nshi-202212310001503707false2022FYhttp://fasb.org/us-gaap/2022#RealEstateInvestmentPropertyNethttp://fasb.org/us-gaap/2022#OtherLiabilitieshttp://fasb.org/us-gaap/2022#GainLossOnInvestmentshttp://fasb.org/us-gaap/2022#GainLossOnInvestments00.125000000000015037072022-01-012022-12-3100015037072022-06-30iso4217:USD00015037072023-03-27xbrli:shares00015037072022-12-3100015037072021-12-31iso4217:USDxbrli:shares0001503707us-gaap:VariableInterestEntityPrimaryBeneficiaryMembernshi:NorthstarHealthcareIncomeOperatingPartnershipLPMember2022-01-012022-12-31xbrli:pure0001503707us-gaap:VariableInterestEntityPrimaryBeneficiaryMembernshi:NorthstarHealthcareIncomeOperatingPartnershipLPMember2022-12-3100015037072021-01-012021-12-3100015037072020-01-012020-12-310001503707us-gaap:CommonStockMember2019-12-310001503707us-gaap:AdditionalPaidInCapitalMember2019-12-310001503707us-gaap:RetainedEarningsMember2019-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001503707us-gaap:ParentMember2019-12-310001503707us-gaap:NoncontrollingInterestMember2019-12-3100015037072019-12-310001503707us-gaap:CommonStockMember2020-01-012020-12-310001503707us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001503707us-gaap:ParentMember2020-01-012020-12-310001503707us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001503707us-gaap:RetainedEarningsMember2020-01-012020-12-310001503707us-gaap:CommonStockMember2020-12-310001503707us-gaap:AdditionalPaidInCapitalMember2020-12-310001503707us-gaap:RetainedEarningsMember2020-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001503707us-gaap:ParentMember2020-12-310001503707us-gaap:NoncontrollingInterestMember2020-12-3100015037072020-12-310001503707us-gaap:CommonStockMember2021-01-012021-12-310001503707us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001503707us-gaap:ParentMember2021-01-012021-12-310001503707us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001503707us-gaap:RetainedEarningsMember2021-01-012021-12-310001503707us-gaap:CommonStockMember2021-12-310001503707us-gaap:AdditionalPaidInCapitalMember2021-12-310001503707us-gaap:RetainedEarningsMember2021-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001503707us-gaap:ParentMember2021-12-310001503707us-gaap:NoncontrollingInterestMember2021-12-310001503707us-gaap:CommonStockMember2022-01-012022-12-310001503707us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001503707us-gaap:ParentMember2022-01-012022-12-310001503707us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001503707us-gaap:RetainedEarningsMember2022-01-012022-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001503707us-gaap:CommonStockMember2022-12-310001503707us-gaap:AdditionalPaidInCapitalMember2022-12-310001503707us-gaap:RetainedEarningsMember2022-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001503707us-gaap:ParentMember2022-12-310001503707us-gaap:NoncontrollingInterestMember2022-12-310001503707nshi:AdvisoroftheRegistrantMember2022-01-012022-12-310001503707nshi:SpecialUnitsHolderMember2022-01-012022-12-310001503707us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-01-012022-12-3100015037072015-02-022022-12-310001503707nshi:DividendReinvestmentPlanMember2015-02-022022-12-310001503707us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001503707us-gaap:BuildingMembersrt:MinimumMember2022-01-012022-12-310001503707us-gaap:BuildingMembersrt:MaximumMember2022-01-012022-12-310001503707us-gaap:LandImprovementsMembersrt:MinimumMember2022-01-012022-12-310001503707us-gaap:LandImprovementsMembersrt:MaximumMember2022-01-012022-12-310001503707us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2022-01-012022-12-310001503707us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2022-01-012022-12-31nshi:portfolio0001503707us-gaap:LeasesAcquiredInPlaceMember2022-12-310001503707us-gaap:LeasesAcquiredInPlaceMember2021-12-310001503707us-gaap:InterestRateCapMember2022-12-310001503707us-gaap:InterestRateCapMember2021-12-31nshi:day0001503707us-gaap:OtherIncomeMember2022-01-012022-12-310001503707us-gaap:OtherIncomeMember2021-01-012021-12-310001503707nshi:ArborsPortfolioMember2022-01-012022-12-310001503707nshi:WinterfellPortfolioMember2022-01-012022-12-310001503707nshi:RochesterNYMember2022-01-012022-12-310001503707nshi:AvamerePortfolioMember2022-01-012022-12-310001503707nshi:WinterfellPortfolioMember2021-01-012021-12-310001503707nshi:SmyrnaMember2021-01-012021-12-310001503707nshi:DiversifiedUSUKMember2022-01-012022-12-310001503707nshi:DiversifiedUSUKMember2022-12-310001503707us-gaap:CorporateJointVentureMember2022-01-012022-12-310001503707us-gaap:CorporateJointVentureMember2021-01-012021-12-310001503707us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001503707us-gaap:BuildingAndBuildingImprovementsMember2021-12-310001503707nshi:TheTrilogyJointVentureMember2022-12-310001503707nshi:TheTrilogyJointVentureMember2021-12-310001503707nshi:DiversifiedUSUKMember2021-12-310001503707nshi:EspressoJointVentureMember2022-12-310001503707nshi:EspressoJointVentureMember2021-12-310001503707nshi:EclipseJointVentureMember2022-12-310001503707nshi:EclipseJointVentureMember2021-12-310001503707nshi:EclipseEnvoyDiversifiedUSUKEspressoTrilogyMember2022-12-310001503707nshi:EclipseEnvoyDiversifiedUSUKEspressoTrilogyMember2021-12-310001503707nshi:SolsticeSeniorLivingLLCMember2022-12-310001503707nshi:SolsticeSeniorLivingLLCMember2021-12-310001503707nshi:MezzanineLoansMembernshi:EspressoJointVentureMember2018-12-310001503707nshi:SolsticeSeniorLivingLLCMembernshi:WinterfellPortfolioMember2022-12-310001503707nshi:SolsticeSeniorLivingLLCMembernshi:WinterfellPortfolioMember2022-12-310001503707nshi:TheTrilogyJointVentureMember2022-01-012022-12-310001503707nshi:TheTrilogyJointVentureMember2021-01-012021-12-310001503707nshi:DiversifiedUSUKMember2021-01-012021-12-310001503707nshi:EspressoJointVentureMember2022-01-012022-12-310001503707nshi:EspressoJointVentureMember2021-01-012021-12-310001503707nshi:EclipseJointVentureMember2022-01-012022-12-310001503707nshi:EclipseJointVentureMember2021-01-012021-12-310001503707nshi:EnvoyJointVentureMember2022-01-012022-12-310001503707nshi:EnvoyJointVentureMember2021-01-012021-12-310001503707nshi:EclipseEnvoyDiversifiedUSUKEspressoTrilogyMember2022-01-012022-12-310001503707nshi:EclipseEnvoyDiversifiedUSUKEspressoTrilogyMember2021-01-012021-12-310001503707nshi:SolsticeSeniorLivingLLCMember2022-01-012022-12-310001503707nshi:SolsticeSeniorLivingLLCMember2021-01-012021-12-310001503707nshi:DiversifiedUSUKAndTrilogyMember2022-12-310001503707nshi:DiversifiedUSUKAndTrilogyMember2021-12-310001503707nshi:DiversifiedUSUKAndTrilogyMember2022-01-012022-12-310001503707nshi:DiversifiedUSUKAndTrilogyMember2021-01-012021-12-310001503707nshi:DiversifiedUSUKAndTrilogyMember2020-01-012020-12-310001503707nshi:FriscoMemberus-gaap:MortgagesMembernshi:FriscoTXNonrecourseMember2022-12-310001503707nshi:FriscoMemberus-gaap:MortgagesMembernshi:FriscoTXNonrecourseMember2021-12-310001503707nshi:MilfordOHMemberus-gaap:LondonInterbankOfferedRateLIBORMembernshi:MilfordOHNonrecourseMemberus-gaap:MortgagesMember2022-01-012022-12-310001503707nshi:MilfordOHMembernshi:MilfordOHNonrecourseMemberus-gaap:MortgagesMember2022-12-310001503707nshi:MilfordOHMembernshi:MilfordOHNonrecourseMemberus-gaap:MortgagesMember2021-12-310001503707nshi:RochesterNYMembernshi:RochesterNYNonrecourseFebruary2025Memberus-gaap:MortgagesMember2022-12-310001503707nshi:RochesterNYMembernshi:RochesterNYNonrecourseFebruary2025Memberus-gaap:MortgagesMember2021-12-310001503707nshi:RochesterNYMembernshi:RochesterNYNonrecourseAugust2027Memberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:MortgagesMember2022-01-012022-12-310001503707nshi:RochesterNYMembernshi:RochesterNYNonrecourseAugust2027Memberus-gaap:MortgagesMember2022-12-310001503707nshi:RochesterNYMembernshi:RochesterNYNonrecourseAugust2027Memberus-gaap:MortgagesMember2021-12-310001503707nshi:RochesterNYMemberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:MortgagesMembernshi:RochesterNYNonrecourseAugust2022Member2022-01-012022-12-310001503707nshi:RochesterNYMemberus-gaap:MortgagesMembernshi:RochesterNYNonrecourseAugust2022Member2022-12-310001503707nshi:RochesterNYMemberus-gaap:MortgagesMembernshi:RochesterNYNonrecourseAugust2022Member2021-12-310001503707us-gaap:NonrecourseMemberus-gaap:MortgagesMembernshi:ArborsPortfolioMember2022-12-310001503707us-gaap:NonrecourseMemberus-gaap:MortgagesMembernshi:ArborsPortfolioMember2021-12-310001503707nshi:WinterfellPortfolioMemberus-gaap:NonrecourseMemberus-gaap:MortgagesMember2022-12-310001503707nshi:WinterfellPortfolioMemberus-gaap:NonrecourseMemberus-gaap:MortgagesMember2021-12-310001503707us-gaap:NonrecourseMemberus-gaap:MortgagesMembernshi:AvamerePortfolioMember2022-12-310001503707us-gaap:NonrecourseMemberus-gaap:MortgagesMembernshi:AvamerePortfolioMember2021-12-310001503707us-gaap:NonrecourseMemberus-gaap:MortgagesMember2022-12-310001503707us-gaap:NonrecourseMemberus-gaap:MortgagesMember2021-12-310001503707nshi:OtherNotesPayableMemberus-gaap:NonrecourseMembernshi:OakCottageofSantaBarbaraMember2022-12-310001503707nshi:OtherNotesPayableMemberus-gaap:NonrecourseMembernshi:OakCottageofSantaBarbaraMember2021-12-310001503707nshi:OtherNotesPayableMemberus-gaap:NonrecourseMember2022-12-310001503707nshi:OtherNotesPayableMemberus-gaap:NonrecourseMember2021-12-310001503707nshi:MortgagesAndOtherNotesPayableMember2022-12-310001503707nshi:MortgagesAndOtherNotesPayableMember2021-12-310001503707us-gaap:MortgagesMembernshi:FloatingRateDebtOneMonthLIBORMember2022-12-310001503707nshi:FriscoMemberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:MortgagesMembernshi:FriscoTXNonrecourseMember2022-01-012022-12-310001503707nshi:RochesterNYMemberus-gaap:MortgagesMember2022-01-012022-12-31nshi:debt_instrumentnshi:property0001503707us-gaap:MortgagesMembernshi:ArborsPortfolioMember2022-01-012022-12-310001503707nshi:WinterfellPortfolioMemberus-gaap:MortgagesMember2022-01-012022-12-310001503707nshi:WinterfellPortfolioMember2022-01-012022-12-310001503707us-gaap:MortgagesMembernshi:AvamerePortfolioMember2022-01-012022-12-310001503707nshi:OtherNotesPayableMemberus-gaap:NonrecourseMembernshi:OakCottageofSantaBarbaraMember2022-06-012022-06-300001503707us-gaap:LineOfCreditMembernshi:DigitalBridgeMember2022-12-310001503707us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:LineOfCreditMembernshi:DigitalBridgeMember2022-01-012022-12-310001503707nshi:AdvisoroftheRegistrantMember2022-01-012022-12-310001503707nshi:AdvisoroftheRegistrantMember2022-12-310001503707nshi:AdvisoroftheRegistrantMembernshi:OperatingCostsMember2022-01-012022-12-31nshi:quarter0001503707nshi:AdvisoroftheRegistrantMembernshi:OperatingCostsMembersrt:MaximumMember2022-01-012022-12-310001503707nshi:RelatedPartyTransitionServicesAgreementMember2022-10-212022-10-210001503707nshi:AdvisoryFees-RelatedPartyMembernshi:AssetManagementFeesMembernshi:AdvisoroftheRegistrantMember2021-12-310001503707nshi:AdvisoryFees-RelatedPartyMembernshi:AssetManagementFeesMembernshi:AdvisoroftheRegistrantMember2022-01-012022-12-310001503707nshi:AdvisoryFees-RelatedPartyMembernshi:AssetManagementFeesMembernshi:AdvisoroftheRegistrantMember2022-12-310001503707nshi:AdvisoroftheRegistrantMemberus-gaap:GeneralAndAdministrativeExpenseMembernshi:OperatingCostsMember2021-12-310001503707nshi:AdvisoroftheRegistrantMemberus-gaap:GeneralAndAdministrativeExpenseMembernshi:OperatingCostsMember2022-01-012022-12-310001503707nshi:AdvisoroftheRegistrantMemberus-gaap:GeneralAndAdministrativeExpenseMembernshi:OperatingCostsMember2022-12-310001503707nshi:AdvisoryFees-RelatedPartyMember2022-01-012022-12-310001503707nshi:OperatingCostsMember2022-01-012022-12-310001503707nshi:AdvisoryFees-RelatedPartyMembernshi:AssetManagementFeesMembernshi:AdvisoroftheRegistrantMember2020-12-310001503707nshi:AdvisoryFees-RelatedPartyMembernshi:AssetManagementFeesMembernshi:AdvisoroftheRegistrantMember2021-01-012021-12-310001503707nshi:AdvisoroftheRegistrantMemberus-gaap:GeneralAndAdministrativeExpenseMembernshi:OperatingCostsMember2020-12-310001503707nshi:AdvisoroftheRegistrantMemberus-gaap:GeneralAndAdministrativeExpenseMembernshi:OperatingCostsMember2021-01-012021-12-310001503707nshi:AdvisorSponsorAndAffiliatesMember2022-12-310001503707nshi:FormerAdvisorFormerSponsorAndAffiliatesMembernshi:NorthstarHealthcareIncomeIncMember2022-12-310001503707nshi:IncentiveFeesMembernshi:AdvisoroftheRegistrantMember2022-01-012022-12-310001503707nshi:SolsticeSeniorLivingLLCMembernshi:WinterfellPortfolioMember2022-01-012022-12-310001503707nshi:NRFAndPartnerFormationCapitalLLCMembernshi:EclipseJointVentureMember2022-12-310001503707nshi:NRFAndPartnerMembernshi:DiversifiedUSUKMember2022-12-310001503707us-gaap:LineOfCreditMembernshi:DigitalBridgeMember2022-10-210001503707nshi:AssetManagementFeesMembernshi:AdvisoroftheRegistrantMember2018-01-012018-01-010001503707us-gaap:RestrictedStockMember2022-12-310001503707srt:DirectorMemberus-gaap:RestrictedStockMember2022-01-012022-12-310001503707srt:DirectorMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001503707srt:DirectorMemberus-gaap:RestrictedStockMember2022-12-310001503707srt:DirectorMemberus-gaap:RestrictedStockUnitsRSUMember2022-12-310001503707us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001503707us-gaap:RestrictedStockMember2022-01-012022-12-310001503707us-gaap:RestrictedStockUnitsRSUMember2022-12-310001503707us-gaap:RestrictedStockUnitsRSUMember2021-12-310001503707us-gaap:CommonStockMember2015-12-172016-01-190001503707us-gaap:CommonStockMembernshi:DividendReinvestmentPlanMember2015-12-172022-12-310001503707nshi:DividendReinvestmentPlanMember2022-01-012022-12-3100015037072022-05-020001503707us-gaap:InterestRateCapMemberus-gaap:FairValueInputsLevel1Member2022-12-310001503707us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateCapMember2022-12-310001503707us-gaap:InterestRateCapMemberus-gaap:FairValueInputsLevel3Member2022-12-310001503707us-gaap:InterestRateCapMemberus-gaap:FairValueInputsLevel1Member2021-12-310001503707us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateCapMember2021-12-310001503707us-gaap:InterestRateCapMemberus-gaap:FairValueInputsLevel3Member2021-12-310001503707us-gaap:MortgagesMember2022-12-310001503707us-gaap:MortgagesMember2021-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Membernshi:OperatingRealEstateNetMember2022-01-012022-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2021-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Membernshi:OperatingRealEstateNetMember2021-01-012021-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Membernshi:OperatingRealEstateNetMember2020-01-012020-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateJointVentureMember2022-01-012022-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateJointVentureMember2021-01-012021-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateJointVentureMember2020-01-012020-12-310001503707nshi:AssetsHeldForSaleMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2022-01-012022-12-310001503707nshi:AssetsHeldForSaleMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2021-01-012021-12-310001503707nshi:AssetsHeldForSaleMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2020-01-012020-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:RealEstateInvestmentMembersrt:MinimumMembernshi:TerminalCapitalizationRateMember2022-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:RealEstateInvestmentMembersrt:MaximumMembernshi:TerminalCapitalizationRateMember2022-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:RealEstateInvestmentMembersrt:MinimumMemberus-gaap:MeasurementInputDiscountRateMember2022-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:RealEstateInvestmentMembersrt:MaximumMemberus-gaap:MeasurementInputDiscountRateMember2022-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:CorporateJointVentureMemberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMembernshi:TerminalCapitalizationRateMember2022-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:CorporateJointVentureMemberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MaximumMembernshi:TerminalCapitalizationRateMember2022-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:CorporateJointVentureMemberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberus-gaap:MeasurementInputDiscountRateMember2022-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:CorporateJointVentureMemberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MaximumMemberus-gaap:MeasurementInputDiscountRateMember2022-12-310001503707nshi:DirectInvestmentsNetLeaseSegmentMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingSegmentMember2022-01-012022-12-310001503707nshi:UnconsolidatedInvestmentsSegmentMember2022-01-012022-12-310001503707nshi:DebtAndSecuritiesSegmentMember2022-01-012022-12-310001503707us-gaap:CorporateMember2022-01-012022-12-310001503707nshi:DirectInvestmentsNetLeaseSegmentMember2021-01-012021-12-310001503707nshi:DirectInvestmentsOperatingSegmentMember2021-01-012021-12-310001503707nshi:UnconsolidatedInvestmentsSegmentMember2021-01-012021-12-310001503707nshi:DebtAndSecuritiesSegmentMember2021-01-012021-12-310001503707us-gaap:CorporateMember2021-01-012021-12-310001503707nshi:DirectInvestmentsNetLeaseSegmentMember2020-01-012020-12-310001503707nshi:DirectInvestmentsOperatingSegmentMember2020-01-012020-12-310001503707nshi:UnconsolidatedInvestmentsSegmentMember2020-01-012020-12-310001503707nshi:DebtAndSecuritiesSegmentMember2020-01-012020-12-310001503707us-gaap:CorporateMember2020-01-012020-12-310001503707nshi:DirectInvestmentsNetLeaseSegmentMember2022-12-310001503707nshi:DirectInvestmentsOperatingSegmentMember2022-12-310001503707nshi:UnconsolidatedInvestmentsSegmentMember2022-12-310001503707nshi:DebtAndSecuritiesSegmentMember2022-12-310001503707us-gaap:CorporateMember2022-12-310001503707nshi:DirectInvestmentsNetLeaseSegmentMember2021-12-310001503707nshi:DirectInvestmentsOperatingSegmentMember2021-12-310001503707nshi:UnconsolidatedInvestmentsSegmentMember2021-12-310001503707nshi:DebtAndSecuritiesSegmentMember2021-12-310001503707us-gaap:CorporateMember2021-12-310001503707nshi:SolsticeSeniorLivingLLCMember2022-12-31nshi:unit0001503707nshi:SolsticeSeniorLivingLLCMember2022-01-012022-12-310001503707us-gaap:SalesRevenueNetMembernshi:SolsticeSeniorLivingLLCMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001503707nshi:WatermarkRetirementCommunitiesMember2022-12-310001503707nshi:WatermarkRetirementCommunitiesMember2022-01-012022-12-310001503707us-gaap:SalesRevenueNetMembernshi:WatermarkRetirementCommunitiesMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001503707nshi:AvamereHealthServicesMember2022-12-310001503707nshi:AvamereHealthServicesMember2022-01-012022-12-310001503707us-gaap:SalesRevenueNetMembernshi:AvamereHealthServicesMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001503707nshi:IntegralMember2022-12-310001503707nshi:IntegralMember2022-01-012022-12-310001503707us-gaap:SalesRevenueNetMembernshi:IntegralMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001503707nshi:ArcadiaMember2022-12-310001503707nshi:ArcadiaMember2022-01-012022-12-310001503707us-gaap:SalesRevenueNetMembernshi:ArcadiaMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001503707nshi:OtherPropertiesMember2022-12-31nshi:property10001503707nshi:OtherPropertiesMember2022-01-012022-12-310001503707nshi:OtherPropertiesMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001503707us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001503707nshi:SolsticeSeniorLivingLLCMember2022-12-310001503707nshi:SpecialtyHosipitalsMembernshi:DiversifiedUSUKMemberus-gaap:SubsequentEventMember2023-02-28nshi:facility0001503707nshi:DiversifiedUSUKMemberus-gaap:SubsequentEventMember2023-02-012023-02-280001503707nshi:DirectInvestmentsOperatingMembernshi:MilfordOHMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:MilfordOHMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:MilfordOHTwoMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:MilfordOHTwoMember2022-01-012022-12-310001503707nshi:FriscoTXOneMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:FriscoTXOneMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:AppleValleyCAMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:AppleValleyCAMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:AuburnCAMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:AuburnCAMember2022-01-012022-12-310001503707nshi:AustinTXMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:AustinTXMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:BakersfieldCAMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:BakersfieldCAMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:BangorMEMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:BangorMEMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:BellinghamWAMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:BellinghamWAMember2022-01-012022-12-310001503707nshi:ClovisCAMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:ClovisCAMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:ColumbiaMOMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:ColumbiaMOMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:CorpusChristiTXMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:CorpusChristiTXMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:EastAmherstNYMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:EastAmherstNYMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:ElCajonCAMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:ElCajonCAMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:ElPasoTXMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:ElPasoTXMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:FairportNYMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:FairportNYMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:FentonMOMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:FentonMOMember2022-01-012022-12-310001503707nshi:GrandJunctionCOOneMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:GrandJunctionCOOneMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:GrandJunctionCOTwoMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:GrandJunctionCOTwoMember2022-01-012022-12-310001503707nshi:GrapevineTXMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:GrapevineTXMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:GrotonCTMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:GrotonCTMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:GulifordCTMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:GulifordCTMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:JolietILMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:JolietILMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:KennewickWAMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:KennewickWAMember2022-01-012022-12-310001503707nshi:LasCrucesNMMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:LasCrucesNMMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:LeesSummitMOMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:LeesSummitMOMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:LodiCAMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:LodiCAMember2022-01-012022-12-310001503707nshi:NormandyParkWAMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:NormandyParkWAMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:PalatineILMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:PalatineILMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:PlanoTXMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:PlanoTXMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:RentonWAMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:RentonWAMember2022-01-012022-12-310001503707nshi:SandyUTMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:SandyUTMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:SantaRosaCAMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:SantaRosaCAMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:SunCityWestAZMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:SunCityWestAZMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:TacomaWAMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:TacomaWAMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:FriscoTXTwoMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:FriscoTXTwoMember2022-01-012022-12-310001503707nshi:AlbanyMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:AlbanyMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:PortTownsendWAMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:PortTownsendWAMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:RoseburgORMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:RoseburgORMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:SandyORMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:SandyORMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:SantaBarbaraCAMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:SantaBarbaraCAMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:WenatcheeWAMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:WenatcheeWAMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:ChurchvilleNYMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:ChurchvilleNYMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:GreeceNYOneMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:GreeceNYOneMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:GreeceNYTwoMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:GreeceNYTwoMember2022-01-012022-12-310001503707nshi:HenriettaNYMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:HenriettaNYMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:PenfieldNYOneMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:PenfieldNYOneMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:PenfieldNYTwoMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:PenfieldNYTwoMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:RochesterNYOneMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:RochesterNYOneMember2022-01-012022-12-310001503707nshi:RochesterNYTwoMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:RochesterNYTwoMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:VictorNYOneMember2022-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:VictorNYOneMember2022-01-012022-12-310001503707nshi:VictorNYTwoMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:VictorNYTwoMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:UndevelopedLandMembernshi:RochesterNYThreeMember2022-12-310001503707nshi:UndevelopedLandMembernshi:PenfieldNYThreeMember2022-12-310001503707nshi:BohemiaNYMembernshi:DirectInvestmentsNetLeaseMember2022-12-310001503707nshi:BohemiaNYMembernshi:DirectInvestmentsNetLeaseMember2022-01-012022-12-310001503707nshi:DirectInvestmentsNetLeaseMembernshi:HauppagueNYMember2022-12-310001503707nshi:DirectInvestmentsNetLeaseMembernshi:HauppagueNYMember2022-01-012022-12-310001503707nshi:IslandiaNYMembernshi:DirectInvestmentsNetLeaseMember2022-12-310001503707nshi:IslandiaNYMembernshi:DirectInvestmentsNetLeaseMember2022-01-012022-12-310001503707nshi:WestburyNYMembernshi:DirectInvestmentsNetLeaseMember2022-12-310001503707nshi:WestburyNYMembernshi:DirectInvestmentsNetLeaseMember2022-01-012022-12-310001503707nshi:DirectInvestmentOperatingLeaseAndUndevelopedLandMember2022-12-310001503707nshi:EspressoJointVentureMember2018-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 000-55190

