February 2013 American Realty Capital Properties Acquisition of Cole Credit Property Trust III in a $ 9.7 Billion Transaction March 27, 2013 Acquisition Will Produce Largest REIT in Net Lease Sector, Increased Earnings and Dividends. CCPT III Stockholders W ill Benefit from Premium Valuation, Certainty of Closing, Immediate Liquidity and Tax - Free Exchange.

2 Additional Information about the Proposed Transaction and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This communication relates to a business combination transaction with Cole Credit Property Trust III, Inc. (“CCPT III”) proposed by American Realty Capital Properties, Inc. (“ARCP”), which may become the subject of a registration statement filed with the Securities and Exchange Commission (the “SEC”). This material is not a substitute for the proxy statement/prospectus ARCP would file with the SEC regarding the proposed transaction if such a negotiated transaction with CCPT III is reached or for any other document which ARCP may file with the SEC and send to ARCP’s or CCPT III’s stockholders in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF ARCP AND CCPT III ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Such documents would be available free of charge through the website maintained by the SEC at www.sec.gov or by directing a request to the ARCP Investor Relations Department, 405 Park Avenue, New York, New York 10022. Copies of such documents filed by ARCP with the SEC also will be available free of charge on ARCP’s website at www.arcpreit.com . ARCP, AR Capital, LLC and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from ARCP’s and CCPT III’s stockholders in respect of the proposed transaction. Information regarding ARCP’s directors and executive officers can be found in ARCP’s definitive proxy statement filed with the SEC on May 4, 2012, as modified by ARCP’s current reports on Form 8 - K filed with the SEC on October 17, 2012 and March 6, 2013. Additional information regarding the interests of such potential participants will be included in any proxy statement/prospectus and other relevant documents filed with the SEC in connection with the proposed transaction if and when they become available. All information in this communication concerning CCPT III, including its business, operations and financial results was obtained from public sources. While ARCP has no knowledge that any such information is inaccurate or incomplete, ARCP has not had the opportunity to verify any of that information.

3 Forward - Looking Statements Information set forth in this communication (including information included or incorporated by reference herein) contains “forward - looking statements” (as defined in Section 21E of the Securities Exchange Act of 1934), which reflect ARCP’s expectations regarding future events. The forward - looking statements involve a number of risks, uncertainties and other factors, many of which are outside ARCP’s control, that could cause actual results to differ materially from those contained in the forward - looking statements. Such risks and uncertainties relating to the proposed transaction include, but are not limited to, CCPT III’s failure to accept ARCP’s proposal and enter into definitive agreements to effect the transaction, whether and when the proposed transaction will be consummated, the new combined company’s plans, market and other expectations, objectives, intentions, as well as any expectations or projections with respect to the combined company, including regarding future dividends and market valuations, and other statements that are not historical facts. The following additional factors, among others, could cause actual results to differ materially from those set forth in the forward - looking statements: the ability to obtain regulatory and stockholder approvals for the transaction; market volatility; unexpected costs or unexpected liabilities that may arise from the transaction, whether or not consummated; the inability to retain key personnel; ARCP’s ability to achieve the cost - savings and synergies contemplated by the proposed transaction within the expected time frame; ARCP’s ability to promptly and effectively integrate the businesses of CCPT III and ARCP; disruption from the proposed transaction making it more difficult to maintain relationships with tenants; the business plans of the tenants of the respective parties; continuation or deterioration of current market conditions; and future regulatory or legislative actions that could adversely affect the companies. Additional factors that may affect future results will be contained in ARCP’s filings with the SEC from time to time. ARCP disclaims any obligation to update and revise statements contained in these materials based on new information or otherwise.

4 ; CCPT III Stockholder Consideration: (i) $13.59 per CCPT III share minimum floor value with a fixed 0.80 exchange ratio or (ii) $12.50 per share in cash (1) . ; Floor, No Cap: Proposal guarantees an exchange value of not less than $13.59 per CCPT III share with no limit on the potential upside. ; Dividend Increase : ARCP’s annual dividend will increase to $0.93 per share upon closing. CCPT III stockholders who elect ARCP stock will receive an annualized dividend of $0.744 per share, ($0.93 x 0.80), a 15% increase (9.4 cents per share) over CCPT III’s current $ 0.65 annualized dividend per share, greater than the proposed $0.70 per share dividend post proposed Internalization. ; Cole Holdings Consideration : Cole Holdings will be paid $335.6 million

as a subordinated management incentive fee pursuant to the terms of CCPT III’s existing advisory agreement. (2) ARCP is Offering to Purchase for $13.59 per Share all of the Outstanding Shares of CCPT III after it Purchases Cole Holdings: ARCP’s $13.59 per share offer provides greater value, certainty and speed of execution than a post Internalization listing. (1) We are proposing up to $1.2 billion (or approximately 20% of the outstanding shares of CCPT III common stock) in cash subject to CCPT III stockholder election and the balance will be paid in ARCP shares . (2) See page 9 for details. Based on a floor of $13.59 per share and a hurdle price of $10.45 per share, as disclosed in the announced merger agreement .

