EXHIBIT 10.1

INTELLECTUAL PROPERTY ASSIGNMENT AGREEMENT

THIS INTELLECTUAL PROPERTY ASSIGMENT AGREEMENT (this "Agreement") is made as of the 27th day of October, 2014.

B E T W E E N:

HATEM ESSADDAM, chemist, domiciled and residing at __________, acting both personally and for a corporation to be incorporated;

(the "Assignor")

-and-

LOOP HOLDINGS, INC., a corporation incorporated under the federal laws of Nevada having its head office at 1999 Avenue of the Stars, Suite 2520, Los Angeles, California, herein represented by its president, Daniel Solomita, duly authorized as he so declares;

(the "Assignee")

-and-

DANIEL SOLOMITA,

(the "Intervenor")

WHEREAS:

| A. | The Assignor has developed a certain technique and method allowing for the depolymerization of polyethylene terephthalate at ambient temperature and atmospheric pressure (the "Technique"). |

| B. | The Assignee wishes to develop a Polyethylene terephthalate depolymerization processing plant (the "Plant"). |

| C. | The Assignor wishes to assign to the Assignee all of his rights, title and interests (including Intellectual Property rights), present and future, in and to the Technique. |

NOW THEREFORE in consideration of the mutual agreements and covenants herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties covenant and agree as follows:

| 1 |

ARTICLE 1

INTERPRETATION

1.1 Defined Terms

In this Agreement and in the Schedules attached hereto, unless the subject matter or context is inconsistent therewith, the following terms and expressions will have the following meanings:

| (a) | "Approvals" has the meaning ascribed thereto in Section 3.1.3; | |

| (b) | "Assignor's Closing Certificate" has the meaning ascribed thereto m Section 6.1.2; | |

| (c) | "Assignee's Closing Certificate" has the meamng ascribed thereto m Section 6.3.3 c); | |

| (d) | "Business Day" means any day other than a Saturday, Sunday or any day on which financial institutions are generally not open for business in the City of Montreal, Province of Quebec; | |

| (e) | "Claims" includes claims, demands, complaints, grievances, actions, applications, suits, causes of action, Orders, charges, indictments, prosecutions, informations or other similar processes, assessments or reassessments; | |

| (f) | "Closing" means the completion of the transactions contemplated herein on the Closing Date; | |

| (g) | "Closing Date" means, subject to the conditions to Closing having been satisfied or waived, the last day of the Transition Period, or such other date as the Parties may agree upon; | |

| (h) | "Closing Time" means 10:00 (a.m.) in Montreal, Quebec on the Closing Date or such other time on the Closing Date as the Parties hereto may agree upon; | |

| (i) | "Confidential Information" means all confidential information relating to (i) the Technique and the Intellectual Property Rights, (ii) the business, finances, operations, research and development activities, products or services of either party; (iii) third-party confidential information and (iv) all other information which is not generally known to the public or is by its nature or the circumstances in which it is made available to a party by the other, is such that it would generally be considered confidential or proprietary. Without limiting the generality of the foregoing, Confidential Information includes, without limitation, all forms of Confidential Information and support containing Confidential Information, whether oral, written or digital, whether provided, disclosed, furnished or prepared before, on or after the date of this Agreement, including all analyses, compilations, data, studies, notes, reports or other documents prepared by or for the other party, based upon or including any of such Confidential Information and, in all cases, includes all copies and tangible or intangible embodiments thereof, in whatever form or medium. However, Confidential Information does not include the information that (i) after disclosure, became part of the public domain otherwise than through the fault of the recipient thereof; (ii) was received by the recipient thereof on a non-confidential basis from a third party, provided that such third party is not known by such recipient to be bound by a confidentiality agreement with or other obligation of secrecy to the disclosing party; or (iii) is required to be disclosed by law to any competent judicial or governmental authority provided however that the other party is provided with the reasonable opportunity to make representations against such order. |

| 2 |

| (j) | "Contract" or "Contracts" means contracts, licences, leases, agreements, obligations, promises, undertakings, understandings, arrangements, documents, commitments, entitlements or engagements to which the Assignor is a party or by which he is bound; | |

| (k) | "Deposit" has the meaning ascribed thereto in Section 2.2(a); | |

| (I) | "Due diligence investigation" means the investigation to be made by the Assignee on the Technique and the Intellectual Property Rights, in accordance with section 6.1.7; | |

| (m) | "Encumbrances" means mortgages, charges, pledges, security interests, liens, encumbrances, actions, claims and demands of any nature whatsoever or howsoever arising and any rights or privileges capable of becoming any of the foregoing; | |

| (n) | "Escrow agreement" means the agreement attached thereto as Schedule 2.2a); | |

| (o) | "Governmental Agencies" means any federal, provincial, municipal or other government or governmental agency, board, commission or authority, domestic or foreign; | |

| (p) | "Governmental Authorizations" means authorizations, approvals, franchises, Orders, certificates, consents, directives, notices, licences, permits, variances, agreements, instructions, registrations or other rights issued to or required by the Assignor by or from any Governmental Agency; | |

| (q) | "Indemnitee" has the meaning ascribed thereto in Section 8.3.1; | |

| (r) | "Indemnitor" has the meaning ascribed thereto in Section 8.3.1; | |

| (s) | "Indemnity Claim" has the meaning ascribed thereto in Section 8.3.1; |

| 3 |

| (t) | "Intellectual Property Rights" means intellectual property rights, whether registered or not, owned, used or held by the Assignor in respect of the Technique, including: |

| (i) | inventions, pending patent applications (including divisionals, reissues, renewals, re-examinations, continuations, continuations-in part and extensions) and issued patents, including those inventions, pending patent applications; | |

| |||

| (ii) | trade-marks, trade dress, trade-names, business names and other indicia of origin; | |

| |||

| (iii) | copyrights; | |

| |||

| (iv) | all know-how, trade secrets, confidential or proprietary technical, business, financial and other information, data, plans, drawings, developments, inventions and ideas, invention disclosures and discoveries, whether or not patentable, including processes, methods of manufacture, process engineering and technology, schematics, sketches, graphs, product specifications, machine settings, techniques, methods, formulae, designs, current and anticipated customer requirements, price lists, client and customer and prospect lists and files, projections and budgets, analyses, and market studies, all business plans, strategic plans, marketing and advertising plans, and all rights therein and thereto; | |

| |||

| (v) | industrial designs and similar rights; and | |

| |||

| (vi) | all rights to commercialize and exploit the Technique; |

| (u) | "Interim Period" means the period between the time of the signing of this Agreement and the Closing Time; | |

| (v) | "Laws" means applicable laws (including common law and civil law), statutes, by-laws, rules, regulations, Orders, ordinances, protocols, codes, guidelines, treaties, policies, notices, directions, decrees, judgments, awards or requirements, in each case of any Governmental Agency; | |

| (w) | "Liabilities" means all costs, expenses, charges, debts, liabilities, claims, demands and obligations, whether primary or secondary, direct or indirect, fixed, contingent, absolute or otherwise, under or in respect of any applicable law or otherwise; | |

| (x) | "Milestones" has the meaning ascribed thereto in Section 2.2; | |

| (y) | "Orders" means orders, injunctions, judgments, administrative complaints, decrees, rulings, awards, assessments, directions, instructions, penalties or sanctions issued, filed or imposed by any Governmental Agency or arbitrator; | |

| (z) | "Osler" means Osler, Hoskin & Harcourt LLP, having a place of business located at 1000 De La Gauchetiere Street West, Suite 2100, Montreal, Quebec H3B 4W5 and hereby represented by Me Antonella Penta; |

| 4 |

| (aa) | "Operating day" means any day where terephthalic acid is produced at the Plant; | |

| (bb) | "Person" or "person" is to be broadly interpreted and includes any individual, corporation, partnership, firm, joint venture, syndicate, association, trust, Governmental Agency, and any other form of entity or organization; | |

| (cc) | "Plant" has the meaning ascribed thereto in the Recitals, being understood that it includes any facility built or owned by the Assignee and/or by its subsidiaries or Person under its control, that is used for any process of depolymerisation of the polyethylene terephthalate based on the Technique; | |

| (dd) | "Process" means the process of extraction of ethylene glycol from the Technique, to be developed by Mr. Jocelyn Proulx in collaboration with the Assignor, as agreed upon between Mr. Proulx and the Assignee; | |

| (ee) | "Purchased assets" has the meaning ascribed thereto in Section 2.1; (ff) "Purchase Price" has the meaning ascribed thereto in Section 2.2; | |

