TLLP EX.10.2 3.31.2013

SECOND AMENDED AND RESTATED

MASTER TERMINALLING SERVICES AGREEMENT

This Second Amended and Restated Master Terminalling Services Agreement (the “Agreement”) is executed as of May 3, 2013, to be effective as of the Effective Date, by and among Tesoro Refining & Marketing Company LLC, a Delaware limited liability company (“TRMC”), Tesoro Alaska Company, a Delaware corporation (“TAK” and, together with TRMC, “Tesoro”) and Tesoro Logistics Operations LLC, a Delaware limited liability company (“TLO”).

RECITALS

WHEREAS, by virtue of their indirect ownership interests in Tesoro Logistics LP, TLO’s parent entity (the “Partnership”), each of TAK and TRMC have an economic interest in the financial and commercial success of the Partnership and its operating subsidiary, TLO; and

WHEREAS, the Parties (as defined below and in the case of TRMC, its predecessor corporate entity) entered into an Amended and Restated Master Terminalling Services Agreement as of February 22, 2013, and desire to amend and restate that agreement in its entirety as set forth herein to memorialize the terms of their ongoing commercial relationship.

NOW, THEREFORE, in consideration of the covenants and obligations contained herein, the parties to this Agreement hereby agree as follows:

Capitalized terms used throughout this Agreement shall have the meanings set forth below, unless otherwise specifically defined herein.

“Additive Facilities” has the meaning set forth in Section 17(a).

“Additized Gasoline” has the meaning set forth in Section 18(a).

“Adjusted Minimum Volume Commitment” means Tesoro’s Minimum Throughput Commitment, adjusted by deducting the applicable Stipulated Volume for each Terminal that is no longer subject to this Agreement at any time.

“Agreement” has the meaning set forth in the Preamble.

“Ancillary Services” means the following services to be provided by TLO to Tesoro: ethanol receipt (rail and truck), ethanol storage, ethanol blending, generic gasoline additization, jet additization, jet certification, lubricity/conductivity additization, Product receipt (barge), proprietary additive additization, red dye additization, transmix loading (truck) and winter flow improver additization.

“Applicable Law” means any applicable statute, law, regulation, ordinance, rule, determination, judgment, rule of law, order, decree, permit, approval, concession, grant, franchise, license, requirement, or any similar form of decision of, or any provision or condition

of any permit, license or other operating authorization issued by any Governmental Authority having or asserting jurisdiction over the matter or matters in question, whether now or hereafter in effect.

“Barrel” means a volume equal to 42 U.S. gallons of 231 cubic inches each, at 60 degrees Fahrenheit under one atmosphere of pressure.

“Base Gasoline” has the meaning set forth in Section 18(a).

“Blending Instructions” has the meaning set forth in Section 21(c).

“bpd” means Barrels per day.

“Business Day” means a day, other than a Saturday or Sunday, on which banks in New York, New York are open for the general transaction of business.

“Capacity Resolution” has the meaning set forth in Section 32(c).

“Carrier” means a third-party agent or contractor hired by Tesoro, who is in the business of transporting Products via tank trucks.

“Commencement Date” has the meaning set forth in Section 2.

“Confidential Information” means all confidential, proprietary or non-public information of a Party, whether set forth in writing, orally or in any other manner, including all non-public information and material of such Party (and of companies with which such Party has entered into confidentiality agreements) that another Party obtains knowledge of or access to, including non-public information regarding products, processes, business strategies and plans, customer lists, research and development programs, computer programs, hardware configuration information, technical drawings, algorithms, know-how, formulas, processes, ideas, inventions (whether patentable or not), trade secrets, schematics and other technical, business, marketing and product development plans, revenues, expenses, earnings projections, forecasts, strategies, and other non-public business, technological, and financial information.

“Curtailment Fee” has the meaning set forth in Section 30(b).

“DCA” has the meaning set forth in Section 18(a).

“Effective Date” means May 1, 2013.

“EPA” has the meaning set forth in Section 14(a).

“Ethanol Services” has the meaning set forth in Section 21(a).

“Excess Amounts” means, for any Month, the aggregate volumes throughput by Tesoro in excess of the Minimum Throughput Commitment, multiplied by the weighted average Terminalling Service Fee paid by Tesoro during such Month.

“Extension Period” has the meaning set forth in Section 3.

“First Offer Period” has the meaning set forth in Section 34(b).

“Force Majeure” means circumstances not reasonably within the control of TLO and which, by the exercise of due diligence, TLO is unable to prevent or overcome that prevent performance of TLO’s obligations, including: acts of God, strikes, lockouts or other industrial disturbances, wars, riots, fires, floods, storms, orders of courts or Governmental Authorities, explosions, terrorist acts, breakage, accident to machinery, equipment, storage tanks or lines of pipe, inability to obtain or unavoidable delays in obtaining material or equipment and other similar events.

“Force Majeure Notice” has the meaning set forth in Section 31(a).

“Force Majeure Period” has the meaning set forth in Section 31(a).

“Governmental Authority” means any federal, state, local or foreign government or any provincial, departmental or other political subdivision thereof, or any entity, body or authority exercising executive, legislative, judicial, regulatory, administrative or other governmental functions or any court, department, commission, board, bureau, agency, instrumentality or administrative body of any of the foregoing.

“Initial Term” has the meaning set forth in Section 3.

“LAC” has the meaning set forth in Section 18(a).

“Minimum Throughput Commitment” means the aggregate Stipulated Volume (on a monthly average basis) in bpd as set forth for all Terminals on Schedule A attached hereto; provided however, that the Minimum Throughput Commitment during the Month in which the Commencement Date occurs shall be prorated in accordance with the ratio of the number of days including and following the Commencement Date in such Month to the total number of days in such Month.

“Month” means a calendar month.

“Notice Period” has the meaning set forth in Section 30(a).

“Offer Period” has the meaning set forth in Section 32(g).

“OPIS” has the meaning set forth in Section 8(a).

“Partnership” has the meaning set forth in the Recitals of this Agreement.

“Partnership Change of Control” means Tesoro Corporation ceases to possess, directly or indirectly, the power to direct or cause the direction of the management and policies of the general partner of the Partnership, whether through ownership of voting securities, by contract, or otherwise.

“Party” or “Parties” means that each of TAK, TRMC and TLO is a “Party” and collectively are the “Parties” to this Agreement.

“Person” means any individual, partnership, limited partnership, joint venture, corporation, limited liability company, limited liability partnership, trust, unincorporated organization or Governmental Authority or any department or agency thereof.

“Product” or “Products” means the petroleum products, ethanol or biofuels, Transmix and intermediate products described herein as being handled under this Agreement.

“Receiving Party Personnel” has the meaning set forth in Section 37(d).

“Red Dye” has the meaning set forth in Section 19(a).

“Refineries” means the Tesoro refineries located in Anacortes, Washington; Kenai, Alaska; Mandan, North Dakota; Salt Lake City, Utah; and Martinez and Los Angeles, California.

“Restoration” has the meaning set forth in Section 32(b).

“Right of First Refusal” has the meaning set forth in Section 32(g).

“Shortfall Payment” has the meaning set forth in Section 7(b).

“Stipulated Volume” means the stipulated volume in bpd as set forth for each Terminal on Schedule A attached hereto.

“Storage Contract” has the meaning set forth in Section 32(g).

“Subject Tank” has the meaning set forth in Section 32(g).

“Suspension Notice” has the meaning set forth in Section 30(a).

“Tank Heels” consist of the minimum quantity of Product which either (a) must remain in a tank during all periods when the tank is available for service to keep the tank in regulatory compliance or (b) is necessary for physical operation of the tank.

“TAK” has the meaning set forth in the Preamble.

“Term” has the meaning set forth in Section 3.

“Terminalling Right of First Refusal” has the meaning set forth in Section 34(b).

“Terminalling Service Fee” means, for a particular Terminal, for any Month during the Term, the total fee per Barrel of throughput paid by Tesoro during that Month for terminalling, dedicated storage and Ancillary Services at that Terminal.

“Terminals” means the Terminals set forth on Schedule A attached hereto.

“Terminal Service Order” has the meaning set forth in Section 5(a).

Termination Notice” has the meaning set forth in Section 31(a).

“Tesoro” has the meaning set forth in the Preamble.

“Tesoro Termination Notice” has the meaning set forth in Section 31(b).

