UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22487

DBX ETF Trust

(Exact name of registrant as specified in charter)

875 Third Avenue

New York, New York 10022

(Address of principal executive offices) (Zip code)

Diane Kenneally

One International Place

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 454-4500

Date of fiscal year end: May 31

Date of reporting period: May 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

May 31, 2020

Annual Report

DBX ETF Trust

Xtrackers MSCI All World ex US Hedged Equity ETF (DBAW)

Xtrackers MSCI Emerging Markets Hedged Equity ETF (DBEM)

Xtrackers MSCI Europe Hedged Equity ETF (DBEU)

Xtrackers MSCI Eurozone Hedged Equity ETF (DBEZ)

Xtrackers MSCI Germany Hedged Equity ETF (DBGR)

Xtrackers MSCI Japan Hedged Equity ETF (DBJP)

DBX ETF Trust

| Page | ||||

| 1 | ||||

| 3 | ||||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 12 | ||||

| 14 | ||||

| 16 | ||||

| 18 | ||||

| 19 | ||||

| 44 | ||||

| 64 | ||||

| 72 | ||||

| 81 | ||||

| 84 | ||||

| 90 | ||||

| 92 | ||||

| 94 | ||||

| 97 | ||||

| 100 | ||||

| 113 | ||||

| 114 | ||||

| 115 | ||||

| Board Considerations in Approval of Investment Advisory and Sub-Advisory Contracts |

118 | |||

| 121 | ||||

| 122 | ||||

To our Shareholders: (Unaudited)

Dear Shareholders,

We are pleased to provide this annual report for 6 of our currency-hedged equity ETFs for the period ended May 31, 2020.

During the reporting period, developed and emerging economies alike shifted from a “sustaining growth” approach to ‘low-growth’ position, however equity markets across these regions avoided their lowest levels anchored by government stimulus. Through the initial phase of the review period, economies were focusing their efforts towards ensuring favorable employment rates, achieving target inflation levels and improving corporate earnings. Each of these factors saw varied levels of success to keep the overall expansion levels afloat. However, as the global pandemic and the accompanying business lockdown ensued, a slowdown took shape globally, causing enormous economic and human losses. Monetary backing from central banks and fiscal stimulus from governments were at the forefront, providing a base for the economies and businesses to recover and partially offset losses.

The U.S. GDP1 increment was marginal by the end of the review period, as lockdown measures culminated in the highest unemployment levels historically. A dire employment scenario led to a steeper spiraling down of consumer consumption than what businesses had anticipated. The direct impact was on the equity markets, which lost all the gains they had accumulated during the period. A relief fund to the tune of USD3.6 trillion was approved by the Treasury through the Coronavirus Aid, Relief and Economic Security (CARES) Act, while the Federal Reserve Board (FRB) brought the federal funds rate near zero levels to infuse liquidity into the economy. A volatile oil market saw oil become the first commodity in history to record negative prices. As a result, inflation levels waned towards the end of the review period.

The Eurozone, which was facing recessionary pressures even before the COVID-19 outbreak, contracted over the review period, drawing down major equity indices by a larger impact. With dwindling household consumption in Germany and France’s GDP impacted by constant strikes over the government’s pension reforms, the euro area’s power houses had already come under pressure. Serving as a virus hotspots, Italy and Spain inflicted the highest damage, further straining the region’s stability. The European Central Bank’s (ECB) efforts to contain the economic damage were not far behind the U.S., as it issued EUR1.35 trillion in the form of Pandemic Emergency Purchase Programme (PEPP). In addition, the regular asset purchase programme was reinitiated, while keeping interest rates at the zero level. The U.K.’s economy contracted as well, following the global trend, and yet again postponed Brexit2 negotiations.

In another first, the world’s fastest growing major economy, China, contracted, as the epicenter of the pandemic underwent a two-month shutdown. Industrial production detracted sharper than the services sector. Over a short positive stint, the first phase of U.S.-China negotiations was convened by the global giants, relaxing tensions prior to the COVID-19 outbreak. However, disrupted supply chains amid a travel ban globally revived growth sustainability concerns for all export-reliant economies, which include emerging economies. Elsewhere, the Japanese economy was formally declared to be in a technical recession3 as it underwent two consecutive quarters of negative growth.

A second wave of the pandemic and U.S.-China trade tensions are among the visible causes of concerns in the near future. Nevertheless, the availability of reasonable debt and synchronized efforts by economies globally to ensure liquidity are expected to ease recessionary concerns. Our team appreciates your trust and looks forward to continue serving your investment needs

1

through innovative index-driven strategies. In view of an appreciating U.S. dollar, our currency-hedged strategy plays a significant role in managing investments in international equities.

Sincerely,

/s/ Freddi Klassen

Freddi Klassen

President and Chief Executive Officer

1 The gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period.

2 Brexit is a combination of words “Britain” and “Exit” and describes the exit of the United Kingdom from the European Union.

3. A “technical recession” is when you have 2 negative quarters of GDP, but it is due mainly to slowing growth or an isolated event rather than a major underlying cause. Technical recessions are usually short in duration and mild in severity.

Assumptions, estimates and opinions contained in this document constitute our judgment as of the date of the document and are subject to change without notice. Any projections are based on a number of assumptions as to market conditions and there can be no guarantee that any projected results will be achieved. Past performance is not a guarantee of future results.

2

DBX ETF Trust

Xtrackers MSCI All World ex US Hedged Equity ETF (DBAW)

The Xtrackers MSCI All World ex US Hedged Equity ETF (DBAW) seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI ACWI ex USA US Dollar Hedged Index (the DBAW Index). The DBAW Index is designed to provide exposure to equity securities in developed and emerging stock markets (excluding the U.S.), while at the same time mitigating exposure to fluctuation between the value of the U.S. dollar and select non-U.S. currencies. For the 12-month period ended May 31, 2020, DBAW returned -0.78%, compared to the DBAW Index return of -0.37%.

Financials, Energy and Real Estate were the major negative contributors, while Health Care, Information Technology and Consumer Discretionary sectors contributed the most to performance. From a geographical perspective, United Kingdom, Brazil and India were the major negative contributors, while Japan and Switzerland contributed positively to performance. The Fund entered into forward foreign currency contracts during the period to hedge against changes in the value of the U.S. dollar against specified non-U.S. currencies. The currency hedging strategy contributed positively to performance.

Xtrackers MSCI Emerging Markets Hedged Equity ETF (DBEM)

The Xtrackers MSCI Emerging Markets Hedged Equity ETF (DBEM) seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI EM US Dollar Hedged Index (the DBEM Index). The DBEM Index is designed to provide exposure to equity securities in the global emerging markets, while at the same time mitigating exposure to fluctuations between the value of the US dollar and the currencies of countries included in the underlying index. For the 12-month period ended May 31, 2020, DBEM returned -1.01%, compared to the DBEM Index return of -0.17%.

