Blueprint

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the fiscal

year ended December 31, 2018

or

☐ Transition Report Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of

1934

For the

transition period from _________ to _________

Commission

File Number: 000-55038

SED INTELLIGENT HOME INC.

(Exact name of

registrant as specified in its charter)

|

Nevada

|

|

27-1467606

|

|

(State or

other jurisdiction of incorporation or

organization)

|

|

(I.R.S.

Employer Identification Number)

|

|

4800

Montgomery Lane, Suite 210

|

|

|

|

Bethesda, MD

20814

|

|

301-971-3940

|

|

(Address of

Principal Executive Offices)

|

|

Registrant’s

telephone number,

including area

code

|

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities

registered pursuant to section 12(g) of the Act: Common Stock,

$0.001 par value

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the

Securities

Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of

the Exchange

Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1)

has filed all reports required to be filed by Section 13 or 15(d)

of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing

requirements for the past 90

days. Yes ☒ No ☐

Indicate by check mark whether the registrant has

submitted electronically and posted on its corporate Web site, if

any, every Interactive Data File required to be submitted and

posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of

this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such

files). Yes ☐ No ☐

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of Regulation S-K is not contained

herein, and will not be contained, to the best of registrant's

knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any

amendment to this Form

10-K. ☐

Indicate by

check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange

Act.

|

Large

accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

|

|

Smaller reporting company ☒

|

|

|

|

Emerging growth

company ☐

|

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange

Act. ☐

Indicate by check mark whether the registrant is a

shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ☐ No ☒

State the

aggregate market value of the voting and non-voting common equity

held by non-affiliates computed by reference to the price at which

the common equity was last sold, or the average bid and asked price

of such common equity, as of the last business day of the

registrant’s most recently completed second fiscal quarter.

The Company’s common stock did not trade during the year

ended December 31, 2018.

Indicate the

number of shares outstanding of each of the registrant’s

classes of common stock, as of the latest practicable date. As of

April 1, 2019, there were 704,043,324 shares outstanding of the

registrant’s common stock, $0.001 par

value.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

Throughout this Report on Form 10-K, the terms the

“Company,” “we,” “us” and

“our” refer to SeD Intelligent Home Inc., and

“our board of directors” refers to the board of

directors of SeD Intelligent Home Inc.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION

This Annual Report on Form 10-K contains forward-looking statements

regarding, among other things, our future operating results and

financial position, our business strategy, and other objectives for

our future operations. The words “anticipate,”

“believe,” “intend,” “expect,”

“may,” “estimate,” “predict,”

“project,” “potential” and similar

expression are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. We have based these forward-looking statements

largely on our current expectations and projections about future

events and financial trends that we believe may affect our

business, financial condition and results of operations. There are

a number of important risks and uncertainties that could cause our

actual results to differ materially from those indicated by

forward-looking statements. We may not actually achieve the plans,

intentions or expectations disclosed in our forward-looking

statements, and you should not place undue reliance on our

forward-looking statements. Actual results or events could differ

materially from the plans, intentions and expectations disclosed in

the forward-looking statements we make. Our forward-looking

statements do not reflect the potential impact of any future

acquisitions, mergers, dispositions, joint ventures or investments

that we may make.

You should read this Report on Form 10-K and the documents that we

have filed as exhibits to this Report on Form 10-K completely

and with the understanding that our actual future results may be

materially different from what we expect. The forward-looking

statements contained in this Report on Form 10-K are made as of the

date of this Report on Form 10-K, and we do not assume

any obligation to update any forward-looking statements, whether as

a result of new information, future events or otherwise, except as

required by applicable law.

SeD

Intelligent Home Inc.

Form

10-K

For the

Year Ended December 31, 2018

Table

of Contents

|

|

|

|

Page

|

|

|

PART I

|

|

|

|

Item 1.

|

Business

|

|

2

|

|

Item 1A.

|

Risk

Factors

|

|

10

|

|

Item 1B.

|

Unresolved

Staff Comments

|

|

15

|

|

Item 2.

|

Properties

|

|

15

|

|

Item 3.

|

Legal

Proceedings

|

|

15

|

|

Item 4.

|

Mine

Safety Disclosures

|

|

15

|

|

|

|

|

|

|

|

PART II

|

|

|

|

Item 5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters,

and Issuer Purchases of Equity Securities

|

|

16

|

|

Item 6.

|

Selected

Financial Data

|

|

16

|

|

Item 7.

|

Management's

Discussion and Analysis of Financial Condition and Results of

Operations

|

|

16

|

|

Item 7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

|

19

|

|

Item 8.

|

Financial

Statements and Supplementary Data

|

|

20

|

|

Item 9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosures

|

|

36

|

|

Item 9A.

|

Controls

and Procedures

|

|

36

|

|

Item 9B.

|

Other

Information

|

|

36

|

|

|

|

|

|

|

|

PART III

|

|

|

|

Item 10.

|

Directors,

Executive Officers and Corporate Governance

|

|

37

|

|

Item 11.

|

Executive

Compensation

|

|

41

|

|

Item 12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

|

43

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

|

44

|

|

Item 14.

|

Principal

Accounting Fees and Services

|

|

46

|

|

|

|

|

|

|

|

PART

IV

|

|

|

|

Item 15.

|

Exhibits,

Financial Statement Schedules

|

|

47

|

|

Item 16.

|

Form

10-K Summary

|

|

48

|

|

Signatures

|

|

|

49

|

PART

I

Item 1. Business.

General

SeD Intelligent Home Inc., formerly known as Homeownusa, was

incorporated in the State of Nevada on December 10, 2009 with the

intention of entering into the home equity lease/rent to own

business. The Company is no longer pursuing this business plan. Our

address is 4800 Montgomery Lane, Suite 210, Bethesda, MD, 20814.

Our telephone number is 301-971-3940.

On December 31, 2013, the Company’s sole director and officer

and nine other shareholders sold their interest in the Company to

CloudBiz International Pte, Ltd (“CloudBiz”), a

Singapore corporation. The total number of shares purchased was

15,730 which represented a 69% interest in the Company’s

issued and outstanding common stock (the

“Transaction”). Along with the Transaction, the sole

director and officer resigned and Mr. Conn Flanigan was appointed

as the Company’s Chief Executive Officer and sole director.

On July 7, 2014 CloudBiz invested $37,000 in the Company. For such

investment, CloudBiz received an additional 74 million shares of

the Company’s common stock. In October 2014, the Company

issued 20,534 shares to 30 new investors for total proceeds of

$2,053. On December 22, 2016 Cloudbiz International Pte. Ltd

transferred 74,015,730 common shares to Singapore eDevelopment.

Singapore eDevelopment subsequently contributed its ownership in

the Company to its subsidiary SeD Home International, Inc. (which

also owned SeD Home, Inc. until December 29, 2017, at which time

SeD Home International, Inc. contributed its shares of SeD Home to

the Company). The majority of the Company’s common stock

continues to be owned by SeD Home International, Inc. On January

10, 2017, our board of directors appointed Fai H. Chan as Director.

On March 10, 2017, Mr. Rongguo (Ronald) Wei, CPA, was appointed as

Chief Financial Officer of the Company.

On March 10, 2017, our board of directors approved and ratified a

change in the Company's fiscal year end from January 31 to December

31, effective immediately as of the date of the board approval. On

September 5, 2017, the Company changed its name to SeD Intelligent

Home Inc., and increased its number of authorized shares to

1,000,000,000 (the par value per share remained

$.001).

On December 29, 2017, the Company, SeD Acquisition Corp., a

Delaware corporation and wholly-owned subsidiary of the Company

(the “Merger Sub”), SeD Home Inc. (“SeD

Home”), a Delaware corporation, and SeD Home International,

Inc., a Delaware corporation entered into an Acquisition Agreement

and Plan of Merger (the “Agreement”) pursuant to which

the Merger Sub was merged with and into SeD Home, with SeD Home

surviving as a wholly-owned subsidiary of the Company. The closing

of this transaction (the “Closing”) also took place on

December 29, 2017 (the “Closing Date”). Effective as of

the Closing, the Company ceased to be a “shell company”

as that term is defined in Rule 405 of the Securities Act and Rule

12b-2 of the Exchange Act. The Company’s business operations

became those operations that SeD Home is currently conducting, and

may conduct in the future.