“TLO” has the meaning set forth in the Preamble.

“Transmix” has the meaning set forth in Section 13.

“TRMC” has the meaning set forth in the Preamble.

The Parties agree that the “Commencement Date” was April 26, 2011.

The initial term of this Agreement shall commence on the Commencement Date and shall continue through April 30, 2021 (the “Initial Term”); provided, however, that Tesoro may, at its option, extend the Initial Term for up to two (2) renewal terms of five (5) years each (each, an “Extension Period”) by providing written notice of its intent to TLO no less than three hundred sixty-five (365) calendar days prior to the end of the Initial Term or the then-current Extension Period. The Initial Term, and any extensions of this Agreement as provided above, shall be referred to herein as the “Term.”

| |

4. | MINIMUM THROUGHPUT COMMITMENT |

(a) During the Term and subject to the terms and conditions of this Agreement, Tesoro shall throughput the Minimum Throughput Commitment at the Terminals, and TLO shall make available to Tesoro commingled storage and throughput capacity at each respective Terminal, sufficient to allow Tesoro to throughput the Stipulated Volume of Products at such Terminal.

(b) Allocation of storage and throughput capacity for separate Products at each Terminal shall be in accordance with current practices, or as otherwise may be set forth in a Terminal Service Order, as described below.

(c) Tesoro may throughput volumes in excess of its Minimum Throughput Commitment, up to the then-available capacity of each Terminal, net of any third-party commitments, as determined by TLO at any time, which allocation of any excess capacity shall be in accordance with current practices, or as otherwise may be set forth in a Terminal Service Order, as described below.

(d) In the event at any time this Agreement is terminated as to one or more Terminals, as provided herein, then the Minimum Throughput Commitment shall thereafter be adjusted to be the Adjusted Minimum Volume Commitment.

| |

5. | TERMINAL SERVICE ORDERS |

(a) In addition to the throughput subject to the Minimum Volume Commitment set forth in this Agreement, TLO and Tesoro may enter into terminal service orders substantially in the form attached hereto as Exhibit 1 (each, a “Terminal Service Order”). Upon a request by Tesoro pursuant to this Agreement or as deemed necessary or appropriate by TLO in connection with the services to be delivered pursuant hereto, TLO shall generate a Terminal Service Order to set forth the specific terms and conditions for providing the applicable services described therein and the applicable fees to be charged for such services. No Terminal Service Order shall be effective until fully executed by both TLO and Tesoro.

(b) Items available for inclusion on a Terminal Service Order include, but are not limited to, the following:

(i) allocation of storage and throughput capacity for separate Products at each Terminal, other than pursuant to current practices;

(ii) per-Barrel fees for the volumes Tesoro throughputs at the Terminals;

(iii) if dedicated storage tanks are to be utilized and the fees payable by Tesoro therefor;

(iv) any allocation of excess capacity, other than pursuant to current practices;

(v) fees to be paid by Tesoro for the use of any allocation of excess capacity;

(vi) any Ancillary Services for each Terminal and the fees for such Ancillary Services;

(vii) any surcharge not otherwise imposed by TLO pursuant to Section 6;

(viii) any capital expenditures and related costs subject to reimbursement pursuant to Section 9;

(ix) any cleaning of tanks or the conversion of a dedicated tank to storage of a different Product pursuant to Section 9 and the fees related thereto;

(x) any Transmix handling fees pursuant to Section 13;

(xi) any special or proprietary additive injection services or higher additive injection rates and the fees for such services pursuant to Sections 16 and 18;

(xii) any fees to be paid by Tesoro to TLO for lubricity and conductivity additive and injection services (including DCA injection) provided pursuant to Section 17 and 18 for Low Sulfur Diesel/Ultra Low Sulfur Diesel Fuel delivered to trucks for Tesoro’s account;

(xiii) any fees for the operation of special additive equipment described in Section 20;

(xiv) the receipt, storage and blending of ethanol into Tesoro’s gasoline pursuant to Section 21;

(xv) the reimbursement of any costs incurred by TLO for periodic software updates, replacement of loading systems or software or other upgrades pursuant to Section 22; and

(xvi) any dedicated storage to be provided and applicable fees therefor.

(c) Any fees set forth in this Agreement and any Terminal Service Order shall be increased on July 1 of each year of the Term, by a percentage equal to the greater of zero or the positive change in the CPI-U (All Urban Consumers), as reported by the U.S. Bureau of Labor Statistics.

(d) In case of any conflict between the terms of this Agreement and the terms of any Terminal Service Order, the terms of the applicable Terminal Service Order shall govern.

If, during the Term, any existing laws or regulations are changed or any new laws or regulations are enacted that require TLO to make substantial and unanticipated expenditures (whether capitalized or otherwise) with respect to the Terminals, TLO may impose a monthly surcharge, as set forth in a Terminal Service Order, to cover Tesoro’s pro rata share of the cost of complying with these laws or regulations, based upon the percentage of Tesoro’s use of the services or facilities impacted by such new laws or regulations. TLO and Tesoro shall use their reasonable commercial efforts to comply with these laws and regulations, and shall negotiate in good faith to mitigate the impact of these laws and regulations and to determine the level of the monthly surcharge.

| |

7. | PAYMENT; SHORTFALL PAYMENTS |

(a) TLO shall invoice Tesoro on a monthly basis and Tesoro shall pay all amounts due under this Agreement and any Terminal Service Order (including Shortfall Payments and Curtailment Fees, each as defined herein) no later than ten (10) calendar days after Tesoro’s receipt of TLO’s invoices. Any past due payments owed by Tesoro to TLO shall accrue interest, payable on demand, at the rate of eight percent (8%) per annum from the due date of the payment through the actual date of payment.

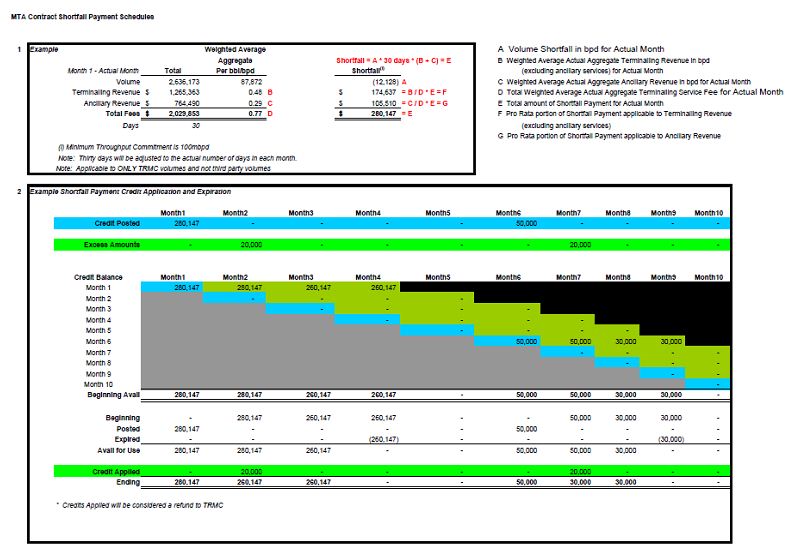

(b) If, during any Month during the Term, Tesoro throughputs aggregate volumes less than the Minimum Throughput Commitment for such Month, then Tesoro shall pay TLO an amount (a “Shortfall Payment”) for any shortfall. Shortfall Payments shall be equal to the weighted average Terminalling Service Fee paid by Tesoro during that Month across all of the Terminals, multiplied by the aggregate monthly shortfall across all Terminals. The dollar amount of any Shortfall Payment paid by Tesoro shall be posted as a credit to Tesoro’s account and may be applied against any Excess Amounts owed by Tesoro during any of the succeeding three (3) Months. For informational purposes only, attached as Exhibit 2 hereto is a sample calculation demonstrating the Shortfall Payment and its application. Credits will be applied in the order in which such credits accrue and any remaining portion of the credit that is not used by Tesoro during the succeeding three (3) Months shall expire (e.g., a credit that accrues in January will be available in February, March and April, will expire at the end of April, and must be applied prior to applying any credit which accrues in February).

