Exhibit 10.1

Execution Version

LEASE

BY AND BETWEEN

BROOKWOOD PHILADELPHIA I, LLC, a Delaware limited liability company, and

BROOKWOOD PHILADELPHIA II, LLC, a Delaware limited liability company,

as tenants in common

(“Landlord”)

and

JETPAY HR & PAYROLL SERVICES, INC.,

(“Tenant”)

TABLE OF CONTENTS

| Page | ||

| 1. | TERMS | 1 |

| 2. | THE PREMISES | 3 |

| 3. | TERM | 4 |

| 4. | CONDITION OF THE PREMISES | 4 |

| 5. | MONTHLY RENT | 4 |

| 6. | TAXES | 5 |

| 7. | OPERATING EXPENSES. | 5 |

| 8. | RECONCILIATION | 6 |

| 9. | INSURANCE. | 7 |

| 10. | WAIVER OF SUBROGATION | 9 |

| 11. | SECURITY DEPOSIT | 9 |

| 12. | USE | 10 |

| 13. | MAINTENANCE; SERVICES. | 10 |

| 14. | SUBLEASE; ASSIGNMENT | 11 |

| 15. | INDEMNITY; NON-LIABILITY OF LANDLORD | 12 |

| 16. | UTILITIES | 13 |

| 17. | HOLDING OVER | 14 |

| 18. | NO RENT DEDUCTION OR SET OFF | 14 |

| 19. | CASUALTY | 14 |

| 20. | SUBORDINATION; ESTOPPEL LETTERS | 15 |

| 21. | ALTERATIONS; RESTORATION. | 17 |

| 22. | DEFAULT; REMEDIES. | 18 |

| 23. | NOTICES | 22 |

| 24. | EMINENT DOMAIN | 22 |

| 25. | QUIET ENJOYMENT | 22 |

| 26. | RULES AND REGULATIONS | 23 |

| 27. | ENVIRONMENTAL. | 23 |

| 28. | FINANCIAL STATEMENTS | 24 |

| 29. | BROKERS | 24 |

| 30. | MISCELLANEOUS. | 24 |

- i -

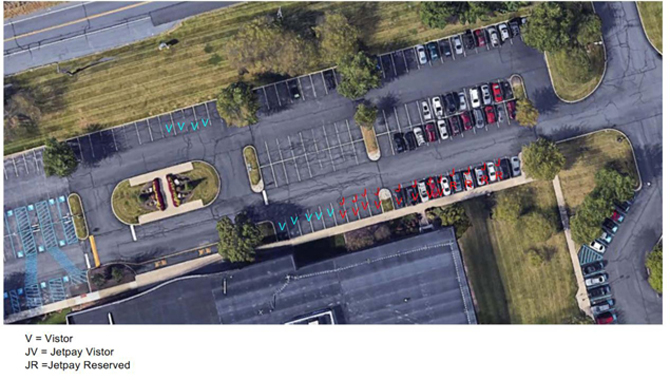

| 31. | PARKING | 26 |

| 32. | SIGNAGE | 26 |

| 33. | INTENTIONALLY OMITTED | 26 |

| 34. | CERTAIN RIGHTS RESERVED TO LANDLORD | 27 |

| 35. | LEASE COMMENCEMENT/ACCEPTANCE OF PREMISES | 27 |

| 36. | WAIVER OF RIGHT TO JURY TRIAL | 27 |

| 37. | RECORDING | 27 |

- ii -

1. TERMS. Each reference in this Lease to any of the following subjects shall be construed to incorporate the data stated for that subject in this Section 1.

| Date of this Lease: | October __, 2017 | |

| Name of Tenant: |

JetPay HR & Payroll Services, Inc., a Delaware corporation | |

| Notice Address of Tenant: | The Premises | |

| Name of Landlord: |

Brookwood Philadelphia I, LLC, and Brookwood Philadelphia II, LLC, as tenants in common | |

|

Notice Address of Landlord:

|

Brookwood Philadelphia I, LLC, and Brookwood Philadelphia II, LLC c/o Brookwood Financial Partners, LLC 138 Conant Street Beverly, Massachusetts 01915 Attention: Kurt Zernich, Director of Asset Management | |

| Landlord’s Remittance Address: |

Brookwood Philadelphia II, LLC PO Box 780219 Philadelphia, PA 19178-0219

via overnight delivery to:

Brookwood Philadelphia II LLC Lockbox 780219 Wells Fargo Bank, MAC Y1372-045 401 Market Street Philadelphia, PA 19106 | |

| Building: | The building located at 7450 Tilghman Street, Allentown, Pennsylvania | |

| Property: | The Building and the real property on which the Building is located and any other buildings and improvements located thereon. | |

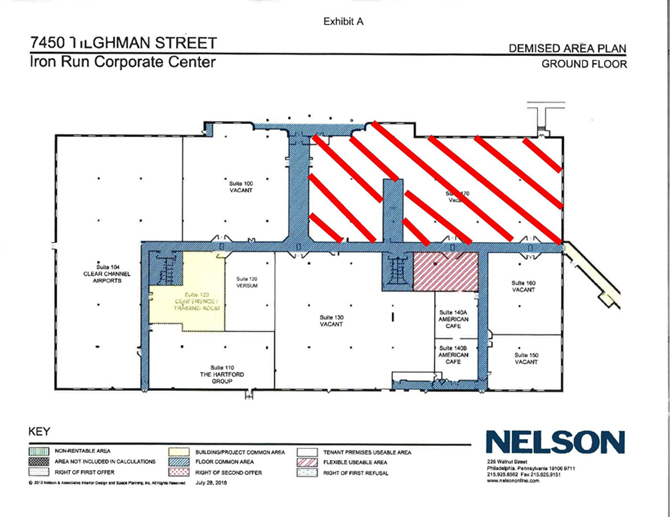

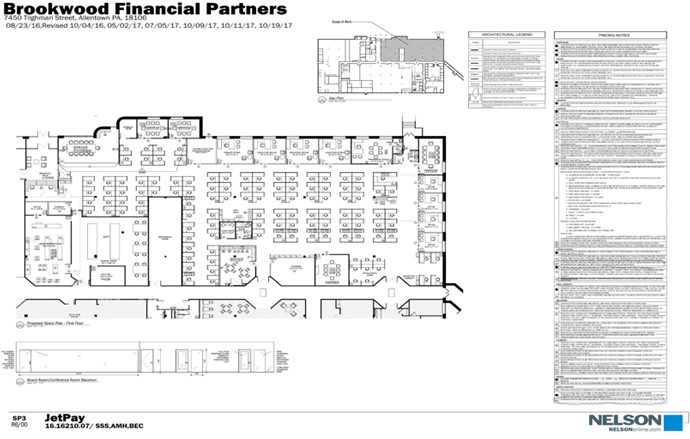

| Premises: | Approximately 24,269 rentable square feet of space in the Building commonly known as Suite 170, as approximately shown by the floor plan attached hereto as Exhibit A. |

| 1 |

| Permitted Use: | General office, and operation of a business providing payroll related services to customers, and no other use or purpose. | |

| Term: | The period of time beginning on the Commencement Date and ending at 11:59 P.M. on the Expiration Date. | |

| Commencement Date: | The later to occur of (i) February 26, 2018 and (ii) Substantial Completion of the Work (as said terms are defined in the Work Letter, Exhibit E). Landlord and Tenant shall confirm the Commencement Date pursuant to Section 35. | |

| Expiration Date: | That certain date which is the last day of the one hundred twenty eighth (128th) complete calendar month following the Commencement Date. | |

| Tenant’s Percentage: | 23.91%, being the ratio of rentable square footage of the Premises to the total rentable square footage of the Building. Landlord represents to Tenant that the total rentable square footage of the Building is approximately 101,520. | |

| Base Taxes: | The Taxes for the calendar year 2018, without reduction for any atypical one-time abatement. | |

| Tax Excess: | Tenant’s Percentage of the amount by which Taxes for any calendar year during the Term exceed Base Taxes. | |

| Base Operating Expenses: | The Operating Expenses for the calendar year 2018. | |

| Operating Expenses Excess: | Tenant’s Percentage of the amount by which Operating Expenses exceed Base Operating Expenses for any calendar year during the Term. | |