Financials, Energy and Materials were the major negative contributors, while Information Technology, Consumer Discretionary and Communication Services sectors contributed the most to performance. From a geographical perspective, majority of countries contributed negatively to performance during the period with the greatest negative contributions coming from Brazil, India and South Africa, while Taiwan and Hong Kong were among the positive contributors. The Fund entered into forward foreign currency contracts during the period to hedge against changes in the value of the U.S. dollar against specified non-U.S. currencies. The currency hedging strategy contributed positively to performance.

Xtrackers MSCI Europe Hedged Equity ETF (DBEU)

The Xtrackers MSCI Europe Hedged Equity ETF (DBEU) seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI Europe US Dollar Hedged Index (the DBEU Index). The DBEU index is designed to provide exposure to equity securities in 15 developed European stock markets, while at the same time mitigating exposure to fluctuations between the value of the U.S. dollar and selected non-U.S. currencies. For the 12-month period ended May 31, 2020, DBEU returned -2.16%, compared to the DBEU Index return of -1.96%.

Majority of sectors contributed negatively to performance during the period with the greatest negative contributions coming from Financials, Energy and Communication Services. The Health Care, Information Technology and Utilities sectors contributed positively to performance. From a geographical perspective, United Kingdom, France and Spain were the major detractors, while Switzerland, Denmark and Sweden contributed positively to performance. The Fund entered into forward foreign currency contracts during the period to hedge against changes in the value of the U.S. dollar against specified non-U.S. currencies. The currency hedging strategy contributed positively to performance.

Xtrackers MSCI Eurozone Hedged Equity ETF (DBEZ)

The Xtrackers MSCI Eurozone Hedged Equity ETF (DBEZ) seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI EMU IMI U.S. Dollar Hedged Index (the DBEZ Index). The DBEZ Index is designed to provide exposure to equities in countries in the European Monetary Union, or the “Eurozone” that have adopted the euro as their common currency and sole legal tender, while at the same time mitigating exposure to the fluctuations between the value of the U.S. dollar and the euro. For the 12-month period ended May 31, 2020, DBEZ returned -2.80%, compared to the DBEZ Index return of -2.57%.

3

DBX ETF Trust

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Majority of sectors contributed negatively to performance during the period with the greatest negative contributions coming from Financials, Industrials and Energy. The Health Care, Information Technology and Utilities sectors contributed positively to performance. Most countries contributed negatively with France, Spain and Italy being the most significant detractors. However, Netherlands, Finland and Ireland contributed positively to the performance. The Fund entered into forward foreign currency contracts during the period to hedge against changes in the value of the U.S. dollar against the euro. The currency hedging strategy contributed positively to performance.

Xtrackers MSCI Germany Hedged Equity ETF (DBGR)

The Xtrackers MSCI Germany Hedged Equity ETF (DBGR) seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI German US Dollar Hedged Index (the DBGR Index). The DBGR Index is designed to provide exposure to Germany’s equity market, while at the same time mitigating exposure to fluctuations between the value of the US dollar and euro. For the 12-month period ended May 31, 2020, DBGR returned 1.15%, compared to the DBGR Index return of 1.40%.

The Health Care, Utilities and Information Technology sectors were the major positive contributors, while Consumer Discretionary and Materials sectors detracted most from the performance. The Fund entered into forward foreign currency contracts during the period to hedge against changes in the value of the U.S. dollar against specified non-U.S. currencies. The currency hedging strategy contributed positively to performance.

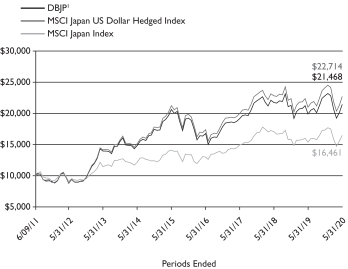

Xtrackers MSCI Japan Hedged Equity ETF (DBJP)

The Xtrackers MSCI Japan Hedged Equity ETF (DBJP) seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI Japan US Dollar Hedged Index (the DBJP Index). The DBJP Index is designed to track the performance of the Japanese equity market, while at the same time mitigating exposure to fluctuations between the value of the U.S. dollar and Japanese yen. For the 12-month period ended May 31, 2020, DBJP returned 7.88%, compared to the DBJP Index return of 8.32%.

Health Care, Information Technology and Consumer Discretionary were the major positive contributors, while Financials, Real Estate and Energy sectors detracted most from the performance. The Fund entered into forward foreign currency contracts during the period to hedge against changes in the value of the U.S. dollar against the Japanese yen. The currency hedging strategy contributed positively to performance.

*************************

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance data visit www.Xtrackers.com. Returns assume that dividends and capital gains distributions have been reinvested. See pages 6-17 of this report for additional performance information, including performance data based on market value. The views expressed in this report reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Current and future portfolio holdings are subject to risk.

4

This Page is Intentionally Left Blank

5

DBX ETF Trust

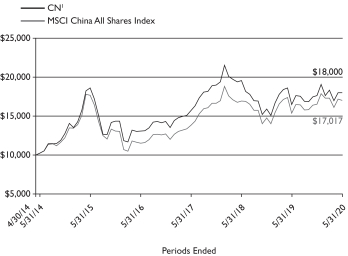

Xtrackers MSCI All World ex US Hedged Equity ETF (DBAW)

The Xtrackers MSCI All World ex US Hedged Equity ETF (the “Fund”), using a “passive” or indexing investment approach, seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI ACWI ex USA US Dollar Hedged Index (the “Underlying Index”). The Underlying Index is designed to track the performance of equity securities in developed and emerging stock markets (excluding the United States), while mitigating exposure to fluctuations between the value of the U.S. dollar and the currencies of the countries included in the Underlying Index. It is not possible to invest directly into an index.

| Performance as of May 31, 2020 |

| Average Annual Total Return | ||||||||

| Net Asset Value | Market Value | MSCI ACWI ex USA US Dollar Hedged Index |

MSCI ACWI ex USA Index | |||||

| One Year |

-0.78% | -0.44% | -0.37% | -3.43% | ||||

| Five Year |

2.22% | 2.13% | 2.68% | 0.79% | ||||

| Since Inception1 |

4.11% | 4.11% | 4.57% | 1.12% | ||||

| Cumulative Total Returns | ||||||||

| Net Asset Value | Market Value | MSCI ACWI ex USA US Dollar Hedged Index |

MSCI ACWI ex USA Index | |||||

| One Year |

-0.78% | -0.44% | -0.37% | -3.43% | ||||

| Five Year |

11.58% | 11.10% | 14.14% | 4.01% | ||||

| Since Inception1 |

29.17% | 29.18% | 32.83% | 7.34% | ||||

1 Total returns are calculated based on the commencement of operations, January 23, 2014 (“Inception”).

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.Xtrackers.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the sale of fund shares or redemption of fund creation units. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are sold in the market or redeemed. Performance for certain funds may reflect a waiver of a portion of investment management fees. Without such waiver, performance would have been lower. The estimated operating expense ratio as disclosed in the most recent prospectus dated October 1, 2019, was 0.40%, and may differ from the expense ratio disclosed in the Financial Highlights table in this report.