In connection with the acquisition of SeD Home, the Company

appointed new officers and directors. Fai H. Chan and Moe T. Chan

serve as co-Chief Executive Officers; Rongguo (Ronald) Wei

and Alan W. L. Lui serve as Co-Chief Financial Officers, and

our Board of Directors includes Fai H. Chan, Moe T. Chan, Conn

Flanigan and Charles MacKenzie.

With the completion of the Company’s acquisition of SeD Home,

we entered into the business of land development. While the Company

will own real estate, the Company does not intend to be a REIT for

federal tax purposes.

SeD Home was incorporated in Delaware on February 24, 2015, and was

named SeD Home USA, Inc. before changing its name in May of

2015. Prior to the Closing, SeD Home was entirely owned and

controlled by Singapore eDevelopment and certain of its

subsidiaries since its incorporation. Since SeD Home’s

incorporation, the management and funding of SeD Home has been

directed by Singapore eDevelopment’s management, including

Singapore eDevelopment’s Chief Executive Officer and

controlling shareholder, Fai H. Chan. The officers and

directors of SeD Home are the same six individuals who are the

officers and directors of the Company (listed above). SeD

Home’s Black Oak project is a 162-acre land sub-division

development located north of Houston, Texas. SeD Home’s

Ballenger Run project is a 197-acre sub-division development near

Washington D.C. in Frederick County, Maryland. SeD Home conducts

its operations through ten wholly and partially owned subsidiaries.

SeD Home’s affiliates will provide project and asset

management via separate agreements with consultants.

The land development business involves converting undeveloped land

into buildable lots. When possible, in future projects we will

attempt to mitigate risk by attempting to enter into contracts with

strategic home building partners for the sale of lots to be

developed. In such circumstances, it is our intention that (i) we

will conduct a feasibility study on a particular land development;

(ii) both SeD Home and the strategic home building partners will

work together in connection with acquisition of the appropriate

land; (iii) strategic home building partners will typically agree

to enter into agreements to purchase up to 100% of the buildable

lots to be developed; (iv) SeD Home and the strategic home building

partners will enter into appropriate agreements; and (v) SeD Home

will proceed to acquire the land for development and will be

responsible for the infrastructure development, ensuring the

completion of the project and delivery of buildable lots to the

strategic home building partner.

We also intend, to the fullest extent practicable, to source land

where local government agencies (including county, district and

other municipalities) and public authorities, such as improvement

districts, will reimburse the majority of infrastructure costs

incurred by the land developer for developing the land to build

taxable properties. The developers and public authorities enter

into agreements whereby the developers are reimbursed for their

costs of infrastructure.

The Company will also consider the potential to purchase

foreclosure property development projects from banks, if attractive

opportunities should arise.

The Company, utilizing the extensive business network of its

management and majority shareholder, may from time to time attempt

to forge joint ventures with other parties. Through its

subsidiaries, SeD Home may manage such joint ventures.

In addition to the completion of our current projects, we intend to

seek additional land development projects in diverse regions across

the United States. Such projects may be within both the for-sale

and for-rent markets, and we may expand from residential properties

to other property types, including but not limited to commercial

and retail properties. We will consider projects in diverse regions

across the United States, however, SeD Home and its management and

consultants have longstanding relationships with local owners,

brokers, managers, lenders, tenants, attorneys and accountants to

help it source deals throughout Maryland and Texas. SeD Home will

continue to focus on off-market deals and raise appropriate

financing.

SeD Home, via a subsidiary, is presently exploring opportunities to

expand its current portfolio by developing communities solely

designed for renters. SeD Home is exploring the potential to pursue

this new endeavor in part to improve cash flow and smooth out the

inconsistencies of income in residential land development. SeD Home

will continue to attempt to mitigate risk and maximize

returns. At the present time, SeD Home owns one home through

its subsidiary SeD USA, LLC which is rented. Previously, SeD Home

owned other homes for rent which have been sold.

Entering into the business of building homes with the intention of

owning and renting those homes would provide an opportunity for SeD

Home to create value by (i) acquiring properties for horizontal and

vertical development; (ii) providing fee generation via property

management and leasing; and (iii) capturing rent escalations over

long term periods. SeD Home and its affiliates would provide

property management for customers seeking to offload home

maintenance and lawn care.

Through our subsidiaries, we will explore the potential to pursue

other business opportunities related to real estate. The Company is

evaluating the potential to enter into activities related to real

estate and home technologies, although we note that these potential

opportunities remain at the exploratory stage, and we may not

pursue these opportunities at the discretion of our management. The

Company is particularly exploring opportunities related to smart

home and eco-friendly home technologies.

We also intend to enlarge the scope of property-related services.

Additional planned activities, which we intend to be carried out

through SeD Home, include financing, home management, realtor

services, insurance and home title validation. We may particularly

provide these services in connection with homes we build. These

activities are also in the planning stages.

The Company has expended minimal resources on the projects

currently being explored as potential additions to our core land

development business, consisting primarily of management time,

payments for market studies and expenditures for the development of

proposed floor plans for potential residential developments. The

Company has not yet determined the estimated time frame for when it

might commence operations in any such new business

opportunities.

As of December 31, 2018, we had total assets of $48,600,709 and

total liabilities of $13,733,045. Total assets as of December 31,

2017 were $58,166,606 and total liabilities were

$24,561,292.

Employees

At the present time, the Company has four full time employees. Much

of our work is done by contractors retained for projects, and at

the present time we have no part time employees.

Compliance with Government Regulation

The development of our real estate projects will require the

Company to comply with federal, state and local environmental

regulations. In connection with this compliance, our real

estate acquisition and development projects will require

environmental studies. To date, the Company has spent approximately

$42,356 on environmental studies and compliance. Such costs

are reflected in construction progress costs in our financial

statements.

The cost of complying with governmental regulations

is significant and will increase if we add additional real

estate projects and become involved in homebuilding in the future

and are required to comply with certain due diligence procedures

related to third party lenders.

At the present time, we believe that we have all of the material

government approvals that we need to conduct our business as

currently conducted. We are subject to periodic local permitting

that must be addressed, but we do not anticipate that such

requirements for government approval will have a material impact on

our business as presently conducted. We are required to comply with

government regulations and to make filings from time to time with

various government entities. Such work is typically handled by

outside contractors we retain.

Intellectual Property

At the present time, the Company does not own any trademarks, but

we anticipate filing trademark applications as we expand into new

areas of business.