NORTHSTAR HEALTHCARE INCOME, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | |

| Maryland | 27-3663988 |

| (State or Other Jurisdiction of | (IRS Employer |

| Incorporation or Organization) | Identification No.) |

16 East 34th Street, 18th Floor, New York, NY 10016

(Address of Principal Executive Offices, Including Zip Code)

(929) 777-3125

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | None | None |

Securities registered pursuant to Section 12(g) of the Act : Common Stock, $0.01 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ¨ | Accelerated filer | ¨ | Non-accelerated filer | ☒ | Smaller reporting company | ☐ |

| | | | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

There is no established trading market for the registrant’s common stock and therefore the aggregate market value of the registrant’s common stock held by non-affiliates cannot be determined.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

The Company has one class of common stock, $0.01 par value per share, 195,421,665 shares outstanding as of March 27, 2023.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the definitive proxy statement related to the registrant’s 2023 Annual Meeting of Stockholders to be filed hereafter are incorporated by reference into Part III (Items 10, 11, 12, 13 and 14) of this Annual Report on Form 10-K.

NORTHSTAR HEALTHCARE INCOME, INC.

FORM 10-K

TABLE OF CONTENTS

| | | | | | | | |

| Index | | Page |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 9A. | Control and Procedures | |

Item 9B. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue,” “future” or other similar words or expressions. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Such statements include, but are not limited to, those relating to our ability to make distributions to our stockholders; our ability to retain our senior executives and other sufficient personnel to manage our business; our ability to realize substantial efficiencies as well as anticipated strategic and financial benefits of the internalization of our management function as operating costs and business disruption may be greater than expected; the operating performance of our investments, our financing needs, the effects of our current strategies and investment activities and our ability to effectively deploy capital. Our ability to predict results or the actual effect of plans or strategies is inherently uncertain. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements and you should not unduly rely on these statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from those forward-looking statements.

All forward-looking statements included in this Annual Report on Form 10-K are based on information available to us on the date hereof and we are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

Factors that could have a material adverse effect on our operations and future prospects are set forth in our filings with the U.S. Securities and Exchange Commission, or the SEC, including in this Annual Report on Form 10-K under the heading “Risk Factor Summary” and Item 1A. “Risk Factors” below. The risk factors set forth in our filings with the SEC could cause our actual results to differ significantly from those contained in any forward-looking statement contained in this report.

RISK FACTOR SUMMARY

Investing in our securities involves a high degree of risk. Below is a summary of principal factors that make an investment in our securities speculative or risky. This summary does not address all of the risks that we face. Additional discussion of the risks summarized in this risk factor summary, as well as other risks that we face, can be found under the heading Item 1A. “Risk Factors” below.

Risks Related to Our Business

•The continuing effects of the COVID-19 pandemic may have a material adverse effect on our business, results of operations, cash flows and financial condition.

•There is a high degree of uncertainty regarding oversight of funds provided through the CARES Act and other statutory relief efforts related to the COVID-19 pandemic.

•Macroeconomic trends, including rising labor costs and historically low unemployment, increases in inflation and rising interest rates may adversely affect our business and financial results.

•We are directly exposed to operational risks at substantially all of our owned properties and are dependent on the operators or managers of these properties to manage these risks.

•Our Winterfell, Rochester and Arbors portfolios do not currently generate sufficient cash flow from operations to satisfy all debt service obligations and capital expenditure needs.

•Events that adversely affect the ability of seniors and their families to afford resident fees at our seniors housing facilities could cause our occupancy rates, resident fee revenues and results of operations to decline.

•Increased competition could adversely affect future occupancy rates, operating margins and profitability at our properties.

•We are subject to risks associated with capital expenditures, and our failure to adequately manage such risks could have a material adverse effect on our business, financial condition and results of operations.