(c) If at any time during the Term, any tank, rack or other equipment or facility of TLO that is dedicated to Tesoro or otherwise being used to provide services hereunder, is removed from service for reasons other than routine repair and maintenance, and if removal of such tank, rack or other equipment or facility from service restricts Tesoro from being able to throughput its Stipulated Volume and receive associated Ancillary Services at the Terminal where such tank, rack or other equipment or facility is located, then until such tank, rack or other equipment or facility is restored to service, Tesoro’s Minimum Throughput Commitment shall be reduced by the difference between the Stipulated Volume and the amount that Tesoro can effectively throughput at such location without restriction until such tank, rack or other equipment or facility is restored to service.

(a) With respect only to the Anchorage, Boise, Burley, Stockton and Vancouver Terminals and on a per Terminal basis, not based on the aggregate of all Terminals, TLO shall bear the risk of any actual volume losses of each Product to the extent that such losses exceed 0.25% of the volumes of such Product received at the Terminal, to be pro rated among users of such Terminal, during any Month during the Term. Volumes and losses of each Product shall be determined and accounted for as of the end of each Month. To the extent that actual losses of any Product are less than 0.25% during any particular Month, Tesoro shall repurchase from TLO the difference between the actual loss and the 0.25% allowance at a price per Barrel for that Product as reported by the Oil Price Information Service (“OPIS”) using the monthly average OPIS unbranded contract rack posting for that Product during the Month in which the volume difference was accounted for. All such sales shall be “AS IS”, “WHERE IS”, without any warranty, express or implied, including warranties of merchantability, fitness or title, all of which are expressly excluded. If volume losses of any Product exceed 0.25% during any particular Month, TLO shall pay Tesoro for the difference between the actual loss and the 0.25% allowance at a price per Barrel for that Product as reported by OPIS using the monthly average OPIS unbranded contract rack posting for that Product during the Month in which the volume difference was accounted for. Deliveries on Saturday, Sunday or federal holidays shall be excluded from the calculation for the applicable Month.

(b) For all other Terminals, TLO shall have no obligation to measure volume gains and losses and shall have no liability whatsoever for physical losses, except if such losses are caused by the gross negligence or willful misconduct of TLO, as further described in Section 27 herein.

(a) Tesoro shall reimburse TLO for: (i) the actual cost of any regulatory fees incurred by TLO based on Tesoro’s proportionate share of the actual volumes Tesoro throughputs based upon the percentage of Tesoro’s use of the services or facilities impacted by regulatory fees; (ii) the actual cost of any capital expenditures that TLO agrees to make upon Tesoro’s request pursuant to a Terminal Service Order to provide services hereunder, other than capital expenditures required for TLO to continue to provide those services specified hereunder; and (iii) the actual cost of any third-party fees, including port fees, incurred in connection with carrying out the terms of this Agreement or any Terminal Service Order.

(b) If cleaning of any tanks is performed by TLO at the specific request of Tesoro, a Terminal Service Order shall provide for Tesoro to bear (or reimburse TLO) for all costs to clean, degas or otherwise prepare the tank(s) including, without limitation, the cost of removal, processing, transportation, disposal, of all waste and the cost of any taxes or charges TLO may be required to pay in regard to such waste. For any tanks that are dedicated to Tesoro for segregated storage of Tesoro’s Products as set forth in any Terminal Service Order, Tesoro agrees to reimburse TLO for the reasonable cost of changes necessary to return the segregated storage tanks to TLO on termination of their dedication for segregated storage under this Agreement or any Purchase order, in the same condition as originally received less normal wear and tear. If Tesoro requests that any such dedicated tank be converted to storage of a different Product, then a Purchase order shall provide for Tesoro to be responsible for reimbursing TLO for all costs of such conversion, including all costs to clean, degas or otherwise prepare the tank(s) including, without limitation, the cost of removal, processing, transportation, disposal, of all waste and the cost of any taxes or charges TLO may be required to pay in regard to such waste. Tesoro shall not be responsible to TLO for any throughput fees and dedicated tank storage fees associated with any dedicated storage tanks taken out of service during the period that such tank is out of service.

(c) All of the foregoing reimbursements shall be made in accordance with the payment terms set forth in Section 7(a) herein.

| |

10. | CUSTODY TRANSFER AND TITLE |

(a) Pipeline

(i) Receipts. For Product received into a Terminal by pipeline, custody of the Product shall pass to TLO at the flange where it enters the Terminal’s receiving line. For receipts of Product at a Terminal rack at Mandan, Salt Lake City or Wilmington, custody shall transfer at the point where the pipeline from the Refinery crosses onto the property controlled by TLO.

(ii) Deliveries. For Product delivered by a Terminal into pipeline, custody of the Product shall pass to Tesoro at the flange where it exits the Terminal’s delivery line.

(b) Rail Receipts. For Product received by rail, custody shall pass to TLO when the locomotive used to transfer Tesoro’s rail cars to the Terminal is uncoupled from such rail cars at the Terminal.

(c) Truck. For receipts and deliveries to or from trucks, custody shall pass at the flange where the hoses at TLO’s facility interconnect with the truck.

(d) Marine. For receipts and deliveries to or from marine vessel at Vancouver, custody shall pass at the flange where TLO’s facility interconnects with the hoses connected to the marine vessel; for receipts and deliveries to or from marine vessel at Anchorage, custody shall pass at the flange where TLO’s facility interconnects with the Port of Anchorage Valve Yard.

(e) General. Upon re-delivery of any Product to Tesoro’s account, Tesoro shall become solely responsible for any loss, damage or injury to person or property or the environment, arising out of transportation, possession or use of such Product after transfer of custody and the loss allowance provisions hereof shall apply to Product while in TLO’s custody. Title to all Tesoro’s Product received in the Terminals shall remain with Tesoro at all times. Both Parties acknowledge that this Agreement and any Terminal Service Orders represent a bailment of Products by Tesoro to TLO and not a consignment of Products, it being understood that TLO has no authority hereunder to sell or seek purchasers for the Products of Tesoro, except as provided in Section 8 above and Section 13 below. Tesoro hereby warrants that it shall, at all times, have good title to and the right to deliver, throughput, store and receive Products pursuant to the terms of this Agreement or any applicable Terminal Service Order.

(a) Tesoro warrants that all Products delivered under this Agreement or any Purchaser Order shall meet the latest applicable pipeline specifications or otherwise mutually agreed upon specifications for that Product upon receipt at the applicable Terminal and contain no deleterious substances or concentrations of any contaminants that may make it or its components commercially unacceptable in general industry application. Tesoro shall not deliver to any of the Terminals any Products which: (i) would in any way be injurious to any of the Terminals; (ii) would render any of the Terminals unfit for the proper storage of similar Products; (iii) would contaminate or otherwise downgrade the quality of the Products stored in commingled storage; (iv) may not be lawfully stored at the Terminals; or (v) otherwise do not meet applicable Product specifications for such Product that are customary in the location of the Terminal. If, however, there are Products that do not have such applicable specifications, the specifications shall be mutually agreed upon by the Parties. Should Tesoro’s commingled Products not meet or exceed the minimum quality standards set forth in this Agreement or any applicable Terminal Service Order, Tesoro shall be liable for all loss, damage and cost incurred thereby, including damage to Products of third parties commingled with Tesoro’s unfit Products.

(b) TLO shall have the right to store compatible Products received for Tesoro’s account with Products belonging to TLO or third parties in TLO’s commingled storage tanks. TLO shall handle Tesoro’s fungible Products in accordance with TLO’s prevailing practices and procedures for handling such Products. The quality of all Products tendered into commingled storage for Tesoro’s account shall be verified either by Tesoro’s refinery analysis or supplier’s certification, such that Products so tendered shall meet TLO’s Product specifications. All costs for such analysis shall be borne solely by Tesoro. TLO shall have the right to sample any Product tendered to the Terminals hereunder. The cost of such sampling shall be borne solely by TLO. All Products returned to Tesoro shall meet or exceed Product specifications in effect on the date the Products are delivered to Tesoro. Notwithstanding any other provision herein, any and all Products that leave the Terminals shall meet all relevant ASTM, EPA, federal and state specifications, and shall not leave the Terminals in the form of a sub-octane grade Product.

(c) TLO shall exercise reasonable care to ensure that all Products delivered by third parties into commingled storage with Tesoro’s Products meet applicable Product specifications for such Product that are customary in the location of the Terminal. In the event that Tesoro’s Products are commingled with third-party Products that do not meet or exceed the minimum quality standards set forth in this Agreement or any Terminal Service Order, TLO shall be liable for all loss, damage and cost incurred thereby.

