zk1211969.htm

As filed with the Securities and Exchange Commission on September 28, 2012

Registration No. 333-176415

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

POST-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Integrity Applications, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

|

3841

|

|

98-0668934

|

|

(State or Other Jurisdiction of Incorporation

|

|

(Primary Standard Industrial Classification

|

|

(I.R.S. Employer Identification

|

|

or Organization)

|

|

Code Number)

|

|

Number)

|

|

Integrity Applications, Inc.

102 Ha’Avoda St.

Ashkelon, Israel

972 (8) 675-7878

|

|

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

|

|

Avner Gal

Chief Executive Officer

Integrity Applications, Inc.

P.O. Box 432

Ashkelon 78100, Israel

972 (8) 675-7878

972 (8) 675-7850 (facsimile)

|

|

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

|

|

Copies to :

Robert L. Grossman, Esq.

Greenberg Traurig, P.A.

333 Avenue of the Americas, Suite 4400

Miami, FL 33131

(305) 579-0500

(305) 579-0717 (facsimile)

|

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

¨ Large accelerated filer

|

¨ Accelerated filer

|

|

¨ Non-accelerated filer (Do not check if a smaller reporting company)

|

x Smaller reporting company

|

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

1,295,545 Shares

Common Stock

This prospectus relates to the resale by the selling stockholders named herein of up to an aggregate of 1,295,545 shares of common stock, par value $0.001 per share, of Integrity Applications, Inc. The shares of common stock being offered by the selling stockholders hereunder were acquired by the selling stockholders in a private placement, which was commenced on July 26, 2010 and consisted of seven closings held on December 16, 2010, December 30, 2010, January 31, 2011, March 31, 2011, April 29, 2011, May 31, 2011 and July 29, 2011, respectively. There is no relationship between Integrity Applications, Inc., the registrant under the registration statement of which this prospectus is a part, and Integrity Applications, Incorporated, the engineering and software services company based in Chantilly, Virginia.

There is no public market for our common stock. We are seeking a qualification for our common stock to be quoted on the Over-the-Counter Bulletin Board; however, no assurance can be given as to our success in qualifying for quotation on the OTCBB. The selling stockholders may sell their shares of our common stock at a fixed price of $6.25 per share (the offering price per share of common stock in our most recent private placement prior to the commencement of this offering, completed in July 2011) until our common stock is quoted on the OTCBB, and thereafter in a variety of transactions as described under the heading “Plan of Distribution” beginning on page 76, including transactions on any stock exchange, market or facility on which our common stock may be traded, in privately negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to such market prices or at negotiated prices. We have no basis for estimating either the number of shares of our common stock that will ultimately be sold by the selling stockholders or the prices at which such shares will be sold (unless sold at a fixed price, as described above).

All of the shares of common stock are being sold by the selling stockholders named in this prospectus. We will not receive any of the proceeds from the sale of the shares of common stock being sold by the selling stockholders. We are bearing all of the expenses in connection with the registration of the shares of common stock, but all selling and other expenses incurred by the selling stockholders, including commissions and discounts, if any, attributable to the sale or disposition of the shares will be borne by them.

You should read this prospectus, the applicable prospectus supplement, if any, and other offering materials carefully before you invest.

An investment in our common stock involves substantial risks. See “Risk Factors” beginning on page 8 of this prospectus.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is September 28, 2012.

TABLE OF CONTENTS

Prospectus

| |

|

Page

|

|

| |

|

|

|

|

|

|

|

1

|

|

| |

|

|

|

|

|

|

|

|

1

|

|

| |

|

|

|

|

|

|

|

|

2

|

|

| |

|

|

|

|

|

|

|

|

8

|

|

| |

|

|

|

|

|

|

|

|

24

|

|

| |

|

|

|

|

|

|

|

|

24

|

|

| |

|

|

|

|

|

|

|

|

24

|

|

| |

|

|

|

|

|

|

|

|

24

|

|

| |

|

|

|

|

|

|

|

|

25

|

|

| |

|

|

|

|

|

|

|

|

26

|

|

| |

|

|

|

|

|

|

|

|

33

|

|

| |

|

|

|

|

|

|

|

|

48

|

|

| |

|

|

|

|

|

|

|

|

54

|

|

| |

|

|

|

|

|

|

|

|

59

|

|

| |

|

|

|

|

|

|

|

|

61

|

|

| |

|

|

|

|

|

|

|

|

65

|

|

| |

|

|

|

|

|

|

|

|

68

|

|

| |

|

|

|

|

|

|

|

|

69

|

|

| |

|

|

|

|

|

|

|

|

69

|

|

| |

|

|

|

|

|

|

|

|

69

|

|

This Post-Effective Amendment No. 1 to the Registration Statement on Form S-1 (Registration No. 333-176415) previously filed with, and declared effective by, the Securities and Exchange Commission is being filed to include the Registrant’s financial statements for the year ended December 31, 2011 and for the three and six month periods ended June 30, 2012, to make corresponding changes, and to update the disclosure herein as necessary. The information included in this Post-Effective Amendment No. 1 updates and supplements the Registration Statement and the Prospectus contained therein. All applicable registration fees were paid at the time of the original filing of the Registration Statement.

This prospectus includes forward-looking statements. These forward looking statements include statements about our expectations, beliefs or intentions regarding our product development efforts, business, financial condition, results of operations, strategies or prospects. All statements other than statements of historical fact included in this prospectus, including statements regarding our future activities, events or developments, including such things as future revenues, product development, market acceptance, responses from competitors, capital expenditures (including the amount and nature thereof), business strategy and measures to implement strategy, competitive strengths, goals, expansion and growth of our business and operations, plans, references to future success, projected performance and trends, and other such matters, are forward-looking statements. The words “believe,” “expect,” “intend,” “anticipates,” or “propose,” and other similar words and phrases, are intended to identify forward-looking statements. The forward-looking statements made in this prospectus are based on certain historical trends, current conditions and expected future developments as well as other factors we believe are appropriate in the circumstances. These statements relate only to events as of the date on which the statements are made and we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. All of the forward-looking statements made in this prospectus are qualified by these cautionary statements and there can be no assurance that the actual results anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Whether actual results will conform to our expectations and predictions is subject to a number of risks and uncertainties that may cause actual results to differ materially. Risks and uncertainties, the occurrence of which could adversely affect our business, include the risks identified in this prospectus under the caption “Risk Factors” beginning on page 8.

This summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding to invest in our common stock. You should read this entire prospectus, including the section entitled “Risk Factors,” and our financial statements and the notes thereto before deciding to invest in our common stock. Unless the context otherwise requires, the terms “we”, “our”, “ours” and “us”, refer to A.D. Integrity Applications, Ltd., an Israeli corporation, which we refer to as Integrity Israel, for all periods prior to July 15, 2010 and to Integrity Israel and Integrity Applications, Inc., a Delaware corporation, which we refer to as Integrity U.S., on a combined basis, for all periods from and including July 15, 2010.

