UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31

| OR | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| For the transition period from _________ to __________ | |||||

Commission file numbers: 001-35263 and 333-197780

| (VEREIT, Inc.) | ||||||||||||||

| (VEREIT Operating Partnership, L.P.) | ||||||||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

| (Registrant’s telephone number, including area code) | |||||

| Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: | ||||||||||||||

| Title of each class: | Trading Symbol(s): | Name of each exchange on which registered: | ||||||||||||

| $0.01 par value per share (VEREIT, Inc.) | ||||||||||||||

| $0.01 par value per share (VEREIT, Inc.) | ||||||||||||||

Securities registered pursuant to Section 12(g) of the Securities Act of 1934: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933.

VEREIT, Inc. Yes o No x VEREIT Operating Partnership, L.P. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934.

VEREIT, Inc. Yes o No x VEREIT Operating Partnership, L.P. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. VEREIT, Inc. Yes x No o VEREIT Operating Partnership, L.P. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). VEREIT, Inc. Yes x No o VEREIT Operating Partnership, L.P. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| VEREIT, Inc. | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | |||||||||||||||||||||

| Smaller reporting company | Emerging growth company | |||||||||||||||||||||||||

| VEREIT Operating Partnership, L.P. | Large accelerated filer | ☐ | Accelerated filer | ☐ | ☒ | |||||||||||||||||||||

| Smaller reporting company | Emerging growth company | |||||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. VEREIT, Inc. ¨ VEREIT Operating Partnership, L.P. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. VEREIT, Inc. ☒ VEREIT Operating Partnership, L.P. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

VEREIT, Inc. Yes ☐ No x VEREIT Operating Partnership, L.P. Yes ☐ No x

The aggregate market value of voting and non-voting common stock held by non-affiliates of VEREIT, Inc. as of June 30, 2020 was approximately $6.9 billion based on the closing sale price for VEREIT, Inc.’s common stock on that day as reported by the New York Stock Exchange.

There were 229,029,658 shares of common stock of VEREIT, Inc. outstanding as of February 19, 2021.

There is no public trading market for the common units of VEREIT Operating Partnership, L.P. As a result, the aggregate market value of the common units held by non-affiliates of VEREIT Operating Partnership, L.P. cannot be determined.

DOCUMENTS INCORPORATED BY REFERENCE

EXPLANATORY NOTE

Combined Reporting

This report combines the Annual Reports on Form 10-K

As the sole general partner of VEREIT Operating Partnership, L.P., VEREIT, Inc. has the full, exclusive and complete responsibility for the Operating Partnership’s day-to-day management and control.

We believe combining the Annual Reports on Form 10-K

•enhancing investors’ understanding of the Company and the Operating Partnership by enabling investors to view the business as a whole in the same manner as management views and operates the business;

•eliminating duplicative disclosure and providing a more streamlined and readable presentation since a substantial portion of the disclosure applies to both the Company and the Operating Partnership; and

•creating time and cost efficiencies through the preparation of one combined report instead of two separate reports.

There are a few differences between the Company and the Operating Partnership, which are reflected in the disclosure in this report. We believe it is important to understand the differences between the Company and the Operating Partnership in the context of how we operate as an interrelated consolidated company. VEREIT, Inc. is a real estate investment trust whose only material asset is its ownership of partnership interests of the Operating Partnership. As a result, VEREIT, Inc. does not conduct business itself, other than acting as the sole general partner of the Operating Partnership, issuing equity or debt from time to time and guaranteeing certain unsecured debt of the Operating Partnership and certain of its subsidiaries. The Operating Partnership holds substantially all of the assets of the Company and holds the ownership interests in the Company’s joint ventures. The Operating Partnership conducts the operations of the business and is structured as a partnership with no publicly traded equity. Except for net proceeds from public equity or debt issuances by VEREIT, Inc., which are generally contributed to the Operating Partnership in exchange for partnership units, the Operating Partnership generates the capital required by the Company’s business through the Operating Partnership’s operations, by the Operating Partnership’s direct or indirect incurrence of indebtedness or through the issuance of partnership units. To help investors understand the significant differences between VEREIT, Inc. and the Operating Partnership, there are separate sections in this report that separately discuss VEREIT, Inc. and the Operating Partnership, including the consolidated financial statements and certain notes to the consolidated financial statements as well as separate disclosures in Item 9A. Controls and Procedures and Exhibit 31 and Exhibit 32 certifications. As sole general partner with control of the Operating Partnership, VEREIT, Inc. consolidates the Operating Partnership for financial reporting purposes. Therefore, the assets and liabilities of VEREIT, Inc. and VEREIT Operating Partnership, L.P. are the same on their respective consolidated financial statements. The separate discussions of VEREIT, Inc. and VEREIT Operating Partnership, L.P. in this report should be read in conjunction with each other to understand the results of the Company on a consolidated basis and how management operates the Company.

Reverse Stock Split

The Company effected a one-for-five reverse stock split of shares of Common Stock after markets closed on December 17, 2020, whereby every five shares of VEREIT's issued and outstanding shares of common stock, $0.01 par value per share, were converted into one share of common stock, $0.01 par value per share. A corresponding reverse split of the outstanding common partnership interests in the Operating Partnership also took effect on December 17, 2020. All common stock/unit and per share/unit data for all periods presented in this Annual Report on Form 10-K have been updated to give effect to the reverse stock split.

VEREIT, INC. and VEREIT OPERATING PARTNERSHIP, L.P.

For the fiscal year ended December 31, 2020

| Page | |||||

PART I | |||||

PART II | |||||

PART III | |||||

PART IV | |||||

F-1 | |||||

1

Forward-Looking Statements

This Annual Report on Form 10-K includes “forward-looking statements” which reflect our expectations and projections regarding future events and plans, future financial condition, results of operations, liquidity and business, including leasing and occupancy, acquisitions, dispositions, rent receipts, rent relief requests, rent relief granted, the payment of future dividends, the Company’s growth and the impact of the coronavirus (COVID-19) on our business. Generally, the words “anticipates,” “assumes,” “believes,” “continues,” “could,” “estimates,” “expects,” “goals,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “targets,” “will,” variations of such words and similar expressions identify forward-looking statements. These forward-looking statements are based on information currently available and involve a number of known and unknown assumptions and risks, uncertainties and other factors, which may be difficult to predict and beyond the Company’s control, that could cause actual events and plans or could cause our business, financial condition, liquidity and results of operations to differ materially from those expressed or implied in the forward-looking statements. These factors include, among other things, those discussed below. Information regarding historical rent collections should not serve as an indication of future rent collection. We disclaim any obligation to publicly update or revise any forward-looking statements, whether as a result of changes in underlying assumptions or factors, new information, future events or otherwise, except as may be required by law.

The following are some, but not all, of the assumptions, risks, uncertainties and other factors that could cause our actual results to differ materially from those presented in our forward-looking statements:

•The uncertain duration and extent of the impact of COVID-19 on our business and the businesses of our tenants (including their ability to timely make rental payments) and the economy generally.

•Federal, state or local legislation or regulation that could impact the timely payment of rent by tenants in light of COVID-19.

•We may be unable to renew leases, lease vacant space or re-lease space as leases expire on favorable terms or at all.

•We are subject to risks associated with tenant, geographic and industry concentrations with respect to our properties.

•We may be subject to risks accompanying the management of our industrial and office partnerships, in each of which we hold a non-controlling ownership interest.

•Our properties may be subject to impairment charges.

•We could be subject to unexpected costs or liabilities that may arise from potential dispositions, including related to limited partnership, tenant-in-common and Delaware statutory trust real estate programs (“1031 real estate programs”) and our management of such programs.

•We are subject to competition in the acquisition and disposition of properties and in the leasing of our properties including that we may be unable to acquire, dispose of, or lease properties on advantageous terms or at all.

•We are subject to risks associated with bankruptcies or insolvencies of tenants, from tenant defaults generally or from the unpredictability of the business plans and financial condition of our tenants, which are heightened as a result of the COVID-19 pandemic.

•We have substantial indebtedness, which may affect our ability to pay dividends, and expose us to interest rate fluctuation risk and the risk of default under our debt obligations.

