|

FORM N-14

|

|

|

THE SECURITIES ACT OF 1933

Pre-Effective Amendment No.

Post-Effective Amendment No.

|

*

*

|

|

LoCorr Investment Trust

(Exact Name of Registrant as Specified in Charter)

|

|

|

687 Excelsior Boulevard

Excelsior, MN 55331

(Address of Principal Executive Offices) (Zip Code)

|

|

|

Registrant’s Telephone Number, including Area Code: 952.767.2920

|

|

|

CT Corporation System

1300 East Ninth Street

Cleveland, OH 44114

(Name and Address of Agent for Service)

|

|

|

With copy to:

|

|

|

JoAnn Strasser

Thompson Hine LLP 41 South High Street, Suite 1700 Columbus, Ohio 43215-6101 |

|

Gaithersburg, MD 20878

|

Steben Managed Futures Strategy Fund

|

|

LoCorr Macro Strategies Fund

|

|

Class A Shares Target Fund (SKLAX)

|

Class A Shares Acquiring Fund (LFMAX)

|

|

|

Class C Shares Target Fund (SKLCX)

|

Class C Shares Acquiring Fund (LFMCX)

|

|

|

Class I Shares Target Fund (SKLIX)

|

Class I Shares Acquiring Fund (LFMIX)

|

|

|

Class N Shares Target Fund (SKLNX)

|

Class A Shares Acquiring Fund (LFMAX)

|

|

Sincerely,

|

|

|

Kenneth Steben

|

|

|

President

|

|

|

Steben Alternative Investment Funds

|

Gaithersburg, MD 20878

To Be Held January 17, 2020

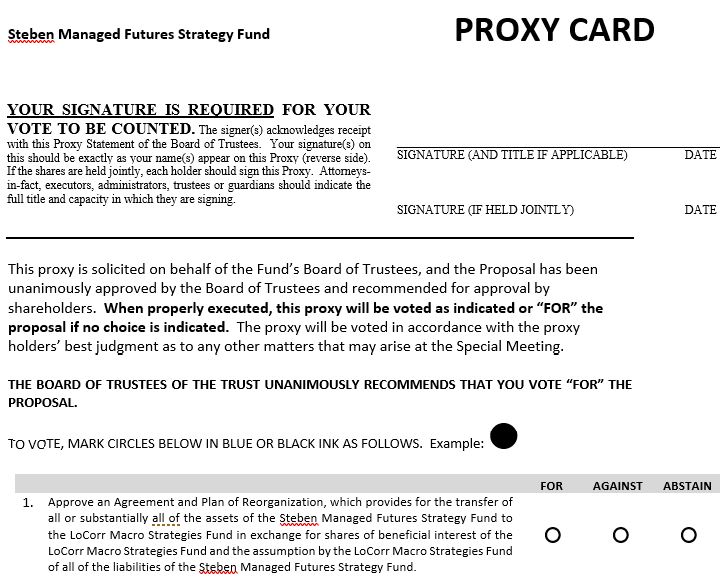

| Proposal: |

Approve an Agreement and Plan of Reorganization, which provides for the transfer of all or substantially all of the assets of the Steben Managed Futures Strategy Fund to the LoCorr Macro Strategies Fund in

exchange for shares of beneficial interest of the LoCorr Macro Strategies Fund and the assumption by the LoCorr Macro Strategies Fund of all of the liabilities of the Steben Managed Futures Strategy Fund.

|

Proposal.

STEBEN MANAGED FUTURES STRATEGY FUND,

Gaithersburg, MD 20878

by and in exchange for shares of beneficial interest of

a series of LoCorr Investment Trust

INTRODUCTION

| Proposal: |

Approve an Agreement and Plan of Reorganization, which provides for the transfer of all or substantially all of the assets of the Steben Managed Futures Strategy Fund to the LoCorr Macro Strategies Fund in

exchange for shares of beneficial interest of the LoCorr Macro Strategies Fund and the assumption by the LoCorr Macro Strategies Fund of all of the liabilities of the Steben Managed Futures Strategy Fund.

|

|

Steben Managed Futures Strategy Fund

|

LoCorr Macro Strategies Fund t

|

|

|

Class A Shares Target Fund (SKLAX)

|

à

|

Class A Shares Acquiring Fund (LFMAX)

|

|

Class C Shares Target Fund (SKLCX)

|

à

|

Class C Shares Acquiring Fund (LFMCX)

|

|

Class I Shares Target Fund (SKLIX)

|

à

|

Class I Shares Acquiring Fund (LFMIX)

|

|

Class N Shares Target Fund (SKLNX)

|

à

|

Class A Shares Acquiring Fund (LFMAX)

|

| • |

The Target Fund’s Prospectus and Statement of Additional Information filed in Post-Effective Amendment No. 16 to Steben Alternative Investment Funds’ registration statement on Form N-1A (File Nos.

811-22880 and 333-190813), dated July 29, 2019, filed on July 26, 2019, as supplemented;

|

| • |

The Acquiring Fund’s Prospectus and Statement of Additional Information filed in Post-Effective Amendment No. 45 to LoCorr Investment Trust’s registration statement on Form N-1A (File Nos. 811-22509 and

333-171360), dated March 1, 2019, filed on March 1, 2019, as supplemented;

|

| • |

The Target Fund’s Annual Report, filed on Form N-CSR (File No. 811-22880), for the fiscal year ended March 31, 2019, filed on June 3, 2019;

|

| • |

The Target Fund’s Semi-Annual Report, filed on Form N-CSRS (File No. 81122880), for the six-month period ended September 30, 2019, filed on November 25, 2019;

|

| • |

The Acquiring Fund’s Annual Report, filed on Form N-CSR (File No. 811-22509), for the fiscal year ended December 31, 2018, filed on March 6, 2019; and

|

| • |

The Acquiring Fund’s Semi-Annual Report, filed on Form N-CSRS (File No. 811-22509), for the six-month period ended June 30, 2019, filed on September 5, 2019.

|

DECEMBER 18, 2019

|

Table of Contents

|

|

QUESTIONS AND ANSWERS

|

1

|

|

PROPOSAL – THE REORGANIZATION OF STEBEN MANAGED FUTURES STRATEGY FUND \INTO LOCORR MACRO STRATEGIES FUND

|

|

|

SUMMARY

|

9

|

|

Comparison of Management Fees

|

9

|

|

Current Fees and Expenses

|

9

|

|

Shareholder Fees

|

9

|

|

Annual Fund Operating Expenses

|

10

|

|

Fund Turnover

|

12

|

|

Investment Objectives

|

13

|

|

Principal Investment Strategies

|

13

|

|

Principal Investment Risks

|

17

|

|

Comparison of Fund Performance

|

27

|

|

Management of the Funds

|

29

|

|

Buying and Selling Fund Shares

|

30

|

|

Tax Information

|

30

|

|

Payments to Broker-Dealers, Insurers, and Other Financial Intermediaries

|

31

|

|

THE REORGANIZATION

|

32

|

|

The Plan

|

32

|

|

Reasons for the Reorganization

|

33

|

|

U.S. Federal Income Tax Consequences

|

35

|

|

Securities to Be Issued, Shareholder Rights

|

36

|

|

Capitalization

|

37

|

|

ADDITIONAL INFORMATION ABOUT THE FUNDS

|

37

|

|

Additional Investment Strategies and General Fund Policies

|

37

|

|

Acquiring Fund – Additional Information about the Fund’s Subadvisers’ Processes

|

40

|

|

Fundamental Investment Policies and Restrictions

|

42

|

|

Target Fund

|

42

|

|

Acquiring Fund

|

44

|

|

Other Comparative Information about the Funds

|

45

|

|

Fund Policies on Pricing of Fund Shares, Purchases and Redemptions, Dividends and Distributions,

|

|

|

Frequent Purchases and Redemptions, Tax Consequences and Distribution Arrangements

|

53

|

|

Financial Highlights

|

53

|

|

ADDITIONAL INFORMATION

|

58

|

|

Quorum and Voting

|

58

|

|

Share Ownership

|

58

|

|

Solicitation of Proxies

|

59

|

|

Shareholder Proposals for Subsequent Meetings

|

59

|

|

Shareholder Communications

|

60

|

|

Reports to Shareholders and Financial Statements

|

60

|

|

“Householding”

|

60

|

|

APPENDIX A: FORM OF AGREEMENT AND PLAN OF REORGANIZATION

|

A-1

|

|

APPENDIX B: ACQUIRING FUND POLICIES ON PRICING OF FUND SHARES, PURCHASES AND REDEMPTIONS, DIVIDENDS AND DISTRIBUTIONS, FREQUENT PURCHASES AND REDEMPTIONS, TAX CONSEQUENCES AND DISTRIBUTION ARRANGEMENTS

|

B-1 |

| Q. |

What is being proposed?

