UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10/A

(Amendment No. 2)

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to

Section 12(b) or (g) of The Securities Exchange Act of 1934

PASSPORT POTASH INC.

(Exact

name of registrant as specified in its charter)

| British Columbia, Canada | Not Applicable |

| (State or other Jurisdiction of Incorporation or | (I.R.S. Employer Identification No.) |

| organization) | |

| 608 – 1199 West Pender Street | |

| Vancouver, BC, Canada | V6E 2R1 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, including area code: (604) 687-0300

Securities registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the

Act:

Common Shares, without par value

(Title of class)

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (do not check if a smaller reporting company) | Smaller reporting company [X] |

1

TABLE OF CONTENTS

2

REFERENCES

As used in this registration statement on Form 10 (the “Registration Statement”): (i) the terms the “Registrant”, “we”, “us”, “our”, “Passport Potash” and the “Company” mean Passport Potash Inc. and its subsidiaries, if any; (ii) “SEC” refers to the Securities and Exchange Commission; (iii) “Securities Act” refers to the United States Securities Act of 1933, as amended; (iv) “Exchange Act” refers to the United States Securities Exchange Act of 1934, as amended; and (v) all dollar amounts refer to United States dollars unless otherwise indicated.

NOTE ABOUT FORWARD-LOOKING STATEMENTS

Certain statements contained in this Registration Statement on Form 10 constitute “forward-looking statements.” These statements appear in a number of places in this Registration Statement and documents included herein and include statements regarding the Registrant’s intent, belief or current expectation and that of the Registrant’s officers and directors. These forward-looking statements involve known and unknown risks and uncertainties that may cause the Registrant’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. In certain cases, forward-looking statements can be identified by the use of words such as “believe”, “intend”, “may”, “will”, “should”, “plans”, “anticipates”, “believes”, “potential”, “intends”, “expects” and other similar expressions. Forward-looking statements may include, but are not limited to, statements with respect to the future price of commodities, the estimation of mineral resources, the realization of mineral resource estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, currency fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, the completion of financings and regulatory approvals, and the timing and possible outcome of pending litigation and the timing and magnitude of such events, which are inherently risky and uncertain. Important factors that you should also consider, include, but are not limited to, the factors discussed under “Risk Factors” in this Registration Statement.

Readers are cautioned that the foregoing list is not exhaustive of all factors that could cause actual results, performance or achievements to differ materially from those described in forward looking statements, as there may be other factors that cause results, performance or achievements to not be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Registrant assumes no obligation to update or to publicly announce the results of any change to any of the forward-looking statements contained or included herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements, other than where a duty to update such information or provide further disclosure is imposed by applicable law, including applicable United States federal securities laws.

ITEM 1. BUSINESS

General

We were incorporated on July 31, 1987 under the laws of Québec, Canada under the name “Bakertalc Inc.” On January 21, 1994, we changed our name to “Palace Explorations Inc.” On November 11, 1996, we changed our name to “X-Chequer Resources Inc.” On September 29, 2004 we changed our name to “International X-Chequer Resources Inc.” On October 18, 2007, we changed our name to “Passport Metals Inc.” On November 10, 2009 we changed our name to “Passport Potash Inc.” Effective April 26, 2011, we continued our governing corporate jurisdiction from the Province of Québec to the Province of British Columbia under the name “Passport Potash Inc.”

Effective September 29, 2004, we effected a share consolidation (reverse stock split) of our issued and outstanding shares of common stock on a basis of twelve (12) old shares for one (1) new share.

3

Effective October 18, 2007, we effected a forward stock split of our issued and outstanding shares of common stock on a basis of one (1) old share for three (3) new shares.

We are a reporting issuer in the Canadian Provinces of British Columbia, Alberta, Ontario and Québec and our common shares are listed for trading on the TSX Venture Exchange (the “TSX-V”) under the trading symbol “PPI”.

Our head and principal office is located at 608 - 1199 West Pender Street, Vancouver, British Columbia, Canada, V6E 2R1. Our registered and records office is located at 1500 – 1055 West Georgia Street, Vancouver, British Columbia, Canada, V6E 4N7.

We are an exploration stage company engaged in the acquisition, exploration and development of mineral resource properties. We currently have an interest in or have the right to earn an interest in six properties, Southwest Exploration Property, Twin Buttes Ranch, Sweetwater/American Potash, Mesa Uranium, Ringbolt Property and Fitzgerald Ranch (the Holbrook Basin properties), which are all located in Arizona. We have not established any proven or probable reserves on our mineral property interests and we are not in actual development or production of any mineral deposit at this time. There is no assurance that a commercially viable mineral deposit exists on any of our property interests. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined with respect to our mineral property interests.

Our independent auditors’ report accompanying our February 29, 2012 and February 28, 2011 financial statements contains an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern. Our financial statements have been prepared assuming that we will continue as a going concern, which contemplates that we will realize our assets and satisfy our liabilities and commitments in the ordinary course of business.

Loss of Foreign Private Issuer Status under U.S. Securities Laws

Based on our analysis of the number of our shares held by persons resident in the U.S. as of August 31, 2011, as well as the majority of our assets being in the U.S., we do not meet the definition of a “foreign private issuer” under U.S. securities laws. As a result, effective March 1, 2012, we are subject to U.S. securities laws as applicable to a U.S. domestic company. The loss of foreign private issuer status has several implications on us, including that additional restrictions generally apply to the resale of securities issued by us on or after March 1, 2012, unless we file an effective registration statement with the U.S. Securities and Exchange Commission in respect of the resale of those securities.

Intercorporate Relationships

The chart below illustrates our corporate structure, including our subsidiaries, the jurisdictions of incorporation, and the percentage of voting securities held.

4

JOBS Act

Recently the United States Congress passed the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), which provides for certain exemptions from various reporting requirements applicable to public companies that are reporting companies and are “emerging growth companies.” We are an “emerging growth company” as defined in section 3(a) of the Exchange Act (as amended by the JOBS Act, enacted on April 5, 2012), and we will continue to qualify as an “emerging growth company” until the earliest to occur of: (a) the last day of the fiscal year during which we have total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the SEC) or more; (b) the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act; (c) the date on which we have, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or (d) the date on which we are deemed to be a “large accelerated filer”, as defined in Exchange Act Rule 12b–2. Therefore, we expect to continue to be an emerging growth company for the foreseeable future.

Generally, a registrant that registers any class of its securities under section 12 of the Exchange Act is required to include in the second and all subsequent annual reports filed by it under the Exchange Act, a management report on internal control over financial reporting and, subject to an exemption available to registrants that meet the definition of a “smaller reporting company” in Exchange Act Rule 12b-2, an auditor attestation report on management’s assessment of internal control over financial reporting. However, for so long as we continue to qualify as an emerging growth company, we will be exempt from the requirement to include an auditor attestation report in our annual reports filed under the Exchange Act, even if we do not qualify as a “smaller reporting company”. In addition, section 103(a)(3) of the Sarbanes-Oxley Act of 2002 has been amended by the JOBS Act to provide that, among other things, auditors of an emerging growth company are exempt from the rules of the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the registrant (auditor discussion and analysis). Furthermore, as an emerging growth company, we are able to avail ourselves to the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and to not present to our shareholders a nonbinding advisory vote on executive compensation, obtain approval of any golden parachute payments not previously approved, or present the relationship between executive compensation actually paid and our financial performance. Additionally, we have irrevocably elected to comply with new or revised accounting standards even though we are an emerging growth company.

