U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2016

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission file number 000-54175

5V, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 27–3828846 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification Number) |

Floor 12, Building 5, Zhongchuang Plaza,

No.396, Tongjiang Zhong Road, Xinbei District

Changzhou City, Jiangshu Province, China

(Address of principal executive offices)

+86-13510608355

(Registrant’s telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☒ No ☐.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 100,000,000 shares of common stock of the registrant, par value $.0001 per share, were outstanding as of August 15, 2016.

5V, INC.

- INDEX -

| Page | |||

| PART I – FINANCIAL INFORMATION: | |||

| Item 1. | Financial Statements: | 1 | |

| Consolidated Balance Sheets as of June 30, 2016 (Unaudited) and September 30, 2015 | F-2 | ||

| Consolidated Statements of Operations (Unaudited) for the Three and Six Months Ended June 30, 2016 and 2015 | F-3 | ||

| Consolidated Statements of Cash Flows (Unaudited) for the Six Months Ended June 30, 2016 and 2015 | F-4 | ||

| Notes to the Consolidated Financial Statements (Unaudited) | F-5 – F-15 | ||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 2 | |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 4 | |

| Item 4. | Controls and Procedures | 4 | |

| PART II – OTHER INFORMATION: | |||

| Item 1. | Legal Proceedings | 5 | |

| Item 1A. | Risk Factors | 5 | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 5 | |

| Item 3. | Defaults Upon Senior Securities | 5 | |

| Item 4. | Mine Safety Disclosures | 5 | |

| Item 5. | Other Information | 5 | |

| Item 6. | Exhibits | 5 | |

| Signatures | 6 | ||

FORWARD-LOOKING STATEMENTS

Certain statements made in this Quarterly Report on Form 10-Q are “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of 5V, Inc. (the “Company”) to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. The Company’s plans and objectives are based, in part, on assumptions involving the continued expansion of business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of the Company. Although the Company believes its assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance the forward-looking statements included in this Report will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the objectives and plans of the Company will be achieved.

PART I – FINANCIAL INFORMATION

Item 1.

5V, INC. AND SUBSIDIARIES

FINANCIAL STATEMENTS

At June 30, 2016 and September 30, 2015

For the Nine months ended June 30, 2016 and 2015

| 1 |

5V, INC. AND SUBSIDIARIES

INDEX

| PAGE | |

| CONSOLIDATED BALANCE SHEETS | F-2 |

| CONSOLIDATED STATEMENTS OF OPERATIONS | F-3 |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | F-4 |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | F-5 - F-15 |

| F-1 |

| 5V, Inc and Subsidiaries |

| Consolidated Balance Sheets |

| June 30, 2016 | September 30, 2015 | |||||||

| (Unaudited) | (Audited) | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 1,936 | $ | 1,975 | ||||

| Prepaid expenses | - | 1,500 | ||||||

| Total Current Assets | 1,936 | 3,475 | ||||||

| Land, Property & equipment (net) | - | - | ||||||

| Total Assets | $ | 1,936 | $ | 3,475 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts payable and accrued expenses | $ | 5,482 | $ | 16,000 | ||||

| Due to related parties | 215,627 | 189,381 | ||||||

| Total Current Liabilities | 221,109 | 205,381 | ||||||

| Total Liabilities | 221,109 | 205,381 | ||||||

| Commitments & contingencies | - | - | ||||||

| Stockholders' Deficit | ||||||||

| Common stock, $0.0001 par value, 400,000,000 shares authorized; 100,000,000 shares issued at December 31, 2015 and September 30, 2015, respectively | 10,000 | 10,000 | ||||||

| Additional paid-in capital | 42,037 | 42,037 | ||||||

| Subscription receivables | (51,287 | ) | (51,287 | ) | ||||

| Accumulated loss | (219,923 | ) | (202,656 | ) | ||||

| Total stockholders' deficit | (219,173 | ) | (201,906 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | $ | 1,936 | $ | 3,475 | ||||