The Fund’s net asset value or “NAV” is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not have traded in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary trading, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

6

DBX ETF Trust

Performance Summary (Unaudited)

Xtrackers MSCI All World ex US Hedged Equity ETF (DBAW) (Continued)

* As a percent of total investments excluding securities lending collateral and cash equivalents.

Portfolio holdings and characteristics are subject to change. For more complete details about the Fund’s investment portfolio see page 19.

7

DBX ETF Trust

Performance Summary (Unaudited)

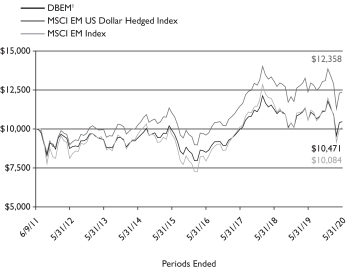

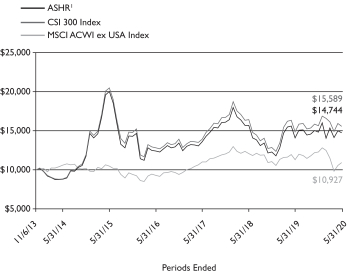

Xtrackers MSCI Emerging Markets Hedged Equity ETF (DBEM)

The Xtrackers MSCI Emerging Markets Hedged Equity ETF (the “Fund”), using a “passive” or indexing investment approach, seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI EM US Dollar Hedged Index (the “Underlying Index”). The Underlying Index is designed to track emerging market performance while mitigating exposure to fluctuations between the value of the U.S. dollar and the currencies of the countries included in the Underlying Index. It is not possible to invest directly into and index.

| Performance as of May 31, 2020 |

| Average Annual Total Return | ||||||||

| Net Asset Value | Market Value | MSCI EM US Dollar Hedged Index |

MSCI EM Index | |||||

| One Year |

-1.01% | 0.15% | -0.17% | -4.39% | ||||

| Five Year |

1.07% | 1.12% | 2.26% | 0.88% | ||||

| Since Inception1 |

0.51% | 0.59% | 2.38% | 0.09% | ||||

| Cumulative Total Returns | ||||||||

| Net Asset Value | Market Value | MSCI EM US Dollar Hedged Index |

MSCI EM Index | |||||

| One Year |

-1.01% | 0.15% | -0.17% | -4.39% | ||||

| Five Year |

5.46% | 5.73% | 11.82% | 4.47% | ||||

| Since Inception1 |

4.71% | 5.42% | 23.58% | 0.84% | ||||

1 Total returns are calculated based on the commencement of operations, June 9, 2011 (“Inception”).

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.Xtrackers.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the sale of fund shares or redemption of fund creation units. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are sold in the market or redeemed. Performance for certain funds may reflect a waiver of a portion of investment management fees. Without such waiver, performance would have been lower. The estimated operating expense ratio as disclosed in the most recent prospectus dated October 1, 2019, was 0.65%, and may differ from the expense ratio disclosed in the Financial Highlights table in this report.

The Fund’s net asset value or “NAV” is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not have traded in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary trading, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

8

DBX ETF Trust

Performance Summary (Unaudited)

Xtrackers MSCI Emerging Markets Hedged Equity ETF (DBEM) (Continued)

* As a percent of total investments excluding exchange-traded funds, securities lending collateral and cash equivalents.

Portfolio holdings and characteristics are subject to change. For more complete details about the Fund’s investment portfolio see page 44.

9

DBX ETF Trust

Performance Summary (Unaudited)

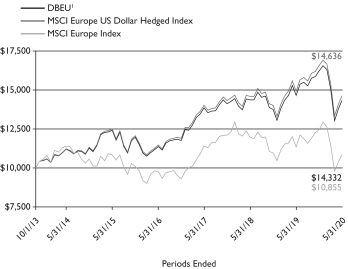

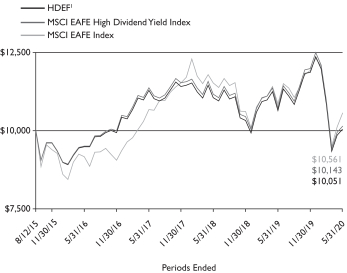

Xtrackers MSCI Europe Hedged Equity ETF (DBEU)

The X-trackers MSCI Europe Hedged Equity ETF (the “Fund”), using a “passive” or indexing investment approach, seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI Europe US Dollar Hedged Index (the “Underlying Index”). The Underlying Index is designed to track the performance of the developed markets in Europe, while mitigating exposure to fluctuations between the value of the U.S. dollar and the currencies of the countries included in the Underlying Index. It is not possible to invest directly into an index.

| Performance as of May 31, 2020 | ||||||||

| Average Annual Total Return | ||||||||

| Net Asset Value | Market Value | MSCI Europe US Dollar Hedged Index |

MSCI Europe Index | |||||

| One Year |

-2.16% | -1.87% | -1.96% | -4.41% | ||||

| Five Year |

2.90% | 2.88% | 3.22% | 0.03% | ||||

| Since Inception1 |

5.55% | 5.58% | 5.88% | 1.24% | ||||

| Cumulative Total Returns | ||||||||

| Net Asset Value | Market Value | MSCI Europe US Dollar Hedged Index |

MSCI Europe Index | |||||

| One Year |

-2.16% | -1.87% | -1.96% | -4.41% | ||||

| Five Year |

15.36% | 15.25% | 17.17% | 0.13% | ||||

| Since Inception1 |

43.32% | 43.63% | 46.36% | 8.55% | ||||

1 Total returns are calculated based on the commencement of operations, October 1, 2013 (“Inception”).

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.Xtrackers.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the sale of fund shares or redemption of fund creation units. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are sold in the market or redeemed. Performance for certain funds may reflect a waiver of a portion of investment management fees. Without such waiver, performance would have been lower. The estimated operating expense ratio as disclosed in the most recent prospectus dated October 1, 2019, was 0.45%, and may differ from the expense ratio disclosed in the Financial Highlights table in this report.

The Fund’s net asset value or “NAV” is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not have traded in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary trading, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

10

DBX ETF Trust

Performance Summary (Unaudited)

Xtrackers MSCI Europe Hedged Equity ETF (DBEU) (Continued)

* As a percent of total investments excluding exchange-traded funds, securities lending collateral and cash equivalents.

Portfolio holdings and characteristics are subject to change. For more complete details about the Fund’s investment portfolio see page 64.