Recent History

Southwest Option Agreement

On September 30, 2008 we entered into a mineral property option agreement (the “Southwest Option Agreement”) with Southwest Exploration Inc. (“Southwest”) to acquire an undivided 100% interest in 13Arizona State Land Department exploration permits (“ASLD Exploration Permits”) comprising 8,413.3 acres ( 3,404.76 ha) of mineral exploration property located in Navajo County, in the Holbrook Basin, Arizona. Under the terms of the Southwest Option Agreement, any after acquired permits within the area of common interest may be made part of the property. Pursuant to this clause, 32 additional ASLD Exploration Permits were made part of the property for a total of 45 ASLD Exploration Permits.

Under the terms of the Southwest Option Agreement, as amended, we could acquire a 100% interest in the Southwest mining claims, subject to a 1% NSR retained by Southwest, in exchange for the following considerations:

| (a) |

$100,000 (paid) on execution of the agreement; | |

| (b) |

1,000,000 options (issued) upon receipt of TSX-V approval of the agreement; | |

| (c) |

$125,000 from 90 days following issuance of a drilling permit from the Arizona State Land Department. This permit was received on June 11, 2009 and $125,000 was paid July 23, 2009; | |

| (d) |

250,000 shares on April 1, 2009 (issued); | |

| (e) |

2,681,000 shares on October 1, 2009 (issued); | |

| (f) |

5,000,000 shares on November 1, 2010 (issued); | |

| (g) |

$350,000 from six months following TSX-V approval of the issuance of 5,000,000 shares (paid); |

5

| (h) |

Funding of $200,000 in exploration expenditures pursuant to the completion of a NI 43-101 technical report (completed); | |

| (i) |

250,000 shares upon completion of a NI 43-101 technical report after drilling (issued); and | |

| (j) |

Southwest shall retain a 1% NSR (purchased by the Company). |

If and when the option is exercised, the 100% right, title, and interest in and to the property will vest in us free and clear of all charges, encumbrances and claims, except for the NSR.

Currently, we have a blanket bond with the Arizona State Land Department in the amount of $15,000 for the ASLD Exploration Permits. In addition, we also have a bond with the Arizona Oil and Gas Conservation Commission in the amount of $55,000 for drilling permits.

We entered into an amendment to the Southwest Option Agreement, dated September 18, 2009, whereby the parties agreed to settle the October 1, 2009 scheduled cash payment of $225,000 with the issuance of 2,681,000 shares of the Company.

We entered into a second amendment to the Southwest Option Agreement, dated April 1, 2010, whereby the parties agreed to extend the due date for the payment of $250,000 to Southwest until October 1, 2010. As we had not satisfied this payment obligation by October 1, 2010, we issued 5,000,000 shares of our common stock to Southwest on November 8, 2010 in full satisfaction of the outstanding payment.

We completed the exercise of our option to purchase the 100% interest in the Southwest claims and the purchase of the 1% net smelter royalty in an agreement dated February 13, 2012. The Southwest permits are held by PPI Holding Corporation, our wholly owned Arizona subsidiary.

Twin Buttes Ranch Lease and Option Agreement

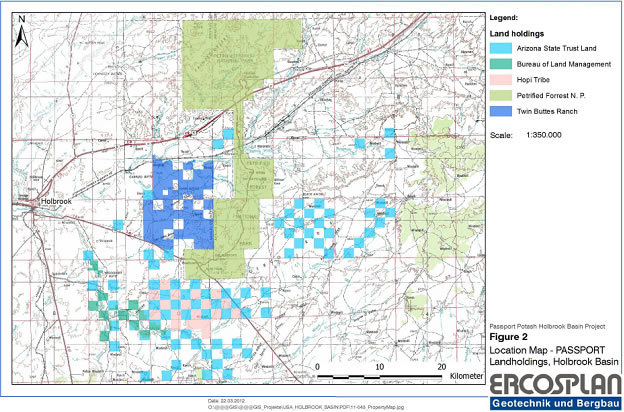

On August 28, 2009 we entered into a four-year lease with an option to purchase (the “Lease & Option Agreement”) with Twin Buttes Ranch, LLC respecting the Twin Buttes Ranch located in the potash-bearing Holbrook Basin of east-central Arizona. The Twin Buttes Ranch comprises some 28,526 acres (11,544 hectares) of private deeded land with 76.7% or approximately 21,894 acres (8,860 hectares) overlying the potash horizons within the Holbrook Basin.

Under the terms of the Lease & Option Agreement, we may acquire a 100% undivided interest in the deeded land and sub-surface mineral rights comprising the Twin Buttes Ranch property by making lease payments totaling $500,000 over a four year period and, upon exercising our option to purchase, by paying $20,000,000 for the entire Twin Buttes Ranch including all sub-surface mineral rights except those pertaining to oil and gas, petrified wood and geothermal resources. There are no royalties associated with the sub-surface mineral rights.

On September 30, 2010 we announced that we had amended the terms of the Lease & Option Agreement to provide for an extension of a portion of the initial cash payment until December 1, 2010.

Details of the payments under the Lease & Option Agreement are as follows:

| (a) |

A payment of $50,000 and $10,000 legal costs on or before November 26, 2009 (paid); | |

| (b) |

A payment of $25,000 on September 17, 2010 (paid); | |

| (c) |

A payment of $75,000 on December 1, 2010 (paid); | |

| (d) |

A payment of $150,000 on August 28, 2011 (paid); | |

| (e) |

A payment of $200,000 on August 28, 2012 (paid); and | |

| (f) |

Upon exercising its option to purchase the entire Twin Butte Ranch, the Company must deliver a certified cheque in the amount of $1,000,000 on or before 5pm (Arizona time), August 28, 2013 (the option expiry date), followed by a payment of $ 19,000,000 within thirty days. |

6

The Lease & Option Agreement will expire on August 28, 2013, or such other time mutually agreed to in writing by the parties. All payments to date have been made and the option is in good standing.

Sweetwater and American Potash Option Agreement

On November 12, 2010 we entered into an option of Arizona exploration leases (the “Sweetwater Option Agreement”) with Sweetwater River Resources, LLC (“Sweetwater”) and American Potash, LLC (“American Potash”) to acquire the right, title and interest in five mineral exploration permits within the Holbrook Basin. The five permits consist of Arizona State Land Department exploration permits that cover more than 3,200 acres.

Pursuant to the terms of the Sweetwater Option Agreement, we could acquire a 100% interest in the exploration permits for the consideration of: (i) issuing 500,000 shares of our common stock by December 15, 2010; (ii) cash payment of CAD$90,000 payable in three installments of $30,000 each at 12 months, 18 months and 24 months from the date of signing the Sweetwater Option Agreement; and (iii) meeting the exploration expenditures a required by the Arizona State Land Department. We are responsible for payment of all exploration expenditures on the permits. Pursuant to the Sweetwater Option Agreement, the property was subject to a 2% net smelter royalty in favor of American Potash which we had the option to purchase at a price of $150,000 for 1% or $300,000 for the full 2%.