|

| A. |

The Board of Trustees recommends that shareholders of the Target Fund approve the Plan that authorizes the reorganization of the Target Fund into the Acquiring Fund. You are receiving this Proxy

Statement/Prospectus because, as a shareholder of the Target Fund on the Record Date (defined below), you have the right to vote on the Plan.

|

| Q. |

Why am I being asked to approve the Plan to reorganize my Fund into the LoCorr Macro Strategies Fund?

|

| A. |

Steben believes the proposed Reorganization offers a number of benefits to shareholders of the Target Fund, including being shareholders of a Fund with greater asset size that creates greater

opportunity to benefit from long‑term economies of scale. Steben also believes that the Target Fund shareholders will benefit from the expertise and experience of the Acquiring Fund’s adviser, LoCorr Fund Management, LLC.

|

| Q. |

If the Reorganization occurs, how will the Acquiring Fund be managed?

|

| A. |

If the Reorganization is consummated, (i) the Target Fund will be reorganized into the Acquiring Fund; (ii) the Acquiring Fund will be managed by its current investment team at LoCorr; (iii) the

investment objective of the Acquiring Fund, which is similar to that of the Target Fund, will not change; and (iv) the investment policies, principal strategy and risks of the Acquiring Fund will not change.

|

| Q. |

What is the recommendation of the Board of Trustees on the Reorganization?

|

| A. |

At a meeting held on November 1, 2019, the Board of Trustees of the Target Fund considered the Reorganization and determined that the Reorganization would be in the best interests of the Target Fund

and its shareholders and that the Reorganization would not dilute the interests of the Target Fund’s shareholders. In reaching these determinations, the Trustees reviewed and analyzed various factors it deemed relevant,

including the following factors, among others:

|

| • |

The terms of the Reorganization, including that no sales loads, commissions or other transactional fees would be imposed on Target Fund shareholders in connection with the Reorganization and that

Target Fund shareholders would receive a number of full and fractional shares of the Acquiring Fund equal in value to their holdings in the Target Fund as of the Closing Date;

|

| • |

The Funds’ investment objectives, policies and strategies are similar from an investment perspective in that both Funds pursue a managed futures investment strategy through a wholly-owned subsidiary,

as well as a fixed income investment strategy;

|

| • |

Following the Reorganization, based on current expenses and determined on a pro forma basis, the total annual operating expense ratios for the Acquiring Fund’s Class A, Class C and Class I shares are

anticipated to be lower than the total annual operating expense ratios for the Target Fund’s Class A, Class C and Class I shares, respectively, and Class N shares (as compared to the Acquiring Fund’s Class A shares).

|

| • |

The larger asset base of the Acquiring Fund creates the opportunity for shareholders of the Target Fund to benefit from long-term economies of scale;

|

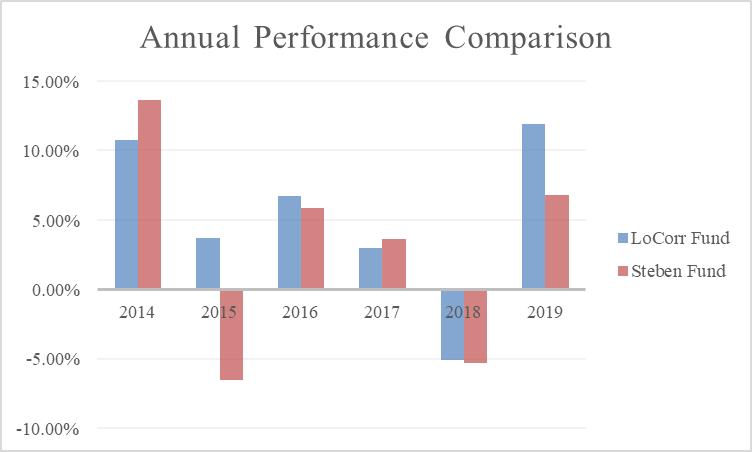

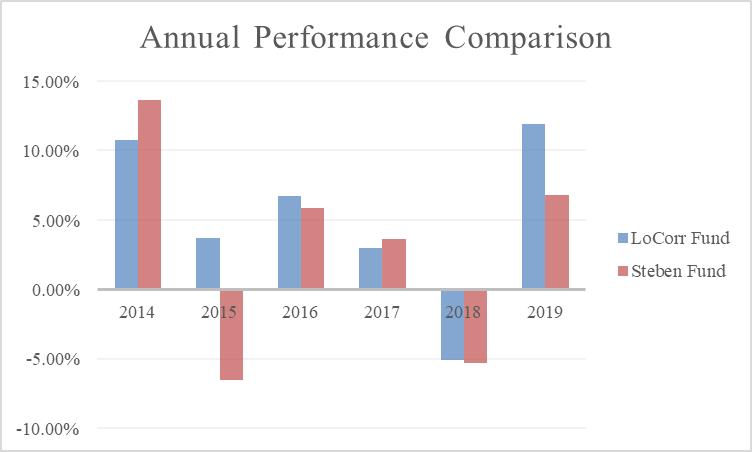

| • |

The Acquiring Fund has generally outperformed the Target Fund since the Target Fund’s inception date of April 1, 2014. Below are the average annual returns for both Funds’ Class I shares as of

9/30/19 for the periods shown:

|

|

Performance as of 9/30/19

|

1 yr

|

3 yr

|

5yr

|

Since inception

of the Target

Fund (4/1/14)

|

|

Steben Managed Futures Strategy Fund

|

5.12%

|

1.37%

|

2.05%

|

2.89%

|

|

LoCorr Macro Strategies Fund

|

9.20%

|

1.92%

|

4.50%

|

5.94%

|

| • |

The calendar year performance of the two Funds’ Class I shares, since the Target Fund’s inception date of 4/1/14, through 9/30/19, are as follows:

|

| • |

As of September 30, 2019, the Acquiring Fund has outperformed its benchmark for the 1-year and 5-year periods and since inception of the Acquiring Fund (March 24, 2011);

|

| • |

Information provided by LoCorr demonstrating it is an experienced provider of investment advisory services to mutual funds. The nature and quality of services that the shareholders of the Target

Fund are expected to receive as shareholders of the Acquiring Fund will generally be comparable to the nature and quality of services that such shareholders currently receive;

|

| • |

The background and experience of the Acquiring Fund’s portfolio managers and subadvisers, including that two of the Target Fund’s trading advisors, Milburn and Revolution, also serve as subadvisers to

the Acquiring Fund;

|

| • |

Prior to the Reorganization, the futures and currency forwards positions held by the Target Fund will be converted to cash, but the Target Fund’s fixed income investments will be transferred to the

Acquiring Fund. For more information about the conversion of the Target Fund’s futures and currency forwards positions, please refer to the section entitled “The Plan” below.

|

| • |

The Reorganization is expected to be tax-free for federal income tax purposes for each Fund and its shareholders, although prior to the Closing Date, Target Fund shareholders may receive an additional

taxable distribution of ordinary income and/or capital gains that the Target Fund has accumulated prior to the date of the distribution;

|

| • |

That the Acquiring Fund may not be able to utilize certain tax loss carry forwards, if any, that would otherwise be available;

|

| • |

There will be no change in the rights of the Target Fund’s shareholders as a result of the Reorganization;

|

| • |

The Reorganization will be submitted to the shareholders of the Target Fund for their approval and that shareholders who do not wish to become shareholders of the Acquiring Fund may redeem their

