UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

| JETPAY CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| N/A |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

|

7450 Tilghman Street |

| Allentown, PA 18106 | |

| 610-797-9500 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Date: Tuesday, September 11, 2018

Time: 10 AM, Eastern Time

Location:

Offices of Dechert LLP

2929 Arch Street, 21st Floor

Philadelphia, PA 19104

To JetPay Corporation Stockholders:

We invite you to attend the 2018 Annual Meeting of Stockholders (the “Annual Meeting”) of JetPay Corporation (“JetPay” or the "Company"). At this meeting, you and the other stockholders will be able to vote on the following proposals, together with any other business that may properly come before the meeting:

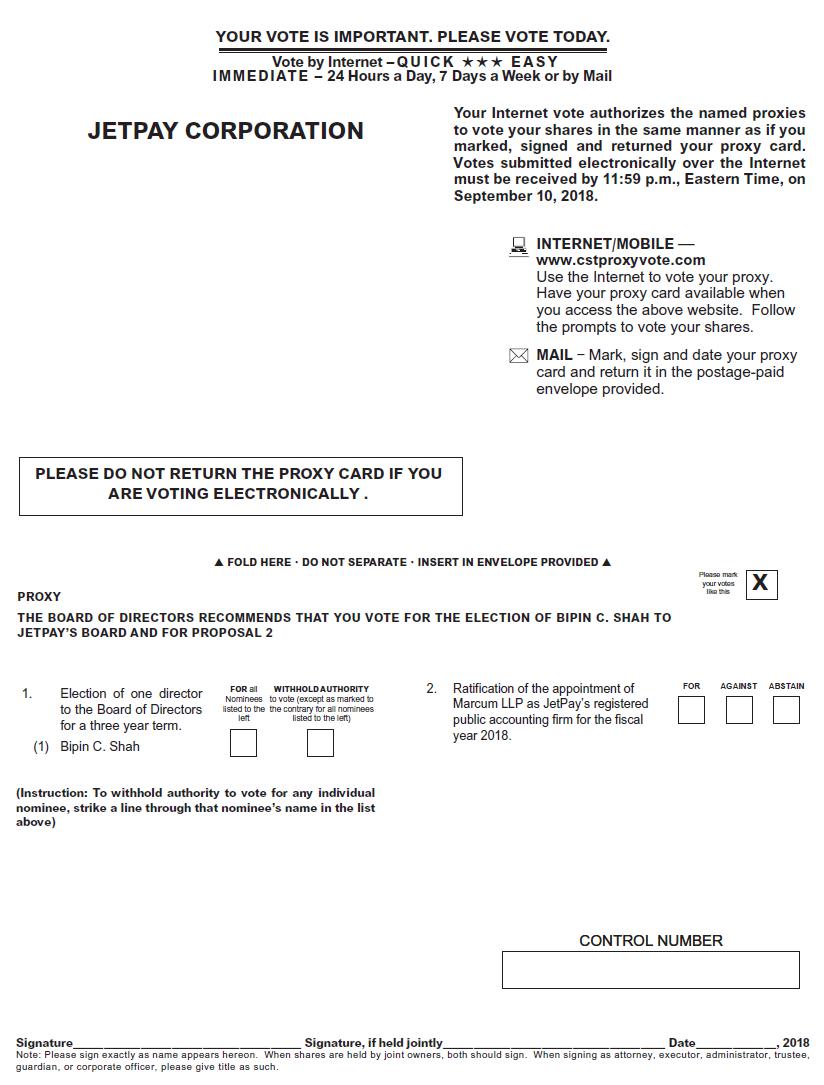

| 1. | Election of one director to the Board of Directors (the “Board”) for a three-year term. The Board has nominated Bipin C. Shah for re-election to the Board. |

| 2. | Ratification of the appointment of Marcum LLP as JetPay’s registered public accounting firm for fiscal year 2018. |

You may vote on these proposals in person by attending the Annual Meeting or by proxy. The attached proxy statement provides details on voting by proxy. If you cannot attend the Annual Meeting, we urge you to complete and return promptly the enclosed proxy card in the enclosed self-addressed stamped envelope so that your shares will be represented and voted at the Annual Meeting in accordance with your instructions. Of course, if you attend the Annual Meeting, you may withdraw your proxy and vote your shares at the Annual Meeting.

Only stockholders of record at the close of business on August 3, 2018 can vote at the Annual Meeting and any adjournment or postponement of the Annual Meeting. As of the record date, there were 15,439,310 shares of JetPay common stock outstanding.

| By Order of the Board of Directors, | |

| /s/ Peter B. Davidson | |

| Allentown, Pennsylvania | Peter B. Davidson |

| August 6, 2018 | Secretary |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2018 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 11, 2018.

JetPay’s Proxy Statement for the 2018 Annual Meeting of Stockholders and the Annual Report

on Form 10-K for the fiscal year ended December 31, 2017 are available via the Internet at http://www.cstproxy.com/jetpaycorp/2018

TABLE OF CONTENTS

| ii |

|

7450 Tilghman Street |

| Allentown, PA 18106 | |

| 610-797-9500 |

PROXY STATEMENT

The Board of Directors (the “Board”) of JetPay Corporation (“JetPay”, the “Company” or “we”) is soliciting proxies to be used at the 2018 Annual Meeting of Stockholders of JetPay to be held on Tuesday, September 11, 2018, at 10 AM, Eastern Time, at the offices of Dechert LLP, 2929 Arch Street, 21st Floor, Philadelphia, PA 19104. JetPay will begin mailing this proxy statement and the enclosed proxy card on or about August 8, 2018 to its stockholders entitled to vote at the Annual Meeting.

The Board is soliciting your proxy to vote on the proposals at the Annual Meeting and to obtain your support for the proposals. You are invited to attend the Annual Meeting and vote your shares directly. If you do not attend, you may vote by proxy, which allows you to direct another person to vote your shares at the Annual Meeting on your behalf, using the accompanying proxy card. Even if you plan to attend the Annual Meeting, it is a good idea to complete, sign and return the proxy card in case your plans change. You can always vote in person at the Annual Meeting, even if you have already returned the proxy card, by revoking your original proxy card.

The Proxy Card. The proxy card permits you to vote by proxy, whether or not you attend the Annual Meeting. When you sign the proxy card, you appoint certain individuals as your representatives at the Annual Meeting (the “proxies”). The proxies will vote your shares of JetPay common stock at the Annual Meeting as you have instructed on the proxy card. If a proposal comes up for a vote that is not on the proxy, and for which the Company did not receive notice of at least 60 days before this proxy solicitation, the proxies will vote your shares as they deem appropriate.

This Proxy Statement. This proxy statement contains important information for you to consider when deciding how to vote on the proposals. Please read it carefully. It is divided into six sections following this Introduction:

| Sections | Page | |

| The Proposals | 4 | |

| Independent Registered Public Accounting Firm | 8 | |

| About the Board of Directors and Executive Officers | 9 | |

| Executive Compensation | 15 | |

| The Principal Stockholders of JetPay | 18 | |

| Additional Information | 20 |

JetPay will bear the cost of soliciting proxies for an affirmative vote on the proposals. JetPay will not reimburse any other person or entity for the cost of preparing its own proxy materials or soliciting proxies for any matter. JetPay’s directors, officers and employees may solicit proxies, but will receive no special compensation for any solicitation activities. Proxies may be solicited by mail, in person, by telephone, facsimile or by other means. JetPay will reimburse brokers, nominees, custodians and fiduciaries for their reasonable out-of-pocket expenses in forwarding proxy materials to the beneficial owners of JetPay common stock.

When And Where. JetPay will hold the Annual Meeting on Tuesday, September 11, 2018, at 10 AM, Eastern Time, at the offices of Dechert LLP, 2929 Arch Street, 21st Floor, Philadelphia, PA 19104.

Record Date. The Board has fixed the close of business on August 3, 2018 as the record date for the Annual Meeting (the “record date”). All stockholders of record at the close of business on the record date are entitled to notice of and are entitled to vote in person or by proxy at the Annual Meeting.

Quorum Requirement. JetPay’s Amended and Restated Bylaws require that a majority of the outstanding shares of JetPay’s capital stock issued and outstanding and entitled to vote be represented at the Annual Meeting, whether in person or by proxy, to constitute a quorum to transact business at the Annual Meeting. Abstentions and broker non-votes will be counted in determining whether there is a quorum present at the Annual Meeting.