•We may be subject to increases in our borrowing costs as a result of changes in interest rates and other factors, including the phasing out of the London Inter-Bank Offered Rate (“LIBOR”) after 2021.

•Our overall borrowing and operating flexibility may be adversely affected by the terms and restrictions within the indenture governing the senior unsecured notes (the “Senior Notes”), and the Credit Agreement governing the terms of the Credit Facility (as both terms are defined in Liquidity and Capital Resources), and compliance with such covenants and/or our ability to access capital markets (including on attractive terms) may be more difficult as a result of the impact of COVID-19.

•Our access to capital and terms of future financings may be affected by adverse changes to our credit rating.

•We may be affected by the incurrence of additional secured or unsecured debt.

•We may not generate cash flows sufficient to pay our dividends to stockholders or meet our debt service obligations.

•We may be affected by risks resulting from losses in excess of insured limits.

•We may fail to remain qualified as a real estate investment trust (“REIT”) for U.S. federal income tax purposes.

•Compliance with the REIT annual distribution requirements may limit our operating flexibility.

•We may be unable to retain or hire key personnel.

•We may be impacted by the continuation or deterioration of current market conditions.

2

All forward-looking statements should be read in light of the risks identified in Part I, Item 1A. Risk Factors within this Annual Report on Form 10-K for the year ended December 31, 2020.

We use certain defined terms throughout this Annual Report on Form 10-K that have the following meanings:

When we refer to “annualized rental income,” we mean the rental revenue under our leases on operating properties on a straight-line basis, which includes the effect of rent escalations and any tenant concessions, such as free rent, and our pro rata share of such revenues from properties owned by unconsolidated joint ventures. Annualized rental income excludes any adjustments to rental income due to changes in the collectability assessment, contingent rent, such as percentage rent, and operating expense reimbursements. Management uses annualized rental income as a basis for tenant, industry and geographic concentrations and other metrics within the portfolio. Annualized rental income is not indicative of future performance.

When we refer to a “creditworthy tenant,” we mean a tenant that has entered into a lease that we determine is creditworthy and may include tenants with an investment grade or below investment grade credit rating, as determined by major credit rating agencies, or unrated tenants. To the extent we determine that a tenant is a “creditworthy tenant” even though it does not have an investment grade credit rating, we do so based on our management’s determination that a tenant should have the financial wherewithal to honor its obligations under its lease with us. As explained further below, this determination is based on our management’s substantial experience performing credit analysis and is made after evaluating a tenant’s due diligence materials that are made available to us, including financial statements and operating data.

When we refer to a “direct financing lease,” we mean a lease that requires specific treatment due to the significance of the lease payments from the inception of the lease compared to the fair value of the property, term of the lease, a transfer of ownership, or a bargain purchase option. These leases are recorded as a net asset on the balance sheet. The amount recorded is calculated as the fair value of the remaining lease payments on the leases and the estimated fair value of any expected residual property value at the end of the lease term.

When we refer to properties that are net leased on a “long term basis,” we mean properties with remaining primary lease terms of generally seven to 10 years or longer on average, depending on property type.

Under a “net lease,” the tenant occupying the leased property (usually as a single tenant) does so in much the same manner as if the tenant were the owner of the property. There are various forms of net leases, most typically classified as triple net or double net. Triple net leases typically require that the tenant pay all expenses associated with the property (e.g., real estate taxes, insurance, maintenance and repairs). Double net leases typically require that the tenant pay all operating expenses associated with the property (e.g., real estate taxes, insurance and maintenance), but excludes some or all major repairs (e.g., roof, structure and parking lot). Accordingly, the owner receives the rent “net” of these expenses, rendering the cash flow associated with the lease predictable for the term of the lease. Under a net lease, the tenant generally agrees to lease the property for a significant term and agrees that it will either have no ability or only limited ability to terminate the lease or abate rent prior to the expiration of the term of the lease as a result of real estate driven events such as casualty, condemnation or failure by the landlord to fulfill its obligations under the lease.

When we refer to “operating properties” we mean properties owned and consolidated by the Company, omitting properties (the “Excluded Properties”) for which (i) the related mortgage loan is in default, and (ii) management decides to transfer the properties to the lender in connection with settling the mortgage note obligation. At December 31, 2020 and 2019, there were no Excluded Properties. During the year ended December 31, 2020, there were no Excluded Properties. During the year ended December 31, 2019, there was one Excluded Property which was an office property comprised of 145,186 square feet, of which 6,926 square feet were vacant, with principal outstanding of $19.5 million on the related mortgage loan. During the year ended December 31, 2018, there was one Excluded Property, which was a vacant industrial property, comprised of 307,725 square feet, with principal outstanding of $16.2 million on the related mortgage loan.

The real estate portfolio and economic metrics of our operating properties omits the square feet of one redevelopment property and includes the Company's pro rata share of square feet and annualized rental income from the Company's unconsolidated joint ventures, based upon the Company's legal ownership percentage, which may, at times, not equal the Company's economic interest because of various provisions in certain joint venture agreements regarding distributions of cash flow based on capital account balances, allocations of profits and losses and payments of preferred returns.

3

PART I

Item 1. Business.