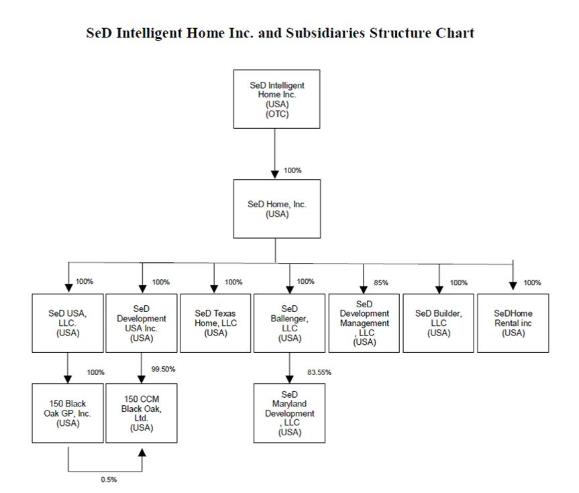

Corporate Organization

The following chart describes the Company’s ownership of

various subsidiaries:

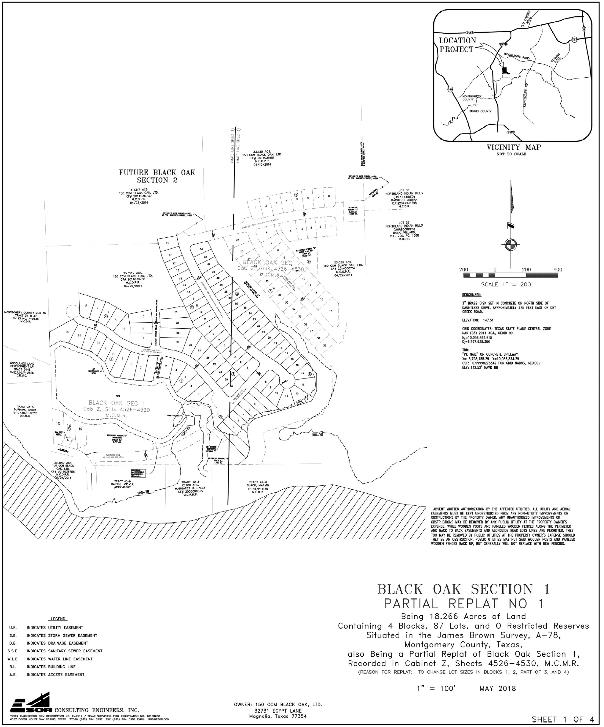

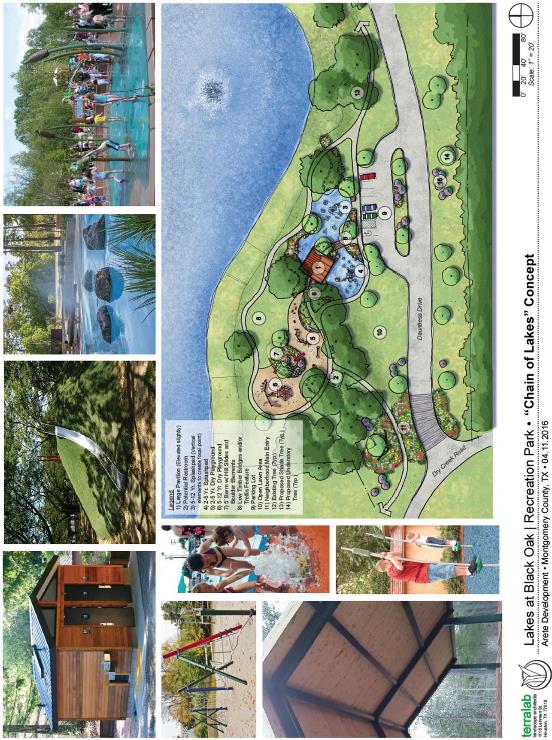

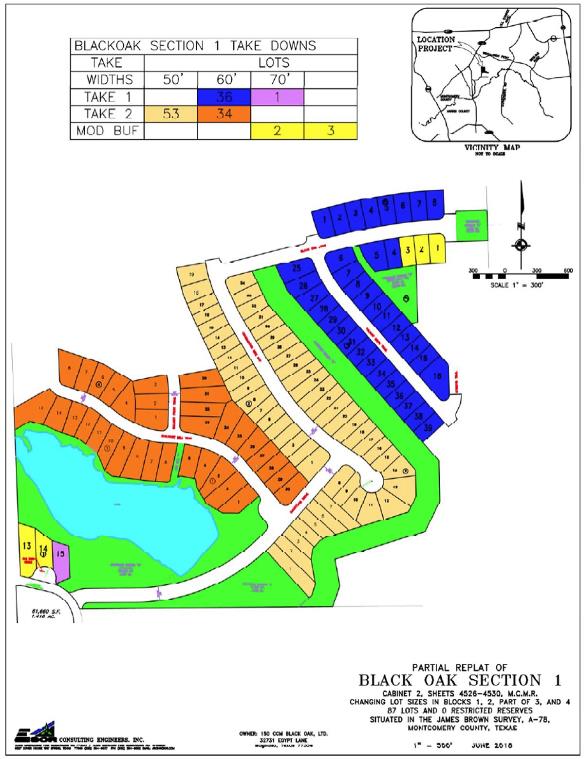

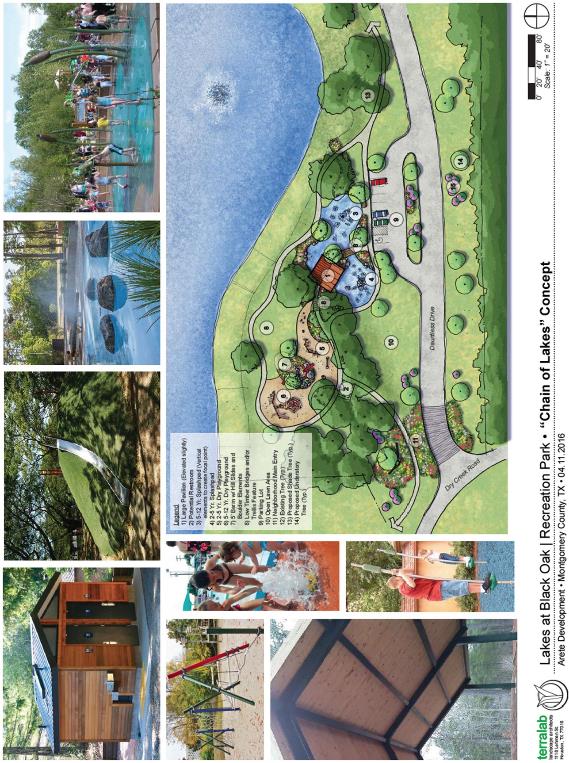

Black Oak

Our Black Oak project is a 162-acre land infrastructure development

and sub-division project situated in Magnolia, Texas north of

Houston. 150 Black Oak, Ltd. was a partnership formed by our

former partner prior to our investment in this project. Black Oak

had contracts to purchase seven contiguous parcels of land. Our

initial equity investment was US$4.3 million for ownership of 60%

of the partnership. Upon this initial investment in February 2014,

we changed the name of the partnership to 150 CCM Black Oak, Ltd

(“Black Oak”) and subsequently increased our ownership

to 69%. On July 23, 2018, SeD Development USA, LLC, a wholly owned

subsidiary of the Company, entered into two Partnership Interest

Purchase Agreements through which it purchased an aggregate of 31%

of Black Oak. Prior to the Partnership Interest Purchase

Agreements, the Company owned and controlled Black Oak through its

68.5% limited partnership interest and its ownership of the General

Partner, 150 Black Oak GP, Inc, a 0.5% owner in Black Oak. As a

result of the purchase, the Company, through its subsidiaries, now

owns 100% of Black Oak. 150 Black Oak GP, Inc., is wholly owned by

SeD USA, LLC, which in turn is wholly owned by SeD Home. The

limited partnership interests are owned by SeD Development USA,

Inc., which is wholly owned by SeD Home. 150 Black Oak GP, Inc. was

previously jointly owned with a partner, but is now entirely owned

by SeD USA, LLC.

Black Oak was obligated, under the Limited Partnership Agreement

(as amended) signed between previous limited partners of Black Oak,

to pay a $6,500 per month management fee to Arete Real Estate and

Development Company (Arete), and $2,000 per month to American Real

Estate Investments LLC (AREI). Arete was also entitled to be paid a

developer fee of 3% of all development costs excluding certain

costs. The fees were to accrue until $1,000,000 in revenue and/or

builder deposits relating to the Black Oak Project has received. On

December 31, 2017, the Company had $314,630 owed to Arete and

$48,000 to AREI in accounts payable and accrued expenses. On April

26, 2018, SeD Development USA, Arete and AREI reached an agreement

to terminate the terms related to management fees and developer

fees in the Limited Partnership Agreement. In July 2018, per the

terms of the termination agreement, Black Oak LP paid Arete

$300,000 and AREI $30,000 to fulfill the commitments. Following the

termination of these agreements and the payments, no further

management fees or developer fees have accrued or been

paid.