On March 27, 2012, we completed the exercise of the option under the Sweetwater Option Agreement and the repurchase of the 2% NSR royalty in respect of the Sweetwater exploration permits. The permits are held by PPI Holding Corporation, our wholly owned subsidiary.

Mesa Option Agreement

On August 31, 2010 we entered into a mineral property option agreement (the “Mesa Option Agreement”) with Mesa Uranium Corp. (“Mesa”) in respect of three Arizona State Land Department exploration permits covering approximately 1,950 acres, which are wholly owned by Mesa. Pursuant to the terms of the agreement, we had the right to acquire a 75% interest in the Mesa permits in consideration for the issuance of 500,000 shares of our common stock to Mesa, the payment of $20,000.00 cash to Mesa and meeting the minimum exploration expenditures as required by the Arizona State Land Department. Upon earning a 75% interest in the permits, we had the right to acquire the remaining 25% interest in the Mesa permits by paying $100,000 in cash, stock equivalent or work expenditures. Under the terms of the agreement, we are responsible for payment of all exploration expenditures on the leases. The property was subject to a 2% net smelter royalty which we had the option to purchase at a price of $150,000 per 1% or $300,000 for the full 2%.

On February 13, 2012, we exercised our option to acquire a 75% interest in the Mesa permits. On March 9, 2012, we announced that we had exercised our option to acquire the remaining 25% interest in the Mesa properties under the Mesa Option Agreement and to acquire the 2% NSR on those properties thereby acquiring a royalty-free, 100% interest in the Mesa properties. The permits are held by PPI Holding Corporation, our wholly owned subsidiary.

Ringbolt Option Agreement

On March 28, 2011 we entered into an option agreement (the “Ringbolt Option Agreement”) with Ringbolt Ventures Ltd., Potash Green, LLC, Wendy Walker Tibbetts and Joseph J. Hansen pursuant to which we acquired the right to acquire a 100% interest in the Ringbolt potash property located in the Holbrook Basin of southeast Arizona. The Ringbolt property is comprised of 15,994.32 acres of mineral exploration permits on land managed by the Arizona State Land Department.

Pursuant to the terms of the Ringbolt Option Agreement, we may acquire a 90% interest in the property by: (i) making cash payments totaling $1.0 million ($50,000 upon execution of the agreement, $250,000 upon TSX Venture Exchange approval, $350,000 on or before the 1st anniversary of TSX Venture Exchange approval, and $350,000 on or before the 2nd anniversary of TSX Venture Exchange approval), (ii) incurring a total of $2.25 million in exploration expenditures on the property over three years ($500,000 within 1 year of TSX Venture Exchange approval, $750,000 within 1 year of the 1st anniversary of TSX Venture Exchange approval, and $1,000,000 within 1 year of the 2nd anniversary of TSX Venture Exchange approval), and (iv) issuing four million common shares over a three-year period (1,000,000 shares upon TSX Venture Exchange approval, 1,400,000 shares on or before the 1st anniversary of TSX Venture Exchange approval, and 1,600,000 shares on or before the 2nd anniversary of TSX Venture Exchange approval). Upon satisfaction of these terms, we will have the right to purchase the remaining 10% interest for a cash payment of $5 million, which shall remain exercisable until the Ringbolt property goes into commercial production (defined as the sale of any mineral products from the property). In addition, pursuant to the Ringbolt Option Agreement, the Ringbolt property will be subject to a 1% gross overriding royalty on production from the property.

7

On May 18, 2012, we delivered a letter to North American Potash Developments Inc. (formerly Ringbolt Ventures Ltd.) and the other optionors (collectively, the “Optionor”), informing them that they were in breach of the Ringbolt Option Agreement and that the payment of cash and shares that were due on May 17, 2012 would not be paid until Optionor cured the defaults delineated in the default letter.

On May 25, 2012, we were informed by the Optionor that it had filed a civil action in Utah seeking specific performance of the Ringbolt Option Agreement.

On June 19, 2012, we filed an answer and counterclaim to the Ringbolt civil action and tendered to the Utah court the $350,000 in cash and the 1,400,000 shares which were due pursuant to the Ringbolt Option Agreement on May 17, 2012, pending a ruling by the court on the sufficiency of tender. The court ruled that tender to the court was not sufficient, therefore, the cash and shares were released to Optionor on July 10, 2012.

On September 10, 2012, we announced that the court had granted our motion for a preliminary injunction, which enjoined Optionor from terminating the Ringbolt Option Agreement based upon the grounds alleged by Optionor. We intend to continue to vigorously defend our rights in the Ringbolt Option Agreement.

Cooperative Agreement with Hopi Tribe

Portions of our Holbrook Basin potash project in Arizona are located adjacent to land privately owned by the Hopi Tribe. On March 8, 2011 we finalized a cooperative agreement with the Hopi Tribe which establishes a cooperative arrangement between us and the Hopi Tribe and gives us access across the privately owned Hopi lands to conduct exploration activities while allowing the Tribe to share in our study results. We are in continuing discussions with the Hopi Tribe on the project.

Fitzgerald Ranch Living Trust LOI

On August 17, 2011 we entered into a binding letter of intent with co-trustees of the Fitzgerald Living Trust (the “Seller”) to acquire real estate covering a total of 41,000 contiguous acres of royalty-free private land (the “Fitzgerald Ranch”) located near Holbrook and adjacent to our Twin Butte Ranch holdings in the Holbrook Basin. On May 14, 2012, we announced that we have entered into a purchase agreement (the “Agreement”) to acquire the Fitzgerald Ranch in exchange for a total purchase price of $15 million on the following material terms: (i) $250,000 to be irrevocably released to the Seller upon execution of the Agreement; (ii) an additional $250,000 to be placed into escrow and irrevocably released to the Seller on July 1, 2012; (iii) during the term of the Agreement, we have the right to perform exploration activities on the property; (iv) a payment of $14.5 million at closing to take place on December 18, 2012; and (v) the final purchase is subject to TSX Venture Exchange approval.

A provision of the Agreement grants us the right to perform exploration activities on the property. We have added 8 additional drill holes to our 2012 drill program which will be drilled on the Fitzgerald Ranch.

8

Joint Exploration Agreement with HNZ Potash, LLC

On July 27, 2012, we entered into a Joint Exploration Agreement (the “Agreement”) with HNZ Potash, LLC (“HNZ”) to jointly explore and potentially develop twenty-one permitted parcels in which we hold ASLD exploration permits and which are located on the southernmost area of our landholdings (the “Permit Property”). The Permit Property is within HNZ’s private landholdings and has not been previously explored by us. Under the terms of the Agreement, HNZ has agreed to pay us 50% of certain costs previously incurred by us with respect to the Permit Property, and we will assign a 50% interest in the Permit Property to HNZ.

