Table of Contents

As filed with the Securities and Exchange Commission on March 26, 2012

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| NATIONSTAR MORTGAGE LLC | NATIONSTAR CAPITAL CORPORATION | |

| (Exact name of registrant as specified in its charter) | (Exact name of registrant as specified in its charter) |

| Delaware | Delaware | |

| (State or other jurisdiction of incorporation or organization) | (State or other jurisdiction of incorporation or organization) | |

| 6162 | 6162 | |

| (Primary standard industrial classification code number) | (Primary standard industrial classification code number) | |

| 75-2921540 | 27-1996157 | |

| (I.R.S. Employer Identification No.) | (I.R.S. Employer Identification No.) | |

| 350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 |

350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 | |

| (Address, including zip code, and telephone number, including area code, of principal executive offices) |

(Address, including zip code, and telephone number, including area code, of principal executive offices) | |

and the Guarantors identified in Table of Additional Registrant Guarantors below

| Anthony W. Villani, Esq. Acting Executive Vice President and General Counsel Nationstar Mortgage LLC 350 Highland Drive Lewisville, Texas, 75067 (469) 549-2000 |

Duane McLaughlin, Esq. Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 (212) 225-2000 | |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

(Copies of all communications, including communications sent to agent for service) |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per unit |

Proposed maximum aggregate offering price(1) |

Amount of registration fee(2) | ||||

| 10.875% Senior Notes due 2015 |

$35,000,000 | 100% | $35,000,000 | $4,011 | ||||

| Guarantees for the 10.875% Senior Notes due 2015 |

(3) | (3) | (3) | (3) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457 under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Calculated pursuant to Rule 457 under the Securities Act. |

| (3) | Pursuant to Rule 457(n) under the Securities Act, no registration fee is required with respect to the guarantees. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Table of Additional Registrant Guarantors

| Name |

Jurisdiction | I.R.S. Employer ID # | Address and Telephone # | |||

| Centex Land Vista Ridge Lewisville III General Partner, LLC |

Delaware | 75-2921540 | 350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 | |||

| Centex Land Vista Ridge Lewisville III, L.P. |

Delaware | 20-3437712 | 350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 | |||

| Harwood Service Company LLC |

Delaware | 75-2925375 | 350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 | |||

| Harwood Insurance Services, LLC |

California | 75-2921540 | 350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 | |||

| Harwood Service Company Of Georgia, LLC |

Georgia | 73-1643246 | 350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 | |||

| Harwood Service Company Of New Jersey, LLC | New Jersey | 74-3047401 | 350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 | |||

| Homeselect Settlement Solutions, LLC |

Delaware | 20-1356314 | 350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 | |||

| Nationstar 2009 Equity Corporation |

Delaware | 27-1285662 | 350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 | |||

| Nationstar Equity Corporation |

Nevada | 75-2711305 | 350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 | |||

| Nationstar Industrial Loan Company |

Tennessee | 75-2786875 | 350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 | |||

| Nationstar Industrial Loan Corporation |

Minnesota | 75-2903483 | 350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 | |||

| NSM Recovery Services Inc. |

Delaware | 27-3275696 | 350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 | |||

| NSM Foreclosure Services Inc. |

Delaware | 27-3916074 | 350 Highland Drive Lewisville, Texas 75067 (469) 549-2000 |

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is neither an offer to sell nor a solicitation of an offer to purchase these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 26, 2012

PROSPECTUS

Nationstar Mortgage LLC

Nationstar Capital Corporation

Offer to Exchange any and all of our $35,000,000 in aggregate principal amount of unregistered 10.875% Senior Notes due 2015 for $35,000,000 aggregate principal amount of our new 10.875% Senior Notes due 2015 that have been registered under the Securities Act of 1933, as amended

Terms of the Exchange Offer

| • | We are offering to exchange any and all of our $35,000,000 in aggregate principal amount of 10.875% Senior Notes due 2015 that were issued on December 19, 2011 (the “Old Notes”) for an equal amount of new 10.875% Senior Notes 2015 (the “New Notes”, and together with the Old Notes, the “Notes”). |

| • | The exchange offer expires at 5:00 p.m., New York City time, on , 2012 (such date and time, the “Expiration Date”, unless we extend or terminate the exchange offer, in which case the “Expiration Date” will mean the latest date and time to which we extend the exchange offer). |

| • | Tenders of Old Notes may be withdrawn at any time prior to the Expiration Date. |

| • | All Old Notes that are validly tendered and not validly withdrawn will be exchanged. |

| • | The exchange of Old Notes for New Notes generally will not be a taxable exchange for U.S. federal income tax purposes. |

| • | We will not receive any proceeds from the exchange offer. |

| • | The terms of the New Notes to be issued in the exchange offer are substantially the same as the terms of the Old Notes, except that the offer of the New Notes is registered under the Securities Act of 1933, as amended (the “Securities Act”), and the New Notes have no transfer restrictions, rights to additional interest or registration rights. |

| • | The Notes are a further issuance of $250,000,000 in aggregate principal amount of 10.875% Senior Notes due 2015 that we issued on March 26, 2010 and that we exchanged pursuant to an exchange offer registered under the Securities Act on September 14, 2011. The New Notes are fungible with the notes we issued in the exchange offer. |

| • | The New Notes will be senior unsecured obligations of each of Nationstar Mortgage LLC and Nationstar Capital Corporation, jointly and severally, and will be unconditionally guaranteed, jointly and severally, by each of our existing and future domestic subsidiaries other than non-guarantor subsidiaries as defined by the indenture governing the New Notes. See “Description of the New Notes.” |

| • | The New Notes will not be listed on any securities exchange. A public market for the New Notes may not develop, which could make selling the New Notes difficult. |

We are making the exchange offer in reliance on the position of the staff of the SEC as set forth in interpretive letters addressed to third parties in other transactions, including the SEC staff’s no-action letter, Exxon Capital Holdings Corporation, available May 13, 1988. See “Description of the Exchange Offer—Resale of the New Notes.”

Each broker-dealer that receives New Notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such New Notes. The letter of transmittal accompanying this prospectus states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of New Notes received in exchange for Old Notes where such Old Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. Starting on the Expiration Date (as defined herein) and ending on the close of business 90 days after the Expiration Date, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

Investing in the New Notes to be issued in the exchange offer involves certain risks. See “Risk Factors” beginning on page 18.

We are not making an offer to exchange Notes in any jurisdiction where the offer is not permitted.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2012.

Table of Contents

| Page | ||||

| i | ||||

| i | ||||

| i | ||||

| 1 | ||||

| 18 | ||||

| 41 | ||||

| 43 | ||||

| 47 | ||||

| 48 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

58 | |||

| 102 | ||||

| 106 | ||||

| 114 | ||||

| Changes in and Disagreements with Accountants on Accounting or Financial Disclosure |

137 | |||

| 138 | ||||

| 141 | ||||

| 153 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

155 | |||

| 157 | ||||

| 212 | ||||

| 215 | ||||

| 218 | ||||

| 218 | ||||

| 218 | ||||

| 218 | ||||

| F-1 | ||||

| A-1 | ||||

We have not authorized anyone to give any information or make any representation about the offering that is different from, or in addition to, that contained in this prospectus or the related registration statement. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this document does not extend to you. The information contained in this document speaks only as of the date of this document unless the information specifically indicates that another date applies.

