UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

| Commission file number: |

CORVUS GOLD INC.

(Exact Name of Registrant as Specified in its Charter)

| | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | ||

| | | |

| (Address of Principal Executive Offices) | (Zip code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

| Trading Symbol |

| Name of each exchange on which registered: |

| | | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| | Small reporting company |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of October 5, 2020, the registrant had

Table of Contents

| Page |

||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

||

CORVUS GOLD INC.

CONDENSED INTERIM CONSOLIDATED BALANCE SHEETS

(Expressed in Canadian dollars)

| August 31, 2020 | May 31, 2020 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Accounts receivable | ||||||||

| Prepaid expenses | ||||||||

| Total current assets | ||||||||

| Property and equipment | ||||||||

| Right-of-use assets | ||||||||

| Capitalized acquisition costs (note 3) | ||||||||

| Total assets | $ | $ | ||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued liabilities (note 5) | $ | $ | ||||||

| Lease liabilities | ||||||||

| Total current liabilities | ||||||||

| Asset retirement obligations (note 3) | ||||||||

| Lease liabilities | ||||||||

| Total liabilities | ||||||||

| Shareholders’ equity | ||||||||

| Share capital (note 4) | ||||||||

| Contributed surplus (note 4) | ||||||||

| Accumulated other comprehensive income - cumulative translation differences | ||||||||

| Deficit accumulated during the exploration stage | ( | ) | ( | ) | ||||

| Total shareholders’ equity | ||||||||

| Total liabilities and shareholders’ equity | $ | $ | ||||||

Nature and continuance of operations (note 1)

Approved on behalf of the Directors:

| “Jeffrey Pontius” | Director | |

| “Anton Drescher” | Director |

These accompanying notes form an integral part of these condensed interim consolidated financial statements

CORVUS GOLD INC.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

(Expressed in Canadian dollars)

THREE MONTHS ENDED AUGUST 31,

| 2020 |

2019 | |||||||

| Operating expenses | ||||||||

| Administration | $ | $ | ||||||

| Consulting fees (notes 4 and 5) | ||||||||

| Depreciation | ||||||||

| Exploration expenditures (notes 3 and 4) | ||||||||

| Insurance | ||||||||

| Investor relations (notes 4 and 5) | ||||||||

| Office and miscellaneous | ||||||||

| Professional fees (note 4) | ||||||||

| Regulatory | ||||||||

| Rent | ||||||||

| Travel | ||||||||

| Wages and benefits (notes 4 and 5) | ||||||||

| Total operating expenses | ( | ) | ( | ) | ||||

| Other income (expense) | ||||||||

| Interest income and expense | ||||||||

| Foreign exchange loss | ( | ) | ( | ) | ||||

| Total other expenses | ( | ) | ( | ) | ||||

| Net loss for the period | ( | ) | ( | ) | ||||

| Other comprehensive loss | ||||||||

| Exchange difference on translating foreign operations | ( | ) | ( | ) | ||||

| Comprehensive loss for the period | $ | ( | ) | $ | ( | ) | ||

| Basic and diluted net loss per share | $ | ( | ) | $ | ( | ) | ||

| Weighted average number of shares outstanding | ||||||||

These accompanying notes form an integral part of these condensed interim consolidated financial statements

CORVUS GOLD INC.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(Expressed in Canadian dollars)

THREE MONTHS ENDED AUGUST 31,

| 2020 |

2019 |

|||||||

| Operating activities |

||||||||

| Net loss for the period |

$ | ( |

) | $ | ( |

) | ||

| Add items not affecting cash: |

||||||||

| Depreciation |

||||||||

| Stock-based compensation (note 4) |

||||||||

| Foreign exchange loss |

||||||||

| Changes in non-cash items: |

||||||||

| Accounts receivable |

||||||||

| Prepaid expenses |

( |

) | ||||||

| Accounts payable and accrued liabilities |

( |

) | ||||||

| Cash used in operating activities |

( |

) | ( |

) | ||||

| Financing activities |

||||||||

| Cash received from issuance of shares |

||||||||

| Share issuance costs |

( |

) | ||||||

| Lease liabilities payments |

( |

) | ( |

) | ||||

| Cash provided by financing activities |

( |

) | ||||||

| Investing activities |

||||||||

| Effect of foreign exchange on cash |

( |

) | ( |

) | ||||

| Increase (decrease) in cash and cash equivalents |

( |

) | ||||||

| Cash and cash equivalents, beginning of the period |

||||||||

| Cash and cash equivalents, end of the period |

$ | $ | ||||||

Supplemental cash flow information (note 8)

These accompanying notes form an integral part of these condensed interim consolidated financial statements

CORVUS GOLD INC.

CONDENSED INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(Unaudited)

(Expressed in Canadian dollars)

THREE MONTHS ENDED AUGUST 31, 2020

| Number of |

Amount |

Contributed |

Accumulated |

Deficit |

Total |

|||||||||||||||||||

| Balance, May 31, 2019 |

$ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

| Net loss for the period |

- | ( |

) | ( |

) | |||||||||||||||||||

| Shares issued for cash |

||||||||||||||||||||||||

| Other comprehensive income |

||||||||||||||||||||||||

| Exchange difference on translating foreign operations |

- | ( |

) | ( |

) | |||||||||||||||||||

| Share issuance costs |

- | ( |

) | ( |

) | |||||||||||||||||||

| Stock-based compensation |

- | |||||||||||||||||||||||

| Balance, August 31, 2019 |

$ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

| Net loss for the period |

- | ( |

) | ( |

) | |||||||||||||||||||

| Shares issued for cash |

||||||||||||||||||||||||

| Share issued for capitalized acquisition costs |

||||||||||||||||||||||||

| Other comprehensive income |

||||||||||||||||||||||||

| Exchange difference on translating foreign operations |

- | |||||||||||||||||||||||

| Share issuance costs |

- | ( |

) | ( |

) | |||||||||||||||||||

| Stock-based compensation |

- | |||||||||||||||||||||||

| Balance, May 31, 2020 |

$ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

| Net loss for the period |

- | ( |

) | ( |

) | |||||||||||||||||||

| Other comprehensive income |

||||||||||||||||||||||||

| Exchange difference on translating foreign operations |

- | ( |

) | ( |

) | |||||||||||||||||||

| Stock-based compensation |

- | |||||||||||||||||||||||

| Balance, August 31, 2020 |

$ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

These accompanying notes form an integral part of these condensed interim consolidated financial statements

| 1. |

NATURE AND CONTINUANCE OF OPERATIONS |

On August 25, 2010, International Tower Hill Mines Ltd. (“ITH”) completed a Plan of Arrangement (the “Arrangement”) whereby its existing Alaska mineral properties (other than the Livengood project) and related assets and the North Bullfrog mineral property and related assets in Nevada (collectively, the “Nevada and Other Alaska Business”) were indirectly spun out into a new public company, being Corvus Gold Inc. (“Corvus” or the “Company”). As part of the Arrangement, ITH transferred its wholly-owned subsidiary Corvus Gold Nevada Inc. (“Corvus Nevada”) (which held the North Bullfrog property), to Corvus and a wholly-owned Alaskan subsidiary of ITH, Talon Gold Alaska, Inc. sold to Raven Gold Alaska Inc. (“Raven Gold”), the Terra, Chisna, LMS and West Pogo properties. As a consequence of the completion of the Arrangement, the Terra, Chisna, LMS, West Pogo and North Bullfrog properties were transferred to Corvus.

