1

Investor Review

Q1 2017

Exhibit 99.1

2 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

About the Data

INVESTOR REVIEW

This data and other information described herein are as of and for the three months ended March 31, 2017, unless otherwise

indicated. Future performance may not be consistent with past performance and is subject to change and inherent risks and

uncertainties. This information should be read in conjunction with the financial statements and the Management's Discussion and

Analysis of Financial Condition and Results of Operations sections contained in VEREIT, Inc.'s (the "Company", "VEREIT", "us", "our" and

"we") Annual Report on Form 10-K for the year ended December 31, 2016 and Quarterly Report on Form 10-Q for the three months

ended March 31, 2017. Effective January 1, 2017, the Company determined certain non-GAAP measures and operating metrics,

which include portfolio metrics, should exclude the impact of properties owned by the Company for which as of the reporting date,

(i) the related mortgage loan is in default, and (ii) management has made a decision to transfer the properties to the lender in

connection with settling the mortgage note obligation ("Excluded Properties") to better reflect the ongoing operations of the

Company. Excluded Properties at March 31, 2017, included one vacant office property and one vacant industrial property,

comprising an aggregate of 578,000 square feet, which each secured a mortgage note payable, with aggregate Debt Outstanding of

$41.8 million.

Tenants, Trademarks and Logos

VEREIT is not affiliated with, is not endorsed by, does not endorse and is not sponsored by or a sponsor of the products or services

pictured or mentioned. The names, logos and all related product and service names, design marks and slogans are the trademarks

or service marks of their respective companies.

3 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

Forward-Looking Statements

INVESTOR REVIEW

Information set forth herein (including information included or incorporated by reference herein) contains “forward-looking

statements” (within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended), which reflect VEREIT’s expectations regarding future events and VEREIT's future financial

condition, results of operations and business. The forward-looking statements involve a number of assumptions, risks, uncertainties

and other factors that could cause actual results to differ materially from those contained in the forward-looking statements.

Generally, the words “expects,” “anticipates,”“assumes,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,”

variations of such words and similar expressions identify forward-looking statements. These forward-looking statements are subject

to a number of risks, uncertainties and assumptions, most of which are difficult to predict and many of which are beyond VEREIT’s

control. If a change occurs, VEREIT’s business, financial condition, liquidity and results of operations may vary materially from those

expressed in the forward-looking statements.

The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements:

VEREIT’s plans, market and other expectations, objectives, intentions and other statements that are not historical facts; the

developments disclosed herein; VEREIT’s ability to execute on and realize success from its business plan; VEREIT’s ability to meet its

2017 guidance; the unpredictability of the business plans and financial condition of VEREIT’s tenants; the impact of impairment

charges in respect of certain of VEREIT’s properties or other assets; risks associated with pending government investigations and

litigations related to VEREIT's previously disclosed audit committee investigation; the inability of Cole Capital to regain its prior level

of capital raise; the ability to retain or hire key personnel; and continuation or deterioration of current market conditions. Additional

factors that may affect future results are contained in VEREIT’s filings with the U.S. Securities and Exchange Commission (the “SEC”),

which are available at the SEC’s website at www.sec.gov. VEREIT disclaims any obligation to publicly update or revise any forward-

looking statements, whether as a result of changes in underlying assumptions or factors, new information, future events or

otherwise, except as required by law.

4 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

Contents

INVESTOR REVIEW

All data is as of March 31, 2017 and based on Annualized Rental Income (“ARI”), unless otherwise noted.

For definitions and reconciliations of the Company's non-GAAP measures and operating metrics, please view the

Definitions & Reconciliations section of this presentation.

Company Overview 5

Portfolio Metrics & Analysis 11

Key Financial Highlights 23

Highlights & Guidance 27

Contact Information 30

Definitions & Reconciliations 31

‹#›

DRA

F

T

a

Company Overview

Q1 2017

6 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

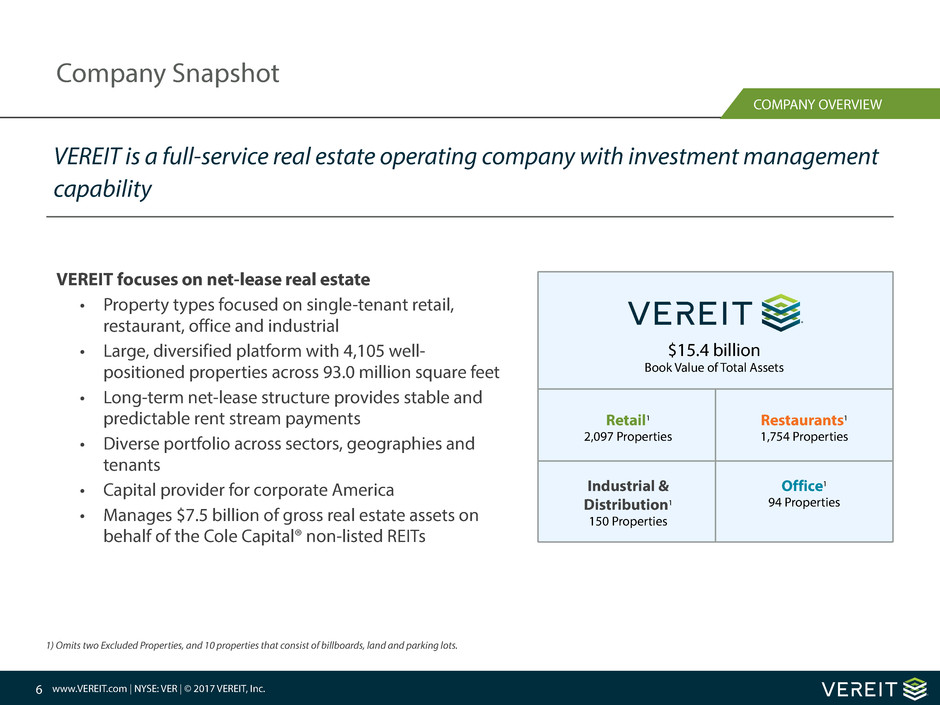

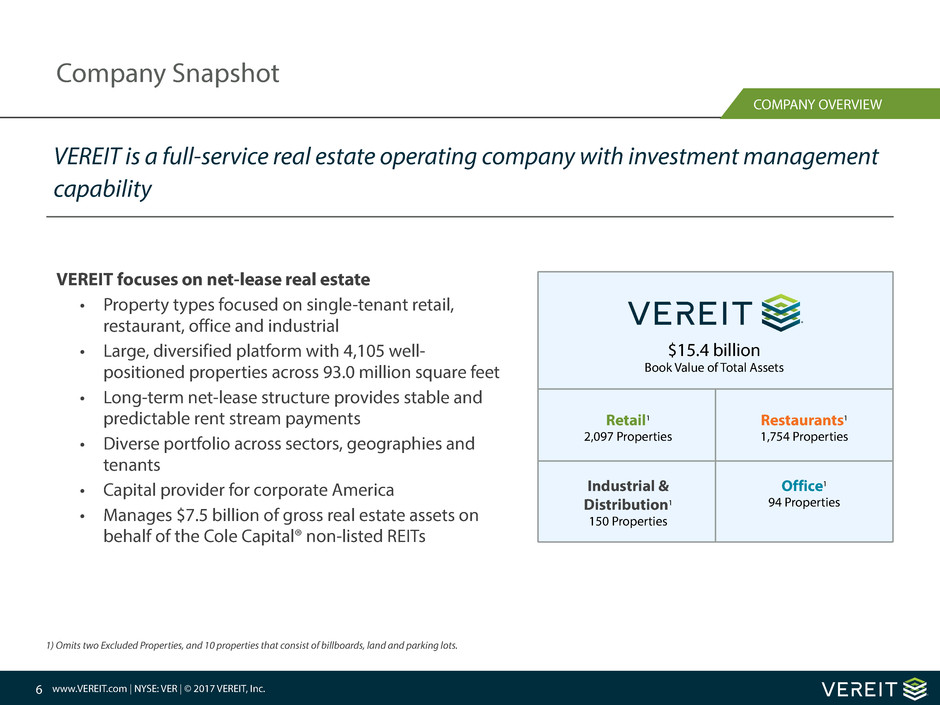

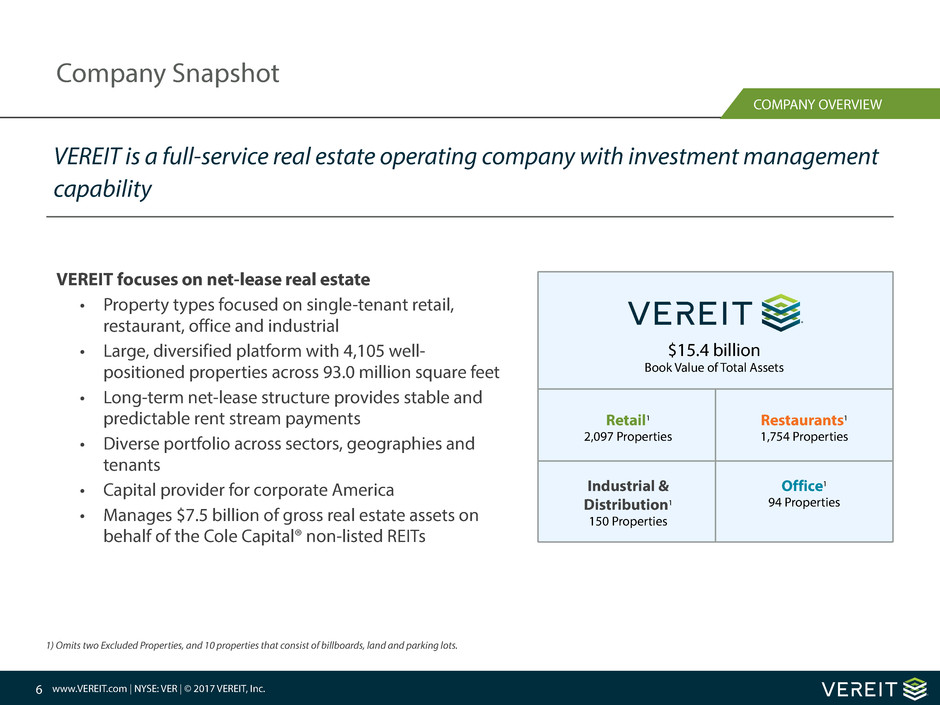

VEREIT focuses on net-lease real estate

• Property types focused on single-tenant retail,

restaurant, office and industrial

• Large, diversified platform with 4,105 well-

positioned properties across 93.0 million square feet

• Long-term net-lease structure provides stable and

predictable rent stream payments

• Diverse portfolio across sectors, geographies and

tenants

• Capital provider for corporate America

• Manages $7.5 billion of gross real estate assets on

behalf of the Cole Capital® non-listed REITs

VEREIT is a full-service real estate operating company with investment management

capability

COMPANY OVERVIEW

Company Snapshot

$15.4 billion

Book Value of Total Assets

Retail1

2,097 Properties

Industrial &

Distribution1

150 Properties

Restaurants1

1,754 Properties

Office1

94 Properties

1) Omits two Excluded Properties, and 10 properties that consist of billboards, land and parking lots.

