United States

Securities and Exchange Commission

Washington, D.C. 20549

Amendment No. 2 to Form 20-F

(Mark One)

[ X ] Registration Statement Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934

or

[ ] Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended _____________________

or

[ ] Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ______________ to __________________

or

[ ] Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of event requiring this shell company report ______________________

Commission file number: 000-54242

Mill City Gold Corp.

(Exact name of Registrant as specified in its charter)

Mill City Gold Corp.

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

4719 Chapel Road, N.W., Calgary, Alberta, T2L 1A7

(Address of principal executive offices)

James R. Brown, President & CEO, (403) 640-0110, jim.brown@millcitygold.com, 4719 Chapel Road, N.W.,

Calgary, Alberta T2L 1A7

(Name, telephone, e-mail and/or facsimile number and address of Company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act. None

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Stock, No Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not Applicable

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

¨Yes þNo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

¨Yes þNo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for shorter period that the registrant was required to submit and post such files).

¨Yes ¨No (not required)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

Non-accelerated filer þ

|

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP ¨

|

International Financial Reporting Standards as issued

by the International Accounting Standards Board ¨

|

Other þ

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.þItem 17 ¨Item 18

GENERAL INFORMATION:

Unless otherwise indicated, all references herein are to Canadian dollars.

GLOSSARY

The following is a glossary of geological and technical terms used in this registration statement:

Airborne magnetic survey – A geophysical survey using a magnetometer aboard, or towed behind, an aircraft.

Andesite – is an extrusive igneous, volcanic rock, of intermediate composition between basalt and dacite.

Albite – is a plagioclase feldspar mineral.

Alteration – Any physical or chemical change in a rock or mineral subsequent to its formation. Milder and more localized than metamorphism.

Aluminosilicates – are minerals composed of aluminum, silicon and oxygen. They have a major component of kaolin and other clay minerals.

Anomalies – Any departure from the norm which may indicate the presence of mineralization in the underlying bedrock.

Arkosic sandstones – is a detrital sedimentary rock containing at least 25% feldspar.

Arsenopyrite – is an iron arsenic sulfide. It is a hard metallic, opaque, steel grey to silver white mineral with a relatively high specific gravity.

Assessment work – The amount of work, specified by mining law, that must be performed each year in order to retain legal control of mining claims.

Basalt – An extrusive volcanic rock composed primarily of plagioclase, pyroxene and some olivine.

Basaltic – An extrusive igneous rock that is very dark in color. It is the most common type of rock in the earth’s crust and it makes up most of the ocean floor.

-2-

Calc-alkaline – Rocks that include volcanic types such as basalt andesite, dacite, rhyolite, and also their coarser-grained intrusive equivalents (gabbro, diorite, granodiorite, and granite).

Carbonate – A class of sedimentary rocks composed primarily of carbonate minerals. The two major types are limestone, which is composed of calcite or aragonite (different crystal forms of CaCO3) and dolostone, which is composed of the mineral dolomite.

Clastic metasediments – Composed of fragments, or clasts, of pre-existing rock. Geologists use the term clastic with reference to sedimentary rocks as well as to particles in sediment transport whether in suspension or as bed load, and in sediment deposits.

Conglomerate – A sedimentary rock consisting of rounded, water-worn pebbles or boulders cemented into a solid mass.

Craton – An old and stable part of the continental lithosphere. Having often survived cycles of merging and rifting of continents, cratons are generally found in the interiors of tectonic plates. They are characteristically composed of ancient crystalline basement rock, which may be covered by younger sedimentary rock. They have a thick crust and deep lithospheric roots that extend as much as a few hundred kilometers into the earth’s mantle.

Dacite – An intrusive igneous volcanic rock intermediate in compositions between andesite and rhyolite.

Detrital sedimentary rock – Formed from solid particles of pre-existing rocks or organic debris.

Diabase – A common basic igneous rock usually occurring in dykes or sills.

Diorite – An intrusive igneous rock composed chiefly of sodic plagioclase, hornblende, biotite or pyroxene.

Dykes –Long and relatively thin bodies of igneous rock that, while in the molten state, intruded a fissure

in older rocks.

Exploration stage – Includes all issuers engaged in the search for mineral deposits (reserves) which are not in either the development or production stage.

Folded – Any bending or wrinkling of rock strata.

Fault – A break in the earth’s crust caused by tectonic forces which have moved the rock on one side with respect to the other.

Feldspar – A group of rock-forming tectosilicate minerals which make up as much as 60% of the earth’s crust.

Felsic – Term used to describe light-colored rocks containing feldspar, feldspathoids and silica.

g/t – Grams per tonne.

Gabbro – A dark, coarse-grained igneous rock.

Granite – A coarse-grained intrusive igneous rock consisting of quartz, feldspar and mica.

Granitoid – is a general, descriptive field term for light-colored, coarse-grained igneous rocks.

Greenstone Belts – Zones of variably metamorphosed mafic to ultramafic volcanic sequences with associated sedimentary rocks that occur within Archaean and Proterozoic cratons between granite and gneiss bodies. The name comes from the green hue imparted by the color of the metamorphic minerals within the mafic rocks.

-3-

Greywackes – A variety of sandstone generally characterized by its hardness, dark color, and poorly sorted angular grains of quartz, feldspar, and small rock fragments or lithic fragments set in a compact, clay-fine matrix.

Hematite – An oxide of iron, and one of that metal’s most common ore minerals.

Hornblende – A common constituent of many igneous and metamorphic rocks.

Intrusive – A body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface.

Induced polarization survey – A method of ground geophysical surveying employing an electrical current to determine indications of mineralization.

Komatites – Ultramafic mantle-derived volcanic rocks.

Lithosphere – Outermost shell of a rocky planet. It comprises the crust and the portion of the upper mantle that behaves elastically on time scales of thousands of years or greater.

Mafic – Igneous rocks composed mostly of dark, iron- and magnesium-rich minerals.

Magnetic survey – A geophysical survey that measures the intensity of the earth’s magnetic field.

Magnetometer – An instrument used to measure the magnetic attraction of underlying rocks.

Metamorphism – The process by which the form or structure of rocks is changed by heat and pressure.

Metasedimentary – A sediment or sedimentary rock which shows evidence of metamorphism.

Metavolcanic – A type of metamorphic rock that was first produced by a volcano, then buried underneath subsequent rock and finally, was subjected to high pressures and temperatures, causing the rock to recrystallize. Metavolcanic rock is commonly found in greenstone belts.

Monzonites –An intermediate igneous intrusive rock composed of approximately equal amounts of sodic to intermediate plagioclase and orthoclase feldspars with minor amounts of hornblende, biotite and other minerals.

Ni-Cu-PGE – Nickel, Copper, Platinum Group Elements.

Orthogneiss - a metamorphic rock form originating from igneous rock characterized by banding caused by segregation of different types of rock, typically light and dark silicates.

Pegmatite - A very coarse-grained, intrusive igneous rock composed of interlocking grains usually larger than 2.5 cm in size.

Plagioclase –An important series of tectosilicate minerals within the feldspar family.

Plutons – Refers to rocks of igneous origin that have come from great depth.