The Company was incorporated on April 13, 2010 under the Business Corporations Act (British Columbia). These condensed interim consolidated financial statements reflect the cumulative operating results of the predecessor, as related to the mineral properties that were transferred to the Company from June 1, 2006.

The Company is engaged in the business of acquiring, exploring and evaluating mineral properties, and either joint venturing or developing these properties further or disposing of them when the evaluation is completed. At August 31, 2020, the Company had interests in properties in Nevada, U.S.A.

The business of mining and exploration involves a high degree of risk and there can be no assurance that current exploration programs will result in profitable mining operations. The Company has no source of revenue, and has significant cash requirements to meet its administrative overhead and maintain its mineral property interests. The recoverability of amounts shown for mineral properties is dependent on several factors. These include the discovery of economically recoverable reserves, the ability of the Company to obtain the necessary financing to complete the development of these properties, and future profitable production or proceeds from disposition of mineral properties. The carrying value of the Company’s mineral properties does not reflect current or future values.

These condensed interim consolidated financial statements have been prepared on a going concern basis, which presume the realization of assets and discharge of liabilities in the normal course of business for the foreseeable future. The Company’s ability to continue as a going concern is dependent upon achieving profitable operations and/or obtaining additional financing.

In assessing whether the going concern assumption is appropriate, management takes into account all available information about the future within one year from the date the condensed interim consolidated financial statements are issued.

The Company has sustained significant losses from operations, has negative cash flows, and has an ongoing requirement for capital investment to explore its mineral properties. As at August 31, 2020, the Company had working capital of $

The Company expects that it will need to raise substantial additional capital to accomplish its business plan over the next several years. There is no assurance that additional capital or other types of financing will be available if needed or that these financings will be on terms at least as favourable to the Company as those previously obtained, or at all. As well, there can be no assurance that the Company will not be impacted by adverse consequences that impact the global financial markets as a whole, including any adverse consequences that may be brought about by pandemics, or increased severity of existing pandemics, which may reduce resources, share prices and financial liquidity and which may severely limit the financing capital available in the mineral exploration sector. Should such financing not be available in that time-frame, the Company will be required to reduce its activities and will not be able to carry out all of its presently planned exploration and development activities on its currently anticipated scheduling.

These condensed interim consolidated financial statements do not include any adjustments to the amounts and classification of assets and liabilities that might be necessary should the Company be unable to continue in business.

All currency amounts are stated in Canadian dollars unless noted otherwise.

| 2. |

SIGNIFICANT ACCOUNTING POLICIES |

These condensed interim consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 8-03 of Regulation S-X under the Securities Exchange Act of 1934, as amended. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for annual financial statements. These condensed interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements for the year ended May 31, 2020 as filed in our Annual Report on Form 10-K. In the opinion of the Company’s management these condensed interim consolidated financial statements reflect all adjustments, consisting of normal recurring adjustments, necessary to present fairly the Company’s financial position at August 31, 2020 and the results of its operations for the three months then ended. Operating results for the three months ended August 31, 2020 are not necessarily indicative of the results that may be expected for the year ending May 31, 2021. The 2020 year-end balance sheet data was derived from audited financial statements but does not include all disclosures required by U.S. GAAP.

The preparation of these condensed interim consolidated financial statements in conformity with U.S. GAAP requires management to make judgments, estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of these condensed interim consolidated financial statements, and the reported amounts of revenues and expenses during the period. These judgments, estimates and assumptions are continuously evaluated and are based on management’s experience and knowledge of the relevant facts and circumstances. While management believes the estimates to be reasonable, actual results could differ from those estimates and could impact future results of operations and cash flows.

Basis of consolidation

These condensed interim consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries (collectively, the “Group”), Corvus Gold (USA) Inc. (“Corvus USA”) (a Nevada corporation), Corvus Nevada (a Nevada corporation), Raven Gold (an Alaska corporation), SoN Land and Water LLC (“SoN”) (a Nevada limited liability company) and Mother Lode Mining Company LLC (a Nevada limited liability company). All intercompany transactions and balances were eliminated upon consolidation.

Loss per share

Basic loss per share is calculated using the weighted average number of common shares outstanding during the period. The Company uses the treasury stock method to compute the dilutive effect of options, warrants and similar instruments. Under this method, the dilutive effect on earnings (loss) per share is calculated presuming the exercise of outstanding options, warrants and similar instruments. It assumes that the proceeds of such exercise would be used to repurchase common shares at the average market price during the period. However, the calculation of diluted loss per share excludes the effects of various conversions and exercise of options and warrants that would be anti-dilutive. For the period ended August 31, 2020,

| 3. | MINERAL PROPERTIES |

The Company had the following activity related to capitalized acquisition costs:

| North | Mother | Total | ||||||||||

| (note 3(a)) | (note 3(b)) | |||||||||||

| Balance, May 31, 2020 | $ | $ | $ | |||||||||

| Currency translation adjustments | ( | ) | ( | ) | ( | ) | ||||||

| Balance, August 31, 2020 | $ | $ | $ | |||||||||

The following table presents costs incurred for exploration and evaluation activities for the three months ended August 31, 2020:

| North | Mother | Total | ||||||||||

| (note 3(a)) | (note 3(b)) | |||||||||||

| Exploration costs: | ||||||||||||

| Assay | $ | $ | $ | |||||||||

| Drilling | ||||||||||||

| Equipment rental | ||||||||||||

| Field costs | ||||||||||||

| Geological/ Geophysical | ||||||||||||

| Land maintenance & tenure | ||||||||||||

| Permits | ||||||||||||

| Studies | ||||||||||||

| Travel | ||||||||||||

| Cost recovery | ( | ) | ( | ) | ||||||||

| Total expenditures (recovery) for the period | $ | $ | $ | |||||||||

The following table presents costs incurred for exploration and evaluation activities for the three months ended August 31, 2019:

| North | Mother | Alaskan royalty | Total | |||||||||||||

| (note 3(a)) | (note 3(b)) | (note 3(c)) | ||||||||||||||

| Exploration costs: | ||||||||||||||||

| Assay | $ | $ | $ | $ | ||||||||||||

| Asset retirement obligations | ||||||||||||||||

| Drilling | ||||||||||||||||

| Equipment rental | ||||||||||||||||

| Field costs | ||||||||||||||||

| Geological/ Geophysical | ||||||||||||||||

| Land maintenance & tenure | ||||||||||||||||

| Permits | ||||||||||||||||

| Studies | ||||||||||||||||

| Travel | ||||||||||||||||

| Cost recovery | ( | ) | ( | ) | ||||||||||||

| Total expenditures (recovery) for the period | $ | $ | $ | ( | ) | $ | ||||||||||

| (a) | North Bullfrog Project, Nevada |

The Company’s North Bullfrog project consists of certain leased patented lode mining claims and federal unpatented mining claims owned

| (i) | Interests acquired from Redstar Gold Corp. |

On October 9, 2009, a US subsidiary of ITH at the time (Corvus Nevada) completed the acquisition of all of the interests of Redstar Gold Corp. (“Redstar”) and Redstar Gold U.S.A. Inc. (“Redstar US”) in the North Bullfrog project, which consisted of

The Company is required to pay annual advance minimum royalty payments (recoupable from production royalties) for as long as there are mining activities continuing on the claims or contiguous claims held by the Company. The required annual advance minimum royalty payments are:

| ● | |

| ● | |

The lessor is entitled to receive a separate NSR royalty related to all production from the leased property of the various individual leases which may be purchased by the Company as follows:

| ● | a |

| ● | a |

| ● | a |

| ● | a |

| ● | a |

| ● | a |

| ● | a |

The various NSR royalties above relate only to the property covered by each specific lease and are not cumulative.