7 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

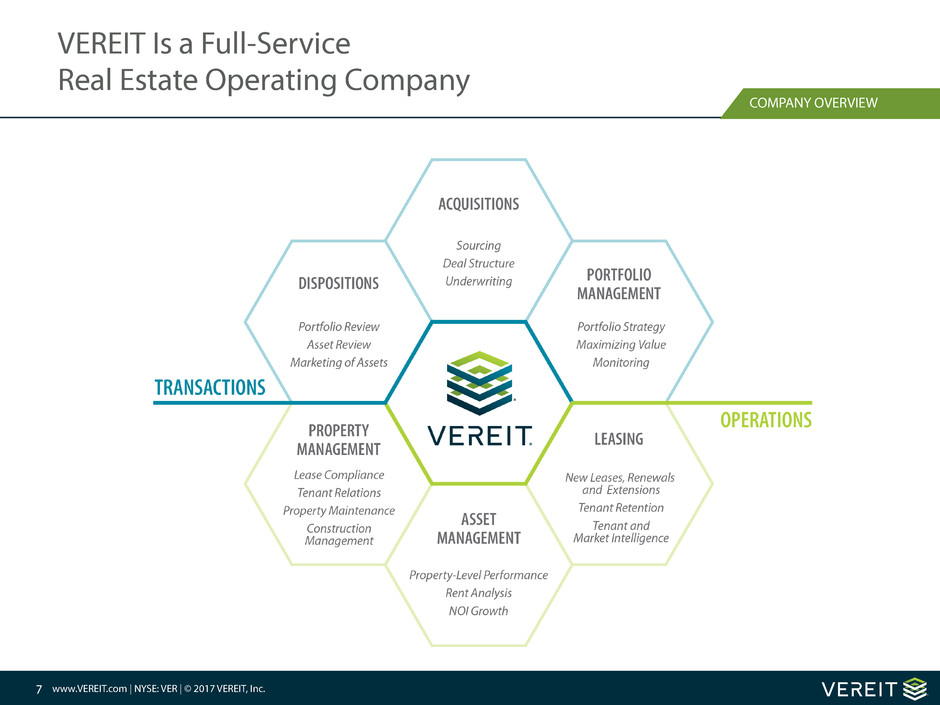

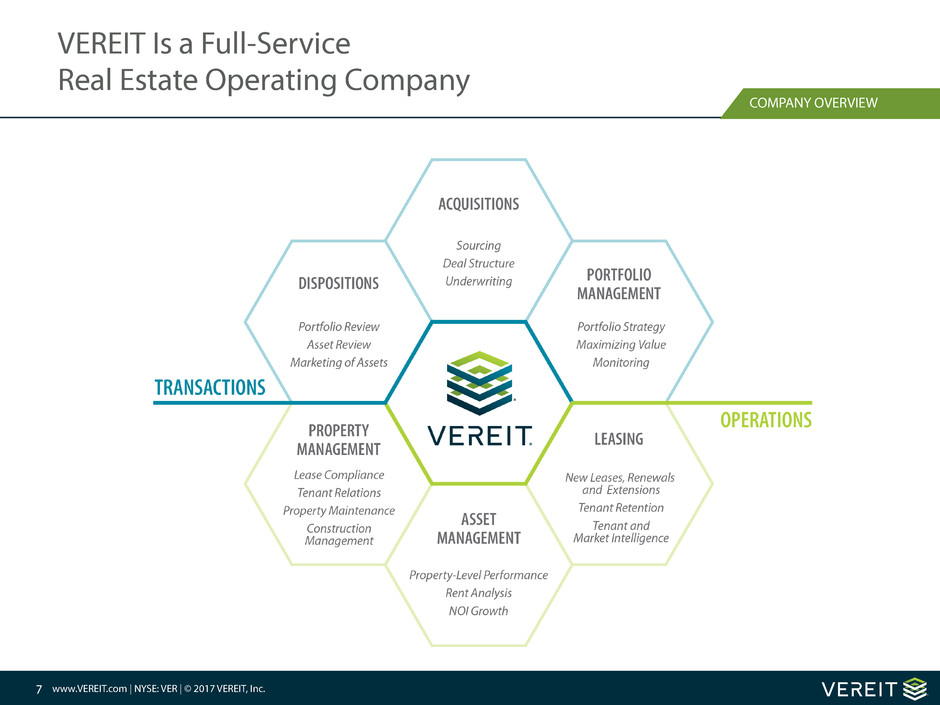

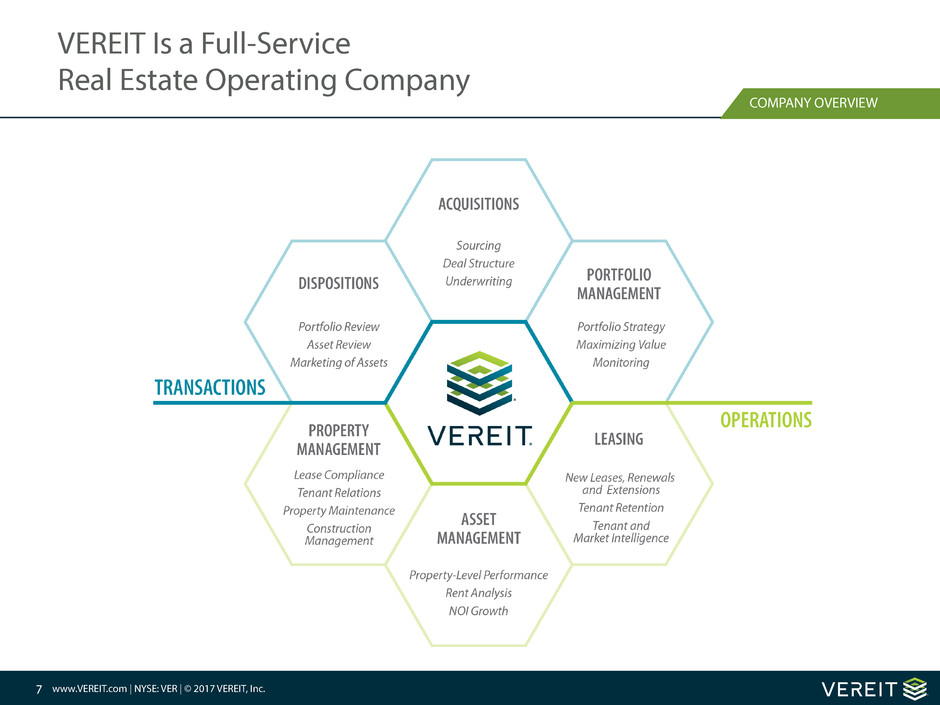

VEREIT Is a Full-Service

Real Estate Operating Company

COMPANY OVERVIEW

8 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

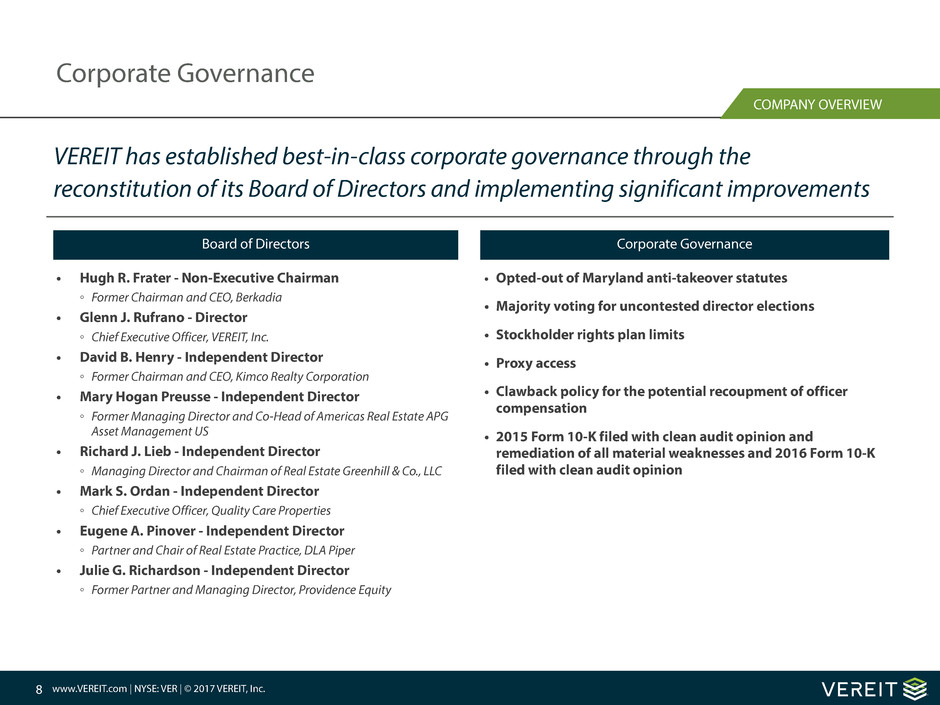

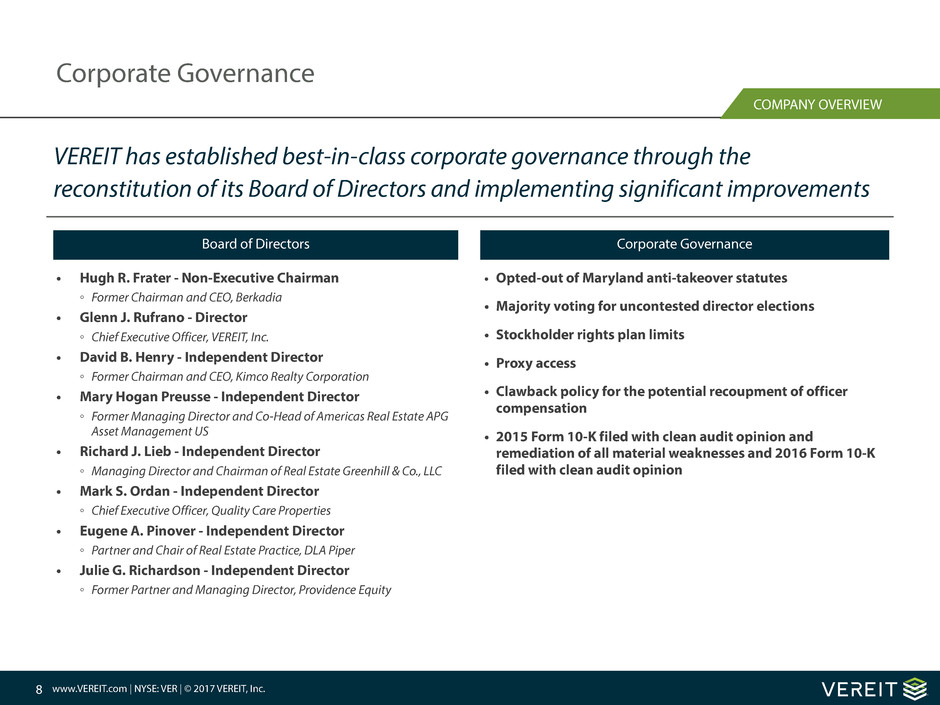

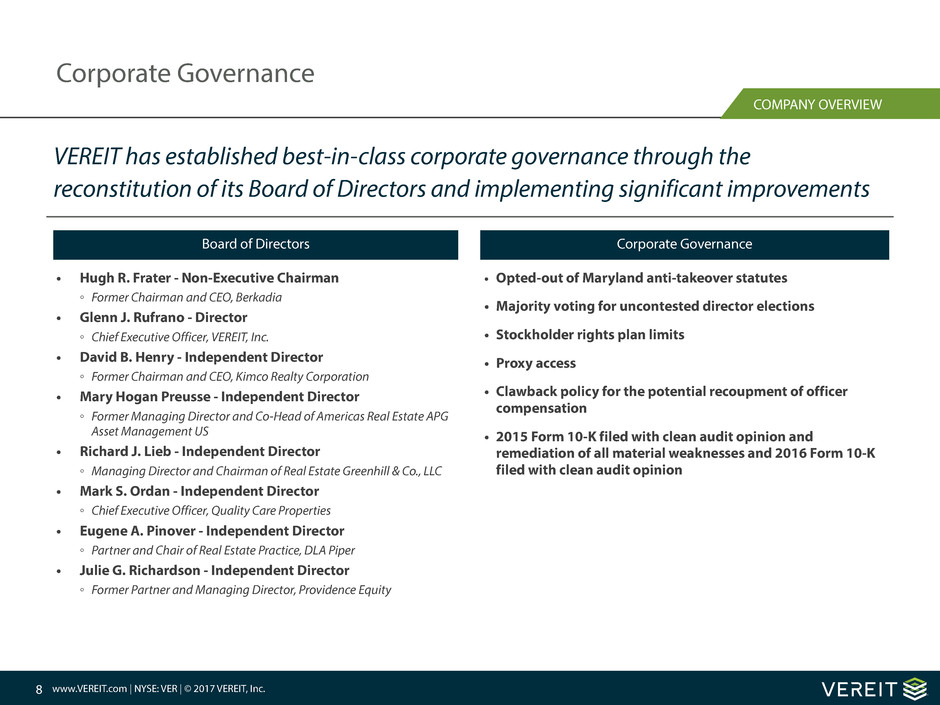

VEREIT has established best-in-class corporate governance through the

reconstitution of its Board of Directors and implementing significant improvements

COMPANY OVERVIEW

Corporate Governance

• Hugh R. Frater - Non-Executive Chairman

◦ Former Chairman and CEO, Berkadia

• Glenn J. Rufrano - Director

◦ Chief Executive Officer, VEREIT, Inc.

• David B. Henry - Independent Director

◦ Former Chairman and CEO, Kimco Realty Corporation

• Mary Hogan Preusse - Independent Director

◦ Former Managing Director and Co-Head of Americas Real Estate APG

Asset Management US

• Richard J. Lieb - Independent Director

◦ Managing Director and Chairman of Real Estate Greenhill & Co., LLC

• Mark S. Ordan - Independent Director

◦ Chief Executive Officer, Quality Care Properties

• Eugene A. Pinover - Independent Director

◦ Partner and Chair of Real Estate Practice, DLA Piper

• Julie G. Richardson - Independent Director

◦ Former Partner and Managing Director, Providence Equity

Board of Directors Corporate Governance

• Opted-out of Maryland anti-takeover statutes

• Majority voting for uncontested director elections

• Stockholder rights plan limits

• Proxy access

• Clawback policy for the potential recoupment of officer

compensation

• 2015 Form 10-K filed with clean audit opinion and

remediation of all material weaknesses and 2016 Form 10-K

filed with clean audit opinion

9 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

VEREIT Has a Best-in-Class Management Team

Glenn J. Rufrano

Chief Executive Officer

• Since assuming role of CEO on April 1, 2015, has reconstituted Board of

Directors, formalized new management team and implemented

business plan to guide the Company’s strategy

• Prior to VEREIT, was Chairman and CEO of O’Connor Capital Partners, a

real estate investment firm he co-founded in 1983

• From 2010 to 2013 was President and CEO of Cushman & Wakefield

• Previously held executive leadership roles at Centro Properties Group

and New Plan Excel Realty Trust

• Serves on Board of Ventas and previously served on Boards of General

Growth Properties and Trizec Properties

• Having joined VEREIT in May 2015, oversees the Company’s legal and

regulatory affairs

• Prior to joining VEREIT, served as EVP, General Counsel and the Chief

Compliance Officer for Revlon, the global cosmetics company, where she was

responsible for legal and regulatory affairs, served on senior operating

committee and oversaw corporate governance

• Previously served as SVP - Law for MacAndrews & Forbes, Inc., Assistant United

States Attorney for the Southern District of New York, and as an associate with

Stillman & Friedman P.C. and Fried, Frank, Harris, Shriver & Jacobson LLP

• Law degree from Columbia Law School and undergraduate degree from the

Wharton School, University of Pennsylvania

• As EVP and CFO, oversees the accounting, external reporting, financial

planning & analysis, treasury and IT functions at VEREIT, including support

for both the public and Cole REITs.

• Prior to joining VEREIT as CFO in October, 2015, served as EVP and CFO of

Cushman & Wakefield from 2012 to 2015

• Prior to Cushman, was CFO for EXOR, Inc., a leading European investment

company from 1991 to 2012, where he was involved in over 15 U.S.

acquisitions and divestitures ranging in size from $20mm to $700+mm

• Served on Board of Directors of Cushman & Wakefield

• As EVP and COO, is responsible for VEREIT’s asset management,

property management, construction management, underwriting,

credit analysis and leasing

• Also serves on VEREIT investment committee, which reviews each

asset to ensure alignment with the Company’s objectives

• Previously was founder of CapLease (NYSE:LSE), a net-lease REIT,

where he served as CEO from 2001-2014 and Chairman from

2007-2014

• As CEO and President of Cole Capital, provides strategic direction

and oversees all aspects of management including external and

internal sales, product development and due diligence, broker-

dealer relationship management, securities operations and capital

markets

• Prior to joining Cole, served as SVP and Director of National

Accounts for American Funds, where he was responsible for leading

business development, strategy and relationship management with

broker-dealers, as well as the global banking channel in the U.S.

• As EVP and CIO, oversees VEREIT’s real estate transaction activities

for single-tenant retail, office and industrial and anchored shopping

centers including acquisitions, sale-leaseback transactions, build-to-

suits and dispositions

• Previously served as President and CEO of Opus West Corporation

from 1993 to 2009, where he was responsible for design,

construction and development of more than 50 million square feet

of commercial real estate

• Served as VP, Real Estate Development for Koll Company prior to

Opus West

Michael J. Bartolotta

Executive Vice President and Chief Financial Officer

Lauren Goldberg

Executive Vice President, General Counsel and Secretary

Paul McDowell

Executive Vice President and Chief Operating Officer

Thomas W. Roberts

Executive Vice President and Chief Investment Officer

Bill Miller

Executive Vice President, Investment Management;

President and CEO of Cole Capital

COMPANY OVERVIEW

10 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

þ April 2015 – Glenn Rufrano began as CEO

þ June 2015 – Appointed Deloitte & Touche LLP as VEREIT’s

independent registered public accountant

þ July 2015 – Changed name to VEREIT, Inc.

þ July 2015 – Moved to the NYSE and began trading under the

ticker VER

þ August 2015 – Board of Directors adopted several shareholder-

friendly Corporate Governance enhancements

þ August 2015 - Introduced Business Plan: A Foundation for

Growth

þ 2015 – Completed $1.4 billion of dispositions; Achieved $0.84

AFFO per diluted share; Reduced debt by $2.4 billion including

secured and unsecured debt; Created $1.8 billion of capacity on

revolving line of credit; Reduced Net Debt to Normalized

EBITDA from 7.5x to 7.0x

þ February 2016 – Announced that VEREIT remediated all material

weaknesses that existed as of December 31, 2014

þ May 2016 – Announced issuance of $1 billion of senior notes

and $300 million term loan, allowing the Company to later

refinance $1.3 billion of bonds coming due in February 2017,

staggering the debt repayment and improving the maturity

schedule

þ August 2016 – Completed offering of 69 million shares of

common stock; Upon closing, announced net proceeds from

the offering to be approximately $702.5 million

þ November 2016 – Received an investment grade rating of 'BBB-'

with a Stable outlook from Fitch Ratings

þ 2016 – Completed $1.14 billion of dispositions; Achieved $0.78

AFFO per diluted share; Reduced debt by $1.7 billion including

secured and unsecured debt; Created $2.3 billion of capacity

on revolving line of credit; Reduced Net Debt to Normalized

EBITDA from 7.0x to 5.7x

þ January 2017 – Announced Cole Capital® raised $487.2 million

of new capital during 2016, an increase of approximately 80%

over 2015

þ February 2017 – Announced substantial completion of the core

components of the 2015 business plan and, in certain areas,

exceeded expectations; Timely filing of VEREIT's Annual Report

on Form 10-K

þ April 2017 – Moody's and S&P upgraded the Company to

investment grade1

COMPANY OVERVIEW

Key Accomplishments

1) S&P had previously rated the Company's bonds investment grade.

Since April 2015, VEREIT successfully implemented its business plan, enhanced its

