nshi-20200930NorthStar Healthcare Income, Inc.0001503707Yes12/31Non-accelerated Filer190,153,995false10-Q9/30/20202020Q3falsefalsefalseTrueFalse0.010.0150,000,00050,000,00000000.010.01400,000,000400,000,000190,020,662189,111,561190,020,662189,111,56130509155142.923.042.682.342.900.125000000000015037072020-01-012020-09-30xbrli:shares00015037072020-11-12iso4217:USD00015037072020-09-3000015037072019-12-31xbrli:pure0001503707nshi:NorthstarHealthcareIncomeOperatingPartnershipLPMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2020-01-012020-09-300001503707nshi:NorthstarHealthcareIncomeOperatingPartnershipLPMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2020-09-30iso4217:USDxbrli:shares00015037072020-07-012020-09-3000015037072019-07-012019-09-3000015037072019-01-012019-09-300001503707us-gaap:CommonStockMember2018-12-310001503707us-gaap:AdditionalPaidInCapitalMember2018-12-310001503707us-gaap:RetainedEarningsMember2018-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001503707us-gaap:ParentMember2018-12-310001503707us-gaap:NoncontrollingInterestMember2018-12-3100015037072018-12-310001503707us-gaap:CommonStockMember2019-01-012019-03-310001503707us-gaap:AdditionalPaidInCapitalMember2019-01-012019-03-310001503707us-gaap:ParentMember2019-01-012019-03-3100015037072019-01-012019-03-310001503707us-gaap:NoncontrollingInterestMember2019-01-012019-03-310001503707us-gaap:RetainedEarningsMember2019-01-012019-03-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-03-310001503707us-gaap:CommonStockMember2019-03-310001503707us-gaap:AdditionalPaidInCapitalMember2019-03-310001503707us-gaap:RetainedEarningsMember2019-03-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-03-310001503707us-gaap:ParentMember2019-03-310001503707us-gaap:NoncontrollingInterestMember2019-03-3100015037072019-03-310001503707us-gaap:CommonStockMember2019-04-012019-06-300001503707us-gaap:AdditionalPaidInCapitalMember2019-04-012019-06-300001503707us-gaap:ParentMember2019-04-012019-06-3000015037072019-04-012019-06-300001503707us-gaap:NoncontrollingInterestMember2019-04-012019-06-300001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-04-012019-06-300001503707us-gaap:RetainedEarningsMember2019-04-012019-06-300001503707us-gaap:CommonStockMember2019-06-300001503707us-gaap:AdditionalPaidInCapitalMember2019-06-300001503707us-gaap:RetainedEarningsMember2019-06-300001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-06-300001503707us-gaap:ParentMember2019-06-300001503707us-gaap:NoncontrollingInterestMember2019-06-3000015037072019-06-300001503707us-gaap:CommonStockMember2019-07-012019-09-300001503707us-gaap:AdditionalPaidInCapitalMember2019-07-012019-09-300001503707us-gaap:ParentMember2019-07-012019-09-300001503707us-gaap:NoncontrollingInterestMember2019-07-012019-09-300001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-07-012019-09-300001503707us-gaap:RetainedEarningsMember2019-07-012019-09-300001503707us-gaap:CommonStockMember2019-09-300001503707us-gaap:AdditionalPaidInCapitalMember2019-09-300001503707us-gaap:RetainedEarningsMember2019-09-300001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-09-300001503707us-gaap:ParentMember2019-09-300001503707us-gaap:NoncontrollingInterestMember2019-09-3000015037072019-09-300001503707us-gaap:CommonStockMember2019-12-310001503707us-gaap:AdditionalPaidInCapitalMember2019-12-310001503707us-gaap:RetainedEarningsMember2019-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001503707us-gaap:ParentMember2019-12-310001503707us-gaap:NoncontrollingInterestMember2019-12-310001503707us-gaap:CommonStockMember2020-01-012020-03-310001503707us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310001503707us-gaap:ParentMember2020-01-012020-03-3100015037072020-01-012020-03-310001503707us-gaap:NoncontrollingInterestMember2020-01-012020-03-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001503707us-gaap:RetainedEarningsMember2020-01-012020-03-310001503707us-gaap:CommonStockMember2020-03-310001503707us-gaap:AdditionalPaidInCapitalMember2020-03-310001503707us-gaap:RetainedEarningsMember2020-03-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001503707us-gaap:ParentMember2020-03-310001503707us-gaap:NoncontrollingInterestMember2020-03-3100015037072020-03-310001503707us-gaap:CommonStockMember2020-04-012020-06-300001503707us-gaap:AdditionalPaidInCapitalMember2020-04-012020-06-300001503707us-gaap:ParentMember2020-04-012020-06-3000015037072020-04-012020-06-300001503707us-gaap:NoncontrollingInterestMember2020-04-012020-06-300001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012020-06-300001503707us-gaap:RetainedEarningsMember2020-04-012020-06-300001503707us-gaap:CommonStockMember2020-06-300001503707us-gaap:AdditionalPaidInCapitalMember2020-06-300001503707us-gaap:RetainedEarningsMember2020-06-300001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300001503707us-gaap:ParentMember2020-06-300001503707us-gaap:NoncontrollingInterestMember2020-06-3000015037072020-06-300001503707us-gaap:CommonStockMember2020-07-012020-09-300001503707us-gaap:AdditionalPaidInCapitalMember2020-07-012020-09-300001503707us-gaap:ParentMember2020-07-012020-09-300001503707us-gaap:NoncontrollingInterestMember2020-07-012020-09-300001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-07-012020-09-300001503707us-gaap:RetainedEarningsMember2020-07-012020-09-300001503707us-gaap:CommonStockMember2020-09-300001503707us-gaap:AdditionalPaidInCapitalMember2020-09-300001503707us-gaap:RetainedEarningsMember2020-09-300001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-300001503707us-gaap:ParentMember2020-09-300001503707us-gaap:NoncontrollingInterestMember2020-09-300001503707nshi:AdvisoroftheRegistrantMember2020-01-012020-09-300001503707nshi:SpecialUnitsHolderMember2020-01-012020-09-300001503707us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2020-01-012020-09-3000015037072015-02-022015-02-020001503707nshi:DividendReinvestmentPlanMember2015-02-022015-02-0200015037072016-01-192016-01-190001503707nshi:FollowonPrimaryOfferingMember2016-01-192016-01-190001503707nshi:DividendReinvestmentPlanMember2016-01-192016-01-190001503707nshi:DividendReinvestmentPlanMember2015-12-3100015037072015-02-022020-09-300001503707nshi:DividendReinvestmentPlanMember2015-02-022020-09-30nshi:employee0001503707nshi:OperatingRealEstateNetMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2020-09-300001503707us-gaap:VariableInterestEntityPrimaryBeneficiaryMembernshi:MortgageNotesPayableMember2020-09-300001503707us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2020-09-30nshi:property0001503707nshi:PeregrinePortfolioMember2019-01-012019-12-310001503707nshi:MeasurementInputTerminalCapitalizationRateMembersrt:MinimumMemberus-gaap:ValuationTechniqueDiscountedCashFlowMember2020-09-300001503707nshi:MeasurementInputTerminalCapitalizationRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MaximumMember2020-09-300001503707us-gaap:MeasurementInputDiscountRateMembersrt:MinimumMemberus-gaap:ValuationTechniqueDiscountedCashFlowMember2020-09-300001503707us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MaximumMember2020-09-300001503707us-gaap:LeasesAcquiredInPlaceMember2020-09-300001503707nshi:RegulatoryReserveDepositMember2020-09-30utr:D0001503707nshi:WinterfellPortfolioMember2020-01-012020-09-30nshi:facility0001503707nshi:WinterfellPortfolioMember2020-09-300001503707nshi:AquaPortfolioMember2020-01-012020-09-300001503707nshi:PeregrinePortfolioMember2020-01-012020-09-300001503707nshi:GriffinAmericanJointVentureMember2020-01-012020-09-300001503707nshi:EclipseJointVentureMember2020-01-012020-09-300001503707nshi:TheTrilogyJointVentureMember2020-01-012020-09-300001503707srt:MinimumMemberus-gaap:BuildingMember2020-01-012020-09-300001503707us-gaap:BuildingMembersrt:MaximumMember2020-01-012020-09-300001503707us-gaap:LandImprovementsMembersrt:MinimumMember2020-01-012020-09-300001503707us-gaap:LandImprovementsMembersrt:MaximumMember2020-01-012020-09-300001503707srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2020-01-012020-09-300001503707us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2020-01-012020-09-300001503707us-gaap:BuildingAndBuildingImprovementsMember2020-09-300001503707us-gaap:BuildingAndBuildingImprovementsMember2019-12-310001503707nshi:EclipseJointVentureMember2020-09-300001503707nshi:EclipseJointVentureMember2019-12-310001503707nshi:EnvoyJointVentureMember2020-09-300001503707nshi:EnvoyJointVentureMember2019-12-310001503707nshi:GriffinAmericanJointVentureMember2020-09-300001503707nshi:GriffinAmericanJointVentureMember2019-12-310001503707nshi:EspressoJointVentureMember2020-09-300001503707nshi:EspressoJointVentureMember2019-12-310001503