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-4 to register this exchange offer of the New Notes, which you can access on the SEC’s website at http://www.sec.gov. This prospectus, which forms part of the registration statement, does not contain all of the information included in that registration statement. For further information about us and about the New Notes offered in this prospectus, you should refer to the registration statement and its exhibits. You may read and copy any materials we file with the SEC at the public reference room maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. These materials are also available to the public from the SEC’s website at http://www.sec.gov.

Certain market and industry data included in this prospectus has been obtained from third party sources that we believe to be reliable. Market estimates are calculated by using independent industry publications, government publications and third party forecasts in conjunction with our assumptions about our markets. We have not independently verified such third party information. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the headings “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors” in this prospectus.

The information contained on or that can be accessed through any of our websites is not incorporated in, and is not part of, this prospectus or the registration statement.

i

Table of Contents

This prospectus summary contains basic information about our company and the offering. It may not contain all the information that may be important to you. Investors should carefully read this entire prospectus, including the information set forth under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in our consolidated financial statements and related notes before making an investment decision.

Unless otherwise indicated or the context otherwise requires, references in this prospectus to “Nationstar,” the “Company,” “we,” “us” or “our” refer collectively to Nationstar Mortgage LLC and its subsidiaries. With respect to the discussion of the terms of the notes on the cover page, in the section entitled “Prospectus Summary—Summary of the Exchange Offer,” in the section entitled “Prospectus Summary—Summary of the New Notes” and in the section entitled “Description of the New Notes,” references to “we,” “us” or “our” include only Nationstar Mortgage LLC and Nationstar Capital Corporation and not any other subsidiaries of Nationstar Mortgage LLC. References in this prospectus to “Fortress” refer to Fortress Investment Group LLC. For certain industry and other terms, investors are referred to the section entitled “Glossary of Industry and Other Terms” beginning on page 102.

Company Overview

We are a leading high touch non-bank residential mortgage servicer with a broad array of servicing capabilities across the residential mortgage product spectrum. We have been the fastest growing mortgage servicer since 2007 as measured by growth in aggregate unpaid principal balance (“UPB”), having grown 70.2% annually on a compounded basis. As of December 31, 2011, we serviced over 645,000 residential mortgage loans with an aggregate UPB of $106.6 billion (including $7.8 billion of servicing under contract), making us the largest high touch non-bank servicer in the United States. Our clients include national and regional banks, government organizations, securitization trusts, private investment funds and other owners of residential mortgage loans and securities.

We attribute our growth to our strong servicer performance and high touch servicing model, which emphasizes borrower interaction to improve loan performance and minimize loan defaults and foreclosures. We believe our exceptional track record as a servicer, coupled with our ability to scale our operations without compromising servicer quality, have enabled us to add new mortgage servicing portfolios with relatively low capital investment. We are a preferred partner of many large financial organizations, including government-sponsored enterprises (“GSEs”) and other regulated institutions that value our strong performance and also place a premium on our entirely U.S.-based servicing operations. We employ over 2,500 people in the United States and are a licensed servicer in all 50 states.

In addition to our core servicing business, we are one of only a few non-bank servicers with a fully integrated loan originations platform and suite of adjacent businesses designed to meet the changing needs of the mortgage industry. Our originations platform complements and enhances our servicing business by allowing us to replenish our servicing portfolio as loans pay off over time, while our adjacent businesses broaden our product offerings by providing mortgage-related services spanning the life cycle of a mortgage loan. We believe our integrated approach, together with the strength and diversity of our servicing operations and our strategies for growing substantial portions of our business with minimal capital outlays (which we refer to as our “capital light” approach), position us to take advantage of the major structural changes currently occurring across the mortgage industry.

Servicing Industry Dynamics

Mortgage servicers provide day-to-day administration and servicing for loans on behalf of mortgage owners and earn revenues based primarily on the UPB of loans serviced. Servicers collect and remit monthly loan

1

Table of Contents

principal and interest payments and provide related services in exchange for contractual servicing fees. Servicers also provide special services such as overseeing the resolution of troubled loans. As the mortgage industry continues to struggle with elevated borrower delinquencies, this special servicing function has become a particularly important component of a mortgage servicer’s role and, we believe, a key differentiator among mortgage servicers.

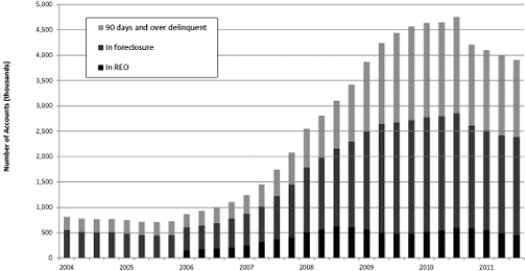

According to Inside Mortgage Finance, there were approximately $10.3 trillion of U.S. residential mortgage loans outstanding as of December 31, 2011. In the aftermath of the U.S. financial crisis, the residential mortgage industry is undergoing major structural changes that affect the way mortgage loans are originated, owned and serviced. These changes have benefited and should continue to significantly benefit non-bank mortgage servicers. Banks currently dominate the residential mortgage servicing industry, servicing over 90% of all residential mortgage loans as of December 31, 2011. Over 50% of all residential mortgage loan servicing is concentrated among just four banks. However, banks are currently under tremendous pressure to exit or reduce their exposure to the mortgage servicing business as a result of increased regulatory scrutiny and capital requirements, headline risk associated with sizeable legal settlements, as well as potentially significant earnings volatility. Furthermore, banks’ mortgage servicing operations, which have historically been oriented towards payment processing, are often ill-equipped to maximize loan performance through high touch servicing.

As a result of these factors and the overall increased demands on servicers by mortgage owners, mortgage servicing is shifting from banks to non-bank servicers. Already, over the last 18 months, banks have completed servicing transfers on $275 billion of mortgage loans. We believe this represents a fundamental change in the mortgage servicing industry and expect the trend to continue at an accelerated rate in the future. Because the mortgage servicing industry is characterized by high barriers to entry, including the need for specialized servicing expertise and sophisticated systems and infrastructure, compliance with GSE and client requirements, compliance with state-by-state licensing requirements and the ability to adapt to regulatory changes at the state and federal levels, we believe we are one of the few mortgage servicers competitively positioned to benefit from the shift.

Our Business

Residential Mortgage Servicing

Our leading residential mortgage servicing business serves a diverse set of clients encompassing a broad range of mortgage loans, including prime and non-prime loans, traditional and reverse mortgage loans, GSE and

2

Table of Contents

government agency-insured loans, as well as private-label loans issued by non-government affiliated institutions. We have grown our residential mortgage servicing portfolio from an aggregate UPB of $12.7 billion as of December 31, 2007 to $106.6 billion as of December 31, 2011 (including $7.8 billion of servicing under contract). Since December 2008, we have added over $104 billion in UPB to our servicing platform through approximately 300 separate transfers from 30 different counterparties (excluding $7.8 billion of servicing under contract). This growth has been funded primarily through internally generated cash flows and proceeds from debt financings.