portfolio, de-levered its balance sheet and achieved investment-grade ratings

‹#›

DRA

F

T

a

Portfolio Metrics & Analysis

Q1 2017

12 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

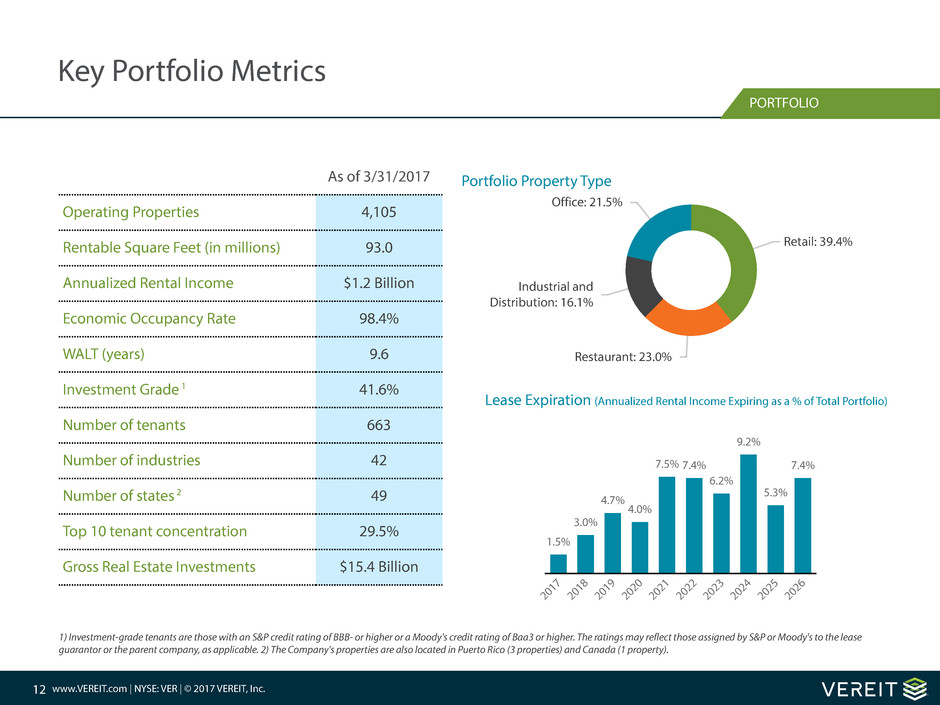

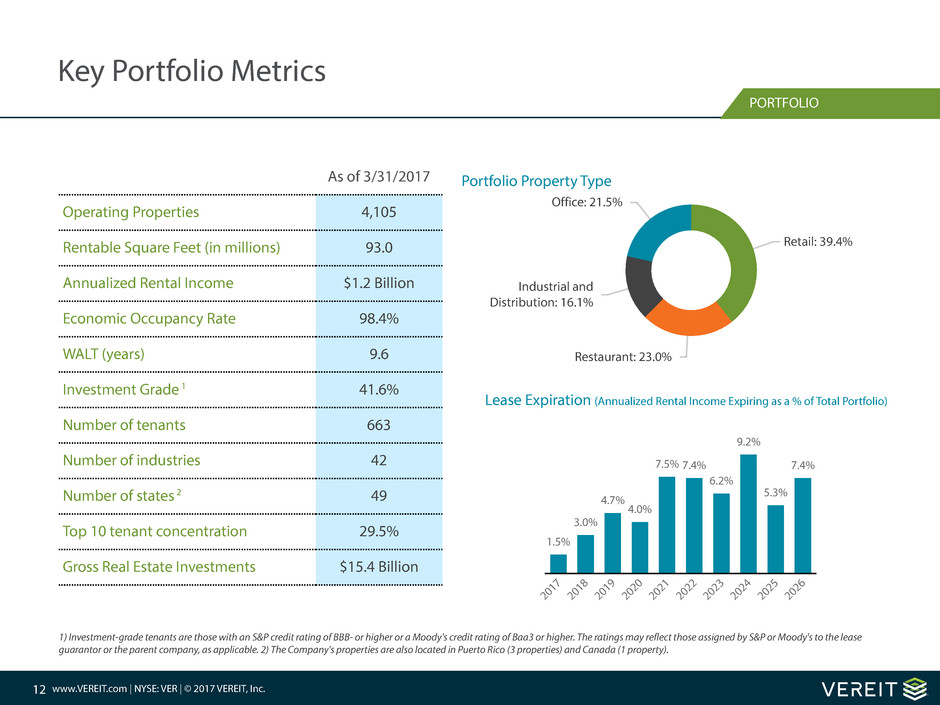

Key Portfolio Metrics

PORTFOLIO

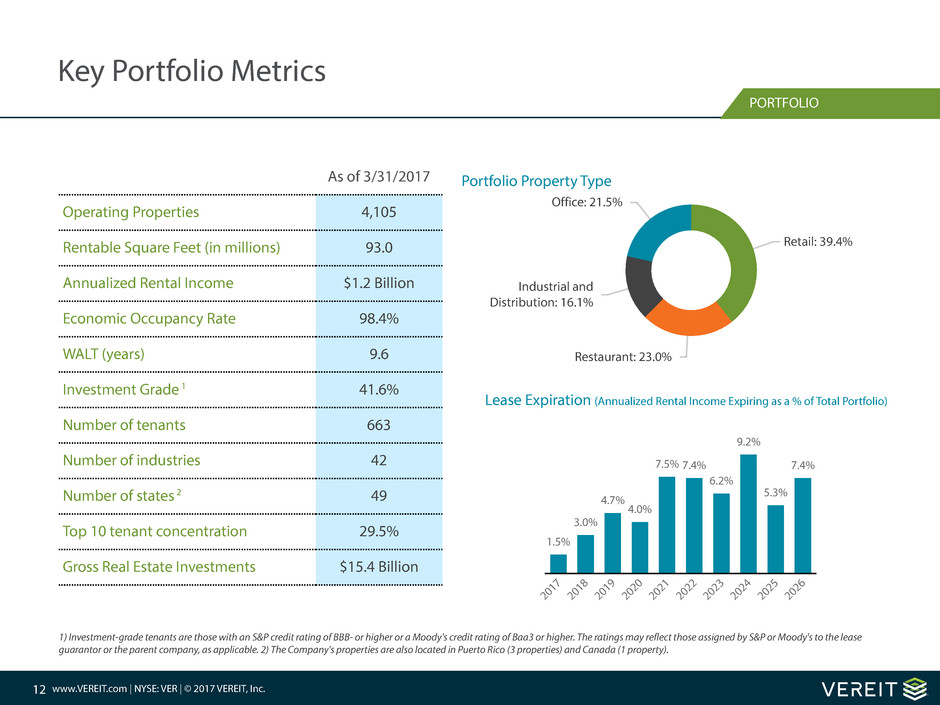

As of 3/31/2017

Operating Properties 4,105

Rentable Square Feet (in millions) 93.0

Annualized Rental Income $1.2 Billion

Economic Occupancy Rate 98.4%

WALT (years) 9.6

Investment Grade 1 41.6%

Number of tenants 663

Number of industries 42

Number of states 2 49

Top 10 tenant concentration 29.5%

Gross Real Estate Investments $15.4 Billion

1) Investment-grade tenants are those with an S&P credit rating of BBB- or higher or a Moody's credit rating of Baa3 or higher. The ratings may reflect those assigned by S&P or Moody's to the lease

guarantor or the parent company, as applicable. 2) The Company’s properties are also located in Puerto Rico (3 properties) and Canada (1 property).

Retail: 39.4%

Restaurant: 23.0%

Industrial and

Distribution: 16.1%

Office: 21.5%

Portfolio Property Type

Lease Expiration (Annualized Rental Income Expiring as a % of Total Portfolio)

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

1.5%

3.0%

4.7%

4.0%

7.5% 7.4%

6.2%

9.2%

5.3%

7.4%

13 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

Geographically Diverse Portfolio

PORTFOLIO

14 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

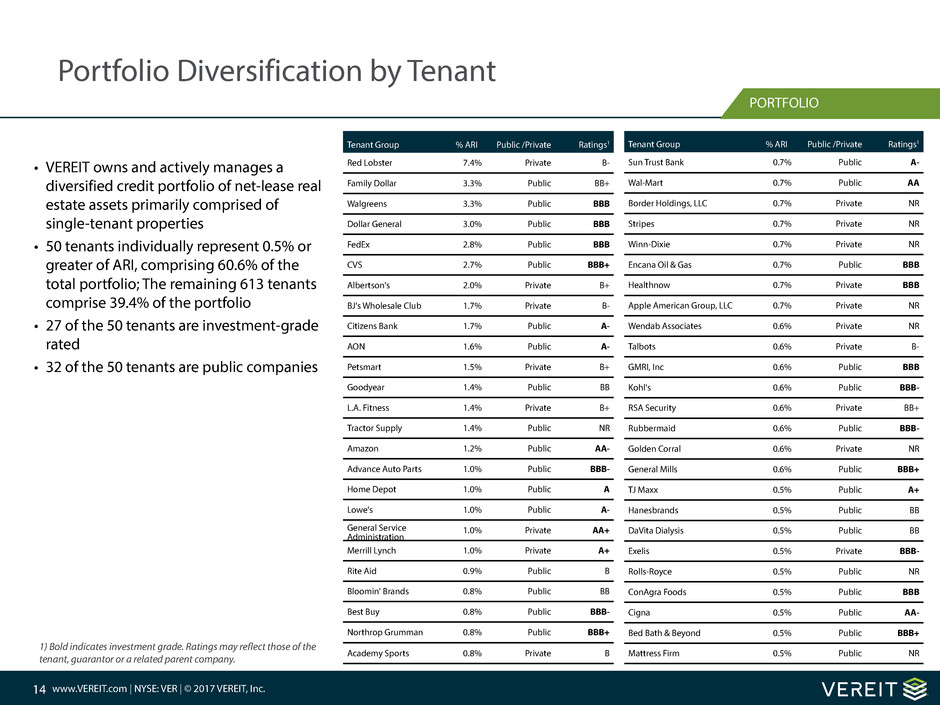

Portfolio Diversification by Tenant

PORTFOLIO

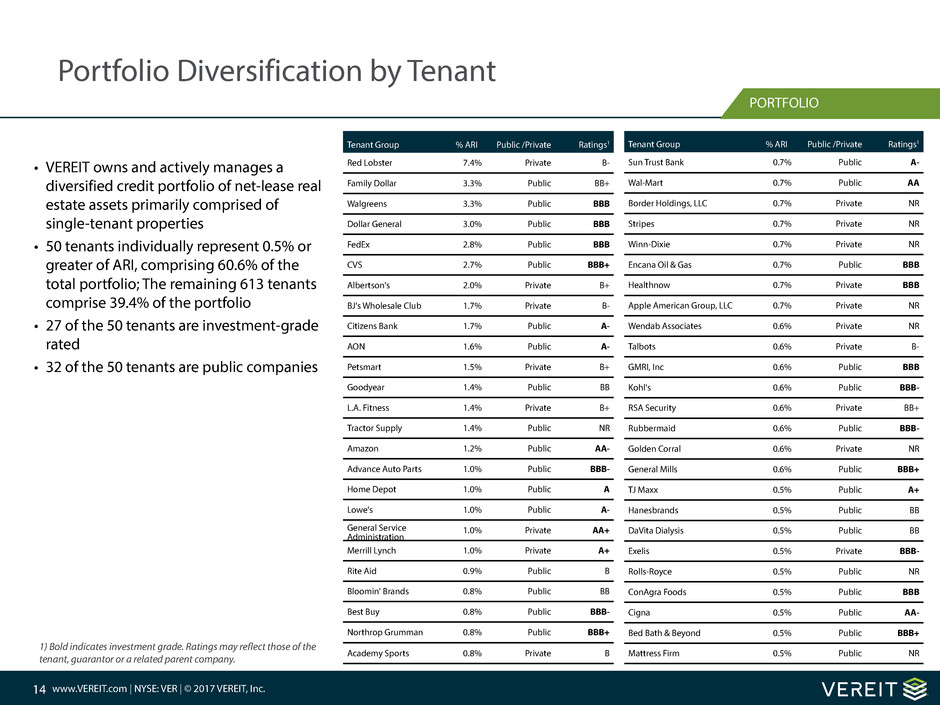

1) Bold indicates investment grade. Ratings may reflect those of the

tenant, guarantor or a related parent company.