5 ; No Lock - Up: All CCPT III shares converted into ARCP shares will be immediately tradable on NASDAQ; stockholders are not “ locked up.” Significant market support is anticipated from numerous index inclusions at and subsequent to closing. ; Tax - Free Exchange: The stock - for - stock option is designed to provide CCPT III stockholders with a tax - free exchange for those who elect to receive stock consideration. ; Operating Synergies and Integration: ARCP estimates general and administrative expense (G&A) savings will exceed $ 30 million annually. The majority of the real estate assets owned by CCPT III are net leased properties similar to ARCP’s existing property portfolio. This should result in a seamless integration requiring minimal additional resources or increased expenses. ARCP’s proposal provides CCPT III stockholders with immediate liquidity, tax and operating efficiencies, seamless portfolio integration, certainty of value and swift execution. CCPT III Stockholders Receive Significant Transaction Benefits.

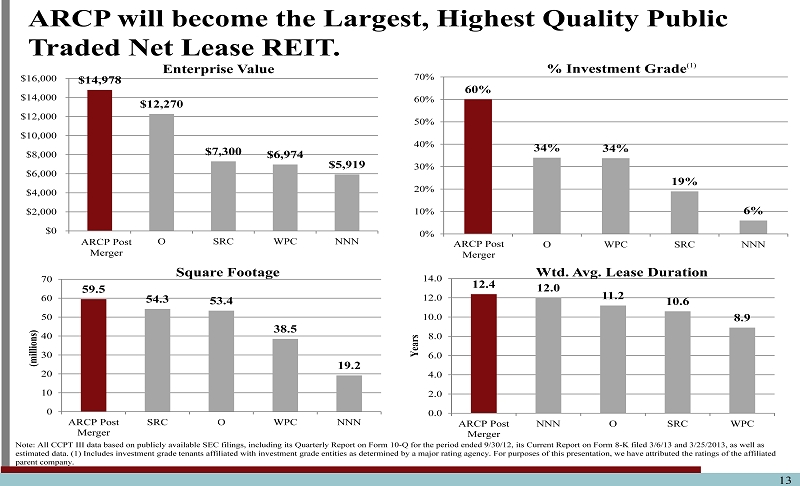

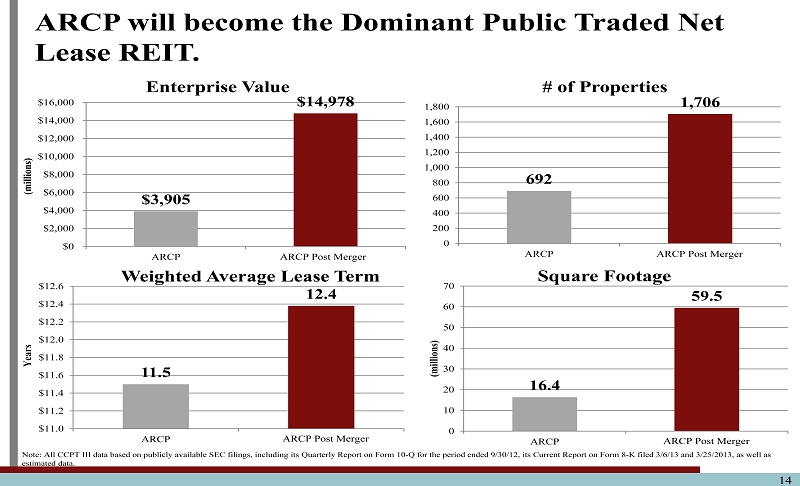

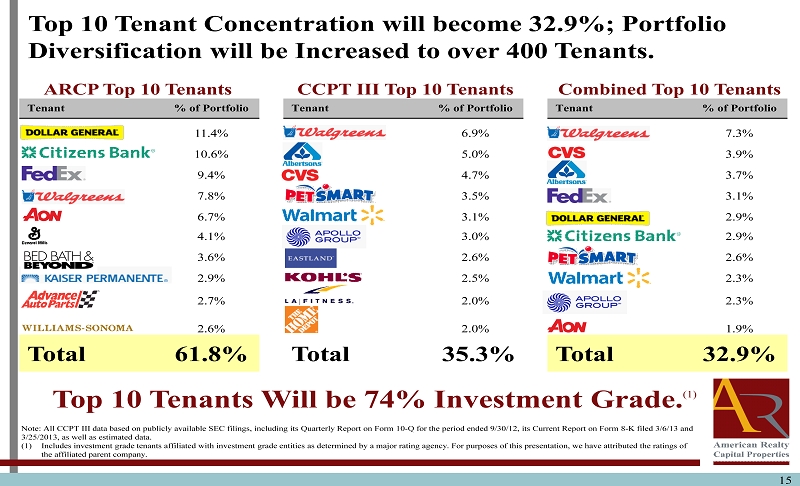

6 ; Immediate Accretion to AFFO per Share (1) : Greater financial disclosures have enabled ARCP to refine its proposal such that the transaction is still more than 10% accretive to ARCP’s AFFO per share. ; Dividend Growth: Increased AFFO per share allows for annualized dividend increase of $0.02 per share to $0.93 per share. ; Largest Net Lease REIT: Combination will result in largest publicly traded net