United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

(Mark One)

| [X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2018

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 0-54402

BIORESTORATIVE THERAPIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 91-1835664 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 40 Marcus Drive, Melville, New York | 11747 | |

| (Address of principal executive offices) | (Zip Code) |

(631) 760-8100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| None | Not applicable |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

As of June 30, 2018, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $9,435,076 based on the closing sale price as reported on the OTCQB market. As of March 27, 2019, there were 14,676,794 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

INDEX

This Annual Report contains forward-looking statements as that term is defined in the federal securities laws. The events described in forward-looking statements contained in this Annual Report may not occur. Generally these statements relate to business plans or strategies, projected or anticipated benefits or other consequences of our plans or strategies, projected or anticipated benefits from acquisitions to be made by us, or projections involving anticipated revenues, earnings or other aspects of our operating results. The words “may,” “will,” “expect,” “believe,” “anticipate,” “project,” “plan,” “intend,” “estimate,” and “continue,” and their opposites and similar expressions are intended to identify forward-looking statements. We caution you that these statements are not guarantees of future performance or events and are subject to a number of uncertainties, risks and other influences, many of which are beyond our control, that may influence the accuracy of the statements and the projections upon which the statements are based. Factors which may affect our results include, but are not limited to, the risks and uncertainties discussed in Item 7 of this Annual Report under “Factors That May Affect Future Results and Financial Condition”.

Any one or more of these uncertainties, risks and other influences could materially affect our results of operations and whether forward-looking statements made by us ultimately prove to be accurate. Our actual results, performance and achievements could differ materially from those expressed or implied in these forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether from new information, future events or otherwise.

Intellectual Property

This Annual Report includes references to our federally registered trademarks, BioRestorative Therapies, the Dragonfly Logo, brtxDISC, ThermoStem, Stem Pearls and Stem the Tides of Time. We also own allowed trademark applications for BRTX and BRTX-100. The Dragonfly Logo is also registered with the U.S. Copyright Office. This Annual Report also includes references to trademarks, trade names and service marks that are the property of other organizations. Solely for convenience, trademarks and trade names referred to in this Annual Report appear without the ®, SM or ™ symbols, and copyrighted content appears without the use of the symbol ©, but the absence of use of these symbols does not reflect upon the validity or enforceability of the intellectual property owned by us or third parties.

| 2 |

| ITEM 1. | BUSINESS. |

(a) Business Development

As used in this Annual Report on Form 10-K (the “Annual Report”), references to the “Company”, “we”, “us”, or “our” refer to BioRestorative Therapies, Inc. and its subsidiaries.

We were incorporated in Nevada on June 13, 1997. On August 15, 2011, we changed our name from “Stem Cell Assurance, Inc.” to “BioRestorative Therapies, Inc.” Effective January 1, 2015, we reincorporated in Delaware.

In January 2017, we submitted an Investigational New Drug application to the U.S. Food and Drug Administration, or the FDA, to obtain authorization to commence a Phase 2 clinical trial investigating the use of BRTX-100, our lead cell therapy candidate, in the treatment of chronic lower back pain arising from degenerative disc disease. In February 2017, we received such authorization from the FDA.

In January 2019, a United States patent related to the ThermoStem Program was issued to us.

In March 2018, we engaged Defined Health, a business development and strategy firm, to conduct an independent review of BRTX-100, our lead cell therapy candidate to treat chronic lumbar disc disease. As noted in the report presented by Defined Health, key opinion leaders interviewed by Defined Health reacted positively to the value proposition of BRTX-100.

In September 2018, we entered into a one year material transfer agreement with the University of Pennsylvania pursuant to which the university is provided access to our proprietary brown adipose tissue (brown fat) cells for research purposes.

In August 2018, the Journal of Translational Medicine published the results of our study evaluating the benefits of long-term hypoxic (low oxygen) culturing of human bone marrow-derived mesenchymal stems cells used in BRTX-100.

In March 2018, we appointed Dr. Wayne J. Olan, a member of our Scientific Advisory Board, as Clinical Director of our Regenerative Disc/Spine Program.

In October 2018, we created a Disc Advisory Committee of our Scientific Advisory Board and we appointed Dr. Jason Lipetz as Chairman of the Disc Advisory Committee. We have also appointed Dr. Olan to the Disc Advisory Committee as well as Drs. Harvinder Sandhu, Christopher Plasteras and Gerard Malanga to the Scientific Advisory Board and the Disc Advisory Committee.

In January 2018, we hired Adam D. Bergstein to serve as Senior Vice President, Planning and Business Development. See Item 10 (“Directors, Executive Officers and Corporate Governance”). Mr. Bergstein resigned his position in October 2018.

In October 2018, we hired Lance Alstodt to serve as Executive Vice President and Chief Strategy Officer. See Item 10 (“Directors, Executive Officers and Corporate Governance”).

| 3 |

During the year ended December 31, 2018, we raised an aggregate of $589,168 in connection with sales of common stock and warrants and from the exercise of warrants, and an aggregate of $4,149,173 in debt financing (net of repayments). As of December 31, 2018, our outstanding debt of $5,161,916, together with interest at rates ranging between 0% and 15% per annum, was due through December 2019.

Subsequent to December 31, 2018, we have received aggregate equity financing and debt financing of $600,000 and $3,073,918, respectively, debt (inclusive of accrued interest) of $643,900 has been exchanged for common stock, $1,254,805 of debt (inclusive of accrued interest and prepayment premiums) has been repaid, and the due date for the repayment of an aggregate of $155,000 of debt has been extended to December 2020. Giving effect to the above actions, we currently have notes payable with an aggregate principal balance of $107,500 which are past due.

(b) Business

General

We are a life sciences company focused on the development of regenerative medicine products and therapies using cell and tissue protocols, primarily involving adult (non-embryonic) stem cells. Our two core developmental programs, as described below, relate to the treatment of disc/spine disease and metabolic disorders:

| ● | Disc/Spine Program (brtxDisc). Our lead cell therapy candidate, BRTX-100, is a product formulated from autologous (or a person’s own) cultured mesenchymal stem cells, or MSCs, collected from the patient’s bone marrow. We intend that the product will be used for the non-surgical treatment of painful lumbosacral disc disorders. The BRTX-100 production process involves collecting bone marrow and whole blood from a patient, isolating and culturing (in a proprietary method) stem cells from the bone marrow and cryopreserving the cells in an autologous carrier. In an outpatient procedure, BRTX-100 is to be injected by a physician into the patient’s painful disc. The treatment is intended for patients whose pain has not been alleviated by non-surgical procedures or conservative therapies and who potentially face the prospect of highly invasive surgical procedures. In January 2017, we submitted an Investigational New Drug, or IND, application to the FDA to obtain authorization to commence a Phase 2 clinical trial investigating the use of BRTX-100 in the treatment of chronic lower back pain arising from degenerative disc disease. In February 2017, we received such authorization from the FDA. We intend to commence such clinical trial during the third quarter of 2019 (assuming the receipt of necessary funding). See “Disc/Spine Program” below. | |

| ● | Metabolic Program (ThermoStem). We are developing a cell-based therapy candidate to target obesity and metabolic disorders using brown adipose (fat) derived stem cells, or BADSC, to generate brown adipose tissue, or BAT. We refer to this as our ThermoStem Program. BAT is intended to mimic naturally occurring brown adipose depots that regulate metabolic homeostasis in humans. Initial preclinical research indicates that increased amounts of brown fat in animals may be responsible for additional caloric burning, as well as reduced glucose and lipid levels. Researchers have found that people with higher levels of brown fat may have a reduced risk for obesity and diabetes. See “Metabolic Brown Adipose (Fat) Program” below. |

| 4 |

We have also licensed an investigational curved needle device designed to deliver cells and/or other therapeutic products or material to the spine and discs (and other parts of the body). See “Curved Needle Device” below.