In October 2015, the project obtained a $6.0 million construction

loan from Revere High Yield Fund, LP. This loan was paid off in

October of 2017. Currently the Black Oak project does not have any

financing from third parties.

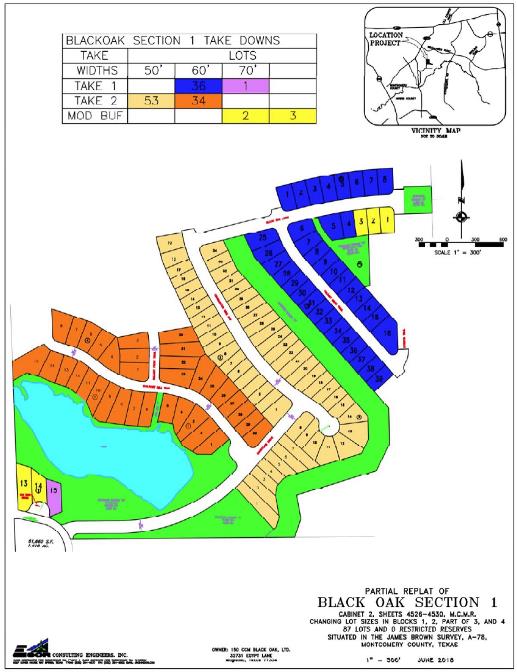

The site plan at Black Oak is being revised to allow for

approximately 420-512 residential lots of varying sizes. We

anticipate that our involvement in land development aspects of this

project will take approximately three to five additional years to

complete. Since February of 2015, we have completed several

important tasks related to the project, including clearing certain

portions of the property, paving certain roads within the project

and complying with the local improvement district to ensure

reimbursement of these costs.

The

estimated construction costs and completion date for each phase are

as follows:

|

Black

Oak

|

Estimated

Construction Costs

|

Expected

Completion Date

|

|

Phase

1

|

$7,080,000

|

April

2019

|

|

Phase

2

|

5,690,000

|

April

2020

|

|

Phase

3

|

3,850,000

|

August

2020

|

|

Phase

4

|

4,020,000

|

April

2021

|

|

Total

|

$20,640,000

|

|

On July

3, 2018, 150 CCM Black Oak Ltd. entered into a Purchase and Sale

Agreement with Houston LD, LLC for the sale of 124 lots within the

Black Oak project (the “Black Oak Purchase Agreement”).

Pursuant to the Black Oak Purchase Agreement, it was agreed that

124 lots would be sold for a range of prices based on the lot type.

In addition, Houston LD, LLC agreed to contribute a

“community enhancement fee” for each lot, collectively

totaling $310,000 which is held in escrow. 150 CCM Black Oak, Ltd.

will apply these funds exclusively towards an amenity package on

the property. The closing of the transactions contemplated by the

Black Oak Purchase Agreement was subject to Houston LD, LLC

completing due diligence to its satisfaction.

On July

20, 2018, Black Oak LP received $4,592,079 of district

reimbursement for previous construction costs incurred in the land

development. Of this amount, $1,650,000 will remain on deposit in

the District’s Capital Projects Fund for the benefit of Black

Oak LP and will be released upon receipt of the evidence of the:

(a) execution of a purchase agreement between Black Oak LP and a

home builder with respect to the Black Oak development and (b) of

the completion, finishing and making ready for home construction of

at least 105 unfinished lots in the Black Oak development. In 2018,

$446,745 was released to reimburse the construction costs leaving a

balance of $1,203,255 on December 31, 2018.

On

October 12, 2018, 150 CCM Black Oak, Ltd. entered into an Amended

and Restated Purchase and Sale Agreement (the “Amended and

Restated Black Oak Purchase Agreement”) for these 124 lots.

Pursuant to the Amended and Restated Black Oak Purchase Agreement,

the purchase price remained at $6,175,000. 150 CCM Black Oak, Ltd.

was required to meet certain closing conditions and the timing for

the closing was extended.

On

January 18, 2019, the sale of 124 lots at Black Oak was completed

for $6,175,000 and the community enhancement fee equal to $310,000

was delivered to the escrow account.

At the present time, the Company is also considering expanding its

current policy of selling buildable lots to include a strategy of

building housing for sale or rent, particularly at our Black Oak

property.

Ballenger Run

In November 2015, we completed the $15.65 million acquisition of

Ballenger Run, a 197-acre land sub-division development located in

Frederick County, Maryland. Previously, on May 28, 2014, the

RBG Family, LLC entered into the Assignable Real Estate Sales

Contract with NVR, Inc. (“NVR”) by which RBG Family,

LLC would sell the 197 acres for $15,000,000 to NVR. On December

10, 2014, NVR assigned this contract to SeD Maryland Development,

LLC in the Assignment and Assumption Agreement and entered into a

series of Lot Purchase Agreements by which NVR would purchase

subdivided lots from SeD Maryland Development, LLC.

SeD Maryland Development’s acquisition of the 197

acres was funded in part from a $5.6 million deposit from NVR

Inc. (“NVR”). The balance of $10.05 million was derived

from a total equity contribution of $15.2 million by SeD Ballenger

LLC (“SeD Ballenger”) and CNQC Maryland Development LLC

(a unit of Qingjian International Group Co, Ltd, China,

“CNQC”). The project is owned by SeD Maryland

Development, LLC (“SeD Maryland”). SeD Maryland is

83.55% owned by SeD Ballenger and 16.45% by CNQC.

SeD Maryland entered into a Project Development and Management

Agreement for Ballenger Run with MacKenzie Development Company, LLC

and Cavalier Development Group, LLC on February 25, 2015. MacKenzie

Development Company, LLC assigned its rights and obligations to

this agreement to Adams Aumiller Properties, LLC on September 9,

2017. Pursuant to this Project Development and Management

Agreement, Adams Aumiller, LLC and Cavalier Development Group, LLC

coordinate and manage the construction, financing, and development

of Ballenger Run. SeD Maryland compensates Adams Aumiller LLC and

Cavalier Development Group, LLC with a monthly aggregate fee of

$14,667 until all single family and townhome lots are sold. The

monthly aggregate fee will then adjust to $11,000 which will

continue for approximately eight months to allow all close out

items to be finished including the release of guarantees and

securities as required by the government authorities. The Project

Development and Management Agreement for Ballenger Run also

requires SeD Maryland to pay a fee of $1,200 and $500 for each

single-family and townhome, respectively, sold to a third party.

SeD Maryland also paid a fee of $50,000 after the sale of the

parcel underlying the multi-family lots in August

2018.

This property is zoned for 443 entitled Residential Lots, 210

entitled Multifamily Units and 200 entitled continuing care

retirement community units approved for twenty (20) years from the

date of a Developers Rights & Responsibilities Agreement dated

October 8, 2014, as amended on September 6, 2016. We are presently

seeking to revise the zoning of this property to include 479

entitled residential lots and 210 entitled multi-family units, with

no entitled continuing care retirement community units. We

anticipate that the completion of our involvement in this project

will take approximately three years from the date of this Annual

Report.

Revenue from Ballenger Run is anticipated to come from three main

sources:

● The sale of 479 entitled and constructed residential lots

to NVR;

● The sale of the lot for the 210 entitled multi-family

units; and

● The sale of 479 front foot benefit

assessments.

Revenues may be adversely impacted, if we fail to attain certain

goals, meet certain conditions or if market prices for this

development unexpectedly begin to drop.