The Company has an option to purchase a property related to

| (ii) | Interests acquired directly by Corvus Nevada |

| (1) | Pursuant to a mining lease and option to purchase agreement made effective December 1, 2007 between Corvus Nevada and a group of arm’s length limited partnerships, Corvus Nevada has leased (and has the option to purchase) patented mining claims referred to as the “Mayflower” claims which form part of the North Bullfrog project. The terms of the lease/option are as follows: |

| ● | Terms: Initial term of years, commencing December 1, 2007, with the option to extend the lease for an additional years. Pursuant to an extension agreement dated January 15, 2016 and fully executed and effective as of November 22, 2017, the parties agreed to extend the lease and option granted for an additional years with the same lease payment terms. |

| ● | Lease Payments: Corvus Nevada will pay USD |

| ● | Anti-Dilution: Pursuant to an amended agreement agreed to by the lessors in March 2015, the Company, all future payments will be satisfied by the delivery of an additional ½ common shares of the Company for each of the ITH common shares due per the original agreement ( |

| ● | Work Commitments: USD |

| ● | Retained Royalty: Corvus Nevada will pay the lessors a NSR royalty of |

| (2) | Pursuant to a mining lease and option to purchase made effective March 1, 2011 between Corvus Nevada and an arm’s length individual, Corvus Nevada has leased, and has the option to purchase, |

| (3) | Pursuant to a purchase agreement made effective March 28, 2013, Corvus Nevada agreed to purchase the surface rights of |

| (4) | In December 2013, SoN completed the purchase of a parcel of land approximately 30 kilometres north of the North Bullfrog project which carries with it |

| (5) | On March 30, 2015, Lunar Landing, LLC signed a lease agreement with Corvus Nevada to lease private property containing the |

| (b) | Mother Lode Property, Nevada |

Pursuant to a purchase agreement made effective June 9, 2017 between Corvus Nevada and Goldcorp USA, Inc. (“Goldcorp USA”), Corvus Nevada has acquired 100% of the Mother Lode property (the “Mother Lode Property”). In addition, Corvus Nevada staked two additional adjacent claim blocks to the Mother Lode Property. In connection with the acquisition, the Company issued

| (c) | Alaskan Royalty Interest, Alaska |

On June 7, 2019, the Company completed the sale of the royalties where four non-core Alaskan royalty interests owned by Corvus were sold to EMX Royalty Corporation (“EMX”) for a purchase price of $

The general terms of the Alaskan royalty package sale include:

| ● | Chisna project |

| ● | LMS project |

| ● | Goodpaster District |

| ● | West Pogo project |

Acquisitions

The acquisition of title to mineral properties is a detailed and time-consuming process. The Company has taken steps, in accordance with industry norms, to verify title to mineral properties in which it has an interest. Although the Company has taken every reasonable precaution to ensure that legal title to its properties is properly recorded in the name of the Company (or, in the case of an option, in the name of the relevant optionor), there can be no assurance that such title will ultimately be secured.

Environmental Expenditures

The operations of the Company may in the future be affected from time to time in varying degrees by changes in environmental regulations, including those for future removal and site restoration costs. Both the likelihood of new regulations and their overall effect upon the Company vary greatly and are not predictable. The Company’s policy is to meet or, if possible, surpass standards set by relevant legislation by application of technically proven and economically feasible measures.

Environmental expenditures that relate to ongoing environmental and reclamation programs are charged against earnings as incurred or capitalized and amortized depending on their future economic benefits. Estimated future removal and site restoration costs, when the ultimate liability is reasonably determinable, are charged against earnings over the estimated remaining life of the related business operation, net of expected recoveries.

The Company has estimated the fair value of the liability for asset retirement that arose as a result of exploration activities to be $

| 4. |

SHARE CAPITAL |

Authorized

Unlimited common shares without par value.

Share issuances

There were

Stock options

Stock options awarded to employees and non-employees by the Company are measured and recognized in the Condensed Interim Consolidated Statement of Operations and Comprehensive Loss over the vesting period.

The Company has adopted an incentive stock option plan, first adopted in 2010 and then most recently amended in 2019 (the “Amended 2010 Plan”). The essential elements of the Amended 2010 Plan provide that the aggregate number of common shares of the Company’s share capital that may be made issuable pursuant to options granted under the Amended 2010 Plan (together with any other shares which may be issued under other share compensation plans of the Company) may not exceed

A summary of the status of the stock option plan as of August 31, 2020, and May 31, 2020, and changes during the periods are presented below:

| Three months ended August 31, 2020 |

Year ended May 31, 2020 |

|||||||||||||||

| Number of |

Weighted |

Number of |

Weighted |

|||||||||||||

| Balance, beginning of the period |

$ | $ | ||||||||||||||

| Granted |

||||||||||||||||

| Balance, end of the period |

$ | $ | ||||||||||||||

The weighted average remaining contractual life of options outstanding at August 31, 2020 was

Stock options outstanding are as follows:

| August 31, 2020 |

May 31, 2020 |

|||||||||||||||||||||||

| Expiry Date |

Exercise |

Number of |

Exercisable End |

Exercise |

Number of |

Exercisable |

||||||||||||||||||

| September 8, 2019* |

$ | $ | ||||||||||||||||||||||

| September 9, 2020* |

$ | $ | ||||||||||||||||||||||

| November 13, 2020 |

$ | $ | ||||||||||||||||||||||

| September 15, 2021 |

$ | $ | ||||||||||||||||||||||

| July 31, 2022 |

$ | $ | ||||||||||||||||||||||

| October 11, 2022 |

$ | $ | ||||||||||||||||||||||

| November 19, 2023 |

$ | $ | ||||||||||||||||||||||

| April 9, 2024 |

$ | $ | ||||||||||||||||||||||

| June 13, 2024 |

$ | $ | ||||||||||||||||||||||

| February 3, 2025 |

$ | $ | ||||||||||||||||||||||

*The Company’s share trading policy (the “Policy”) requires that all restricted persons and others who are subject to the Policy refrain from conducting any transactions involving the purchase or sale of the Company’s securities, during the period in any quarter commencing 30 days prior to the scheduled issuance of the next quarter or year-end public disclosure of the financial results as well as when there is material data on hand. In accordance with the terms of the Amended 2010 Plan, if stock options are set to expire during a restricted period and are not exercised prior to any such restriction, they will not expire but instead will be available for exercise for days after such restrictions are lifted.

The Company uses the fair value method for determining stock-based compensation for all options granted during the periods. The fair value of options granted was (2019 - $

| For the period ended August 31, |

2020 |

2019 |

||||||

| Risk-free interest rate |

N/A | % | ||||||

| Expected life of options (in years) |

N/A | |

||||||

| Annualized volatility |

N/A | % | ||||||

| Dividend yield |

N/A | % | ||||||

| Exercise price |

N/A | $ | ||||||

| Fair value per share |

N/A | $ | ||||||

Annualized volatility was determined by reference to historic volatility of the Company.