707nshi:TheTrilogyJointVentureMember2020-09-300001503707nshi:TheTrilogyJointVentureMember2019-12-310001503707nshi:EclipseEnvoyGriffinAmericanEspressoTrilogyMember2020-09-300001503707nshi:EclipseEnvoyGriffinAmericanEspressoTrilogyMember2019-12-310001503707nshi:OperatorPlatformMember2020-09-300001503707nshi:OperatorPlatformMember2019-12-3100015037072019-03-012019-03-310001503707nshi:EspressoJointVentureMembernshi:MezzanineLoansMember2018-12-310001503707nshi:TheTrilogyJointVentureMember2018-10-310001503707nshi:TheTrilogyJointVentureMember2018-10-012018-10-310001503707nshi:TheTrilogyJointVentureMember2018-10-300001503707nshi:WinterfellPortfolioMembernshi:SolsticeSeniorLivingLLCMember2020-09-300001503707nshi:WinterfellPortfolioMember2020-09-300001503707nshi:EclipseJointVentureMember2020-07-012020-09-300001503707nshi:EclipseJointVentureMember2019-07-012019-09-300001503707nshi:EnvoyJointVentureMember2020-07-012020-09-300001503707nshi:EnvoyJointVentureMember2019-07-012019-09-300001503707nshi:GriffinAmericanJointVentureMember2020-07-012020-09-300001503707nshi:GriffinAmericanJointVentureMember2019-07-012019-09-300001503707nshi:EspressoJointVentureMember2020-07-012020-09-300001503707nshi:EspressoJointVentureMember2019-07-012019-09-300001503707nshi:TheTrilogyJointVentureMember2020-07-012020-09-300001503707nshi:TheTrilogyJointVentureMember2019-07-012019-09-300001503707nshi:EclipseEnvoyGriffinAmericanEspressoTrilogyMember2020-07-012020-09-300001503707nshi:EclipseEnvoyGriffinAmericanEspressoTrilogyMember2019-07-012019-09-300001503707nshi:OperatorPlatformMember2020-07-012020-09-300001503707nshi:OperatorPlatformMember2019-07-012019-09-300001503707nshi:SolsticeSeniorLivingLLCMember2020-07-012020-09-300001503707nshi:EclipseJointVentureMember2020-01-012020-09-300001503707nshi:EclipseJointVentureMember2019-01-012019-09-300001503707nshi:EnvoyJointVentureMember2020-01-012020-09-300001503707nshi:EnvoyJointVentureMember2019-01-012019-09-300001503707nshi:GriffinAmericanJointVentureMember2020-01-012020-09-300001503707nshi:GriffinAmericanJointVentureMember2019-01-012019-09-300001503707nshi:EspressoJointVentureMember2020-01-012020-09-300001503707nshi:EspressoJointVentureMember2019-01-012019-09-300001503707nshi:TheTrilogyJointVentureMember2020-01-012020-09-300001503707nshi:TheTrilogyJointVentureMember2019-01-012019-09-300001503707nshi:EclipseEnvoyGriffinAmericanEspressoTrilogyMember2020-01-012020-09-300001503707nshi:EclipseEnvoyGriffinAmericanEspressoTrilogyMember2019-01-012019-09-300001503707nshi:OperatorPlatformMember2020-01-012020-09-300001503707nshi:OperatorPlatformMember2019-01-012019-09-300001503707nshi:TheTrilogyJointVentureMember2020-01-012020-09-300001503707us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2020-09-300001503707us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2019-12-310001503707us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2020-01-012020-09-300001503707us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2019-01-012019-09-300001503707us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2020-07-012020-09-300001503707us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2019-07-012019-09-30nshi:Investment0001503707nshi:MezzanineLoansMember2020-01-012020-09-300001503707nshi:EspressoJointVentureMembernshi:MezzanineLoansMember2020-09-300001503707nshi:EspressoJointVentureMembernshi:MezzanineLoansMember2019-12-310001503707nshi:EspressoJointVentureMembernshi:MezzanineLoansMembersrt:WeightedAverageMember2020-01-012020-09-300001503707nshi:EspressoJointVentureMembernshi:MezzanineLoansMembersrt:WeightedAverageMember2020-09-300001503707nshi:DenverCOMembernshi:DenverCONonrecourseMemberus-gaap:MortgagesMember2020-09-300001503707nshi:DenverCOMembernshi:DenverCONonrecourseMemberus-gaap:MortgagesMember2019-12-310001503707nshi:FriscoTXNonrecourseMemberus-gaap:MortgagesMembernshi:FriscoMember2020-09-300001503707nshi:FriscoTXNonrecourseMemberus-gaap:MortgagesMembernshi:FriscoMember2019-12-310001503707nshi:MilfordOHMembernshi:MilfordOHNonrecourseMemberus-gaap:MortgagesMember2020-09-300001503707nshi:MilfordOHMembernshi:MilfordOHNonrecourseMemberus-gaap:MortgagesMember2019-12-310001503707nshi:RochesterNYNonrecourseFebruary2025Memberus-gaap:MortgagesMembernshi:RochesterNYMember2020-09-300001503707nshi:RochesterNYNonrecourseFebruary2025Memberus-gaap:MortgagesMembernshi:RochesterNYMember2019-12-310001503707nshi:RochesterNYNonrecourseAugust2027Memberus-gaap:MortgagesMembernshi:RochesterNYMember2020-09-300001503707nshi:RochesterNYNonrecourseAugust2027Memberus-gaap:MortgagesMembernshi:RochesterNYMember2019-12-310001503707nshi:RochesterPortfolioMemberus-gaap:MortgagesMembernshi:RochesterNYNonrecourseAugust2021Member2020-09-300001503707nshi:RochesterPortfolioMemberus-gaap:MortgagesMembernshi:RochesterNYNonrecourseAugust2021Member2019-12-310001503707us-gaap:NonrecourseMembernshi:ArborsPortfolioMemberus-gaap:MortgagesMember2020-09-300001503707us-gaap:NonrecourseMembernshi:ArborsPortfolioMemberus-gaap:MortgagesMember2019-12-310001503707us-gaap:NonrecourseMembernshi:WatermarkFountainsPortfolioMemberus-gaap:MortgagesMember2020-09-300001503707us-gaap:NonrecourseMembernshi:WatermarkFountainsPortfolioMemberus-gaap:MortgagesMember2019-12-310001503707us-gaap:NonrecourseMemberus-gaap:MortgagesMembernshi:WatermarkFountainsPortfolio2Member2020-09-300001503707us-gaap:NonrecourseMemberus-gaap:MortgagesMembernshi:WatermarkFountainsPortfolio2Member2019-12-310001503707us-gaap:NonrecourseMembernshi:WinterfellPortfolioMemberus-gaap:MortgagesMember2020-09-300001503707us-gaap:NonrecourseMembernshi:WinterfellPortfolioMemberus-gaap:MortgagesMember2019-12-310001503707us-gaap:NonrecourseMembernshi:AvamerePortfolioMemberus-gaap:MortgagesMember2020-09-300001503707us-gaap:NonrecourseMembernshi:AvamerePortfolioMemberus-gaap:MortgagesMember2019-12-310001503707us-gaap:NonrecourseMemberus-gaap:MortgagesMember2020-09-300001503707us-gaap:NonrecourseMemberus-gaap:MortgagesMember2019-12-310001503707us-gaap:NonrecourseMembernshi:OtherNotesPayableMembernshi:OakCottageofSantaBarbaraMember2020-09-300001503707us-gaap:NonrecourseMembernshi:OtherNotesPayableMembernshi:OakCottageofSantaBarbaraMember2019-12-310001503707us-gaap:NonrecourseMembernshi:OtherNotesPayableMember2020-09-300001503707us-gaap:NonrecourseMembernshi:OtherNotesPayableMember2019-12-310001503707nshi:MortgagesAndOtherNotesPayableMember2020-09-300001503707nshi:MortgagesAndOtherNotesPayableMember2019-12-310001503707nshi:FloatingRateDebtOneMonthLIBORMemberus-gaap:MortgagesMember2020-09-30nshi:debt_instrument0001503707nshi:RochesterPortfolioMemberus-gaap:MortgagesMember2020-01-012020-09-300001503707nshi:ArborsPortfolioMemberus-gaap:MortgagesMember2020-01-012020-09-300001503707nshi:WatermarkFountainsPortfolioMember2020-01-012020-09-300001503707us-gaap:NonrecourseMemberus-gaap:MortgagesMembernshi:WatermarkFountainsPortfolio2Member2020-01-012020-09-300001503707nshi:WinterfellPortfolioMemberus-gaap:MortgagesMember2020-01-012020-09-300001503707nshi:WinterfellPortfolioMember2020-01-012020-09-300001503707nshi:AvamerePortfolioMemberus-gaap:MortgagesMember2020-01-012020-09-3000015037072020-05-012020-05-010001503707nshi:RochesterNYMemberus-gaap:MortgagesMember2020-07-012020-07-010001503707nshi:RochesterNYMemberus-gaap:MortgagesMember2020-05-012020-05-010001503707nshi:RochesterNYMemberus-gaap:MortgagesMember2020-09-300001503707nshi:ColonyNorthStarInc.Memberus-gaap:LineOfCreditMember2017-10-310001503707nshi:ColonyNorthStarInc.Memberus-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-09-300001503707nshi:ColonyNorthStarInc.Memberus-gaap:LineOfCreditMember2017-10-012017-10-310001503707nshi:ColonyNorthStarInc.Memberus-gaap:LineOfCreditMember2017-11-300001503707nshi:ColonyNorthStarInc.Memberus-gaap:LineOfCreditMember2020-04-012020-04-300001503707nshi:ColonyNorthStarInc.Memberus-gaap:LineOfCreditMember2020-07-012020-09-300001503707nshi:ColonyNorthStarInc.Memberus-gaap:LineOfCreditMember2020-01-012020-09-300001503707nshi:DenverCOMembernshi:DenverCONonrecourseMemberus-gaap:MortgagesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-09-300001503707nshi:FriscoTXNonrecourseMemberus-gaap:MortgagesMemberus-gaap:LondonInterbankOfferedRateLIBORMembernshi:FriscoMember2020-01-012020-09-300001503707nshi:MilfordOHMembernshi:MilfordOHNonrecourseMemberus-gaap:MortgagesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-09-300001503707nshi:RochesterNYNonrecourseAugust2027Memberus-gaap:MortgagesMembernshi:RochesterNYMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-09-300001503707nshi:RochesterPortfolioMemberus-gaap:MortgagesMemberus-gaap:LondonInterbankOfferedRateLIBORMembernshi:RochesterNYNonrecourseAugust2021