The accompanying notes are an integral part of these financial statements

| F-2 |

| 5V, Inc and Subsidiaries |

| Consolidated Statements of Operations |

| (Unaudited) |

| For the Three Months Ended | For the Nine Months Ended | |||||||||||||||

| June 30, 2016 | June 30, 2015 | June 30, 2016 | June 30, 2015 | |||||||||||||

| Revenues | $ | - | $ | - | $ | - | $ | - | ||||||||

| Cost of sales | - | - | - | - | ||||||||||||

| Gross margin | - | - | - | - | ||||||||||||

| Operating expenses | ||||||||||||||||

| General and administrative expenses | 4,156 | 6,488 | 17,268 | 31,417 | ||||||||||||

| Total Operating Expenses | 4,156 | 6,488 | 17,268 | 31,417 | ||||||||||||

| Income (Loss) from operation | (4,156 | ) | (6,488 | ) | (17,268 | ) | (31,417 | ) | ||||||||

| Other income (loss) | ||||||||||||||||

| Interest income, net | - | - | 2 | - | ||||||||||||

| Total other income | - | - | 2 | - | ||||||||||||

| Loss before income tax | (4,156 | ) | (6,488 | ) | (17,266 | ) | (31,417 | ) | ||||||||

| Income tax | - | - | - | - | ||||||||||||

| Net loss | (4,156 | ) | (6,488 | ) | (17,266 | ) | (31,417 | ) | ||||||||

| Foreign currency translation adjustment | - | - | - | - | ||||||||||||

| Comprehensive loss | $ | (4,156 | ) | $ | (6,488 | ) | $ | (17,266 | ) | $ | (31,417 | ) | ||||

| Common Shares Outstanding, basic and diluted | 100,000,000 | 100,000,000 | 100,000,000 | 100,000,000 | ||||||||||||

| Net loss per share | ||||||||||||||||

| Basic and diluted | $ | - | $ | (0.0001 | ) | $ | (0.0002 | ) | $ | (0.0003 | ) | |||||

The accompanying notes are an integral part of these financial statements

| F-3 |

| 5V, Inc and Subsidiaries |

| Consolidated Statements of Cash Flows |

| (Unaudited) |

| For the Nine Months Ended | ||||||||

| June 30, 2016 | June 30, 2015 | |||||||

| Cash flows from operating activities | ||||||||

| Net loss | $ | (17,266 | ) | $ | (31,417 | ) | ||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses | 1,500 | (2,000 | ) | |||||

| Accounts payable and accrued expenses | (10,519 | ) | (660 | ) | ||||

| Net cash used in operating activities | (26,285 | ) | (34,077 | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from related party | 26,246 | 34,078 | ||||||

| Net cash provided by financing activities | 26,246 | 34,078 | ||||||

| NET INCREASE (DECREASE) IN CASH | (39 | ) | 1 | |||||

| CASH | ||||||||

| Beginning of period | 1,975 | 1,974 | ||||||

| End of period | $ | 1,936 | $ | 1,975 | ||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION CASH PAID FOR: | ||||||||

| Interest Expense | $ | - | $ | - | ||||

| Income Taxes | $ | - | $ | - | ||||

The accompanying notes are an integral part of these financial statements

| F-4 |

5V, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 1- | ORGANIZATION AND BUSINESS |

| 5V, Inc. (the “Company”), formerly China Gate Acquisition Corp. 1, was organized on February 19, 2010 as a Delaware corporation with fiscal year ending September 30. The Company is a shell with no business activity whose purpose is to seek out and attract partners for possible merger or acquisition. | |

| On April 28, 2011, the China Gate Acquisition Corp. 1 incorporated a wholly-owned subsidiary under the name “5V Inc.” under the laws of the State of Delaware. | |

| On May 3, 2011, the Company effectuated a merger (the “Merger”) pursuant to which its wholly-owned subsidiary, 5V, Inc. (“5V”) merged with and into the Company, with the Company continuing as the surviving corporation and the officer and directors of the Corporation replacing the sole officer and director of 5V. On the same day, the Company changed its name from “China Gate Acquisition Corp. 1” to “5V, Inc.” by filing a Certificate of Ownership and Merger with the Office of Secretary of State of Delaware. | |

| On August 24, 2012, Jun Jiang and Xiong Wu (collectively the “Purchasers”) purchased all of the issued and outstanding shares of common stocks of the Company’s existing shareholders (the “Sellers”) for an aggregate purchase of $250,000. As a result of the consummation of the transaction, the Purchasers collectively own 100% of the Company’s outstanding common stock, resulting in no liability owed to the original shareholders (the “Sellers”) thereafter. | |

| On December 31, 2012, the Company’s Board of Directors and shareholders approved an increase in the authorized shares of common stocks from 100,000,000 to 400,000,000. The amendment to the Company’s Certificate of Incorporation was filed with the Secretary of State of Delaware on April 16, 2013. | |