lease REIT by property square footage and market capitalization, resulting in expected near - term MSCI, Russell and S&P index inclusions, increased share liquidity and enhanced access to capital. ; Highest Quality Net Lease Property Portfolio: Combined property portfolio will have the largest enterprise value, highest investment grade tenant %, longest weighted average remaining lease term, highest occupancy, and lowest average property age of public net lease REITs. ; Increased Tenant Diversification : Concentration of top ten tenants reduced significantly from approximately 62% to less than 33%. ARCP Stockholders Post Merger Receive Significant Benefits. (1) Based on 2013 guidance issued on February 28, 2013.

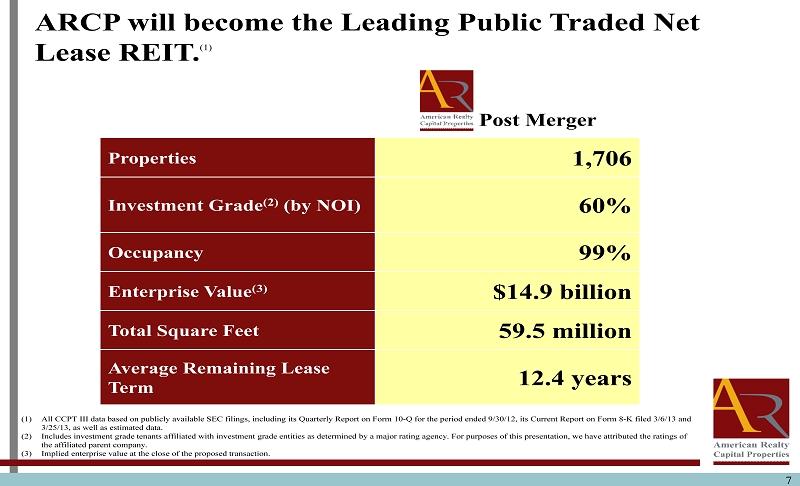

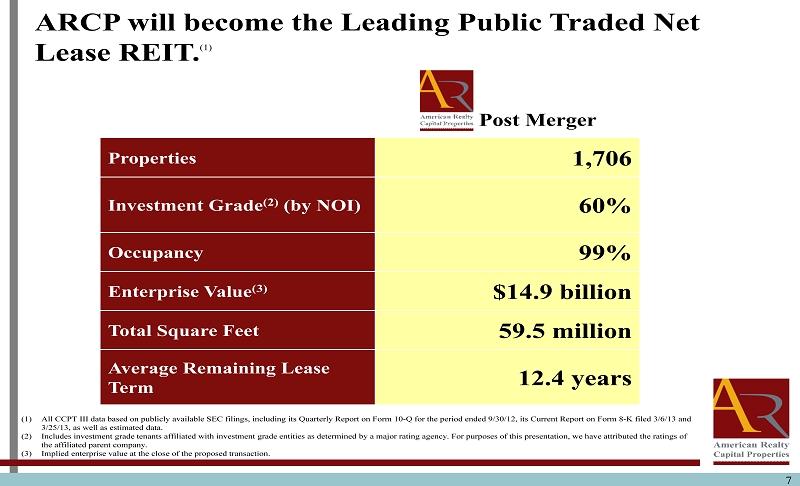

Properties 1,706 Investment Grade (2) (by NOI) 60% Occupancy 99% Enterprise Value (3) $14.9 billion Total Square Feet 59.5 million Average Remaining Lease Term 12.4 years ARCP will become the Leading Public Traded Net Lease REIT. (1) Post Merger (1) All CCPT III data based on publicly available SEC filings, including its Quarterly Report on Form 10 - Q for the period ended 9/30 /12, its Current Report on Form 8 - K filed 3/6/13 and 3/25/13, as well as estimated data. (2) Includes investment grade tenants affiliated with investment grade entities as determined by a major rating agency. For purpo ses of this presentation, we have attributed the ratings of the affiliated parent company . (3) Implied enterprise value at the close of the proposed transaction. 7

