UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 27, 2018

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-38070

Floor & Decor Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

27-3730271 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

2233 Lake Park Drive Smyrna, Georgia |

|

30080 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (404) 471-1634

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

|

|

|

|

Class A Common Stock $0.001 par value per share |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes ☒ |

|

No ☐ |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Yes ☐ |

|

No ☒ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes ☒ |

|

No ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

|

Yes ☒ |

|

No ☐ |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§299.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☒ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the Registrant’s Common Stock held by non-affiliates as of June 28, 2018 was $2.3 billion. There were 97,727,273 shares of Common Stock outstanding as of as of February 20, 2019.

Documents Incorporated by Reference:

Portions of the Registrant’s proxy statement for the Annual Meeting of Shareholders to be filed pursuant to Regulation 14A of the Exchange Act on or before April 26, 2019, are incorporated by reference into Part III of this Form 10-K.

|

PART I |

||

|

3 |

||

|

Item 1 |

5 |

|

|

Item 1A |

19 |

|

|

Item 1B |

39 |

|

|

Item 2 |

40 |

|

|

Item 3 |

41 |

|

|

Item 4 |

41 |

|

|

PART II |

||

|

Item 5 |

42 |

|

|

Item 6 |

44 |

|

|

Item 7 |

Management’s Discussion And Analysis Of Financial Condition And Results Of Operations |

47 |

|

Item 7A |

63 |

|

|

Item 8 |

64 |

|

|

Item 9 |

Changes In And Disagreements With Accountants On Accounting And Financial Disclosure |

95 |

|

Item 9A |

95 |

|

|

Item 9B |

96 |

|

|

PART III |

||

|

Item 10 |

97 |

|

|

Item 11 |

97 |

|

|

Item 12 |

Security Ownership Of Certain Beneficial Owners And Management And Related Stockholder Matters |

97 |

|

Item 13 |

Certain Relationships And Related Transactions, And Director Independence |

97 |

|

Item 14 |

97 |

|

|

PART IV |

||

|

Item 15 |

98 |

|

|

Item 16 |

101 |

|

|

102 |

||

2

PART I

The discussion in this Annual Report on Form 10-K (this “Annual Report”), including under Item 1A, “Risk Factors” of Part I and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of Part II, contains forward-looking statements. All statements other than statements of historical fact contained in this Annual Report, including statements regarding our future operating results and financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements are based on management’s current expectations and assumptions regarding the Company’s business, the economy and other future conditions, including the impact of natural disasters on sales. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “seeks,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “budget,” “potential” or “continue” or the negative of these terms or other similar expressions.

The forward-looking statements contained in this Annual Report are only predictions. Although we believe that the expectations reflected in the forward-looking statements in this Annual Report are reasonable, we cannot guarantee future events, results, performance or achievements. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements in this Annual Report, including, without limitation, those factors described in Item 1A, “Risk Factors” of Part I and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of Part II. Some of the key factors that could cause actual results to differ from our expectations include the following:

|

· |

an overall decline in the health of the economy, the hard surface flooring industry, consumer spending and the housing market; |

|

· |

any disruption in our distribution capabilities resulting from our inability to operate our distribution centers going forward; |

|

· |

competition from other stores and internet-based competition; |

|

· |

our failure to execute our business strategy effectively and deliver value to our customers; |

|

· |

our inability to manage our growth; |

|

· |

our inability to manage costs and risks relating to new store openings; |

|

· |

our dependence on foreign imports for the products we sell, which may include the impact of tariffs; |

|

· |

our inability to find, train and retain key personnel; |

|

· |

violations of laws and regulations applicable to us or our suppliers; |

|

· |

our failure to adequately protect against security breaches involving our information technology systems and customer information; |

|

· |

our failure to successfully anticipate consumer preferences and demand; |

|

· |

our inability to find available locations for our stores or our store support center on terms acceptable to us; |

|

· |

our inability to obtain merchandise on a timely basis at prices acceptable to us; |

|

· |

suppliers may sell similar or identical products to our competitors; |

|

· |

our inability to maintain sufficient levels of cash flow to meet growth expectations; |

|

· |

our inability to manage our inventory obsolescence, shrinkage and damage; |

|

· |

fluctuations in material and energy costs; |

|

· |

our vulnerability to natural disasters and other unexpected events; and |

3

|

· |

restrictions imposed by our indebtedness on our current and future operations. |

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The forward-looking statements contained in this Annual Report speak only as of the date hereof. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. If a change to the events and circumstances reflected in our forward-looking statements occurs, our business, financial condition and operating results may vary materially from those expressed in our forward-looking statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events or otherwise.

4

Except where the context suggests otherwise, the terms “Floor & Decor Holdings, Inc.,” “Floor & Decor,” the “Company,” “we,” “us,” and “our” refer to Floor & Decor Holdings, Inc., a Delaware corporation, together with its consolidated subsidiaries.

Our fiscal year is the 52 or 53 week period ending on the Thursday preceding December 31. The following discussion contains references to fiscal 2014, fiscal 2015, fiscal 2016, fiscal 2017, fiscal 2018, fiscal 2019, and fiscal 2020, which represent our fiscal years ended or ending, as applicable, December 25, 2014, December 29, 2016, December 28, 2017, December 27, 2018, and December 26, 2019, all of which are 52 week periods, and our fiscal years ended December 31, 2015, and December 31, 2020, which are 53 week periods.

Our Company

Founded in 2000, Floor & Decor is a high‑growth, differentiated, multi‑channel specialty retailer of hard surface flooring and related accessories with 100 warehouse‑format stores across 28 states. We believe that we offer the industry’s broadest in‑stock assortment of tile, wood, laminate, vinyl, and natural stone flooring along with decorative and installation accessories at everyday low prices positioning us as the one‑stop destination for our customers’ entire hard surface flooring needs. We appeal to a variety of customers, including professional installers and commercial businesses (“Pro”), Do It Yourself customers (“DIY”) and customers who buy the products for professional installation (“Buy it Yourself” or “BIY”). Our Pro customers are loyal, shop often and help promote our brand. The combination of our category and product breadth, low prices, in‑stock inventory in project‑ready quantities, proprietary credit offerings, free storage options and dedicated customer service positions us to gain share in the attractive Pro customer segment. We believe our DIY customers spend significant time planning their projects while conducting extensive research in advance. We provide our customers with the education and inspiration they need before making a purchase through our differentiated online and in‑store experience.

Our warehouse‑format stores, which average approximately 75,000 square feet, are typically larger than any of our specialty retail flooring competitors’ stores. Other large format home improvement retailers only allocate a small percentage of their floor space to hard surface flooring and accessories. When our customers walk into a Floor & Decor store for the first time, we believe they are amazed by our visual presentation, our store size, our everyday low prices and the breadth and depth of our merchandise. We believe that our inspiring design centers, creative and informative visual merchandising, and accessible price points greatly enhance our customers’ experience. Our stores are easy to navigate and designed to interactively showcase the wide array of designs and product styles a customer can create with our flooring and decorative accessories. We engage our customers both through our trained store associates and designers who can assist in narrowing choices and making the process of home renovation easier, as well as our staff dedicated to serving Pro customers. By carrying a deep level of in-stock hard surface flooring inventory and wide range of tools and accessories, we seek to offer our customers immediate availability on everything they need to complete their entire flooring or remodeling project. In addition to our stores, our website FloorandDecor.com showcases our products, offers informational training and design ideas and has our products available for sale, which a customer can pick up in‑store or have delivered. Our ability to purchase directly from manufacturers through our direct sourcing model enables us to be fast to market with a balanced assortment of bestseller and unique, hard to find items that are the latest trend‑right products. We believe these factors create a differentiated value proposition for Floor & Decor and drive customer loyalty with our Pro, DIY and BIY hard surface flooring customers in our markets, as evidenced by our track record of consistent double digit comparable store sales growth, which has averaged 14.9% over the last five years. Based on these characteristics, we believe Floor & Decor is redefining and expanding the addressable market size of the hard surface flooring category and that we have an opportunity to significantly expand our store base to approximately 400 stores nationwide within the next 10-15 years, as described in more detail below.