| Security Deposit: | $40,448.33 | |

| Exhibits: |

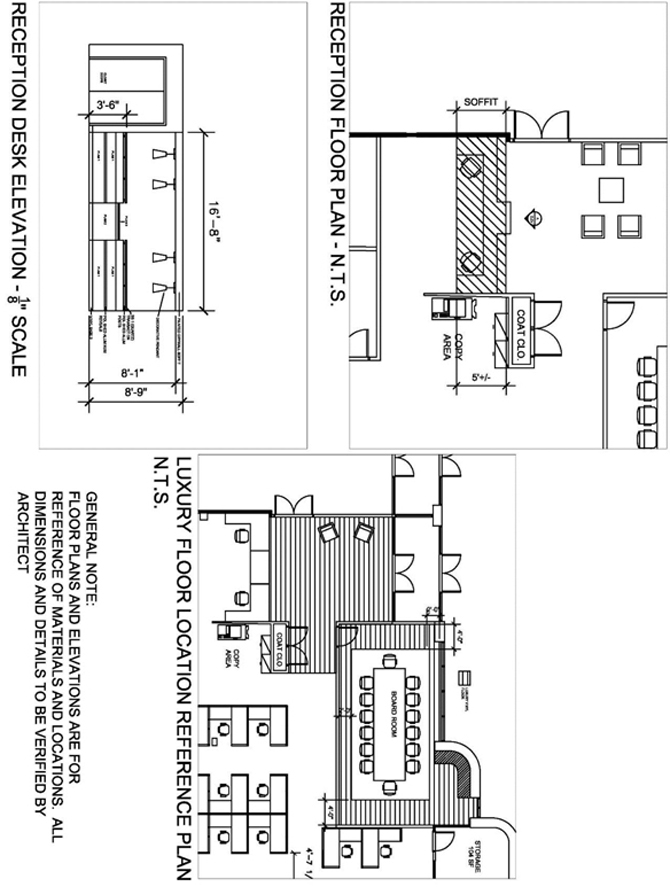

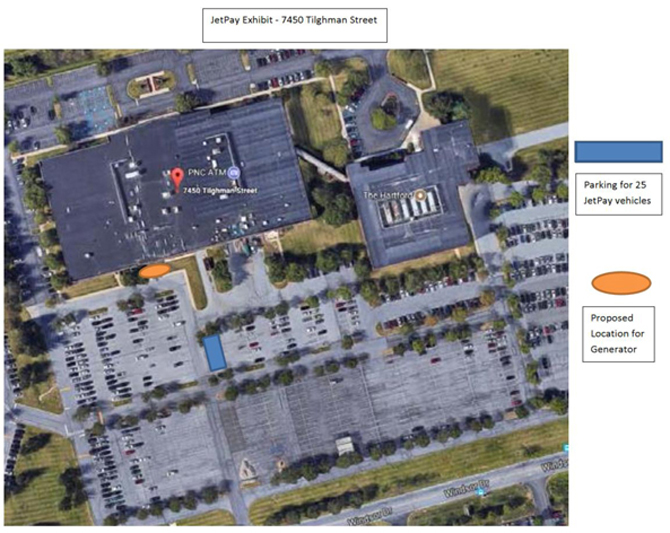

Exhibit A The Premises Exhibit B Rules and Regulations Exhibit C Commencement Letter Exhibit D Additional Stipulations Exhibit E Work Letter Exhibit F Parking Plans and Location of Generator

All of the Exhibits listed above are incorporated into and made part of this Lease. |

| 2 |

| Rent: | Base Rent and all Additional Rent. | |

| Additional Rent: | All amounts required to be paid by Tenant to Landlord pursuant to this Lease other than Base Rent, including, without limitation, Operating Expenses and Taxes. | |

| Base Rent: |

| Months of Term | Base Rent

(per annum) | Base Rent

(per month) | Base Rent

(per rentable square foot, per annum) | |||||||||

| Commencement Date-12 | $ | 485,380.00 | $ | 40,448.33 | $ | 20.00 | ||||||

| 13-24 | $ | 497,514.50 | $ | 41,459.54 | $ | 20.50 | ||||||

| 25-36 | $ | 509,952.36 | $ | 42,496.03 | $ | 21.01 | ||||||

| 37-48 | $ | 522,701.17 | $ | 43,558.43 | $ | 21.54 | ||||||

| 49-60 | $ | 535,768.70 | $ | 44,647.39 | $ | 22.08 | ||||||

| 61-72 | $ | 549,162.92 | $ | 45,763.58 | $ | 22.63 | ||||||

| 73-84 | $ | 562,891.99 | $ | 46,907.67 | $ | 23.19 | ||||||

| 85-96 | $ | 576,964.29 | $ | 48,080.36 | $ | 23.77 | ||||||

| 97-108 | $ | 591,388.40 | $ | 49,282.37 | $ | 24.37 | ||||||

| 109-120 | $ | 606,173.11 | $ | 50,514.43 | $ | 24.98 | ||||||

| 121-128 (plus any additional days necessary for the Term to expire on the Expiration Date) | $ | 621,327.44 | $ | 51,777.29 | $ | 25.60 | ||||||

*Plus the Utility Charge pursuant to Section 16 below.

Notwithstanding the foregoing, Base Rent shall be abated for the first (1st) through the fourth (4th) months of the Term and the thirteenth (13th) through the fifteenth (15th) months of the Term (collectively, the “Base Rent Abatement Period”). In no event shall the Base Rent Abatement Period be deemed to reduce or eliminate Tenant’s obligation to pay Additional Rent or any other amounts due hereunder other than Base Rent. If Tenant defaults under this Lease beyond any applicable notice and cure period, then Tenant’s right to abate the Base Rent shall immediately terminate and be of no further force and effect and any and all Base Rent which had been abated prior to Tenant’s default shall immediately become due and payable.

2. THE PREMISES. Landlord leases to Tenant, and Tenant leases from Landlord, upon and subject to the terms and conditions of this Lease, the Premises. The Premises are leased with the right of Tenant to use for its customers, employees and visitors, in common with other parties entitled thereto, such common areas and facilities as Landlord may from time to time designate and provide.

| 3 |

3. TERM. The Premises are leased for the Term. If for any reason Landlord is unable to deliver possession of the Premises to Tenant on or prior to the Commencement Date, then Landlord shall not be liable to Tenant for any resultant loss or damage and this Lease shall not be affected except that the Commencement Date shall be extended by one (1) day for each day of such delay.

4. CONDITION OF THE PREMISES. The Premises are leased in an “as is” and “where is” condition without any warranty of fitness for use or occupation express or implied, it being agreed that Tenant has had an opportunity to examine the condition of the Premises, that Landlord has made no representations or warranties of any kind with respect to such condition, and that Landlord has no obligation to do or approve any work or make or approve any improvements to or with respect to the Premises to prepare the same for Tenant’s occupancy, except in all respects for the Landlord’s Work described in the Work Letter attached as Exhibit E.

5. MONTHLY RENT. Commencing on the Commencement Date, Base Rent shall be paid monthly in advance on or before the first day of each calendar month in accordance with the schedule set forth in Section 1. The Base Rent shall not be adjusted or modified if the actual rentable square footage of the Premises varies from the rentable square footage set forth in Section 1. If the Commencement Date shall be on any day other than the first day of a calendar month, Base Rent for any partial month shall be prorated based on the number of days in that month. Unless otherwise provided herein, commencing on the Commencement Date, Additional Rent shall be paid monthly in advance on or before the first day of each calendar month. If the Commencement Date shall be on any day other than the first day of a calendar month, Additional Rent for any partial month shall be prorated based on the number of days in that month. Rent shall be paid to Landlord, without notice or demand, and without deduction or offset, in lawful money of the United States of America, at Landlord’s Remittance Address as set forth in Section 1 or to such other address as Landlord may from time to time designate in writing. Tenant acknowledges that the late payment of Rent or other sums due hereunder shall cause Landlord to incur costs not contemplated by this Lease, the exact amount of which shall be extremely difficult to ascertain. Such costs include, but are not limited to, processing and accounting charges, and late charges which may be imposed on Landlord by the terms of any mortgage or trust deed covering the Property. Accordingly, if any installment of Rent or any other sums due from Tenant shall not be received by Landlord within five (5) business days of when due, Tenant shall pay to Landlord a late charge equal to five percent (5%) of such overdue amount. In addition, any amount due to Landlord, if not paid when due, shall bear interest from the date due until paid at the lesser of: (i) the Prime Rate (as hereinafter defined) plus five percent (5%) per annum, or (ii) the highest rate permitted by law (the “Default Rate”). The term “Prime Rate” shall mean the Prime Rate as published in The Wall Street Journal from time to time. The parties agree that such late charges represent a fair and reasonable estimate of the costs Landlord shall incur by reason of late payment by Tenant. The acceptance of such late charges by Landlord shall in no event constitute a waiver of Tenant’s default with respect to the overdue amount or prevent Landlord from exercising any of the other rights and remedies granted hereunder. Notwithstanding anything to the contrary in this Lease, Tenant shall pay the first full monthly installment of Rent due hereunder (i.e. Rent for the first complete month of the Term, or, if applicable, for the first complete month following any initial abatement period) simultaneously with Tenant’s execution and delivery of this Lease.

| 4 |

6. TAXES. Tenant shall pay monthly commencing in January 1, 2019, as Additional Rent, one-twelfth (1/12) of the Tax Excess based on estimates provided by Landlord from time to time and subject to reconciliation as provided in Section 8 below. No credit or payment shall be due to Tenant in the event Taxes for any year are less than Base Taxes. “Taxes” means all taxes, assessments and fees levied upon the Property by any governmental entity based upon the ownership, leasing, renting or operation of the Property. Landlord may allocate Taxes incurred with respect to multiple buildings on the Property among such buildings, in a reasonable, fair and consistent manner. Taxes shall not include any federal, state or local net income, capital stock, succession, transfer, replacement, gift, estate or inheritance taxes; provided, however, if at any time during the Term, a tax or excise on income is levied or assessed by any governmental entity in lieu of or as a substitute for, in whole or in part, real estate taxes or other ad valorem taxes, such tax shall constitute and be included in Taxes to the extent, and only to the extent, that it is a substitute for real estate taxes or other ad valorem taxes. In addition to the foregoing, Tenant shall pay Landlord, as Additional Rent, for any use, rent or sales tax, service tax, value added tax, franchise tax or any other tax on Rent however designated as well as for any taxes which are reasonably attributable to the cost or value of Tenant’s equipment, furniture, fixtures and other personal property located in the Premises or the cost or value of any leasehold improvements made in or to the Premises by or for Tenant. All expenses, including attorneys’ fees and disbursements, experts’ and other witnesses’ fees, incurred in contesting the validity or amount of any Taxes or in obtaining a refund of Taxes shall be considered as part of the Taxes for the year in which the expenses are incurred.