The patents and patent applications for the Disc/Spine Program, the ThermoStem Program and the curved needle device are listed below under “Technology; Research and Development”.

Overview

Every human being has stem cells in his or her body. These cells exist from the early stages of human development until the end of a person’s life. Throughout our lives, our body continues to produce stem cells that regenerate to produce differentiated cells that make up various aspects of the body such as skin, blood, muscle and nerves. These are generally referred to as adult (non-embryonic) stem cells. These cells are important for the purpose of medical therapies aiming to replace lost or damaged cells or tissues or to otherwise treat disorders.

Regenerative cell therapy relies on replacing diseased, damaged or dysfunctional cells with healthy, functioning ones or repairing damaged or diseased tissue. A great range of cells can serve in cell therapy, including cells found in peripheral and umbilical cord blood, bone marrow and adipose (fat) tissue. Physicians have been using adult stem cells from bone marrow to treat various blood cancers for 60 years (the first successful bone marrow transplant was performed in 1956). Recently, physicians have begun to use stem cells to treat various other diseases. We intend to develop cell and tissue products and regenerative therapy protocols, primarily involving adult stem cells, to allow patients to undergo cellular-based treatments.

We intend to concentrate initially on therapeutic areas in which risk to the patient is low, recovery is relatively easy, results can be demonstrated through sufficient clinical data, and patients and physicians will be comfortable with the procedure. We believe that there will be readily identifiable groups of patients who will benefit from these procedures.

Accordingly, we have focused our initial developmental efforts on cellular-based therapeutic products and clinical development programs in selective areas of medicine for which the treatment protocol is minimally invasive. Such areas include the treatment of the disc and spine and metabolic-related disorders. Upon regulatory approval, we will seek to obtain third party reimbursement for our products and procedures; however; patients may be required to pay for our products and procedures out of pocket in full and without the ability to be reimbursed by any governmental and other third party payers.

We have undertaken research and development efforts in connection with the development of investigational therapeutic products and medical therapies using cell and tissue protocols, primarily involving adult stem cells. See “Disc/Spine Program”, “Metabolic Brown Adipose (Fat) Program” and “Curved Needle Device” below. As a result of these programs, we have obtained two United States and two non-United States patents related to research regarding our ThermoStem Program, we have obtained licenses for two patent applications related to our Disc/Spine Program and we have obtained a license for one United States patent related to a curved needle device.

We have established a laboratory facility and will seek to further develop cellular-based treatments, products and protocols, stem cell-related intellectual property, or IP, and translational research applications. See “Laboratory” below.

| 5 |

We have not generated any significant revenues from our operations. The implementation of our business plan, as discussed below, will require the receipt of sufficient equity and/or debt financing to purchase necessary equipment, technology and materials, fund our research and development efforts, retire our outstanding debt (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Availability of Additional Funds”) and otherwise fund our operations. We intend to seek such financing from current shareholders and debtholders as well as from other accredited investors. We also intend to seek to raise capital through investment bankers and from biotech funds, strategic partners and other financial institutions. We anticipate that we will require approximately $20,000,000 in financing to commence and complete a Phase 2 clinical trial and we will require approximately $45,000,000 in further additional funding to complete our clinical trials using BRTX-100, as further described in this Item 1 (assuming the receipt of no revenues from operations), repay our outstanding debt ($5,161,916 as of December 31, 2018) (assuming that no debt is converted into equity) and fund general operations. We will also require a substantial amount of additional funding to implement our other programs described in this Item 1. No assurance can be given that the anticipated amounts of required funding are correct or that we will be able to accomplish our goals within the timeframes projected. In addition, no assurance can be given that we will be able to obtain any required financing on commercially reasonable terms or otherwise. We may also seek to have our debtholders convert all or a portion of their debt into equity. No assurance can be given that we will be able to convert such debt into equity on commercially reasonable terms or otherwise. If we are unable to obtain adequate funding, we may be required to significantly curtail or discontinue our proposed operations. See Item 7 (“Management’s Discussion and Analysis of Financial Condition and Results of Operations – Factors That May Affect Future Results and Financial Condition – We will need to obtain a significant amount of financing to initiate and complete our clinical trials and implement our business plan. – We will need to obtain additional financing to satisfy debt obligations”).

Disc/Spine Program

General

Among the initiatives that we are currently pursuing is our Disc/Spine Program, with our initial product candidate being called BRTX-100. We have obtained a license (see “License” below) that permits us to use technology for adult stem cell treatment of disc and spine conditions. The technology is an advanced stem cell culture and injection procedure into the intervertebral disc, or IVD, that may offer relief from lower back pain, buttock and leg pain, and numbness and tingling in the leg and foot.

Lower back pain is the most common, most disabling, and most costly musculoskeletal ailment faced worldwide. According to a recent market report, there are nearly 25 million people in the United States with chronic lower back pain of which approximately 5 million have pain caused by a protruding or injured disc. We believe that between 500,000 and 1 million of these back pain sufferers will have an invasive surgical procedure to try to alleviate the pain associated with these lower back conditions. Clinical studies have documented that the source of the pain is most frequently damage to the IVD. This can occur when forces, whether a single load or repetitive microtrauma, exceed the IVD’s inherent capacity to resist those loads. Aging, obesity, smoking, lifestyle, and certain genetic factors may predispose one to an IVD injury. Current surgical approaches to back pain are extremely invasive and costly (often altering the spine’s biomechanics unfavorably and predisposing it to further disc degeneration) and are associated with unacceptably low success rates.

| 6 |

While once thought to be benign, the natural history of lower back pain is often one of chronic recurrent episodes of pain leading to progressive disability. This is believed to be a direct result of the IVD’s poor healing capacity after injury. The IVD is the largest avascular (having few or no blood vessels) structure in the body and is low in cellularity. Therefore, its inherent capacity to heal after injury is poor. The clinical rationale of BRTX-100 is to deliver a high concentration of the patient’s own cultured MSCs into the site of pathology to promote healing and relieve pain.

We have developed a mesenchymal stem cell product candidate, BRTX-100, derived from autologous (or a person’s own) human bone marrow, cultured and formulated, in a proprietary method, specifically for introduction into a painful lumbar disc.

In January 2017, we submitted an IND application to the FDA to obtain authorization to commence a Phase 2 clinical trial investigating the use of BRTX-100, our lead cell therapy candidate, in the treatment of chronic lower back pain arising from degenerative disc disease. In February 2017, we received such authorization from the FDA. We intend to commence such clinical trial during the third quarter of 2019 (assuming the receipt of necessary funding).

In addition to developing BRTX-100, we may also seek to sublicense the technology to a strategic third party, who may assist in gaining FDA approval for a lumbar disc indication, or third parties for use in connection with cellular-based developmental programs with regard to disc and spine related conditions.