Porphyry – Any igneous rock in which relatively large crystals, called phenocrysts, are set in a fine-grained groundmass.

Proved reserves – Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

Pyrite – A yellow iron sulphide mineral, normally of little value. It is sometimes referred to as “fool’s gold”.

-4-

Pyroclastic – Clastic rocks composed solely or primarily of volcanic materials. Where the volcanic material has been transported and reworked through mechanical action, such as by wind or water, these rocks are termed volcaniclastic.

Pyroxene – a silicate mineral.

Quartz – Common rock-forming mineral consisting of silicon and oxygen.

Reserves – That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination.

Rhyolitic – A fine-grained, extrusive igneous rock which has the same chemical composition as granite.

Sandstone – a sedimentary rock consisting of grains of sand cemented together.

Schist – Medium-grained to coarse-grained metamorphic rock composed of laminated, often flaky parallel layers of chiefly micaceous minerals.

Sericite – A fine grained mica which consist of a group of sheet silicate minerals

Shear or sheared – The deformation of rocks by lateral movement along innumerable parallel planes, generally resulting from pressure and producing such metamorphic structures as cleavage and schistosity.

Silica – Silicon dioxide. Quartz is a common example.

Sills – An intrusive sheet of igneous rock of roughly uniform thickness that has been forced between the bedding planes of existing rock.

Siltstone – A sedimentary rock which has a grain size in the silt range, finer than sandstone and coarser than claystones.

Sulphide – A compound of sulphur and some other element.

Tectonics – A field of study within geology concerned generally with the structures within the lithosphere of the earth and particularly with the forces and movements that have operated in a region to create these structures.

Tectosilicate – Comprises nearly 75% of the earth’s crust. Tectosilicates, with the exception of the quartz group, are aluminosilicates.

Tholeiitic basalts – A type of basalt (an igneous rock) which includes very little sodium as compared with other basalts. Chemically, this type of rock has been described as a subalkaline basalt.

Tuffs – Rock composed of fine volcanic ash.

Ultramafic – Rocks are igneous and meta-igneous rocks with very low silica content and are composed of usually greater than 90% mafic minerals (dark colored, high magnesium and iron content).

VLF electromagnetic survey – Very low frequency geophysical survey method which measures the electromagnetic properties of rocks.

VMS – Volcanic massive sulphide.

Volcanic rocks – Igneous rocks formed from magma that has flowed out or has been violently ejected from a volcano.

-5-

Volcaniclastics – see “Pyroclastic” above.

VTEM – Versatile Time Domaine Electro-Magnetics. VTEM is the dominate time-domain electromagnetic system in the world.

Wackes – A name for a poorly sorted sandstone, a mixture of grains of sand, silt and clay size.

FORWARD LOOKING STATEMENTS

The Company cautions readers regarding forward looking statements found in the following discussion and elsewhere in this registration statement and in any other statement made by, or on the behalf of the Company, whether or not in future filings with the Securities Exchange Commission (the “SEC”). Forward looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by or on behalf of the Company. The Company disclaims any obligation to update forward looking statements.

-6-

PART I

Item 1. Identity of Directors, Senior Management and Advisers.

Directors and Senior Management

The following are the names, business addresses and positions of the directors and officers of Mill City Gold Corp. (the “Company”), as of March 18, 2011 .

|

Name and Business Address

|

Position(s)

|

|

James R. Brown

4719 Chapel Road NW

Calgary, Alberta T2L 1A7

Canada

|

Chairman, President, CEO and Director

|

|

Janice Brown

4719 Chapel Road N.W.

Calgary, Alberta T2L 1A7

Canada

|

Chief Financial Officer, Secretary and Director

|

|

Gordon S. McKinnon

141 Adelaide Street West, Suite 520

Toronto, Ontario M5H 3L5

Canada

|

Director

|

|

Herb J. Leary

1620 Palisades Drive

Pacific Palisades, CA 90272

USA

|

Director

|

Auditors

For the past three years, the Company’s auditors have been D&H Group LLP, Chartered Accountants, 10th Floor, 1333 West Broadway, Vancouver, British Columbia, V6H 4C1, Canada. D&H Group LLP is licensed to practice public accounting in the Province of British Columbia by the Institute of Chartered Accountants of British Columbia and is registered with the Public Company Accounting Oversight Board and the Canadian Public Accountability Board.

Legal Counsel

The Company’s Canadian legal counsel is DuMoulin Black LLP, 10th Floor, 595 Howe Street, Vancouver, British Columbia V6C 2T5, and its United States legal counsel is Dill Dill Carr Stonbraker & Hutchings, P.C., 455 Sherman Street, Suite 300, Denver, Colorado 80203.

Item 2. Offer Statistics and Expected Timetable.

Not applicable.

-7-

Item 3. Key Information.

Selected Financial Data

The selected financial data of the Company for the years ended December 31, 2009, 2008, 2007, 2006 and 2005, was derived from the financial statements of the Company which have been audited by D&H Group LLP, independent Chartered Accountants, as indicated in their report which is included elsewhere in this registration statement.

The selected financial data at and for the nine-month periods ended September 30, 2010 and 2009, have been derived from the unaudited financial statements of the Company, also included herein and, in the opinion of the Company, included all adjustments (consisting of normally recurring adjustments) necessary to present fairly the information set forth therein.

The information in the following table was extracted from the more detailed financial statements and related notes included herein and should be read in conjunction with such financial statements and with the information appearing under the heading “Item 5. Operating and Financial Review and Prospects.”

Reference is made to Note 13 of the Company’s audited financial statements for the years ended December 31, 2009, 2008 and 2007 and Note 12 of the Company’s financial statements for the nine months ended September 30, 2010 and 2009, which are included herein, for a discussion of the material differences between Canadian generally accepted accounting principles (“GAAP”) and US GAAP, and their effect on the Company’s financial statements.

To date, the Company has not generated any cash flow from operations to fund ongoing operational requirements and cash commitments. The Company has financed its operations principally through the sale of its equity securities. The Company currently has sufficient funds to maintain operations at its current level of activity. It will continue to rely on the sale of its equity securities to provide funds for its activities; however, there is no assurance that it will be able to do so.

|

Nine Months Ended

September 30,

(unaudited)

|

Year Ended December 31,

|

|||||||||||||||||||||||||||

|

2010

|

2009

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||||||||

|

Revenues

|

$ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||

|

(Loss) from Operations

|

$ | (283,803 | ) | $ | (551,737 | ) | $ | (714,570 | ) | $ | (952,222 | ) | $ | (774,408 | ) | $ | (680,764 | ) | $ | (755,325 | ) | |||||||

|

Net (Loss)

|

$ | (287,175 | ) | $ | (323,782 | ) | $ | (465,478 | ) | $ | (1,384,069 | ) | $ | (731,228 | ) | $ | (336,882 | ) | $ | (751,881 | ) | |||||||

|

Total Assets

|

$ | 2,409,207 | $ | 2,692,485 | $ | 2,644,740 | $ | 2,985,198 | $ | 1,509,824 | $ | 1,908,042 | $ | 950,788 | ||||||||||||||

|

Net Assets

|

$ | 2,382,865 | $ | 2,688,518 | $ | 2,613,224 | $ | 2,955,019 | $ | 1,481,591 | $ | 1,871,120 | $ | 895,853 | ||||||||||||||

|

Capital Stock

|

$ | 6,124,765 | $ | 6,329,972 | $ | 6,113,547 | $ | 6,318,792 | $ | 3,891,544 | $ | 3,841,544 | $ | 2,685,063 | ||||||||||||||

|

Weighted Average

Number of Shares

|

51,351,899 | 50,795,123 | 50,872,288 | 46,722,645 | 37,927,152 | 36,087,618 | 26,144,530 | |||||||||||||||||||||

|

Dividends per Share

|

$ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||

|

Basic and Fully Diluted (Loss) per Share

|

$ | (0.01 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.03 | ) | $ | (0.02 | ) | $ | (0.01 | ) | $ | (0.03 | ) | |||||||