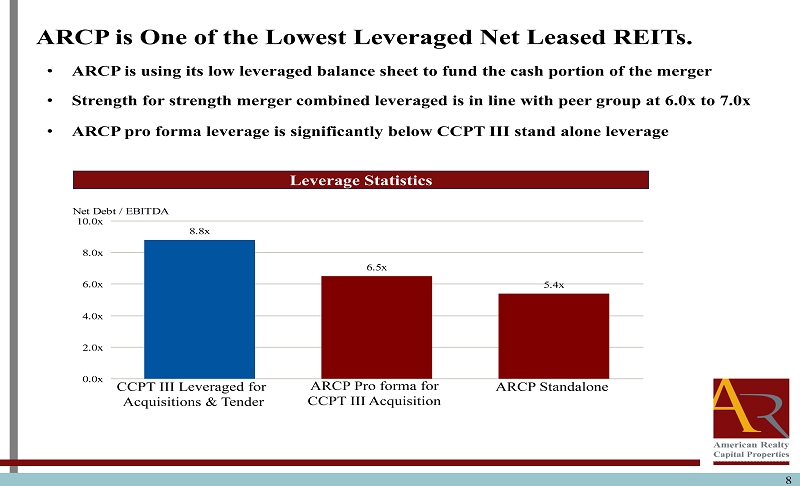

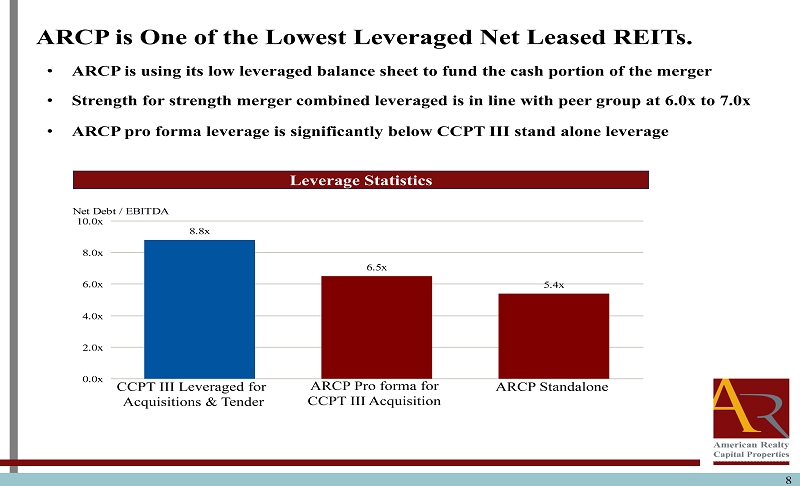

ARCP is One of the Lowest Leveraged Net Leased REITs. 8 • ARCP is using its low leveraged balance sheet to fund the cash portion of the merger Leverage Statistics 8.8x 6.5x 5.4x 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x Net Debt / EBITDA ARCP Standalone ARCP Pro forma for CCPT III Acquisition CCPT III Leveraged for Acquisitions & Tender • Strength for strength merger combined leveraged is in line with peer group at 6.0x to 7.0x • ARCP pro forma leverage is significantly below CCPT III stand alone leverage

Cost Impact to CCPT III Stockholders Internalizing Cole. 9 Note: All CCPT III data based on publicly available SEC filings, including its Quarterly Report on Form 10 - Q for the period ended 9/30 /12, its Current Report on Form 8 - K filed 3/6/13 and 3/25/2013, as well as estimated data. • ARCP’s Proposal agrees to pay the Internalization fees approved by CCPT III to be paid to Cole’s management. • However, paying Cole’s management an Internalization Fee of $165 million in cash and stock, in violation of industry best practices, comes right out of the pocket of CCPT III’s stockholders. • Were CCPT III’s Board of Directors to reconsider its commitment to proceeding with the Internalization, CCPT III’s stockholders would benefit from our increased offer price by an amount equal to 34 cents per share. Description Amount Calculation Internalization Stock Payment $145,565,548 $13.59 offer price x 10,711,225 CCPT IIII shares to be issued to Cole Holdings. Internalization Cash Payment $20,000,000 Total Internalization Fees $165,565,548 Contingent Listing Consideration N/A 2,141,245 CCPT III shares to be issued to Cole Holdings upon listing, will be cancelled. Earn Out Based on Performance TBD Earn out is payable on a 2 - year trailing average multiple of EBITDA in excess of $25 million. Cole Holdings management expects approximately $29 million of 2013E pro - forma EBITDA contribution from Cole Holdings alone. Subordinated Incentive Fee $226,723,857 ($13.59 offer price - $10.45 hurdle price) x 481,367,00 0 CCPT III shares outstanding x 15% profit participation to Cole Holdings, where $10.45 is the hurdle price and 15% is the promote interest Less : Subordinated Incentive Fee Discount ($56,680,964) 25% reduction in subordinated incentive fee Total Internalization and Other Fees Paid to Cole Holdings $335,608,441