Stock-based compensation has been allocated to the same expenses as cash compensation paid to the same employees or consultants, as follows:

| For the three months ended August 31, |

2020 |

2019 |

||||||

| Consulting fees |

$ | $ | ||||||

| Exploration expenditures – Geological/geophysical |

||||||||

| Investor relations |

||||||||

| Professional fees |

||||||||

| Wages and benefits |

||||||||

| $ | $ | |||||||

| 5. |

RELATED PARTY TRANSACTIONS |

The Company entered into the following transactions with related parties:

| For the three months ended August 31, |

2020 |

2019 |

||||||

| Consulting fees to CFO |

$ | $ | ||||||

| Wages and benefits to CEO and COO |

||||||||

| Geological consulting fees to a company owned by a director in common |

||||||||

| Directors fees (included in consulting fees) |

||||||||

| Stock-based compensation to related parties |

||||||||

| $ | $ | |||||||

As at August 31, 2020, included in accounts payable and accrued liabilities was ( May 31, 2020 – $

These amounts were unsecured, non-interest bearing and had no fixed terms or terms of repayment. Accordingly, fair value could not be readily determined.

The Company has also entered into change of control agreements with officers of the Company. In the case of termination, the officers are entitled to an amount equal to a multiple (ranging from two times to three times) of the sum of the annual base salary or fees then payable to the officer, the aggregate amount of bonus(es) (if any) paid to the officer within the calendar year immediately preceding the Effective Date of Termination, and an amount equal to the vacation pay which would otherwise be payable for the one year period next following the Effective Date of Termination.

| 6. |

GEOGRAPHIC SEGMENTED INFORMATION |

The Company operates in

| Canada |

United States |

Total |

||||||||||

| August 31, 2020 |

||||||||||||

| Capitalized acquisition costs |

$ | $ | $ | |||||||||

| Property and equipment |

$ | $ | $ | |||||||||

| Right-of-use assets |

$ | $ | $ | |||||||||

| May 31, 2020 |

||||||||||||

| Capitalized acquisition costs |

$ | $ | $ | |||||||||

| Property and equipment |

$ | $ | $ | |||||||||

| Right-of-use assets |

$ | $ | $ | |||||||||

| For the three months ended August 31, |

2020 |

2019 |

||||||

| Net loss for the period – Canada |

$ | ( |

) | $ | ( |

) | ||

| Net loss for the period – United States |

( |

) | ( |

) | ||||

| Net loss for the period |

$ | ( |

) | $ | ( |

) | ||

| 7. |

SUBSIDIARIES |

Significant subsidiaries for the periods ended August 31, 2020 and 2019 are:

| Country of |

Principal Activity |

The Company’s 2020 |

The Company’s 2019 |

|||||||

| Corvus Gold (USA) Inc. |

USA |

|

% | % | ||||||

| Raven Gold Alaska Inc. |

USA |

|

% | % | ||||||

| Corvus Gold Nevada Inc. |

USA |

|

% | % | ||||||

| SoN Land & Water LLC |

USA |

|

% | % | ||||||

| Mother Lode Mining Company LLC |

USA |

|

% | % | ||||||

| 8. |

SUPPLEMENTAL CASH FLOW INFORMATION |

| For the three months ended August 31, |

2020 |

2019 |

||||||

| Supplemental cash flow information |

||||||||

| Interest paid |

$ | $ | ||||||

| Income taxes paid (received) |

$ | $ | ||||||

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with our condensed interim consolidated financial statements for the three months ended August 31, 2020, and the related notes thereto, which have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). This discussion and analysis contains forward-looking statements and forward-looking information that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements and information as a result of many factors. See section heading “Note Regarding Forward-Looking Statements” below. All currency amounts are stated in Canadian dollars unless noted otherwise.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES AND PROVEN AND PROBABLE RESERVES

Corvus Gold Inc. (“we”, “us”, “our,” “Corvus” or the “Company”) is a mineral exploration company engaged in the acquisition and exploration of mineral properties. The mineral estimates in the technical report entitled “Technical Report and Preliminary Economic Assessment for the Integrated Mother Lode and North Bullfrog Projects, Bullfrog Mining District, Nye County, Nevada”, dated November 1, 2018 and amended on November 8, 2018, with an effective date of September 18, 2018 (the “Technical Report”) referenced in this Quarterly Report on Form 10-Q have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. As used in the Technical Report referenced in this Quarterly Report on Form 10-Q, the terms “Mineral Reserve”, “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 “Standards of Disclosure for Mineral Projects” (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended.

These definitions differ materially from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7 (“SEC Industry Guide 7”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves, and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all or any part of a mineral deposit in these categories will ever be converted into reserves. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all, or any part, of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this report and the Technical Report referenced in this report contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies reporting under SEC Industry Guide 7 requirements.

The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC. These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) and, following a two-year transition period, the SEC Modernization Rules will replace the historical property disclosure requirements for mining registrants that are included in SEC Industry Guide 7. The Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules until its fiscal year beginning May 31, 2021. Under the SEC Modernization Rules, the definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” have been amended to be substantially similar to the corresponding CIM Definition Standards and the SEC has added definitions to recognize “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” which are also substantially similar to the corresponding CIM Definition Standards; however there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards and therefore once the Company begins reporting under the SEC Modernization Rules there is no assurance that the Company’s Mineral Reserve and Mineral Resource estimates will be the same as those reported under CIM Definition Standards as contained in this report.

CAUTIONARY NOTE TO ALL INVESTORS CONCERNING ECONOMIC ASSESSMENTS THAT INCLUDE INFERRED RESOURCES

The Company currently holds or has the right to acquire interests in an advanced stage exploration project in Nye County, Nevada referred to as the North Bullfrog Project (the “NBP”) and the Mother Lode Project (“MLP” or “Mother Lode”). Mineral resources that are not mineral reserves have no demonstrated economic viability. The preliminary economic assessment included in the Technical Report on the NBP-MLP is preliminary in nature and includes Inferred Mineral Resources that have a great amount of uncertainty as to their existence, and are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. It cannot be assumed that all, or any part, of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies. There is no certainty that such Inferred Mineral Resources at the NBP and MLP will ever be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable. Readers should refer to the Technical Report for additional information.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q and the exhibits attached hereto contain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, as amended, and “forward-looking information” within the meaning of applicable Canadian securities legislation, collectively “forward-looking statements”. Such forward-looking statements concern our anticipated results and developments in the operations of the Company in future periods, planned exploration activities, the adequacy of the Company’s financial resources and other events or conditions that may occur in the future. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible” and similar expressions, or statements that events, conditions or results “will,” “may,” “could” or “should” (or the negative and grammatical variations of any of these terms) occur or be achieved. These forward-looking statements may include, but are not limited to, statements concerning:

| ● |

the Company’s strategies and objectives, both generally and in respect of its specific mineral properties; |

| ● |

the results of the preliminary economic assessment; |

| ● |

the timing of decisions regarding the timing and costs of exploration programs with respect to, and the issuance of the necessary permits and authorizations required for, the Company’s exploration programs, including for the NBP and the MLP; |

| ● |

the Company’s estimates of the quality and quantity of the Mineral Resources at its mineral properties; |

| ● |

the timing and cost of planned exploration programs of the Company, and the timing of the receipt of results therefrom; |

| ● |

the Company’s future cash requirements and use of proceeds of sales; |

| ● |

general business and economic conditions; |

| ● |

the Company’s ability to meet its financial obligations as they come due, and the ability to raise the necessary funds to continue operations; |