Adjustment to United States Generally Accepted Accounting Principles

The financial statements of the Company have been prepared in accordance with Canadian GAAP which differs in certain material respects from US GAAP. Material differences between Canadian and US GAAP and their effect on the Company’s consolidated financial statements are summarized in the tables below.

Under US GAAP, the following financial information would be adjusted from Canadian GAAP (references are made to Note 13 of the Company’s audited financial statements for the years ended December 31, 2009, 2008 and 2007 and Note 12 of the Company’s financial statements for the nine months ended September 30, 2010 and 2009, which are included herein):

-8-

|

Nine Months Ended

September 30,

(unaudited)

|

Year Ended December 31,

|

||||||||||||||||||||

|

2010

|

2009

|

2009

|

2008

|

2007

|

|||||||||||||||||

|

Statement of Loss

|

|||||||||||||||||||||

|

Net loss – Canadian GAAP

|

$ | (287,175 | ) | $ | (323,782 | ) | $ | (465,478 | ) | $ | (1,384,069 | ) | $ | (731,228 | ) | ||||||

|

Unproven mineral interests expensed under US GAAP

|

(7,864 | ) | (14,138 | ) | (28,236 | ) | (1,166,221 | ) | (94,343 | ) | |||||||||||

|

Impairment charge not recognized under US GAAP

|

7,864 | 14,098 | 14,198 | 481,526 | - | ||||||||||||||||

|

Reversal of future income tax recovery

|

-- | (225,000 | ) | (225,000 | ) | - | - | ||||||||||||||

|

Net (loss) – US GAAP

|

$ | (287,175 | ) | $ | (548,822 | ) | $ | (704,516 | ) | $ | (2,068,764 | ) | $ | (825,571 | ) | ||||||

|

(Loss) per share – US GAAP

|

$ | (0.01 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.04 | ) | $ | (0.02 | ) | ||||||

|

September 30,

(unaudited)

|

December 31,

|

|||||||||||||||

|

2010

|

2009

|

2009

|

2008

|

|||||||||||||

|

Balance Sheets

|

||||||||||||||||

|

Total assets – Canadian GAAP

|

$ | 2,409,207 | $ | 2,644,740 | $ | 2,644,740 | $ | 2,985,198 | ||||||||

|

Unproven mineral interests expensed under US GAAP

|

(1,180,459 | ) | (1,180,459 | ) | (1,180,459 | ) | (1,166,421 | ) | ||||||||

|

Goodwill not recognized under US GAAP

|

(100,000 | ) | (100,000 | ) | (100,000 | ) | (100,000 | ) | ||||||||

|

Total assets – US GAAP

|

$ | 1,128,748 | $ | 1,364,281 | $ | 1,364,281 | $ | 1,718,777 | ||||||||

|

Closing deficit – Canadian GAAP

|

$ | (5,817,486 | ) | $ | (5,530,311 | ) | $ | (5,530,311 | ) | $ | (5,064,833 | ) | ||||

|

Unproven mineral interests expensed under US GAAP

|

(1,180,459 | ) | (1,180,459 | ) | (1,180,459 | ) | (1,166,421 | ) | ||||||||

|

Goodwill not recognized under US GAAP

|

(100,000 | ) | (100,000 | ) | (100,000 | ) | (100,000 | ) | ||||||||

|

Reversal of future income tax recovery

|

(225,000 | ) | (225,000 | ) | (225,000 | ) | - | |||||||||

|

Deficit – US GAAP

|

$ | (7,322,945 | ) | $ | (7,035,770 | ) | $ | (7,035,770 | ) | $ | (6,331,254 | ) | ||||

|

Nine Months Ended

September 30,

(unaudited)

|

Year Ended December 31,

|

|||||||||||||||||||

|

2010

|

2009

|

2009

|

2008

|

2007

|

||||||||||||||||

|

Statements of Cash Flows

|

||||||||||||||||||||

|

Cash flow (used in) operating activities – Canadian GAAP

|

$ | (223,667 | ) | $ | (286,162 | ) | $ | (350,057 | ) | $ | (422,383 | ) | $ | (513,075 | ) | |||||

|

Exploration expenses incurred on unproven mineral interests

|

- | (14,238 | ) | (28,236 | ) | (1,166,221 | ) | (94,343 | ) | |||||||||||

|

Cash flows (used in) operating activities – US GAAP

|

$ | (223,667 | ) | $ | (300,400 | ) | $ | (378,293 | ) | $ | (1,588,604 | ) | $ | (607,418 | ) | |||||

|

Cash flow from (used in) investing activities – Canadian GAAP

|

$ | - | $ | (19,256 | ) | $ | (33,029 | ) | $ | (1,517,472 | ) | $ | 102,650 | |||||||

|

Add unproven mineral interest expensed in US GAAP

|

- | 14,238 | 28,236 | 1,166,221 | 94,343 | |||||||||||||||

|

Cash flows from (used in) investing activities – US GAAP

|

$ | - | $ | (5,018 | ) | $ | (4,793 | ) | $ | (351,251 | ) | $ | 196,993 | |||||||

-9-

Exchange Rate History

The following table sets forth the average exchange rate for one Canadian dollar expressed in terms of one U.S. dollar for the fiscal years ended December 31, 2009, 2008, 2007, 2006 and 2005 and the period from January 1, 2010 through September 30, 2010, calculated by using the average of the exchange rates on the last day of each month during the period:

|

Period

|

Average

|

|

January 1, 2010 - September 30, 2010

|

0.9598

|

|

January 1, 2009 - December 31, 2009

|

0.8793

|

|

January 1, 2008 - December 31, 2008

|

0.9335

|

|

January 1, 2007 - December 31, 2007

|

0.9376

|

|

January 1, 2006 - December 31, 2006

|

0.8844

|

|

January 1, 2005 - December 31, 2005

|

0.8276

|

The following table sets forth high and low exchange rates for one Canadian dollar expressed in terms of one U.S. dollar for the past six months:

|

Month

|

High

|

Low

|

|

January 2011

|

1.0138

|

0.9980

|

|

December 2010

|

0.9843

|

0.9827

|

|

November 2010

|

0.9988

|

0.9741

|

|

October 2010

|

0.9972

|

0.9689

|

|

September 2010

|

0.9786

|

0.9506

|

|

August 2010

|

0.9848

|

0.9399

|

The noon rate of exchange on March 18, 2011 , reported by the United States Federal Reserve Bank of New York for the conversion of Canadian dollars into United States dollars was CDN$0.9846 (US$1.0156 = CDN$1.00) .