Our Company

Overview

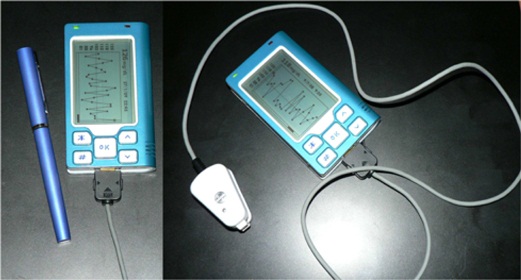

We are a development stage medical device company focused on the design, development and commercialization of non-invasive glucose monitoring devices for use by persons suffering from diabetes. Our wholly-owned subsidiary, Integrity Israel, was founded in 2001 with a mission to develop, produce and market non-invasive glucose monitors for home use by diabetics. We have developed a non-invasive blood glucose monitor, the GlucoTrack® DF-F glucose monitoring device, which is designed to help people with diabetes obtain blood glucose level readings without the pain, inconvenience, cost and difficulty of conventional (invasive) spot finger-stick devices. The GlucoTrack DF-F utilizes a patented combination of ultrasound, electromagnetic and thermal technologies to obtain blood glucose measurements in less than one minute via a small sensor that is clipped onto one’s earlobe and connected to a small, handheld control and display unit, all without drawing blood.

We began the performance and safety stage of formal clinical trials in Israel in connection with our CE Mark application in March 2012. We expect to begin clinical trials in the United States by mid 2013, if our clinical trial protocol is approved by the U.S. Food and Drug Administration. The GlucoTrack DF-F has not yet been approved for commercial sale in the United States, the European Union or any other jurisdiction. See “Business - Government Regulation - Regulation of the Design, Manufacture and Distribution of Medical Devices” below for a discussion of the approval process for commercial sale. There can be no assurance that approval for commercial sale in any jurisdiction will be obtained.

We have not yet generated any revenues from our operations and have incurred losses of $13,889,930 from inception through June 30, 2012 and cumulative negative operating cash flow of $10,400,810. We are dependent upon external sources for financing our, operations and there can be no assurance that we will succeed in obtaining the necessary financing to continue our operations. As a result, our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

Early Clinical Trials

Integrity Israel conducted early clinical trials involving over 5,000 readings from approximately 350 patients over the last six years. Clinical data collected since 2009 at the Soroka University Medical Center in Be’er Sheva, Israel indicate a positive correlation between GlucoTrack DF-F readings and those obtained from conventional invasive devices. More specifically, a set of early clinical studies conducted on 116 subjects of various weights, ages, diabetes types and genders involved 2,364 measurements, of which 96% were within the clinically acceptable zones (zones A and B) of the Clarke Error Grid, which we refer to as the CEG. Similarly, approximately 97% of the 1,306 measurements in an at-home study of 24 participants were within clinically acceptable zones A and B of the CEG. Measurements are clinically acceptable, compared to a referenced invasive device, when the variance, if any, between the devices would have no worse than a benign effect on the patients. The results of these early clinical trials may not be indicative of future results due to their relatively small sample sizes. Analyses of our at home tests show that there are a few parameters that reduce accuracy of the measurements obtained from the GlucoTrack DF-F, such as the learning curve associates with the use of the device, the use of another home-use device as a reference measurement, failure to properly follow instructions for use, including use of the reference (invasive) device, and the variability of the ambient temperature in a given testing environment. We have made modifications to the GlucoTrack DF-F to limit the effect of these parameters, including the addition of a sensor to gauge the ambient temperature in the testing environment, and modifications to the software utilized by the GlucoTrack device to take the ambient temperature into account in determining the patient’s blood glucose level. While we believe that these modifications will improve the results of the GlucoTrack device, no assurance can be given as to the extent (if any) to which these modifications will improve the effectiveness of the device. We believe that the results of the home study show that, with some modifications to the GlucoTrack DF-F, we will be able to improve the accuracy and reliability measurements of glucose levels in home and home-like environments.

Recent Developments

Reorganization

On July 15, 2010, Integrity U.S., Integrity Israel, and Integrity Acquisition Corp. Ltd., an Israeli corporation, completed a reverse triangular merger, which we refer to as the reorganization, pursuant to which Integrity Acquisition merged with and into Integrity Israel and all of the stockholders and option holders of Integrity Israel became entitled to receive shares and options in Integrity U.S. in exchange for their shares and options in Integrity Israel. Following the reorganization, the former equity holders of Integrity Israel received the same proportional ownership in Integrity U.S. as they had in Integrity Israel prior to the reorganization. As a result of the reorganization, Integrity Israel became a wholly owned subsidiary of Integrity U.S.

Private Placement

On July 26, 2010, we commenced an offering of up to 2,000,000 shares of our common stock to accredited investors at a price of $6.25 per share in a private placement transaction. The private placement resulted in the sale by us of an aggregate of 1,295,545 shares of common stock in seven closings held on December 16, 2010, December 30, 2010, January 31, 2011, March 31, 2011, April 29, 2011, May 31, 2011 and July 29, 2011, respectively.

In connection with the private placement, we agreed to issue to Andrew Garrett, Inc., the placement agent for the private placement, in partial consideration for its services as such, warrants to purchase a number of shares of common stock equal to 10% of the number of shares sold at each closing thereof. In total, we issued to Andrew Garrett, Inc. warrants to purchase up to an aggregate of 129,556 shares of common stock at an exercise price of $6.25 per share in connection with the private placement. The warrants have a five year term expiring on the fifth anniversary of the date on which the shares of common stock underlying such warrants are fully registered with the SEC. The warrants include customary adjustment provisions for stock splits, reorganizations and other similar transactions.

On December 16, 2010, we issued 259,185 shares of common stock to the holders of certain Senior Secured Promissory Notes issued by Integrity Israel in April 2010. Such issuance was made in accordance with the terms of the notes and was made in partial repayment of the aggregate outstanding principal amount thereof. Upon the issuance of the shares described above and the payment of any additional principal amount outstanding in cash, all of the Senior Notes were retired on December 16, 2010. Also on December 16, 2010, we issued 54,792 shares of common stock to the holders of certain Junior Promissory Notes issued by Integrity Israel in November 2010 in accordance with, and in full repayment of, such notes.

Stockholder Dispute

Integrity Israel is party to a loan and investment agreement dated February 18, 2003 with Y.H. Dimri Holdings, pursuant to which Dimri loaned Integrity Israel a principal amount of NIS 1,440,000 subject to linkage differences in Israel ($367,066 based on an exchange rate of $3.923 NIS/dollar as of June 30, 2012), which we refer to as the first phase loan. Upon completion of the development of the prototype of Integrity Israel’s monitoring device, Dimri could have advanced an additional loan to Integrity Israel in the amount of NIS 1,248,000 ($318,124 based on the same exchange rate), which we refer to as the second phase loan. In connection with the first phase loan, Dimri received shares of common stock representing 25% of Integrity Israel’s ordinary shares at such time. Under the investment agreement, certain rights in Integrity Israel were granted to Dimri, including an anti-dilution provision that provided that Dimri’s holdings in Integrity Israel would not be diluted below 18% of Integrity Israel’s issued capital shares as a result of any investment in Integrity Israel, subject to the fulfillment of certain requirements. On the date of the reorganization, Dimri owned 18% of Integrity Israel’s ordinary shares and, therefore, upon the completion of the reorganization, Dimri was entitled to receive 18% of the shares of common stock of the Company outstanding on such date in exchange for his shares in Integrity Israel, subject to the fulfillment of certain requirements . We believe, based on the advice of Israeli counsel, that, given Dimri no longer owns shares in Integrity Israel as a result of the reorganization, rights attached to the shares in Integrity Israel no longer exist in Integrity Israel and do not and have never existed in us. However, Dimri has refused to acknowledge or agree to the termination of these rights and has challenged our position. See “Certain Relationships and Related Transactions” on page 60 for a further description of the Dimri agreement.

