5 mm diameter). The core size for drillholes collared from an underground exploration ramp at West Zone was AQ (27 mm diameter).

Core sizes for Pretium’s surface collared drillholes were PQ (85 mm diameter), HQ (63.5 mm diameter) and NQ (47.6 mm diameter). Approximately 50% to 60% of the Pretium core was HQ size. For drillholes less than 600 m length, core size was commenced at HQ and reduced to NQ when required. For drillholes greater than 600 m length the commencing core size was PQ which was run down to between 200 m and 300 m in order to minimize drill path deviation. All drillcore collected from the underground drilling in 2013 was HQ size. No significant bias was noted between the PQ and HQ drill core samples that intersected the VOK mineralization. No testing was required on the NQ drill tails as these were almost without exception at depths below the main mineralization zones.

The drill collars were surveyed by McElhanney Surveying from Terrace, British Columbia. McElhanney Surveying used a total station instrument and permanent ground control stations for reference and have completed all the surveying on the Brucejack Project since 2009. All underground drill collars were surveyed by Procon.

Drillhole paths were surveyed at a nominal 50 m interval using a Reflex EZ single shot instrument. All drillhole paths were checked in a mining software package for deviation errors, which, if present, were corrected on a real time basis. There is no apparent drilling or recovery factor that would materially impact the accuracy and reliability of the drilling results.

Split PQ samples weigh approximately 10 kg. HQ samples were around 6 kg and NQ 3 to 4 kg. These weights assume a nominal 1.5 m sample length. In general, the average sample size submitted to the primary analytical laboratory, ALS Chemex (“ALS”) was 6.5 kg. Samples at ALS were crushed to 70% passing 2 mm, (-10 mesh). Samples were riffle split and 500 g were pulverized to 85% passing 75 µm (-200 mesh). The remaining coarse reject material was returned to Pretium for storage in their Stewart, British Columbia warehouse.

Gold was determined using fire assay on a 30 g aliquot with an atomic absorption spectroscopy finish. In addition, a 33 element package was also analysed using a four acid digest with an inductively coupled plasma-atomic emission spectroscopy finish, which included silver. Specific gravity determinations were done by ALS using the pycnometer method on pulps from the drilling program.

Sampling procedures (prior to dispatch) have been completed under the supervision and security of Pretium’s staff. Laboratory sample reduction and analytical procedures have been conducted by independent accredited companies in line with standard industry practices.

Pretium ensured quality control was monitored throughout the drilling campaigns with the insertion of blanks, certified reference materials, and duplicates. All data was stored and managed by independent database managing company, Geospark Consulting Inc. who carried out real time quality assurance/quality control (“QA/QC”) analysis.

Snowden carried out several site inspections and reviewed Pretium’s procedures including:

|

|

·

|

independent sampling to verify the grade tenor;

|

|

|

·

|

inspection of the underground workings to confirm the mineralization style;

|

|

|

·

|

review of diamond core;

|

|

|

·

|

review of site procedures;

|

|

|

·

|

independent QA/QC analysis; and

|

|

|

·

|

independent data validation.

|

It is the opinion of the author of the Brucejack Technical Report that the sample preparation, security, and analytical procedures are satisfactory and that the data is suitable for use in Mineral Resource estimates.

Bulk Sample Test Work

In 2013, Pretium excavated a bulk sample from within the VOK to further evaluate the geological interpretation and provide a comparison with the results from the Mineral Resource estimate. The location of the proposed bulk sample was selected to be representative of the grade and character of the typical mineralization in the VOK.

4

The design of the bulk sample was limited by provincial legislation to a maximum allowable bulk sample size of 10,000 t. The bulk sample was collected as a series of nominal 100-t rounds in underground development. Pretium elected to process the bulk sample both through a sample tower on site and at a custom mill (Contact Mill) in Montana, U.S.A. In Snowden’s opinion, the results of assaying of the samples from the sample tower provided an unacceptable degree of variation in the results due to the coarse gold nature of the mineralization and this information was not used further.

Prior to the December 2013 Mineral Resource estimate, the mill results from the underground bulk sample processing were used to investigate the local accuracy of the November 2012 Mineral Resource estimate within the VOK, and to determine whether the estimation methodology could be improved for the December 2013 Mineral Resource estimate.