Exchange rates are based upon the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York.

Capitalization and Indebtedness

The following table sets forth the Company’s current liabilities and capitalization as of September 30, 2010:

| $ | ||||

|

Current Liabilities

|

26,342 | |||

|

Stockholder’s Equity

|

||||

|

Common Shares, no par value, unlimited common shares

authorized, 51,544,207 shares issued and outstanding

|

6,124,765 | |||

|

Contributed Surplus

|

2,075,586 | |||

|

Deficit

|

(5,817,486 | ) | ||

| 2,382,865 | ||||

|

Total Capitalization

|

2,409,207 |

-10-

Risk Factors

The operations of the Company are speculative due to the high risk nature of its business which involves the exploration of its projects. The following risk factors apply to the Company’s operations:

The Company is an exploration stage company with limited financial resources and if the Company is unable to secure additional funding and/or if the Company’s exploration programs are unsuccessful, the Company may fail.

Mineral exploration involves significant risk and few properties that are explored are ultimately developed into producing mines. Substantial expenditures may be required to establish ore reserves through drilling, to develop metallurgical processes to extract the metals from the ore and to construct the mining and processing facilities at any site chosen for mining. Current exploration programs may not result in any commercial mining operation. The Company’s options in unproved mineral claims are without a known body of commercial ore and the proposed programs are an exploratory search for ore. The Company is presently carrying out exploration with the objective of establishing an economic body of ore. If the Company’s exploration programs are successful, additional funds will be required for the development of an economic ore body and to place it into commercial production. The only sources of future funds presently available to the Company are the sale of equity capital, the exercise of warrants and options or the offering by the Company of an interest in the mineral claim to be earned to another party or parties. If the Company is unable to secure additional funding, the Company may lose its interest in one or more of its mineral claims and/or may be required to cease operations.

Because the Company has limited financial resources and has not generated any revenue from its operations, the Company may not be able to continue its operations and an investment in the Company’s common shares may be worthless.

The Company has limited financial resources, has a history of losses and has no source of operating cash flow. The Company has not generated any revenues from its mineral claims and does not anticipate any in the foreseeable future. Additional funding may not be available to it for further exploration of its option interests or to fulfill its obligations under any applicable agreements. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration of its projects with the possible loss of such interests. Historically, the only source of funds available to the Company has been through the sale of its common shares.

As of September 30, 2010, the Company held $554,762 in cash and cash equivalents and had working capital of $533,331. The Company does not have sufficient financial resources to conduct additional exploration of its mineral property interests. It is intending to raise further equity capital to fund further exploration activities. The Company may not be able to raise the necessary funds, if any, and may not be able to raise such funds at terms which are acceptable to the Company. In the event the Company is unable to raise adequate finances to fund the proposed activities, it may have to abandon one or more of its projects. Any further additional equity financing undertaken by the Company may cause dilution to its shareholders.

See “Item 4. Information on the Company” and “Item 5. Operating and Financial Review and Prospects.”

The Company’s financial statements were prepared on a going concern basis which assumes that the Company will be able to realize its assets and discharge its liabilities in the normal course of business.

The Company’s operations are subject to government regulations which may subject the Company to penalties for failure to comply and may limit the Company’s ability to conduct exploration activities and could cause the Company to delay or abandon its projects.

Exploration activities require permits from various federal, provincial or territorial and local governmental authorities and are subject to national and local laws and regulations governing prospecting, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety, and others which currently or in the future may have a substantial adverse impact on the Company. See “Item 4. Information on the Company - Business Overview - Government Regulations.” Such operations and exploration

-11-

activities are also subject to substantial regulation under these laws by governmental agencies and may require that the Company obtain permits from various governmental agencies. There can be no assurance, however, that all permits which the Company may require for its operations and exploration activities will be obtainable on reasonable terms or on a timely basis or that such laws and regulations would not have an adverse effect on any mining project which the Company might undertake.

In order to comply with applicable laws, the Company may be required to make capital expenditures until a particular problem is remedied. Existing and possible future environmental legislation, regulation and action could cause additional expense, capital expenditures, restriction and delays in the activities of the Company, the extent of which cannot be reasonably predicted. Violators may be required to compensate those suffering loss or damage by reason of their exploration activities and may be fined if convicted of an offense under such legislation.

Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in exploration operations may be required to compensate those suffering loss or damage by reason of exploration activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations and, in particular, environmental laws.

Amendments to current laws, regulations and permits governing activities of mineral exploration companies, or more stringent implementation thereof, could require increases in exploration expenditures, or require delays in exploration or abandonment of new mineral properties.

Exploration for minerals on the Company’s projects are subject to significant risks which could increase the costs of exploration and could cause the Company to delay or abandon its projects.

Resource exploration and development is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but also from finding mineral deposits that, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection, the combination of which factors may result in the Company not receiving an adequate return of investment capital.

All of the claims to which the Company has a right to acquire an interest are in the exploration stages only and are without a known body of commercial ore. Development of the subject mineral properties would follow only if favorable exploration results are obtained. The business of exploration for minerals and mining involves a high degree of risk. Few properties that are explored are ultimately developed into producing mines.

There is no assurance that the Company’s mineral exploration and development activities will result in any discoveries of commercial bodies of ore. The long-term profitability of the Company’s operations will in part be directly related to the costs and success of its exploration programs, which may be affected by a number of factors.

Substantial expenditures are required to establish reserves through drilling and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that funds required for development can be obtained on a timely basis.

There is no assurance that the TSX Venture Exchange (the “TSX-V”) will approve the acquisitions of any additional properties by the Company, whether by way of option or otherwise.

Mineral exploration involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Operations in which the Company has a direct or indirect interest will be subject to all

-12-

the hazards and risks normally incidental to exploration for gold (also “Au”), silver (also “Ag”) and other metals, any of which could result in work stoppages, damage to property, and possible environmental damage.

The Company will continue to rely upon consultants and others for exploration and, if required, development expertise. If any of the Company’s option interests merit development, substantial expenditures will be required to establish ore reserves through drilling, to develop metallurgical processes to extract the metal from the ore and, in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining. The Company may not discover minerals in sufficient quantities to justify commercial operations and the Company may not be able to obtain the funds required for development on a timely basis. The economics of developing gold, silver and other mineral properties are affected by many factors including the cost of operations, variations in the grade of ore mined, fluctuations in metal markets, costs of processing equipment and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection.

Because the Company is subject to compliance with governmental regulation, the cost of its exploration programs may increase.

The Company’s operations may be subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailings disposal areas, which would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner which means stricter standards, and enforcement, fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations.

The Company may incur liability for certain risks against which the Company does not have insurance, which could reduce or eliminate any future profitability and negatively impact the price of the Company’s shares.

In the course of exploration of mineral concessions, certain risks, and in particular, unexpected or unusual geological operating conditions including rock bursts, cave-ins, fires, flooding and earthquakes may occur. It is not always possible to fully insure against such risks and the Company may decide not to take out insurance against such risks as a result of high premiums or other reasons. Should such liabilities arise, they could reduce or eliminate any future profitability and result in increasing costs and a decline in the value of the securities of the Company. The Company does not have any insurance coverage on its mineral concessions.