The Proposals. Stockholders will vote on the following proposals at the Annual Meeting:

| · | election of one director; and |

| · | ratification of the appointment of Marcum LLP as JetPay’s independent registered public accounting firm for fiscal year 2018. |

Other Matters. No stockholder proposals have been submitted for inclusion in this proxy statement or for consideration at the Annual Meeting. Neither JetPay nor its Board intend to bring any other matter before the Annual Meeting. If other matters requiring the vote of the stockholders properly come before the Annual Meeting, which were omitted from this proxy statement pursuant to Rule 14a-8 or 14a-9 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the proxies named in the enclosed proxy card will have discretionary authority to vote the proxies held by them with respect to such matters in accordance with their best judgment on such matters.

Presence of Independent Registered Public Accountants. Representatives of Marcum LLP, JetPay’s independent registered public accounting firm, will be present at the Annual Meeting. The representatives will have the opportunity to make a statement at the Annual Meeting, if they choose, and are expected to be available to respond to appropriate stockholder questions.

The Stockholders. As of the close of business on the record date, there were 15,439,310 shares of JetPay common stock issued and outstanding, excluding treasury shares. In addition, as of the record date, there were 133,333 shares of Series A Convertible Preferred Stock (“Series A Preferred Stock”) outstanding, convertible into 15,999,960 shares of common stock, and 9,000 shares of Series A-1 Convertible Preferred Stock Outstanding (“Series A-1 Preferred Stock”), convertible into 1,038,462 shares of common stock. A complete list of stockholders entitled to vote at the Annual Meeting will be available for inspection by any stockholder, for any purpose relating to the Annual Meeting, for ten days prior to the meeting during ordinary business hours at JetPay’s headquarters located at 7450 Tilghman Street, Allentown, Pennsylvania 18106 or at the offices of Dechert LLP located at 2929 Arch Street, Philadelphia, Pennsylvania 19104.

You are entitled to one vote for each share of JetPay common stock that you owned of record at the close of business on the record date. In addition, the holders of JetPay’s Series A Preferred Stock and Series A-1 Preferred Stock are entitled to vote with the holders of JetPay’s common stock as a single class. Each holder of shares of the Series A Preferred Stock or Series A-1 Preferred Stock shall be entitled to the number of votes as provided for in the Certificate of Designation applicable to the Series A Preferred Stock or Series A-1 Preferred Stock, as applicable. The presence, in person or by proxy, of the holders of a majority of the shares of capital stock issued and outstanding and entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Abstentions are counted as “shares present” at the meeting for purposes of determining whether a quorum exists. Abstentions have the effect of a vote “against” any matter to which they are specified. Proxies submitted by brokers that do not indicate a vote for some or all of the proposals because the brokers do not have discretionary voting authority and have not received instructions as to how to vote on those proposals (so-called “broker non-votes”) are considered “shares present” at the meeting for purposes of determining whether a quorum exists. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters, but not on non-routine matters. Broker non-votes will not affect the outcome of the vote on any matter unless the matter requires the affirmative vote of a majority of the outstanding shares and in such case will have the effect of a vote “against” that matter.

| 2 |

No Dissenters’ Rights

The proposed corporate actions on which the stockholders are being asked to vote are not corporate actions for which stockholders of a Delaware corporation have dissenter’s rights under the Delaware General Corporation Law.

Vote Required to Approve Proposals

With respect to Proposal 1, the nominee for director receiving the highest number of affirmative votes at the Annual Meeting shall be elected as a director. Stockholders do not have the right to cumulate their votes in the election of directors. Proposal 2 requires the approval of a majority of all shares of JetPay common stock entitled to vote for such proposal that are represented at the Annual Meeting in person or by proxy. For purposes of determining approval of these proposals, an abstention will have the same legal effect of a vote “against” the proposal and broker non-votes will not affect the results of this vote.

You may vote in one of three ways:

| · | return your completed, signed and dated proxy card before the Annual Meeting; |

| · | via the Internet at http://www.cstproxy.com; or |

| · | cast a written ballot in person at the Annual Meeting (you will need a legal proxy from your broker if you hold your shares in street name). |

Voting By Proxy. By returning a completed proxy card or voting via the Internet before the Annual Meeting, you will direct the appointed persons (known as “proxies”) to vote your shares at the Annual Meeting in accordance with your instructions. Gregory M. Krzemien, JetPay’s Chief Financial Officer, and Peter B. Davidson, JetPay’s Vice-Chairman and Corporate Secretary, will serve as proxies for the Annual Meeting. If you complete the entire proxy card except for the voting instructions, the proxies will vote your shares (i) for the election of the nominated director, and (ii) for the ratification of the appointment of Marcum LLP as JetPay’s independent registered public accounting firm for fiscal year 2018. If the nominee for election to the Board is unable to serve, which is not anticipated, then the designated proxies will vote your shares for a substitute nominee chosen by the Board. If any other matters properly come before the Annual Meeting, then the designated proxies will vote your shares in their discretion on such matters.

How To Revoke Your Proxy. You may revoke your proxy at any time before it is exercised at the Annual Meeting by any of the following means:

| · | notifying JetPay’s Corporate Secretary in writing (notice to be sent to JetPay’s executive offices, the address for which is located on the first page of this proxy statement); |

| · | submitting another proxy card with a later date; or |

| · | attending the Annual Meeting and voting by written ballot (mere attendance at the Annual Meeting will not by itself revoke your proxy). |

Only the record owner of your shares can vote your shares or revoke a proxy the record owner has given. If your shares are held in street name, you will not be able to revoke the proxy given by the street name holder.

| 3 |

The director nominee currently serves on the Board and was nominated for re-election by the Board’s nominating committee (the “Nominating Committee”), which nomination was approved by the Board. The nominee has agreed to be nominated to stand for election at the Annual Meeting.

Pursuant to our Amended and Restated Certificate of Incorporation, the number of directors shall be set from time to time by the Board. The number of directors is currently set at eight (including one vacancy left by Jonathan M. Lubert’s resignation on January 9, 2018). Our Board, other than the directors appointed by the holders of our shares of Series A Preferred Stock (the “Series A Directors”), is divided into three classes with only one class of directors being elected in each year and each class serving a three-year term. The term of office of the third class of directors, consisting only of Mr. Bipin C. Shah, will expire at the Annual Meeting. The term of office of the first class of directors, consisting of Mr. Robert Frankfurt, will expire at the 2019 annual meeting of stockholders. The term of office of the second class of directors, consisting of Ms. Diane (Vogt) Faro and Mr. Robert Metzger, will expire at the 2020 annual meeting of stockholders. Under the Certificate of Designation for our Series A Preferred Stock, as amended, the term of office for each of our Series A Directors – Messrs. Donald J. Edwards, Steven M. Michienzi and Laurence L. Stone – is until the applicable Series A Director is removed by the holders of the Series A Preferred Stock or until his earlier death, resignation, retirement or disqualification.

Biographical information for the director nominee appears below.

Bipin C. Shah has been the Chairman of the Board since inception and Chief Executive Officer of the Company from inception until May 5, 2016 and is 80 years of age. Since the sale of Genpass, Inc. to U.S. Bancorp in 2005, Mr. Shah has been a private investor, focusing on opportunities in the payments business. From 2000 to 2005, Mr. Shah was the Chief Executive Officer of Genpass, Inc. where he led the development of the MoneyPass, a surcharge-free ATM network, as well as a payroll debit card used by several large payroll companies. From 1992 until its sale to Paymentech in 1996, he was the Chief Executive Officer of Gensar, Inc., a company that specialized in the processing of restaurant debit and credit card transactions. During his tenure at Gensar, Inc., he led development of the “Tip Management System” along with other technology enhancements. From 1980 to 1991, Mr. Shah was employed by CoreStates Financial Corp and its predecessor, Philadelphia National Bank, ultimately serving as Vice Chairman and Chief Operating Officer. While at CoreStates, Mr. Shah oversaw the acquisitions of seven ATM and point of sale businesses and was active in the development of several products for the financial services industry’s payments infrastructure, including the Money Access Center network, the introduction of debit to the point-of-sale, cash-back, and pay-at-the-pump. From 1985 to 1992, Mr. Shah served as a director of VISA USA and VISA INTERNATIONAL and currently serves on an advisory board of FinPay, L.L.C. He has served on the Board of Trustees for Baldwin-Wallace College and the Franklin Institute. Earlier in his career, he was a Senior Vice President at the Federal Reserve Bank of Philadelphia and a Senior Vice President at American Express, as well as the President of Vertex Division of MAI. Mr. Shah holds a Bachelor of Arts in Philosophy from Baldwin-Wallace College and a Masters in Philosophy from the University of Pennsylvania. We believe that Mr. Shah’s career as an executive in the payment processing industry and as an investor generally provides him with the necessary skills to chair the Board and provide advice to our management team with respect to operational, strategic and management issues as well as general industry trends.