7. OPERATING EXPENSES. Tenant shall pay monthly, as Additional Rent, one-twelfth (1/12) of the Operating Expenses Excess based on estimates provided by Landlord from time to time and subject to reconciliation as provided in Section 8 below. No credit or payment shall be due to Tenant in the event Operating Expenses for any year are less than Base Operating Expenses. “Operating Expenses” means and includes all legitimate bona fide expenses, costs, fees and disbursements paid or incurred by or on behalf of Landlord for managing, operating, maintaining, improving, servicing or repairing the Building or Property and all associated plumbing, heating, ventilation, air conditioning, lighting, electrical, mechanical and other systems, including, without limitation, costs of: performing the Landlord’s obligations described in Section 13; janitorial services, the repair, maintenance, repaving and re-striping of any parking and dock areas; providing any services or amenities such as conference rooms, parking garage, or cafeteria, as applicable; exterior maintenance, repair and repainting; landscaping; snow removal; utilities (unless otherwise provided in Section 16); a management fee and administration costs of five percent (5%) of gross revenue (Base Rent and Additional Rent from the Building); supplies and sundries; sales or use taxes on supplies or services; charges or assessments under any easement, license, declaration, restrictive covenant or association; legal and accounting expenses; insurance premiums for casualty insurance and liability insurance carried on the Building by Landlord; and compensation and all fringe benefits, worker’s compensation insurance premiums and payroll taxes paid to, for or with respect to all persons directly engaged in the operation, administration maintenance and repair of the Property, excluding any salaries and compensation to persons that own any equity in the Landlord, or such persons’ relatives. Landlord may allocate any item of Operating Expenses that benefits multiple buildings on the Property among such buildings, , in a reasonable, fair and consistent manner.. Landlord may allocate any item of Operating Expenses among different portions or occupants of the Building or Property based on use or other considerations as determined by Landlord in Landlord’s discretion, , in a reasonable, fair and consistent manner.. If there is less than ninety five percent (95%) occupancy during any period, Landlord will adjust those Operating Expenses that are affected by variations in occupancy levels to the amount of Operating Expenses that would have been incurred had there been ninety five percent (95%) occupancy.

| 5 |

Notwithstanding the foregoing, Operating Expenses shall not include costs of alterations to the premises of other tenants of the Property, depreciation charges, interest and principal payments on mortgages, ground rental payments and real estate brokerage and leasing commissions; costs incurred for Landlord’s general overhead and any other expenses not directly attributable to the operation and management of the Building or the Property; costs of selling or financing any of Landlord’s interest in the Property; costs incurred by Landlord for the repair of damage to the Property to the extent that Landlord is reimbursed by insurance proceeds; and the costs of services and utilities separately chargeable to individual tenants of the Building. The costs of capital improvements shall not be included in Operating Expenses except for those capital improvements which are intended to reduce Operating Expenses, which are for replacements (as opposed to additions or new improvements) on non-structural items located in the common areas required to keep such areas in good condition, or which are required under any governmental laws, regulations, or ordinances that were not applicable to the Building as of the Date of this Lease, which, together with any financing charges incurred in connection therewith, shall be amortized over their useful life in accordance with generally accepted accounting principles.

Notwithstanding the foregoing, the maximum increase in the amount of Controllable Operating Expenses (defined hereinbelow) that may be included in calculating such Operating Expenses for each calendar year after 2018 during the Term shall be limited to 5% per calendar year on a cumulative basis. For the purposes hereof, Controllable Operating Expenses means all Operating Expenses other than real estate taxes, insurance premiums for casualty insurance and liability insurance carried on the Building by Landlord in reasonable amounts of coverage, and snow removal, janitorial supplies, and water and sewer.

8. RECONCILIATION. Any failure by Landlord to deliver any estimate or statement of Additional Rent required under this Lease shall not operate as a waiver of Landlord’s right to collect all or any portion of Additional Rent due hereunder. On an annual basis, Landlord shall provide Tenant with a statement of all actual Operating Expenses for the preceding year. If Tenant has made estimated payments of Operating Expenses or Taxes in excess of the actual amount due, Landlord shall credit Tenant with any overpayment against the next Rent otherwise due, provided, however, if such overpayment occurs within the final year of the Term, then Landlord shall within sixty (60) days reimburse Tenant in the amount of such overpayment in cash as part of Landlord’s reconciliation procedure at the end of the Term. If the actual amount due exceeds the estimated payments made by Tenant during the preceding year, Tenant shall pay the difference to Landlord within fifteen (15) business days and such obligation shall survive the expiration or earlier termination of this Lease.

| 6 |

Tenant shall have the right during the Term, by providing written notice to Landlord (the “Review Notice”) within sixty (60) days after receiving Landlord’s statement of actual Operating Expenses, to review Landlord’s records relating to Operating Expenses for such year. Within a reasonable period of time after receipt of a timely Review Notice, Landlord shall make such records available for Tenant’s review at either Landlord’s home office or at the office of the property manager for the Building. If Tenant fails to give Landlord written notice stating in reasonable detail any objection to Landlord’s statement of actual Operating Expenses within thirty (30) days after such records are made available to Tenant for review then Tenant shall be deemed to have approved Landlord’s statement of Operating Expenses for such year and Tenant shall have no further right to object or contest such statement. Upon Landlord’s receipt of a timely objection notice from Tenant, Landlord and Tenant shall work together in good faith to resolve the discrepancy between Landlord’s statement and Tenant’s review. If Landlord and Tenant determine that Operating Expenses for the year in question are less than reported in Landlord’s statement, Landlord shall provide Tenant with a credit against future Rent in the amount of any overpayment by Tenant. Likewise, if Landlord and Tenant determine that Operating Expenses for the year in question are greater than reported in Landlord’s statement, Tenant shall forthwith pay to Landlord the amount of underpayment by Tenant. Any information obtained by Tenant pursuant to the provisions of this section shall be treated as confidential and Landlord may require that Tenant execute a confidentiality agreement as a condition of Tenant’s review. If Tenant retains an agent to review Landlord’s books and records for any year, such agent must (i) be a CPA firm (ii) not be compensated on a contingency basis, and (iii) execute a confidentiality agreement with respect to such review. Tenant shall be solely responsible for all costs incurred by Tenant in connection with such review. Notwithstanding anything herein to the contrary, Tenant shall not be permitted to review Landlord’s records or to dispute any statement of Operating Expenses if Tenant is in default or if Tenant has not first paid to Landlord the amount due as shown on Landlord’s statement of actual Operating Expenses.

9. INSURANCE.

(A) Tenant shall maintain the following insurance in force from the date upon which Tenant first enters the Premises and throughout the Term and thereafter for so long as Tenant is in occupancy of any part of the Premises:

(i) Commercial General Liability insurance with limits of at least $1,000,000 per occurrence, $2,000,000 general aggregate, and, if the Tenant manufacturers or produces a product, $2,000,000 products completed operations aggregate or such larger amounts as Landlord may reasonably require from time to time, covering bodily injury and property damage arising out of the use of the Premises, as well as products/completed operations, blanket contractual liability, personal injury and advertising liability;

(ii) Worker’s Compensation insurance as required by the state in which the Premises is located covering occupational injuries or disease to all employees of Tenant and to any contractors, subcontractors or other agents used by Tenant for work or other activities on or about the Premises. Such policy shall include Employer’s Liability limits of at least $500,000 each accident, $500,000 each employee, and $500,000 disease;

| 7 |

(iii) Business Automobile Liability insurance for all owned (Symbol 1), non-owned (Symbol 9) hired, rented and/or borrowed (Symbol 8) vehicles used by the Tenant, its employees or agents. Such policy shall include a combined single limit of liability of at least $1,000,000 per claim for bodily injury and property damage and shall provide that employees are insureds;

(iv) Excess or Umbrella Liability insurance with a limit of at least $5,000,000 providing additional limits of insurance over the primary per occurrence and aggregate limits of the Commercial General Liability (including bodily injury, property damage, products/completed operations, personal/advertising injury and blanket contractual liability), Employer’s Liability, and Business Auto Liability insurance required in (i), (ii), and (iii) above; and

(v) Property insurance covering “all risk” of physical damage to Tenant’s personal property and any property in the care, custody, and control of the Tenant. In addition this policy shall cover any direct or indirect physical damage to all alterations, additions, improvements (including carpeting, floor coverings, paneling, decorations, fixtures and any improvements or betterments to the Premises made by Tenant or by Landlord at Tenant’s request or for Tenant’s benefit) situated in or about the Premises. Such coverage shall be for the full replacement value of the covered property.

