UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ________________

Commission file number:

(Exact name of registrant as specified in its charter) |

| ||

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

|

( |

(Registrant’s telephone number, including area code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one).

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☐ | Smaller reporting company | ||

(Do not check if a smaller reporting company) |

|

| |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of May 3, 2024 there were

VERDE RESOURCES, INC.

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2024

TABLE OF CONTENTS

|

|

| PAGE |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| F-1 |

| ||

|

|

|

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

| 4 |

| |

|

|

|

|

|

| 10 |

| ||

|

|

|

|

|

| 10 |

| ||

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| 11 |

| ||

|

|

|

|

|

| 11 |

| ||

|

|

|

|

|

Unregistered Sales of Equity Securities and Use of Proceeds. |

| 11 |

| |

|

|

|

|

|

| 11 |

| ||

|

|

|

|

|

| 11 |

| ||

|

|

|

|

|

| 11 |

| ||

|

|

|

|

|

| 12 |

| ||

|

|

|

|

|

|

| 13 |

|

| 2 |

| Table of Contents |

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. All statements, other than statements of historical facts, included in this Form 10-Q including, without limitation, statements in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding the Company’s financial position, business strategy and the plans and objectives of management for future operations, events or developments which the Company expects or anticipates will or may occur in the future, including such things as future capital expenditures (including the amount and nature thereof); expansion and growth of the Company’s business and operations; and other such matters are forward-looking statements. These statements are based on certain assumptions and analyses made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate under the circumstances. However, whether actual results or developments will conform with the Company’s expectations and predictions is subject to a number of risks and uncertainties, including general economic, market and business conditions; the business opportunities (or lack thereof) that may be presented to and pursued by the Company; changes in laws or regulation; and other factors, most of which are beyond the control of the Company.

These forward-looking statements can be identified by the use of predictive, future-tense or forward-looking terminology, such as “believes,” “anticipates,” “expects,” “estimates,” “plans,” “may,” “will,” or similar terms. These statements appear in a number of places in this filing and include statements regarding the intent, belief or current expectations of the Company, and its directors or its officers with respect to, among other things: (i) trends affecting the Company’s financial condition or results of operations for its limited history; (ii) the Company’s business and growth strategies; and, (iii) the Company’s financing plans. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Such factors that could adversely affect actual results and performance include, but are not limited to, the Company’s limited operating history, potential fluctuations in quarterly operating results and expenses, government regulation, technological change and competition. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to our filings with the SEC under the Exchange Act and the Securities Act of 1933, as amended, including our Current Report on Form 10-K and Form 10-K/A filed with the Securities and Exchange Commission on October 16, 2023 and February 15, 2024 respectively.

Consequently, all of the forward-looking statements made in this Form 10-Q are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequence to or effects on the Company or its business or operations. The Company assumes no obligations to update any such forward-looking statements.

| 3 |

| Table of Contents |

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and Item Regulation S-X, Rule 10-01(c) Interim Financial Statements, and, therefore, do not include all information and footnotes necessary for a complete presentation of financial position, results of operations, cash flows, and stockholders’ equity in conformity with generally accepted accounting principles. In the opinion of management, all adjustments considered necessary for a fair presentation of the results of operations and financial position have been included and all such adjustments are of a normal recurring nature. Operating results for the nine months ended March 31, 2024 are not necessarily indicative of the results that can be expected for the year ended June 30, 2024.

VERDE RESOURCES, INC.

INDEX TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED MARCH 31, 2024

|

| Page |

|

|

|

|

|

Unaudited Condensed Consolidated Balance Sheets as at March 31, 2024 and June 30, 2023 (audited) |

| F-2 |

|

|

|

|

|

| F-3 |

| |

|

|

|

|

| F-4 |

| |

|

|

|

|

| F-5 |

| |

|

|

|

|

Notes to Unaudited Condensed Consolidated Financial Statements |

| F-7 |

|

| F-1 |

| Table of Contents |

VERDE RESOURCES, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Currency expressed in United States Dollars (“US$”), except for number of shares)

|

| March 31, 2024 |

|

| June 30, 2023 |

| ||

ASSETS |

|

|

| (audited) |

| |||

Current assets: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ |

|

| $ |

| ||

Accounts receivable |

|

|

|

|

|

| ||

Inventories |

|

|

|

|

|

| ||

Amount due from related party |

|

|

|

|

|

| ||

Advance to supplier |

|

|

|

|

|

| ||

Prepayments |

|

|

|

|

|

| ||

Other receivables and deposits |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

|

|

|

| ||

Right of use assets, net |

|

|

|

|

|

| ||

Intangible assets |

|

|

|

|

|

| ||

Security deposit |

|

|

|

|

|

| ||

Deposit paid for acquisition of subsidiaries |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Total non-current assets |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

LIABILTIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

| $ |

|

| $ |

| ||

Accrued liabilities and other payables |

|

|

|

|

|

| ||

Finance lease liabilities |

|

|

|

|

|

| ||

Operating lease liability |

|

|

|

|

|

| ||

Bank loan |

|

|

|

|

|

| ||

Amount due to director |

|

|

|

|

|

| ||

Amounts due to related parties |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Non-current liabilities: |

|

|

|

|

|

|

|

|

Finance lease liabilities |

|

|

|

|

|

| ||

Operating lease liability |

|

|

|

|

|

| ||

Promissory notes |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Total non-current liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

Preferred stock, $ |

|

|

|

|

|

| ||

Common stock, $ |

|

|

|

|

|

| ||

Common stock, $ |

|

|

|

|

|

| ||

Common stock, $ |

|

| ( | ) |

|

|

| |

Additional paid-in capital |

|

|

|

|

|

| ||

Accumulated other comprehensive income |

|

| ( | ) |

|

| ( | ) |

Accumulated deficit |

|

| ( | ) |

|

| ( | ) |

Stockholders’ equity |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

| $ |

|

| $ |

| ||

See accompanying notes to unaudited condensed consolidated financial statements.

| F-2 |

| Table of Contents |

VERDE RESOURCES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME

(Currency expressed in United States Dollars (“US$”), except for number of shares)

|

| Three Months ended March 31, |

|

| Nine Months ended March 31, |

| ||||||||||

|

| 2024 |

|

| 2023 |

|

| 2024 |

|

| 2023 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Revenue |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross (loss)/profit |

|

| ( | ) |

|

| ( | ) |

|

|

|

| ( | ) | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

Total operating expenses |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS FROM OPERATION |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

Rental income |

|

|

|

|

|

|

|

| |

|

|

| |

| ||

Other (expense) income |

|

| ( | ) |

|

|

|

|

|

|

|

|

| |||

Total other (expense) income, net |

|

| ( | ) |

|

|

|

|

| ( | ) |

|

| ( | ) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS BEFORE INCOME TAXES |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operation |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

Loss from discontinued operation |

|

|

|

|

| ( | ) |

|

|

|

|

| ( | ) | ||

NET LOSS |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss) : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– Foreign currency adjustment income |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE LOSS |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– Basic |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

– Diluted |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average Common Shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– Basic |

|

|

|

|

|

|

|

|

|

|

|

| ||||

– Diluted |

|

|

|

|

|

|

|

|

|

|

|

| ||||

See accompanying notes to unaudited condensed consolidated financial statements.

| F-3 |

| Table of Contents |

VERDE RESOURCES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Currency expressed in United States Dollars (“US$”))

|

| Nine Months ended March 31, |

| |||||

|

| 2024 |

|

| 2023 |

| ||

|

|

|

|

|

|

| ||

Cash flows from operating activities: |

|

|

|

|

|

| ||

Net loss |

| $ | ( | ) |

| $ | ( | ) |

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash (used in) operating activities |

|

|

|

|

|

|

|

|

Depreciation of property, plant and equipment |

|

|

|

|

|

| ||

Amortization |

|

|

|

|

|

| ||

Stock-based compensation |

|

|

|

|

|

| ||

Finance cost interest element of promissory notes (non-cash) |

|

|

|

|

|

| ||

Lease interest expense |

|

|

|

|

|

| ||

Fair value adjustment on convertible promissory note |

|

|

|

|

| ( | ) | |

Deposit paid for acquisition of subsidiary written off |

|

|

|

|

|

| ||

Impairment on trade receivables |

|

|

|

|

|

| ||

Impairment on other receivables |

|

|

|

|

|

| ||

Gain on disposal of property, plant and equipment |

|

|

|

|

| ( | ) | |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

|

|

|

| ||

Other receivables, deposits and prepayments |

|

| ( | ) |

|

| ( | ) |

Inventories |

|

| ( | ) |

|

| ( | ) |

Accounts payables |

|

|

|

|

|

| ||

Accrued liabilities and other payables |

|

| ( | ) |

|

|

| |

Advanced to director |

|

| ( | ) |

|

| ( | ) |

Advanced from related parties |

|

|

|

|

|

| ||

Net cash used in operating activities |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Proceeds from disposal of property, plant and equipment |

|

|

|

|

|

| ||

Proceed from disposal of discontinued operation, net |

|

|

|

|

|

| ||

Payments of deposit for acquisition of subsidiary company |

|

|

|

|

| ( | ) | |

Net cash flows on acquisition of subsidiary company |

|

|

|

|

|

| ||

Purchase of property, plant and equipment |

|

| ( | ) |

|

| ( | ) |

Net cash used in investing activities |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

