UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22487

DBX ETF Trust

(Exact name of registrant as specified in charter)

875 Third Avenue

New York, New York 10022

(Address of principal executive offices) (Zip code)

Diane Kenneally

100 Summer Street

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 454-4500

Date of fiscal year end: May 31

Date of reporting period: May 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| (a) | The Report to Shareholders is attached herewith. |

May 31, 2023

Annual Report

DBX ETF Trust

Xtrackers International Real Estate ETF (HAUZ)

DBX ETF Trust

| Page | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 6 | ||||

| 7 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| Board Considerations in Approval of Investment Advisory Contracts |

32 | |||

| 35 | ||||

| 38 | ||||

To our Shareholders: (Unaudited)

Dear shareholder,

We are pleased to provide this annual report on our Xtrackers International Real Estate ETF for the period ended May 31, 2023.

The global economy witnessed a period of volatility due to heightened inflation, growing interest rates, and sluggish industrial activity amid geopolitical tension between Russia and Ukraine. Rising inflation in both developed and emerging economies affected the cost of living as disposable incomes were eroded, resulting in aggressive interest rate hikes by the major central banks. The U.S. Federal Reserve (Fed) has raised rates eight consecutive times from June 2022 until its recent meeting in May 2023 — from 1% to 5.25%. The European Central Bank (ECB) has followed suit and raised Eurozone interest rates from 0% to 3.75%. Meanwhile, in Q2 2023, financial distress due to regional banking turmoil created new headwinds for the U.S. economy and increased the risk of recession later this year.

The Russia-Ukraine war and China’s Zero COVID policy added to supply headwinds, causing a slowdown in Europe. The energy crisis was aggravated by the closure of Nord Stream 1, the main pipeline supplying Russian gas to Europe. However, Eurozone inflation declined to a one-year low in March 2023 as CPI1 came in at 6.1%, significantly lower than the multi-decade high of 10.7% reached in October 2022. In the U.S., GDP2 grew at a weaker rate in 2022 than in 2021 but saw green shoots emerge in the second half 2022, followed by a slowdown in the first quarter of 2023. Inflation peaked in June 2022 and then continued on its downward trajectory. The labor market remained moderately resilient as the unemployment rate stayed stable during the period amid slowing wage growth. Meanwhile, in the U.K., markets remained volatile amid political and economic uncertainty as the austerity plan released in September 2022 by then Prime Minister Liz Truss received a negative welcome from markets, sending the pound sterling to an all-time low against the U.S. dollar. Markets cheered Rishi Sunak’s appointment as the country’s new prime minister while many of the policies announced by the former government were reversed.

The Bank of Japan remained accommodative and widened the band within which it had been maintaining 10-year bond yields. Japanese equity markets rose sharply in the first half of 2023, backed by strong GDP numbers, while CPI accelerated 4.1% year on year in April 2023, the biggest rise since 1981, increasing investor optimism that Japan is moving away from the deflationary stagnation of the past.

Notably, high borrowing costs and global monetary tightening made the global real estate markets non-compelling to investors. In the U.S., remote work and rising interest rates weighed on the commercial real estate sector. Office property values dropped 25% from 2022 levels, and average occupancy declined to less than half since March 2020. Within commodities, energy prices softened in the first half of 2023, and industrial metals saw price declines due to weakening demand from top consumer China, while precious metals such as gold and silver recorded robust price gains

We believe central banks across the world will likely remain cautious in their approach to monetary policy and watch for positive signs in the economy before taking any interest rate action. Recent banking system stress and debt ceiling-related concerns are also likely to weigh on the U.S. Federal Reserve’s (Fed’s) decisions in the coming months. Unlike the Fed, the ECB has clearly maintained its stance on monetary action and is willing to hike rates further until inflation is within its comfort range. The entire world, in our view, will be keenly watching how China recovers from its COVID-19-induced restrictions to induce an uptick in industrial activity and income recovery while boosting private sector investment.

Our team appreciates your trust and looks forward to serving your investment needs through innovative index-driven strategies.

Sincerely,

/s/ Freddi Klassen

Freddi Klassen

President and Chief Executive Officer

1 The Consumer Price Index (CPI) is a price index, the price of a weighted average market basket of consumer goods and services purchased by households.

2 Gross domestic product (GDP) is the monetary value of all finished goods and services produced within a country’s borders within a specific time period.

Assumptions, estimates and opinions contained in this document constitute our judgment as of the date of the document and are subject to change without notice. Any projections are based on a number of assumptions as to market conditions and there can be no guarantee that any projected results will be achieved. Past performance is not a guarantee of future results.

1

This Page is Intentionally Left Blank

2

DBX ETF Trust

Xtrackers International Real Estate ETF

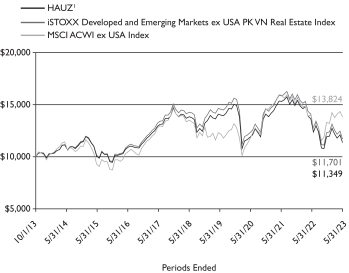

Xtrackers International Real Estate ETF (HAUZ), seeks investment results that correspond generally to the performance, before fees and expenses, of the iSTOXX Developed and Emerging Markets ex USA PK VN Real Estate Index (the HAUZ Index). The HAUZ index is a free-float capitalization weighted index that provides exposure to publicly traded real estate securities in countries outside the United States, Pakistan, and Vietnam. For the 12-month period ended May 31, 2023, HAUZ shares returned -16.79%, compared to the HAUZ Index return of -16.97%.

The majority of the sectors contributed negatively to performance during the period with the greatest negative contribution coming from Real Estate Management & Development, Retail REITs and Office REITs. The Financial Services and Electric Utilities sectors were the positive contributors to performance. From a geographical perspective, most countries contributed negatively with Hong Kong, Germany and Japan being the most significant detractors. However, Mexico, India and Brazil contributed positively to the performance.

*************************

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance data visit www.Xtrackers.com. Returns assume that dividends and capital gains distributions have been reinvested. See pages 4-5 of this report for additional performance information, including performance data based on market value. The views expressed in this report reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Current and future portfolio holdings are subject to risk.

3

DBX ETF Trust

Xtrackers International Real Estate ETF (HAUZ)

The Xtrackers International Real Estate ETF (the “Fund”), using a “passive” or indexing investment approach, seeks investment results that correspond generally to the performance, before fees and expenses, of the iSTOXX Developed and Emerging Markets ex USA PK VN Real Estate Index (the “Underlying Index”). The Underlying Index is a free-float capitalization weighted index that provides exposure to publicly traded real estate securities in countries outside the United States, excluding Pakistan and Vietnam. The MSCI ACWI ex USA Index is designed to provide exposure to equity securities in developed and emerging stock markets (excluding the United States). It is not possible to invest directly into an index.

| Performance as of May 31, 2023 | ||||||||

| Average Annual Total Return | ||||||||

| Net Asset Value | Market Value | iSTOXX Developed and Emerging Markets ex USA PK VN Real Estate Index2 |

MSCI ACWI ex USA Index | |||||

| One Year |

-16.79% | -16.48% | -16.97% | -1.41% | ||||

| Five Year |

-4.16% | -4.02% | -4.14% | 2.22% | ||||

| Since Inception1 |

1.32% | 1.35% | 1.64% | 3.41% | ||||

| Cumulative Total Returns | ||||||||

| Net Asset Value | Market Value | iSTOXX Developed and Emerging Markets ex USA PK VN Real Estate Index2 |

MSCI ACWI ex USA Index | |||||

| One Year |

-16.79% | -16.48% | -16.97% | -1.41% | ||||

| Five Year |

-19.14% | -18.56% | -19.04% | 11.62% | ||||

| Since Inception1 |

13.49% | 13.80% | 17.01% | 38.24% | ||||

1 Total returns are calculated based on the commencement of operations, October 1, 2013 (“Inception”).

2 On February 22, 2019, the Fund changed its Underlying Index from MSCI Asia Pacific ex Japan US Dollar Hedged Index to the iSTOXX Developed and Emerging Markets ex USA PK VN Real Estate Index. Returns reflect performance for the MSCI Asia Pacific ex Japan US Dollar Hedged Index through February 21, 2019.

Prior to February 22, 2019, the Fund was known as Xtrackers MSCI Asia Pacific ex Japan Hedged Equity ETF (DBAP) and had a different investment strategy. Past performance may have been different if the Fund’s current investment strategy had been in effect.

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.Xtrackers.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the sale of fund shares or redemption of fund creation units. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are sold in the market or redeemed. Performance for certain funds may reflect a waiver of a portion of the unitary advisory fee. Without such waiver, performance would have been lower. The gross expense ratio of the Fund, as stated in the fee table of the prospectus dated October 1, 2022, was 0.12%, and may differ from the expense ratio disclosed in the Financial Highlights table in this report.

The Fund’s net asset value or “NAV” is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not have traded in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary trading, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

4

DBX ETF Trust

Performance Summary (Unaudited)

Xtrackers International Real Estate ETF (HAUZ) (Continued)

| Growth of an Assumed $10,000 Investment |

1 Based on Net Asset Value from commencement of operations, October 1, 2013.

| Sector Diversification* as of May 31, 2023 | ||

| Real Estate Operations/Development |

34.3% | |||

| Diversified |

15.3% | |||

| Real Estate Management/Services |

12.0% | |||

| Warehouse/Industry |

10.0% | |||

| Shopping Centers |

8.3% | |||

| Office Property |

5.3% | |||

| Apartments |

4.0% | |||

| Other |

10.8% | |||

|

|

|

|||

| Total |

100.0% |

| Ten Largest Equity Holdings as of May 31, 2023 (18.0% of Net Assets) | ||

| Description | % of Net Assets | |||

| Goodman Group (Australia) |

2.6% | |||

| Sun Hung Kai Properties Ltd. (Hong Kong) |

2.3% | |||

| Mitsui Fudosan Co. Ltd. (Japan) |

2.2% | |||

| Mitsubishi Estate Co. Ltd. (Japan) |

1.8% | |||

| Link (Hong Kong) |

1.8% | |||

| Vonovia SE (Germany) |

1.6% | |||

| Segro PLC (United Kingdom) |

1.5% | |||

| CK Asset Holdings Ltd. (Hong Kong) |

1.4% | |||

| Sumitomo Realty & Development Co. Ltd. (Japan) |

1.4% | |||

| KE Holdings, Inc. (China) |

1.4% | |||

| Country Diversification* as of May 31, 2023 | ||

| Japan |

21.1% | |||

| Hong Kong |

14.1% | |||

| Australia |

10.5% | |||

| United Kingdom |

7.3% | |||

| Singapore |

7.3% | |||

| Canada |

6.4% | |||

| Sweden |

3.3% | |||

| Thailand |

2.7% | |||

| France |

2.5% | |||

| Germany |

2.5% | |||

| China |

2.3% | |||

| Philippines |

2.3% | |||

| Switzerland |

2.1% | |||

| Other |

15.6% | |||

|

|

|

|||

| Total |

100.0% |

* As a percent of total investments excluding exchange-traded funds, securities lending collateral and cash equivalents.