•We depend on two operators/managers, Watermark Retirement Communities, or Watermark, and Solstice Senior Living, or Solstice, for a significant majority of our revenues and net operating income. Adverse developments in Watermark’s or Solstice’s business and affairs or financial condition could have a material adverse effect on us.

•If we must replace any of our operators or managers, we might be unable to reposition the properties on as favorable terms, or at all, and we could be subject to delays, limitations and expenses, which could have a material adverse effect on us.

•Our strategy depends upon identifying and executing on disposition opportunities that achieve a desired return.

•Our joint venture partners could take actions that decrease the value of an investment to us and lower our overall return.

•We may have limited rights to information or ability to influence material decisions for our unconsolidated investments.

•Our unconsolidated investments involve different asset classes, structures and jurisdictions, which may expose us to different risks.

Risks Related to Our Capital Structure

•Market conditions and the actual and perceived state of the capital markets generally could negatively impact our business, financial condition and results of operations.

•We may be forced to dispose of assets at suboptimal times due to debt maturities.

•We require capital in order to operate our business, and the failure to obtain such capital would have a material adverse effect on our business, financial condition and results of operations.

•We use significant leverage in connection with our investments, which increases the risk of loss associated with our investments and restricts our ability to engage in certain activities.

•Our distribution policy is subject to change. We may not be able to make distributions in the future.

•Stockholders are not currently able to sell any of their shares of our common stock back to us pursuant to our share repurchase program, or the Share Repurchase Program, and if they do sell their shares on any limited market that may develop, they may not receive the price they paid upon subscription.

•Our board of directors determined an estimated value per share of $2.93 for our common stock as of June 30, 2022, which may not reflect the current value of shares of our common stock.

•No public trading market for our shares currently exists, and as a result, it will be difficult for stockholders to sell their shares and, if stockholders are able to sell their shares, stockholders will likely sell them at a substantial discount to the price paid for those shares.

•If we do not successfully implement a liquidity transaction, stockholders may have to hold their investments for an indefinite period.

Risks Related to Our Company and Corporate Structure

•As a result of the Internalization, we are newly self-managed.

•We may not realize some or all of the targeted benefits of the Internalization.

•We are reliant on certain transition services provided by our Former Advisor under the TSA, and may not find a suitable provider for these transition services if our Former Advisor no longer provides the transition services to which we are entitled under the TSA.

•Our ability to operate our business successfully would be harmed if key personnel terminate their employment with us.

•We are subject to substantial litigation risks and may face significant liabilities and damage to our professional reputation as a result of litigation allegations and negative publicity.

•We are subject to substantial regulation, numerous contractual obligations and extensive internal policies and failure to comply with these matters could have a material adverse effect on our business, financial condition and results of operations.

Risks Related to Regulatory Matters and Our REIT Tax Status

•Our failure to continue to qualify as a real estate investment trust, or REIT, would subject us to federal income tax.

PART I

Item 1. Business

References to “we,” “us” or “our” refer to NorthStar Healthcare Income, Inc. and its subsidiaries, unless context specifically requires otherwise.

Overview

We own a diversified portfolio of seniors housing properties, including independent living facilities, or ILFs, assisted living facilities, or ALFs, and memory care facilities, or MCFs, located throughout the United States. In addition, we have made investments through non-controlling interests in joint ventures in a broader spectrum of healthcare real estate, including seniors housing properties, as well as continuing care retirement communities, or CCRCs, skilled nursing facilities, or SNFs, medical office buildings, or MOBs, specialty hospitals and ancillary services businesses, across the United States and United Kingdom.

We were formed in October 2010 as a Maryland corporation and commenced operations in February 2013. We elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended, or the Internal Revenue Code, commencing with the taxable year ended December 31, 2013. We conduct our operations so as to continue to qualify as a REIT for U.S. federal income tax purposes.

From inception through December 31, 2022, we raised $2.0 billion in total gross proceeds from the sale of shares of our common stock in our continuous, public offerings, including $232.6 million pursuant to our distribution reinvestment plan, or our DRP, collectively referred to as our Offering.

The Internalization

From inception through October 21, 2022, we were externally managed by CNI NSHC Advisors, LLC or its predecessor, or the Former Advisor, an affiliate of NRF Holdco, LLC, or the Former Sponsor. The Former Advisor was responsible for managing our operations, subject to the supervision of our board of directors, pursuant to an advisory agreement. On October 21, 2022, we completed the internalization of our management function, or the Internalization. In connection with the Internalization, we agreed with the Former Advisor to terminate the advisory agreement and arranged for the Former Advisor to continue to provide certain services for a transition period. Going forward, we will be self-managed under the leadership of Kendall Young, who was appointed by the board of directors as Chief Executive Officer and President concurrent with the Internalization.

Our Strategy

Our primary objective is to maximize value and generate liquidity for shareholders. The key elements of our strategy include:

•Grow the Operating Income Generated by Our Portfolio. Through active portfolio management, we will continue to review and implement operating strategies and initiatives that address factors impacting the industry, including inflation and other economic conditions, to enhance the performance of our existing investment portfolio.

•Deploy Strategic Capital Expenditures. We will continue to invest capital into our investments in order to maintain market position, functional and operating standards, and improve occupancy and resident rates, in an effort to enhance the overall value of our assets.

•Pursue Dispositions and Opportunities for Asset Repositioning to Maximize Value. We will actively pursue dispositions of assets and portfolios where we believe the disposition will achieve a desired return and generate value for shareholders. Additionally, we will continue to assess the need for strategic repositioning of assets, joint ventures, operators and markets to position our portfolio for optimal performance.

Our Investments

Our investments are categorized as follows:

•Direct Investments - Operating - Properties operated pursuant to management agreements with managers, in which we own a controlling interest.

•Direct Investments - Net Lease - Properties operated under net leases with an operator, in which we own a controlling interest.

•Unconsolidated Investments - Joint ventures, which include properties operated under net leases with an operator or pursuant to management agreements with managers, in which we own a minority, non-controlling interest.

Our direct investments are in seniors housing facilities, which includes ILFs, ALFs, and MCFs, as described in further detail below. Revenues generated by seniors housing facilities typically come from private pay sources, including private insurance, and to a much lesser extent government reimbursement programs, such as Medicaid.

•Independent living facilities. ILFs are properties with central dining facilities that provide services that include security, housekeeping, nutrition and limited laundry services. ILFs are designed specifically for independent seniors who are able to live on their own, but desire the security and conveniences of community living. ILFs typically offer several services covered under a regular monthly fee.

•Assisted living facilities. ALFs provide services that include minimal assistance for activities in daily living and permit residents to maintain some of their privacy and independence as they do not require constant supervision and assistance. Services may be bundled within one monthly fee or based on the care needs of the resident and usually include three meals per day in a central dining room, daily housekeeping, laundry, medical reminders and 24-hour availability of assistance with the activities of daily living, such as eating, dressing and bathing. ALFs typically are comprised of studios, one and two bedroom suites equipped with private bathrooms and efficiency kitchens.

•Memory care facilities. MCFs offer specialized options for seniors with Alzheimer’s disease and other forms of dementia. These facilities offer dedicated care and specialized programming for various conditions relating to memory loss in a secured environment. Residents require a higher level of care and more assistance with activities of daily living than in ALFs. Therefore, these facilities have staff available 24 hours a day to respond to the unique needs of their residents.

Through our unconsolidated investments, we have additional investments in seniors housing facilities, as well as in additional types of healthcare real estate, including the following:

•Continuing care retirement communities. CCRCs provide, as a continuum of care, the services described for ILFs, ALFs and SNFs in an integrated campus.