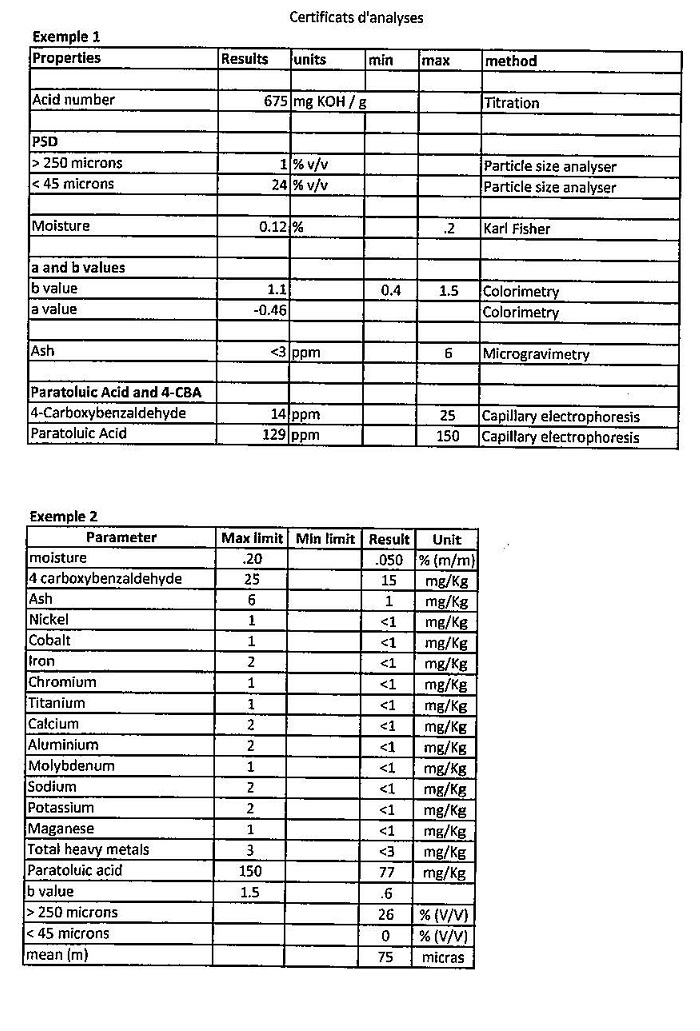

| (gg) | "Specifications" means the Specifications provided by Selenis Canada attached hereto as Schedule 1.1(gg); | |

| (hh) | "Technique" has the meaning ascribed thereto in the Recitals;; | |

| (ii) | "Technique Sheet" means a document prepared by the Assignor and containing all of the information regarding the Technique in its integrality and the Intellectual Property Rights, including, without limitation, starting product, end product, chemicals used to depolymerize, process of the Technique and all explanations necessary to apply the Technique in an industrial process; | |

| (jj) | "Third Party Liability" has the meaning ascribed thereto in Section 8.3.2; | |

|

|

|

| (kk) | "Transition Period" means a period of sixty (60) days following the reception of the Technique Sheet by the Assignee; and |

| (ll) | "Warranty Claim" means a claim made by either the Assignee or the Assignor based on or with respect to the inaccuracy or non-performance or non-fulfilment or breach of any representation, warranty or covenant made by the other party contained in this Agreement or contained in any document or certificate given in order to carry out the transactions contemplated hereby. |

1.2 Materiality

Any reference to the word "material" herein means any violation or inaccuracy, that would materially affect the Purchased Assets but excluding (a) any changes in general economic conditions; and (b) any changes generally affecting the industry in which the Assignor operates.

| 5 |

1.3 Schedules

The Schedules constitute a part of this Agreement and are incorporated into this Agreement for all purposes as if fully set forth herein. Any disclosure made in any Schedule to this Agreement that may be applicable to another Schedule to this Agreement shall be deemed to be made with respect to such other Schedule to the extent that it is prima facie apparent from a reading of such Schedule that it would also qualify or apply to such other Schedule. The following Schedules which are attached to this Agreement are incorporated into this Agreement by reference and are deemed to be part hereof:

Schedule I.I (gg) | Specifications |

Schedule 2.2 (a) | Escrow Agreement |

1.4 Currency

Unless otherwise indicated, all dollar amounts referred to in this Agreement are stated in Canadian dollars.

1.5 Choice of Law and Attornment

This Agreement shall be governed by and construed in accordance with the laws of the Province of Quebec and the laws of Canada applicable therein. The Parties agree that the courts of the Province of Quebec, district of Montreal, will have non-exclusive jurisdiction to determine all disputes and claims arising between the Parties.

1.6 Interpretation Not Affected by Headings or Party Drafting

The division of this Agreement into articles, sections, paragraphs and clauses and the insertion of headings are for convenience of reference only and shall not affect the construction or interpretation of this Agreement. The terms "this Agreement", "hereof ', "herein", "hereunder" and similar expressions refer to this Agreement and the Schedules hereto and not to any particular article, section, paragraph, clause or other portion hereof and include any agreement or instrument supplementary or ancillary hereto. Each party hereto acknowledges that it and its legal counsel have reviewed and participated in settling the terms of this Agreement, and the Parties hereby agree that any rule of construction to the effect that any ambiguity is to be resolved against the drafting party shall not be applicable in the interpretation of this Agreement.

1.7 Number and Gender

In this Agreement, unless there is something in the subject matter or context inconsistent therewith:

| (a) | words in the singular number include the plural and such words shall be construed as if the plural had been used; | |

| |||

| (b) | words in the plural include the singular and such words shall be construed as if the singular had been used; and | |

| |||

| (c) | words importing the use of any gender shall include all genders where the context or party referred to so requires and the rest of the sentence shall be construed as if the necessary grammatical and terminological changes had been made. |

| 6 |

1.8 Time of Essence

Time shall be of the essence of this Agreement in all respects.

ARTICLE 2

PURCHASE AND SALE

2.1 Assignment

On the terms and subject to the conditions set forth in this Agreement, the Assignor agrees to assign, sell, transfer and deliver to the Assignee at the Closing Time, free and clear of all Encumbrances, all of the Assignor's rights, title and interest in and to the Technique and the Intellectual Property Rights (collectively, the "Purchased Assets"), and the Assignee agrees to purchase and accept from the Assignor at the Closing Time, the Purchased Assets.

2.2 Purchase Price

The purchase price payable by the Assignee to the Assignor for the Purchased Assets shall be ONE MILLION THREE HUNDRED THOUSAND DOLLARS $(1,300,000.00) (the"Purchase Price"), exclusive of all Taxes, payable as follows:

| (a) | Within five (5) days following the reception, by the Assignee, of results confirming that the Technique meets the Specifications under the testing conditions of Techsolutions Environment Inc. and analysis by the University of Montreal for purity levels exceeding the Specifications, the Assignor will remit the Technique Sheet to the Assignee and the Assignee will deposit an amount of TWO HUNDRED FIFTY THOUSAND DOLLARS ($250,000.00) with Osler, in trust, to be held in accordance with the Escrow Agreement (the "Deposit"); | |

| |||

| (b) | Subject to the conditions set out in Article 6 hereunder having been complied with and subject to the terms of the Escrow Agreement, on the Closing Date, the Assignee shall give irrevocable instructions to Osler to proceed to the transfer of the Deposit to Me Charles Derome, in trust for the benefit of the Assignor, and shall remit and additional amount of TWO HUNDRED FIFTY THOUSAND DOLLARS ($250,000.00) to Me Charles Derome, in trust for the benefit of the Assignor, by wire transfer; | |

| |||

| (c) | Subject to the Closing, TWO HUNDRED THOUSAND DOLLARS ($200,000) to be paid by wire transfer to the Assignor within sixty (60) days of each of the following milestone having been met (collectively, the "Milestones"), which Milestones are to be calculated separately one from the other and not cumulatively: |

|

| (i) | An average of twenty (20) metric tons per day of terephthalic acid meeting the Specifications is produced at the Plant for twenty (20) Operating days; |

| 7 |

|

| (ii) | An average of thirty (30) metric tons per day of terephthalic acid meeting the Specifications having been produced at the Plant for thirty (30) Operating days; | |

|

| |||

|

| (iii) | An average of sixty (60) metric tons per day of terephthalic acid meeting the Specifications having been produced a the Plant for sixty (60) Operating days; and | |

|

| |||

|

| (iv) | An average of one hundred (100) metric tons per day of terephthalic acid meeting the Specifications having been produced at the Plant for sixty (60) Operating days. |