We have established a laboratory, which includes a clean room facility, to perform the production of cell products (possibly including BRTX-100) for use in our clinical trials, for third party cell products or for general research purposes. We may also use this laboratory to develop our pipeline of future products and expand our stem cell-related IP. See “Laboratory” and “Technology; Research and Development” below.

BRTX-100

Our lead product candidate, BRTX-100, is an autologous hypoxic (low oxygen) cultured mesenchymal stem cell product derived from a patient’s own bone marrow and formulated with a proprietary carrier. We have designed the cryopreserved sterile cellular product candidate to be provided in vials for injection into painful lumbar discs. We anticipate the product candidate will be delivered using a standard 20 gauge 3.5 inch introducer needle and a 25 gauge 6 inch needle that will extend into the disc center upon delivery. Upon regulatory approval, we plan to provide training to medical practitioners with regard to the approved injection procedure. It is anticipated that the delivery of the product candidate will be a 30 minute procedure.

Mesenchymal stem cells used in BRTX-100 are similar to other MSCs under development by others; however, in order to enhance the survivability of our bone marrow-derived MSCs in the avascular environment of the damaged disc, BRTX-100 is designed to expand under hypoxic conditions for a period of approximately three weeks. This process is intended to result in an approximate 40 million cell count population with enhanced viability and therapeutic potential following injection locally into injured spinal discs. Publications and scientific literature have indicated that MSCs preconditioned in hypoxic environment show enhanced skeletal muscle regeneration properties and improved impacts upon circulation and vascular formation compared to MSCs cultured under normoxic (normal oxygen) conditions.

| 7 |

In August 2018, the Journal of Translational Medicine published the results of our study evaluating the benefits of long-term hypoxic culturing of human bone marrow-derived MSCs.

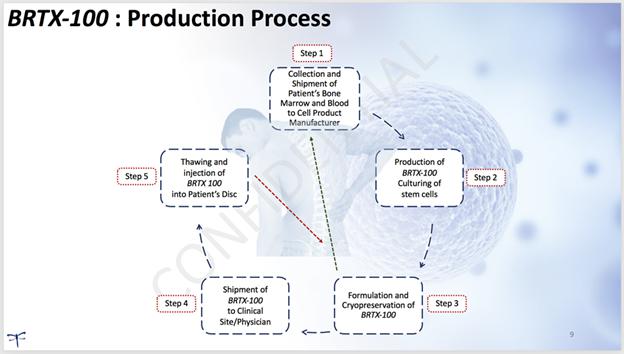

Production and Delivery

The production of our product candidate, BRTX-100, begins with the physician collecting bone marrow from the patient under local anesthesia. Peripheral blood is also collected from the patient. The physician will then send the patient’s bone marrow and blood samples to our laboratory (or a contract laboratory) for culturing and formulation. The hypoxic culturing process applied is intended to result in the selection of a cell population that is suitable for an improved possibility of survival in the internal disc environment. We anticipate that the cell culturing process and product formulation will take approximately three weeks, with an additional two weeks required for quality control testing required to meet product release criteria. We will then send the therapeutic cryopreserved stem cells (BRTX-100) in a sterile vial back to the physician’s offices where it will undergo a controlled thaw prior to the procedure. The price structure for the procedure and our services has not been determined and no assurances can be given in this regard. The following illustrates the process:

| 8 |

License

Pursuant to our license agreement with Regenerative Sciences, LLC, or Regenerative, that became effective in April 2012, we have obtained, among other things, a worldwide (excluding Asia and Argentina), exclusive, royalty-bearing license from Regenerative to utilize or sublicense a certain method for culturing cells for use in our developmental program involving disc and spine conditions, including protruding or painful discs. The investigational technology that has been licensed is an advanced stem cell culture and injection procedure that may offer relief from lower back pain, buttock and leg pain, and numbness and tingling in the leg and foot. Pursuant to the license agreement, we have also obtained a worldwide, exclusive, royalty-bearing license from Regenerative to utilize or sublicense a certain investigational curved needle device for the administration of specific cells and/or cell products to the disc and/or spine (and other parts of the body). It will be necessary to advance the design of this investigational device to facilitate the delivery of substances, including living cells, to specific locations within the body and minimize the potential for damage to nearby structures.

The license agreement provides for the requirement that we achieve certain milestones or pay certain minimum royalty amounts in order to maintain the exclusive nature of the licenses. The license agreement also provides for a royalty-bearing sublicense of certain aspects of the technology to Regenerative for use for certain purposes, including in the United States and the Cayman Islands. Further, the license agreement requires that Regenerative furnish certain training, assistance and consultation services with regard to the licensed technology.

Animal Study

The efficacy and safety of our product candidate, BRTX-100, has been tested in a degenerative intervertebral rabbit disc model. In this study, 80 rabbits underwent surgery to create a puncture in the discs. Four weeks post surgery, each rabbit had either contrast, a biomaterial carrier or BRTX-100 injected into the discs. In order to study the biodistribution and efficacy of BRTX-100, the rabbits were evaluated at day 56 and day 120.

The key safety findings of the animal study are as follows:

| ● | There was no evidence or observation of gross toxicity related to the administration of BRTX-100 at either time point. The clinical pathology across both groups and time points were within expected normal historical ranges and under the conditions of the test. No abnormalities (including fractures or overt signs of lumbar disc disease) were identified after review of the radiographic images taken at both endpoints for both groups. No toxicity or adverse finding was evident in the systemic tissues or the discs of animals receiving BRTX-100. | |

| ● | There was no detectable presence of human cells (BRTX-100) observed at the day 56 interim time point. This is consistent with the proposed mechanism of action that BRTX-100 acts through a paracrine effect of secreted growth and immunomodulation factors. |

| 9 |

The key efficacy findings of the animal study are as follows:

| ● | BRTX-100 showed a statistically significant DHI (disc height increase) over the control group at day 120. | |

| ● | BRTX-100 showed a statistically significant improvement in disc histology over the control group at day 120 as graded by a validated histology scale. BRTX-100 showed a significant improvement in the cellularity and matrix of the disc when compared to the control at day 120. |

Clinical Trial

In January 2017, we submitted an IND application to the FDA to obtain authorization to commence a Phase 2 clinical trial investigating the use of BRTX-100, our lead cell therapy candidate, in the treatment of chronic lower back pain arising from degenerative disc disease. In February 2017, we received such authorization from the FDA. We intend to commence such clinical trial during the third quarter of 2019 (assuming the receipt of necessary funding).

The following describes the Phase 2 clinical trial authorized by the FDA:

A Phase 2 Prospective, Double-Blinded, Placebo Controlled, Randomized Study

| ● | General | ||

| ● | 72 patients; randomized 2:1, BRTX-100 to control | ||

| ● | 10-20 clinical trial sites | ||

| ● | Primary efficacy endpoint at 12 months | ||

| ● | Patient safety and efficacy follow up at 24 months | ||

| ● | Primary Efficacy Endpoint | ||

| ● | Responder endpoint - % of patients that meet the improvement in function and reduction in pain threshold | ||

| ● | Improvement in function defined as at least a 30% increase in function based on the Oswestry questionnaires (ODI) | ||

| ● | Reduction of pain defined as at least a 30% decrease in pain as measured using the Visual Analogue Scale (VAS) | ||

| ● | Additional or Secondary Endpoints | ||

| ● | Quality of life assessment | ||

| ● | Evolution of affected disc(s) by magnetic resonance imaging (MRI) | ||

The FDA approval process can be lengthy, expensive and uncertain and there is no guarantee that the clinical trial(s) will be commenced or completed or that the product will ultimately receive approval or clearance. See “Government Regulation” below and Item 7 (“Management’s Discussion and Analysis of Financial Condition and Results of Operations – Factors That May Affect Future Results and Financial Condition – Risks Related to Our Cell Therapy Product Development Efforts; and – Risks Related to Government Regulation”).