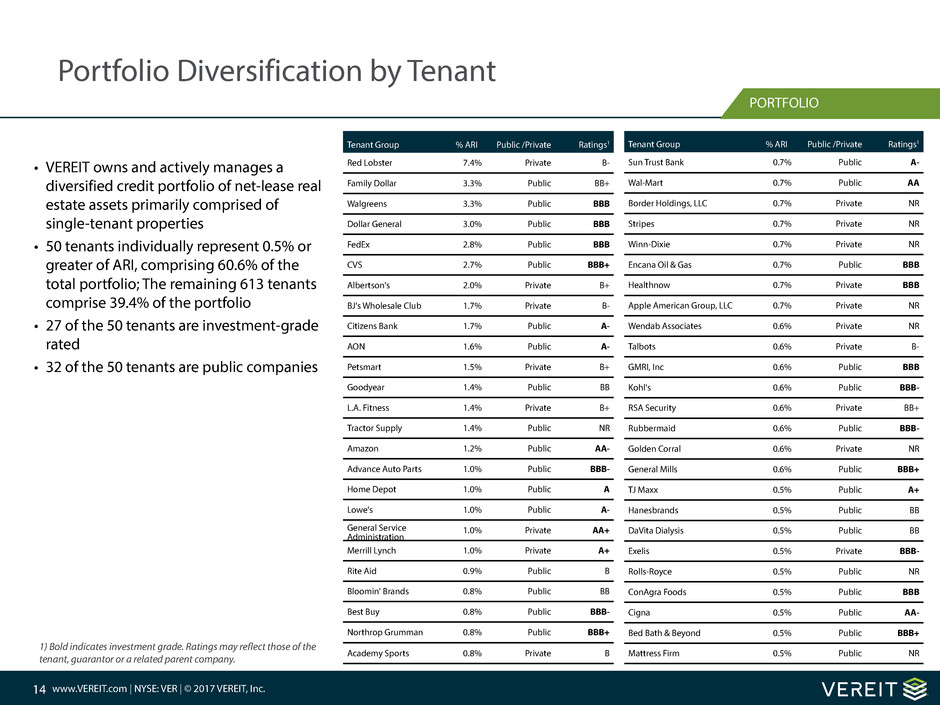

Tenant Group % ARI Public /Private Ratings1

Red Lobster 7.4% Private B-

Family Dollar 3.3% Public BB+

Walgreens 3.3% Public BBB

Dollar General 3.0% Public BBB

FedEx 2.8% Public BBB

CVS 2.7% Public BBB+

Albertson's 2.0% Private B+

BJ's Wholesale Club 1.7% Private B-

Citizens Bank 1.7% Public A-

AON 1.6% Public A-

Petsmart 1.5% Private B+

Goodyear 1.4% Public BB

L.A. Fitness 1.4% Private B+

Tractor Supply 1.4% Public NR

Amazon 1.2% Public AA-

Advance Auto Parts 1.0% Public BBB-

Home Depot 1.0% Public A

Lowe's 1.0% Public A-

General Service

Administration

1.0% Private AA+

Merrill Lynch 1.0% Private A+

Rite Aid 0.9% Public B

Bloomin' Brands 0.8% Public BB

Best Buy 0.8% Public BBB-

Northrop Grumman 0.8% Public BBB+

Academy Sports 0.8% Private B

Tenant Group % ARI Public /Private Ratings1

Sun Trust Bank 0.7% Public A-

Wal-Mart 0.7% Public AA

Border Holdings, LLC 0.7% Private NR

Stripes 0.7% Private NR

Winn-Dixie 0.7% Private NR

Encana Oil & Gas 0.7% Public BBB

Healthnow 0.7% Private BBB

Apple American Group, LLC 0.7% Private NR

Wendab Associates 0.6% Private NR

Talbots 0.6% Private B-

GMRI, Inc 0.6% Public BBB

Kohl's 0.6% Public BBB-

RSA Security 0.6% Private BB+

Rubbermaid 0.6% Public BBB-

Golden Corral 0.6% Private NR

General Mills 0.6% Public BBB+

TJ Maxx 0.5% Public A+

Hanesbrands 0.5% Public BB

DaVita Dialysis 0.5% Public BB

Exelis 0.5% Private BBB-

Rolls-Royce 0.5% Public NR

ConAgra Foods 0.5% Public BBB

Cigna 0.5% Public AA-

Bed Bath & Beyond 0.5% Public BBB+

Mattress Firm 0.5% Public NR

• VEREIT owns and actively manages a

diversified credit portfolio of net-lease real

estate assets primarily comprised of

single-tenant properties

• 50 tenants individually represent 0.5% or

greater of ARI, comprising 60.6% of the

total portfolio; The remaining 613 tenants

comprise 39.4% of the portfolio

• 27 of the 50 tenants are investment-grade

rated

• 32 of the 50 tenants are public companies

15 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

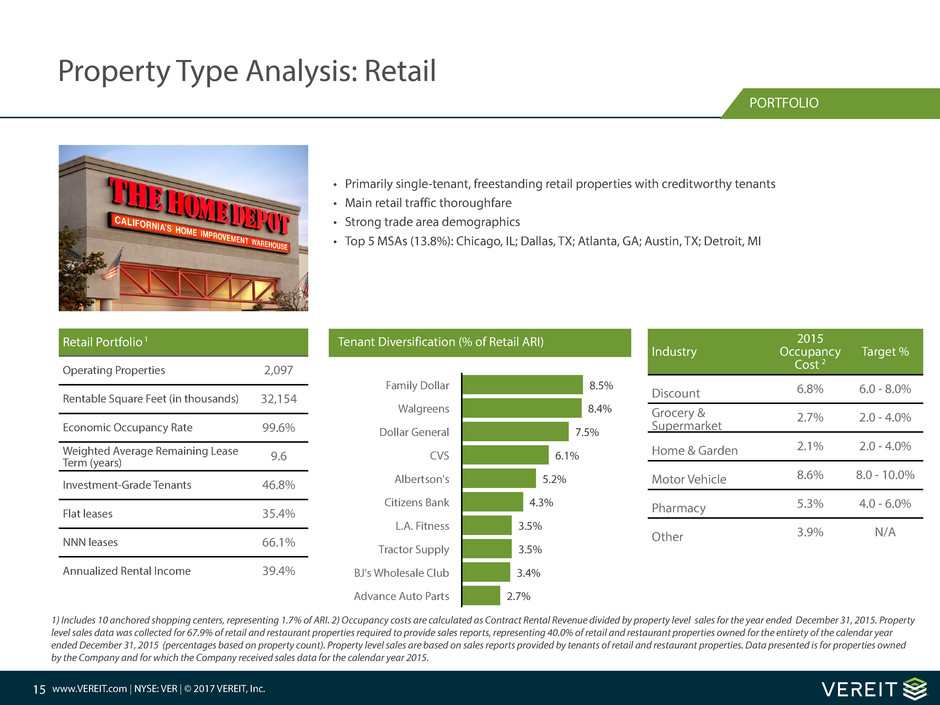

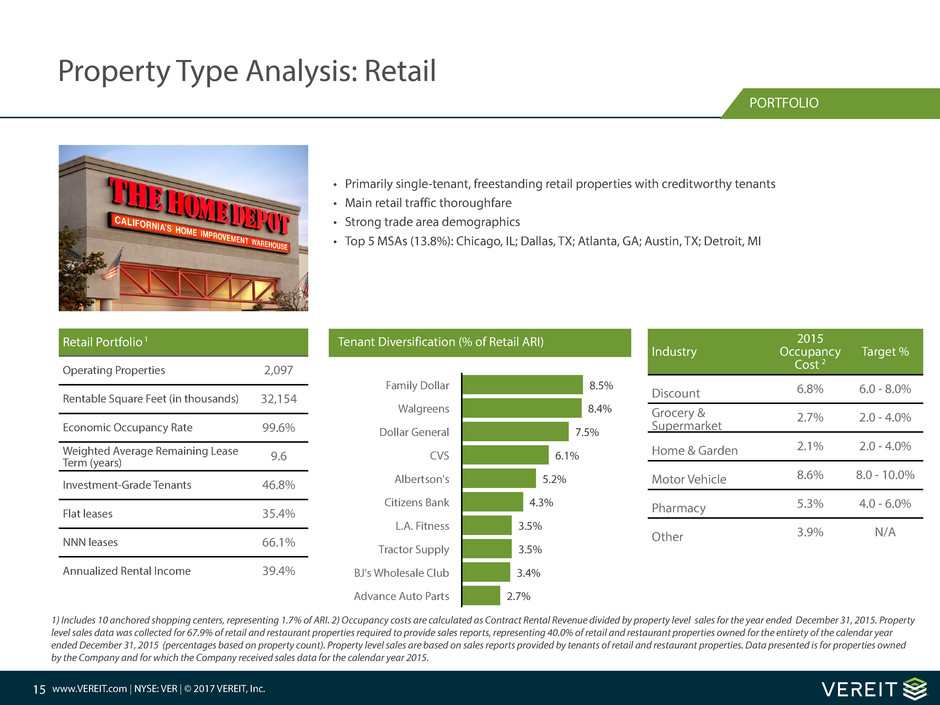

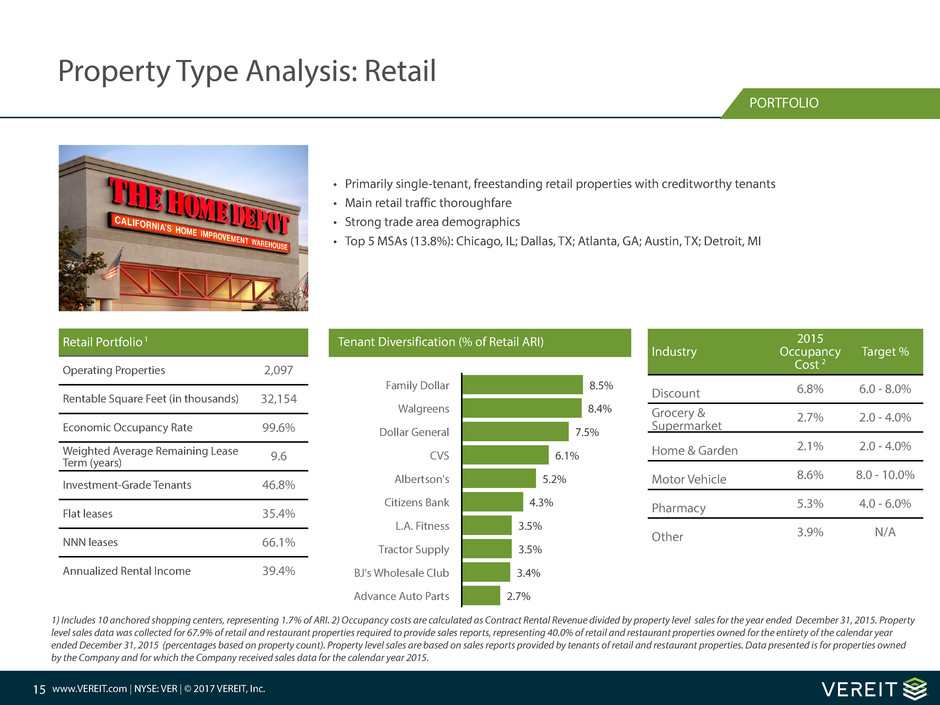

• Primarily single-tenant, freestanding retail properties with creditworthy tenants

• Main retail traffic thoroughfare

• Strong trade area demographics

• Top 5 MSAs (13.8%): Chicago, IL; Dallas, TX; Atlanta, GA; Austin, TX; Detroit, MI

Property Type Analysis: Retail

1) Includes 10 anchored shopping centers, representing 1.7% of ARI. 2) Occupancy costs are calculated as Contract Rental Revenue divided by property level sales for the year ended December 31, 2015. Property

level sales data was collected for 67.9% of retail and restaurant properties required to provide sales reports, representing 40.0% of retail and restaurant properties owned for the entirety of the calendar year

ended December 31, 2015 (percentages based on property count). Property level sales are based on sales reports provided by tenants of retail and restaurant properties. Data presented is for properties owned

by the Company and for which the Company received sales data for the calendar year 2015.

Retail Portfolio 1

Operating Properties 2,097

Rentable Square Feet (in thousands) 32,154

Economic Occupancy Rate 99.6%

Weighted Average Remaining Lease

Term (years) 9.6

Investment-Grade Tenants 46.8%

Flat leases 35.4%

NNN leases 66.1%

Annualized Rental Income 39.4%

PORTFOLIO

Family Dollar

Walgreens

Dollar General

CVS

Albertson's

Citizens Bank

L.A. Fitness

Tractor Supply

BJ's Wholesale Club

Advance Auto Parts

8.5%

8.4%

7.5%

6.1%

5.2%

4.3%

3.5%

3.5%

3.4%

2.7%

Tenant Diversification (% of Retail ARI)

Industry

2015

Occupancy

Cost 2

Target %

Discount 6.8% 6.0 - 8.0%

Grocery &

Supermarket 2.7% 2.0 - 4.0%

Home & Garden 2.1% 2.0 - 4.0%

Motor Vehicle 8.6% 8.0 - 10.0%

Pharmacy 5.3% 4.0 - 6.0%

Other 3.9% N/A

16 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

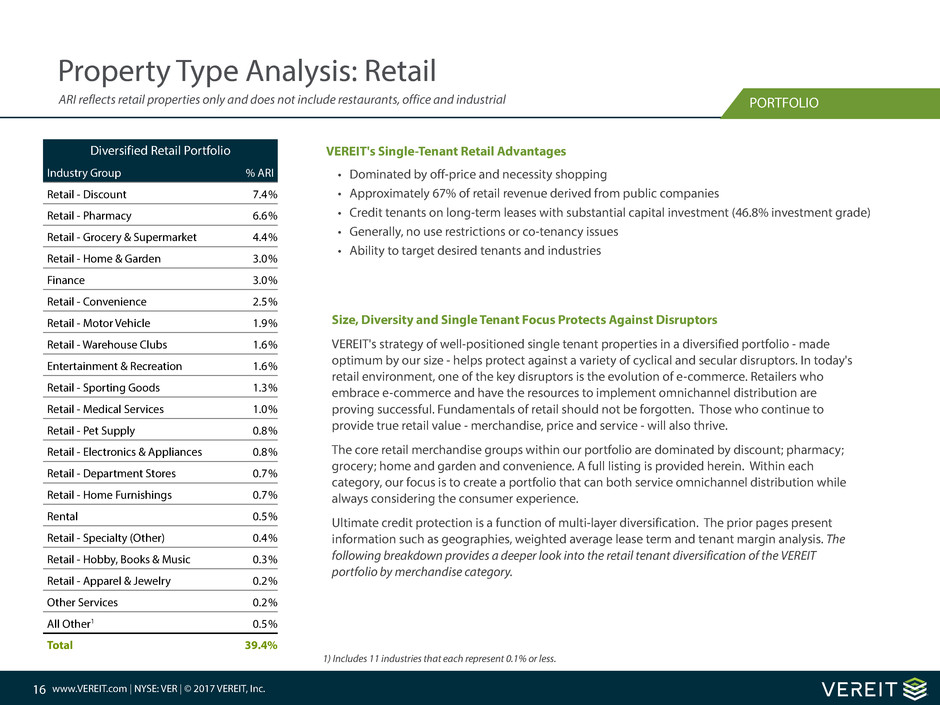

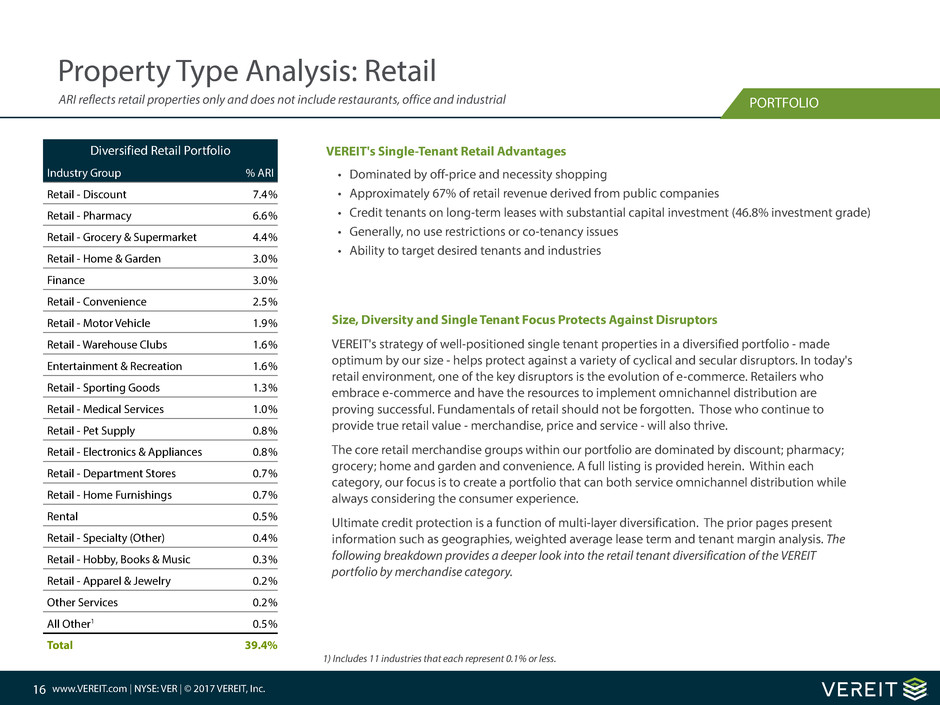

Property Type Analysis: Retail

PORTFOLIO

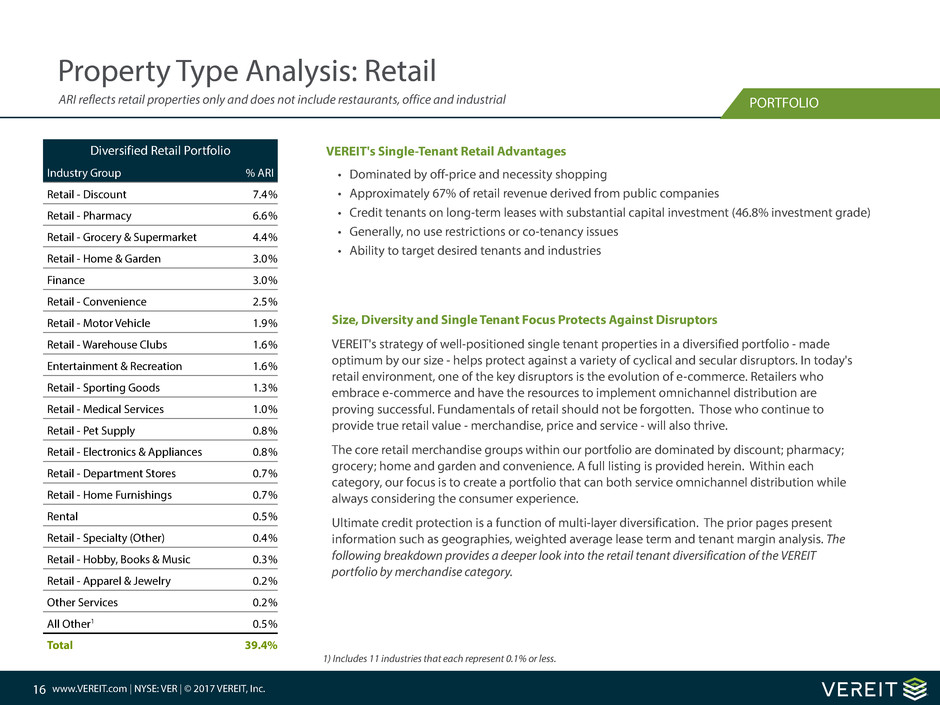

Size, Diversity and Single Tenant Focus Protects Against Disruptors

VEREIT's strategy of well-positioned single tenant properties in a diversified portfolio - made

optimum by our size - helps protect against a variety of cyclical and secular disruptors. In today's

retail environment, one of the key disruptors is the evolution of e-commerce. Retailers who

embrace e-commerce and have the resources to implement omnichannel distribution are

proving successful. Fundamentals of retail should not be forgotten. Those who continue to

provide true retail value - merchandise, price and service - will also thrive.

The core retail merchandise groups within our portfolio are dominated by discount; pharmacy;

grocery; home and garden and convenience. A full listing is provided herein. Within each

category, our focus is to create a portfolio that can both service omnichannel distribution while

always considering the consumer experience.

Ultimate credit protection is a function of multi-layer diversification. The prior pages present

information such as geographies, weighted average lease term and tenant margin analysis. The

following breakdown provides a deeper look into the retail tenant diversification of the VEREIT

portfolio by merchandise category.

VEREIT's Single-Tenant Retail Advantages

• Dominated by off-price and necessity shopping

• Approximately 67% of retail revenue derived from public companies

• Credit tenants on long-term leases with substantial capital investment (46.8% investment grade)

• Generally, no use restrictions or co-tenancy issues

• Ability to target desired tenants and industries

Diversified Retail Portfolio

Industry Group % ARI

Retail - Discount 7.4%

Retail - Pharmacy 6.6%

Retail - Grocery & Supermarket 4.4%

Retail - Home & Garden 3.0%

Finance 3.0%

Retail - Convenience 2.5%

Retail - Motor Vehicle 1.9%

Retail - Warehouse Clubs 1.6%

Entertainment & Recreation 1.6%

Retail - Sporting Goods 1.3%

Retail - Medical Services 1.0%

Retail - Pet Supply 0.8%

Retail - Electronics & Appliances 0.8%

Retail - Department Stores 0.7%

Retail - Home Furnishings 0.7%

Rental 0.5%

Retail - Specialty (Other) 0.4%

Retail - Hobby, Books & Music 0.3%

Retail - Apparel & Jewelry 0.2%

Other Services 0.2%

All Other1 0.5%

Total 39.4%

1) Includes 11 industries that each represent 0.1% or less.

ARI reflects retail properties only and does not include restaurants, office and industrial

17 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

Property Type Analysis: Retail

Category by Percent of Portfolio ARI

PORTFOLIO

Retail - Discount

Tenant % ARI

Investment

Grade

Family Dollar 3.3%

Dollar General 3.0% ü

Wal-Mart 0.7% ü

Ross 0.1% ü

Dollar Tree 0.1%

TJ Maxx <0.1% ü

Cost Plus <0.1% ü

Gabe's <0.1%

Big Lots <0.1% ü

Marshall's <0.1% ü

Shopko

Hometown <0.1%

Five Below <0.1%

Deals R Us <0.1%

Total 7.4%

Retail - Pharmacy

Tenant % ARI InvestmentGrade

Walgreens 3.3% ü

CVS 2.4% ü

Rite Aid 0.9%

Total 6.6%

Retail - Grocery & Supermarket

Tenant % ARI

Investment

Grade

Albertson's 2.0%

Kroger 0.4% ü

Giant Eagle 0.2%

Harps Grocery 0.2%

Dahl's 0.2%

Natural Grocers 0.1%

Koninklijke

Ahold 0.1% ü

Bi-Lo's Grocery 0.1%

Publix 0.1%

Stop & Shop 0.1% ü

Whole Foods 0.1% ü

Trader Joe's 0.1%

Food Lion 0.1% ü

Dominick's 0.1%

Family Fare

Supermarket 0.1%

Sprouts 0.1%

Glen's Market <0.1%

Price Rite <0.1%

Fresh Market <0.1%

Hy-Vee <0.1%

Harris Teeter <0.1% ü

Food 4 Less <0.1% ü

Apple Market <0.1%

Safeway Stores <0.1%

Total 4.4%

Retail - Home & Garden

Tenant % ARI

Investment

Grade

Tractor Supply 1.4%

Lowe's 1.0% ü

Home Depot 0.4% ü

Bed Bath &

Beyond 0.1% ü

Floor & Décor 0.1%

Pier 1 Imports <0.1%

Sherwin-

Williams <0.1% ü

Northern Tool &

Equipment <0.1%

Lumber

Liquidators <0.1%

Leslie's Pool &

Spa <0.1%

Total 3.0%

Finance

Tenant % ARI

Investment

Grade

Citizens Bank 1.7% ü

Sun Trust Bank 0.7% ü

US Bank 0.2% ü

PLS Check Cashers 0.2%

Sovereign Bank <0.1% ü

Bank of America <0.1% ü

Synovus Bank <0.1%

PNC Bank <0.1% ü

Community Bank <0.1%

Fifth Third Bank <0.1% ü

Key Bank <0.1% ü

First Bank <0.1%

Huntington

National Bank <0.1% ü

Region's Bank <0.1% ü

Wells Fargo <0.1% ü

Travis Credit

Union <0.1%

TCF National Bank <0.1% ü

Scottrade <0.1% ü

TitleMax of GA <0.1%

Cashland <0.1%

Edward Jones <0.1%

Chase Bank <0.1% ü

Accomplishments

Through People <0.1%

Total 3.0%

NOTE: Amounts may not total due to rounding.