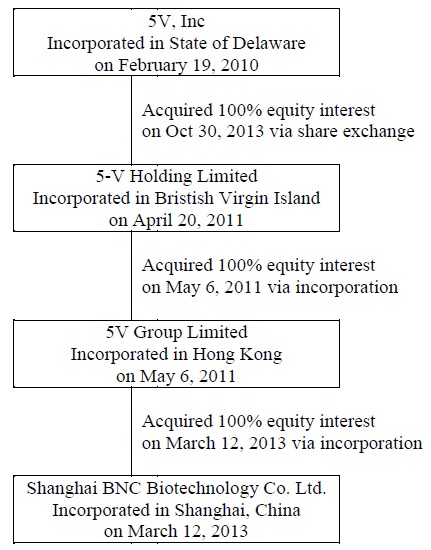

| On October 30, 2013, the Company, 5-V Holding Limited, a British Virgin Islands company (“5V BVI”) and the shareholders of 5V BVI (the “5V BVI Shareholders”) entered into a share exchange agreement (the “Share Exchange Agreement”). Pursuant to the Share Exchange Agreement, the Company agreed to acquire 100% of the issued and outstanding shares of 5V BVI from the 5V BVI Shareholders in exchange for the issuance of 92,500,000 shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) to 5V BVI Shareholders. The 5V BVI Shareholders agreed to exchange each share of their 5V BVI shares for 2,000 5V DE Shares. The transaction pursuant to the Share Exchange Agreement is hereby referred to as the Share Exchange. The Share Exchange was consummated on October 30, 2013 (the “Closing Date”). As a result of the Share Exchange, 5V BVI will become a wholly-owned subsidiary of the Company. | |

| 5V BVI was incorporated in the British Virgin Islands (“BVI”) on April 20, 2011, as a BVI Business Company under the BVI Business Companies Act, 2004. 5V BVI was organized to provide business services and financing to emerging growth entities. |

| F-5 |

5V, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 1- | ORGANIZATION AND BUSINESS (continued) |

| On May 6, 2011, 5V BVI incorporated a wholly-owned subsidiary named “5V Group Limited” in Hong Kong under the Companies Ordinance as a limited liability company. 5V Group Limited is a shell with no business activity and whose purpose is to seek out and attract partners for possible merger or acquisition. | |

| On March 12, 2013, 5V Group Limited established a wholly-owned subsidiary named "Shanghai BNC Biotechnology Co., Ltd." ("Shanghai BNC") in the People's Republic of China ("PRC') as a limited liability company under the Company Laws of PRC. Shanghai BNC plans to engage in the research, sale and after-market service of herb diet nutritional supplement and skin-care product in China. | |

| 5V, Inc., 5-V Holding limited, 5V Group Limited, and Shanghai BNC are hereafter referred to as the “Company”, which structure is summarized in the following chart. |

| F-6 |

5V, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 2- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| Basis of Presentation | |

| The accompanying financial statements have been prepared on the accrual basis of accounting in accordance with generally accepted accounting principles in the United States of America ("US GAAP") and are presented in U.S. dollars. | |

| The consolidated financial statements include the accounts of the Company and all its wholly-owned subsidiaries which require consolidation. Inter-company transactions have been eliminated in consolidation. | |

| Certain amounts in the prior year's consolidated financial statements and notes have been revised to conform to the current year presentation. | |

Interim Financial Statements

The unaudited consolidated financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) applicable to interim financial information and the requirements of Form 10-Q and Rule 8-03 of Regulation S-X of the Securities and Exchange Commission. Accordingly, they do not include all of the information and disclosure required by accounting principles generally accepted in the United States of America for complete financial statements. Interim results are not necessarily indicative of results for a full year. In the opinion of management, all adjustments considered necessary for a fair presentation of the financial position and the results of operations and cash flows for the interim periods have been included.

These consolidated financial statements should be read in conjunction with the audited financial statements for the year ended September 30, 2015, as not all disclosures required by generally accepted accounting principles for annual financial statements are presented. The interim consolidated financial statements follow the same accounting policies and methods of computations as the audited financial statements for the year ended September 30, 2015.