Repayments to lease liabilities |

|

| ( | ) |

|

| ( | ) |

Drawdown of bank loan |

|

|

|

|

|

| ||

Repayment of bank loan |

|

| ( | ) |

|

| ( | ) |

Lease interest paid |

|

| ( | ) |

|

| ( | ) |

Advanced from related parties |

|

|

|

|

|

| ||

Advanced from other payables |

|

|

|

|

|

| ||

Proceeds from issuance of common stock and common stock to be issued |

|

|

|

|

|

| ||

Net cash provided by financing activities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Net change in cash and cash equivalent |

|

|

|

|

| ( | ) | |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents |

|

|

|

|

| ( | ) | |

|

|

|

|

|

|

|

|

|

BEGINNING OF PERIOD |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

END OF PERIOD |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

Cash paid for income taxes |

| $ |

|

| $ |

| ||

Cash paid for interest |

| $ |

|

| $ |

| ||

See accompanying notes to unaudited condensed consolidated financial statements.

| F-4 |

| Table of Contents |

VERDE RESOURCES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE NINE MONTHS ENDED MARCH 31, 2024 AND 2023

(Currency expressed in United States Dollars (“US$”), except for number of shares)

|

|

No. of Shares |

|

| Common shares Stock |

|

| Shares to be issued Amount |

|

| Shares to be cancelled Amount |

|

| Additional paid-in capital |

|

| Accumulated other comprehensive (loss) income |

|

| Accumulated losses |

|

| Total stockholders’ equity |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Balance as of July 1, 2023 |

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ | ( | ) |

| $ |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares to be issued to service provider |

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Shares issued for private placement |

|

|

|

|

|

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Common stock subject to forfeiture |

|

| ( | ) |

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) |

|

| - |

|

|

|

|

|

| ( | ) | |||

Shares to be issued for private placement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - |

|

|

|

| |||||||

Net loss for the period |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||||

Foreign currency translation adjustment |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

| ( | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of December 31,2023 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

|

| $ | ( | ) |

| $ | ( | ) |

| $ |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares issued for previously committed private placement |

|

| - |

|

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Shares previously committed issued to service provider |

|

| - |

|

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Shares to be issued for private placement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Shares cancelled |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ( | ) | |||||

Shares to be issued to service provider |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net loss for the period |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||||

Foreign currency translation adjustment |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of March 31, 2024 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

|

| $ | ( | ) |

| $ | ( | ) |

| $ |

| |||||

| F-5 |

| Table of Contents |

VERDE RESOURCES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE NINE MONTHS ENDED MARCH 31, 2024 AND 2023

(Currency expressed in United States Dollars (“US$”), except for number of shares)

|

| Common Stock shares |

|

| Common Stock Amount |

|

| Shares to be issued Amount |

|

| Additional paid-in capital |

|

| Accumulated other comprehensive income |

|

| Accumulated losses |

|

| Accumulated other comprehensive income of disposal group held for sale |

|

| Total stockholders’ equity |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Balance as of July 1, 2022 |

|

|

|

| $ |

|

| $ | - |

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

|

| $ |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share issued to service provider |

|

|

|

|

|

|

|

|

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

| |||||||

Shares issued for private placement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - |

|

|

|

|

|

|

| |||||||

Shares issued for conversion of promissory note (“PN”) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - |

|

|

|

| |||||||

Fair value adjustment on conversion of PN |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Net loss for the period |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

| ( | ) | |||||

Foreign currency translation adjustment |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

| ( | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of December 31,2022 |

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

|

| $ |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares issued to service provider |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Shares to be issued for private placement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Net loss for the period |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

| ( | ) | |||||

Foreign currency translation adjustment |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Reclassification arising from disposal group held for sale |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of March 31, 2023 |

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

|

| $ |

| |||||||

See accompanying notes to unaudited condensed consolidated financial statements.

| F-6 |

| Table of Contents |

VERDE RESOURCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED MARCH 31, 2024 AND 2023

(Currency expressed in United States Dollars (“US$”), except for number of shares)

NOTE 1 - ORGANIZATION AND BUSINESS BACKGROUND

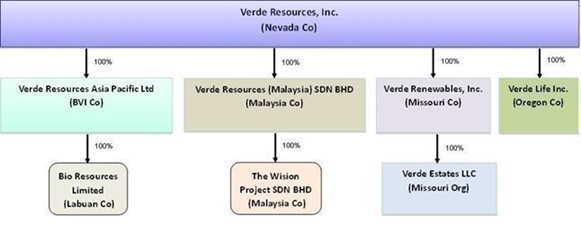

Verde Resources, Inc. (the “We” or “Company” or “VRDR”) was incorporated on April 22, 2010, in the State of Nevada, U.S.A..

We currently operate in the distribution of THC-free cannabinoid (CBD) products, production and distribution of renewable commodities and real property holding. However, the Company has been undergoing a restructuring exercise to shift its focus towards renewable energy and sustainability development with the world faced with challenges of climate change and environmental dehydration.