Our performance record stands out when compared to other mortgage servicers:

| • | As of December 2011, a GSE ranked us in the top 5 out of over 1,000 approved servicers in foreclosure prevention workouts. |

| • | In 2011, we were in the top tier of rankings for Federal Housing Administration-(“FHA”) and Housing and Urban Development-approved servicers, with a Tier 1 ranking (out of four possible tiers). |

| • | As of December 31, 2011, our delinquency and default rates on non-prime mortgages we service on behalf of third party investors in asset-backed securities (“ABS”) were each 40% lower than the peer group average. |

Our high touch, active servicing approach emphasizes increased borrower contact in an effort to improve loan performance and reduce loan defaults and foreclosures, thereby minimizing credit losses and maximizing cash flows for our clients. Where appropriate, we perform loan modifications, often facilitated by government programs such as the Home Affordable Modification Program (“HAMP”), which serve as an effective alternative to foreclosure by keeping borrowers in their homes and bringing them current on their loans. We believe our proven servicing approach and relative outperformance have led large financial institutions, GSEs and government organizations to award major servicing and subservicing contracts to us, often on a repeat basis.

Our systems and infrastructure play a key role in our servicing success. Through careful monitoring and frequent direct communication with borrowers, we are able to quickly identify potential payment problems and work with borrowers to address issues efficiently. To this end, we leverage our proprietary processing, loss mitigation and caller routing systems to implement a single point of contact model for troubled loans that ensures smooth and prompt communication with borrowers, consistent with standards imposed on the largest bank servicers by the Office of the Comptroller of the Currency (the “OCC”), the Federal Reserve and the Federal Deposit Insurance Corporation (“FDIC”). Our core systems are scalable to multiples of our current size.

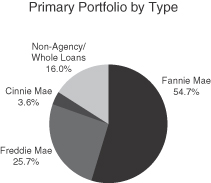

We service loans as the owner of mortgage servicing rights (“MSRs”), which we refer to as “primary servicing,” and we also service loans on behalf of other MSR or mortgage owners, which we refer to as “subservicing.” As of December 31, 2011, our primary servicing and subservicing portfolios represented 46.4% and 53.6%, respectively, of our total servicing portfolio (excluding $7.8 billion of servicing under contract).

Primary Servicing

Primary servicers act as servicers on behalf of mortgage owners and directly own the MSRs, which represent the contractual right to a stream of cash flows (expressed as a percentage of UPB) in exchange for performing specified mortgage servicing functions and temporarily advancing funds to cover payments on delinquent and defaulted mortgages.

We have grown our primary servicing portfolio to $45.8 billion in UPB as of December 31, 2011 (excluding $7.8 billion of servicing under contract) from $12.7 billion in UPB as of December 31, 2007, representing a compound annual growth rate of 37.8%. We plan to continue growing our primary servicing portfolio principally by acquiring MSRs from banks and other financial institutions under pressure to exit or reduce their exposure to

3

Table of Contents

the mortgage servicing business. As the servicing industry paradigm continues to shift from bank to non-bank servicers at an increasing pace, we believe there will be a significant opportunity to increase our market share of the servicing business.

We acquire MSRs on a standalone basis and have also developed an innovative model for investing on a capital light basis by co-investing with financial partners in “excess MSRs.” Excess MSRs are the servicing fee cash flows (“excess fees”) on a portfolio of mortgage loans after payment of a basic servicing fee. In these transactions, we provide all servicing functions in exchange for the basic servicing fee, then share the excess fee with our co-investment partner on a pro rata basis. Through December 31, 2011, we added $10 billion of loan servicing through excess MSRs and expect to continue to deploy this co-investment strategy in the future.

Subservicing

Subservicers act on behalf of MSR or mortgage owners that choose to outsource the loan servicing function. In our subservicing portfolio, we earn a contractual fee per loan we service. The loans we subservice often include pools of underperforming mortgage loans requiring high touch servicing capabilities. Many of our recent subservicing transfers have been facilitated by GSEs and other large mortgage owners that are seeking to improve loan performance through servicer upgrades. Subservicing represents another capital light means of growing our servicing business, as subservicing contracts are typically awarded on a no-cost basis and do not require substantial capital.

We have grown our subservicing portfolio to $53.0 billion in UPB as of December 31, 2011 by completing 290 transfers with 26 counterparties since we entered the subservicing business in August 2008. We expect to enter into additional subservicing arrangements as mortgage owners seek to transfer credit stressed loans to high touch subservicers with proven track records and the infrastructure and expertise to improve loan performance.

Adjacent Businesses

We operate or have investments in several adjacent businesses which provide mortgage-related services that are complementary to our servicing and originations businesses. These businesses offer an array of ancillary services, including providing services for delinquent loans, managing loans in the foreclosure/real estate owned (“REO”) process and providing title insurance agency, loan settlement and valuation services on newly originated and re-originated loans. We offer these adjacent services in connection with loans we currently service, as well as on a third party basis in exchange for base and/or incentive fees. In addition to enhancing our core businesses, these adjacent services present an opportunity to increase future earnings with minimal capital investment, including by expanding the services we provide to large banks and other financial institutions seeking to outsource these functions to a third party.

Originations

We are one of only a few non-bank servicers with a fully integrated loan originations platform to complement and enhance our servicing business. In 2011, we originated approximately $3.4 billion of loans, up from $2.8 billion in 2010. We originate primarily conventional agency (GSE) and government-insured residential mortgage loans and, to mitigate risk, typically sell these loans within 30 days while retaining the associated servicing rights.

A key determinant of the profitability of our primary servicing portfolio is the longevity of the servicing cash flows before a loan is repaid or liquidates. Our originations efforts are primarily focused on “re-origination,” which involves actively working with existing borrowers to refinance their mortgage loans. By re-originating loans for existing borrowers, we retain the servicing rights, thereby extending the longevity of the servicing cash flows, which we refer to as “recapture.” We recaptured 35.4% of the loans we service that were refinanced or

4

Table of Contents

repaid by the borrower during 2011 and our goal for 2012 is to achieve a recapture rate of over 55%. Because the refinanced loans typically have lower interest rates or lower monthly payments, and, in general, subsequently refinance more slowly and default less frequently, these refinancings also typically improve the overall quality of our primary servicing portfolio.

With our in-house originations capabilities, we believe we are better protected against declining servicing cash flows as we replace servicing run-off through new loan originations or retain our servicing portfolios through re-origination. In addition, our re-origination strategy allows us to generate additional loan servicing more cost-effectively than MSRs can otherwise be acquired in the open market.

Our Strengths

We believe our servicing platform, coupled with our originations and adjacent businesses, position us well for a variety of market environments. The following competitive strengths contribute to our leading market position and differentiate us from our competitors:

Top Performing Preferred Servicing Partner

Through careful monitoring and frequent direct communication with borrowers, our high touch, high-quality servicing model allows us to improve loan performance and reduce loan defaults and foreclosures, thereby minimizing credit losses and maximizing cash flows for our clients. In recognition of our performance, as of December 2011, a GSE ranked us in the top 5 out of over 1,000 approved servicers in foreclosure prevention workouts. Our demonstrated ability to achieve strong results and relative outperformance, as well as our entirely U.S.-based servicing operations, have made us a preferred partner of large financial institutions, GSEs and government organizations, which have awarded major servicing and subservicing contracts to us, often on a repeat basis.