The estimated construction costs and completion date for each phase

are as follows:

|

Ballenger Run

|

Estimated Construction Costs

|

Expected Completion Date

|

|

Phase 1

|

$13,786,000

|

Completed

|

|

Phase 2

|

10,210,000

|

December 2019

|

|

Phase 3

|

10,170,000

|

September 2020

|

|

Phase 4

|

3,460,000

|

March 2020

|

|

Phase 5

|

1,690,000

|

December 2021

|

|

Total

|

$39,316,000

|

|

Financing from Union Bank (f/k/a The Bank of Hampton Roads, Shore

Bank and Xenith Bank) closed simultaneous with the settlement on

the land on November 23, 2015, pursuant to a subsequent amendment

to the terms of this loan, the loan provides (i) for a maximum of

$11 million outstanding; (ii) that the maturity of this loan will

be December 31, 2019; and (iii) includes an $800,000 letter of

credit facility, with an annual rate of 1.5% on all issued letters

of credit.

This loan is to fund the development of the first 276 lots, the

multi-family parcel and senior living parcel, the amenities

associated with these phases, and certain road

improvements.

Expenses from Ballenger Run include, but are not limited to costs

associated with land prices, closing costs, hard development costs,

cost in lieu of construction, soft development costs and interest

costs. We presently estimate these costs to be between $55 and $56

million. We may also encounter expenses which we have not

anticipated, or which are higher than presently

anticipated.

This project will have five phases. The first phase has been

completed and we are currently in the second phase for completion

of this project.

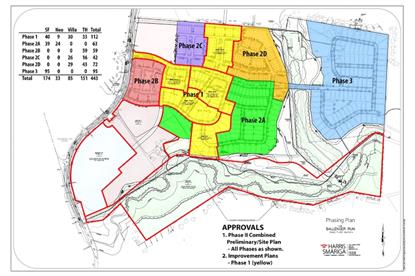

The following chart describes the various phases of this project

(the chart does not reflect our current attempt to revise the

zoning at this project to reflect the addition of 36 villa lots to

replace the 200 continuing care retirement community units

originally planned):

Phase 1 construction of all infrastructure was completed in 2017.

The initial model lot sales with NVR began in May 2017 and all lot

sales of varying types as outlined in the chart set forth above are

continuing through the first quarter of 2018. In the fourth quarter

of 2017 all improvement plans and cost estimates were approved for

Phases 2A, 2B, 2C and 2D. Phase 2B is the next phase of lot

takedowns for NVR. Phase 2B plat recordation and final construction

began in March of 2018. Lot sales to NVR also began in March of

2018. Phases 2A and 2C plat

recordation and construction began in June of 2018. Phase 2D

construction began in September.

Sale of Residential Lots

The 479 Residential Lots were contracted for sale under a Lot

Purchase Agreement to NVR, a company based in the US and listed on

the New York Stock Exchange. NVR is a home builder which is engaged

in the construction and sale of single-family detached homes,

townhouses and condominium buildings. It also operates a mortgage

banking and title services business. Under the Lot Purchase

Agreements, NVR provided SeD Home with an upfront deposit

of $5.6 million and has agreed to purchase the lots at a range

of prices. The lot types and quantities to be sold to NVR under the

Lot Purchase Agreements include the following:

|

Lot Type

|

|

|

Single

Family Detached Large

|

85

|

|

Single

Family Detached Small

|

89

|

|

Single

Family Detached Neo Traditional

|

33

|

|

Single

Family Attached 28’ Villa

|

121

|

|

Single

Family Attached 20’ End Unit

|

46

|

|

Single

Family Attached 16’ Internal Unit

|

105

|

|

Total

|

479

|

There are five different types of Lot Purchase Agreements

(“LPAs”), which are essentially the same except for the

price and unit details for each type of lot. Under the LPAs, NVR

shall purchase 30 available lots per quarter. The LPAs provide

several conditions related to preparation of the lots which must be

met so that a lot can be made available for sale to NVR. SeD

Maryland is to provide customary lot preparation including but not

limited to survey, grading, utilities installation, paving, and

other infrastructure and engineering. In the event NVR does not

purchase the lots under the LPAs, SeD Maryland would be entitled to

keep the NVR deposit and terminate the LPAs. Should SeD Maryland

breach the LPAs, it would have to return the remainder of the NVR

deposit that has not already been credited to NVR for any sales of

lots under the LPAs and NVR would be able to seek specific

performance of the LPAs as well as any other rights available at

law or in equity.

The sale of 13 model lots to NVR began in May of 2017. 102 lots

were sold in the year ended December 31, 2018, compared to 42 lots

sold in the year ended December 31, 2017. NVR

has started marketing houses and has commenced

sales.

Sale of Lots for the Multi-family Units

In June

2016, SeD Maryland entered into a lot purchase agreement with

Orchard Development Corporation relating to the sale of 210

multifamily units in the Ballenger Run Project for a total purchase

price of $5,250,000, which closed on August 7, 2018.

Sale of the Front Foot Benefit Assessments

We have established a front foot benefit assessment on all of the

NVR lots. This is a 30-year annual assessment allowed in Frederick

County which requires homeowners to pay the developer to reimburse

the costs of installing public water and sewer to the lots. These

assessments become effective as homes are settled, at which time we

can sell the collection rights to the assessments to investors who

will pay a lump sum up front so we can realize the revenue sooner.

Front foot benefit assessments are subject to amendment by

regulatory agencies, legislative bodies, and court rulings, and any

changes to front foot benefit assessments could cause us to

reassess these projections.

Wetland Impact Permit

The Ballenger project will require a joint wetland impact permit,

which requires the review of several state and federal agencies,

including the US Army Corps of Engineers. The permit is primarily

required for Phase 3 construction which will not start until 2019

or later but it also affects a pedestrian trail at the Ballenger

project and the multi-family sewer connection. The US Army Corps of

Engineers allowed us to proceed with construction on Phase 1 but

required archeological testing. As of

the date of this report, the archeological testing has been

completed with no further recommendations on Phase 1 of the

project. Required architectural studies on the final phase of

development will likely result in the loss of only one lot,

however, we cannot be certain of future reviews and their impact on

the project.

K-6 Grade School Site

In connection with getting the necessary approvals for the

Ballenger Project, we agreed to transfer thirty acres of land that

abuts the development for the construction of a local K-6 grade

school. We will not be involved in the construction of such

school.

Home Incubation Project

Recognizing that large land sub-division projects have a longer

time horizon, we previously introduced a home incubation initiative

to market completed U.S. single-family homes, with existing

tenants, to investors in Asia (the “Home Incubation

Project”).

Under the Home Incubation Project, we purchased 27 homes, mostly

located in Texas. We sold 24 of the homes by the end of 2016 and an

additional two in 2017. SeD Home retains only one rental home

at the present time.

Competition

There are a number of companies engaged in the development of land.

Should we expand our operations into the business of constructing

homes ourselves, we will face increased competition, including

competition from large, established and well-financed companies,

some of which may have considerable ties and experience in the

geographical areas in which we seek to operate. Similarly, as we

consider other opportunities we may wish to pursue in addition to

our current land development business, we anticipate that we will

face experienced competitors.

We will compete in part on the basis of the skill, experience and

innovative nature of our management team, and their track record of

success in diverse industries.

Item 1A. Risk Factors.

An investment in our common stock involves a high degree of risk.

You should carefully consider the risks described below and the

other information in this report before making a decision to invest

in our common stock. If any of the following risks and

uncertainties develop into actual events, our business, results of

operations and financial condition could be adversely affected. In

those cases, the trading price of our common stock could decline

and you may lose all or part of your investment.

Risks Related to Our Company

We will need additional capital to expand our current operations or

to enter into new fields of operations.

Both the expansion of our current land development operations into

new geographic areas and the proposed expansion of the Company into

new businesses in the real estate industry will require additional

capital. We will need to seek additional financing either through

borrowing, private offerings of our securities or through strategic

partnerships and other arrangements with corporate partners. We

cannot be assured that additional financing will be available to

us, or if available, will be available to us on terms favorable to

us. If adequate additional financing is not available on acceptable

terms, we may not be able to implement our business development

plan or expand our operations.

We must retain key personnel for the success of our

business.

Our success is highly dependent on the skills and knowledge of our

management team, including their knowledge of our projects and

network of relationships. If we are unable to retain the members of

such team, or adequate substitutes, this could have a material

adverse effect on our business and financial

condition.