The Company may not be able to obtain supplies and infrastructure necessary to conduct its exploration operations and, as such, may have to delay or abandon its projects.

Some of the Company’s property interests are not in developed areas and the availability of infrastructure (water and power, and in some areas roads) at an economic cost cannot be assured. Power is an integral requirement of any production facility on the Company’s properties. In the event the Company is unable to obtain water or power at any of its properties, the Company may not be able to conduct exploration activities, or in the event the Company discovers mineralization, the Company may not be able to begin a development program, in which case the Company may lose its interest in the property or may have to abandon the property.

The Company may not have proper title to its properties and, as a result, may incur significant expenses to obtain proper title, or may have to abandon any such property.

The Company owns, leases or has under option mining claims, mineral claims or concessions which constitute the Company’s property holdings. The ownership and validity of mining claims and concessions are often uncertain and may be contested.

-13-

In those jurisdictions where the Company has property interests, the Company makes a search of mining records in accordance with mining industry practices to confirm that it has acquired satisfactory title to its properties but does not obtain title insurance with respect to such properties. The possibility exists that title to one or more of its concessions, particularly title to undeveloped claims, might be defective because of errors or omissions in the chain of title, including defects in conveyances and defects in locating or maintaining such claims, or concessions.

The Company’s mineral property interests may be subject to prior unregistered agreements or transfers or native land claims and title may be affected by undetected defects. Surveys have not been carried out on any of the Company’s mineral properties; therefore their existence and area could be in doubt. Until competing interests in the mineral lands have been determined, the Company can give no assurance as to the validity of title of the Company to those lands or the size of such mineral lands.

The Company is not aware of challenges to the location or area of its property interests.

If the Company, or the person or entity from which the Company has obtained an option for property interests, does not have proper title to its property interests, the Company may incur significant expenses defending or acquiring proper title and/or may have to abandon such interests, which may result in significant losses for the Company and could result in the Company having to cease operations.

If the Company is unable to effectively compete against other companies, or if the Company cannot market any minerals discovered on its properties, the Company may have to cease operations.

The mineral industry is intensely competitive in all its phases. The Company competes with many companies possessing greater financial resources and technical facilities than itself for the acquisition of mineral concessions, claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees.

Even if commercial quantities of ore are discovered, a ready market may not exist for their sale. Factors beyond the control of the Company may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in the Company not receiving an adequate return on invested capital or losing its investment capital.

If the Company obtains funding through the sale of additional common shares, the shareholders may experience dilution.

The Company may in the future grant to some or all of its directors, officers, insiders and key employees options to purchase the Company’s common shares as non-cash incentives to those employees. Such options may be granted at exercise prices equal to market prices, or at prices as allowable under the policies of the TSX-V, when the public market is depressed. To the extent that significant numbers of such options may be granted and exercised, the interests of then existing shareholders of the Company may be subject to additional dilution.

The Company is currently without a source of revenue and will most likely be required to issue additional shares to finance its operations and, depending on the outcome of its exploration programs, may issue additional shares to finance additional exploration programs of any or all of its projects or to acquire additional properties. The issuance of additional shares may cause the Company’s existing shareholders to experience dilution of their ownership interests.

Conflicts of interest may arise among the members of our board of directors and such conflicts may cause the Company to enter into transactions on terms which are not beneficial to the Company.

Several of the Company’s directors are also directors, officers or shareholders of other companies. Some of the directors and officers are engaged and will continue to be engaged in the search for additional business opportunities on behalf of other corporations, and situations may arise where these directors and officers will be in direct

-14-

competition with the Company. Such associations may give rise to conflicts of interest from time to time. Such a conflict poses the risk that the Company may enter into a transaction on terms which could place the Company in a worse position than if no conflict existed. Conflicts, if any, will be dealt with in accordance with the relevant provisions of the Business Corporations Act (British Columbia) (the “BCBCA”). The directors of the Company are required by law to act honestly and in good faith with a view to the best interest of the Company and to disclose any interest which they many have in any project or opportunity of the Company. However, each director has a similar obligation to other companies for which such director serves as an officer or director. No material conflicts of interests which have arisen since January 1, 2007 through the date of this registration statement.

The prices of metals fluctuate in the market and such fluctuations could negatively impact the Company’s ability to raise funding and may cause certain activities to become uneconomic.

Factors beyond the control of the Company may affect the marketability of any substances discovered. The prices of various metals have experienced significant movement over short periods of time, and are affected by numerous factors beyond the control of the Company, including international economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates and global or regional consumption patterns, speculative activities and increased production due to improved mining and production methods. The supply of and demand for metals are affected by various factors, including political events, economic conditions and production costs in major mineral producing regions. Variations in the market prices of metals may impact the Company’s ability to raise funding to continue exploration of its projects. In addition, any significant fluctuations in metal prices will impact the Company’s decision to accelerate or reduce its exploration activities.

This registration statement contains statements about future events and results which may not be accurate.

Statements contained in this registration statement that are not historical facts are forward-looking statements that involve risks and uncertainties. Such statements may not prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Without limiting the generality of the foregoing, such risks and uncertainties include interpretation of results and geology, results of pre-feasibility and feasibility studies, recovery, accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in production, delays in exploration activities, political risks involving doing business in other nations and the policies of these other nations, the inherent uncertainty of production fluctuations and failure to obtain adequate financing on a timely basis.

The Company is dependent upon its management and the loss of any of its management and/or if the Company is unable to recruit additional managers could negatively impact the Company’s ability to continue its operations.

The success of the operations and activities of the Company is dependent to a significant extent on the efforts and abilities of its key management, Mr. James R. Brown, the Chairman, President, Chief Executive Officer and a director of the Company, and Mrs. Janice Brown, the Chief Financial Officer, Corporate Secretary, and a director of the Company. The loss of services of either Mr. Brown or Mrs. Brown could have a material adverse effect on the Company. The Company has not entered into employment agreements with any of its officers and is not expected to do so in the foreseeable future. The Company has not obtained key-man life insurance on any of its officers or directors. The Company’s ability to recruit and retain highly qualified management personnel is critical to its success; if it is unable to do so this may materially affect the Company’s financial performance.

The Company’s common shares are not traded in the United States and investors may find it difficult to sell the Company’s common shares.

As of the date of this registration statement, there is no established market in the United States for the Company’s common shares. The Company’s common shares are classified as a grey market security under the symbol “MCYGF”. There are no market makers in this security. It is not listed, traded or quoted on any stock exchange, the Over the Counter Bulletin Board (“OTCBB”) or the Pink Sheets. Trades in grey market stocks are reported by broker-dealers to their Self Regulatory Organization (SRO) and the SRO distributes the trade data to market data vendors and financial websites so investors can track price and volume. Since grey market securities are not traded

-15-

or quoted on an exchange or interdealer quotation system, investors’ bids and offers are not collected in a central spot so market transparency is diminished and best execution of orders is difficult. Management anticipates that the Company will seek to have its common shares quoted on the OTCBB or Pink Sheets; however, there are no assurances as to if, or when, the Company’s common shares will be quoted on the OTCBB or Pink Sheets. In addition, even if the Company’s shares are quoted on the OTCBB or Pink Sheets, trading may continue to be sporadic and limited. Consequently, the Company’s shareholders in the United States may not be able to use their shares for collateral or loans and may not be able to liquidate at a suitable price in the event of an emergency. In addition, the Company’s shareholders may not be able to resell their shares in the United States and may have to hold them indefinitely.