Portfolio holdings and characteristics are subject to change. For more complete details about the Fund’s investment portfolio see page 7.

5

DBX ETF Trust

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions paid on purchases and sales of fund shares, and (2) ongoing costs, including unitary advisory fees and other Fund expenses. In the most recent six-month period the Fund limited these expenses; had it not done so, expenses would have been higher. The expense examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The examples in the tables are based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (December 1, 2022 to May 31, 2023).

Actual expenses

The first line in the following tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line in the following tables provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses (which is not the Funds’ actual return). The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only, and do not reflect any transactional costs. Therefore the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value December 1, 2022 |

Ending Account Value May 31, 2023 |

Annualized Expense Ratio |

Expenses Paid During the Period Per $1,000(1) |

|||||||||||||

| Xtrackers International Real Estate ETF | ||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 951.10 | 0.10 | % | $ | 0.49 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,024.43 | 0.10 | % | $ | 0.50 | ||||||||

(1) Expenses are equal to each Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 182 (the number of days in the most recent six-month period), then divided by 365.

6

DBX ETF Trust

Xtrackers International Real Estate ETF

May 31, 2023

| Number |

Value |

|||||||

| COMMON STOCKS — 99.2% | ||||||||

| Australia — 10.5% | ||||||||

| Abacus Property Group REIT |

292,013 | $ | 485,669 | |||||

| Arena REIT |

231,956 | 558,411 | ||||||

| Aspen Group Ltd./Australia REIT |

4,023 | 4,921 | ||||||

| BWP Trust REIT |

332,887 | 803,546 | ||||||

| Cedar Woods Properties Ltd. |

27,149 | 84,509 | ||||||

| Centuria Industrial REIT |

353,755 | 721,138 | ||||||

| Centuria Office REIT |

322,954 | 299,915 | ||||||

| Charter Hall Group REIT |

320,087 | 2,320,017 | ||||||

| Charter Hall Long Wale REIT |

429,557 | 1,198,128 | ||||||

| Charter Hall Retail REIT |

347,603 | 836,819 | ||||||

| Charter Hall Social Infrastructure REIT |

222,282 | 421,480 | ||||||

| Cromwell Property Group REIT |

1,043,774 | 364,758 | ||||||

| Dexus REIT |

719,381 | 3,822,145 | ||||||

| Dexus Convenience Retail REIT REIT |

91,974 | 148,802 | ||||||

| Dexus Industria REIT |

153,053 | 281,297 | ||||||

| GDI Property Group Partnership REIT |

342,387 | 156,211 | ||||||

| Goodman Group REIT |

1,148,538 | 14,590,518 | ||||||

| GPT Group REIT |

1,086,476 | 2,946,044 | ||||||

| Growthpoint Properties Australia Ltd. REIT |

190,136 | 375,292 | ||||||

| Healthco REIT |

92,478 | 82,290 | ||||||

| HMC Capital Ltd. REIT |

139,338 | 396,759 | ||||||

| HomeCo Daily Needs REIT |

1,160,622 | 897,561 | ||||||

| Hotel Property Investments Ltd. REIT |

138,538 | 307,516 | ||||||

| Ingenia Communities Group REIT |

250,036 | 679,605 | ||||||

| Lifestyle Communities Ltd. (a) |

64,785 | 629,304 | ||||||

| Mirvac Group REIT |

2,671,157 | 3,975,871 | ||||||

| National Storage REIT |

742,195 | 1,210,385 | ||||||

| Newmark Property REIT |

34,610 | 30,461 | ||||||

| Peet Ltd. |

250,990 | 192,477 | ||||||

| REA Group Ltd. (a) |

34,143 | 3,038,814 | ||||||

| Region RE Ltd. REIT |

752,730 | 1,222,695 | ||||||

| Rural Funds Group REIT |

261,709 | 304,857 | ||||||

| Scentre Group REIT |

3,492,120 | 6,124,399 | ||||||

| Stockland REIT |

1,606,498 | 4,428,889 | ||||||

| US Masters Residential Property Fund REIT * |

499,199 | 92,071 | ||||||

| Vicinity Ltd. REIT |

3,071,770 | 3,687,548 | ||||||

| Waypoint REIT Ltd. REIT |

445,858 | 770,394 | ||||||

|

|

|

|||||||

| (Cost $65,469,266) |

58,491,516 | |||||||

|

|

|

|||||||

| Austria — 0.2% | ||||||||

| CA Immobilien Anlagen AG |

29,015 | 790,336 | ||||||

| IMMOFINANZ AG * |

21,627 | 356,915 | ||||||

| S IMMO AG |

5,982 | 72,065 | ||||||

| UBM Development AG |

2,426 | 70,607 | ||||||

|

|

|

|||||||

| (Cost $1,536,219) |

1,289,923 | |||||||

|

|

|

|||||||

| Belgium — 1.9% | ||||||||

| Aedifica SA REIT (a) |

27,086 | 1,811,994 | ||||||

| Ascencio REIT |

3,637 | 189,218 | ||||||

| Atenor |

2,425 | 62,047 | ||||||

| Care Property Invest NV REIT |

24,615 | 330,650 | ||||||

| Cofinimmo SA REIT (a) |

22,007 | 1,703,317 | ||||||

| Home Invest Belgium SA REIT (a) |

6,221 | 118,053 | ||||||

| Immobel SA (a) |

2,473 | 104,272 | ||||||

| Number |

Value |

|||||||

| Belgium (Continued) | ||||||||

| Intervest Offices & Warehouses NV REIT (a) |

18,245 | $ | 301,491 | |||||

| Montea NV REIT |

10,612 | 858,691 | ||||||

| Nextensa SA REIT (a) |

1,708 | 79,391 | ||||||

| Retail Estates NV REIT |

7,371 | 503,712 | ||||||

| VGP NV (a) |

8,842 | 871,476 | ||||||

| Warehouses De Pauw CVA REIT |

109,181 | 3,054,281 | ||||||

| Wereldhave Belgium Comm VA REIT |

2,011 | 103,337 | ||||||

| Xior Student Housing NV REIT (a) |

17,149 | 510,998 | ||||||

|

|

|

|||||||

| (Cost $14,725,084) |

10,602,928 | |||||||

|

|

|

|||||||

| Brazil — 0.6% | ||||||||

| Aliansce Sonae Shopping Centers SA |

327,572 | 1,385,909 | ||||||

| Cyrela Brazil Realty SA Empreendimentos e Participacoes |

203,518 | 742,247 | ||||||

| Ez Tec Empreendimentos e Participacoes SA |

98,523 | 339,124 | ||||||

| Multiplan Empreendimentos Imobiliarios SA |

204,811 | 1,060,863 | ||||||

|

|

|

|||||||

| (Cost $3,603,678) |

3,528,143 | |||||||

|

|

|

|||||||

| Canada — 6.4% | ||||||||

| Allied Properties Real Estate Investment Trust REIT |

86,521 | 1,414,328 | ||||||

| Altus Group Ltd. |

30,983 | 1,006,782 | ||||||

| American Hotel Income Properties REIT LP (a) |

55,208 | 99,507 | ||||||

| Artis Real Estate Investment Trust REIT |

51,993 | 265,836 | ||||||

| Boardwalk Real Estate Investment Trust REIT |

22,210 | 987,547 | ||||||

| Canadian Apartment Properties REIT (a) |

114,323 | 4,125,317 | ||||||

| Chartwell Retirement Residences |

159,116 | 1,054,686 | ||||||

| Choice Properties Real Estate Investment Trust REIT (a) |

170,092 | 1,696,791 | ||||||

| Colliers International Group, Inc. |

24,690 | 2,296,626 | ||||||

| Crombie Real Estate Investment Trust REIT (a) |

71,966 | 757,091 | ||||||

| CT Real Estate Investment Trust REIT (a) |

50,041 | 552,943 | ||||||

| Dream Industrial Real Estate Investment Trust REIT |

173,342 | 1,764,918 | ||||||

| Dream Office Real Estate Investment Trust REIT (a) |

17,431 | 186,582 | ||||||

| DREAM Unlimited Corp., Class A (a) |

18,078 | 276,097 | ||||||

| First Capital Real Estate Investment Trust REIT |

130,087 | 1,426,909 | ||||||

| FirstService Corp. |

24,910 | 3,613,810 | ||||||

| Granite Real Estate Investment Trust REIT |

42,771 | 2,506,539 | ||||||

| H&R Real Estate Investment Trust REIT |

176,439 | 1,314,888 | ||||||

| InterRent Real Estate Investment Trust REIT |

93,843 | 906,466 | ||||||

| Killam Apartment Real Estate Investment Trust REIT |

77,943 | 1,003,460 | ||||||

| Mainstreet Equity Corp. * |

1,042 | 103,510 | ||||||

| Minto Apartment Real Estate Investment Trust REIT, 144A (a) |

27,738 | 299,561 | ||||||

| Morguard Corp. |

3,133 | 235,096 | ||||||

| See Notes to Financial Statements. | 7 |

DBX ETF Trust

Schedule of Investments

Xtrackers International Real Estate ETF (Continued)