(B) Tenant’s Commercial General Liability, and Excess Liability/Umbrella Liability policies shall name Landlord, Landlord’s managing agent, and Landlord’s mortgagee as Additional Insureds and shall be primary insurance as to any insurance carried by the parties designated as Additional Insureds. All policies purchased and maintained by Tenant to satisfy the requirements in this Lease must be purchased from an insurance company with a minimum rating of “A- X” or its equivalent from one of the major rating agencies (AM Best, Moodys, Standard & Poors, Fitch) that is admitted or eligible to do business in the state where the Premises is located.

(C) Tenant shall provide Landlord with a certificate of insurance for each policy simultaneously with the delivery of an executed counterpart of this Lease and prior to each renewal of such insurance. Such certificates of insurance shall be on an ACORD Form 27 or ISO Form 2026 or their equivalent, shall certify that such policy has been or shall be issued and that it provides the coverage and limits required above, and shall provide that the insurance shall not be canceled or materially changed unless thirty (30) days prior written notice shall be given to Landlord. In addition to providing the certificates of insurance required herein, Tenant shall also promptly furnish any additional information, including complete copies of Tenant’s insurance policies, as Landlord may request from time to time pertaining to Tenant’s insurance coverage. Tenant shall notify Landlord in writing at least sixty (60) days in advance if Tenant intends to or receives a notice that its insurance company intends to cancel or non-renew such insurance for any reason, or if the required coverage or limits are to be materially changed from the initial requirements in this Lease. In the event that the applicable statutory time period is less than sixty (60) days, then Tenant shall notify Landlord within three (3) business days of receipt of any cancellation or non-renew notice. In the event that Tenant fails to obtain or maintain the insurance required above or fails to provide the Certificates of Insurance required, Landlord may, at its option, obtain such insurance on behalf of Tenant. Tenant shall pay, as Additional Rent upon demand, the reasonable cost of such insurance plus a twenty-five percent (25%) surcharge. Landlord’s failure to obtain such coverage on behalf of Tenant shall not limit Tenant’s liability in the event of an uncovered loss.

| 8 |

(D) Landlord shall carry or cause to be carried such insurance in amounts and with deductibles as a reasonably prudent landlord would purchase and maintain with respect to the Property. Tenant shall pay Tenant’s Percentage of Landlord’s insurance premiums (“Insurance Premiums”) during the Term of the Lease as a part of Operating Expenses. Tenant shall not do or permit to be done anything which shall contravene, invalidate, or increase the cost of the Landlord’s insurance and shall comply with all rules, orders, regulations, requirements and recommendations of Landlord or its insurance companies relating to or affecting the condition, use, or occupancy of the Premises. If Tenant does conduct any activity within or about the Premises that results in an increase to the cost of Landlord’s insurance Tenant shall reimburse Landlord for the entire amount of such additional premiums or surcharges on demand.

10. WAIVER OF SUBROGATION. Notwithstanding any other language of this Lease to the contrary, Landlord and Tenant each waive their respective rights to recover from the other for any and all loss of or damage to their respective property if such loss or damage is covered, or required by this Lease to be covered, by insurance. Tenant shall obtain an endorsement acknowledging such waiver from its insurance company(s) evidencing compliance with this section.

11. SECURITY DEPOSIT. Upon execution of this Lease, Tenant shall deposit with Landlord the amount of the Security Deposit specified in Section 1 of this Lease. Provided that Tenant has paid all amounts due and has otherwise performed all obligations hereunder, the Security Deposit shall be returned to Tenant without interest within sixty (60) days of the expiration of the Term, further provided that Landlord may deduct from the Security Deposit prior to returning it any amounts owed by Tenant to Landlord. If Tenant defaults under any provision of this Lease, Landlord may, but shall not be obligated to, apply all or any part of the Security Deposit to cure the default. In the event Landlord elects to apply the Security Deposit as provided for above, Tenant shall, within five (5) business days after Landlord’s demand, restore the Security Deposit to the original amount. Furthermore, if Tenant defaults under this Lease more than two (2) times during any twelve (12) month period, irrespective of whether such default is cured, then, without limiting Landlord’s other rights and remedies, Landlord may, in Landlord’s sole discretion, modify the amount of the Security Deposit. Within ten (10) days after notice of such modification, Tenant shall submit to Landlord the required additional sums and Tenant’s failure to do so shall constitute an Event of Default without further notice or right to cure, and Landlord shall have the right to exercise any remedy provided for in this Lease. Landlord may, at its discretion, commingle the Security Deposit with its other funds. Upon any sale or other conveyance of the Building, Landlord shall transfer the Security Deposit (or any amount of the Security Deposit remaining) to a successor owner, and Tenant agrees to look solely to the successor owner for repayment of the same, if it was transferred. The Security Deposit shall not operate as a limitation on any recovery to which Landlord may be entitled.

| 9 |

12. USE. The Premises shall be used for the Permitted Use and for no other purposes whatsoever. Tenant shall not do or permit to be done in or about the Premises, Building or Property anything which is prohibited by any ordinance, order, rule, regulation, certificate of occupancy, or other governmental requirement, now in force or which may hereafter be enacted, including, without limitation, the Americans with Disabilities Act of 1990, as amended (collectively, “Applicable Law”). Tenant shall comply with all Applicable Law in its use of the Premises and common areas of the Property. Tenant shall use and cause all contractors, agents, employees, invitees and visitors of Tenant to use the Premises and any common area of the Property in such a manner as to prevent waste, nuisance and any disruption of other occupants. Tenant shall not place a load upon any floor in the Premises exceeding the floor load per square foot of area which such floor was designed to carry or which is allowed by law. Tenant shall, at Tenant’s sole cost and expense, make any changes necessary to bring the Premises into compliance with any Applicable Law. The judgment of any court of competent jurisdiction or the admission by Tenant in any action or proceeding against Tenant, whether Landlord is a party thereto or not, that Tenant has violated any Applicable Law in the use or occupancy of the Premises, Building or Property shall be conclusive of that fact as between Landlord and Tenant.

13. MAINTENANCE; SERVICES. Excepting only those obligations for which Landlord is expressly responsible pursuant to this section, Tenant will, throughout the Term and at its sole cost, keep and maintain the Premises and all fixtures and equipment located therein, including, without limitation, carpeting, wall-covering, doors, plumbing and other fixtures, and any alterations performed for the benefit of the Premises, clean safe and in good working order, condition and repair and make all necessary repairs and replacements thereto, including, without limitation, replacing all interior broken glass with glass of the same size and quality as that broken and repairing or replacing all systems or portions of systems exclusively serving the Premises including, without limitation, electrical, mechanical, plumbing and heating, ventilating and air conditioning systems. All repairs and replacements required of Tenant in connection herewith shall be of a quality and class at least equal to the minimum building standards established by the then applicable building code requirements in Allentown, Pennsylvania and shall be done in a good and workmanlike manner in compliance with all applicable laws and the terms and conditions of this Lease. If Tenant fails to consistently maintain the Premises in compliance with the terms hereof, Landlord shall have the right to do such acts and expend such funds at the expense of Tenant as are reasonably required and Tenant shall reimburse Landlord for the cost thereof as Additional Rent upon demand. If Tenant uses heat generating machines or equipment in the Premises that materially affect the temperature otherwise maintained by the heating, ventilating and air conditioning system, Landlord reserves the right to install supplementary units for the Premises and the cost of supplementary units, if installed by Landlord, including the cost of installation, operation and maintenance, shall be paid by Tenant to Landlord as Additional Rent upon demand. Should Tenant require any additional service not provided by Landlord pursuant to this Lease, including any services furnished outside the Building’s normal business hours, Landlord may, but shall not be obligated to, furnish such additional service and Tenant agrees to pay Landlord’s charges therefor, including a reasonable administrative fee, any taxes imposed thereon, and, where appropriate, a reasonable allowance for depreciation of any systems being used to provide such service, as Additional Rent upon demand.

Landlord shall maintain the roof, foundation, exterior walls, structural portions, elevators, if any, any common areas and electrical, plumbing, mechanical and fire protection systems (subject to systems exclusive to the Premises such as dishwashers) of the Building, the cost of which shall be included as a part of Operating Expenses, provided that Landlord shall have no obligation to make any repairs unless Landlord has first received written notice of the need for such repairs from Tenant. Notwithstanding the foregoing, any damage to the Property occasioned by the negligence or willful act of Tenant or any person claiming under Tenant, or contractors, agents, employees, invitees or visitors of Tenant or any such person, shall be repaired by and at the sole expense of Tenant, except that Landlord shall have the right, at its sole option, to make such repairs and to charge Tenant for all costs and expenses incurred in connection therewith and Tenant shall pay the cost therefor as Additional Rent upon demand.