Our Company was founded in 2000 by our Vice Chairman Vincent West, who opened the first Floor & Decor store in Atlanta, Georgia, with the vision of being the low‑price leader for hard surface flooring. As we have grown, we have implemented a customer‑focused and decentralized approach to managing our business. We provide our store leadership and regional operating teams with regular training and sophisticated information technology systems. We also train and incentivize our store associates to deliver a superior experience to our customers. Taken together, these elements create a customer‑centric culture that helps us achieve our operational and financial goals.

Over the last several years, we have invested significant resources across our business and infrastructure to support innovation and growth. We believe that these investments will continue to strengthen our customer value proposition and further differentiate Floor & Decor from our competition, positioning us for continued market share gains. We have made significant

5

investments in product innovation across all categories, improving our assortment and seeking to provide more value to our Pro, DIY and BIY customers. We have also invested in technology and personnel to support our stores. We believe that our investments in our business will continue to improve our customer value proposition, differentiating us and strengthening our competitive advantage.

We believe our strong financial results are a reflection of our consistent and disciplined culture of innovation and reinvestment, creating a differentiated business model in the hard surface flooring category, as evidenced by the following:

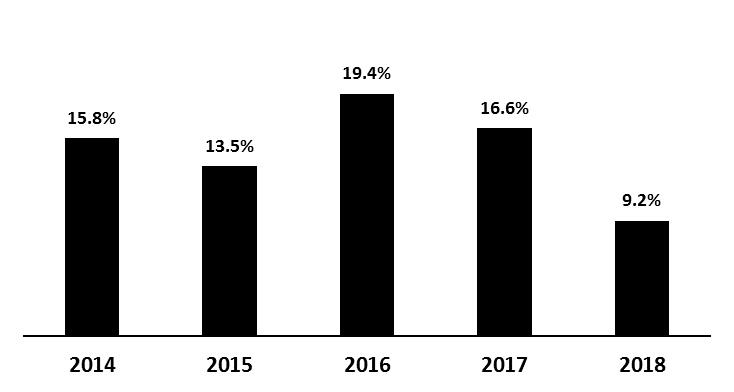

•ten years of comparable store sales growth averaging 14.8% per year (and averaging 14.9% per year for fiscal 2014 to fiscal 2018), with a 9.2% increase in fiscal 2018 compared to 16.6% for fiscal 2017

•store base expansion from 47 warehouse‑format stores at the end of fiscal 2014 to 100 warehouse-format stores at the end of fiscal 2018, representing a compound annual growth rate (“CAGR”) of 20.8%; we added 17 warehouse‑format stores during fiscal 2018, which was a 20.5% growth in units compared to fiscal 2017;

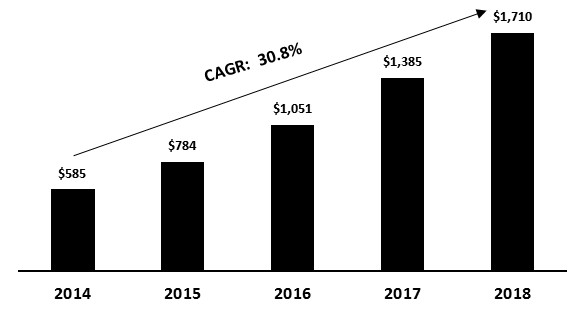

•total net sales growth from $584.6 million to $1.71 billion from fiscal 2014 to fiscal 2018, representing a CAGR of 30.8%;

•net income growth from $15.1 million to $116.2 million from fiscal 2014 to fiscal 2018, representing a CAGR of 66.6%;

•Adjusted EBITDA growth from $51.2 million to $191.9 million from fiscal 2014 to fiscal 2018, representing a CAGR of 39.1%, which includes significant investments in our sourcing and distribution network, integrated IT systems and corporate overhead to support our future growth. Adjusted EBITDA was $191.9 million for fiscal 2018, an increase of 20.9% over fiscal 2017. Adjusted EBITDA is a non‑GAAP (as defined below) financial measure. For a reconciliation of net income to Adjusted EBITDA, see Item 6 “Selected Financial Data.”

|

Net Sales (in millions) |

Comparable Store Sales Growth |

Our Competitive Strengths

We believe our strengths, described below, set us apart from our competitors and are the key drivers of our success.

Unparalleled Customer Value Proposition. Our customer value proposition is a critical driver of our business. The key components include:

|

· |

Differentiated Assortment Across a Wide Variety of Hard Surface Flooring Categories. Our stores are generally larger than those of our specialty retail flooring competitors, and we allocate substantially more square footage to hard surface flooring and accessories than other large format home improvement retailers. We believe we have the most comprehensive in‑stock, trend‑right product assortment in the industry within our categories with on average approximately 3,800 stock keeping units (“SKUs”) in each store which, based on our market experience, is a far greater in‑stock offering than any other flooring retailer. Additionally, we customize our product assortment at the store level for |

6

the regional preferences of each market. We have an ongoing product line review process across all categories that allows us to identify and interpret emerging trends in hard surface flooring. We work with our suppliers to quickly introduce new products and styles in our stores. We appeal to a wide range of customers through our “good/better/best” merchandise selection, as well as through our broad range of product styles from classic to modern, as well as new trend‑right products. We consistently innovate with proprietary brands and products that appeal to certain customers with over 50 proprietary brands, including AquaGuard®, DuraLux® , and NuCore®. |

|

· |

Low Prices. We provide everyday low prices in the retail hard surface flooring market. Our merchandising and individual store teams competitively shop each market so that we can offer our flooring products and related accessories at low prices. We also work with our vendors to identify and create new, affordable products in categories traditionally considered high‑end to further democratize hard surface flooring by providing a greater number of options to a larger customer base. We believe we are unique in our industry in employing an “everyday low price” strategy, where we strive to offer our products at consistently everyday low prices throughout the year instead of engaging in frequent promotional activities. Our ability to provide these low prices is supported by our direct‑sourcing model, which strives to eliminate third‑party intermediaries and shortens time to market. We believe this strategy creates trust with our Pro, DIY and BIY customers because they consistently receive low prices at Floor & Decor without having to wait for a sale or negotiate to obtain the lowest price. |

|

· |

One‑Stop Project Destination with Immediate Availability. We carry an extensive range of products, including flooring and decorative accessories, as well as installation accessories such as thin set, underlayment, grout and tools, to fulfill a customer’s entire flooring project. Our large in‑stock assortment, including decorative and installation accessories, differentiates us from our competitors. Our stores stock job‑size quantities to immediately fulfill a customer’s entire flooring project. In the instance where a product is not available in the store, our three regional distribution centers and neighboring stores can quickly ship the product to meet a customer’s needs. On average, each warehouse‑format store carries approximately 3,800 SKUs, which equates to 1.3 million square feet of flooring products or $2.5 million of inventory at cost. Customers also have access to all of our inventory for in‑store pick up or delivery through FloorandDecor.com. |

