UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

OR

For the fiscal year ended

OR

OR

For the transition period from _____ to ______

Date of event requiring this shell company report ________________

Commission file number

| (Exact name of Registrant as specified in its charter) |

| N/A |

| (Translation of Registrant’s name into English) |

| (Jurisdiction of incorporation or organization) |

| (Address of principal executive offices) |

| Tel: +1- |

(Name, Telephone, E-mail and/or Facsimi le number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Global Market | ||||

| Tel Aviv Stock Exchange |

(1) Evidenced by American Depositary Receipts.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

| None |

| (Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

| None |

| (Title of Class) |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: Ordinary Shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer," accelerated filer,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer ☐ | Accelerated filer ☐ | |

| Emerging growth company |

If an emerging growth company that prepares

its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange

Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐

Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No

TABLE OF CONTENTS

| i |

Unless the context otherwise requires, all references to “BrainsWay,” “we,” “us,” “our,” the “Company” and similar designations refer to BrainsWay Ltd., a limited liability company incorporated under the laws of the State of Israel, and its consolidated subsidiaries. The term “including” means “including but not limited to”, whether or not explicitly so stated. The term “NIS” refers to New Israeli Shekels, the lawful currency of the State of Israel, the terms “dollar”, “US$”, “$” or “U.S.” refer to U.S. dollars, the lawful currency of the United States of America. Our functional and presentation currency is the U.S. dollar. Unless otherwise indicated, U.S. dollar amounts herein (other than amounts originally receivable or payable in dollars) have been translated for the convenience of the reader from the original NIS amounts at the representative rate of exchange as of December 31, 2021 ($1 = NIS 3.11). The dollar amounts presented should not be construed as representing amounts that are receivable or payable in dollars or convertible into dollars, unless otherwise indicated. Foreign currency transactions in currencies other than U.S. dollars are translated in this Annual Report into U.S. dollars using exchange rates in effect at the date of the transactions.

The “BrainsWay” name and design logo are our registered trademarks. BrainsWay also asserts all rights, including but not limited to trademark, with respect to the term “Deep TMS.” Solely for convenience, the trademarks, service marks, and trade names referred to in this Annual Report are without the ® and TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks, and trade names. This Annual Report contains additional trademarks, service marks, and trade names of others, which are the property of their respective owners. All trademarks, service marks, and trade names appearing in this Annual Report are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

This Annual Report includes statistics and other data relating to markets, market sizes, and other industry data pertaining to our business that we have obtained from industry publications, surveys, and other information available to us. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Market data and statistics are inherently predictive, speculative and are not necessarily reflective of actual market conditions. Such statistics are based on market research, which itself is based on sampling and subjective judgments by both the researchers and the respondents, including judgments about what types of products and transactions should be included in the relevant market. In addition, the value of comparisons of statistics for different markets is limited by many factors, including that (i) the markets are defined differently, (ii) the underlying information was gathered by different methods, and (iii) different assumptions were applied in compiling the data. Likewise, market size calculations and definitions are based on shifting and sometimes limited assumptions, including but not limited to relating to pricing models for our products. Accordingly, the market statistics included in this Annual Report should be viewed with caution. We believe that information from these industry publications included in this Annual Report is reliable.

| ii |

FORWARD-LOOKING STATEMENTS

Some of the statements under the sections entitled “Item 3. Key Information — Risk Factors,” “Item 4. Information on the Company,” “Item 5. Operating and Financial Review and Prospects” and elsewhere in this Annual Report may include forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms including “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would,” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. In addition, the sections of this Annual Report entitled “Item 4. Information on the Company” contain information obtained from independent industry and other sources that we may not have independently validated. You should not put undue reliance on any forward-looking statements. Unless we are required to do so under U.S. federal securities laws or other applicable laws, we do not intend to update or revise any forward-looking statements.

Factors that could cause our actual results to differ materially from those expressed or implied in such forward-looking statements include, but are not limited to:

| ● | market perception and acceptance of Deep Transcranial Magnetic Stimulation, or Deep TMS™, technology (“Deep TMS”); |

| ● | physician and patient satisfaction with the effectiveness, competitive advantages, and benefits of our Deep TMS system; |

| ● | availability of reimbursement from third-party payers, including insurance companies and Medicare; | |

| ● | the adequacy of our existing capital to meet our future capital requirements; |

| ● | our ability to commercialize Deep TMS, including internationally, by ourselves or through third-party distributors; |

| ● | our ability to develop enhancements to our Deep TMS system through our research and development efforts; |

| ● | our reliance on third parties to conduct our clinical trials and manufacture our product candidates for clinical testing; |

| ● | our ability to complete and obtain favorable results from existing clinical trials, and to launch and successfully complete new clinical trials, for Deep TMS indications; |

| ● | our ability to obtain regulatory approvals of Deep TMS and enhancements to our Deep TMS system on our anticipated time frames, or at all; |

| ● | our ability to comply with applicable regulatory approvals and requirements; |

| ● | our ability to obtain and maintain adequate protection of our intellectual property, including intellectual property licensed to us; |

| ● | our ability to operate within the changing market conditions caused by the COVID-19 global pandemic; and | |

| ● |

our ability to operate within a disrupted global supply chain, in particular given our reliance on third party suppliers of components and manufacturing vendors.

|

| iii |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

You should carefully consider the risks we describe below, in addition to the other information set forth elsewhere in this Annual Report, including our financial statements and the related notes beginning on page F-1, before deciding to invest in our ordinary shares (the “Ordinary Shares”) or our American Depositary Shares (“ADSs”). The risks and uncertainties described below in this annual report on Form 20-F for the year ended December 31, 2021 are not the only risks facing us. We may face additional risks and uncertainties not currently known to us or that we currently deem to be immaterial. Any of the risks described below or incorporated by reference in this Form 20-F, and any such additional risks, could materially adversely affect our reputation, business, financial condition or results of operations. In such case, you may lose all or part of your investment.

Summary of Risk Factors

The following is a summary of some of the principal risks we face. The list below is not exhaustive, and investors should read this “Risk factors” section in full.

| · | We have a history of operating losses. We expect to incur additional losses in the future and may never be profitable. |

| · | We cannot ensure that our existing capital will be sufficient to meet our capital requirements. |

| · | Raising additional capital may cause dilution to our existing shareholders, restrict our operations or require us to relinquish rights to our technologies or product candidate(s). |

| · | Our success depends on Deep TMS as a safe treatment option for patients, as well as market perception and acceptance of TMS generally, and patient satisfaction with the effectiveness of Deep TMS. |

| · | Our long-term growth depends on our ability to increase market penetration and further commercialize Deep TMS, as well as develop enhancements and features to the Deep TMS system through our research and development efforts. If we fail to do so, we may be unable to achieve future growth. |

| · | We operate in a very competitive environment and if we are unable to compete successfully against our existing or potential competitors, our revenues and operating results may be negatively affected. |

| · | If we are unable to adequately train physicians and other treatment providers and operators on the safe and appropriate use of our Deep TMS systems, we may be unable to achieve our expected growth. |

| 1 |

| · | Failure to secure or maintain adequate coverage and reimbursement of our Deep TMS system for the currently authorized indications and other indications for which we obtain FDA authorization in the future, if any, may make physicians reluctant to use or recommend Deep TMS and have a material adverse effect on our sales, results of operations, and financial condition. |