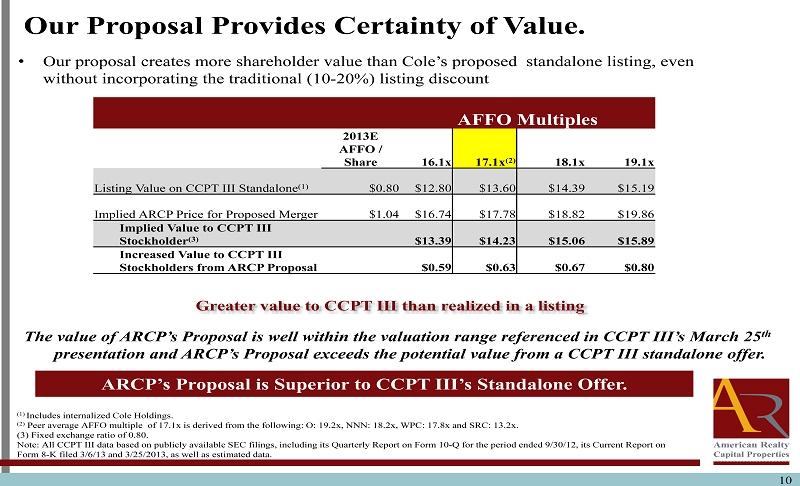

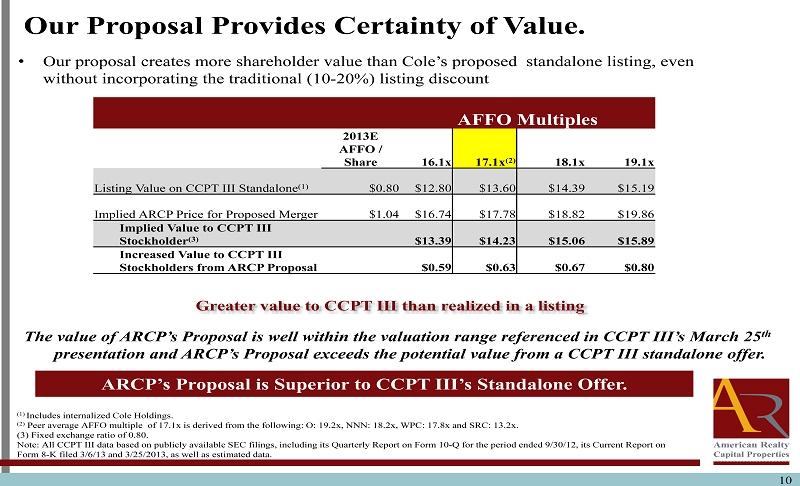

AFFO Multiples 2013E AFFO / Share 16.1x 17.1x (2) 18.1x 19.1x Listing Value on CCPT III Standalone (1) $0.80 $12.80 $13.60 $14.39 $15.19 Implied ARCP Price for Proposed Merger $1.04 $16.74 $17.78 $18.82 $19.86 Implied Value to CCPT III Stockholder (3) $13.39 $14.23 $15.06 $15.89 Increased Value to CCPT III Stockholders from ARCP Proposal $0.59 $0.63 $0.67 $0.80 Our Proposal Provides Certainty of Value. 10 • Our proposal creates more shareholder value than Cole’s proposed standalone listing, even without incorporating the traditional (10 - 20%) listing discount (1) Includes internalized Cole Holdings. (2) Peer average AFFO multiple of 17.1x is derived from the following: O: 19.2x, NNN: 18.2x, WPC: 17.8x and SRC: 13.2x. (3) Fixed exchange ratio of 0.80. Note: All CCPT III data based on publicly available SEC filings, including its Quarterly Report on Form 10 - Q for the period ended 9/30 /12, its Current Report on Form 8 - K filed 3/6/13 and 3/25/2013, as well as estimated data. Greater value to CCPT III than realized in a listing The value of ARCP’s Proposal is well within the valuation range referenced in CCPT III’s March 25 th presentation and ARCP’s Proposal exceeds the potential value from a CCPT III standalone offer. ARCP’s Proposal is Superior to CCPT III’s Standalone Offer.