| ● |

the Company’s expectation that it will be able to add additional mineral projects of merit to its assets; |

| ● |

the potential for the existence or location of additional high-grade veins at the NBP, or high-grade mineralization at the MLP; |

| ● |

the potential to expand Company’s existing deposits and discover new deposits; |

| ● |

the potential for any delineation of higher grade mineralization at the NBP or MLP; |

| ● |

the potential for there to be one or more additional vein zones; |

| ● |

the potential discovery and delineation of mineral deposits/resources/reserves and any expansion thereof beyond the current estimate; |

| ● |

the potential for the NBP or the MLP mineralization systems to continue to grow and/or to develop into a major new higher-grade, bulk tonnage, Nevada gold discovery; |

| ● |

the Company’s expectation that it will be able to build itself into a non-operator gold producer with significant carried interests and royalty exposure; |

| ● |

that the Company will operate at a loss; |

| ● |

that the Company will need to scale back anticipated costs and activities or raise additional funds; |

| ● |

that the Company will have to raise substantial additional capital to accomplish its business plan over the next couple of years; |

| ● |

the estimated reclamation and asset retirement costs; |

| ● |

the plans related to the potential development of the MLP and the NBP; and |

| ● |

the NBP and MLP work plans and mine development plan/programs. |

Such forward-looking statements reflect the Company’s current views with respect to future events and are subject to certain known and unknown risks, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others, risks related to:

| ● |

risks related to the evolving novel coronavirus (“COVID-19”) pandemic and health crisis and the governmental and regulatory actions taken in response thereto; |

| ● |

our requirement of significant additional capital; |

| ● |

our limited operating history; |

| ● |

our history of losses; |

| ● |

cost increases for our exploration and, if warranted, development projects; |

| ● |

our properties being in the exploration stage; |

| ● |

mineral exploration and production activities; |

| ● |

our lack of mineral production from our properties; |

| ● |

estimates of Mineral Resources; |

| ● |

changes in Mineral Resource estimates; |

| ● |

differences in United States and Canadian Mineral Reserve and Mineral Resource reporting; |

| ● |

our exploration activities being unsuccessful; |

| ● |

fluctuations in gold, silver and other metal prices; |

| ● |

our ability to obtain permits and licenses for production; |

| ● |

government and environmental regulations that may increase our costs of doing business or restrict our operations; |

| ● |

proposed legislation that may significantly affect the mining industry; |

| ● |

land reclamation requirements; |

| ● |

competition in the mining industry; |

| ● |

equipment and supply shortages; |

| ● |

tax issues; |

| ● |

current and future joint ventures and partnerships; |

| ● |

our ability to attract qualified management; |

| ● |

the ability to enforce judgment against certain of our directors; |

| ● |

currency fluctuations; |

| ● |

claims on the title to our properties; |

| ● |

surface access on our properties; |

| ● |

potential future litigation; |

| ● |

our lack of insurance covering all our operations; |

| ● |

our status as a “passive foreign investment company” under US federal tax code; |

| ● |

the common shares; and |

| ● |

events such as war, terrorism, natural disaster or outbreaks of disease (including COVID-19). |

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including without limitation those discussed in Part I, Item 1A, Risk Factors, of our Annual Report on Form 10-K, as filed with the SEC on August 13, 2020, which are incorporated herein by reference, as well as other factors described elsewhere in this report and the Company’s other reports filed with the SEC.

The Company’s forward-looking statements contained in this Quarterly Report on Form 10-Q are based on the beliefs, expectations and opinions of management as of the date of this report. The Company does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change, except as required by law. For the reasons set forth above, investors should not attribute undue certainty to or place undue reliance on forward-looking statements.

Current Business Activities

General

The Company’s material mineral properties are the NBP and the MLP, advanced exploration stage projects in Nevada which have a number of high-priority, bulk tonnage and high-grade vein targets (held through Corvus Nevada, a Nevada subsidiary). While exploring the NBP, the Company acquired the MLP in June 2017, which is located approximately 19 km to the south east of the NBP. The MLP was mined in the late 1980s and has substantial gold mineralization remaining unexploited extending to the north of the existing open pit mine.

The primary focus of the Company will be to leverage its exploration expertise to expand its existing deposits and discover major new gold deposits. Other than with respect to the ongoing exploration of the MLP and NBP, the Company’s strategy is to leverage its other non-core assets by maintaining a retained royalty.

Highlights of activities during the period and to the date of this MD&A include:

| ● |

Corvus commenced trading on the Nasdaq Capital Market as of market open on August 12, 2020 under the ticker KOR. |

| ● |

A total of 29 RC drill holes were completed during the period totaling 5,145 m. Fourteen (14) holes were drilled at the NBP for 2,502 m and 15 holes were drilled at the MLP for 2,643 m. |

| ● |

Two core drilling rigs operated at MLP to deepen previously drilled and cased holes. A total of 1,602 m of HQ core were produced in the reporting period in 11 holes. |

| ● |

Approval of the Mother Lode Exploration Project was received from BLM and the reclamation bond was increased accordingly. |

| ● |

Right-of-Ways were approved by BLM which provided main road access to the MLP and, the access to and use of water well sites at MW-3, MW-4 and PW-2. Reclamation bonds were placed with the BLM Tonopah office. |

| ● |

The Lynnda Strip NOI was approved by BLM and reclamation bonding was complete. Drilling at Lynnda Strip can proceed pending wildlife clearance surveys. |

| ● |

Water quality samples were collected for surface springs stations at NBP in June. |

| ● |

The water production volumes for Corvus wells at both NBP and MLP, and utilized for the drilling at both sites, were reported to the NDWR. |

Nevada Properties

NBP and MLP

Our principal mineral properties are the NBP and the MLP, which form a unified gold exploration project (the “NBP-MLP”) located in northwestern Nye County, Nevada, in the Northern Bullfrog Hills and Bare Mountains to the east, north and west of the town of Beatty. The NBP-MLP does not have any known proven or probable reserves under SEC Industry Guide 7 and the project is exploratory in nature. The Technical Report is available under Corvus’ SEDAR profile at www.sedar.com and EDGAR profile at www.sec.gov, which describes the integration of the two properties into a single mining operation. The Technical Report is referred to herein for informational purposes only and is not incorporated herein by reference. The Technical Report contains disclosure regarding Mineral Resources that are not SEC Industry Guide 7 compliant proven or probable reserves. See “Cautionary Note to U.S. Investors Regarding Estimates of Measured, Indicated and Inferred Resources and Proven and Probable Reserves” above.

The following disclosure is derived, in part, and supported by the Technical Report.

The NBP-MLP is located in the Bullfrog Hills and Bare Mountains of northwestern Nye County, Nevada (Figure 1). The NBP-MLP covers approximately 129 square kilometers (12,895 hectares) of patented and unpatented mining claims in sections 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31, 32, 33, 34, 35, and 36 of T10S, R46E; sections 1, 2, 3, 4, 5, 6, 10, 11, 12, 13, 14, 15, 23, 24, 25, 26, 34 and 35 of T11S, R46E; sections 2, 3, 4, 5, 6, 7, 8, 9, 10, and 18 of T12S R46E; sections 19, 30, 31, and 32 of T10S, R47E; sections 4, 5, 6, 7, 8, 9, 10, 11, 14, 15, 16, 17, 18, 22, 23, 26, 27, 34, 35 and 36 of T11S, R47E; sections 1, 2, 3, 4, 8, 9, 10, 11, 12 and 13 of T12S R47E; sections 4, 9, 10, 15, 22, 27, 31, 32, 33 and 34 of T11S R48E; and sections 4, 5, 6, 7, 8, 9, 16, 17 and 18 of T12S R48E of MDBM. The total number of unpatented claims is 1601. Corvus has total of nine option/lease agreements in place that give us control of an aggregate of 51 patented lode claims (see Private Lands in Figure 1). Corvus Nevada owns an additional five patented claims (the Millman claims) and a 430 acre property with 1600 acre-feet of water rights located north of NBP in the Sarcobatus hydrographic basin (Basin 146).