Overview

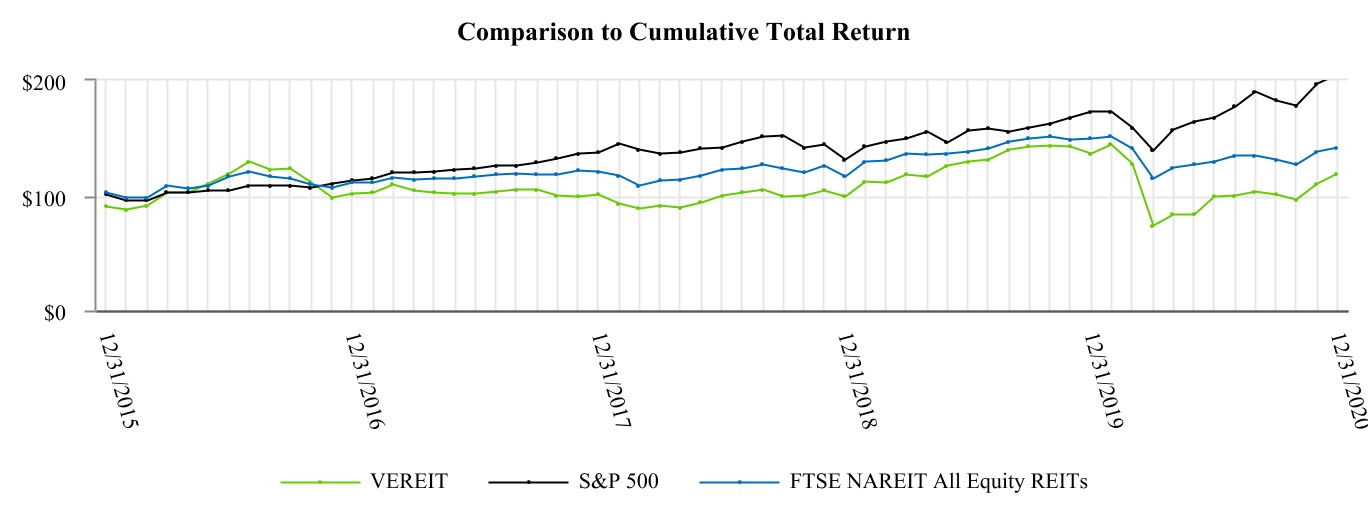

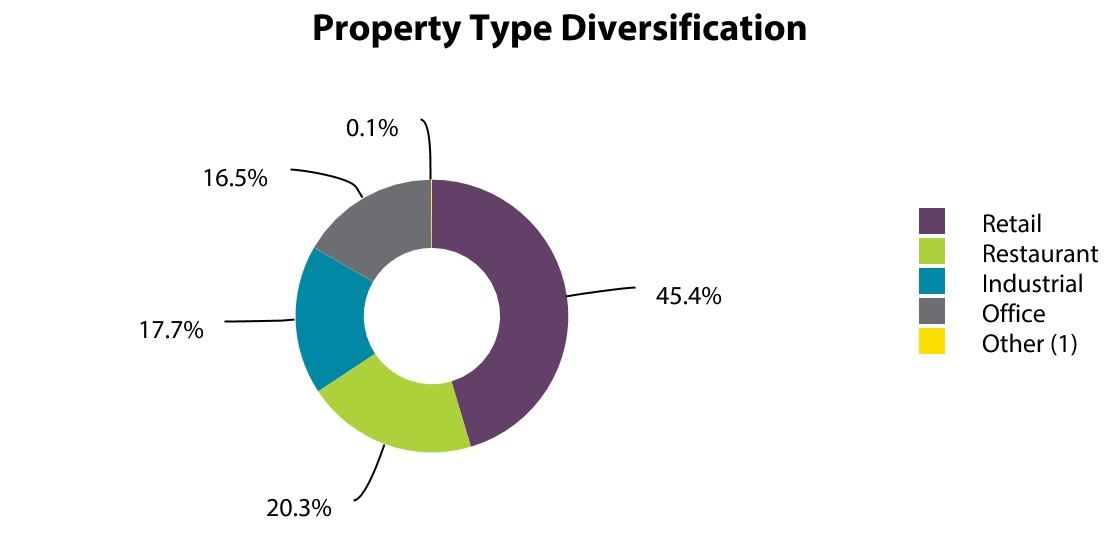

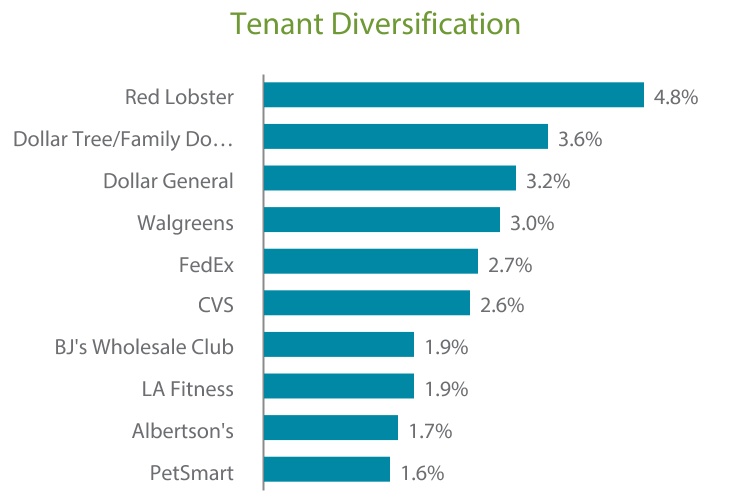

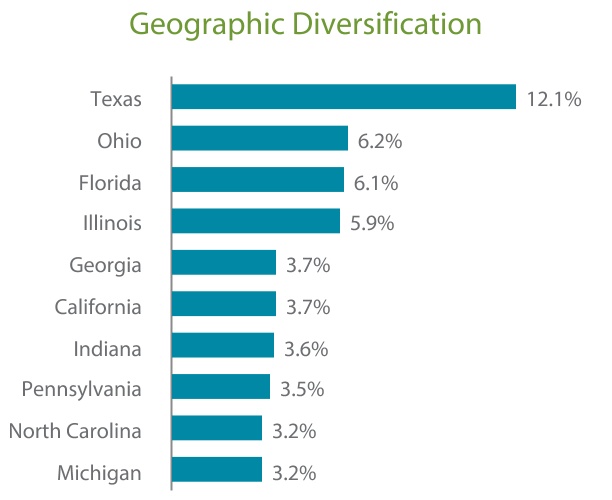

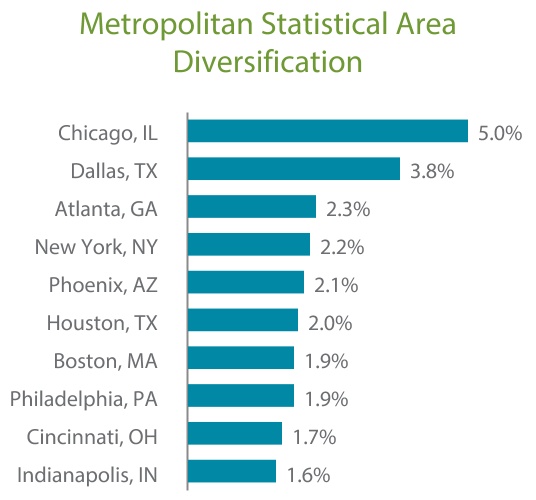

VEREIT is a full-service real estate operating company which owns and actively manages one of the largest portfolios of single-tenant commercial properties in the U.S. and has a business model of providing equity capital to creditworthy organizations in return for long-term leases on their properties. As discussed in further detail below, our full-service real estate operations include portfolio management through strategic acquisitions and dispositions, property management, asset management and leasing. The Company has 3,831 retail, restaurant, office and industrial real estate properties with an aggregate of 89.7 million square feet of which 97.9% was leased, with a weighted-average remaining lease term of 8.3 years. Omitting the square feet of one redevelopment property and including the pro rata share of square feet and annualized rental income from the Company’s unconsolidated joint ventures, we owned an aggregate of 89.5 million square feet, of which 98.1% was leased, with a weighted-average remaining lease term of 8.4 years as of December 31, 2020. Of VEREIT’s 3,831 properties, annualized rental income as a percentage of the total portfolio was approximately 45% retail, 20% restaurant, 17% office, 18% industrial and 0.1% other. Our properties are located throughout the U.S. (including Puerto Rico) with the two highest concentrations in the Southeast and Midwest regions.

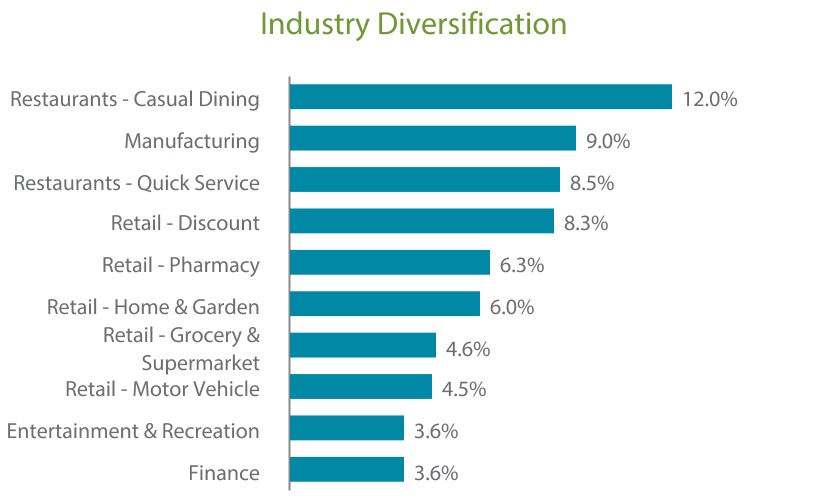

As of December 31, 2020 and 2019, there were no tenants exceeding 10% of our consolidated annualized rental income. As of December 31, 2020 and 2019, properties located in Texas represented 12.1% and 12.8%, respectively, of our consolidated annualized rental income. As of each of December 31, 2020 and 2019, tenants in the casual dining restaurant industry accounted for 12.0% of our consolidated annualized rental income.

Prior to the fourth quarter of 2017, the Company operated through two business segments, the real estate investment segment and the investment management segment, Cole Capital. The Company completed the sale of Cole Capital on February 1, 2018. The assets, liabilities and related financial results of substantially all of the Cole Capital segment are reflected in the financial statements as discontinued operations. Following the sale of Cole Capital, the Company's financial results are reported as a single segment for all periods presented.

VEREIT, Inc. was incorporated in the State of Maryland on December 2, 2010 and has elected to be treated as a REIT for U.S. federal income tax purposes. Substantially all of our real estate operations are conducted through the Operating Partnership, of which VEREIT, Inc. is the sole general partner. VEREIT Inc. is the holder of 99.9% of the common partnership interests in the Operating Partnership (the “OP Units”) as of December 31, 2020. The Operating Partnership was formed in the State of Delaware on January 13, 2011. VEREIT, Inc.’s shares of common stock (“Common Stock”) and 6.70% Series F Cumulative Redeemable Preferred Stock (“Series F Preferred Stock”) trade on the New York Stock Exchange (the “NYSE”) under the trading symbols “VER” and “VER PRF,” respectively.