The Board recommends that you vote FOR the election of Bipin C. Shah to JetPay’s Board.

| 4 |

Biographical information for the current directors not currently standing for re-election appears below.

Diane (Vogt) Faro has been on the Board since April 1, 2014, has been the Chief Executive Officer since May 5, 2016 and is 66 years of age. Since December 2011 until May 5, 2016, Ms. Faro was President of National Benefit Programs, LLC, a provider of brand loyalty and discount programs to small to mid-size businesses. Prior to joining National Benefit Programs, from 2009 to December 2011, Ms. Faro was a consultant for the electronic payments industry focused on assisting companies in growing revenues. From 2005 to 2009, Ms. Faro was President of Global Merchant Services at First Data Corporation, a payment processing company where she was responsible for over $1 billion in annualized revenues. Ms. Faro also served as President of First Data’s Alliance Group. Prior to these roles at First Data, Ms. Faro was Chief Executive Officer of Chase Merchant Services LLC, which processed over $170 billion in payment volume annually during her tenure. Ms. Faro has served on the Board of Directors of the Electronic Transactions Association, Merchant Link and Front Stream Payments, all of which are private companies in the payment processing industry. Ms. Faro is one of the founding members of the Women’s Networking in Electronic Transactions (W.net), which offers women in the payments industry a place to network and find mentors. Ms. Faro’s extensive experience in the payments industry provides her with the necessary skills to provide the Board and management with valuable insight into marketing and operational issues and lead our management team with respect to operational, strategic and management issues.

Donald J. Edwards has been on the Board since October 11, 2013, when he was appointed by the holders of our Series A Preferred Stock, and is 52 years of age. Mr. Edwards is the Managing Principal of Flexpoint Ford, LLC, a private equity investment firm focused on healthcare and financial services. Mr. Edwards has been with Flexpoint Ford, LLC since 2004. Previously, from 2002 to 2004, Mr. Edwards was President and CEO of Liberte Investors (now First Acceptance Corporation), which he guided through the acquisition of a leading provider of non-standard consumer automobile insurance. Mr. Edwards was a Principal of GTCR, a private equity firm with more than $6 billion under management, from 1994 to 2002, where he was the head of the firm’s healthcare investment effort. From 1988 to 1992, Mr. Edwards was an associate at Lazard Freres and Co., specializing in mergers and acquisitions. Mr. Edwards holds a B.S. degree in finance with highest honors from the University of Illinois and an M.B.A. from Harvard Business School where he was a Baker Scholar. We believe that Mr. Edwards’ experience as an executive in a private equity firm focused on the financial services industry and his knowledge of the capital markets generally provide him with the necessary skills to serve as a member of the Board and enable him to provide valuable insight to the Board regarding strategic issues, general investor trends, as well as capital raising matters.

Robert Frankfurt has been on the Board since October 30, 2017, and is 53 years of age. Mr. Frankfurt founded Myca Partners, Inc., an investment advisory services firm (“Myca”), in 2006 to invest in small cap U.S. public and private companies. Prior to forming Myca, Mr. Frankfurt spent more than a decade as a partner and senior portfolio manager at various investment partnerships. Mr. Frankfurt recently served on a number of public company boards, including Handy & Harman Ltd. (NASDAQ: HNH), an industrial products technology company, which was sold in October 2017 to Steel Partners Holdings L.P., Jive Software, Inc. (NASDAQ: JIVE), a global provider of communication and collaboration solutions for businesses and government agencies prior to its sale to ESW Capital, LLC in June 2017, and Peerless Systems Corp (NASDAQ: PRLS). Mr. Frankfurt began his career as a financial analyst in the mergers and acquisition department of Bear, Stearns & Co. and later joined Hambro Bank America as an associate focused on mergers and acquisitions and venture capital transactions. Mr. Frankfurt graduated from the Wharton School of Business with a B.S. in Economics and received an MBA from the Anderson Graduate School of Management at UCLA. We believe that Mr. Frankfurt, with a career of over 30 years in assisting senior management and providing board leadership for numerous companies, including NASDAQ-listed companies in the technology and payment processing industry, brings valuable expertise to our organization in the areas of strategic direction, financing strategies, acquisitions, and overall industry expertise.

| 5 |

Robert Metzger has been on the Board since November 20, 2017 when he was appointed to serve as a Class B Director, and is 50 years of age. Mr. Metzger has served as Director of the Investment Banking Academy at the Gies College of Business at the University of Illinois since April 2015 and he has also been the Director of the Gies College of Business Honors Programs since January 2017. In addition, he serves as a Lecturer in the Department of Finance at the University of Illinois. Since 2016, Mr. Metzger has served as a senior director at William Blair & Company, an investment bank. Mr. Metzger previously served as partner and managing director at William Blair & Company, where he was head of the Technology group from January 2011 to December 2015 and head of the Financial Services Investment Banking Group from April 2007 to December 2015. Prior to joining William Blair & Company, Mr. Metzger worked at ABN Amro Incorporated, A.T. Kearney, and Price Waterhouse. Mr. Metzger currently serves as a member of the Board of Directors and Audit Committees at WageWorks, USA Technologies, and Millennium Trust Company, and serves as a Senior Advisor of Mission OG. Mr. Metzger graduated from the University of Illinois at Urbana-Champaign with a B.S. in Accountancy and received an MBA from the Kellogg School of Management at Northwestern University. We believe that Mr. Metzger, with his extensive and valuable experience of over 25 years in investment banking and academics, including the experiences he gained from his leadership roles on various boards, including companies in the human resources and payment technology space, is of great value in assisting management and the board with strategic direction and increasing stockholder value.

Steven M. Michienzi has been on the Board since October 11, 2013, when he was appointed by the holders of our Series A Preferred Stock, and is 34 years of age. Mr. Michienzi is a Principal of Flexpoint Ford, LLC, where his primary responsibilities include the evaluation and management of investments across the financial services industry. Mr. Michienzi has been with Flexpoint Ford, LLC since 2009. From June 2006 to June 2009, Mr. Michienzi worked in the investment banking division of Wachovia Securities specializing in mergers and acquisitions and capital raising advisory assignments. Mr. Michienzi serves as a director of GeoVera Investment Group, Ltd., a homeowners’ insurance company, and Corporate Finance Group, Inc., a provider of finance and accounting advisory services. He previously served as a director of Financial Pacific Holdings, LLC, an equipment leasing company. Mr. Michienzi graduated magna cum laude with a B.S. in economics from Duke University where he was elected into Phi Beta Kappa honor society. We believe that Mr. Michienzi’s experience as an investment professional at a private equity firm focused on the financial services industry and his knowledge of evaluating and managing investments generally provide him with the necessary skills to serve as a member of the Board and enable him to provide valuable insight to the Board regarding strategic issues, general investor trends, and future acquisition investments.

Laurence L. Stone has been on the Board since October 18, 2016, when he was appointed by the holders of our Series A Preferred Stock, and is 53 years of age. Mr. Stone is the managing member of Sundara Investment Partners, LLC; the sole shareholder of LHLJ, Inc.; and the managing member of Main Line Trading Partners, LLC. Mr. Stone worked for Mercury Payment Systems from June 2006 until its sale to Vantiv, Inc. in 2014, including his roles as a Principal and a Director. Prior to Mercury Payment Systems, Mr. Stone founded and served as an officer of Card Payment Services and Card Payment Systems, Independent Sales Organization merchant processing companies. Mr. Stone served as Chief Executive Officer of Card Payment Systems from 1997 until Concord EFS’s acquisition of Card Payment Systems in 2000. Mr. Stone started his payment processing career at CitiCorp Card Acceptance Services in 1988. Mr. Stone serves on the boards of directors of Olivam Partners, LP and Clutch Holdings, Inc. Mr. Stone holds a B.S. degree in Economics from the Wharton School of the University of Pennsylvania in Finance. We believe that Mr. Stone’s experience as an executive in the payment processing industry provides him with the necessary skills to serve as a member of the Board and enable him to provide valuable insight to the Board regarding operational, sales and management issues.

| 6 |

The audit committee of the Board (the “Audit Committee”) selects the independent registered public accounting firm to audit JetPay’s books of account and other corporate records. The Audit Committee’s selection of Marcum LLP to audit JetPay’s books of account and other corporate records for 2018 is being submitted to you for ratification. Stockholders are not required to ratify the appointment of Marcum LLP as the Company’s independent registered public accounting firm. However, the ratification of Marcum LLP is being submitted as a matter of good corporate practice. If stockholders do not ratify the appointment of Marcum LLP, the adverse vote will be considered a directive to the Audit Committee to select other auditors for the next fiscal year.