Figure 1. Property Map showing the Location of the NBP and the MLP with respect to the town of Beatty, NV.

Studies at the NBP have been focused on the integration of the NBP and the newly acquired MLP into a single mining operation. The Technical Report describing the integrated NBP-MLP dated November 1, 2018 and amended November 8, 2018 is available on SEDAR.

NBP Drilling Activities

During the period, 14 RC holes were drilled at the NBP investigating the West Sierra Blanca area. The RC rig was then moved to Cat Hill with 3 holes completed before the end of the period. The results of this drilling are pending.

MLP Drilling Activities

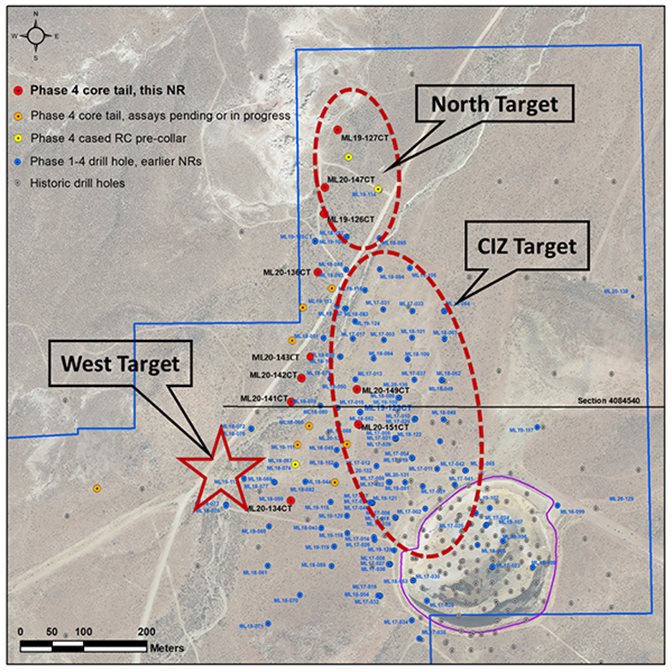

During the period, 15 RC holes were drilled at the MLP. Core tail drilling was completed in a total of 11 holes which had been drilled and cased previously, and then were advanced to total depth during this reporting period by core drilling below the casing bottom. This core tail program was designed to further define the gold mineralization in the Central Intrusive Zone (“CIZ”) target which consists of a north trending intrusive dike swarm to the east of and in the footwall of the Fluorspar Canyon Fault. Figure 2 shows the location of the core tail holes drilled in this period, and the general locations for targets identified for further exploration. The core tail drilling was designed to expand resources in three areas; (1) the CIZ target, (2) the Upper Oxide target and (3) the North target.

Figure 2 – Locations of Core Tail holes at the Mother Lode Project, Nevada

Drilling in the CIZ has confirmed the direct association of gold mineralization with the north trending dike swarm which forms a broad zone of mineralization and remains open at depth. This mineralization is predominantly oxide with relatively high grades. Tests on this mineralization indicate high values of CN solubility indicating that it is suitable for low cost heap leach processing. Material at the top of this zone exhibit diatreme type explosive features which are very favorable for gold mineralization. Figure 3 shows a cross section (along 4084540 N in Figure 2) which illustrates the relative positions of the Main Zone mineralization, the Upper Oxide and CIZ targets.

The core tail drilling also produced additional intercepts which further defined the body of heap leachable mineralization in the Upper Oxide target.

The holes in the North target also encountered explosively produced diatreme/breccia mineralization, which may have the potential to transition into a large deposit at depth.

Figure 3 – Cross section along 4084540 N showing the New CIZ at the MLP

North Bullfrog Project Development

Further metallurgical testing of YellowJacket vein and vein stockwork mineralization has indicated that high gold recovery is possible at a relatively coarse grind size (48 mesh). Gold recoveries of 86% could be achieved from leaching of a gravity concentrate and then blending the gravity tail with relatively low grade disseminated mineralization. This has led the company to modify the project plan for NBP processing with:

| ● |

Milling of the YellowJacket mineralization with a plant using two stage crushing with a rod mill to produce a 48 mesh gravity feed material, reducing milling cost due to the coarser grind; |

| ● |

Treatment to produce gravity concentrate to recover approximately 45% of the contained gold, followed by intensive CN leaching of that concentrate; and |

| ● |

Blending the gravity tail material with low grade, disseminated mineralization on a heap leach pad allowing an additional recovery of 41% of the contained gold and eliminating the need for a tail storage facility. |

These changes in processing approach would allow a much simpler plant with lower capex cost and lower operating cost.

Mother Lode Project Development

The processing plant configuration at Mother Lode has been revised during the period:

| ● |

Mill processing would use biological oxidation (biox) of the whole sulphide mineralization, no concentration would be performed. Metallurgical testing of whole mineralization biox on MLP sulphide mineralization has demonstrated a nominally 11% increase in gold recovery to 91% by elimination of losses that occur during production of the concentrate; |

| ● |

Capital costs and operating costs of the biox mill would be lower, due to elimination of the oxygen plant, floatation circuit, autoclave and reduced power requirements; and |

| ● |

Only sulphide mineralization produced at North Bullfrog would be hauled to Mother Lode for processing, which would result in substantial reduction in transport costs due to the reduced volume of material. |

The MLP Resource model was updated to incorporate new drilling data developed since the 2018 PEA report. The MLP open pit configuration was revised based on Whittle Optimization, and the new designs incorporated into the updated project configuration.

Use of Proceeds

On October 10, 2019, the Company announced the completion of a $23,000,000 public bought deal financing, where the Company issued 11,500,000 common shares at a price of $2.00 per common share (the “Offering”). The net proceeds to the Company from the Offering was $21,020,000 after deducting the underwriter’s fee in the amount of $1,380,000, and the estimated expenses of the Offering of $600,000, which was paid out of the proceeds of the Offering.

The net proceeds of the Offering are anticipated to be applied as set out below. There are no material changes to the anticipated use of proceeds as described in the prospectus relating to the Offering.

| Use of Net Proceeds |

Amount |

|||

| Exploration Expenditures at the North Bullfrog and Mother Lode Properties |

||||

| Resource Expansion Drilling (42,000 m) |

$ | 10,000,000 | ||

| New Discovery Drilling (7,000 m) |

$ | 2,300,000 | ||

| Metallurgical Studies |

$ | 1,500,000 | ||

| Mining and Development Studies |

$ | 600,000 | ||

| Corporate general and administration, land and permits |

$ | 6,620,000 | ||

| TOTAL |

$ | 21,020,000 | ||

The Company expects to use the net proceeds over a period of approximately 20 months to accelerate resource expansion at both the MLP and NBP, by spending approximately $10,000,000 on drilling activities. This work includes approximately 12,000 m of core and 30,000 m of RC drilling, taking place over approximately a 12 to 15 month period of time. In addition, the Company will spend approximately $2,300,000 on its ongoing “New Discovery” drilling program that is testing a series of high priority surface targets for the discovery of new ore deposits. This drilling program includes approximately 1,000 m of core and 6,000 m of RC drilling taking place over a period of approximately 12 to 15 months. The Company will also use the funding to advance the MLP and NBP processing and mining characterization to define an optimized development plan with approximately $1,500,000 of spending on advance metallurgical testing and design work for both the sulfide and oxide mineralization to more accurately define the process flow sheet and facility design criteria and approximately $600,000 on mining studies to further advance the overall project development design and financial requirements.