Subsequent Events | |

| In preparing the accompanying financial statements, we evaluated the period from the balance sheet date through the date the financial statements were issued for material subsequent events requiring recognition or disclosure. No such events were identified for this period. |

| F-7 |

5V, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 2- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

| Use of Estimates | |

| The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. | |

| Cash and Cash Equivalents | |

| In accordance with FASB ASC Topic 230-10-50-6, “Statement of Cash Flows”, the Company considers all highly liquid debt instruments with a maturity of three months or less when purchased to be cash equivalents. | |

| Property, plant and equipment | |

| Property, plant and equipment, are stated at cost less depreciation and amortization and accumulated impairment loss. Cost represents the purchase price of the asset and other costs incurred to bring the asset into its existing use. Maintenance, repairs and betterments, including replacement of minor items, are charged to expense; major additions to physical properties are capitalized. | |

| Depreciation of property, plant and equipment is calculated based on cost, less their estimated residual value, if any, using the straight-line method over their estimated useful lives. | |

| Upon sale or retirement of property, plant and equipment, the related cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in operation. | |

| The estimated useful lives of the assets are as follows: | |

| Office equipment and furniture 3-5 years |

| F-8 |

5V, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 2- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

| Impairment of Long-life Assets | |

| Long-lived assets and certain identifiable intangibles are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future net cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell. | |

| Revenue Recognition | |

| The Company recognizes revenue when the earnings process is complete, both significant risks and rewards of ownership are transferred or services have been rendered and accepted, the selling price is fixed or determinable, and collectability is reasonably assured. | |

| The Company did not generate any revenues since inception. |

| F-9 |

5V, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 2- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

| Income Taxes | |

| The Company accounts for income taxes in accordance with FASB ASC Topic 740 which requires that deferred tax assets and liabilities be recognized for future tax consequences attributable to differences between financial statement carrying amounts of existing assets and liabilities and their respective tax bases. In Addition, FASB ASC 740 requires recognition of future tax benefits, such as carry forwards, to the extent that realization of such benefits is more likely than not and that a valuation allowance be provided when it is more likely than not that some portion of the deferred tax asset will not be realized. | |

| The Company has accumulated deficiency in its operation. Because there is no certainty that we will realize taxable income in the future, we did no record any deferred tax benefit as a result of these losses. | |

| The Company accounts for income taxes in interim periods in accordance with FASB ASC 740-270, "Interim Reporting". The Company has determined an estimated annual effect tax rate. The rate will be revised, if necessary, as of the end of each successive interim period during the Company’s fiscal year to its best current estimate. The estimated annual effective tax rate is applied to the year-to-date ordinary income (or loss) at the end of the interim period. | |

| Fair Value of Measurements | |

| The Company adopted the guidance of FASB ASC 820 for fair value measurements which clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows: |

| Level 1: | Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date. | |

| Level 2: | Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other then quoted prices that are observable, and inputs derived from or corroborated by observable market data. | |

| Level 3: | Inputs are unobservable Inputs which reflect the reporting entity’s own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information. | |

| The carrying amounts reported in the balance sheets for cash and accrued expenses approximate their fair market value based on the short-term maturity of these instruments. The Company did not identify any assets or liabilities that are required to be presented on the balance sheets at fair value in accordance with the accounting guidance. | ||

| F-10 |

5V, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 2- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

| Basic and Diluted Loss per Share | |

| The Company reports loss per share in accordance with FASB ASC 260 “Earnings per share”. The Company’s basic earnings per share are computed using the weighted average number of shares outstanding for the periods presented. Diluted earnings per share are computed based on the assumption that any dilutive options or warrants were converted or exercised. Dilution is computed by applying the treasury stock method. Under this method, the Company’s outstanding stock warrants are assumed to be exercised, and funds thus obtained were assumed to be used to purchase common stock at the average market price during the period. There were no dilutive instruments outstanding during the three and nine months ended June 30, 2016 and 2015 However, if present, a separate computation of diluted loss per share would not have been presented, as these common stock equivalents would have been anti-dilutive due to the Company's net loss. | |

| Comprehensive Income | |

| FASB ASC 220, “Comprehensive Income", establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. | |

| Segment Reporting | |

| FASB ASC 820 “Segments Reporting” establishes standards for reporting information about operating segments on a basis consistent with the Company’s internal organization structure as well as information about geographical areas, business segments and major customers in financial statements. The Company currently operates in one principal business segment. | |