The Board recommends that you vote FOR the ratification of the appointment of Marcum LLP as JetPay’s independent registered public accounting firm for fiscal year 2018.

| 7 |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The reports of Marcum LLP on JetPay’s consolidated financial statements for the fiscal years ended December 31, 2017 and 2016 did not contain any adverse opinion or disclaimer of opinion or modification or qualification as to uncertainty, audit scope or accounting principles. In connection with its audits, there have been no disagreements between JetPay and Marcum LLP on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Marcum LLP, would have caused them to refer to any such disagreements in its report on JetPay’s consolidated financial statements for such period.

Audit Fees and Related Matters

Audit Fees

The Company was billed $321,000 by Marcum for the audit of JetPay’s annual financial statements for the year ended December 31, 2017 and for the review of the financial statements included in JetPay’s Quarterly Reports on Form 10-Q filed for each of the first three calendar quarters of 2017.

The Company was billed $294,000 by Marcum for the audit of JetPay’s annual financial statements for the year ended December 31, 2016 and for the review of the financial statements included in JetPay’s Quarterly Reports on Form 10-Q filed for each of the first three calendar quarters of 2016.

Audit-Related Fees

During the years ended December 31, 2017 and 2016, we did not incur any audit-related fees.

Tax Fees

During the years ended December 31, 2017 and 2016, there were no fees billed for income tax preparation services by our independent registered public accounting firm.

All Other Fees

During the years ended December 31, 2017 and 2016, there were no fees billed for other matters by our independent registered public accounting firm.

Pre-Approval Policy

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the Company’s independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services. The independent registered public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by the independent registered public accounting firm in accordance with such pre-approval. The Audit Committee approved all of the Company’s Audit Related Fees, Tax Fees and All Other Fees incurred by the Company in 2017 and 2016.

| 8 |

Presence of Independent Registered Public Accounting Firm

Representatives of Marcum LLP will be at the Annual Meeting and will have the opportunity to make a statement at the Annual Meeting, if they desire. Representatives of Marcum LLP are expected to be available to respond to appropriate stockholder questions.

ABOUT THE BOARD OF DIRECTORS AND EXECUTIVE OFFICERS

About the Board and its Standing Committees

JetPay’s Board is currently comprised of seven directors: Donald J. Edwards, Diane (Vogt) Faro, Robert Frankfurt, Robert Metzger, Steven M. Michienzi, Bipin C. Shah and Laurence L. Stone. Bipin C. Shah serves as Chairman of the Board. The Board has one vacancy left by the resignation of Jonathan M. Lubert on January 9, 2018.

The Board has determined that Messrs. Edwards, Frankfurt, Metzger, Michienzi and Stone are independent under the rules and regulations of The NASDAQ Stock Market (the “Independent Directors”).

In addition to the Audit Committee, the Board has a standing Nominating Committee and a Compensation Committee. Each of the standing committees of the Board is governed by a charter and such charters are posted on the Company’s website at www.jetpay.com.

Board Leadership Structure and Role in Risk Oversight

Ms. Faro serves as the Company’s principal executive officer. We do not currently have a lead independent director. The Board has determined that this leadership structure is appropriate as the Board believes that its other structural features, including five independent, non-employee directors on a board currently consisting of seven directors and key committees consisting wholly of independent directors, provide for substantial independent oversight of the Company’s management. However, the Board recognizes that depending on future circumstances, other leadership models may become more appropriate. Accordingly, the Board will continue to periodically review its leadership structure.

Risk Oversight

Management is responsible for the day-to-day management of risks faced by our company, while the Board currently has responsibility for the oversight of risk management. In its risk oversight role, the Board seeks to ensure that the risk management processes designed and implemented by management are adequate. The Board also reviews with management our strategic objectives, which may be affected by identified risks, our plans for monitoring and controlling risk, the effectiveness of such plans, appropriate risk tolerance and our disclosure of risk. Our Audit Committee is responsible for periodically reviewing with management and our independent auditors the adequacy and effectiveness of our policies for assessing and managing risk. The other committees of the Board also monitor certain risks related to their respective committee responsibilities. All committees report to the full Board as appropriate, including when a matter rises to the level of a material or enterprise level risk.

| 9 |

Meetings of the Board and its Standing Committees During 2017

JetPay’s Board held thirteen formal meetings and took action by unanimous written consent zero times during 2017. Standing committees of the Board held five formal meetings and took action by unanimous written consents six times during 2017, as set forth on the following chart. All directors attended more than 95% of the aggregate of JetPay’s Board meetings and the meetings of the standing committees of the Board on which they served. The Company does not have a policy with respect to attendance of members of the Board at annual meetings. Six directors attended the 2017 annual meeting of stockholders.

The following chart describes the calendar year 2017 composition and the functions of the standing committees of the Board:

| BOARD COMMITTEES | ||||||

|

Committee |

Members |

No. of Held and |

Functions | |||

|

Audit |

January 1, 2017 to May 7, 2017: Robert B. Palmer † ** Jonathan M. Lubert Steven M. Michienzi

May 7, 2017 to October 30, 2017: Jonathan M. Lubert Steven M. Michienzi

October 30, 2017 to January 9, 2018: Robert Frankfurt † Jonathan M. Lubert * Steven M. Michienzi

January 9, 2018 to January 30, 2018: Robert Frankfurt † Steven M. Michienzi

January 30, 2018 to Current: Robert Frankfurt † Robert Metzger Steven M. Michienzi |

4 meetings

|

· Selects independent registered public accounting firm. · Confers with independent registered public accounting firm and internal personnel on the scope of registered public accounting firm’s examinations. · Reviews internal controls and procedures. · Reviews related party transactions.

| |||

|

Nominating

|

January 1, 2017 to May 7, 2017: Donald J. Edwards † Jonathan M. Lubert Robert B. Palmer **

May 7, 2017 to January 9, 2018: Donald J. Edwards † Jonathan M. Lubert *

January 9, 2018 to January 30, 2018: Donald J. Edwards †

January 30, 2018 to Current: Donald J. Edwards † Robert Frankfurt

|

1 meeting

1 unanimous consent |

· Develops and recommends to the Board criteria for the selection of new directors to the Board. · Seeks candidates to fill vacancies on the Board. · Retains and terminates search firms to be used to identify director candidates. · Recommends to the Board processes for evaluating the performance of the Board. · Recommends to the Board nominees for election as directors at the annual meeting of stockholders. | |||

|

Compensation |

January 1, 2017 to May 7, 2017: Donald J. Edwards† Steven M. Michienzi Robert B. Palmer **

May 7, 2017 to Current: Donald J. Edwards† Steven M. Michienzi

|

0 meetings

5 unanimous consents |

· Annually reviews CEO compensation and performance. · Annually establishes goals for CEO. · Annually reviews CFO and Vice Chairman compensation. · Annually recommends to the Board compensation for CEO, CFO and Vice Chairman. · Reviews and determines director compensation. · Hires compensation consultants. · Recommends executive compensation to the Board. · Administers stock incentive plans.

| |||

† Chairman of Committee

* Jonathan M. Lubert resigned from the Board effective January 9, 2018 for reasons unrelated to any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

** Robert B. Palmer passed away on May 7, 2017.

| 10 |

The following table provides summary information concerning cash and certain other compensation paid or accrued by JetPay to or on behalf of JetPay’s Board for the year ended December 31, 2017.