Member2020-01-012020-09-300001503707nshi:AdvisoroftheRegistrantMember2020-06-012020-06-300001503707nshi:AdvisoroftheRegistrantMembernshi:AssetManagementFeesMember2020-09-300001503707nshi:AdvisoroftheRegistrantMembernshi:AssetManagementFeesMember2020-01-012020-09-300001503707nshi:IncentiveFeesMembernshi:AdvisoroftheRegistrantMember2020-01-012020-09-300001503707nshi:DispositionFeesMembernshi:AdvisoroftheRegistrantMember2020-01-012020-06-300001503707nshi:AdvisoroftheRegistrantMembernshi:OperatingCostsMember2020-01-012020-09-30nshi:quarter0001503707nshi:AdvisoroftheRegistrantMembernshi:OperatingCostsMembersrt:MaximumMember2020-01-012020-09-300001503707nshi:AdvisoryFees-RelatedPartyMembernshi:AdvisoroftheRegistrantMembernshi:AssetManagementFeesMember2019-12-310001503707nshi:AdvisoryFees-RelatedPartyMembernshi:AdvisoroftheRegistrantMembernshi:AssetManagementFeesMember2020-01-012020-09-300001503707nshi:AdvisoryFees-RelatedPartyMembernshi:AdvisoroftheRegistrantMembernshi:AssetManagementFeesMember2020-09-300001503707nshi:AdvisoroftheRegistrantMemberus-gaap:GeneralAndAdministrativeExpenseMembernshi:OperatingCostsMember2019-12-310001503707nshi:AdvisoroftheRegistrantMemberus-gaap:GeneralAndAdministrativeExpenseMembernshi:OperatingCostsMember2020-01-012020-09-300001503707nshi:AdvisoroftheRegistrantMemberus-gaap:GeneralAndAdministrativeExpenseMembernshi:OperatingCostsMember2020-09-300001503707nshi:AdvisorSponsorAndAffiliatesMember2020-09-300001503707nshi:SolsticeSeniorLivingLLCMemberus-gaap:CorporateJointVentureMember2020-01-012020-09-300001503707nshi:ColonyNorthStarInc.Membernshi:EclipseJointVentureMember2020-09-300001503707nshi:GriffinAmericanJointVentureMembernshi:ColonyNorthStarInc.Member2020-09-300001503707nshi:AmericanHealthcareInvestorsLLCMembernshi:SponsoroftheRegistrantMember2020-09-300001503707nshi:AmericanHealthcareInvestorsLLCMembernshi:Mr.JamesF.FlahertyIIIMember2020-09-300001503707nshi:TheTrilogyJointVentureMember2015-12-310001503707nshi:TheTrilogyJointVentureMember2015-12-012015-12-310001503707nshi:TheTrilogyJointVentureMember2018-10-310001503707nshi:TheTrilogyJointVentureMember2018-10-012018-10-310001503707nshi:TheTrilogyJointVentureMember2018-10-300001503707nshi:MezzanineLoanMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2015-07-310001503707nshi:EspressoJointVentureMembernshi:MezzanineLoanMember2015-07-012015-07-310001503707nshi:ColonyNorthStarInc.Memberus-gaap:LineOfCreditMember2020-09-300001503707nshi:AdvisoroftheRegistrantMembernshi:AssetManagementFeesMember2018-01-012018-01-010001503707us-gaap:RestrictedStockMember2020-09-300001503707srt:DirectorMemberus-gaap:RestrictedStockMember2020-01-012020-09-300001503707srt:DirectorMemberus-gaap:RestrictedStockMember2020-09-300001503707us-gaap:RestrictedStockMember2014-12-312014-12-310001503707us-gaap:RestrictedStockMember2020-01-012020-09-300001503707us-gaap:RestrictedStockMember2019-12-310001503707us-gaap:CommonStockMember2015-12-172016-01-190001503707nshi:DividendReinvestmentPlanMembernshi:DistributionSupportAgreementMember2020-09-300001503707nshi:FollowonDistributionReinvestmentPlanMembernshi:DividendReinvestmentPlanMember2020-09-300001503707nshi:FollowonDistributionReinvestmentPlanMember2020-09-300001503707nshi:DividendReinvestmentPlanMember2016-04-300001503707nshi:DividendReinvestmentPlanMember2016-12-310001503707nshi:DividendReinvestmentPlanMember2017-12-310001503707nshi:DividendReinvestmentPlanMember2018-12-310001503707nshi:DividendReinvestmentPlanMember2019-12-310001503707nshi:DividendReinvestmentPlanMember2020-01-012020-09-300001503707nshi:DividendReinvestmentPlanMemberus-gaap:CommonStockMember2015-12-172020-09-3000015037072015-12-172017-12-3100015037072018-01-012018-12-3100015037072019-01-012019-01-3100015037072019-01-012019-12-310001503707nshi:RealEstateDebtInvestmentsMember2020-09-300001503707nshi:RealEstateDebtInvestmentsMember2019-12-310001503707us-gaap:MortgagesMember2020-09-300001503707us-gaap:MortgagesMember2019-12-310001503707us-gaap:LineOfCreditMember2020-09-300001503707us-gaap:LineOfCreditMember2019-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2020-09-300001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Membernshi:OperatingRealEstateNetMember2020-01-012020-09-300001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Membernshi:OperatingRealEstateNetMember2019-01-012019-12-310001503707nshi:AssetsHeldForSaleMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2020-01-012020-09-300001503707nshi:AssetsHeldForSaleMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2019-01-012019-12-310001503707us-gaap:RealEstateInvestmentMembernshi:TerminalCapitalizationRateMembersrt:MinimumMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsNonrecurringMember2020-09-300001503707us-gaap:RealEstateInvestmentMembernshi:TerminalCapitalizationRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsNonrecurringMembersrt:MaximumMember2020-09-300001503707us-gaap:MeasurementInputDiscountRateMemberus-gaap:RealEstateInvestmentMembersrt:MinimumMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsNonrecurringMember2020-09-300001503707us-gaap:MeasurementInputDiscountRateMemberus-gaap:RealEstateInvestmentMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsNonrecurringMembersrt:MaximumMember2020-09-30nshi:segment0001503707nshi:WatermarkRetirementCommunitiesMember2020-09-30nshi:unit0001503707nshi:WatermarkRetirementCommunitiesMember2020-01-012020-09-300001503707us-gaap:SalesRevenueNetMembernshi:WatermarkRetirementCommunitiesMember2020-01-012020-09-300001503707nshi:SolsticeSeniorLivingLLCMember2020-09-300001503707nshi:SolsticeSeniorLivingLLCMember2020-01-012020-09-300001503707us-gaap:SalesRevenueNetMembernshi:SolsticeSeniorLivingLLCMember2020-01-012020-09-300001503707nshi:AvamereHealthServicesMember2020-09-300001503707nshi:AvamereHealthServicesMember2020-01-012020-09-300001503707us-gaap:SalesRevenueNetMembernshi:AvamereHealthServicesMember2020-01-012020-09-300001503707nshi:ArcadiaMember2020-09-300001503707nshi:ArcadiaMember2020-01-012020-09-300001503707us-gaap:SalesRevenueNetMembernshi:ArcadiaMember2020-01-012020-09-300001503707nshi:IntegralMember2020-09-300001503707nshi:IntegralMember2020-01-012020-09-300001503707us-gaap:SalesRevenueNetMembernshi:IntegralMember2020-01-012020-09-300001503707nshi:SeniorLifestyleMember2020-09-300001503707nshi:SeniorLifestyleMember2020-01-012020-09-300001503707us-gaap:SalesRevenueNetMembernshi:SeniorLifestyleMember2020-01-012020-09-300001503707nshi:OtherEntityMember2020-09-300001503707nshi:OtherEntityMember2020-01-012020-09-300001503707us-gaap:SalesRevenueNetMembernshi:OtherEntityMember2020-01-012020-09-300001503707us-gaap:SalesRevenueNetMember2020-01-012020-09-300001503707nshi:DirectInvestmentsNetLeaseSegmentMember2020-07-012020-09-300001503707nshi:DirectInvestmentsOperatingSegmentMember2020-07-012020-09-300001503707nshi:UnconsolidatedInvestmentsSegmentMember2020-07-012020-09-300001503707nshi:DebtAndSecuritiesSegmentMember2020-07-012020-09-300001503707us-gaap:CorporateMember2020-07-012020-09-300001503707nshi:DirectInvestmentsNetLeaseSegmentMember2019-07-012019-09-300001503707nshi:DirectInvestmentsOperatingSegmentMember2019-07-012019-09-300001503707nshi:UnconsolidatedInvestmentsSegmentMember2019-07-012019-09-300001503707nshi:DebtAndSecuritiesSegmentMember2019-07-012019-09-300001503707us-gaap:CorporateMember2019-07-012019-09-300001503707nshi:DirectInvestmentsNetLeaseSegmentMember2020-01-012020-09-300001503707nshi:DirectInvestmentsOperatingSegmentMember2020-01-012020-09-300001503707nshi:UnconsolidatedInvestmentsSegmentMember2020-01-012020-09-300001503707nshi:DebtAndSecuritiesSegmentMember2020-01-012020-09-300001503707us-gaap:CorporateMember2020-01-012020-09-300001503707nshi:DirectInvestmentsNetLeaseSegmentMember2019-01-012019-09-300001503707nshi:DirectInvestmentsOperatingSegmentMember2019-01-012019-09-300001503707nshi:UnconsolidatedInvestmentsSegmentMember2019-01-012019-09-300001503707nshi:DebtAndSecuritiesSegmentMember2019-01-012019-09-300001503707us-gaap:CorporateMember2019-01-012019-09-300001503707nshi:DirectInvestmentsNetLeaseSegmentMember2020-09-300001503707nshi:DirectInvestmentsOperatingSegmentMember2020-09-300001503707nshi:UnconsolidatedInvestmentsSegmentMember2020-09-300001503707nshi:DebtAndSecuritiesSegmentMember2020-09-300001503707us-gaap:CorporateMember2020-09-300001503707nshi:DirectInvestmentsNetLeaseSegmentMember2019-12-310001503707nshi:DirectInvestmentsOperatingSegmentMember2019-12-310001503707nshi:UnconsolidatedInvestmentsSegmentMember2019-12-310001503707nshi:DebtAndSecuritiesSegmentMember2019-12-310001503707us-gaap:CorporateMember2019-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2020