| 10 |

14. SUBLEASE; ASSIGNMENT. Tenant shall not mortgage, pledge, hypothecate or otherwise encumber its interest in this Lease. Tenant shall not allow the Premises to be occupied, in whole or in part, by any other party and shall neither sublet the Premises, in whole or in part, nor assign this Lease, nor amend any sublease or assignment to which Landlord has consented, without in each case obtaining the prior written consent of Landlord. Any sublease or assignment, or amendment to any sublease or assignment, without Landlord’s prior written consent shall, at Landlord’s option, be null, void and of no effect, and shall, at Landlord’s option, constitute an Event of Default. The provisions of this section shall apply to a transfer, by one or more transfers, of all, or substantially all, of the business or assets of Tenant, of a majority of the stock, partnership or membership interests, or other evidences of ownership, of Tenant, and of any shares, voting rights or ownership interests of Tenant which results in a change in the identity of the entity or entities which exercise, or may exercise, effective control of Tenant as if such transfers were an assignment of this Lease. Tenant must request Landlord’s consent to any assignment or sublease at least thirty (30) days prior to the proposed effective date of the assignment or sublease. At the time of its request, Tenant shall provide Landlord in writing: (a) the name and address of the proposed assignee or subtenant, (b) a complete copy of the proposed assignment or sublease, (c) reasonably satisfactory information about the nature, business, and business history of the proposed assignee or subtenant and its proposed use of the Premises, and (d) banking, financial or other credit information about the proposed assignee or subtenant sufficient to enable Landlord to determine its financial condition and operating performance. Landlord shall not unreasonably withhold, condition or delay its consent to Tenant’s written request to sublease the Premises or assign this Lease which is made in compliance with the terms and conditions of this section. Without limiting the other instances in which it may be reasonable for Landlord to withhold its consent to an assignment or sublease, Landlord’s refusal to consent to any proposed assignment or sublease shall not be unreasonable if: (a) the financial condition or operating performance of the proposed subtenant or assignee, determined in Landlord’s reasonable discretion, is less than the greater of the financial condition or operating performance of the Tenant on (i) the date of execution of this Lease or (ii) the date of Tenant’s request for Landlord’s consent to the proposed assignment or sublease, (b) Tenant is in default under any of the terms, covenants or conditions of this Lease, (c) the proposed use of the Premises may result in: (i) increased wear and tear on the Premises, Building or Property or (ii) any adverse effect on other tenants in the Building or adjacent buildings owned by Landlord, (d) the proposed subtenant or assignee is a governmental agency, (e) Landlord has space available elsewhere in the Building which can accommodate the needs of the proposed subtenant or assignee or the proposed subtenant or assignee is a prospect to whom Landlord has made a proposal for the lease of space within the prior six (6) months, in Allentown, PA, (g) the proposed subtenant or assignee would cause Landlord to be in violation of any covenant or restriction contained in another lease or other agreement, or (h) Landlord’s lender, if any, does not consent to the proposed sublease or assignment.

| 11 |

No subletting or assignment shall release Tenant from Tenant’s obligations under this Lease or alter the primary liability of Tenant to pay the Rent and to perform all other obligations to be performed by Tenant hereunder. Any subtenant shall, at Landlord’s election, attorn to Landlord following any early termination of this Lease and any assignee shall be jointly and severally liable for the full performance of all of Tenant’s obligations hereunder. Landlord may require, as a condition to granting Landlord’s consent with respect to the provisions of this section, that the proposed subtenant or assignee enter into a written agreement with Landlord confirming the obligations of such subtenant or assignee under this Lease. Tenant shall pay, as Additional Rent on demand, all legal fees incurred by Landlord in connection with each proposed assignment or sublease whether or not Landlord’s consent is obtained. If Tenant receives rent or other payments under any assignment or sublease in excess of the payments made by Tenant to Landlord under this Lease (as such amounts are adjusted on a per square foot basis if less than all of the Premises is transferred), then Tenant shall pay Landlord one-half of such excess after deducting the actual out of pocket costs of tenant improvements, market brokerage commissions, and reasonable legal fees incurred by Tenant in connection with such sublease or assignment. Landlord’s consent to one assignment or sublease shall not be deemed a waiver of the requirement of Landlord’s consent to any subsequent assignment or sublease. In the event Tenant seeks to assign its interest in this Lease, and Landlord does not consent to such proposed assignment, Landlord may elect to terminate this Lease in its entirety, and the last day of the Term of this Lease shall be the thirtieth (30th) day after Landlord notifies Tenant of Landlord’s election to terminate this Lease. In the event Tenant seeks to sublet all or any portion of the Premises and Landlord does not consent to such proposed sublease, Landlord may elect to terminate this Lease with respect to the portion of the Premises that would be subject to such sublease and the last day of the Term of this Lease for such space shall be the thirtieth (30th) day after Landlord notifies Tenant of Landlord’s election to terminate this Lease and, if less than the entire Premises is affected, Landlord shall have the right to perform any alterations to make such space a self-contained rental unit.

15. INDEMNITY; NON-LIABILITY OF LANDLORD. Except to the extent prohibited by law, as a material part of the consideration for Landlord’s execution of this Lease, Tenant shall neither hold nor attempt to hold Landlord or its employees or Landlord’s agents or contractors or their employees liable for, and Tenant covenants and agrees that it shall indemnify and defend Landlord for and against any and all penalties, damages, fines, causes of action, liabilities, judgments, expenses (including, without limitation, attorneys’ fees) or charges incurred in connection with or arising from: (i) the use or occupancy of the Premises by Tenant or any person claiming under Tenant; (ii) any acts, omissions or negligence of Tenant or any person claiming under Tenant, or contractors, agents, employees, invitees or visitors of Tenant or any such person; (iii) any breach, violation or nonperformance by Tenant or any person claiming under Tenant or the employees, agents, contractors, invitees or visitors of Tenant or any such person of any term, covenant or provision of this Lease or any law, ordinance or governmental requirement of any kind; (iv) any injury or damage to the person, property or business of Tenant, its employees, agents, contractors, invitees, visitors or any other person entering upon the Property under the express or implied invitation of Tenant; or (v) any matter occurring in the Premises during the Term, except for any such matter occurring in the Premises which arises directly as a result of Landlord’s gross negligence or willful misconduct and not as a result of any other matter described in (i) through (iv) above.

| 12 |

Except for the grossly negligent acts or willful misconduct of the Landlord, the Landlord, to the fullest extent not prohibited by law, shall not be liable for any damage occasioned by failure to keep the Premises, Building or Property in repair, nor for any damage done or occasioned by or from plumbing, gas, electricity, water, sprinkler, or other pipes or sewerage or the bursting, leaking or running of any pipes, tank or plumbing fixtures, in, above, upon or about the Premises or the Building nor from any damage occasioned by water, snow or ice being upon or coming through the roof, skylights, trap door or otherwise, nor for any damages arising from acts, or neglect of co-tenants or other occupants of the Building or of any owners or occupants of adjacent or contiguous property, nor for any loss of or injury to property or business occurring, through, in connection with or incidental to the failure to furnish any such services or the interruption of any services to the Premises. Further, Landlord shall not be liable or responsible to Tenant for any loss or damage to any property or person occasioned by theft or any other criminal act, fire, act of God, public enemy, injunction, riot, strike, insurrection, war, court order, law of requisition or order of any governmental authority.

Landlord shall not be liable in any event for incidental or consequential damages to Tenant by reason of any default by Landlord hereunder, whether or not Landlord is notified that such damages may occur. The term “Landlord”, as used in this Lease, so far as covenants or obligations to be performed by Landlord are concerned, means only the owner or owners at the time in question of the Landlord’s interest in the Building, and in the event of any transfer or transfers of title to the Landlord’s interest in the Building, the Landlord herein named (and in case of any subsequent transfers or conveyances, the then grantor) shall be automatically freed and relieved from and after the date of such transfer or conveyance of all liability as respects the performance of any covenants or obligations on the part of the Landlord contained in this Lease thereafter to be performed. Tenant’s sole recourse against Landlord, and any successor to the interest of Landlord in the Premises, is to the interest of Landlord, and any successor, in the Premises and the Building of which the Premises are a part. In no event whatsoever shall Landlord or any beneficiary of any trust of which Landlord is a trustee or any of Landlord’s officers, directors, partners, managers, members, shareholders, agents, attorneys and employees ever be personally liable hereunder.

16. UTILITIES. Tenant shall contract directly with public utility providers for all utilities which are separately metered to the Premises and shall pay such utility providers directly and promptly when due. If any utility is not separately metered to the Premises, the cost of such utility consumed on the Premises, as reasonably determined by Landlord, by reference to a submeter, if applicable, or otherwise, shall be paid by Tenant as a part of Operating Expenses. Tenant’s obligation to pay for utilities provided to the Premises during the Term shall survive the expiration or earlier termination of the Lease. Tenant shall not utilize an alternative provider for a utility service other than the public utility provider servicing the Property unless Tenant shall first obtain the written consent of Landlord. Landlord shall in no way be liable or responsible for any loss, damage, or expense that Tenant may sustain or incur by reason of any change, failure, interruption, or defect in the supply or character of the electric energy furnished to the Premises or Building. To ensure the proper functioning and protection of all utilities, Tenant agrees to abide by all reasonable regulations and requirements which Landlord may prescribe and to allow Landlord and its utility providers access to all electric lines, feeders, risers, wiring, and any other machinery within the Premises.

| 13 |

17. HOLDING OVER. If Tenant or any party claiming by or under Tenant remains in occupancy of the Premises or any part thereof beyond the expiration or earlier termination of this Lease, such holding over shall be without right and a tenancy at sufferance, and Tenant shall be liable to Landlord for any loss or damage incurred by Landlord as a result thereof, including consequential damages. In addition, for each month or any part thereof that such holding over continues, Tenant shall pay to Landlord a monthly fee for the use and occupancy of the Premises equal to the greater of (a) the monthly fair market rental for the Premises and (b) one hundred fifty percent (150%) of the Rent payable for the month immediately preceding such hold over for the first thirty (30) days of such holdover and equal to the greater of (a) the monthly fair market rental for the Premises and (b) two hundred percent (200%) of the Rent payable for the month immediately preceding such hold over thereafter, and there shall be no adjustment or abatement for any partial month. The provisions of this section shall not be deemed to limit or exclude any of Landlord’s rights of re-entry or any other right granted to Landlord hereunder, at law or in equity.