2.3 Transition Period Paymnet

In addition to the payment of the Purchase Price, during the Transition Period, the Assignee shall make a consulting payment in the amount of up to SIXTEEN THOUSAND DOLLARS ($16,000) to the Assignor payable as follows:

| (a) | EIGHT THOUSAND DOLLARS ($8,000) payable concurrently with the Deposit by check made payable to the Assignor; and | |

| |||

| (b) | subject to the conditions set out in Article 6 hereunder having been complied with, EIGHT THOUSAND DOLLARS ($8,000) payable on the Closing Date by check made payable to the Assignor. |

2.4 Royalties

In addition to the payment of the Purchase Price, the Assignee shall provide the Assignor a royalty payment as follows up to a maximum aggregate amount of TWENTY-FIVE MILLION SEVEN HUNDRED THOUSAND DOLLARS ($25,700,000):

| (a) | 10% of gross profits on the sale of all products derived by the Assignee from the Technique; | |

| |||

| (b) | 10% of any license fee paid to the Assignee in respect of any licensing or other right to use the Technique granted to a third party by the Assignee; | |

| |||

| (c) | 5% of any royalty or other similar payment made to the Assignee by a third party to whom a license or other right to use the Technique has been granted by the Assignee; and | |

| |||

| (d) | 5% of any royalty or other similar payment made to the Assignee by a third party in respect of a sub-license or other right to use the Technique granted by the third party. |

2.5 Access to the Assignee's books, records and financial statements

| a) | Upon reasonable notice to the Assignee, the Assignor shall have the right to inspect the books, records and financial statements of the Assignee and/or of any of its subsidiaries, legal person under its control, related person according to the Income Tax Act (R.S.C. 1985, C.-1) or of any person or corporation to which the Assignee has assigned, transferred or otherwise alienated any part of its rights in the Technique and the Intellectual Property Rights, at the premises of the Assignee, to ascertain the royalty payments to be made pursuant to Section 2.4 above. This right shall be exercisable by the Assignor no more than two (2) times per fiscal year; | |

| b) | Within ten (10) days following the preparation of its financial statements for the preceding year, the Assignee shall notify the Assignor, in writing, that the said financial statements are available for consultation. |

| 8 |

ARTICLE 3

REPRESENTATIONS AND WARRANTIES

3.1 Representations and Warranties of the Assignor

As a material inducement to the Assignee entering into this Agreement and completing the transactions contemplated by this Agreement, the Assignor represents and warrants to the Assignee as of the date of this Agreement and as of the Closing Date as follows:

| 3.1.1 | No Other Purchase Agreements. No person has any agreement, option, understanding or commitment, or any right or privilege (whether by law or contractual) capable of becoming an agreement, option or commitment, for the purchase or other acquisition from the Assignor of any of the Purchased Assets, or for any rights or interest therein by way of licence, right to use or similar right. | |

| 3.1.2 | Absence of Conflicts. The Assignor is not a party to, bound or affected by or subject to any: |

| (a) | Contract; | |

| |||

| (b) | charter or by-law; or | |

| |||

| (c) | Laws or Governmental Authorizations; |

that would be violated, breached by, or under which default would occur or an Encumbrance would, or with notice or the passage of time would, be created, or in respect of which the obligations of the Assignor will increase or the rights or entitlements of the Assignor will decrease or any obligation on the part of the Assignor to give notice to any Governmental Agency will arise, as a result of the execution and delivery of, or the performance of obligations under, this Agreement or any other agreement to be entered into under the terms of this Agreement.

| 3.1.3 | Contractual and Regulatory Approvals. (a) The Assignor is under no obligation, contractual or otherwise, to request or obtain the consent of, or notify any Person; (b) no permits, licences, certifications, authorizations or approvals, or notifications (collectively, "Approvals") to, or Governmental Agency are required to be obtained by the Assignor, in connection with the execution, delivery or performance by it of this Agreement or the completion of any of the transactions contemplated herein. Complete and correct copies of agreements under which the Assignor is obligated to request or obtain such Approvals have been provided to the Assignee. |

| 9 |

| 3.1.4 | Bankruptcy. The Assignor is not an insolvent person within the meaning of the Bankruptcy and Insolvency Act (Canada) nor has made an assignment in favour of neither his creditors nor a proposal in bankruptcy to his creditors or any class thereof nor had any petition for a receiving order presented in respect of it. The Assignor has not initiated proceedings with respect to a compromise or arrangement with his creditors or for its winding up, liquidation or dissolution. No receiver has been appointed in respect of the Assignor or any of the Purchased Assets and no execution or distress has been levied upon any of the Purchased Assets. | |

| 3.1.5 | Intellectual Property Rights. |

| (a) | Other than a patent application submitted to the French patent office which was subsequently withdrawn, there are no Intellectual Property Rights in respect of the Technique which have been registered, or for which applications for registration have been filed, by or on behalf of the Assignor in any jurisdiction. | |

| |||

| (b) | There are no Contracts relating to the Intellectual Property Rights | |

| |||

| (c) | Neither the Technique nor the Intellectual Property Rights were developed by or on behalf of or using grants, subsidies, compensation, or the facilities of any academic or research institution or governmental authority, other than research and development tax credits and other similar tax or governmental benefits that are available to the general public, and that do not obligate the Assignor to transfer title to any Intellectual Property Rights owned or purported to be owned by the Assignor or impose any licensing obligations on the Assignor with respect to such Intellectual Property Rights | |

| |||

| (d) | There are no Claims by the Assignor relating to breaches, violations, infringements or interferences with any of the Intellectual Property Rights by any other Person and the Assignor has no knowledge of any facts upon which such a Claim could be based. No other Person is using the Technique so as to breach, violate, infringe or interfere with the rights of the Assignor. | |

| |||

| (e) | There are no Claims in progress or pending or, to the Assignor's knowledge, threatened against the Assignor relating to the Intellectual Property Rights and there is no valid basis for any such Claim. The use, possession, reproduction, distribution, sale, licensing, sublicensing or other dealings involving any of the Intellectual Property Rights does not breach, violate, infringe or interfere with any rights of any other Person. |

| 3.1.6 | Liabilities. There are no Liabilities (contingent or otherwise) of the Assignor of any kind whatsoever in respect of which the Assignee may become liable on or after the consummation of the transactions contemplated by this Agreement. | |

| 3.1.7 | Litigation. The Assignor has not received a written notice in respect of any actions, suits or proceedings, either judicial or administrative (whether or not purportedly on behalf of the Assignor) pending or, to the knowledge of the Assignor, threatened, by or against or affecting it which relate to the Purchased Assets, at law or in equity, or before or by any court or any federal, provincial, municipal or other governmental department, commission, board, bureau, agency or instrumentality, whether domestic or foreign nor to the knowledge of the Assignor do any facts exist which could reasonably be expected to give rise to any of the same, except for the notice sent by Ventix Environnement Inc., of which the Assignee hereby confirms having received a copy. |

| 10 |

| 3.1.8 | Title to Purchased Assets; Specifications. The Assignor is the exclusive owner of all right, title and interest in and to the Technique and the Intellectual Property Rights free and clear of all Encumbrances. No third parties made any contributions to the development of the Technique or any of the Intellectual Property rights. As at the Closing Time, the Assignee will be the owner of and will have good and marketable title to all of the Purchased Assets free and clear of all Encumbrances. The Technique is currently capable of meeting the Specifications. | |

| 3.1.9 | Compliance with Laws. In relation to the Purchased Assets, the Assignor is not in violation in any material respect of any federal, provincial or other law, regulation or order of any Governmental Agency. | |

| 3.1.10 | Residency. The Assignor is not a non-resident of Canada for the purposes of the Income Tax Act (R.S.C. 1985, C.-1). | |

| 3.1.11 | Disclosure. No representation or warranty contained in this Section 3.1, and no statement contained in any schedule, certificate, list, summary or other disclosure document provided or to be provided to the Assignee pursuant hereto, or in connection with the transactions contemplated hereby, contains or will contain any untrue statement of a material fact, or omits or will omit to state any material fact which is necessary in order to make the statements contained herein and therein not misleading. |

ARTICLE 4

SURVIVAL AND LIMITATIONS OF REPRESENTATIONS AND WARRANTIES

4.1 Survival of Representations and Warranties by the Assignor

The representations, warranties, covenants and obligations made by the Assignor contained in this Agreement or contained in any document or certificate provided by the Assignor in order to carry out the transactions contemplated hereby shall survive the Closing and shall continue in full force and effect for the benefit of the Assignee indefinitely.