Commission File Number: 000-55190

NORTHSTAR HEALTHCARE INCOME, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | |

| Maryland | 27-3663988 |

| (State or Other Jurisdiction of | (IRS Employer |

| Incorporation or Organization) | Identification No.) |

590 Madison Avenue, 34th Floor, New York, NY 10022

(Address of Principal Executive Offices, Including Zip Code)

(212) 547-2600

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | None | None |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer ý

| | Smaller reporting company o

Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

The Company has one class of common stock, $0.01 par value per share, 190,153,995 shares outstanding as of November 12, 2020.

NORTHSTAR HEALTHCARE INCOME, INC.

FORM 10-Q

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue,” “future” or other similar words or expressions. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Such statements include, but are not limited to, those relating to our ability to make distributions to our stockholders, our reliance on our advisor and our sponsor, the operating performance of our investments, our financing needs, the effects of our current strategies and investment activities and our ability to effectively deploy capital. Our ability to predict results or the actual effect of plans or strategies is inherently uncertain. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements and you should not unduly rely on these statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from those forward-looking statements. These factors include, but are not limited to:

•the financial impact of the COVID-19 virus on our operations, including our ability to comply with the terms of our borrowings, the severity of which depends on the extent and nature of exposure of residents and staff to COVID-19, the availability and timeliness of adequate tests, better access to supplies and the duration of the crisis, among other factors;

•our ability to manage our liquidity and access to capital;

•our ability to implement our business strategy;

•our dependence on our managers and tenants to operate our properties successfully and in compliance with applicable law and the terms of our borrowings;

•the ability and willingness of our tenants, operators, managers and other third parties to satisfy their respective obligations to us, including in some cases their obligation to indemnify us from and against various claims and liabilities;

•the ability of our property managers and tenants to maintain the financial strength and liquidity necessary to satisfy their respective obligations and liabilities to us and third parties;

•factors that can cause volatility in our operating income generated by our operating properties, including without limitation national and regional economic conditions, development of new competing properties, costs and availability of food, materials, energy, labor and services, employee benefit costs, insurance costs and professional and general liability claims, and the timely delivery of accurate property-level financial results for those properties;

•the ability and willingness of our tenants to renew their leases with us upon expiration of the leases and our ability to reposition our properties on the same or better terms in the event of nonrenewal or in the event of a termination or default;

•our ability to comply with the terms of our borrowings, which depends in part on the performance of our tenants and managers;

•the nature and extent of future competition, including new construction in the markets in which our assets are located;

•the extent and timing of future healthcare reform and regulation, including changes in reimbursement policies, procedures and rates;

•risks associated with our joint ventures and unconsolidated entities, including our reliance on joint venture partners, lack of decision making authority and the financial condition of our joint venture partners;

•our dependence on the resources and personnel of our advisor, our sponsor and their affiliates, including our advisor’s ability to manage our portfolio on our behalf;

•the performance of our advisor, our sponsor and their affiliates;

•the impact of continued business uncertainties surrounding our sponsor, as well as adverse changes in the financial health and public perception of our sponsor;

•our advisor’s and its affiliates’ ability to attract and retain qualified personnel to support our operations and potential changes to key personnel providing management services to us;

•our reliance on our advisor and its affiliates and sub-advisors/co-venturers in providing management services to us, the payment of substantial fees to our advisor, and various potential conflicts of interest in our relationship with our sponsor;

•our use of leverage;

•the impact of fluctuations in interest rates;

•illiquidity of properties, joint venture or debt investments in our portfolio;

•our ability to make distributions to our stockholders;

•the lack of a public trading market for our shares;

•the effect of paying distributions to our stockholders from sources other than cash flow provided by operations;

•the potential failure to maintain effective internal controls and disclosure controls and procedures;

•regulatory requirements with respect to our business and the healthcare industry generally, as well as the related cost of compliance;

•legislative and regulatory changes, including changes to laws governing the taxation of real estate investment trusts, or REITs;

•our ability to maintain our qualification as a REIT for federal income tax purposes and limitations imposed on our business by our status as a REIT;

•the loss of our exemption from registration under the Investment Company Act of 1940, as amended, or the Investment Company Act; and

•other risks associated with investing in our targeted investments, including changes in our industry, interest rates, the securities markets, the general economy or the capital markets and real estate markets specifically.

The foregoing list of factors is not exhaustive. All forward-looking statements included in this Quarterly Report on Form 10-Q are based on information available to us on the date hereof and we are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

Factors that could have a material adverse effect on our operations and future prospects are set forth in our filings with the U.S. Securities and Exchange Commission, or the SEC, including Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 and in Part II, Item 1A of this Quarterly Report on Form 10-Q under the heading “Risk Factors.” The risk factors set forth in our filings with the SEC could cause our actual results to differ significantly from those contained in any forward-looking statement contained in this report.