If we fail to effectively manage our growth our future business

results could be harmed and our managerial and operational

resources may be strained.

As we proceed with the expansion of our operations, we expect to

experience significant and rapid growth in the scope and complexity

of our business. We will need to hire additional personnel in order

to successfully advance our operations. This growth is likely to

place a strain on our management and operational resources. The

failure to develop and implement effective systems, or to hire and

retain sufficient personnel for the performance of all of the

functions necessary to effectively service and manage our potential

business, or the failure to manage growth effectively, could have a

materially adverse effect on our business and financial

condition.

There are risks related to conflicts of interest with our partners

in the Ballenger Run Project.

The Company owns the Ballenger Run Project with another LLC member.

This entity is controlled, however, by the Company not only through

the Company’s majority voting interest in such project, but

also through the control of the entity responsible for such

project’s day-to-day operations. The project will be

dependent upon SeD Development Management LLC, a subsidiary of SeD

Home, for the services required for its operations. The

Company’s control of both the voting control of this project

as well as the control of the entity responsible for the day to day

interests of the project could create conflicts of interest between

our Company and our partner in the project. SeD Maryland, the owner

of the project, has no employees, and this project will be

dependent upon SeD Development Management LLC and its affiliates

for the services required for its operations.

The terms of the Management Agreement between SeD Maryland and SeD

Development Management LLC were not negotiated at

arm’s-length, although it was adopted by CNQC, the other

member. Pursuant to the Management Agreement, the owners of SeD

Maryland, SeD Ballenger and CNQC, have delegated the day-to-day

operations of developing Ballenger Run to SeD Development

Management, LLC.

Despite this delegation, potential conflict between CNQC and SeD

Development Management, LLC regarding the management of day-to-day

operations of Ballenger Run could undermine our ability to

effectively implement our vision for these projects, and could

result in costly and time-consuming litigation.

Members of our management may face competing demands relating to

their time, and this may cause our operating results to

suffer.

Fai H. Chan, one of our Co-Chief Executive Officers, is both an

officer and director of Singapore eDevelopment, the entity which

owns SeD Home International, Inc., our majority shareholder. Mr.

Chan is involved in a number of other projects other than our

Company’s real estate business and will continue to be so

involved. Moe T. Chan is a consultant to Singapore eDevelopment and

will also be involved in projects other than our Company’s

real estate business. Both of our Co-Chief Executive Officers have

their primarily residences and business offices in Asia, and

accordingly, there will be limits on how often they are able to

visit the locations of our real estate projects. Similarly, our

Co-Chief Financial Officers are both also engaged in non-real

estate activities of Singapore eDevelopment, and only one of our

Co-Chief Financial Officers resides and works in the United States

(at an office located in Bethesda, MD).

Since some members of our board of directors are not residents of

the United States, shareholders may not be able to enforce a U.S.

judgment for claims brought against such directors.

Several members of our senior management team, including our

Co-Chief Executive Officers, have their primary residences and

business offices in Asia, and some portion of the assets of these

directors are located outside the United States. As a result, it

may be more difficult for shareholders to enforce a lawsuit within

the United States against these non-U.S. residents than if they

were residents of the United States. Also, it may be more difficult

for shareholders to enforce any judgment obtained in the United

States against the assets of our non-U.S. resident management

located outside the United States than if these assets were located

within the United States. A foreign court may not enforce

liabilities predicated on U.S. federal securities laws in original

actions commenced in certain foreign jurisdictions, or judgments of

U.S. courts obtained in actions based upon the civil liability

provisions of U.S. federal securities laws.

Concentration of ownership of our common stock by our majority

shareholder will limit other investors from influencing significant

corporate decisions.

Our majority shareholder will be able to make decisions such as (i)

making amendments to our certificate of incorporation and by-laws,

(ii) whether to issue additional shares of common stock and

preferred stock, (iii) employment decisions, including compensation

arrangements, (iv) whether to enter into material transactions with

related parties, (v) election and removal of directors and (vi) any

merger or other significant corporate transactions. The interests

of our majority shareholder may not coincide with the interests of

other shareholders.

Our relationship with our majority shareholder and its parent and

affiliates may be on terms which are perceived by investors as more

or less favorable than those that could be obtained from third

parties.

Our majority shareholder, SeD Home International, Inc., presently

owns 99.99% of our issued and outstanding common stock. While we

anticipate that such percentage will be diluted over time, our

majority shareholder, its parent and affiliates will be perceived

as having influence over our management and operations, and any

loans or other agreements which we may enter into with our majority

shareholder and its parent and affiliates may be perceived by

investors as being on terms that are less favorable than we could

otherwise receive; such perception could adversely impact the price

of our common stock. Similarly, such agreements could be perceived

as being on terms more favorable than those that could be obtained

from third parties, and any unwillingness by our majority

shareholder and its parent and affiliates to engage with our common

stock could discourage investors.

Risks Relating to the Real Estate Industry

The market for real estate is subject to fluctuations that may

impact the value of the land or housing inventory that we hold,

which may impact the price of our common stock.

Investors should be aware that the value of any real estate we own

may fluctuate from time to time in connection with broader market

conditions and regulatory issues which we cannot predict or

control, including interest rates, the availability of credit, the

tax benefits of homeownership and wage growth, unemployment and

demographic trends in the regions in which we conduct business.

Should the price of real estate decline in the areas in which we

have purchased land, the price at which we will be able to sell

lots to home builders, or if we build houses, the price at which

can sell such houses to buyers, will decline.

The regulation of mortgages could adversely impact home

buyers’ willingness to buy new homes which we may be involved

in building and selling.

If we become active in the construction and sale of homes to

customers, the ability of home buyers to get mortgages could have

an impact on our sales, as we anticipate that the majority of home

buyers will be financed through mortgage financing.

An increase in interest rates will cause a decrease in the

willingness of buyers to purchase land for building homes and

completed homes.

An increase in interest rates will likely impact sales, reducing

both the number of homes and lots we can sell and the price at

which we can sell them.

Our business, results of operations and financial condition could

be adversely impacted by significant inflation or

deflation.

Significant inflation could have an adverse impact on us by

increasing the costs of land, materials and labor. We may not be

able to offset cost increases caused by inflation. In addition, our

costs of capital, as well as those of our future business partners,

may increase in the event of inflation, which may cause us to need

to cancel projects. Significant deflation could cause the value of

our inventories of land or homes to decline, which could sharply

impact our profits.

New environmental regulations could create new costs for our land

development business, and other business in which we may commence

operations.

At the present time, we are subjected to a number of environmental

regulations. If we expand into the business of building homes

ourselves, we will be subjected to an increasing number of

environmental regulations. The number and complexity of local,

state and federal regulations may increase over time. Additional

environmental regulations can add expenses to our existing

business, and to businesses which we may enter into the future,

which may reduce our profits.

Zoning and land use regulations impacting the land development and

homebuilding industries may limit our activities and increase our

expenses, which would adversely affect our profits.

We must comply with zoning and land use regulations impacting the

land development and home building industries. We will need to

obtain the approval of various government agencies to expand our

operations as currently into new areas and to commence the building

of homes. Our ability to gain the necessary approvals is not

certain, and the expense and timing of approval processes may

increase in ways that adversely impact our profits.

The availability and cost of skilled workers in the building trades

may impact the timing and profitability of projects that we

participate in.

Should there be a lack of skilled workers to be retained by our

Company and its partners, the ability to complete land development

and potential construction projects may be delayed.

Shortages in required materials could impact the profitability of

construction partnerships we may participate in.

Should a shortage of required materials occur, such shortage could

cause added expense and delays that will undermine our

profits.

Our ability to have a positive relationship with local communities

could impact our profits.

Should we develop a poor relationship with the communities in which

we will operate, such relationship will impact our

profits.

We may face litigation in connection with either our current

activities or activities which we may conduct in the

future.