The purposes of the Agreement are to: (i) conduct exploration and to evaluate the potential for development and mining of the Permit Property; (ii) to acquire interests within the lands owned by the Hopi Tribe commonly referred to as the Dobell Ranch lands as more particularly described in the Agreement; (iii) if justified by the exploration activities, the parties upon mutual agreement will form an entity to seek a mining lease to jointly engage in development and mining of the Permit Property; (iv) to complete and satisfy all environmental compliance obligations and continuing obligations affecting the Permit Property; and (v) to perform any other activity necessary, appropriate, or incidental to any of the foregoing. During the term of the Agreement, the parties will equally share the costs for maintaining the Permit Property in good standing with the ASLD. The parties may, either alone or jointly, conduct exploration of any or all of the Permit Property pursuant to one or more plans of exploration.

The term of the Agreement shall begin on the effective date of the Agreement and extend to the expiration of the fifth year term of the last permit covered by the Agreement, or any permit obtained as a replacement therefor (the “Term”); provided, however, that, if during the Term the participants (or any entity formed by the participants) jointly apply for a mineral lease or mineral leases on any portion of the Permit Property, the Term shall be automatically extended to the date a final determination is issued by the ASLD regarding the last mineral lease application.

Other provisions in the Agreement include the following:

- The parties will provide to each other existing exploration data from their Holbrook Basin potash exploration activities. The data provided by each Party may be used by the other party to update their existing or future resource reports or any other future reports.

- The parties will provide each other vehicular access across existing pave and unpaved roads on property controlled by the other party.

- The parties have established an area of mutual interest and have agreed to jointly pursue opportunities within this area.

The foregoing description of the Joint Exploration Agreement does not purport to be complete and is qualified in its entirety by reference to the Joint Exploration Agreement, which is attached hereto as Exhibit 10.12, and is incorporated herein by reference.

Business Operations

Corporate Summary

Our principal property is our Holbrook Basin potash project comprised of exploration permits and claims, some of which we hold directly and others which are subject to option, a lease over with an option to purchase the Twin Buttes Ranch property, and a purchase agreement for the Fitzgerald Ranch property. Our interest in our Holbrook Basin project is comprised of 53 Arizona State Land Department exploration permits, the Twin Buttes Ranch lease and option, the purchase agreement for the Fitzgerald Ranch property, and the option to purchase the Ringbolt exploration permits (an additional 25 ASLD permits).

We have acquired a strategic position in the Holbrook Basin with land holdings encompassing over 122,000 acres. The infrastructure in the Holbrook Basin provides a strategic advantage for us, with immediate access to BNSF rail lines, Interstate 40 and a major power plant within 25 miles of the project. Our 30-hole drill program combined with historic records show that the potash deposits in the Holbrook Basin are relatively shallow by industry standards, with deposits being found at depths between 800 and 1,300 feet, which is another major advantage for us.

9

Potash Industry Overview

Potash

Potash is used to describe a wide variety of compounds valued primarily for their potassium content, which is commonly measured in K2O units. The most concentrated and commonly available form of potash is potassium chloride (KCl), also referred to as Muriate of Potash (MOP), which is between 60-62% K2O by weight. Secondary forms of potash include sulfate of potash magnesia, also known as langbeinite (22% K2O), potassium sulfate (50% K2O) and potassium nitrate (44% K2O).

Potash is primarily used as an agricultural fertilizer due to its high potassium content. Potassium, nitrogen and phosphate are the three primary nutrients essential for plant growth. A proper balance of these nutrients improves plant health and increases crop yields. Potash helps regulate plants’ physiological functions and improves plant durability, providing crops with protection from drought, disease, parasites and cold weather. Currently, no cost effective substitutes exist for these three nutrients. Less effective nutrient sources do exist, however, the relatively low nutrient content of these sources and cost of transportation reduce their attractiveness as a viable, economic alternative to potash.

Potash is primarily mined from underground mines and less frequently, from naturally occurring surface or sub-surface brines. It is mined through both conventional underground methods and surface or solution mining. Unlike nitrogen and phosphate, potash does not require additional chemical conversion to be used as a plant nutrient.

Domestically, approximately 85% of all potash produced is used as a fertilizer, most of it in the form of potassium chloride, according to the U.S. Geological Survey. The chemical industry consumes the remaining 15% of potash produced.

Demand for Potash

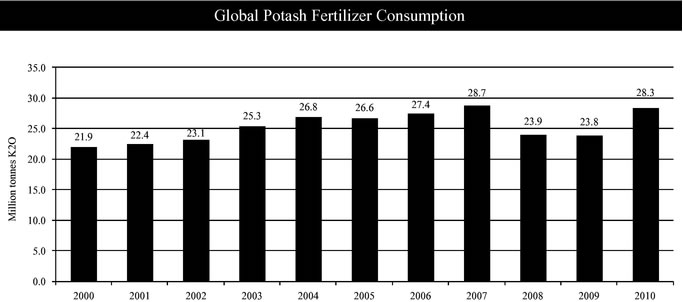

Potash demand depends primarily on the demand for fertilizer, which is based on the total planted acreage, crop mix, soil characteristics, fertilizer application rates, crop yields and farm income. Each of these factors is affected by current and projected grain stocks and prices, agricultural policies, improvements in agronomic efficiency, fertilizer application rates and weather. From 2000 to 2010, global consumption of potash as a fertilizer grew at a compound annual growth rate (“CAGR”) of 2.6% per year, from approximately 21.9 million tonnes K2O to approximately 28.3 million tonnes K2O, according to Fertecon.

10

Source: Fertecon

While developed countries have traditionally been the largest consumers of potash, developing countries are the fastest growing markets for potash, including in the emerging and developing economies of India, China and Brazil. Over the next eight years, Fertecon estimates that potash fertilizer consumption will grow in India, China and Brazil at a CAGR of 8.8%, 4.8% and 3.7%, respectively. Population and income growth are two important drivers of potash demand.

According to the USGS Mineral Commodity Summaries (January 2012), approximately 15% of U.S. potash consumption is used in the production of potassium chemicals for industrial markets. Industrial applications for potassium chloride include the production of potassium hydroxide, which is used in the production of other potassium chemicals; the production of potassium carbonate, which is primarily used for specialty glasses for cathode-ray tubes and as a component in dry-chemical fire extinguishers; leavening agents; and as a pharmaceutical ingredient. Potassium chloride is also used in the oil and gas industry as a drilling fluid additive. Other industrial applications of potassium chloride include use as a flux in secondary aluminum processing, as a potassium supplement in animal feeds, and in ceramics, textiles and dyes. From 2000 to 2010, U.S. industrial consumption of potash grew at a CAGR of 1.3%, from 725 thousand tonnes to 825 thousand tonnes, according to Fertecon.

Only 12 countries produce nearly all of the world's supply, making much of the world dependent upon imports to satisfy their potash requirements. With its highly developed agricultural economy and limited domestic production capability, the U.S. is the second largest consumer of potash globally, representing 15.9% of total estimated consumption for 2010, as reported by Fertecon. According to Fertecon, in 2010, the U.S. was the largest importer of potash in the world, importing approximately 90% of its potash. The high level of potash consumption in the U.S. is in large part due to its extensive cultivation of commodity crops such as corn, wheat, cotton and soybeans.