ARTICLE 5

COVENANTS

5.1 Covenants of the Parties

| 5.1.1 | Exclusivity. In consideration of the substantial expenditure of time and effort undertaken and to be undertaken by the Assignee, the Assignor shall not, until the date which is six (6) months from the termination of this Agreement pursuant to Section 6.2 or Section 6.4, (i) offer to assign or sell, solicit any offer to assign or purchase, or engage in any negotiations relating to the purchase of the Technique or any Intellectual Property Right by any person or entity other than the Assignee, (ii) offer to license the Technique or any of the Intellectual Property Rights or enter into any negotiation related thereto, or (iii) provide any information related to the Technique or any Intellectual Property Rights to any person or entity other than the Assignee. |

| 11 |

| 5.1.2 | Reimbursement of fees and expenses. The Assignor agrees that where the Assignee terminates this Agreement for any reason according to the present agreement, then the Assignor shall remit to the Assignee all product and equipment purchased in connection with all testing conducted. | |

| 5.1.3 | Transition Period. During the Transition Period, (i) the Assignee shall conduct its legal due diligence investigation within the first thirty (30) days thereof (other than being satisfied with the financial viability associated with commercializing the Technique), and (ii) the Assignor shall transmit all of the know-how related to the Technique and the Intellectual Property Rights and collaborate with Techsolutions Environment Inc. for the development of the Process on an industrial scale. | |

| 5.1.4 | Filings and Authorizations. Each of the Parties, as promptly as practicable after the execution of this Agreement, shall (i) make, or cause to be made, all filings and submissions under all Laws applicable to it, that are required to consummate the transactions contemplated hereby, (ii) use reasonable efforts to obtain, or cause to be obtained, all authorizations necessary or advisable to be obtained by it in order to consummate such transactions and (iii) use reasonable efforts to take, or cause to be taken, all other actions necessary, proper or advisable in order for it to fulfill its obligations under this Agreement. | |

| 5.1.5 | Notice of Untrue Representation or Warranty. The Assignor shall notify the Assignee promptly upon any representation or warranty made by him contained in this Agreement becoming incorrect prior to Closing, and, for the purposes of this Section 5.1.5, unless otherwise specified, each representation and warranty shall be deemed to be given at and as of all times from the date of this Agreement to the Closing Date. Any such notice shall set out particulars of the untrue or incorrect representation or warranty and details of any actions being taken by the Assignor to rectify the incorrectness. No such notice shall relieve the Assignor of any liability provided for in this Agreement. | |

| 5.1.6 | Actions to Satisfy Closing Conditions. Each of the Parties shall take all such actions as are within its power to control, and use reasonable commercial efforts to cause other actions to be taken which are not within its power to control, so as to ensure compliance with each of the conditions and covenants set forth in Article 5 and Article 6 which are for the benefit of any other party, provided that the Assignee shall not be required to dispose of or make any change to its business, the business of any of its Affiliates or the business of the Corporation, or expend any material amounts or incur any other obligation in order to comply with this Section (other than amounts specifically contemplated to be paid pursuant to this Agreement). | |

| 5.1.7 | Assignment of Intellectual Property Rights. At the Closing Date, if all the obligations of the Assignee under the present agreement are fulfilled, the Assignor shall assign the Intellectual Property Rights and waive any moral rights he has therein and filed all such documents as may be required to effect the assignment with the relevant Governmental Agencies. |

| 12 |

| 5.1.8 | Documents. On the Closing Date, the Assignor shall remit to the Assignee all such documents in his possession related to the Intellectual Property Rights. | |

| 5.1.9 | Non-Compete (Assignor). The Assignor agrees that he shall not, directly or indirectly, be involved in any business or project, whether personally or as a shareholder, director, officer, employee, consultant, lender or otherwise, which is similar to the business of commercializing the Technique or is competitive therewith anywhere in North America or Europe for a period of five (5) years following receipt of the last payment made pursuant to Section 2.3 hereof. | |

| 5.1.10 | Confidentiality. The Confidential Information disclosed by either party during the course of their relationship shall be kept confidential by the recipient thereof and not be disclosed to anyone without a "need to know" for the purposes of carrying out the intent of this Agreement. Neither party shall disclose the Confidential Information to any third party. Each party shall take the necessary steps to protect the Confidential Information and these steps must be at least as protective as those taken to protect each party's own Confidential Information, provided these steps are diligent. | |

|

| The Confidential Information shall be used strictly in connection with the execution of its obligations and rights towards the other party. The Assignee may disclose to its Affiliates, licensees or other third parties to whom rights to use the Intellectual Property have been granted, as well as to sub-contractors or other consultants in order to allow the sub-contractors or other consultants to perform their duties, provided that such persons are under obligations of confidentiality and undertake not to disclose or use said Confidential Information otherwise than as permitted by the Assignee. |

|

|

|

|

| The obligations and undertakings under this Section 5.1.10 shall remain in force and survive for as long as the Confidential Information remains secret. |

|

|

|

| 5.1.11 | Confidentiality and non-compete (Assignee and Intervenor). In the event that this Agreement would be resiliated by either party as provided herein or that it would not be carried on for any reason whatsoever, or if the conditions of this Agreement are not met or realized, including, without limitation, if the Assignee, after its due diligence verification, is not satisfied of the financial viability associated with commercializing the Technique, it is understood that the Confidential Information, the Technique and the Intellectual Property rights will remain the sole property of the Assignor and that the Assignee and the Intervenor shall not use the Confidential Information or disclose, transfer or otherwise communicate the Confidential Information to any third party whatsoever and that any information that they would have received in respect with this Agreement regarding the Technique or the Intellectual Property Rights will remain strictly confidential and that they shall not, directly or indirectly, be involved in any business or project, whether personally or as a shareholder, director, officer, employee, consultant, lender or otherwise, which is similar to the business of commercializing the Technique or that would use, be based on or employ all or part of the Technique, the Intellectual Property Rights or the Confidential Information, anywhere in the world and indefinitely. |

| 13 |

| 5.1.12 | Default. If any party herein breaches the undertakings set forth in Sections 5.1.9,5.1.10 or 5.1.11 hereinabove, as applicable, and if such breach is not remedied within five (5) days of receipt of a written notice of default from one party to the breaching party (the "Defaulting Party"), the Defaulting Party shall pay the party victim of the breach (the "Non-Defaulting Party"), upon request, an amount of $1000 per day as liquidated damages, without prejudice to any other recourse including, without limitation, injunctive relief. | |

|

| Each party hereby acknowledges and agrees that the breach of the terms of Sections 5.1.9, 5.1.10 or 5.1.11 shall cause serious and irreparable harm to the Non-Defaulting Party. Consequently, in case of such breach, the Non-Defaulting Party shall have immediate recourse to injunctive relief and damages and interest, and this, in addition to any claim for the payment of the aforementioned liquidated damages. |

|

|

|

|

| In addition, and without limiting the generality of the foregoing, each party hereby acknowledges and declares that: |

| a) | The undertakings pursuant to Sections 5.1.9, 5.1.10 and 5.1.11 are reasonable in terms of the duration, the territory and the activities to which they refer; | |

| |||

| b) | The scope and consequences of the liquidated damages clause are clear, concise and coherent; | |

| |||

| c) | The terms of this Section and of Sections 5.1.9, 5.1.10 and 5.1.11 have been negotiated in good faith by the parties hereto which terms they consider reasonable and the parties declare being satisfied therewith; and | |

| |||

| d) | The liquidated damages are justifiable, clearly reasonable and proportional to the prejudice that would be suffered by the Non-Defaulting Party in case of default on the part of the Defaulting Party to abide by their undertakings and, consequently, each party hereby recognises that the liquidated damages clause is not abusive but rather realistic given its purpose and that it does not give an excessive or unfair advantage to the Non-Defaulting Party. | |

| |||

|

| The payment of any liquidated damages pursuant to this Section or pursuant to any judicial proceedings instituted by the beneficiaries of the undertakings in this Section shall not in any way constitute acquiescence to such default or to the furtherance thereof. | |

|

|

|

|

|

| In addition, if despite the foregoing, a court should consider any of the aforementioned restrictions or the resulting liquidated damages to be excessive, the parties consent to such court reducing the scope of such restriction or the amount of the contested liquidated damages, to an amount which the court considers to be reasonable under the circumstances as opposed to rendering the restrictions or the liquidated damages unenforceable. | |

|

|

|

|

|

| Finally, it is understood between the parties that the aforementioned confidentiality and non-competition restrictions are separate and distinct from one another, so that if one restriction is considered to be unenforceable, this shall not in itself be cause for the other restrictions to be considered unenforceable. | |

| 14 |

| 5.1.13 | Consulting Agreement. The Parties agree to negotiate a Consulting Agreement upon the establishment of the Plant whereby the Assignor will provide certain consulting services to the Assignee, the whole on terms and conditions to be negotiated by the Parties in good faith. | |

| 5.1.14 | Tax Matters. Prior to the Closing Date, the Assignor shall become duly registered under under the Excise Tax Act (Canada) with respect to the goods and services tax and under the Quebec Sales Tax Act with respect to the Quebec sales tax and shall provide the Assignee with such registration numbers. |