As we expand our activities, the likelihood of litigation shall

increase. The expenses of such litigation may be substantial. We

may be exposed to litigation for environmental, health, safety,

breach of contract, defective title, construction defects, home

warranty and other matters. Such litigation could include expensive

class action matters. We could be responsible for matters assigned

to subcontractors, which could be both expensive and difficult to

predict.

As we expand operations, we will incur greater insurance costs and

likelihood of uninsured losses.

If we expand our operations into home building, we may experience

material losses for personal injuries and damage to property in

excess of insurance limits. In addition, our premiums may

raise.

Health and safety incidents that occur in connection with our

potential expansion into the home building business could be

costly.

If we commence operations in the homebuilding business, we will be

exposed to the danger of health and safety risks to our employees

and contractors. Health and safety incidents could result in the

loss of the services of valued employees and contractors and expose

us to significant litigation and fines. Insurance may not cover, or

may be insufficient to cover, such losses.

Adverse weather conditions, natural disasters and man-made

disasters may delay our projects or cause additional

expenses.

The land development operations which we currently conduct and the

construction projects which we may become involved in at a later

date may be adversely impacted by unexpected weather and natural

disasters, including but not limited to storms, hurricanes,

tornados, floods, blizzards, fires or earthquakes. Man-made

disasters including terrorist attacks, electrical outages and

cyber-security incidents may also impact the costs and timing of

the completion of our projects. Cyber-security incidents, including

those that result in the loss of financial or other personal data,

could expose us to litigation and reputational damage. If insurance

is unavailable to us on acceptable terms, or if our insurance is

not adequate to cover business interruptions and losses from the

conditions described above and similar incidents, or results of

operations will be adversely affected. In addition, damage to new

homes caused by these conditions may cause our insurance costs to

increase.

We have a concentration of revenue and credit risk with one

customer.

We have been highly dependent on sales of residential lots to NVR.

Pursuant to agreements between NVR and SeD Maryland Development,

LLC, NVR will be the sole purchaser of 479 residential lots at our

Ballenger project (subject to an increase in zoning approvals for

the number of residential lots from 443 to 479). During 2018, we

received $12.0 million in revenue from lot sales to NVR. Therefore,

at the present time, a significant portion of our business depends

largely on NVR’s continued relationship with us. A decision

by NVR to discontinue or limit its relationship with us could have

a material adverse impact on the Company.

Risks Associated with Real Estate Related Debt and Other

Investments

Any real estate debt security that we originate or purchase is

subject to the risks of delinquency and foreclosure.

We may originate and purchase real estate debt securities, which

are subject to numerous risks including delinquency and

foreclosure. We will not have recourse to the personal assets of

our tenants. The ability of a lessee to pay rent depends primarily

upon the successful operation of the property, rather than upon the

existence of independent income or assets of the

tenant.

Any hedging strategies we utilize may not be successful in

mitigating our risks.

We may enter into hedging transactions to manage, for example, the

risk of interest rate or price changes. To the extent that we may

occasionally use derivative financial instruments, we will be

exposed to credit, basis and legal enforceability risks. Derivative

financial instruments may include interest rate swap contracts,

interest rate cap or floor contracts, futures or forward contracts,

options or repurchase agreements. In this context, credit risk is

the failure of the counterparty to perform under the terms of the

derivative contract. If the fair value of a derivative contract is

positive, the counterparty owes us, which creates credit risk for

us. Basis risk occurs when the index upon which the contract is

based is more or less variable than the index upon which the hedged

asset or liability is based, thereby making the hedge less

effective. Finally, legal enforceability risks encompass general

contractual risks, including the risk that the counterparty will

breach the terms of, or fail to perform its obligations under, the

derivative contract. We may not be able to manage these risks

effectively.

Risks Related to Our Potential Expansion into New Fields of

Operations

If we pursue the development of new technologies, we will be

required to respond to rapidly changing technology and customer

demands.

In the event that the Company enters the business of developing

“Smart Home” and similar technologies (an area which we

are presently exploring), the future success of such operation will

depend on our ability to adapt to technological advances,

anticipate customer demands and develop new products. We may

experience technical or other difficulties that could delay or

prevent the development, introduction or marketing of products.

Also, we may not be able to adapt new or enhanced services to

emerging industry standards, and our new products may not be

favorably received.

Risks Related to Our Common Stock

The shares of our common stock are currently not being traded and

there can be no assurance that there will be an active market in

the future.

Our shares of common stock are not publicly traded, and if trading

commences, the price may not reflect our value. There can be no

assurance that there will be an active market for our shares of

common stock in the future. As a result, investors may not be able

to liquidate their investment or liquidate it at a price that

reflects the value of the business.

It is possible that we will not establish an active market unless

our stock is listed for trading on an exchange, and we cannot

assure shareholders that we will ever satisfy exchange listing

requirements.

It is possible that a significant trading market for our shares

will not develop unless the shares are listed for trading on a

national exchange. Exchange listing would require us to satisfy a

number of tests as to corporate governance, public float,

shareholders, equity, assets, market makers and other matters, some

of which we do not currently meet. We cannot assure shareholders

that we will ever satisfy listing requirements for a national

exchange or that there ever will be significant liquidity in our

shares.

If we issue additional shares of our common stock, shareholders

will experience dilution of their ownership interest.

We may issue shares of our authorized but unissued equity

securities in the future. Such shares may be issued in connection

with raising capital, acquiring assets or firing or retaining

employees or consultants. If we issue such shares,

shareholders’ ownership will be diluted.

We do not intend to pay dividends in the foreseeable future, and

investors should not purchase our stock expecting to receive

dividends.

We have not paid any dividends on our common stock in the past, and

we do not anticipate that we will pay dividends in the foreseeable

future. Accordingly, some investors may decline to invest in our

common stock, and this may reduce the liquidity of our

stock.

The limitations on liability for officers, directors and employees

under the laws of the State of Nevada and the existence of

indemnification rights for our officers, directors and employees

could result in substantial expenditures by the Company and could

discourage lawsuits against our officers, directors and

employees.

Our Articles of Incorporation contain a specific provision that

eliminates the liability of our officers and directors for monetary

damages to our company and shareholders. Further, we intend to

provide indemnification to our officers and directors to the

fullest extent permitted by the laws of the State of Nevada. We may

also enter into employment and other agreements in the future

pursuant to which we will have indemnification obligations. The

foregoing indemnification obligations could result in the Company

incurring substantial expenditures to cover the cost of settlement

or damage awards against officers and directors. These obligations

may discourage the filing of derivative litigation by our

shareholders against our officers and directors even where such

litigation may be perceived as beneficial by our

shareholders.

Item 1B. Unresolved Staff Comments.

Not Applicable.

Item 2. Properties.

Black Oak

The Black Oak property is located in Montgomery County in Magnolia,

Texas. This property is located east of FM 2978 via Standard Road

to Dry Creek Road and South of the Woodlands, one of the most

successful, fastest growing master planned communities in Texas.

This residential land development consists of approximately 450

lots on 162 acres. Black Oak LP is the primary developer

responsible for all infrastructure development. This property is

included in Harris County Improvement District

#17.

Ballenger Run

Ballenger Run is a residential land development project located in

Frederick County in Frederick, Maryland. This property is located

approximately 40 miles from Washington, DC, 50 miles from Baltimore

and is located less than four miles from I-70 and I-270. Ballenger

Run is situated on approximately 197 acres of land and entitled for

853 residential units consisting of 443 residential Lots, 210

multi-family units and 200 age restricted units, however,

we are presently seeking to revise the

zoning of this property to include 479 entitled residential lots

and 210 entitled multi-family units, with no entitled continuing

care retirement community units. SeD Maryland Development, LLC is

the primary developer responsible for all infrastructure

development. SeD Maryland will pursue the required zoning

approval to change the number of lots.

Development of Properties

At the present time, the Company is considering expanding its

current policy of selling buildable lots to include a strategy of

building housing for sale or rent, particularly at our Black Oak

property.