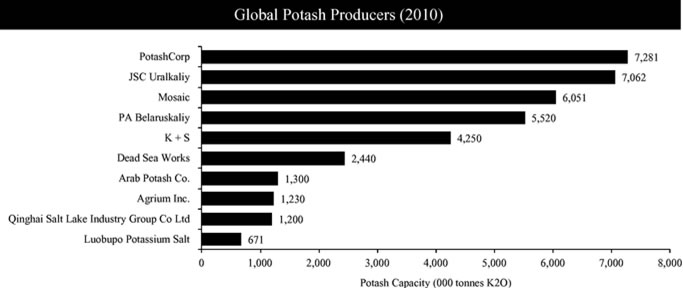

Supply of Potash

The supply of potash is influenced by a broad range of factors including available capacity and achievable operating rates; mining, production and freight costs; government policies and global trade. According to Fertecon, in 2010, seven countries accounted for approximately 91% of the world's aggregate potash production. This scarcity has resulted in a high degree of concentration among the leading producers. Canada currently accounts for approximately 29% of global potash production. The next six largest producers, Russia, Belarus, China, Germany, Israel and Jordan, account for approximately 62% of global production. The U.S. produces approximately 17% of the potash it consumes. U.S. potash reserves are concentrated in the southwestern U.S and account for approximately 3.3% of world production. The leading global providers of potash are shown in the following chart:

11

Source: Fertecon

Based on demand growth expectations, and assuming normal effective capacity utilization rates and timely completion of all announced capacity expansions, Fertecon projects the global potash market to grow from 34.6 million tonnes of K2O total sales in 2010 to 46.6million tonnes in 2020.

Competitive Business Conditions

We compete with numerous other companies and individuals in the search for and acquisition or control of attractive mineral properties. Our ability to acquire further properties will depend not only on our ability to operate and develop our properties but also on our ability to select and acquire suitable properties or prospects for exploration or development.

In regards to our plan to produce potash, there are a limited number of potash producers presently. If we are successful at becoming a producer of potash, our ability to be competitive with those producers will require that we establish a reliable supply of potash to the market.

Regulation

The exploration and development of a mining prospect is subject to regulation by a number of federal and state government authorities. These include the United States Environmental Protection Agency and the Bureau of Land Management as well as the various state environmental protection agencies. The regulations address many environmental issues relating to air, soil and water contamination and apply to many mining related activities including exploration, mine construction, mineral extraction, ore milling, water use, waste disposal and use of toxic substances. In addition, we are subject to regulations relating to labor standards, occupational health and safety, mine safety, general land use, export of minerals and taxation. Many of the regulations require permits or licenses to be obtained and the filing of Notices of Intent and Plans of Operations, the absence of which or inability to obtain will adversely affect the ability for us to conduct our exploration, development and operation activities. The failure to comply with the regulations and terms of permits and licenses may result in fines or other penalties or in revocation of a permit or license or loss of a prospect.

12

If we are successful in the future at discovering a commercially viable mineral deposit on our property interests, then if and when we commence any mineral production, we will also need to comply with laws that regulate or propose to regulate our mining activities, including the management and handling of raw materials, disposal, storage and management of hazardous and solid waste, the safety of our employees and post-mining land reclamation.

We cannot predict the impact of new or changed laws, regulations or permitting requirements, or changes in the ways that such laws, regulations or permitting requirements are enforced, interpreted or administered. Health, safety and environmental laws and regulations are complex, are subject to change and have become more stringent over time. It is possible that greater than anticipated health, safety and environmental capital expenditures or reclamation and closure expenditures will be required in the future. We expect continued government and public emphasis on environmental issues will result in increased future investments for environmental controls at our operations.

The Minerals Section of the Arizona State Land Department is responsible for mining/mineral activities on Arizona State Trust land. Exploration Permits and Mining Leases are governed by: Arizona Revised Statutes Title 27, Minerals, Oil and Gas; Title 37 Public Lands; Title 41 State Government; and Arizona Administrative Code Title 12 Natural Resources, Chapter 5. In order to explore for minerals on Arizona State Trust lands we are required to comply with the following:

| • |

A non-refundable filing fee of $500.00 is required for each application. | ||

| • |

An environmental disclosure questionnaire must accompany each application. | ||

| • |

A maximum 640 acres or 1 whole section is permitted per application. | ||

| • |

An exploration permit is valid for one (1) year, renewable up to five (5) years. | ||

| • |

Lease boundaries, access routes, mine workings, roads, water sources, residences, utilities, etc. must be plotted separately on a USGS Topographic Map included with the application. | ||

| • |

The application must be signed by the applicant(s) or an authorized agent. If an agent is filing for the applicant, a notarized Power of Attorney must be filled with the Department. The filing fee for a Power of Attorney is $50.00. | ||

| • |

The processing of an Exploration Permit takes a minimum of sixty (60) days. | ||

| • |

The Application is reviewed by the ASLD Minerals Section and if necessary, other ASLD divisions, outside agencies and any interested parties. | ||

| • |

Rent is $2.00 per acre for first year which includes the second year and $1.00 per acre per year for years three through five. | ||

| • |

An Exploration Plan of Operation must be submitted annually and approved by the ASLD prior to startup of exploration activities. | ||

| • |

If any surface disturbance is planned as part of the exploration activities, Archaeological and Biological surveys as well as any other applicable permits must be submitted for ASLD review (three (3) copies of each and an electronic copy in pdf format). | ||

| • |

A bond is established based on the proposed exploration activities. Typically a $3,000.00 bond is required for a single permit or a blanket bond of $15,000.00 for five or more permits held by an individual or company. | ||

| • |

Minimum work expenditure requirements are: | ||

| • |

$10 per acre per year for years 1-2; | ||

| • |

$20 per acre per year for years 3-5; and | ||

| • |

Proof of work expenditures must be submitted to the ASLD Minerals Section each year in the form of invoice and paid receipts. If no work was completed on-site, the applicant can pay the equal amount to the department. | ||

| • |

An exploration permit is not a right to mine. | ||

If discovery of a valuable mineral deposit is made, the permitee must apply for a mineral lease before actual mining activities can begin.

Prospecting on Federal lands is administered by the Bureau of Land Management (“BLM”). Prospecting Permits are covered by the Public Domain Mineral Leasing Act of 1920, as amended (30 U.S.C. 181 et seq.), the Acquired Lands Mineral Leasing Act of 1947, as amended (30 U.S.C. 351-359), and the Federal Land Policy Management

13

Act of 1976 (FLPMA), (43 U.S.C. 1701 et seq.) which authorizes the management and use of the public lands. The regulations governing these minerals are found in the 43 CFR 3500 regulations.

We have applied for prospecting permits with the BLM but have not yet been granted permission to begin exploration activities. The permits are still in process.

Employees

As at June 25, 2012, we do not have any employees, however, we have 10 individuals working on a consulting basis. Our operations are managed by our officers with input from our directors. We engage geological and engineering consultants from time to time as required to assist in evaluating our property interests and recommending and conducting work programs.