On June 23, 2011, Dimri appealed to the District Court of HaMerkaz District in Petah Tikva, Israel, requesting the court to appoint an arbitrator to decide the dispute between Integrity Israel, the founders of Integrity Israel and Dimri (HPB 40754-06-11). On September 25, 2011, Integrity Israel's counsel filed an answer with the Court, disputing the facts and allegation raised in Dimri's motion and suggesting choosing an arbitrator with certain capacities, experience and skills. At a hearing held on October 11, 2011, the court appointed an arbitrator in this matter. The proposed arbitrator was required to inform the court no later than November 1, 2011 if there is anything that will preclude his service as an arbitrator in this matter. If there was, an alternate arbitrator would be appointed by the court. On November 27, 2011, the proposed arbitrator informed the court that he would not be able to serve as an arbitrator in this matter. On December 26, 2011, a new arbitrator was appointed in this matter. On February 14, 2012, a first procedural meeting took place with the appointed arbitrator, as a result of which Dimri was required to submit a statement of claim to the arbitrator (with a copy to the defendants’ attorneys) by March 15, 2012. On March 20, 2012, Dimri submitted a statement of claim to the arbitrator and pled for a declaratory judgment against Integrity Israel and the Founders of Integrity Israel. Dimri claimed that its rights under the loan and investment agreement, Integrity Israel’s Articles of Association and two other internal agreements entered into among the Founders of Integrity Israel are valid and in effect. Dimri also pled for an injunction requiring the founders of Integrity Israel to transfer shares of our Common Stock held by them to Dimri, from time to time, in such amounts necessary so that Dimri’s holdings in us would not be diluted below 18% of our issued share capital at any time. The defendants in the arbitration submitted a statement of defense on May 28, 2012 and Dimri submitted a reply on June 14, 2012. At a preliminary session held on June 19, 2012, the arbitrator suggested that the parties meet with him in order to examine whether a settlement can be reached. A meeting for this purpose had been set for August 27, 2012 but has been postponed by the arbitrator. A new meeting date has not yet been set. The arbitrator also decided that in case no settlement can be achieved, Dimri will be required to submit its affidavits by August 31, 2012 and the defendants will be required to submit their affidavits by October 31, 2012. Testimony and summary hearings have been set for December 2012.

We do not know what other actions Dimri will ultimately bring, if any, and against whom they will brought. Nevertheless, we, our counsel and Integrity Israel’s counsel believe that we and Integrity Israel have defenses to any such claims and appropriate claims and counterclaims of our own and we intend to strongly defend against any such action by Dimri and to assert our own claims and counterclaims as we deem necessary.

On September 16, 2012, the Company entered into a short-term loan agreement with Bank Leumi pursuant to which Bank Leumi loaned the Company 200,000 New Israeli Shekels ($51,388, based on the exchange rate of 0.25694 NIS/dollar in effect on such date) (the “Loan”). The Company borrowed the Loan to provide interim or bridge financing until the Company secures the transfer of certain funds located in bank accounts not immediately accessible by the Company due to geographic constraints. All principal and accrued but unpaid interest on the Loan is due and payable on October 31, 2012. The Loan, which is secured by the Company’s funds on deposit with Bank Leumi, accrues interest at a rate of 6.3% per annum, increasing to 13.35%, at the option of Bank Leumi, if the Company experiences liquidity issues, as determined by Bank Leumi. The Company may prepay the Loan at any time prior to the maturity date thereof. The Company may not use the proceeds of the loan to make payments to its shareholders or to repurchase any of its outstanding shares of common stock.

Going Concern

We have not yet generated any revenues from our operations and have incurred accumulated losses and cumulative negative operating cash flow of $13,889,930 and $10,400,810, respectively, from September 30, 2001 (inception) through June 30, 2012. We currently have no sources of recurring revenue and are therefore dependent upon external sources for financing our operations. There can be no assurance that we will succeed in obtaining the necessary financing to continue our operations. As a result, our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern. Management’s plans concerning these matters are described in Note 1B to our financial statements incorporated included in this prospectus; however management cannot assure you that its plans will be successful in addressing these issues. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. If we cannot successfully continue as a going concern, our stockholders may lose their entire investment in the common stock.

Market Opportunity

Diabetes is a chronic, life-threatening disease for which there is no known cure. Diabetes is caused by the body’s inability to produce or effectively utilize the hormone insulin. This inability prevents the body from adequately regulating blood glucose levels. Glucose, the primary source of energy for cells, must be maintained at certain concentrations in the blood in order to permit optimal cell function and health. Normally, the pancreas provides control of blood glucose levels by secreting the hormone insulin to decrease blood glucose levels when concentrations are too high. In people with diabetes, blood glucose levels fluctuate between very high levels, a condition known as hyperglycemia, and very low levels, a condition known as hypoglycemia. Hyperglycemia can lead to serious long-term complications, such as blindness, kidney disease, nervous system disease, amputations, stroke and cardiovascular disease. Hypoglycemia can lead to confusion, loss of consciousness or death.

According to the Diabetes Atlas (Fourth Edition) published by the International Diabetes Federation in 2009, an estimated 285 million adults aged from 20 to 79 worldwide, or 6.4% of the world’s adult population, will suffer from diabetes in 2010, not including those persons who suffer from Impaired Glucose Tolerance or Gestational Diabetes. The International Diabetes Federation estimates that this number will grow to approximately 438 million adults worldwide, or 7.7% of the world’s adult population, in 2030, and that by 2030 the number of adults suffering from diabetes will have increased by 98.1% in Africa, 93.9% in the Middle East and North Africa, 72.1% in Southeast Asia, 65.1% in South and Central America, 47.0% in the Western Pacific, 42.4% in North America and the Caribbean and 20.0% in Europe, over such regions’ respective 2010 levels. According to a statement made by the President of the International Diabetes Federation at a press briefing at the European Association for the Study of Diabetes in September 2011, an estimated 366 million people currently suffer from diabetes, and approximately 4.6 million deaths are attributable to diabetes annually.

According to the U.S. Department of Health and Human Services National Diabetes Education Program, about 75% of all newly diagnosed cases of Type 1 diabetes in the United States occur in juveniles younger than 18 years of age. In addition, according to the National Diabetes Education Program, Type 2 diabetes is occurring with increasing frequency in young people. The increase in prevalence is related to an increase in obesity amongst children. According to the 2007-2008 National Health and Examination Survey, approximately 16% of children and teens were overweight, about double the number two decades before.

The U.S. Centers for Disease Control and Prevention, in its 2011 National Diabetes Fact Sheet, estimates that the direct medical costs and indirect expenditures attributable to diabetes in the United States were $174 billion in 2007, an increase of $42 billion since 2002. Of this amount, the CDC estimates that approximately $116 billion were direct medical costs. The International Diabetes Federation estimates that worldwide healthcare expenditures to treat and prevent diabetes and its complications will total at least $376 billion in 2010, including $198 billion in the United States alone, and $490 billion worldwide in 2030.