All quantities of Products received or delivered by or into truck, rail, or marine vessel shall be measured and determined based upon the meter readings at each Terminal, as reflected by delivery tickets or bills of lading, or if such meters are unavailable, by applicable calibration tables. All quantities of Products received and delivered by pipeline at each Terminal shall be measured and determined based upon the meter readings of the pipeline operator, as reflected by delivery tickets, or if such meters are unavailable, by applicable calibration tables. Deliveries to a Terminal rack at Mandan, Salt Lake City or Wilmington from a Refinery shall be deemed to be the same as the corresponding volumes delivered contemporaneously from the Terminal rack. Deliveries by book transfer shall be reflected by entries in the books of TLO. All quantities shall be adjusted to net gallons at 60° F in accordance with ASTM D-1250 Petroleum Measurement Tables, or latest revisions thereof. Meters and temperature probes shall be calibrated according to applicable API standards. Tesoro shall have the right, at its sole expense, and in accordance with rack location procedure, to independently certify such calibration. Storage tank gauging shall be performed by TLO’s personnel. TLO’s gauging shall be deemed accurate unless challenged by an independent certified gauger. Tesoro may perform joint gauging at its sole expense with TLO’s personnel at the time of delivery or receipt of Product, to verify the amount involved. If Tesoro should request an independent gauger, such gauger must be acceptable to TLO and such gauging shall be at Tesoro’s sole expense.

| |

13. | PRODUCT DOWNGRADE AND INTERFACE |

Product downgraded as a result of ordinary Terminal or pipeline operations including line flushing, rack meter provings or other necessary Terminals operations shall not constitute losses for which TLO is liable to Tesoro. TLO shall account for the volume of Product downgraded, and Tesoro’s inventory of Products and/or interface shall be adjusted, provided that, in some cases interface volume (“Transmix”) received shall be ratably shared between Tesoro and other customers receiving Products in the same shipment or stored in commingled storage. Tesoro shall remove its Transmix upon notice from TLO and shall be subject to applicable Transmix handling fees upon its removal, as provided in a Terminal Service Order. If Transmix is not removed within fifteen (15) Business Days after notification, TLO shall have the right to sell such Transmix at market rates and return any proceeds to Tesoro, less applicable Transmix handling fees and delivery costs in effect at the time of such sale.

| |

14. | PRODUCT DELIVERIES, RECEIPTS AND WITHDRAWALS |

(a) All supervised deliveries, receipts and withdrawals hereunder shall be made within the normal business hours of each Terminal and at such times as may be required by Tesoro upon prior notice and approval by TLO, all in accordance with the agreed-upon scheduling. Unsupervised deliveries, receipts and withdrawals shall be made only with TLO’s prior approval and in strict accordance with TLO’s current operating procedures for the Terminals. Tesoro warrants that all vehicles permitted to enter the Terminals on behalf of Tesoro shall meet all requirements and standards promulgated by applicable regulatory authority including the Department of Transportation, the Occupational Safety and Health Administration, and the Environmental Protection Agency (the “EPA”). Tesoro further warrants that it shall only send to the Terminals those employees, agents and other representatives acting on behalf of and at Tesoro’s direction who have been properly instructed as to the characteristics and safe hauling methods associated with the Products to be loaded and hauled. Tesoro further agrees to be responsible to TLO for the performance under this Agreement or any Terminal Service Order by its agents and/or representatives receiving or delivering Products at the Terminals.

(b) Tesoro shall withdraw from the Terminals only those Products that it is authorized to withdraw hereunder. Tesoro shall neither duplicate nor permit the duplication of any loading device (i.e., card lock access) provided hereunder. Tesoro shall be fully and solely responsible for all Products loaded through the use of the loading devices issued to Tesoro in accordance with this Agreement or pursuant to any Terminal Service Order; provided, however; that Tesoro shall not have any responsibility or liability hereunder in the event that the load authorization system provided hereunder fails or malfunctions in any way unless a credit department override is provided, which authorizes Tesoro to load the Products.

(c) Both Parties shall abide by all federal, state and local statutes, laws and ordinances and all rules and regulations which are promulgated by TLO and which are either furnished to Tesoro or posted at the Terminals, with respect to the use of the Terminals as herein provided. It is understood and agreed by Tesoro that these rules and regulations may be changed, amended or modified by TLO at any time. All changes, amendments and

modifications shall become binding upon Tesoro ten (10) days following the posting of a copy at the affected Terminals or the receipt by Tesoro of a copy, whichever occurs sooner.

(d) For all purposes hereunder, Tesoro’s jobbers, distributors, Carriers, haulers and other customers designated in writing or otherwise by Tesoro to have loading privileges under this Agreement or any Terminal Service Order or having possession of any loading device furnished to Tesoro pursuant to this Agreement or any Terminal Service Order, together with their respective officers, servants and employees, shall, when they access the Terminals, be deemed to be representatives of Tesoro.

| |

15. | DELIVERIES INTO TRANSPORT TRUCKS |

Prior to transporting any Products loaded into transport trucks at the Terminals, TLO shall make or cause to be made, the following certifications on the delivery receipt or bill of lading covering the Products received:

“If required by 49 CFR 172.204, this is to certify that the above-named materials are properly classified, described, packaged, marked and labeled, and are in proper condition for transportation according to the applicable regulations of the Department of Transportation. Carrier hereby certifies that the cargo tank used for this shipment is a proper container for the commodity loaded therein and complies with Department of Transportation specifications and certifies that cargo tank is properly placarded and marked to comply with regulations pertaining to hazardous materials.”

TLO may require each Carrier coming into the Terminals to expressly agree in writing to be bound by the provisions of a carrier access agreement with respect to withdrawals and loading of Products hereunder or thereunder, to conduct its operations at the Terminals in a safe manner, in accordance with all Applicable Law.

At each Terminal, TLO shall provide equipment for the injection of generic additives, as provided below. Subject to the other provisions set forth herein, and the availability of suitable space in a Terminal and its equipment, Tesoro shall have the option of installing its own proprietary additive systems at the Terminals which TLO shall operate, or utilizing the generic additive service provided by TLO, or a combination of both. Tesoro shall designate pursuant to a Terminal Service Order which additive injection service it desires. TLO shall be responsible for providing generic additives as provided herein, and Tesoro shall be responsible for providing any special or proprietary additives requested by Tesoro.

| |

17. | LUBRICITY AND CONDUCTIVITY ADDITIVE |

(a) TLO owns, maintains and operates diesel lubricity and conductivity additive injection facilities (the “Additive Facilities”) at each of the Terminals. TLO shall continue to maintain and operate such Additive Facilities in accordance with customary industry standards during the Term or pursuant to an applicable Terminal Service Order, including all required reporting and record keeping prescribed by Applicable Law.

(b) During the Term or pursuant to an applicable Terminal Service Order, TLO shall arrange for purchase and delivery of any and all required lubricity and conductivity additive for injection through the Additive Facilities at the Terminals.

(c) During the Term or pursuant to an applicable Terminal Service Order, TLO shall inject into all Ultra Low Sulfur Diesel delivered to Tesoro at the Terminals an amount of lubricity and conductivity additive that TLO determines to be sufficient to comply with current ASTM diesel lubricity and conductivity specifications. TLO shall, upon request, provide Tesoro with documentation of additive specifications and additive injection, which TLO shall keep on file at each Terminal.

| |

18. | DCA ADDITIVE INJECTION |

(a) All gasoline Product leaving the Terminals shall be additized (“Additized Gasoline”). As an exception, TLO shall accommodate a request from Tesoro to lift base gasoline from the Terminals. In that case, the bill of lading issued by TLO shall label all such Product as base gasoline (“Base Gasoline”). TLO shall provide a generic Deposit Control Additive (“DCA”) injection service, including all required reporting and record keeping prescribed by Applicable Law. The additive supplied shall be a an EPA certified DCA. Subject to the other provisions hereof, Tesoro may request TLO to instead inject a different proprietary DCA into certain gasoline delivered hereunder, instead of the generic DCA provided by TLO, and TLO shall accommodate such requests pursuant to a Terminal Service Order specifying the specific additization required and fees to be charged for its injection, subject to Tesoro providing a suitable Additized Gasoline system for such proprietary additive. TLO shall ensure that such additive is injected into all appropriate gasoline Product delivered to Tesoro at a rate no lower than the Lowest Allowable Concentration (“LAC”) at which such additive was certified. The gasoline additization rate shall be determined by Tesoro, but shall not be less than 1.1 times the LAC specified by the respective additive manufacturer or supplier.