ITEM 1A. RISK FACTORS

In addition to the factors discussed elsewhere in this Registration Statement, the following are certain material risks and uncertainties that are specific to our industry and properties that could materially adversely affect our business, financial condition and results of operations.

Risks Associated with the Holbrook Basin Project

The Holbrook Project may be subject to unknown land title defects.

Although we believe we have exercised reasonable due diligence with respect to determining title to our properties, there is no guarantee that title to our properties and other tenure will not be challenged or impugned. No assurances can be given that there are no title defects affecting our properties. Our properties may be subject to prior unregistered liens, agreements, transfers or claims and title may be affected by, among other things, undetected defects. There may be valid challenges to the title of our properties which, if successful, could prevent us from operating our properties as planned or permitted or prevent us from enforcing our rights with respect to our properties.

We may not locate any commercially viable mineral deposits on any of our current properties within the Holbrook Basin Project, which would have an adverse effect on the value of our common stock.

Our exploration for commercially viable mineral deposits is highly speculative in nature and involves the substantial risk that no viable mineral deposits will be located on any of our properties within the Holbrook Basin Project. There is a considerable risk that any exploration program we conduct on our properties may not result in the discovery of any significant mineralization or commercially viable mineral deposits. We may encounter numerous geological features that limit our ability to locate mineralization or that interfere with our planned exploration programs, each of which could result in our exploration efforts proving unsuccessful. In such a case, we may incur the costs associated with an exploration program without realizing any benefit. This would likely result in a decrease in the value of our common stock and investors may lose their entire investment.

There is no guarantee that we will be able to finance the Holbrook Basin Project for production if we are successful at locating a commercially viable mineral deposit.

If we are successful at locating a commercially viable mineral deposit on any of our current properties within the Holbrook Basin Project, then any decision to proceed with production on the Holbrook Basin Project will require significant production financing. If we are unable to source production financing on commercially viable terms, we may not be able to proceed with the project and may have to write-off our investment in the project.

14

A portion of our properties is within the expanded boundaries of the Petrified Forest National Park, which may expose us to increased environmental and regulatory scrutiny.

Our Holbrook Basin Project is in close proximity to the Petrified Forest National Park (“PFNP”), a national park in northeastern Arizona protected by the United States National Parks Services. In December 2004, the United States government enacted legislation which expanded the authorized boundary of PFNP by approximately 125,000 acres to include adjacent lands. Portions of our Twin Butte Ranch property fall within the expanded boundaries of the PFNP. Although the enabling legislation for the expansion of the PFNP provides that the Secretary of the Interior may only acquire land in private ownership from willing sellers, the proximity of our properties to the PFNP may expose us to increased environmental and regulatory scrutiny.

The proximity of our properties to the PFNP could lead to the denials of approvals and permits necessary to develop portions or our Holbrook Project. Furthermore, the proposed expansion of the PFNP could limit our ability to acquire additional mineral rights, and additional acquisitions of lands or interests in land by the National Park Service would lead to further overlap with our current holdings.

Continued government and public emphasis on environmental issues can be expected to result in increased future investments in environmental controls at ongoing operations, which may lead to increased expenses. Permit renewals and compliance with present and future environmental laws and regulations applicable to our operations may require substantial capital expenditures and may have a material adverse effect on our business, financial condition and operating results.

We are currently in litigation with respect to the Ringbolt Option Agreement covering approximately 16,000 acres of ASLD exploration permits, which if we are unsuccessful in the outcome of such litigation may adversely affect our business operations.

We are currently a defendant as well as a plaintiff by counterclaim in a civil claim brought by the interest holders of the Arizona State Land Department mineral exploration permits covering approximately 16,000 acres known as the Ringbolt Property. The outcome of this litigation is uncertain and if we are not able to maintain our right to acquire the Ringbolt Property, this may have an adverse affect on our business operations.

Risks Related to Our Business

We are an "emerging growth company" under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation, shareholder approval of any golden parachute payments not previously approved and presenting the relationship between executive compensation actually paid and our financial performance. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

15

We will remain an “emerging growth company” for up to five years after our first sale of common stock pursuant to a Securities Act registration statement, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any August 31.

Our status as an “emerging growth company” under the JOBS Act of 2012 may make it more difficult to raise capital as and when we need it. Because of the exemptions from various reporting requirements provided to us as an “emerging growth company”, we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected..

We are an exploration stage company with no current revenue source and a history of operating losses and there is an expectation that we will generate operating losses for the foreseeable future; we may not achieve profitability for some time, if at all.

We have a history of operating losses and there can be no assurance that we will ever be profitable. We presently have no ability to generate earnings as our properties are in the exploration stage. Significant operating losses are to be anticipated for at least the next several years before we will be able to generate any revenues. If the Holbrook Basin Project is successfully developed and operated, we anticipate that we will retain future earnings and other cash resources for the future operation and development of our business.

We will require additional financing in order to continue our exploration activities and our assessment of the commercial viability of our mineral properties, and if we raise additional financing existing securityholders may experience dilution.

We will need to raise additional financing to complete further exploration of our mineral properties. Furthermore, if the costs of our planned exploration programs are greater than anticipated, we may have to seek additional funds through public or private share offerings or arrangements with corporate partners. There can be no assurance that we will be successful in our efforts to raise these required funds, or on terms satisfactory to us. The continued exploration of our mineral properties and the development of our business will depend upon our ability to establish the commercial viability of our mineral properties and to ultimately develop cash flow from operations and reach profitable operations. We currently are in the exploration stage and we have no revenue from operations and we are experiencing significant negative cash flow from operations. Accordingly, the only other sources of funds presently available to us are through the sale of equity. We presently believe that debt financing will not be an alternative to us as all of our properties are in the exploration stage. Alternatively, we may finance our business by offering an interest in our mineral properties to be earned by another party or parties carrying out further exploration thereof or to obtain project or operating financing from financial institutions, neither of which is presently intended. If we are able to raise funds from the sale of our securities, existing securityholders may experience significant dilution of their ownership interests and possibly to the value of their existing securities. If we are unable to obtain this additional financing, we will not be able to continue our exploration activities and our assessment of the commercial viability of our mineral properties.

As our mineral properties do not contain any reserves or any known body of economic mineralization, we may not discover commercially exploitable quantities of potash on our mineral properties that would enable us to enter into commercial production, achieve revenues and recover the money we spend on exploration.

Our properties do not contain reserves in accordance with the definitions adopted by the SEC and there is no assurance that any exploration programs that we carry out will establish reserves. All of our mineral properties are in the exploration stage as opposed to the development stage and have no known body of economic mineralization. The known potash mineralization at these projects has not yet been determined to be economic, and may never be determined to be economic. We plan to conduct further exploration activities on our mineral properties, which future exploration may include the completion of feasibility studies necessary to evaluate whether a commercial mineable mineral body exists on any of our mineral properties. There is a substantial risk that these exploration activities will not result in discoveries of commercially recoverable quantities of potash. Any determination that our properties contain commercially recoverable quantities of potash may not be reached until such time that final comprehensive feasibility studies have been concluded that establish that a potential mine is likely to be economic. There is a substantial risk that any preliminary or final feasibility studies carried out by us will not result in a positive determination that our mineral properties can be commercially developed.