The outcome of clinical data from various clinical studies (including the 1998 UK Prospective Diabetes Study) supports the recommendation that frequent monitoring of blood glucose levels is an important component of effective diabetes management. The 1993 Diabetes Control and Complications Trial, consisting of patients with Type 1 diabetes, and the 1998 UK Prospective Diabetes Study, consisting of patients with Type 2 diabetes, demonstrated that patients who intensely managed blood glucose levels delayed the onset and slowed the progression of diabetes-related complications. In the Diabetes Control and Complications Trial, a major component of intensive management was monitoring blood glucose levels at least four times per day using conventional spot finger-stick blood glucose meters. The Diabetes Control and Complications Trial demonstrated that intensive management reduced the risk of complications by 76% for eye disease, 60% for nerve disease and 50% for kidney disease. However, the Diabetes Control and Complications Trial also found that intensive management led to a two- to three-fold increase in the frequency of hypoglycemic events. In an article entitled Intensive Diabetes Treatment and Cardiovascular Disease in Patients with Type 1 Diabetes, published in the December 22, 2005 edition of the New England Journal of Medicine, Vol. 353, No. 25, at pages 2643-2653, the authors of a peer-reviewed study concluded that intensive diabetes therapy has long-term beneficial effects on the risk of cardiovascular disease in patients with Type 1 diabetes. The study showed that intensive diabetes therapy reduced the risk of cardiovascular disease by 42% and the risk of non-fatal heart attack, stroke or death from cardiovascular disease by 57%. However, despite evidence that intensive glucose management reduces the long-term complications associated with diabetes, in an article entitled Lack of Compliance With Home Blood Glucose Monitoring Predicts Hospitalization in Diabetes, published in the August 2001 edition of Diabetes Care, Vol. 24, No. 8, at pages 1502-1503, a publication published by the American Diabetes Association, the author, Mark R. Burge, MD, reported that up to 67% of patients with diabetes fail to routinely monitor their glucose levels. In an article entitled Self-Monitoring of Blood Glucose (SMBG): Considerations for Intensive Diabetes Management, published in December 2005 as a Supplement to Pharmacy and Therapeutics, Volume 30, No. 12, the author, Robyn Graham, Pharm D, reported that only 14% of American diabetics (about 2.5 million people out of 18.2 million Americans with diabetes) practice self monitoring of blood glucose regularly.

Spot finger-stick devices are the most prevalent devices for blood glucose monitoring. These devices require inserting a strip into a glucose meter, taking a blood sample with a finger-stick and placing a drop of blood on the test strip that yields a single point in time blood glucose measurement. Despite continued developments in the field of blood glucose monitors, the routine measurement of glucose levels remains invasive, painful, inconvenient, difficult and costly. This has resulted in a sub-optimal measurement regimen for many diabetics.

The FDA has approved continuous glucose monitoring systems for blood glucose monitoring, when prescribed by a doctor. Continuous glucose monitoring systems use sensors inserted under the skin to check glucose levels in interstitial fluid. The sensor stays in place for several days to a week and then must be replaced. A transmitter sends information about glucose levels via radio waves from the sensor to a pager-like wireless monitor. According to the National Institute of Diabetes and Digestive and Kidney Diseases at the National Institutes of Health, continuous glucose monitoring device users must check blood samples with a conventional glucose meter to calibrate the continuous glucose monitoring systems devices, and because currently approved continuous glucose monitoring systems are not as accurate as standard blood glucose meters, the National Institute of Diabetes and Digestive and Kidney Diseases recommends that continuous glucose monitoring device users should confirm glucose levels with a meter before changing treatment.

We believe that a significant market opportunity exists for a reliable, inexpensive, non-invasive blood glucose measurement device and that such a device could greatly increase compliance with blood glucose measurement recommendations and help many diabetics better manage their disease, providing significant benefits to both patients and payors.

Competitive Advantage

Our non-invasive blood glucose monitor, the GlucoTrack DF-F, utilizes a combination of ultrasound, electromagnetic and thermal technologies to obtain blood glucose measurements in less than one minute via a small sensor that is clipped onto one’s earlobe and connected to a handheld control and display unit.

We believe that the GlucoTrack DF-F addresses the expressed, currently unmet needs of the diabetic market as it removes or diminishes two of the most significant barriers to the recommended frequent monitoring of blood glucose by diabetics:

| |

·

|

pain, as the GlucoTrack DF-F is a truly non-invasive device; and

|

| |

·

|

cost, as, despite the relatively high upfront cost of purchasing a GlucoTrack DF-F, we anticipate that the total cost of purchasing a device and purchasing replacement ear clips every six months (anticipated to be the only recurring cost, other than recalibration costs, which are expected to be minimal) over the useful life of the device will be substantially lower than the cost of purchasing conventional glucose meters and single use testing strips over that same period. See Figure B on page 37 and the accompanying footnotes for a direct cost comparison of the GlocoTrack DF-F and conventional (invasive) spot finger-stick devices.

|

Despite the fact that the overall costs associated with owning and using a GlucoTrack DF-F device are expected to be substantially lower than the cost of purchasing and using single use invasive devices over an extended period of time, as demonstrated in Figure B on page 36 below, the significant initial purchase price of a GlucoTrack device might present a barrier to adoption of the GlucoTrack system by patients. In light of this fact, we are exploring various marketing options to lessen the initial financial burden associated with purchasing a GlucoTrack device, including a leasing program. In addition, we intend to seek appropriate coding and reimbursement approval for the GlucoTrack device from third-party payors, including government payors, such as the Medicare and Medicaid programs, managed care organizations and other third-party payors. There can be no assurance that such third party-payors will provide any reimbursement coverage for the GlucoTrack or, if so, whether such reimbursement coverage will be adequate. See “Risk Factors - If the GlucoTrack DF-F or our future product candidates, if any, fail to achieve acceptable pricing, adequate third party reimbursement or market acceptance, we may not be able to generate significant revenue or achieve or sustain profitability. ” on page 15 of this prospectus.

We believe that the GlucoTrack DF-F will only require calibration once every few months; although, in informal discussions with the FDA, the FDA has indicated that initially it would require recalibration of the GlucoTrack DF-F every month. Monthly (or perhaps less frequent) recalibration presents an advantage as compared to other non-invasive devices under different stages of development, as they generally require more frequent recalibration (although one company claims that its device under development does not require any calibration or recalibration). Furthermore, the GlucoTrack DF-F does not use any optical method (either Infra Red (IR) or Near Infra Red (NIR) technology), which we understand are being used by other developers of noninvasive blood glucose measurement devices. We believe that optical technologies are less reliable than the GlucoTrack DF-F’s combination of ultrasound, electromagnetic and thermal technologies due to inherent physiological limitations with optical technology.

We expect that the initial calibration and the first one or two recalibrations would be completed by experienced clinicians in a clinical setting, and all other recalibrations after the initial one or two recalibrations would be completed by the patient in his or her home or another location of his or her choosing. As with all other non-invasive glucose monitoring devices that require recalibration, in order to recalibrate the GlucoTrack DF-F a clinician or patient will need to obtaining a measurement of the patient’s blood glucose levels using an invasive device, which measurement is used as a reference point in the recalibration process.