Working capital and general corporate expenditures cover costs over a period of approximately 20 months for land payments (approximately $1,000,000), personnel (approximately $2,800,000) and the office, general corporate, land and permitting operating expenses ($2,820,000).

Progress accounting of expenditures against the use of proceeds on a quarterly basis is listed as follows:

| Company Cost Center |

Total ($ M) |

Expended

($ M) (October 1, 2019 – |

Expended

($ M) (June 1, 2020 – |

Cumulative ($ M) (October 1, 2019 – August 31, 2020) |

||||||||||||

| Exploration Expenditures at the North Bullfrog and Mother Lode Properties |

||||||||||||||||

| Resource Expansion Drilling |

$ | 10.00 | $ | 4.05 | $ | 1.75 | $ | 5.80 | ||||||||

| New Discovery Drilling |

$ | 2.30 | $ | 2.10 | $ | 1.43 | $ | 3.53 | ||||||||

| Metallurgical Studies |

$ | 1.50 | $ | 0.80 | $ | 0.43 | $ | 1.23 | ||||||||

| Mining and Development Studies |

$ | 0.60 | $ | 0.26 | $ | 0.14 | $ | 0.40 | ||||||||

| Corporate general and administration, land & permits |

$ | 6.62 | $ | 3.43 | $ | 1.09 | $ | 4.52 | ||||||||

| TOTAL |

$ | 21.02 | $ | 10.64 | $ | 4.84 | $ | 15.48 | ||||||||

Expenditures correlate with progress and time for the budgeted amounts for the period October 1, 2019 – August 31, 2020. Corporate general and administration, land and permits expenditures were impacted by scheduled timing of expenditures and financial fees due to the offering.

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by NI 43-101, has supervised the preparation of the scientific and technical information that forms the basis for the disclosure in this Report on Form 10-Q (other than the Mother Lode Mineral Resource estimate) and has reviewed and approved the disclosure herein. Mr. Pontius is not independent of the Company, as he is the Chief Executive Officer and President and holds common shares and incentive stock options in Corvus.

Carl E. Brechtel (Colorado PE 23212, Nevada PE 008744 and Registered Member 353000 of SME), a qualified person as defined by NI 43-101, has coordinated execution of the technical work and has reviewed and approved the disclosure in this Report on Form 10-Q related thereto. Mr. Brechtel is not independent of the Company, as he is the Chief Operating Officer and holds Common Shares and incentive stock options in Corvus.

The work program at the NBP and the MLP was designed and supervised by Mark Reischman, Corvus’ Nevada Exploration Manager, who is responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to American Assay Laboratories in Reno, Nevada, for preparation and assaying.

Assaying for the NBP and the MLP holes has been performed by American Assay Laboratories (“AAL”) in Sparks, Nevada. Corvus has no business relationship with AAL beyond being a customer for analytical services. The Sparks laboratory is Standards Council of Canada, Ottawa, Ontario Accredited Laboratory No. 536 and conforms with requirements of CAN-P-1579, CAN-P-4E (ISO/IEC 17025:2005).

Check assaying has been performed by Bureau Veritas North America (“BV”, formerly Inspectorate America Corporation), in Sparks Nevada and Vancouver, Canada, and ALS Minerals Laboratories (“ALS Minerals”), in Sparks, Nevada. Corvus has no business relationship with BV or ALS Minerals beyond being a customer for analytical services. The BV laboratory is Accredited Laboratory No. 720 and conforms to requirements of CAN-P-1579, CAN-P-4E (ISO 9001:2008) and ALS is Accredited Laboratory No. 660 and conforms to requirements of CAN-P-1579, CAN-P-4E (ISO/IEC 17025:2005).

Mr. Scott E. Wilson, CPG (10965), Registered Member of SME (4025107) and President of Resource Development Associates Inc., is an independent consulting geologist specializing in Mineral Reserve and Mineral Resource calculation reporting, mining project analysis and due diligence evaluations. He has acted as the Qualified Person, as defined in NI 43-101, for the Mineral Resource estimate and the Technical Report. Mr. Wilson has over 29 years of experience in surface mining, resource estimation and strategic mine planning. Mr. Wilson and Resource Development Associates Inc. are independent of the Company under NI 43-101. Mr. Wilson, a Qualified Person, has verified the data underlying the information disclosed herein by reviewing the reports of AAL and all procedures undertaken for QA/QC. All matters were consistent and accurate accordingly to his professional judgment. There were no limitations on the verification process.

For additional information on the NBP-MLP, including information relating to exploration, data verification and the Mineral Resource estimates, see the Technical Report, which is available under Corvus’ SEDAR profile at www.sedar.com and EDGAR profile at www.sec.gov. The Technical Report is referred to herein for informational purposes only and is not incorporated herein by reference. The Technical Report contains disclosure regarding Mineral Resources that are not Guide 7 compliant proven or probable reserves, see “Cautionary Note to U.S. Investors Regarding Estimates of Measured, Indicated and Inferred Resources and Proven and Probable Reserves” above.

Results of Operations

Three months ended August 31, 2020 Compared to Three months ended August 31, 2019

For the three months ended August 31, 2020, the Company had a net loss of $6,510,604 compared to a net loss of $2,935,406 in the comparative period of the prior year. Included in net loss was $917,040 (2019 - $795,757) in stock-based compensation charges which is a result of stock options granted during the period and previously granted stock options which vested during the period. Stock-based compensation in the current period comprised of stock options granted on July 31, 2017, November 19, 2018, April 9, 2019, June 13, 2019, October 11, 2019 and February 3, 2020 which vested during the period. The prior period comparative had stock-based compensation arising from stock options granted on July 31, 2017, November 19, 2018, April 9, 2019 and June 13, 2019 which vested during the comparative period of the prior year. The increase in loss of $3,575,198 in the three month period of the current year was due to a combination of factors discussed below.

The primary factor for the increase in the net loss was the exploration expenditures of $4,433,234 incurred in the current period compared to $1,394,155 in the comparative period of the prior year. The exploration activities of the Company increased mainly due to an increase of $3,024,706 incurred in the exploration in the current period compared with the comparative period of the prior year as the Company secured further financing in October 2019 and partly due to increased stock-based compensation charges of $82,340 during the current period compared to $67,967 in the comparative period of the prior year.

Consulting fees increased to $502,964 (2019 - $443,107) mainly due to an increase in stock-based compensation charges of $432,741 during the current period compared to $373,424 in the comparative period of the prior year.

Investor relations expenses decreased to $316,426 (2019 - $334,513) and travel expenses decreased to $15,476 (2019 - $43,391). The decreases were mainly due to a decrease in investor relations fees and investor relations-related activities and travels in the current period due to COVID-19. The decrease in investor relations expenses was offset by an increase in stock-based compensation charges of $131,133 during the current period compared to $106,843 in the comparative period of the prior year.