Unique and Inspiring Shopping Environment. Our stores average approximately 75,000 square feet and are typically designed with warehouse features including high ceilings, clear signage, bright lighting and industrial racking and are staffed with knowledgeable store associates. We offer an easy‑to‑navigate store layout with clear lines of sight and departments organized by our major product categories of tile, wood, laminate, vinyl, natural stone, decorative accessories and installation accessories. We believe our unique signage, which clearly displays individual product features and benefits, improves the ease of shopping and facilitates customer decision making. We use merchandise displays and point of sale marketing throughout our stores to highlight product features, benefits and design elements. These features educate and enable customers to visualize how the product would look in their homes or businesses. Furthermore, we encourage customers to interact with our merchandise, to experiment with potential designs and to see the actual product they will purchase, an experience that is not possible in flooring stores that do not carry in‑stock inventory in project‑ready quantities. The majority of our stores have design centers that showcase project ideas to further inspire our customers, and we employ experienced designers in all of our stores to provide free design consulting. Additionally, we provide a robust online experience for potential customers on FloorandDecor.com. For our DIY customers, we also offer weekly “how‑to” installation classes on Saturdays. We believe inspiring and educating customers within our stores and on our website provides us with a significant competitive advantage in serving our customers.

Extensive Service Offerings to Enhance the Pro Customer Experience. Our focus on meeting the unique needs of the Pro customer, and by extension the BIY customer, drives our estimated sales mix of approximately 60% Pro and BIY customers, which we believe represents a higher percentage than our competitors. We provide an efficient one‑stop shopping experience for our Pro customers, offering low prices on a broad selection of high‑quality flooring products, deep inventory levels to support immediate availability of our products, modest financial credit, free storage for purchased inventory, the convenience of early store hours and, in most stores, separate entrances for merchandise pick‑up. Additionally, each store has a dedicated Pro sales force with technology to service our Pro customer more efficiently, and we have rolled out Pro Zones, which are areas offering a variety of services to Pro customers, in a majority of our stores. We believe by serving the needs of Pro customers, we drive repeat and high‑ticket purchases, customer referrals and brand awareness from this attractive and loyal customer segment.

7

Decentralized Culture with an Experienced Store‑Level Team and Emphasis on Training. We have a decentralized culture that empowers managers at the store and regional levels to make key decisions to maximize the customer experience. Our store managers, who carry the title Chief Executive Merchant, have significant flexibility to customize product mix, pricing, marketing, merchandising, visual displays and other elements in consultation with their regional leaders. We tailor the merchandising assortment for each of our stores for local market preferences, which we believe differentiates us from our national competitors that tend to have standard assortments across markets. Throughout the year, we train all of our employees on a variety of topics, including product knowledge, sales strategies, leadership and store operations. Our store managers and store department managers are an integral part of our company, and many have over 15 years of relevant industry experience in retail. We have made important investments in the training and development of our people, including the creation of a full time training department. Approximately 73% of our new store management positions are filled through internal promotions, including 92% of our Chief Executive Merchants. We also have incentive compensation programs for all employees, regardless of position or title. We train prospective store managers at our Floor & Decor University, which is part of an extensive training program. Once a year, we hold a four day training session with our senior management, regional directors and store managers, where we focus on the upcoming year’s strategic priorities to keep our entire business aligned. We believe our decentralized culture and coordinated training foster an organization aligned around providing a superior customer experience, ultimately contributing to higher net sales and profitability.

Sophisticated, Global Supply Chain. Our merchandising team has developed direct sourcing relationships with manufacturers and quarries in over 21 countries. Through these relationships, we believe we understand the best places to procure our various product categories. We currently source our products from more than 240 vendors worldwide and have developed long‑term relationships with many of them. We often collaborate with our vendors to design and manufacture products for us to address emerging customer preferences that we observe in our stores and markets. We procure the majority of our products directly from the manufacturers, which eliminates additional costs from exporters, importers, wholesalers and distributors. We believe direct sourcing is a key competitive advantage, as many of our specialty retail flooring competitors are too small to have the scale or the resources to work directly with suppliers. Over the past several years, we have established a Global Sourcing and Compliance Department to, among other things, enhance our policies and procedures with respect to addressing compliance with appropriate regulatory bodies, including compliance with the requirements of the Lacey Act of 1900 (as amended, the “Lacey Act”), the California Air Resources Board (“CARB”) and the Environmental Protection Agency (“EPA”). We also utilize third‑party consultants for audits, testing and surveillance to ensure product safety and compliance. Additionally, we have invested in technology and personnel to collaborate throughout the entire supply chain process to support our direct sourcing model, which has improved our ability to find, manage and source trend‑right merchandise quickly and at lower costs, allowing us to offer products at low prices while maintaining attractive gross margins.

Highly Experienced Management Team with a Proven Track Record. Led by our Chief Executive Officer, Tom Taylor, our management team brings substantial expertise from leading retailers and other companies across various core functions, including store operations, merchandising, marketing, real estate, e‑commerce, supply chain management, finance, legal and information technology. Tom Taylor, who joined us in 2012, spent 23 years at The Home Depot, where he most recently served as Executive Vice President of Merchandising and Marketing with responsibility for all stores in the United States and Mexico. Over the course of his career at The Home Depot, Tom Taylor helped expand the store base from fewer than 15 stores to over 2,000 stores. Our Executive Vice President and Chief Merchandising Officer, Lisa Laube, has over 30 years of merchandising and leadership experience with leading specialty retailers, including most recently as President of Party City. Our Executive Vice President and Chief Financial Officer, Trevor Lang, brings more than 20 years of accounting and finance experience, including 18 years of Chief Financial Officer and Vice President of Finance experience at public companies, including most recently as the Chief Financial Officer and Chief Administrative Officer of Zumiez Inc. Our entire management team drives our organization with a focus on strong merchandising, superior customer experience, expanding our store footprint, and fostering a strong, decentralized culture. We believe our management team is an integral component of our achieving strong financial results.

Our Growth Strategy

We expect to continue to drive our strong net sales and profit growth through the following strategies:

Open Stores in New and Existing Markets. We believe there is an opportunity to significantly expand our store base in the United States from 100 warehouse‑format stores currently to approximately 400 stores nationwide over the next 10-15 years based on our internal research with respect to housing density, demographic data, competitor concentration and other variables in both new and existing markets. We plan to target new store openings in both new and existing, adjacent and underserved markets. We have a disciplined approach to new store development, based on an analytical, research‑driven site selection method and a rigorous real estate

8

approval process. We believe our new store model delivers strong financial results and returns on investment, targeting net sales on average of $10 million to $13 million and positive four‑wall adjusted EBITDA in the first year, pre‑tax payback in approximately two years and cash‑on‑cash returns of greater than 50% in the third year. On average, our stores opened after 2011 have exceeded this model. Over the past several years, we have made significant investments in personnel, information technology, warehouse infrastructure and connected customer strategies to support our current growth and the expansion of our stores. We intend to grow our store base by approximately 20% annually for the next several years. The performance of our new stores opened over the last three years, the performance of our older stores over that same time frame, our disciplined real estate strategy and the track record of our management team in successfully opening retail stores support our belief in the significant store expansion opportunity.