To our knowledge, there are currently no available devices that are cleared or approved for use in either the United States or the European Union for spot or continuous non-invasive blood glucose measurement. The FDA has previously approved a single non-invasive product for glucose trend analysis, the GlucoWatch®, so long as the device was used with conventional finger-stick glucose monitoring devices. However, the device is no longer available commercially.

Corporate Information

Our principal executive offices are located at 102 Ha’Avoda Street, Ashkelon Israel and our telephone number is 972 (8) 675-7878. Our website address is www.integrity-app.com. Information contained on our website or that can be accessed through our website does not constitute a part of this prospectus and is not incorporated herein by reference. There is no relationship between Integrity Applications, Inc., the registrant under the registration statement of which this prospectus is a part, and Integrity Applications, Incorporated, the engineering and software services company based in Chantilly, Virginia.

GlucoTrack® is a registered trademark of Integrity Applications, Inc.

|

Common stock offered by the selling stockholders:

|

1,295,545 shares

|

| |

|

|

Common stock outstanding:

|

5,295,543 shares as of August 31, 2012, excluding shares of common stock issuable upon exercise of outstanding warrants and stock options.

|

| |

|

|

Trading market:

|

There is currently no market for our common stock and we can offer no assurances that a market for our shares of common stock will develop in the future. We are seeking a qualification for our common stock to be quoted on the OTCBB; however, no assurance can be given as to our success in qualifying for quotation on the OTCBB.

|

| |

|

|

Price per share:

|

The selling stockholders may sell their shares of our common stock at a fixed price of $6.25 per share (the offering price per share of common stock in our most recent private placement prior to the commencement of this offering, completed in July 2011) until our common stock is quoted on the OTCBB, and thereafter at prevailing market prices or privately negotiated prices.

|

| |

|

|

Use of proceeds:

|

We will not receive any of the proceeds from the sale or other disposition of the shares of common stock offered hereby.

|

| |

|

|

Risk factors:

|

We are subject to a number of risks that you should be aware of before you decide to purchase our common stock. These risks are discussed more fully in the section captioned “Risk Factors,” beginning on page 8 of this prospectus.

|

An investment in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the following risk factors. If any of these risks actually occur, our business, financial condition and results of operations could be materially harmed. In addition, risks and uncertainties not presently known to us or that we currently deem immaterial may also materially harm our business, financial condition and results of operations. If this were to happen, the value of our common stock could decline significantly and you could lose all or part of your investment.

A former stockholder of Integrity Israel who is entitled to receive shares in our company, subject to the fulfillment of certain requirements, has challenged our and Integrity Israel’s position that certain rights he had in Integrity Israel terminated upon the reorganization.

Integrity Israel is party to a loan and investment agreement with Dimri, pursuant to which Dimri loaned Integrity Israel a principal amount NIS 1,440,000, subject to linkage differences in Israel ($367,066 based on an exchange rate of $3.923 NIS/dollar as of June 30, 2012). In connection with such loan, Dimri received shares of common stock representing 25% of Integrity Israel’s ordinary shares at such time. Under the Dimri agreement, certain rights in Integrity Israel were granted to Dimri, including an anti-dilution provision that provided that Dimri’s holdings in Integrity Israel would not be diluted below 18% of Integrity Israel’s issued capital shares as a result of any investment in Integrity Israel, subject to the fulfillment of certain requirements. On the date of the reorganization, Dimri owned 18% of Integrity Israel’s ordinary shares and, therefore, upon the completion of the reorganization, Dimri was entitled to receive 18% of the shares of common stock of the Company outstanding on such date in exchange for its shares in Integrity Israel, subject to the fulfillment of certain requirements. We believe, based on the advice of Israeli counsel, that, given Dimri no longer owns shares in Integrity Israel as a result of the reorganization, rights attached to the shares in Integrity Israel no longer exist in Integrity Israel and do not and have never existed in us. However, Dimri has refused to acknowledge or agree to the termination of these rights and has challenged our position. On June 23, 2011, Dimri appealed to the District Court of HaMerkaz District in Petah Tikva, Israel, requesting the court to appoint an arbitrator to decide the dispute between Integrity Israel, the founders of Integrity Israel and Dimri (HPB 40754-06-11). On September 25, 2011, Integrity Israel's counsel filed an answer with the Court, disputing the facts and allegations raised in Dimri's motion and suggesting choosing an arbitrator with certain capacities, experience and skills. At a hearing held on October 11, 2011, the court appointed an arbitrator in this matter. On November 27, 2011, the proposed arbitrator informed the court that he would not be able to serve as an arbitrator in this matter. On December 26, 2011, a new arbitrator was appointed in this matter. On February 14, 2012, a first procedural meeting took place with the appointed arbitrator, as a result of which Dimri was required to submit a statement of claim to the arbitrator (with a copy to the defendants’ attorneys) by March 15, 2012. On March 20, 2012, Dimri submitted a statement of claim to the arbitrator and pled for a declaratory judgment against Integrity Israel and the founders of Integrity Israel. Dimri claimed that its rights under the loan and investment agreement, Integrity Israel’s Articles of Association and two other internal agreements entered into among the founders of Integrity Israel are valid and in effect. Dimri also pled for an injunction requiring the founders of Integrity Israel to transfer shares of our common stock held by them to Dimri, from time to time, in such amounts necessary so that Dimri’s holdings in us would not be diluted below 18% of our issued share capital at any time. The defendants in the arbitration submitted a statement of defense on May 28, 2012 and Dimri submitted a reply on June 14, 2012. At a preliminary session held on June 19, 2012, the arbitrator suggested that the parties meet with him in order to examine whether a settlement can be reached. A meeting for this purpose had been set for August 27, 2012 but has been postponed by the arbitrator. A new meeting date has not yet been set. The arbitrator also decided that in case no settlement can be achieved, Dimri will be required to submit its affidavits by August 31, 2012 and the defendants will be required to submit their affidavits by October 31, 2012. Testimony and summary hearings have been set for December 2012.

As a condition to the private placement, our founders, Avner Gal, Zvi Cohen, David Malka, Ilana Freger and Alex Reikhman, entered into an Irrevocable Undertaking of Indemnification with us pursuant to which, among other things, the founders agreed to indemnify us and hold us harmless from any adverse consequences (excluding the fees and costs of defending us) that result from Dimri’s, or Dimri’s successors’ or assigns’, enforcement of the anti-dilution rights granted to Dimri as described above. The founders’ obligations under the Irrevocable Undertaking of Indemnification only obligate each founder to transfer up to such number of shares of our common stock that he or she owned as of July 26, 2010 to Dimri or to us. The term of the Irrevocable Undertaking of Indemnification is three years (subject to extension if there is a pending action), provided that, after two years, any founder may sell or transfer up to twenty percent (20%) of his or her shares of common stock covered by the Irrevocable Undertaking of Indemnification so long as no action is pending by Dimri against us at the time of such sale and the sale price of the common stock is at least $6.25 per share. No assurances can be made that the Irrevocable Undertaking of Indemnification will fully protect us or our stockholders from any adverse consequences of an action by Dimri to enforce its anti-dilution rights. In addition, Dimri may assert other rights that it had under the Investment Agreement, for which we are not indemnified.