18. NO RENT DEDUCTION OR SET OFF. Tenant’s covenant to pay Rent is and shall be independent of each and every other covenant of this Lease. Tenant agrees that any claim by Tenant against Landlord shall not be deducted from Rent nor set off against any claim for Rent in any action. No payment by Tenant or receipt by Landlord of a lesser amount than the Rent herein stipulated shall be deemed to be other than on account of the earliest stipulated Rent, nor shall any endorsement or statement on any check or any letter accompanying any check or payment as Rent be deemed an accord and satisfaction, and Landlord may accept such check or payment without prejudice to Landlord’s right to recover the balance of such Rent or pursue any remedy provided in this Lease or at law. In connection with the foregoing, Landlord shall have the absolute right in its sole discretion to apply any payment received from Tenant to any account or other payment of Tenant then not current and due or delinquent.

19. CASUALTY. If the Premises or any part thereof are damaged by fire or other casualty, Tenant shall give prompt notice thereof to Landlord. If the Premises or the Building are totally or partially damaged or destroyed by fire or other casualty, thereby rendering the Premises totally or partially inaccessible or unusable, Landlord shall diligently restore and repair the Premises and the Building to substantially the same condition they were in prior to such damage. Provided that such damage was not caused by the act or omission of Tenant or any of its employees, agents, licensees, invitees or subtenants, until the repair and restoration of the Premises is completed Base Rent shall be abated for that part of the Premises that Tenant is unable to use without substantial interference and is not occupied while repairs are being made, based on the ratio that the amount of unusable rentable area bears to the total rentable area of the Premises. Landlord shall bear the costs and expenses of repairing and restoring the Premises and the Building, provided, however, that Landlord shall not be obligated to spend more than the net proceeds of insurance proceeds made available for such repair and restoration nor shall Landlord be obligated to repair or restore, or to pay for the repair or restoration of, any furnishings, equipment or personal property belonging to Tenant or any alterations, additions, or improvements (including carpeting, floor coverings, paneling, decorations, fixtures) made to the Premises or Building by Tenant or by Landlord at Tenant’s request or for Tenant’s benefit. It shall be Tenant’s sole responsibility to repair and restore all such items.

| 14 |

Notwithstanding the foregoing, (a) if there is a destruction of the Building that exceeds twenty-five percent (25%) of the replacement value of the Building from any risk, whether or not the Premises are damaged or destroyed, or (b) if Landlord reasonably believes that the repairs and restoration cannot be completed despite reasonable efforts within ninety (90) days after the occurrence of such damage, or (c) if Landlord reasonably believes that there shall be less than two (2) years remaining in the Term (exclusive of any extension options) upon the substantial completion of such repairs and restoration, or (d) if any mortgagee or lender fails or refuses to make sufficient insurance proceeds available for repairs and restoration, or (e) if zoning or other applicable laws or regulations do not permit such repairs and restoration, Landlord shall have the right to terminate this Lease by giving written notice of termination to Tenant within one hundred eighty (180) days after the occurrence of such damage. If this Lease is terminated pursuant to the preceding sentence, all Rent payable hereunder shall be apportioned and paid to the date of termination.

All time periods provided in this Section for Landlord’s performance shall be subject to extension on account of delays in effectuating a satisfactory settlement with any insurance company involved and events beyond Landlord’s reasonable control. In the event of any damage or destruction to the Building or Premises, it shall be Tenant’s responsibility to secure the Premises and, upon notice from Landlord, to remove forthwith, at its sole cost and expense, property belonging to Tenant or its licensees from such portion of the Premises as Landlord shall request.

Notwithstanding anything to the contrary in this section, in the event Landlord elects or is required to repair and restore the Premises, and such repair has not commenced within ninety (90) days after the date of casualty, or been substantially completed within two hundred seventy (270) days following the date repair was commenced, Tenant shall have the right to terminate the Lease by providing written notice to Landlord, such termination to be effective sixty (60) days after notice from Tenant is received by Landlord, unless Landlord substantially completes the repairs within such sixty (60) day period.

20. SUBORDINATION; ESTOPPEL LETTERS.

(A) This Lease is expressly subordinate to any current or future mortgage or mortgages placed on the Property and to all other documents executed in connection with any such mortgage. Tenant agrees not to pay rent more than thirty (30) days in advance and to attorn to any party acquiring rightful possession of the Premises by or through any such mortgage ("Successor Landlord"). Notwithstanding anything to the contrary in this Lease, Successor Landlord shall not be liable for or bound by any of the following matters: (i) any right of Tenant to any offset, defense, claim, counterclaim, reduction, deduction, or abatement against Tenant's payment of rent or performance of Tenant's other obligations under this Lease, arising from Landlord's breach or default under this Lease ("Offset Right") that Tenant may have against Landlord or any other party that was landlord under this Lease at any time before the occurrence of any attornment by Tenant ("Former Landlord") relating to any event or occurrence before the date of attornment, including any claim for damages of any kind whatsoever as the result of any breach by Former Landlord that occurred before the date of attornment; provided, however, the foregoing shall not limit either (x) Tenant’s right to exercise against Successor Landlord any Offset Right otherwise available to Tenant because of events occurring after the date of attornment or (y) Successor Landlord’s obligation to correct any conditions that existed as of the date of attornment and violate Successor Landlord’s obligations as landlord under this Lease; (ii) any obligation with respect to any security deposited with Former Landlord, unless such security was actually delivered to Successor Landlord; (iii) any payment of rent that Tenant may have made to Former Landlord more than thirty (30) days before the date such rent was first due and payable under the Lease with respect to any period after the date of attornment other than, and only to the extent that, the Lease expressly required such a prepayment; and (iv) to commence or complete any initial construction of improvements in the Premises, unless sums to commence or complete such construction shall have been actually delivered to Successor Landlord by way of an assumption of escrow accounts or otherwise; and (v) to pay Tenant any sum(s) that any Former Landlord owed to Tenant unless such sums, if any, shall have been actually delivered to Successor Landlord by way of an assumption of escrow accounts or otherwise.

| 15 |

Tenant shall send to each Mortgagee (after notification of the identity of such Mortgagee and the mailing address thereof is provided to Tenant) copies of all default notices that Tenant sends to Landlord; such notices to said mortgagee shall be sent concurrently with the sending of the notices to Landlord and in the same manner as notices are required to be sent pursuant to this Lease. Tenant will accept performance of any provision of this Lease by such mortgagee as performance by, and with the same force and effect as though performed by, Landlord. If any act or omission of Landlord would give Tenant the right, immediately or after lapse of a period of time, to cancel or terminate this Lease, or to claim a partial or total eviction, Tenant shall not exercise such right until (a) Tenant gives notice of such act or omission to Landlord and Mortgagee, and (b) a reasonable period of time for remedying such act or omission elapses following the time when Mortgagee becomes entitled under the applicable mortgage to remedy same (which reasonable period shall in no event be less than the period to which Landlord is entitled under this Lease).

(B) Tenant agrees that from time to time it shall deliver to Landlord or Landlord’s mortgagee or designee within ten (10) business days of the date of Landlord’s or Landlord’s mortgagees or such other designee’s request, a statement, in writing, certifying (i) that this Lease is unmodified and in full force and effect, if this is so, or if there have been modifications, that the Lease, as modified, is in full force and effect; (ii) the dates to which Rent and other charges have been paid; (iii) that Landlord is not in default under any provisions of this Lease or, if in default, the nature thereof in reasonable detail; (iv) the subordination of this Lease to any current or future mortgage or mortgages placed on the Property by Landlord and Tenant’s agreement to attorn to any party acquiring rightful possession of the Premises by or through any such mortgage; and (v) such other true statements as Landlord or Landlord’s mortgagee or designee may require. Tenant’s failure to execute and deliver such statements within the time required shall, at Landlord’s election, be an Event of Default and shall also be conclusive upon Tenant that (a) this Lease is in full force and effect and has not been modified except as represented by Landlord; (b) that Landlord is not in default under any provisions of this Lease and that Tenant has no right of offset, counterclaim or deduction against Rent; and (c) not more than one month’s Rent has been paid in advance.