A series of statistical tests were run to determine whether any bias exists between the surface diamond drilling, underground diamond drilling, underground channel samples, and chip samples. No significant difference/bias, based on the statistical analysis, was evident between the different sample types.

However, additional test work in the estimation did display some bias caused by directional drilling in the area of the bulk sample. The underground drilling had been aligned in a north-south orientation which is consistent with the orientation of some high-grade mineralization identified in the bulk sample, resulting in under sampling of this mineralization. Removal of the underground drillholes resulted in an increase in the grade of the local estimate.

While there is no bias evident between the channel samples and the drilling, the location of numerous channel samples in the centre of some of the higher-grade mineralization does result in a local overestimation around the bulk sample crosscuts. Consequently, the decision was made not to use the channel samples for the final mineral resource estimate.

The final metal and tonnes from the mill accounting were compared to those predicted by the November 2012 Mineral Resource estimate for each drive to assess the effectiveness of the resource modelling process. This test work has in part relied on comparisons between the test estimates and results from the bulk sample processing. However, readers of this prospectus and the Brucejack Technical Report should be warned that there is a significant difference in the sample support for the resource estimate (each block in the resource estimate represents 2,700 t whereas the bulk sample packages are around 100 t), and the grade is not homogenous throughout any block. In other words, the grade can vary from a high-grade side of the block to a low-grade side of the block, whereas the block grade represents an average of the whole block. If the bulk sample happens to take a high-grade part of the block, then the comparison will look like the resource estimate under-estimated the grade, and conversely if the bulk sample takes a low-grade part of the block, then the comparison will look like the resource estimate over-estimated the grade in the block. Whilst it is not entirely valid to compare the results of the bulk sample with the resource estimate (given the different sample support) locally, it does provide the best opportunity to fine-tune the estimate to some hard data. The reader should be warned that the results are only used to give some local perspective to the grade estimates.

The results indicated that the November 2012 Mineral Resource underestimated the total metal content in the bulk sample by about 10%. In more detail, the November 2012 Mineral Resource estimated high-grade into lower-grade areas, and low-grade into the high-grade areas, a result of extrapolating the high-grade values around the high-grade core. This extrapolation of high-grade values was based on the nature of the mineralization and the interpreted continuity of the high grades.

Based on the bulk sample comparisons, Snowden concludes that the November 2012 Mineral Resource was a good representation of the contained metal within the VOK deposit and satisfactory for mining studies based around bulk underground mining, but that it was not locally accurate at the 10 m block scale. As a result further test work was undertaken to adjust the estimation method for the December 2013 Mineral Resource, to produce an estimate that is more responsive to the local scale grade variations.

The results of the test work included:

|

|

·

|

Removal of channel samples as these caused local scale over-estimation.

|

|

|

·

|

Local adjustment of domain boundaries and incorporation of the north-south mineralization domains into the main stockwork domain packages. Test work using separate domaining of the north-south mineralisation resulted in over-estimation of the grade in these areas.

|

|

|

·

|

Adjustment of the estimation parameters and methodology to reduce smoothing, including the method for re-blocking the high-grade Multiple Indicator Kriging estimates, the chosen parent cell size, and search neighbourhood parameters.

|

Mineral Resource Estimation

The mineralization in the VOK exists as steeply dipping semi-concordant (to stratigraphy) and discordant pod-like zones hosted in stockwork vein systems within the volcanic and volcaniclastic sequence. High-grade mineralization zones appear to be spatially associated, at least in part, with intensely silicified zones resulting from local silica flooding and over-pressure caprock formation. High-grade mineralization occurs both in the main east-west trending vein stockwork system, as well as in the rarer north-south trending part of the system. Snowden notes that Pretium has taken these various observations into consideration in its interpretation of the mineralization domains for the VOK.

5

A threshold grade of 0.3 g/t gold was found to generally identify the limits to the broad zones of mineralization as represented in the drill cores at West Zone and the VOK. In the VOK, a 1 g/t gold to 3 g/t gold threshold grade was used together with Pretium’s interpretation of the lithological domains, to interpret high-grade corridors within the broader mineralized zones, and define a series of mineralized domains for grade estimation.