| · | We rely on third-party suppliers for some components used in manufacturing our Deep TMS products, and we may be unable to immediately transition to alternative parties for these components. |

| · | We rely, and in the future, expect to rely on a network of third-party distributors to market and distribute our products internationally, and if we are unable to maintain and expand this network, we may be unable to generate anticipated revenues. |

| · | Clinical trials involve a lengthy and expensive process with an uncertain outcome, which may delay or cause us to abandon the development of Deep TMS for additional indications. |

| · | We rely in part on third parties to conduct our clinical trials. If these third parties fail to perform their duties on time or as expected, we may not be able to obtain regulatory authorization for additional indications that we may seek for Deep TMS. |

| · | Our collaboration arrangements may not be successful, which could adversely affect our ability to develop and commercialize our products. |

| · | If product liability lawsuits are brought against us, our business may be harmed, and we may be required to pay damages that exceed our insurance coverage. |

| · | Our insurance policies protect us only from some business risks, which will leave us exposed to significant uninsured liabilities. |

| · | Our operations could be affected in the event of further COVID-19 global pandemic outbreaks. | |

|

· | Our operations could be adversely affected by negative global trends, including supply chain disruptions and the “Great Resignation.”. |

| · | Performance issues, service interruptions, or price increases by our shipping carriers could adversely affect our business and harm our reputation and ability to provide our services on a timely basis. |

| · | If we experience significant disruptions in our information technology systems, our business may be adversely affected. |

| · | We rely on the use of technology and may become subject to cyber-terrorism or other compromises and shut-downs. |

| · | Security and privacy breaches may expose us to liability and harm our reputation and business. |

| · | We may seek to grow our business through acquisitions or investments in new or complementary businesses, products or technologies, through the licensing of products or technologies from third parties. The failure to manage acquisitions, investments, licenses or other strategic alliances, or the failure to integrate them with our existing business, could harm our business. |

| · | Our products and operations are subject to extensive government regulation and oversight both in the United States and abroad, and our failure to comply with applicable requirements could harm our business. |

| · | We may not receive the necessary regulatory clearances or approvals to market our product for other proposed indications in the future, and failure to timely obtain necessary clearances or approvals for such future indications would adversely affect our ability to grow our business. |

| · | Modifications to our Deep TMS systems and treatments may require new 510(k) clearances, de novo classification or PMA, and may require us to cease marketing or recall the modified products until authorizations are obtained. |

| · | Our products must be manufactured in accordance with federal and state regulations, and we could be forced to recall our installed systems or terminate production if we fail to comply with these regulations. |

| · | If treatment guidelines for the clinical conditions we are targeting change or the standard of care evolves, we may need to redesign and seek new marketing authorization from the FDA for one or more of our products. |

| · | The misuse or off-label use of Deep TMS may harm our reputation in the marketplace, result in injuries that lead to product liability suits or result in costly investigations, fines or sanctions by regulatory bodies, particularly if we are deemed to have engaged in the promotion of these uses, any of which could be costly to our business. |

| · | Deep TMS may cause or contribute to adverse medical events that we are required to report to the FDA, and if we fail to do so, we would be subject to sanctions that could harm our reputation, business, financial condition, and results of operations. The discovery of serious safety issues with our products, or a recall of our products either voluntarily or at the direction of the FDA or another governmental authority, could have a negative impact on us. |

| 2 |

| · | If we or our distributors do not obtain and maintain international regulatory registrations or approvals for Deep TMS, we will be unable to market and sell our products outside of the United States. |

| · | We are subject to certain federal, state, and foreign fraud and abuse laws, health information privacy and security laws, and transparency laws, which, if violated, could subject us to substantial penalties. Additionally, any challenge to or investigation into our practices under these laws could cause adverse publicity and be costly to respond to, and thus could harm our business. |

| · | Healthcare policy changes, including recently enacted legislation reforming the U.S. healthcare system, could harm our cash flows, financial condition, and results of operations. |

| · | We depend on our intellectual property, and our future success is dependent on our ability to protect our intellectual property and not infringe on the rights of others. |

| · | The lives of our patents may not be sufficient to effectively protect our products and business. |

| · | Our right to the essential intellectual property upon which the Deep TMS technology is based results from in-license agreements with government agencies and research institutions, the termination of which would prevent us from commercializing Deep TMS. |

| · | Our license agreements for our critical patents and related intellectual property impose significant monetary obligations and other requirements that may adversely affect our ability to successfully execute our business plan. |

| · | The key patents that underlie our Deep TMS technology are subject to the U.S. government’s royalty free usage rights on a worldwide basis for any discovery based on such patents, which may have unexpected, adverse consequences upon the market for our product. |

| · | If we are unable to protect the confidentiality of our trade secrets or know-how, such proprietary information may be used by others to compete against us. |

| · | Legal proceedings or third-party claims of intellectual property infringement and other challenges may require us to spend substantial time and money and could prevent us from developing or commercializing Deep TMS. |

| · | The Israeli government grants that we have received require us to meet several conditions and may restrict our ability to manufacture our Deep TMS systems and transfer relevant know-how outside of Israel and require us to pay royalties and satisfy specified conditions, including increased royalties if we manufacture our Deep TMS systems outside of Israel or payment of a redemption fee if we transfer relevant know-how outside of Israel. |

| · | International patent protection is particularly uncertain, and if we are involved in opposition proceedings in foreign countries, we may have to expend substantial sums and management resources. |

| · | Our manufacturing, assembly and other significant functions are located in Israel and, therefore, our business and operations may be adversely affected by political, economic and military conditions in Israel. |

| · | Exchange rate fluctuations between the U.S. dollar, the New Israeli Shekel and other foreign currencies may negatively affect our future revenues. |

| · | The price of the ADSs may be volatile and may fluctuate due to factors beyond our control. |

| · | The significant share ownership position of our officers, directors, and entities affiliated with certain of our directors may limit your ability to influence corporate matters. |

Risks Related to our Financial Condition and Capital Requirements

We have a history of operating losses. We expect to incur additional losses in the future and may never be profitable.