As of March 31, 2024, the Company has the following subsidiaries:-

Company name |

|

Place of incorporation |

| Principal activities and place of operation |

| Effective interest held |

|

|

|

|

|

|

|

Verde Resources Asia Pacific Limited (“VRAP”) |

|

|

| |||

|

|

|

|

|

|

|

Verde Resources (Malaysia) Sdn Bhd (“Verde Malaysia”) |

|

|

| |||

|

|

|

|

|

|

|

Verde Renewables, Inc. (“VRI”) |

|

|

| |||

|

|

|

|

|

|

|

Verde Life Inc. (“VLI”) |

|

|

| |||

|

|

|

|

|

|

|

The Wision Project Sdn Bhd (“Wision”) |

|

|

| |||

|

|

|

|

|

|

|

Verde Estates LLC (“VEL”) |

|

|

| |||

|

|

|

|

|

|

|

Bio Resources Limited (“BRL”) |

|

|

|

The Company and its subsidiaries are hereinafter referred to as (the “Company”).

| F-7 |

| Table of Contents |

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited condensed consolidated financial statements reflect the application of certain significant accounting policies as described in this note and elsewhere in the accompanying unaudited condensed consolidated financial statements and notes.

· | Basis of Presentation |

The accompanying unaudited condensed consolidated financial statements have been prepared by management in accordance with both accounting principles generally accepted in the United States (“GAAP”), and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Certain information and note disclosures normally included in audited financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted pursuant to those rules and regulations, although the Company believes that the disclosures made are adequate to make the information not misleading.

In the opinion of management, the condensed consolidated balance sheet as of June 30, 2023 which has been derived from audited financial statements and these unaudited condensed consolidated financial statements reflect all normal and recurring adjustments considered necessary to state fairly the results for the periods presented. The results for the period ended March 31, 2024 are not necessarily indicative of the results to be expected for the entire fiscal year ending June 30, 2024 or for any future period.

These unaudited condensed consolidated financial statements and notes thereto should be read in conjunction with the Management’s Discussion and the audited financial statements and notes thereto included in the Annual Report on Form 10-K for the year ended June 30, 2023, filed with the SEC on October 16, 2023.

· | Use of Estimates and Assumptions |

The preparation of unaudited condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates. The Company’s periodic filings with the Securities and Exchange Commission include, where applicable, disclosures of estimates, assumptions, uncertainties and markets that could affect the financial statements and future operations of the Company.

In preparing these unaudited condensed consolidated financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheet and revenues and expenses during the periods reported. Actual results may differ from these estimates.

· | Basis of Consolidation |

The unaudited condensed consolidated financial statements include the financial statements of Verde Resources, Inc. and its subsidiaries. All significant inter-company balances and transactions within the Company and its subsidiaries have been eliminated upon consolidation. The Company accounts for acquisitions in accordance with guidance found in ASC 805, Business Combinations. The guidance requires consideration given, including contingent consideration, assets acquired, and liabilities assumed to be valued at their fair market values at the acquisition date.

· | Segment Reporting |

Accounting Standard Codification (“ASC”) Topic 280, Segment Reporting establishes standards for reporting information about operating segments on a basis consistent with the Company’s internal organization structure as well as information about geographical areas, business segments and major customers in consolidated financial statements. Currently, the Company operates in four reportable operating segments.

· | Concentrations of Credit Risk |

The Company’s financial instruments that are exposed to concentrations of credit risk primarily consist of its cash and cash equivalents, accounts receivable and related party receivables, advance to suppliers and other receivables and deposits. The Company places its cash and cash equivalents with financial institutions of high credit worthiness. At times, its cash and cash equivalents with a particular financial institution may exceed any applicable government insurance limits. The Company’s management also assesses the financial strength and credit worthiness of any parties to which it extends funds or trades with, and as such, it believes that any associated credit risk exposures are limited.

· | Risks and Uncertainties |

The Company is venturing into the production and distribution of renewable commodities that are subject to significant risks and uncertainties, including financial, operational, technological, and other risks associated with a production operation for renewable commodities, including the potential risk of business failure.