May 31, 2023

| Number |

Value |

|||||||

| Canada (Continued) | ||||||||

| Morguard North American Residential Real Estate Investment Trust REIT |

21,329 | $ | 257,963 | |||||

| Nexus Industrial REIT REIT |

28,815 | 178,279 | ||||||

| NorthWest Healthcare Properties Real Estate Investment Trust REIT (a) |

145,114 | 798,538 | ||||||

| Primaris Real Estate Investment Trust REIT (a) |

48,430 | 448,564 | ||||||

| RioCan Real Estate Investment Trust REIT (a) |

200,962 | 2,959,802 | ||||||

| SmartCentres Real Estate Investment Trust REIT (a) |

88,907 | 1,657,400 | ||||||

| Tricon Residential, Inc. |

181,921 | 1,460,133 | ||||||

| True North Commercial Real Estate Investment Trust REIT (a) |

56,497 | 107,233 | ||||||

|

|

|

|||||||

| (Cost $41,535,152) |

35,763,202 | |||||||

|

|

|

|||||||

| Chile — 0.2% | ||||||||

| Cencosud Shopping SA |

322,468 | 500,988 | ||||||

| Parque Arauco SA |

443,024 | 620,272 | ||||||

| Plaza SA |

187,760 | 236,362 | ||||||

|

|

|

|||||||

| (Cost $1,461,610) |

1,357,622 | |||||||

|

|

|

|||||||

| China — 2.3% | ||||||||

| A-Living Smart City Services Co. Ltd., 144A (a) |

537,757 | 335,229 | ||||||

| China Resources Mixc Lifestyle Services Ltd., 144A |

422,407 | 1,923,650 | ||||||

| China Vanke Co. Ltd., Class H |

1,179,657 | 1,558,158 | ||||||

| Greattown Holdings Ltd., Class B * |

97,300 | 21,211 | ||||||

| Guangzhou R&F Properties Co. Ltd., Class H * |

1,039,761 | 155,401 | ||||||

| KE Holdings, Inc., Class A * |

1,616,905 | 7,621,601 | ||||||

| Poly Property Services Co. Ltd., Class H |

97,098 | 460,171 | ||||||

| Shanghai Jinqiao Export Processing Zone Development Co. Ltd., Class B |

193,100 | 184,217 | ||||||

| Shanghai Lingang Holdings Corp. Ltd., Class B |

95,706 | 72,737 | ||||||

| Shanghai Lujiazui Finance & Trade Zone Development Co. Ltd., Class B |

721,340 | 430,640 | ||||||

| Shanghai Shibei Hi-Tech Co. Ltd., Class B |

295,800 | 63,005 | ||||||

| Shanxi Guoxin Energy Corp. Ltd., Class B |

68,300 | 23,359 | ||||||

| Shenzhen Properties & Resources Development Group Ltd., Class B |

15,300 | 9,127 | ||||||

| Sino-Ocean Group Holding Ltd. *(a) |

2,005,458 | 121,687 | ||||||

|

|

|

|||||||

| (Cost $20,236,640) |

12,980,193 | |||||||

|

|

|

|||||||

| Denmark — 0.0% | ||||||||

| Jeudan A/S (a) |

||||||||

| (Cost $252,976) |

6,516 | 234,140 | ||||||

|

|

|

|||||||

| Egypt — 0.1% | ||||||||

| Arab Developers Holding * |

280,455 | 5,818 | ||||||

| Egyptians Housing Development & Reconstruction * |

2,227,878 | 20,548 | ||||||

| El Kahera Housing * |

428,198 | 14,342 | ||||||

| Emaar Misr for Development SAE * |

176,430 | 16,958 | ||||||

| Number |

Value |

|||||||

| Egypt (Continued) | ||||||||

| Heliopolis Housing |

287,265 | $ | 93,896 | |||||

| Medinet Nasr Housing |

889,644 | 100,481 | ||||||

| Palm Hills Developments SAE * |

743,811 | 48,071 | ||||||

| Pioneers Properties * |

108,580 | 7,555 | ||||||

| Six of October Development & Investment * |

55,509 | 32,335 | ||||||

| Talaat Moustafa Group |

628,120 | 192,095 | ||||||

| Zahraa El Maadi Investment & Development Co. Sae |

101,058 | 19,819 | ||||||

|

|

|

|||||||

| (Cost $678,998) |

551,918 | |||||||

|

|

|

|||||||

| Finland — 0.3% | ||||||||

| Citycon OYJ * |

52,371 | 336,113 | ||||||

| Kojamo OYJ |

130,878 | 1,308,783 | ||||||

|

|

|

|||||||

| (Cost $2,795,294) |

1,644,896 | |||||||

|

|

|

|||||||

| France — 2.5% | ||||||||

| Altarea SCA REIT *(a) |

3,145 | 395,640 | ||||||

| ARGAN SA REIT |

6,613 | 493,509 | ||||||

| Carmila SA REIT * |

37,770 | 561,317 | ||||||

| Covivio SA REIT |

31,218 | 1,522,297 | ||||||

| Gecina SA REIT |

31,661 | 3,231,927 | ||||||

| ICADE REIT |

21,495 | 853,385 | ||||||

| Klepierre SA REIT |

127,609 | 2,881,412 | ||||||

| Mercialys SA REIT (a) |

62,134 | 497,139 | ||||||

| Nexity SA (a) |

25,625 | 523,975 | ||||||

| Unibail-Rodamco-Westfield REIT *(a) |

66,892 | 3,052,221 | ||||||

|

|

|

|||||||

| (Cost $18,775,389) |

14,012,822 | |||||||

|

|

|

|||||||

| Germany — 2.5% | ||||||||

| Deutsche EuroShop AG |

8,073 | 173,854 | ||||||

| Deutsche Wohnen SE |

34,430 | 683,096 | ||||||

| DIC Asset AG |

25,104 | 142,114 | ||||||

| Hamborner REIT AG REIT |

47,728 | 337,862 | ||||||

| Instone Real Estate Group SE, 144A |

28,684 | 154,123 | ||||||

| LEG Immobilien SE * |

49,739 | 2,572,328 | ||||||

| PATRIZIA SE |

25,523 | 225,027 | ||||||

| TAG Immobilien AG * |

122,119 | 975,132 | ||||||

| Vonovia SE |

472,381 | 8,641,871 | ||||||

|

|

|

|||||||

| (Cost $31,817,948) |

13,905,407 | |||||||

|

|

|

|||||||

| Greece — 0.1% | ||||||||

| LAMDA Development SA * |

||||||||

| (Cost $386,035) |

54,162 | 368,395 | ||||||

|

|

|

|||||||

| Hong Kong — 14.0% | ||||||||

| C C Land Holdings Ltd. |

602,137 | 123,070 | ||||||

| C&D International Investment Group Ltd. * |

510,805 | 1,284,149 | ||||||

| Champion REIT (a) |

1,600,313 | 580,575 | ||||||

| China Jinmao Holdings Group Ltd. |

4,233,688 | 605,720 | ||||||

| China Overseas Grand Oceans Group Ltd. (a) |

1,169,109 | 524,201 | ||||||

| China Overseas Land & Investment Ltd. |

2,510,017 | 5,091,696 | ||||||

| China Overseas Property Holdings Ltd. |

820,833 | 752,861 | ||||||

| China Resources Land Ltd. |

1,924,850 | 7,204,433 | ||||||

| Chinese Estates Holdings Ltd. * |

302,442 | 92,723 | ||||||

| CK Asset Holdings Ltd. |

1,438,609 | 7,755,156 | ||||||

| See Notes to Financial Statements. | 8 |

DBX ETF Trust

Schedule of Investments

Xtrackers International Real Estate ETF (Continued)