DIRECTOR COMPENSATION (5) (6)

Fees Earned ($) | Option Awards ($) | Total ($) | ||||||||||

| Donald J. Edwards | 26,500 | - | 26,500 | |||||||||

| Robert Frankfurt (1) | 6,887 | - | 6,887 | |||||||||

| Jonathan M. Lubert (2) | 19,000 | - | 19,000 | |||||||||

| Robert Metzger (3) | 3,129 | - | 3,129 | |||||||||

| Steven M. Michienzi | 24,000 | - | 24,000 | |||||||||

| Robert B. Palmer (4) | 8,543 | - | 8,543 | |||||||||

| Laurence L. Stone | 22,000 | 22,000 | ||||||||||

| (1) | Robert Frankfurt was appointed to the Board of Directors on October 30, 2017. |

| (2) | Jonathan M. Lubert resigned from the Board of Directors effective January 9, 2018. |

| (3) | Robert Metzger was appointed to the Board of Directors on November 20, 2017. |

| (4) | Robert B. Palmer was an independent director prior to his passing on May 7, 2017. |

| (5) | Diane (Vogt) Faro and Bipin C. Shah received compensation from the Company in 2017 and accordingly are not deemed independent directors and are not paid director fees. |

| (6) | In addition to the fees set forth above, Messrs. Metzger and Frankfurt will receive fees related to their service on a special committee that was created in November 2017. Each member of such committee will receive a retainer of $37,500 and the chairman (Mr. Metzger) will receive an additional $37,500 chair fee. These fees will not be paid until certain specified future events. |

Effective April 1, 2014, the Compensation Committee approved a plan which the Board ratified to provide cash compensation to the non-employee directors of the Company for their service. The plan includes: a $10,000 annual retainer to be paid in quarterly installments in arrears; a $1,000 fee to each non-employee director for each board meeting attended in person or by teleconference; and a $500 fee to each non-employee director for each board committee meeting attended in person or by teleconference. Additionally, an annual retainer fee of $5,000 will be paid to the Chairman of the Compensation Committee and a $10,000 annual retainer fee will be paid to the Chairman of the Audit Committee. The fees for Messrs. Edwards and Michienzi are payable to their employer, Flexpoint Ford, LLC.

We have established a Nominating Committee of the Board of Directors, which consists of Messrs. Edwards (Chair) and Frankfurt, each of whom is an independent director under the rules and regulations of The NASDAQ Stock Market. The Nominating Committee operates pursuant to a charter which has been posted on our website and can be found at www.jetpay.com.

The Nominating Committee is responsible for overseeing the selection of persons to be nominated to serve on our Board. The Nominating Committee considers persons identified by its members, management, shareholders, investment bankers and others.

Guidelines for Selecting Director Nominees

The Nominating Committee’s guidelines for selecting nominees generally provide that persons to be nominated:

| · | should have demonstrated notable or significant achievements in business, education or public service; |

| · | should possess the requisite intelligence, education and experience to make a significant contribution to the Board and bring a range of skills, diverse perspectives and backgrounds to the Board’s deliberations; and |

| · | should have the highest ethical standards, a strong sense of professionalism and intense dedication to serving the interests of the stockholders. |

| 11 |

The Nominating Committee will consider a number of qualifications and factors relating to management and leadership experience, background and integrity and professionalism in evaluating a person’s candidacy for membership on the Board. The Nominating Committee may require certain skills or attributes, such as financial or accounting experience, to meet specific Board needs that arise from time to time. The Nominating Committee does not have a policy with regard to consideration of candidates for election to the Board recommended by stockholders and does not distinguish among nominees recommended by stockholders and other persons. The Board believes that the governance and nominating committee charter provides adequate and proper procedures for identifying director nominees and, therefore, it is appropriate not to have such a policy. Stockholders wishing to recommend a nominee for director are to submit such nomination in writing, along with any other supporting materials the stockholder deems appropriate, to the Secretary of the Company, Peter B. Davidson, at the Company’s corporate offices at 7450 Tilghman Street, Allentown, Pennsylvania 18106.

We have established an Audit Committee of the Board. As required by the rules of The NASDAQ Stock Market, each of the members of our Audit Committee is able to read and understand fundamental financial statements. Prior to his death in May 2017, Mr. Robert B. Palmer was the audit committee “financial expert” and was determined to be “financially sophisticated” as defined by the rules of the SEC and The NASDAQ Stock Market, respectively. On October 30, 2017, the Board named Robert Frankfurt as the Chairman of the Audit Committee and as an audit committee “financial expert,” and on January 30, 2018, the Board of Directors appointed Robert Metzger to serve on the Audit Committee. Messrs. Frankfurt, Metzger and Michienzi, the current members of the Audit Committee, have extensive financial experience and an understanding of financial statements, generally accepted accounting principles and financial reporting internal controls and procedures. Our Audit Committee operates pursuant to a charter which has been posted on our website and can be found at www.jetpay.com. The Audit Committee’s duties, which are specified in the Audit Committee Charter, include:

| · | reviewing and discussing with management and the independent auditor the annual audited financial statements, and recommending to the full Board whether the audited financial statements should be included in our Form 10-K; |

| · | discussing with management and the independent auditor significant financial reporting issues and judgments made in connection with the preparation of our financial statements; |

| · | discussing with management major risk assessment and risk management policies; |

| · | monitoring the independence of the independent auditor; |

| · | verifying the rotation of the lead (or coordinating) audit partner having primary responsibility for the audit and the audit partner responsible for reviewing the audit as required by law; |

| · | reviewing and approving all related-party transactions; |

| · | inquiring and discussing with management our compliance with applicable laws and regulations; |

| · | pre-approving all audit services and permitted non-audit services to be performed by our independent auditor, including the fees and terms of the services to be performed; |

| · | appointing or replacing the independent auditor; |

| · | determining the compensation and oversight of the work of the independent auditor (including resolution of disagreements between management and the independent auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or related work; and |

| · | establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or reports which raise material issues regarding our financial statements or accounting policies. |

The Audit Committee consists of Messrs. Frankfurt, Metzger and Michienzi, each of whom is an independent director under the rules and regulations of The NASDAQ Stock Market.

| 12 |

Management is responsible for the Company’s internal controls and the financial reporting process. Marcum LLP, JetPay’s independent registered public accounting firm, is responsible for performing an independent audit of JetPay’s consolidated financial statements in accordance with auditing standards generally accepted in the United States and to issue a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes and review all related party transactions. In this context, the Audit Committee has met and held discussions with management and Marcum LLP regarding the Company’s audited consolidated financial statements. Management has represented to the Audit Committee that JetPay’s consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and Marcum LLP. The Audit Committee discussed with Marcum LLP matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees) as adopted by the Public Company Accounting Oversight Board. Marcum LLP also provided to the Audit Committee the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with Marcum LLP that firm’s independence. Based on the Audit Committee’s discussion with management and Marcum LLP, and the Audit Committee’s review of management’s representation and Marcum LLP’s report to the Audit Committee, the Audit Committee recommended that the Board include the Company’s audited consolidated financial statements in JetPay’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017.

| The Audit Committee of the Board of Directors | |

| Robert Frankfurt | |

| Robert Metzger | |

| Steven M. Michienzi |

Our Compensation Committee is composed of two members of our Board of Directors and is currently comprised of Messrs. Edwards (Chair) and Michienzi. All of the members of our Compensation Committee are independent under the rules of The NASDAQ Stock Market, are “non-employee directors” within the meaning of Rule 16b-3(b)(3) of the Exchange Act and are “outside directors” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). Pursuant to its charter (which is available at www.jetpay.com), the Compensation Committee is charged with performing an annual review of our executive officers’ salary, incentive opportunities and equity holdings to determine whether they provide adequate incentives and motivation to the executive officers and whether they adequately compensate the executive officers relative to officers in other comparable companies, as set forth in the Compensation Committee Charter, the Compensation Committee duties include the following.

| · | Our Compensation Committee annually reviews and approves corporate goals and objectives relevant to CEO compensation, evaluates the CEO’s performance in light of those goals and objectives, and determines the CEO’s compensation levels based on this evaluation. |

| · | Our Compensation Committee annually makes recommendations to our Board with respect to the compensation of the Company’s Chief Financial Officer, Vice-Chairman and Chief Operating Officer. In addition, our Compensation Committee has the authority to review the compensation of all of our executive officers. The CEO advises our Compensation Committee on the annual performance and appropriate levels of compensation of our executive officers (other than the CEO). |

| · | Our Compensation Committee has the authority to retain and terminate any compensation consultant to assist in the evaluation of director, CEO and other executive officer compensation. No compensation study was commissioned for 2017 or 2016. |

| 13 |

The current executive officers are as follows:

| Name | Age | Position | ||

| Diane (Vogt) Faro | 66 | Chief Executive Officer | ||

| Gregory M. Krzemien | 59 | Chief Financial Officer | ||

| Peter B. Davidson | 64 | Vice-Chairman and Corporate Secretary | ||

| Michael Collester | 54 | Chief Operating Officer |

Biographical information for the Company’s executive officers who are not members of the Company’s Board is set forth below.