Notwithstanding the indemnification by our founders, any such challenge by Dimri, or any other legal action, if any, brought by Dimri against us, Integrity Israel and/or the founders, could have a material adverse effect on us and our stockholders, including (i) significant costs and expenses that may be incurred in connection with any action, suit or other proceeding, (ii) potential dilution of the interests of our other stockholders (including purchasers in this offering) if Dimri is successful in such challenge and either (a) the founders cannot transfer their shares until the end of the two-year lock-up imposed by the Israeli Tax Authorities or (b) the founders otherwise exhaust all of their shares in satisfaction of their indemnification obligations, (iii) the impact that the loss of shares of common stock owned by Messrs. Gal and Malka, who are key employees of ours, as a result of their indemnification obligation would have on their commitment to us given the loss of a portion of their economic interests in us and (iv) if a court were to order Integrity Israel to issue shares to Dimri as part of a successful challenge, we would not wholly own Integrity Israel.

We have a history of operating losses and do not expect to generate revenues or become profitable in the near future.

We are an early stage medical device company with a limited operating history. We are not profitable and have incurred losses since our inception. We do not anticipate that we will generate revenue from the sale of products until at least early 2013. Our initial product, the GlucoTrack DF-F, has not been approved for marketing in the United States, the European Union or any other jurisdiction and may not be sold or marketed without FDA clearance or approval in the United States, the receipt of a CE Mark in the European Union or the receipt of regulatory approval in accordance with the applicable requirements of any other jurisdiction. We continue to incur research and development and general and administrative expenses related to our operations and the development of our first product. Our net losses for the years ended December 31, 2011 and 2010 were approximately $2.4 million and $2.8 million, respectively, and we had an accumulated deficit of approximately $13.9 million as of June 30, 2012. We expect to continue to incur losses for the foreseeable future, and these losses will likely increase as we prepare for and begin to commercialize GlucoTrack DF-F, if it is approved. If the GlucoTrack DF-F and possibly other products fail in clinical trials or do not gain regulatory clearance or approval, or if the GlucoTrack DF-F does not achieve market acceptance, we may never become profitable. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

Our independent registered public accounting firm noted in its report accompanying our financial statements for the fiscal year ended December 31, 2011 that we had suffered significant losses during the development stage, had a negative operating cash flow since inception and that the development and commercialization of our product is expected to require substantial expenditures. We have not yet generated any revenues from our operations to fund our activities, and are therefore dependent upon external sources for financing our operations. There can be no assurance that we will succeed in obtaining the necessary financing to continue our operations. As a result, our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern. Management’s plans concerning these matters are described in Note 1B to our financial statements included in this prospectus; however management cannot assure you that its plans will be successful in addressing these issues. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. If we cannot successfully continue as a going concern, our stockholders may lose their entire investment in the common stock.

We will require substantial additional funding, which may not be available to us on acceptable terms, or at all.

As of June 30, 2012, cash on hand was approximately $0.8 million. Based on our current strategy and operating plan, we believe that our cash and cash equivalents will enable us to operate for a period of about four months from June 30, 2012. In order to fund our anticipated liquidity needs beyond such four month period (or possibly earlier if we change our current strategy or operating plan in a way that accelerates or increases our liquidity needs), we will need to raise additional capital. Our future funding requirements will depend on many factors, including but not limited to:

· our need to extend or expand research and development activities;

· the need and ability to hire additional management and scientific and medical personnel;

· the effect of competing technological and market developments;

· the need to implement additional internal systems and infrastructure, including financial and reporting systems;

· the rate of progress and cost of our clinical trials;

|

|

·

|

the costs associated with establishing commercialization capabilities, including a sales force if we distribute our product other than through distributors;

|

· the costs and timing of seeking and obtaining FDA and other non-U.S. regulatory clearances and approvals; and

· the ability to maintain, expand and defend the scope of our intellectual property portfolio.

Until we can generate a sufficient amount of product revenue to finance our cash requirements, which we may never do, we expect to finance future cash needs primarily through public or private equity offerings, debt financings or strategic collaborations. We do not know whether additional funding will be available on acceptable terms, or at all. If we are not able to secure additional funding when needed, or at all, we may have to delay, reduce the scope of or eliminate clinical trials or research and development programs. To the extent that we raise additional funds by issuing equity securities, our stockholders may experience significant dilution, and debt financing, if available, may involve restrictive covenants.

The recent worldwide economic crisis and market instability may materially and adversely affect the demand for our products, if and when approved, as well as our ability to obtain credit or secure funds through sales of our stock, which may materially and adversely affect our business, financial condition and ability to fund our operations.

The current worldwide economic crisis may reduce the demand for new and innovative medical devices, resulting in delayed market acceptance of our products, if and when they are approved. Such a delay could have a material adverse impact on our business, expected cash flows, results of operations and financial condition. Additionally, we have funded our operations to date primarily through private sales of common stock. The recent economic turmoil and instability in the world’s equity and credit markets may materially adversely affect our ability to sell additional shares of common stock and/or borrow cash. There can be no assurance that we will be able to raise additional working capital on acceptable terms or at all, and any failure to do so may materially adversely affect our ability to continue operations.

Healthcare reforms, changes in healthcare policies, including recently enacted legislation reforming the U.S. healthcare system, and changes to third-party reimbursements for diabetes-related products may affect reimbursement of and demand for our products and have a material adverse effect on our financial condition and results of operations.

The United States government has in the past considered and may in the future consider healthcare policies and proposals intended to curb rising healthcare costs, including those that could significantly affect reimbursement for healthcare products such as the GlucoTrack DF-F. These policies have included, and may in the future include: basing reimbursement policies and rates on clinical outcomes, the comparative effectiveness and costs of different treatment technologies and modalities; imposing price controls and taxes on medical device providers; competitive bidding; and other measures.

Congress passed health care reform legislation that the President signed into law on March 23, 2010 and March 30, 2010. The package signed into law is considered by some to be the most dramatic change to the country’s health care system in decades. The principal aim of the law currently enacted is to expand health insurance coverage to the uninsured. The law’s most far-reaching changes do not take effect until 2014, including a requirement that most Americans carry health insurance. The consequences of these significant changes on the sale of our products are unknown and speculative at this point.

The enacted legislation contains many provisions designed to generate the revenues necessary to fund the coverage expansions. Included among these provisions are fees or taxes on certain health-related industries, including medical device manufacturers like us. The legislation imposes an annual excise tax (or sales tax) on medical devices like ours, beginning with calendar year 2013. The taxes would be allocated based on our proportionate share of the prior-year’s aggregate domestic gross receipts from medical device sales.

In addition to the new legislation discussed above, the effect of which cannot presently be quantified given its recent enactment, various healthcare reform proposals have also emerged at the state level. Future significant changes in the healthcare systems in the United States or elsewhere could also have a negative impact on the demand for the GlucoTrack DF-F or other GlucoTrack products, if approved for sale, or our future products, if any. These include changes that may lower reimbursement rates for such products from what we might otherwise have obtained and changes that may be proposed or implemented by the current administration or Congress.