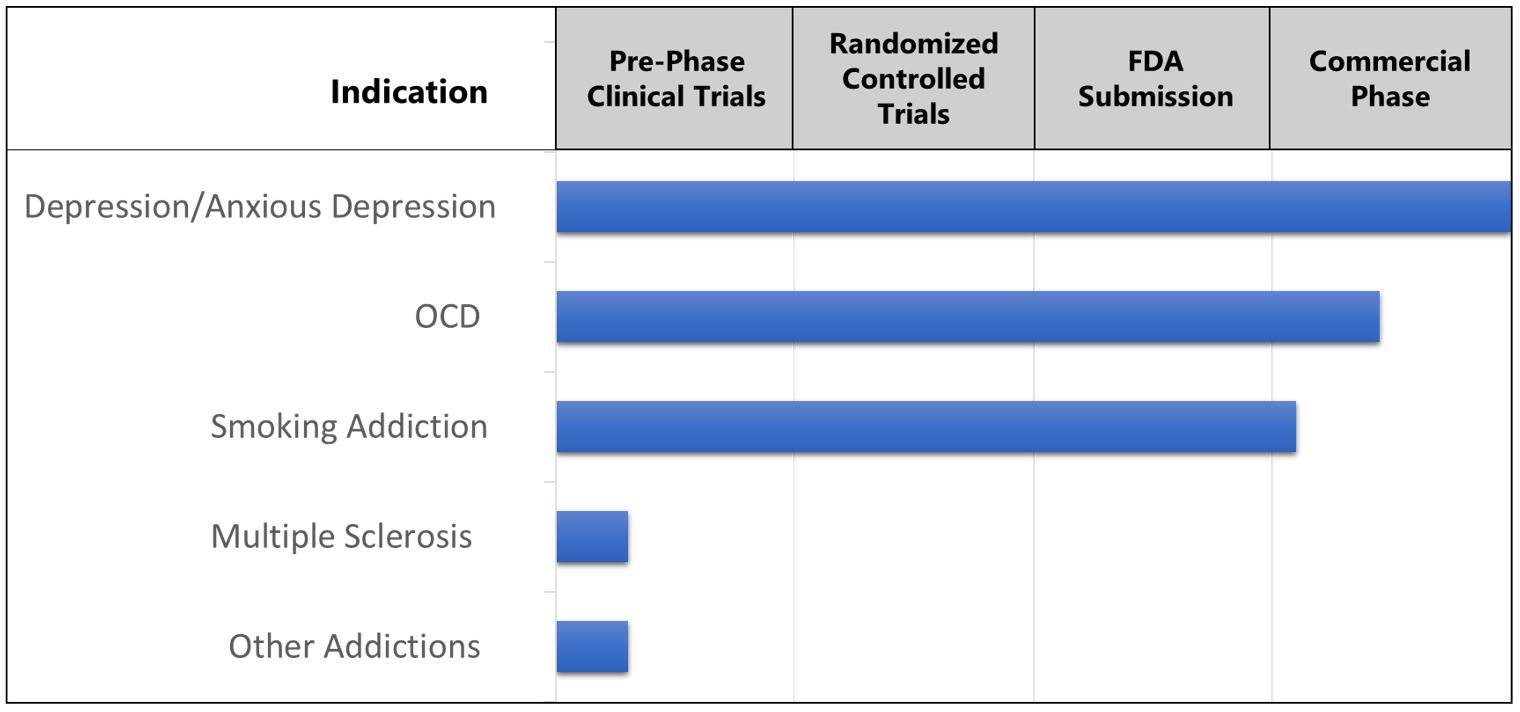

We have incurred net losses since our inception, largely reflecting research and development, general and administrative expenses, and sales and marketing expenses. We have experienced net losses of $6.5 million and $5.4 million for the years ended December 31, 2021 and 2020, respectively. As a result of ongoing losses, as of December 31, 2021, we had an accumulated deficit of $83.8 million. While we have sold and leased Deep TMS systems in various markets over the last few years, primarily for Major Depressive Disorder (MDD) including anxious depression, and recently also for Obsessive-Compulsive Disorder (OCD) and smoking addiction, we expect to continue to incur significant sales and marketing, product development, regulatory and other expenses as we continue to expand our commercialization efforts to increase adoption of Deep TMS and expand existing relationships with our customers, to obtain regulatory clearances or approvals for Deep TMS in additional countries and for additional indications, and to develop new enhancements or features to our existing Deep TMS systems. The net losses we incur may fluctuate significantly from period to period. We will need to generate additional revenues to achieve and sustain profitability, and even if we achieve profitability, we cannot be sure that we will remain profitable for any substantial period of time. Our failure to achieve or maintain profitability could negatively impact the value of the ADSs.

| 3 |

We cannot ensure that our existing capital will be sufficient to meet our capital requirements.

We believe that our existing capital, other sources of liquidity will be sufficient to meet our capital requirements. To date we have funded our operations primary through offerings of our securities, research and development grants from the Israel Innovation Authority and other sources, a loan under our credit facility which has been repaid, and a Paycheck Protection Program loan through the Unites States Small Business Administration which has been forgiven. We expect to generate revenues primarily through sales, lease and other potential income generated by the commercial distribution of Deep TMS systems for approved indications.

The adequacy of our available funds to meet our operating and capital requirements will depend on many factors, including our ability to achieve revenue growth and maintain favorable operating margins; our ability to increase the market share of Deep TMS and expand our operations and offerings, including our sales and marketing efforts; the cost, progress and results of our future research, product development and clinical programs for additional enhancements to Deep TMS and future indications for the system; the costs and timing of obtaining regulatory approvals for future indications of Deep TMS; our ability to improve or maintain coverage and reimbursement arrangements with third-party and government payers; the terms and conditions of commercial agreements for marketing and distribution of Deep TMS; the effect of competing technological and market developments; and costs incurred in enforcing and defending certain of the patents and other intellectual property rights upon which our technologies are based, to the extent such rights are challenged.

We cannot be certain that in the future alternative financing sources will be available to us at such times or in the amounts we need or whether we can negotiate commercially reasonable terms or at all, or that our actual cash requirements will not be greater than anticipated. Any issuance of additional equity or equity-linked securities could be dilutive to our existing shareholders, and any new equity securities could have rights, preferences, and privileges superior to those of holders of the Ordinary Shares or ADSs. Additional debt financing, if available, may involve covenants restricting our operations or our ability to incur additional debt, pay dividends, repurchase our shares, make investments and engage in merger, consolidation, or asset sale transactions. If we are unable to obtain future financing through the methods we described above or through other means, our business may be materially impaired and we may be unable to complete our business objectives and may be required to cease operations, curtail one or more product development or commercialization programs, significantly reduce expenses, sell assets, seek a merger or joint venture partner, file for protection from creditors, or liquidate all our assets.

Risks Related to our Business and Industry

Our success depends on Deep TMS as a safe treatment option for patients, as well as market perception and acceptance of TMS generally.

Our business currently depends entirely on the success of Deep TMS, our proprietary TMS solution. TMS is an emerging treatment option for patients. As a result, physician and patient awareness of TMS therapy as a treatment option for applicable brain disorders, and experience with TMS therapies, is limited. Because the market for TMS therapy is still developing and contains a limited number of market participants, sales of Deep TMS could be negatively impacted by unfavorable market reactions to TMS generally, Deep TMS in particular, and/or negative developments in the industry. For example, with respect to TMS generally, in June 2018 researchers in medical centers of the U.S. Veterans Affairs reported research findings that showed that approximately 40% of the 81 patients with treatment-resistant major depression achieved remission in a randomized trial of a competitor’s TMS device, but the rate was virtually the same with sham treatments versus active stimulation. As another example, with respect to Deep TMS in particular, in February 2020, we announced that a multicenter study of our Deep TMS system for Post-Traumatic Stress Disorder (PTSD) was discontinued after interim results showed subjects treated with the H-Coil that was involved in the study (i.e., the same as that used in our multicenter OCD study) did not demonstrate sufficient efficacy relative to the sham group. If the use of our Deep TMS system or other TMS therapies results in serious adverse events (e.g., seizures), or such products malfunction or are misused, patients and physicians may attribute such negative events to TMS and/or Deep TMS, which may adversely affect market adoption of this form of therapy. For example, a paper entitled “Seizure risk with repetitive TMS: Survey results from over a half-million treatment sessions” published in 2021 in Brain Stimulation claims that Deep TMS appears to be associated with a higher relative seizure risk than with generic figure-8 coil TMS. While the authors of the paper themselves cite numerous reasons to view the results with caution (e.g., including but not limited to sampling bias, inability to verify reported seizures, and the absence of information on patient-specific risk factors) and while the claims in the paper were based on a small data set obtained from an informal survey which appear to be inconsistent with other more comprehensive studies, we may nonetheless be unable to successfully educate the public about these often nuanced and technical deficiencies and thus the overall safety of our technology. In addition, if patients undergoing treatment with any available TMS solutions perceive the benefits to be inadequate or the administration of TMS to be too burdensome or inconvenient, and/or if adverse events and/or factors such as discomfort and noise with available TMS solutions are too numerous or severe compared to the relevant rates of alternative therapies or pharmaceutical options, it will be difficult to demonstrate the value of Deep TMS to patients and physicians. Additionally, psychiatrists may find it difficult to train existing employees and/or hire additional staff, allocate sufficient space or operate our device given that psychiatry is a field not traditionally associated with medical equipment treatment options. As a result of any one or a combination of these reasons, demand for and the use of Deep TMS may decline or may not increase at the pace or to the levels we expect. These reported findings may have a negative effect on market perception of the effectiveness of the TMS therapy in general, and by extension Deep TMS.