•Skilled Nursing Facilities. SNFs provide services that include daily nursing, therapeutic rehabilitation, social services, housekeeping, nutrition and administrative services for individuals requiring certain assistance for activities in daily living. A typical SNF includes mostly one and two bed units, each equipped with a private or shared bathroom and community dining facilities. Revenues generated from SNFs typically come from government reimbursement programs, including Medicare and Medicaid, as well as private pay sources, including private insurance.

•Care Homes. Care homes are daily rate or rental properties in the United Kingdom that may provide residential, nursing and/or dementia care. Revenues generated from care homes typically come from private pay sources, as well as government reimbursement.

•Medical Office Buildings. MOBs are typically either single-tenant properties associated with a specialty group or multi-tenant properties leased to several unrelated medical practices. Tenants include physicians, dentists, psychologists, therapists and other healthcare providers, who require space devoted to patient examination and treatment, diagnostic imaging, outpatient surgery and other outpatient services. MOBs are similar to commercial office buildings, although they require greater plumbing, electrical and mechanical systems to accommodate physicians’ requirements such as sinks in every room, brighter lights and specialized medical equipment.

•Specialty Hospitals. Services provided by operators and tenants in hospitals are paid for by private sources, third-party payers (e.g., insurance and Health Maintenance Organizations), or through the Medicare and Medicaid programs. Our hospital properties typically will include long-term acute care, specialty and rehabilitation hospitals and generally are leased to operators under triple-net lease structures.

For financial information regarding our reportable segments, refer to Note 11, “Segment Reporting” in our accompanying consolidated financial statements included in Part II, Item 8. “Financial Statements and Supplementary Data.”

The following table presents a summary of investments as of December 31, 2022 (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Properties(1) | | | | |

| Investment Type / Portfolio | | Amount(2) | | Seniors Housing | | MOB | | SNF | | Hospitals | | Total | | Primary Locations | | Ownership

Interest |

| Direct Investments - Operating | | | | | | | | | | | | | | | | |

| Winterfell | | $ | 711,505 | | | 32 | | — | | — | | — | | 32 | | 12 U.S. States | | 100.0% |

| Rochester | | 186,277 | | | 10 | | — | | — | | — | | 10 | | New York | | 97.0% |

| Avamere | | 93,474 | | | 5 | | — | | — | | — | | 5 | | Washington/Oregon | | 100.0% |

| Aqua | | 82,769 | | | 4 | | — | | — | | — | | 4 | | Texas/Ohio | | 97.0% |

| Oak Cottage | | 18,613 | | | 1 | | — | | — | | — | | 1 | | California | | 100.0% |

| | | | | | | | | | | | | | | | |

| Subtotal | | $ | 1,092,638 | | | 52 | | — | | — | | — | | 52 | | | | |

| | | | | | | | | | | | | | | | |

Direct Investments -

Net Lease | | | | | | | | | | | | | | | | |

| Arbors | | $ | 103,915 | | | 4 | | — | | — | | — | | 4 | | New York | | 100.0% |

| Total Direct Investments | | $ | 1,196,553 | | | 56 | | — | | — | | — | | 56 | | | | |

| | | | | | | | | | | | | | | | |

| Unconsolidated Investments | | | | | | | | | | | | | | | | |

Trilogy(3) | | $ | 128,884 | | | 23 | | — | | 75 | | — | | 98 | | 4 U.S. States | | 23.2% |

Diversified US/UK(4) | | 28,442 | | | 95 | | 106 | | 39 | | 9 | | 249 | | 17 U.S. States & U.K. | | 14.3% |

| Eclipse | | 834 | | | 35 | | — | | 9 | | — | | 44 | | 10 U.S. States | | 5.6% |

| Espresso | | 18,019 | | | 1 | | — | | 32 | | — | | 33 | | Ohio/Michigan | | 36.7% |

| Subtotal | | $ | 176,179 | | | 154 | | 106 | | 155 | | 9 | | 424 | | | | |

Solstice(5) | | 323 | | | — | | — | | — | | — | | — | | | | 20.0% |

| Total Unconsolidated Investments | | $ | 176,502 | | | 154 | | 106 | | 155 | | 9 | | 424 | | | | |

| | | | | | | | | | | | | | | | |

| Total Investments | | $ | 1,373,055 | | | 210 | | 106 | | 155 | | 9 | | 480 | | | | |

_______________________________________

(1)Classification based on predominant services provided, but may include other services.

(2)For direct investments, amount represents operating real estate, before accumulated depreciation as presented in our consolidated financial statements as of December 31, 2022. For unconsolidated investments, amount represents the carrying value of our investments in unconsolidated ventures as presented in our consolidated financial statements as of December 31, 2022. For additional information, refer to “Note 3, Operating Real Estate” and “Note 4, Investments in Unconsolidated Ventures” of Part II, Item 8. “Financial Statements and Supplementary Data.”

(3)Includes institutional pharmacy, therapy businesses and lease purchase buy-out options, which are not subject to property count.

(4)Refer to “—Business Update” for additional information on recent transactions.

(5)Represents our investment in Solstice Senior Living, LLC, or Solstice, the manager of the Winterfell portfolio. Solstice is a joint venture between affiliates of Integral Senior Living, LLC, or ISL, a management company of ILF, ALF and MCF founded in 2000, which owns 80.0%, and us, who owns 20.0%.

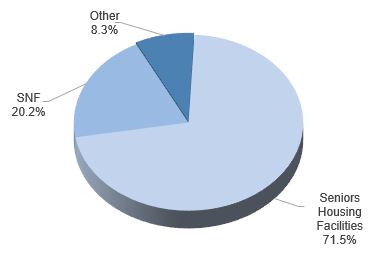

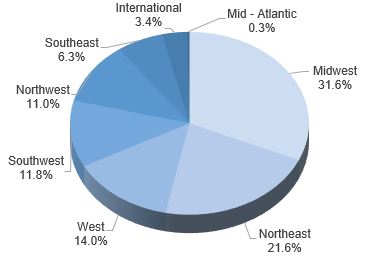

The following presents the properties of our direct and unconsolidated investments by property type and geographic location based on our proportionate share of cost as of December 31, 2022:

| | | | | | | | |

Real Estate Equity by Property Type(1) | | Real Estate Equity by Geographic Location |

| | |

_______________________________________

(1)Classification based on predominant services provided, but may include other services.

The following table presents the operators and managers of our direct investments (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, 2022 | | Year Ended December 31, 2022 |

| Operator / Manager | | Properties Under Management | | Units Under Management(1) | | Property and Other Revenues(2) | | % of Total Property and Other Revenues |

Solstice Senior Living(3) | | 32 | | | 3,993 | | | $ | 112,553 | | | 60.8 | % |

| Watermark Retirement Communities | | 14 | | | 1,782 | | | 45,276 | | | 24.3 | % |

| Avamere Health Services | | 5 | | | 453 | | | 19,778 | | | 10.7 | % |

| Integral Senior Living | | 1 | | | 40 | | | 4,913 | | | 2.7 | % |

Arcadia Management(4) | | 4 | | | 572 | | | 1,597 | | | 0.9 | % |

Other(5) | | — | | | — | | | 1,019 | | | 0.6 | % |

| Total | | 56 | | | 6,840 | | | $ | 185,136 | | | 100.0 | % |

_______________________________________

(1)Represents rooms for ALFs, ILFs and MCFs, based on predominant type.

(2)Includes rental income received from our net lease properties as well as rental income, ancillary service fees and other related revenue earned from ILF residents and resident fee income derived from our ALFs and MCFs, which includes resident room and care charges, ancillary fees and other resident service charges.