We cannot predict what healthcare initiatives, if any, will be implemented at the federal or state level, or the effect any future legislation or regulation will have on us. In addition to the taxes imposed by the new federal legislation, any further expansion in government’s role in the U.S. healthcare industry may lower reimbursements for our products, reduce medical procedure volumes and materially adversely affect our business, financial condition and results of operations.

Our product research and development activities may not meet all the applicable regulatory requirements needed to receive regulatory approval and may not result in commercially viable products.

Our current product candidate, the GlucoTrack DF-F, is in the early stages of development and, therefore, is prone to the risks of failure inherent in medical device product development. We will likely be required to undertake significant clinical trials to demonstrate to the FDA that the GlucoTrack DF-F is either safe and effective for its intended use or is substantially equivalent in terms of safety and effectiveness to an existing, lawfully marketed predicate device. We may also be required to undertake clinical trials by non-U.S. regulatory agencies. Clinical trials are expensive and uncertain processes that may take years to complete. Failure can occur at any point in the process and early positive results do not ensure that the entire clinical trial will be successful. Product candidates in clinical trials may fail to show desired efficacy and safety traits despite early promising results. A number of companies in the medical device industry have suffered significant setbacks in advanced clinical trials, even after their product candidates demonstrated promising results at earlier points.

The results of limited early clinical trials may not be indicative of future results, and our planned clinical trials may not prove to be safe and efficacious or otherwise sufficient to satisfy the requirements of the FDA or other non-U.S. regulatory authorities.

Positive results from limited early clinical trials that we have conducted should not be relied upon as evidence that later-stage or large-scale clinical trials will succeed. These early clinical trials involved limited patient populations and there is no assurance that the experimental protocol or protocols, as the case may be, used in these informal trials will be methodologically similar to ones submitted to the FDA for its approval. Because of the sample size, possible variation in methodology, differences in exclusion/inclusion criteria, or differences in endpoints, the results of these early clinical trials may not be indicative of future results. We will likely be required to demonstrate through well-controlled clinical trials that the GlucoTrack DF-F or future product candidates, if any, are safe and effective for their intended uses. In the event that the FDA deems the GlucoTrack DF-F to be a class II device, which we do not believe is likely at this point, then we would be required to demonstrate that it is substantially equivalent in terms of safety and effectiveness to a device lawfully marketed either through a premarket notification or prior to May 28, 1976.

Further, the GlucoTrack DF-F or our future product candidates, if any, may not be cleared or approved, as the case may be, even if the clinical data are satisfactory and support, in our view, its or their clearance or approval. The FDA or other non-U.S. regulatory authorities may disagree with our trial design or interpretation of the clinical data. In addition, any of these regulatory authorities may change requirements for the clearance or approval of a product candidate even after reviewing and providing comment on a protocol for a pivotal clinical trial that has the potential to result in FDA approval. In addition, any of these regulatory authorities may also clear or approve a product candidate for fewer or more limited uses than we request or may grant clearance or approval contingent on the performance of costly post-marketing clinical trials. In addition, the FDA or other non-U.S. regulatory authorities may not approve the labeling claims necessary or desirable for the successful commercialization of the GlucoTrack DF-F or our future product candidates, if any.

The materials used to coat the sensors of the personal ear-clip of the GlucoTrack DF-F have failed an in vitro cytotoxicity test, as a result of which we may be required to utilize other materials for such coating, which would materially extend the time required for us to obtain CE Mark approval to market the GlucoTrack DF-F in Europe and FDA approval or clearance to market the GlucoTrack DF-F in the United States.

The sensors in the personal ear-clip of the GlucoTrack DF-F are currently coated in a nickel coating. In connection with our CE Mark application and expected future FDA application, we recently conducted an in vitro (test tube) cytotoxicity test of the nickel coating. The results from this in vitro cytotoxicity test showed that the nickel coating failed the test as it had caused adverse reactions, described as severe, in an in vitro setting. Subsequent to that result, in accordance with ISO 10993-1 and ISO 14971, the contract research organization that conducted the initial cytotoxicity test conducted an evaluation, based on existing data, of the toxicity of the nickel coating in in vivo (live patient) settings, including analysis of the 15,089 exposures, from 363 patients, recorded as part of our early clinical trials of the GlucoTrack DF-F. Based on this evaluation, the contract research organization concluded that the GlucoTrack DF-F did not present any evidence to support a conclusion that the nickel coating presented a risk regarding a sensitization or irritation response in patients. When we submit our completed CE Mark application, we will be required to provide the Notified Body the results of the in vitro cytotoxicity test and a written explanation as to why we believe the nickel coating is safe for users of the GlucoTrack DF-F despite the results of such test. In accordance with ISO 10993-1, we expect to present the lack of evidence of a sensitization or irritation in response in our early clinical trials as evidence that the nickel coating is safe for users. If the Notified Body is not satisfied with our explanation, it may require us to utilize a different coating for the sensors in the personal ear-clip, which would materially extend the time required for us to obtain CE Mark approval to market the GlucoTrack DF-F in Europe (if at all). Furthermore, any acceptance of such explanation by the Notified Body in connection with our CE Mark application does not provide any assurance that the FDA will accept such explanation if and when we apply for approval or clearance to market the GlucoTrack DF-F in the United States.

We are highly dependent on the success of our initial product candidate, the GlucoTrack DF-F, and cannot give any assurance that it will ever receive regulatory approval or clearance or be successfully commercialized.

We are highly dependent on the success of our initial product candidate, the GlucoTrack DF-F. We cannot give any assurance that the FDA will permit us to clinically test the device, nor can we give any assurance that the clinical trials will be successful or that the GlucoTrack DF-F will receive regulatory clearance or approval or be successfully commercialized, for a number of reasons, including, without limitation, the potential introduction by our competitors of more clinically-effective or cost-effective alternatives, failure in our sales and marketing efforts, or the failure to obtain appropriate coding or positive coverage determinations for reimbursement. Any failure to obtain approval to conduct clinical trials, favorable clinical data, clearance or approval of or to successfully commercialize the GlucoTrack DF-F would have a material adverse effect on our business.

If our competitors develop and market products that are more effective, safer or less expensive than the GlucoTrack DF-F or our future product candidates, if any, our commercial opportunities may be rendered less competitive and will be adversely affected.

The life sciences industry is highly competitive and we face significant competition from many medical device companies that are researching and marketing products designed to address the needs of persons suffering from diabetes. We are currently developing medical devices that will compete with other medical devices that currently exist or are being developed. Products that we may develop in the future are also likely to face competition from other medical devices and therapies. Some of our competitors have significantly greater financial, manufacturing, marketing and product development resources than we do. Large medical device companies, in particular, have extensive experience in clinical testing and in obtaining regulatory clearances or approvals for medical devices. These companies also have significantly greater research and marketing capabilities than us. Some of the medical device companies that we expect to compete with include Roche Disetronic, a division of Roche Diagnostics; LifeScan, Inc., a division of Johnson & Johnson; the MediSense and TheraSense divisions of Abbott Laboratories; Bayer Corporation; Echo Therapeutics, Inc.; GlucoLight; C8 MediSensors, Grove Instruments; and Medtronic, Inc. In addition, many other universities and private and public research institutions are or may become active in research involving blood glucose measurement devices.