ARI reflects retail properties only and does not include restaurants, office and industrial

18 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

Property Type Analysis: Retail

Category by Percent of Portfolio ARI

PORTFOLIO

Retail - Convenience

Tenant % ARI

Investment

Grade

Stripes 0.7%

Thorntons Oil 0.4%

Kum & Go 0.4%

Pantry Gas &

Convenience 0.2%

RaceTrac 0.2%

SuperAmerica 0.1%

Irving Oil 0.1%

Pilot Flying J 0.1%

Circle K 0.1% ü

WaWa 0.1%

7-Eleven <0.1% ü

Susser Road

Ranger <0.1%

Sunoco <0.1% ü

MotoMart <0.1%

GetGo <0.1%

Total 2.5%

Retail - Motor Vehicle

Tenant % ARI

Investment

Grade

Advance Auto

Parts 1.0% ü

CarMax 0.3%

Lube Stop 0.1%

AutoZone 0.1% ü

O'Reilly Auto

Parts 0.1% ü

Americas's

PowerSports 0.1%

Tire Kingdom <0.1%

NTW / Big O

Tires <0.1%

National Tire &

Battery <0.1% ü

Bridgestone

Tire <0.1%

Tires Plus <0.1%

Jiffy Lube <0.1%

Big O Tires <0.1% ü

Total 1.9%

Retail - Warehouse Clubs

Tenant % ARI

Investment

Grade

BJ's Wholesale

Club 1.4%

Sam's Club 0.3% ü

Total 1.6%

Entertainment & Recreation

Tenant % ARI

Investment

Grade

L.A. Fitness 1.4%

24 Hour Fitness 0.1%

Gold's Gym 0.1%

Anytime Fitness <0.1%

Total 1.6%

Retail - Sporting Goods

Tenant % ARI

Investment

Grade

Academy

Sports 0.8%

Dick's Sporting

Goods 0.2%

West Marine 0.2%

Gander

Mountain 0.1%

iFit Golf <0.1%

Total 1.3%

Retail - Medical Services

Tenant % ARI

Investment

Grade

Fresenius

Medical Care 0.5% ü

DaVita Dialysis 0.3%

Physicians

Immediate Care 0.1%

St. Luke's

Urgent Care <0.1%

Lenscrafters <0.1%

Dental Dream <0.1%

Aspen Dental <0.1%

Smile Brands of

Tennessee <0.1%

Accelerated

Rehab <0.1%

Cascade

Chiropractic <0.1%

Advanced

Dental Implant

and Denture

Center <0.1%

Dr. Elie El-Hage,

D.D.S <0.1%

Total 1.0%

Retail - Pet Supply

Tenant % ARI

Investment

Grade

Petsmart 0.8%

Petco 0.1%

Total 0.8%

Retail - Electronics & Appliances

Tenant % ARI

Investment

Grade

Best Buy 0.5% ü

HH Gregg 0.2%

Conn's 0.1%

CompUSA <0.1%

Total 0.8%

Retail - Home Furnishings

Tenant % ARI

Investment

Grade

Mattress Firm 0.5%

Garden Ridge 0.1%

At Home 0.1%

Ashley

Furniture <0.1%

Sleep Train <0.1%

Kirklands <0.1%

Sleep America <0.1%

Total 0.7%

NOTE: Amounts may not total due to rounding.

ARI reflects retail properties only and does not include restaurants, office and industrial

19 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

Property Type Analysis: Retail

Category by Percent of Portfolio ARI

PORTFOLIO

Rental

Tenant % ARI

Investment

Grade

Aaron Rents 0.4%

Vanguard Car

Rental 0.1% ü

Sunbelt Rentals <0.1%

Total 0.5%

Retail - Specialty (Other)

Tenant % ARI

Investment

Grade

Ulta Salon 0.1%

Toys R Us 0.1%

Coborn's Liquor

Store <0.1%

Babies R Us <0.1%

Ca$h Wi$e <0.1%

BevMo! <0.1%

The Vitamin

Shoppe <0.1%

GNC <0.1%

Sally Beauty

Supply <0.1%

Austin Custom

Winery <0.1%

Tinder Box <0.1%

Cigarettes

Cheaper <0.1%

Total 0.4%

Retail - Hobby, Books & Music

Tenant % ARI

Investment

Grade

Hobby Lobby 0.2%

Michael's <0.1%

Jo-Ann's <0.1%

Music & Arts

Center <0.1%

GameStop <0.1%

Total 0.3%

Retail - Apparel & Jewelry

Tenant % ARI

Investment

Grade

DSW 0.1%

Bob's Stores 0.1%

Charming

Charlie <0.1%

Rue 21 <0.1%

Shoe Carnival <0.1%

Justice <0.1%

Catherines <0.1%

Maurice's <0.1%

Men's

Wearhouse <0.1%

Total 0.2%

Other Services

Tenant % ARI

Investment

Grade

Goodyear 0.1%

Monro Muffler <0.1%

Massage Envy <0.1%

Portrait

Innovations <0.1%

Weight

Watchers <0.1%

4th Street

Laundromat <0.1%

Fantastic Sam's <0.1%

Tic Tac Nails <0.1%

Great Nails <0.1%

Nail Paradise <0.1%

MM's Nails <0.1%

Passion's Nail

and Spa <0.1%

Le Nails <0.1%

BP Nails <0.1%

Cuts By Us <0.1%

Cool Cuts 4

Kids <0.1%

Nail Care Salon <0.1%

All Cleaners <0.1%

Supercuts <0.1%

Total 0.2%

Retail - Department Stores

Tenant % ARI

Investment

Grade

Kohl's 0.6% ü

Beall's 0.1%

Total 0.7%

NOTE: Amounts may not total due to rounding.

ARI reflects retail properties only and does not include restaurants, office and industrial

20 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

Property Type Analysis: Restaurants

1) Occupancy costs are calculated as Contract Rental Revenue divided by property level sales for the year ended December 31, 2015. Property level sales data was collected for 67.9% of retail and restaurant

properties required to provide sales reports, representing 40.0% of retail and restaurant properties owned for the entirety of the calendar year ended December 31, 2015 (percentages based on property count).

Property level sales are based on sales reports provided by tenants of retail and restaurant properties. Data presented is for properties owned by the Company and for which the Company received sales data

for the calendar year 2015.

Restaurant Portfolio

Operating Properties 1,754

Rentable Square Feet (in thousands) 8,583

Economic Occupancy Rate 94.8%

Weighted Average Remaining Lease

Term (years) 13.5

Investment-Grade Tenants 2.8%

Flat leases 7.8%

NNN leases 99.4%

Annualized Rental Income 23.0%

• Single-tenant quick service, casual and family dining properties

• Creditworthy tenants, including franchisors, operating strong national and regional brands

• Main retail traffic thoroughfare

• Strong trade area demographics

• Top 5 MSAs (13.6%): Atlanta, GA; Dallas, TX; Chicago, IL; Detroit, MI; Houston, TX

Red Lobster

Bloomin' Brands

Border Holdings, LLC

Apple American Group, LLC

Wendab Associates

GMRI, Inc

Golden Corral

Neighborhood Restaurant

Partners Florida, LLC

DineEquity Inc.

Arby's Restaurant Group, Inc.

32.0%

3.5%

3.1%

2.9%

2.8%

2.8%

2.6%

2.2%

2.1%

2.0%

PORTFOLIO

Industry

2015

Occupancy

Cost 1

Target %

Casual Dining 6.5% 6.75 - 8.0%

Quick Service 7.3% 7.5 - 8.5%

Tenant Diversification (% of Restaurant ARI)

21 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

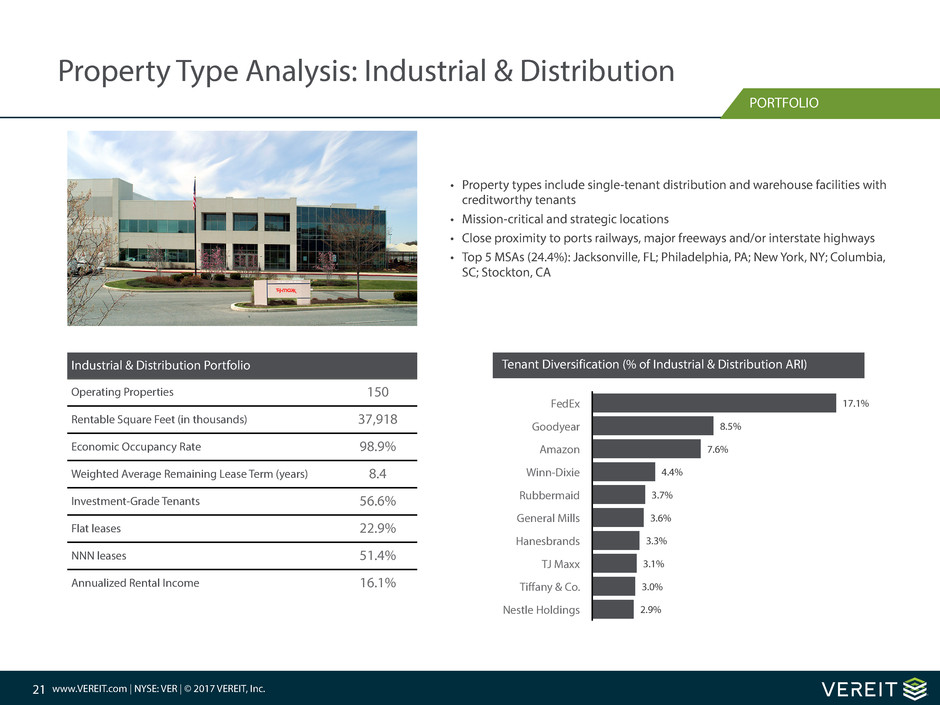

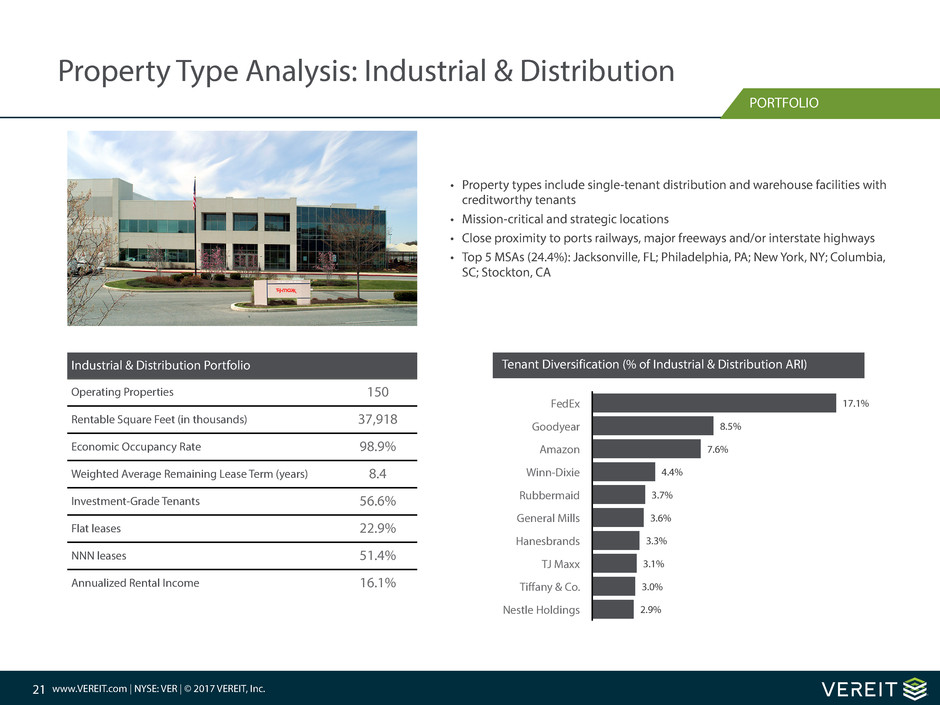

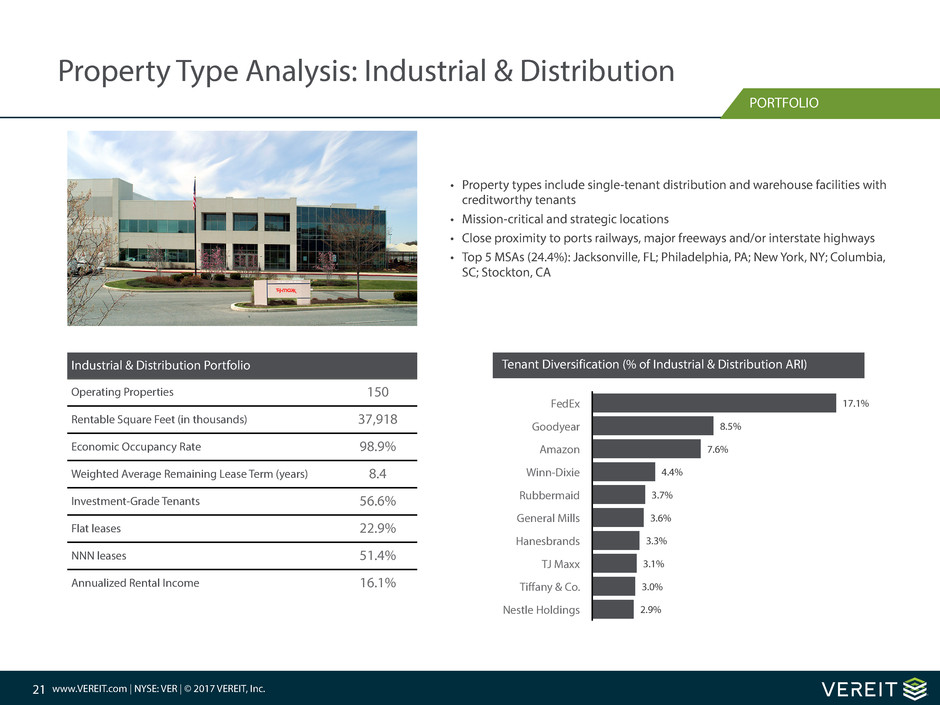

Property Type Analysis: Industrial & Distribution

Industrial & Distribution Portfolio

Operating Properties 150

Rentable Square Feet (in thousands) 37,918

Economic Occupancy Rate 98.9%

Weighted Average Remaining Lease Term (years) 8.4

Investment-Grade Tenants 56.6%

Flat leases 22.9%

NNN leases 51.4%

Annualized Rental Income 16.1%

• Property types include single-tenant distribution and warehouse facilities with

creditworthy tenants

• Mission-critical and strategic locations

• Close proximity to ports railways, major freeways and/or interstate highways

• Top 5 MSAs (24.4%): Jacksonville, FL; Philadelphia, PA; New York, NY; Columbia,

SC; Stockton, CA

FedEx

Goodyear

Amazon

Winn-Dixie

Rubbermaid

General Mills

Hanesbrands

TJ Maxx

Tiffany & Co.