16

Our exploration activities on our mineral properties may not be successful, which could lead us to abandon our plans to develop such properties and our investments in exploration.

We are an exploration stage company and have not as yet established any reserves on our properties. Our long-term success depends on our ability to establish commercially recoverable quantities of potash on our mineral properties that can then be developed into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of mineral exploration is determined in part by the following factors:

- identification of potential mineral mineralization based on superficial analysis;

- availability of government-granted exploration permits;

- the quality of management and geological and technical expertise; and

- the capital available for exploration.

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop processes to extract potash, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be established or determined to be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; potash prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon such investments if we are unable to identify commercially exploitable mineral reserves. The decision to abandon a project may reduce the trading price of our common stock and impair our ability to raise future financing. We cannot provide any assurance to investors that we will discover any mineralized material in sufficient quantities on any of our properties to justify commercial operations. Further, we will not be able to recover the funds that we spend on exploration if we are not able to establish commercially recoverable quantities of potash on our mineral properties.

We have a history of operating losses and there can be no assurances we will be profitable in the future.

We have a history of operating losses, expect to continue to incur losses, are considered to be in the exploration stage, and may never be profitable. Further, we have been dependent on sales of our equity securities to meet our cash requirements. We incurred net profit of $8,505,659 in the year ended February 29, 2012, however, this net profit was a result of substantial non-cash decrease in derivative liability, and net losses totaling $31,208,831 in the year ended February 28, 2011. Further, we do not expect positive cash flow from operations in the near term. There is no assurance that actual cash requirements will not exceed our estimates. In particular, additional capital may be required in the event that: (i) the costs to acquire additional mineral exploration claims are more than we currently anticipate; (ii) exploration costs for additional claims increase beyond our expectations; or (iii) we encounter greater costs associated with general and administrative expenses or offering costs.

Our participation in mineral exploration prospects has required and will continue to require substantial capital expenditures. The uncertainty and factors described throughout this section may impede our ability to economically discover mineral prospects. As a result, we may not be able to achieve or sustain profitability or positive cash flows from operating activities in the future.

17

Our operations are subject to losses due to exchange rate fluctuation.

We maintain accounts in Canadian currency. Our equity financings have to-date been priced in Canadian dollars, however our material project is located in the United States and requires regular currency conversions to U.S. dollars. Our operations are accordingly subject to currency fluctuations and such fluctuations may materially affect our financial position and results. We do not engage in currency hedging activities.

Declining economic conditions could negatively impact our business.

Our operations are affected by local, national and worldwide economic conditions. Markets in the US, Canada and elsewhere have been experiencing extreme volatility and disruption for more than 12 months, due in part to the financial stresses affecting the liquidity of the banking system and the financial markets generally. The consequences of a potential or prolonged recession may include a lower level of economic activity and uncertainty regarding energy prices and the capital and commodity markets. Instability in the financial markets, as a result of recession or otherwise, also may affect the cost of capital and our ability to raise capital.

The mining industry is very competitive and our ability to attract and retain qualified contractors and staff is critical to our success. The departure of key personnel or loss of key contractors could adversely affect our ability to run our business and achieve our business objectives.

We will compete in the hiring of appropriate geological, engineering, permitting, environmental and other operational experts to assist with the location, exploration and development of our mineral property interests and implementation of our business plan. We believe we will have to offer or pay appropriate cash compensation and options to induce persons to be associated with an exploration stage company.

In addition, we depend to a great extent on principal members of our management. If we lose the services of any key personnel, in particular, Mr. Joshua Bleak, our President and CEO, who has been instrumental in the growth and expansion of our business, it could significantly impede our growth plans and corporate strategies, identifying business opportunities, recruiting new staff, and retaining existing capable staff. The recruiting and retaining qualified scientific, technical and managerial personnel is critical to our success. We do not currently have any key man life insurance policies. We may not be able to retain existing personnel or attract and retain qualified staff in the future.

If we are unable to hire qualified contractors and staff and retain personnel in key positions because of our limited resources, we may be unable to proceed with the implementation of our business plan of exploring and possibly developing our mineral property interests. In that event, investors will have their investment impaired or it may be entirely lost.

We face competition from larger companies having access to substantially more resources than we possess.

Our competitors include other mineral exploration and mining companies and fertilizer producers in the United States and globally, including state-owned and government-subsidized entities. Many of these competitors are large, well-established companies and have substantially larger operating staffs and greater capital resources than we do. We may not be able to successfully conduct our operations, evaluate and select suitable properties and consummate transactions in this highly competitive environment. Specifically, these larger competitors may be able to pay more for exploratory prospects and productive mineral properties and may be able to define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. In addition, such companies may be able to expend greater resources on the existing and changing technologies that we believe are and will be increasingly important to attaining success in the industry. If our competition is such that we cannot compete and generate a sufficient return on our investment and operations, we may be forced to curtail our operations, resulting in a loss to investors.

18

There is substantial doubt as to whether we can continue as a going concern.

Our auditors have included an explanatory paragraph in their opinion that accompanies our audited financial statements as of and for the year ended February 29, 2012, indicating that we have incurred losses since inception of the exploration stage of $25,453,864 which raises substantial doubt about our ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Our officers and directors may be subject to conflicts of interest.

Some of our officers and directors serve only part time and may be subject to conflicts of interest. Each may devote part of his working time to other business endeavors, including consulting relationships with other corporate entities, and may have responsibilities to these other entities. Such conflicts may include deciding how much time to devote to our affairs, as well as what business opportunities should be presented to us. Because of these relationships, some of our officers and directors may be subject to conflicts of interest.

Joshua Bleak, our President CEO and a director, as well as John Eckersley, our Vice President and a director, serve full time (40 hours per week). All of the other directors and officers only provide services to us on a part time basis as follows:

Laara Shaffer (CFO and a director) – 15 hours per week;

Ali

Rahimtula (director) – 10 hours per week;

Matthew Salmon (director) – 10

hours per week;

David Salisbury (director) – 10 hours per week;

Dennis

Ickes (director) – 10 hours per week; and

Jerry Aiken (director) – 10 hours

per week.

We are required to indemnify our directors and executive officer against liability to us and our stockholders, and such indemnification could increase our operating costs.

Our Articles require us to indemnify our directors and officers against claims associated with carrying out the duties of their offices. Our Articles also require us to reimburse them for expenses actually and reasonably incurred by such director and/or officer in respect of legal proceedings relating to carrying out the duties of their offices.

Since our directors and executive officer are aware that they may be indemnified for carrying out the duties of their offices, they may be less motivated to meet the standards required by law to properly carry out such duties, which could increase our operating costs. Further, if our directors or executive officer file a claim against us for indemnification, the associated expenses could also increase our operating costs.

General Risks Associated with Our Exploration Activities

Mining operations are subject to comprehensive regulation, which may cause substantial delays or require capital outlays in excess of those anticipated, causing an adverse effect on our business operations.