Target Fund shares before the closing of the Reorganization, although redemption may be a taxable transaction for them;

|

| • |

The costs of the Reorganization, other than costs incurred to reposition the Target Fund in connection with the Reorganization, will be borne by LoCorr or its affiliates;

|

| • |

The Board noted that the Acquisition had resulted in a change of control of Steben, and the assignment and termination of the investment advisory, subadvisory and trading advisory agreements with

respect to the Target Fund and its subsidiary. The Board considered that since the closing of the Acquisition, Steben, the subadvisor and the trading advisors were providing services to the Target Fund and its subsidiary

pursuant to the interim agreements. The Board considered that, if the proposed Reorganization is not approved by shareholders by March 29, 2020, the interim agreements will expire and Steben intends to recommend that the Board

vote to liquidate the Target Fund; and

|

| • |

In light of the Target Fund’s inability to attract assets and reach scale and its history of redemption activity, the most likely alternative to the Reorganization would be the liquidation of the

Target Fund and the subsidiary, which would be less desirable than the Reorganization, as a liquidating distribution would result in a taxable transaction for the Target Fund’s shareholders.

|

| Q. |

Will I own the same number of shares of the Acquiring Fund as I currently own of the Target Fund?

|

| A. |

No. You will receive shares of the class of the Acquiring Fund outlined below with equivalent dollar value as the shares of the Target Fund you own as of the time the Reorganization closes. However,

the number of shares you receive will depend on the relative net asset values (“NAVs”) of the shares of the Target Fund and the corresponding class of shares of the Acquiring Fund as of the close of trading on the New York Stock

Exchange (“NYSE”) on the day of the closing of the Reorganization.

|

|

Steben Managed Futures Strategy Fund

|

LoCorr Macro Strategies Fund

|

|

|

Class A Shares Target Fund

|

à

|

Class A Shares Acquiring Fund

|

|

Class C Shares Target Fund

|

à

|

Class C Shares Acquiring Fund

|

|

Class I Shares Target Fund

|

à

|

Class I Shares Acquiring Fund

|

|

Class N Shares Target Fund

|

à

|

Class A Shares Acquiring Fund

|

| Q. |

How do the Funds’ investment objectives and principal investment strategies compare?

|

| A. |

The following summarizes the primary similarities and differences in the Funds’ investment objectives and principal investment strategies.

|

| • |

Target Fund. The Fund seeks to achieve positive long term absolute returns with low correlation to broad equity and fixed income market returns.

|

| • |

Acquiring Fund. The Fund's primary investment objective is capital appreciation in rising and falling equity markets with managing volatility as a

secondary objective.

|

| • |

Both Funds utilize a managed futures strategy.

|

| • |

Both Funds pursue a fixed income strategy. The Target Fund invests generally between 60% and 80% of its assets directly in fixed income investments to generate returns and interest income. The

Acquiring Fund allocates approximately 75% of its assets to its fixed income strategy.

|

| • |

Target Fund. The Target Fund seeks to achieve its investment objective by pursuing a managed futures strategy which intends to capture absolute returns in the commodity and financial futures

markets (equity, interest rate and currency) by investing in (i) futures contracts (such as currency futures, futures on broad-based security indices and futures on commodities), (ii) foreign currency transactions (such as U.S.

and foreign spot currencies and currency forward contracts); and options on futures and swaps. The Target Fund invests generally between 60% to 80% of its assets directly in fixed income investments to generate returns and

interest income, diversifying the returns of the Fund’s investments in managed futures. Steben allocates fixed income assets to the Fund’s subadviser, who invests primarily in investment grade securities.

|

| • |

Acquiring Fund. The Acquiring Fund seeks to achieve its investment objective by allocating its assets using two principal strategies, a managed futures strategy and a fixed income strategy.

The managed futures strategy is designed to produce capital appreciation by capturing returns related to the commodity and financial markets by investing long or short in: (i) futures,

(ii) forwards, (iii) options, (iv) spot contracts, or (v) swaps, each of which may be tied to (a) currencies, (b) interest rates, (c) stock market indices, (d) energy resources, (e) metals or (f) agricultural products. The

Acquiring Fund’s fixed income strategy is designed to generate interest income and preserve principal by investing primarily in investment grade securities.

|

| Q. |

How do the Funds compare in size?

|

| A. |

As of October 31, 2019, the Target Fund’s net assets were approximately $66 million, and the Acquiring Fund’s net assets were approximately $697 million. If the Reorganization were completed as of

October 31, 2019, the combined net assets of the Acquiring Fund would be approximately $763 million. The asset size of each Fund fluctuates on a daily basis, and the asset size of the Acquiring Fund after the Reorganization may

be larger or smaller than the combined assets of the Funds as of October 31, 2019.

|

| Q. |

How do the fee and expense structures of the Funds compare?

|

| A. |

Advisory Fees. The Target Fund pays an advisory fee at an annual rate of 1.75% of average daily net assets, while the Acquiring Fund pays an advisory fee at an

annual rate of 1.65% of average daily net assets.

|

| Q. |

Will the Reorganization result in higher investment advisory fees for Target Fund shareholders?

|

| A. |

No. The Reorganization will result in lower investment advisory fees for Target Fund shareholders. The Acquiring Fund will retain the same investment advisory fee schedule after the Reorganization,

which is an annual rate of 1.65% of average daily net assets. The Target Fund pays an investment advisory fee at the annual rate of 1.75% of average daily net assets.

|

| Q. |

Will the Reorganization result in higher total net operating expenses?

|

| A. |

No. The Target Fund’s Class A, Class C, Class I and Class N shares have a net operating expense of 2.24%, 2.99%, 1.99% and 2.24%, respectively. The Acquiring Fund’s Class A, Class C, Class I and

Class A (as compared to the Target Fund’s Class N) shares currently have a net operating expense ratio of 2.25%, 3.00%, 2.00% and 2.25%, respectively, which includes approximately 0.07% of recoupment of fee waivers previously

waived by the Acquiring Fund’s adviser. The recoupment of previously waived fees is expected to be completed by January 31, 2020, resulting in a pro forma net operating expense ratio of approximately 2.17%, 2.92%, 1.92% and

2.17% after that date for Class A, Class C, Class I and Class A (as compared to Target Fund’s Class N) shares, respectively.

|

| Q. |

What are the U.S. federal income tax consequences of the Reorganization?

|

| A. |

The Reorganization is expected to qualify as a tax-free reorganization for U.S. federal income tax purposes (under section 368(a) of the Internal Revenue Code of 1986, as amended) (the “Code”) and will

not take place unless counsel provides an opinion to that effect. Assuming the Reorganization so qualifies, shareholders should not recognize any capital gain or loss for federal income tax purposes as a direct result of the

Reorganization. Prior to the Closing Date, the futures positions held by the Target Fund’s Cayman Fund will be converted to cash. As a result, you may receive an additional taxable distribution of ordinary income and/or capital

gains that the Target Fund has accumulated prior to the date of the distribution.

|

| Q. |

Will my cost basis for U.S. federal income tax purposes change as a result of the Reorganization?

|

| A. |

Your total cost basis for U.S. federal income tax purposes is not expected to change as a result of the Reorganization. However, since the number of shares you hold after the Reorganization is expected

to be different than the number of shares you held prior to the Reorganization, your average cost basis per share may change.

|

| Q. |

Will the service providers to my Fund change?

|

| A. |

Yes. Steben serves as the investment adviser to the Target Fund. LoCorr serves as the investment adviser to the Acquiring Fund and will continue to serve in that capacity following the Reorganization.

|

| Q. |

Will there be any sales load, commission or other transactional fee in connection with the Reorganization?

|

| A. |

No. There will be no sales load, commission or other transactional fee in connection with the Reorganization. The full and fractional value of shares of the Target Fund will be exchanged for full and

fractional corresponding shares of the Acquiring Fund having equal value, without any sales load, commission or other transactional fee being imposed. Target Fund Class C shareholders that receive Class C shares of the

Acquiring Fund will be subject to a 1.00% contingent deferred sales charge for any Acquiring Fund Class C shares sold less than one year after the Reorganization. For the purposes of the application of the contingent deferred

sales charge, a Target Fund Class C shareholder’s holding period prior to the close of the Reorganization will count towards the one-year period. Class N shareholders of the Target Fund that receive Class A shares of the