Nestle Holdings

17.1%

8.5%

7.6%

4.4%

3.7%

3.6%

3.3%

3.1%

3.0%

2.9%

PORTFOLIO

Tenant Diversification (% of Industrial & Distribution ARI)

22 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

Property Type Analysis: Office

Office Portfolio

Operating Properties 94

Rentable Square Feet (in thousands) 14,295

Economic Occupancy Rate 96.5%

Weighted Average Remaining Lease Term (years) 6.4

Investment-Grade Tenants 62.4%

Flat leases 9.4%

NNN leases 21.7%

Annualized Rental Income 21.5%

• Property types include primarily single-tenant corporate headquarters

and business operations with creditworthy tenants

• Strategic location for corporate operations

• Strong 10-mile demographics and local business environment

• Top 5 MSAs (39.5%): Chicago, IL; Dallas, TX; Boston, MA; Washington, DC;

New York, NY

AON

Merrill Lynch

General Service Administration

Northrop Grumman

Petsmart

Encana Oil & Gas

Healthnow

RSA Security

Exelis

Rolls-Royce

7.3%

4.5%

4.4%

3.7%

3.5%

3.2%

3.2%

2.8%

2.5%

2.4%

PORTFOLIO

Tenant Diversification (% of Office ARI)

‹#›

DRA

F

T

a

Key Financial Highlights

Q1 2017

24 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

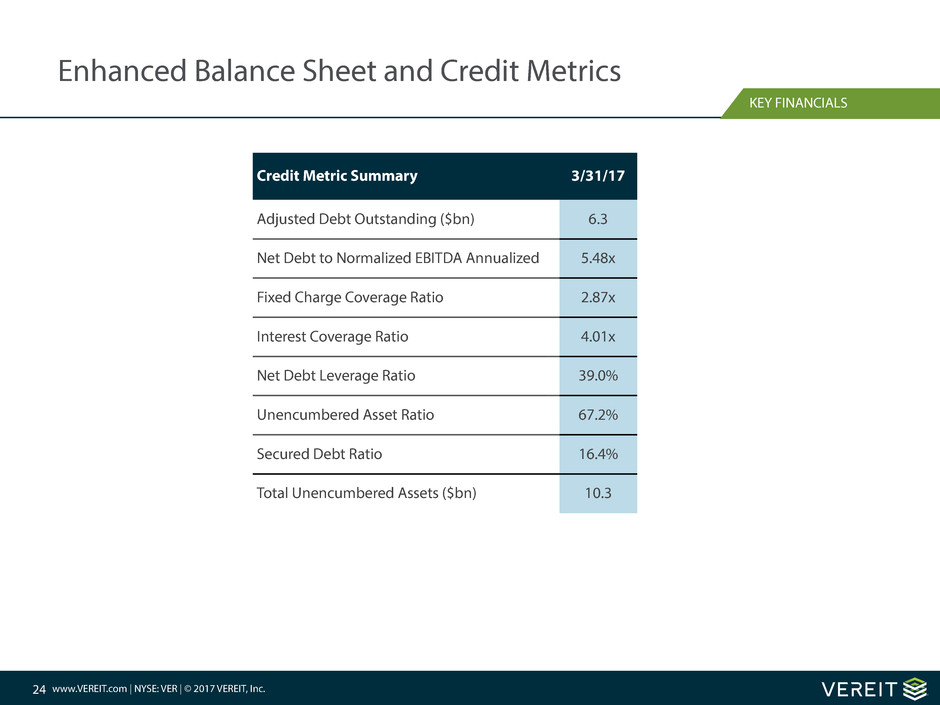

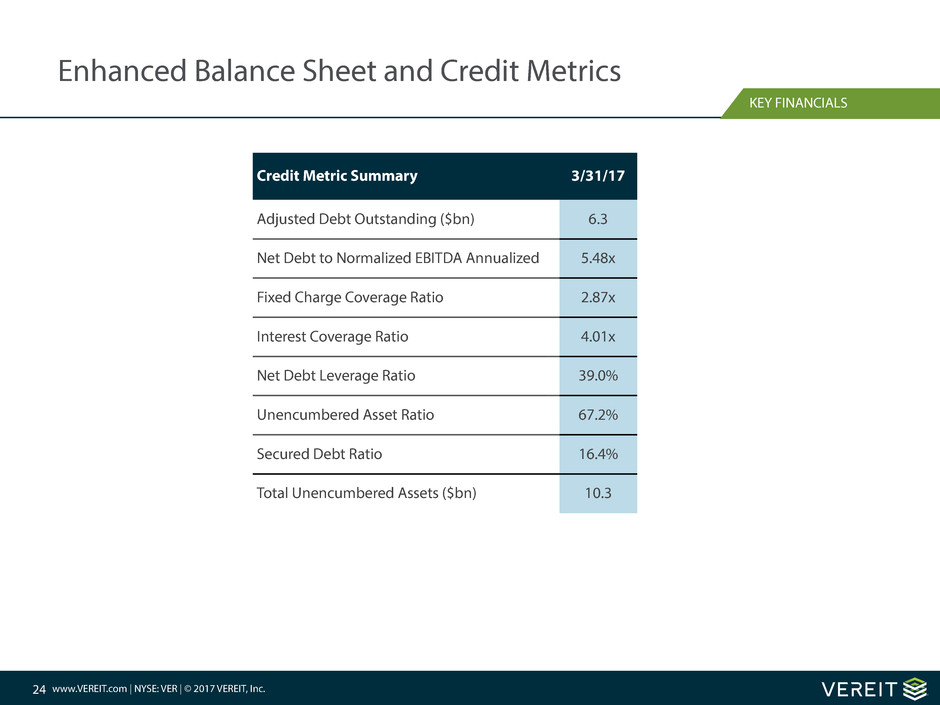

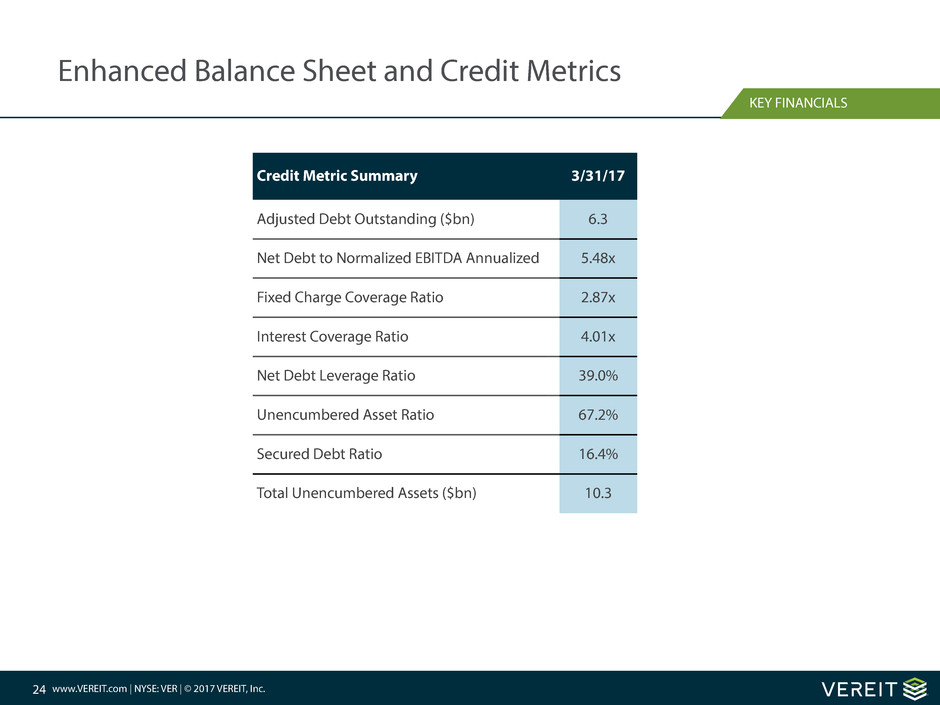

Enhanced Balance Sheet and Credit Metrics

Credit Metric Summary 3/31/17

Adjusted Debt Outstanding ($bn) 6.3

Net Debt to Normalized EBITDA Annualized 5.48x

Fixed Charge Coverage Ratio 2.87x

Interest Coverage Ratio 4.01x

Net Debt Leverage Ratio 39.0%

Unencumbered Asset Ratio 67.2%

Secured Debt Ratio 16.4%

Total Unencumbered Assets ($bn) 10.3

KEY FINANCIALS

25 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

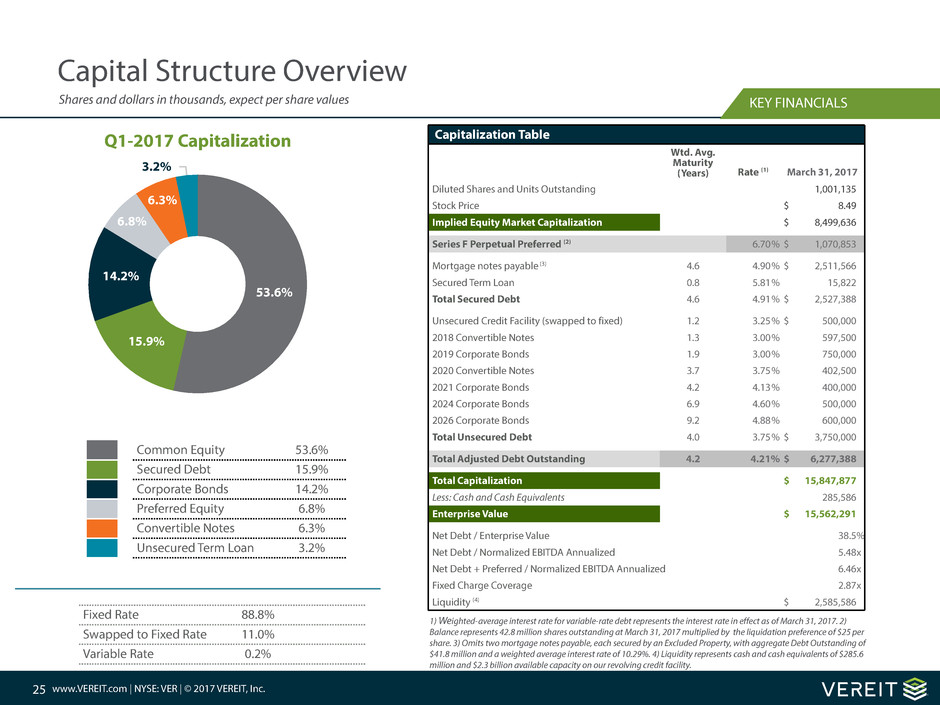

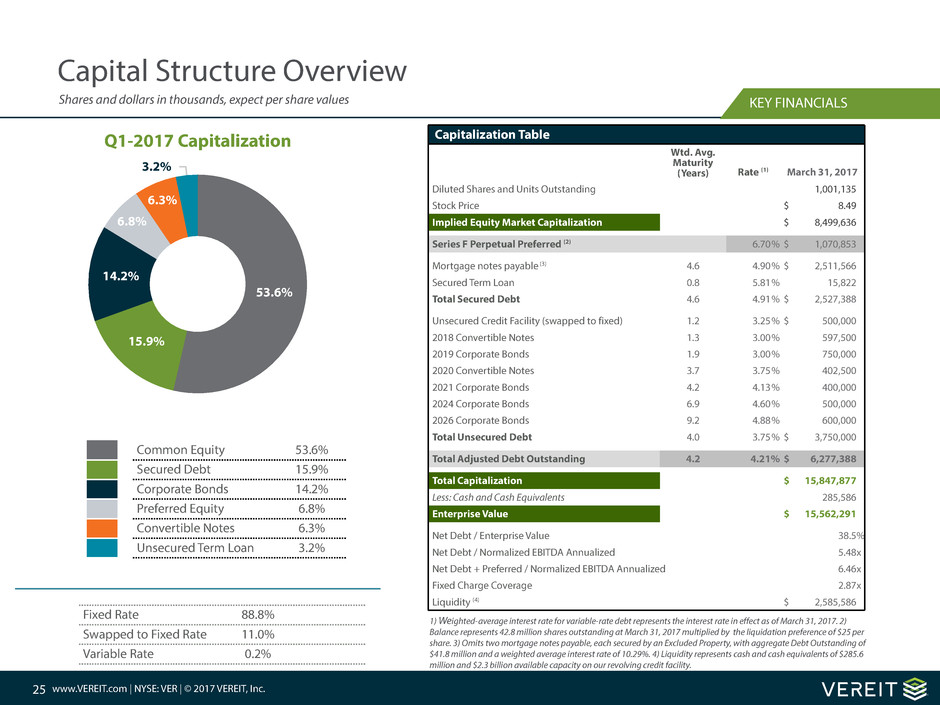

53.6%

15.9%

14.2%

6.8%

6.3%

3.2%

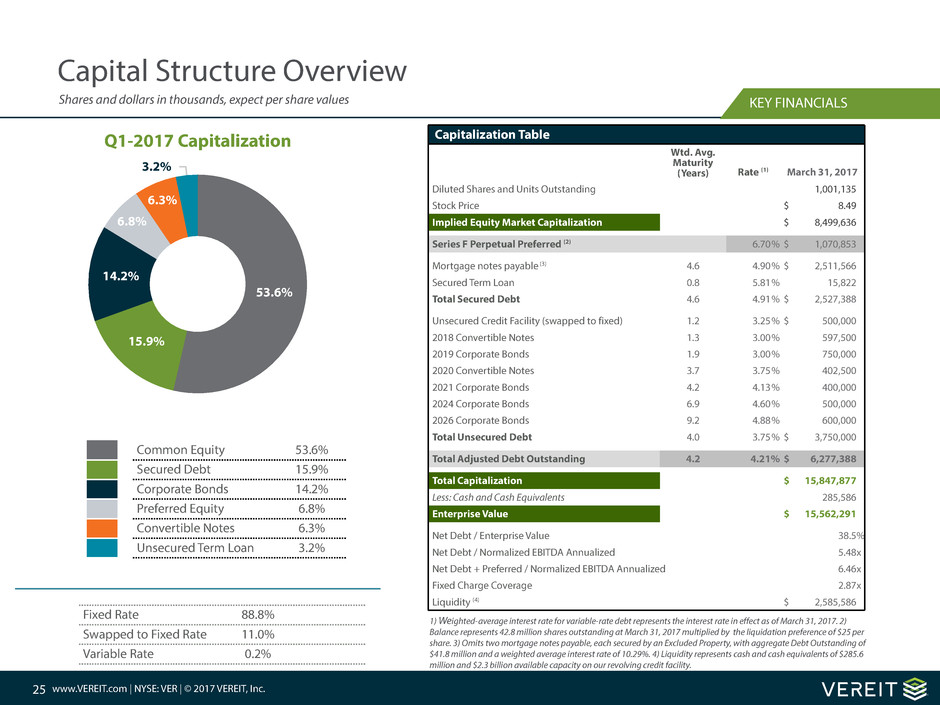

Capital Structure Overview

KEY FINANCIALSShares and dollars in thousands, expect per share values

Q1-2017 Capitalization Capitalization Table

Wtd. Avg.

Maturity

(Years) Rate (1) March 31, 2017

Diluted Shares and Units Outstanding 1,001,135

Stock Price $ 8.49

Implied Equity Market Capitalization $ 8,499,636

Series F Perpetual Preferred (2) 6.70% $ 1,070,853

Mortgage notes payable (3) 4.6 4.90% $ 2,511,566

Secured Term Loan 0.8 5.81% 15,822

Total Secured Debt 4.6 4.91% $ 2,527,388

Unsecured Credit Facility (swapped to fixed) 1.2 3.25% $ 500,000

2018 Convertible Notes 1.3 3.00% 597,500

2019 Corporate Bonds 1.9 3.00% 750,000

2020 Convertible Notes 3.7 3.75% 402,500

2021 Corporate Bonds 4.2 4.13% 400,000

2024 Corporate Bonds 6.9 4.60% 500,000

2026 Corporate Bonds 9.2 4.88% 600,000

Total Unsecured Debt 4.0 3.75% $ 3,750,000

Total Adjusted Debt Outstanding 4.2 4.21% $ 6,277,388

Total Capitalization $ 15,847,877

Less: Cash and Cash Equivalents 285,586

Enterprise Value $ 15,562,291

Net Debt / Enterprise Value 38.5%

Net Debt / Normalized EBITDA Annualized 5.48x

Net Debt + Preferred / Normalized EBITDA Annualized 6.46x

Fixed Charge Coverage 2.87x

Liquidity (4) $ 2,585,586

1) Weighted-average interest rate for variable-rate debt represents the interest rate in effect as of March 31, 2017. 2)

Balance represents 42.8 million shares outstanding at March 31, 2017 multiplied by the liquidation preference of $25 per

share. 3) Omits two mortgage notes payable, each secured by an Excluded Property, with aggregate Debt Outstanding of

$41.8 million and a weighted average interest rate of 10.29%. 4) Liquidity represents cash and cash equivalents of $285.6

million and $2.3 billion available capacity on our revolving credit facility.