| 4 |

Even if TMS therapy is widely accepted by physicians and patients, our success will depend in large part on our ability to educate and train physicians and patients, and to successfully demonstrate the safety, tolerability, ease of use, efficacy, cost effectiveness and other advantages of Deep TMS. We have been engaging in an active marketing campaign to raise awareness of Deep TMS and its benefits, but we cannot assure that these efforts will be successful or that they will not prove to be too costly. Physicians may find patient set up and the subsequent procedures for future treatment sessions to be difficult or complicated compared to competing treatment methods. Any of these factors could slow market adoption of Deep TMS.

Our long-term growth depends on our ability to increase market penetration and further commercialize Deep TMS, as well as develop enhancements and features to the Deep TMS system through our research and development efforts. If we fail to do so, we may be unable to achieve future growth.

Our strategy depends on our ability to further commercialize and increase market penetration of Deep TMS for MDD (including reduction of comorbid anxiety symptoms, commonly referred to as anxious depression), OCD, and smoking addiction, develop and seek regulatory approvals of Deep TMS for new indications and add new enhancements or features for the Deep TMS system. These goals are also designed to respond to changing customer demands, competitive pressures, and technologies. Our industry is characterized by intense competition, including from existing treatments (e.g., anti-depressant medications), a growing number of Traditional TMS competitors, rapid technological changes, new product introductions and enhancements, price competition, and evolving industry standards. It is important that we anticipate changes in technology and market demand, as well as physician practices to successfully develop, obtain clearance or approval, if required, and successfully introduce new, enhanced, and competitive technologies to meet our prospective customers’ needs on a timely and cost-effective basis.

We might be unable to further commercialize Deep TMS for approved indications or develop or obtain regulatory clearances or approvals to market Deep TMS for new indications, or to develop and obtain regulatory approvals for enhancements or new features for the Deep TMS system. Additionally, Deep TMS for MDD (including reduction of comorbid anxiety symptoms, commonly referred to as anxious depression), OCD, smoking addiction, and any future indications, even if cleared, might not be sufficiently accepted by physicians or the third-party payers who reimburse for the procedures performed with our products. We may be unable to devise pricing strategies that are attractive to customers. The success of any new indications, enhancements or features for the Deep TMS system will depend on numerous additional factors, including our ability to:

| ● | properly identify and anticipate clinician and patient needs; |

| 5 |

| ● | demonstrate the benefits associated with the use of Deep TMS when compared to the products and devices of our competitors; |

| ● | demonstrate the safety and efficacy of new indications, and obtain regulatory approvals of Deep TMS for such indications; |

| ● | adequately protect our intellectual property and avoid infringing upon the intellectual property rights of third parties; and |

| ● | develop and obtain the necessary regulatory clearances or approvals for enhancements or features for the Deep TMS system. |

If we do not develop and obtain regulatory clearances or approvals for new indications, enhancements or features in time to meet market demand, or if there is insufficient demand for these indications, enhancements or features, our results of operations will suffer. Our research and development efforts may require a substantial investment of time and resources before we are adequately able to determine the commercial viability of a new indication for Deep TMS, any enhancements to the Deep TMS system or any other innovation. In addition, even if we are able to develop enhancements or new features for Deep TMS, these enhancements or features may not produce sales in excess of the costs of development and they may be quickly rendered obsolete by changing customer preferences or the introduction by our competitors of products embodying new technologies or enhancements or features.

Furthermore, we must carefully manage our introduction of new indications. If potential customers believe such indications will be subject to additional future enhancements or features or may become available at a more attractive price, they may delay purchases until such indications are available. We may also have excess or obsolete inventory as we upgrade to newer models of our products and/or transition to new indications, and we have limited experience in managing product transitions.

Our success also depends upon patient satisfaction with the effectiveness of Deep TMS.

In order to generate significant revenues from Deep TMS, patients must be satisfied with the effectiveness of Deep TMS. We train our physician customers to properly diagnose patient candidates and select the appropriate patient candidates for treatment using the Deep TMS system, explain to their patients the time-period over which the results from a treatment course can be expected to occur, and measure the success of treatments using medical guidelines. However, our physician customers may not properly diagnose or select appropriate patient candidates for Deep TMS treatment and/or may utilize unprescribed protocols, which may produce results that do not meet patients’ expectations. To the extent physicians do not make the proper measurements for a specific patient, use the same procedures at each treatment session, and/or use proscribed protocols during treatment, it could result in variability of the treatment efficacy and results for the patient. If patients are not satisfied with the results of Deep TMS, our reputation, and future results of operations may be adversely affected.

We operate in a very competitive environment and if we are unable to compete successfully against our existing or potential competitors, our revenues and operating results may be negatively affected.

Our Deep TMS systems for MDD (including reduction of comorbid anxiety symptoms, commonly referred to as anxious depression), OCD, smoking addiction, and any future indications are or will be subject to intense competition. The industry in which we operate is subject to rapid change and is highly sensitive to the introduction of new products or other market activities of current or new industry participants. Our ability to compete successfully will depend on our ability to develop and obtain regulatory clearances of Deep TMS for indications that reach the market in a timely manner, to receive adequate coverage and reimbursement from third-party payers, and to successfully demonstrate to physicians and patients the merits of Deep TMS compared to the products of our competitors. If we are not successful in convincing others of the merits of Deep TMS or educating them on the use of the Deep TMS system, they may not use our system or use them effectively and we may be unable to increase our revenues.