Scalable Technology and Infrastructure

Our highly scalable technology and infrastructure have enabled us to manage rapid growth over the past several years while maintaining our high servicing standards and enhancing loan performance. We have made significant investments in loan administration, customer service, compliance and loss mitigation, as well as in employee training and retention. Our staffing, training and performance tracking programs, centralized in the Dallas/Fort Worth, Texas area, have allowed us to expand the size of our servicing team while maintaining high quality standards. With our core systems scalable to multiples of our current size, we believe our infrastructure positions us well to take advantage of structural changes in the mortgage industry. Because the mortgage servicing industry is characterized by high barriers to entry, we also believe we are one of the few mortgage servicers competitively positioned to benefit from existing and future market opportunities.

Track Record of Efficient Capital Deployment

We have an established track record of deploying capital to grow our business. For example, since December 2008, we have effectively used capital from internally generated cash flows and proceeds from debt financings to add over $104 billion in UPB to our servicing platform (excluding $7.8 billion of servicing under contract). In addition, we employ capital light strategies, including our innovative strategy for co-investment in excess MSRs with financial partners as well as subservicing arrangements, to add new mortgage servicing portfolios with relatively low capital investment. Through December 31, 2011, we added $10 billion of loan servicing through excess MSRs and expect to continue to deploy this co-investment strategy in the future, while also evaluating subservicing arrangements as mortgage owners seek to transfer credit stressed loans to high touch subservicers in order to improve loan performance. We believe that our experience of efficiently deploying capital for growth puts us in a strong position to manage future growth opportunities.

5

Table of Contents

Attractive Business Model with Strong Recurring Revenues

Banks are under tremendous pressure to exit or reduce their exposure to the mortgage servicing business, and GSEs are looking for strong mortgage servicers as the mortgage industry continues to struggle with elevated borrower delinquencies. As the shift from bank to non-bank servicers accelerates, we believe there will be a significant opportunity for us to achieve growth on attractive terms. Our senior management team has already demonstrated its ability to identify, evaluate and execute servicing portfolio acquisitions. We have developed an attractive business model to grow our business and generate strong, recurring, contractual fee-based revenue with minimal credit risk. These revenue streams provide us with significant capital to grow our business organically.

Integrated Originations Capabilities

As one of only a few non-bank servicers with a fully integrated loan originations platform, we are often able to extend the longevity of our servicing cash flows through loan refinancings. We recaptured 35.4% of the loans we service that were refinanced or repaid by the borrower during 2011 and our goal for 2012 is to achieve a recapture rate of over 55%. Because, in general, refinanced loans subsequently refinance more slowly and default less frequently than many currently outstanding loans, these refinancings also typically improve the overall quality of our primary servicing portfolio. We believe our in-house originations capabilities allow us to generate additional loan servicing more cost-effectively than MSRs can otherwise be acquired in the open market.

Strong and Seasoned Management Team

Our senior management team is comprised of experienced mortgage industry executives with a track record of generating financial and operational improvements. Our current Chief Executive Officer has been with us for more than a decade and has managed the company through the most recent economic downturn and through multiple economic cycles. Several members of our management team have held senior positions at other residential mortgage companies. Our senior management team has demonstrated its ability to adapt to changing market conditions and has developed a proven ability to identify, evaluate and execute successful portfolio and platform acquisitions. We believe that the experience of our senior management team and its management philosophy are significant contributors to our operating performance.

Growth Strategies

We expect to drive future growth in the following ways:

Grow Residential Mortgage Servicing

We expect to grow our business primarily by adding to our residential mortgage servicing portfolios through MSR acquisitions and subservicing transfers. Over the last 18 months, banks and other financial institutions have completed a significant number of MSR sales and subservicing transfers, and we expect an even greater number over the next 18 months. We are continuously reviewing, evaluating and, when attractive, pursuing MSR sales and subservicing transfers, and we believe we are well-positioned to compete effectively for these opportunities. We believe our success in this area has been, and will continue to be, driven by our strong servicer performance, as well as by the systems and infrastructure we have implemented to meet specific client requirements.

Pursue Capital Light Servicing Opportunities

We intend to pursue capital light strategies that will allow us to grow our MSR and subservicing portfolios with minimal capital outlays. Within our subservicing portfolio, since August 2008, we have grown our servicing UPB to $53.0 billion with no capital outlays. Many of our recent subservicing transfers have been facilitated by GSEs and other large mortgage owners and we expect to leverage our relationships to complete additional

6

Table of Contents

subservicing transfers as mortgage owners seek to transfer credit stressed loans to high touch servicers through subservicing arrangements. Within our MSR portfolio, we have developed an innovative strategy for co-investing on a capital light basis in excess MSRs with financial partners. Through December 31, 2011, we added $10 billion of loan servicing through excess MSRs and expect to continue to deploy this co-investment strategy in the future. We anticipate that these capital light strategies will allow us to significantly expand our mortgage servicing portfolio with reduced capital investment.

Expand Originations to Complement Servicing

We also expect our originations platform to play an important role in driving our growth and, in particular, enhancing the profitability of our servicing business. As one of only a few non-bank servicers with a fully integrated loan originations platform, we originate new GSE-eligible and FHA-insured loans for sale into the securitization market and retain the servicing rights associated with those loans. More importantly, we re-originate loans from existing borrowers seeking to take advantage of improved loan terms, thereby extending the longevity of the related servicing cash flows, which increases the profitability and the credit quality of the servicing portfolio. Through our originations platform, we generate additional loan servicing more cost-effectively than MSRs can otherwise be acquired in the open market. Finally, we facilitate borrower access to government programs designed to encourage refinancings of troubled or stressed loans, improving overall loan performance. We believe this full range of abilities makes us a more attractive counterparty to entities seeking to transfer servicing to us, and we expect it to contribute to the growth of our servicing portfolio.

Meet Evolving Needs of the Residential Mortgage Industry

We expect to drive growth across all of our businesses by being a solution provider to a wide range of financial and government organizations as they navigate the structural changes taking place across the mortgage industry. With banks under pressure to reduce their exposure to the mortgage market, with the U.S. government under pressure to address its large mortgage exposure and with weak market conditions contributing to elevated loan delinquencies and defaults, we expect there to be numerous compelling situations requiring our expertise. We believe the greatest opportunities will be available to servicers with the proven track record, scalable infrastructure and range of services that can be applied flexibly to address different organizations’ needs. To position ourselves for these opportunities, since 2010 we have expanded our business development team and hired a dedicated senior executive whose primary role is to identify, evaluate, and enhance acquisition and partnership opportunities across the mortgage industry, including with national and regional banks, mortgage and bond insurers, private investment funds and various government agencies. We have also expanded and enhanced our loan transfer, collections and loss mitigation infrastructure in order to be able to accommodate substantial additional growth. We expect these efforts to position us to be a key participant in the long term restructuring and recovery of the mortgage sector.