Peter B. Davidson has served as the Company’s Chief Administrative Officer and Corporate Secretary since inception and as the Company’s Vice-Chairman since January 2013, while still retaining his duties as Corporate Secretary. As Vice-Chairman, Mr. Davidson is involved in enterprise-level risk management for the Company. Mr. Davidson was formerly Chief Executive Officer of Brooks FI Solutions, LLC, an entity that provides retail banking and payment solutions that he founded in 2006. Immediately prior to founding Brooks FI Solutions, Mr. Davidson was Executive Vice President of Genpass, Inc. where, from 2002 until its acquisition and subsequent integration by U.S. Bancorp in 2005, he led its efforts to bring stored value products to market. While at Genpass, Inc., he was also involved in the development and implementation of MoneyPass, a surcharge-free ATM network. Earlier in his career, Mr. Davidson served as President of Speer & Associates, leading domestic and international consulting engagements in the retail banking and electronic funds transfer industry; Executive Vice President at HSBC USA and President of HSBC Mortgage, where he was responsible for managing its consumer businesses; and Senior Vice President at CoreStates Financial, where he managed the credit card and consumer lending businesses and developed remote banking strategies. Mr. Davidson holds a B.S. in Economics from the Wharton School of the University of Pennsylvania in Finance and Accounting, and an MBA from Widener University in Finance.

Gregory M. Krzemien has served as the Company’s Chief Financial Officer since February 7, 2013. From 1999 to October, 2012, Mr. Krzemien served as Chief Financial Officer, Treasurer and Corporate Secretary of Mace Security International, Inc., a publicly traded company that is a manufacturer of personal defense sprays, personal protection products and electronic surveillance equipment, and the operator of a UL rated wholesale security monitoring station. From 1992 to 1999, Mr. Krzemien served as Chief Financial Officer and Treasurer of Eastern Environmental Services, Inc., a publicly traded solid waste company. From 1981 to 1992, Mr. Krzemien held various positions at Ernst & Young LLP, including Senior Audit Manager from October 1988 to August 1992. Mr. Krzemien has significant experience in the areas of mergers and acquisitions, SEC reporting, strategic planning and analysis, financings, corporate governance, risk management and investor relations. Mr. Krzemien holds a B.S. Honors Degree in Accounting from the Pennsylvania State University.

Michael Collester has served as the Company’s Chief Operating Officer since August 23, 2016. In April 2004, Mr. Collester formed ACI Merchant Systems, LLC, which was acquired by JetPay in November 2014. From 2004 to present, Mr. Collester has served in executive roles at ACI, including Chief Executive Officers and President. From 1989 to 2000, Mr. Collester served as CEO/President of ACI Merchant Services, Inc., a merchant services provider dedicated exclusively to serving financial institutions which he founded which became recognized as the premier Agent/Referral Bank processing company in the United States and, in 2000, merged with Fifth Third Bank. Mr. Collester served as Senior Vice President at Fifth Third Bank from 2000 through 2003. Mr. Collester holds a B.S. degree in Quantitative Business Analysis from the Pennsylvania State University.

| 14 |

Compensation of Executive Officers for 2017 and 2016

The following table sets forth the compensation earned by our Named Executive Officers for the fiscal year ended December 31, 2017 and for the preceding fiscal year.

SUMMARY COMPENSATION TABLE

| Name and Principal Position | Year | Salary ($) | Option Awards ($)(4) | Stock Awards ($)(5) | All Other Compensation ($)(6) | Total ($) | ||||||||||||||||

| Bipin C. Shah | ||||||||||||||||||||||

| Chairman of the Board and | 2017 | 300,000 | - | - | 4,846 | 304,846 | ||||||||||||||||

| Chief Executive Officer (1) | 2016 | 300,000 | - | - | 4,846 | 304,846 | ||||||||||||||||

| Diane (Vogt) Faro, | 2017 | 433,000 | - | 97,328 | 8,100 | 538,428 | ||||||||||||||||

| Chief Executive Officer (2) | 2016 | 262,136 | 839,672 | - | 2,770 | 1,104,578 | ||||||||||||||||

| Peter B. Davidson, | ||||||||||||||||||||||

| Vice-Chairman and | 2017 | 275,000 | - | - | - | 275,000 | ||||||||||||||||

| Corporate Secretary | 2016 | 275,000 | - | - | - | 275,000 | ||||||||||||||||

| Gregory M. Krzemien, | 2017 | 283,846 | 109,464 | - | 7,824 | 401,134 | ||||||||||||||||

| Chief Financial Officer | 2016 | 270,000 | - | - | 7,950 | 277,950 | ||||||||||||||||

| Michael Collester | 2017 | 318,750 | - | - | 8,100 | 326,850 | ||||||||||||||||

| Chief Operating Officer (3) | 2016 | 195,233 | - | - | 5,857 | 201,090 | ||||||||||||||||

| (1) | Bipin C. Shah resigned as Chief Executive Officer on May 5, 2016. Compensation after Mr. Shah’s resignation as Chief Executive Officer related to Mr. Shah’s service as Chairman of the Board. |

| (2) | Diane (Vogt) Faro was appointed as Chief Executive Officer on May 5, 2016. |

| (3) | Michael Collester was appointed as Chief Operating Officer on August 23, 2016. |

| (4) | Represents the aggregate grant date fair value of stock options granted during the year indicated. The grant date fair value of stock option awards was determined using the Black-Scholes option pricing model in accordance with FASB ASC Topic 718 utilizing the assumptions discussed in Note 12. Stockholders’ Equity (Deficit) in the Company’s consolidated financial statements for the year ended December 31, 2017 included in the Company’s Annual Report on Form 10-K as filed with the SEC. |

| (5) | The amounts in this column represent the fair value of stock awards received by the Named Executive Officer. |

| (6) | The amounts in this column represent matching contributions received by the Named Executive Officer from participation in the Company’s defined contribution pension plan. |

At the 2013 annual meeting, our stockholders elected to conduct non-binding advisory votes on the compensation of the Named Executive Officers every three years. The first non-binding advisory vote on executive compensation took place at the 2016 annual stockholders’ meeting, where our stockholders approved the compensation of our named Executive Officers. The next non-binding advisory vote on executive compensation, along with the next non-binding advisory vote on the frequency of stockholder votes on executive compensation, will take place at the 2019 annual stockholders’ meeting.

| 15 |

Outstanding Equity Awards at Fiscal Year End

The following table sets forth the outstanding equity awards held by our Named Executive Officers as of December 31, 2017.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

Option Awards

| Name | Number of Securities Underlying Unexercised | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price | Option Expiration Date | ||||||||||||

| Bipin C. Shah | 250,000 (1) | - | $3.00 | 12/12/23 | ||||||||||||

| Diane (Vogt) Faro | 411,437 (2) | 188,563 | $2.48 to $2.60 | 5/6/26 to 11/1/26 | ||||||||||||

| Peter B. Davidson | 125,000 (1) | - | 3.00 | 12/12/23 | ||||||||||||

| Gregory M. Krzemien | 204,166 (3) | 95,834 | $3.00 to $3.10 | 8/30/23 to 11/15/27 | ||||||||||||

| Michael Collester | - | - | - | - | ||||||||||||

| (1) | Options granted on December 12, 2013 to Mr. Shah and Mr. Davidson vested equally over four years on the annual anniversary date of the grant. |

| (2) | Options in the amount of 250,000 granted on May 5, 2016 and 350,000 on October 31, 2016 to Ms. Faro vest daily over two years from the dates of the grants. |

| (3) | Options in the amount of 200,000 granted on August 30, 2013 to Mr. Krzemien vested with respect to 50,000 shares immediately on the date of grant with the remainder vesting in 18 equal monthly installments. Additional options in the amount of 100,000 granted to Mr. Krzemien on November 15, 2017 vest monthly over two years from the date of the grant. |

Potential Payments upon Termination or Change-in-Control

Except for the agreements with Ms. Faro, Mr. Krzemien and Mr. Collester, the terms of which are summarized below, we do not have employment agreements with any of our Named Executive Officers or any other contract, agreement, plan or arrangement that provides for payments to any Named Executive Officer in connection with any termination of employment, a change in control of the Company or a change in the Named Executive Officer’s responsibilities.