11

DBX ETF Trust

Performance Summary (Unaudited)

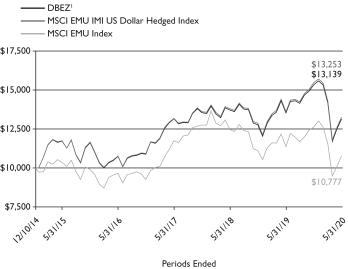

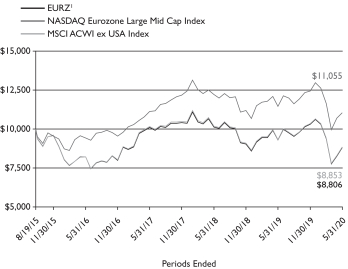

Xtrackers MSCI Eurozone Hedged Equity ETF (DBEZ)

The Xtrackers MSCI Eurozone Hedged Equity ETF (the “Fund”), using a “passive” or indexing investment approach, seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI EMU IMI US Dollar Hedged Index (the “Underlying Index”). The Underlying Index is designed to track the performance of equity securities based in the countries in the European Monetary Union (the “EMU”), while seeking to mitigate exposure to fluctuations between the value of the U.S. dollar and the euro. It is not possible to invest directly into an index.

| Performance as of May 31, 2020 | ||||||||

| Average Annual Total Return | ||||||||

| Net Asset Value | Market Value | MSCI EMU IMI US Dollar Hedged Index |

MSCI EMU Index | |||||

| One Year |

-2.80% | -2.08% | -2.57% | -5.30% | ||||

| Five Year |

2.31% | 2.29% | 2.45% | 0.68% | ||||

| Since Inception1 |

5.11% | 5.20% | 5.27% | 1.37% | ||||

| Cumulative Total Returns | ||||||||

| Net Asset Value | Market Value | MSCI EMU IMI US Dollar Hedged Index |

MSCI EMU Index | |||||

| One Year |

-2.80% | -2.08% | -2.57% | -5.30% | ||||

| Five Year |

12.11% | 11.98% | 12.88% | 3.45% | ||||

| Since Inception1 |

31.39% | 32.04% | 32.53% | 7.77% | ||||

1 Total returns are calculated based on the commencement of operations, December 10, 2014 (“Inception”).

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.Xtrackers.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the sale of fund shares or redemption of fund creation units. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are sold in the market or redeemed. Performance for certain funds may reflect a waiver of a portion of investment management fees. Without such waiver, performance would have been lower. The estimated operating expense ratio as disclosed in the most recent prospectus dated October 1, 2019, was 0.45%, and may differ from the expense ratio disclosed in the Financial Highlights table in this report.

The Fund’s net asset value or “NAV” is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not have traded in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary trading, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

12

DBX ETF Trust

Performance Summary (Unaudited)

Xtrackers MSCI Eurozone Hedged Equity ETF (DBEZ) (Continued)

* As a percent of total investments excluding securities lending collateral and cash equivalents.

Portfolio holdings and characteristics are subject to change. For more complete details about the Fund’s investment portfolio see page 72.

13

DBX ETF Trust

Performance Summary (Unaudited)

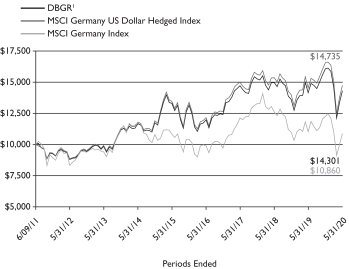

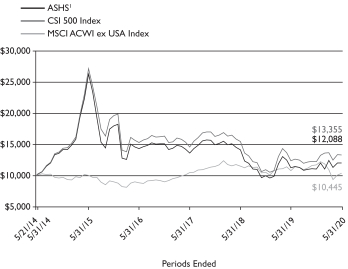

Xtrackers MSCI Germany Hedged Equity ETF (DBGR)

The Xtrackers MSCI Germany Hedged Equity ETF (the “Fund”), using a “passive” or indexing investment approach, seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI Germany US Dollar Hedged Index (the “Underlying Index”). The Underlying Index is designed to track the performance of the German equity market while mitigating exposure to fluctuations between the value of the US dollar and the euro. It is not possible to invest directly into an index.

| Performance as of May 31, 2020 | ||||||||

| Average Annual Total Return | ||||||||

| Net Asset Value | Market Value | MSCI Germany US Dollar Hedged Index |

MSCI Germany Index | |||||

| One Year |

1.15% | 2.23% | 1.40% | -1.54% | ||||

| Five Year |

1.48% | 1.62% | 1.82% | 0.05% | ||||

| Since Inception1 |

4.06% | 4.13% | 4.41% | 0.92% | ||||

| Cumulative Total Returns | ||||||||

| Net Asset Value | Market Value | MSCI Germany US Dollar Hedged Index |

MSCI Germany Index | |||||

| One Year |

1.15% | 2.23% | 1.40% | -1.54% | ||||

| Five Year |

7.61% | 8.36% | 9.43% | 0.27% | ||||

| Since Inception1 |

43.01% | 43.92% | 47.35% | 8.60% | ||||

1 Total returns are calculated based on the commencement of operations, June 9, 2011 (“Inception”).

Prior to May 31, 2013, this Fund was known as dbx-trackers MSCI Canada Hedged Equity Fund (DBCN) and had a different investment strategy. Past performance may have been different if the Fund’s current investment strategy had been in effect.

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.Xtrackers.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the sale of fund shares or redemption of fund creation units. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are sold in the market or redeemed. Performance for certain funds may reflect a waiver of a portion of investment management fees. Without such waiver, performance would have been lower. The estimated operating expense ratio as disclosed in the most recent prospectus dated October 1, 2019, was 0.45%, and may differ from the expense ratio disclosed in the Financial Highlights table in this report.

The Fund’s net asset value or “NAV” is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not have traded in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary trading, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

14

DBX ETF Trust

Performance Summary (Unaudited)

Xtrackers MSCI Germany Hedged Equity ETF (DBGR) (Continued)

* As a percent of total investments excluding exchange-traded funds, securities lending collateral and cash equivalents.

Portfolio holdings and characteristics are subject to change. For more complete details about the Fund’s investment portfolio see page 81.

15

DBX ETF Trust

Performance Summary (Unaudited) (Continued)

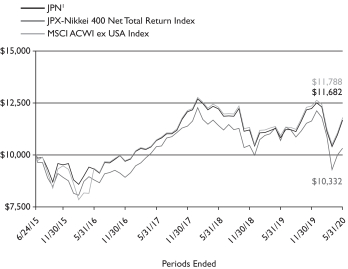

Xtrackers MSCI Japan Hedged Equity ETF (DBJP)

The Xtrackers MSCI Japan Hedged Equity ETF (the “Fund”), using a “passive” or indexing investment approach, seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI Japan US Dollar Hedged Index (the “Underlying Index”). The Underlying Index is designed to track the performance of the Japanese equity market while mitigating exposure to fluctuations between the value of the US dollar and Japanese yen. It is not possible to invest directly into an index.

| Performance as of May 31, 2020 | ||||||||

| Average Annual Total Return | ||||||||

| Net Asset Value | Market Value | MSCI Japan US Dollar Hedged Index |

MSCI Japan Index | |||||

| One Year |

7.88% | 8.66% | 8.32% | 6.98% | ||||

| Five Year |

0.80% | 0.87% | 1.36% | 3.09% | ||||

| Since Inception1 |

8.88% | 8.84% | 9.56% | 5.70% | ||||

| Cumulative Total Returns | ||||||||

| Net Asset Value | Market Value | MSCI Japan US Dollar Hedged Index |

MSCI Japan Index | |||||

| One Year |

7.88% | 8.66% | 8.32% | 6.98% | ||||

| Five Year |

4.09% | 4.42% | 6.97% | 16.46% | ||||

| Since Inception1 |

114.68% | 114.03% | 127.14% | 64.61% | ||||

1 Total returns are calculated based on the commencement of operations, June 9, 2011 (“Inception”).

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.Xtrackers.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the sale of fund shares or redemption of fund creation units. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are sold in the market or redeemed. Performance for certain funds may reflect a waiver of a portion of investment management fees. Without such waiver, performance would have been lower. The estimated operating expense ratio as disclosed in the most recent prospectus dated October 1, 2019, was 0.45%, and may differ from the expense ratio disclosed in the Financial Highlights table in this report.