· | Cash and Cash Equivalents |

Cash and cash equivalents are carried at cost and represent cash in banks, money market funds, and certificates of term deposits with maturities of less than three months, which are readily convertible to known amounts of cash and which, in the opinion of management, are subject to an insignificant risk of loss in value. The Company had $

At March 31, 2024 and June 30, 2023, cash and cash equivalents consisted of bank deposits and petty cash on hands.

| F-8 |

| Table of Contents |

· | Accounts Receivable |

Accounts receivable are recognized and carried at net realizable value. An allowance for doubtful accounts will be recorded in the period when a loss is probable based on an assessment of specific evidence indicating troubled collection, historical experience, accounts aging, ongoing business relation and other factors. Accounts are written off after exhaustive efforts at collection. If accounts receivable are to be provided for, or written off, they would be recognized in the consolidated statement of operations within operating expenses. As of March 31, 2024 and June 30, 2023, the longest credit term for certain customers are

For the three and nine months ended March 31, 2024, the allowance for doubtful debts for accounts receivables amounted to $

· | Expected Credit Loss |

ASU No. 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments requires entities to use a current lifetime expected credit loss methodology to measure impairments of certain financial assets. Using this methodology will result in earlier recognition of losses than under the previous incurred loss approach, which requires waiting to recognize a loss until it is probable of having been incurred. There are other provisions within the standard that affect how impairments of other financial assets may be recorded and presented, and that expand disclosures. The Company adopted the new standard effective July 1, 2023, the first day of the Company’s fiscal year and applied to accounts receivable and other financial instruments. The adoption of this guidance did not materially impact the net earning and financial position and has no impact on the cash flows.

· | Inventories |

Inventories are stated at the lower of cost or market value (net realizable value), cost being determined on a first-in-first-out method. Cost of raw materials include cost of materials and incidental costs in bringing the inventory to its current location. Costs of finished goods, on the other hand include material, labor and overhead costs. The Company provides inventory allowances based on excess and obsolete inventories determined principally by customer demand.

As of March 31, 2024 and June 30, 2023, the Company did not record an allowance for obsolete inventories, nor have there been any write-offs.

· | Property, Plant and Equipment |

Property, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis over the following expected useful lives from the date on which they become fully operational and after taking into account their estimated residual values:

|

| Expected useful life |

|

Land and buildings |

|

| |

Plant and machinery |

|

| |

Office equipment |

|

| |

Computer |

|

| |

Motor vehicles |

|

| |

Furniture and fittings |

|

| |

Renovation |

|

|

Expenditures for maintenance and repairs, which do not materially extend the useful lives of the assets, are charged to expense as incurred. Expenditures for major renewals and betterment which substantially extend the useful life of assets are capitalized. The cost and related accumulated depreciation of assets retired or sold are removed from the respective accounts, and any gain or loss is recognized in the unaudited condensed consolidated statements of income and other comprehensive income in other income or expenses.

Depreciation expense for the three months ended March 31, 2024 and 2023 totaled $

Depreciation expense for the nine months ended March 31, 2024 and 2023 were $

· | Intangible assets |

Intangible assets acquired from third parties are measured initially at fair value , and where they have an infinite live, are not amortized. The Company annually evaluates the recoverability of the infinite-lived intangible assets for possible impairment whenever events or circumstances indicate that the carrying amount of such assets may not be recoverable. The recoverability of these assets is measured by a comparison of the carrying amounts to the future discounted cash flows the assets are expected to generate. If such a review indicates that the carrying amount of intangible assets is not recoverable, the carrying amount of such assets is reduced to fair value.

As of March 31, 2024 and June 30, 2023, the Company did not record an impairment on the intangible assets.

· | Impairment of Long-lived Assets |

In accordance with the provisions of ASC Topic 360, Impairment or Disposal of Long-Lived Assets, all long-lived assets such as property and equipment and intangible assets owned and held by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is evaluated by a comparison of the carrying amount of an asset to its estimated future undiscounted cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amounts of the assets exceed the fair value of the assets.

There has been no impairment charge for the three and nine months ended March 31, 2024 and 2023.

| F-9 |

| Table of Contents |

· | Advance to Supplier |

Advance to supplier is provided for the provision of goods and services and they are secured either by a security deposit or a legally enforceable right to recover.

· | Revenue Recognition |

ASC Topic 606, Revenue from Contracts with Customers (“ASC Topic 606”), establishes principles for reporting information about the nature, amount, timing and uncertainty of revenue and cash flows arising from the entity’s contracts to provide goods or services to customers.

The Company applies the following five steps in order to determine the appropriate amount of revenue to be recognized as it fulfills its obligations under each of its agreements:

· | identify the contract with a customer; |

· | identify the performance obligations in the contract; |

· | determine the transaction price; |

· | allocate the transaction price to performance obligations in the contract; and |

· | recognize revenue as the performance obligation is satisfied. |

Revenue is recognized when the Company satisfies its performance obligation under the contract by transferring the promised product to its customer that obtains control of the product which typically occurs at delivery date at a point in time, and collection is reasonably assured. A performance obligation is a promise in a contract to transfer a distinct product or service to a customer. Most of the Company’s contracts have a single performance obligation, as the promise to transfer products or services is not separately identifiable from other promises in the contract and, therefore, not distinct.

The Company considers customer order confirmations, whether formal or otherwise, to be a contract with the customer. In determining the transaction price, the Company evaluates whether the price is subject to refund or adjustment to determine the net consideration to which the Company expects to be entitled.