May 31, 2023

| Number |

Value |

|||||||

| Hong Kong (Continued) | ||||||||

| Emperor International Holdings Ltd. |

127,696 | $ | 8,809 | |||||

| ESR Group Ltd., 144A |

1,879,038 | 2,774,781 | ||||||

| Far East Consortium International Ltd. |

707,798 | 179,023 | ||||||

| Fortune Real Estate Investment Trust REIT |

939,963 | 678,414 | ||||||

| GR Properties Ltd. * |

470,000 | 55,836 | ||||||

| Hang Lung Group Ltd. |

556,662 | 829,135 | ||||||

| Hang Lung Properties Ltd. |

1,204,908 | 1,908,582 | ||||||

| Henderson Land Development Co. Ltd. |

880,673 | 2,795,609 | ||||||

| HKR International Ltd. |

441,839 | 124,172 | ||||||

| Hong Kong Ferry Holdings Co. Ltd. |

139,456 | 127,373 | ||||||

| Hongkong Land Holdings Ltd. |

714,287 | 3,064,291 | ||||||

| Hysan Development Co. Ltd. |

398,035 | 1,009,801 | ||||||

| Joy City Property Ltd. * |

2,383,276 | 82,200 | ||||||

| K Wah International Holdings Ltd. |

659,583 | 217,382 | ||||||

| Kerry Properties Ltd. |

384,237 | 839,326 | ||||||

| Kowloon Development Co. Ltd. |

201,098 | 218,611 | ||||||

| Lai Sun Development Co. Ltd. * |

78,644 | 14,266 | ||||||

| Langham Hospitality Investments and Langham Hospitality Investments Ltd. (b) |

628,986 | 75,527 | ||||||

| Link REIT |

1,710,713 | 9,943,147 | ||||||

| LVGEM China Real Estate Investment Co. Ltd. * |

670,455 | 119,047 | ||||||

| New World Development Co. Ltd. |

930,495 | 2,222,752 | ||||||

| Paliburg Holdings Ltd. * |

110,000 | 22,483 | ||||||

| Poly Property Group Co. Ltd. |

1,042,469 | 231,712 | ||||||

| Prosperity REIT |

786,676 | 165,812 | ||||||

| Shandong Hi-Speed Holdings Group Ltd. *(a) |

1,259,026 | 780,031 | ||||||

| Shenzhen Investment Ltd. |

1,470,942 | 259,304 | ||||||

| Shin Hwa World Ltd. * |

803,373 | 10,365 | ||||||

| Shun Tak Holdings Ltd. * |

916,618 | 138,167 | ||||||

| Sino Land Co. Ltd. |

2,437,102 | 3,169,252 | ||||||

| Sun Hung Kai Properties Ltd. |

1,025,849 | 13,065,135 | ||||||

| Sunlight Real Estate Investment Trust REIT |

609,322 | 215,607 | ||||||

| Swire Properties Ltd. |

713,230 | 1,700,108 | ||||||

| Touyun Biotech Group Ltd. * |

501,628 | 35,244 | ||||||

| Wang On Properties Ltd. |

2,949,152 | 20,344 | ||||||

| Wharf Holdings Ltd. |

653,642 | 1,372,705 | ||||||

| Wharf Real Estate Investment Co. Ltd. |

1,043,610 | 5,152,560 | ||||||

| Yuexiu Property Co. Ltd. (a) |

808,933 | 876,282 | ||||||

|

|

|

|||||||

| (Cost $97,551,118) |

78,517,779 | |||||||

|

|

|

|||||||

| India — 1.9% | ||||||||

| Brigade Enterprises Ltd. |

97,874 | 665,570 | ||||||

| DLF Ltd. |

647,087 | 3,714,427 | ||||||

| Godrej Properties Ltd. * |

91,554 | 1,538,554 | ||||||

| Indiabulls Real Estate Ltd. * |

309,616 | 251,677 | ||||||

| Macrotech Developers Ltd., 144A * |

177,370 | 1,169,397 | ||||||

| Oberoi Realty Ltd. |

78,473 | 882,837 | ||||||

| Omaxe Ltd. * |

35,128 | 21,400 | ||||||

| Phoenix Mills Ltd. |

66,520 | 1,179,611 | ||||||

| Prestige Estates Projects Ltd. |

112,252 | 655,682 | ||||||

| Privi Speciality Chemicals Ltd. |

12,212 | 164,747 | ||||||

| Sobha Ltd. |

22,141 | 139,338 | ||||||

| Number |

Value |

|||||||

| India (Continued) | ||||||||

| Sunteck Realty Ltd. |

39,700 | $ | 134,938 | |||||

|

|

|

|||||||

| (Cost $8,325,284) |

10,518,178 | |||||||

|

|

|

|||||||

| Indonesia — 0.3% | ||||||||

| PT Alam Sutera Realty Tbk * |

7,531,106 | 86,917 | ||||||

| PT Andalan Perkasa Abadi Tbk * |

507,804 | 1,694 | ||||||

| PT Bumi Serpong Damai Tbk * |

5,455,112 | 382,113 | ||||||

| PT Ciputra Development Tbk |

5,752,942 | 410,650 | ||||||

| PT Jaya Real Property Tbk |

1,752,867 | 59,637 | ||||||

| PT Kawasan Industri Jababeka Tbk * |

10,146,852 | 87,321 | ||||||

| PT Lippo Karawaci Tbk * |

22,223,923 | 137,880 | ||||||

| PT Pakuwon Jati Tbk |

10,400,593 | 324,715 | ||||||

| PT PP Properti Tbk * |

3,602,844 | 12,018 | ||||||

| PT Puradelta Lestari Tbk |

5,783,559 | 64,819 | ||||||

| PT Summarecon Agung Tbk |

7,197,504 | 307,298 | ||||||

|

|

|

|||||||

| (Cost $1,883,907) |

1,875,062 | |||||||

|

|

|

|||||||

| Israel — 1.8% | ||||||||

| Adgar Investment and Development Ltd. |

59,230 | 67,556 | ||||||

| AFI Properties Ltd. * |

3,849 | 106,970 | ||||||

| Africa Israel Residences Ltd. |

4,477 | 195,624 | ||||||

| Airport City Ltd. * |

45,023 | 590,671 | ||||||

| Alony Hetz Properties & Investments Ltd. |

104,514 | 811,778 | ||||||

| Alrov Properties and Lodgings Ltd. (a) |

2,040 | 95,147 | ||||||

| Amot Investments Ltd. |

142,920 | 703,704 | ||||||

| Arad Investment & Industrial Development Ltd. |

1,777 | 177,655 | ||||||

| Aura Investments Ltd. (a) |

86,241 | 127,227 | ||||||

| Azrieli Group Ltd. |

24,728 | 1,298,982 | ||||||

| Big Shopping Centers Ltd. * |

7,982 | 671,480 | ||||||

| Blue Square Real Estate Ltd. |

3,299 | 186,548 | ||||||

| Carasso Real Estate Ltd. |

11,703 | 71,817 | ||||||

| Duniec Brothers Ltd. *(a) |

2,224 | 103,729 | ||||||

| Electra Real Estate Ltd. |

15,693 | 172,226 | ||||||

| G City Ltd. |

56,649 | 171,087 | ||||||

| Gav-Yam Lands Corp. Ltd. (a) |

18,326 | 126,591 | ||||||

| Israel Canada T.R Ltd. (a) |

97,374 | 183,045 | ||||||

| Isras Investment Co. Ltd. |

1,051 | 184,314 | ||||||

| Keystone REIT Ltd. REIT |

98,875 | 152,166 | ||||||

| Kvutzat Acro Ltd. |

22,947 | 165,823 | ||||||

| Lahav L.R. Real Estate Ltd. (a) |

40,920 | 34,588 | ||||||

| Megureit Israel Ltd. REIT *(a) |

76,752 | 82,980 | ||||||

| Melisron Ltd. (a) |

15,296 | 950,126 | ||||||

| Menivim- The New REIT Ltd. REIT (a) |

402,217 | 167,458 | ||||||

| Mivne Real Estate KD Ltd. |

424,560 | 1,044,193 | ||||||

| Norstar Holdings, Inc. *(a) |

26,100 | 54,619 | ||||||

| Prashkovsky Investments and Construction Ltd. |

4,939 | 102,074 | ||||||

| Property & Building Corp. Ltd. *(a) |

1,781 | 77,726 | ||||||

| Rani Zim Shopping Centers Ltd. * |

33,520 | 19,251 | ||||||

| Reit 1 Ltd. REIT |

126,578 | 521,908 | ||||||

| REIT Azorim HF Living Ltd. REIT *(a) |

30,674 | 35,142 | ||||||

| Sella Capital Real Estate Ltd. REIT |

139,303 | 272,269 | ||||||

| Summit Real Estate Holdings Ltd. |

26,476 | 336,005 | ||||||

| Villar International Ltd. |

2,804 | 109,008 | ||||||

| See Notes to Financial Statements. | 9 |

DBX ETF Trust

Schedule of Investments

Xtrackers International Real Estate ETF (Continued)