The Fund’s net asset value or “NAV” is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not have traded in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary trading, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

16

DBX ETF Trust

Performance Summary (Unaudited)

Xtrackers MSCI Japan Hedged Equity ETF (DBJP) (Continued)

* As a percent of total investments excluding securities lending collateral and cash equivalents.

Portfolio holdings and characteristics are subject to change. For more complete details about the Fund’s investment portfolio see page 84.

17

DBX ETF Trust

As a shareholder of one or more of the Funds, you incur two types of costs: (1) transaction costs, including brokerage commissions paid on purchases and sales of fund shares, and (2) ongoing costs, including management fees and other Fund expenses. In the most recent six-month period the Funds limted these expenses; had they not done so, expenses would have been higher. The expense examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The examples in the tables are based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (December 1, 2019 to May 31, 2020).

Actual expenses

The first line in the following tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line in the following tables provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses (which is not the Funds’ actual return). The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only, and do not reflect any transactional costs. Therefore the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning |

Ending Account Value May 31, 2020 |

Annualized Expense Ratio |

Expenses Paid During the Period Per $1,000(1) |

|||||||||||||

| Xtrackers MSCI All World ex US Hedged Equity ETF |

|

|||||||||||||||

| Actual |

$ | 1,000.00 | $ | 906.50 | 0.40 | % | $ | 1.91 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,023.00 | 0.40 | % | $ | 2.02 | ||||||||

| Xtrackers MSCI Emerging Markets Hedged Equity ETF |

|

|||||||||||||||

| Actual |

$ | 1,000.00 | $ | 938.60 | 0.65 | % | $ | 3.15 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,021.75 | 0.65 | % | $ | 3.29 | ||||||||

| Xtrackers MSCI Europe Hedged Equity ETF | ||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 882.30 | 0.46 | % | $ | 2.16 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.70 | 0.46 | % | $ | 2.33 | ||||||||

| Xtrackers MSCI Eurozone Hedged Equity ETF | ||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 856.60 | 0.46 | % | $ | 2.14 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.70 | 0.46 | % | $ | 2.33 | ||||||||

| Xtrackers MSCI Germany Hedged Equity ETF | ||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 890.00 | 0.45 | % | $ | 2.13 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.75 | 0.45 | % | $ | 2.28 | ||||||||

| Xtrackers MSCI Japan Hedged Equity ETF | ||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 940.20 | 0.46 | % | $ | 2.23 | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.70 | 0.46 | % | $ | 2.33 | ||||||||

(1) Expenses are equal to each Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183 (the number of days in the most recent six-month period), then divided by 366.

18

DBX ETF Trust

Xtrackers MSCI All World ex US Hedged Equity ETF

May 31, 2020

| See Notes to Financial Statements. | 19 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 20 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 21 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 22 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 23 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 24 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 25 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 26 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 27 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 28 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 29 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 30 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 31 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 32 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 33 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 34 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 35 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| See Notes to Financial Statements. | 36 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

A summary of the Fund’s transactions with affiliated investments during the year ended May 31, 2020 is as follows:

| Value ($) at

|

Purchases Cost ($) |

Sales Proceeds ($) |

Net Realized Gain/(Loss) ($) |

Net Change in Unrealized Appreciation (Depreciation) ($) |

Income ($) | Capital Gain Distributions ($) |

Number of Shares at 5/31/2020 |

Value ($) at 5/31/2020 |

||||||||||||||||||||||||||||

| COMMON STOCKS — 0.1% |

| |||||||||||||||||||||||||||||||||||

| Germany — 0.1% |

|

|||||||||||||||||||||||||||||||||||

| Deutsche Bank AG*(d) |

| |||||||||||||||||||||||||||||||||||

| 64,295 | 5,329 | (1,078 | ) | 36 | 13,670 | — | — | 9,839 | 82,252 | |||||||||||||||||||||||||||

| SECURITIES LENDING COLLATERAL —1.3% |

| |||||||||||||||||||||||||||||||||||

| DWS Government & Agency Securities Portfolio “DWS Government Cash Institutional Shares”, 0.07% (e)(f) |

| |||||||||||||||||||||||||||||||||||

| 1,641,117 | — | (373,121 | )(g) | — | — | 16,441 | — | 1,267,996 | 1,267,996 | |||||||||||||||||||||||||||

| CASH EQUIVALENTS — 2.0% |

| |||||||||||||||||||||||||||||||||||

| DWS Government Money Market Series “Institutional Shares”, 0.12% (e) |

| |||||||||||||||||||||||||||||||||||

| 856,243 | 30,253,989 | (29,160,714 | ) | — | — | 32,975 | — | 1,949,518 | 1,949,518 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

| 2,561,655 | 30,259,318 | (29,534,913 | ) | 36 | 13,670 | 49,416 | — | 3,227,353 | 3,299,766 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

| * | Non-income producing security. |

| (a) | Stapled Security — A security contractually bound to one or more other securities to form a single saleable unit which cannot be sold separately. |

| See Notes to Financial Statements. | 37 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| (b) | All or a portion of these securities were on loan. In addition, “Other assets and liabilities, net” may include pending sales that are also on loan. The value of securities loaned at May 31, 2020 amounted to $1,481,130, which is 1.5% of net assets. |

| (c) | Investment was valued using significant unobservable inputs. |

| (d) | Affiliated issuer. This security is owned in proportion with its representation in the index. |

| (e) | Affiliated fund managed by DWS Investment Management Americas, Inc. The rate shown is the annualized seven-day yield at period end. |

| (f) | Represents cash collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates. In addition, the Fund held non-cash U.S. Treasury securities collateral having a value of $341,623. |

| (g) | Represents the net increase (purchase cost) or decrease (sales proceeds) in the amount invested in cash collateral for the year ended May 31, 2020. |