PART I Financial Information

Item 1. Financial Statements

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Dollars in Thousands, Except Share Data)

| | | | | | | | | | | |

| September 30, 2020 (Unaudited) | | December 31, 2019 |

| Assets | | | |

| Cash and cash equivalents | $ | 72,305 | | | $ | 41,884 | |

| Restricted cash | 26,504 | | | 16,936 | |

| Operating real estate, net | 1,571,696 | | | 1,700,218 | |

| Investments in unconsolidated ventures | 230,257 | | | 268,894 | |

| Real estate debt investments, net | 55,038 | | | 55,468 | |

| Assets held for sale | — | | | 1,649 | |

| Receivables, net | 15,650 | | | 13,314 | |

| Deferred costs and intangible assets, net | 26,951 | | | 28,355 | |

| Other assets | 9,561 | | | 14,489 | |

Total assets(1) | $ | 2,007,962 | | | $ | 2,141,207 | |

| | | |

| Liabilities | | | |

| Mortgage and other notes payable, net | $ | 1,421,453 | | | $ | 1,431,922 | |

| Line of credit - related party | 35,000 | | | — | |

| Due to related party | 3,884 | | | 5,780 | |

| Escrow deposits payable | 4,429 | | | 3,292 | |

| Accounts payable and accrued expenses | 37,025 | | | 28,135 | |

| Other liabilities | 4,124 | | | 4,574 | |

Total liabilities(1) | 1,505,915 | | | 1,473,703 | |

| Commitments and contingencies (Note 13) | | | |

| Equity | | | |

| NorthStar Healthcare Income, Inc. Stockholders’ Equity | | | |

Preferred stock, $0.01 par value, 50,000,000 shares authorized, no shares issued and outstanding as of September 30, 2020 and December 31, 2019 | — | | | — | |

Common stock, $0.01 par value, 400,000,000 shares authorized, 190,020,662 and 189,111,561 shares issued and outstanding as of September 30, 2020 and December 31, 2019, respectively | 1,900 | | | 1,891 | |

| Additional paid-in capital | 1,707,876 | | | 1,702,260 | |

| Retained earnings (accumulated deficit) | (1,211,046) | | | (1,041,297) | |

| Accumulated other comprehensive income (loss) | (869) | | | (470) | |

| Total NorthStar Healthcare Income, Inc. stockholders’ equity | 497,861 | | | 662,384 | |

| Non-controlling interests | 4,186 | | | 5,120 | |

| Total equity | 502,047 | | | 667,504 | |

| Total liabilities and equity | $ | 2,007,962 | | | $ | 2,141,207 | |

_______________________________________

(1)Represents the consolidated assets and liabilities of NorthStar Healthcare Income Operating Partnership, LP (the “Operating Partnership”). The Operating Partnership is a consolidated variable interest entity (“VIE”), of which the Company is the sole general partner and owns approximately 99.99%. As of September 30, 2020, the Operating Partnership includes $0.6 billion and $0.5 billion of assets and liabilities, respectively, of certain VIEs that are consolidated by the Operating Partnership. Refer to Note 2, “Summary of Significant Accounting Policies.”

Refer to accompanying notes to consolidated financial statements (unaudited).

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in Thousands, Except Per Share Data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Property and other revenues | | | | | | | | |

| Resident fee income | | $ | 28,006 | | | $ | 32,283 | | | $ | 90,033 | | | $ | 97,658 | |

| Rental income | | 39,114 | | | 40,410 | | | 118,309 | | | 121,168 | |

| Other revenue | | 635 | | | 85 | | | 1,612 | | | 1,445 | |

| Total property and other revenues | | 67,755 | | | 72,778 | | | 209,954 | | | 220,271 | |

| Interest income | | | | | | | | |

| Interest income on debt investments | | 1,927 | | | 1,946 | | | 5,738 | | | 5,771 | |

| Expenses | | | | | | | | |

| Real estate properties - operating expenses | | 46,501 | | | 45,359 | | | 137,530 | | | 135,213 | |

| Interest expense | | 16,459 | | | 17,218 | | | 49,591 | | | 51,908 | |

| Transaction costs | | — | | | 29 | | | 7 | | | 105 | |

| Asset management and other fees - related party | | 4,431 | | | 4,994 | | | 13,293 | | | 14,983 | |

| General and administrative expenses | | 3,446 | | | 2,807 | | | 8,763 | | | 8,210 | |

| Depreciation and amortization | | 15,945 | | | 16,164 | | | 48,929 | | | 54,525 | |

| Impairment loss | | — | | | — | | | 91,437 | | | 10,146 | |

| Total expenses | | 86,782 | | | 86,571 | | | 349,550 | | | 275,090 | |

| Other income (loss) | | | | | | | | |

| Realized gain (loss) on investments and other | | — | | | 204 | | | — | | | 5,926 | |

| Income (loss) before equity in earnings (losses) of unconsolidated ventures and income tax expense | | (17,100) | | | (11,643) | | | (133,858) | | | (43,122) | |

| Equity in earnings (losses) of unconsolidated ventures | | (1,043) | | | (3,037) | | | (36,799) | | | (7,666) | |

| Income tax expense | | (15) | | | (17) | | | (43) | | | (38) | |

| Net income (loss) | | (18,158) | | | (14,697) | | | (170,700) | | | (50,826) | |

| Net (income) loss attributable to non-controlling interests | | 171 | | | 73 | | | 951 | | | 439 | |

| Net income (loss) attributable to NorthStar Healthcare Income, Inc. common stockholders | | $ | (17,987) | | | $ | (14,624) | | | $ | (169,749) | | | $ | (50,387) | |

| Net income (loss) per share of common stock, basic/diluted | | $ | (0.09) | | | $ | (0.08) | | | $ | (0.90) | | | $ | (0.27) | |

| Weighted average number of shares of common stock outstanding, basic/diluted | | 189,756,911 | | | 189,094,572 | | | 189,378,629 | | | 189,061,291 | |

| Distributions declared per share of common stock | | $ | — | | | $ | — | | | $ | — | | | $ | 0.03 | |

Refer to accompanying notes to consolidated financial statements (unaudited).

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Dollars in Thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Net income (loss) | | $ | (18,158) | | | $ | (14,697) | | | $ | (170,700) | | | $ | (50,826) | |

| Other comprehensive income (loss) | | | | | | | | |

| Foreign currency translation adjustments related to investment in unconsolidated venture | | 459 | | | 786 | | | (399) | | | (88) | |

| Total other comprehensive income (loss) | | 459 | | | 786 | | | (399) | | | (88) | |

| Comprehensive income (loss) | | (17,699) | | | (13,911) | | | (171,099) | | | (50,914) | |

| Comprehensive (income) loss attributable to non-controlling interests | | 171 | | | 73 | | | 951 | | | 439 | |

| Comprehensive income (loss) attributable to NorthStar Healthcare Income, Inc. common stockholders | | $ | (17,528) | | | $ | (13,838) | | | $ | (170,148) | | | $ | (50,475) | |

Refer to accompanying notes to consolidated financial statements (unaudited).

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(Dollars and Shares in Thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | Retained Earnings (Accumulated Deficit) | | Accumulated Other Comprehensive Income (Loss) | | Total Company’s Stockholders’ Equity | | Non-controlling Interests | | Total Equity |

| Shares | | Amount | | | | | | |

| Balance as of December 31, 2018 | 188,495 | | | $ | 1,885 | | | $ | 1,697,998 | | | $ | (958,924) | | | $ | (2,284) | | | $ | 738,675 | | | $ | 5,699 | | | $ | 744,374 | |

| Share-based payment of advisor asset management fees | 352 | | | 4 | | | 2,496 | | | — | | | — | | | 2,500 | | | — | | | 2,500 | |

| Amortization of equity-based compensation | — | | | — | | | 45 | | | — | | | — | | | 45 | | | — | | | 45 | |

| Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 256 | | | 256 | |

| Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (72) | | | (72) | |

| Shares redeemed for cash | (279) | | | (3) | | | (1,975) | | | — | | | — | | | (1,978) | | | — | | | (1,978) | |

| Distributions declared | — | | | — | | | — | | | (5,413) | | | — | | | (5,413) | | | — | | | (5,413) | |

| Proceeds from distribution reinvestment plan | 687 | | | 7 | | | 4,869 | | | — | | | — | | | 4,876 | | | — | | | 4,876 | |

| Other comprehensive income (loss) | — | | | — | | | — | | | — | | | 200 | | | 200 | | | — | | | 200 | |

| Net income (loss) | — | | | — | | | — | | | (18,617) | | | — | | | (18,617) | | | (52) | | | (18,669) | |

| Balance as of March 31, 2019 (Unaudited) | 189,255 | | | $ | 1,893 | | | $ | 1,703,433 | | | $ | (982,954) | | | $ | (2,084) | | | $ | 720,288 | | | $ | 5,831 | | | $ | 726,119 | |

| Share-based payment of advisor asset management fees | 352 | | | 4 | | | 2,496 | | | — | | | — | | | 2,500 | | | — | | | 2,500 | |

| Issuance and amortization of equity-based compensation | 25 | | | — | | | 46 | | | — | | | — | | | 46 | | | — | | | 46 | |

| Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 62 | | | 62 | |

| Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (67) | | | (67) | |

| Shares redeemed for cash | (450) | | | (5) | | | (3,199) | | | — | | | — | | | (3,204) | | | — | | | (3,204) | |

| Other comprehensive income (loss) | — | | | — | | | — | | | — | | | (1,074) | | | (1,074) | | | — | | | (1,074) | |

| Net income (loss) | — | | | — | | | — | | | (17,146) | | | — | | | (17,146) | | | (314) | | | (17,460) | |

| Balance as of June 30, 2019 (Unaudited) | 189,182 | | | $ | 1,892 | | | $ | 1,702,776 | | | $ | (1,000,100) | | | $ | (3,158) | | | $ | 701,410 | | | $ | 5,512 | | | $ | 706,922 | |

| Share-based payment of advisor asset management fees | 352 | | | 4 | | | 2,496 | | | — | | | — | | | 2,500 | | | — | | | 2,500 | |

| Amortization of equity-based compensation | — | | | — | | | 45 | | | — | | | — | | | 45 | | | — | | | 45 | |

| Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 112 | | | 112 | |

| Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (74) | | | (74) | |

| Shares redeemed for cash | (315) | | | (3) | | | (2,231) | | | — | | | — | | | (2,234) | | | — | | | (2,234) | |

| Other comprehensive income (loss) | — | | | — | | | — | | | — | | | 786 | | | 786 | | | — | | | 786 | |

| Net income (loss) | — | | | — | | | — | | | (14,624) | | | — | | | (14,624) | | | (73) | | | (14,697) | |

| Balance as of September 30, 2019 (Unaudited) | 189,219 | | | $ | 1,893 | | | $ | 1,703,086 | | | $ | (1,014,724) | | | $ | (2,372) | | | $ | 687,883 | | | $ | 5,477 | | | $ | 693,360 | |

Refer to accompanying notes to consolidated financial statements (unaudited).

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY (Continued)

(Dollars and Shares in Thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | Retained Earnings (Accumulated Deficit) | | Accumulated Other Comprehensive Income (Loss) | | Total Company’s Stockholders’ Equity | | Non-controlling Interests | | Total Equity |

| Shares | | Amount | | | | | | |

| Balance as of December 31, 2019 | 189,111 | | | $ | 1,891 | | | $ | 1,702,260 | | | $ | (1,041,297) | | | $ | (470) | | | $ | 662,384 | | | $ | 5,120 | | | $ | 667,504 | |

| Share-based payment of advisor asset management fees | 400 | | | 4 | | | 2,496 | | | — | | | — | | | 2,500 | | | — | | | 2,500 | |

| Amortization of equity-based compensation | — | | | — | | | 38 | | | — | | | — | | | 38 | | | — | | | 38 | |

| Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 86 | | | 86 | |

| Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (85) | | | (85) | |

| Shares redeemed for cash | (320) | | | (3) | | | (1,995) | | | — | | | — | | | (1,998) | | | — | | | (1,998) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Other comprehensive income (loss) | — | | | — | | | — | | | — | | | (1,044) | | | (1,044) | | | — | | | (1,044) | |

| Net income (loss) | — | | | — | | | — | | | (12,481) | | | — | | | (12,481) | | | (66) | | | (12,547) | |

| Balance as of March 31, 2020 (Unaudited) | 189,191 | | | $ | 1,892 | | | $ | 1,702,799 | | | $ | (1,053,778) | | | $ | (1,514) | | | $ | 649,399 | | | $ | 5,055 | | | $ | 654,454 | |

| Share-based payment of advisor asset management fees | 400 | | | 4 | | | 2,496 | | | — | | | — | | | 2,500 | | | — | | | 2,500 | |

| Issuance and amortization of equity-based compensation | 29 | | | — | | | 39 | | | — | | | — | | | 39 | | | — | | | 39 | |

| Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 7 | | | 7 | |

| Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (54) | | | (54) | |

| | | | | | | | | | | | | | | |

| Other comprehensive income (loss) | — | | | — | | | — | | | — | | | 186 | | | 186 | | | — | | | 186 | |

| Net income (loss) | — | | | — | | | — | | | (139,281) | | | — | | | (139,281) | | | (714) | | | (139,995) | |

| Balance as of June 30, 2020 (Unaudited) | 189,620 | | | $ | 1,896 | | | $ | 1,705,334 | | | $ | (1,193,059) | | | $ | (1,328) | | | $ | 512,843 | | | $ | 4,294 | | | $ | 517,137 | |

| Share-based payment of advisor asset management fees | 400 | | | 4 | | | 2,496 | | | — | | | — | | | 2,500 | | | — | | | 2,500 | |

| Amortization of equity-based compensation | — | | | — | | | 46 | | | — | | | — | | | 46 | | | — | | | 46 | |

| Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 75 | | | 75 | |

| Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (12) | | | (12) | |

| Other comprehensive income (loss) | — | | | — | | | — | | | — | | | 459 | | | 459 | | | — | | | 459 | |

| Net income (loss) | — | | | — | | | — | | | (17,987) | | | — | | | (17,987) | | | (171) | | | (18,158) | |

| Balance as of September 30, 2020 (Unaudited) | 190,020 | | | $ | 1,900 | | | $ | 1,707,876 | | | $ | (1,211,046) | | | $ | (869) | | | $ | 497,861 | | | $ | 4,186 | | | $ | 502,047 | |

Refer to accompanying notes to consolidated financial statements (unaudited).

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in Thousands)

(Unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2020 | | 2019 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | (170,700) | | | $ | (50,826) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Equity in (earnings) losses of unconsolidated ventures | 36,799 | | | 7,666 | |

| Depreciation and amortization | 48,929 | | | 54,525 | |

| Impairment loss | 91,437 | | | 10,146 | |

| Capitalized interest for mortgage and other notes payable | 222 | | | 193 | |

| Amortization of below market debt | 2,311 | | | 2,253 | |

| Straight-line rental income, net and amortization of lease inducements | 224 | | | (478) | |

| Amortization of discount/accretion of premium on investments | (92) | | | (83) | |

| Amortization of deferred financing costs | 1,416 | | | 1,367 | |

| Amortization of equity-based compensation | 123 | | | 136 | |

| Realized (gain) loss on investments and other | — | | | (5,926) | |

| Allowance for uncollectible accounts | 1,803 | | | 595 | |

| Issuance of common stock as payment for asset management fees | 7,500 | | | 7,500 | |

| Changes in assets and liabilities: | | | |

| Receivables | (4,363) | | | (790) | |

| Other assets | 4,961 | | | (644) | |

| Due to related party | (1,896) | | | (1,330) | |

| Escrow deposits payable | 1,137 | | | 1,739 | |

| Accounts payable and accrued expenses | 8,274 | | | (5,257) | |

| Other liabilities | (105) | | | (743) | |

| Net cash provided by operating activities | 27,980 | | | 20,043 | |

| Cash flows from investing activities: | | | |

| Capital expenditures for operating real estate | (8,990) | | | (14,644) | |

| Sale of operating real estate | 927 | | | 19,618 | |

| Investment in unconsolidated ventures | — | | | (39,801) | |

| Distributions from unconsolidated ventures | 1,963 | | | 16,846 | |

| Other assets | (35) | | | 934 | |

| Net cash (used in) investing activities | (6,135) | | | (17,047) | |

| Cash flows from financing activities: | | | |

| Borrowings from mortgage notes | — | | | 12,800 | |

| Repayment of mortgage notes | (14,418) | | | (45,868) | |

| Borrowings from line of credit - related party | 35,000 | | | — | |

| Payment of deferred financing costs | — | | | (708) | |

| Payments under finance leases | (457) | | | (424) | |

| Shares redeemed for cash | (1,998) | | | (7,416) | |

| Distributions paid on common stock | — | | | (10,813) | |

| Proceeds from distribution reinvestment plan | — | | | 4,876 | |

| Contributions from non-controlling interests | 168 | | | 430 | |

| Distributions to non-controlling interests | (151) | | | (213) | |

| Net cash provided by (used in) financing activities | 18,144 | | | (47,336) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 39,989 | | | (44,340) | |

| Cash, cash equivalents and restricted cash-beginning of period | 58,820 | | | 94,508 | |

| Cash, cash equivalents and restricted cash-end of period | $ | 98,809 | | | $ | 50,168 | |

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2020 | | 2019 |

| Supplemental disclosure of non-cash investing and financing activities: | | | |

| Accrued capital expenditures | $ | 616 | | | $ | 835 | |

| Assets acquired under finance leases | 112 | | | — | |

Refer to accompanying notes to consolidated financial statements (unaudited).