Acquiring Fund pursuant to the Reorganization will be able to purchase additional Class A shares of the Acquiring following the Reorganization on a load-waived basis provided that they qualify to do so. It is expected, based on

the terms of the Acquiring Fund’s currently effective prospectus, that such Class N shareholders will be able to qualify for subsequent load-waived purchases of Acquiring Fund Class A shares after the Reorganization.

|

| Q. |

Can I still add to my existing Target Fund account until the Reorganization?

|

| A. |

Yes. Current Target Fund shareholders may continue to make additional investments until the Closing Date (anticipated to be on or about January 31, 2020), unless the Board of Trustees determines to

limit future investments to ensure a smooth transition of shareholder accounts or for any other reason.

|

| Q. |

Will either Fund pay fees or expenses associated with the Reorganization?

|

| A. |

No. The costs of the Reorganization will be borne by LoCorr. Such costs, including preparation and filing of the Proxy Statement/Prospectus, printing and mailing costs, solicitation costs, board

meeting costs, and legal, accounting and auditor fees, are estimated to be approximately $60,000. However, the Funds will bear any brokerage commissions, transaction costs and similar expenses in connection with any purchases

or sales of securities related to Fund repositioning in connection with the Reorganization, which are expected to be minimal.

|

| Q. |

If shareholders approve the Reorganization, when will the Reorganization take place?

|

| A. |

If Target Fund shareholders approve the Reorganization and other conditions are satisfied or waived, the Reorganization is expected to occur on or about January 31, 2020, or as soon as reasonably

practicable after shareholder approval is obtained. An account in the Acquiring Fund will be set up in your name, and you will receive shares of the corresponding class of shares of the Acquiring Fund. You will receive

confirmation of this transaction following the completion of the Reorganization.

|

| Q. |

What happens if the Reorganization is not completed?

|

| A. |

If the proposed Reorganization is not approved by shareholders, the Adviser intends to recommend that the Board of Trustees vote to liquidate the Target Fund. Shareholders would receive a liquidating

distribution on the liquidation date equal to the value of the shares owned. The liquidating distribution would result in a taxable transaction.

|

| Q. |

How many votes am I entitled to cast?

|

| A. |

Each shareholder is entitled to one (1) vote per share held, and fractional votes for fractional shares held, on any matter submitted to a vote at the Meeting.

|

| Q. |

Who is eligible to vote?

|

| A. |

Shareholders who owned shares of the Target Fund at the close of business on December 6, 2019 (the “Record Date”) will receive notice of the Meeting and be entitled to be present and vote at the

Meeting.

|

| Q. |

What is the required vote to approve the Proposal?

|

| A. |

Approval of the Plan requires the affirmative vote of a “majority of the outstanding voting securities” as defined under the 1940 Act (such a majority referred to herein as a “1940 Act Majority”) of

the Target Fund. A 1940 Act Majority means the lesser of the vote of (i) 67% or more of the shares of the Target Fund entitled to vote thereon present at the Meeting, if the holders of more than 50% of such outstanding shares

are present in person or represented by proxy; or (ii) more than 50% of such outstanding shares of the Target Fund entitled to vote thereon.

|

| Q. |

How can I vote my shares?

|

| A. |

You can vote or provide instructions in any one of four ways:

|

| • |

By Internet through the website listed in the proxy voting instructions;

|

| • |

By telephone by calling the toll-free number listed on your proxy card(s) and following the recorded instructions;

|

| • |

By mail, by sending the enclosed proxy card(s) (signed and dated) in the enclosed envelope; or

|

| • |

In person at the Meeting on January 17, 2020.

|

| Q. |

If I vote my proxy now as requested, can I change my vote later?

|

| A. |

Yes. You may revoke your proxy vote at any time before it is voted at the Meeting by (1) delivering a written revocation to the Secretary of the Target Fund; (2) submitting a subsequently executed

proxy vote; or (3) attending the Meeting and voting in person. Even if you plan to attend the Meeting, we ask that you return the enclosed proxy card or vote by telephone or the internet. This will help us to ensure that an

adequate number of shares are present at the Meeting for consideration of the Proposal. Target Fund shareholders should send notices of revocation to Steben Alternative Investment Funds at Steben & Company, 9711

Washingtonian Blvd, Suite 400, Gaithersburg, MD, 20878.

|

|

Target Fund Class A

|

Acquiring Fund Class A

|

Acquiring Fund Class A (Pro Forma)

|

|

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a % of offering price)

|

5.75%

|

5.75%

|

5.75%

|

|

Maximum Deferred Sales Charge (Load)

(as a % of original purchase price)

|

1.00%*

|

1.00%**

|

1.00%**

|

|

Maximum Sales Charge (Load) Imposed on

Reinvested Dividends and other Distributions |

None

|

None

|

None

|

|

Redemption Fee

|

None

|

None

|

None

|

|

Management fee

|

Target Fund Class C

|

Acquiring Fund Class C

|

Acquiring Fund Class C (Pro Forma)

|

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a % of offering price)

|

None

|

None

|

None

|

|

Maximum Deferred Sales Charge (Load)

(as a % of original purchase price)

|

1.00%***

|

1.00%***

|

1.00%***

|

|

Maximum Sales Charge (Load) Imposed on

Reinvested Dividends and other Distributions |

None

|

None

|

None

|

|

Redemption Fee

|

None

|

None

|

None

|

|

Target Fund Class I

|

Acquiring Fund Class I

|

Acquiring Fund Class I (Pro Forma)

|

|

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a % of offering price)

|

None

|

None

|

None

|

|

Maximum Deferred Sales Charge (Load)

(as a % of original purchase price)

|

None

|

None

|

None

|

|

Maximum Sales Charge (Load) Imposed on

Reinvested Dividends and other Distributions |

None

|

None

|

None

|

|

Redemption Fee

|

1.00%****

|

None

|

None

|

|

Target Fund Class N

|

Acquiring Fund Class A

|

Acquiring Fund Class A (Pro Forma)

|

|

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a % of offering price)

|

None

|

5.75%

|

5.75%

|

|

Maximum Deferred Sales Charge (Load)

(as a % of original purchase price)

|

None

|

1.00%**

|

1.00%**

|

|

Maximum Sales Charge (Load) Imposed on

Reinvested Dividends and other Distributions |

None

|

None

|

None

|

|

Redemption Fee

|

1.00%****

|

None

|

None

|

|

Target Fund Class A

|

Acquiring Fund Class A

|

Acquiring Fund Class A (Pro Forma)

|

|

|

Management Fees

|

1.75%

|

1.65%

|

1.65%

|

|

Distribution and/or Service (12b-1) Fees

|

0.25%

|

0.25%

|

0.25%

|

|

Other Expenses

|

0.24%(1)

|

0.34%

|

0.26%

|

|

Acquired Fund Fees and Expenses

|

0.00%

|

0.01%(2)

|

0.01%(2)

|

|

Total Annual Fund Operating Expenses

|

2.24%

|

2.25%

|

2.17%

|

|

Target Fund Class C

|

Acquiring Fund Class C

|

Acquiring Fund Class C (Pro Forma)

|

|

|

Management Fees

|

1.75%

|

1.65%

|

1.65%

|

|

Distribution and/or Service (12b-1) Fees

|

1.00%

|

1.00%

|

1.00%

|

|

Other Expenses

|

0.24%(1)

|

0.34%

|

0.26%

|

|

Acquired Fund Fees and Expenses

|

0.00%

|

0.01%(2)

|

0.01%(2)

|

|

Total Annual Fund Operating Expenses

|

2.99%

|

3.00%

|

2.92%

|

|

Target Fund Class I

|

Acquiring Fund Class I

|

Acquiring Fund Class I (Pro Forma)

|

|

|

Management Fees

|

1.75%

|

1.65%

|

1.65%

|

|

Distribution and/or Service (12b-1) Fees

|

0.00%

|

0.00%

|

0.00%

|

|

Other Expenses

|

0.24%(1)

|

0.34%

|

0.26%

|

|

Acquired Fund Fees and Expenses

|

0.00%

|

0.01%(2)

|

0.01%(2)

|

|

Total Annual Fund Operating Expenses

|

1.99%

|

2.00%

|

1.92%

|

|

Target Fund Class N

|

Acquiring Fund Class A

|

Acquiring Fund Class A (Pro Forma)