| ADR: | American Depositary Receipt |

| CDI: | Chess Depositary Interest |

| CPO: | Ordinary Participation Certificates |

| GDR: | Global Depositary Receipt |

| JSC: | Joint Stock Company |

| NVDR: | Non Voting Depositary Receipt |

| PJSC: | Public Joint Stock Company |

| PSQC: | Public Shareholders Qatari Company |

| QPSC: | Qatari Public Shareholders Company |

| QSC: | Qatari Shareholders Company |

| REIT: | Real Estate Investment Trust |

| RSP: | Risparmio (Convertible Savings Shares) |

| SAE: | Societe Anonyme Egyptienne |

| SAQ: | Societe Anonyme Qatar |

| 144A: | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

At May 31, 2020, open futures contracts purchased were as follows:

| Contract Description |

Currency | Number of Contracts |

Notional Amount |

Contract Value |

Expiration Date |

Unrealized Appreciation |

||||||||||||||||

| MINI S&P/TSX 60 Futures |

CAD | 5 | $ | 148,431 | $ | 166,267 | 6/18/2020 | $ | 17,836 | |||||||||||||

| MSCI EAFE Futures |

USD | 22 | 1,571,016 | 1,898,160 | 6/19/2020 | 327,144 | ||||||||||||||||

| MSCI Emerging Markets Index Futures |

USD | 16 | 673,990 | 746,320 | 6/19/2020 | 72,330 | ||||||||||||||||

|

|

|

|||||||||||||||||||||

| Total unrealized appreciation |

$ | 417,310 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||

As of May 31, 2020, the Fund had the following forward foreign currency contracts outstanding:

| Counterparty |

Settlement Date |

Currency To Deliver |

Currency To Receive |

Unrealized Appreciation |

Unrealized Depreciation |

|||||||||||||||||

| Citigroup Global Markets |

6/3/2020 | AED | 669,700 | USD | 182,301 | $ | — | $ | (20 | ) | ||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | AUD | 3,413,500 | USD | 2,234,972 | — | (40,304 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | AUD | 2,470,600 | USD | 1,617,638 | — | (29,146 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | AUD | 208,000 | USD | 136,184 | — | (2,459 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | BRL | 3,304,800 | USD | 605,768 | — | (13,437 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | BRL | 3,141,600 | USD | 578,922 | — | (9,705 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | BRL | 613,000 | USD | 112,954 | — | (1,901 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | CAD | 2,802,900 | USD | 2,018,159 | — | (17,579 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | CAD | 2,549,000 | USD | 1,835,186 | — | (16,145 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | CAD | 1,182,000 | USD | 851,057 | — | (7,426 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | CAD | 2,389,300 | USD | 1,720,422 | — | (14,920 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | CHF | 3,460,800 | USD | 3,588,404 | — | (10,157 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | CHF | 1,452,400 | USD | 1,505,930 | — | (4,284 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | CHF | 512,000 | USD | 530,888 | — | (1,493 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | CHF | 1,285,100 | USD | 1,332,497 | — | (3,758 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | CLP | 159,063,400 | USD | 190,402 | — | (8,327 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | CLP | 13,480,400 | USD | 16,158 | — | (684 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | CNH | 6,861,400 | USD | 971,222 | 10,102 | — | |||||||||||||||

| Citigroup Global Markets |

6/3/2020 | COP | 332,003,700 | USD | 84,446 | — | (4,538 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | COP | 23,380,500 | USD | 5,929 | — | (338 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | CZK | 1,161,500 | USD | 47,066 | — | (847 | ) | ||||||||||||||

| See Notes to Financial Statements. | 38 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| Counterparty |

Settlement Date |

Currency To Deliver |

Currency To Receive |

Unrealized Appreciation |

Unrealized Depreciation |

|||||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | DKK | 1,351,000 | USD | 198,464 | $ | — | $ | (2,736 | ) | ||||||||||||

| RBC Capital Markets |

6/3/2020 | DKK | 7,952,300 | USD | 1,168,176 | — | (16,131 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | EGP | 632,000 | USD | 39,698 | — | (83 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | EUR | 1,774,000 | USD | 1,944,100 | — | (25,251 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | EUR | 2,337,800 | USD | 2,561,855 | — | (33,381 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | EUR | 7,668,000 | USD | 8,403,170 | — | (109,222 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | EUR | 6,284,000 | USD | 6,886,541 | — | (89,445 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | GBP | 786,000 | USD | 991,493 | 20,768 | — | |||||||||||||||

| Citigroup Global Markets |

6/3/2020 | GBP | 585,800 | USD | 738,959 | 15,485 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | GBP | 4,429,900 | USD | 5,587,942 | 116,933 | — | |||||||||||||||

| RBC Capital Markets |

6/3/2020 | GBP | 2,095,100 | USD | 2,643,251 | 55,764 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | HKD | 50,130,200 | USD | 6,463,460 | — | (3,255 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | HKD | 6,000,000 | USD | 773,590 | — | (400 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | HKD | 12,796,900 | USD | 1,649,989 | — | (791 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | HUF | 5,831,900 | USD | 18,167 | — | (483 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | HUF | 16,042,500 | USD | 49,964 | — | (1,340 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | ILS | 708,300 | USD | 204,227 | 2,509 | — | |||||||||||||||

| RBC Capital Markets |

6/3/2020 | ILS | 165,000 | USD | 47,567 | 576 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | INR | 140,527,300 | USD | 1,863,658 | 5,770 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | INR | 24,742,000 | USD | 328,039 | 929 | — | |||||||||||||||

| Citigroup Global Markets |

6/3/2020 | JPY | 587,581,900 | USD | 5,496,428 | 47,796 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | JPY | 547,950,300 | USD | 5,125,797 | 44,668 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | JPY | 44,227,000 | USD | 413,715 | 3,600 | — | |||||||||||||||

| RBC Capital Markets |

6/3/2020 | JPY | 600,252,200 | USD | 5,614,976 | 48,853 | — | |||||||||||||||

| Citigroup Global Markets |

6/3/2020 | KRW | 1,189,186,700 | USD | 985,242 | 25,028 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | KRW | 2,113,059,800 | USD | 1,754,669 | 48,470 | — | |||||||||||||||

| RBC Capital Markets |

6/3/2020 | KRW | 251,403,000 | USD | 208,763 | 5,767 | — | |||||||||||||||

| RBC Capital Markets |

6/3/2020 | KRW | 327,187,000 | USD | 270,626 | 6,438 | — | |||||||||||||||

| Citigroup Global Markets |

6/3/2020 | MXN | 9,408,000 | USD | 393,209 | — | (30,868 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | MXN | 968,700 | USD | 40,481 | — | (3,184 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | MXN | 2,305,000 | USD | 96,334 | — | (7,567 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | MYR | 2,370,900 | USD | 549,965 | 4,695 | — | |||||||||||||||

| Citigroup Global Markets |

6/3/2020 | NOK | 3,889,900 | USD | 380,676 | — | (19,499 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | NZD | 13,300 | USD | 8,203 | — | (52 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | NZD | 256,100 | USD | 157,969 | — | (1,003 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | PHP | 561,200 | USD | 11,119 | 34 | — | |||||||||||||||