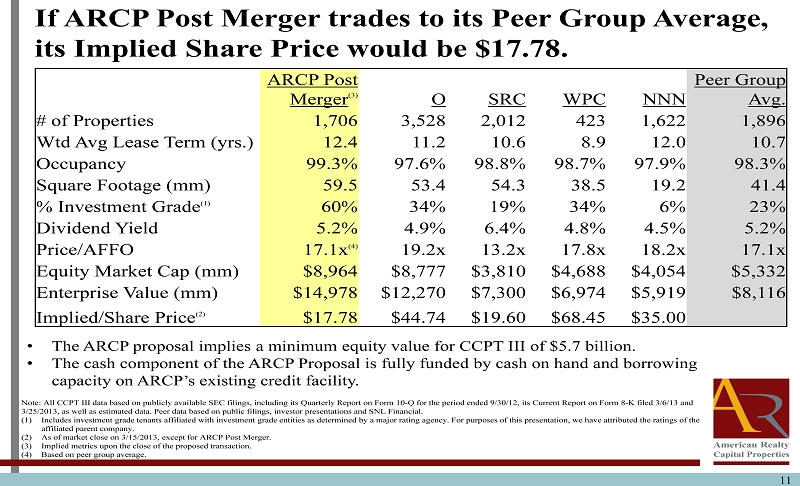

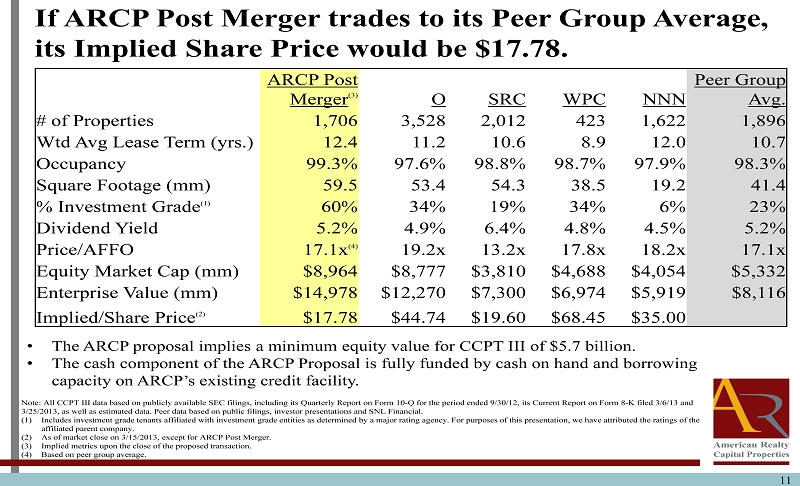

ARCP Post Merger (3) O SRC WPC NNN Peer Group Avg. # of Properties 1,706 3,528 2,012 423 1,622 1,896 Wtd Avg Lease Term (yrs.) 12.4 11.2 10.6 8.9 12.0 10.7 Occupancy 99.3% 97.6% 98.8% 98.7% 97.9% 98.3% Square Footage (mm) 59.5 53.4 54.3 38.5 19.2 41.4 % Investment Grade (1) 60% 34% 19% 34% 6% 23% Dividend Yield 5.2% 4.9% 6.4% 4.8% 4.5% 5.2% Price/AFFO 17.1x (4) 19.2x 13.2x 17.8x 18.2x 17.1x Equity Market Cap (mm) $8,964 $ 8,777 $3,810 $4,688 $4,054 $5,332 Enterprise Value (mm) $ 14,978 $ 12,270 $7,300 $6,974 $ 5,919 $8,116 Implied/Share Price (2) $17.78 $ 44.74 $ 19.60 $ 68.45 $ 35.00 If ARCP Post Merger trades to its Peer Group Average, its Implied Share Price would be $17.78 . 11 • The ARCP proposal implies a minimum equity value for CCPT III of $5.7 billion. • The cash component of the ARCP Proposal is fully funded by cash on hand and borrowing capacity on ARCP’s existing credit facility. Note: All CCPT III data based on publicly available SEC filings, including its Quarterly Report on Form 10 - Q for the period ended 9/30 /12, its Current Report on Form 8 - K filed 3/6/13 and 3/25/2013, as well as estimated data. Peer data based on public filings, investor presentations and SNL Financial. (1) Includes investment grade tenants affiliated with investment grade entities as determined by a major rating agency. For purpo ses of this presentation, we have attributed the ratings of the affiliated parent company. (2) As of market close on 3/15/2013, except for ARCP Post Merger. (3) Implied metrics upon the close of the proposed transaction. (4) Based on peer group average.