Increase Comparable Store Sales. We expect to grow our comparable store sales by continuing to offer our customers a dynamic and expanding selection of compelling, value‑priced hard surface flooring and accessories while maintaining strong service standards for our customers. We regularly introduce new products into our assortment through our category product line review process, including collaboration with our vendors to bring to market innovative products such as water‑resistant laminates. Because almost half of our stores have been opened for less than three years, we believe they will continue to drive comparable store sales growth as they ramp to maturity. We believe that we can continue to enhance our customer experience by focusing on service, optimizing sales and marketing strategies, investing in store staff and infrastructure, remodeling existing stores and improving visual merchandising and the overall aesthetic appeal of our stores. We also believe that growing our proprietary credit offering, further integrating connected customer strategies and enhancing other key information technology, will contribute to increased comparable store sales. As we increase awareness of Floor & Decor’s brand, we believe there is a significant opportunity to gain additional market share, especially from independent flooring retailers and large format home improvement retailers. We are also adding adjacent categories that align with flooring projects like frameless glass in the bathroom and customized countertops for the kitchen. We believe the combination of these initiatives plus the expected growth of the hard surface flooring category described in more detail under “Our Industry” below will continue to drive strong comparable store sales growth.

Continue to Invest in the Pro Customer. We believe our differentiated focus on Pro customers has created a competitive advantage for us and will continue to drive our net sales growth. We will invest in gaining and retaining Pro customers due to their frequent and high‑ticket purchases, loyalty and propensity to refer other potential customers. We have made important investments in the Pro services regional team to better recruit and train the Pro services team in each store, new technology such as integrated CRM software to help us further penetrate and grow our Pro business, dedicated phone lines for our Pro customers to call and text, commercial credit and open account terms, jobsite delivery, a dedicated website for Pro customers, training on technical flooring installation solutions, and tools to facilitate large commercial jobs sourced throughout the store. We plan to further invest in initiatives to increase speed of service, improve financing solutions, leverage technology, elevate our Pro branding, dedicate additional store staffing to support Pro customers and enhance the in‑store experience for our Pro customers. We have implemented a “Pro Zone” in a majority of our stores that focuses on the specific needs of the Pro customer. After successful tests, we completed the role out of our Pro loyalty program to all stores in the second half of fiscal 2018. Additionally, we communicate our value proposition and various Pro‑focused offerings by hosting a number of Pro networking events. Building on our success in serving the Pro customer, in 2016 we entered the adjacent commercial sales channel, thereby increasing the size of the addressable market we serve. Our commercial effort, which we have branded F&D Commercial, initially targets corporate customers with large flooring needs across the hospitality, multi‑family and retail sectors. We believe Pro customers will continue to be an integral part of our sales growth, and the commercial channel will provide incremental revenue and profit opportunities in the future.

Expand Our “Connected Customer” Experience. Floor & Decor’s online experience allows our Pro, BIY and DIY customers to explore our product selection and design ideas before and after visiting our stores and offers the convenience of making online purchases for delivery or pick up in‑store. We believe our online platform reflects our brand attributes and provides a powerful tool to educate, inspire and engage our consumers, and we view our website and multi‑channel strategies as leading our brand. Our research indicates that 72% of our shoppers have visited our website. We continuously invest in our connected customer strategies to improve how our customers experience our brand. For example, we regularly update our website, which provides our customers with inspirational vignettes, videos, products and education. Additional initiatives include: (i) implementing our new CRM to obtain a single view of our customers, (ii) developing personalized content based on location, purchase and browsing history, (iii) developing more relevant content and improved search and purchasing tools to help customers add decorative and installation accessories, (iv) creating frequently asked questions to help customers choose the best product for their jobs and (v) implementing online scheduling tools to help customers access our designers. We believe this reinforces our unique customer value proposition and ultimately drives sales. Currently, e‑commerce sales represent approximately 8% of our total net sales. While the hard surface flooring category has a relatively low penetration of e‑commerce sales due to the nature of the product, we believe our connected customer presence represents an attractive growth opportunity to drive consumers to Floor & Decor.

9

Enhance Margins Through Increased Operating Leverage. Since 2011, we have invested significantly in our sourcing and distribution network, integrated IT systems and corporate overhead to support our growth. We expect to leverage these investments as we grow our net sales. Additionally, we believe operating margin improvement opportunities will include enhanced product sourcing processes and overall leveraging of our store‑level fixed costs, existing infrastructure, supply chain, corporate overhead and other fixed costs resulting from increased sales productivity. We anticipate that the planned expansion of our store base and growth in comparable store sales will also support increasing economies of scale.

Our Industry

Floor & Decor operates in the large, growing and highly fragmented $13 billion hard surface flooring market (in manufacturers’ dollars), which is part of the larger $22 billion U.S. floor coverings market (in manufacturers’ dollars) based on internal research as well as a 2018 research report by Catalina Research, Inc., a leading provider of market research for the floor coverings industry (the “Catalina Floor Coverings Report”). We estimate that, after retail markup, the addressable hard surface flooring market for Floor & Decor is $21 billion, of which we represent approximately 8%. The competitive landscape of the hard surface flooring market includes big‑box home improvement centers, national and regional specialty flooring retailers, and independent flooring retailers. We believe we benefit from growth in the overall hard surface flooring market, which grew on average 8% per year from 2012 to 2018 and is estimated to grow on average 3%‑6% per year from 2019 through 2023, assuming no negative economic cycle, housing downturn or recession. We believe that growth in the hard surface flooring market has been and will continue to be driven by home remodeling demand drivers such as the aging household inventory, millennials forming households, existing home sales, rising home equity values and the secular shift from carpet to hard surface flooring. In addition, we believe we have an opportunity to increase our market share as our competitors are unable to compete with our combination of price, service and in‑stock assortment.

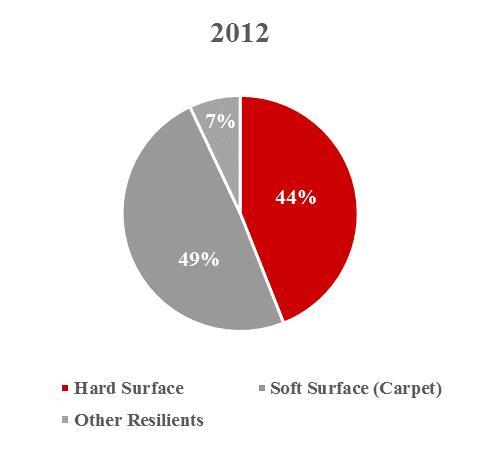

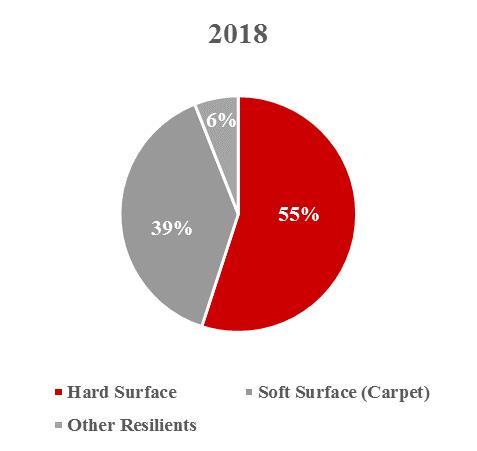

Based on our internal market research, key long‑term industry trends include increasing spend on home renovations, aging of the existing housing stock, rising level of home ownership, growing average size of homes and favorable demographic trends. Throughout this decade, hard surface flooring has consistently taken share from carpet as a percentage of the total floor coverings market, increasing from 44% of the market in 2012 to 55% in 2018. Historically, mix shift towards hard surface flooring has been driven by product innovation, changing consumer preferences, better hygiene qualities, increasing ease of installation and higher durability. Product innovation, which has been aided by the increasing use of technology such as inkjet tile printing, waterproof wood‑look flooring and water‑resistant laminates, and non‑traditional uses of hard surface flooring including walls, fireplaces and patios, has increased the size of the hard surface flooring market and has allowed us to better serve customer needs.