The Company effected a one-for-five reverse stock split of shares of Common Stock after markets closed on December 17, 2020. Certain prior period amounts have been updated to reflect the reverse stock split. A corresponding reverse split of the outstanding OP Units also took effect on December 17, 2020. See Note 2 – Summary of Significant Accounting Policies and Note 12 – Equity for further discussion.

2020 Highlights and Developments

Operations

•Acquired controlling financial interests in 51 commercial properties for an aggregate purchase price of $342.5 million, which includes the consolidation of one property previously owned by one of the Company’s unconsolidated joint ventures and two land parcels, including one for build-to-suit development, and $1.9 million of external acquisition-related expenses that were capitalized. The Company also acquired a mezzanine position in two last-mile distribution facilities for $10.0 million and a preferred equity interest in one distribution center for $22.8 million.

•Acquired $246.8 million for the industrial partnership and $33.1 million for the office partnership.

•Disposed of 77 properties, including the sale of three consolidated properties to the office partnership, for an aggregate gross sales price of $438.4 million, of which our share was $435.5 million, resulting in proceeds of $408.0 million after closing costs, including proceeds from the contribution of properties to the office partnership. The Company recorded a gain of $96.2 million related to the sales. The Company also received $14.6 million upon the sale of the two last-mile distribution facilities, in which the Company had a mezzanine position.

4

Debt

•Closed a senior note offering, consisting of $600.0 million aggregate principal amount of the Operating Partnership’s 3.40% Senior Notes due 2028 (the “Senior Notes due January 2028”) in June of 2020.

•Closed on a senior note offering, consisting of $500.0 million aggregate principal amount of the Operating Partnership’s 2.20% Senior Notes due 2028 (the “Senior Notes due June 2028”) and $700.0 million aggregate principal amount of the Operating Partnership’s 2.85% Senior Notes due 2032 (the “Senior Notes due 2032”) in November of 2020.

•The Company fully repaid its 3.75% Convertible Senior Notes due 2020 (the “2020 Convertible Notes”).

•As of December 31, 2020, no amounts were outstanding under the Revolving Credit Facility (as defined in Liquidity and Capital Resources) and the Company repaid the outstanding balance of $900.0 million on the Credit Facility Term Loan (as defined in Liquidity and Capital Resources).

•Terminated the $900.0 million interest rate swaps and the $400.0 million forward starting interest rate swaps.

•Total secured debt decreased by $195.9 million, from $1.5 billion to $1.3 billion.

Equity

•Effected a one-for-five reverse stock split of shares of Common Stock. A corresponding reverse split of the outstanding OP Units also took effect on December 17, 2020.

•Issued an aggregate of 13.3 million shares under the ATM Program (as defined in Liquidity and Capital Resources), at a weighted average price per share of $36.41, for gross proceeds of $484.1 million. The weighted average price per share, net of commissions, was $36.00, for net proceeds of $478.7 million.

•Redeemed a total of 12.0 million shares of Series F Preferred Stock, representing approximately 38.87% of the issued and outstanding preferred shares as of the beginning of the year. The shares of Series F Preferred Stock were redeemed at a redemption price of $25.00 per share plus all accrued and unpaid dividends.

•For the fourth quarter of 2020, declared a quarterly dividend of $0.385 per share of Common Stock, as updated for the one-for-five reverse stock split which if annualized, is $1.540 per share of Common Stock. An equivalent distribution by the Operating Partnership is applicable per OP Unit.

Primary Investment Focus

We own and actively manage a diversified portfolio of single-tenant retail, restaurant, office and industrial real estate assets subject to long-term net leases with creditworthy tenants. Our focus is on single-tenant, net-leased properties that are strategically located and essential to the business operations of the tenant, as well as retail properties that offer necessity and value-oriented products or services. We actively manage the portfolio by considering several metrics including property type, tenant concentration, geography, credit and key economic factors for appropriate balance and diversity. We believe that actively managing our portfolio allows us to attain the best operating results for each asset and the overall portfolio through strategic planning, implementation of these plans and responding proactively to changes and challenges in the marketplace.

Investment Policies

When evaluating prospective investments in or dispositions of real property, management considers relevant real estate and financial factors, including the location of the property, the leases and other agreements affecting the property and business operations of the tenant, the creditworthiness of major tenants, its income-producing capacity, its physical condition, its prospects for appreciation, its prospects for liquidity, tax considerations and other factors. In this regard, our management has substantial discretion with respect to the selection of specific investments, subject in certain instances to the approval of the Board of Directors.

As part of our overall portfolio strategy, we seek to lease space and/or acquire properties leased to creditworthy tenants that meet our underwriting and operating guidelines. Prior to entering into any transaction, our corporate credit analysis and underwriting professionals conduct a review of a tenant’s credit quality. In addition, we consistently monitor the credit quality of our portfolio by actively reviewing the creditworthiness of certain tenants, focusing primarily on those tenants representing the greatest concentration of our portfolio. This review primarily includes an analysis of the tenant’s financial statements either quarterly, or as frequently as the lease permits. We also consider tenant credit quality when assessing our portfolio for strategic dispositions. When we assess tenant credit quality, we, among other factors that we may deem relevant: (i) review relevant

5

financial information, including financial ratios, net worth, revenue, cash flows, leverage and liquidity; (ii) evaluate the depth and experience of the tenant’s management team; and (iii) assess the strength/growth of the tenant’s industry. On an on-going basis, we evaluate the need for an allowance for doubtful accounts arising from estimated losses that could result from the tenant’s inability to make required current rent payments and an allowance against accrued rental revenue for future potential losses that we deem to be unrecoverable over the term of the lease. The factors considered in determining the credit risk of our tenants include, but are not limited to: payment history; credit status and change in status (credit ratings for public companies are used as a primary metric) including as a result of the ongoing COVID-19 pandemic; change in tenant space needs (i.e., expansion/downsize); tenant financial performance; economic conditions in a specific geographic region; and industry specific credit considerations. We are of the opinion that the credit risk of our portfolio is reduced by the high quality of our existing tenant base, our review of prospective tenants’ risk profiles prior to lease execution and consistent monitoring of our portfolio to identify potential problem tenants and mitigation options.

Financing Policies

We rely on leverage to allow us to invest in a greater number of assets and enhance our asset returns. We intend to finance future acquisitions with the most advantageous source of capital available to us at the time of the transaction, which may include a combination of public and private offerings of our equity and debt securities, unsecured corporate-level debt, and other public, private or bank debt. In addition, we may acquire properties in exchange for the issuance of Common Stock or OP Units and we may acquire properties subject to existing mortgage indebtedness.

We also may obtain secured or unsecured debt to acquire properties, and we expect that our financing sources will include the public debt market, banks and institutional investment firms, including asset managers and life insurance companies. Although we intend to maintain a conservative capital structure, our charter does not contain a specific limitation on the amount of debt we may incur and the Board of Directors may implement or change target debt levels at any time without the approval of our stockholders.

We intend to continue to emphasize unsecured corporate-level or OP-level debt in our financing and to seek to reduce the percentage of our assets which are secured by mortgage loans. For information relating to our Credit Facility, see Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources.

Competition

We are subject to competition in the acquisition and disposition of properties and in the leasing of our properties. We compete with a number of developers, owners and operators of retail, restaurant, office and industrial real estate, many of which own properties similar to ours in the same markets in which our properties are located. We also may face new competitors and, due to our focus on single-tenant properties located throughout the United States, and because many of our competitors are locally or regionally focused, we do not expect to encounter the same competitors in each region of the United States. Our competitors may be willing to accept lower returns on their investments and may succeed in buying the properties that we have targeted for acquisition and may succeed in disposing of or leasing properties similar to ours for lower sale or rental rates. Foreign investors may view the U.S. real estate market as being more stable than other international markets and may increase investments in high-quality single-tenant properties, especially in gateway cities. We may also incur costs in connection with unsuccessful acquisitions that we will not be able to recover.