| RBC Capital Markets |

6/3/2020 | PHP | 13,280,600 | USD | 263,107 | 771 | — | |||||||||||||||

| Citigroup Global Markets |

6/3/2020 | PLN | 654,500 | USD | 158,004 | — | (5,169 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | PLN | 54,900 | USD | 13,252 | — | (435 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | QAR | 858,700 | USD | 235,907 | 62 | — | |||||||||||||||

| Citigroup Global Markets |

6/3/2020 | RUB | 37,921,400 | USD | 510,659 | — | (28,206 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | RUB | 20,400,000 | USD | 274,727 | — | (15,158 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | SEK | 1,949,000 | USD | 199,592 | — | (7,258 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | SEK | 4,986,200 | USD | 510,620 | — | (18,572 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | SEK | 10,941,600 | USD | 1,120,492 | — | (40,756 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | SGD | 795,900 | USD | 565,431 | 2,076 | — | |||||||||||||||

| RBC Capital Markets |

6/3/2020 | SGD | 212,300 | USD | 150,822 | 552 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | TRY | 911,400 | USD | 129,432 | — | (3,955 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | TWD | 4,084,700 | USD | 138,324 | 2,275 | — | |||||||||||||||

| Citigroup Global Markets |

6/3/2020 | TWD | 9,943,000 | USD | 336,055 | 4,886 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | TWD | 21,134,600 | USD | 715,215 | 11,289 | — | |||||||||||||||

| RBC Capital Markets |

6/3/2020 | TWD | 67,626,400 | USD | 2,292,576 | 40,157 | — | |||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 182,326 | AED | 669,700 | — | (5 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 2,265,881 | AUD | 3,413,500 | 9,394 | — | |||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 1,778,079 | AUD | 2,678,600 | 7,348 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 608,265 | BRL | 3,304,800 | 10,940 | — | |||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 691,270 | BRL | 3,754,600 | 12,212 | — | |||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 2,027,863 | CAD | 2,802,900 | 7,875 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 1,844,164 | CAD | 2,549,000 | 7,167 | — | |||||||||||||||

| See Notes to Financial Statements. | 39 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| Counterparty |

Settlement Date |

Currency To Deliver |

Currency To Receive |

Unrealized Appreciation |

Unrealized Depreciation |

|||||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 2,583,787 | CAD | 3,571,300 | $ | 10,038 | $ | — | |||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 3,602,486 | CHF | 3,460,800 | — | (3,925 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 1,511,814 | CHF | 1,452,400 | — | (1,600 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 1,870,615 | CHF | 1,797,100 | — | (1,980 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 197,560 | CLP | 159,063,400 | 1,169 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 16,763 | CLP | 13,480,400 | 79 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 957,718 | CNH | 6,861,400 | 3,401 | — | |||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 89,410 | COP | 332,003,700 | — | (426 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 6,306 | COP | 23,380,500 | — | (40 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 47,994 | CZK | 1,161,500 | — | (81 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 201,621 | DKK | 1,351,000 | — | (421 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 1,186,786 | DKK | 7,952,300 | — | (2,480 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 39,905 | EGP | 632,000 | — | (124 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 4,573,864 | EUR | 4,111,800 | — | (9,277 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 123,297 | EUR | 113,000 | 2,147 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 8,403,804 | EUR | 7,555,000 | — | (16,857 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 6,990,146 | EUR | 6,284,000 | — | (14,159 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 1,695,960 | GBP | 1,371,800 | — | (1,762 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 5,366,672 | GBP | 4,340,900 | — | (5,580 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 110,580 | GBP | 89,000 | — | (664 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 2,590,193 | GBP | 2,095,100 | — | (2,706 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 6,345,141 | HKD | 49,179,200 | — | (1,103 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 122,621 | HKD | 951,000 | 57 | — | |||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 2,425,094 | HKD | 18,796,900 | — | (324 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 18,730 | HUF | 5,831,900 | — | (80 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 51,524 | HUF | 16,042,500 | — | (220 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 202,178 | ILS | 708,300 | — | (460 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 47,098 | ILS | 165,000 | — | (107 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 2,186,970 | INR | 165,269,300 | — | (1,972 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 5,454,006 | JPY | 587,581,900 | — | (5,375 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 5,496,610 | JPY | 592,177,300 | — | (5,366 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 213,103 | JPY | 22,757,000 | — | (2,078 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 5,360,405 | JPY | 577,495,200 | — | (5,307 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 961,192 | KRW | 1,189,186,700 | — | (978 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 1,707,551 | KRW | 2,113,059,800 | — | (1,352 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 467,926 | KRW | 578,590,000 | — | (741 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 425,071 | MXN | 9,408,000 | — | (993 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 43,767 | MXN | 968,700 | — | (102 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 104,143 | MXN | 2,305,000 | — | (242 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 545,662 | MYR | 2,370,900 | — | (391 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 400,193 | NOK | 3,889,900 | — | (18 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 8,236 | NZD | 13,300 | 20 | — | |||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 158,590 | NZD | 256,100 | 382 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 11,116 | PHP | 561,200 | — | (31 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 262,826 | PHP | 13,280,600 | — | (490 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 163,453 | PLN | 654,500 | — | (280 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 13,711 | PLN | 54,900 | — | (24 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 235,848 | QAR | 858,700 | — | (3 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 537,032 | RUB | 37,921,400 | 1,832 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 288,698 | RUB | 20,400,000 | 1,187 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 736,356 | SEK | 6,935,200 | — | (313 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 1,161,744 | SEK | 10,941,600 | — | (497 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 563,110 | SGD | 795,900 | 244 | — | |||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 150,205 | SGD | 212,300 | 65 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 133,589 | TRY | 911,400 | — | (202 | ) | ||||||||||||||

| Citigroup Global Markets |

6/3/2020 | USD | 467,590 | TWD | 14,027,700 | — | (372 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 704,369 | TWD | 21,134,600 | — | (443 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 2,254,589 | TWD | 67,626,400 | — | (2,170 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | USD | 408,719 | ZAR | 7,206,200 | 1,715 | — | |||||||||||||||

| See Notes to Financial Statements. | 40 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| Counterparty |

Settlement Date |

Currency To Deliver |

Currency To Receive |

Unrealized Appreciation |

Unrealized Depreciation |

|||||||||||||||||

| RBC Capital Markets |

6/3/2020 | USD | 660,379 | ZAR | 11,643,400 | $ | 2,780 | $ | — | |||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | ZAR | 4,007,200 | USD | 217,480 | — | (10,753 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/3/2020 | ZAR | 3,199,000 | USD | 173,610 | — | (8,592 | ) | ||||||||||||||

| RBC Capital Markets |

6/3/2020 | ZAR | 11,643,400 | USD | 631,918 | — | (31,240 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/4/2020 | IDR | 4,195,241,900 | USD | 277,794 | — | (9,190 | ) | ||||||||||||||

| RBC Capital Markets |

6/4/2020 | IDR | 1,679,087,700 | USD | 111,088 | — | (3,774 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/4/2020 | THB | 16,913,900 | USD | 521,599 | — | (10,109 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