If economic quantities of minerals are found on any of our mineral property interests by us in sufficient quantities to warrant mining operations, such mining operations will be subject to federal, state, and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Mining operations are also subject to federal, state, and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of mining methods and equipment. Various permits from government bodies are required for mining operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal, provincial, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus resulting in an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may elect not to insure against due to prohibitive premium costs and other reasons. To date we have not been required to spend material amounts on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations.

19

Mineral exploration and development and mining activities are subject to certain environmental regulations, which may prevent or delay the commencement or continuance of our operations.

Mineral exploration and development and future potential mining operations are or will be subject to stringent federal, state and local laws and regulations relating to improving or maintaining environmental quality. Environmental laws often require parties to pay for remedial action or to pay damages regardless of fault. Environmental laws also often impose liability with respect to divested or terminated operations, even if the operations were terminated or divested of many years ago.

Future potential mining operations and current exploration activities are or will be subject to extensive laws and regulations governing prospecting, development, production, exports, taxes, labor standards, occupational health, waste disposal, protection and remediation of the environment, protection of endangered and protected species, mine safety, toxic substances and other matters. Mining is also subject to risks and liabilities associated with pollution of the environment and disposal of waste products occurring as a result of mineral exploration and production. Compliance with these laws and regulations will impose substantial costs on us and will subject us to significant potential liabilities.

Costs associated with environmental liabilities and compliance are expected to increase with the increasing scale and scope of operations and we expect these costs may increase in the future.

We believe that our operations comply, in all material respects, with all applicable environmental regulations. However, we are not fully insured at the current date against possible environmental risks.

Our operations are dependent on receiving the required permits and approvals from governmental authorities. Denial or delay by a government agency in issuing any of our permits and approvals or imposition of restrictive conditions on us with respect to these permits and approvals may impair our business and operations.

We must obtain numerous environmental and exploration permits and approvals authorizing our future operations. A decision by a government agency to deny a permit or approval could have a material adverse effect on our ability to continue operations at the affected location and may have a material adverse effect on our business operations.

In addition, if we are successful at indentifying a commercially viable potash deposit on our Holbrook Basin Project, the future potential development of such deposit into a mine is also predicated upon securing all necessary permits and approvals. A denial of or delay in obtaining any of these permits or approvals or the issuance of any of these permits with cost-prohibitive conditions could interfere with any potential development of this property and have a material adverse effect on our business, financial condition or results of operations.

Our business involves many operating risks, which may result in substantial losses, and insurance may be unavailable or inadequate to protect us against these risks.

Our operations are subject to hazards and risks associated with the exploration of natural resources and related fertilizer materials and products, such as: fires; explosions; inclement weather and natural disasters; mechanical failures; unscheduled downtime; and availability of needed equipment at acceptable prices. Any of these risks can cause substantial losses resulting from: damage to and destruction of property, natural resources and equipment; regulatory investigations and penalties; revocation or denial of our permits; suspension of our operations; and repair and remediation costs.

Our liability for environmental hazards may extend to those created either by the previous owners of properties that we purchase or lease or by acquired companies prior to the date we acquire them. We do not currently maintain insurance against all of the risks described above. In the future we may not be able to obtain insurance at premium levels that justify its purchase. We may also experience losses in amounts in excess of the insurance coverages carried. Either of these occurrences could harm our financial condition and results of operations.

20

Potash is a commodity with a selling price that is highly dependent on the business and economic conditions and governmental policies affecting the agricultural industry. These factors are outside of our control and may significantly affect our profitability.

If we are able to achieve commercial production on any of our properties, our future revenues, operating results, profitability and rate of growth will depend primarily upon business and economic conditions and governmental policies affecting the agricultural industry, which we cannot control. The agricultural products business can be affected by a number of factors. The most important of these factors, for U.S. markets, are: weather patterns and field conditions (particularly during periods of traditionally high crop nutrients consumption); quantities of crop nutrients imported to and exported from North America; current and projected grain inventories and prices, both of which are heavily influenced by U.S. exports and world-wide grain markets; and U.S. governmental policies, including farm and biofuel policies and subsidies, which may directly or indirectly influence the number of acres planted, the level of grain inventories, the mix of crops planted or crop prices.

International market conditions, which are also outside of our control, may also significantly influence our future operating results. The international market for crop nutrients is influenced by such factors as the relative value of the U.S. dollar and its impact upon the cost of importing crop nutrients, foreign agricultural policies, the existence of, or changes in, import barriers, or foreign currency fluctuations in certain foreign markets, changes in the hard currency demands of certain countries and other regulatory policies of foreign governments, as well as the laws and policies of the United States affecting foreign trade and investment.

Government regulation may adversely affect our business and results of operations.

Projects related to mineral exploration, mining and natural resources are subject to various and numerous federal, state and local government regulations, which may be changed from time to time. There are federal, state and local laws and regulations primarily relating to protection of human health and the environment applicable to the exploration, mining, development, production, handling, storage, transportation and disposal of natural resources, including potash, or its by-products and other substances and materials produced or used in connection with mining operations. Activities subject to regulation include the use, handling, processing, storage, transportation and disposal of hazardous materials, and we could incur substantial additional costs to comply with environmental, health and safety law requirements related to these activities. We also could incur substantial costs for liabilities arising from past unknown releases of, or exposure to, hazardous substances.

Under the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, we could be held jointly and severally responsible for the removal or remediation of any hazardous substance contamination at future facilities, at neighboring properties to which such contamination may have migrated and at third-party waste disposal sites to which we have sent waste. We could also be held liable for natural resource damages. Liabilities under these and other environmental health and safety laws involve inherent uncertainties. Violations of environmental, health and safety laws are subject to civil, and, in some cases, criminal sanctions. As a result of liabilities under and violations of environmental, health and safety laws and related uncertainties, we may incur unexpected interruptions to operations, fines, penalties or other reductions in income, third-party claims for property damage or personal injury or remedial or other costs that would negatively impact our financial condition and operating results. Finally, we may discover currently unknown environmental problems or conditions. The discovery of currently unknown environmental problems may subject us to material capital expenditures or liabilities in the future.

Continued government and public emphasis on environmental issues can be expected to result in increased future investments for environmental controls at ongoing operations, which may lead to increased expenses. Permit renewals and compliance with present and future environmental laws and regulations applicable to our operations may require substantial capital expenditures and may have a material adverse effect on our business, financial condition and operating results.

21

Risks Related to Our Securities

We do not intend to pay dividends and there will thus be fewer ways in which you are able to make a gain on your investment.

We do not anticipate paying any cash dividends on our common stock in the foreseeable future and we may not have sufficient funds legally available to pay dividends. To the extent that we require additional funding currently not provided for in our financing plans, our funding sources may prohibit the payment of any dividends. Because we do not intend to declare dividends, any gain on your investment will need to result from an appreciation in the price of our common stock. There will therefore be fewer ways in which you are able to make a gain on your investment.

Our stock is a penny stock. Trading of our stock may be restricted by the SEC's penny stock regulations which may limit a stockholder's ability to buy and sell our stock.