Regulations

Compliance with various governmental regulations has an impact on our business, including our capital expenditures, earnings and competitive position, which can be material. We incur costs to monitor and take actions to comply with governmental regulations that are applicable to our business, which include, among others, federal securities laws and regulations, applicable stock exchange requirements, REIT and other tax laws and regulations, environmental and health and safety laws and regulations, local zoning, usage and other regulations relating to real property, and the Americans with Disabilities Act of 1990 (“ADA”). See “Item 1A - Risk Factors” for a discussion of material risks to us, including, to the extent material, to our competitive position, relating to governmental regulations, and see “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations” together with our consolidated financial statements, including the related notes included therein, for a discussion of material information relevant to an assessment of our financial condition and results of operations, including, to the extent material, the effects that compliance with governmental regulations may have upon our capital expenditures and earnings.

The coronavirus (COVID-19) pandemic has impacted all states where our tenants operate their businesses or where our properties are located. Our business and our tenants’ businesses have been impacted and may continue to be impacted by measures taken to control the COVID-19 outbreak (including “shelter-in-place” or “stay-at-home” orders, density limitations

6

and social distancing orders (collectively, “Closure Orders”), and other mandates issued by local, state or federal authorities) as well as state, local or industry-initiated efforts to freeze tenant rent or suspend or modify the process by which a landlord can enforce evictions. These measures have affected and may continue to affect our ability to collect rent or enforce remedies for the failure to pay rent. While we believe our tenants generally do not have a clear contractual right to cease paying rent due to government-mandated closures and we intend to enforce our rights under the lease agreements, the ongoing COVID-19 pandemic and the related governmental orders continue to present novel situations for which the ultimate legal outcome cannot be assured and it is possible future governmental action could impact our rights under the lease agreements.

Human Capital

As of December 31, 2020, we had approximately 160 employees. We value our employees and their individual and collective contributions to the Company in the furtherance of our corporate, operational, social, environmental and governance initiatives. Our company culture is based on treating others the way we would like to be treated and we strive to foster a work environment that is inclusive, fair and engaged.

Our success depends on our ability to attract and retain key members of our executive and senior management teams and staff supporting our continuing operations. We have developed robust benefit programs focused on the recruitment and retention of employees. These benefit programs include, but are not limited to, competitive compensation packages, health and welfare benefits, life and disability insurance, 401(k) plan matching, and parental leave, along with programs focused on employee training and education, wellness, assistance and engagement. We also encourage employees to become more proficient in their jobs and prepare for greater responsibility by offering reimbursement to employees seeking professional certifications, designations or licenses. Further, we have a commitment to providing equal opportunities in all aspects of employment and we do not discriminate against any person based on race, color, religion, sex, national origin, age, disability, sexual orientation, gender identification or expression, genetic information or any other basis made unlawful by federal, state or local law, ordinance or regulation.

In addition, as a result of COVID-19, the Company implemented and is continuing its work-from-home policy to protect its employees. The Company maintains a strong commitment to supporting its employees’ health through the pandemic and has instituted safety protocols and procedures for employees when they are in a Company office.

The Company empowers employees to strengthen their communities and to support their local social programs. To further this initiative, the Company established the VEREIT Values Program in 2015 whose mission is to connect employees with charitable organizations in their communities. Since its inception, employees have contributed time and resources to various charitable organizations.

Available Information

We electronically file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports, and proxy statements, with the SEC. You may access any materials we file with the SEC through the EDGAR database at the SEC’s website at http://www.sec.gov. In addition, copies of our filings with the SEC may be obtained from our website at www.ir.vereit.com. We are providing our website address solely for the information of investors. We do not intend for the information contained on our website to be incorporated into this Annual Report on Form 10-K or other filings with the SEC.

7

Item 1A. Risk Factors.

Investors should carefully consider the following factors, together with all the other information included in this Annual Report on Form 10-K, in evaluating the Company and our business. If any of the following risks actually occur, our business, financial condition and results of operations could be materially and adversely affected, the trading price of VEREIT's securities could decline and its stockholders and/or the Operating Partnership's unitholders may lose all or part of their investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. Unless expressly stated otherwise, references in this “Risk Factors” section to our “capital stock” represent VEREIT’s Common Stock and any class or series of its preferred stock, references to our “stockholders” represent holders of VEREIT’s Common Stock and any class or series of its preferred stock, and references to our “unitholders” represent holders of the OP Units and any class of series of the Operating Partnership’s preferred units.

Risks Related to Our Business and Operations

The ongoing pandemic of the novel coronavirus (COVID-19) has negatively affected and will likely continue to negatively affect our business, financial condition, liquidity and results of operations and those of our tenants.

The COVID-19 pandemic has had, and likely will continue to have, repercussions across local, national and global economies and financial markets. COVID-19 has impacted all states where our tenants operate their businesses or where our properties are located and measures taken to control the COVID-19 outbreak, including Closure Orders, and other mandates issued by local, state or federal authorities, have had and are continuing to have an adverse effect on our business and the businesses of our tenants. The full extent of the adverse impact on our results of operations, liquidity, and our ability to acquire, dispose of, or lease properties for our portfolio, our joint venture portfolios and/or for the 1031 real estate program property that we manage is unknown and will depend on future developments, which are highly uncertain and cannot be predicted. Our results of operations, liquidity and cash flows could be materially affected.

Many of our tenants operate in industries that depend on in-person activities or interactions with their customers to be profitable and to fund their obligations under lease agreements with us. Measures taken to control the COVID-19 outbreak, including Closure Orders, and other mandates have, with respect to some portion of our tenants, (i) decreased or prevented our tenants’ customers’ willingness, need or ability to frequent their businesses, and/or (ii) impacted supply chains from local, national and international suppliers or otherwise delayed the delivery of inventory or other materials necessary for our tenants’ operations, which has adversely affected, and is likely to continue to adversely affect, their ability to maintain profitability and make rental payments to us under their leases. Further, places that have seen increased cases of COVID-19 have reinstituted and/or may in the future reinstitute measures to control and decrease the spread of COVID-19, which may prolong the adverse effect on our business and/or the business of our tenants. In light of the spread of COVID-19 and the resulting economic downturn, tenants have requested and may in the future request rent relief, including rent deferrals, rent abatement, lease restructures or early termination of their leases, and they may be forced to temporarily or permanently cease or limit operations or declare bankruptcy which could reduce our cash flows and negatively affect our ability to pay dividends at current levels or at all. Specifically, as a result of COVID-19 and various governmental orders currently or previously in place, a number of our tenants have temporarily or permanently closed their businesses, have limited operations and/or have submitted requests for rent relief or failed to pay rent. While the Company has worked with and continues to work with tenants requesting rent relief, there can be no guarantee that future rent collections will be received at the same level as historical rent collections or that new governmental closure orders or restrictions will not be instituted in the future. In addition, state, local or industry-initiated efforts, such as tenant rent freezes or suspension of a landlord’s ability to enforce evictions, may continue to affect our ability to collect rent or enforce remedies for the failure to pay rent. We believe our tenants generally do not have a clear contractual or common law right to cease paying rent due to government-mandated closures and we intend to enforce our rights under the lease agreements. However, the ongoing COVID-19 pandemic and the related governmental orders continue to present novel situations for which the ultimate legal outcomes cannot be assured, and it is possible future governmental action could impact our rights under the lease agreements.

The spread of COVID-19 has caused and is continuing to cause significant financial market volatility and a general economic downturn, and the length and extent of such volatility and downturn are unknown and cannot be predicted with any certainty. The financial impact of COVID-19 could have a material and adverse effect on our results of operations, liquidity and cash flows, in particular due to the potential (i) inability of our tenants to satisfy their rent obligations, (ii) inability of the Company to renew leases, lease vacant space or re-let space as leases expire on favorable terms, or at all, (iii) reductions or other changes in demand for certain types of or uses for commercial real estate; and (iv) difficulty for the Company accessing debt and equity capital on attractive terms, or at all. The effect of COVID-19 may also negatively impact our future compliance with financial covenants in our credit facility, indentures governing our senior notes and other debt agreements and result in a default and acceleration of indebtedness which could negatively impact our ability to make additional borrowings under our credit facility. The financial impact of COVID-19 could also negatively affect our ability to pay dividends or fund acquisitions.