|

|

|

Management Fees

|

1.75%

|

1.65%

|

1.65%

|

|

Distribution and/or Service (12b-1) Fees

|

0.25%

|

0.25%

|

0.25%

|

|

Other Expenses

|

0.24%(1)

|

0.34%

|

0.26%

|

|

Acquired Fund Fees and Expenses

|

0.00%

|

0.01%(2)

|

0.01(2)

|

|

Total Annual Fund Operating Expenses

|

2.24%

|

2.25%

|

2.17%

|

|

1 year

|

3 years

|

5 years

|

10 years

|

|

|

Target Fund

(Class A) |

$789

|

$1,235

|

$1,706

|

$3,002

|

|

Acquiring Fund (Class A)

|

$790

|

$1,224

|

$1,683

|

$2,949

|

|

Pro Forma Fund (Class A)

|

$782

|

$1,215

|

$1,672

|

$2,934

|

|

Target Fund

(Class C) |

$402*

|

$924

|

$1,572

|

$3,308

|

|

Acquiring

Fund (Class C) |

$403**

|

$913

|

$1,549

|

$3,257

|

|

Pro Forma Fund (Class C)

|

$395***

|

$904

|

$1,538

|

$3,242

|

|

Target Fund

(Class I)

|

$202

|

$624

|

$1,073

|

$2,317

|

|

Acquiring

Fund (Class I) |

$203

|

$613

|

$1,048

|

$2,259

|

|

Pro Forma Fund (Class I)

|

$195

|

$603

|

$1,037

|

$2,243

|

|

Target Fund (Class N)

|

$227

|

$700

|

$1,200

|

$2,575

|

|

Acquiring Fund (Class A)

|

$790

|

$1,224

|

$1,683

|

$2,949

|

|

Pro Forma Fund (Class A)

|

$782

|

$1,215

|

$1,672

|

$2,934

|

|

Target Fund

|

Acquiring Fund

|

|

Investment Objectives

|

|

|

The Fund seeks to achieve positive long term absolute returns with low correlation to broad equity and fixed

income market returns.

|

The Fund's primary investment objective is capital appreciation in rising

and falling equity markets with managing volatility as a secondary objective.

|

|

Target Fund

|

Acquiring Fund

|

|

Principal Investment Strategy – Managed Futures

|

|

|

The Fund seeks to achieve its investment objective by pursuing a managed futures strategy which intends to capture

absolute returns in the commodity and financial futures markets (equity, interest rate and currency) by investing in:

• futures

contracts (such as currency futures, futures on broad-based security indices and futures on commodities);

• foreign

currency transactions (such as U.S. and foreign spot currencies and currency forward contracts); and

• options

on futures and swaps (collectively, Derivative Instruments).

The Fund may invest directly in Derivative Instruments or it may invest up to 25% of its total assets at the time

of purchase in a wholly owned and controlled subsidiary (Subsidiary) to pursue its managed futures strategy through investments in Derivative Investments. The principal investment strategies of the Subsidiary are the same as the

principal investment strategies of the Fund.

The Fund’s adviser generally expects that the Fund’s performance will have a low correlation to the long-term

performance of the general global equity, fixed income, currency and commodity markets; however, the Fund’s performance may correlate to the performance of any one or more of those markets over short-term periods.

The Fund invests in the Subsidiary to gain exposure to the commodities markets within the limitations of the

federal tax laws, rules and regulations that apply to regulated investment companies. The Subsidiary invests exclusively in any of the investments named above or may use a combination of such investments. Such investment exposure

could far exceed the value of the Subsidiary’s portfolio and its investment performance could be primarily dependent upon investments it does not own. The Subsidiary complies with the same asset coverage requirements under the

Investment Company Act of 1940, as amended (1940 Act) with respect to its investments in Derivative Instruments that are applicable to the Fund’s transactions in derivatives. The Subsidiary is organized under the laws of the

Cayman Islands.

|

The Managed Futures strategy is designed to produce capital appreciation by capturing returns related to the

commodity and financial markets by investing long or short in: (i) futures, (ii) forwards, (iii) options, (iv) spot contracts, or (v) swaps, each of which may be tied to (a) currencies, (b) interest rates, (c) stock market

indices, (d) energy resources, (e) metals or (f) agricultural products. These derivative instruments are used as substitutes for securities, interest rates, currencies and commodities and for hedging. To the extent the Fund

uses swaps or structured notes under the Managed Futures strategy, the investments will generally have payments linked to commodity or financial derivatives. The Fund does not invest more than 25% of its assets in contracts with

any one counterparty. Managed futures sub-strategies may include investment styles that rely upon buy and sell signals generated from technical analysis systems such as trend-pattern recognition, as well as from fundamental

economic analysis and relative value comparisons. Managed Futures strategy investments will be made without restriction as to country.

The Fund will execute its Managed Futures strategy primarily by investing up to 25% of its total assets

(measured at the time of purchase) in a wholly-owned and controlled subsidiary (the “Subsidiary”). The Subsidiary will invest primarily in futures, forwards, options, spot contracts, swaps, and other assets intended to serve as

margin or collateral for derivative positions. The Subsidiary is subject to the same investment restrictions as the Fund.

|

|

Target Fund

|

Acquiring Fund

|

|

Use of Outside Managers

|

|

|

The Fund utilizes managers who employ a variety of managed futures trading strategies (Trading Advisors). The

managed futures strategies to which the Fund seeks exposure typically include the following investment styles:

• trend

following - quantitative and other strategies are used to identify underlying market trends over various time frames in prices to seek to exploit the market’s tendency to exhibit consecutive periods of price advances and/or

declines

• short-term

systematic and discretionary trading - quantitative strategies are used in an attempt to exploit short-term price patterns in financial and commodity markets

• counter-trend

or mean reversion strategies - quantitative and other methods are used in an attempt to forecast price reversals over various time frames

The managed futures programs employed by the Trading Advisors have a wide variety of trading styles across a broad

range of financial markets and asset classes. Managed futures strategies typically invest either long or short in one or a combination of Derivative Instruments for both speculative and hedging purposes, each of which may be tied

to (a) agricultural products, (b) currencies, (c) equity (stock market) indices, (d) energy, (e) fixed income and interest rates, (f) metals or (g) other commodities.

Each Trading Advisor implements its designated managed futures program by investing in a variety of Derivative

Instruments. The Fund does not have a policy limiting the amount of the Fund’s portfolio that it may invest in foreign investments. There are no formal limitations on the markets, strategies or instruments in which the Fund or the

Trading Advisors may invest. The Trading Advisors may or may not be registered under the Commodity Exchange Act (CEA).

|

The Fund’s adviser delegates management of the Fund’s Managed Futures Strategy to one or more sub-advisers.

Graham Capital Management, L.P. (“GCM”) executes its strategy by employing macro-oriented quantitative

investment techniques to select long and short positions in the global futures and foreign exchange markets. These techniques are designed to produce attractive absolute and risk-adjusted returns while maintaining low

correlation to traditional asset classes. The strategy is a quantitative trading system driven by trend-following models. This program signals buy and sell orders based on a number of factors, including price, volatility, and

length of time a position has been held in the portfolio. The program trades a broad range of markets, including global interest rates, foreign exchange, global stock indices and commodities.

Millburn Ridgefield Corporation (“Millburn”) invests the Fund’s asset allocated to it in a diversified portfolio

of futures, forward and spot contracts (and may also invest in option and swap contracts) on currencies, interest rate instruments, stock indices, metals, energy and agricultural commodities. Millburn invests globally pursuant

to its proprietary quantitative and systematic trading methodology, based upon signals generated from an analysis of price, price-derivatives, fundamental and other quantitative data. Millburn’s Diversified Program generally

seeks maximum diversification subject to liquidity and sector concentration constraints. Each market is traded using a diversified set of trading systems, which may be optimized for groups of markets, sectors or specific

markets. The following factors, among others, are considered in constructing a universe of markets to trade: profitability, liquidity of markets, professional judgment, desired diversification, transaction costs, exchange

regulations and depth of market.