| 16 |

21. ALTERATIONS; RESTORATION.

(A) Tenant shall not make or permit to be made any alterations, additions, or improvements in or to the Premises (“Alterations”) without first obtaining the prior written consent of Landlord which consent may be withheld in Landlord’s sole discretion. All Alterations (i) must comply with all applicable laws, (ii) must be compatible with the Building and its mechanical, electrical, heating, ventilating, air-conditioning and life safety systems; (iii) must not interfere with the use and occupancy of any other portion of the Building by any other tenant or their invitees; and (iv) must not affect the integrity of the structural portions of the Building. In addition, Landlord may impose as a condition to such consent such additional requirements as Landlord in its sole discretion deems necessary or desirable, including, without limitation: (a) Tenant’s submission to Landlord, for Landlord’s prior written approval, of all plans and specifications relating to the Alterations; (b) Landlord’s prior written approval of the time or times when the Alterations are to be performed; (c) Landlord’s prior written approval of the contractors and subcontractors performing work in connection with the Alterations; (d) Tenant’s receipt of all necessary permits and approvals from all governmental authorities having jurisdiction over the Premises prior to the construction of the Alterations; (e) Tenant’s delivery to Landlord of such bonds and insurance as Landlord customarily requires; (f) Tenant’s payment to Landlord of a commercially reasonable fee for Landlord’s supervision of any Alterations; (g) Tenant’s and Tenant’s contractor’s compliance with such construction rules and regulations and building standards as Landlord promulgates from time to time; and (i) Tenant’s delivery to Landlord of “as built” drawings of the Alterations in such form or medium as Landlord may require. All direct and indirect costs relating to any modifications, alterations or improvements of Building, whether outside or inside of the Premises, required by any governmental agency or by law as a condition or as the result of any Alteration requested or effected by Tenant shall be borne by Tenant. Landlord may elect to perform such modifications, alterations or improvements (at Tenant’s sole cost and expense) or require such performance directly by Tenant. Tenant shall not permit any mechanic’s lien or other liens to be placed upon the Premises or the Building as a result of any materials, services or labor ordered by or provided to Tenant or any of Tenant’s agents, officers, or employees. Without waiving any other rights or remedies under this Lease, Landlord may bond or insure or otherwise discharge any such lien and Tenant shall reimburse Landlord for any amount paid by Landlord in connection therewith as Additional Rent upon demand. Notwithstanding the foregoing, Landlord will not withhold its consent to the performance by Tenant of cosmetic Alterations that (a) cost less than $20,000.00 in the aggregate in any calendar year (b) are not visible from the exterior of the Premises, and (c) comply with requirements (i) through (iv) of this subsection, provided prior notice of such cosmetic Alterations has been provided to Landlord.

(B) Upon the expiration or earlier termination of the Lease, Tenant shall surrender the Premises in good working order and condition. Tenant shall remove any and all Alterations, trade fixtures, equipment, data/telecommunications cabling and wiring installed by or on behalf of Tenant and furniture from the Premises and Tenant shall fully repair any damage, including any structural damage above normal wear and tear, occasioned by the removal of the same. Notwithstanding the foregoing, Landlord may require that Tenant not remove any or all Alterations and any such Alteration or Alterations shall become a part of the realty and shall belong to Landlord without compensation, and title thereto shall pass to Landlord under this Lease as by a bill of sale. At Landlord’s election, all Alterations, trade fixtures, equipment, wire and cable, furniture, fixtures, other personal property not removed shall conclusively be deemed to have been abandoned by Tenant and may be appropriated, sold, stored, destroyed or otherwise disposed of by Landlord without notice to Tenant or to any other person and without obligation to account for them. Tenant shall pay Landlord all reasonable expenses incurred in connection with Landlord’s disposition of such property, including without limitation the cost of repairing any damage to the Building or the Premises caused by removal of such property, and shall hold Landlord harmless from loss, liability, or expense arising from the claims of third parties such as Tenant’s lenders whose loans are secured by such property. Tenant’s obligations under this section shall survive the end of this Lease.

| 17 |

22. DEFAULT; REMEDIES.

(A) In addition to any other acts or omissions designated in this Lease as Events of Default, each of the following shall constitute an Event of Default by Tenant hereunder: (i) the failure to make any payment of Rent or any installment thereof or to pay any other sum required to be paid by Tenant under this Lease or under the terms of any other agreement between Landlord and Tenant after written notice and grace period of five (5) days to cure (the notice and cure period shall not be offered for more than 2 defaults per 12 month period); (ii) the use or occupancy of the Premises for any purpose other than the Permitted Use without Landlord’s prior written consent or the conduct of any activity in the Premises which constitutes a violation of law; (iii) if the interest of Tenant or any part thereof under this Lease shall be levied on under execution or other legal process and said interest shall not have been cleared by said levy or execution within fifteen (15) days from the date thereof; (iv) if any voluntary or involuntary petition in bankruptcy or for corporate reorganization or any similar relief shall be filed by or against Tenant or any guarantor of the Lease or if a receiver shall be appointed for Tenant or any guarantor or any of the property of Tenant or guarantor; (v) if Tenant or any guarantor of the Lease shall make an assignment for the benefit of creditors or if Tenant shall admit in writing its inability to meet Tenant’s debts as they mature; (vi) if any insurance required to be maintained by Tenant pursuant to this Lease shall be cancelled or terminated or shall expire or shall be reduced or materially changed, except, in each case, as permitted in this Lease, or mutually agreed to in writing by the parties; (vii) if Tenant shall fail to immediately discharge or bond over any lien placed upon the Premises in violation of this Lease; (viii) if Tenant shall abandon or vacate the Premises during the Term; (ix) if Tenant shall fail to execute and deliver an estoppel certificate or subordination agreement as required hereunder; or (x) the failure to observe or perform any of the other covenants or conditions in this Lease which Tenant is required to observe and perform and which Tenant has not corrected within twenty (20) days after written notice thereof to Tenant, provided, however, that if (x) Tenant can not through best efforts correct such failure within said twenty (20) day period, and (y) Tenant has provided Landlord with written documentation detailing the steps taken to correct the failure prior to the twentieth (20th) day of said period, then Tenant shall have such longer period as is reasonably required to correct any such default not to exceed twenty (20) additional days; provided, however, that if said failure involves the creation of a condition which, in Landlord’s reasonable judgment, is dangerous or hazardous, Tenant shall be required to cure same within 24 hours.

(B) Upon the occurrence of an Event of Default by Tenant beyond any applicable notice and cure period, the unamortized cost of all legal fees, Tenant allowances, work performed by Landlord to the Premises, and any other Tenant inducements paid or provided under this Lease plus interest on the foregoing items accruing from the date of such Event of Default at the Default Rate shall immediately become due, and Landlord may, at its option, with or without notice or demand of any kind to Tenant or any other person, exercise any one or more of the following described remedies, in addition to all other rights and remedies provided at law, in equity or elsewhere herein, and such rights and remedies shall be cumulative and none shall exclude any other right allowed by law:

| 18 |

(i) Landlord may terminate this Lease, repossess and re-let the Premises, in which case Landlord shall be entitled to recover as damages (in addition to any other sums or damages for which Tenant may be liable to Landlord) a lump sum equal to the amount by which the present value of the excess Rent remaining to be paid by Tenant for the balance of the Term of the Lease exceeds the fair market rental value of the Premises, after deduction of all anticipated expenses of reletting. For the purpose of determining present value, Landlord and Tenant agree that the interest rate shall be the rate applicable to the then-current yield on obligations of the U.S. Treasury having a maturity date on or about the Expiration Date. Should the fair market rental value of the Premises for the balance of the Term (after deduction of all anticipated expenses of reletting) exceed the value of the Rent to be paid by Tenant for the balance of the Term, Landlord shall have no obligation to pay to or otherwise credit Tenant for any such excess amount;

(ii) Landlord may, without terminating the Lease, terminate Tenant’s right of possession, repossess the Premises including, without limitation, removing all or any part of Tenant’s personal property in the Premises and to place such personal property in storage or a public warehouse at the expense and risk of Tenant, and relet the same for the account of Tenant for such rent and upon such terms as shall be satisfactory to Landlord. For the purpose of such reletting, Landlord is authorized to decorate, repair, remodel or alter the Premises. Tenant shall pay to Landlord as damages a sum equal to all Rent under this Lease for the balance of the Term unless and until the Premises are relet. If the Premises are relet, Tenant shall be responsible for payment upon demand to Landlord of any deficiency between the Rent as relet and the Rent for the balance of this Lease, all costs and expenses of reletting, and all reasonable decoration, repairs, remodeling, alterations, additions and collection of the rent accruing therefrom. Tenant shall not be entitled to any rents received by Landlord in excess of the rent provided for in this Lease. No re-entry or taking possession of the Premises by Landlord shall be construed as an election to terminate this Lease unless a written notice of such intention be given to Tenant or unless the termination thereof be decreed by a court of competent jurisdiction. Notwithstanding any reletting without termination, Landlord may at any time thereafter elect to terminate this Lease for any breach, and in addition to the other remedies it may have, recover as damages (in addition to any other sums or damages for which Tenant may be liable to Landlord) a lump sum equal to the amount by which the present value of the excess Rent remaining to be paid by Tenant for the balance of the Term of the Lease exceeds the fair market rental value of the Premises, after deduction of all anticipated expenses of reletting. In the event Landlord repossesses the Premises as provided above, Landlord may remove all persons and property from the Premises and store any such property at the cost of Tenant, without liability for damage; and

(iii) Landlord may, but shall not be obligated to, and without waiving or releasing Tenant from any obligations of Tenant hereunder, make any payment or perform such other act on Tenant’s part to be made or performed as provided in this Lease. All sums so paid by Landlord and all necessary incidental costs shall be payable to Landlord as Additional Rent on demand and Tenant covenants to pay such sums.

| 19 |

(iv) By notice to Tenant, Landlord shall have the right to accelerate all Rent and all expense due hereunder and otherwise payable in installments over the remainder of the Term; and the amount of accelerated rent to the termination date, without further notice or demand for payment, shall be due and payable by Tenant within five (5) days after Landlord has so notified Tenant, such amount collected from Tenant shall be discounted to present value using an interest rate of six percent (6%) per annum. Any Additional Rent which has not been included, in whole or in part, in accelerated rent, shall be due and payable by Tenant during the remainder of the Term, in the amounts and at the times otherwise provided for in this Lease.