Professional fees increased to $158,185 (2019 - $77,089) mainly due to an increase in the audit-related fees as the Company prepared for a transition in its filing status, and an increase in stock-based compensation charges of $7,506 during the current period compared to $5,919 in the comparative period of the prior year.

Regulatory expenses increased to $154,312 (2019 - $61,087) mainly due to the entry fee to the Nasdaq Capital Markets as the Company commenced trading as of market open on August 12, 2020.

Wages and benefits increased to $506,453 (2019 - $449,807) mainly due to an increase in pension benefits and an increase in stock-based compensation charges of $263,320 during the current period compared to $241,604 in the comparative period of the prior year.

Other expense categories that reflected only moderate change period over period were administration expenses of $106 (2019 - $107), depreciation expenses of $14,281 (2019 - $9,031), insurance expenses of $62,559 (2019 - $55,698), office expenses of $37,933 (2019 - $26,732) and rent expenses of $7,403 (2019 - $14,141).

Other items amounted to a loss of $301,272 compared to $26,548 in the prior period. There was an increase in foreign exchange loss of $340,176 (2019 - $42,614), which was the result of factors outside of the Company’s control and an increase in interest income and expenses of $38,904 (2019 - $16,066) as a result of more investment in cashable GIC’s during the current period net of interest expenses.

Liquidity and Capital Resources

The Company has no revenue generating operations from which it can internally generate funds. To date, the Company’s ongoing operations have been financed by the sale of its equity securities by way of public offerings, private placements and the exercise of incentive stock options and share purchase warrants. The Company believes that it will be able to secure additional private placements and public financings in the future, although it cannot predict the size or pricing of any such financings. In addition, the Company can raise funds through the sale of interests in its mineral properties, although current market conditions have substantially reduced the number of potential buyers/acquirers of any such interest(s). This situation is unlikely to change until such time as the Company can develop a bankable feasibility study on one of its projects. When acquiring an interest in mineral properties through purchase or option, the Company will sometimes issue Common Shares to the vendor or optionee of the property as partial or full consideration for the property interest in order to conserve its cash.

The condensed interim consolidated financial statements have been prepared on a going concern basis, which presume the realization of assets and discharge of liabilities in the normal course of business for the foreseeable future. The Company’s ability to continue as a going concern is dependent upon achieving profitable operations and/or obtaining additional financing.

In assessing whether the going concern assumption is appropriate, management takes into account all available information about the future within one year from the date the condensed interim consolidated financial statements are issued.

The Company has sustained significant losses from operations, has negative cash flows and has an ongoing requirement for capital investment to explore its mineral properties. Based on its current plans, budgeted expenditures, and cash requirements, the Company has sufficient cash to finance its current plans for the 12 months from the date the condensed interim consolidated financial statement are issued.

The Company reported cash and cash equivalents of $9,211,817 as at August 31, 2020 compared to $14,913,158 as at May 31, 2020. The change in cash position was the net result of $5,288,310 used for operating activities, and $10,882 used for lease liabilities payments during the period ended August 31, 2020.

As at August 31, 2020, the Company had working capital of $8,850,994 compared to working capital of $14,568,048 as at May 31, 2020.

The Company expects that it will operate at a loss for the foreseeable future and believes the current cash and cash equivalents will be sufficient for it to maintain its currently held properties, and fund its currently anticipated general and administrative costs for at least the next 12 months from the date of this report. In any event, the Company will be required to raise additional funds, again through public or private equity financings in the future in order to continue in business. Should such financing not be available in that time-frame, the Company will be required to reduce its activities and will not be able to carry out all of its presently planned exploration and, if warranted, development activities at the NBP and the MLP on its currently anticipated scheduling.

Despite the Company’s success to date in raising significant equity financing to fund its operations, there is significant uncertainty that the Company will be able to secure any additional financing in the current or future equity markets. See “Risk Factors – We will require additional financing to fund exploration and, if warranted, development and production”. Failure to obtain additional financing could have a material adverse effect on our financial condition and results of operation and could cast uncertainty on our ability to continue as a going concern. The quantity of funds to be raised and the terms of any proposed equity financing that may be undertaken will be negotiated by management as opportunities to raise funds arise. Specific plans related to the use of proceeds will be devised once financing has been completed and management knows what funds will be available for these purposes. Due to this uncertainty, if the Company is unable to secure additional financing, it may be required to reduce all discretionary activities at the NBP and the Mother Lode Property to preserve its working capital to fund anticipated non-discretionary expenditures in the future.

The Company has no exposure to any asset-backed commercial paper. Other than cash held by its subsidiaries for their immediate operating needs in Alaska and Nevada, all of the Company’s cash reserves are on deposit with a major Canadian chartered bank. The Company does not believe that the credit, liquidity or market risks with respect thereto have increased as a result of the current market conditions. However, in order to achieve greater security for the preservation of its capital, the Company has, of necessity, been required to accept lower rates of interest, which has also lowered its potential interest income.

Off-Balance Sheet Arrangements

The Company has no off-balance sheet arrangements.

Environmental Regulations

The operations of the Company may in the future be affected from time to time in varying degrees by changes in environmental regulations, including those for future removal and site restoration costs. Both the likelihood of new regulations and their overall effect upon the Company vary greatly and are not predictable. The Company’s policy is to meet or, if possible, surpass standards set by relevant legislation by application of technically proven and economically feasible measures.

Certain U.S. Federal Income Tax Considerations for U.S. Holders

The Company has been a “passive foreign investment company” (“PFIC”) for U.S. federal income tax purposes in recent years and expects to continue to be a PFIC in the future. Current and prospective U.S. shareholders should consult their tax advisors as to the tax consequences of PFIC classification and the U.S. federal tax treatment of PFICs. Additional information on this matter is included in the Company’s Annual Report on Form 10-K as filed with the SEC on August 13, 2020, under “Certain United States Federal Income Tax Considerations”.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 4. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

As of August 31, 2020 an evaluation was carried out under the supervision of and with the participation of the Company’s management, including the Chief Executive Officer (the principal executive officer) and Chief Financial Officer (the principal financial officer and accounting officer), of the effectiveness of the design and operation of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act). Based on the evaluation, the Chief Executive Officer and the Chief Financial Officer have concluded that, as of August 31, 2020, the Company’s disclosure controls and procedures were effective in ensuring that: (i) information required to be disclosed in reports filed or submitted to the SEC under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in applicable rules and forms and (ii) material information required to be disclosed in our reports filed under the Exchange Act is accumulated and communicated to management, including the Chief Executive Officer and Chief Financial Officer, in a manner that allows for accurate and timely decisions regarding required disclosures.

The effectiveness of our or any system of disclosure controls and procedures, however well designed and operated, can provide only reasonable assurance that the objectives of the system will be met and is subject to certain limitations, including the exercise of judgement in designing, implementing and evaluating controls and procedures and the assumptions used in identifying the likelihood of future events.

Changes in Internal Control over Financial Reporting

There were no changes in internal control over financial reporting during the period ended August 31, 2020 that have materially, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

None.

There have been no material changes from the risk factors set forth in our Annual Report on Form 10-K as filed with the SEC on August 13, 2020.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

Unregistered Sales of Equity Securities

None.

Repurchase of Securities

None.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. MINE SAFETY DISCLOSURES