Deep TMS competes with several existing Traditional TMS competitors, including Neuronetics, Magventure, MAG & More, CloudTMS, Magstim, and Nexstim. Competing TMS therapy companies have developed or may develop treatments that have improved efficacy when compared to our products or that require a less significant investment of resources from physicians. Likewise, psychiatrists and other customers may not be able to easily compare Deep TMS to our focal TMS competitors given limited data from head-to-head studies and marketing campaigns and tactics employed by competitors which may have access to greater resources than we do.

| 6 |

We also face competition from pharmaceutical and other companies, many of which have greater resources than we do, that develop competitive products, such as anti-depressant medications (including but not limited to a nasal spray utilizing the drug esketamine, which was recently approved by the FDA for use in conjunction with an oral antidepressant) and to a lesser degree, ECT, home-use alternatives such as transcranial direct current stimulation (TDCS) devices, prescription digital therapeutics (PDTs), and other neuromodulation treatment options. Our commercial opportunity could be reduced or eliminated if these competitors develop and commercialize anti-depressant medications or other treatments that are safer or more effective than Deep TMS, or are offered at more competitive prices, are more easily administered to patients or are otherwise more attractive to our customers and patients. At any time, these and other potential market entrants may develop treatment alternatives that may make Deep TMS less competitive.

We also note that competition varies based on the indication, and some of the indications we are advancing may face marketability challenges based on existing treatment options. For example, there are a variety of smoking cessation products currently available on the market, including nicotine patch treatment. Electronic cigarettes, or e-cigarettes, are also widely available substitutes for tobacco smoking. Deep TMS for smoking cessation may not be a marketable alternative to these existing options, particularly to the extent smokers need to pay out-of-pocket given the unavailability of reimbursement for this indication.

In addition, our competitors may have more established distribution networks than we do (including but not limited to exclusivity or other arrangements with large clinic networks), or may be acquired by enterprises that have more established distribution networks than we do. Our competitors may also develop and patent processes or products earlier than we can or obtain domestic or international regulatory clearances or approvals for competing products more rapidly than we can, which could impair our ability to develop and commercialize similar products. Furthermore, our educational efforts to distinguish between Deep TMS and traditional TMS may be limited, and our competitors may thereby succeed in obtaining regulatory pathways for their products based on our clinical data without having to invest in clinical trials themselves. In addition, we compete with our competitors to engage the services of independent distributors outside the United States, both those presently working with us and those with whom we hope to work as we expand.

Furthermore, our competitors may be seeking predicate FDA approvals in other psychiatric and neurological indications, and TMS products of various companies are frequently used off-label, and in certain circumstances, are marketed outside of the United States for other indications.

Moreover, the potential for both TMS competitors or other medical device or pharmaceutical companies to introduce new and disruptive products or forms of therapy can significantly impact our financial performance and ability to compete.

If we are unable to adequately train physicians and other treatment providers and operators on the safe and appropriate use of our Deep TMS systems, we may be unable to achieve our expected growth.

There is a learning process involved for treatment providers to become proficient in the use of our Deep TMS systems, which requires us to spend considerable time and resources for training. It is critical to the success of our commercialization efforts to train a sufficient number of physicians and to provide them with adequate, ongoing instruction and training in the use of our Deep TMS systems. This training process generally requires physicians to review and study product materials and engage in hands-on training sessions. This training process may also take longer than expected or be more complicated than the physicians or their personnel are comfortable with and may therefore affect our ability to increase sales. Convincing physicians to dedicate the time and energy necessary for adequate training is challenging, and we may not be successful in these efforts.

The use of our Deep TMS system to treat OCD requires a special procedure to provoke the patient to exhibit symptoms of OCD while the patient is treated with Deep TMS. This procedure requires special training and may make the treatment more difficult to apply than alternative treatments, as the treatment must be tailored for the condition of each patient. As a result, this may lead to a variability of the overall results and between patients, which could discourage use of Deep TMS for OCD. In addition, if the physicians and operators do not apply the treatment of OCD patients properly or experience difficulties in the use of the system for OCD, this could reduce the level of satisfaction with this system for OCD, and adversely affect our revenues and our operating results.

| 7 |

We may be unable to forecast our future growth accurately.

We may be unable to predict future growth related to Deep TMS for MDD (including reduction of comorbid anxiety symptoms, commonly referred to as anxious depression), OCD, smoking addiction, and other psychiatric indications because some of these disorders are inherently difficult to diagnose and there are frequent co-morbidities (overlap) in these disorders that complicate treatment methods. Diagnosis for psychiatric disorders, such as MDD and OCD, is based on an individual’s reported experiences and mental status examination, and accordingly is subject to significant error. For example, it is estimated that about half of the individuals in the United States who experience a major depressive episode annually are not diagnosed correctly. In addition, there is a rising trend in which primary care providers, rather than mental health professionals, prescribe anti-depressant medications. Primary care providers often prescribe anti-depressants without a psychiatric diagnosis of disease. In 73% of visits in which a primary care provider prescribed an anti-depressant, patients did not have a psychiatric diagnosis. Without a psychiatric diagnosis, treatment cannot be tailored to the underlying condition. Accordingly, a significant portion of MDD patients that are considered treatment-resistant may be unresponsive to first-line treatment as a result of incorrect diagnosis, and any such patients may not respond to Deep TMS treatment. In addition, the H-Coils for our Deep TMS systems may prove to be interchangeable and clinicians may be able to treat patients with multiple disorders in the same procedure. With respect to comorbidities, there is a high rate of tobacco use amongst patients suffering from mental health conditions such as depression and anxiety. Approximately 3 of every 10 cigarettes smoked by adults in the United States are smoked by persons with mental health conditions. As a result of the foregoing factors, the addressable market for Deep TMS for MDD (including reduction of comorbid anxiety symptoms, commonly referred to as anxious depression), OCD, and smoking addiction, may be smaller than we currently anticipate, and predictions for our future growth may prove to be inaccurate. This may have a materially adverse effect on our future results of operations.

We may be unable to manage our anticipated growth effectively, which could make it difficult to execute our business strategy.

We have been growing rapidly and have a relatively short history of operating as a commercial-stage company. We intend to continue to grow our business operations and may experience periods of rapid growth and expansion. This anticipated growth could create a strain on our organizational, administrative and operational infrastructure, including our supply chain operations, quality control, technical support and customer service, sales force management and general and financial administration. These risks increase as we expand into new countries, each requiring varied and often time-consuming regulatory challenges. We may be unable to maintain the quality, regulatory infrastructure, or delivery timelines, of our products or customer service or satisfy customer demand if our business grows too rapidly. Our ability to manage our growth properly will require us to continue to improve our operational, financial and management controls, and our reporting systems and procedures. We may implement new enterprise software systems in a number of areas affecting a broad range of business processes and functional areas. The time and resources required to implement these new systems is uncertain and failure to complete this in a timely and efficient manner could harm our business.

As our commercial operations and sales volume grow, we will need to continue to increase our workflow capacity for our supply chain, regulatory expansion, customer service, training and education personnel, billing, accounting reporting and general process improvements and expand our internal quality assurance program, among other things. Our current work force may not be sufficient to handle our expanding growth and we will be required to expand and train these personnel as we increase our sales efforts. We may not successfully implement these increases in scale or the expansion of our personnel, which could harm our business.

If we are unable to successfully expand our sales and customer support team and adequately address our customers’ needs, it could negatively impact revenues and market acceptance of Deep TMS and we may never generate sufficient revenues to achieve or sustain profitability.

| 8 |

As of December 31, 2021, we had 118 employees, including 49 employees in sales and marketing. Our operating results are directly dependent upon the sales and marketing efforts of our sales and customer support team and, to a lesser extent, on our independent third party distributors outside of the United States. If our employees or our independent distributors fail to adequately promote, market and sell or lease our Deep TMS systems, our revenues could significantly decrease and/or fail to meet our targets.