6/4/2020 | USD | 286,756 | IDR | 4,195,241,900 | 228 | — | |||||||||||||||

| RBC Capital Markets |

6/4/2020 | USD | 114,613 | IDR | 1,679,087,700 | 248 | — | |||||||||||||||

| JP Morgan & Chase Co. |

6/4/2020 | USD | 531,750 | THB | 16,913,900 | — | (41 | ) | ||||||||||||||

| Citigroup Global Markets |

7/3/2020 | AED | 669,700 | USD | 182,293 | — | (3 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | AUD | 3,413,500 | USD | 2,265,881 | — | (9,456 | ) | ||||||||||||||

| RBC Capital Markets |

7/3/2020 | AUD | 477,000 | USD | 316,634 | — | (1,320 | ) | ||||||||||||||

| RBC Capital Markets |

7/3/2020 | AUD | 2,678,600 | USD | 1,778,084 | — | (7,391 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | BRL | 3,304,800 | USD | 607,352 | — | (10,888 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | BRL | 1,010,000 | USD | 185,875 | — | (3,069 | ) | ||||||||||||||

| RBC Capital Markets |

7/3/2020 | BRL | 3,754,600 | USD | 690,197 | — | (12,189 | ) | ||||||||||||||

| Citigroup Global Markets |

7/3/2020 | CAD | 2,802,900 | USD | 2,027,886 | — | (7,891 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | CAD | 2,549,000 | USD | 1,844,190 | — | (7,177 | ) | ||||||||||||||

| RBC Capital Markets |

7/3/2020 | CAD | 3,571,300 | USD | 2,583,826 | — | (10,049 | ) | ||||||||||||||

| Citigroup Global Markets |

7/3/2020 | CHF | 3,460,800 | USD | 3,605,458 | 3,816 | — | |||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | CHF | 1,452,400 | USD | 1,513,043 | 1,535 | — | |||||||||||||||

| RBC Capital Markets |

7/3/2020 | CHF | 1,797,100 | USD | 1,872,145 | 1,909 | — | |||||||||||||||

| Citigroup Global Markets |

7/3/2020 | CLP | 159,063,400 | USD | 197,494 | — | (1,227 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | CLP | 13,480,400 | USD | 16,761 | — | (80 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | CNH | 824,000 | USD | 114,747 | — | (434 | ) | ||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | CNH | 6,861,400 | USD | 955,527 | — | (3,576 | ) | ||||||||||||||

| Citigroup Global Markets |

7/3/2020 | COP | 332,003,700 | USD | 89,105 | 373 | — | |||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | COP | 23,380,500 | USD | 6,285 | 37 | — | |||||||||||||||

| Citigroup Global Markets |

7/3/2020 | CZK | 1,161,500 | USD | 48,001 | 80 | — | |||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | DKK | 1,351,000 | USD | 201,739 | 412 | — | |||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | DKK | 1,147,000 | USD | 171,280 | 354 | — | |||||||||||||||

| RBC Capital Markets |

7/3/2020 | DKK | 7,952,300 | USD | 1,187,478 | 2,425 | — | |||||||||||||||

| Citigroup Global Markets |

7/3/2020 | EUR | 4,111,800 | USD | 4,576,569 | 9,141 | — | |||||||||||||||

| Citigroup Global Markets |

7/3/2020 | EUR | 845,000 | USD | 940,514 | 1,879 | — | |||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | EUR | 7,555,000 | USD | 8,408,700 | 16,530 | — | |||||||||||||||

| RBC Capital Markets |

7/3/2020 | EUR | 6,284,000 | USD | 6,994,218 | 13,888 | — | |||||||||||||||

| Citigroup Global Markets |

7/3/2020 | GBP | 1,371,800 | USD | 1,696,166 | 1,730 | — | |||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | GBP | 4,340,900 | USD | 5,367,306 | 5,463 | — | |||||||||||||||

| RBC Capital Markets |

7/3/2020 | GBP | 2,095,100 | USD | 2,590,465 | 2,616 | — | |||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | HKD | 49,179,200 | USD | 6,339,242 | — | (325 | ) | ||||||||||||||

| RBC Capital Markets |

7/3/2020 | HKD | 18,796,900 | USD | 2,423,218 | 156 | — | |||||||||||||||

| Citigroup Global Markets |

7/3/2020 | HUF | 5,831,900 | USD | 18,727 | 80 | — | |||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | HUF | 16,042,500 | USD | 51,508 | 214 | — | |||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | IDR | 4,195,241,900 | USD | 284,732 | — | (1,098 | ) | ||||||||||||||

| RBC Capital Markets |

7/3/2020 | IDR | 1,679,087,700 | USD | 113,976 | — | (424 | ) | ||||||||||||||

| Citigroup Global Markets |

7/3/2020 | ILS | 708,300 | USD | 202,272 | 452 | — | |||||||||||||||

| RBC Capital Markets |

7/3/2020 | ILS | 165,000 | USD | 47,116 | 102 | — | |||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | INR | 165,269,300 | USD | 2,179,299 | 702 | — | |||||||||||||||

| Citigroup Global Markets |

7/3/2020 | JPY | 587,581,900 | USD | 5,456,361 | 5,309 | — | |||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | JPY | 592,177,300 | USD | 5,498,958 | 5,274 | — | |||||||||||||||

| RBC Capital Markets |

7/3/2020 | JPY | 577,495,200 | USD | 5,362,570 | 5,093 | — | |||||||||||||||

| RBC Capital Markets |

7/3/2020 | JPY | 131,829,000 | USD | 1,224,169 | 1,179 | — | |||||||||||||||

| Citigroup Global Markets |

7/3/2020 | KRW | 1,189,186,700 | USD | 961,114 | 954 | — | |||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | KRW | 2,113,059,800 | USD | 1,707,261 | 1,157 | — | |||||||||||||||

| RBC Capital Markets |

7/3/2020 | KRW | 578,590,000 | USD | 467,869 | 710 | — | |||||||||||||||

| Citigroup Global Markets |

7/3/2020 | MXN | 9,408,000 | USD | 423,064 | 924 | — | |||||||||||||||

| JP Morgan & Chase Co. |

7/3/2020 | MXN | 968,700 | USD | 43,565 | 100 | — | |||||||||||||||

| RBC Capital Markets |

7/3/2020 | MXN | 2,305,000 | USD | 103,662 | 236 | — | |||||||||||||||

| See Notes to Financial Statements. | 41 |

DBX ETF Trust

Schedule of Investments

Xtrackers MSCI All World ex US Hedged Equity ETF (Continued)

May 31, 2020

| Counterparty |

Settlement Date |

Currency To Deliver |

Currency To Receive |

Unrealized Appreciation |

Unrealized Depreciation |

|||||||||||||||||||||||

| RBC Capital Markets |

7/3/2020 | MYR | 2,370,900 | USD | 545,411 | $ | 901 | $ | — | |||||||||||||||||||

| Citigroup Global Markets |

7/3/2020 | NOK | 3,889,900 | USD | 400,290 | 18 | — | |||||||||||||||||||||

| JP Morgan & Chase Co. |