| Related Parties | |

| Parties are considered to be related to the Company if the parties, directly or indirectly, through one or more intermediaries, control, are controlled by, or are under common control with the Company. Related parties also include principal owners of the Company, its management, members of the immediate families of principal owners of the Company and its management and other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. The Company discloses all related party transactions. All transactions shall be recorded at fair value of the goods or services exchanged. Property purchased from a related party is recorded at the cost to the related party and any payment to or on behalf of the related party in excess of the cost is reflected as a distribution to related party. |

| F-11 |

5V, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 2- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

| Recent Accounting Pronouncements | |

| In November 2015, the FASB issued ASU No. 2015-17, Balance Sheet Classification of Deferred Taxes, which requires entities to present deferred tax assets (DTAs) and deferred tax liabilities (DTLs), along with any related valuation allowance, as noncurrent in a balance sheet. This ASU eliminates current guidance requiring deferred taxes for each jurisdiction to be presented as a net current asset or liability and a net noncurrent asset or liability. As a result, each jurisdiction would have one net noncurrent DTA or DTL balance. The ASU does not change the existing requirement that only permits offsetting DTAs and DTLs within a particular jurisdiction. This standard is effective January 1, 2017. The Company is currently assessing the impact of the adoption of this guidance on the consolidated financial statements. | |

In January 2016, the FASB issued ASU No. 2016-01, Recognition and Measurement of Financial Assets and Financial Liabilities, which revises the accounting related to (1) the classification and measurement of investments in equity securities and (2) the presentation of certain fair value changes for financial liabilities measured at fair value. The ASU also amends certain disclosure requirements associated with the fair value of financial instruments. The new guidance requires the fair value measurement of investments in equity securities and other ownership interests in an entity, including investments in partnerships, unincorporated joint ventures and limited liability companies (collectively, “equity securities”) that do not result in consolidation and are not accounted for under the equity method. Entities will need to measure these investments and recognize changes in fair value in net income. Entities will no longer be able to recognize unrealized holding gains and losses on equity securities they classify under current guidance as available for sale in other comprehensive income (OCI). They also will no longer be able to use the cost method of accounting for equity securities that do not have readily determinable fair values. Instead, for these types of equity investments that do not otherwise qualify for the net asset value practical expedient, entities will be permitted to elect a practicability exception and measure the investment at cost less impairment plus or minus observable price changes (in orderly transactions). The ASU also establishes an incremental recognition and disclosure requirement related to the presentation of fair value changes of financial liabilities for which the fair value option (FVO) has been elected. Under this guidance, an entity would be required to separately present in OCI the portion of the total fair value change attributable to instrument-specific credit risk as opposed to reflecting the entire amount in earnings. For derivative liabilities for which the FVO has been elected, however, any changes in fair value attributable to instrument-specific credit risk would continue to be presented in net income, which is consistent with current guidance. The standard is effective beginning January 1, 2018 via a cumulative-effect adjustment to beginning retained earnings, except for guidance relative to equity securities without readily determinable fair values which is applied prospectively. The Company is currently assessing the impact of the adoption of this guidance on the consolidated financial statements.

In March 2016, the FASB issued ASU No. 2016-09 "Compensation – Stock Compensation," which identifies areas for simplification involving several aspects of accounting for equity-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, an option to recognize gross stock compensation expense with actual forfeitures recognized as they occur, as well as certain classifications on the statement of cash flows. This guidance is effective for fiscal years, and interim periods within those years, beginning after December 15, 2016 with early adoption permitted subject to certain requirements. The Company is currently assessing the impact that adopting this new accounting standard will have on its consolidated financial statements and footnote disclosures.

| |

| The Company believes that there were no other accounting standards recently issued that had or are expected to have a material impact on our financial position or results of operations. |

| F-12 |

5V, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 3- | GOING CONCERN |

| The accompanying financial statements were prepared in conformity with U.S. GAAP, which contemplates continuation of the Company as a going concern and depends upon the Company’s ability to establish itself as a profitable business. The Company has an accumulated loss since inception of $219,923, including net operating loss of $17,266 and $31,417 for the nine months ended June 30, 2016 and 2015, respectively. As of June 30, 2016, the Company has a shareholders' deficit of $219,173, and a working capital deficit of $219,173, which is not sufficient to finance its business for the next twelve months. Due to the start-up nature of the Company, the Company expects to incur additional losses in the immediate future. The Company’s ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they become due. The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern. To date, the Company’s cash flow requirements have been primarily met through advances from shareholders. | |