All data was composited to the nominal sample length of 1.5 m prior to statistical analysis and estimation. Statistical analysis of the gold and silver data was carried out by lithological domain (at the VOK) and mineralized domain. Review of the statistics indicated that the grade distributions for the mineralization within the different lithologies are very similar and as a result these were combined for analysis. This is in agreement with field observations which indicate that the stockwork mineralization is superimposed on the stratigraphic sequence. The summary statistics of composite samples from all domains exhibit a strong positive skewness with high (greater than 1.6) coefficient of variation (ratio of the standard deviation to the mean) and some extreme grades.

Because of the extreme positive skew in the histograms of the gold and silver grades within the high-grade domains, Snowden elected to use a non-linear approach to estimation, employing the use of indicator and truncated distribution kriging. In this approach the proportion of high grade in a block was modelled, as was the grade of the high-grade portion, and the grade of the low-grade portion.

The high-grade population, which contains a significant number of samples with extreme grades, required indicator kriging methods for grade estimation. The low-grade population was estimated using ordinary kriging on the truncated (low-grade; less than 5 g/t gold and less than 50 g/t silver) part of the grade distribution.

Specific gravity was estimated into the model blocks using simple kriging of specific gravity measurements determined on sample pulps by ALS. As part of the 2012 surface drilling and 2013 underground drilling programs, Pretium selected a portion of the samples (207 and 204 samples, respectively) for core density (water immersion method) as well as the pulp specific gravity measurements in order to determine the impact of porosity.

Results of the comparison between the pulp specific gravity and core density measurements indicate that the core density is on average the same as the pulp specific gravity within the siliceous zone and approximately 3% lower, on average, for all other rock types. Consequently, all specific gravity estimates in the Mineral Resource model (which are based on the pulp specific gravity measurements), with the exception of the siliceous zone, were factored down by 3% to yield the corresponding bulk density.

Grade estimates and models were validated by: undertaking global grade comparisons with the input drillhole composites; visual validation of block model cross sections; grade trend plots; and comparing the results of the model to the bulk sample cross cuts.

The resource classification definitions (Measured, Indicated, Inferred) used for the estimates in the Brucejack Technical Report are those published by the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) in the “CIM Definition Standards” document.

In order to identify those blocks in the block model that could reasonably be considered as a Mineral Resource, the block model was filtered by a cut-off grade of 5 g/t gold equivalent (“AuEq”). The AuEq calculation used is: AuEq = Au + Ag/53. These blocks were then used as a guide to develop a set of wireframes defining coherent zones of mineralization which were classified as Measured, Indicated or Inferred and reported (Table 1.1 and Table 1.2).

Classification was applied based on geological confidence, data quality and grade variability. Areas classified as Measured Resources at West Zone are within the well-informed portion where the resource is informed by 5 m by 5 m or 5 m by 10 m spaced drilling. Measured Resources within VOK are informed by 5 m by 10 m to 10 m by 10 m underground fan drilling and restricted to the vicinity of the underground bulk sample.

Areas classified as Indicated Resources are informed by drilling on a 20 m by 20 m to 20 m by 40 m grid within West Zone and VOK. In addition, some blocks at the edge of the areas with 20 m by 20 m to 20 m by 40 m drilling, were downgraded to Inferred where the high grades appear to have too much influence. The remainder of the Mineral Resource is classified as Inferred Resources where there is some drilling information (and within around 100 m of drilling) and the blocks occur within the mineralized interpretation.

Areas where there is no informing data and/or the lower-grade material is outside of the mineralized interpretation are not classified as a part of the Mineral Resource.

The Mineral Resource was reported above a 5 g/t AuEq cut-off grade for the VOK and West Zone (Table 1.1 and Table 1.2). The Mineral Resources are depleted for historical mining in West Zone and the recent underground bulk sample mining in VOK.