Revolution Capital Management, LLC (“Revolution”) focuses on short-term, systematic and quantitative trading,

applying statistical analysis to all aspects of research, development, and operations. The strategy seeks to provide superior risk-adjusted returns while maintaining low correlations both to traditional equity and bond

investments as well as the trend-following strategies often employed by commodity trading advisors.

|

|

Target Fund

|

Acquiring Fund

|

|

Principal Investment Strategy – Fixed Income

|

|

|

The Fund invests generally between 60% to 80% of its assets directly in fixed income investments to generate

returns and interest income, diversifying the returns of the Fund’s investments in managed futures. The Fund’s adviser allocates these assets to Principal Global Investors, LLC, the Fund’s subadviser, who invests primarily in

investment grade securities, which the Fund defines as those that have a rating, at the time purchased, by Moody’s Investors Service, Inc. (Moody’s) of Baa3/P-3 or higher; by Standard & Poor’s Ratings Group (S&P) of

BBB-/A-3 or higher; or by Fitch Ratings (Fitch) of BBB-/F3 or higher; or, if unrated determined by the Adviser or the subadviser to be of comparable quality. The Fund also may invest up to ten percent of its assets in lower

quality fixed income securities, known as “high yield” or “junk” bonds, which are rated lower than investment grade securities. The fixed income portion of the Fund’s portfolio is invested without restriction as to issuer country,

type of entity, capitalization or the maturity of individual securities. The Fund does not maintain any particular average maturity of its fixed income investments.

The Fund’s subadviser relies on qualitative and quantitative analysis to arrive at security selection decisions.

Qualitative factors provide the foundation of its internal credit rating, including size and position within the industry/sector, completeness of the business model, earnings predictability, management quality, and cost structure.

Quantitative analysis focuses on financial analysis to assess financial strength and liquidity. Additionally, an important component of security selection is relative-value assessment. Key principles of the subadviser’s sell

discipline are guided by predetermined relative-value objectives for sectors, issuers and specific securities, pricing performance or fundamental performance that varies from expectations, deteriorating fundamentals, overvaluation

and alternative investments offering the opportunity to achieve more favorable risk-adjusted returns.

|

The adviser anticipates that, based upon its analysis of long-term historical returns and volatility of various

asset classes, the Fund will allocate approximately 25% of its assets to the Managed Futures strategy and approximately 75% of its assets to the Fixed Income strategy. However, as market conditions change the portion allocated

may be higher or lower.

The Fixed Income strategy is sub-advised by Nuveen Asset Management and is designed to generate interest income

and preserve principal by investing primarily in investment grade securities including: (1) obligations issued or guaranteed by the U.S. Government, its agencies or instrumentalities, (2) securities issued or guaranteed by

foreign governments, their political subdivisions or agencies or instrumentalities, (3) bonds, notes, or similar debt obligations issued by U.S. or foreign corporations or special-purpose entities backed by corporate debt

obligations, (4) U.S. asset-backed securities (“ABS”), (5) U.S. residential mortgage-backed securities (“MBS”), (6) U.S. commercial mortgage-backed securities (“CMBS”), (7) interest rate-related futures contracts and (8)

interest rate-related or credit default-related swap contracts. The Fund defines investment grade fixed income securities as those that are rated, at the time purchased, in the top four categories by a rating agency such as

Moody’s Investors Service, Inc. (“Moody’s”) or Standard & Poor’s Ratings Services (“S&P”), or, if unrated, determined to be of comparable quality. However, the fixed income portion of the Fund’s portfolio will be

invested without restriction as to individual issuer country, type of entity, or capitalization. Futures and swap contracts are used for hedging purposes and as substitutes for fixed income securities. The Fund’s adviser

delegates management of the Fund’s Fixed Income strategy portfolio to a sub-adviser.

|

|

Investment Process

|

|

|

Trading Advisor Selection.

After identifying a universe of Trading Advisors and managed futures programs that meet Steben’s internal criteria, Steben selects potential managed futures programs using a methodology based on both quantitative and qualitative

assessments. Steben employs a portfolio construction process based on its assessment of each managed futures program’s historical return and risk profiles and the Fund’s investment objective. In general, Steben seeks to select

Trading Advisors and managed futures programs based on the programs’ expected individual risk-adjusted performance and their potential diversification benefits to the Fund’s overall portfolio. For each prospective allocation to a

new Trading Advisor, Steben will conduct an evaluation of the Trading Advisor and its strategy, team, and approach through analysis of, among other criteria, its prior investment returns, portfolio exposures, current assets under

management, and investment strategy outlook. Trading Advisors are generally not registered under the Investment Advisers Act of 1940, as amended (Advisers Act).

|

Adviser’s Investment Process

The Fund’s adviser will pursue the Fund’s investment objectives, in part, by utilizing its investment and risk

management process.

• Sub-Adviser Selection represents the result of quantitative and qualitative reviews that will identify a

sub-adviser chosen for its managed futures expertise, historical performance, management accessibility, commitment, investment strategy, as well as process and methodology. Using this selection process, the adviser believes

it can identify a sub-adviser that can produce positive, risk-adjusted returns. The adviser replaces a sub-adviser when its returns are below expectations or it deviates from its traditional investment process.

|

|

Investment and Operational Due

Diligence. For each selected managed futures program that Steben considers for investment, Steben completes an investment due diligence process that, among other things, reviews the respective Trading Advisor’s

trading strategy, performance, experience, management team, strategy implementation, firm organizational strength and risk management. In addition, Steben conducts a separate operational due diligence review of the Trading

Advisor’s investment and organizational documents, the Trading Advisor’s relationships with its auditors, prime brokers, fund administrators and other service providers, technology infrastructure, management and organization,

legal, regulatory and compliance capabilities, policies and practices regarding valuation and the calculation of net asset values, trading processes, fees and cash movement, among other factors.

Allocation. Steben

allocates the assets of the Fund and the Subsidiary among the Trading Advisors so as to provide exposure to what Steben considers to be an appropriate mix of trading styles and managed futures investment strategies given its

strategic market views. The allocations are determined at Steben’s discretion in order to attempt to achieve the investment objective of the Fund. Allocations will not necessarily be equally weighted to each Trading Advisor, and

the amount allocated to any program can change over time. New managed futures programs may be added and existing ones may be removed at any time.

Monitoring. Steben

monitors the performance and risk exposures of the Trading Advisors and the Derivative Investments. If an investment’s performance or risk deviates significantly from Steben’s expectations, Steben will review the issue with the

Trading Advisor. An unfavorable review could prompt Steben to reduce the allocation to the Trading Advisor’s program, or remove it altogether. However, Steben need not reduce the allocation if the outcome of the review is

favorable.

Steben also performs periodic ongoing due diligence reviews of each Trading Advisor, in order to track

enhancements or changes to their trading programs, as well as any significant organizational or operational developments. An unfavorable review could prompt an allocation reduction or a removal of the Trading Advisor from the

Fund’s portfolio.

|

• Risk Management represents the ongoing attention to the historical return performance of each Underlying Fund as well as

the interaction or correlation of returns between Underlying Funds. Using this risk management process, the adviser believes the Fund, over time, will not be highly correlated to the equity markets and will provide the

potential for reducing volatility in investors’ portfolios.

Sub-Advisers’ Investment Processes

Graham Capital Management, L.P.

Graham Capital Management, L.P. (“GCM”) serves as a sub-adviser to the Fund. GCM executes the strategy within the Macro Strategies Fund by employing macro-oriented quantitative

investment techniques to select long and short positions in the global futures and foreign exchange markets. These techniques are designed to produce attractive absolute and risk-adjusted returns while maintaining low

correlation to traditional asset classes. The strategy within the Macro Strategies Fund is a quantitative trading system driven by trend-following models. This program signals buy and sell orders based on a number of factors,

including price, volatility, and length of time a position has been held in the portfolio. The strategy employs sophisticated techniques to gradually enter and exit positions over the course of a trend in order to maximize

profit opportunities. It is expected that the average holding period of instruments traded pursuant to the strategy within the Macro Strategies Fund will be approximately six to eight weeks; however, that average may differ

depending on various factors and the system will make daily adjustments to positions based on both price activity and market volatility. The program trades a broad range of markets, including global interest rates, foreign

exchange, global stock indices and commodities.