We believe we have an opportunity to continue to gain share in the hard surface flooring market with the largest selection of tile, wood, laminate, vinyl, natural stone, decorative accessories and installation accessories. Our strong focus on the customer

10

experience drives us to remain innovative and locally relevant while maintaining low prices and in‑stock merchandise in a one‑stop shopping destination.

Our Products

We offer an assortment of tile, wood, laminate, vinyl, and natural stone flooring, along with decorative and installation materials at everyday low prices. Our objective is to carry a broad and deep in-stock product offering in order to be the one‑stop destination for our customer’s entire project needs. We seek to showcase products in our stores and online to provide multiple avenues for inspiration throughout a customer’s decision‑making process.

Our strategy is to fulfill the product needs of our Pro, DIY and BIY customers with our extensive assortment, in‑stock inventory and merchandise selection across a broad range of price points. We offer bestseller products in addition to the more unique, hard to find items that we believe our customers have come to expect from us. We source our products from around the world, constantly seeking new and exciting merchandise to offer our customers. Our goal is to be at the forefront of hard surface flooring trends in the market, while offering low prices given our ability to source directly from manufacturers and quarries.

We utilize a regional merchandising strategy in order to carry products in our stores that cater to the preferences of our local customer base. This strategy is executed by our experienced merchandising team, which consists of category merchants and regional merchants, who work with our individual stores to ensure they have the appropriate product mix for their location. Our category merchants are constantly seeking new products and following trends by attending trade shows and conferences, as well as by meeting with vendors around the world. We schedule regular meetings to review information gathered and make future product decisions. This constant connectivity between our stores, regional merchants, category merchants, and our vendors allows us to quickly bring new, innovative, and compelling products to market.

11

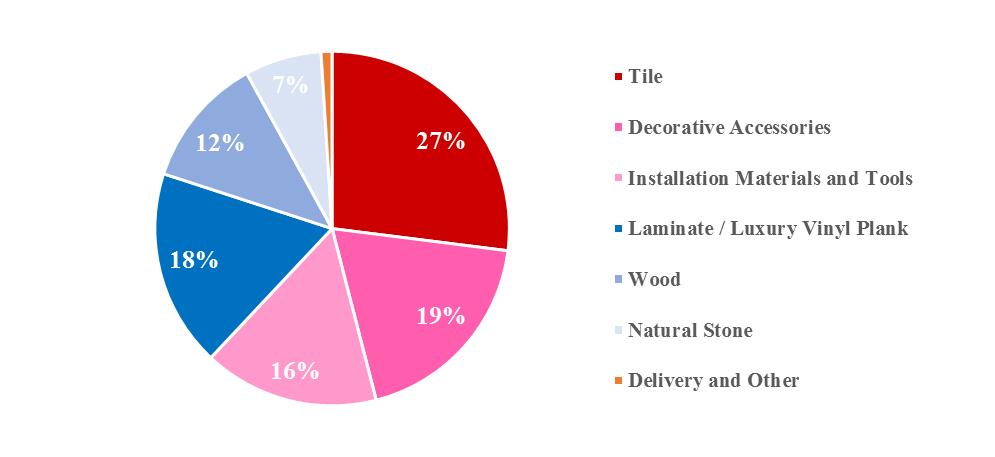

Our fiscal 2018 net sales by key product categories are set forth below:

|

Category |

|

Products Offered |

|

Select Product Highlights |

|

Tile |

|

Porcelain, White Body, Ceramic |

|

We offer a wide selection of Porcelain and Ceramic tiles from 4”x4” all the way up to 24”x72” and 48”x48”. We source many products directly from Italy, where many design trends in tile originate. We offer traditional stone looks as well as wood‑looking planks and contemporary products like cement‑look and vein cut styles. We work with many factories in the United States, China, Italy, Mexico, Brazil, Turkey and other countries to bring the most in‑demand styles at low prices. |

|

Wood |

|

Solid Prefinished Hardwood, Solid Unfinished Hardwood, Engineered Hardwood, Bamboo, Cork, Wood Wall |

|

We sell common species such as Oak, Walnut, Birch, Hickory and Maple but also exotics such as Bamboo, Brazilian Cherry, and Acacia, all in multiple colors. Our wood flooring comes in multiple widths from 21/4” up to 93/4” wide planks. Customers have the option of buying prefinished or unfinished flooring in many of our stores. |

|

Natural Stone |

|

Marble, Travertine, Limestone, Slate, Granite |

|

Natural stone is quarried around the world, and we typically buy directly from the source. For example, we buy natural stones from Italy, Spain, Turkey, Portugal, India, and China. We work with factories in these countries and others to cut stone tiles in many sizes, finishes and colors. |

12

|

Category |

|

Products Offered |

|

Select Product Highlights |

|

Laminate/Luxury Vinyl Plank |

|

Laminate Flooring, Luxury Vinyl, Engineered/Composite Vinyl |

|

Laminate, AquaGuard® water-resistant laminate, NuCore®, DuraLux® Rigid and Luxury Vinyl plank flooring is offered in styles that mimic our bestselling tile and wood species, colors and finishes. Our product offers a full range of installation methods, many are water‑resistant to waterproof, and all are great for customers who want the beauty of real hardwood and stone but the ease of maintenance and durability that laminate and luxury vinyl offer. |

|

Decorative Accessories |

|

Glass, Natural Stone, Tile Mosaics and Decorative Tiles, Decorative Trims, Prefabricated Countertops, Medallions, Wall Tile |

|

With over 800 choices in glass, stone mosaics and decoratives, we can customize nearly any look or style a customer desires. This trend‑forward and distinctive category is a favorite of our designers and offers customers an inexpensive way to quickly update a backsplash or shower. |

|

Installation Materials and Tools |

|

Grout, Underlayment, Adhesives, Mortar, Backer Board, Power and Hand Tools, Wood Moldings, Wood Glues, Blades |

|

This category offers everything a customer needs to complete his or her project, including backer board, mortar, grout, underlayment, adhesives, wood glues, molding and tools. We sell top brands, which we believe are highly valued by our customers. |

Stores

We operate 100 warehouse‑format stores across 28 states and one small 5,500 square foot design center. Most of our stores are situated in highly visible retail and industrial locations. Our warehouse‑format stores average approximately 75,000 square feet and carry on average approximately 3,800 flooring, decorative and installation accessory SKUs, which equates to approximately 1.3 million square feet of flooring products or $2.5 million of inventory at cost.

Each of our stores is led by a store manager who holds the title Chief Executive Merchant and is supported by an operations manager, department managers, a design team, and a Pro sales team. Our store managers focus on providing superior customer service and creating customized store offerings that are tailored to meet the specific needs of their stores. Beyond the store managers, each store is staffed with associates, the number of whom vary depending on sales volume and size of the store. We dedicate significant resources to training all of our new store managers through Floor & Decor University and in the field across all product areas, with store‑level associates receiving certification on specific product areas. Ongoing training and continuing education are provided for all employees throughout the year.

We believe there is an opportunity to significantly expand our store base in the United States from our 100 warehouse‑format stores currently to approximately 400 stores nationwide within the next 10-15 years based on our internal research with respect to housing density, demographic data, competitor concentration and other variables in both new and existing markets. For the next several years, we plan to grow our store base by approximately 20% per year, with approximately half being opened in existing geographies and approximately half being opened in new markets. We have developed a disciplined approach to new store development, based on an analytical, research‑driven method to site selection and a rigorous real estate review and approval process. By focusing on key demographic characteristics for new site selection, such as aging of homes, length of home ownership and median income, we expect to open new stores with attractive returns.