6

Table 1.1 - VOK Mineral Resource Estimate Based on a Cut-off Grade of 5 g/t AuEq – December 2013(1)(4)(5)

|

Category

|

Tonnes

(million)

|

Gold

(g/t)

|

Silver

(g/t)

|

Contained(3)

|

|

|

Gold

(Moz)

|

Silver

(Moz)

|

||||

|

Measured

|

2.0

|

19.3

|

14.4

|

1.2

|

0.9

|

|

Indicated

|

13.4

|

17.4

|

14.3

|

7.5

|

6.1

|

|

M + I

|

15.3

|

17.6

|

14.3

|

8.7

|

7.0

|

|

Inferred(2)

|

5.9

|

25.6

|

20.6

|

4.9

|

3.9

|

|

Notes:

|

(1)

|

Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues. The Mineral Resources in the Bruckjack Technical Report were estimated using the CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council.

|

|

|

(2)

|

The quantity and grade of reported Inferred resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as an Indicated or Measured Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category.

|

|

(3)

|

Contained metal and tonnes figures in totals may differ due to rounding.

|

|

(4)

|

The Mineral Resource estimate stated in Table 1.1 and Table 1.2 is defined using 5 m by 5 by 5 m blocks in the well drilled portion of West Zone (5 m by 10 m drilling or better) and 10 m by 10 m by 10 m blocks in the remainder of West Zone and in the VOK.

|

|

|

(5)

|

The AuEq value is defined as AuEq = Au + Ag/53.

|

Table 1.2 - West Zone Mineral Resource Estimate Based on a Cut-off Grade of 5 g/t AuEq – April 2012(1)(4)(5)

|

Category

|

Tonnes

(millions)

|

Gold

(g/t)

|

Silver

(g/t)

|

Contained(3)

|

|

|

Gold

(Moz)

|

Silver

(Moz)

|

||||

|

Measured

|

2.4

|

5.85

|

347

|

0.5

|

26.8

|

|

Indicated

|

2.5

|

5.86

|

190

|

0.5

|

15.1

|

|

M+I

|

4.9

|

5.85

|

267

|

0.9

|

41.9

|

|

Inferred(2)

|

4.0

|

6.44

|

82

|

0.8

|

10.6

|

Notes: (1), (2), (3), (4) and (5) - refer to footnotes in Table 1.1.

Mineral Processing and Metallurgical Testing

Metallurgical Testing

Several metallurgical test programs were carried out to investigate the metallurgical performance of the mineralization. The main test work was completed from 2009 to early 2014. The samples tested were generated from various drilling programs, including the samples tested by the bulk sample processing programs. The metallurgical test programs conducted on the Brucejack mineralization included head sample characteristics, gravity concentration, gold/silver bulk flotation, cyanidation, table concentrate melting and the determination of various process related parameters. The early test work focused on developing the flowsheet for gravity concentration, bulk flotation, and flotation concentrate cyanidation. The test work also studied the metallurgical responses of the samples to the gravity concentration flowsheet for gravity concentration followed by whole ore leaching. The later test work concentrated on the gravity-flotation concentration flowsheet.

In general, the VOK Zone and West Zone mineralization is moderately hard. The mineral samples tested responded well to the conventional combined gravity and flotation flowsheet. The gold in the mineralization was amenable to centrifugal gravity concentration. On average, 40 to 50% of the gold in the samples were recovered by the gravity concentration. The flotation tests results indicated that bulk flotation can effectively recover the gold remained in the gravity concentration tailings using potassium amyl xanthate as a collector at the natural pH. Two stages of cleaner flotation would significantly upgrade rougher flotation concentrate. The gold in the mineralization showed better metallurgical performance, compared to silver. On average, approximately 96 to 97% of the gold and 91 to 92% of the silver were recovered to the gravity concentrate and bulk flotation concentrate at the grind size of 80% passing approximately 70 to 80 µm. There was a significant variation in metallurgical performances among the samples tested. This may be a result of the nugget gold effect. The industrial runs on the 10,000-t bulk sample for the 2013 bulk sample processing program and the 1,200-t high-grade Cleo mineralization conducted in 2014 showed that the gravity/flotation process flowsheet as designed for the Brucejack mineralization suited the treatment of the bulk sample. The results also showed that the gravity/flotation flowsheet adapted well for the varying mineralization and the wide range feed grades that were experienced during processing of the bulk sample.

7