Office Space

At the present time, the Company is renting offices in Houston,

Texas and Bethesda, Maryland through SeD Home. At the present time,

our office space is sufficient for our operations as presently

conducted, however, as we expand into new projects and into new

areas of operations we anticipate that we will require additional

office space.

Item 3. Legal Proceedings.

The Company is not a party to any pending legal proceedings, and no

such proceedings are known to be contemplated.

There are no material proceedings to which any director, officer or

affiliate of the Company, or any owner of record or beneficially of

more than five percent of any class of voting securities of the

Company, or any associate of any such director, officer, affiliate

of the Company, or security holder is a party adverse to the

Company or any of its subsidiaries or has a material interest

adverse to the Company or any of its subsidiaries.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Company’s Common Equity, Related

Stockholder Matters and Small Business Issuer Purchases of Equity

Securities

Market Information

There is presently no established public trading market for our

shares of common stock. We do plan to reapply for quoting of

our common stock on the OTC Bulletin Board. However, we can provide

no assurance that our shares of common stock will be quoted on

the Bulletin Board or, if traded, that a public market will

materialize. In connection with the change of the Company’s

name from Homeownusa to SeD Intelligent Home Inc., the

Company’s symbol changed from HMUS to SEDH on December 13,

2017.

Holders

At March 22, 2019, the Company had 53 shareholders.

Dividends

Since inception we have not paid any dividends on our common stock.

We currently do not anticipate paying any cash dividends in the

foreseeable future on our common stock. Although we intend to

retain our earnings, if any, to finance the exploration and growth

of our business, our board of directors will have the discretion to

declare and pay dividends in the future. Payment of dividends in

the future will depend upon our earnings, capital requirements, and

other factors, which our board of directors may deem

relevant.

Securities authorized for issuance under equity compensation

plans.

The Company does not have securities authorized for issuance under

any equity compensation plans

Performance graph

Not applicable to smaller reporting companies.

Recent sales of unregistered securities; use of proceeds from

registered securities

On December 29, 2017, we issued 630,000,000 shares of our Common

Stock to SeD Home International, Inc., the sole shareholder of SeD

Home, in exchange for all 500,000,000 of the issued and outstanding

shares of SeD Home. Such securities were not registered under the

Securities Act of 1933 and were issued pursuant to the exemption

under Section 4(2) of the Securities Act.

Purchases of Equity Securities by the issuer and affiliated

purchasers

The Company did not repurchase any shares of the Company’s

common stock during 2018.

Item 6. Selected Financial Data.

Not applicable to smaller reporting companies.

Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations.

This Form 10-K contains certain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. For this purpose, any statements contained in this Form 10-K

that are not statements of historical fact may be deemed to be

forward-looking statements. Without limiting the foregoing, words

such as “may”, “will”,

“expect”, “believe”,

“anticipate”, “estimate” or

“continue” or comparable terminology are intended to

identify forward-looking statements. These statements by their

nature involve substantial risks and uncertainties, and actual

results may differ materially depending on a variety of factors,

many of which are not within our control. These factors include by

are not limited to economic conditions generally and in the

industries in which we may participate; competition within our

chosen industry, including competition from much larger

competitors; technological advances and failure to successfully

develop business relationships.

Results of Operations

Results of Operations for the Year Ended December 31, 2018 Compared

to the Year Ended December 31, 2017

|

|

|

|

|

|

|

|

Revenue

|

$17,675,034

|

$6,957,042

|

|

Operating

Expenses

|

$16,389,804

|

$7,336,319

|

|

Net Income

(Loss)

|

$1,322,350

|

$(249,769)

|

Revenue

Revenue was $17,675,034 for the period ended December 31, 2018 as

compared to $6,957,042 for the period ended December 31, 2017. This

increase in revenue is primarily attributable to the Company having

an increase in property sales from the Ballenger Project. We

anticipate even higher level of revenue from sales in 2019.

Builders are required to purchase minimum numbers of lots based on

sales agreements we enter into with them. We collect revenue from

the sale of lots to builders; we do not build any houses ourselves

at the present time.

Income

from the sale of Front Foot Benefits, assessed on Ballenger Run

project lots, increased from $0 in the year ended December 31, 2017

to $413,613 in year ended December 31, 2018. The increase is a

result of the increased sale of properties in 2018. The revenue is

expected to further increase in 2019 as we sell more

lots.

Rental income declined from $88,438 in the period ended December

31, 2017 to $8,730 in the period ended December 31, 2018 as certain

rental properties were sold (we now own only one rental property).

Unless we acquire additional rental-income producing assets, such

rental income may decline further in 2019 if this remaining rental

home is sold.

Operating Expenses

Cost of sales increased from $6,217,779 in the period ended

December 31, 2017 to $ 15,641,324 in the period ended December 31,

2018. The Company had a gross margin of 12% in 2018 compared to 11%

in 2017, as there have not been any significant changes to

projected project costs.

The general and administrative expenses decreased from $1,118,540

for the period ended December 31, 2017 to $748,480 for the period

ended December 31, 2018 due to a decrease in professional

fees.

Net Income (Loss)

After a net loss of $249,769 for the period ended December 31,

2017, we had a net income of $1,322,350 for the period ended on

December 31, 2018, in large part because of our increased property

sales from our Ballenger project.

Liquidity and Capital Resources

Our real estate assets have decreased to $43,764,545 of December

31, 2018 from $52,543,092 as of December 31, 2017. This decrease

primarily reflects a higher increase in the cost of sales than in

the capitalized costs related to the construction in progress. Our

liabilities declined from $24,561,292 at December 31, 2017 to

$13,733,045 at December 31, 2018. Our total assets have decreased

to $48,600,709 as of December 31, 2018 from $58,166,606 as of

December 31, 2017.

As of December 31, 2018, we had cash in the amount of $715,754,

compared to $358,233 as of December 31, 2017. Our Ballenger Run

revolver loan balance from Union Bank was $13,899 at December 31,

2018 and $8,132,020 at December 31, 2017 and the credit limit is

$11 million. In addition, we owed $6 million to Revere High Yield

Fund, which was paid off in October 2017 with related party debt.

The interest of related party loans is accruing and the due date of

these loans could be extended.

Based

on the sales contract with NVR, the 2019 revenue from Ballenger

project is expected to be approximately $17.2 million. The loan

from Union Bank was repaid in January of 2019.

Currently the Black Oak project does not have any financing from

third parties. On July 20, 2018, Black Oak was reimbursed

$4,592,079 from the Harris County Improvement District 17

(“HC17”) for previous expenses incurred by Black Oak in

the development and installation of infrastructure within the Black

Oak project. The future development

timeline of Black Oak is based on multiple limiting conditions,

such as the amount of the funds raised from capital market, the

loans from third party financial institutions, and the government

reimbursements, etc. The development will be step by step and

expenses will be contingent on the amount of funding we will

receive.

Summary of Cash Flows

A summary of cash flows from operating, investing and financing

activities for the years ended December 31, 2018 and 2017 are as

follows:

|

|

|

|

|

|

|

|

|

Net

cash Provided by (Used in) Operating Activities

|

$12,209,666

|

$(2,688,056)

|

|

Net

Cash Used in Investing Activities

|

$(3,000)

|

$(7,892)

|

|

Net

Cash (Used in) Provided by financing activities

|

$(10,576,405)

|

$2,654,542

|

|

Net

Increase (Decrease) in Cash

|

$1,630,261

|

$(41,406)

|

|

Cash

and restricted cash at beginning of the year

|

$3,014,903

|

$3,056,309

|

|

Cash

and restricted cash at end of the year

|

$4,645,164

|

$3,014,903

|

Cash Flows from Operating Activities

Cash flows from operating activities include costs related to

assets which we plan to sell, such as land purchased for

development and resale. In 2018, cash provided by operating

activities was $12,209,666 compared with 2017, in which the cash we