In addition, our future revenues will largely depend on our ability to successfully execute our marketing efforts and adequately address our customers’ needs. We believe it is necessary to expand our sales force, including by hiring additional sales representatives or distributors with specific technical backgrounds that can support our customers’ needs.

As we develop and seek regulatory clearances for new indications, enhancements and features and increase our marketing efforts, we will need to expand the reach of our marketing and sales networks. Our future success will depend largely on our ability to continue to hire, train, retain and motivate skilled employees, and distributors with significant technical knowledge in various areas. New hires require training and take time to achieve full productivity. If we fail to train new hires adequately, or if we experience high turnover in our sales force in the future, new hires may not become as productive as may be necessary to maintain or increase our sales. If we are unable to expand our sales and marketing capabilities domestically and internationally, we may be unable to effectively commercialize our Deep TMS systems, which could harm our business.

Failure to secure or maintain adequate coverage and reimbursement of our Deep TMS system for the currently authorized indications and other indications for which we obtain FDA authorization in the future, if any, may make physicians reluctant to use or recommend Deep TMS and have a material adverse effect on our sales, results of operations, and financial condition.

Patients generally rely on third-party payers to reimburse all or part of the costs associated with outpatient treatment services. Patients may, thus, be unwilling to undergo, and physicians may be unwilling to prescribe, a given course of treatment in the absence of adequate coverage and reimbursement. Accordingly, our ability to successfully commercialize our Deep TMS system depends significantly on the extent to which treatment sessions using Deep TMS are covered and reimbursed by government healthcare programs, such as Medicare and Medicaid (among others), commercial health insurers, managed care organizations, and other third-party payers.

Third-party payers are increasingly examining the medical necessity and cost effectiveness of medical products and services, in addition to safety and efficacy. Significant uncertainty exists as to the reimbursement status of any newly approved (or cleared) products or therapies, such as Deep TMS for smoking addiction, which represent novel approaches to treatment of a disease, addiction, or condition. Even if a third-party payer covers a particular treatment that uses Deep TMS, the resulting reimbursement rate may not be adequate to cover a provider’s cost to purchase or lease the Deep TMS system or ensure such transaction is profitable for the provider. Reimbursement by a third-party payer may depend upon a number of factors, including the third-party payer’s determination that a treatment is neither experimental nor investigational, safe, effective, and medically necessary, appropriate for the specific patient, cost-effective, supported by peer-reviewed medical journals and included in clinical practice guidelines.

In the United States, there is no uniform policy of coverage and reimbursement among third-party payers, including private insurers. Therefore, coverage and reimbursement for treatments can differ significantly from payer to payer. However, many third-party payers often rely upon Medicare coverage policies and payment limitations in setting their own coverage and reimbursement policies and methodologies. Private insurance coverage for Deep TMS as a treatment for MDD generally requires one to four failures of anti-depressant medications.

Medicare coverage for Deep TMS as a treatment for MDD generally requires that certain, specified clinical criteria relating to medical necessity are met (and documented). In particular, subject to variations by payor and locale, under applicable payor policies, Deep TMS may be covered for MDD if: (i) prescribed by a licensed physician, knowledgeable in the use of TMS (ii) as a treatment for an adult with a confirmed diagnosis of MDD and no contraindications, (iii) where there is sufficient documentation of failure of between 1 and 4 previous medication trials (depending on the relevant Medicare Administrative Contractor policy). Other relevant coverage factors considered under these policies include resistance to treatment with psychopharmacologic agents for depression, history of response to repetitive TMS, and whether the individual is a candidate for electroconvulsive therapy (ECT) and TMS is less burdensome to the patient.

| 9 |

Reimbursement for Deep TMS as an MDD treatment is also generally limited to 36 treatment sessions.

In 2021 there has been emerging reimbursement coverage for Deep TMS for the treatment of OCD. While the criteria for this emerging Deep TMS for OCD coverage varies with each payer, generally, coverage requires the failure of a combination of between two and four medication trials of two different classes, for specified periods, and may also require a trial of psychotherapy, before qualifying for reimbursement. Maintaining the reimbursement coverage obtained during 2021 and obtaining coverage from additional payers may be difficult, and payers may condition coverage subject to satisfaction of varied criteria.

Obtaining adequate reimbursement of Deep TMS for smoking addiction, or for any future indications, as applicable, may be difficult. Currently, there is no third-party coverage of Deep TMS as a treatment for smoking addiction, as payors that have evaluated Deep TMS for smoking addiction coverage have not yet concluded that it is a reasonable and necessary therapy for smoking addiction. We are working to gather and submit additional clinical data in order to sufficiently demonstrate the efficacy of Deep TMS for the treatment of smoking addiction. These efforts may be expensive and time-consuming. Therefore, it may take significant time to obtain sufficient reimbursement coverage of Deep TMS for smoking addiction. We may be required to conduct expensive pharmacoeconomic studies to justify coverage and reimbursement or the level of reimbursement compared to existing approved biologics and other therapies. There may be significant delays in obtaining coverage and reimbursement for newly approved therapies in the United States, and coverage may be more limited than the indications for which the product is approved by the FDA or similar regulatory authorities outside the United States. Further, there is no guarantee that Deep TMS will ever be adequately covered or reimbursed for smoking addiction, if at all, or any other future indication for which we obtain authorization, if any. Nonetheless, the availability of reimbursement coverage in any given indication is not always the exclusive path to commercialization, and we may pursue and/or develop cash-pay, corporate wellness programs, and/or other alternate models in order to monetize these indications.

In addition, the U.S. federal government and state legislatures have continued to implement cost containment programs, including price controls and restrictions on coverage and reimbursement. To contain costs, governmental healthcare programs and third-party payers are increasingly challenging the price, scrutinizing the medical necessity, and reviewing the cost-effectiveness of medical treatments.

Outside of the United States, reimbursement systems vary significantly by country. Many foreign markets have government-managed healthcare systems that govern reimbursement for psychiatric treatments and procedures and certain markets, including Japan, impose additional criteria that must be met (such as the need for approval by sometimes insular medical societies) before coverage may be practically obtained even on approved procedures. Additionally, some foreign reimbursement systems provide for limited payments in a given period and therefore result in extended payment periods. If adequate levels of reimbursement from third-party payers outside of the United States, including Japan, are not obtained, international sales and lease transactions for the Deep TMS system may not materialize or grow significantly.

The marketability of Deep TMS may suffer if the government and third-party payers fail to provide adequate coverage and reimbursement. Even if favorable coverage and reimbursement status is attained, less favorable coverage policies and reimbursement rates may be implemented in the future.

We rely on third-party suppliers for some components used in manufacturing Deep TMS, and we may be unable to immediately transition to alternative parties for these components.