Millburn Ridgefield Corporation

Millburn Ridgefield Corporation (“Millburn”) serves as a sub-adviser to the Fund. Millburn’s Diversified Program invests in a diversified portfolio of futures, forward and spot

contracts (and may also invest in option and swap contracts) on currencies, interest rate instruments, stock indices, metals, energy and agricultural commodities. Millburn invests globally pursuant to its proprietary

quantitative and systematic trading methodology, based upon signals generated from an analysis of price, price-derivatives, fundamental and other quantitative data. Millburn’s Diversified Program generally seeks maximum

diversification subject to liquidity and sector concentration constraints. Each market is traded using a diversified set of trading systems, which may be optimized for groups of markets, sectors or specific markets. The

following factors, among others, are considered in constructing a universe of markets to trade: profitability, liquidity of markets, professional judgment, desired diversification, transaction costs, exchange regulations and

depth of market.

|

|

|

Revolution Capital Management, LLC

Revolution Capital Management, LLC (“Revolution”) serves as a sub-adviser to the Fund. Revolution focuses on

short-term, systematic and quantitative trading, applying statistical analysis to all aspects of research, development, and operations. The strategy seeks to provide superior risk-adjusted returns while maintaining low

correlations both to traditional equity and bond investments as well as the trend-following strategies often employed by commodity trading advisors.

Nuveen Asset Management, LLC

Nuveen Asset Management, LLC (“Nuveen”), serves as a sub-adviser to the Fund, selects securities using a

“top-down” approach that begins with the formulation of Nuveen’s general economic outlook. Following this, various sectors and industries are analyzed and selected for investment. Finally, Nuveen selects individual securities

within these sectors or industries that it believes have above peer-group expected yield, potential for capital preservation or appreciation. Nuveen selects futures and swaps to hedge interest rate and credit risks and as

substitutes for securities when it believes derivatives provide a better return profile or when specific securities are temporarily unavailable. Nuveen sells securities and derivatives to adjust interest rate risk, adjust

credit risk, when a price target is reached, or when a security’s or derivative’s price outlook is deteriorating.

|

|

Benchmarks

|

|

|

ICE BofA Merrill Lynch T-Bill Index and

Barclay Systematic Traders Index

|

Barclay CTA Index and

Bank of America Merrill Lynch 3-Month Treasury Bill Index

|

|

Target Fund

|

Acquiring Fund

|

How They Compare

|

|

Mortgage and Asset-Backed Securities Risk. Mortgage-backed securities (MBS), asset-backed securities (ABS) and commercial mortgage-backed securities (CMBS) are subject to credit risk because underlying

loan borrowers may default. In addition, these securities are subject to prepayment risk because the underlying loans held by the issuers may be paid off prior to maturity. The value of these securities may go down as a result

of changes in prepayment rates on the underlying mortgages or loans. During periods of declining interest rates, prepayment rates usually increase and the Fund may have to reinvest prepayment proceeds at a lower interest rate.

CMBS are less susceptible to prepayment risk because underlying loans may have prepayment penalties or prepayment lock out periods.

|

ABS, MBS

and CMBS Risk. ABS, MBS and CMBS are subject to credit risk because underlying loan borrowers may default. Additionally, these

securities are subject to prepayment risk because the underlying loans held by the issuers may be paid off prior to maturity. The value of these securities may go down as a result of changes in prepayment rates on the

underlying mortgages or loans. During periods of declining interest rates, prepayment rates usually increase and the Fund may have to reinvest prepayment proceeds at a lower interest rate. CMBS are less susceptible to this

risk because underlying loans may have prepayment penalties or prepayment lock out periods.

|

The risks are similar.

|

|

Commodity Risk. Investing in the commodities markets may subject the Fund to greater volatility than investments in traditional securities. Commodity prices may

be influenced by unfavorable weather, animal and plant disease, geologic and environmental factors as well as economic and political developments and changes in government regulation such as tariffs, embargoes or burdensome

production rules and restrictions.

|

Commodity

Risk. Investing in the commodities markets may

subject the Fund to greater volatility than investments in traditional securities. Commodity prices may be influenced by unfavorable weather, animal and plant disease, geologic and environmental factors as well as changes in

government regulation such as tariffs, embargoes or burdensome production rules and restrictions.

|

The risks are similar.

|

|

Counterparty Risk. The Fund is subject to the risk that its counterparty will be unable or unwilling to perform its obligations under the transactions and that the Fund will sustain losses.

|

Not considered a principal risk.

|

A principal risk of the Target Fund’s strategy is counterparty risk, but that risk is not a principal risk of the Acquiring Fund’s strategy.

|

|

Target Fund

|

Acquiring Fund

|

How They Compare

|

|

Credit Risk. Failure of an issuer or guarantor of a fixed income security to make timely interest or principal payments or otherwise honor its obligations

could cause the Fund to lose money. In addition, the credit quality of securities held by the Fund may be lowered if an issuer’s financial condition changes.

|

Credit

Risk. There is a risk that issuers and counterparties will not make payments on securities and other investments held by the Fund,

resulting in losses to the Fund. In addition, the credit quality of securities held by the Fund may be lowered if an issuer’s financial condition changes.

|

The risks are similar.

|

|

Currency Risk. Investments in foreign currencies or financial instruments related to foreign currencies are subject

to the risk that those currencies will change adversely in value relative to the U.S. dollar. Similarly, investments that speculate on the appreciation of the U.S. dollar are subject to the risk that the U.S. dollar may decline

in value relative to foreign currencies. Foreign currencies are subject to risks caused by, among other factors, inflation, interest rates, budget deficits and low savings rates, political factors and government controls.

|

Foreign Currency Risk. Currency trading risks include market risk, credit risk and

country risk. Market risk results from adverse changes in exchange rates in the currencies the Fund is long or short. Credit risk results because a currency-trade counterparty may default. Country risk arises because a

government may interfere with transactions in its currency.

|

The risks are similar.

|

|

Cybersecurity and Operational Risk. Cybersecurity breaches may allow an unauthorized party to gain access to Fund assets, customer data, or proprietary information, or cause the Fund and/or its

service providers to suffer data corruption or lose operational functionality. Additionally, a cybersecurity breach could result in a failure to maintain investors’ confidential information and could result in the theft of

financial assets. Operational risk may arise from human error, error by third parties, communication errors, or technology failures, among other causes.

|

Not considered a principal risk.

|

A principal risk of the Target Fund’s strategy is cybersecurity and operational risk, but that risk is not a principal risk of the Acquiring Fund’s

strategy.

|

|

Derivative Instrument Risk. Derivative Instruments can be highly volatile, illiquid and difficult

to value, and changes in the value of these instruments held directly or indirectly by the Fund may not correlate with the underlying instrument or the Fund’s other investments. Futures, forward currency and options contracts

may experience potentially dramatic price changes (losses) and imperfect correlations between the price of the contract and the underlying security, index or currency which will increase the volatility of the Fund and may

involve a small investment of cash relative to the magnitude of the risk assumed. There may not be a liquid secondary market for the futures contracts. Price valuations or market movements of options may not justify purchasing

put options or, if purchased, the options may expire unexercised, resulting in a loss of the premium paid for the options. There are additional risks associated with Derivative Instruments that are possibly greater than the

risks associated with investing directly in the underlying instruments, including leveraging risk and counterparty credit risk. A small investment in a Derivative Instrument could have a potentially large impact on the Fund’s

performance.

|

Derivatives

Risk. Derivatives

are subject to tracking risk because they may not be perfect substitutes for the instruments they are intended to hedge or replace. Short positions are subject to potentially unlimited liability. Purchased options may expire

worthless. Over the counter derivatives, such as swaps, are subject to counterparty default. Leverage inherent in derivatives will tend to magnify the Fund’s losses.

|

The risks are similar.

|

|

Target Fund

|

Acquiring Fund

|

How They Compare

|

|

Fixed Income Risk. Prices of fixed income securities tend to move inversely with changes in interest rates. Typically, a rise in rates will adversely affect fixed income security prices and,

accordingly, the Fund’s returns and share price. In addition, the Fund may be subject to “call” risk, which is the risk that during a period of falling interest rates the issuer may redeem a security by repaying it early (which

may reduce the Fund’s income if the proceeds are reinvested at lower interest rates), and “extension” risk, which occurs during a rising interest rate environment because certain obligations will be paid off by an issuer more

slowly than anticipated (causing the value of those securities held by the Fund to fall).