3/31/17

Common Equity 53.6%

Secured Debt 15.9%

Corporate Bonds 14.2%

Preferred Equity 6.8%

Convertible Notes 6.3%

Unsecured Term Loan 3.2%

Fixed Rate 88.8% 88.2%

Swapped to Fixed Rate 11.0% 11.6%

Variable Rate 0.2% 0.2%

26 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

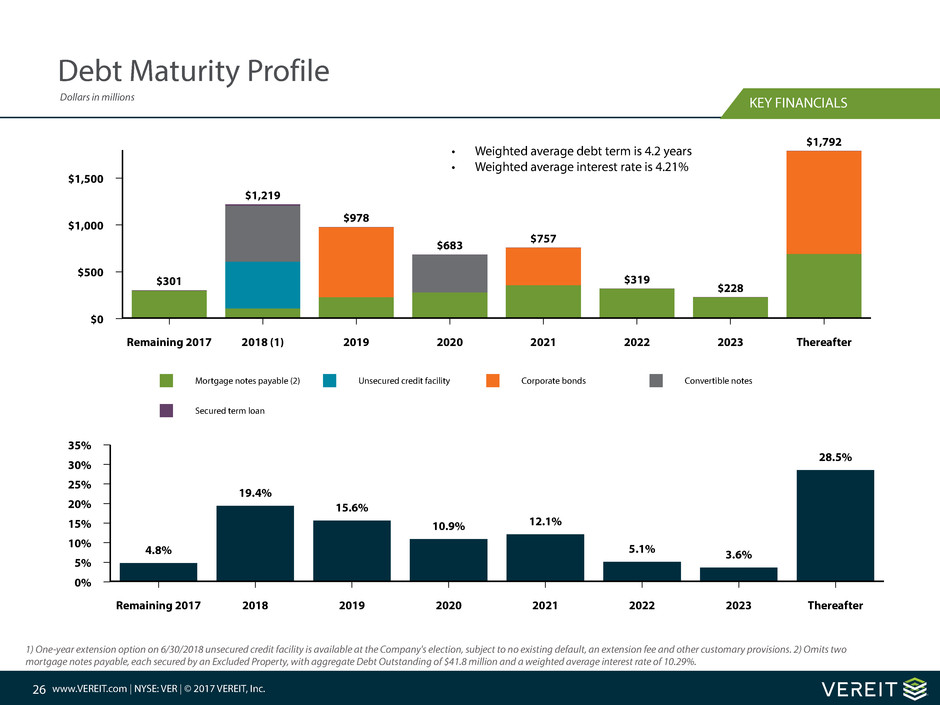

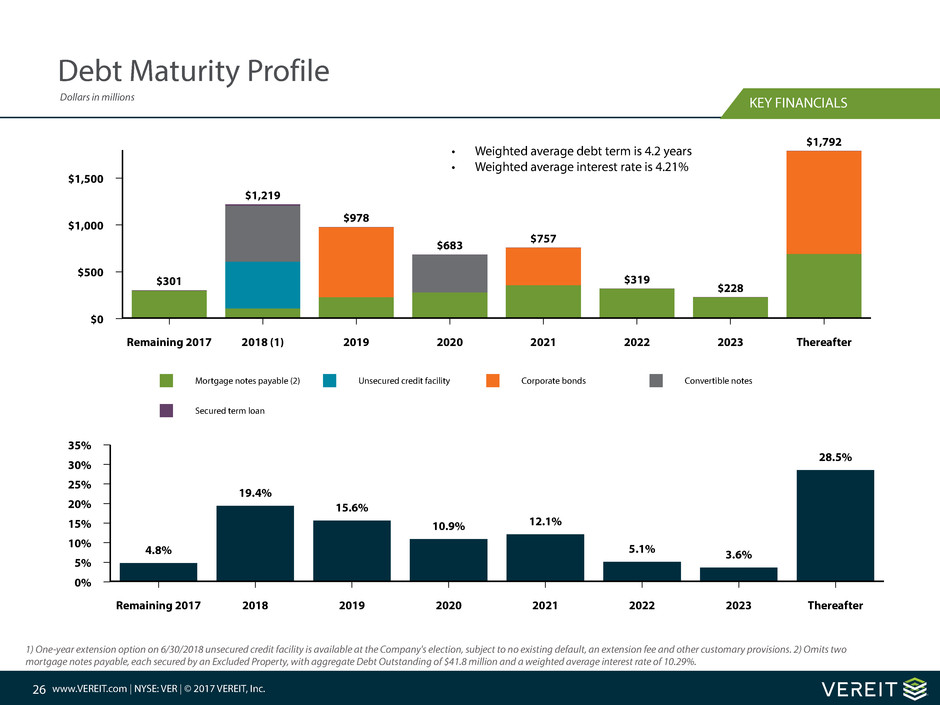

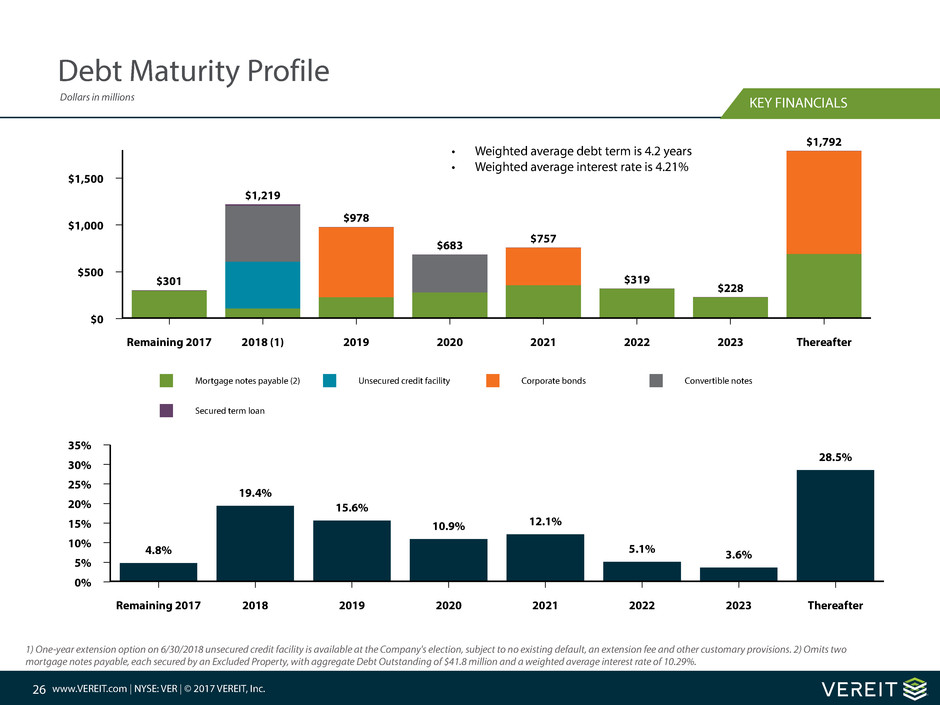

Mortgage notes payable (2) Unsecured credit facility Corporate bonds Convertible notes

Secured term loan

$1,500

$1,000

$500

$0

Remaining 2017 2018 (1) 2019 2020 2021 2022 2023 Thereafter

$319

$228

$978

$757

$1,792

$683

$301

$1,219

Debt Maturity Profile

Dollars in millions KEY FINANCIALS

• Weighted average debt term is 4.2 years

• Weighted average interest rate is 4.21%

1) One-year extension option on 6/30/2018 unsecured credit facility is available at the Company's election, subject to no existing default, an extension fee and other customary provisions. 2) Omits two

mortgage notes payable, each secured by an Excluded Property, with aggregate Debt Outstanding of $41.8 million and a weighted average interest rate of 10.29%.

35%

30%

25%

20%

15%

10%

5%

0%

Remaining 2017 2018 2019 2020 2021 2022 2023 Thereafter

4.8%

19.4%

15.6%

10.9% 12.1%

5.1% 3.6%

28.5%

‹#›

DRA

F

T

a

Highlights & Guidance

Q1 2017

28 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

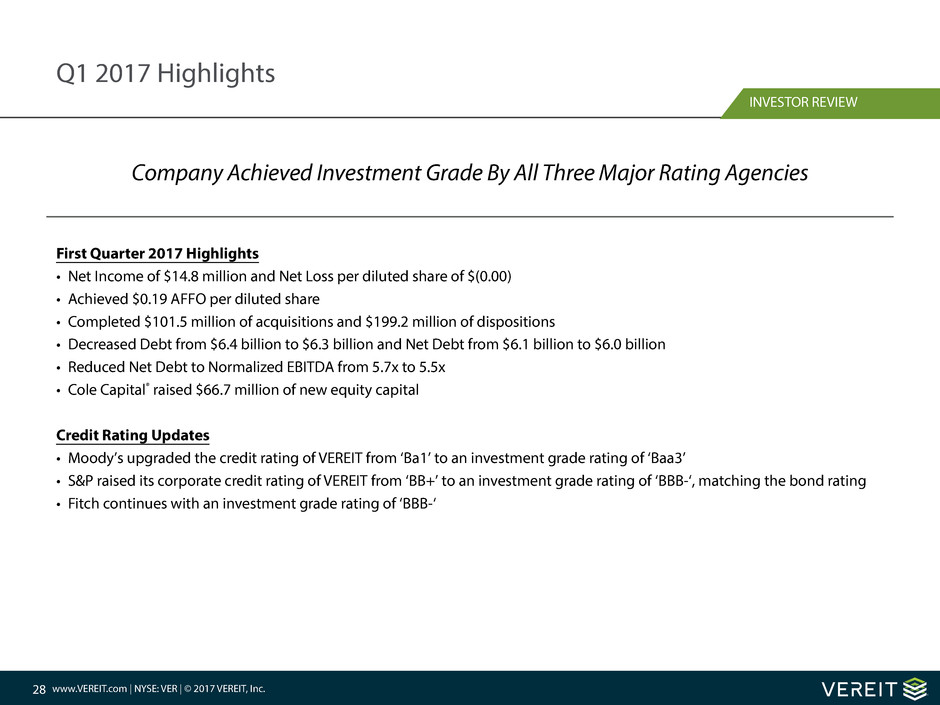

Company Achieved Investment Grade By All Three Major Rating Agencies

INVESTOR REVIEW

Q1 2017 Highlights

First Quarter 2017 Highlights

• Net Income of $14.8 million and Net Loss per diluted share of $(0.00)

• Achieved $0.19 AFFO per diluted share

• Completed $101.5 million of acquisitions and $199.2 million of dispositions

• Decreased Debt from $6.4 billion to $6.3 billion and Net Debt from $6.1 billion to $6.0 billion

• Reduced Net Debt to Normalized EBITDA from 5.7x to 5.5x

• Cole Capital® raised $66.7 million of new equity capital

Credit Rating Updates

• Moody’s upgraded the credit rating of VEREIT from ‘Ba1’ to an investment grade rating of ‘Baa3’

• S&P raised its corporate credit rating of VEREIT from ‘BB+’ to an investment grade rating of ‘BBB-‘, matching the bond rating

• Fitch continues with an investment grade rating of ‘BBB-‘

29 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

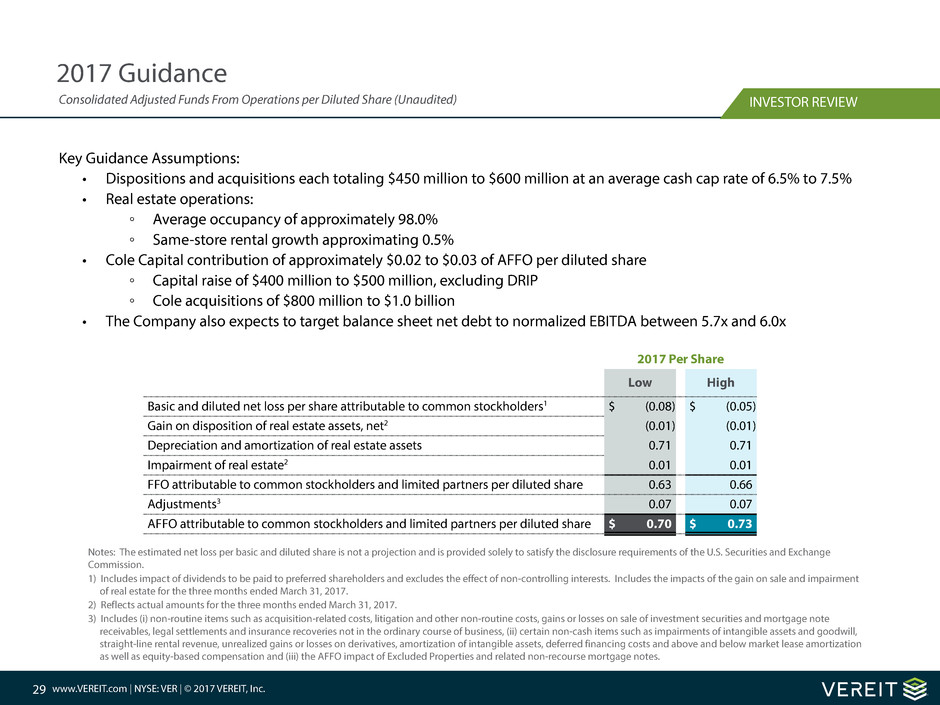

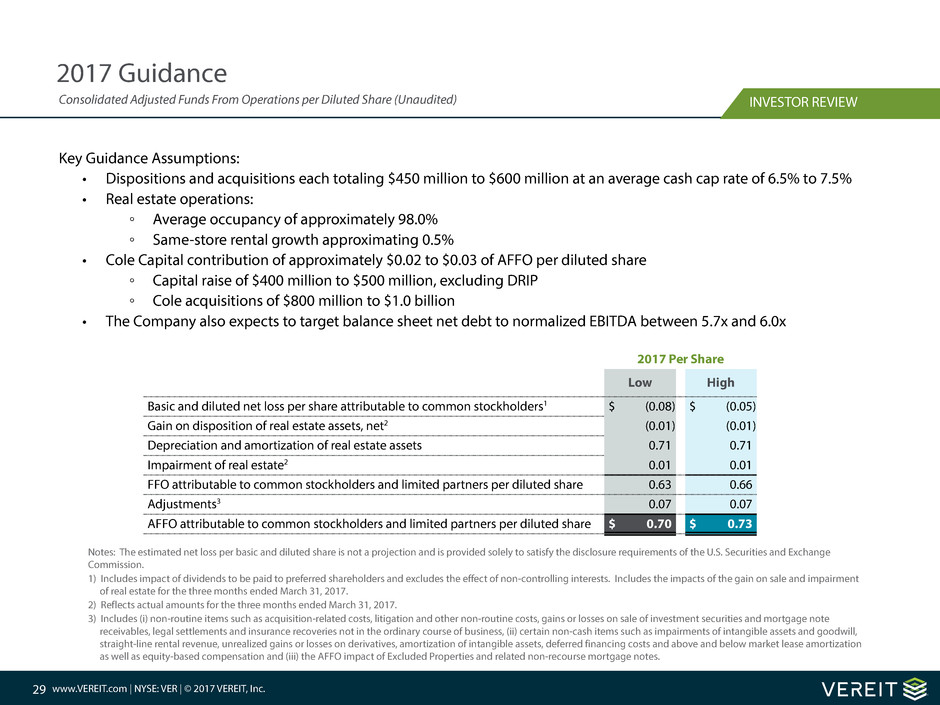

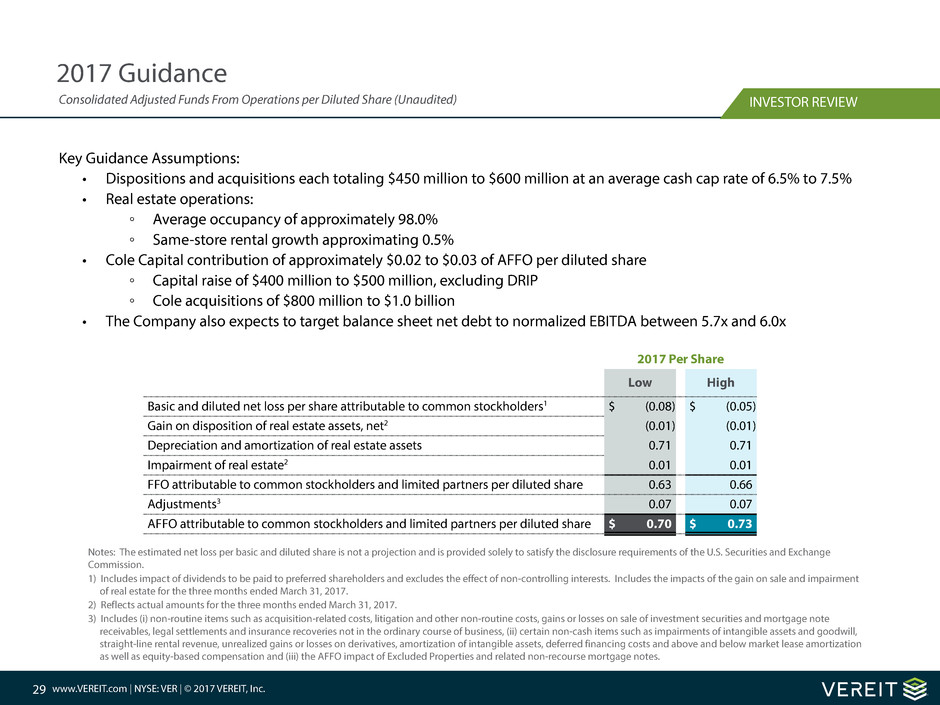

2017 Guidance

INVESTOR REVIEWConsolidated Adjusted Funds From Operations per Diluted Share (Unaudited)

Key Guidance Assumptions:

• Dispositions and acquisitions each totaling $450 million to $600 million at an average cash cap rate of 6.5% to 7.5%

• Real estate operations:

◦ Average occupancy of approximately 98.0%

◦ Same-store rental growth approximating 0.5%

• Cole Capital contribution of approximately $0.02 to $0.03 of AFFO per diluted share

◦ Capital raise of $400 million to $500 million, excluding DRIP

◦ Cole acquisitions of $800 million to $1.0 billion

• The Company also expects to target balance sheet net debt to normalized EBITDA between 5.7x and 6.0x

2017 Per Share

Low High

Basic and diluted net loss per share attributable to common stockholders1 $ (0.08) $ (0.05)

Gain on disposition of real estate assets, net2 (0.01) (0.01)

Depreciation and amortization of real estate assets 0.71 0.71

Impairment of real estate2 0.01 0.01

FFO attributable to common stockholders and limited partners per diluted share 0.63 0.66

Adjustments3 0.07 0.07

AFFO attributable to common stockholders and limited partners per diluted share $ 0.70 $ 0.73

Notes: The estimated net loss per basic and diluted share is not a projection and is provided solely to satisfy the disclosure requirements of the U.S. Securities and Exchange

Commission.