We rely on suppliers for most of the components used in manufacturing Deep TMS, including the computer controlling the stimulator, the helmet, and the arm of the helmet, and we may not have sufficient contractual assurances for the long-term supply of these components. We now assemble our proprietary stimulator in our new-generation Deep TMS systems; however, we remain dependent on a single source third-party supplier for stimulators used in older versions of our Deep TMS system, and accordingly we must still rely on third-party suppliers for those older versions. In addition, we rely on the outsourcing company utilized for the manufacture of certain components in our newer systems, including our proprietary stimulator and various other components. For us to be successful, our suppliers and contract manufacturer must be able to provide us with components in sufficient quantities, in compliance with quality and regulatory requirements, in accordance with agreed upon specifications, at acceptable costs and on a timely basis. While these suppliers have generally met our demand requirements on a timely basis in the past, their ability, and willingness to continue to do so going forward may be limited for several reasons, including our lack of long-term agreements with those suppliers, our relative importance as a customer of those suppliers, or, as applicable, their ability to produce the components for or provide assembly services to manufacture our Deep TMS systems. An interruption in our commercial operations could occur if we encounter delays or difficulties in securing these components, if we cannot obtain an acceptable substitute. In addition, we have experienced, and may continue to experience, more general supply chain issues, which are in part related to, or exacerbated by, the COVID-19 pandemic. See “—Our operations could be adversely affected by the global supply chain disruptions.”

| 10 |

Any transition to a new supplier or contract manufacturer could be time-consuming and expensive, may result in interruptions in our operations and product delivery, could affect the performance specifications of Deep TMS or could require that we modify its design. If we are required to change our contract manufacturer, we will be required to verify that the new manufacturer maintains facilities, procedures, and operations that comply with our quality and applicable regulatory requirements, which could further impede our ability to manufacture Deep TMS systems in a timely manner. If the change in manufacturer results in a significant change to any product, a new 510(k) clearance from the FDA or similar non-U.S. regulatory authorization may be necessary before we implement the change, which could cause a substantial delay. We cannot assure you that we will be able to identify and engage alternative suppliers or contract manufacturers on similar terms or without delay. Furthermore, our contract manufacturer could require us to move to a different production facility. The occurrence of any of these events could harm our ability to meet the demand for Deep TMS in a timely and cost-effective manner.

We face risks associated with our international business.

We currently market and sell Deep TMS systems outside of the United States in various countries and/or intend to market and expand the commercialization of Deep TMS in other markets, including Canada, Europe, Australia, and various Middle Eastern, Central/South American, and Asian countries.

We are assessing the opportunity to expand into other international markets. However, our expansion plans may not be realized, or if realized, may not be successful. We expect each market to have particular regulatory hurdles to overcome, and future developments in these markets, including the uncertainty relating to governmental policies and regulations, could harm our business.

The sale, lease, and shipment of the Deep TMS system across international borders, as well as the purchase of components and products from international sources, subjects us to extensive U.S. and other foreign governmental trade, import, export, regulatory, and customs regulations and laws. Compliance with these regulations and laws is costly and exposes us to penalties for non-compliance. We expect our international activities will be dynamic over the foreseeable future as we continue to pursue opportunities in international markets. Our international business operations are subject to a variety of risks, including:

| ● | difficulties in staffing and managing foreign and geographically dispersed operations, to the extent we establish non-U.S. operations; |

| ● | differing and multiple payer reimbursement regimes, government payers or patient self-pay systems; |

| ● | difficulties in determining and creating the proper sales pathway in new, international markets; |

| ● | compliance with various U.S. and international laws, including export control laws and the U.S. Foreign Corrupt Practices Act of 1977 (FCPA) and similar international laws, and anti-money laundering laws; |

| ● | differing regulatory requirements for obtaining marketing authorizations for our products in non-U.S. jurisdictions; |

| ● | changes in, or uncertainties relating to, foreign rules and regulations that may impact our ability to sell our products, perform services or repatriate profits to the United States; |

| 11 |

| ● | tariffs and trade barriers, export regulations, sanctions, and other regulatory and contractual limitations on our ability to sell our products in certain foreign markets; |

| ● | potential adverse tax consequences, including imposition of limitations on or increase of withholding and other taxes on remittances and other payments by foreign subsidiaries or joint ventures; |

| ● | imposition of differing labor laws and standards; |

| ● | armed conflicts or economic, political, and/or social instability in foreign countries and regions; |

| ● | fluctuations in foreign currency exchange rates; |

| ● |

supply lags, inefficiencies, difficulty managing expenses in our local currency in the event that its value diverges from that of the currencies of the jurisdictions where we earn income, and other risks created by any sourcing, manufacture, assembly and/or production of our products/components outside of the U.S., while commercial activities are largely focused in the U.S.

| |

| ● | an inability, or reduced ability, to protect our intellectual property, including any effect of compulsory licensing imposed by government action; and |

| ● | availability of government subsidies or other incentives that benefit competitors in their local markets that are not available to us. |

We rely and in the future expect to rely on a network of third-party distributors to market and distribute our products internationally, and if we are unable to maintain and expand this network, we may be unable to generate anticipated revenues.

We rely, and expect to rely in the future, on a network of third-party distributors to market and distribute our products in international markets. We are assessing the opportunity to continue expanding into other international markets. We may face significant challenges and risks in managing a geographically dispersed distribution network. We have limited ability to control any third-party distributors and agents. Our distributors and agents may be unable to successfully market, lease, and sell our products and may not devote sufficient time and resources to support the marketing, sales, education, and training efforts that we believe enable the products to develop, achieve or sustain market acceptance. Additionally, in some international jurisdictions, we rely on our distributors to manage the regulatory process, while complying with all applicable rules and regulations, and we are dependent on their ability to do so effectively. In addition, if a dispute arises with a distributor or if a distributor is terminated by us or goes out of business, it may take time to locate an alternative distributor, to seek appropriate regulatory approvals with the new distributor and to train new personnel to market our products, and our ability to sell those systems in the region formerly serviced by such terminated distributor could be harmed. Any of these factors could reduce our revenues from affected markets, increase our costs in those markets or damage our reputation. In addition, if an independent distributor or agent were to depart and be retained by one of our competitors, we may be unable to prevent that distributor or agent from helping competitors solicit business from our existing customers, which could further adversely affect our sales. As a result of our reliance on third-party distributors and agents, we may be subject to disruptions and increased costs due to factors beyond our control, including labor strikes, third-party error, and other issues. During the COVID-19 global pandemic, our distributors have faced operational challenges, clinic closures due to governmental quarantine mandates and various other financial and operational difficulties. We believe that these difficulties have limited our ability to penetrate these markets. If the services of any of these third-party distributors and agents become unsatisfactory, we may experience delays in meeting our customers’ demands, and we may be unable to find a suitable replacement on a timely basis or on commercially reasonable terms. Any failure to deliver products in a timely manner may damage our reputation and could cause us to lose potential customers.