|

Fixed Income Risk. Typically, a rise in interest rates causes a decline in the value of

fixed income securities. The value of fixed income securities typically falls when an issuer’s credit quality declines and may even become worthless if an issuer defaults.

|

The risks are similar.

|

|

Interest Rate Risk. When interest rates increase, the value of the Fund’s exposure to fixed income instruments will generally decline in value. Long-term fixed income securities will normally have

more price volatility because of this risk than short-term fixed income securities.

|

Interest Rates and Bond Maturities Risk. Interest rate changes may adversely affect

the market value of an investment. Fixed-income securities typically decline in value when interest rates rise. Fixed-income securities typically increase in value when interest rates decline. The Fund may experience adverse

exposure from either increasing or declining rates. Bonds with longer maturities will be more affected by interest rate changes than intermediate-term bonds.

|

The risks are similar.

|

|

Target Fund

|

Acquiring Fund

|

How They Compare

|

|

Foreign Investment Risk. Investments in instruments issued by entities based outside of the U.S. may be affected by political and economic events unique to a country or region,

currency controls, exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political instability and differing auditing and legal standards.

In addition, Trading Advisors located in jurisdictions outside of the U.S. are subject to the laws of those jurisdictions.

|

Foreign Investment Risk. Foreign investing involves risks not typically associated

with U.S. investments, including adverse fluctuations in foreign currency values, adverse political, social and economic developments, less liquidity, greater volatility, less developed or less efficient trading markets,

political instability and differing auditing and legal standards. Investing in emerging markets imposes risks different from, or greater than, risks of investing in foreign developed countries.

|

The risks are similar.

|

|

General Economic and Market Events Risk. Events in the financial markets have resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both domestic

and foreign. In addition, relatively high market volatility and reduced liquidity in credit and fixed-income markets may adversely affect issuers worldwide. Increases in the level of short-term interest rates could cause

fixed-income markets to experience continuing high volatility, which could negatively impact the Fund’s performance. Banks and financial services companies could suffer losses if interest rates were to rise or economic

conditions deteriorate.

|

Not considered a principal risk.

|

A principal risk of the Target Fund’s strategy is general economic and market events risk, but that risk is not a principal risk of the Acquiring Fund’s

strategy.

|

|

Managed Futures Regulatory Risk. Government regulation of Derivative Instruments by mutual funds is continuing to evolve. The Securities and Exchange Commission previously proposed a rule

designed to modernize the regulation of derivatives usage by mutual funds. Although the rule was later withdrawn, it is anticipated that the rule may be re-proposed, which could have a significant impact on the manner in which

certain managed futures mutual funds, including the Fund, operate. If this rule is re-proposed and adopted as anticipated, it may compel the Fund to change its investment strategy, make the Fund’s investment strategy more costly

to implement, or require the Fund to cease operating as an investment company registered under the 1940 Act. The likelihood of these events, or the impact of potential future regulation, is currently not predictable.

|

Not considered a principal risk.

|

A principal risk of the Target Fund’s strategy is managed futures regulatory risk, but that risk is not a principal risk of the Acquiring Fund’s strategy.

|

|

Target Fund

|

Acquiring Fund

|

How They Compare

|

|

Government Securities Risk. Securities of certain U.S. government agencies and instrumentalities are not guaranteed by the U.S. Treasury, and the Fund must look principally to the agency

or instrumentality issuing or guaranteeing the securities for repayment.

|

Not considered a principal risk.

|

A principal risk of the Target Fund’s strategy is government securities risk, but that risk is not a principal risk of the Acquiring Fund’s strategy.

|

|

High Yield Risk. Lower-quality fixed income securities, known as “high yield” or “junk” bonds, present greater risk than bonds of higher quality, including an increased risk of default. An economic

downturn or period of rising interest rates could adversely affect the market for these bonds and reduce the Fund’s ability to sell its bonds. The lack of a liquid market for these bonds could decrease the Fund’s share price.

|

Not considered a principal risk.

|

A principal risk of the Target Fund’s strategy is high yield risk, but that risk does not apply to the Acquiring Fund’s strategy.

|

|

Leverage Risk. Investments in Derivative Instruments may give rise to a form of leverage. Leverage creates exposure to gains and losses in a greater amount than the dollar amount made in an

investment. Leverage can magnify the effects of changes in the value of the Fund’s investments and make the Fund more volatile. Relatively small market movements may result in large changes in the value of a leveraged

investment. The potential loss on such leveraged investments may be substantial relative to the initial investment therein. Not only can the Fund utilize leverage directly but the Subsidiary also utilizes leverage through its

investment in Derivative Instruments. Trading Advisors may engage in speculative transactions which involve substantial risk and leverage, such as making short sales.

|

Leverage Risk. Using derivatives to increase the Fund’s combined long and short

exposure creates leverage, which can magnify the Fund’s potential for gain or loss and, therefore, amplify the effects of market volatility on the Fund’s share price.

|

The risks are similar.

|

|

Target Fund

|

Acquiring Fund

|

How They Compare

|

|

Loan Risk. Investments in loans may subject the Fund to heightened credit risks as loans tend to be highly

leveraged and potentially more susceptible to the risks of interest deferral, default and/or bankruptcy.

|

Not considered a principal risk.

|

A principal risk of the Target Fund’s strategy is loan risk, but that risk is not a principal risk of the Acquiring Fund’s strategy.

|

|

Management Risk. The investment processes used by the Fund’s adviser, Trading Advisor or the subadviser could fail to achieve the Fund’s investment objective or their judgment may prove to be

incorrect or not produce the desired results and cause your investment to lose value.

|

Management

Risk. The Fund’s

adviser’s and sub-adviser’s judgments about the attractiveness, value and potential appreciation of particular asset classes, securities and derivatives in which the Fund invests may prove to be incorrect and may not produce the

desired results. Additionally, the adviser’s judgments about the potential performance of the sub-adviser may also prove incorrect and may not produce the desired results.

|

The risks are similar.

|

|

Market Disruption and Geopolitical Risk. Instability in the financial markets or in various countries or regions around the world may result in market volatility and may have long-term effects on the

U.S. and worldwide financial markets and may result in a loss to your investment.

|

Not considered a principal risk.

|

A principal risk of the Target Fund’s strategy is market disruption and geopolitical risk, but that risk is not a principal risk of the Acquiring Fund’s

strategy.

|

|

Market Risk. The market

value of a security or instrument may fluctuate, sometimes rapidly and unpredictably. These fluctuations, which are often referred to as “volatility,” may cause a security or instrument to be worth less than it was worth at an

earlier time. Market risk may affect a single issuer, industry, commodity, sector of the economy, or the market as a whole.

|

Market Risk. Overall securities and derivatives market risks may affect the value of

individual instruments in which the Fund invests. Factors such as domestic and foreign economic growth and market conditions, interest rate levels, and political events affect the securities and derivatives markets. When the

value of the Fund’s investments goes down, your investment in the Fund decreases in value and you could lose money.

|

The risks are similar.

|

|

Short Sales Risk. The Trading Advisors may make short sales, which may be considered speculative transactions and involve substantial risk and leverage. Short sales expose the Fund to the risk

that it will be required to cover the short position at a time when the underlying instrument has appreciated in value, thus resulting in a loss to the Fund.

|

Short Position Risk. The Fund will incur a loss as a result of a short position if

the price of the short position instrument increases in value between the date of the short position sale and the date on which an offsetting position is purchased. The Fund is required to make a margin deposit in connection

with such short sales; The Fund may have to pay a fee to borrow particular securities and will often be obligated to pay over any dividends and accrued interest on borrowed securities. Short positions may be considered

speculative transactions and involve special risks, including greater reliance on the adviser’s ability to accurately anticipate the future value of a security or instrument. The Fund’s losses are potentially unlimited in a

short position transaction.

|

The risks are similar.

|

|

Target Fund

|

Acquiring Fund

|

How They Compare

|

|

Subsidiary Risk. The Fund’s investment in the Subsidiary exposes the Fund to the risks associated with the Subsidiary’s investments, which are generally the risks of futures-related investments.