ARTICLE 6

CONDITIONS

6.1 Conditions to the Obligations of the Assignee

Notwithstanding anything herein contained, the obligation of the Assignee to complete the transactions provided for herein will be subject to the fulfilment of the following conditions at or prior to the Closing Time.

| 6.1.1 | Completion of Process Development. Testing conducted by Techsolutions Environment Inc. shall demonstrate that the Technique allows the production of sufficient levels of terephthalic acid to be commercialized in an industrial process, the whole as set out in Section 5.1.3. | |

| 6.1.2 | Accuracy of Representations and Warranties and Performance of Covenants. The representations and warranties of the Assignor contained in this Agreement or in any document or certificate delivered in order to carry out the transactions contemplated hereby shall be true and accurate in all material respects (except where such representations and warranties are already qualified by the term "material" in which event such representations and warranties shall be true and correct in all respects) on the Closing Date. In addition, the Assignor shall have complied with all covenants and agreements herein agreed to be performed or caused to be performed by him at or prior to the Closing Time and the Assignor shall deliver to the Assignee at the Closing Time a certificate confirming compliance with this Section (the "Assignor's Closing Certificate"). | |

| 6.1.3 | Material Adverse Changes. Since the date of this Agreement there will have been no material change in the Purchased Assets, howsoever arising. | |

| 6.1.4 | No Restraining Proceedings. No order, decision or ruling of any court, tribunal or regulatory authority having jurisdiction over the Assignor shall have been made, and no action or proceeding shall be pending or threatened in writing which, in the opinion of counsel to the Assignee (acting reasonably), is likely to result in an order, decision or ruling to disallow, enjoin, prohibit or impose any material limitations or conditions on the purchase and sale of the Purchased Assets contemplated hereby or the right of the Assignee to own the Purchased Assets. |

| 15 |

| 6.1.5 | Consents. All consents and approvals required to be obtained in order to carry out the transactions contemplated hereby in compliance with all laws and agreements binding upon the Parties hereto shall have been obtained. Further, the Assignor shall have delivered to the Assignee evidence of the discharge of all Encumbrances in respect of the Purchased Assets, if any. | |

| 6.1.6 | Deliveries. | |

The Assignor shall deliver or cause to be delivered to the Assignee the following in form and substance satisfactory to the Assignee, acting reasonably: |

| (a) | the Assignor's Closing Certificate; | |

| |||

| (b) | all documents required to be filed in respect of Section 5.1.7 or to be remitted in respect of Section 5.1.8; and | |

| |||

| (c) | all such other deliveries as may reasonably be requested by the Assignee. |

| 6.1.7 | Due Diligence. The Assignee shall be satisfied with its due diligence investigation, including, without limitation, being satisfied with the financial viability associated with commercializing the Technique and all processing costs related thereto; | |

| 6.1.8 | No Legal Action. No action or proceeding will be pending or threatened in writing and no order or notice will have been made, issued or delivered by any Governmental Agency, seeking to enjoin, restrict or prohibit, or enjoining, restricting or prohibiting the transactions contemplated by this Agreement. | |

| 6.1.9 | Financing. The Assignee shall have secured financing required to pay the Purchase Price. |

6.2 Waiver or Termination by the Assignee

The conditions contained in Section 6.1 hereof are inserted for the exclusive benefit of the Assignee and may be waived in whole or in part by the Assignee at any time. The Assignor acknowledges that the waiver by the Assignee of any condition or any part of any condition shall constitute a waiver only of such condition or such part of such condition, as the case may be, and shall not constitute a waiver of any covenant, agreement, representation or warranty made by the Assignor herein that corresponds or is related to such condition or such part of such condition, as the case may be. If any of the conditions contained in Section 6.1 hereof are not fulfilled or complied with as herein provided, the Assignee may, at or prior to the Closing Time at its option, rescind this Agreement by notice in writing to the Assignor and in such event the Assignee shall be released from all obligations hereunder other than those which are meant by their nature to survive including, without limitation, Section 5.1.2, 5.1.9, 5.1.10, and 5.1.12. |

6.3 Conditions to the Obligations of the Assignor

Notwithstanding anything herein contained, the obligations of the Assignor to complete the transactions provided for herein will be subject to the fulfilment of the following conditions at or prior to the Closing Time. |

| 16 |

| 6.3.1 | Performance of Covenants. The Assignee shall have complied with all covenants and agreements herein agreed to be performed or caused to be performed by it at or prior to the Closing Time. | |

| 6.3.2 | No Restraining Proceedings. No order, decision or ruling of any court, tribunal or regulatory authority having jurisdiction shall have been made, and no action or proceeding shall be pending or threatened which, in the opinion of counsel to the Assignor, is likely to result in an order, decision or ruling, to disallow, enjoin or prohibit the purchase and sale of the Purchased Assets contemplated hereby. | |

| 6.3.3 | Deliveries. | |

Assignee shall deliver or cause to be delivered to the Assignor the following in form and substance satisfactory to the Assignor acting reasonably: |

| (a) | certified copies of all resolutions of Assignee approving the entering into and completion of the transactions contemplated by this Agreement; | |

| |||

| (b) | a recent certificate of status, compliance, good standing or similar certificate with respect to Assignee issued by the appropriate government officials of its jurisdiction of formation; and | |

| |||

| (c) | The Assignee shall deliver to the Assignor, at the Closing Time, a certificate confirming compliance with this Section ("the Assignee's Closing Certificate"). |

| 6.3.4 | No Legal Action. No action or proceeding will be pending or threatened by any Person (other than the Assignor), and no order or notice will have been made, issued or delivered by any Governmental Agency, seeking to enjoin, restrict or prohibit, or enjoining, restricting or prohibiting the transactions contemplated by this Agreement. |

6.4 Waiver or Termination by the Assignor

The conditions contained in Section 6.3 hereof are inserted for the exclusive benefit of the Assignor and may be waived in whole or in part by the Assignor at any time. The Assignee acknowledges that the waiver by the Assignor of any condition or any part of any condition shall constitute a waiver only of such condition or such part of such condition, as the case may be, and shall not constitute a waiver of any covenant, agreement, representation or warranty made by the Assignee herein that corresponds or is related to such condition or such part of such condition, as the case may be. If any of the conditions contained in Section 6.3 hereof are not fulfilled or complied with as herein provided, the Assignor may, at or prior to the Closing Time at its option, rescind this Agreement by notice in writing to the Assignee and in such event the Assignor shall be released from all obligations hereunder, and unless the condition or conditions which have not been fulfilled are reasonably capable of being fulfilled or caused to be fulfilled by the Assignee, then the Assignee shall also be released from all obligations hereunder other than those which by their nature are meant to survive, including without limitation Sections 5.1.10, 5.1.11 and 5.1.12. |

| 17 |

ARTICLE 7

CLOSING

7.1 Closing Arrangements

Subject to the terms and conditions hereof, the closing of the transactions contemplated herein (the "Closing") shall be held at the Closing Time by way of virtual closing or at such place or places as may be mutually agreed upon by the Assignor and the Assignee. |

7.2 Documents to be Delivered

At or before the Closing Time, the Assignor shall execute, or cause to be executed, and shall deliver, or cause to be delivered, to the Assignee all documents, instruments and things which are to be delivered by the Assignor pursuant to the provisions of this Agreement, and the Assignee shall execute, or cause to be executed, and shall deliver, or cause to be delivered, to the Assignor all documents, instruments and things which the Assignee is to deliver or to cause to be delivered pursuant to the provisions of this Agreement. |