| The Company is planning on obtaining financing either through issuance of equity or debt. To the extent that funds generated from any private placements, public offerings and/or bank financing are insufficient, the Company will have to raise additional working capital through other channels. |

| Note 4- | COMMON STOCK AND PREFERRED STOCK |

| The Company has authority to issue 410,000,000 shares of capital stock. These shares are divided into two classes with 400,000,000 shares designated as common stock at $0.0001 par value and 10,000,000 shares designated as preferred stock at $0.0001 par value. As of June 30, 2016, the Company has no preferred stocks issued and outstanding, and has issued and outstanding of 100,000,000 shares of common stock at par value of $0.0001 per share. | |

| Upon formation of the Company, 7,500,000 shares of common stock were issued to two founders for $750. | |

| On October 30, 2013, the Company issued 92,500,000 shares of common stocks to acquire 100% of 5-V Holding Limited and its subsidiaries. |

| F-13 |

5V, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 5- | ADVANCE FROM A RELATED PARTY |

| One of the Company’s stockholders advanced funds to the Company to cover legal, audit, and filing fees, general office administration and other expenses. The advances are unsecured, no interest bearing, and payable upon demand. On August 24, 2012, Jun Jiang and Xiong Wu (the “Purchasers”) purchased all of the issued and outstanding shares of common stocks of the Company from the then existing shareholders (the “Sellers”). Concurrently with the transaction, the Sellers agreed to transfer to the Purchasers all of their claims on advances to the Company. | |

| Advance from a related party consist of the following: |

| June 30, | September 30, | ||||||||

| 2016 | 2015 | ||||||||

| Jiang, Jun, CEO of the Company | $ | 215,627 | $ | 189,381 | |||||

| Total accounts payable and accrued expenses | $ | 215,627 | $ | 189,381 | |||||

| Note 6- | OFFICE RENTAL EXPENSE |

| From time to time, our officers and directors provide office space to us for free. However, we have not reached a formal lease agreement with any officer as of the date of this filing. The office rental expenses were $0 and $0 for the nine months ended June 30, 2016 and 2015, respectively. |

| Note 7- | INCOME TAX |

| The Company has operating losses that may be applied against future taxable income. The potential tax benefits arising from these losses carry forwards, which expire beginning the year 2030, are offset by a valuation allowance due to the uncertainty of profitable operations in the future. The cumulative net operating loss carry forward as of June 30, 2016 and September 2015 was $219,923 and $202,656, respectively. The statutory tax rate for fiscal years 2016 and 2015 is 35%. The significant components of the deferred tax assets as follows: |

| June 30, | September 30, | ||||||||

| 2016 | 2015 | ||||||||

| Losses carry forwards | $ | 76,973 | $ | 70,930 | |||||

| Less-Valuation allowance | (76,973 | ) | (70,930 | ) | |||||

| Total net deferred tax assets | $ | - | $ | - | |||||

| F-14 |

5V, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 8- | COMMITMENTS AND CONTINGENCIES |

| Control by principal stockholder/officer | |

| The chief executive officer beneficially owns and in the aggregate, the majority of the voting power of the Company. Accordingly, the chief executive officer has the ability to control the approval of most corporate actions, including approving significant expenses, increasing the authorized capital stock and the dissolution, merger or sale of the Company's assets. | |

| Economic and Political Risks | |

| The Company faces a number of risks and challenges not typically associated with companies in North America and Western Europe, since its assets exist solely in the PRC, and its revenues are derived from its operations therein. The PRC is a developing country with an early stage market economic system, overshadowed by the state. Its political and economic systems are very different from the more developed countries and are in a state of change. The PRC also faces many social, economic and political challenges that may produce major shocks and instabilities and even crises, in both its domestic arena and in its relationships with other countries, including the United States. Such shocks, instabilities and crises may in turn significantly and negatively affect the Company's performance. |

| F-15 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

Since immediately after the share exchange transaction with 5V BVI on October 30, 2013, we have been planning to engage in the research, sale and after-market service of herb diet nutritional supplement and skin-care products in China. There can be no assurance that we will be able to successfully implement our business plan to develop the herb diet nutritional supplement and skin-care product in China as discussed above, and we may also continue to serve as a vehicle to effectuate an asset acquisition, merger, exchange of capital stock or other business combination with a domestic or foreign business in the herb nutrition business or other businesses. We have made no efforts to identify such a possible business combination. As a result, the Company has not conducted negotiations or entered into a letter of intent concerning any target business as discussed above. The Company’s principal business objective for the next 12 months and beyond such time will be to achieve long-term growth potential through a combination with a business rather than immediate, short-term earnings. The Company will not restrict its potential candidate target companies to any specific business, industry or geographical location and, thus, may acquire any type of business. There is no assurance that we will be able to identify and acquire any business entity. Even if we successfully acquire a business entity, there is no assurance that we can generate revenue and become profitable.