Company History

Nationstar Mortgage LLC is a Delaware limited liability company. We were formed in 1994 in Denver, Colorado as Nova Credit Corporation, a Nevada corporation. In 1997, we moved our executive offices and primary operations to Lewisville, Texas and changed our name to Centex Credit Corporation. In 2001, Centex Credit Corporation was merged into Centex Home Equity Company, LLC, a Delaware limited liability company (“CHEC”). In 2006, FIF HE Holdings LLC, acquired all of our outstanding membership interests (the “Acquisition”), and we changed our name to Nationstar Mortgage LLC. Nationstar Capital Corporation, a Delaware corporation, is our wholly-owned subsidiary formed solely for the purpose of being a corporate co-issuer of the notes.

In March 2012, our parent, Nationstar Mortgage Holdings Inc. (“Parent”) completed an initial public offering and related reorganization transactions pursuant to which all of the equity interests in Nationstar

7

Table of Contents

Mortgage LLC were transferred from FIF HE Holdings LLC to two direct, wholly-owned subsidiaries of our Parent. Trading in our Parent’s common stock on the New York Stock Exchange commenced on March 8, 2012 under the symbol “NSM.” On March 13, 2012, our Parent closed the initial public offering. Including 2,500,000 shares issued following the exercise of the underwriters’ overallotment option, the aggregate shares issued in connection with the initial public offering amounted to 19,166,667 shares. In addition, in connection with the initial public offering, FIF HE Holdings LLC offered to certain of our current and former members of management the opportunity to exchange their Series 1 Class A units for shares of our Parent’s common stock that were held by FIF HE Holdings LLC (the “Unit Exchange”). Following the initial public offering, related reorganization transactions, the Unit Exchange, and the exercise of the underwriters’ over-allotment option, FIF HE Holdings LLC owns approximately 77.1% of our common stock. FIF HE Holdings LLC, in turn, is primarily owned by certain private equity funds managed by an affiliate of Fortress. Fortress is a leading global investment management firm with approximately $43.1 billion in fee paying assets under management as of December 31, 2011. Fortress is headquartered in New York and has affiliates with offices in Dallas, Frankfurt, London, Los Angeles, New Canaan, Philadelphia, Rome, San Francisco, Singapore, Seoul, Shanghai, Sydney and Tokyo.

Ownership Structure

The following chart sets forth our ownership structure as of March 13, 2012:

Corporate Information

Our executive offices are located at 350 Highland Drive, Lewisville, Texas 75067 and our telephone number is (469) 549-2000.

8

Table of Contents

Summary of the Exchange Offer

| Background |

On December 19, 2011, we issued $35,000,000 aggregate principal amount of Old Notes in an unregistered offering. In connection with that issuance, we entered into a registration rights agreement on December 19, 2011 (the “Registration Rights Agreement”) in which we agreed, among other things, to complete this exchange offer. Under the terms of the exchange offer, you are entitled to exchange Old Notes for New Notes evidencing the same indebtedness and with substantially similar terms. You should read the discussion under the heading “Description of the Notes” for further information regarding the New Notes. |

| The Notes are a further issuance of $250,000,000 in aggregate principal amount of 10.875% Senior Notes due 2015 that we issued on March 26, 2010 and that we exchanged pursuant to an exchange offer registered under the Securities Act on September 14, 2011. The New Notes are fungible with the notes we issued in the exchange offer. |

| The Exchange Offer |

We are offering to exchange, for each $1,000 aggregate principal amount of our Old Notes validly tendered and accepted, $1,000 aggregate principal amount of our New Notes. |

| We will not pay any accrued and unpaid interest on the Old Notes that we acquire in the exchange offer. Instead, interest on the notes will accrue from the most recent date to which interest has been paid or, if no interest has been paid, from and including December 19, 2011, the date on which we issued the Old Notes. |

| As of the date of this prospectus, approximately $35,000,000 aggregate principal amount of the Old Notes are outstanding. |

| Denominations of New Notes |

Tendering holders of Old Notes must tender Old Notes in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. New Notes will be issued in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

| Expiration Date |

The exchange offer will expire at 5:00 p.m., New York City time, on , 2012, unless we extend or terminate the exchange offer in which case the “Expiration Date” will mean the latest date and time to which we extend the exchange offer. |

| Settlement Date |

The settlement date of the exchange offer will be as soon as practicable after the Expiration Date of the exchange offer. |

| Withdrawal of Tenders |

Tenders of Old Notes may be withdrawn at any time prior to the Expiration Date. |

| Conditions to the Exchange Offer |

Our obligation to consummate the exchange offer is subject to certain customary conditions, which we may assert or waive. See “Description of the Exchange Offer—Conditions to the Exchange Offer.” |

9

Table of Contents

| Procedures for Tendering |

To participate in the exchange offer, you must follow the automatic tender offer program (“ATOP”), procedures established by The Depository Trust Company (“DTC”), for tendering Old Notes held in book-entry form. The ATOP procedures require that the exchange agent receive, prior to the Expiration Date of the exchange offer, a computer-generated message known as an “agent’s message” that is transmitted through ATOP and that DTC confirm that: |

| • | DTC has received instructions to exchange your Old Notes; and |

| • | you agree to be bound by the terms of the letter of transmittal. |

| For more details, please read “Description of the Exchange Offer—Terms of the Exchange Offer” and “Description of the Exchange Offer—Procedures for Tendering.” If you elect to have Old Notes exchanged pursuant to this exchange offer, you must properly tender your Old Notes prior to 5:00 p.m., New York City time, on the Expiration Date. All Old Notes validly tendered and not properly withdrawn will be accepted for exchange. Old Notes may be exchanged only in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

| Consequences of Failure to Exchange |

If we complete the exchange offer and you do not participate in it, then: |

| • | your Old Notes will continue to be subject to the existing restrictions upon their transfer; |

| • | we will have no further obligation to provide for the registration under the Securities Act of those Old Notes except under certain limited circumstances; and |

| • | the liquidity of the market for your Old Notes could be adversely affected. |

| Taxation |

The exchange pursuant to the exchange offer generally will not be a taxable event for U.S. federal income tax purposes. See “Certain U.S. Federal Income Tax Considerations” in this prospectus. |

| Use of Proceeds |

We will not receive any cash proceeds from the issuance of the New Notes in this exchange offer. |

| Exchange Agent and Information Agent |

Wells Fargo Bank, National Association, is the exchange agent and the information agent for the exchange offer. |

Risk Factors

You should consider carefully all of the information included in this prospectus and, in particular, the information under the heading “Risk Factors” beginning on page 18 prior to deciding whether to invest in the notes.