12 Appendix

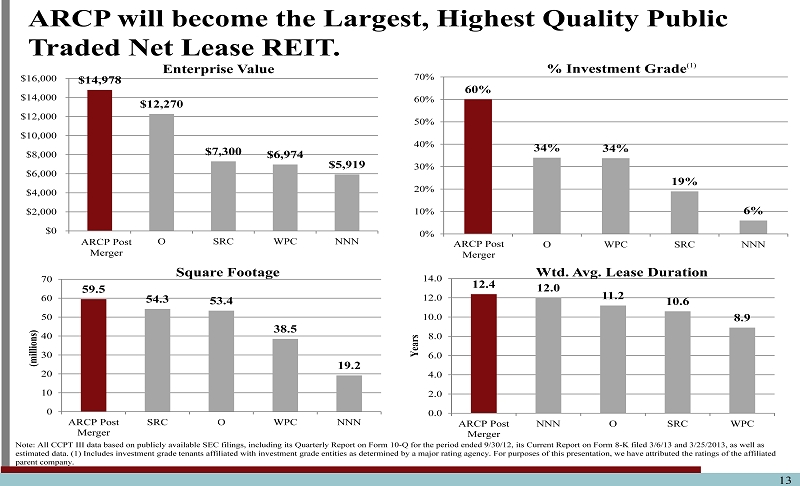

$ 14,978 $12,270 $7,300 $6,974 $5,919 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 New Co O SRC WPC NNN Enterprise Value ARCP will become the Largest, Highest Quality Public Traded Net Lease REIT. 13 60% 34% 34% 19% 6% 0% 10% 20% 30% 40% 50% 60% 70% New Co O WPC SRC NNN % Investment Grade (1) Note: All CCPT III data based on publicly available SEC filings, including its Quarterly Report on Form 10 - Q for the period ended 9/30 /12, its Current Report on Form 8 - K filed 3/6/13 and 3/25/2013, as well as estimated data . (1) Includes investment grade tenants affiliated with investment grade entities as determined by a major rating agency. For pu rposes of this presentation, we have attributed the ratings of the affiliated parent company. ARCP Post Merger ARCP Post Merger 59.5 54.3 53.4 38.5 19.2 0 10 20 30 40 50 60 70 ARCP Post Merger SRC O WPC NNN (millions) Square Footage 12.4 12.0 11.2 10.6 8.9 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 ARCP Post Merger NNN O SRC WPC Years Wtd. Avg. Lease Duration

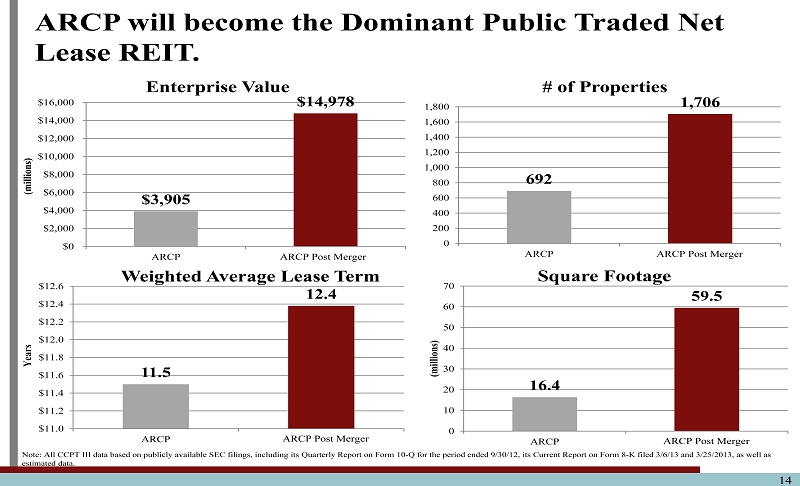

ARCP will become the Dominant Public Traded Net Lease REIT. 692 1,706 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 ARCP New Co # of Properties $ 3,905 $ 14,978 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 ARCP New Co (millions) Enterprise Value 14 11.5 12.4 $11.0 $11.2 $11.4 $11.6 $11.8 $12.0 $12.2 $12.4 $12.6 ARCP New Co Years Weighted Average Lease Term 16.4 59.5 0 10 20 30 40 50 60 70 ARCP New Co (millions) Square Footage Note: All CCPT III data based on publicly available SEC filings, including its Quarterly Report on Form 10 - Q for the period ended 9/30 /12, its Current Report on Form 8 - K filed 3/6/13 and 3/25/2013, as well as estimated data. ARCP Post Merger ARCP Post Merger ARCP Post Merger ARCP Post Merger