The Company also follows the guidance provided in ASC 606, Revenue from Contracts with Customers, for determining whether the Company is the principal or an agent in arrangements with customers that involve another party that contributes to the provision of goods to a customer. In these instances, the Company determines whether it has promised to provide the goods itself (as principal) or to arrange for the specified goods to be provided by another party (as an agent). This determination is a matter of judgment that depends on the facts and circumstances of each arrangement.

The Company derives its revenue from the sale of products and services in its role as a principal.

Rental income

Rental income is recognized on a straight line basis over the term of the respective lease agreement.

· | Cost of revenue |

Cost of revenue consists primarily of the cost of goods sold, which are directly attributable to the sales of products.

· | Leases |

The Company determines if an arrangement is a lease or contains a lease at inception. Operating lease liabilities are recognized based on the present value of the remaining lease payments, discounted using the discount rate for the lease at the commencement date. As the rate implicit in the lease is not readily determinable for the operating lease, the Company generally uses an incremental borrowing rate based on information available at the commencement date to determine the present value of future lease payments. Operating lease right-of-use (“ROU assets”) assets represent the Company’s right to control the use of an identified asset for the lease term and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. ROU assets are generally recognized based on the amount of the initial measurement of the lease liability. Lease expense is recognized on a straight-line basis over the lease term.

ROU assets are reviewed for impairment when indicators of impairment are present. ROU assets from operating and finance leases are subject to the impairment guidance in ASC Topic 360, Property, Plant, and Equipment, as ROU assets are long-lived nonfinancial assets.

ROU assets are tested for impairment individually or as part of an asset group if the cash flows related to the ROU asset are not independent from the cash flows of other assets and liabilities. An asset group is the unit of accounting for long-lived assets to be held and used, which represents the lowest level for which identifiable cash flows are largely independent of the cash flows of other groups of assets and liabilities.

The Company recognized no impairment of ROU assets as of March 31, 2024 and June 30, 2023.

The operating lease is included in operating lease right-of-use assets and operating lease liabilities as current and non-current liabilities in the unaudited condensed consolidated balance sheets at March 31, 2024 and June 30, 2023.

| F-10 |

| Table of Contents |

Leases that transfer substantially all the rewards and risks of ownership to the lessee, other than legal title, are accounted for as finance leases. Substantially all of the risks or benefits of ownership are deemed to have been transferred if any one of the four criteria is met: (i) transfer of ownership to the lessee at the end of the lease term, (ii) the lease containing a bargain purchase option, (iii) the lease term exceeding 75% of the estimated economic life of the leased asset, (iv) the present value of the minimum lease payments exceeding 90% of the fair value. At the inception of a finance lease, we as the lessee records an asset and an obligation at an amount equal to the present value of the minimum lease payments. The leased asset is amortized over the shorter of the lease term or its estimated useful life if title does not transfer to us, while the leased asset is depreciated in accordance with our depreciation policy if the title is to eventually transfer to us. The periodic rent payments made during the lease term are allocated between a reduction in the obligation and interest element using the effective interest method in accordance with the provisions of ASC Topic 842.

· | Income Taxes |

The Company adopted the ASC Topic 740, Income tax provisions of paragraph 740-10-25-13, which addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the unaudited condensed consolidated financial statements. Under paragraph 740-10-25-13, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the unaudited condensed consolidated financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon ultimate settlement. Paragraph 740-10-25-13 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. The Company had no material adjustments to its liabilities for unrecognized income tax benefits according to the provisions of paragraph 740-10-25-13.

The estimated future tax effects of temporary differences between the tax basis of assets and liabilities are reported in the accompanying balance sheets, as well as tax credit carry-backs and carry-forwards. The Company periodically reviews the recoverability of deferred tax assets recorded on its balance sheets and provides valuation allowances as management deems necessary.

Uncertain Tax Positions

The Company did not take any uncertain tax positions and had no adjustments to its income tax liabilities or benefits pursuant to the ASC Topic 740 provisions of Section 740-10-25 for the three and nine months ended March 31, 2024 and 2023.

· | Foreign Currencies Translation |

The Company’s functional and reporting currency is the United States dollar (“US$”) and the accompanying unaudited condensed consolidated financial statements have been expressed in United States dollars. The Company’s subsidiaries in Malaysia have functional currency of Malaysian Ringgit (“MYR”), being the primary currency of the economic environment in which their operations are conducted.

Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the unaudited condensed consolidated statement of operations.

For reporting purposes, in accordance with ASC Topic 830 ”Translation of Financial Statements”, capital accounts of the unaudited condensed consolidated financial statements are translated into United States dollars from MYR at their historical exchange rates when the capital transactions occurred. Assets and liabilities are translated at the exchange rates as of balance sheet date. Income and expenditures are translated at the average exchange rate of the respective period. The gains and losses resulting from translation of financial statements subsidiaries to the reporting currency are recorded as a separate component of accumulated other comprehensive income within the statements of changes in stockholder’s equity.