As an alternative to undertaking the Phase 2 clinical trial ourselves, we are exploring the possible licensing of our rights with respect to our product candidate, BRTX-100, to a strategic partner. Such an arrangement could possibly eliminate or significantly reduce the need to raise the substantial capital needed to commence and complete the clinical trials and undertake the commercialization of BRTX-100 and would provide licensing-related revenue to us. No assurance can be given that any licensing agreement will be entered into, whether upon commercially reasonable terms or otherwise.

| 10 |

Defined Health Report

In March 2018, we engaged Defined Health, a business development and strategy consulting firm, to conduct an independent review of BRTX-100. Defined Health has worked with many of the leading companies in the pharmaceutical, biotech and healthcare industries for over 25 years.

The review was intended to collect informed, independent opinions regarding BRTX-100 among key opinion leaders, or KOLs (i.e., orthopedic surgeons specializing in back and spine surgery with experience in stem cell therapy), who, upon studying applicable clinical material, could offer opinions regarding the future therapeutic potential of BRTX-100.

As noted in the Defined Health report, the KOLs reacted positively to the value proposition of our product candidate, BRTX-100, and were optimistic that the clinical data presented to date is likely to be mirrored in future clinical investigations. Given the opportunity, the KOLs indicated that they would likely participate in a clinical trial should it be offered at their center and that they would recommend the study to appropriately eligible patients. The report indicated that, if BRTX-100 were to be granted FDA approval, the KOLs anticipate that it would be integrated into the standard of care for eligible chronic lumbar disc disease patients.

Metabolic Brown Adipose (Fat) Program

Since June 2011, we have been engaging in pre-clinical research efforts with respect to an investigational platform technology utilizing brown adipose (fat) derived stem cells, or BADSCs, for therapeutic purposes. We have labeled this initiative our ThermoStem Program.

Brown fat is a specialized adipose (fat) tissue found in the human body that plays a key role in the evolutionarily conserved mechanisms underlying thermogenesis (generation of non-shivering body heat) and energy homeostasis in mammals - long known to be present at high levels in hibernating mammals and human newborns. Recent studies have demonstrated that brown fat is present in the adult human body and may be correlated with the maintenance and regulation of healthy metabolism, thus potentially being involved in caloric regulation. The pre-clinical ThermoStem Program involves the use of a cell-based (brown adipose tissue construct) treatment for metabolic disease, such as type 2 diabetes, obesity, hypertension and other metabolic disorders, as well as cardiac deficiencies. We have had initial success in transplanting the brown adipose tissue construct in animals, and we are currently exploring ways to deliver into humans. Even though present, BAT mass is very low in healthy adults and even lower in obese populations. Therefore, it may not be sufficient to either naturally impact whole body metabolism, or to be targeted by drugs intended to increase its activity in the majority of the population. Increasing BAT mass is crucial in order to benefit from its metabolic activity and this is what our ThermoStem Program seeks to accomplish. We may also identify other naturally occurring biologics and chemically engineered molecules that may enhance brown adipose tissue performance and activity.

| 11 |

Obesity, the abnormal accumulation of white fat tissue, leads to a number of metabolic disorders and is the driving force behind the rise of type 2 diabetes and cardiovascular diseases worldwide. Pharmacological efforts to alter metabolic homeostasis through modulating central control of appetite and satiety have had limited market penetration due to significant psychological and physiological safety concerns directly attributed to modulating these brain centers. Adipose tissue is one of the largest organs in the human body and plays a key role in central energy balance and lipid homeostasis. White and brown adipose tissues are found in mammals. White adipose tissue’s function is to store energy, whereas BAT specializes in energy expenditure. Recent advancements in unraveling the mechanisms that control the induction, differentiation, proliferation, and thermogenic activity of BAT, along with the application of imaging technologies for human BAT visualization, have generated optimism that these advances may provide novel strategies for targeting BAT activation/thermogenesis, leading to efficacious and safe obesity targeted therapies.

We are developing a cell-based product candidate to target obesity and metabolic disorders using BADSCs. Our goal is to develop a bioengineered implantable brown adipose tissue construct intended to mimic ones naturally occurring in the human body. We have isolated and characterized a human multipotent stem cell population that resides within BAT depots. We have expanded these stem cells to clinically relevant numbers and successfully differentiated them into functional brown adipocytes. We intend to use adult stem cells that may be differentiated into progenitor or fully differentiated brown adipocytes, or a related cell type, which can be used therapeutically in patients. We are focusing on the development of treatment protocols that utilize allogeneic cells (i.e., stem cells from a genetically similar but not identical donor).

In order to deliver these differentiated cells into target locations in vivo, we seeded BADSCs onto 3-dimensional biological scaffolds. Pre-clinical animal models of diet-induced obesity, that were transplanted with differentiated BADSCs supported by a biological scaffold, presented significant reductions in weight and blood glucose levels compared to saline injected controls. We are identifying technology for in vivo delivery in small animal models. Having completed our proof of concept using our BAT in small animals, we are currently developing our next generation BAT. It is anticipated that this next version will contain a higher purity of BADSC and a greater percent of functional brown adipocytes, which is expected to increase the therapeutic effect compared to our first generation product. In addition, we are exploring the delivery of the therapeutic using encapsulation technology, which will only allow for reciprocal exchange of small molecules between the host circulation and the BAT implant. We expect that encapsulation may present several advantages over our current biological scaffolds, including prevention of any immune response or implant rejection that might occur in an immunocompetent host and an increase in safety by preventing the implanted cells from invading the host tissues and forming tumors. We have developed promising data on the loading of human stem cell-derived tissue engineered brown fat into an encapsulation device to be used as a cell delivery system for our metabolic platform program for the treatment of type 2 diabetes, obesity, hyperlipidemia and hypertension. This advancement may lead to successful transplantation of brown fat in humans. We are evaluating the next generation of BAT constructs that will first be tested in small animal models. No assurance can be given that this delivery system will be effective in vivo in animals or humans. Our allogeneic brown adipose derived stem cell platform potentially provides a therapeutic and commercial model for the cell-based treatment of obesity and related metabolic disorders.

| 12 |

In June 2012, we entered into an Assignment Agreement with the University of Utah Research Foundation, or the Foundation, and a Research Agreement with the University of Utah, or the Utah Research Agreement. Pursuant to the Assignment Agreement, which provides for royalty payments, we acquired the rights to two provisional patent applications that relate to human brown fat cell lines. No royalty amounts are payable to date. The applications have been converted to a utility application in the United States and several foreign jurisdictions. Pursuant to the Utah Research Agreement, the University of Utah, or the University, provided research services relating to the identification of brown fat tissue and the development and characterization of brown fat cell lines. The Utah Research Agreement provides that all inventions, discoveries, patent rights, information, data, methods and techniques, including all cell lines, cell culture media and derivatives thereof, are owned by us. In February 2019, we entered into a Services Agreement with the University of Utah pursuant to which the university has been retained to provide research services with regard to the ThermoStem Program. Pursuant to this agreement, we will initiate preclinical models to study the efficacy of our generation 2 encapsulated brown adipose tissue construct.