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Business and Organization

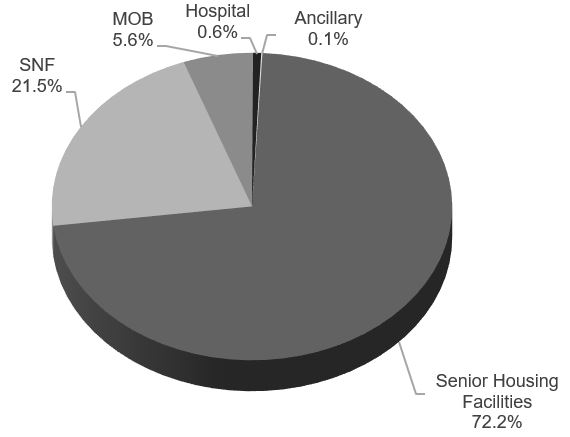

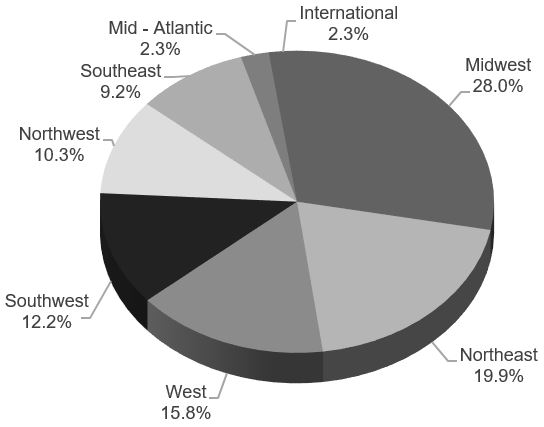

NorthStar Healthcare Income, Inc., together with its consolidated subsidiaries (the “Company”), was formed to acquire, originate and asset manage a diversified portfolio of equity, debt and securities investments in healthcare real estate, directly or through joint ventures, with a focus on the mid-acuity senior housing sector, which the Company defines as assisted living (“ALF”), memory care (“MCF”), skilled nursing (“SNF”), independent living (“ILF”) facilities and continuing care retirement communities (“CCRC”), which may have independent living, assisted living, skilled nursing and memory care available on one campus. The Company also invests in other healthcare property types, including medical office buildings (“MOB”), hospitals, rehabilitation facilities and ancillary healthcare services businesses. The Company’s investments are predominantly in the United States, but it also selectively makes international investments.

The Company was formed in October 2010 as a Maryland corporation and commenced operations in February 2013. The Company elected to be taxed as a real estate investment trust (“REIT”) under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), commencing with the taxable year ended December 31, 2013. The Company conducts its operations so as to continue to qualify as a REIT for U.S. federal income tax purposes.

Substantially all of the Company’s business is conducted through NorthStar Healthcare Income Operating Partnership, LP (the “Operating Partnership”). The Company is the sole general partner of the Operating Partnership. The limited partners of the Operating Partnership are NorthStar Healthcare Income Advisor, LLC (the “Prior Advisor”) and NorthStar Healthcare Income OP Holdings, LLC (the “Special Unit Holder”), each an affiliate of the Company’s sponsor. The Prior Advisor invested $1,000 in the Operating Partnership in exchange for common units and the Special Unit Holder invested $1,000 in the Operating Partnership and was issued a separate class of limited partnership units (the “Special Units”), which are collectively recorded as non-controlling interests on the accompanying consolidated balance sheets as of September 30, 2020 and December 31, 2019. As the Company issued shares, it contributed substantially all of the proceeds from its continuous, public offerings to the Operating Partnership as a capital contribution. As of September 30, 2020, the Company’s limited partnership interest in the Operating Partnership was 99.99%.

The Company’s charter authorizes the issuance of up to 400.0 million shares of common stock with a par value of $0.01 per share and up to 50.0 million shares of preferred stock with a par value of $0.01 per share. The board of directors of the Company is authorized to amend its charter, without the approval of the stockholders, to increase the aggregate number of authorized shares of capital stock or the number of shares of any class or series that the Company has authority to issue.

The Company completed its initial public offering (the “Initial Offering”) on February 2, 2015 by raising gross proceeds of $1.1 billion, including 108.6 million shares issued in its initial primary offering (the “Initial Primary Offering”) and 2.0 million shares issued pursuant to its distribution reinvestment plan (the “DRP”). In addition, the Company completed its follow-on offering (the “Follow-On Offering”) on January 19, 2016 by raising gross proceeds of $700.0 million, including 64.9 million shares issued in its follow-on primary offering (the “Follow-on Primary Offering”) and 4.2 million shares issued pursuant to the DRP. The Company refers to its Initial Primary Offering and its Follow-on Primary Offering collectively as the “Primary Offering” and its Initial Offering and Follow-On Offering collectively as the “Offering.” In December 2015, the Company registered an additional 30.0 million shares to be offered pursuant to the DRP. From inception through September 30, 2020, the Company raised total gross proceeds of $2.0 billion, including $232.6 million in DRP proceeds.

The Company is externally managed and has no employees. The Company is sponsored by Colony Capital, Inc. (NYSE: CLNY) (“Colony Capital” or the “Sponsor”), which was formed as a result of the mergers of NorthStar Asset Management Group Inc.(“NSAM”), its prior sponsor, with Colony Capital, Inc. (“Colony”) and NorthStar Realty Finance Corp. (“NorthStar Realty”) in January 2017. Effective June 25, 2018, the Sponsor changed its name from Colony NorthStar, Inc. to Colony Capital, Inc. and its ticker symbol from “CLNS” to “CLNY.” Following the mergers, the Sponsor became an internally-managed equity REIT, with a diversified real estate and investment management platform.

Colony Capital manages capital on behalf of its stockholders, as well as institutional and retail investors in private funds, non-traded and traded REITs and registered investment companies. The Company’s advisor, CNI NSHC Advisors, LLC (the “Advisor”), is a subsidiary of Colony Capital and manages its day-to-day operations pursuant to an advisory agreement.

Impact of COVID-19

At the time of preparation of the third quarter 2020 financial statements, the world is continuing to face a global pandemic, the coronavirus 2019 (“COVID-19”). Efforts to address the pandemic continue to significantly impact economic and financial markets globally and across all facets of industries, including real estate. Specifically, the Company's healthcare real estate

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

business and investments have experienced a myriad of challenges, including, but not limited to, declines in resident occupancy and operating cash flows, increases in cost burden faced by operators, lease concessions sought by tenants, and a stressed market affecting real estate values in general. Most of these COVID-19 effects on the Company's business significantly impacted results of operations beginning with the three months ended June 30, 2020, and continuing through the three months ended September 30, 2020. At this time, the Company anticipates these pronounced and significant effects to be sustained and continue in future periods. While the Company itself has the ability to meet its near term liquidity needs, general market concerns over credit and liquidity continue to permeate in an economic downturn environment. The effects of COVID-19 may also lead to heightened risk of litigation at the investment and corporate level, with an ensuing increase in litigation and related costs.

If a general economic downturn resulting from efforts to contain COVID-19 persists over an extended period of time, this could have a prolonged negative impact on the Company's financial condition and results of operations. At this time, as the extent and duration of the increasingly broad effects of COVID-19 on the global economy remain unclear, it is difficult for the Company to assess and estimate the impact on the Company's results of operations with any meaningful precision. Accordingly, any estimates of the effects of COVID-19 as reflected and or discussed in these financial statements are based upon the Company's best estimates using information known to the Company as of the date of this Quarterly Report on Form 10-Q, and such estimates may change, the effects of which could be material. The Company will continue to monitor the progression of COVID-19 and reassess its effects on the Company’s results of operations and recoverability in value across its assets as conditions change.

2. Summary of Significant Accounting Policies

Basis of Accounting

Basis of Quarterly Presentation

The accompanying unaudited consolidated financial statements and related notes of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial reporting and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, certain information and note disclosures normally included in the consolidated financial statements prepared under U.S. GAAP have been condensed or omitted. In the opinion of management, all adjustments considered necessary for a fair presentation of the Company’s financial position, results of operations and cash flows have been included and are of a normal and recurring nature. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. These consolidated financial statements should be read in conjunction with the Company’s consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the U.S. Securities and Exchange Commission on March 23, 2020.

Reclassifications

Certain prior period amounts have been reclassified on the consolidated statements of cash flows from the supplemental disclosure of non-cash investing and financing activities to adjustments to reconcile net income (loss) to net cash provided by operating activities to conform to current period presentation. Further, federal COVID-19 provider relief funds, which totaled $0.8 million for the three months ended June 30, 2020 and presented as resident fee income have been reclassified to other revenue on the consolidated statements of operations during the three months ended September 30, 2020.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company, the Operating Partnership and their consolidated subsidiaries. The Company consolidates entities in which it has a controlling financial interest by first considering if an entity meets the definition of a variable interest entity (“VIE”) for which the Company is deemed to be the primary beneficiary or if the Company has the power to control an entity through majority voting interest or other arrangements. All significant intercompany balances are eliminated in consolidation.