Translation of MYR into U.S. dollars has been made at the following exchange rates for the following periods:-

|

| March 31, 2024 |

|

| March 31, 2023 |

| ||

Period-end MYR:US$ exchange rate |

|

|

|

|

|

| ||

Average period MYR:US$ exchange rate |

|

|

|

|

|

| ||

· | Comprehensive Income |

ASC Topic 220, Comprehensive Income, establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated other comprehensive income, as presented in the accompanying unaudited condensed consolidated statements of changes in stockholders’ equity, consists of changes in unrealized gains and losses on foreign currency translation. This comprehensive income is not included in the computation of income tax expense or benefit.

· | Net Loss per Share |

The Company calculates net loss per share in accordance with ASC Topic 260, Earnings per Share. Basic income per share is computed by dividing the net income by the weighted-average number of Common Shares outstanding during the period. Diluted income per share is computed similar to basic income per share except that the denominator is increased to include the number of additional Common Shares that would have been outstanding if the potential Common Stock equivalents had been issued and if the additional Common Shares were dilutive.

| F-11 |

| Table of Contents |

· | Stock Based Compensation |

The Company accounts for stock-based compensation in accordance with ASC Topic 718-10, Compensation-Stock Compensation, which requires the measurement and recognition of compensation expense for all share-based payment awards made to employees, directors and non-employee including employee stock options, restricted stock units, and stock appreciation rights are based on estimated fair values. Stock-based compensation expense recognized during the period is based on the value of the portion of share-based payment awards that is ultimately expected to vest during the period.

· | Retirement Plan Costs |

Contributions to retirement plans (which are defined contribution plans) are charged to general and administrative expenses in the accompanying statements of operation as the related employee service are provided.

· | Mineral Acquisition and Exploration Costs |

Mineral property acquisition and exploration costs are expensed as incurred. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs incurred to develop such property are capitalized. Such costs will be amortized using the units-of-production method over the estimated life of the probable reserves.

· | Related Parties |

The Company follows the ASC 850-10, Related Party for the identification of related parties and disclosure of related party transactions.

Pursuant to section 850-10-20 the related parties include a) affiliates of the Company; b) entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of section 825–10–15, to be accounted for by the equity method by the investing entity; c) trusts for the benefit of employees, such as pension and Income-sharing trusts that are managed by or under the trusteeship of management; d) principal owners of the Company; e) management of the Company; f) other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g) other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The unaudited condensed consolidated financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated or combined financial statements is not required in those statements. The disclosures shall include: a) the nature of the relationship(s) involved; b) a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statements; c) the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d) amount due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

· | Commitments and Contingencies |

The Company follows the ASC 450-20, Commitments to report accounting for contingencies. Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or un-asserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or un-asserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s unaudited condensed consolidated financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. Management does not believe, based upon information available at this time that these matters will have a material adverse effect on the Company’s financial position, results of operations or cash flows. However, there is no assurance that such matters will not materially and adversely affect the Company’s business, financial position, and results of operations or cash flows.

| F-12 |

| Table of Contents |

· | Fair Value of Financial Instruments |

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and has adopted paragraph 820-10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 of the FASB Accounting Standards Codification establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements and related disclosures, paragraph 820-10-35-37 of the FASB Accounting Standards Codification establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three (3) levels of fair value hierarchy defined by paragraph 820-10-35-37 of the FASB Accounting Standards Codification are described below:

Level 1 | Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. |

|

|

Level 2 | Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. |

|

|

Level 3 | Pricing inputs that are generally observable inputs and not corroborated by market data. |

Financial assets are considered Level 3 when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least one significant model assumption or input is unobservable.

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. If the inputs used to measure the financial assets and liabilities fall within more than one level described above, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument.

The carrying amounts of the Company’s financial assets and liabilities, such as cash and cash equivalents, accounts receivable, prepayments and other receivables, accounts payable, accrued liabilities and other payables, loans payable, and amounts due to related parties approximate their fair values because of the short maturity of these instruments.

· | Recent Accounting Pronouncements |

During the period ended March 31, 2024, there have been no new, or existing, recently issued accounting pronouncements that are of significance, or potential significance, that impact the Company’s unaudited condensed consolidated financial statements.