In February 2014, our research with regard to the identification of a population of brown adipose derived stem cells was published in Stem Cells, a respected stem cell journal.

In March 2014, we entered into a Research Agreement with Pfizer Inc., a global pharmaceutical company. Pursuant to the Pfizer Research Agreement, we were engaged to provide research and development services with regard to a joint study of the development and validation of a human brown adipose cell model. The Pfizer Research Agreement provided for an initial payment to us of $250,000 and the payment of up to an additional $525,000 during the two-year term of the Agreement, all of which has been received.

In August 2015, we entered into a one year research collaboration agreement with the University of Pennsylvania with regard to the understanding of brown adipose biology and its role in metabolic disorders. In September 2018, we entered into a one year material transfer agreement with the University of Pennsylvania pursuant to which the university is provided access to our proprietary brown adipose tissue cells for research purposes. No amounts are payable by or to us pursuant to either agreement.

In September 2015, a United States patent related to the ThermoStem Program was issued to us.

In April 2017, an Australian patent related to the ThermoStem Program was issued to us.

In December 2017, a Japanese patent related to the ThermoStem Program was issued to us.

In January 2019, a United States patent related to the ThermoStem Program was issued to us.

Following our research activities, we intend to undertake preclinical animal studies in order to determine whether our proposed treatment protocol is feasible. Such studies are planned to begin by the second quarter of 2019 (assuming the receipt of necessary financing). Following the completion of such studies, we intend to file an IND with the FDA and initiate a clinical trial. See “Government Regulation” below and Item 7 (“Management’s Discussion and Analysis of Financial Condition and Results of Operations – Factors That May Affect Future Results and Financial Condition – Risks Related to Our Cell Therapy Product Development Efforts; and – Risks Related to Government Regulation”). The FDA approval process can be lengthy, expensive and uncertain and there is no guarantee of ultimate approval or clearance.

| 13 |

We anticipate that much of our development work in this area will take place at our laboratory facility, outside core facilities at academic, research or medical institutions, or contractors. See “Laboratory” below.

Curved Needle Device

Pursuant to the Regenerative license agreement discussed under “Disc/Spine Program-License” above, we have licensed and further developed an investigational curved needle device, or CND, that is a needle system with a curved inner cannula to allow access to difficult-to-locate regions for the delivery or removal of fluids and other substances. The investigational CND is intended to deliver stem cells and/or other therapeutic products or material to the interior of a human intervertebral disc, the spine region, or potentially other areas of the body. The device is designed to rely on the use of pre-curved nested cannulae that allow the cells or material to be deposited in the posterior and lateral aspects of the disc to which direct access is not possible due to outlying structures such as vertebra, spinal cord and spinal nerves. We anticipate that the use of the investigational CND will facilitate the delivery of substances, including living cells, to specific locations within the body and minimize the potential for damage to nearby structures. The investigational device may also have more general use applications. In August 2015, a United States patent for the CND was issued to the licensor, Regenerative Sciences, LLC. We anticipate that FDA approval or clearance will be necessary for the investigational CND prior to commercialization. See “Government Regulation” below and Item 7 (“Management’s Discussion and Analysis of Financial Condition and Results of Operations – Factors That May Affect Future Results and Financial Condition – Risks Related to Our Cell Therapy Product Development Efforts; and – Risks Related to Government Regulation”). The FDA review and approval process can be lengthy, expensive and uncertain and there is no guarantee of ultimate approval or clearance.

Laboratory

We have established a laboratory in Melville, New York for research purposes and have built a cleanroom within the laboratory for the possible production of cell-based product candidates, such as BRTX-100, for use in a clinical trial, for third party cell products or general research purposes.

As operations grow, our plans include the expansion of our laboratory to perform cellular characterization and culturing, protocol and stem cell-related IP development, translational research and therapeutic outcome analysis. As we develop our business and our stem cell product candidates and obtain regulatory approval, we will seek to establish ourselves as a key provider of adult stem cells for therapies and expand to provide cells in other market areas for stem cell therapy. We may also use outside laboratories specializing in cell therapy services and manufacturing of cell products.

Technology; Research and Development

We intend to utilize our laboratory or a third party laboratory in connection with cellular research activities. We also intend to obtain cellular-based therapeutic technology licenses and increase our IP portfolio. We intend to seek to develop potential stem cell delivery systems or devices. The goal of these specialized delivery systems or devices is to deliver cells into specific areas of the body, control the rate, amount and types of cells used in a treatment, and populate these areas of the body with sufficient stem cells so that there is a successful therapeutic result.

| 14 |

We also intend to perform research to develop certain stem cell optimization compounds, media designed to enhance cellular growth and regeneration for the purpose of improving pre-treatment and post-treatment outcomes.

In our Disc/Spine Program, three patent applications have been filed with regard to technology that is the subject of the license agreement between us and Regenerative (see “Disc/Spine Program-License” above). Regenerative has been issued a patent from one of these applications with regard to its curved needle therapeutic delivery device. The other two applications remain pending.

In our ThermoStem Program, we have three pending United States patent applications within two patent families. We have been issued a United States patent in each of the two patent families. Patent applications with regard to the first patent family in the ThermoStem Program have been filed in five foreign jurisdictions (of which two applications have granted as foreign patents and one application has lapsed). Patent applications with regard to the second patent family in the ThermoStem Program have been filed in four foreign jurisdictions.

Our patent applications and those of Regenerative are currently in prosecution (i.e., we and Regenerative are seeking issued patents). A description of the patent applications and issued patents is set forth in the table below:

| Program | I.D. | Jurisdiction | Title | |||

Disc/Spine (brtxDisc) |

13/132,840* | US | Methods and compositions to facilitate repair of avascular tissue | |||

| 15/891,852 | US | Surgical methods and compositions to facilitate repair of avascular tissue | ||||

| U.S. Patent No. 9,113,950 B2** | US | Therapeutic delivery device | ||||

| Metabolic | U.S. Patent No. 9,133,438 | US | Brown fat cell compositions and methods | |||

| (ThermoStem) | 13/932,468 | US | ||||

| 15/910,625 | US | |||||

| AU Patent No. 2012275335 | Australia | |||||

| 12743811.7 | Europe | |||||

| 230237 | Israel | |||||

| JP Patent No. 6243839 | Japan | |||||

| U.S. Patent No. 10,167,449 | US | Human brown adipose derived stem cells and uses | ||||

| 16/183,370 | US | |||||

| 2014253920 | Australia | |||||

| 14729769.1 | Europe | |||||

| 242150 | Israel | |||||

| 2016-509105 | Japan |

*Patent application filed by licensor, Regenerative Sciences, LLC

**Patent issued to licensor, Regenerative Sciences, LLC

| 15 |

In March 2014, we entered into a Research and Development Agreement with Rohto Pharmaceutical Co., Ltd., a Japanese pharmaceutical company. Pursuant to the Rohto Research and Development Agreement, we were engaged to provide research and development services with regard to stem cells.

In March 2014, we entered into the Pfizer Research Agreement, as discussed above under “Metabolic Brown Adipose (Fat) Program”.