(b) Notwithstanding the above, Tesoro shall be solely responsible for registering with the EPA or any other government agency its use of generic or proprietary additive in its fuels, as required by Applicable Law. Tesoro shall submit, to each applicable Terminal, evidence of registration in compliance with 40 C.F.R. Part 80. Tesoro shall also be responsible for full compliance with any quarterly or other regulatory reporting, and any other requirements under Applicable Law, rule or regulation related to use of generic or proprietary additive in Tesoro’s Product.

(a) TLO shall provide a generic red dye additive (“Red Dye”) injection service for diesel, including all required reporting and recordkeeping prescribed by Applicable Law. TLO shall be responsible for determining the injection rates, Red Dye inventory levels, meter readings, and calculations of actual treat rates, in compliance with the minimum levels prescribed by the Internal Revenue Service.

(b) Tesoro is responsible for designating which of its accounts shall be authorized to use Red Dye diesel injection services. TLO equipment shall enable designated Carriers and accounts to inject Red Dye upon request prior to loading diesel Product at Terminals. Tesoro’s Carrier shall be solely responsible for designating that a load of diesel Product be injected with Red Dye, and TLO shall have no liability with regard to whether a load of Product is additized with Red Dye. TLO shall not be responsible for any loss, damage or liability that arises from Carrier injecting or failing to inject Red Dye into Tesoro’s Product.

| |

20. | SPECIAL ADDITIVE EQUIPMENT |

As set forth in a Terminal Service Order, and subject to the other provisions set forth herein and the availability of suitable space in a Terminal, TLO shall install and maintain at the Terminals, at Tesoro’s sole risk, cost and expense, such special additive equipment as may be desirable for Products to be delivered to Tesoro's account hereunder. The engineering and installation of any fixture, equipment or appurtenance placed on the Terminals in respect thereof shall be subject to TLO’s prior approval and supervision. During the Term, TLO shall operate the special additive equipment with any fees therefor to be set forth in a Terminal Service Order.

(a) Any such gasoline additive system shall include one above ground storage tank (and any necessary modifications thereto), one additive injection pump, any and all necessary piping and injectors. For the avoidance of doubt, the above ground storage tank shall be supplied by Tesoro.

(b) Subject to the supervision of TLO, TLO or its designee shall install the additive system. Tesoro shall be responsible for 100% of all costs of the Additized Gasoline system, including without limitation, costs associated with any required piping, nozzles, fittings, equipment, injection panels, labor and/or installation thereof, and if any existing load rack equipment will not support such additional additive system, then Tesoro shall bear all costs of enlarging or renovating such load rack to support the additional additive system requested by Tesoro pursuant to a Terminal Service Order. Tesoro shall reimburse TLO for all such costs within ten days after receipt of an invoice from TLO for such costs. Upon completion of the installation of the Additized Gasoline system, the Additized Gasoline system shall become the property of TLO, free and clear of any security interest or lien.

(c) Tesoro shall reimburse TLO for any and all necessary modifications to an additional additive system required by Tesoro during the Term.

| |

21. | ETHANOL BLENDING SERVICES |

(a) Where ethanol receiving, storage and blending facilities are available at a Terminal, and upon Tesoro’s request pursuant to a Terminal Service Order, TLO shall receive, store and blend ethanol into Tesoro’s gasoline at a Terminal (“Ethanol Services”). TLO shall provide and operate all equipment required for the Ethanol Services. The equipment shall consist of truck and/or rail unloading racks, tanks, pumps, motors, injectors, computer control, and any other ancillary equipment necessary for the providing of the Ethanol Services.

(b) Tesoro shall be solely responsible for supplying inventories of ethanol at its own expense, including the scheduling and transporting of ethanol into the Terminals, subject to mutually agreeable notice and scheduling procedures. TLO shall receive Tesoro’s ethanol into fungible ethanol storage at the Terminal.

(c) Upon a request from Tesoro for Ethanol Services, a Terminal Service Order shall provide the desired blending ratio of ethanol to gasoline at each applicable Terminal, including the minimum Octane (R+M/2) rating (“Blending Instructions”), for each grade of Tesoro’s gasoline Product, prior to blending. TLO shall not change the blending ratios without the prior written authorization of Tesoro.

(d) TLO shall maintain for a minimum of five (5) years written or electronic records of the type and volume of oxygenate blended into Tesoro’s gasoline.

(e) TLO shall maintain an industry standard quality assurance oversight program of the ethanol blending process. TLO shall provide Tesoro with an end-of-year report that, at a minimum, summarizes the volume of Tesoro’s gasoline received by TLO, the volume of oxygenate added to Tesoro’s gasoline, and total volume of blended gasoline. TLO will provide such report within fifteen (15) Business Days of Tesoro’s request.

(f) TLO shall allow Tesoro or its agents to monitor the oxygenate blending operation by periodic audit, sampling, testing and/or records review to ensure the overall volumes and type of oxygenate blended into gasoline is consistent with the oxygenate claimed by Tesoro as required by 40 CFR 80.101(d)(4)(ii)(B)(2). The scope and type of such audits will be negotiated in good faith by the Parties in advance via written notice.

(g) TLO shall rely on Blending Instructions and data provided by Tesoro in performing its obligations under this Agreement and any Terminal Service Order. Tesoro agrees to be solely responsible for all claims arising from TLO’s use of or reliance on these Blending Instructions and data.

(h) When performing the Ethanol Services as per Tesoro’s Blending Instructions, TLO shall not certify to Tesoro or any third-party that blended gasoline does or shall meet ASTM D 4814 or any federal, state, or local regulatory specifications. Tesoro agrees that it is receiving from TLO the Blended Gasoline in an “AS IS, WHERE IS” condition without warranties of any kind, including any warranties of merchantability or fitness for a particular purpose, or its ability to meet ASTM or regulatory specifications.

| |

22. | ACCOUNTING PROVISIONS AND DOCUMENTATION |

(a) TLO shall furnish Tesoro with the following reports covering services hereunder involving Tesoro’s Products:

(i) within ten (10) Business Days following the end of the Month, a statement showing, by Product: (A) Tesoro’s monthly aggregate deliveries into the Terminals; (B) Tesoro’s monthly receipts from the Terminals; (C) calculation of all Tesoro’s monthly storage and handling fees; (D) Tesoro’s opening inventory for the preceding Month; (E) appropriate monthly loss allowance adjustments (as applicable in accordance with Section 8); and (vi) Tesoro’s closing inventory for the preceding Month;

(ii) a copy of any meter calibration report, to be available for inspection upon reasonable request by Tesoro at the Terminals following any calibration;

(iii) upon delivery from the Terminals, a hard copy bill of lading to the Carrier for each truck, barge, or rail delivery. Upon reasonable request only, a hard copy bill of lading shall be provided to Tesoro’s accounting group. Upon each truck delivery from the Terminals, bill of lading information shall be sent electronically through General Electric Information Services Petroex System or other mutually agreeable system;

(iv) for each marine shipment, all bills of lading (or other appropriate document in the case of barges) and inspection reports (if conducted by independent inspector); and

(v) transfer documents for each in-tank transfer.

(b) TLO shall be required to maintain the capabilities to support truck load authorization technologies at each Terminal. However, costs incurred by TLO for periodic software updates, replacement of loading systems or software or other upgrades made at the request of Tesoro shall be recoverable from Tesoro pursuant to a Terminal Service Order either as a lump sum payment or through an increase in terminalling fees. Notwithstanding the foregoing, if an update, replacement or upgrade is made other than at Tesoro’s request, TLO and Tesoro shall mutually agree pursuant to a Terminal Service Order on a fee for such update, replacement or upgrade.

| |

23. | AUDIT AND CLAIMS PERIOD |

Each Party and its duly authorized agents and/or representatives shall have reasonable access to the accounting records and other documents maintained by the other Party which relate to this Agreement and any Terminal Service Order, and shall have the right to audit such records at any reasonable time or times during the Term and for a period of up to three years after termination of this Agreement or any applicable Terminal Service Order. Claims as to shortage in quantity or defects in quality shall be made by written notice within ninety (90) days after the delivery in question or shall be deemed to have been waived.