(3)Solstice is a joint venture of which affiliates of ISL own 80%.

(4)During the year ended December 31, 2022, we recorded rental income to the extent rental payments were received.

(5)Consists primarily of interest income earned on corporate-level cash accounts.

Direct Investments - Operating

We generate revenues from resident fees and rental income through our operating properties. Resident fee income is recorded by our ALFs and MCFs when services are rendered and includes resident room and care charges and other resident charges and rental income is generated from our ILFs.

Our operating properties allow us to participate in the risks and rewards of the operations of the facilities, as compared to receiving only contractual rent under a net lease. We engage independent managers to operate these facilities pursuant to management agreements, including procuring supplies, hiring and training all employees, entering into all third-party contracts for the benefit of the property, including resident/patient agreements, complying with laws and regulations, including but not limited to healthcare laws, and providing resident care and services, in exchange for a management fee. As a result, we must rely on our managers’ personnel, expertise, technical resources and information systems, risk management processes, proprietary information, good faith and judgment to manage our operating properties efficiently and effectively. We also rely on our managers to set appropriate resident fees, to provide accurate property-level financial results in a timely manner and otherwise

operate our seniors housing facilities in compliance with the terms of our management agreements and all applicable laws and regulations.

Our management agreements generally provide for monthly management fees which are calculated based on various performance measures, including revenue, net operating income and other objective financial metrics. We are also required to reimburse our managers for expenses incurred in the operation of the properties, as well as to indemnify our managers in connection with potential claims and liabilities arising out of the operation of the properties. Our management agreements are terminable after a stated term with certain renewal rights, though we have the ability to terminate earlier upon certain events with or without the payment of a fee.

Watermark Retirement Communities and Solstice, together with their affiliates, manage substantially all of our operating properties. As of December 31, 2022, Watermark and Solstice or their respective affiliates collectively managed 46 of our seniors housing facilities pursuant to management agreements. For the year ended December 31, 2022, properties managed by Watermark and Solstice represented 24.6% and 61.1% of our total property and other revenues, respectively, and 22.4% and 59.5% of our operating real estate, respectively. Through our 20.0% ownership of Solstice, we are entitled to certain rights and minority protections. The following table presents a summary of the terms of the Watermark and Solstice management agreements:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Manager | | Portfolio | | Properties | | Expiration Date | | Management Fees |

| Solstice Senior Living | | Winterfell | | 32 | | | October 2025 | | •5% of monthly gross revenues, subject to certain exclusions •7% of actual costs of certain capital projects •Additional fees if net operating income exceeds annual target •Additional fees if net operating income long-term growth is achieved |

Watermark Retirement Communities(1) | | Aqua | | 2 | | | December 2023 | | •5% of monthly gross revenues, subject to certain exclusions •Eligible for promote in connection with disposition |

| Aqua | | 2 | | | February 2024 | |

| Rochester | | 10 | | | August 2023 | |

| | | | | | | | |

| | | | | | | | |

_______________________________________

(1)Affiliates of Watermark also own a 3% non-controlling interest in the Rochester and Aqua portfolios, which may impact various rights and economics under the management agreements.

Direct Investments - Net Lease

We generate revenues from rental income from net leases to operators through our net lease properties. A net lease will typically provide for fixed rental payments, subject to periodic increases based on certain percentages or the consumer price index, and obligate the operator to pay all property-related expenses, including maintenance, utilities, repairs, taxes, insurance and capital expenditures.

As of December 31, 2022, we had four ALF properties operated by Arcadia Management under net leases. These leases obligate Arcadia to pay a fixed rental amount and pay all property-level expenses, with a lease term that expires in August 2029. However, Arcadia has been unable to satisfy its obligations under its leases since February 2021, and instead remits rent and pays property-level expenses based on its available cash. We are in discussions with Arcadia regarding the rent shortfalls and resulting defaults under the leases. However, we expect the rent shortfalls to continue in the near-term, in varying amounts based on the property’s performance, and may also directly incur operating expenses to the extent Arcadia is unable to generate sufficient cash flow.

Unconsolidated Investments

The following table presents our unconsolidated investments (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Properties as of December 31, 2022 |

| Portfolio | | Partner | | Acquisition Date | | Ownership | | Amount(1) | | Seniors Housing Facilities | | MOB | | SNF | | Hospitals | | Total |

| Trilogy | | American Healthcare REIT / Management Team of Trilogy Investors, LLC | | Dec-2015 | | 23.2 | % | | $ | 128,884 | | | 23 | | | — | | | 75 | | | — | | | 98 | |

Diversified US/UK (2) | | NRF and Partner | | Dec-2014 | | 14.3 | % | | 28,442 | | | 95 | | | 106 | | | 39 | | | 9 | | | 249 | |

| Eclipse | | NRF and Partner/

Formation Capital, LLC | | May-2014 | | 5.6 | % | | 834 | | | 35 | | | — | | | 9 | | | — | | | 44 | |

| Espresso | | Formation Capital, LLC/Safanad Management Limited | | Jul-2015 | | 36.7 | % | | 18,019 | | | 1 | | | — | | | 32 | | | — | | | 33 | |

| Subtotal | | | | | | | | $ | 176,179 | | | 154 | | | 106 | | | 155 | | | 9 | | | 424 | |

| Solstice | | | | Jul-2017 | | 20.0 | % | | 323 | | | — | | | — | | | — | | | — | | | — | |

| Total | | | | | | | | $ | 176,502 | | | 154 | | | 106 | | | 155 | | | 9 | | | 424 | |

_______________________________________

(1)Represents the carrying value of our investments in unconsolidated ventures as presented in our consolidated financial statements as of December 31, 2022. For additional information, refer to “Note 4, Investments in Unconsolidated Ventures” of Part II, Item 8. “Financial Statements and Supplementary Data.”

(2)Refer to “—Business Update” for additional information on recent transactions.

We report our proportionate interest of revenues and expenses from unconsolidated joint ventures through equity in earnings (losses) of unconsolidated ventures on our consolidated statements of operations. Our unconsolidated investment portfolios are as follows:

•Diversified US/UK. Consists of three sub-portfolios: a portfolio of 15 MOBs, or the MOB Sub-Portfolio, a diversified portfolio of 91 MOBs, 47 seniors housing facilities, including ALFs, MCFs and CCRCs, 39 SNFs and nine specialty hospitals, or the Mixed U.S. Sub-Portfolio, and 48 care homes located in the United Kingdom operated under a net lease, or the U.K. Sub-Portfolio. The Former Sponsor and other minority partners own the remaining 85.7% of this portfolio.

•Trilogy. Portfolio of predominantly SNFs, as well as ALFs, ILFs, MCFs, and CCRCs located in the Midwest and operated pursuant to management agreements with Trilogy Health Services. The portfolio includes ancillary services businesses, including a therapy business and a pharmacy business. American Healthcare REIT, Inc., or AHR, and management of Trilogy own the remaining 76.8% of this portfolio.

•Eclipse. Portfolio of SNFs, ALFs, MCFs, and ILFs located in 10 U.S. States, and leased to, or managed by, five different operators/managers. The Former Sponsor and other minority partners and Formation Capital, LLC, or Formation, own 86.4% and 8.0% of this portfolio, respectively.

•Espresso. The joint venture is actively conducting the sales process for its remaining net lease portfolio of 32 SNFs and one ALF located in Ohio and Michigan. An affiliate of Formation acts as the general partner and manager of this investment. Formation and Safanad Management Limited own the remaining 63.3% of this portfolio.