10

Table of Contents

Summary of the New Notes

| Issuers |

Nationstar Mortgage LLC, a Delaware limited liability company, and Nationstar Capital Corporation, a Delaware corporation. |

| Securities Offered |

U.S. $35,000,000 aggregate principal amount of 10.875% Senior Notes due April 1, 2015. |

| The Notes are a further issuance of $250,000,000 in aggregate principal amount of 10.875% Senior Notes due 2015 that we issued on March 26, 2010 and that we exchanged pursuant to an exchange offer registered under the Securities Act on September 14, 2011. The New Notes are fungible with the notes we issued in the exchange offer. |

| Maturity Date |

April 1, 2015. |

| Interest Rate |

10.875% per annum, payable semi-annually in arrears on April 1 and October 1 of each year, commencing April 1, 2012. Interest on the New Notes will accrue from the most recent date to which interest has been paid or, if no interest has been paid, from and including December 19, 2011. |

| Guarantees |

The New Notes will be guaranteed on an unsecured senior basis by each of our existing and future domestic subsidiaries, other than our securitization and certain finance subsidiaries and subsidiaries that in the future we designate as excluded restricted and unrestricted subsidiaries. |

| Ranking |

The New Notes and the guarantees will be our and the guarantors’ general unsecured senior indebtedness, respectively, and will: |

| • | rank equally in right of payment to all of our and the guarantors’ existing and future indebtedness and other obligations that are not, by their terms, expressly subordinated in right of payment to the notes and the guarantees; |

| • | rank senior in right of payment to any of our and the guarantors’ existing and future senior subordinated and subordinated indebtedness and other obligations that are, by their terms, expressly subordinated in right of payment to the notes and the subsidiary guarantees; and |

| • | be effectively junior in right of payment to all of our and the guarantors’ existing and future senior secured indebtedness and other obligations to the extent of the value of the assets securing such indebtedness and other obligations. |

| Form and Denomination |

The New Notes will be issued in fully-registered form. The New Notes will be represented by one or more global notes, deposited with the trustee as custodian for DTC and registered in the name of Cede & Co., DTC’s nominee. Beneficial interests in the global notes will be shown on, and any transfers will be effective only through, records maintained by DTC and its participants. |

11

Table of Contents

| The New Notes will be issued in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

| Optional Redemption |

We may redeem the New Notes, in whole or in part, at any time prior to April 1, 2013, at a price equal to 100% of the aggregate principal amount of the New Notes plus the applicable “make whole” premium, as described in “Description of the New Notes—Redemption—Optional Redemption,” plus accrued and unpaid interest, if any, to the applicable redemption date. |

| We may redeem the New Notes, in whole or in part, at any time on or after April 1, 2013, at the applicable redemption price specified in “Description of the New Notes—Redemption—Optional Redemption,” plus accrued and unpaid interest, if any, to the applicable redemption date. |

| In addition, we may redeem up to 35% of the aggregate principal amount of the New Notes at any time on or prior to April 1, 2013 with the net cash proceeds from certain equity offerings at the applicable redemption price specified “Description of the New Notes—Redemption—Optional Redemption,” plus accrued and unpaid interest, if any, to the applicable redemption date. |

| Change of Control |

If certain change-of-control events occur, we must offer to repurchase all of the New Notes at 101% of their principal amount, plus accrued and unpaid interest, if any, to the repurchase date. |

| Asset Sales |

If we sell assets under certain circumstances, we will be required to make an offer to purchase the New Notes at their face amount, plus accrued and unpaid interest, if any, as of the purchase date. |

| Absence of a Public Market |

The New Notes are new securities for which there currently is no market and we cannot assure you that any public market for the New Notes will develop or be sustained. |

| Certain Covenants |

The indenture governing the New Notes will, among other things, limit our ability and the ability of our subsidiaries to: |

| • | incur or guarantee additional indebtedness; |

| • | incur liens; |

| • | pay dividends on or make distributions in respect of our capital stock or make other restricted payments; |

| • | make investments; |

| • | consolidate, merge, sell or otherwise dispose of certain assets; and |

| • | enter into transactions with our affiliates. |

| These covenants are subject to important exceptions, limitations and qualifications as described in “Description of the New Notes—Certain Covenants.” |

12

Table of Contents

| Listing |

We do not intend to list the New Notes on any securities exchange. |

| Governing Law |

The New Notes are governed by, and construed in accordance with, the laws of the State of New York, without regard to conflicts of laws principles thereof. |

| Book-Entry Depository |

DTC. |

| Trustee |

Wells Fargo Bank, National Association |

| Risk Factors |

You should refer to the section entitled “Risk Factors” for a discussion of material risks you should carefully consider before deciding to invest in the New Notes. |

13

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize consolidated financial information for our business. You should read these tables along with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and our consolidated financial statements and the related notes included elsewhere in this prospectus.

The summary consolidated statement of operations data for the years ended December 31, 2009, 2010 and 2011 and the summary consolidated balance sheet data as of December 31, 2010 and 2011 have been derived from our audited financial statements included elsewhere in this prospectus. The summary consolidated balance sheet data at December 31, 2009 has been derived from our audited financial statements that are not included in this prospectus.

| Year Ended December 31, | ||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| (in thousands, except per share data) | ||||||||||||

| Statement of Operations Data—Consolidated |

||||||||||||

| Revenues: |

||||||||||||

| Total fee income |

$ | 100,218 | $ | 184,084 | $ | 268,598 | ||||||

| Gain (loss) on mortgage loans held for sale |

(21,349 | ) | 77,344 | 109,136 | ||||||||

|

|

|

|

|

|

|

|||||||

| Total revenues |

78,869 | 261,428 | 377,734 | |||||||||

| Total expenses and impairments |

142,367 | 220,976 | 306,183 | |||||||||

| Other income (expense): |

||||||||||||

| Interest income |

52,518 | 98,895 | 66,802 | |||||||||

| Interest expense |

(69,883 | ) | (116,163 | ) | (105,375 | ) | ||||||

| Loss on interest rate swaps and caps |

(14 | ) | (9,801 | ) | 298 | |||||||

| Fair value changes in ABS securitizations |

— | (23,297 | ) | (12,389 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Total other income (expense) |

(17,379 | ) | (50,366 | ) | (50,664 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net (loss) income |

$ | (80,877 | ) | $ | (9,914 | ) | $ | 20,887 | ||||

|

|

|

|

|

|

|

|||||||

| December 31, | ||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| (in thousands) | ||||||||||||