Diane (Vogt) Faro Employment Agreement

On May 5, 2016, the Company and Ms. Faro entered into an executive employment agreement, which commenced on May 5, 2016. Pursuant to the agreement, Ms. Faro agreed to serve as Chief Executive Officer for an initial term of two years. Ms. Faro received a base salary of $400,000 beginning on the agreement’s commencement date and ending on the first anniversary thereof, and received a base salary of $450,000 through the end of the term. In addition to her base salary, Ms. Faro was eligible to receive an annual cash bonus of up to 50% of her base salary as of the end of the calendar year to which such bonus relates, as determined in the sole discretion of the Board. Ms. Faro’s employment agreement expired by its terms on May 5, 2018.

Gregory Krzemien Employment Agreement

On November 15, 2017, the Company and Mr. Krzemien entered into an employment agreement. Pursuant to the agreement, Mr. Krzemien continues to serve as Chief Financial Officer of the Company for an initial term ending November 15, 2020. Mr. Krzemien receives a base salary of $300,000 per annum, retroactive to July 1, 2017. During the term of Mr. Krzemien’s employment, Mr. Krzemien’s salary may be increased on an annual basis by the Board in its discretion based on Mr. Krzemien’s performance. In addition to his base salary, Mr. Krzemien is eligible to receive an annual bonus as determined by the Board in its sole discretion. On the effective date of the agreement, the Company awarded to Mr. Krzemien 100,000 options to purchase shares of the Company’s common stock pursuant to the Company’s Amended and Restated 2013 Stock Incentive Plan, at an exercise price of $3.00 per share and shall vest ratably on a monthly basis beginning on the effective date of the agreement and ending on the second anniversary thereof.

| 16 |

In the event Mr. Krzemien is terminated by the Company without cause (other than by notice of nonrenewal of the agreement) or Mr. Krzemien terminates his employment for good reason, then, in addition to the payment of any base salary earned but unpaid through the date of termination and any accrued but unused vacation time as of the date of termination, the Company shall (i) continue to pay to Mr. Krzemien his base salary for a period of twelve (12) months following the date of the termination and (ii) accelerate the vesting of the options granted to Mr. Krzemien that would have vested during twelve months following Mr. Krzemien’s termination had no such termination occurred. The Company’s obligations to make such payments and provide such benefits are conditional upon Mr. Krzemien’s continued compliance with certain restrictive covenants in favor of the Company and Mr. Krzemien’s execution, delivery and non-revocation of a release of claims against the Company and a mutual non-disparagement agreement with the Company.

Following the termination of his employment, Mr. Krzemien shall have certain continuing obligations under the agreement, including but not limited to those relating to the non-disclosure of confidential information, non-competition, non-solicitation and proprietary rights.

Michael Collester Employment Agreement and Transition Agreement

On August 23, 2016, the Company and Mr. Collester entered into an amended and restated employment agreement, which commenced on August 23, 2016. The agreement amended and restated the employment agreement, dated as of November 7, 2014, by and between JetPay Payments, PA and Mr. Collester. Pursuant to the agreement, Mr. Collester agreed to serve as Chief Operating Officer of the Company for an initial term ending December 31, 2017. Following the termination of the initial term, Mr. Collester’s employment agreement was automatically renewed for an additional year. On March 28, 2018, Mr. Collester and the Company entered into a transition agreement pursuant to which Mr. Collester agreed to terminate his employment with the Company effective December 31, 2018 and to work with the Chief Executive Officer of the Company prior to that date to transition his responsibilities to other employees of the Company.

Under his employment agreement, Mr. Collester received a base salary of $325,000 and was eligible for a discretionary bonus. Pursuant to the transition agreement, the Company will pay Mr. Collester an aggregate amount of $124,750 in compensation for Collester’s work performed prior to the termination of his employment.

Following the termination of his employment, Mr. Collester shall have certain continuing obligations under his employment agreement and transition agreement, including but not limited to those relating to the non-disclosure of confidential information, non-competition, non-solicitation and proprietary rights.

| 17 |

THE PRINCIPAL STOCKHOLDERS OF JETPAY

Beneficial Ownership

The following beneficial ownership table sets forth information as of July 31, 2018 regarding ownership of shares of JetPay common stock by the following persons:

| · | each person who is known to JetPay to own beneficially more than 5% of the outstanding shares of JetPay common stock; |

| · | each director of JetPay; |

| · | each Named Executive Officer; and |

| · | all directors and executive officers of JetPay, as a group. |

| · | Unless otherwise indicated, to JetPay’s knowledge, all persons listed on the beneficial ownership table below have sole voting and investment power with respect to their shares of JetPay common stock. Unless otherwise indicated, the address of the holder is c/o the Company, 7450 Tilghman Street, Allentown, Pennsylvania 18106. |

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percentage of Outstanding Common Stock Beneficially Owned (12) | ||||||

| 5% or Greater Stockholders: | ||||||||

| Flexpoint Fund II, L.P. (1) | 11,959,920 | 43.7 | % | |||||

| Sundara Investment Partners, LLC (2) | 4,040,040 | 20.7 | % | |||||

| Gene M. Valentino (3) | 2,429,556 | 15.7 | % | |||||

| Michael Collester (4) | 1,640,000 | 10.6 | % | |||||

| WLES, L.P. (5) | 1,512,334 | 9.6 | % | |||||

| Wellington Management Company, LLP (6) | 1,309,225 | 8.5 | % | |||||

| C. Nicholas Antich (7) | 972,173 | 6.3 | % | |||||

| Carol A. Antich (7) | 972,173 | 6.3 | % | |||||

| Directors and Named Executive Officers: | ||||||||

| Donald J. Edwards (1) | 11,959,920 | 43.7 | % | |||||

| Laurence L. Stone (2) | 4,903,196 | 25.2 | % | |||||

| Michael Collester (4) | 1,640,000 | 10.6 | % | |||||

| Bipin C. Shah (8) | 1,218,364 | 7.8 | % | |||||

| Diane (Vogt) Faro (9) | 628,917 | 3.9 | % | |||||

| Peter B. Davidson (10) | 254,688 | 1.6 | % | |||||

| Gregory M. Krzemien (11) | 241,666 | 1.5 | % | |||||

| Robert Frankfurt | - | * | ||||||

| Robert Metzger | - | * | ||||||

| Steven M. Michienzi | - | * | ||||||

| All current directors and executive officers as a group (10 persons) | 20,846,751 | 63.9 | % | |||||

| * | Represents less than 1%. |

| (1) | The business address of Flexpoint is 676 N. Michigan Avenue, Suite 3300, Chicago, IL 60611. The general partner of Flexpoint Fund II, L.P. is Flexpoint Management II, L.P., of which the general partner is Flexpoint Ultimate Management II, LLC. The sole managing member of Flexpoint Ultimate Management II, LLC is Donald J. Edwards. Represents 11,959,920 shares of common stock issuable upon the conversion of 99,666 shares of Series A Preferred Stock owned by Flexpoint. |

| (2) | Based solely on the information contained in a Schedule 13D/A filed by Sundara Investment Partners, LLC and Laurence L. Stone on March 29, 2017. The business address of Mr. Stone and Sundara Investment Partners, LLC is 725 Eagle Farm Road, Villanova, PA 19085. Mr. Stone is the managing member of Sundara. Mr. Stone reported beneficial ownership over 4,903,196 shares, including (i) 4,040,040 shares of common stock issuable upon conversion of 33,667 shares of Series A Preferred Stock owned by Sundara; (ii) 13,300 shares of common stock held by Mr. Stone directly; (iii) 125,000 shares of common stock owned by LHLJ, Inc.; (iv) 388,573 shares of common stock owned by Main Line Trading Partners, LLC; and (v) 336,283 shares of common stock owned by The Stone Family Trust, an irrevocable trust for the benefit of Mr. Stone’s children, of which his wife serves as a trustee. |

| 18 |

| (3) | The business address of Mr. Valentino is 316 South Baylen, Suite 590, Pensacola, FL 32502. |

| (4) | The business address of Mr. Collester is 136 East Watson Avenue, Langhorne, PA 19047. |