We believe that our ability to successfully compete will depend on, among other things:

· the results of our clinical trials;

· our ability to recruit and enroll patients for our clinical trials;

· the efficacy, safety, performance and reliability of our product candidates;

· the speed at which we develop product candidates;

· our ability to design and successfully execute appropriate clinical trials;

· our ability to obtain prompt and favorable IRB review and approval at each of our clinical sites;

· the timing and scope of regulatory clearances or approvals;

|

|

·

|

our ability to commercialize and market any of our product candidates that may receive regulatory clearance or approval;

|

|

|

·

|

our ability to obtain appropriate coding, coverage and adequate levels of reimbursement under private and governmental health insurance plans, including Medicare;

|

· our ability to protect intellectual property rights related to our products;

· our ability to have partners manufacture and sell commercial quantities of any approved products to the market; and

· acceptance of our product candidates by physicians and other health care providers.

If our competitors market products that are more effective, safer, easier to use or less expensive than the GlucoTrack DF-F or our future product candidates, if any, or that reach the market sooner than the GlucoTrack DF-F or our future product candidates, if any, we may not achieve commercial success. In addition, the medical device industry is characterized by rapid technological change. It may be difficult for us to stay abreast of the rapid changes in each technology. If we fail to stay at the forefront of technological change, we may be unable to compete effectively. Technological advances or products developed by our competitors may render our technologies or product candidates obsolete or less competitive.

Our product development activities could be delayed or stopped.

We do not know whether our planned clinical trials will begin on time, or at all, or be completed on schedule, or at all. The commencement of our planned clinical trials could be substantially delayed or prevented by several factors, including:

· the failure to obtain sufficient funding to pay for all necessary clinical trials;

|

|

·

|

limited number of, and competition for, suitable patients that meet the protocol’s inclusion criteria and do not meet any of the exclusion criteria;

|

|

|

·

|

limited number of, and competition for, suitable sites to conduct the clinical trials, and delay or failure to obtain FDA approval, if necessary, to commence a clinical trial;

|

· delay or failure to obtain sufficient supplies of the product candidate for clinical trials;

|

|

·

|

requirements to provide the medical device required in clinical trials free of cost, which may require significant expenditures that we are unable or unwilling to make;

|

|

|

·

|

delay or failure to reach agreement on acceptable clinical trial agreement terms or clinical trial protocols with prospective sites or investigators; and

|

|

|

·

|

delay or failure to obtain institutional review board approval or renewal of such approval to conduct a clinical trial at a prospective or accruing site, respectively.

|

The completion of clinical trials could also be substantially delayed or prevented by several factors, including:

· slower than expected rates of patient recruitment and enrollment;

· failure of patients to complete the clinical trial;

· unforeseen safety issues;

· lack of efficacy evidenced during clinical trials;

· termination of clinical trials by one or more clinical trial sites;

· inability or unwillingness of patients or medical investigators to follow clinical trial protocols; and

· inability to monitor patients adequately during or after treatment.

Our clinical trials may be suspended or terminated at any time by the FDA, other regulatory authorities, the institutional review board for any given site, or us. Any failure or significant delay in completing clinical trials for GlucoTrack or future product candidates, if any, could materially harm our financial results and the commercial prospects for our product candidates.

The regulatory approval process is expensive, time-consuming and uncertain and may prevent us from ever obtaining clearance or approval for the commercialization of the GlucoTrack DF-F or our future product candidates, if any.

The research, testing, manufacturing, labeling, approval, selling, marketing and distribution of medical devices are subject to extensive regulation by the FDA and other non-U.S. regulatory authorities, which regulations differ from country to country. We are not permitted to market our product candidates in the United States until we receive a clearance letter under the 510(k) premarket notification process or approval of a Section 515 premarket approval from the FDA, depending on the nature of the device. We have not submitted an application or premarket notification for or received marketing clearance or approval for any of our product candidates. Obtaining approval of any premarket approval can be a lengthy, expensive and uncertain process. While the FDA normally reviews and clears a premarket notification in three months, there is no guarantee that our products will qualify for this more expeditious regulatory process, which is reserved for Class I and II devices, nor is there any assurance that, even if a device is reviewed under the 510(k) premarket notification process, the FDA will review it expeditiously or determine that the device is substantially equivalent to a lawfully marketed non-premarket approval device. If the FDA fails to make this finding, then we cannot market the device. In lieu of acting on a premarket notification, the FDA may seek additional information or additional data which would further delay our ability to market the product. In addition, failure to comply with FDA, non-U.S. regulatory authorities or other applicable U.S. and non-U.S. regulatory requirements may, either before or after product clearance or approval, if any, subject us to administrative or judicially imposed sanctions, including:

· restrictions on the products, manufacturers or manufacturing process;

|

|

·

|

adverse inspectional observations (Form 483), warning letters or non-warning letters incorporating inspectional observations, i.e., so-called “untitled letter”;

|

· civil and criminal penalties;

· injunctions;

· suspension or withdrawal of regulatory clearances or approvals;

· product seizures, detentions or import bans;

· voluntary or mandatory product recalls and publicity requirements;

· total or partial suspension of production;

· imposition of restrictions on operations, including costly new manufacturing requirements; and

· refusal to clear or approve pending applications or premarket notifications.

Regulatory approval of a premarket approval application, premarket approval application supplement or clearance pursuant to a 510(k) premarket notification is not guaranteed, and the approval or clearance process, as the case may be, is expensive and may, especially in the case of the premarket approval application, take several years. The FDA also has substantial discretion in the medical device clearance or approval processes. Despite the time and expense exerted, failure can occur at any stage and we could encounter problems that cause us to abandon clinical trials or to repeat or perform additional preclinical studies and clinical trials. The number of preclinical studies and clinical trials that will be required for FDA clearance or approval varies depending on the medical device candidate, the disease or condition that the medical device candidate is designed to address, and the regulations applicable to any particular medical device candidate. The FDA can delay, limit or deny clearance or approval of a medical device candidate for many reasons, including:

· a medical device candidate may not be deemed safe or effective, in the case of a premarket approval application;

|

|

·

|

a medical device candidate may not be deemed to be substantially equivalent to a lawfully marketed non-premarket approval device in the case of a 510(k) premarket notification;

|

· FDA officials may not find the data from the clinical trials sufficient;

· the FDA might not approve our third-party manufacturer’s processes or facilities; or

· the FDA may change its clearance or approval policies or adopt new regulations.

Failure to timely and sufficiently recruit and enroll patients for clinical trials may cause the development of our product candidates to be delayed, which could increase development costs.

We may encounter delays if we are unable to recruit, enroll and retain enough patients to complete clinical trials. Patient enrollment depends on many factors, including the size of the patient population, the nature of the protocol, the proximity of patients to clinical sites and the eligibility and exclusion criteria for the trial. Delays in patient enrollment are not unusual. Any such delays in planned patient enrollment may result in increased costs, which could harm our ability to develop products.

Even if we obtain regulatory clearances or approvals for the GlucoTrack DF-F or our future product candidates, if any, the terms of clearances or approvals and ongoing regulation of our products may limit how we manufacture and market our product candidates, which could materially impair our ability to generate anticipated revenues.