| Balance Sheet Data—Consolidated |

||||||||||||

| Cash and cash equivalents |

$ | 41,645 | $ | 21,223 | $ | 62,445 | ||||||

| Accounts receivable |

513,939 | 441,275 | 562,300 | |||||||||

| Mortgage servicing rights |

114,605 | 145,062 | 251,050 | |||||||||

| Total assets |

1,280,185 | 1,947,181 | 1,787,931 | |||||||||

| Notes payable(1) |

771,857 | 709,758 | 873,179 | |||||||||

| Unsecured senior notes |

— | 244,061 | 280,199 | |||||||||

| Legacy assets securitized debt |

177,675 | 138,662 | 112,490 | |||||||||

| Excess spread financing (at fair value) |

— | — | 44,595 | |||||||||

| ABS nonrecourse debt (at fair value) |

— | 496,692 | — | |||||||||

| Total liabilities |

1,016,362 | 1,690,809 | 1,506,622 | |||||||||

| Total members’ equity |

263,823 | 256,372 | 281,309 | |||||||||

14

Table of Contents

| (1) | A summary of notes payable as of December 31, 2011 follows: |

| Notes Payable |

December 31, 2011 | |||

| (in thousands) | ||||

| Servicing |

||||

| 2010-ABS Advance Financing Facility |

$ | 219,563 | ||

| 2011-Agency Advance Financing Facility |

25,011 | |||

| MBS Advance Financing Facility |

179,904 | |||

| Securities Repurchase Facility (2011) |

11,774 | |||

| MSR Note |

10,180 | |||

| Originations |

||||

| $300 Million Warehouse Facility |

251,722 | |||

| $100 Million Warehouse Facility |

16,047 | |||

| $175 Million Warehouse Facility |

46,810 | |||

| $50 Million Warehouse Facility |

7,310 | |||

| ASAP+ Short-Term Financing Facility |

104,858 | |||

|

|

|

|||

| $ | 873,179 | |||

|

|

|

|||

The following tables summarize consolidated financial information for our Operating Segments. Management analyzes our performance in two separate segments, the Servicing Segment and the Originations Segment, which together constitute our Operating Segments. In addition, we have a legacy asset portfolio, which primarily consists of non-prime and non-conforming mortgage loans, most of which were originated from April to July 2007. The Servicing Segment provides loan servicing on our servicing portfolio and the Originations Segment involves the origination, packaging and sale of GSE mortgage loans into the secondary markets via whole loan sales or securitizations.

| Year Ended December 31, | ||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| (in thousands) | ||||||||||||

| Statement of Operations Data—Operating Segments Information |

||||||||||||

| Revenues: |

||||||||||||

| Total fee income |

$ | 101,289 | $ | 189,884 | $ | 269,585 | ||||||

| Gain on mortgage loans held for sale |

54,437 | 77,498 | 109,431 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total revenues |

155,726 | 267,382 | 379,016 | |||||||||

| Total expenses and impairments |

118,429 | 194,203 | 279,537 | |||||||||

| Other income (expense): |

||||||||||||

| Interest income |

8,404 | 12,111 | 14,981 | |||||||||

| Interest expense |

(29,315 | ) | (60,597 | ) | (68,979 | ) | ||||||

| Gain (loss) on interest rate swaps and caps |

— | (9,801 | ) | 298 | ||||||||

|

|

|

|

|

|

|

|||||||

| Total other income (expense) |

(20,911 | ) | (58,287 | ) | (53,700 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net income |

$ | 16,386 | $ | 14,892 | $ | 45,779 | ||||||

|

|

|

|

|

|

|

|||||||

15

Table of Contents

| Year Ended December 31, | ||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| (in thousands) | ||||||||||||

| Net Income from Operating Segments to Adjusted EBITDA Reconciliation: |

||||||||||||

| Net income from Operating Segments |

$ | 16,386 | $ | 14,892 | $ | 45,779 | ||||||

| Adjust for: |

||||||||||||

| Interest expense from unsecured senior notes |

— | 24,628 | 30,464 | |||||||||

| Depreciation and amortization |

1,542 | 1,873 | 3,395 | |||||||||

| Change in fair value of MSRs |

27,915 | 6,043 | 39,000 | |||||||||

| Fair value changes on excess spread financing(1) |

— | — | 3,060 | |||||||||

| Share-based compensation |

579 | 8,999 | 14,764 | |||||||||

| Exit costs |

— | — | 1,836 | |||||||||

| Fair value changes on interest rate swaps |

— | 9,801 | (298 | ) | ||||||||

| Ineffective portion of cash flow hedge |

— | (930 | ) | (2,032 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA(2) |

$ | 46,422 | $ | 65,306 | $ | 135,968 | ||||||

|

|

|

|

|

|

|

|||||||

| (1) | Relates to a financing arrangement on certain MSRs which are carried at fair value under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 825, Financial Instruments. |

| (2) | Adjusted EBITDA is a key performance measure used by management in evaluating the performance of our segments. Adjusted EBITDA represents our Operating Segments’ income (loss), and excludes income and expenses that relate to the financing of the senior notes, depreciable (or amortizable) asset base of the business, income taxes (if any), exit costs from our restructuring and certain non-cash items. Adjusted EBITDA also excludes results from our legacy asset portfolio and certain securitization trusts that were consolidated upon adoption of the new accounting guidance eliminating the concept of a qualifying special purpose entity (“QSPE”). |

Adjusted EBITDA provides us with a key measure of our Operating Segments’ performance as it assists us in comparing our Operating Segments’ performance on a consistent basis. Management believes Adjusted EBITDA is useful in assessing the profitability of our core business and uses Adjusted EBITDA in evaluating our operating performance as follows:

| • | Financing arrangements for our Operating Segments are secured by assets that are allocated to these segments. Interest expense that relates to the financing of the senior notes is not considered in evaluating our operating performance because this obligation is serviced by the excess earnings from our Operating Segments after the debt obligations that are secured by their assets. |

| • | To monitor operating costs of each Operating Segment excluding the impact from depreciation, amortization and fair value change of the asset base, exit costs from our restructuring and non-cash operating expense, such as share-based compensation. Operating costs are analyzed to manage costs per our operating plan and to assess staffing levels, implementation of technology-based solutions, rent and other general and administrative costs. |

Management does not assess the growth prospects and the profitability of our legacy asset portfolio and certain securitization trusts that were consolidated upon adoption of the new accounting guidance, except to the extent necessary to assess whether cash flows from the assets in the legacy asset portfolio are sufficient to service its debt obligations.

We also use Adjusted EBITDA (with additional adjustments) to measure our compliance with covenants such as leverage coverage ratios for our senior notes.

16

Table of Contents

Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

| • | Adjusted EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; |

| • | Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| • | Adjusted EBITDA does not reflect the cash requirements necessary to service principal payments related to the financing of the business; |

| • | Adjusted EBITDA does not reflect the interest expense or the cash requirements necessary to service interest or principal payments on our corporate debt; |

| • | although depreciation and amortization and changes in fair value of MSRs are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future and Adjusted EBITDA does not reflect any cash requirements for such replacements; and |

| • | other companies in our industry may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. |

Because of these and other limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. Adjusted EBITDA is presented to provide additional information about our operations. Adjusted EBITDA is a non-GAAP measure and should be considered in addition to, but not as a substitute for or superior to, operating income, net income, operating cash flow and other measures of financial performance prepared in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only supplementally.

17

Table of Contents

You should carefully consider the risks described below, as well as the other information contained in this prospectus. The risks described below are not the only ones facing our company. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business or results of operations in the future. Any of the following risks could materially adversely affect our business, financial condition or results of operations. In such case, you may lose all or part of your investment in the notes.

Risks Related to Our Business and Industry

Our foreclosure proceedings in certain states have been delayed due to inquiries by certain state Attorneys General, court administrators and state and federal government agencies, the outcome of which could have a negative effect on our operations, earnings or liquidity.