The Company currently does not engage in any business activities that provide cash flow. During the next twelve months, we may incur costs related to:

(i) filing Exchange Act reports,

(ii) WFOE’S compliance with Chinese laws and regulations,

(iii) research, sale and after-market service of herb diet nutritional supplement and skin-care products in China, and

(iv) investigating, analyzing and consummating an acquisition, whether or not the acquired entity is in a business related to herb nutrition.

We have not decided as to whether we will spend any funds on organically developing the herb nutrition business and skin-care product business in China, or identifying and commencing an acquisition in the herb nutrition area or other areas.

We believe we will be able to pay our expenses through deferrals of fees by certain service providers and through funds, as necessary, to be loaned to or invested in us by our stockholders, management or other investors. As of the date of the period covered by this report, the Company has no assets. There are no assurances that the Company will be able to secure any additional funding as needed. Currently, however, our ability to continue as a going concern is dependent upon our ability to generate future profitable operations and/or to obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when they come due. Our ability to continue as a going concern is also dependent on our ability to find a suitable target company and enter into a possible reverse merger with such company. Management’s plan includes obtaining additional funds by equity financing and/or related party advances, however there is no assurance of additional funding will be available.

The Company may consider acquiring a business which is either a company that has recently commenced its operations and is seeking to develop a new product or service, or is an established business which may be experiencing financial or operating difficulties and is in need of additional capital or is seeking to expand into new markets. Alternatively, a business combination may involve the acquisition of, or merger with, a company which does not need substantial additional capital but desires to establish a public trading market for its shares while avoiding, among other things, the time delays, significant expense, and loss of voting control which may occur in an initial public offering.

| 2 |

Any target business that is selected may be a financially unstable company or an entity in its early stages of development or growth, including entities without established records of sales or earnings. In that event, we will be subject to numerous risks inherent in the business and operations of financially unstable and early stage or potential emerging growth companies. In addition, we may effectuate a business combination with an entity in an industry characterized by a high level of risk, and, although our management will endeavor to evaluate the risks inherent in a particular target business, there can be no assurance that we will properly ascertain or assess all significant risks. Our management anticipates that it will likely be able to effectuate only one business combination, primarily due to our limited financing and the dilution of interest for present and prospective stockholders, which is likely to occur as a result of our management’s plan to offer a controlling interest to a target business in order to achieve a tax-free reorganization. This lack of diversification should be considered a substantial risk in investing in us, because it will not permit us to offset potential losses from one venture against gains from another.

The Company anticipates that the selection of a business combination will be complex and extremely risky. Through information obtained from industry publications and professionals, our management believes that there are numerous firms seeking the perceived benefits of becoming a publicly traded corporation. Such perceived benefits of becoming a publicly traded corporation include, among other things, facilitating or improving the terms on which additional equity financing may be obtained, providing liquidity for the principals of and investors in a business, creating a means for providing incentive stock options or similar benefits to key employees, and offering greater flexibility in structuring acquisitions, joint ventures and the like through the issuance of stock. Potentially available business combinations may occur in many different industries and at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities extremely difficult and complex. We do not currently intend to retain any entity to act as a “finder” to identify and analyze the merits of potential target businesses.

Results of Operations

The Company has not conducted any active operations since inception, except for its efforts to locate suitable acquisition candidates. No revenue has been generated by the Company from February 19, 2010 (Inception) to date. It is unlikely the Company will have any revenues unless it is able to effect an acquisition or merger with an operating company, of which there can be no assurance. It is management's assertion that these circumstances may hinder the Company's ability to continue as a going concern. The Company’s plan of operation for the next twelve months shall be to continue its efforts to locate suitable acquisition candidates.

For the three months ended June 30, 2016 and 2015, the Company had general and administrative expenses $4,156 and $6,488 comprised of legal, filing, accounting, audit, and other professional service fees incurred in relation to the filing of the Company’s annual and quarterly reports in connection with its reporting obligations and therefore generated a net loss of $4,156 and $6,488, respectively. The lower expenses during the three months ended June 30, 2016 resulted from overall cost cutting efforts by the Company.