The Company does not pay dividends on its common shares; therefore, investors seeking dividend income should not purchase the common shares.

The Company has never declared or paid cash dividends on its common shares and does not anticipate doing so in the foreseeable future. Additionally, the determination as to the declaration of dividends is within the discretion of the Company’s Board of Directors, which may never declare cash dividends on the Company’s common stock. Investors cannot expect to receive a dividend on the Company’s common shares in the foreseeable future, if at all.

Investors in the United States may not be able to enforce their civil liabilities against the Company or its directors and officers.

It may be difficult to bring and enforce suits against the Company. The Company is a corporation incorporated in British Columbia. Only one of the Company’s directors is a resident of the United States, and all or a substantial portion of its assets are located outside of the United States. As a result, it may be difficult for U.S. holders of the Company’s common shares to effect service of process on these persons within the United States or to enforce judgments obtained in the U.S. based on the civil liability provisions of the U.S. federal securities laws against the Company or its officers and directors. In addition, a shareholder should not assume that the courts of Canada (i) would enforce judgments of U.S. courts obtained in actions against the Company, its officers or directors predicated upon the civil liability provisions of the U.S. federal securities laws or other laws of the United States, or (ii) would enforce, in original actions, liabilities against the Company, its officers or directors predicated upon the U.S. federal securities laws or other laws of the United States.

However, U.S. laws would generally be enforced by a Canadian court provided that those laws are not contrary to Canadian public policy, are not foreign penal laws or laws that deal with taxation or the taking of property by a foreign government and provided that they are in compliance with applicable Canadian legislation regarding the limitation of actions. Also, a judgment obtained in a U.S. court would generally be recognized by a Canadian court except, for example:

|

|

a)

|

where the U.S. court where the judgment was rendered had no jurisdiction according to applicable Canadian law;

|

|

|

b)

|

the judgment was subject to ordinary remedy (appeal, judicial review and any other judicial proceeding which renders the judgment not final, conclusive or enforceable under the laws of the applicable state) or not final, conclusive or enforceable under the laws of the applicable state;

|

|

|

c)

|

the judgment was obtained by fraud or in any manner contrary to natural justice or rendered in contravention of fundamental principles of procedure;

|

|

|

d)

|

a dispute between the same parties, based on the same subject matter has given rise to a judgment rendered in a Canadian court or has been decided in a third country and the judgment meets the necessary conditions for recognition in a Canadian court;

|

|

|

e)

|

the outcome of the judgment of the U.S. court was inconsistent with Canadian public policy;

|

-16-

|

|

f)

|

the judgment enforces obligations arising from foreign penal laws or laws that deal with taxation or the taking of property by a foreign government; or

|

|

|

g)

|

there has not been compliance with applicable Canadian law dealing with the limitation of actions.

|

The Company may be deemed to be a “Passive Foreign Investment Company” for U.S. tax purposes which could subject U.S. shareholders to increased tax liability.

The Company may be deemed to be a “Passive Foreign Investment Company”. See “Item 10. Additional Information - Taxation.” As a result, a United States holder of the Company’s common shares could be subject to increased tax liability, possibly including an interest charge, upon the sale or other disposition of the United States holder’s common shares or upon the receipt of “excess distributions,” unless such holder of common shares elects to be taxed currently on his or her pro rata portion of the Company’s income, whether or not the income was distributed in the form of dividends or otherwise. The election requires certain conditions be met such as filing on or before the due date, as extended, for filing the shareholder’s income tax return for the first taxable year to which the election will apply. Otherwise, the election may only partially apply.

Item 4. Information on the Company.

History and Development of the Company

The Company was incorporated pursuant to the Business Corporations Act (Alberta) on August 28, 1998 under the name “Pantera Enterprises Inc.” The Company changed its name to “Mill City International Corporation” on November 29, 2002 after having acquired 977887 Alberta Inc. from Mill City International Inc. (“MIY”). The Company issued 13,668,413 of its common shares to MIY in exchange for all of the issued and outstanding shares of 977887 Alberta Inc. MIY then distributed those shares to its shareholders who were shareholders as of October 31, 2002.

Effective September 1, 2004, the Company continued and became a company under the Business Corporations Act (British Columbia), changing its name to “Mill City Gold Corp.” See “Item 10. Additional Information - Memorandum and Articles of Association.”

By acquiring 977887 Alberta Inc., the Company acquired an undivided 44.5% interest in a diamond exploration property in the Northwest Territories (the “Yamba Lake property”). This property was optioned to another company in 1998 and returned to the Company in January 2007.

In 2003, the Company entered into eight purchase agreements to acquire eleven unproven mineral interests located in Nevada. Expenditures on the Nevada properties were funded by a short form offering that resulted in gross proceeds of $1,400,000. The Company optioned these Nevada property interests to other companies in 2004, and these optionees conducted exploration activities on these properties. In 2007, the company that optioned nine of the eleven mineral interests in Nevada returned these properties to the Company. The Company terminated these nine interests in April 2008, as the properties did not warrant further exploration. The other company that optioned the remaining two properties exercised its option in 2007, resulting in the Company having a 20% carried interest. During 2008, the Company impaired its interest in these two properties to $100 due to minimal exploration activities during the year. In May 2009, exploration on these properties was discontinued as three-dimensional modeling of all the geologic data from the 2008 drilling program concluded that further exploration and development was not economic. Accordingly, the Company wrote off its remaining interests in these Nevada properties in 2009.

Beginning in 2007, the Company began to change its focus to properties in northern Ontario. In 2007, the Company acquired an option to earn a 50% interest in 74 staked mineral claims located in the James Bay Lowlands region of northern Ontario, Canada (the “Northern Star Eagle and Southern Star Eagle properties”) and in 2008, the Company acquired an option to earn an undivided 50% interest in 17 mining claims, also located in the James Bay Lowlands region (the “GP2 property”).

-17-

In October 2010, after receiving approval of the TSX-V, the Company acquired an option to earn an undivided 75% participating interest in 59 mining claims in the West Timmins Gold District in northern Ontario (the “Croxall property”) and cancelled its option on the Northern Star Eagle and the Southern Star Eagle claims.

In November 2010, the Company acquired an option to earn a 70% interest in 48 claims located in the Yukon Territory (the “Rosebud 12 property”).

The Company’s head office is located at 4719 Chapel Road N.W., Calgary, Alberta T2L 1A7 and its phone number is (403) 640-0110. The Company’s registered office is located at 10th Floor, 595 Howe Street, Vancouver, BC V6C 2T5 and its phone number is (604) 602-6802.