ARTICLE 8

INDEMNIFICATION

8.1 Indemnity by the Assignor

| 8.1.1 | The Assignor hereby agrees to indemnify and save the Assignee harmless from and against any claims, demands, actions, causes of action, damage, loss, deficiency, cost, Liability and expense which may be made or brought against the Assignee or which the Assignee may suffer or incur as a result of, in respect of or arising out of: |

| (a) | any non-performance or non-fulfilment of any covenant or agreement on the part of the Assignor contained in this Agreement or in any document given in order to carry out the transactions contemplated hereby; | |

| |||

| (b) | any successful claim made by Ventix Environment Inc. in respect of the Technique or the Intellectual Property Rights; | |

| |||

| (c) | any misrepresentation, inaccuracy, incorrectness or breach of any representation or warranty made by the Assignor contained in this Agreement or contained in any document or certificate given in order to carry out the transactions contemplated hereby; and | |

| |||

| (d) | all costs and expenses including, without limitation, reasonable legal fees incidental to or in respect of the foregoing. |

8.2 Indemnity by the Assignee

| 8.2.1 | The Assignee hereby agrees to indemnify and save the Assignor harmless from and against any claims, demands, actions, causes of action, damage, loss, deficiency, cost, Liability and expense which may be made or brought against the Assignor or which the Assignor may suffer or incur as a result of, in respect of or arising out of: |

| 18 |

| (a) | any non-performance or non-fulfilment of any covenant or agreement on the part of the Assignee contained in this Agreement or in any document given in order to carry out the transactions contemplated hereby; | |

| |||

| (b) | any willful misconduct or fraudulent misrepresentation made by the Assignee contained in this Agreement or contained in any document or certificate given in order to carry out the transactions contemplated hereby; and | |

| |||

| (c) | all costs and expenses including, without limitation, reasonable legal fees incidental to or in respect of the foregoing. |

8.3 Provisions Relating to Indemnity Claims

| 8.3.1 | Promptly after becoming aware of any matter that may give rise to a claim by the Assignee for indemnification by the Assignor pursuant to Section 8.1 or a claim by the Assignor for indemnification by the Assignee pursuant to Section 8.2, (an "Indemnity Claim"), the party making the claim (the "Indemnitee") will provide to the other party (the "Indemnitor") written notice of the Indemnity Claim specifying (to the extent that information is available) the factual basis for the Indemnity Claim and the amount of the Indemnity Claim (the "Damages") or, if Damages are not then determinable, an estimate of the amount of Damages, if an estimate is feasible in the circumstances. | |

| 8.3.2 | With respect to any Indemnity Claim that relates to an alleged liability to any third person (the "Third Party Liability"), provided the Indemnitor first admits the Indemnitee's right to indemnification for the amount of such Third Party Liability which may at any time be determined or settled, then in any legal, administrative or other proceedings in connection with the matters forming the basis of the Third Party Liability, the following procedures will apply: |

| (a) | except as contemplated by paragraph (c) below, the Indemnitor will have the right to assume carriage of the compromise or settlement of the Third Party Liability and the conduct of any related legal, administrative or other proceedings, but the Indemnitee shall, at its cost and expense, have the right and shall be given the opportunity to participate in the defense of the Third Party Liability, to consult with the Indemnitor in the settlement of the Third Party Liability and the conduct of related legal, administrative and other proceedings (including consultation with counsel); | |

| |||

| (b) | each party will co-operate with the other in relation to the Third Party Liability, will keep it fully advised with respect thereto, will provide it with copies of all relevant documentation as it becomes available, will provide it with access to all records and files relating to the defense of the Third Party Liability and will meet with representatives of the other party at all reasonable times to discuss the Third Party Liability; and | |

| |||

| (c) | notwithstanding paragraphs (a) and (b), the Indemnitor will not settle the Third Party Liability or conduct any legal, administrative or other proceedings in any manner which could, in the reasonable opinion of the Indemnitee, have a material adverse effect on the Purchased Assets, except with the prior written consent of the Indemnitee. |

| 19 |

| 8.3.3 | If, with respect to any Third Party Liability, the Indemnitor does not admit the Indemnitee' s right to indemnification or declines to assume carriage of the settlement or of any legal, administrative or other proceedings relating to the Third Party Liability, then the following provisions will apply: |

| (a) | the Indemnitee, at its discretion, may assume carriage of any legal, administrative or other proceedings relating to the Third Party Liability and may defend the Third Party Liability on such terms as the Indemnitee, acting in good faith, considers advisable, | |

| |||

| (b) | any cost, loss, damage or expense incurred or suffered by the Indemnitee in the settlement of such Third Party Liability or the conduct of any legal, administrative or other proceedings shall be added to the amount of the Indemnity Claim; and | |

| |||

| (c) | if, pursuant to this Section 8.3.3, the Indemnitee undertakes the investigation and defence of any Third Party Liability, then the Indemnitee may compromise and settle the legal, administrative or other proceedings relating to the Third Party Liability but the Indemnitor shall not be bound by any compromise or settlement of such legal, administrative or other proceedings relating to such Third Party Liability effected without its consent (which consent is not to be unreasonably withheld) and, in no event, shall the Indemnitor be required to assume any liability for any Third Party Liability in excess of the limitations set forth herein. |

| 8.3.4 | An Indemnity Claim not involving a Third Party Liability shall be indemnified, paid or reimbursed promptly after such Indemnity Claim has been finally determined or agreed to in writing by the Assignee and Assignor. | |

| 8.3.5 | Any Claim for Damages made by the Assignee hereunder may be set-off by the Assignee against any payment owed to the Assignor. The exercise of such right of set off by the Assignee in good faith, whether or not ultimately determined to be justified, shall not constitute a default under this Agreement, regardless of whether the Assignor disputes such set off, or whether such set off is for a contingent or an unliquidated amount. |

ARTICLE 9

INTERVENTION

9.1 Intervention of Daniel Solomita

The Intervenor intervenes herein, for purposes only of: (i) his obligations set forth in Sections 5.1.10, 5.1.l l and 5.1.12; and (ii) to become surety of the Assignee's obligations pursuant to Sections 5.1.10, 5.1.11 and 5.1.12, only to the extent that the Intervenor controls the Assignee (as the term "control" is defined in the Canada Business Corporations Act), the whole in accordance with Section 2333 of the Civil Code of Quebec, the Intervenor herby renouncing to the benefit of discussion and division. |

| 20 |

ARTICLE 10

GENERAL PROVISIONS

10.1 Further Assurances

Each of the Assignor and the Assignee hereby covenants and agrees that at any time and from time to time after the Closing Date it will, upon the request and cost of the other, do, execute, acknowledge and deliver or cause to be done, executed, acknowledged and delivered all such further acts, deeds, assignments, transfers, conveyances and assurances as may be required for the better carrying out and performance of all the terms of this Agreement. |

10.2 Remedies Cumulative

The rights and remedies of the Parties under this Agreement are cumulative and in addition to and not in substitution for any rights or remedies provided by law. Any single or partial exercise by any party hereto of any right or remedy for default or breach of any term, covenant or condition of this Agreement does not waive, alter, affect or prejudice any other right or remedy to which such party may be lawfully entitled for the same default or breach. |

10.3 Notices

| (a) | Any notice, designation, communication, request, demand or other document, required or permitted to be given or sent or delivered hereunder to any party hereto shall be in writing and shall be sufficiently given or sent or delivered if it is: |

|

| (i) | delivered personally to an officer or director of such party; | |

|

| |||

|

| (ii) | sent by fax machine; or | |

|

| |||

|

| (iii) | sent by electronic mail in portable document format ("PDF"). |

| (b) | Notices shall be sent to the following addresses or fax numbers: |

|

| (i) | in the case of the Assignor:

Hatem Essadam

with a copy (which shall not constitute notice) to:

Derome Avocats 5064, avenue du Pare Montreal, QC, H2V 4G 1 |

| 21 |

|

| Attention: Me Charles Derome Fax number: 514-271-4708 Email: info@deromeavocats.ca | ||

|

|

|

|

|

|

|

| (ii) | in the case of the Assignee: |

|

|

|

|

|

|

|

|

| Loop Holdings, Inc. 1999 Avenue of the Stars, Suite 2520 Los Angeles, California 90067 |

|

|

|

|

|

|

|

|

| Attention: Daniel Solomita Fax number: Email: |

|

|

|

|

|

|

|

|

| and with a copy (which shall not constitute notice) to: |

|

|

|

|

|

|

|

|

| Osler, Hoskin & Harcourt LLP 1000 De La Gauchetiere Street West, Suite 2100 Montreal, Quebec H3B 4W5 |

|

|

|

|

|

|

|

|

| Attention: Antonella Penta Fax Number: (514) 904-8101 Email: apenta@osler.com |

or to such other address or fax number as the party entitled to or receiving such notice, designation, communication, request, demand or other document shall, by a notice given in accordance with this Section, have communicated to the party giving or sending or delivering such notice, designation, communication, request, demand or other document.