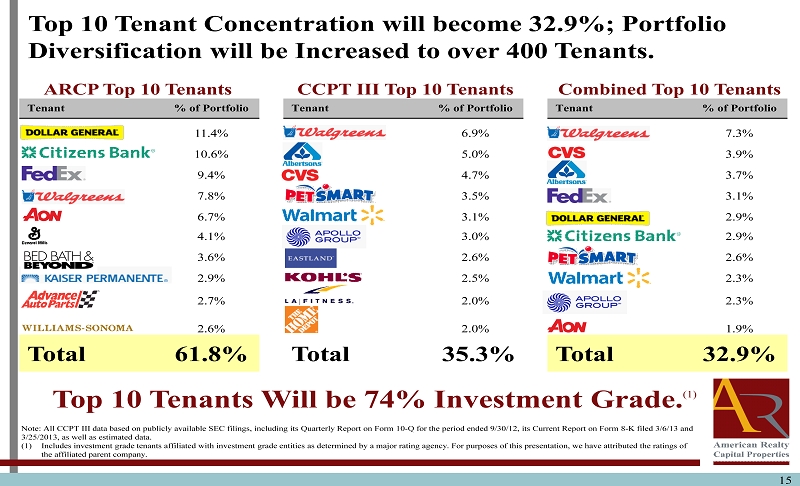

Top 10 Tenant Concentration will become 32.9%; Portfolio Diversification will be Increased to over 400 Tenants. Top 10 Tenants Will be 74 % Investment Grade. (1) Tenant % of Portfolio Tenant % of Portfolio Tenant % of Portfolio 11.4% 6.9% 7.3% 10.6% 5.0% 3.9% 9.4% 4.7% 3.7% 7.8% 3.5% 3.1% 6.7% 3.1% 2.9% 4.1% 3.0% 2.9% 3.6% 2.6% 2.6% 2.9% 2.5% 2.3% 2.7% 2.0% 2.3% 2.6% 2.0% 1.9% Total 61.8% Total 35.3% Total 32.9% ARCP Top 10 Tenants CCPT III Top 10 Tenants Combined Top 10 Tenants 15 Note: All CCPT III data based on publicly available SEC filings, including its Quarterly Report on Form 10 - Q for the period ended 9/30 /12, its Current Report on Form 8 - K filed 3/6/13 and 3/25/2013, as well as estimated data. (1) Includes investment grade tenants affiliated with investment grade entities as determined by a major rating agency. For purposes of th is presentation, we have attributed the ratings of the affiliated parent company.

16 Funds from Operations and Adjusted Funds from Operations ARCP considers FFO and AFFO, which is FFO as adjusted to exclude acquisition - related fees and expenses, amortization of above - market lease assets and liabilities, amortization of deferred financing costs, straight - line rent, non - cash mark - to - market adjustments, amortization of restricted stock, non - cash compensation and non - recurring gains and losses useful indicators of the performance of a REIT. Because FFO calculations exclude such factors as depreciation and amortization of real estate assets and gains or losses from sales of operating real estate assets (which can vary among owners of identical assets in sim ila r conditions based on historical cost accounting and useful - life estimates), they facilitate comparisons of operating performance between periods and between other REITs in ARCP's peer groups. Accounting for real estate assets in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values have histo ric ally risen or fallen with market conditions, many industry investors and analysts have considered the presentation of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. Additionally, ARCP believes that AFFO, by excluding acquisition - related fees and expenses, amortization of above - market lease assets and liabilities, amortization of deferred financing costs, straight - line rent, non - cash mark - to - market adjustments, amortization of restricted stock, non - cash compensation and non - recurring gains and losses, provides information consistent with management’s analyses of the operating performance of the properties. By providing AFFO, ARCP believes it is presenting useful information that assists investors and analysts to better assess the sustainability of its operating perfor man ce. Further, ARCP believes AFFO is useful in comparing the sustainability of its operating performance with the sustainability of the operating performance of other real estate companies, including exchange - traded and non - traded REITs. As a result, ARCP believes that the use of FFO and AFFO, together with the required GAAP presentations, provide a more complete understanding of its performance relative to its peers and a more informed and appropriate basis on which to make decisions involving operating, financing, and investing activities. FFO and AFFO are not in accordance with, or a substitute for, measures prepared in accordance with GAAP, and may be different from non - GAAP measures used by other companies. In addition, FFO and AFFO are not based on any comprehensive set of accounting rules or principles. Non - GAAP measures, such as FFO and AFFO, have limitations in that they do not reflect all of the amounts associated with ARCP's results of operations that would be reflected in measures determined in accordance with GAAP. These measures should only be used to evaluate ARCP's performance in conjunction with corresponding GAAP measures.