| (5) | Based solely on the information contained in a Schedule 13D/A filed by WLES, L.P. on March 12, 2018. The business address of WLES, L.P. is 2233 Wolf Front Road, Van Alstyne, TX 75495. The general partner of WLES, L.P. is Transaction Guy & The Triumphant Ones, LLC, a Texas limited liability company. The controlling members of the general partnership are Trent R. Voigt and Sue Lynn Voigt, husband and wife and individual residents of the State of Texas. Includes 266,667 shares of common stock subject to outstanding warrants that are exercisable within 60 days of July 31, 2018. |

| (6) | Based solely on the information contained in a Schedule 13G filed by Wellington Management Company, LLP on January 10, 2013, Schedule 13D filed on January 17, 2017 and Amendment to Schedule 13G filed on February 8, 2018. The business address of the entity is 80 Congress Street, Boston, Massachusetts 02210. Excludes 1,038,462 of common stock issuable upon conversion of 9,000 shares of Series A-1 Preferred Stock owned by affiliates of Wellington because each of the options provides that the holder thereof does not have the right to exercise the option to the extent (but only to the extent) that such exercise would result in it or any of its affiliates beneficially owning more than 9.9% of the common stock. |

| (7) | The business address of Mr. C. Nicholas Antich and Carol A. Antich is 3939 West Drive, Center Valley PA 18034. Includes 204,420 shares owned by Mr. C. Nicholas Antich, 204,420 shares owned by Mrs. Carol A. Antich, the wife of Mr. C. Nicholas Antich, 537,813 shares owned by Mr. C. Nicholas Antich and Carol A. Antich, as Tenants by the Entireties, and 25,520 shares owned by Brittany N. McCausland Trust u/a 2/17/99, of which Mr. and Mrs. Antich are the trustees and on whose behalf Mr. and Mrs. Antich have the right to act. |

| (8) | Includes 250,000 shares of common stock subject to outstanding options that are exercisable within 60 days of July 31, 2018 and 585,310 shares of common stock in the Bipin C. Shah Trust U/A dated July 31, 2001. The business address of the trustee is 159 West Lancaster Avenue, Paoli, PA 19301. |

| (9) | Includes 584,177 shares of common stock subject to outstanding options that are exercisable within 60 days of July 31, 2018. |

| (10) | Includes 125,000 shares of common stock subject to outstanding options that are exercisable within 60 days of July 31, 2018. |

| (11) | Includes 241,666 shares of common stock subject to outstanding options that are exercisable within 60 days of July 31, 2018. |

| (12) | Percentage calculations based on 15,439,310 shares of common stock outstanding on July 31, 2018. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our officers, directors and persons who beneficially own more than ten percent of our common stock to file reports of ownership and changes in ownership with the SEC. These reporting persons are also required to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of such forms furnished to us and written representations from certain reporting persons, there were three late Form 4 filings in fiscal year 2017, all of which related to our directors or officers, one for Diane (Vogt) Faro, one for Gregory M. Krzemien, and one of which related to Laurence L. Stone.

| 19 |

Policies and Procedures Governing Related-Person Transactions

The Audit Committee reviews with both management and the independent accounting firm all related party transactions or dealings with parties related to the Company to ensure that the terms of such transactions are no less favorable to the Company than those that would be available with respect to such transactions with unaffiliated third parties.

Certain Relationships and Related Party Transactions

Until February 28, 2018, JetPay HR & Payroll Services’ headquarters were located in Center Valley, Pennsylvania and consisted of approximately 22,500 square feet leased from C. Nicholas Antich, the former president of JetPay HR & Payroll Services, and Carol A. Antich. The office lease expired on February 28, 2018. Rent expense under this lease was $135,500 for the three months ended March 31, 2018 and $542,000 for the year ended December 31, 2017.

On August 22, 2013, JetPay Payments Services, TX, LLC (“JetPay Payments, TX”) entered into a Master Service Agreement with JetPay Solutions, LTD, a United Kingdom based entity 75% owned by WLES, an entity owned by Trent Voigt, a former 10% owner and employee of the Company. The Company initiated transaction business under this agreement beginning in April 2014 with revenue earned from JetPay Solutions, LTD of $1,000 for the three months ended March 31, 2018 and $42,000 for the year ended December 31, 2017.

On June 7, 2013, the Company issued an unsecured promissory note to Trent Voigt, the then Chief Executive Officer of JetPay Payments, TX, in the amount of $491,693. The note matured on December 31, 2017, as extended by a Settlement Agreement dated July 26, 2016 and bore interest at an annual rate of 4% with interest expense of $0 recorded in each of the three months ended March 31, 2018 and 2017, respectively. The transaction was approved upon resolution and review by the Company’s Audit Committee of the terms of the note to ensure that such terms were no less favorable to the Company than those that would be available with respect to such transactions from unaffiliated third parties. This unsecured promissory note was paid down to $57,000 on August 30, 2017 and paid in full on July 19, 2018.

On October 18, 2016, the Company entered into a loan and security agreement with JetPay HR & Payroll Services and Payroll Tax Filing Services, Inc. (“PTFS”), as borrowers, the Company and JetPay Payment Services, FL, LLC, as guarantors, and LHLJ, Inc., an entity controlled and majority-owned by Laurence L. Stone, as lender. Pursuant to the loan and security agreement, LHLJ, Inc., LHLJ, Inc. provided JetPay HR & Payroll Services and PTFS a term loan of $9.5 million. The loan carries an interest rate of 8% and matures on October 18, 2021. Interest expense related to this promissory note was $170,000 for the three months ended March 31, 2018 and $730,000 for the year ended December 31, 2017. Additionally, in March 2018, Mr. Stone was granted a special bonus of $75,000 for his extraordinary efforts and involvement in assisting management with several strategic initiatives.

On June 12, 2017, JetPay Payments, TX filed suit against J.T. Holdings and Trent Voigt, the previous Chief Executive Officer of JetPay Payments, TX, with respect to the lease entered into by JetPay Payments, TX with J.T. Holdings’ property in Sunnyvale, TX. The previous lease expired on January 31, 2016. While a new lease Agreement had not been signed, a dispute arose regarding the amount of rent to be paid, as well as the rights of the parties to access the property. On June 26, 2017, the Parties entered into an agreement whereby JetPay Payments, TX was granted an extension on the lease until June 30, 2018 at a rate of $6,000 per month and agreed to place into an escrow account $230,000 until all claims between the parties were adjudicated. Rent expense was $18,000 for the three months ended March 31, 2018 and $60,000 for the year ended December 31, 2017. On December 12, 2017, Trent Voigt and J.T. Holdings filed counterclaims against JetPay. The Company settled the matter with J.T. Holdings and Trent Voigt for $450,000, together with a release of all claims, on May 7, 2018. A loss accrual of $450,000 was recorded at March 31, 2018.

As a result of a settlement between the Company and Valley National Bank, on July 11, 2018, the conversion price of the Series A Preferred Stock was adjusted upward to $2.50 (from $2.36) and the conversion of the Series A-1 Preferred Stock was adjusted upward to $2.60 (from $2.45), Shares of the Company’s Series A Preferred Stock and Series A-1 Preferred Stock may be converted by the holder into that number of shares of common stock obtained multiplying the number the number of preferred shares to be converted by $300 and dividing the product by the then-applicable conversion price of the Series A Preferred Stock or the Series A-1 Preferred Stock, as applicable.

| 20 |

Submission of Stockholder Proposals

March 1, 2019 is the deadline for stockholders to submit proposals pursuant to Rule 14a-8 of the Exchange Act for inclusion in JetPay’s Proxy Statement for JetPay’s 2019 Annual Meeting of Stockholders. If any stockholder proposal is submitted after March 1, 2019, the Proxy holders will be allowed to use their discretionary voting authority when the proposal is raised at the 2019 Annual Meeting without any discussion of the matter in the Proxy Statement for that meeting.

Our Annual Report on Form 10-K for the year ended December 31, 2017, as filed with the SEC, is included in the 2017 Annual Report to Shareholders which accompanies this proxy statement.

Stockholders who wish to communicate with directors should do so by writing to the Company’s Secretary, Peter B. Davidson, at the Company’s offices at 7450 Tilghman Street, Allentown, Pennsylvania 18106. The Secretary of the Company reviews all such correspondence and regularly forwards to the Board a summary of all such correspondence and copies of all correspondence that, in the opinion of the Secretary, deals with the functions of the Board or Board Committees or that he otherwise determines warrants the Board’s attention. Directors may at any time request copies of and review all correspondence received by the Company that is addressed to members of the Board. Concerns relating to accounting, internal controls or auditing matters will be brought to the attention of the Audit Committee.