Any notice, designation, communication, request, demand or other document given or sent or delivered as aforesaid shall:

| (a) | if delivered personally, be deemed to have been given, sent, delivered and received on the date of delivery; | |

| |||

| (b) | if sent by fax machine, be deemed to have been given, sent, delivered and received at the time that receipt thereof has been acknowledged by electronic confirmation or otherwise; and | |

| |||

| (c) | if sent by electronic mail, be deemed to have been given, sent, delivered and received at the time sent, provided however, the PDF was sent before 5:00 p.m. Montreal time on a Business Day; if sent by electronic mail after 5:00 p.m. or on a day other than a Business Day, as the case may be, shall be deemed to have been given, sent, delivered and received at 9:00 a.m. Montreal time on the next Business Day. |

| 22 |

10.4 Counterparts

This Agreement may be executed in several counterparts and by facsimile transmission or by electronic mail in .pdf format, each of which so executed shall be deemed to be an original, and such counterparts together shall constitute but one and the same instrument.

10.5 Expenses of Parties

Subject to Section 5.1.2, each of the Parties hereto shall bear all expenses incurred by it in connection with this Agreement including, without limitation, the charges of their respective counsel, accountants, financial advisors and finders.

10.6 Announcements

No announcement with respect to this Agreement will be made by any party hereto without affording the other party a reasonable opportunity to review and comment on any such announcement. The foregoing will not apply to any announcement by any party required in order to comply with laws pertaining to timely disclosure, provided that such party consults with the other Parties before making any such announcement.

10.7 Assignment

The rights of the Assignor hereunder shall not be assignable without the written consent of the Assignee.

10.8 Successors and Assigns

This Agreement shall be binding upon and enure to the benefit of the Parties hereto and their respective successors, permitted assigns, personal and legal representatives. Nothing herein, express or implied, is intended to confer upon any person, other than the Parties hereto and their respective successors, assigns, personal and legal representatives, any rights, remedies, obligations or liabilities under or by reason of this Agreement.

10.9 Entire Agreement

This Agreement and the Schedules referred to herein constitute the entire agreement between the Parties hereto and supersede all prior agreements, representations, warranties, statements, promises, information, arrangements and understandings, whether oral or written, express or implied, with respect to the subject matter hereof. None of the Parties hereto shall be bound to or charged with any oral or written agreements, representations, warranties, statements, promises, information, arrangements or understandings not specifically set forth in this Agreement or in the Schedules, documents and instruments to be delivered on or before the Closing Date pursuant to this Agreement. The Parties hereto further acknowledge and agree that, in entering into this Agreement and in delivering the Schedules, documents and instruments to be delivered on or before the Closing Date, they have not in any way relied, and will not in any way rely, upon any oral or written agreements, representations, warranties, statements, promises, information, arrangements or understandings, express or implied, not specifically set forth in this Agreement or in such Schedules, documents or instruments.

| 23 |

10.10 Waiver

Any party hereto which is entitled to the benefits of this Agreement may, and has the right to, waive any term or condition hereof at any time on or prior to the date of signature of the present Agreement; provided, however, that such waiver shall be evidenced by written instrument duly executed on behalf of such party.

10.11 Amendments

No modification or amendment to this Agreement may be made unless agreed to by the Parties hereto in writing.

10.12 Language

This Agreement has been drafted in English at the express request of the Parties. Cetteconvention a ete redigee en anglais a la demande expresse desparties.

[SIGNATURE PAGE FOLLOWS]

| 24 |

IN WITNESS WHEREOF the Parties hereto have duly executed this Agreement as of the day and year first written above.

________________________________

HATEM ESSADAM

The Assignor

The Assignee

By: Daniel Solomita

Title: President

The Intervenor

Intellectual Property Assignment

| 25 |

SCHEDULE 1.1 (gg)

SPECIFICATIONS

| 26 |

SCHEDULE 2.2 (a)

ESCROW AGREEMENT

THIS ESCROW AGREEMENT is made as of the ___ day of October, 2014

BETWEEN:

HATEM ESSADDAM, chemist, domiciled and residing at ___________________________, acting both personally and for a corporation to be incorporated;

(the "Assignor")

- and -

LOOP HOLDINGS, INC., a corporation incorporated under the federal laws of Nevada having its head office at 1999 Avenue of the Stars, Suite 2520, Los Angeles, California, herein represented by its president, Daniel Solomita, duly authorized as he so declares;

(the "Assignee")

- and -

OSLER, HOSKIN & HARCOURTLLP, a law firm having a place of business at 1000 De La Gauchetière Street West, suite 2100, Montreal, Québec, H3B 4W5;

(the "Escrow Agent").

RECITALS:

| A. | The Assignor and the Assignee have entered into an Intellectual Property Assignment Agreement dated October 27, 2014 (the "Purchase Agreement") pursuant to which the Assignor agrees to assign and transfer all of his rights, title and interest in and to the technique and method developed by him for the depolymerization of polyethylene terephthalate at ambient temperature and atmospheric pressure. |

| B. | The Purchase Agreement provides for the deposit by the Assignee of the aggregate sum of $250,000, to be held in escrow in accordance with the terms and conditions of this Agreement. |

| C. | The parties wish to set out the terms upon which the Escrow Funds (as defined in Section 3 of this Agreement) are to be held and disbursed by the Escrow Agent. |

| 27 |

THEREFORE, the parties agree as follows:

1. Defined Terms

Unless otherwise specifically defined in this Agreement, all capitalized terms used in this Agreement shall have the meanings given to them in the Purchase Agreement.

2. Certain Rules of Interpretation

| (a) | Consent - Whenever a provision of this Agreement requires an approval or consent and the approval or consent is not delivered within the applicable time limit, then, unless otherwise specified, the party whose consent or approval is required shall be conclusively deemed to have withheld its approval or consent. | |

| (b) | Currency – Unless otherwise specified, all references to money amounts are to the lawful currency of Canada. | |

| (c) | Governing Law - This Agreement is a contract made under and shall be governed by and construed in accordance with the laws of the Province of Quebec and the federal laws of Canada applicable in the Province of Quebec. | |

| (d) | Headings - Headings and Sections are inserted for convenience of reference only and shall not affect the construction or interpretation of this Agreement | |

| (e) | Including - Where the word "including" or "includes" is used in this Agreement, it means "including (or includes) without limitation". | |

| (f) | No Strict Construction - The language used in this Agreement is the language chosen by the parties to express their mutual intent, and no rule of strict construction shall be applied against any party. | |

| (g) | Number and Gender - Unless the context otherwise requires, words importing the singular include the plural and vice versa and words importing gender include all genders. | |

| (h) | Severability - If, in any jurisdiction, any provision of this Agreement or its application to any party or circumstance is restricted, prohibited or unenforceable, the provision shall, as to that jurisdiction, be ineffective only to the extent of the restriction, prohibition or unenforceability without: |

| (i) | invalidating the remaining provisions of this Agreement, | |

| |||

| (ii) | affecting the validity or enforceability of such provision in any other jurisdiction, or | |

| |||

| (iii) | affecting its application to other parties or circumstances. |

| (i) | Statutory references - A reference to a statute includes all regulations and rules made pursuant to the statute and, unless otherwise specified, the provisions of any statute or regulation which amends, supplements or supersedes the statute or the regulation. |

| 28 |

| (j) | Time - Time is of the essence in the performance of the parties' respective obligations. | |

| (k) | Time Periods - Unless otherwise specified, time periods within or following which any payment is to be made or act is to be done shall be calculated by excluding the day on which the period commences and including the day on which the period ends and by extending the period to the next business day following if the last day of the period is not a business day. |

3. Appointment of Escrow Agent

Each of the Assignor and the Assignee appoint the Escrow Agent to act as Escrow Agent on the terms and conditions set forth in this Agreement and the Escrow Agent accepts such appointment on such terms and conditions.