TLO hereby waives, relinquishes and releases any and all liens, including without limitation, any and all warehouseman’s liens, custodian’s liens, rights of retention and/or similar rights under all applicable laws, which TLO would or might otherwise have under or with respect to the Products throughput, stored or handled hereunder. TLO further agrees to furnish documents reasonably acceptable to Tesoro and its lender(s) (if applicable), and to cooperate with Tesoro in assuring and demonstrating that Products titled in Tesoro’s name shall not be subject to any lien on the Terminals or TLO’s Products throughput or stored there.

| |

25. | NEWLY IMPOSED TAXES AND REGULATORY FEES |

(a) Tesoro shall promptly pay or reimburse TLO for any newly imposed taxes, levies, royalties, assessments, licenses, fees, charges, surcharges and sums due of any nature whatsoever (other than income taxes, gross receipt taxes and similar taxes) imposed by any federal, state or local government or agency that TLO incurs on Tesoro’s behalf for the services provided by TLO under this Agreement or any Terminal Service Order. If TLO is required to pay any of the foregoing, Tesoro shall promptly reimburse TLO in accordance with the payment terms set forth in this Agreement or any Terminal Service Order.

(b) Upon written request by TLO, Tesoro shall supply TLO with a completed signed original notification certificate of gasoline and diesel fuel registrant as required by the Internal Revenue Service’s excise tax regulation. Tesoro further agrees to comply with all Applicable Law with respect to such taxes.

(c) If Tesoro is exempt from the payment of any taxes allocated to Tesoro under the foregoing provisions, Tesoro shall furnish TLO with the proper exemption certificates.

| |

26. | LIMITATION ON LIABILITY |

Notwithstanding anything to the contrary contained herein, neither Party shall be liable or responsible to the other Party or such other Party’s affiliated Persons for any consequential, incidental, or punitive damages, or for loss of profits or revenues (collectively referred to as “special damages”) incurred by such Party or its affiliated Persons that arise out of or relate to this Agreement, REGARDLESS OF WHETHER ANY SUCH CLAIM ARISES UNDER OR RESULTS FROM CONTRACT, NEGLIGENCE, OR STRICT LIABILITY OF THE PARTY WHOSE LIABILITY IS BEING WAIVED HEREBY; provided that the foregoing limitation is not intended and shall not affect special damages imposed in favor of unaffiliated Persons that are not Parties to this Agreement.

(a) Notwithstanding anything else contained in this Agreement or any Terminal Service Order, TLO shall release, defend, protect, indemnify, and hold harmless Tesoro from and against any and all demands, claims (including third-party claims), losses, costs, suits, or causes of action (including, but not limited to, any judgments, losses, liabilities, fines, penalties, expenses, interest, reasonable legal fees, costs of suit, and damages, whether in law or equity and

whether in contract, tort, or otherwise) for or relating to (i) personal or bodily injury to, or death of the employees of Tesoro and, as applicable, its Carriers, customers, representatives, and agents, (ii) loss of or damage to any property, products, material, and/or equipment belonging to Tesoro and, as applicable, its Carriers, customers, representatives, and agents, and each of their respective affiliates, contractors, and subcontractors (except for those volume losses of Products provided for in Section 8), (iii) loss of or damage to any other property, products, material, and/or equipment of any other description (except for those volume losses of Products provided for in Section 8), and/or personal or bodily injury to, or death of any other Person or Persons; and with respect to clauses (i) through (iii) above, which is caused by or resulting in whole or in part from the acts and omissions of TLO in connection with the ownership or operation of the Terminals and the services provided hereunder, and, as applicable, its carriers, customers (other than Tesoro), representatives, and agents, or those of their respective employees with respect to such matters, and (iv) any losses incurred by Tesoro due to violations of this Agreement or any Terminal Service Order by TLO, or, as applicable, its customers (other than Tesoro), representatives, and agents; PROVIDED THAT TLO SHALL NOT BE OBLIGATED TO INDEMNIFY OR HOLD HARMLESS TESORO FROM AND AGAINST ANY CLAIMS TO THE EXTENT THEY RESULT FROM THE BREACH OF CONTRACT, GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF TESORO.

(b) Notwithstanding anything else contained in this Agreement or any Terminal Service Order, Tesoro shall release, defend, protect, indemnify, and hold harmless TLO and, and each of its respective affiliates, officers, directors, shareholders, agents, employees, successors-in-interest, and assignees from and against any and all demands, claims (including third-party claims), losses, costs, suits, or causes of action (including, but not limited to, any judgments, losses, liabilities, fines, penalties, expenses, interest, reasonable legal fees, costs of suit, and damages, whether in law or equity and whether in contract, tort, or otherwise) for or relating to (i) personal or bodily injury to, or death of the employees of TLO and, as applicable, its carriers, customers, representatives, and agents; (ii) loss of or damage to any property, products, material, and/or equipment belonging to TLO and, as applicable, its carriers, customers, representatives, and agents, and each of their respective affiliates, contractors, and subcontractors (except for those volume losses of Products provided for in Section 8); (iii) loss of or damage to any other property, products, material, and/or equipment of any other description (except for those volume losses of Products provided for in Section 8), and/or personal or bodily injury to, or death of any other Person or Persons; and with respect to clauses (i) through (iii) above, which is caused by or resulting in whole or in part from the acts and omissions of Tesoro, in connection with Tesoro’s and its customers’ use of the Terminals and the services provided hereunder and Tesoro’s Products stored hereunder, and, as applicable, its Carriers, customers, representatives, and agents, or those of their respective employees with respect to such matters; and (iv) any losses incurred by TLO due to violations of this Agreement or any Terminal Service Order by Tesoro, or, as applicable, its Carriers, customers, representatives, and agents; PROVIDED THAT TESORO SHALL NOT BE OBLIGATED TO INDEMNIFY OR HOLD HARMLESS TLO FROM AND AGAINST ANY CLAIMS TO THE EXTENT THEY RESULT FROM THE BREACH OF CONTRACT, GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF TLO. For the avoidance of doubt, nothing herein shall constitute a release by Tesoro of any volume losses that are caused by the TLO’s gross negligence, breach of this Agreement or any Terminal Service Order or willful misconduct.

(a) At all times during the Term and for a period of two (2) years after termination of this Agreement for any coverage maintained on a “claims-made” or “occurrence” basis, Tesoro and/or its Carrier (if applicable) shall maintain at their expense the below listed insurance in the amounts specified below which are minimum requirements. Tesoro shall require that Carrier cause all of its contractors providing authorized drivers or authorized vehicles, to carry such insurance, and Tesoro shall be liable to TLO for their failure to do so. Such insurance shall provide coverage to TLO and such policies, other than Worker’s Compensation Insurance, shall include TLO as an Additional Insured. Each policy shall provide that it is primary to and not contributory with any other insurance, including any self-insured retention, maintained by TLO (which shall be excess) and each policy shall provide the full coverage required by this Agreement and any Terminal Service Order. All such insurance shall be written with carriers and underwriters acceptable to TLO, and eligible to do business in the states where the Terminals are located and having and maintaining an A.M. Best financial strength rating of no less than “A-” and financial size rating no less than “VII”; provided that Tesoro and/or the Carrier may procure worker’s compensation insurance from the state fund of the state where the Terminal(s) are located. All limits listed below are required MINIMUM LIMITS:

(i) Workers Compensation and Occupational Disease Insurance which fully complies with Applicable Law of the state where each Terminal is located, in limits not less than statutory requirements;

(ii) Employers Liability Insurance with a minimum limit of $1,000,000 for each accident, covering injury or death to any employee which may be outside the scope of the worker’s compensation statute of the jurisdiction in which the worker’s service is performed, and in the aggregate as respects occupational disease;

(iii) Commercial General Liability Insurance, including contractual liability insurance covering Carrier’s indemnity obligations under this Agreement or any Terminal Service Order, with minimum limits of $1,000,000 combined single limit per occurrence for bodily injury and property damage liability, or such higher limits as may be required by TLO or by Applicable Law from time to time. This policy shall include Broad Form Contractual Liability insurance coverage which shall specifically apply to the obligations assumed in this Agreement and any Terminal Service Order by Tesoro;

(iv) Automobile Liability Insurance covering all owned, non-owned and hired vehicles, with minimum limits of $1,000,000 combined single limit per occurrence for bodily injury and property damage liability, or such higher limit(s) as may be required by Tesoro or by Applicable Law from time to time. Coverage must assure compliance with Sections 29 and 30 of the Motor Carrier Act of 1980 and all applicable rules and regulations of the Federal Highway Administration’s Bureau of Motor Carrier Safety and Interstate Commerce Commissioner (Form MCS 90 Endorsement). Limits of liability for this insurance must be in accordance with the financial responsibility requirement of the Motor Carrier Act, but not less than $1,000,000 per occurrence;

(v) Excess (Umbrella) Liability Insurance with limits not less than $4,000,000 per occurrence. Additional excess limits may be utilized to supplement inadequate limits in the primary policies required in items (ii), (iii), and (iv) above;

(vi) Pollution Legal Liability with limits not less than $25,000,000 per loss with an annual aggregate of $25,000,000. Coverage shall apply to bodily injury and property damage including loss of use of damaged property and property that has not been physically injured; cleanup costs, defense, including costs and expenses incurred in the investigation, defense or settlement of claim; and

(vii) Property Insurance, with a limit of no less than $1,000,000, which property insurance shall be first-party property insurance to adequately cover Tesoro’s owned property; including personal property of others.