Variable Interest Entities

A VIE is an entity that lacks one or more of the characteristics of a voting interest entity. A VIE is defined as an entity in which equity investors do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. The determination of

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

whether an entity is a VIE includes both a qualitative and quantitative analysis. The Company bases its qualitative analysis on its review of the design of the entity, its organizational structure including decision-making ability and relevant financial agreements and the quantitative analysis on the forecasted cash flow of the entity. The Company reassesses its initial evaluation of an entity as a VIE upon the occurrence of certain reconsideration events.

A VIE must be consolidated only by its primary beneficiary, which is defined as the party who, along with its affiliates and agents, has both the: (i) power to direct the activities that most significantly impact the VIE’s economic performance; and (ii) obligation to absorb the losses of the VIE or the right to receive the benefits from the VIE, which could be significant to the VIE. The Company determines whether it is the primary beneficiary of a VIE by considering qualitative and quantitative factors, including, but not limited to: which activities most significantly impact the VIE’s economic performance and which party controls such activities; the amount and characteristics of its investment; the obligation or likelihood for the Company or other interests to provide financial support; consideration of the VIE’s purpose and design, including the risks the VIE was designed to create and pass through to its variable interest holders and the similarity with and significance to the business activities of the Company and the other interests. The Company reassesses its determination of whether it is the primary beneficiary of a VIE each reporting period. Significant judgments related to these determinations include estimates about the current and future fair value and performance of investments held by these VIEs and general market conditions.

The Company evaluates its investments and financings, including investments in unconsolidated ventures and securitization financing transactions to determine whether each investment or financing is a VIE. The Company analyzes new investments and financings, as well as reconsideration events for existing investments and financings, which vary depending on type of investment or financing.

As of September 30, 2020, the Company has identified certain consolidated and unconsolidated VIEs. Assets of each of the VIEs, other than the Operating Partnership, may only be used to settle obligations of the respective VIE. Creditors of each of the VIEs have no recourse to the general credit of the Company.

Consolidated VIEs

The most significant consolidated VIEs are the Operating Partnership and certain properties that have non-controlling interests. These entities are VIEs because the non-controlling interests do not have substantive kick-out or participating rights. The Operating Partnership consolidates certain properties that have non-controlling interests. Included in operating real estate, net on the Company’s consolidated balance sheets as of September 30, 2020 is $553.2 million related to such consolidated VIEs. Included in mortgage and other notes payable, net on the Company’s consolidated balance sheet as of September 30, 2020 is $460.5 million, collateralized by the real estate assets of the related consolidated VIEs.

Unconsolidated VIEs

As of September 30, 2020, the Company identified unconsolidated VIEs related to its real estate equity investments with a carrying value of $230.3 million. The Company’s maximum exposure to loss as of September 30, 2020 would not exceed the carrying value of its investment in the VIEs and its investment in a mezzanine loan to a subsidiary of one of the VIEs. Based on management’s analysis, the Company determined that it is not the primary beneficiary of these VIEs and, accordingly, they are not consolidated in the Company’s financial statements as of September 30, 2020. The Company did not provide financial support to its unconsolidated VIEs during the nine months ended September 30, 2020. As of September 30, 2020, there were no explicit arrangements or implicit variable interests that could require the Company to provide financial support to its unconsolidated VIEs.

Voting Interest Entities

A voting interest entity is an entity in which the total equity investment at risk is sufficient to enable it to finance its activities independently and the equity holders have the power to direct the activities of the entity that most significantly impact its economic performance, the obligation to absorb the losses of the entity and the right to receive the residual returns of the entity. The usual condition for a controlling financial interest in a voting interest entity is ownership of a majority voting interest. If the Company has a majority voting interest in a voting interest entity, the entity will generally be consolidated. The Company does not consolidate a voting interest entity if there are substantive participating rights by other parties and/or kick-out rights by a single party or through a simple majority vote.

The Company performs on-going reassessments of whether entities previously evaluated under the voting interest framework have become VIEs, based on certain events, and therefore subject to the VIE consolidation framework.

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Investments in Unconsolidated Ventures

A non-controlling, unconsolidated ownership interest in an entity may be accounted for using the equity method or the Company may elect the fair value option.

The Company will account for an investment under the equity method of accounting if it has the ability to exercise significant influence over the operating and financial policies of an entity, but does not have a controlling financial interest. Under the equity method, the investment is adjusted each period for capital contributions and distributions and its share of the entity’s net income (loss). Capital contributions, distributions and net income (loss) of such entities are recorded in accordance with the terms of the governing documents. An allocation of net income (loss) may differ from the stated ownership percentage interest in such entity as a result of preferred returns and allocation formulas, if any, as described in such governing documents. Equity method investments are recognized using a cost accumulation model, in which the investment is recognized based on the cost to the investor, which includes acquisition fees. The Company records as an expense certain acquisition costs and fees associated with consolidated investments deemed to be business combinations and capitalizes these costs for investments deemed to be acquisitions of an asset, including an equity method investment.

Non-controlling Interests

A non-controlling interest in a consolidated subsidiary is defined as the portion of the equity (net assets) in a subsidiary not attributable, directly or indirectly, to the Company. A non-controlling interest is required to be presented as a separate component of equity on the consolidated balance sheets and presented separately as net income (loss) and comprehensive income (loss) attributable to controlling and non-controlling interests. An allocation to a non-controlling interest may differ from the stated ownership percentage interest in such entity as a result of a preferred return and allocation formula, if any, as described in such governing documents.

Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that could affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could materially differ from those estimates and assumptions.

Comprehensive Income (Loss)

The Company reports consolidated comprehensive income (loss) in separate statements following the consolidated statements of operations. Comprehensive income (loss) is defined as the change in equity resulting from net income (loss) and other comprehensive income (loss) (“OCI”). The only component of OCI for the Company is foreign currency translation adjustments related to its investment in an unconsolidated venture.

Fair Value Option

The fair value option provides an election that allows a company to irrevocably elect to record certain financial assets and liabilities at fair value on an instrument-by-instrument basis at initial recognition. The Company may elect to apply the fair value option for certain investments due to the nature of the instrument. Any change in fair value for assets and liabilities for which the election is made is recognized in earnings.

Cash, Cash Equivalents and Restricted Cash

The Company considers all highly-liquid investments with an original maturity date of three months or less to be cash equivalents. Cash, including amounts restricted, may at times exceed the Federal Deposit Insurance Corporation deposit insurance limit of $250,000 per institution. The Company mitigates credit risk by placing cash and cash equivalents with major financial institutions. To date, the Company has not experienced any losses on cash and cash equivalents.

Restricted cash consists of amounts related to operating real estate (escrows for taxes, insurance, capital expenditures, security deposits received from tenants and payments required under certain lease agreements) and other escrows required by lenders of the Company’s borrowings.

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

The following table provides a reconciliation of cash, cash equivalents, and restricted cash as reported on the consolidated balance sheets to the total of such amounts as reported on the consolidated statements of cash flows (dollars in thousands):

| | | | | | | | | | | | | | |

| | September 30, 2020 (Unaudited) | | December 31, 2019 |

| Cash and cash equivalents | | $ | 72,305 | | | $ | 41,884 | |

| Restricted cash | | 26,504 | | | 16,936 | |

| Total cash, cash equivalents and restricted cash | | $ | 98,809 | | | $ | 58,820 | |

Operating Real Estate

Operating real estate is carried at historical cost less accumulated depreciation. Major replacements and betterments which improve or extend the life of the asset are capitalized and depreciated over their useful life. Ordinary repairs and maintenance are expensed as incurred. Operating real estate is depreciated using the straight-line method over the estimated useful life of the assets, summarized as follows:

| | | | | | | | |

| Category: | | Term: |

| Building | | 30 to 50 years |

| Building improvements | | Lesser of the useful life or remaining life of the building |

| Land improvements | | 9 to 15 years |

| Tenant improvements | | Lesser of the useful life or remaining term of the lease |

| Furniture, fixtures and equipment | | 5 to 14 years |

Construction costs incurred in connection with the Company’s investments are capitalized and included in operating real estate, net on the consolidated balance sheets. Construction in progress is not depreciated until the asset is available for its intended use.

Lessee Accounting

A leasing arrangement, a right to control the use of an identified asset for a period of time in exchange for consideration, is classified by the lessee either as a finance lease, which represents a financed purchase of the leased asset, or as an operating lease. For leases with terms greater than 12 months, a lease asset and a lease liability are recognized on the balance sheet at commencement date based on the present value of lease payments over the lease term.

Lease renewal or termination options are included in the lease asset and lease liability only if it is reasonably certain that the option to extend would be exercised or the option to terminate would not be exercised. As the implicit rate in most leases are not readily determinable, the Company’s incremental borrowing rate for each lease at commencement date is used to determine the present value of lease payments. Consideration is given to the Company’s recent debt financing transactions, as well as publicly available data for instruments with similar characteristics, adjusted for the respective lease term, when estimating incremental borrowing rates.