8

As a result of COVID-19, the Company implemented and is continuing its work-from-home policy to protect its employees. The COVID-19 pandemic may also impact the continued service and availability of our personnel, including our executive officers, and our ability to recruit, attract and retain skilled personnel. If significant portions of our workforce, including key personnel, are unable to work effectively because of illness, government actions or other restrictions implemented or reinstituted in connection with COVID-19, the impact on our business could be exacerbated.

The full extent of the adverse impact of COVID-19 (including any prolonged or permanent impact to societal behaviors due to COVID-19 (e.g., working, shopping, dining, entertainment, etc.)) on our business, financial condition, liquidity and results of operations cannot be predicted and may be material. The magnitude will depend on factors beyond our control including actions taken by local, state, federal and international governments, non-governmental organizations, the medical community, our tenants, and the public in general. Moreover, our other risk factors herein could be heightened as a result of the impact of COVID-19.

We are primarily dependent on single-tenant leases for our revenue and, accordingly, if we are unable to renew leases, lease vacant space, including vacant space resulting from tenant defaults, or re-lease space as leases expire, on favorable terms or at all, our financial condition could be adversely affected.

We focus our investment activities on ownership of freestanding, single-tenant net leased commercial properties. Therefore, the financial failure of, or other default by, a significant tenant or multiple tenants could cause a material reduction in our revenues and operating cash flows. In addition, this risk is increased where we lease multiple properties to a single tenant under a master lease. In such an instance, a default specific to a particular property could lead to a termination of the entire master lease, resulting in the loss of revenue from all properties under the master lease. We are subject to competition in the leasing of our properties and compete with developers, owners and operators of real estate, who may have greater financial and other resources than we do. We cannot assure you that our leases will be renewed or that we will be able to lease or re-lease the properties on favorable terms, or at all, or that lease terminations will not cause us to sell the properties at a loss. If our properties are nearing the end of the lease term or become vacant and our competitors offer alternative space at rental rates below current market rates or below the rental rates we charge, we may lose existing or potential tenants and we may be pressured to reduce our rental rates, offer substantial rent or other concessions, and/or accommodate requests for remodeling and other improvements in order to retain tenants or to attract new tenants. Certain of our properties may be specifically suited to the particular needs of a tenant (e.g., a retail bank branch or distribution warehouse) and major renovations and expenditures may be required in order for us to re-lease the space for other uses. We have and may continue to experience vacancies due to the default of a tenant under its lease, the expiration of a lease or if we are not willing to agree to existing or new tenant accommodations or concessions. We typically must incur all of the costs of ownership for a property that is vacant and if vacancies continue, we may suffer reduced rental income. If we are unable to renew leases, lease vacant space, including vacant space resulting from tenant defaults, or re-lease space as leases expire, on favorable terms or at all, our financial condition, liquidity and results of operations could be adversely affected.

We are subject to tenant, geographic and industry concentrations that make us more susceptible to adverse events with respect to certain tenants, geographic areas or industries.

We have tenant, geographic and industry concentrations within our portfolio which may increase as we continue to acquire or dispose of properties. Any adverse change in the financial condition of a tenant with whom we have a significant credit concentration, or any downturn of the economy in any state or industry in which we have a significant credit concentration, could result in a material reduction of our cash flows or material losses to us. These concentrations may also strengthen tenant bargaining power and make us more susceptible to adverse regulatory changes, natural disasters or other unexpected events that may impact a particular tenant, geographic location or industry which could negatively affect our operations or result in a material reduction of our cash flows or material losses to us.

Our net leases may require us to pay property-related expenses that are not the obligations of our tenants.

Under the terms of the majority of our net leases, in addition to satisfying their rent obligations, our tenants are responsible for the payment or reimbursement of property expenses such as real estate taxes, insurance and ordinary maintenance and repairs. However, under the provisions of certain existing leases and leases that we may enter into in the future, we may be required to pay some or all of the expenses of the property, such as the costs of environmental liabilities, roof and structural repairs, real estate taxes, insurance, certain non-structural repairs and maintenance. If our properties incur significant expenses that must be paid by us under the terms of our leases, our business, financial condition and results of operations may be adversely affected.

Real estate investments are relatively illiquid and we may not be able to dispose of properties when appropriate or on favorable terms which could, among other things, adversely impact our ability to make cash distributions to our stockholders and unitholders.

9

We expect to hold our real estate investments until such time as we decide that a sale or other disposition is appropriate given our investment objectives and REIT qualification limitations. We generally intend to hold properties for an extended period of time, but our management or Board of Directors may exercise their discretion as to whether and when to sell a property (including in connection with joint venture arrangements) to achieve investment or portfolio objectives. Real estate investments are, in general, relatively illiquid and may become even more illiquid during periods of economic downturn. Our ability to dispose of properties on advantageous terms or at all depends on certain factors beyond our control, including competition from other sellers, the availability of attractive financing for potential buyers, and the quality of the underlying tenants. In addition, if our competitors sell assets similar to assets we intend to divest and/or at valuations below our valuations for comparable assets, we may be unable to divest our assets at all or at favorable pricing or terms. Furthermore, we may be required to seek modifications of an underlying lease or expend funds to correct defects or to make improvements before a property can be sold. We cannot predict the various market conditions affecting real estate investments that will exist at any particular time in the future. As a result, once we determine to sell a property we may not be able to do so quickly, on favorable terms or at all. Due to the uncertainty of market conditions that may affect the disposition of our properties, we cannot assure you that we will be able to sell our properties at a profit or at all in the future, which may impact the extent to which our stockholders and unitholders will receive cash distributions and realize potential appreciation on our real estate investments. In addition, certain significant real property expenditures generally do not change in response to economic or other conditions, including debt service obligations, real estate taxes, and operating and maintenance costs. This combination of variable disposition revenue and relatively fixed expenditures may result, under certain market conditions, in reduced earnings. Therefore, we may be unable to adjust our portfolio promptly in response to economic, market or other conditions, which could adversely affect our business, financial condition, liquidity and results of operations.

A substantial portion of our properties are leased to tenants with a below investment grade rating, as determined by major credit rating agencies, or are leased to tenants that are not rated, and may have a greater risk of default.

As of December 31, 2020, approximately 61.3% of our tenants were not rated or did not have an investment grade credit rating from a major ratings agency or were not affiliates of companies having an investment grade credit rating, which percentage may increase over time, including as property acquisition volume increases. Our investments in properties leased to such tenants may have a greater risk of default and bankruptcy than investments in properties leased to investment grade tenants, and these tenants may be more susceptible to default if economic conditions decline, including in the tenant’s industry. When we invest in properties where the tenant does not have a publicly available credit rating, we will use certain credit-assessment tools as well as rely on our own underwriting and analysis of the tenant’s credit which includes, among other things, reviewing the tenant’s available financial information (e.g., financial ratios, net worth, revenue, cash flows, leverage and liquidity, if applicable). If our credit estimates are inaccurate, the default or bankruptcy risk for a tenant may be greater than anticipated. These outcomes could have an adverse impact on our returns on the assets and hence our operating results.

Dividends paid from sources other than our cash flow from operations could affect our profitability, restrict our ability to generate sufficient cash flow from operations, and dilute stockholders’ and unitholders’ interests in us.

We may not generate sufficient cash flow from operations to pay dividends and we may in the future pay dividends from sources other than from our cash flow from operations, such as from the proceeds of property or other asset dispositions, borrowings (including on our existing Revolving Credit Facility), cash and cash equivalents balances, and/or offerings of debt and/or equity securities. We have not established any limit on the amount of borrowings and/or the sale of property or other assets or the proceeds from an offering of debt or equity securities that may be used to fund dividends, except that, in accordance with our organizational documents and Maryland law, we may not make dividend distributions that would: (1) cause us to be unable to pay our debts as they become due in the usual course of business; (2) cause our total assets to be less than the sum of our total liabilities plus senior liquidation preferences; or (3) jeopardize our ability to qualify as a REIT. Funding dividends from borrowings could restrict the amount we can borrow for portfolio investments, which may affect our ability to acquire properties and our profitability. Funding dividends with the sale of property or other assets or the proceeds of offerings of debt or equity securities may affect our ability to generate cash flows. Payment of dividends from these sources could affect our profitability, restrict our ability to generate sufficient cash flow from operations, and dilute stockholders’ and unitholders’ interests in us, any or all of which may adversely affect the overall return of our stockholders. In addition, funding dividends from the sale of additional debt or equity securities could dilute our stockholders’ interest in us. As a result, the return our stockholders realize on their investment may be reduced.