We have secured registrations in the U.S. Patent and Trademark Office for the following trademarks:

| ● |  | |

| ● |  | |

| ● |  | |

| ● | THERMOSTEM | |

| ● | STEM PEARLS, and | |

| ● | STEM THE TIDES OF TIME. |

We own a published application in the U.S. Patent and Trademark Office for the trademark BRTX and an allowed application in the U.S. Patent and Trademark Office for the trademark BRTX-100.

We also have federal common law rights in the trademark BioRestorative Therapies and other trademarks and trade names used in the conduct of our business that are not registered.

Our success will depend in large part on our ability to develop and protect our proprietary technology. We intend to rely on a combination of patent, trade secret and know-how, copyright and trademark laws, as well as confidentiality agreements, licensing agreements, non-compete agreements and other agreements, to establish and protect our proprietary rights. Our success will also depend upon our ability to avoid infringing upon the proprietary rights of others, for if we are judicially determined to have infringed such rights, we may be required to pay damages, alter our services, products or processes, obtain licenses or cease certain activities. We conduct prior rights searches before launching any new product or service to put us in the best position to avoid claims of infringement.

During the years ended December 31, 2018 and 2017, we incurred $1,513,150 and $2,152,433, respectively, in research and development expenses.

Scientific Advisors

We have established a Scientific Advisory Board whose purpose is to provide advice and guidance in connection with scientific matters relating to our business. The Scientific Advisory Board has established a Disc Advisory Committee which focuses on matters relating to our Disc/Spine Program. Our Scientific Advisory Board members are Dr. Wayne Marasco (Chairman), Dr. Naiyer Imam, Dr. Wayne Olan, Dr. Joy Cavagnaro, Dr. Jason Lipetz, Dr. Harvinder Sandhu, Dr. Christopher Plastaras and Dr. Gerard A. Malanga. The Disc Advisory Committee members are Dr. Lipetz (Chairman), Dr. Olan, Dr. Sandhu, Dr. Plastaras and Dr. Malanga. See Item 10 (“Directors, Executive Officers and Corporate Governance – Scientific Advisors”) for a listing of the principal positions for Drs. Marasco, Imam, Olan, Cavagnaro, Lipetz, Sandhu, Plastaras and Malanga.

| 16 |

Competition

We will compete with many pharmaceutical, biotechnology and medical device companies, as well as other private and public stem cell companies involved in the development and commercialization of cell-based medical technologies and therapies.

Regenerative medicine is rapidly progressing, in large part through the development of cell-based therapies or devices designed to isolate cells from human tissues. Most efforts involve cell sources, such as bone marrow, adipose tissue, embryonic and fetal tissue, umbilical cord and peripheral blood and skeletal muscle.

Many of our competitors and potential competitors have substantially greater financial, technological, research and development, marketing and personnel resources than we do. We cannot, with any accuracy, forecast when or if these companies are likely to bring their products and therapies to market in competition with those that we are pursuing.

With the enactment of the Biologics Price Competition and Innovation Act of 2009, or the BPCIA, an abbreviated pathway for the approval of biosimilar and interchangeable biological products was created. For the FDA to approve a biosimilar product, it must find that there are no clinically meaningful differences between the reference product and the proposed biosimilar product. Interchangeability requires that a product is biosimilar to the reference product, and the product must demonstrate that it can be expected to produce the same clinical results as the reference product and, for products administered multiple times, the biologic and the reference biologic may be switched after one has been previously administered without increasing safety risks or risks of diminished efficacy relative to exclusive use of the reference biologic. Under the BPCIA, an application for a biosimilar product cannot be submitted to the FDA until four years following approval of the reference product, and it may not be approved by the FDA until 12 years after the original branded product is approved under a biologics license application, or BLA.

We believe that, if any of our product candidates are approved as a biological product under a BLA, it should qualify for the 12-year period of exclusivity. However, there is a risk that the FDA could permit biosimilar applicants to reference approved biologics other than our therapeutic candidates, thus circumventing our exclusivity and potentially creating the opportunity for competition sooner than anticipated. Additionally, this period of regulatory exclusivity does not apply to companies pursuing regulatory approval via their own traditional BLA, rather than via the abbreviated pathway. Moreover, the extent to which a biosimilar, once approved, will be substituted for any one of our reference products in a way that is similar to traditional generic substitution for non-biological products is not yet clear, and will depend on a number of marketplace and regulatory factors that are still developing.

| 17 |

Customers

Upon regulatory approval, our cell product candidates are intended to be marketed to physicians, other health care professionals, hospitals, research institutions, pharmaceutical companies and the military. It is anticipated that physicians who are trained and skilled in performing spinal injections will be the physicians most likely to treat discs with injections of BRTX-100 upon regulatory approval. These physicians would include interventional physiatrists (physical medicine physicians), pain management anesthesiologists, interventional radiologists and neurosurgeons.

Governmental Regulation

U.S. Government Regulation

The health care industry is highly regulated in the United States. The federal government, through various departments and agencies, state and local governments, and private third-party accreditation organizations, regulate and monitor the health care industry, associated products, and operations. The FDA and comparable regulatory agencies in state and local jurisdictions and in foreign countries impose substantial requirements upon the clinical development, approval, manufacture, distribution and marketing of medical products, including drugs, biologics, and medical devices. These agencies and other federal, state and local entities regulate research and development activities and the testing, manufacture, quality control, safety, effectiveness, labeling, packaging, storage, distribution, record keeping, approval, post-approval monitoring, advertising, promotion, sampling and import and export of medical products. The following is a general overview of the laws and regulations pertaining to our business.

FDA Regulation of Stem Cell Treatment and Products

The FDA regulates the manufacture of human stem cell treatments and associated products under the authority of the Public Health Service Act, or PHSA, and the Federal Food, Drug, and Cosmetic Act, or FDCA. Stem cells can be regulated under the FDA’s Human Cells, Tissues, and Cellular and Tissue-Based Products Regulations, or HCT/Ps, or may also be subject to the FDA’s drug, biologic, or medical device regulations, each as discussed below.

Human Cells, Tissues, and Cellular and Tissue-Based Products Regulation

Under Section 361 of the PHSA, the FDA issued specific regulations governing the use of HCT/Ps in humans. Pursuant to Part 1271 of Title 21 of the Code of Federal Regulations, or CFR, the FDA established a unified registration and listing system for establishments that manufacture and process HCT/Ps. The regulations also include provisions pertaining to donor eligibility determinations; current good tissue practices covering all stages of production, including harvesting, processing, manufacture, storage, labeling, packaging, and distribution; and other procedures to prevent the introduction, transmission, and spread of communicable diseases.

| 18 |

The HCT/P regulations strictly constrain the types of products that may be regulated solely under these regulations. Factors considered include the degree of manipulation, whether the product is intended for a homologous function, whether the product has been combined with noncellular or non-tissue components, and the product’s effect or dependence on the body’s metabolic function. In those instances where cells, tissues, and cellular and tissue-based products have been only minimally manipulated, are intended strictly for homologous use, have not been combined with noncellular or nontissue substances, and do not depend on or have any effect on the body’s metabolism, the manufacturer is only required to register with the FDA, submit a list of manufactured products, and adopt and implement procedures for the control of communicable diseases. If one or more of the above factors has been exceeded, the product would be regulated as a drug, biological product, or medical device rather than an HCT/P.