Clinical trials involve a lengthy and expensive process with an uncertain outcome, which may delay or cause us to abandon the development of Deep TMS for additional indications.

| 12 |

We are currently at various stages of completed, ongoing or planned clinical trials of Deep TMS for new indications. Development of medical devices includes pre-clinical studies and sometimes clinical trials, and is a long, expensive, and uncertain process, subject to delays and failure at any stage. Clinical trials for Deep TMS involve certain specific risks, including factors related to trial design and patient enrollment. Additionally, if we are unable to recruit a sufficient number of patients for our clinical trials, we may be unable to generate sufficient data to support marketing authorization. Moreover, our research and development, pre-clinical and clinical trial activities are subject to extensive regulation and review by numerous governmental authorities. We cannot predict whether we will encounter problems with any of our completed, ongoing or planned clinical trials, which would cause us or regulatory authorities to delay or suspend clinical trials, or delay the analysis of data from completed or ongoing clinical trials. We estimate that clinical trials involving various indications of Deep TMS will continue for several years; however, such trials may also take significantly longer to complete and may cost more money than we have expected. Furthermore, the data obtained from the studies and trials may be inadequate to support regulatory authorizations or to enable market acceptance of certain indications of Deep TMS. Failure can occur at any stage of testing, and we may experience numerous unforeseen events during, or as a result of, the clinical trial process that could delay or prevent commercialization of the current, or a future, version of, Deep TMS, for any particular indication, including but not limited to:

| ● | delays in securing clinical investigators or trial sites for the clinical trials; |

| ● | delays in obtaining institutional review board and other regulatory approvals to commence a clinical trial; |

| ● | slower than anticipated patient recruitment and enrollment; |

| ● | negative or inconclusive results from clinical trials; |

| ● | unforeseen safety issues; |

| ● | an inability to monitor patients adequately during or after treatment; |

| ● | placement of a clinical trial on hold by the FDA, institutional review boards/ethics committees or other regulatory authorities; |

| ● | changes in governmental regulations or administrative actions, including governmental changes in permissible endpoints or other measures utilized in clinical trials; |

| ● | problems with investigator or patient compliance with the trial protocols; |

| ● | the FDA or other regulators disagreeing as to the design, protocol or implementation of our clinical trials; |

| ● | exceeding budgeted costs due to difficulty in accurately predicting costs associated with clinical trials; |

| ● | the quality of the products falling below acceptable standards; and |

| ● | the inability to manufacture sufficient quantities of our products to commence or complete clinical trials. |

Additionally, the FDA or other regulatory entities may disagree with our interpretation of the data from our pre-clinical studies and clinical trials, or may find the clinical trial design, conduct or results inadequate to demonstrate safety or efficacy, and may require us to pursue additional pre-clinical studies or clinical trials, which could further delay authorization of additional indications for Deep TMS. A number of companies in the medical device and biotechnology industries, including those with greater resources and experience than us, have suffered significant setbacks in advanced clinical trials, even after seeing promising results in earlier clinical trials. We do not know whether any clinical trials we or our clinical partners may conduct will demonstrate adequate efficacy and safety to result in regulatory authorization to market new indications for Deep TMS. In addition, the results of our past clinical trials of Deep TMS may not be predictive of future trial results. If later-stage clinical trials involving Deep TMS for new indications do not produce favorable results, our ability to obtain regulatory authorization for such indications may be adversely impacted, which will have a material adverse effect on our business, financial condition, and results of operations.

| 13 |

We rely in part on third parties to conduct our clinical trials. If these third parties fail to perform their duties on time or as expected, we may not be able to obtain regulatory authorization for additional indications that we may seek for Deep TMS.

Our clinical trials are managed by our both own staff and personnel as well as certain third-parties, including clinical trial sites, medical institutions, clinical research organizations, or CROs, and private practices, for, among other things, site monitoring, statistical work, and electronic data capture in our clinical trials. Nevertheless, we are responsible for ensuring that each of our clinical trials is conducted in accordance with applicable protocols, and legal, regulatory, and scientific standards, including current good clinical practices, or cGCPs, which are set forth in regulations and guidelines enforced by the FDA and comparable foreign regulatory authorities for clinical trials. If we or any such third parties fail to comply with applicable cGCPs, the clinical data generated in such trials may be deemed unreliable and the FDA or comparable foreign regulatory authorities may require us to perform additional clinical trials before granting a marketing authorization for any particular indication. In addition, if such third parties do not devote sufficient time and resources to our clinical trials or otherwise carry out their contractual duties or obligations or meet expected deadlines, if they need to be replaced or if the quality or accuracy of the clinical data they assist in obtaining is compromised due to the failure to adhere to our clinical protocols, regulatory requirements or for other reasons, our clinical trials may be extended, delayed or terminated, and we may not be able to obtain regulatory authorization for or successfully commercialize Deep TMS for a specified indication.

Our collaboration arrangements may not be successful, which could adversely affect our ability to develop and commercialize our products.

We are currently involved in a number of research and development collaborations with third parties relating to the development of new technology and additional uses of Deep TMS. These and any future collaborations that we enter into may not be successful. The success of our collaboration arrangements will depend heavily on the efforts and activities of our collaborators. Collaborations are subject to numerous risks, which may include that:

| ● | collaborators have significant discretion in determining the efforts and resources that they will apply to collaborations; |

| ● | collaborators may not pursue development and commercialization of our products or may elect not to continue or renew development or commercialization programs based on trial or test results or may change their strategic focus due to the acquisition of competitive products, |

| ● | availability of funding or other external factors, such as a business combination that diverts resources or creates competing priorities; |

| ● | collaborators could independently develop, or develop with third parties, products that compete directly or indirectly with our products or product candidates; |

| ● | a collaborator with marketing, manufacturing, and distribution rights to one or more products may not commit sufficient resources to or otherwise not perform satisfactorily in carrying out these activities; |

| ● | we could grant exclusive rights to our collaborators that would prevent us from collaborating with others; |

| ● | collaborators may not properly maintain or defend our intellectual property rights or may use our intellectual property or proprietary information in a way that gives rise to actual or threatened litigation that could jeopardize or invalidate our intellectual property or proprietary information or expose us to potential liability; |

| ● | disputes may arise between us and a collaborator that causes the delay or termination of the research, development, and/or commercialization of our current or future products or that results in costly litigation or arbitration that diverts management attention and resources; |

| 14 |

| ● | our collaborators may default on their obligations to us and we may be forced to terminate, litigate, and/or renegotiate such arrangements; |

| ● | our collaborators may have claims that we breached our obligations to them which may result in termination, renegotiation, litigation or delays in performance of such arrangements; |

| ● | collaborations may be terminated, and, if terminated, may result in a need for additional capital to pursue further development or commercialization of the applicable current or future products; |

| ● | collaborators may own or co-own intellectual property covering our products that results from our collaborating with them, and in such cases, we would not have the exclusive right to develop or commercialize such intellectual property; and |

| ● | a collaborator’s sales and marketing activities or other operations may not be in compliance with applicable laws resulting in civil or criminal proceedings. |

If any of our collaboration arrangements are not successful, it could have a material adverse effect on our business, financial condition, and results of operations.

If product liability lawsuits are brought against us, our business may be harmed, and we may be required to pay damages that exceed our insurance coverage.

Our business exposes us to potential product liability claims that are inherent in the testing, manufacture, and sale of medical devices for the treatment of MDD (including reduction of comorbid anxiety symptoms, commonly referred to as anxious depression), OCD, smoking addiction, and other potential indications. Our treatments are designed for patients who suffer from significant psychiatric, neurological disorders, and addictions, and these patients are more likely to experience significant adverse health outcomes, which could increase the risk of product liability lawsuits. Furthermore, if physicians and other operators are not sufficiently trained in the use of our Deep TMS systems, they may misuse or ineffectively use our system, which may result in unsatisfactory patient outcomes. We could become the subject of product liability lawsuits alleging that component failures, malfunctions, manufacturing flaws, design defects or inadequate disclosure of product-related risks or product-related information resulted in an unsafe condition or injury to