(b) All such policies must be endorsed with a Waiver of Subrogation endorsement, effectively waiving rights of recovery under subrogation or otherwise, against TLO, and shall contain where applicable, a severability of interest clause and a standard cross liability clause.

(c) Upon execution of this Agreement and prior to the operation of any equipment by Tesoro, Carrier or its authorized drivers at the Terminals, Tesoro and/or Carrier will furnish to TLO, and at least annually thereafter (or at any other times upon request by TLO) during the Term (and for any coverage maintained on a “claims-made” basis, for two (2) years after the termination of this Agreement or any applicable Terminal Service Order), insurance certificates and/or certified copies of the original policies to evidence the insurance required herein, including on behalf of Carrier’s contractors providing authorized vehicles or authorized drivers. Such certificates shall be in the form of the “Accord” Certificate of Insurance, and reflect that they are for the benefit of TLO and shall provide that there will be no material change in or cancellation of the policies unless TLO is given at least thirty (30) days prior written notice. Certificates providing evidence of renewal of coverage shall be furnished to TLO prior to policy expiration.

(d) Tesoro and/or Carrier shall be solely responsible for any deductibles or self-insured retention.

| |

29. | GOVERNMENT REGULATIONS |

(a) Product Certification. Each Party certifies that none of the Products covered by this Agreement or any Terminal Service Order were derived from crude petroleum, petrochemical, or gas which was produced or withdrawn from storage in violation of any federal, state or other governmental law, nor in violation of any rule, regulation or promulgated by any governmental agency having jurisdiction in the premises.

(b) Applicable Law. The Parties are entering into this Agreement and any Terminal Service Order in reliance upon and shall comply in all material respects with all Applicable Law which directly or indirectly affects the Products throughput hereunder, or any receipt, throughput delivery, transportation, handling or storage of Products hereunder or the ownership, operation or

condition of each Terminal. Each Party shall be responsible for compliance with all Applicable Laws associated with such Party’s respective performance hereunder and the operation of such Party’s facilities. In the event any action or obligation imposed upon a Party under this Agreement and any Terminal Service Order shall at any time be in conflict with any requirement of Applicable Law, then this Agreement and any Terminal Service Order shall immediately be modified to conform the action or obligation so adversely affected to the requirements of the Applicable Law, and all other provisions of this Agreement and any Terminal Service Order shall remain effective.

(c) New Or Changed Applicable Law: If during the Term, any new Applicable Law becomes effective or any existing Applicable Law or its interpretations is materially changed, which change is not addressed by another provision of this Agreement or any Terminal Service Order and which has a material adverse economic impact upon a Party, either Party, acting in good faith, shall have the option to request renegotiation of the relevant provisions of this Agreement or any Terminal Service Order with respect to future performance. The Parties shall then meet to negotiate in good faith amendments to this Agreement or to an applicable Terminal Service Order that will conform to the new Applicable Law while preserving the Parties’ economic, operational, commercial and competitive arrangements in accordance with the understandings set forth herein.

| |

30. | SUSPENSION OF REFINERY OPERATIONS |

(a) In the event that Tesoro decides to permanently or indefinitely suspend refining operations at any of Tesoro’s Refineries for a period that shall continue for at least twelve (12) consecutive Months, Tesoro may provide written notice to TLO of Tesoro’s intent to terminate that part of this Agreement or any Terminal Service Order relating to the applicable associated Terminal (the “Suspension Notice”). Such Suspension Notice shall be sent at any time after Tesoro has publicly announced such suspension and, upon the expiration of the twelve (12)-Month period following the date such notice is sent (the “Notice Period”), that part of this Agreement or any Terminal Service Order relating to such Terminal shall terminate. If Tesoro publicly announces, more than two Months prior to the expiration of the Notice Period, its intent to resume operations at the applicable Refinery, then the Suspension Notice shall be deemed revoked and the applicable portion of this Agreement or any Terminal Service Order shall continue in full force and effect as if such Suspension Notice had never been delivered.

(b) During the Notice Period, for any Month during which Tesoro does not throughput any volumes of Products at an affected Terminal, Tesoro shall be permitted to reduce its Minimum Throughput Commitment by an amount equal to the Stipulated Volume for such affected Terminal(s), provided that Tesoro pays TLO a fee for such Month (a “Curtailment Fee”). Curtailment Fees for each applicable Month shall be equal to (i) such Terminal’s Stipulated Volume multiplied by (ii) the number of days in the Month, multiplied by (iii) the weighted average monthly Terminalling Service Fee incurred by Tesoro at such Terminal during the twelve (12) calendar Months immediately preceding the Refinery’s suspension of operations. For avoidance of doubt, for the purposes of calculating Shortfall Payments during any Month in which Tesoro pays TLO a Curtailment Fee, volume shortfalls shall be determined by deducting volumes throughput at the Terminals by TRMC during such Month from the Adjusted Minimum

Throughput Commitment reduced by an amount equal to the Stipulated Volume for such affected Terminal(s).

(c) Upon the expiration of the Notice Period, Tesoro shall no longer owe TLO any future Curtailment Fees and shall have no throughput obligation with respect to the affected Terminal, and Tesoro’s Minimum Throughput Commitment shall be adjusted to the Adjusted Minimum Volume Commitment for the remaining unaffected Terminals, by deducting the applicable Stipulated Volume for the Terminal removed from this Agreement or any Terminal Service Order under this Section 30. If refining operations at any of the Refineries are suspended for any reason (including Refinery turnarounds and other scheduled maintenance), then Tesoro shall remain liable for Shortfall Payments under this Agreement or any applicable Terminal Service Order for the duration of the suspension, unless and until this Agreement or applicable Terminal Service Order is terminated as provided above. Schedule B attached hereto includes a list of the Terminals associated with each of the Refineries.

(a) As soon as possible upon the occurrence of a Force Majeure, TLO shall provide Tesoro with written notice of the occurrence of such Force Majeure (a “Force Majeure Notice”). TLO shall identify in such Force Majeure Notice the approximate length of time that TLO reasonably believes in good faith such Force Majeure shall continue (the “Force Majeure Period”). If TLO advises in any Force Majeure Notice that it reasonably believes in good faith that the Force Majeure Period shall continue for more than twelve (12) consecutive Months, then, subject to Section 32 below, at any time after TLO delivers such Force Majeure Notice, either Party may terminate this Agreement or any Terminal Service Order solely with respect to the affected Terminal(s), but only upon delivery to the other Party of a notice (a “Termination Notice”) at least twelve (12) Months prior to the expiration of the Force Majeure Period; provided, however; that such Termination Notice shall be deemed cancelled and of no effect if the Force Majeure Period ends prior to the expiration of such twelve (12)-Month period. If this Agreement or any Terminal Service Order is terminated as to a Terminal under this Section 31, then Tesoro’s Minimum Throughput Commitment shall be adjusted to the Adjusted Minimum Volume Commitment for the remaining unaffected Terminals, by deducting the applicable Stipulated Volume for the Terminal so removed from this Agreement or any Terminal Service Order. For the avoidance of doubt, neither Party may exercise its right under this Section 31(a) to terminate this Agreement or any Terminal Service Order as a result of a Force Majeure with respect to any Terminal that has been unaffected by, or has been restored to working order since, the applicable Force Majeure, including pursuant to a Restoration under Section 32.