1) Includes impact of dividends to be paid to preferred shareholders and excludes the effect of non-controlling interests. Includes the impacts of the gain on sale and impairment

of real estate for the three months ended March 31, 2017.

2) Reflects actual amounts for the three months ended March 31, 2017.

3) Includes (i) non-routine items such as acquisition-related costs, litigation and other non-routine costs, gains or losses on sale of investment securities and mortgage note

receivables, legal settlements and insurance recoveries not in the ordinary course of business, (ii) certain non-cash items such as impairments of intangible assets and goodwill,

straight-line rental revenue, unrealized gains or losses on derivatives, amortization of intangible assets, deferred financing costs and above and below market lease amortization

as well as equity-based compensation and (iii) the AFFO impact of Excluded Properties and related non-recourse mortgage notes.

30 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

800.606.3610

Phoenix

2325 East Camelback Road

Suite 1100

Phoenix, AZ 85016

602.778.6000

New York City

5 Bryant Park

23rd Floor

New York, NY 10018

212.413.9100

Investor Relations

877.405.2653

InvestorRelations@VEREIT.com

Contact Us

CONTACT

Registered Stockholders

Computershare (Transfer Agent)

P.O. Box 43078

Providence, RI 02940

By overnight delivery

Computershare

250 Royal Street

Canton, MA 02021

Telephone inquiries

TFN 855.866.0787

(US, CA, Puerto Rico)

TN 781.575.3100

(non-US)

Email

web.queries@computershare.com

Follow Us

LinkedIn

www.linkedin.com/company/vereit

Twitter

twitter.com/vereitinc

YouTube

https://www.youtube.com/channel/

UCUNu7AUOolITuwpNhr2JEGg

Flickr

https://www.flickr.com/

photos/143027056@N07/

‹#›

DRA

F

T

a

Definitions & Reconciliations

Q1 2017

32 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

Definitions

INVESTOR REVIEW

Annualized Rental Income is rental revenue under our leases on Operating Properties

on a straight-line basis, which includes the effect of rent escalations and any tenant

concessions, such as free rent, and excludes any bad debt allowances and any contingent

rent, such as percentage rent. Management uses Annualized Rental Income as a basis for

tenant, industry and geographic concentrations and other metrics within the portfolio.

Annualized Rental Income is not indicative of future performance.

Debt Outstanding and Adjusted Debt Outstanding are non-GAAP measures that

represent the Company's outstanding principal debt balance, excluding certain GAAP

adjustments, such as premiums and discounts, financing and issuance costs, and related

accumulated amortization. Beginning in 2017, Adjusted Debt Outstanding omits the

outstanding principal balance of mortgage notes secured by Excluded Properties. We

believe that the presentation of Debt Outstanding and Adjusted Debt Outstanding,

which show our contractual debt obligations, provides useful information to investors to

assess our overall liquidity, financial flexibility, capital structure and leverage. Debt

Outstanding and Adjusted Debt Outstanding should not be considered as alternatives to

the Company's consolidated debt balance as determined in accordance with GAAP or any

other GAAP financial measures and should only be considered together with, and as a

supplement to, the Company's financial information prepared in accordance with GAAP.

Economic Occupancy Rate equals the sum of square feet leased (including month-to-

month agreements) divided by Rentable Square Feet.

EBITDA and Normalized EBITDA as disclosed represents EBITDA, or earnings before

interest, taxes, depreciation and amortization, modified to exclude non-routine items

such as acquisition related expenses, merger and other non-routine transactions costs,

gains or losses on sale of investments, legal settlements and insurance recoveries not in

the ordinary course of business and extinguishment of debt cost. We also exclude certain

non-cash items such as impairments of intangible assets, straight-line rental revenue,

unrealized gains or losses on derivatives, write-off of program development costs, and

amortization of intangibles, deferred financing costs, above-market lease assets and

below-market lease liabilities.

Beginning in 2017, Normalized EBITDA omits the Normalized EBITDA impact of

Excluded Properties. Management believes that excluding these costs from EBITDA

provides investors with supplemental performance information that is consistent

with the performance models and analysis used by management, and provides

investors a view of the performance of our portfolio over time. The Company

believes that Normalized EBITDA is a useful non-GAAP supplemental measure to

investors and analysts for assessing the performance of the Company's business

segments.

Therefore, Normalized EBITDA should not be considered as an alternative to net

income, as computed in accordance with GAAP, or as an indicator of the Company's

financial performance. The Company uses Normalized EBITDA as one measure of its

operating performance when formulating corporate goals and evaluating the

effectiveness of the Company's strategies. Normalized EBITDA may not be

comparable to similarly titled measures of other companies.

Excluded Properties are properties owned by the Company for which as of the

reporting date, (i) the related mortgage loan is in default, and (ii) management has

made a decision to transfer the properties to the lender in connection with settling

the mortgage note obligation.

Fixed Charge Coverage Ratio is the sum of (i) Interest Expense, excluding non-cash

amortization, (ii) secured debt principal amortization and (iii) dividends attributable

to preferred shares divided by Normalized EBITDA. Management believes that Fixed

Charge Coverage Ratio is a useful supplemental measure of our ability to satisfy fixed

financing obligations.

33 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

Definitions

INVESTOR REVIEW

Funds from Operations ("FFO") and Adjusted Funds from Operations ("AFFO"): Due

to certain unique operating characteristics of real estate companies, as discussed below,

the National Association of Real Estate Investment Trusts, Inc. ("NAREIT"), an industry

trade group, has promulgated a supplemental performance measure known as FFO,

which we believe to be an appropriate supplemental performance measure to reflect the

operating performance of a REIT. FFO is not equivalent to our net income or loss as

determined under GAAP.

NAREIT defines FFO as net income or loss computed in accordance with GAAP, excluding

gains or losses from disposition of property, depreciation and amortization of real estate

assets and impairment write-downs on real estate including the pro rata share of

adjustments for unconsolidated partnerships and joint ventures. We calculated FFO in

accordance with NAREIT's definition described above.

In addition to FFO, we use AFFO as a non-GAAP supplemental financial performance

measure to evaluate the operating performance of the Company. AFFO, as defined by the

Company, excludes from FFO non-routine items such as acquisition related expenses,

litigation and other non-routine costs, gains or losses on sale of investment securities or

mortgage notes receivable and legal settlements and insurance recoveries not in the

ordinary course of business. We also exclude certain non-cash items such as impairments

of goodwill and intangible assets, straight-line rental revenue, unrealized gains or losses

on derivatives, reserves for loan loss, gains or losses on the extinguishment or forgiveness

of debt, non-current portion of the tax benefit or expense, equity-based compensation

and amortization of intangible assets, deferred financing costs, above-market lease assets

and below-market lease liabilities.

Effective January 1, 2017, we determined to omit the impact of the Excluded Properties

and related non-recourse mortgage notes from AFFO. Management believes that

excluding these costs from FFO provides investors with supplemental performance

information that is consistent with the performance models and analysis used by

management, and provides investors a view of the performance of our portfolio over

time. AFFO allows for a comparison of the performance of our operations with other

publicly-traded REITs, as AFFO, or an equivalent measure, is routinely reported by

publicly-traded REITs, and we believe often used by analysts and investors for comparison

purposes.

For all of these reasons, we believe FFO and AFFO, in addition to net income (loss), as

defined by GAAP, are helpful supplemental performance measures and useful in

understanding the various ways in which our management evaluates the performance of

the Company over time. However, not all REITs calculate FFO and AFFO the same way, so

comparisons with other REITs may not be meaningful. FFO and AFFO should not be

considered as alternatives to net income (loss) and are not intended to be used as a

liquidity measure indicative of cash flow available to fund our cash needs. Neither the

SEC, NAREIT, nor any other regulatory body has evaluated the acceptability of the

exclusions used to adjust FFO in order to calculate AFFO and its use as a non-GAAP

financial performance measure.

Gross Real Estate Investments represent total gross real estate and related assets of

Operating Properties, including net investments in unconsolidated entities, investment in

direct financing leases, investment securities backed by real estate and loans held for

investment, net of gross intangible lease liabilities.

34 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

Definitions

INVESTOR REVIEW

Interest Expense, excluding non-cash amortization is a non-GAAP measure that

represents interest expense incurred on the outstanding principal balance of our debt.

This measure excludes (i) the amortization of deferred financing costs, premiums and

discounts, which is included in interest expense in accordance with GAAP, and (ii)the

impact of Excluded Properties and related non-recourse mortgage notes. We believe that

the presentation of Interest Expense, excluding non-cash amortization, which shows the

interest expense on our contractual debt obligations, provides useful information to

investors to assess our overall solvency and financial flexibility. Interest Expense,

excluding non-cash amortization should not be considered as an alternative to the

Company's interest expense as determined in accordance with GAAP or any other GAAP

financial measures and should only be considered together with and as a supplement to

the Company's financial information prepared in accordance with GAAP.

Interest Coverage Ratio equals Normalized EBITDA divided by Interest Expense,

excluding non-cash amortization. Management believes that Interest Coverage Ratio is a

useful supplemental measure of our ability to service our debt obligations.

Investment-Grade Tenants are those with a Standard & Poor’s credit rating of BBB- or

higher or a Moody’s credit rating of Baa3 or higher. The ratings may reflect those

assigned by Standard & Poor’s or Moody’s to the lease guarantor or the parent company,

as applicable.

Net Debt is a non-GAAP measure used to show the Company's Adjusted Debt

Outstanding, less all cash and cash equivalents. We believe that the presentation of Net

Debt provides useful information to investors because our management reviews Net

Debt as part of its management of our overall liquidity, financial flexibility, capital

structure and leverage.

Net Debt Leverage Ratio equals Net Debt divided by Gross Real Estate Investments. We

believe that the presentation of Net Debt Leverage Ratio provides useful information to

investors because our management reviews Net Debt Leverage Ratio as part of its

management of our overall liquidity, financial flexibility, capital structure and leverage.

Net Debt to Normalized EBITDA Annualized equals Net Debt divided by the current

quarter Normalized EBITDA multiplied by four. We believe that the presentation of Net Debt

to Normalized EBITDA Annualized provides useful information to investors because our

management reviews Net Debt to Normalized EBITDA Annualized as part of its management

of our overall liquidity, financial flexibility, capital structure and leverage.

Normalized EBITDA Annualized equals Normalized EBITDA, for the respective quarter,

multiplied by four.

Operating Properties refers to all properties owned by the Company and beginning in

2017, it omits Excluded Properties.

Rentable Square Feet is leasable square feet of Operating Properties.

Secured Debt Ratio equals secured Adjusted Debt Outstanding divided by Adjusted

Debt Outstanding.

Unencumbered Asset Ratio equals unencumbered Gross Real Estate Investments

divided by Gross Real Estate Investments. Management believes that Unencumbered

Asset Ratio is a useful supplemental measure of our overall liquidity and leverage.

Weighted Average Remaining Lease Term is the number of years remaining on each

respective lease, weighted based on Annualized Rental Income of Operating Properties.

35 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

Reconciliations

(in thousands, except share and per share data)

INVESTOR REVIEW

Net income $ 14,790

Adjustments:

Interest expense 73,743

Depreciation and amortization 183,152

Provision for income taxes 4,254

Proportionate share of adjustments for unconsolidated entities 1,246

EBITDA $ 277,185

Gain on disposition of real estate assets, including joint ventures, net (12,481)

Impairments 6,725

Acquisition-related expenses 617

Litigation and other non-routine costs, net of insurance recoveries 12,875

Gain on derivative instruments, net (824)

Amortization of above-market lease assets and deferred lease

incentives, net of amortization of below-market lease liabilities 1,305

Loss on extinguishment and forgiveness of debt, net 70

Net direct financing lease adjustments 621

Straight-line rent, net of bad debt expense related to straight-line rent (12,797)

Other amortization and non-cash charges 861

Proportionate share of adjustments for unconsolidated entities (48)

Adjustment for Excluded Properties (764)

Normalized EBITDA $ 273,345

Net income $ 14,790

Dividends on non-convertible preferred stock (17,973)

Gain on real estate assets and interest in joint venture, net (12,481)

Depreciation and amortization of real estate assets 178,295

Impairment of real estate 6,725

Proportionate share of adjustments for unconsolidated entities 709

FFO attributable to common stockholders and limited partners $ 170,065

Acquisition-related expenses 617

Litigation and other non-routine costs, net of insurance recoveries 12,875

Gain on derivative instruments, net (824)

Amortization of premiums and discounts on debt and investments, net (847)

Amortization of above-market lease assets and deferred lease incentives,

net of amortization of below-market lease liabilities 1,305

Net direct financing lease adjustments 621

Amortization and write-off of deferred financing costs 6,347

Amortization of management contracts 4,146

Deferred tax expense 1,649

Loss on extinguishment and forgiveness of debt, net 70

Straight-line rent, net of bad debt expense related to straight-line rent (12,797)

Equity-based compensation expense 3,111

Other amortization and non-cash charges 634

Proportionate share of adjustments for unconsolidated entities 55

Adjustment for Excluded Properties 294

AFFO attributable to common stockholders and limited partners $ 187,321

Weighted-average shares outstanding - basic 973,849,610

Limited Partner OP Units and effect of dilutive securities 24,402,139

Weighted-average shares outstanding - diluted 998,251,749

FFO attributable to common stockholders and limited partners per diluted

share $ 0.170

AFFO attributable to common stockholders and limited partners per diluted

share $ 0.188

EBITDA and Normalized EBITDA Three Months Ended 3/31/17 FFO and AFFO Three Months Ended 3/31/2017

36 www.VEREIT.com | NYSE: VER | © 2017 VEREIT, Inc.

Reconciliations

(dollars in thousands)

INVESTOR REVIEW

Interest Expense, excluding non-cash amortization $ 68,123

Normalized EBITDA 273,345

Interest Coverage Ratio 4.01x

Interest Expense, excluding non-cash amortization $ 68,123

Secured debt principal amortization 8,993

Dividends attributable to preferred shares 17,973

Total fixed charges 95,089

Normalized EBITDA 273,345

Fixed Charge Coverage Ratio 2.87x

Mortgage notes payable and other debt, net $ 2,586,917

Corporate bonds, net 2,227,307

Convertible debt, net 976,031

Credit facility, net 497,148

Total debt - as reported 6,287,403

Adjustments:

Deferred financing costs, net 51,936

Net premiums (20,131)

Debt Outstanding $ 6,319,208

Debt Outstanding - Excluded Properties (41,820)

Adjusted Debt Outstanding 6,277,388

Interest expense - as reported $ (73,743)

Adjustments:

Amortization of deferred financing and issuance costs (6,443)

Amortization of net premiums 1,881

Interest Expense, excluding non-cash amortization -

Excluded Properties (1,058)

Interest Expense, excluding non-cash amortization $ (68,123)

Debt

Three Months Ended 3/31/17

3/31/17

Interest

Adjusted Debt Outstanding $ 6,277,388

Less: cash and cash equivalents 285,586

Net Debt 5,991,802

Normalized EBITDA annualized 1,093,380

Net Debt to Normalized EBITDA annualized ratio 5.48x

Net Debt $ 5,991,802

Gross Real Estate Investments 15,367,137

Net Debt Leverage Ratio 39.0%

Unencumbered Gross Real Estate Investments $ 10,319,871

Gross Real Estate Investments 15,367,137

Unencumbered Asset Ratio 67.2%

Secured Debt Outstanding $ 2,527,388

Gross Real Estate Investments 15,367,137

Secured Debt Ratio 16.4%

Financial and Operations

Statistics and Ratios

Three Months Ended 3/31/17