May 31, 2023

| Number |

Value |

|||||||

| Israel (Continued) | ||||||||

| Vitania Ltd. (a) |

17,472 | $ | 93,279 | |||||

|

|

|

|||||||

| (Cost $13,268,533) |

10,264,766 | |||||||

|

|

|

|||||||

| Italy — 0.0% | ||||||||

| Immobiliare Grande Distribuzione SIIQ SpA REIT |

38,279 | 101,207 | ||||||

| Risanamento SpA *(a) |

390,059 | 44,162 | ||||||

|

|

|

|||||||

| (Cost $184,816) |

145,369 | |||||||

|

|

|

|||||||

| Japan — 21.0% | ||||||||

| Activia Properties, Inc. REIT (a) |

349 | 982,940 | ||||||

| Advance Logistics Investment Corp. REIT |

452 | 455,187 | ||||||

| Advance Residence Investment Corp. REIT |

665 | 1,703,969 | ||||||

| Aeon Mall Co. Ltd. |

64,800 | 815,827 | ||||||

| AEON REIT Investment Corp. REIT |

1,193 | 1,371,333 | ||||||

| Comforia Residential REIT, Inc. REIT |

450 | 1,090,255 | ||||||

| CRE Logistics REIT, Inc. REIT |

382 | 523,040 | ||||||

| Daito Trust Construction Co. Ltd. |

46,100 | 4,371,936 | ||||||

| Daiwa House REIT Investment Corp. REIT |

1,422 | 2,977,025 | ||||||

| Daiwa Office Investment Corp. REIT (a) |

187 | 776,295 | ||||||

| Daiwa Securities Living Investments Corp. REIT |

1,289 | 1,098,808 | ||||||

| ES-Con Japan Ltd. (a) |

25,600 | 142,736 | ||||||

| ESCON Japan Reit Investment Corp. REIT |

224 | 185,658 | ||||||

| Frontier Real Estate Investment Corp. REIT |

347 | 1,224,428 | ||||||

| Fukuoka REIT Corp. REIT |

479 | 559,173 | ||||||

| Global One Real Estate Investment Corp. REIT |

677 | 521,384 | ||||||

| GLP J REIT |

3,157 | 3,339,689 | ||||||

| Goldcrest Co. Ltd. |

9,400 | 114,847 | ||||||

| Hankyu Hanshin REIT, Inc. REIT (a) |

464 | 469,928 | ||||||

| Health Care & Medical Investment Corp. REIT |

237 | 274,293 | ||||||

| Heiwa Real Estate Co. Ltd. |

20,100 | 525,824 | ||||||

| Heiwa Real Estate REIT, Inc. REIT (a) |

645 | 700,329 | ||||||

| Hoshino Resorts REIT, Inc. REIT |

170 | 833,482 | ||||||

| Hulic Co. Ltd. (a) |

458,600 | 3,817,427 | ||||||

| Hulic Reit, Inc. REIT |

864 | 981,404 | ||||||

| Ichigo Office REIT Investment Corp. REIT |

1,005 | 652,425 | ||||||

| Ichigo, Inc. |

151,900 | 266,367 | ||||||

| Industrial & Infrastructure Fund Investment Corp. REIT |

1,384 | 1,585,931 | ||||||

| Invincible Investment Corp. REIT |

4,115 | 1,746,552 | ||||||

| Japan Excellent, Inc. REIT |

584 | 521,238 | ||||||

| Japan Hotel REIT Investment Corp. REIT |

2,954 | 1,672,415 | ||||||

| Japan Logistics Fund, Inc. REIT |

465 | 1,086,659 | ||||||

| Japan Metropolitan Fund Invest REIT |

4,664 | 3,291,489 | ||||||

| Japan Prime Realty Investment Corp. REIT |

478 | 1,228,229 | ||||||

| Japan Real Estate Investment Corp. REIT |

688 | 2,609,884 | ||||||

| Kabuki-Za Co. Ltd. |

6,100 | 207,823 | ||||||

| Keihanshin Building Co. Ltd. |

29,500 | 251,050 | ||||||

| Number |

Value |

|||||||

| Japan (Continued) | ||||||||

| Kenedix Office Investment Corp. REIT |

561 | $ | 1,268,840 | |||||

| Kenedix Residential Next Investment Corp. REIT |

509 | 778,901 | ||||||

| Kenedix Retail REIT Corp. REIT |

405 | 727,588 | ||||||

| Ki-Star Real Estate Co. Ltd. |

5,300 | 173,550 | ||||||

| LaSalle Logiport REIT |

1,188 | 1,427,658 | ||||||

| Leopalace21 Corp. * |

158,500 | 348,277 | ||||||

| LIFULL Co. Ltd. |

42,400 | 73,441 | ||||||

| Mirai Corp. REIT |

1,192 | 401,841 | ||||||

| Mirarth Holdings, Inc. |

61,700 | 184,153 | ||||||

| Mitsubishi Estate Co. Ltd. |

886,600 | 10,172,278 | ||||||

| Mitsubishi Estate Logistics REIT Investment Corp. REIT |

309 | 960,960 | ||||||

| Mitsui Fudosan Co. Ltd. |

638,100 | 12,160,049 | ||||||

| Mitsui Fudosan Logistics Park, Inc. REIT |

371 | 1,333,014 | ||||||

| Mori Hills REIT Investment Corp. REIT |

1,076 | 1,186,785 | ||||||

| Mori Trust Sogo Reit, Inc. REIT |

1,705 | 877,425 | ||||||

| Nippon Accommodations Fund, Inc. REIT |

343 | 1,664,488 | ||||||

| Nippon Building Fund, Inc. REIT |

1,140 | 4,552,983 | ||||||

| Nippon Kanzai Holdings Co. Ltd. |

14,600 | 272,009 | ||||||

| Nippon Prologis REIT, Inc. REIT (a) |

1,581 | 3,306,504 | ||||||

| NIPPON REIT Investment Corp. REIT |

309 | 720,996 | ||||||

| Nomura Real Estate Holdings, Inc. |

78,600 | 1,898,687 | ||||||

| Nomura Real Estate Master Fund, Inc. REIT |

2,357 | 2,765,002 | ||||||

| NTT UD REIT Investment Corp. REIT |

670 | 619,096 | ||||||

| One REIT, Inc. REIT |

154 | 265,971 | ||||||

| Open House Group Co. Ltd. |

54,600 | 2,094,664 | ||||||

| Orix JREIT, Inc. REIT |

1,364 | 1,821,726 | ||||||

| Pressance Corp. |

16,300 | 213,032 | ||||||

| Relo Group, Inc. |

77,100 | 1,082,154 | ||||||

| SAMTY Co. Ltd. (a) |

20,000 | 305,050 | ||||||

| Samty Residential Investment Corp. REIT |

318 | 273,127 | ||||||

| Sankei Real Estate, Inc. REIT |

318 | 194,376 | ||||||

| Sekisui House Reit, Inc. REIT |

2,159 | 1,228,504 | ||||||

| SOSiLA Logistics REIT, Inc. REIT (a) |

486 | 473,077 | ||||||

| SRE Holdings Corp. * |

6,800 | 172,050 | ||||||

| Star Asia Investment Corp. REIT |

1,278 | 525,964 | ||||||

| Starts Corp., Inc. |

21,700 | 421,218 | ||||||

| Starts Proceed Investment Corp. REIT |

152 | 257,186 | ||||||

| Sumitomo Realty & Development Co. Ltd. |

319,700 | 7,709,046 | ||||||

| Sun Frontier Fudousan Co. Ltd. |

17,600 | 166,029 | ||||||

| Takara Leben Real Estate Investment Corp. REIT |

428 | 281,218 | ||||||

| Tama Home Co. Ltd. (a) |

11,600 | 289,346 | ||||||

| TOC Co. Ltd. |

30,700 | 131,181 | ||||||

| Tokyo Tatemono Co. Ltd. |

139,800 | 1,721,046 | ||||||

| Tokyu Fudosan Holdings Corp. |

407,500 | 2,169,989 | ||||||

| Tokyu REIT, Inc. REIT |

404 | 540,440 | ||||||

| Tosei Corp. |

22,900 | 273,230 | ||||||

| Tosei Reit Investment Corp. REIT |

195 | 183,116 | ||||||

| United Urban Investment Corp. REIT (a) |

1,449 | 1,534,925 | ||||||

| XYMAX REIT Investment Corp. REIT (a) |

149 | 117,097 | ||||||

|

|

|

|||||||

| (Cost $140,286,228) |

117,296,566 | |||||||

|

|

|

|||||||

| See Notes to Financial Statements. | 10 |

DBX ETF Trust

Schedule of Investments

Xtrackers International Real Estate ETF (Continued)