When opening new stores, inventory orders are placed several months prior to a new store opening. Significant investment is made in building out or constructing the site, hiring and training employees in advance, and advertising and marketing the new store through pre‑opening events to draw the flooring industry community together. Each new store is thoughtfully designed with store

13

interiors that include interchangeable displays on wheels, racking to access products and stand‑up visual displays to allow ease of shopping and an exterior highlighted by a large, bold Floor & Decor sign. The majority of our stores have design centers that showcase project ideas to further inspire our customers, and, in all of our stores, we employ experienced designers to provide design consulting to our customers free of charge. Additionally, we have rolled out “Pro Zones”, which are dedicated areas offering a variety of services to Pro customers, in a majority of our stores.

Our new store model targets a store size of 60,000‑80,000 square feet, total initial net cash investment of approximately $4 million to $5 million, targeting net sales on average of $10 million to $13 million and positive four‑wall Adjusted EBITDA in the first year, pre‑tax payback in two to three years and cash‑on‑cash returns of greater than 50% in the third year. On average, our stores opened after 2011 have exceeded this model. We believe the success of our stores across geographies and vintages supports the portability of Floor & Decor into a wide range of markets. The performance of our new stores is inherently uncertain and is subject to numerous factors that are outside of our control. As a result, we cannot assure you that our new stores will achieve our target results.

Connected Customer

Our website and our call center are important parts of our integrated connected customer strategy. We aim to elevate the customer experience through our website FloorandDecor.com. Growing our e‑commerce sales provides us with additional opportunity to enhance our connected customer experience for our customers. Home renovation and remodeling projects typically require significant investments of time and money from our DIY customers, and they consequently plan their projects carefully and conduct extensive research online. FloorandDecor.com is an important tool for engaging our DIY customers throughout this process, educating them on our product offerings and providing them with design ideas. Our Pro customers use the website to browse our broad product assortment, to continually educate themselves on new techniques and trends and to share our virtual catalogue and design ideas with their customers. In addition, sales associates at our call center are available to assist our customers with their projects and questions. We designed the website to be a reflection of our stores and to promote our wide selection of high quality products and low prices. To this end, we believe the website provides not only the same region‑specific product selection that customers can expect in our stores, but also the opportunity to extend our assortment by offering our entire portfolio of products.

In addition to highlighting our broad product selection, we believe FloorandDecor.com offers a convenient opportunity for customers to purchase products online and pick them up in our stores. Approximately 77% of our e‑commerce sales are picked up in‑store. As we continue to grow, we believe connected customer will become an increasingly important part of our strategy.

Marketing and Advertising

We use a multi‑platform approach to increasing Floor & Decor’s brand awareness, while historically maintaining a low average advertising to net sales ratio of approximately 3%. We use traditional advertising media, combined with social media and online marketing, to share the Floor & Decor story with a growing audience. We take the same customized approach with our marketing as we do with our product selection; each region has a varied media mix based on local trends and what we believe will most efficiently drive sales. To further enhance our targeting efforts, our store managers have significant input into their respective stores’ marketing spend.

A key objective of our messaging is to make people aware of our stores, products and services. Based on our internal research, we estimate the conversion rate from a customer visiting one of our stores to purchasing our products is 76%.

As part of our focus on local markets, our stores have events that promote Floor & Decor as a hub for the local home improvement community. We feature networking events for Pro customers, giving them a chance to meet our sales teams, interact with others in the home improvement industry and learn about our newest products. For DIY customers, we regularly offer how‑to classes on product installation. We believe these events serve to raise the profile of the Floor & Decor stores in our communities while showcasing our tremendous selection of products and services.

We want our customers to have a great experience at their local Floor & Decor store. Through our TV and radio commercials, print and outdoor ads, in‑store flyers, online messaging and community events, we show our customers that we are a trusted resource with a vast selection, all at a low price.

14

Sourcing

Floor & Decor has a well‑developed and geographically diverse supplier base. We source our industry leading merchandise assortment from over 240 suppliers in over 21 countries, and maintain good relationships with our vendors. No supplier accounts for more than 10% of our net sales, other than one supplier that accounts for approximately 13% of our net sales. We are focused on bypassing agents, brokers, distributors and other middlemen in our supply chain in order to reduce costs and lead time. Over the past several years, we have established a Global Sourcing and Compliance Department to, among other things, develop and implement policies and procedures in order to address compliance with appropriate regulatory bodies, including compliance with the requirements of the Lacey Act, CARB and the EPA. In addition, we utilize third‑party consultants for audits, testing and surveillance to ensure product safety and compliance. Additionally, we have invested in technology and personnel to collaborate throughout the entire supply chain process. We believe that our direct sourcing model and the resulting relationships we have developed with our suppliers are distinct competitive advantages. The cost savings we achieve by directly sourcing our merchandise enable us to offer our customers low prices. Additionally, our close relationships with suppliers allow us to collaborate with them directly to develop and quickly introduce innovative and quality products that meet our customers’ evolving tastes and preferences at low prices. We plan to continue increasing the percentage of merchandise that we directly source from suppliers.

Distribution and Order Fulfillment

Merchandise inventory is our most significant working capital asset and is considered “in-transit” or “available for sale”, based on whether we have physically received the products at an individual store location or in one of our three distribution centers. In-transit inventory generally varies due to contractual terms, country of origin, transit times, international holidays, weather patterns and other factors, but approximately 16% of our inventory is in-transit, while roughly 84% is available for sale in our stores or at one of our three distribution centers.

We have invested significant resources to develop and enhance our distribution network. We have three distribution centers strategically located across the United States in port cities near Savannah, Georgia; Houston, Texas; and Los Angeles, California. We closed our distribution center near Miami, Florida in the first quarter of fiscal 2018. Third‑party brokers arrange the shipping of our international and domestic purchases to our distribution centers and stores and bill us for shipping costs according to the terms of the purchase agreements with our suppliers. We are typically able to transport inventory from our distribution centers to our stores in less than one week. This quick turnaround time enhances our ability to maintain project‑ready quantities of the products stocked in our stores. To further strengthen our distribution capabilities, we have converted all of our distribution centers to Company‑operated facilities. In conjunction with the change in responsibility, we have implemented a warehouse management and transportation management system tailored to our unique needs across all three distribution centers. We believe this system will increase service levels, reduce shrinkage and damage, help us better manage our inventory and allow us to better implement our connected customer initiatives.

In the fourth quarter of fiscal 2017, we began operating in a newly constructed, leased 1.4 million square foot distribution center near Savannah, Georgia. In December 2017, we relocated all of the existing inventory from our prior leased 378,000 square foot distribution center located near Savannah, Georgia to this new distribution center, and in the first quarter of fiscal 2018, we relocated all of the existing inventory from our 322,000 square foot leased distribution center near Miami, Florida to this new distribution center. We exited our lease on the 378,000 square foot distribution center near Savannah, Georgia in the first quarter of fiscal 2018 and plan to exit our lease on the 322,000 square foot distribution center near Miami, Florida in 2021.

We anticipate opening a new distribution center in Maryland in late fiscal 2019, and we plan to continue to seek further opportunities to enhance our distribution capabilities and align them with our strategic growth initiatives.