Because we are an enterprise in the early stages of operations and have not generated significant revenues from operations, it is difficult to anticipate the likely regulatory status of the array of products and services that we may offer. We believe that some of the adult autologous (self derived) stem cells that will be used in our cellular therapy products and services, including the brown adipose (fat) tissue that we intend to use in our ThermoStem Program, may be regulated by the FDA as HCT/Ps under 21 C.F.R. Part 1271. This regulation defines HCT/Ps as articles “containing or consisting of human cells or tissues that are intended for implantation, transplantation, infusion or transfer into a human recipient.” However, the FDA may disagree with this position or conclude that some or all of our stem cell therapy products or services do not meet the applicable definitions and exemptions to the regulation. If we are not regulated solely under the HCT/P provisions, we would need to expend significant resources to comply with the FDA’s broad regulatory authority under the FDCA. Third party litigation concerning the autologous use of a stem cell mixture to treat musculoskeletal and spinal injuries has increased the likelihood that some of our products and services are likely to be regulated as a drug or biological product and require FDA approval. In past litigation, the FDA asserted that the defendants’ use of cultured stem cells without FDA approval is in violation of the FDCA, claiming that the defendants’ product is a drug. The defendants asserted that their procedure is part of the practice of medicine and therefore beyond the FDA’s regulatory authority. The District Court ruled in favor of the FDA, and in February 2014 the Circuit Court affirmed the District Court’s holding.

If regulated solely under the FDA’s HCT/P statutory and regulatory provisions, once our laboratory in the United States becomes operational, it will need to satisfy the following requirements, among others, to process and store stem cells:

| ● | registration and listing of HCT/Ps with the FDA; | |

| ● | donor eligibility determinations, including donor screening and donor testing requirements; | |

| ● | current good tissue practices, specifically including requirements for the facilities, environmental controls, equipment, supplies and reagents, recovery of HCT/Ps from the patient, processing, storage, labeling and document controls, and distribution and shipment of the HCT/Ps to the laboratory, storage, or other facility; | |

| ● | tracking and traceability of HCT/Ps and equipment, supplies, and reagents used in the manufacture of HCT/Ps; | |

| ● | adverse event reporting; | |

| ● | FDA inspection; and | |

| ● | abiding by any FDA order of retention, recall, destruction, and cessation of manufacturing of HCT/Ps. |

| 19 |

Non-reproductive HCT/Ps and non-peripheral blood stem/progenitor cells that are offered for import into the United States and regulated solely under Section 361 of the PHSA must also satisfy the requirements under 21 C.F.R. § 1271.420. Section 1271.420 requires that the importer of record of HCT/Ps notify the FDA prior to, or at the time of, importation and provide sufficient information for the FDA to make an admissibility decision. In addition, the importer must hold the HCT/P intact and under conditions necessary to prevent transmission of communicable disease until an admissibility decision is made by the FDA.

If the FDA determines that we have failed to comply with applicable regulatory requirements, it can impose a variety of enforcement actions including public warning letters, fines, consent decrees, orders of retention, recall or destruction of product, orders to cease manufacturing, and criminal prosecution. If any of these events were to occur, it could materially adversely affect us.

To the extent that our cellular therapy activities are limited to developing products and services outside the United States, as described in detail below, the products and services would not be subject to FDA regulation, but will be subject to the applicable requirements of the foreign jurisdiction. We intend to comply with all applicable foreign governmental requirements.

Drug and Biological Product Regulation

An HCT/P product that does not meet the criteria for being solely regulated under Section 361 of the PHSA will be regulated as a drug, device or biological product under the FDCA and/or Section 351 of the PHSA, and applicable FDA regulations. The FDA has broad regulatory authority over drugs and biologics marketed for sale in the United States. The FDA regulates the research, clinical testing, manufacturing, safety, effectiveness, labeling, storage, recordkeeping, promotion, distribution, and production of drugs and biological products. The FDA also regulates the export of drugs and biological products manufactured in the United States to international markets in certain situations.

The process required by the FDA before a drug or biologic may be marketed in the United States generally involves the following:

● completion of non-clinical laboratory tests, animal studies and formulation studies conducted according to Good Laboratory Practice, or GLP, or other applicable regulations;

● submission of an IND, which allows clinical trials to begin unless the FDA objects within 30 days;

● performance of adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed drug or biologic for its intended use or uses conducted in accordance with FDA regulations and Good Clinical Practices, or GCP, which are international ethical and scientific quality standards meant to ensure that the rights, safety and well-being of trial participants are protected and that the integrity of the data is maintained;

| 20 |

● registration of clinical trials of FDA-regulated products and certain clinical trial information;

● preparation and submission to the FDA of a new drug application, or NDA, in the case of a drug or BLA in the case of a biologic;

● review of the product by an FDA advisory committee, where appropriate or if applicable;

● satisfactory completion of pre-approval inspection of manufacturing facilities and clinical trial sites at which the product, or components thereof, are produced to assess compliance with Good Manufacturing Practice, or cGMP, requirements and of selected clinical trial sites to assess compliance with GCP requirements; and

● FDA approval of an NDA or BLA which must occur before a drug or biologic can be marketed or sold.

Approval of an NDA requires a showing that the drug is safe and effective for its intended use and that the methods, facilities, and controls used for the manufacturing, processing, and packaging of the drug are adequate to preserve its identity, strength, quality, and purity. To obtain a BLA, a manufacturer must show that the proposed product is safe, pure, and potent and that the facility in which the product is manufactured, processed, packed, or held meets established quality control standards.

For purposes of an NDA or BLA approval by the FDA, human clinical trials are typically conducted in the following phases (which may overlap):

● Phase 1: The investigational product is initially given to healthy human subjects or patients and tested for safety, dosage tolerance, absorption, metabolism, distribution and excretion. These trials may also provide early evidence on effectiveness. During Phase 1 clinical trials, sufficient information about the investigational product’s pharmacokinetics and pharmacologic effects may be obtained to permit the design of well-controlled and scientifically valid Phase 2 clinical trials.

● Phase 2: These clinical trials are conducted in a limited number of human subjects in the target population to identify possible adverse effects and safety risks, to determine the efficacy of the investigational product for specific targeted diseases and to determine dosage tolerance and dosage levels. Multiple Phase 2 clinical trials may be conducted by the sponsor to obtain information prior to beginning larger and more costly Phase 3 clinical trials.

● Phase 3: Phase 3 clinical trials are undertaken after Phase 2 clinical trials demonstrate that a dosage range of the investigational product appears effective and has a tolerable safety profile. The Phase 2 clinical trials must also provide sufficient information for the design of Phase 3 clinical trials. Phase 3 clinical trials are conducted to provide statistically significant evidence of clinical efficacy and to further test for safety risks in an expanded human subject population at multiple clinical trial sites. These clinical trials are intended to further evaluate dosage, effectiveness and safety, to establish the overall benefit-risk profile of the investigational product and to provide an adequate basis for product labeling and approval by the FDA. In most cases, the FDA requires two adequate and well-controlled Phase 3 clinical trials to demonstrate the efficacy of an investigational drug or biologic.

| 21 |

All clinical trials must be conducted in accordance with FDA regulations, GCP requirements and their protocols in order for the data to be considered reliable for regulatory purposes. Progress reports detailing the results of the clinical trials must be submitted at least annually to the FDA and more frequently if serious adverse events occur. Phase 1, Phase 2 and Phase 3 clinical trials may not be completed successfully within any specified period, or at all. These government regulations may delay or prevent approval of product candidates for a considerable period of time and impose costly procedures upon our business operations.