May 31, 2023

| Number |

Value |

|||||||

| Luxembourg — 0.2% | ||||||||

| ADLER Group SA, 144A *(a) |

53,031 | $ | 26,538 | |||||

| Aroundtown SA (a) |

553,942 | 578,747 | ||||||

| Grand City Properties SA |

51,049 | 375,521 | ||||||

|

|

|

|||||||

| (Cost $4,728,759) |

980,806 | |||||||

|

|

|

|||||||

| Malaysia — 0.6% | ||||||||

| AmFIRST Real Estate Investment Trust REIT |

147,300 | 10,532 | ||||||

| Axis Real Estate Investment Trust REIT |

834,084 | 334,320 | ||||||

| Capitaland Malaysia Trust REIT |

486,908 | 53,274 | ||||||

| Eastern & Oriental Bhd * |

490,636 | 33,485 | ||||||

| Eco World Development Group Bhd |

714,000 | 115,249 | ||||||

| Eco World International Bhd * |

546,800 | 71,674 | ||||||

| Ecofirst Consolidated BHD * |

482,900 | 35,050 | ||||||

| IGB Commercial Real Estate Investment Trust REIT |

459,500 | 49,778 | ||||||

| IGB Real Estate Investment Trust REIT |

959,000 | 326,212 | ||||||

| IOI Properties Group Bhd |

665,600 | 157,189 | ||||||

| Iskandar Waterfront City Bhd * |

358,600 | 25,251 | ||||||

| KIP REIT |

222,352 | 43,357 | ||||||

| KLCCP Stapled Group (b) |

104,900 | 157,958 | ||||||

| KSL Holdings Bhd * |

233,500 | 41,484 | ||||||

| Land & General Bhd |

1,121,900 | 25,522 | ||||||

| LBS Bina Group Bhd |

701,500 | 62,315 | ||||||

| Mah Sing Group Bhd |

828,600 | 106,818 | ||||||

| Malton Bhd * |

97,400 | 8,336 | ||||||

| Matrix Concepts Holdings Bhd |

525,294 | 167,302 | ||||||

| MKH Bhd |

198,000 | 51,479 | ||||||

| Paramount Corp. Bhd |

202,240 | 34,835 | ||||||

| Pavilion Real Estate Investment Trust REIT |

374,500 | 103,859 | ||||||

| Sentral REIT |

319,800 | 58,549 | ||||||

| Sime Darby Property Bhd |

1,450,546 | 146,139 | ||||||

| SP Setia Bhd Group |

853,205 | 97,974 | ||||||

| Sunway Bhd |

1,169,961 | 397,972 | ||||||

| Sunway Real Estate Investment Trust REIT |

867,100 | 306,223 | ||||||

| Symphony Life Bhd * |

322,700 | 26,568 | ||||||

| Titijaya Land Bhd * |

93,900 | 5,289 | ||||||

| Tropicana Corp. Bhd * |

283,591 | 84,177 | ||||||

| UEM Sunrise Bhd |

782,900 | 44,950 | ||||||

| UOA Development Bhd |

199,400 | 74,740 | ||||||

| YNH Property Bhd * |

239,100 | 251,248 | ||||||

| YTL Hospitality REIT |

505,800 | 103,012 | ||||||

|

|

|

|||||||

| (Cost $3,895,899) |

3,612,120 | |||||||

|

|

|

|||||||

| Mexico — 1.8% | ||||||||

| CFE Capital S de RL de CV REIT |

571,903 | 900,128 | ||||||

| Concentradora Fibra Danhos SA de CV REIT |

604,484 | 754,658 | ||||||

| Corp. Inmobiliaria Vesta SAB de CV |

456,670 | 1,443,178 | ||||||

| FIBRA Macquarie Mexico REIT, 144A |

522,715 | 883,346 | ||||||

| Fibra MTY SAPI de CV REIT |

1,475,526 | 986,274 | ||||||

| Fibra Uno Administracion SA de CV REIT |

1,924,859 | 2,783,516 | ||||||

| Prologis Property Mexico SA de CV REIT (a) |

445,215 | 1,494,475 | ||||||

| Number |

Value |

|||||||

| Mexico (Continued) | ||||||||

| TF Administradora Industrial S de RL de CV REIT (a) |

546,848 | $ | 990,644 | |||||

|

|

|

|||||||

| (Cost $7,846,109) |

10,236,219 | |||||||

|

|

|

|||||||

| Netherlands — 0.7% | ||||||||

| Argo Properties NV *(a) |

9,488 | 117,592 | ||||||

| CTP NV, 144A |

73,654 | 942,271 | ||||||

| Eurocommercial Properties NV REIT |

30,164 | 686,249 | ||||||

| NEPI Rockcastle NV |

285,220 | 1,621,254 | ||||||

| NSI NV REIT (a) |

12,565 | 267,375 | ||||||

|

|

|

|||||||

| (Cost $4,519,515) |

3,634,741 | |||||||

|

|

|

|||||||

| New Zealand — 0.7% | ||||||||

| Argosy Property Ltd. |

580,079 | 378,961 | ||||||

| Goodman Property Trust REIT |

713,097 | 914,625 | ||||||

| Investore Property Ltd. |

187,596 | 155,161 | ||||||

| Kiwi Property Group Ltd. |

1,036,126 | 565,112 | ||||||

| Precinct Properties New Zealand Ltd. |

902,100 | 651,512 | ||||||

| Property for Industry Ltd. |

342,538 | 474,243 | ||||||

| Stride Property Group (b) |

354,824 | 289,223 | ||||||

| Vital Healthcare Property Trust REIT |

318,522 | 437,175 | ||||||

|

|

|

|||||||

| (Cost $5,067,074) |

3,866,012 | |||||||

|

|

|

|||||||

| Norway — 0.2% | ||||||||

| Entra ASA, 144A |

51,847 | 447,609 | ||||||

| KMC Properties ASA * |

51,814 | 25,110 | ||||||

| Olav Thon Eiendomsselskap ASA |

17,853 | 271,569 | ||||||

| Selvaag Bolig ASA |

27,362 | 76,367 | ||||||

|

|

|

|||||||

| (Cost $1,364,568) |

820,655 | |||||||

|

|

|

|||||||

| Philippines — 2.3% | ||||||||

| 8990 Holdings, Inc. * |

1,289,300 | 209,144 | ||||||

| ACEN Corp. * |

464,085 | 48,425 | ||||||

| AREIT, Inc. REIT |

522,040 | 306,754 | ||||||

| Ayala Corp. |

191,035 | 2,245,069 | ||||||

| Ayala Land, Inc. |

4,916,196 | 2,302,278 | ||||||

| Belle Corp. |

1,441,000 | 30,791 | ||||||

| DDMP Reit, Inc. REIT |

4,280,000 | 96,788 | ||||||

| DoubleDragon Corp. |

355,170 | 46,800 | ||||||

| Filinvest Land, Inc. |

5,923,000 | 74,881 | ||||||

| Filinvest REIT Corp. REIT |

1,011,200 | 74,364 | ||||||

| GT Capital Holdings, Inc. |

59,771 | 549,178 | ||||||

| Megaworld Corp. |

6,683,600 | 242,780 | ||||||

| MREIT, Inc. REIT |

532,600 | 130,874 | ||||||

| RL Commercial REIT, Inc. REIT |

2,499,300 | 259,899 | ||||||

| Robinsons Land Corp. |

1,157,461 | 286,480 | ||||||

| SM Prime Holdings, Inc. |

9,667,457 | 5,629,021 | ||||||

| Vista Land & Lifescapes, Inc. |

2,009,900 | 61,199 | ||||||

|

|

|

|||||||

| (Cost $16,056,726) |

12,594,725 | |||||||

|

|

|

|||||||

| Poland — 0.2% | ||||||||

| Archicom SA |

2,847 | 14,659 | ||||||

| Atal SA (a) |

4,517 | 49,702 | ||||||

| Cavatina Holding SA * |

4,168 | 17,100 | ||||||

| Develia SA * |

299,085 | 271,432 | ||||||

| Dom Development SA |

5,768 | 187,418 | ||||||

| Echo Investment SA (a) |

98,643 | 95,089 | ||||||

| See Notes to Financial Statements. | 11 |

DBX ETF Trust

Schedule of Investments

Xtrackers International Real Estate ETF (Continued)