Business Overview

The Company is a junior mineral exploration company engaged in the acquisition and exploration of precious metals on mineral properties located in Canada, with the aim of developing them to a stage where they can be exploited at a profit or to arrange joint ventures whereby other companies provide funding for development and exploitation. The Company is currently focusing on its northern Ontario properties and its newly acquired Yukon property. As of the date of this registration statement, the Company has not earned any production revenue, nor found any proved reserves on any of its properties. The Company is a reporting issuer in British Columbia, Alberta and Quebec and its common shares trade on the TSX-V.

No capital expenditures were made by the Company since January 1, 2007 other than expenditures relating to the Company’s mineral property interests. Such expenditures are outlined as follows:

|

Year

|

Description and Amount of Capital Expenditure

|

|

2007

|

Payment of license fees in the amount of $94,343 on its Nevada and Yamba Lake property interests

|

|

2008

|

$402,501 of acquisition costs and $641,148 of exploration costs on the Northern Star Eagle and Southern Star Eagle properties

$120,000 of acquisition costs and $525,073 of exploration costs on the GP2 property

|

|

2009

|

$12,500 of acquisition costs and $9,431 of exploration costs on the Northern Star Eagle and Southern Star Eagle properties

$12,500 of acquisition costs and $4,807 of exploration costs on the GP2 property

|

|

2010

|

$12,500 of acquisition costs on the GP2 property

$7,864 of annual maintenance costs on the Yamba Lake property

$17,500 of acquisition costs on the Croxall property

$108,000 of acquisition costs on the Rosebud 12 property

|

These expenditures have been funded through the sale of the Company’s equity securities. In January 2008, the exercise of warrants resulted in proceeds of $777,000 and in June 2008, the Company completed a non-brokered private placement to raise net proceeds of $1,478,998. In October 2010, the Company completed a private placement for $1,500,000 in gross proceeds.

There have been no divestitures of properties since January 1, 2007, except for the termination of its mineral interests in Nevada in 2008 and 2009 and the cancellation of its option on the Northern Star Eagle and the Southern Star Eagle claims in October 2010. The Company concluded that the various Nevada properties as well as the Northern Star Eagle and the Southern Star Eagle properties did not warrant further exploration and therefore made a business decision to cancel the various option agreements.

The Company intends to focus its efforts on its Rosebud 12 property located in the Yukon Territory, Canada, and its Croxall property located in northern Ontario. The Company’s 2011 exploration plans for the Rosebud 12 property include extensive mechanized trenching of existing gold-in-soil anomalies, additional soil sampling, ground magnetic surveys and geological mapping. The goal of this work is to identify and prioritize drill targets. The Company’s

-18-

2011 exploration plans for the Croxall property will consist of a drilling program comprised of 6 or more holes totaling at least 2,500 meters. The Company does not have any exploration plans in 2011 for the GP2 property.

Government Regulations

The current and anticipated future operations of the Company, including development activities and commencement of production on its properties, require permits from various federal, territorial and local governmental authorities and such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in the development and operation of mines and related facilities generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Such operations and exploration activities are also subject to substantial regulation under these laws by governmental agencies and may require that the Company obtain permits from various governmental agencies. The Company believes it is in substantial compliance with all material laws and regulations which currently apply to its activities. There can be no assurance, however, that all permits which the Company may require for construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms or that such laws and regulations, or that new legislation or modifications to existing legislation, would not have an adverse effect on any exploration or mining project which the Company might undertake.

The Company has obtained all necessary permits and authorizations required for its current exploration. The Company has had no material costs related to compliance and/or permits in recent years, and anticipates no material costs in the next year. Unfavorable amendments to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a materially adverse impact on the Company and cause increases in capital expenditures which could result in a cessation of operations by the Company.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in exploration and mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violation of applicable laws or regulations.

The enactment of new laws or amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in the development of new mining properties.

Organizational Structure

The Company had one wholly-owned subsidiary, Mill City Gold Inc., a Nevada corporation that has been wound up as the Company no longer has any mineral property interests in Nevada. On February 17, 2011, the Company filed a certificate of dissolution to dissolve this corporate entity.

Property, Plant and Equipment

The Company’s operations are focused on the exploration of its mineral property interests. As of the date of this registration statement, the Company does not have any plant, material equipment, mines or producing properties. The Company’s proposed programs are exploratory in nature and all of the Company’s properties are without known reserves.

The Company’s principal assets are its options to acquire interests in unproven mineral claims. Under Canadian GAAP, option payments and exploration, development and field support costs directly relating to mineral claims are deferred until the claims to which they relate are placed into production, sold or abandoned. The deferred costs will

-19-

be amortized over the life of the orebody following commencement of production or written off if the property is sold or abandoned. Administration costs and other exploration costs that do not relate to any specific property are expensed as incurred.

On a periodic basis, management reviews the carrying values of deferred acquisition and exploration expenditures with a view to assessing whether there has been any impairment in value. Management takes into consideration various information including, but not limited to, results of exploration activities conducted to date, estimated future metal prices, and reports and opinions of outside geologists, mine engineers and consultants. In the event that reserves are determined to be insufficient to recover the carrying value of any property, the carrying value will be written down or written off, as appropriate. As of December 31, 2009, the Company has not established that its option interests or its mineral claims have any known or proven reserves.

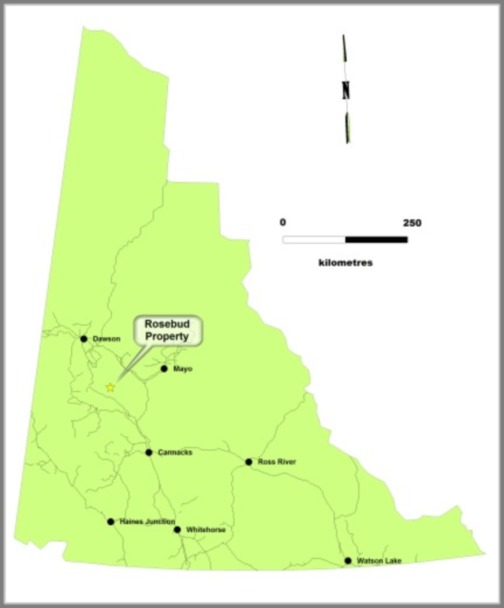

Rosebud 12 Property

Location and Access

The Rosebud 12 property was staked to cover the inferred source of a 99th percentile Geological Survey of Canada (“GSC”) gold silt anomaly (greater than 99.9 parts per billion gold) in the headwaters of Rosebud Creek, a tributary of the Stewart River. The Rosebud 12 property is located on a parallel trend approximately 76 kilometers northeast of the Coffee Creek property of Kaminak Gold Corporation, and 72 kilometers east of the White Gold property of Underworld Resources Inc./Kinross Gold Corporation.

Like the Klondike and the rest of the White Gold district, and in contrast to the rest of Canada, the Rosebud 12 property is in the part of the Yukon that was not glaciated during the last ice age. As a result, gold placers, and soil and silt geochemistry are very effective in locating gold deposits.

Access to the property is via helicopter. There is no infrastructure located at the property. Power needed for exploration activities would be provided by diesel-powered generators. Water would be provided from nearby sources, such as streams or lakes, located on the property, subject to obtaining the necessary permits from government authorities.