The FDA may require, or companies may pursue, additional clinical trials, referred to as Phase 4 clinical trials, after a product is approved. Such trials may be made a condition to be satisfied for continuing drug approval. The results of Phase 4 clinical trials can confirm the effectiveness of a product candidate and can provide important safety information. In addition, the FDA has authority to require sponsors to conduct post-marketing trials to specifically address safety issues identified by the agency.

Changes to some of the conditions established in an approved application, including changes in indications, labeling, manufacturing processes or facilities, require submission and FDA approval of a new NDA or BLA, or an NDA or BLA supplement, before the change can be implemented. An NDA or BLA supplement for a new indication typically requires clinical data similar to that in the original application, and the FDA uses the same procedures and actions in reviewing NDA and BLA supplements as it does in reviewing NDAs and BLAs.

Drug and biological products must also comply with applicable requirements, including monitoring and recordkeeping activities, manufacturing requirements, reporting to the applicable regulatory authorities of adverse experiences with the product, providing the regulatory authorities with updated safety and efficacy information, product sampling and distribution requirements, and complying with promotion and advertising requirements, which include, among others, standards for direct-to-consumer advertising, restrictions on promoting drugs for uses or in patient populations that are not described in the drug’s approved labeling, or off-label use, limitations on industry-sponsored scientific and educational activities and requirements for promotional activities involving the internet. Although physicians may, in their independent professional medical judgment, prescribe legally available drugs for off-label uses, manufacturers typically may not market or promote such off-label uses. Modifications or enhancements to the product or its labeling, or changes of the site of manufacture, are often subject to the approval of the FDA and other regulators, who may or may not grant approval or may include a lengthy review process.

In the event that the FDA does not regulate our product candidates in the United States solely under the HCT/P regulation, our products and activities could be regulated as drug or biological products under the FDCA. If regulated as drug or biological products, we will need to expend significant resources to ensure regulatory compliance. If an IND and NDA or BLA are required for any of our product candidates, there is no assurance as to whether or when we will receive FDA approval of the product candidate. The process of designing, conducting, compiling and submitting the non-clinical and clinical studies required for NDA or BLA approval is time-consuming, expensive and unpredictable. The process can take many years, depending on the product and the FDA’s requirements.

| 22 |

In addition, even if a product candidate receives regulatory approval, the approval may be limited to specific disease states, patient populations and dosages, or might contain significant limitations on use in the form of warnings, precautions or contraindications, or in the form of onerous risk management plans, restrictions on distribution or use, or post-marketing trial requirements. Further, even after regulatory approval is obtained, later discovery of previously unknown problems with a product may result in restrictions on the product, including safety labeling or imposition of a Risk Evaluation and Mitigation Strategy, or REMS, the requirement to conduct post-market studies or clinical trials or even complete withdrawal of the product from the market. Delay in obtaining, or failure to obtain, regulatory approval for our products, or obtaining approval but for significantly limited use, would harm our business. Further, we cannot predict what adverse governmental regulations may arise from future United States or foreign governmental action.

If the FDA determines that we have failed to comply with applicable regulatory requirements, it can impose a variety of enforcement actions from public warning letters, fines, injunctions, consent decrees and civil penalties to suspension or delayed issuance of approvals, seizure of our products, total or partial shutdown of our production, withdrawal of approvals, and criminal prosecutions. If any of these events were to occur, it could materially adversely affect us.

FDA Expedited Review Programs

The FDA is authorized to expedite the review of NDAs and BLAs in several ways. Under the Fast Track program, the sponsor of a drug or biologic product candidate may request the FDA to designate the product for a specific indication as a Fast Track product concurrent with or after the filing of the IND. Drug and biologic products are eligible for Fast Track designation if they are intended to treat a serious or life-threatening condition and demonstrate the potential to address unmet medical needs for the condition. Fast Track designation applies to the combination of the product candidate and the specific indication for which it is being studied.

In addition to other benefits, such as the ability to have greater interactions with the FDA, the FDA may initiate review of sections of a Fast Track NDA or BLA before the application is complete, a process known as rolling review.

Any product submitted to the FDA for marketing, including under a Fast Track program, may also be eligible for the following other types of FDA programs intended to expedite development and review:

● Breakthrough therapy designation. To qualify for the breakthrough therapy program, product candidates must be intended to treat a serious or life-threatening disease or condition, and preliminary clinical evidence must indicate that such product candidates may demonstrate substantial improvement on one or more clinically significant endpoints over existing therapies. The FDA will seek to ensure the sponsor of a breakthrough therapy product candidate receives intensive guidance on an efficient drug development program, intensive involvement of senior managers and experienced staff on a proactive, collaborative and cross-disciplinary review, and rolling review.

| 23 |

● Priority review. A product candidate is eligible for priority review if it treats a serious condition and, if approved, it would be a significant improvement in the safety or effectiveness of the treatment, diagnosis or prevention of a serious condition compared to marketed products. The FDA aims to complete its review of priority review applications within six months as opposed to ten months for standard review.

● Accelerated approval. Drug or biologic products studied for their safety and effectiveness in treating serious or life-threatening illnesses and that provide meaningful therapeutic benefit over existing treatments may receive accelerated approval. Accelerated approval means that a product candidate may be approved on the basis of adequate and well-controlled clinical trials establishing that the product candidate has an effect on a surrogate endpoint that is reasonably likely to predict a clinical benefit, or on the basis of an effect on a clinical endpoint other than survival or irreversible morbidity or mortality or other clinical benefit, taking into account the severity, rarity and prevalence of the condition and the availability or lack of alternative treatments. As a condition of approval, the FDA may require that a sponsor of a drug or biologic product candidate receiving accelerated approval perform adequate and well-controlled post-marketing clinical trials. In addition, the FDA currently requires as a condition for accelerated approval pre-approval of promotional materials.

Fast Track designation, breakthrough therapy designation, priority review and accelerated approval do not change the standards for approval but may expedite the development or approval process.

Further, with the passage of the 21st Century Cures Act, or the Cures Act, in December 2016, Congress authorized the FDA to accelerate review and approval of products designated as regenerative advanced therapies. A product is eligible for this designation if it is a regenerative medicine advanced therapy, or RMAT, (which may include a cell therapy) that is intended to treat, modify, reverse or cure a serious or life-threatening disease or condition, and preliminary clinical evidence indicates that the drug has the potential to address unmet medical needs for such disease or condition. The benefits of a RMAT designation include early interactions with the FDA to expedite development and review, benefits available to breakthrough therapies, potential eligibility for priority review and accelerated approval based on surrogate or intermediate endpoints.

Medical Device Regulation

The FDA also has broad authority over the regulation of medical devices marketed for sale in the United States. The FDA regulates the research, clinical testing, manufacturing, safety, labeling, storage, recordkeeping, premarket clearance or approval, promotion, distribution, and production of medical devices. The FDA also regulates the export of medical devices manufactured in the United States to international markets.

| 24 |

Under the FDCA, medical devices are classified into one of three classes, Class I, Class II, or Class III, depending upon the degree of risk associated with the medical device and the extent of control needed to ensure safety and effectiveness. Class I devices are subject to the lowest degree of regulatory scrutiny because they are considered low risk devices and need only comply with the FDA’s General Controls. The General Controls include compliance with the registration, listing, adverse event reporting requirements, and applicable portions of the Quality System Regulation as well as the general misbranding and adulteration prohibitions.