4. Deposit

On the date and pursuant to the terms of Section 2.2(a) of the Purchase Agreement, the Assignee shall deposit the sum of $250,000 (the "Escrow Funds") by wire transfer of immediately available funds to the account specified by the Escrow Agent or, at the option of the Assignee, by official bank draft drawn upon a Canadian chartered bank or by negotiable cheque payable in Canadian funds and certified by a Canadian chartered bank or trust company, on the terms and conditions set forth in this Agreement. On the date of receipt of the Deposit, the Escrow Agent shall acknowledge receipt of the Escrow Funds by written receipt to the Assignor and the Assignee.

5. Holding of Escrow Funds

The Escrow Funds shall be held for a period ending on March 1, 2015 (the "Outside Date") unless paid out earlier in accordance with Section 8 of this Agreement.

6. Escrow Account

The Escrow Agent shall hold the Escrow Funds and any interest received thereon pursuant to this Agreement and the Escrow Funds and any interest received thereon shall be invested and reinvested in term deposits or certificates of deposit selected by the Escrow Agent and issued by a Canadian chartered bank with maturity dates not exceeding thirty (30) days.

7. Interest on Escrow Funds

All interest accruing from the date the Deposit is remitted to the Escrow Agent on the Escrow Funds or any part thereof held by the Escrow Agent shall accrue to the benefit of the party to which the portion of the Escrow Funds to which the interest relates is paid.

8. Release of Escrow Funds

Where all of the conditions set out in Article 6 of the Purchase Agreement (the "Closing Conditions") have been met, the Assignee shall provide the Escrow Agent with irrevocable written instructions to pay the Escrow Funds to the Assignor, with a copy of such instructions being delivered to the Assignor. Where the Closing Conditions have not been met, the Assignee shall provide the Escrow Agent with irrevocable written instructions to pay the Escrow Funds to the Assignee, with a copy of such instructions being delivered to the Assignor. In each case, the Escrow Agent shall act in accordance with the irrevocable written instructions of the Assignee. Where no instructions are received by the Escrow Agent prior to the Outside Date, the Escrow Agent shall remit the Escrow Funds to the Assignee.

| 29 |

9. Termination of Agreement

This Agreement may be terminated, other than the conditions of this Agreement for the protection of the Escrow Agent, at any time by and upon the receipt of a written notice of termination signed by the Assignee and the Assignor. Unless so terminated, this Agreement, other than the conditions of this Agreement for the protection of the Escrow Agent, shall terminate upon payment by the Escrow Agent in accordance with the terms of this Agreement of all of the Escrow Funds and any interest received thereon.

10. Determinations

The parties agree that the Escrow Agent shall not be required to make any determination or decision with respect to the validity of any claim made by any party, or of any denial thereof, but shall be entitled to rely conclusively on the terms of this Agreement and the documents tendered to it in accordance with the terms of this Agreement.

11. Costs and Expenses

The Escrow Agent's fee (plus applicable Goods and Services Tax) for accepting its appointment as escrow agent under this Agreement will be paid by the Assignee. No other fees, costs or expenses will be payable to the Escrow Agent hereunder save and except for: (i) the reasonable legal fees, disbursements and other costs incurred by the Escrow Agent in the event that the Escrow Agent pays the Escrow Funds or any portion thereof into court pursuant to Section 13(f) of this Agreement; and (ii) any reasonable disbursements incurred by the Escrow Agent in carrying out its duties herein. The obligation in this Section shall survive the termination or discharge of this Agreement or the resignation or removal of the Escrow Agent.

12. Escrow Agent

The acceptance by the Escrow Agent of its duties under this Escrow Agreement is subject to the following terms and conditions which shall govern and control the rights, duties, liabilities and immunities of the Escrow Agent:

| (a) | The Escrow Agent is not a party to, and is not bound by, any agreement which may be evidenced by, or arising out of, the foregoing instructions, other than as expressly set forth herein; | |

| (b) | The Escrow Agent shall be protected in acting upon any written notice, declaration, request, waiver, consent, receipt or other paper or document which the Escrow Agent in good faith believes to be genuine and what it purports to be; | |

| (c) | The Escrow Agent shall not be liable for any error of judgment, or for any act done or step taken or omitted by it in good faith, or for any mistake of fact or law, or for any thing which it may do or refrain from doing in connection with this Agreement, except for its own gross negligence or wilful misconduct; |

| 30 |

| (d) | The Escrow Agent shall incur no liability under this Agreement or in connection with this Agreement for anything whatsoever other than as a result of its own gross negligence or wilful misconduct. The Assignee and the Assignor jointly and severally shall indemnify, hold harmless and defend the Escrow Agent from and against any and all actions, causes of action, claims, demands, damages, losses, costs, liabilities and expenses, of any nature or kind including reasonable legal fees, which may be made or brought against it or which it may suffer or incur as a result of or in respect of or arising out of its appointment as Escrow Agent under this Agreement, except such as shall result solely and directly from its own gross negligence or wilful misconduct; | |

| (e) | In the event of any disagreement between any of the parties resulting in adverse claims or demands with respect to the Escrow Funds and any interest received thereon, the Escrow Agent shall be entitled, at its option, to refuse to comply with any claims or demands on it with respect thereto as long as such disagreement shall continue, and in so refusing, the Escrow Agent may elect to make no delivery of the Escrow Funds and any interest received thereon. In so doing, the Escrow Agent shall not be or become liable in any way to the parties for its failure or refusal to comply with such claims or demands. The Escrow Agent shall be entitled to refrain from acting or refusing to act until such claims or demands shall have been finally determined in a court of competent jurisdiction or shall have been settled by agreement and the Escrow Agent shall have been notified thereof by the Assignee and the Assignor in writing; | |

| (f) | The Escrow Agent may pay the Escrow Funds or any portion thereof (and any interest earned thereon, less any amounts owing under Section 12) into court for a determination by such court as to the entitlement to such Escrow Funds (and any interest earned thereon, less any amounts owing under Section 12) at any time and the Escrow Agent shall thereupon be released from any obligation hereunder; | |

| (g) | The Escrow Agent may employ or retain such counsel who may but need not be counsel for any parties hereto and such other experts, advisors, agents or agencies as it may in its discretion require for the purpose of discharging its duties under this Agreement, and the Escrow Agent shall be fully protected in acting or not acting in good faith on the opinion or advice or on information obtained from any such parties and shall not be responsible for any misconduct or negligent actions on the part of any of them. The costs of such services shall be added to and be part of the Escrow Agent's fees under this Agreement; | |

| (h) | No provision of this Agreement shall require the Escrow Agent to expend or risk its own funds or otherwise incur financial liability in the performance of its duties or in the exercise of any of its rights or powers unless indemnified as aforesaid; | |

| (i) | Nothing in acting as Escrow Agent hereunder shall preclude the Escrow Agent from acting, in any manner, as counsel to the Assignee in connection with any matter or dispute, including disputes pertaining to the Purchase Agreement or this Agreement and the Assignor will not raise any objection in any forum to the Escrow Agent acting as such counsel; and |

| 31 |

| (j) | The Escrow Agent may resign as Escrow Agent hereunder upon 10 days written notice to the Assignee and the Assignor. If a successor escrow agent is not appointed by the Assignee and the Assignor within this 10 day period, the Escrow Agent may, but shall have no duty to, petition the court to name a successor. If no successor escrow agent is appointed by the parties by written notice to the Escrow Agent within the 10 day period, the Escrow Agent shall have no further duties or obligations whatsoever upon the expiration of such period until such time as a successor escrow agent is appointed and, at such time, the sole duty of the Escrow Agent shall be to deliver the Escrow Funds (and any interest earned thereon, less any amounts owing under Section 12) to the successor escrow agent. |

13. Notice

Any notice or other writing required or permitted in connection with this Agreement (in this Section, referred to as a "Notice") shall be in writing and shall be sufficiently given if delivered (whether in person, by courier service or other personal method of delivery), or if transmitted by facsimile or e-mail:

| (a) | in the case of a notice to the Assignor at: | |

|

|

|

Hatem Essadam ___________________, ___________________

with a copy (which shall not constitute notice) to:

Derome Avocats 5064, avenue du Parc Montréal, QC, H2V 4G1

Attention: Me Charles Derome Email: ________________________ | ||

|

|

|

| (b) | in the case of a notice to the Assignee at: |

|

|

|

|