-20-

-21-

Mineral Claims Included in Rosebud 12 Property

The Rosebud 12 property consists of 48 claims covering approximately 2,500 acres. All of the claims expire on June 30, 2011 and can be renewed for twelve-month periods by doing exploration work on the property to the value of $100 per claim or, in the alternative, pay $105 per claim to the Mining Recorder in whose office the claims are recorded and file an Application for Renewal of Grant for Quartz Mining Pay in Lieu with such Mining Recorder.

Agreements

Under the Option and Joint Venture Agreement dated November 8, 2010 and the First Amendment to Option and Joint Venture dated December 1, 2010 with The Yukon Cornelius Syndicate (the “Syndicate”), the Company was granted an option to acquire an undivided 70% interest in the property. The Company initially paid $75,000 in cash and issued 200,000 common shares to members of the Syndicate. By December 31, 2010, the Company must give written notice of its commitment to incur and pay exploration expenses aggregating at least $200,000 by November 2011. To maintain the option in good standing, the Company is also required to make additional annual cash payments totaling $1,375,000 and issue an additional 2,600,000 shares over a five-year period ending in November 2015. The remaining 2,600,000 shares that could potentially be issued on the specified anniversaries of the effective date of the agreement will be issued at a price per share equal to the closing price of the Company’s shares the day preceding the relevant anniversary date. The Company has the option of issuing shares in lieu of any required annual cash payments. Any shares issued in lieu of making cash payments due on the relevant anniversary of the effective date will be issued at a price per share equal to the higher of (a) the average of the closing prices of the Company’s shares on the TSXV over the 20 trading days immediately preceding the relevant anniversary of the effective date, less in each case, the maximum discount from such average permitted by the policies of the TSXV, and (b) $0.125. There are no circumstances under which the Syndicate could require payment in shares as the issuance of shares in lieu of making cash payments is at the Company’s option. By November 2015, the Company must provide written notice of its commitment to fund the preparation of a feasibility study and the study must be delivered within three years after the date of such notice. The Syndicate shall retain a 3% net smelter returns royalty, of which the Company can purchase 1% for $1,500,000 within 90 days of delivery of a positive feasibility study.

Regional and Local Geology

The Rosebud 12 property is underlain by Devono-Mississippian felsic orthogneiss, Devono-Mississippian quartzite and quartz-muscovite schist.

A detailed magnetic derivative map from the McQuesten Survey flown by the Yukon Government and the GSC in 2009 shows that the area is cut by a grid of structures running north-south, east-west, northeast-southwest and northwest-southeast. The staking crew reported the presence of quartz float and kill zones on the property, which warrant follow-up. Based on the favorable geological, geochemical, and geophysical indicators, management of the Company believes that the Rosebud 12 property has excellent potential for a significant gold discovery.

Exploration History

The property area has little history of previous gold exploration. There is no record of gold exploration on or near the property despite the presence of favorable gold geochemistry.

Planned Future Work

The Company’s 2011 exploration plans include extensive mechanized trenching of existing gold-in-soil anomalies, additional soil sampling, ground magnetic surveys and geological mapping. The goal of this work is to identify and prioritize drill targets. The Company has proposed exploration expenditures of $300,000 for 2011.

-22-

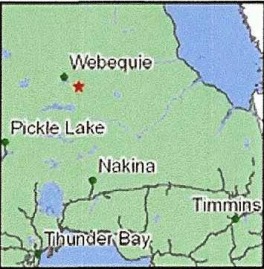

Croxall Property

Location and Access

The Croxall Property is located within the northwest corner of Price Township and parts of southern Ogden and eastern Thorneloe Townships, approximately 18 kilometers southwest of the city center of Timmins, Ontario. It consists of 60 contiguous unpatented mining claim units. The property covers several gold occurrences.

Access to the property is obtained by traveling southwest from the Timmins city center down Dalton Road, a well-maintained gravel road approximately 18 kilometers. Dalton Road crosses through the northern portion of the claim group and a few secondary logging and cottage access roads provide further access to the southern portions of the property. There is no infrastructure located at the property. Power needed for exploration activities would be provided by diesel-powered generators. Water would be provided from nearby sources, such as streams or lakes, located on the property, subject to obtaining the necessary permits from government authorities.

-23-

Mineral Claims Included in Croxall Property

The Croxall property consists of 59 unpatented mining claims totaling 60 mining claim units covering approximately 2,400 acres. The claims expire between February 14, 2016 and August 19, 2016.

Agreements

Under the Letter Agreement dated September 21, 2010 with Temex Resources Corp. (“Temex”), the Company can earn a 75% undivided interest in the property. The Company initially issued 250,000 common shares to Temex. To exercise the option, the Company must (1) incur exploration expenditures of at least $250,000 by September 21, 2011 and an additional $500,000 of exploration expenditures by September 21, 2014; and (2) make all remaining cash payments owed by Temex to the vendors of the property, which payments are $30,000 by June 22, 2011 and $30,000 by June 22, 2012. The Company can extend for one year the time for completion of each milestone of the foregoing work commitment, by notice to Temex if given prior to the applicable anniversary of signing. Each extension shall require the Company, subject to TSX-V approval, to allot and issue to Temex 125,000 common shares. If no extension is granted to the Company in accordance with the foregoing then the Company shall exercise the option on or before September 21, 2014 (the expiration of the “Earn-in Period”) provided that each such extension which is granted to the Company shall extend the Earn-in Period by one year.

Upon exercise of the option by the Company, Temex will have 60 days to either (1) continue to participate in the joint venture on the property with the Company, or (2) allow its interest in the joint venture to be diluted by the Company.

Regional and Local Geology

The Croxall property lies within the southern portion of the Abitibi Greenstone Belt of the Superior province of the Canadian Shield, which consists of an east-west trending suite of dominantly mafic to felsic metavolcanic, metasedimentary rocks and lesser ultramafic metavolcanic rocks, and a variety of granitoid intrusives. Within the Porcupine gold camp, the metavolcanic rocks are divided into two groups, the Deloro and the Tisdale Groups (Pyke, 1982). The Deloro group consists of an older calc-alkaline sequence of andesite, basalt, dacite, and rhyolitic pyroclastic rocks capped by iron formation confined to a larger domal feature to the south, referred to as the Shaw Dome. The younger, overlying Tisdale group consists of basal ultramafic volcanics and basaltic komatiites, overlain by a thick sequence of tholeiitic basalts and capped by dacitic volcaniclastics (Pyke, 1982). A major east striking belt of clastic metasediments separate the Tisdale group to the north and Deloro Group to the south, and is bounded on the south side by the regionally extensive Destor-Porcupine Fault. This sedimentary sequence consisting of wackes, siltstones, sandstones and lesser conglomerate has been divided into two groups referred to as the Porcupine and Timiskaming groups (Piroshco and Kettles, 1991). The two groups of sediments are separated by the Timiskaming

Unconformity. The Porcupine Group is the older of the two groups and conformably overlies the Tisdale Group of rocks, while the younger Timiskaming group of sediments forms an angular unconformity with both the Tisdale Group volcanics and Porcupine Group sediments within the Timmins area (Piroshco and Kettles, 1991).