•Solstice. Operator platform joint venture established to manage the operations of the Winterfell portfolio. An affiliate of ISL owns the remaining 80.0%.

Human Capital

On October 21, 2022, as a result of completing the Internalization, we became a self-managed REIT. Prior to the Internalization, we had no employees and were externally managed by the Former Advisor or its affiliates, who provided management, acquisition, advisory, marketing, investor relations and certain administrative services for us. As of December 31, 2022, we had eight full-time employees.

The decision to internalize, and to be able to employ directly the personnel that advance the Company’s strategic objectives, was a turning point for the Company. We believe our employees are critical to our success. All of our employees are provided with a comprehensive benefits and wellness package, which may include medical, dental and vision insurance, life insurance, 401(k) matching, long-term incentive plans, among other things. In connection with the Internalization, we worked with a compensation consultant to evaluate and benchmark the competitiveness of our compensation programs focused on pay practices that reward performance and support the needs of the Company. Our executive management team oversees our human capital resources and employment practices to ensure that an asset as important as our employees is strategically integrated with our goals and business plan as a healthcare REIT.

We are also committed to providing a safe and healthy workplace. We continuously strive to meet or exceed compliance with all laws, regulations and accepted practices pertaining to workplace safety.

We utilize a professional employer organization, or PEO, who is the employer of record of our employees and administers our benefits, payroll, and other human resource management services.

Portfolio Management

The portfolio management process for our investments includes oversight by our executive and asset management teams, regular management meetings and an operating results review process. These processes are designed to evaluate and proactively identify asset-specific issues and trends on a portfolio-wide, sub-portfolio or asset type basis. The teams work in conjunction with our managers and operators to create tailored action plans to address issues identified.

Our executive and asset management teams are experienced and use many methods to actively manage our investments to enhance or preserve our income, value and capital and mitigate risk. Our teams seek to identify opportunities for our investments that may involve replacing or renovating facilities in our portfolio which, in turn, would allow us to improve occupancy and resident rates and enhance the overall value of our assets. To manage risk, our teams engage in frequent review and dialogue with operators/managers/third party advisors and periodic inspections of our owned properties. In addition, our teams consider the impact of regulatory changes on the performance of our portfolio.

Our teams will continue to monitor the performance of, and actively manage, all of our investments. However, there can be no assurance that our investments will continue to perform in accordance with our expectations.

Profitability and Performance Metrics

We calculate Funds from Operations, or FFO, and Modified Funds from Operations, or MFFO (see “Non-GAAP Financial Measures—Funds from Operations and Modified Funds from Operations” for a description of these metrics) to evaluate the profitability and performance of our business.

Seasonality

Our revenues, and our operators’ revenues, are dependent on occupancy and may fluctuate based on seasonal trends. It is difficult to predict the magnitude of seasonal trends and the related potential impact of the cold and flu season, occurrence of epidemics or any other widespread illnesses on the occupancy of our facilities. A decrease in occupancy could affect our operating income.

Competition

Our investments will experience local and regional market competition for residents, operators and staff. Competition will be based on quality of care, reputation, physical appearance of properties, services offered, family preference, physicians, staff and price. Competition will come from independent operators as well as companies managing multiple properties, some of which may be larger and have greater resources than our operators. Some of these properties are operated for profit while others are owned by governmental agencies or tax-exempt, non-profit organizations. Competitive disadvantages may result in vacancies at facilities, reductions in net operating income and ultimately a reduction in shareholder value.

Inflation

Macroeconomic trends such as increases in inflation and rising interest rates can have a substantial impact on our business and financial results. Many of our costs are subject to inflationary pressures. These include labor, repairs and maintenance, food costs, utilities, insurance and other operating costs. Our managers’ ability to offset increased costs by increasing the rates charged to residents may be limited and cost inflation may therefore substantially affect the net operating income of our operating properties as well as the ability of our net lease operator to make payments to us.

Refer to Item 7A. “Quantitative and Qualitative Disclosures About Market Risk” for additional details.

Regulation

We are subject, in certain circumstances, to supervision and regulation by state and federal governmental authorities and are subject to various laws and judicial and administrative decisions imposing various requirements and restrictions, which, among other things:

•require compliance with applicable REIT rules;

•regulate healthcare operators with respect to licensure, certification for participation in government programs and relationships with patients, physicians, tenants and other referral sources;

•regulate occupational health and safety;

•regulate removal or remediation of hazardous or toxic substances;

•regulate land use and zoning;

•regulate removal of barriers to access by persons with disabilities and other public accommodations;

•regulate tax treatment and accounting standards; and

•regulate use of derivative instruments and our ability to hedge our risks related to fluctuations in interest rates and exchange rates.

Tax Regulation

We elected to be taxed as a REIT under the Internal Revenue Code, commencing with our taxable year ended December 31, 2013. If we maintain our qualification as a REIT for federal income tax purposes, we will generally not be subject to federal income tax on our taxable income that we distribute as dividends to our stockholders. If we fail to maintain our qualification as a REIT in any taxable year after electing REIT status, we will be subject to federal income tax on our taxable income at regular corporate income tax rates and will generally not be permitted to qualify for treatment as a REIT for federal income tax purposes for four years following the year in which our qualification is denied. Such an event could materially and adversely affect our net income. However, we believe that we are organized and operate in a manner that enables us to qualify for treatment as a REIT for federal income tax purposes and we intend to continue to operate so as to remain qualified as a REIT for federal income tax purposes. In addition, we operate certain healthcare properties through structures permitted under the REIT Investment Diversification and Empowerment Act of 2007, which permit the Company, through taxable REIT subsidiaries, or TRSs, to have direct exposure to resident fee income and incur related operating expenses.

U.S. Healthcare Regulation

Overview

ALFs, ILFs, MCFs, hospitals, SNFs and other healthcare providers that operate properties in our portfolio are subject to extensive and complex federal, state and local laws, regulations and industry standards governing their operations. Although the properties within our portfolio may be subject to varying levels of governmental scrutiny, we expect that the healthcare industry, in general, will continue to face increased regulation and pressure. Changes in laws, regulations, reimbursement and enforcement activity can all have a significant effect on our operations and financial condition, as set forth below and under Item 1A. “Risk Factors.”

Fraud and Abuse Enforcement

Healthcare providers are subject to federal and state laws and regulations that govern their operations, including those that require providers to furnish only medically necessary services and submit to third-party payors valid and accurate statements for each service, as well as kickback laws, self-referral laws and false claims laws. In particular, enforcement of the federal False Claims Act has resulted in increased enforcement activity for healthcare providers and can involve significant monetary damages

and awards to private plaintiffs who successfully bring “whistleblower” lawsuits. Sanctions for violations of these laws, regulations and other applicable guidance may include, but are not limited to, loss of licensure, loss of certification or accreditation, denial of reimbursement, imposition of civil and criminal penalties and fines, suspension or exclusion from federal and state healthcare programs or closure of the facility.

Reimbursements

Sources of revenues for our seniors housing properties are primarily private payors, including private insurers and self-pay patients, and payments from state Medicaid programs. By contrast, the skilled nursing facilities and hospitals within our unconsolidated investments receive the majority of their revenues from the Medicare and Medicaid programs, with the balance representing payments from private payors. Medicare is a federal health insurance program for persons aged 65 and over, some disabled persons and persons with end-stage renal disease. Medicaid is a medical assistance program for eligible needy persons that is funded jointly by federal and state governments and administered by the states. Medicaid eligibility requirements and benefits vary by state. The Medicare and Medicaid programs are highly regulated and subject to frequent and substantial changes resulting from legislation, regulations and administrative and judicial interpretations of existing law.