Allegations of irregularities in foreclosure processes, including so-called “robo-signing” by mortgage loan servicers, have gained the attention of the Department of Justice, regulatory agencies, state Attorneys General and the media, among other parties. On December 1, 2011, the Massachusetts Attorney General filed a lawsuit against five large mortgage providers alleging unfair and deceptive business practices, including the use of so-called “robo-signers.” In response, one of the mortgage providers has halted most lending in Massachusetts. Certain state Attorneys General, court administrators and government agencies, as well as representatives of the federal government, have issued letters of inquiry to mortgage servicers, including us, requesting written responses to questions regarding policies and procedures, especially with respect to notarization and affidavit procedures. These requests or any subsequent administrative, judicial or legislative actions taken by these regulators, court administrators or other government entities may subject us to fines and other sanctions, including a foreclosure moratorium or suspension. Additionally, because we do business in all fifty states, our operations may be affected by regulatory actions or court decisions that are taken at the individual state level.

In addition to these inquiries, several state Attorneys General have requested that certain mortgage servicers, including us, suspend foreclosure proceedings pending internal review to ensure compliance with applicable law, and we have received requests from four such state Attorneys General. Pursuant to these requests and in light of industry-wide press coverage regarding mortgage foreclosure documentation practices, we, as a precaution, had already delayed foreclosure proceedings in 23 states, so that we may evaluate our foreclosure practices and underlying documentation. Upon completion of our internal review and after responding to such inquiries, we resumed these previously delayed proceedings. Such inquiries, however, as well as continued court backlog and emerging court processes may cause an extended delay in the foreclosure process in certain states.

Even in states where we have not suspended foreclosure proceedings or where we have lifted or will soon lift any such delayed foreclosures, we have faced, and may continue to face, increased delays and costs in the foreclosure process. For example, we have incurred, and may continue to incur, additional costs related to the re-execution and re-filing of certain documents. We may also be required to take other action in our capacity as a mortgage servicer in connection with pending foreclosures. In addition, the current legislative and regulatory climate could lead borrowers to contest foreclosures that they would not otherwise have contested under ordinary circumstances, and we may incur increased litigation costs if the validity of a foreclosure action is challenged by a borrower. Delays in foreclosure proceedings could also require us to make additional servicing advances by drawing on our servicing advance facilities, or delay the recovery of advances, all or any of which could materially affect our earnings and liquidity and increase our need for capital.

The Dodd-Frank Act could increase our regulatory compliance burden and associated costs, limit our future capital raising strategies, and place restrictions on certain originations and servicing operations all of which could adversely affect our business, financial condition and results of operations.

On July 21, 2010, President Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) into law. The Dodd-Frank Act represents a comprehensive overhaul of the

18

Table of Contents

financial services industry in the United States. The Dodd-Frank Act includes, among other things: (i) the creation of a Financial Stability Oversight Council to identify emerging systemic risks posed by financial firms, activities and practices, and to improve cooperation among federal agencies; (ii) the creation of a Bureau of Consumer Financial Protection (“CFPB”) authorized to promulgate and enforce consumer protection regulations relating to financial products; (iii) the establishment of strengthened capital and prudential standards for banks and bank holding companies; (iv) enhanced regulation of financial markets, including the derivatives and securitization markets; and (v) amendments to the Truth in Lending Act aimed at improving consumer protections with respect to mortgage originations, including originator compensation, minimum repayment standards and prepayment considerations. On July 21, 2011, the CFPB obtained enforcement authority pursuant to the Dodd-Frank Act and began official operations. On October 13, 2011, the CFPB issued guidelines governing how it supervises mortgage transactions, which involves sending examiners to banks and other institutions that service mortgages to assess whether consumers’ interests are protected. On January 11, 2012, the CFPB issued guidelines governing examination procedures for bank and non-bank mortgage originators. The exact scope and applicability of many of these requirements to us are currently unknown as the regulations to implement the Dodd-Frank Act generally have not yet been finalized. These provisions of the Dodd-Frank Act and actions by the CFPB could increase our regulatory compliance burden and associated costs and place restrictions on certain originations and servicing operations, all of which could in turn adversely affect our business, financial condition and results of operations.

The enforcement consent orders by, agreements with, and settlements of, certain federal and state agencies against the largest mortgage servicers related to foreclosure practices could impose additional compliance costs on our servicing business, which could materially and adversely affect our financial condition and results of operations.

On April 13, 2011, the federal agencies overseeing certain aspects of the mortgage market, the OCC, the Federal Reserve and the FDIC, entered into enforcement consent orders with 14 of the largest mortgage servicers in the United States regarding foreclosure practices. The enforcement consent orders require the servicers, among other things to: (i) promptly correct deficiencies in residential mortgage loan servicing and foreclosure practices; (ii) make significant modifications in practices for residential mortgage loan servicing and foreclosure processing, including communications with borrowers and limitations on dual-tracking, which occurs when servicers continue to pursue foreclosure during the loan modification process; (iii) ensure that foreclosures are not pursued once a mortgage has been approved for modification and establish a single point of contact for borrowers throughout the loan modification and foreclosure processes; and (iv) establish robust oversight and controls pertaining to their third party vendors, including outside legal counsel, that provide default management or foreclosure services. While these enforcement consent orders are considered not to be preemptive of the state actions, it is currently unclear how state actions and proceedings will be affected by the federal consents.

On February 9, 2012, federal and state agencies announced a $25 billion settlement with five large banks that resulted from investigations of foreclosure practices. As part of the settlement, the banks have agreed to comply with various servicing standards relating to foreclosure and bankruptcy proceedings, documentation of borrowers’ account balances, chain of title, and evaluation of borrowers for loan modifications and short sales as well as servicing fees and the use of force-placed insurance. The settlement also provides for certain financial relief to homeowners.

Although we are not a party to the above enforcement consent orders and settlements, we could become subject to the terms of the consent orders and settlements if (i) we subservice loans for the mortgage servicers that are parties to the enforcement consent orders and settlements; (ii) the agencies begin to enforce the consent orders and settlements by looking downstream to our arrangement with certain mortgage servicers; (iii) the mortgage servicers for which we subservice loans request that we comply with certain aspects of the consent orders and settlements, or (iv) we otherwise find it prudent to comply with certain aspects of the consent orders and settlements. In addition, the practices set forth in such consent orders and settlements may be adopted by the industry as a whole, forcing us to comply with them in order to follow standard industry practices, or may become required by our servicing agreements. While we have made and continue to make changes to our

19

Table of Contents

operating policies and procedures in light of the consent orders and settlements, further changes could be required and changes to our servicing practices will increase compliance costs for our servicing business, which could materially and adversely affect our financial condition or results of operations.

On September 1, 2011 and November 10, 2011, the New York State Department of Financial Services entered into agreements regarding mortgage servicing practices with seven financial institutions. The additional requirements provided for in these agreements will increase operational complexity and the cost of servicing loans in New York. Other servicers, including us, could be required to enter into similar agreements. In addition, other states may also require mortgage servicers to enter into similar agreements. These additional costs could also materially and adversely affect our financial condition and results of operations.

Legal proceedings, state or federal governmental examinations or enforcement actions and related costs could have a material adverse effect on our liquidity, financial position and results of operations.