In June 2016, the Financial Accounting Standards Board (“FASB”) issued new accounting guidance ASU 2016-13 for recognition of credit losses on financial instruments, which is effective January 1, 2020, with early adoption permitted on January 1, 2019. The guidance introduces a new credit reserving model known as the Current Expected Credit Loss (“CECL”) model, which is based on expected losses, and differs significantly from the incurred loss approach used today. The CECL model requires measurement of expected credit losses not only based on historical experience and current conditions, but also by including reasonable and supportable forecasts incorporating forward-looking information and will likely result in earlier recognition of credit reserves. In November 2019, the FASB issued ASU No. 2019-10, which is to update the effective date of ASU No. 2016-13 for private companies, not-for-profit organizations and certain smaller reporting companies applying for credit losses standard. The new effective date for these preparers is for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. The Company has adopted this update on July 1, 2023, and the adoption does not have material impact on Company’s consolidated financial statements and related disclosures.

CECL adoption will have broad impact on the financial statements of financial services firms, which will affect key profitability and solvency measures. Some of the more notable expected changes include:

– | Higher allowance on financial guarantee reserve and finance lease receivable levels and related deferred tax assets. While different asset types will be impacted differently, the expectation is that reserve levels will generally increase across the board for all financial firms. |

|

|

– | Increased reserve levels may lead to a reduction in capital levels. |

|

|

– | As a result of higher reserving levels, the expectation is that CECL will reduce cyclicality in financial firms’ results, as higher reserving in “good times” will mean that less dramatic reserve increases will be loan related income (which will continue to be recognized on a periodic basis based on the effective interest method) and the related credit losses (which will be recognized up front at origination). This will make periods of loan expansion seem less profitable due to the immediate recognition of expected credit losses. Periods of stable or declining loan levels will look comparatively profitable as the income trickles in for loans, where losses had been previously recognized. |

In March 2023, the FASB issued new accounting guidance, ASU 2023-01, for leasehold improvements associated with common control leases, which is effective for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years. Early adoption is permitted for both interim and annual financial statements that have not yet been made available for issuance. The new guidance introduced two issues: terms and conditions to be considered with leases between related parties under common control and accounting for leasehold improvements. The goals for the new issues are to reduce the cost associated with implementing and applying Topic 842 and to promote diversity in practice by entities within the scope when applying lease accounting requirements.

The Company has reviewed all recently issued, but not yet effective, accounting pronouncements and believe the future adoption of any such pronouncements may not be expected to cause a material impact on its financial condition or the results of its operations.

| F-13 |

| Table of Contents |

NOTE 3 - GOING CONCERN UNCERTAINTIES

The accompanying unaudited condensed consolidated financial statements have been prepared using the going concern basis of accounting, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

The Company has generated recurring losses and suffered from an accumulated deficit of $

The ability of the Company to survive is dependent upon, among other things, obtaining additional financing to continue operations, and development of its business plan. In response to these, management intends to raise additional funds through public or private placement offerings, and related party loans.

No assurance can be given that any future financing, if needed, will be available or, if available, that it will be on terms that are satisfactory to the Company. Even if the Company is able to obtain additional financing, if needed, it may contain undue restrictions on its operations, in the case of debt financing, or cause substantial dilution for its stockholders, in the case of equity financing.

These and other factors raise substantial doubt about the Company’s ability to continue as a going concern. These unaudited condensed consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets and liabilities that may result in the Company not being able to continue as a going concern.

| F-14 |

| Table of Contents |

NOTE 4 – BUSINESS SEGMENT INFORMATION

Currently, the Company currently has four reportable business segments, mainly operating in:

(i) | Distribution of THC-free cannabinoid (CBD) products; |

|

|

(ii) | Production and distribution of renewable commodities; |

|

|

(iii) | Holding of real property; and |

|

|

(iv) | Licensor of proprietary pyrolysis technology. |

In the period ended March 31, 2023, the business segment included the following, which has since been disposed:

(i) | Gold mineral mining. |

In the following table, revenue is disaggregated by primary major product line, and timing of revenue recognition. The table also includes a reconciliation of the disaggregated revenue with the reportable segments for the three and nine months ended March 31, 2024 and 2023:

|

| Three Months ended March 31, 2024 |

| |||||||||||||||||||||

|

| Distribution of THC-free cannabinoid (CBD) products |

|

| Production and distribution of renewable commodities |

|

| Holding property |

|

| Licensor of proprietary pyrolysis technology |

|

| Corporate unallocated |

|

| Consolidated |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Revenue |

| $ |

|

| $ |

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||

Cost of revenue |

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||

Gross profit/(loss) |

|

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||||

Selling, general & administrative expenses |

|

|

|

|

| ( | ) |

|

| ( | ) |

|

|

|

|

| ( | ) |

|

| ( | ) | ||

Loss from operations |

|

|

|

|

| ( | ) |

|

| ( | ) |

|

|

|

|

| ( | ) |

|

| ( | ) | ||

Interest expense |

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||

Rental income |

|

| |

|

|

| |

|

|

| |

|

|

| - |

|

|

| |

|

|

| |

|

Other income |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | ||||

Loss before income tax |

|