We could face potential adverse effects from the bankruptcies or insolvencies of tenants or from tenant defaults generally.

The bankruptcy or insolvency of our tenants may adversely affect the income produced by our properties. Under bankruptcy law, a tenant cannot be evicted solely because of its bankruptcy and has the option to assume or reject any unexpired lease. If the tenant rejects the lease, any resulting claim we have for breach of the lease (excluding collateral securing the claim) will be treated as a general unsecured claim. Our claim against the bankrupt tenant for unpaid and future rent will be subject to a statutory cap

10

that might be substantially less than the remaining rent actually owed under the lease, and it is unlikely that a bankrupt tenant that rejects its lease would pay in full amounts it owes us under the lease. Even if a lease is assumed and brought current, we still run the risk that a tenant could condition lease assumption on a restructuring of certain terms, including rent, that would have an adverse impact on us. Any shortfall resulting from the bankruptcy of one or more of our tenants could adversely affect our cash flows and results of operations and could cause us to reduce the amount of distributions to our stockholders and unitholders. In addition, the financial failure of, or other default by, one or more of our tenants could have an adverse effect on the results of our operations. While we evaluate the creditworthiness of our tenants by reviewing available financial and other pertinent information, there can be no assurance that any tenant will be able to make timely rental payments or avoid defaulting under its lease. If any of our tenants’ businesses experience adverse changes, they may fail to make rental payments when due, close a number of business locations, exercise early termination rights (to the extent such rights are available to the tenant) or declare bankruptcy. A default by a significant tenant or multiple tenants could cause a material reduction in our revenues and operating cash flows. In addition, if a tenant defaults, we may incur substantial costs in protecting our investment.

If a sale-leaseback transaction is re-characterized by the IRS or in a tenant’s bankruptcy proceeding, our REIT status or financial condition could be adversely affected.

We have entered and may continue to enter into sale-leaseback transactions. In a sale-leaseback transaction, we purchase a property and then lease it back to the third party from whom we purchased it. The IRS could challenge our characterization of certain leases and re-characterize them as financing transactions or loans for U.S. federal income tax purposes or, in the event of the bankruptcy of a tenant, a sale-leaseback transaction might be re-characterized as either a financing or a joint venture. If a sale-leaseback transaction is re-characterized by the IRS, we might fail to satisfy the REIT qualification tests and, consequently, lose our REIT status effective with the year of re-characterization. Alternatively, such a re-characterization could cause the amount of our REIT taxable income to be recalculated, which might also cause us to fail to meet the distribution requirement for a taxable year and thus lose our REIT status. Further, if a sale-leaseback is re-characterized as a financing, we would not be considered the owner of the property and, as a result, would have the status of a creditor in relation to the tenant. In that event, we would no longer have the right to sell or encumber our ownership interest in the property. Instead, we would have a claim against the tenant for the amounts owed under the lease, with the claim arguably secured by the property. In bankruptcy, the tenant/debtor might have the ability to propose a plan restructuring the term, interest rate and amortization schedule of its outstanding balance. If confirmed by the bankruptcy court, we could be bound by the new terms and prevented from foreclosing our lien on the property. If the sale-leaseback is re-characterized as a joint venture, we could be treated as co-venturers with our tenant and could be held liable, under some circumstances, for debts incurred by the tenant relating to the property.

We may be unable to enter into and consummate property acquisitions on advantageous terms or our property acquisitions may not perform as we expect due to competitive conditions and other factors.

We intend to acquire properties in the future. The acquisition of properties entails various risks, including the risks that our investments may not perform as we expect and that our cost estimates for bringing an acquired property up to market standards (if needed) may prove inaccurate. Further, we expect to finance any future acquisitions through a combination of borrowings (including under our Revolving Credit Facility), cash and cash equivalent balances, proceeds from equity and/or debt offerings by VEREIT, the Operating Partnership or their subsidiaries, cash flow from operations and proceeds from property or other asset dispositions which, if unavailable, could adversely affect our cash flows. In addition, our ability to acquire properties in the future on satisfactory terms and successfully integrate and operate such properties is subject to the following material risks: (i) we may be unable to acquire desired properties or the purchase price of a desired property may increase significantly because of competition from other real estate investors; (ii) we may acquire properties that are not accretive to our earnings upon acquisition; (iii) we may be unable to obtain the necessary debt or equity financing to consummate an acquisition or, if obtainable, financing may not be on satisfactory terms; (iv) we may need to spend more than budgeted amounts to make necessary improvements to acquired properties; (v) agreements for the acquisition of properties are typically subject to customary conditions to closing, including satisfactory completion of due diligence investigations, and we may spend significant time and money on potential acquisitions that we do not consummate; (vi) we may be unable to quickly and efficiently integrate new acquisitions, particularly acquisitions of portfolios of properties, into our existing operations; and (vii) we may acquire properties and assume existing liabilities without any recourse, or with only limited recourse, for liabilities, whether known or unknown, quantifiable or unquantifiable, such as tax liabilities, accrued but unpaid liabilities, cleanup of environmental contamination, remediation of latent defects, claims by tenants, vendors or other persons against the former owners of the properties and claims for indemnification by general partners, directors, officers and others indemnified by the former owners of the properties. Any of the these risks could adversely affect our business, financial condition, liquidity and results of operations.

The value of our real estate investments is subject to risks including risks associated with the real estate industry.

11

Our real estate investments are subject to various risks, fluctuations and cycles in value and demand, many of which are beyond our control. Certain events may decrease our cash available for distribution to our stockholders and unitholders, as well as the value of our properties. These risks and events include, but are not limited to: (i) adverse changes in international, national or local economic and demographic conditions; (ii) vacancies or our inability to lease space on favorable terms, including possible market pressures to offer tenants rent abatements, tenant improvements, early termination rights or tenant-favorable renewal options; (iii) adverse changes in financial conditions of buyers, sellers and tenants of properties; (iv) ongoing disruption and/or consolidation in the retail sector; (v) negative developments in the real estate market, including as a result of COVID-19 (e.g., decreased demand for certain office properties due to remote work environments) or tenant performance; which may cause us to reevaluate the business and macro-economic assumptions used in the impairment analysis of our properties and may result in a material impact on our financial statements; (vi) inability to collect rent from tenants, or other failures by tenants to perform the obligations under their leases; (vii) competition from other real estate investors; (viii) the obsolescence of our properties over time, including as a result of age or a shift in market preference, which could impact our ability to re-tenant a property, particularly if the property was built to suit a particular tenant; (ix) our ownership or future acquisition of properties subject to leasehold interests in the land (i.e., ground leases) or other similar agreements with terms different than the related operating lease for the property, may limit our uses of these properties, may restrict our ability to lease or sell or otherwise transfer such properties, or may require the ground landlord’s consent to a lease, sale or other transfer, all of which may impair their value; (x) if the operating tenant of a ground-leased property fails to pay or perform obligations under the related ground lease, we could be obligated to pay or perform such obligations at our expense; (xi) the expiration or inability to extend the term of a ground lease could reduce or end the term of the corresponding operating lease prior to the scheduled or desired expiration date of such operating lease; (xii) reductions in the level of demand for commercial space generally, and freestanding net leased properties specifically, and changes in the relative popularity of our tenants and/or properties; (xiii) increases in the supply of freestanding single-tenant properties; (xii) fluctuations in interest rates, which could adversely affect our ability, or the ability of buyers and tenants of our properties, to obtain financing on favorable terms or at all; (xiv) increases in expenses, including, but not limited to, insurance costs, labor costs, energy prices, real estate assessments and other taxes and costs of compliance with laws, regulations and governmental policies, all of which have an adverse impact on the rent a tenant may be willing to pay us in order to lease one or more of our properties; (xv) loss of property rights, adverse impacts on our tenants’ business operations and/or increases in tenant vacancies resulting from eminent domain proceedings; (xvi) civil unrest, acts of God, including earthquakes, floods, hurricanes and other natural disasters, including extreme weather events or damage from rising sea levels from possible future climate change, which may result in uninsured losses, and acts of war or terrorism; and (xvii) changes in, and changes in enforcement of, laws, regulations and governmental policies, including, without limitation, health, safety, environmental, zoning and tax laws, governmental fiscal policies and the ADA. In addition, our properties are subject to the ADA and while our tenants are obligated to comply with the ADA and may be obligated under our leases to pay for the costs associated with that compliance, if compliance involves expenditures that are greater than anticipated or if tenants fail or are unable to comply, we may be required to incur expenses to bring a property into compliance. Any of these factors could materially adversely affect our results of operations through decreased revenues or increased costs.