Management Information Systems

We believe that technology plays a crucial role in the continued growth and success of our business. We have sought to integrate technology into all facets of our business, including supply chain, merchandising, store operations, point‑of‑sale, e‑commerce, finance, accounting and human resources. The integration of technology allows us to analyze the business in real time and react accordingly. Our sophisticated inventory management system is our primary tool for forecasting, placing orders and managing in‑stock inventory. The data‑driven platform includes sophisticated forecasting tools based on historical trends in sales, inventory levels and vendor lead times at the store and distribution center level by SKU, allowing us to support store managers in their regional merchandising efforts. We rely on the forecasting accuracy of our system to maintain the in‑stock, project‑ready quantities that our customers rely on. In addition, our employee training certifications are entirely electronic, allowing us to effectively track the

15

competencies of our staff and manage talent across stores. We believe that our systems are sufficiently scalable to support the continued growth of the business.

Competition

The retail hard surface flooring market is highly fragmented and competitive. We face significant competition from large home improvement centers, national and regional specialty flooring chains and independent flooring retailers. Some of our competitors are organizations that are larger, are better capitalized, have existed longer, have product offerings that extend beyond hard surface flooring and related accessories, and have a more established market presence with substantially greater financial, marketing, personnel and other resources than we have. In addition, while the hard surface flooring category has a relatively low threat of new internet‑only entrants due to the nature of the product, the growth opportunities presented by e‑commerce could outweigh these challenges and result in increased competition in this portion of our connected customer strategy. Further, because the barriers to entry into the hard surface flooring industry are relatively low, manufacturers and suppliers of flooring and related products, including those whose products we currently sell, could enter the market and start directly competing with us.

We believe that the key competitive factors in the retail hard surface flooring industry include:

•product assortment;

•product innovation;

•in‑store availability of products in project‑ready quantities;

•product sourcing;

•product presentation;

•customer service;

•store management;

•store location; and

•low prices.

We believe that we compete favorably with respect to each of these factors by providing a highly diverse selection of products to our customers, at an attractive value, in appealing and convenient retail stores.

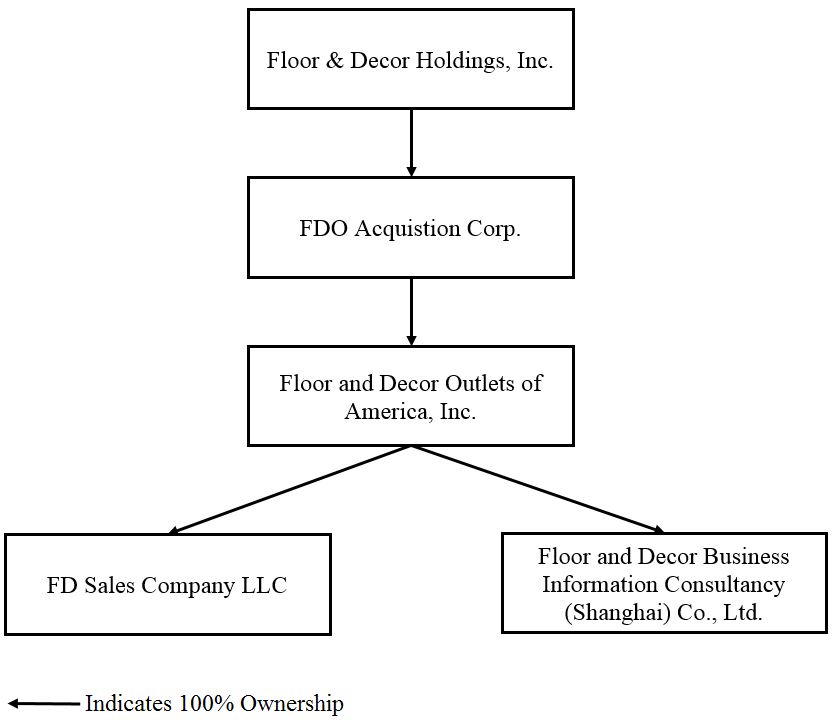

Our Structure

Floor & Decor Holdings, Inc. (formerly known as FDO Holdings, Inc.) was incorporated as a Delaware corporation in October 2010 in connection with our Sponsors’ (as defined below) acquisition of Floor & Decor Outlets of America, Inc. (“F&D”) in November 2010, which in turn converted from a Georgia corporation into a Delaware corporation in connection therewith.

16

The following chart illustrates our current corporate structure:

Employees

As of December 27, 2018, we had 6,566 employees, 4,707 of whom were full‑time and none of whom were represented by a union. Of these employees, 5,742 work in our stores, 579 work in corporate, store support, infrastructure, e‑commerce or similar functions, 232 work in distribution centers, and 13 work in our Asia sourcing office in Shanghai, China. We believe that we have good relations with our employees.

Government Regulation

We are subject to extensive and varied federal, state and local laws and regulations, including those relating to employment, the environment, protection of natural resources, import and export, advertising, labeling, public health and safety, product safety, zoning and fire codes. We operate our business in accordance with standards and procedures designed to comply with applicable laws and regulations. Compliance with these laws and regulations has not historically had a material effect on our financial condition or operating results; however, the effect of compliance in the future cannot be predicted.

Our operations and properties are also subject to federal, state and local laws and regulations governing the environment, environmental protection of natural resources and health and safety, including the use, storage, handling, generation, transportation, treatment, emission, release, discharge and disposal of hazardous materials, substances and wastes and relating to the investigation and clean‑up of contaminated properties. Except to the extent of the capital expenditures related to our initiatives described below, compliance with these laws and regulations has not historically had a material effect on our financial condition or operating results, but we cannot predict the effect of compliance in the future.

In particular, certain of our products are subject to laws and regulations relating to the importation, exportation, acquisition or sale of certain plants and plant products, including those illegally harvested (which is prohibited by the Lacey Act), and the emissions of hazardous materials (which in California is governed by regulations promulgated by CARB and federally by regulations promulgated by the EPA). We have established a Global Sourcing and Compliance Department to, among other things, address these requirements, and we work with third‑party consultants to assist us in designing and implementing compliance programs relating to the requirements of the Lacey Act, CARB and the EPA. Further, we could incur material compliance costs or be subject to compliance

17

liabilities or claims in the future, especially in the event new laws or regulations are adopted or there are changes in existing laws and regulations or in their interpretation.

Our suppliers are also subject to the laws and regulations of their home countries, including in particular laws regulating forestry and the environment. We also support social and environmental responsibility among our supplier community and endeavor to enter into vendor agreements with our suppliers that contain representations and warranties concerning environmental, labor and health and safety matters.

Insurance and Risk Management

We use a combination of insurance and self‑insurance to provide for potential liability for workers’ compensation, general liability, product liability, director and officers’ liability, team member healthcare benefits, and other casualty and property risks. Changes in legal trends and interpretations, variability in inflation rates, changes in workers’ compensation and general liability premiums and deductibles, changes in the nature and method of claims settlement, benefit level changes due to changes in applicable laws, insolvency of insurance carriers, and changes in discount rates could all affect ultimate settlements of claims. We evaluate our insurance requirements on an ongoing basis to ensure we maintain adequate levels of coverage.

Legal Proceedings

We are engaged in various legal actions, claims and proceedings arising in the ordinary course of business, including claims related to breach of contracts, products liabilities, intellectual property matters and employment related matters resulting from our business activities. As with most actions such as these, an estimation of any possible and/or ultimate liability cannot always be determined. Regardless of the outcome, litigation can have an adverse impact on us because of defense and settlement costs, diversion of management resources, and other factors.

Trademarks and other Intellectual Property

As of February 20, 2019, we have 76 registered marks and several pending trademark applications in the United States. We regard our intellectual property, including our over 50 proprietary brands, as having significant value, and our brand is an important factor in the marketing of our products. Accordingly, we have taken, and continue to take, appropriate steps to protect our intellectual property.