(b) Notwithstanding the foregoing, if Tesoro delivers a Termination Notice to TLO (the “Tesoro Termination Notice”) and, within thirty (30) days after receiving such Tesoro Termination Notice, TLO notifies Tesoro that TLO reasonably believes in good faith that it shall be capable of fully performing its obligations under this Agreement or any Terminal Service Order within a reasonable period of time, then the Tesoro Termination Notice shall be deemed revoked and the applicable portion of this Agreement or any Terminal Service Order shall continue in full force and effect as if such Tesoro Termination Notice had never been given.

(c) If either Party terminates a portion of this Agreement or any Terminal Service Order related to one or more specific Terminals, then the Minimum Throughput Commitment shall be reduced by the Stipulated Volume for the applicable Terminal(s).

| |

32. | CAPABILITIES OF FACILITIES |

(a) Interruptions of Service. Subject to Force Majeure and interruptions for routine repair and maintenance, consistent with customary terminal industry standards, TLO shall use reasonable commercial efforts to minimize the interruption of service at each Terminal and any portion thereof. TLO shall promptly inform Tesoro operational personnel of any anticipated partial or complete interruption of service at any Terminal, including relevant information about the nature, extent, cause and expected duration of the interruption and the actions TLO is taking to resume full operations, provided that TLO shall not have any liability for any failure to notify, or delay in notifying, Tesoro of any such matters except to the extent Tesoro has been materially prejudiced or damaged by such failure or delay.

(b) Maintenance and Repair Standards. Subject to Force Majeure and interruptions for routine repair and maintenance, consistent with customary terminal industry standards, TLO shall maintain each Terminal in a condition and with a capacity sufficient to throughput a volume of Tesoro’s Products at least equal to the respective Stipulated Volume for such Terminal. TLO’s obligations may be temporarily suspended during the occurrence of, and for the entire duration of, a Force Majeure or other interruption of service that prevents TLO from terminalling the Minimum Throughput Commitment hereunder. To the extent TLO is prevented from terminalling volumes equal to the full Minimum Throughput Commitment for reasons of Force Majeure or other interruption of service, then Tesoro’s obligation to throughput the Minimum Throughput Commitment and pay any Shortfall Payment shall be reduced proportionately in an amount not to exceed the Stipulated Volume for the affected Terminal. At such time as TLO is capable of terminalling volumes equal to the Minimum Throughput Commitment, Tesoro’s obligation to throughput the full Minimum Throughput Commitment shall be restored. If for any reason, including, without limitation, a Force Majeure event, the throughput or storage capacity of any Terminal should fall below the capacity required for throughput of the Stipulated Volume for that Terminal, then within a reasonable period of time after the commencement of such reduction, TLO shall make repairs to the Terminal to restore the capacity of such Terminal to that required for throughput of the Stipulated Volume (“Restoration”). Except as provided below in Section 32(c), all of such Restoration shall be at TLO’s cost and expense, unless the damage creating the need for such repairs was caused by the negligence or willful misconduct of Tesoro, its employees, agents or customers or the failure of Tesoro’s Products to meet the specifications as provided for in Section 11(a).

(c) Capacity Resolution. In the event of the failure of TLO to maintain any Terminal in a condition and with a capacity sufficient to throughput a volume of Tesoro’s Products equal to the respective Stipulated Volume for such Terminal, then either Party shall have the right to call a meeting between executives of both Parties by providing at least two (2) Business Days’ advance written notice. Any such meeting shall be held at a mutually agreeable location and will be attended by executives of both Parties each having sufficient authority to commit his or her respective Party to a Capacity Resolution (hereinafter defined). At the meeting, the Parties will

negotiate in good faith with the objective of reaching a joint resolution for the Restoration of capacity on the Terminal which will, among other things, specify steps to be taken by TLO to fully accomplish Restoration and the deadlines by which the Restoration must be completed (the “Capacity Resolution”). Without limiting the generality of the foregoing, the Capacity Resolution shall set forth an agreed upon time schedule for the Restoration activities. Such time schedule shall be reasonable under the circumstances, consistent with customary terminal industry standards and shall take into consideration TLO’s economic considerations relating to costs of the repairs and Tesoro’s requirements concerning its refining and marketing operations. TLO shall use commercially reasonable efforts to continue to provide storage and throughput of Tesoro’s Products at the affected Terminal, to the extent the Terminal has capability of doing so, during the period before Restoration is completed. In the event that Tesoro’s economic considerations justify incurring additional costs to restore the Terminal in a more expedited manner than the time schedule determined in accordance with the preceding sentence, Tesoro may require TLO to expedite the Restoration to the extent reasonably possible, subject to Tesoro’s payment, in advance, of the estimated incremental costs to be incurred as a result of the expedited time schedule. In the event the Parties agree to an expedited Restoration plan in which Tesoro agrees to fund a portion of the Restoration cost, then neither Party shall have the right to terminate this Agreement or any applicable Terminal Service Order in connection with a Force Majeure, so long as such Restoration is completed with due diligence, and Tesoro shall pay its portion of the Restoration costs to TLO in advance based on an estimate based on reasonable engineering standards promulgated by the Association for Facilities Engineering. Upon completion, Tesoro shall pay the difference between the actual portion of Restoration costs to be paid by Tesoro pursuant to this Section 32(c) and the estimated amount paid under the preceding sentence within thirty (30) days after receipt of TLO’s invoice therefor, or, if appropriate, TLO shall pay Tesoro the excess of the estimate paid by Tesoro over TLO’s actual costs as previously described within thirty (30) days after completion of the Restoration.

(d) Tesoro’s Right To Cure. If at any time after the occurrence of (x) a Partnership Change of Control or (y) a sale of a Refinery, TLO either (i) refuses or fails to meet with Tesoro within the period set forth in Section 32(c), (ii) fails to agree to perform a Capacity Resolution in accordance with the standards set forth in Section 32(c), or (iii) fails to perform its obligations in compliance with the terms of a Capacity Resolution, Tesoro may, as its sole remedy for any breach by TLO of any of its obligations under Section 32(c), require TLO to complete a Restoration of the affected Terminal, subject to and to the extent permitted under the terms, conditions and/or restrictions of applicable leases, permits and/or Applicable Law. Any such Restoration required under this Section 32(d) shall be completed by TLO at Tesoro’s cost. TLO shall use commercially reasonable efforts to continue to provide storage and throughput of Tesoro’s Products at the affected Terminal, during the period while such Restoration is being completed. Any work performed by TLO pursuant to this Section 32(d) shall be performed and completed in a good and workmanlike manner consistent with applicable industry standards and in accordance with all Applicable Law. Additionally, during such period after the occurrence of (x) a Partnership Change of Control or (y) a sale of a Refinery, Tesoro may exercise any remedies available to it under this Agreement or any Terminal Service Order (other than termination), including the right to immediately seek temporary and permanent injunctive relief for specific performance by TLO of the applicable provisions of this Agreement or any Terminal

Service Order, including, without limitation, the obligation to make Restorations as described herein.

(e) Commingled Storage. Unless otherwise specified in a Terminal Service Order, all storage and throughput of Tesoro’s volumes shall be on a fungible commingled basis, and TLO may commingle such Products with Products of third parties of like grade and kind. All Tank Heels shall be allocated among all storage users on a pro rata basis. Tank heels cannot be withdrawn from any tank without prior approval of TLO. TLO shall have the right to enter into arrangements with third parties to throughput and store volumes of Products at each Terminal, provided however, that TLO shall not enter into any third party arrangements that would restrict or limit the ability of Tesoro to throughput the Stipulated Volume at each Terminal each Month without proration or allocation, on reasonable schedules consistent with Tesoro’s requirements, and to receive the Ancillary Services provided herein.

(f) Dedicated Storage. In the event that the Parties determine to use dedicated storage tanks during the Term pursuant to a Terminal Service Order, such storage tanks and capacities identified on a Terminal Service Order shall be dedicated and used exclusively for the storage and throughput of Tesoro’s Product. For those dedicated tanks, Tesoro shall be responsible for providing all Tank Heels required for operation of such tanks. Tesoro shall pay the fees specified on a Terminal Service Order for the dedication of such tanks. Tank heels cannot be withdrawn from any dedicated storage tank without prior approval of TLO.