Uninsured losses or losses in excess of our insurance coverage could materially adversely affect our financial condition and cash flows, and there can be no assurance as to future costs and the scope of insurance coverage that may be available.

We carry commercial general liability, flood, earthquake, and property and rental loss insurance covering all of the properties in our portfolio under one or more blanket insurance policies with policy specifications, limits and deductibles we believe are customarily carried for similar properties. We do not carry insurance for certain losses and certain types of losses may be either uninsurable or not economically insurable, such as losses due to nuclear explosions, riots, acts of war, or excluded contaminants such as viruses or pathogens. We also carry professional liability, directors’ and officers’ insurance, and cyber liability insurance. We select policy specifications and insured limits that we believe are appropriate and adequate given the relative risk of loss, insurance coverages provided by tenants, the cost of the coverage and industry practice. There can be no assurance, however, that the insured limits on any particular policy will adequately cover an insured loss if one occurs. For any insured loss, we may be required to pay a significant deductible prior to our insurer being obligated to reimburse us for the loss, or the amount of the loss may exceed our coverage limits. We may reduce or discontinue certain coverages in the future if the cost of premiums for any of these policies exceeds, in our judgment, the value of the coverage discounted for the risk of loss. If the damaged properties are subject to recourse indebtedness, we would continue to be liable for the indebtedness, even if these properties were irreparably damaged. Our insurance is placed with several large carriers and if any one of these carriers were to become insolvent, we would be forced to replace coverage with another suitable carrier, and any outstanding claims would be at risk for collection. We cannot be certain that we would be able to replace the coverage at similar or otherwise favorable terms. Our title insurance policies may not insure for the current aggregate market value of our portfolio, and we do not intend to increase our title insurance coverage as the market value of our portfolio increases. As a result of any of the situations described above, our financial condition and cash flows may be materially and adversely affected.

12

We face possible risks associated with the physical effects of climate change which could have a material adverse effect on our properties, operations and business.

Impacts associated with climate change, including rising sea levels, flooding, extreme weather, changes in precipitation and temperature, and air quality, may result in physical damage to, a decrease in demand for, and/or a decrease in rent from and value of our properties located in areas affected by these conditions. A number of our properties are located in areas that have historically been impacted by earthquakes, floods, hurricanes, and tornadoes. To the extent climate change causes increased changes in weather patterns, our markets could experience heightened storm intensity and rising sea-levels. These conditions could result in declining demand for leased space in our buildings or an inability to operate the buildings at all. Climate change may also have indirect effects on our business by increasing the cost of (or making unavailable) property insurance on terms we and/or our tenants find acceptable. There can be no assurance that climate change will not have a material adverse effect on our properties, operations or business.

Our participation in joint ventures creates additional risks as compared to direct real estate investments, and the actions of our joint venture partners could adversely affect our operations or performance.

We participate in and may in the future participate in additional transactions structured to purchase and dispose of assets jointly with unaffiliated third parties (a “joint venture”), including the management of these joint ventures. Such joint ventures include our industrial and office partnerships, in which we hold a non-controlling interest and which we manage. There are additional risks involved in joint venture transactions apart from those associated with purchasing property directly. For example, as a co-investor in a joint venture, we may not be in a position to exercise sole decision-making authority relating to significant decisions affecting the property. In addition, there is the potential of the co-participant in the joint venture becoming bankrupt and the possibility of diverging or inconsistent economic or business interests of us and that participant. We may also provide non-recourse guarantees of the indebtedness of the joint venture. These diverging interests could result in, among other things, exposure to liabilities of the joint venture in excess of our proportionate share of these liabilities.

Historical 1031 real estate programs may divert resources and subject us to unexpected liabilities and costs.

We have served as the asset manager of certain historical 1031 real estate programs, with one program remaining under management. These historical programs may divert resources from our core business operations and could result in unexpected liabilities and costs, including actual or threatened litigation.

Competition that traditional retail tenants face from e-commerce retail sales, or the integration of brick and mortar stores with e-commerce retailers, could adversely affect our business.

Our retail tenants continue to face increased competition from e-commerce retailers. E-commerce sales continue to account for an increasing percentage of retail sales, and this trend is expected to continue as our retail tenants continue to increase their e-commerce presence and/or integrate their brick and mortar stores with an e-commerce platform. Further, these efforts may have been heightened by the measures taken to control the COVID-19 outbreak, including various Closure Orders and other mandates issued by local, state or federal authorities which may have forced many retail tenants to limit or suspend in-person operations. Changes in shopping trends as a result of the growth in e-commerce may also impact the profitability of retailers that do not adapt to changes in market conditions. The continued growth of e-commerce sales could decrease the need for traditional retail outlets and reduce retailers' space and property requirements. Increased demand for services such as curbside pick-up, take-out and other amenities reducing in-store shopping or in-person contact could reduce the demand for properties that do not contain such amenities, or require expenditures to provide or reconfigure properties to allow for such amenities. These conditions could adversely impact our results of operations and cash flows if we are unable to meet the needs of our tenants or if our tenants encounter financial difficulties as a result of changing market conditions.

We may acquire properties or portfolios of properties through tax deferred contribution transactions, which could result in the dilution of our stockholders and unitholders, and limit our ability to sell or refinance such assets.

We have in the past and may in the future acquire properties or portfolios of properties through tax deferred contribution transactions in exchange for OP Units. Under the Third Amended and Restated Agreement of Limited Partnership of the OP, as amended (the “LPA”), after holding OP Units for a period of one year, unless otherwise consented to by the General Partner, holders of OP Units have a right to redeem the OP Units for the cash value of a corresponding number of shares of the General Partner’s Common Stock or, at the option of the General Partner, a corresponding number of shares of the General Partner’s Common Stock. This could result in the dilution of our stockholders and unitholders through the issuance of OP Units that may be exchanged for shares of our Common Stock. This acquisition structure may also have the effect of, among other things, reducing the amount of tax depreciation we could deduct over the tax life of the acquired properties, and may require that we agree to restrictions on our ability to dispose of, or refinance the debt on, the acquired properties in order to protect the contributors’ ability to defer recognition of taxable gain. Similarly, we may be required to incur or maintain debt we would otherwise not incur so we

13

can allocate the debt to the contributors to maintain their tax bases. These restrictions could limit our ability to sell or refinance an asset at a time, or on terms, that would be favorable absent such restrictions.

Risks Related to Liquidity and Indebtedness

We intend to rely on external sources of capital to fund future capital needs, and if we encounter difficulty in obtaining such capital, we may not be able to meet maturing obligations or make any additional investments.

In order to qualify as a REIT under the Internal Revenue Code, we are required, among other things, to distribute annually to our stockholders at least 90% of our REIT taxable income (which does not equal net income as calculated in accordance with U.S. GAAP), determined without regard to the deduction for dividends paid and excluding any net capital gain. Because of this dividend requirement, we may not be able to fund from cash retained from operations all of our future capital needs, including capital needed to refinance maturing obligations or make investments. Market volatility and disruption (including resulting from the COVID-19 pandemic) could hinder our ability to obtain new debt financing or refinance our maturing debt on favorable terms or at all or to raise equity capital. Our access to capital will depend upon a number of factors, including: general market conditions; prevailing interest rates; the market’s perception of our future growth potential; analyst reports about us and the REIT industry; the general reputation of REITs and the attractiveness of their equity securities in comparison to other equity securities, including securities issued by other real estate-based companies; our financial performance and that of our tenants; our current debt levels; our current and expected future earnings; and our cash flow; and the market price per share of our Common Stock. If we are unable to obtain needed capital on satisfactory terms or at all, we may not be able to meet our obligations as they mature or make any additional investments.