(C) Tenant agrees that Landlord may file suit to recover any sums falling due under the terms of this section from time to time and that no suit or recovery of any portion due Landlord hereunder shall be any defense to any subsequent action brought for any amount not theretofore reduced to judgment in favor of Landlord.

(D) Tenant shall promptly pay upon notice, as Additional Rent, all reasonable costs, charges and expenses incurred by Landlord (including, without limitation, reasonable fees and out-of-pocket expenses of legal counsel, collection agents, and other third parties retained by Landlord) together with interest thereon at the rate set forth in Section 5 of this Lease, in collecting any amount due from Tenant, enforcing any obligation of Tenant hereunder, or preserving any rights or remedies of Landlord; and Tenant shall pay all reasonable attorneys’ fees and expenses arising out of any litigation, negotiation or transaction in which Tenant causes Landlord, without Landlord’s fault, to become involved or concerned.

(E) No waiver of any provision of this Lease shall be implied by any failure of Landlord to enforce any remedy on account of the violation of such provision, even if such violation be continued or repeated subsequently, and no express waiver by Landlord shall be valid unless in writing and shall not affect any provision other than the one specified in such written waiver and that provision only for the time and in the manner specifically stated in the waiver. No receipt of monies by Landlord from Tenant after the termination of this Lease shall in any way alter the length of the Term or Tenant’s right of possession hereunder or after the giving of any notice shall reinstate, continue or extend the Term or affect any notice given Tenant prior to the receipt of such monies, it being agreed that after the service of notice or the commencement of a suit or after final judgment for possession of the Premises, Landlord may receive and collect any Rent due, and the payment of Rent shall not waive or affect said notice, suit or judgment. Landlord shall not be required to serve Tenant with any notices or demands as a prerequisite to its exercise of any of its rights or remedies under this Lease, other than those notices and demands specifically required under this Lease. Tenant expressly waives the service of any statutory demand or notice which may be specified in the Landlord and Tenant Act of Pennsylvania, Act of April 6, 1951, as amended, or ay similar or successor provision of law and agrees that five (5) days’ notice shall be sufficient in any case where a longer period may be statutorily specified.

| 20 |

(F) In addition to, and not in lieu of any of the foregoing rights granted to Landlord: TENANT HEREBY EMPOWERS ANY PROTHONOTARY, CLERK OF COURT OR ATTORNEY OF ANY COURT OF RECORD TO APPEAR FOR TENANT IN ANY AND ALL ACTIONS WHICH MAY BE BROUGHT FOR ANY RENT, OR ANY CHARGES HEREBY RESERVED OR DESIGNATED AS RENT OR ANY OTHER SUM PAYABLE BY TENANT TO LANDLORD UNDER OR BY REASON OF THIS LEASE, INCLUDING, WITHOUT LIMITATION, ANY SUM PAYABLE HEREUNDER, AND TO SIGN FOR TENANT AN AGREEMENT FOR ENTERING IN ANY COMPETENT COURT AN ACTION OR ACTIONS FOR THE RECOVERY OF SAID RENT, CHARGES AND OTHER SUMS, AND IN SAID SUIT OR IN SAID ACTION OR ACTIONS TO CONFESS JUDGMENT AGAINST TENANT FOR ALL OR ANY PART OF THE RENT SPECIFIED IN THIS LEASE AND THEN UNPAID INCLUDING, AT LANDLORD’S OPTION, THE RENT FOR THE ENTIRE UNEXPIRED BALANCE OF THE TERM OF THIS LEASE, AND ALL OR ANY PART OF ANY OTHER OF SAID CHARGES OR SUMS, AND FOR INTEREST AND COSTS TOGETHER WITH REASONABLE ATTORNEY’S FEES OF 5%. SUCH AUTHORITY SHALL NOT BE EXHAUSTED BY ONE EXERCISE THEREOF, BUT JUDGMENT MAY BE CONFESSED AS AFORESAID FROM TIME TO TIME AS OFTEN AS ANY OF SAID RENT OR SUCH OTHER SUMS, CHARGES, PAYMENTS, COSTS AND EXPENSES SHALL FALL DUE OR BE IN ARREARS, AND SUCH POWERS MAY BE EXERCISED AS WELL AFTER THE EXPIRATION OF THE TERM OR DURING ANY EXTENSION OR RENEWAL OF THIS LEASE.

WHEN THIS LEASE OR TENANT’S RIGHT OF POSSESSION SHALL BE TERMINATED BY COVENANT OR CONDITION BROKEN, OR FOR ANY OTHER REASON, EITHER DURING THE TERM OF THIS LEASE OR ANY RENEWAL OR EXTENSION THEREOF, AND ALSO WHEN AND AS SOON AS THE TERM HEREBY CREATED OR ANY EXTENSION THEREOF SHALL HAVE EXPIRED, IT SHALL BE LAWFUL FOR ANY ATTORNEY AS ATTORNEY FOR TENANT TO FILE AN AGREEMENT FOR ENTERING IN ANY COMPETENT COURT AN ACTION TO CONFESS JUDGMENT IN EJECTMENT AGAINST TENANT AND ALL PERSONS CLAIMING UNDER TENANT, WHEREUPON, IF LANDLORD SO DESIRES, A WRIT OF EXECUTION OR OF POSSESSION MAY ISSUE FORTHWITH, WITHOUT ANY PRIOR WRIT OF PROCEEDINGS, WHATSOEVER, AND PROVIDED THAT IF FOR ANY REASON AFTER SUCH ACTION SHALL HAVE BEEN COMMENCED THE SAME SHALL BE DETERMINED AND THE POSSESSION OF THE PREMISES HEREBY DEMISED REMAIN IN OR BE RESTORED TO TENANT, LANDLORD SHALL HAVE THE RIGHT UPON ANY SUBSEQUENT DEFAULT OR DEFAULTS, OR UPON THE TERMINATION OF THIS LEASE AS HEREINBEFORE SET FORTH, TO BRING ONE OR MORE ACTION OR ACTIONS AS HEREINBEFORE SET FORTH TO RECOVER POSSESSION OF THE SAID PREMISES.

In any action to confess judgment in ejectment or for rent in arrears, Landlord shall first cause to be filed in such action an affidavit made by it or someone acting for it setting forth the facts necessary to authorize the entry of judgment, of which facts such affidavit shall be conclusive evidence, and if a true copy of this Lease (and of the truth of the copy such affidavit shall be sufficient evidence) be filed in such action, it shall not be necessary to file the origins as a warrant of attorney, any rule of Court, custom or practice to the contrary notwithstanding.

| 21 |

__________ (INITIAL). TENANT WAIVER. TENANT SPECIFICALLY ACKNOWLEDGES THAT TENANT HAS VOLUNTARILY, KNOWINGLY AND INTELLIGENTLY WAIVED CERTAIN DUE PROCESS RIGHTS TO A PREJUDGMENT HEARING BY AGREEING TO THE TERMS OF THE FOREGOING PARAGRAPHS REGARDING CONFESSION OF JUDGMENT. TENANT FURTHER SPECIFICALLY AGREES THAT IN THE EVENT OF DEFAULT, LANDLORD MAY PURSUE MULTIPLE REMEDIES INCLUDING OBTAINING POSSESSION PURSUANT TO A JUDGMENT BY CONFESSION AND ALSO OBTAINING A MONEY JUDGMENT FOR PAST DUE AND ACCELERATED AMOUNTS AND EXECUTING UPON SUCH JUDGMENT. IN SUCH EVENT AND SUBJECT TO THE TERMS SET FORTH HEREIN, LANDLORD SHALL PROVIDE FULL CREDIT TO TENANT FOR ANY MONTHLY CONSIDERATION WHICH LANDLORD RECEIVES FOR THE LEASED PREMISES IN MITIGATION OF ANY OBLIGATION OF TENANT TO LANDLORD FOR THAT MONEY. FURTHERMORE, TENANT SPECIFICALLY WAIVES ANY CLAIM AGAINST LANDLORD AND LANDLORD’S COUNSEL FOR VIOLATION OF TENANT’S CONSTITUTIONAL RIGHTS IN THE EVENT THAT JUDGMENT IS CONFESSED PURSUANT TO THIS LEASE. TENANT SPECIFICALLY WAIVES AND DISCLAIMS SECTION 5601.3(b) OF TITLE 20, CHAPTER 56 OF THE PENNSYLVANIA CONSOLIDATED STATUTES.

23. NOTICES. All notices permitted or required hereunder shall be in writing and (i) delivered personally, (ii) sent by U.S. certified mail, postage prepaid, with return receipt requested, or (iii) sent overnight by nationally recognized overnight courier and sent to the respective parties at the Notice Addresses provided in Section 1 of this Lease. If sent by U.S. certified mail, such notice shall be considered received by the addressee on the second (2nd) business day after posting. If sent by nationally recognized overnight courier, such notice shall be considered received by the addressee on the first (1st) business day after deposit with the courier. Notices may be given by an agent on behalf of Landlord or Tenant. Any notice from Landlord to Tenant shall also be deemed to have been given if delivered to the Premises, addressed to Tenant.