Available Information

We maintain a website at www.FloorandDecor.com. The information on or available through our website is not, and should not be considered, a part of this Annual Report. You may access our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, as well as other reports relating to us that are filed with, or furnished to, the Securities and Exchange Commission (the “SEC”) free of charge on our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC.

18

You should carefully consider the risks described below, together with all of the other information included in this Annual Report, including our consolidated financial statements and the related notes thereto, before making an investment decision. The risks and uncertainties set out below are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially and adversely affect our business, financial condition and operating results. If any of the following events occur, our business, financial condition and operating results could be materially and adversely affected. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to our Business

Our business, financial condition and operating results are dependent on general economic conditions and discretionary spending by our customers, which in turn are affected by a variety of factors beyond our control. If such conditions deteriorate, our business, financial condition and operating results may be adversely affected.

Our business, financial condition and operating results are affected by general economic conditions and discretionary spending by our customers. Such general economic conditions and discretionary spending are beyond our control and are affected by, among other things:

|

· |

consumer confidence in the economy; |

|

· |

unemployment trends; |

|

· |

consumer debt levels; |

|

· |

consumer credit availability; |

|

· |

data security and privacy concerns; |

|

· |

the housing market, including housing turnover and whether home values are rising or declining; |

|

· |

energy prices; |

|

· |

interest rates and inflation; |

|

· |

price deflation, including due to low‑cost imports; |

|

· |

slower rates of growth in real disposable personal income; |

|

· |

natural disasters and unpredictable weather; |

|

· |

national security concerns and other geopolitical risks; |

|

· |

uncertain U.S. political conditions, including the possibility of future government shutdowns; |

|

· |

trade relations and tariffs; |

|

· |

tax rates and tax policy; and |

|

· |

other matters that influence consumer confidence and spending. |

If such conditions deteriorate, our business, financial condition and operating results may be adversely affected. In addition, increasing volatility in financial and capital markets may cause some of the above factors to change with a greater degree of frequency and magnitude than in the past.

19

The hard surface flooring industry depends on home remodeling activity and other important factors.

The hard surface flooring industry is highly dependent on the remodeling of existing homes, businesses and, to a lesser extent, new home construction. In turn, remodeling and new home construction depend on a number of factors that are beyond our control, including interest rates, tax policy, trade policy, employment levels, consumer confidence, credit availability, real estate prices, existing home sales, demographic trends, weather conditions, natural disasters and general economic conditions. In particular:

|

· |

the national economy or any regional or local economy where we operate could weaken; |

|

· |

home‑price appreciation could slow or turn negative; |

|

· |

regions where we have stores that could be impacted by hurricane, fire, or other natural disasters (including those due to the effects of climate change such as increased storm severity, drought, wildfires, and potential flooding due to rising sea levels and storm surges); |

|

· |

interest rates could rise; |

|

· |

credit could become less available; |

|

· |

tax rates and/or health care costs could increase; or |

|

· |

fuel costs or utility expenses could increase. |

Any one or a combination of these factors could result in decreased demand for our products, reduce spending on homebuilding or remodeling of existing homes or cause purchases of new and existing homes to decline. While the vast majority of our net sales are derived from home remodeling activity as opposed to new home construction, a decrease in any of these areas would adversely affect our business, financial condition and operating results.

Any failure by us to successfully anticipate trends may lead to loss of consumer acceptance of our products, resulting in reduced net sales.

Each of our stores is stocked with a customized product mix based on consumer demands in a particular market. Our success therefore depends on our ability to anticipate and respond to changing trends and consumer demands in these markets in a timely manner. If we fail to identify and respond to emerging trends, consumer acceptance of our merchandise and our image with current or potential customers may be harmed, which could reduce our net sales. Additionally, if we misjudge market trends, we may significantly overstock unpopular products, incur excess inventory costs and be forced to reduce the sales price of such products or incur inventory write‑downs, which would adversely affect our operating results. Conversely, shortages of products that prove popular could also reduce our net sales through missed sales and a loss of customer loyalty.

If we fail to successfully manage the challenges that our planned new store growth poses or encounter unexpected difficulties during our expansion, our operating results and future growth opportunities could be adversely affected.

We have 100 warehouse‑format stores and one small‑format standalone design center located throughout the United States as of December 27, 2018. We plan to open 20 warehouse-format stores during fiscal 2019 and to increase the number of new stores that we open during each of the next several years thereafter. We also plan to relocate a warehouse-format store in fiscal 2019. This growth strategy and the investment associated with the development of each new store may cause our operating results to fluctuate and be unpredictable or decrease our profits. We cannot ensure that store locations will be available to us, or that they will be available on terms acceptable to us. If additional retail store locations are unavailable on acceptable terms, we may not be able to carry out a significant part of our growth strategy or our new stores’ profitability may be lower. Our future operating results and ability to grow will depend on various other factors, including our ability to:

|

· |

successfully select new markets and store locations; |

|

· |

negotiate leases on acceptable terms; |

20

|

· |

attract, train and retain highly qualified managers and staff; |

|

· |

maintain our reputation of providing quality, safe and compliant products; and |

|

· |

manage store opening costs. |

In addition, consumers in new markets may be less familiar with our brand, and we may need to increase brand awareness in such markets through additional investments in advertising or high cost locations with more prominent visibility. Stores opened in new markets may have higher construction, occupancy or operating costs, or may have lower net sales, than stores opened in the past. In addition, laws or regulations in these new markets may make opening new stores more difficult or cause unexpected delays. Newly opened stores may not succeed or may reach profitability more slowly than we expect, and the ramp‑up to profitability may become longer in the future as we enter more markets and add stores to markets where we already have a presence. Future markets and stores may not be successful and, even if they are successful, our comparable store sales may not increase at historical rates. To the extent that we are not able to overcome these various challenges, our operating results and future growth opportunities could be adversely affected.

Increased competition could cause price declines, decrease demand for our products and decrease our market share.

We operate in the hard surface flooring industry, which is highly fragmented and competitive. We face competition from large home improvement centers, national and regional specialty flooring chains, Internet‑based companies and independent flooring retailers. Among other things, we compete on the basis of breadth of product assortment, low prices, and the in‑store availability of the products we offer in project‑ready quantities, as well as the quality of our products and customer service. As we expand into new and unfamiliar markets, we may experience different competitive conditions than in the past.

Some of our competitors are organizations that are larger, are better capitalized, have existed longer, have product offerings that extend beyond hard surface flooring and related accessories and have a more established market presence with substantially greater financial, marketing, personnel and other resources than we have. In addition, while the hard surface flooring category has a relatively low threat of new internet‑only entrants due to the nature of the product, the growth opportunities presented by e‑commerce could outweigh these challenges and result in increased competition. Competitors may forecast market developments more accurately than we do, offer similar products at a lower cost or adapt more quickly to new trends and technologies or evolving customer requirements than we do. Further, because the barriers to entry into the hard surface flooring industry are relatively low, manufacturers and suppliers of flooring and related products, including those whose products we currently sell, could enter the market and start directly competing with us. Intense competitive pressures from any of our present or future competitors could cause price declines, decrease demand for our products and decrease our market share. Also, if we continue to grow and become more well‑known, other companies may change their strategies to present new competitive challenges. Moreover, in the future, changes in consumer preferences may cause hard surface flooring to become less popular than other types of floor coverings. Such a change in consumer preferences could lead to decreased demand for our products.

All of these factors may harm us and adversely affect our net sales, market share and operating results.

U.S. policies related to global trade and tariffs could adversely affect our business, financial condition and results of operations.