May 31, 2023

| Number |

Value |

|||||||

| Poland (Continued) | ||||||||

| Globe Trade Centre SA (a) |

132,086 | $ | 180,121 | |||||

| Marvipol Development SA * |

6,983 | 10,310 | ||||||

| MLP Group SA * |

5,429 | 105,434 | ||||||

| Polski Holding Nieruchomosci SA |

7,682 | 20,771 | ||||||

|

|

|

|||||||

| (Cost $842,970) |

952,036 | |||||||

|

|

|

|||||||

| Russia — 0.0% | ||||||||

| LSR Group PJSC *(c) |

30,984 | 0 | ||||||

| PIK Group PJSC *(c) |

192,287 | 0 | ||||||

|

|

|

|||||||

| (Cost $2,472,023) |

0 | |||||||

|

|

|

|||||||

| Singapore — 7.2% | ||||||||

| AIMS APAC REIT (a)(c) |

427,400 | 410,949 | ||||||

| Bukit Sembawang Estates Ltd. |

123,100 | 362,526 | ||||||

| CapitaLand Ascendas REIT |

2,254,769 | 4,493,395 | ||||||

| CapitaLand Ascott Trust (b) |

1,556,637 | 1,217,873 | ||||||

| CapitaLand China Trust REIT |

773,147 | 570,651 | ||||||

| Capitaland India Trust |

614,600 | 480,847 | ||||||

| CapitaLand Integrated Commercial Trust REIT |

3,389,292 | 5,003,199 | ||||||

| CapitaLand Investment Ltd. |

1,670,463 | 4,081,066 | ||||||

| CDL Hospitality Trusts (b) |

483,344 | 413,831 | ||||||

| City Developments Ltd. |

336,298 | 1,675,471 | ||||||

| Cromwell European Real Estate Investment Trust REIT |

207,619 | 360,789 | ||||||

| Daiwa House Logistics Trust REIT |

364,200 | 153,223 | ||||||

| Digital Core REIT Management Pte Ltd. REIT |

483,900 | 203,238 | ||||||

| ESR-LOGOS REIT REIT |

4,172,987 | 1,016,412 | ||||||

| Far East Hospitality Trust (b) |

720,600 | 316,461 | ||||||

| First Real Estate Investment Trust REIT |

811,200 | 152,678 | ||||||

| Frasers Centrepoint Trust REIT |

713,000 | 1,120,928 | ||||||

| Frasers Hospitality Trust (b) |

490,800 | 170,259 | ||||||

| Frasers Logistics & Commercial Trust REIT |

1,916,778 | 1,754,294 | ||||||

| Frasers Property Ltd. |

342,100 | 217,150 | ||||||

| GuocoLand Ltd. |

170,100 | 193,345 | ||||||

| Ho Bee Land Ltd. |

137,600 | 207,185 | ||||||

| Hong Fok Corp. Ltd. |

286,100 | 210,111 | ||||||

| IREIT Global REIT |

372,500 | 133,345 | ||||||

| Keppel REIT |

1,295,900 | 832,146 | ||||||

| Keppel DC REIT |

887,155 | 1,368,531 | ||||||

| Keppel Pacific Oak US REIT |

485,354 | 145,606 | ||||||

| Lendlease Global Commercial REIT |

1,096,851 | 538,367 | ||||||

| Lippo Malls Indonesia Retail Trust REIT * |

3,017,900 | 33,412 | ||||||

| Manulife US Real Estate Investment Trust REIT |

1,126,626 | 190,400 | ||||||

| Mapletree Industrial Trust REIT (a) |

1,317,422 | 2,207,291 | ||||||

| Mapletree Logistics Trust REIT |

2,120,491 | 2,598,085 | ||||||

| Mapletree Pan Asia Commercial Trust REIT |

1,556,870 | 1,896,029 | ||||||

| OUE Commercial Real Estate Investment Trust REIT |

1,618,939 | 400,299 | ||||||

| PARAGON REIT REIT |

741,000 | 525,047 | ||||||

| Parkway Life Real Estate Investment Trust REIT |

257,500 | 682,308 | ||||||

| Prime US REIT |

442,900 | 95,223 | ||||||

| Number |

Value |

|||||||

| Singapore (Continued) | ||||||||

| Sabana Industrial Real Estate Investment Trust REIT |

601,400 | $ | 190,871 | |||||

| Sasseur Real Estate Investment Trust REIT |

342,300 | 188,223 | ||||||

| Singapore Land Group Ltd. |

127,500 | 193,859 | ||||||

| Starhill Global REIT |

918,909 | 345,901 | ||||||

| Suntec Real Estate Investment Trust REIT |

1,223,800 | 1,183,288 | ||||||

| Tuan Sing Holdings Ltd. |

315,700 | 72,235 | ||||||

| UOL Group Ltd. |

307,717 | 1,442,228 | ||||||

| Wing Tai Holdings Ltd. |

209,800 | 226,083 | ||||||

| Yanlord Land Group Ltd. * |

349,900 | 197,567 | ||||||

|

|

|

|||||||

| (Cost $44,966,297) |

40,472,225 | |||||||

|

|

|

|||||||

| South Africa — 0.7% | ||||||||

| Attacq Ltd. REIT |

319,482 | 128,978 | ||||||

| Equites Property Fund Ltd. REIT |

421,823 | 255,441 | ||||||

| Fortress Real Estate Investments Ltd. * |

692,318 | 447,891 | ||||||

| Fortress Real Estate Investments Ltd., Class B * |

467,604 | 115,625 | ||||||

| Growthpoint Properties Ltd. REIT |

1,939,916 | 1,144,395 | ||||||

| Hyprop Investments Ltd. REIT |

214,589 | 326,817 | ||||||

| Redefine Properties Ltd. REIT (a) |

3,925,802 | 618,104 | ||||||

| Resilient REIT Ltd. REIT |

200,069 | 403,848 | ||||||

| SA Corporate Real Estate Ltd. REIT |

1,527,846 | 139,552 | ||||||

| Vukile Property Fund Ltd. REIT (a) |

534,158 | 334,249 | ||||||

|

|

|

|||||||

| (Cost $5,740,708) |

3,914,900 | |||||||

|

|

|

|||||||

| South Korea — 0.5% | ||||||||

| D&D Platform REIT Co. Ltd. REIT |

27,980 | 69,779 | ||||||

| E KOCREF CR-REIT Co. Ltd. REIT |

15,427 | 62,649 | ||||||

| ESR Kendall Square REIT Co. Ltd. REIT |

103,150 | 323,692 | ||||||

| JR Global REIT |

130,465 | 446,761 | ||||||

| KB Star Real Estate Investment Trust, Inc. REIT |

45,326 | 157,604 | ||||||

| Koramco Energy Plus REIT |

30,653 | 127,485 | ||||||

| Korea Asset In Trust Co. Ltd. |

37,138 | 86,042 | ||||||

| Korea Real Estate Investment & Trust Co. Ltd. |

100,571 | 104,492 | ||||||

| LOTTE Reit Co. Ltd. REIT |

71,444 | 210,739 | ||||||

| Mirae Asset Global REIT Co. Ltd. REIT |

17,123 | 43,864 | ||||||

| NH All-One REIT Co. Ltd. REIT |

26,245 | 72,570 | ||||||

| Seobu T&D |

24,271 | 139,162 | ||||||

| Shinhan Alpha REIT Co. Ltd. REIT |

63,060 | 299,324 | ||||||

| SK D&D Co. Ltd. |

6,271 | 97,804 | ||||||

| SK REITs Co. Ltd. REIT |

69,392 | 268,209 | ||||||

|

|

|

|||||||

| (Cost $3,155,251) |

2,510,176 | |||||||

|

|

|

|||||||

| Spain — 0.6% | ||||||||

| Aedas Homes SA, 144A |

6,202 | 88,865 | ||||||

| Inmobiliaria Colonial Socimi SA REIT |

203,412 | 1,187,295 | ||||||

| Lar Espana Real Estate Socimi SA REIT |

30,710 | 160,753 | ||||||

| Merlin Properties Socimi SA REIT |

224,884 | 1,843,669 | ||||||

| Metrovacesa SA, 144A *(a) |

9,172 | 66,590 | ||||||

| Neinor Homes SA, 144A * |

23,080 | 220,466 | ||||||

|

|

|

|||||||

| (Cost $4,719,876) |

3,567,638 | |||||||

|

|

|

|||||||

| See Notes to Financial Statements. | 12 |

DBX ETF Trust

Schedule of Investments

Xtrackers International Real Estate ETF (Continued)

May 31, 2023

| Number |

Value |

|||||||

| Sweden — 3.2% | ||||||||

| Atrium Ljungberg AB, Class B (a) |

30,827 | $ | 499,357 | |||||

| Castellum AB *(a) |

94,230 | 870,127 | ||||||

| Castellum AB (a) |

190,047 | 1,774,117 | ||||||

| Catena AB |

22,368 | 766,179 | ||||||

| Cibus Nordic Real Estate AB |

29,361 | 264,539 | ||||||

| Corem Property Group AB, Class B (a) |

357,576 | 199,099 | ||||||

| Corem Property Group AB, Class D |

2,515 | 26,020 | ||||||

| Dios Fastigheter AB |

63,992 | 367,185 | ||||||

| Eastnine AB |

7,646 | 76,294 | ||||||

| Fabege AB (a) |

185,380 | 1,318,352 | ||||||

| Fastighets AB Balder, Class B *(a) |

444,676 | 1,488,845 | ||||||

| Fastighets AB Trianon * |

40,317 | 58,714 | ||||||

| FastPartner AB, Class A (a) |

35,613 | 151,174 | ||||||

| Heba Fastighets AB, Class B |

75,971 | 187,771 | ||||||

| Hemnet Group AB |

62,248 | 1,049,516 | ||||||

| Hufvudstaden AB, Class A |

78,670 | 938,234 | ||||||

| JM AB (a) |

28,899 | 346,779 | ||||||

| John Mattson Fastighetsforetagen AB *(a) |

13,313 | 75,228 | ||||||

| K-fast Holding AB *(a) |

44,414 | 77,536 | ||||||

| Klarabo Sverige AB, Class B * |

66,127 | 70,601 | ||||||

| Nivika Fastigheter AB, Class B * |

15,480 | 53,906 | ||||||

| NP3 Fastigheter AB |

18,706 | 298,544 | ||||||

| Nyfosa AB |

98,942 | 545,455 | ||||||

| Pandox AB |

59,483 | 609,390 | ||||||

| Platzer Fastigheter Holding AB, Class B |

41,878 | 294,357 | ||||||

| Sagax AB, Class A (a) |

4,885 | 95,154 | ||||||

| Sagax AB, Class B (a) |

133,842 | 2,629,224 | ||||||

| Sagax AB, Class D |

73,524 | 173,616 | ||||||

| Samhallsbyggnadsbolaget i Norden AB (a) |

781,595 | 249,554 | ||||||

| Samhallsbyggnadsbolaget i Norden AB, Class D (a) |

94,439 | 36,271 | ||||||

| Stendorren Fastigheter AB * |

8,937 | 135,489 | ||||||

| Swedish Logistic Property AB, Class B * |

33,646 | 79,141 | ||||||

| Wallenstam AB, Class B (a) |

325,994 | 1,039,361 | ||||||

| Wihlborgs Fastigheter AB |

181,871 | 1,296,739 | ||||||

|

|

|

|||||||

| (Cost $30,500,755) |

18,141,868 | |||||||

|

|

|

|||||||

| Switzerland — 2.1% | ||||||||

| Allreal Holding AG (a) |

10,345 | 1,704,268 | ||||||

| Fundamenta Real Estate AG * |

15,744 | 277,283 | ||||||

| Intershop Holding AG |

829 | 553,181 | ||||||

| Mobimo Holding AG |

4,851 | 1,257,657 | ||||||

| Peach Property Group AG *(a) |

7,053 | 98,448 | ||||||

| PSP Swiss Property AG |

30,928 | 3,308,821 | ||||||

| Swiss Prime Site AG |

51,518 | 4,330,972 | ||||||

| Zug Estates Holding AG, Class B |

182 | 336,466 | ||||||

|

|

|

|||||||

| (Cost $13,522,630) |

11,867,096 | |||||||

|

|

|

|||||||

| Taiwan — 1.2% | ||||||||

| Cathay No. 1 REIT |

897,504 | 525,461 | ||||||

| Cathay No. 2 REIT |

198,000 | 110,703 | ||||||

| Cathay Real Estate Development Co. Ltd. |

453,424 | 243,479 | ||||||

| Chong Hong Construction Co. Ltd. |

150,740 | 389,022 | ||||||

| Farglory Land Development Co. Ltd. |

184,479 | 376,433 | ||||||

| Highwealth Construction Corp. |

1,053,401 | 1,460,414 | ||||||

| Number |

Value |

|||||||

| Taiwan (Continued) | ||||||||

| Hong Pu Real Estate Development Co. |

130,515 | $ | 108,948 | |||||

| Huaku Development Co. Ltd. |

173,338 | 508,266 | ||||||

| Huang Hsiang Construction Corp. |

89,643 | 134,344 | ||||||

| Hung Sheng Construction Ltd. |

251,915 | 184,053 | ||||||

| KEE TAI Properties Co. Ltd. |

278,118 | 117,665 | ||||||

| Kindom Development Co. Ltd. |

254,531 | 244,777 | ||||||

| Kuo Yang Construction Co. Ltd. * |

159,983 | 97,622 | ||||||

| Prince Housing & Development Corp. |

897,799 | 353,539 | ||||||

| Radium Life Tech Co. Ltd. |

392,797 | 117,862 | ||||||

| Ruentex Development Co. Ltd. |

1,412,141 | 1,603,896 | ||||||

| Shining Building Business Co. Ltd. * |

318,249 | 124,286 | ||||||

| Sinyi Realty, Inc. |

196,039 | 190,122 | ||||||

| Taiwan Land Development Corp. *(c) |

243,531 | 0 | ||||||

|

|

|

|||||||

| (Cost $6,587,600) |

6,890,892 | |||||||

|

|

|

|||||||

| Thailand — 2.7% | ||||||||

| Amata Corp. PCL, NVDR |

558,400 | 354,616 | ||||||

| Ananda Development PCL, NVDR * |

1,576,500 | 45,755 | ||||||

| AP Thailand PCL, NVDR |

1,629,700 | 543,233 | ||||||

| Asset World Corp. PCL, NVDR |

5,443,100 | 769,542 | ||||||

| Ba Airport Leasehold REIT REIT |

450,000 | 138,362 | ||||||

| Bangkok Land PCL, NVDR |

8,938,300 | 218,321 | ||||||

| Central Pattana PCL, NVDR |

2,196,700 | 4,260,840 | ||||||

| CP Tower Growth Leasehold Property Fund |

800 | 160 | ||||||

| CPN Retail Growth Leasehold REIT |

1,161,400 | 427,182 | ||||||

| Digital Telecommunications Infrastructure Fund, Class F |

5,100,000 | 1,802,586 | ||||||

| Frasers Property Thailand Industrial Freehold & Leasehold REIT |

1,161,400 | 367,109 | ||||||

| Frasers Property Thailand PCL, NVDR |

255,825 | 111,004 | ||||||

| Golden Ventures Leasehold Real Estate Investment Trust REIT |

238,500 | 62,024 | ||||||

| Grand Canal Land PCL, NVDR * |

822,800 | 51,070 | ||||||

| IMPACT Growth Real Estate Investment Trust REIT |

333,532 | 123,637 | ||||||

| Land & Houses PCL, NVDR |

5,534,800 | 1,351,891 | ||||||

| LH Hotel Leasehold Real Estate Investment Trust, Class F REIT |

261,700 | 94,001 | ||||||

| Lotus’s Retail Growth Freehold And Leasehold Property Fund |

271,900 | 103,916 | ||||||

| LPN Development PCL, NVDR |

775,159 | 98,009 | ||||||

| Noble Development PCL, NVDR |

748,157 | 96,744 | ||||||

| Nusasiri PCL, NVDR * |

6,422,200 | 147,637 | ||||||

| Origin Property PCL, NVDR |

618,700 | 192,010 | ||||||

| Platinum Group PCL, NVDR * |

794,100 | 76,672 | ||||||

| Principal Capital PCL, NVDR * |

412,800 | 54,565 | ||||||

| Property Perfect PCL, NVDR |

6,081,506 | 64,660 | ||||||

| Pruksa Holding PCL, NVDR |

572,600 | 204,030 | ||||||

| Quality Houses PCL, NVDR |

6,135,000 | 405,474 | ||||||

| Rabbit Holdings PCL, NVDR * |

13,658,100 | 243,334 | ||||||

| Rabbit Holdings PCL, PFD NVDR * |

161,700 | 2,927 | ||||||

| Sansiri PCL, NVDR |

10,347,500 | 517,375 | ||||||

| SC Asset Corp. PCL, NVDR |

1,286,800 | 161,220 | ||||||

| Singha Estate PCL, NVDR |

1,916,700 | 86,472 | ||||||

| Supalai PCL |

51,400 | 29,836 | ||||||

| See Notes to Financial Statements. | 13 |

DBX ETF Trust

Schedule of Investments

Xtrackers International Real Estate ETF (Continued)