For the nine months ended June 30, 2016 and 2015, the Company had general and administrative expenses $17,268 and $31,417 comprised of legal, filing, accounting, audit, and other professional service fees incurred in relation to the filing of the Company’s annual and quarterly reports in connection with its reporting obligations and therefore generated a net loss of $17,266 and $31,417, respectively. The lower expenses during the nine months ended June 30, 2016 resulted from overall cost cutting efforts by the Company.

Liquidity and Capital Resources

As of June 30, 2016, the Company had cash of $1,936, as compared to $1,975 as of September 30, 2015. The Company’s liabilities as of June 30, 2016 were $221,109, comprised of $5,482 in accounts payable and 215,627 in short-term advances from a related party. This compares with total liabilities of $205,381, comprised of $16,000 in accounts payable and $189,381 in short-term advances from a related party, as of September 30, 2015. The Company can provide no assurance that it can continue to satisfy its cash requirements for at least the next twelve months.

| 3 |

The following is a summary of the Company's cash flows provided by (used in) operating, investing, and financing activities for the nine months ended June 30, 2016 and 2015.

| Nine Months Ended June 30, 2016 | Nine Months Ended June 30, 2015 | |||||||

| Net Cash (Used in) Operating Activities | $ | (26,285 | ) | $ | (34,077 | ) | ||

| Net Cash (Used in) Investing Activities | - | - | ||||||

| Net Cash Provided by Financing Activities | 26,246 | 34,078 | ||||||

| Net Increase (Decrease) in Cash and Cash Equivalents | $ | (39 | ) | $ | 1 | |||

The Company has nominal assets and has generated no revenues since inception. The Company is also dependent upon the receipt of capital investment or other financing to fund its ongoing operations and to execute its business plan of seeking a combination with a private operating company. In addition, the Company is dependent upon certain related parties to provide continued funding and capital resources. If continued funding and capital resources are unavailable at reasonable terms, the Company may not be able to implement its plan of operations.

Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Item 3. Quantitative and Qualitative Disclosures about Market Risk.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide information required by this Item.

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports filed pursuant to the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules, regulations and related forms, and that such information is accumulated and communicated to our principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure.

As of June 30, 2016, we carried out an evaluation, under the supervision and with the participation of our principal executive officer and our principal financial officer of the effectiveness of the design and operation of our disclosure controls and procedures. Based on this evaluation, our principal executive officer and our principal financial officer concluded that our disclosure controls and procedures were not effective as of the end of the period covered by this report.

Changes in Internal Controls

There were no changes in our internal controls over financial reporting during the quarter ended June 30, 2016 that have materially affected or are reasonably likely to materially affect our internal controls.

| 4 |

PART II – OTHER INFORMATION

| Item 1. | Legal Proceedings. |

There are presently no material pending legal proceedings to which the Company, any of its subsidiaries, any executive officer, any owner of record or beneficially of more than five percent of any class of voting securities is a party or as to which any of its property is subject, and no such proceedings are known to the Registrant to be threatened or contemplated against it.

| Item 1A. | Risk Factors |

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide information required by this Item.

| Item 2 | Unregistered Sales of Equity Securities and Use of Proceeds. |

| None. | |

| Item 3. | Defaults Upon Senior Securities. |

| None. | |

| Item 4. | Mine Safety Disclosures. |

| Not applicable. | |

| Item 5. | Other Information. |

| None. | |

| Item 6. | Exhibits. |

(a) Exhibits required by Item 601 of Regulation S-K.

| Exhibit | Description | |

| 31.1 | Certification of the Company’s Principal Executive Officer and Principal Financial and Accounting Officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, with respect to the registrant’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2016. | |

| 32.1 | Certification of the Company’s Principal Executive Officer and Principal Financial and Accounting Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| 101.INS | XBRL Instance Document | |

| 101.SCH | XBRL Taxonomy Extension Schema Document | |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document. | |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase Document. | |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document. | |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase Document. |

| 5 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| 5V, INC. | ||

| Dated: August 22, 2016 | By: | /s/ Jun Jiang |

| Jun Jiang | ||

| President | ||

| (Principal

Executive officer, and Principal Financial and Accounting Officer) | ||

6