May 31, 2023

| Number |

Value |

|||||||

| Thailand (Continued) | ||||||||

| Supalai PCL |

500 | $ | 290 | |||||

| Supalai PCL, NVDR |

877,365 | 509,275 | ||||||

| Univentures PCL, NVDR |

445,600 | 36,365 | ||||||

| WHA Corp. PCL, NVDR |

6,853,196 | 870,435 | ||||||

| WHA Premium Growth Freehold & Leasehold Real Estate InvestmentTrust, Class F REIT |

1,559,000 | 492,787 | ||||||

|

|

|

|||||||

| (Cost $15,469,223) |

15,115,366 | |||||||

|

|

|

|||||||

| Turkey — 0.4% | ||||||||

| Akfen Gayrimenkul Yatirim Ortakligi AS REIT * |

384,172 | 65,332 | ||||||

| AKIS Gayrimenkul Yatirimi AS REIT * |

248,455 | 60,737 | ||||||

| Akmerkez Gayrimenkul Yatirim Ortakligi AS REIT |

6,147 | 21,739 | ||||||

| Alarko Gayrimenkul Yatirim Ortakligi AS REIT |

25,204 | 70,137 | ||||||

| Baskent Dogalgaz Dagitim Gayrimenkul Yatirim Ortakligi AS |

69,758 | 41,048 | ||||||

| Emlak Konut Gayrimenkul Yatirim Ortakligi AS REIT |

1,353,740 | 465,008 | ||||||

| Gimat Magazacilik Sanayi VE Ticaret |

96,280 | 56,934 | ||||||

| Halk Gayrimenkul Yatirim Ortakligi AS REIT * |

158,825 | 32,534 | ||||||

| Ihlas Gayrimenkul Proje Gelistirme Ve Ticaret AS * |

490,774 | 23,473 | ||||||

| Is Gayrimenkul Yatirim Ortakligi AS |

260,845 | 112,158 | ||||||

| Kiler Gayrimenkul Yatirim Ortakligi AS |

381,253 | 43,285 | ||||||

| Kiler Holding As * |

66,400 | 115,485 | ||||||

| Kizilbuk Gayrimenkul Yatirim Ortakligi |

49,164 | 42,160 | ||||||

| Kuyumcukent Gayrimenkul Yatirimlari AS REIT * |

60,418 | 84,941 | ||||||

| Marti Gayrimenkul Yatirim Ortakligi As |

119,161 | 31,433 | ||||||

| Nurol Gayrimenkul Yatirim Ortakligi AS REIT * |

88,135 | 22,823 | ||||||

| Ozak Gayrimenkul Yatirim Ortakligi |

137,752 | 82,190 | ||||||

| Ozderici Gayrimenkul Yatirim Ortakligi AS REIT * |

96,803 | 18,005 | ||||||

| Panora Gayrimenkul Yatirim Ortakligi |

35,510 | 45,394 | ||||||

| Peker Gayrimenkul Yatirim Ortakligi AS * |

253,206 | 82,572 | ||||||

| Reysas Gayrimenkul Yatirim Ortakligi AS REIT * |

94,886 | 54,689 | ||||||

| Servet Gayrimenkul Yatirim Ortakligi |

8,448 | 73,547 | ||||||

| Sinpas Gayrimenkul Yatirim Ortakligi AS REIT * |

509,687 | 59,836 | ||||||

| Torunlar Gayrimenkul Yatirim Ortakligi AS REIT |

86,457 | 68,669 | ||||||

| Vakif Gayrimenkul Yatirim Ortakligi AS |

443,066 | 67,855 | ||||||

| Yeni Gimat Gayrimenkul Ortakligi AS |

148,959 | 245,114 | ||||||

| Number |

Value |

|||||||

| Turkey (Continued) | ||||||||

| Yesil Gayrimenkul Yatirim Ortakligi AS |

95,653 | $ | 8,688 | |||||

| Ziraat Gayrimenkul Yatirim Ortakligi AS |

511,599 | 109,988 | ||||||

|

|

|

|||||||

| (Cost $2,022,411) |

2,205,774 | |||||||

|

|

|

|||||||

| United Kingdom — 7.3% | ||||||||

| Assura PLC REIT |

1,975,630 | 1,174,347 | ||||||

| Big Yellow Group PLC REIT |

122,146 | 1,740,960 | ||||||

| British Land Co. PLC REIT |

577,881 | 2,456,656 | ||||||

| Capital & Counties Properties PLC REIT |

954,988 | 1,419,152 | ||||||

| CLS Holdings PLC REIT |

116,208 | 197,031 | ||||||

| Derwent London PLC REIT |

68,499 | 1,823,603 | ||||||

| Empiric Student Property PLC REIT |

404,112 | 453,275 | ||||||

| Grainger PLC |

448,882 | 1,381,960 | ||||||

| Great Portland Estates PLC REIT |

137,774 | 825,440 | ||||||

| Hammerson PLC REIT (a) |

2,731,016 | 839,436 | ||||||

| Helical PLC REIT |

75,124 | 226,720 | ||||||

| Henry Boot PLC |

71,608 | 207,677 | ||||||

| Industrials REIT Ltd. REIT |

182,471 | 377,534 | ||||||

| Land Securities Group PLC REIT |

453,014 | 3,380,025 | ||||||

| LondonMetric Property PLC REIT |

610,814 | 1,362,678 | ||||||

| LXI REIT PLC REIT |

1,086,009 | 1,321,772 | ||||||

| Picton Property Income Ltd. REIT |

371,056 | 344,456 | ||||||

| Primary Health Properties PLC REIT |

905,583 | 1,119,013 | ||||||

| Rightmove PLC |

559,597 | 3,631,506 | ||||||

| Safestore Holdings PLC REIT |

145,769 | 1,688,326 | ||||||

| Savills PLC |

94,245 | 1,062,947 | ||||||

| Segro PLC REIT |

822,430 | 8,130,100 | ||||||

| Tritax Big Box REIT PLC REIT |

1,237,891 | 2,147,940 | ||||||

| UK Commercial Property REIT Ltd. REIT |

522,334 | 342,465 | ||||||

| UNITE Group PLC REIT, Series 6 |

219,533 | 2,435,200 | ||||||

| Workspace Group PLC REIT |

91,250 | 568,870 | ||||||

|

|

|

|||||||

| (Cost $51,153,495) |

40,659,089 | |||||||

|

|

|

|||||||

| Virgin Islands — 0.0% | ||||||||

| SF Real Estate Investment Trust REIT |

||||||||

| (Cost $131,397) |

333,016 | 116,986 | ||||||

|

|

|

|||||||

| TOTAL COMMON STOCKS |

555,508,149 | |||||||

|

|

|

|||||||

| PREFERRED STOCKS — 0.1% | ||||||||

| Brazil — 0.1% | ||||||||

| Iguatemi SA (Cost $324,084) |

200,000 | 380,327 | ||||||

|

|

|

|||||||

| RIGHTS — 0.0% | ||||||||

| Austria — 0.0% | ||||||||

| S IMMO AG *, expires 12/31/49 (c) (Cost $0) |

31,199 | 0 | ||||||

|

|

|

|||||||

| WARRANTS — 0.0% | ||||||||

| Malaysia — 0.0% | ||||||||

| Eco World Development Group Bhd *, expires 4/12/29 |

106,640 | 2,542 | ||||||

| Paramount Corp. Bhd *, expires 7/28/24 |

7,840 | 127 | ||||||

|

|

|

|||||||

| (Cost $0) |

2,669 | |||||||

|

|

|

|||||||

| See Notes to Financial Statements. | 14 |

DBX ETF Trust

Schedule of Investments

Xtrackers International Real Estate ETF (Continued)

May 31, 2023

| Number |

Value |

|||||||

| Thailand — 0.0% | ||||||||

| Noble Development PCL *, expires 1/12/24 |

||||||||

| (Cost $0) |

54,825 | $ | 236 | |||||

|

|

|

|||||||

| TOTAL WARRANTS |

2,905 | |||||||

|

|

|

|||||||

| EXCHANGE-TRADED FUNDS — 0.0% | ||||||||

| iShares Global REIT ETF |

500 | 11,190 | ||||||

| Vanguard Global ex-U.S. Real Estate ETF |

500 | 19,665 | ||||||

|

|

|

|||||||

| (Cost $34,635) |

30,855 | |||||||

|

|

|

|||||||

| SECURITIES LENDING COLLATERAL — 2.5% | ||||||||

| DWS Government & Agency Securities Portfolio “DWS Government Cash Institutional Shares”,

5.03% (d)(e) |

13,660,219 | 13,660,219 | ||||||

|

|

|

|||||||

| Number |

Value |

|||||||

| CASH EQUIVALENTS — 0.0% | ||||||||

| DWS Government Money Market Series “Institutional Shares”, 5.04% (d) |

44,853 | $ | 44,853 | |||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 101.8% |

||||||||

| (Cost $703,601,252) |

$ | 569,627,308 | ||||||

| Other assets and liabilities, net — (1.8%) |

(9,858,826 | ) | ||||||

|

|

|

|||||||

| NET ASSETS — 100.0% |

$ | 559,768,482 | ||||||

|

|

|

|||||||

A summary of the Fund’s transactions with affiliated investments during the year ended May 31, 2023 is as follows: