UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

EverBank Financial Corp

(Exact name of registrant as specified in its charter)

Delaware | 001-35533 | 52-2024090 | ||

(State of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

501 Riverside Ave., Jacksonville, FL | 32202 | |||

(Address of principal executive offices) | (Zip Code) | |||

904-281-6000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | ||||

Title of Each Class | Name of Each Exchange on Which Registered | |||

Common Stock, $.01 Par Value | New York Stock Exchange | |||

Depositary Shares, each representing a 1/1,000th of a share of 6.75% Non-Cumulative Perpetual Preferred Stock, Series A | New York Stock Exchange | |||

Securities registered pursuant to Section 12(g) of the Act: | ||||

none | ||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

1

Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý | Accelerated filer o | ||

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No ý

The aggregate market value of the registrant's outstanding voting common stock held by non-affiliates on June 30, 2016 (the last business day of the registrant's most recently completed second fiscal quarter), determined using the per share closing price on that date on the New York Stock Exchange of $14.86, was approximately $1,429,369,372. There was no non-voting common equity of the registrant outstanding on that date.

As of March 28, 2017, there were 127,814,763 shares of common stock outstanding.

Documents Incorporated by Reference

None.

2

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A is being filed by EverBank Financial Corp in order to disclose information required by Items 10, 11, 12, 13 and 14 of Part III, which was previously omitted in reliance on Instruction G to Form 10-K from its Annual Report on Form 10-K for the year ended December 31, 2016, filed with the Securities and Exchange Commission (the “SEC”) on February 17, 2017. The Company is not filing its definitive proxy statement for its 2017 annual shareholder meeting within 120 days of the end of its most recent fiscal year as required under Instruction G to Form 10-K in order to incorporate information contained in the definitive proxy statement into the Form 10-K. This Form 10-K/A discloses such information herein. In connection with the filing of this Form 10-K/A and pursuant to the rules of the SEC, we are including with this Form 10-K/A certain new certifications by our principal executive officer and principal financial officer; accordingly, Item 15 of Part IV has also been amended to reflect the filing of these new certifications.

This Form 10-K/A is limited in scope to the items identified above and should be read in conjunction with the Form 10-K and our other filings with the SEC.

The Form 10-K/A does not reflect events occurring after the filing of the Form 10-K or modify or update those disclosures affected by subsequent events. Consequently, all other information is unchanged and reflects the disclosures made at the time of the filing of the Form 10-K.

3

Part III

Item 10. Directors, Executive Officers and Corporate Governance

Robert M. Clements

Director since 1997 (including predecessor companies)

Age: 54

Mr. Clements has served as Chairman of the Board and Chief Executive Officer of EverBank Financial Corp and its predecessor companies since 1997. Mr. Clements joined the EverBank Financial Corp family of companies in 1994. Mr. Clements was previously a Vice President at Merrill Lynch & Co., where he was a member of the firm’s leveraged buyout group, Merrill Lynch Capital Partners, Inc. He is a former member of the Federal Reserve Board’s Thrift Institutions Advisory Council, and a former director of Fidelity National Financial, Inc., Fidelity National Information Services, Inc., Fortegra Capital and Columbia National Mortgage Corporation. Mr. Clements received a B.A. in Economics from Dartmouth College and an M.B.A. from Harvard Business School.

W. Blake Wilson

Director since 2005

Age: 50

Mr. Wilson has been a director and the President of EverBank Financial Corp since 2005 and has been Chief Operating Officer of EverBank Financial Corp since 2011. From January 2002 to 2011, Mr. Wilson served as our Chief Financial Officer. Mr. Wilson has been involved in the financial services industry since 1989. Prior to joining the Company, Mr. Wilson was the Chief Financial Officer of HomeSide Lending, Inc. and served in various positions there since 1996. He was Vice President of Corporate Finance at Prudential Home Mortgage and also worked for KPMG Peat Marwick’s National Mortgage and Structured Finance Group in Washington, D.C. prior to joining HomeSide Lending. Mr. Wilson has also served on various industry advisory boards. Mr. Wilson received a B.A. in Accounting, cum laude, from the University of Utah.

Joseph D. Hinkel

Director since 2011

Age: 68

Mr. Hinkel is a retired CPA with 36 years of experience at major public accounting firms. From June 2002 to October 2006, he was a Managing Director of KPMG, LLP. Prior to working at KPMG, he was employed by Arthur Andersen LLP from 1971 to 2002, and served as a partner from 1983 to 2002. Subsequent to leaving public accounting, Mr. Hinkel consulted with a number of organizations through 2014. Mr. Hinkel served as a director of Dayton Superior Corporation from 2007 to 2009. He received a B.S. in Business Administration from the University of Dayton in 1971 and practiced as a certified public accountant from 1973 until 2009.

Merrick R. Kleeman

Director since 2009

Age: 53

Mr. Kleeman is a founding partner of Wheelock Street Capital, L.L.C., a real estate private equity firm formed in 2008 to pursue a value oriented investment strategy. Prior to forming Wheelock Street Capital, Mr. Kleeman spent over 15 years working at Starwood Capital Group, where he served as Senior Managing Director and Head of Acquisitions. Mr. Kleeman led the acquisition of Westin Hotels & Resorts, National and American Golf, Le Meridien Hotels & Resorts in collaboration with Starwood Hotels, and the formation of Troon Golf and Starwood Land Ventures. Mr. Kleeman serves on the board of trustees of The Waterside School in Stamford, Connecticut, on the board of the Norwalk Open Door Shelter and on Dartmouth College’s Presidential Leadership Council. Mr. Kleeman received a B.A. from Dartmouth College and an M.B.A. from Harvard Business School, where he was a Baker Scholar.

W. Radford Lovett, II

Director since 2004 (including predecessor companies)

Age: 57

Mr. Lovett is Managing Director and co-founding partner of Lovett Miller & Co., a Florida-based venture capital and private equity firm that invests in privately held companies primarily in the southeastern United States. Mr. Lovett has also served as founder, Chairman and Chief Executive Officer of two successful growth companies, TowerCom Development, LP, a developer of wireless communication infrastructure, and TowerCom Limited, a developer of broadcast communication towers. Mr. Lovett has served as a director of over 20 private companies, and currently serves on the board of directors of five private companies. Prior to co-founding Lovett Miller & Co., Mr. Lovett served as the President of Southcoast Capital Corporation, a Jacksonville-based holding company that invests in private companies, public companies and real estate. In addition, Mr. Lovett is currently a member of the Board of Trustees for the University of North Florida and formerly served as President of the Foundation Board and Co-Chairman of the University of North Florida’s Capital Campaign. He is also a former Chairman of the Youth Crisis Center and the Jacksonville Jaguars Honor Rows Program. Mr. Lovett received a B.A. from Harvard College.

Arrington H. Mixon

Director since 2013

Age: 56

Since 2011, Ms. Mixon has served as a Senior Program Officer and Advisory Board Member for The Leon Levine Foundation and Portfolio Manager for L&L Management, Inc., a North Carolina corporation. Prior to working with The Leon Levine Foundation and L&L Management, Ms. Mixon was an executive with Bank of America Corporation from 1982 through 2009. While with Bank of America, Ms. Mixon served in various positions including as an executive in Enterprise Credit Risk, an executive in Global Portfolio Strategies, the Managing Director of European Global

4

Markets, the Managing Director of Loan Syndications, and as a vice-president in a loan production office. Ms. Mixon received a B.A. in Economics, magna cum laude, from the University of Virginia and a Masters in Finance from the Kellogg Graduate School of Management, Northwestern University.

Robert J. Mylod, Jr.

Director since 2001 (including predecessor companies)

Age: 50

Mr. Mylod is the Managing Partner of Annox Capital Management, a private investment firm that he founded in 2013. From 1999 to 2011, Mr. Mylod held several roles at priceline.com, including Vice Chairman, Head of Worldwide Strategy and Planning, and Chief Financial Officer. Prior to joining priceline.com, Mr. Mylod was a Principal at Stonington Partners, a private equity investment firm. Prior to Stonington Partners, Mr. Mylod was an associate with Merrill Lynch Capital Partners, the merchant banking division of Merrill Lynch & Co. Mr. Mylod is a member of the board of directors of several privately held companies in which Annox Capital Management or its affiliates are a principal investor. Mr. Mylod received an A.B. in English from the University of Michigan and an M.B.A. from the University of Chicago Graduate School of Business.

Russell B. Newton, III

Director since 2009

Age: 63

Mr. Newton is the Chairman and Chief Executive Officer of Timucuan Asset Management, Inc., or Timucuan, a privately owned investment management firm. Mr. Newton has been responsible for directing the investment activities of the Newton family since 1981. In 1988, Mr. Newton formed Timucuan to provide asset management services to those outside the Newton family. Mr. Newton also controls the general partner of The Timucuan Fund, L.P., which he formed in 1990, and Timucuan Opportunity Fund, L.P., which he launched in October 2001. Prior to 1981, Mr. Newton was employed as a public accountant by Peat Marwick Mitchell & Company. Mr. Newton received a B.A. from Bowdoin College and attended the Graduate School of Business Administration, New York University.

William Sanford

Director since 2006

Age: 57

Mr. Sanford is a director and the Vice President Corporate Development of Lipari Foods, Inc. Mr. Sanford was the Interim Chief Executive Officer of Fairway Group Holdings Corp from 2014 to 2015, and joined Fairway in 2008, serving as the President, Chief Financial Officer and Chief Administrative Officer. From 1998 through 2008, he was with Interline Brands, Inc., a Jacksonville, Florida-based distributor and direct marketer of building maintenance products where he served as President, Chief Operating Officer and Secretary and previously as Chief Financial Officer. Mr. Sanford has worked in the wholesale distribution industry since 1984 and has held senior executive positions with Airgas, Inc. and MSC Industrial Direct. Mr. Sanford received a B.S. from Vanderbilt University.

Richard P. Schifter

Director since 2010

Age: 64

Mr. Schifter is a senior advisor to TPG Capital, a global private investment firm. Mr. Schifter was a partner at TPG from 1994 to 2013. Prior to joining TPG Capital, Mr. Schifter was a partner at the law firm of Arnold & Porter LLP in Washington, D.C., where he specialized in bankruptcy law and corporate restructuring. Mr. Schifter joined Arnold & Porter in 1979 and was a partner from 1986 through 1994. Mr. Schifter currently serves on the Boards of Directors of LPL Financial Holdings, Inc., Direct General Corporation and American Airlines Group and on the Board of Overseers of the University of Pennsylvania Law School. Mr. Schifter is also a member of the board of directors of the Youth, I.N.C. (Improving Non-profits for Children). Mr. Schifter received a B.A. with distinction from George Washington University and a J.D., cum laude, from the University of Pennsylvania Law School.

Scott M. Stuart

Director since 2008

Age: 57

Mr. Stuart is co-founder of Sageview Capital L.P., a private equity investment firm. Prior to co-founding Sageview Capital L.P. in 2006, Mr. Stuart worked for the global private equity firm Kohlberg Kravis Roberts & Co., L.P., or KKR, from 1986 to 2005. Mr. Stuart became a partner of KKR in 1994 and served on KKR’s investment committee from 2000 until 2005. From 2000 until his departure in 2005, Mr. Stuart was responsible for KKR’s industry groups in the utilities and consumer products sectors. Prior to joining KKR in 1986, Mr. Stuart worked from 1981 to 1984 in the Mergers and Acquisitions Department at Lehman Brothers Kuhn Loeb, Inc. Mr. Stuart served as a director of the Sealy Corporation from April 2004 through April 2009. Mr. Stuart is Sageview’s designated member of our Board, pursuant to the terms of the Transfer and Governance Agreement described in “Board Composition-Board Rights of Arena, Lovett Miller and Sageview” below. Mr. Stuart received a B.A. from Dartmouth College and an M.B.A. from Stanford University.

Steven J. Fischer

Age: 46

Mr. Fischer has served as Senior Executive Vice President and Chief Financial Officer of EverBank Financial Corp since 2015, and was the Executive Vice President and Chief Financial Officer from 2011 to 2015. Prior to joining the Company, Mr. Fischer was a partner in the Florida/Puerto Rico practice of Deloitte & Touche LLP since 2004, having joined Deloitte in 1992. He has over 18 years of public accounting experience and has provided advisory, attest and consulting services to clients primarily in the financial services industry. Mr. Fischer received a B.S. in Accounting and Finance from Florida State University and is a certified public accountant in Florida and Georgia.

5

Francis X. Ervin, Jr.

Age: 55

Mr. Ervin has served as Executive Vice President and Chief Risk Officer of EverBank Financial Corp since September 2014. From September 2013 through August 2014, Mr. Ervin served as our Senior Vice President and Chief Auditor. Prior to joining the Company, from 2006 through 2013, Mr. Ervin held a variety of senior positions with Bank of America Corporation, including Senior Risk Executive and Senior Audit Director. From 2004 through 2006 he was the Managing Director and Chief Financial Officer of various divisions and subsidiaries of Wachovia Securities, Inc. From 1992 through 2004, Mr. Ervin held a variety of senior financial officer positions with Merrill Lynch & Co., including Chief Financial Officer of the Merrill Lynch U.S. Banks and Merrill Lynch Credit Corporation. From 1985 through 1992 he worked as a Senior Audit Manager, specializing in financial services for PricewaterhouseCoopers. Mr. Ervin received a B.S. in Accountancy from Villanova University and is a certified public accountant.

James R. Hubbard

Age: 58

Mr. Hubbard has served as Executive Vice President, General Counsel and Secretary of EverBank Financial Corp since August 2015. Prior to joining EverBank, Mr. Hubbard was SVP and Chief Legal Officer of Fifth Third Bancorp and served in various positions there since 1992. Prior to joining Fifth Third Bancorp, Mr. Hubbard was with the law firms of Kaye Scholer LLP and Frost Brown Todd LLC. Mr. Hubbard received a B.A. from Colgate University and received a J.D. from the University of Cincinnati College of Law.

John S. Surface

Age: 45

Mr. Surface has served as Senior Executive Vice President - Corporate Development of EverBank Financial Corp since 2015. From 2004 to 2015 he served as Executive Vice President - Corporate Development. Mr. Surface manages the Company’s business development, partnership and mergers and acquisitions activities. He has been with the Company for 18 years and served previously as Vice President of Asset Management for the EverBank Financial Corp family of companies. In addition, he previously worked as an Associate at TSG Equity Partners, a venture capital investment firm. Mr. Surface has served on various nonprofit housing boards, including HabiJax and LISC Jacksonville, and serves on the Williams School Board of Advisors for Washington and Lee University. Mr. Surface received a B.S. in Business Management, magna cum laude and Phi Beta Kappa, from Washington and Lee University and an M.B.A. from Harvard Business School.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s executive officers, directors and persons who own more than 10% of a registered class of the Company’s equity securities, if any, to file reports of ownership and changes in ownership of the Company’s stock with the SEC. Executive officers, directors and greater than 10% stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms filed.

Based solely on a review of the forms filed during or with respect to fiscal year 2016 and written representations from the reporting persons, the Company believes that its executive officers and directors filed all required reports with the SEC on a timely basis.

Code of Business Conduct and Ethics

The Board has adopted a code of business conduct and ethics that applies to all of the Company’s officers and employees and a code of conduct for the directors. The code of business conduct and ethics for the Company’s officers and employees and the code of conduct for directors is available at www.about.everbank under the Corporate Governance section of the Investor Relations tab. Any amendments to the code, or any waivers of its requirements, will be disclosed on the Company’s website.

Code of Ethics for Principal Executive and Senior Financial Officers

The Board has adopted a code of ethics that applies to the Company’s principal executive and senior financial officers. The code of ethics for the Company’s principal executive and senior financial officers is available at https://about.everbank under the Governance section of the Investor Relations tab. Any amendments to the code, or any waivers of its requirements, will be disclosed on the Company’s website.

Corporate Governance Guidelines

The Board has adopted our Corporate Governance Guidelines to assist the Board in the exercise of its fiduciary duties and responsibilities and to promote the effective functioning of the Board and its committees. The Company’s Corporate Governance Guidelines are available at https://about.everbank under the Governance section of the Investor Relations tab. Any amendments to the guidelines will be disclosed on the Company’s website.

Stockholder Nominations for Election to the Board

There have been no changes in the procedures by which the Company’s security holders may recommend nominees to the Board.

Audit Committee

Committee Chair: Joseph D. Hinkel

Additional Committee Members: Arrington H. Mixon, Russell B. Newton, III

Meetings Held in 2016: 6

6

Primary Responsibilities:

Responsibilities | Description |

Controls | Reviewing the adequacy and effectiveness of the Company’s accounting and internal controls and procedures, including the responsibilities, budget, compensation and staffing of the Company’s internal audit function. |

Management Review | Reviewing with management the Company’s administrative, operational and accounting internal controls, including any special audit steps adopted in light of the discovery of material control deficiencies. |

Internal Audit | Direct supervision of the Company’s internal audit group. |

Compliance | Reviewing and discussing with the Company’s independent auditors and management the Company’s compliance with the applicable regulatory requirements. |

Investigations | Investigating matters brought to its attention within the scope of its duties and engaging independent counsel and other advisors as the Audit Committee deems necessary. |

Financial Statements | Reviewing the Company’s annual and quarterly financial statements prior to their filing and prior to the release of earnings, and reviewing the independent auditor’s audit report for inclusion in the Annual Report on Form 10-K, and recommending to the Board whether the audited financial statements should be included in the Company’s Annual Report on Form 10-K. |

Reports | Preparing the Audit Committee report required by SEC rules to be included in the Annual Report on Form 10-K. |

Independent Auditors | Determining the compensation of, and reviewing the performance of, the independent auditors, appointing or terminating the independent auditors and considering and approving, in advance, any services proposed to be performed by the independent auditors. |

Independent Auditor Report | Reviewing an annual report from the independent auditors describing: (i) the independent auditors’ internal quality-control review; (ii) any material issues raised by the most recent internal quality control review, or peer review, of the independent auditors, or by any inquiry or investigation by any governmental or professional authority, within the past five years, with respect to one or more independent audits carried out by the independent auditors, and any steps taken to deal with any such issues; and (iii) all relationships between the independent auditors and the Company. |

Complaints and Submissions | Establishing procedures for: (i) the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters; (ii) the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and (iii) the review, and if necessary investigations of material incidents reported through the Company’s employee incident response system. |

Other | Handling such other matters that are specifically delegated to the Audit Committee by the Board from time to time. |

Committee Independence

Rule 10A-3 promulgated by the SEC under the Exchange Act and Section 303A.07 of the NYSE Listed Company Manual require our Audit Committee to be comprised entirely of independent directors. The Board has affirmatively determined that each of the current and incoming members of the Audit Committee will meet the definition of “independent director” under Section 303A.02 of the NYSE Listed Company Manual and for purposes of serving on an Audit Committee under applicable SEC rules.

Financial Expertise

The Board has determined that each member of the Audit Committee has sufficient knowledge in financial and auditing matters to serve on the Audit Committee. In addition, the Board has determined that Mr. Hinkel is qualified to serve as an “audit committee financial expert” under applicable SEC rules.

Committee Charter

The Audit Committee operates pursuant to a written charter, which is available on the Company’s website at www.about.everbank under the Governance section of the Investor Relations tab.

Item 11. Executive Compensation

COMPENSATION DISCUSSION AND ANALYSIS

In this Compensation Discussion and Analysis, or CD&A, we provide an overview and analysis of our compensation program and policies, the material compensation decisions we have made under those programs and policies with respect to our executives, and the material factors that we considered in making those decisions. Following this CD&A, you will find a series of tables containing specific data about the compensation earned or paid in 2016 to the following individuals, to whom we refer as our “Named Executive Officers”:

Name | Title |

Robert M. Clements | Chairman of the Board and Chief Executive Officer |

W. Blake Wilson | President and Chief Operating Officer |

John S. Surface | Senior Executive Vice President, Corporate Development |

Steven J. Fischer | Senior Executive Vice President and Chief Financial Officer |

Francis X. Ervin, Jr. | Executive Vice President and Chief Risk Officer |

7

Executive Summary

Compensation Philosophy

Our compensation program is designed to attract and retain the top level of our management, whom we refer to as Executive Management, of the caliber and experience necessary to ensure our success, directly link pay to our performance, and create long-term value for our stockholders. This philosophy is reflected in the following guiding design principles:

Category | Description |

Align Pay with Performance and Reinforce Business and Growth Strategies | We have structured our compensation program so that a significant percentage of each executive’s total compensation is “at risk” based on our corporate performance and, in certain cases, individual performance. Our compensation program is designed to reward desired performance and individual contributions, in each case, that promote our business and growth strategies. |

Balance Short-and Long-Term Incentives | In order to both further align the interests of our executives with our stockholders and promote increased stock ownership levels among our executives, we strive to provide a balanced mix of short-term incentive awards, such as annual cash incentive awards, and long-term equity incentive awards, such as stock options, time-based and performance-based restricted stock units. |

Provide Competitive Compensation | In order to attract and retain qualified talent, we endeavor to maintain compensation levels that are competitive with our peers. To this end, we reviewed a comparative analysis of our executive compensation practices against the practices of a peer group comprised of companies similar to us in both growth strategy and business demographics. |

Balance Risk and Return | Our compensation program integrates certain risk mitigation features designed to balance risk and financial results in a manner that does not encourage executives to expose us to imprudent risks. |

2016 Highlights

Operating, financial and strategic highlights for 2016 included the following:

Operating Performance and Financial Highlights(1)

Metric | Performance |

Total Assets | Asset growth to $27.8 billion as of December 31, 2016, an increase of 5% year over year. |

Loans Held for Investment | Loans held for investment of $23.6 billion at December 31, 2016, an increase of 6% year over year. |

Total Deposits | Deposit growth to $19.6 billion as of December 31, 2016, an increase of 8% year over year. Deposit increases were driven by continued inflows of new consumer and commercial deposits. |

Return on Equity and Adjusted Return on Equity | Achieved a GAAP return on equity, or ROE, of 7.72% and an adjusted ROE, of 10.07% for 2016. |

Tangible Common Equity Per Share | Tangible common equity per common share of $14.31 at December 31, 2016, an increase of 7% year over year. |

Credit Quality | Adjusted non-performing assets as a percentage of total assets were 0.70% as of December 31, 2016. |

Capital Ratios | Consolidated common equity Tier 1 ratio of 10.5% and a bank Tier 1 leverage ratio of 8.0% as of December 31, 2016. |

(1) Certain operating performance metrics are non-GAAP financial measures. For a more detailed discussion of these items, including a discussion of why we believe these items are meaningful and a reconciliation of each of these items to the most directly comparable GAAP, financial measure, see pages 34-36 of our annual report on Form 10-K filed with the SEC.

Announcement of Transaction with TIAA

On August 7, 2016, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Teachers Insurance and Annuity Association of America, a New York stock life insurance company (“TIAA”), TCT Holdings, Inc., a Delaware corporation and wholly owned subsidiary of TIAA (“TCT Holdings”), and Dolphin Sub Corporation, a Delaware corporation and wholly owned subsidiary of TCT Holdings (“Merger Sub”). The Merger Agreement provides that, upon the terms and subject to the conditions set forth therein, Merger Sub will merge with and into the Company, with the Company as the surviving entity (the “Merger”). TCT Holdings will (subject to TIAA’s right under the Merger Agreement to elect not to do so), in connection with the Merger, merge with and into such surviving entity (the “Holdco Merger”). Immediately following the Holdco Merger (or, if TIAA elects not to consummate the Holdco Merger, immediately following the Merger), TIAA-CREF Trust Company, FSB, a federal savings association and wholly owned bank subsidiary of TIAA, will merge with and into EverBank, a federal savings association and wholly owned subsidiary of the Company, with EverBank as the surviving bank (the “Bank Merger”). The Merger Agreement was unanimously approved by the Board of Directors of each of the Company, TIAA, TCT Holdings and Merger Sub.

Subject to the terms and conditions of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), (1) holders of the Company’s common stock, par value $0.01 per share (the “Company Common Stock”), will have the right to receive $19.50 in cash without interest (the “Merger Consideration”) for each share of Company Common Stock, and (2) holders of the Company’s Series A 6.75% Non-Cumulative Perpetual Preferred Stock, par value $0.01 per share (the “Company Preferred Stock”), will have the right to receive the liquidation preference of $25,000 plus accrued and unpaid dividends on a share of Company Preferred Stock since the last dividend payment date for the Company Preferred Stock to but excluding the date on which the Effective Time occurs less any dividends declared but unpaid, if any, through the Effective Time, in cash without interest.

In addition, subject to the terms and conditions of the Merger Agreement, at the Effective Time: (1) each outstanding option to purchase shares of Company Common Stock granted by the Company will fully vest and be converted automatically into the right to receive an amount in cash without interest equal to the product of (x) the number of shares of Company Common Stock subject to such option, multiplied by (y) the

8

excess, if any, of the Merger Consideration over the exercise price per share of such option; (2) each outstanding restricted stock unit subject only to service-based vesting conditions granted by the Company will fully vest and be converted automatically into the right to receive an amount in cash without interest equal to the product of (x) the number of shares of Company Common Stock subject to such unit, multiplied by (y) the Merger Consideration; and (3) each outstanding restricted stock unit subject to performance-based vesting conditions granted by the Company will fully vest and be converted automatically into the right to receive an amount in cash without interest equal to the product of (x) the number of shares of Company Common Stock subject to such unit based on target performance, multiplied by (y) the Merger Consideration.

At the Effective Time, Mr. Clements will retire as the Company’s Chairman and Chief Executive Officer, but has agreed to serve as a member of the resulting bank’s board of directors. At the Effective Time, Mr. Wilson will serve the President and Chief Executive Officer of the resulting bank, and will serve as a director of the resulting bank. Mr. Surface will leave the Company at the Effective Time to pursue new opportunities. Mr. Fischer will serve as Chief Financial Officer of the resulting bank and Mr. Ervin will serve as Chief Risk Officer of the resulting bank.

The Merger Agreement provides that the component of our Named Executive Officers’ 2016 annual cash bonuses that is based on our adjusted ROE will be paid at the greater of actual or target performance, with the component of such bonus tied to other financial or non-financial performance metrics determined based on actual performance. In respect of fiscal year 2016, we achieved an adjusted ROE of 10.07%, which exceeded the target performance goal of an adjusted ROE of 10.0%. As a result, the portion of annual cash bonuses for our Named Executive Officers tied to adjusted ROE will be paid out based on our 2016 actual performance. For information concerning how we define adjusted ROE, see the section entitled “Annual Cash Bonuses” below and for information concerning how we calculated adjusted ROE with respect to the 2016 fiscal year, see the table entitled “Calculation of Adjusted ROE for 2016” below.

Each of Messrs. Wilson, Surface, Fischer and Ervin entered into letter agreements with TCT Holdings (each, a “letter agreement” and collectively, the “letter agreements”) which provide for a cash transaction award payable in equal portions on the 18 and 24 month anniversaries of the Effective Time, provided each Named Executive Officer is employed by the resulting bank or an affiliate thereof on each such measurement date. Pursuant to the terms of the letter agreements, there can be no double payment of amounts under the letter agreements and their respective employment agreements, as these executives may be eligible to receive payment of the cash transaction awards or the severance amounts described below, but not both.

Elements of Our Compensation Program

Base salary, annual cash bonuses and long-term incentive stock awards comprise the total direct compensation for our Named Executive Officers. We believe these components allow us to retain our talented executives and align with short-term and long-term stockholder value. The table below provides a summary of the components of total direct compensation for 2016.

9

Element | What the Element Rewards | Purpose and Key Features | Performance Based |

Base Salary | Scope of leadership responsibilities Expected future performance | Provide a steady source of income to the executives | No |

Annual Cash Bonuses | Corporate Performance Achievement of absolute ROE targets (in 2016, 10.0% ROE to achieve 100% of target annual cash bonus) Individual Performance In the case of Mr. Ervin, also the achievement of individual performance objectives | Encourage and reward achievement of short-term performance objectives Bonuses for each Named Executive Officer, other than Mr. Ervin, are based solely on corporate performance (achievement of absolute ROE targets) Bonus for Mr. Ervin based on a combination of corporate and individual performance goals Payouts are not guaranteed, and no payouts are made if performance thresholds are not achieved | Yes, tied to our operating performance |

Long-Term Equity Incentive Awards (In the form of time-based and performance-based restricted stock units) | Appreciation in the value of our common stock | Align executives’ interests with those of our stockholders Combination of time-based and performance-based restricted stock units provides for a balanced long-term equity incentive program Time-based restricted stock units (RSU's) promote executive retention because these awards “cliff” vest 100% on the third anniversary of the award, provided the Named Executive Officer remains employed by us on such date Performance-based restricted stock units (PU's) promote executive retention and align with stockholder interests because these awards vest pro-rata on each of the first, second and third anniversary of the award, provided certain total shareholder return performance hurdles are achieved Dividends or dividend equivalents are not paid on time-based or performance-based restricted stock units | Yes, tied to the appreciation of our stock price |

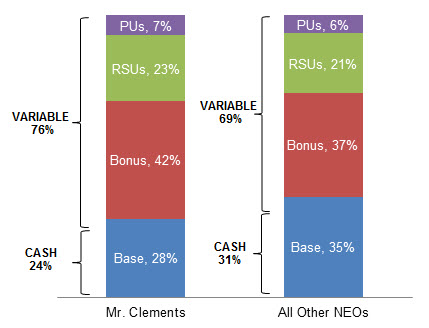

Total Target Compensation Percentages

The graphs immediately below show the mix of compensation elements targeted to be paid for 2016 to Mr. Clements and to the other Named Executive Officers averaged together. In calculating these percentages, we included: (i) 2016 base salaries for Mr. Clements and the other Named Executive Officers; (ii) target bonus amounts that would have been payable in 2017 to Mr. Clements and the other Named Executive Officers for services performed in 2016, assuming a 100% payout of the annual cash bonuses; and (iii) the grant date value of the long-term equity incentive awards granted in 2016 to Mr. Clements and the other Named Executive Officers. We consider the value of the long-term equity incentive awards to be “variable” because the value of time-based restricted stock units aligns with changes in stock price and the performance-based restricted stock units only have value if the Company achieves specified performance goals related to total shareholder return over one-, two and three -year performance periods, with an opportunity for full vesting based on three-year performance.

10

2016 Named Executive Officer Compensation and Corporate Performance

Our compensation practices for Executive Management, including the Named Executive Officers, are designed to align a substantial portion of pay to our annual financial and operational results and to the long-term financial interests of the stockholders. This section illustrates the relationship between pay and how we measure performance.

Summary of Compensation Disclosed in the Summary Compensation Table

The table below shows the 2016 base salary, annual cash bonus award earned and long-term equity incentive grant value for each of our Named Executive Officers. The table is not a substitute for, and should be read together with the Summary Compensation Table which presents 2016 compensation for our Named Executive Officers in accordance with Securities and Exchange Commission disclosure rules and includes additional compensation elements and other important information.

Name | Base Salary | Annual Cash Bonus | Long-Term Equity Incentive Awards ($)(1) | Total | |

Time-Based Restricted Stock Units | Performance-Based Restricted Stock Units | ||||

Robert M. Clements | $775,000 | $1,216,750 | $650,000 | $199,041 | $2,840,791 |

W. Blake Wilson | 675,000 | 1,059,750 | 600,000 | 183,730 | 2,518,480 |

John S. Surface | 415,000 | 347,493 | 187,500 | 57,416 | 1,007,409 |

Steven J. Fischer | 415,000 | 347,493 | 187,500 | 57,416 | 1,007,409 |

Francis X. Ervin, Jr. | 337,000 | 240,674 | 125,000 | 38,277 | 740,951 |

(1) | The long-term equity incentive awards granted in March 2016 to our Named Executive Officers consist of time-based restricted stock units and performance-based restricted stock units. Holders of the performance-based restricted stock units may earn between 0% and 200% of their target award based on the achievement of goals related to total shareholder return over three successive rolling performance periods (1 year, 2 years and 3 years), with an opportunity for full vesting based on three-year performance. The dollar values in the above table, as determined in accordance with FASB ASC Topic 718, represent the grant date fair value of the time-based restricted stock units and performance-based restricted stock units, assuming achievement of target performance levels (100%). |

Annual Cash Bonus

In 2016, our Named Executive Officers were eligible for annual cash bonus payments based on achievement of ROE goals on an absolute basis. In the case of Mr. Ervin, his annual cash bonus payment was also based on achievement of individual performance goals. The split between corporate performance goals and individual performance goals for Mr. Ervin is identified below under the section entitled “Annual Cash Bonuses” below.

When calculating ROE for purposes of the annual cash bonus, the Compensation Committee reserves the right to adjust the Company’s reported net income (presented in accordance with accounting principles generally accepted in the United States of America, or GAAP) to ensure that we fairly compensate our Named Executive Officers for our actual performance and not as a result of one-time unusual items and events. These adjustments generally account for significant unusual and/or nonrecurring items and other factors that are determined to be appropriate by the Compensation Committee. For this reason, we refer to ROE as “adjusted ROE.”

In 2016, we achieved an adjusted ROE of 10.07%, resulting in each Named Executive Officer receiving 104.67% of the portion of his annual cash bonus target tied to corporate performance. A description of how the Compensation Committee calculated adjusted ROE for 2016 is included under the section entitled “Calculation of Adjusted ROE for 2016” below and bonus amounts are identified in the Summary Compensation Table. A description of the factors considered by the Compensation Committee in determining the portion of Mr. Ervin’s annual cash bonus tied to individual performance goals is included in the section entitled “Annual Cash Bonuses” below.

Long-Term Equity Incentive Awards

The long-term equity incentive awards we grant to the Named Executive Officers are linked to our performance for the prior fiscal year and the value of such awards are tied to our future performance.

In 2016, each of the Named Executive Officers received an annual equity grant comprised of a mix of time-based restricted stock unit awards and performance-based restricted stock units. When determining the amount of equity awards granted to the Named Executive Officers in 2016, the Compensation Committee considered the Company’s financial performance in 2015 and the execution by Executive Management of various business and balance sheet repositioning initiatives designed to optimize efficiency and operating leverage. The details surrounding these grants are described under the section entitled “Long-Term Equity Incentives” below and the grant date fair values of these awards are identified in the Summary Compensation Table.

Changes to Our Compensation Program

At the annual meeting of stockholders on May 19, 2016, or 2016 Annual Meeting, the stockholders approved: (i) the material terms of the performance goals and the limits on the grant value of non-employee director awards included in the Company’s Amended and Restated 2011 Omnibus Equity Incentive Plan, or 2011 Plan; and (ii) the material terms of the performance goals included in the Company’s 2011 Executive Incentive Plan.

In addition, we adopted the following changes to our compensation program for 2016:

• | Annual Cash Bonuses. Our Compensation Committee approved several changes to our annual cash bonus program: |

◦ | In 2015, we measured performance using a combination of: (i) absolute ROE targets (weighted at 75%); and (ii) our ROE performance relative to our Peer Group (weighted at 25%). In 2016, we elected to measure performance by solely using absolute ROE targets. |

11

◦ | In 2015, the Company did not have to achieve a threshold goal related to adjusted ROE for members of Executive Management to be eligible to receive the portion of their annual cash bonus tied to individual performance. In 2016, the Company had to achieve an adjusted ROE of 6.5% for members of Executive Management to be eligible to receive the portion of their annual cash bonus tied to individual performance. Mr. Ervin is the only Named Executive Officer impacted by this change. To fully fund annual cash bonuses tied to corporate performance, the Company had to achieve an adjusted ROE of 7.5%. |

◦ | As reflected in the below charts, in 2016 we increased the adjusted ROE Target, Threshold and Maximum levels, and increased the cash payout amounts if the Company were to achieve the Maximum adjusted ROE level. |

2015 Corporate Performance Factors | ||||

Type of ROE | Weighting | Payout Grid | ||

Company Adjusted ROE Achievement | Payout %* | |||

Absolute Adjusted ROE | 75% | Maximum | 10.75% | 135% |

Target | 9.5% | 100% | ||

Threshold | 6.0% | 0% | ||

Relative Adjusted ROE | 25% | Payout Grid | ||

Peer Rank | Payout %* | |||

≥85th Percentile | 135% | |||

70th Percentile | 100% | |||

25th Percentile | 20% | |||

<25th Percentile | 0% | |||

*Note: Amounts in between are interpolated

2016 Corporate Performance Factors | ||||

Type of ROE | Weighting | Payout Grid | ||

Company Adjusted ROE Achievement | Payout %* | |||

Absolute Adjusted ROE | 100% | Maximum | 10.75% | 150% |

Target | 10.0% | 100% | ||

Threshold | 7.5% | 0% | ||

*Note: Amounts in between are interpolated

•The Compensation Committee retained certain positive and negative discretion to adjust results based on absolute ROE (up to +/- 15%) for significant achievement of specified performance factors, such as: (i) restructuring charge management; (ii) business optimizations; (iii) expense management; (iv) risk management compliance (downward adjustment only); and (v) market conditions.

• | Annual Equity Award Program |

•In 2015, our long-term incentive award program was comprised of a mix of nonqualified stock options and restricted stock unit awards. For 2016, our long-term incentive award program included time-based restricted stock units and performance-based restricted stock units in lieu of stock options. Recipients of the performance-based restricted stock units may earn between 0% and 200% of their target award based on the achievement of goals related to total shareholder return over one-, two and three -year performance periods, with an opportunity for full vesting based on three-year performance.

Governance and Compensation Practices

The lists below highlight some of the features of our compensation plans and policies that we believe are in keeping with best practices in executive compensation and corporate governance and practices we have not implemented because we do not believe they would serve our stockholders’ long-term interests.

Practices We Implement:

•A substantial percentage of the compensation of all of our Named Executive Officers is variable and tied to the Company’s performance.

•The change in control definition contained in our 2011 Plan is not a “liberal” definition triggered by mere stockholder approval of a transaction.

•Our Compensation Committee reviews tally sheets when making executive compensation decisions.

•Our Stock Ownership Guidelines require the Chief Executive Officer to own shares of Company stock having a value of not less than five times his base salary and each other Named Executive Officer to own shares of Company stock having a value of not less than three times his base salary.

•Our compensation recoupment policy allows us to recoup compensation from each Named Executive Officer who, any time after January 22, 2015 and during the three-year period preceding the date on which we are required to prepare an accounting restatement due to our material noncompliance with any financial reporting requirement under U.S. securities law, received non-equity incentive compensation or received or realized compensation from equity awards, in either case, based on erroneous financial data.

12

•Our hedging and pledging policy: (i) prohibits our employees, including the Named Executive Officers, and directors from engaging in hedging transactions in our stock; and (ii) places certain limitations on such persons pledging our stock.

•The Compensation Committee does not believe that the work of its compensation consultant has raised any conflicts of interest.

Practices We Do Not Implement:

•Our 2011 Plan expressly prohibits repricing of options and stock appreciation rights (directly or indirectly) without prior stockholder approval.

•No dividend payments or dividend equivalents on restricted stock unit awards.

•No separate Change in Control Agreements.

•We do not maintain any compensation programs that encourage our employees (individually or as part of a group) to take inappropriate risks by providing them with: (i) excessive compensation; or (ii) compensation that could lead to material financial loss to us.

•We do not provide excessive executive perquisites to our Named Executive Officers.

•We do not offer any executive-level retirement benefits to our Named Executive Officers.

•No guaranteed bonuses.

•No discounted stock options or option reloading.

•No liberal share recycling on appreciation awards or full-value awards.

How We Set Compensation

The Compensation Committee of our Board of Directors determines the compensation for our Named Executive Officers. Messrs. Clements and Wilson make recommendations to the Compensation Committee regarding the compensation for those Named Executive Officers who report to them. In the case of Mr. Ervin, Messrs. Clements and Wilson consult with the Chairperson of the Risk Committee of our Board prior to making such recommendations to the Compensation Committee.

Role of the Compensation Committee

The Compensation Committee sets and determines the compensation for Executive Management. Each Named Executive Officer is a member of Executive Management. The Compensation Committee is composed entirely of independent, non-management directors. The Compensation Committee reviews and approves of all aspects of the compensation program for Executive Management and administers our stock incentive plans. In setting compensation, the Compensation Committee does not seek to allocate long-term and current compensation, or cash and non-cash compensation, in specified percentages. The Compensation Committee instead reviews each element of compensation independently and determines the appropriate amount for each element, as discussed below. However, the Compensation Committee traditionally places more emphasis on variable compensation, including annual cash bonuses and long-term equity awards, than on base salary.

The Compensation Committee also approves the performance goals for all Executive Management compensation programs that incorporate performance metrics and evaluates performance at the end of each performance period. The Compensation Committee approves our aggregate annual cash bonus award opportunities and long-term equity incentive awards for Executive Management. The Compensation Committee also sets the level and components of the compensation for Mr. Clements and, after consultation with Mr. Clements, reviews and approves the compensation for Mr. Wilson. After consultation with Messrs. Clements and Wilson, the Compensation Committee also reviews and approves the compensation for the remaining Named Executive Officers and other members of Executive Management.

In making decisions regarding the compensation for the Named Executive Officers, the Compensation Committee focuses primarily on our overall performance, on an absolute and relative basis. The Compensation Committee also considers the general business environment.

The Compensation Committee reviews and tracks each element of compensation for Executive Management through tally sheets. As part of such review, the Compensation Committee examines the value of each element of compensation that each member of Executive Management has received. The Compensation Committee believes that tally sheets provide a comprehensive picture of an executive’s total compensation, give the Compensation Committee a better understanding of how each component of an executive’s compensation package fits together and provide a context for making pay decisions. The Compensation Committee did not make any adjustment to our executive compensation programs as a result of its review of the tally sheets last year.

Role of Executive Officers

Decisions about individual compensation elements and total compensation, including those related to Mr. Clements, are ultimately made by the Compensation Committee. However, we believe that Messrs. Clements and Wilson are in the best possible position to assess the performance of the other members of Executive Management and, accordingly, they also play an important role in the compensation-setting process for executives other than themselves. Messrs. Clements and Wilson discuss Executive Management compensation (including compensation for each of the other Named Executive Officers) with the Compensation Committee and make recommendations on all elements of compensation.

Role of the Compensation Consultant

The Compensation Committee retained the services of Compensation Advisory Partners, LLC, or the Compensation Consultant, to provide independent compensation consulting advice.

The Compensation Consultant advises the Compensation Committee on all matters related to the compensation of the Named Executive Officers and the other members of Executive Management. Specifically, the Compensation Committee requested the Compensation Consultant provide it with the following assistance in 2016:

13

Activity | Description |

Plan Design and 162(m) Compliance | With the expiration of our post-IPO transition period for purposes of Section 162(m), assist in developing a cash incentive plan and equity incentive plan intended to be compliant with Section 162(m). |

Competitive Market Analysis | Conduct a comprehensive review of the competitiveness and effectiveness of our executive compensation program relative to market practices and business goals. |

Recommendation of Changes to Compensation Program | Evaluate pay levels and categories of executive compensation and recommend changes to such compensation, as appropriate. |

Market Trends and Practices | Provide annual analysis to the Compensation Committee regarding market trends and practices. |

Risk Assessments | Assist in the annual risk assessment of incentive compensation plans. |

Review Public Disclosures | Review public disclosures on compensation, including the CD&A and related tables and compensation disclosures. |

Competitive Market Assessment

The Compensation Committee approved a group of eighteen similar-sized publicly-traded financial institutions and high-growth financial services firms, or the Peer Group, that it considered in connection with analyzing and establishing competitive pay for Executive Management. The Compensation Committee selected the Peer Group based upon relative size to the Company, business mix and profitability. The Compensation Committee also considered the views of Executive Management when selecting the Peer Group. The Compensation Consultant validated this selection.

The Compensation Committee periodically reviews and may adjust the peer group companies as part of its regular review of executive compensation pay and practices in connection with future compensation decisions.

For 2016, the Compensation Committee approved: (i) removing FirstMerit Corporation and Astoria Financial Corporation from the peer group; and (ii) adding UMB Financial Corporation and Umpqua Holdings Corporation to the Peer Group. We removed FirstMerit Corporation in light of the announcement that Huntington National Bank would acquire FirstMerit Corporation, which transaction was consummated in August 2016. We removed Astoria Financial Corporation in light of the announcement that New York Community Bank would acquire Astoria Financial Corporation. New York Community Bank is already a member of the Peer Group. Subsequent to removing Astoria Financial Corporation as a member of the Peer Group, the parties mutually agreed not to proceed with the transaction. The Compensation Committee elected to replace these financial institutions with UMB Financial Corporation and Umpqua Holdings Corporation because these companies are similar to us in asset size, and in the types of consumer and commercial lending products and services they offer their customers.

After selecting the Peer Group, the Compensation Committee compared total compensation opportunities (which include base salary, target annual incentive and the targeted value of long-term incentives), as well as each individual element of pay, to the Peer Group. The Compensation Committee intends for the Named Executive Officers’ compensation to be competitive with market practices, but does not benchmark to any particular percentile within the Peer Group. Rather, the Compensation Committee used the market data as one reference point in its compensation decisions, along with many other factors, such as the individual’s performance, expectations regarding future potential contributions, retention strategies, and the Company’s performance as a whole.

EverBank Financial Corp 2016 Peer Group

Institution | Assets* (In Millions) As of December 31, 2016 | Institution | Assets* (In Millions) As of December 31, 2016 |

First Republic Bank | $ 73,278 | Hancock Holding Company | $ 23,975 |

New York Community Bancorp | 48,927 | Valley National Bancorp | 22,864 |

Signature Bank | 39,048 | Prosperity Bancshares, Inc. | 22,331 |

BOK Financial Corporation | 32,772 | PacWest Bancorp | 21,870 |

First Citizens Bancshares Inc. | 30,196 | F.N.B. Corporation | 21,845 |

Cullen/Frost Bankers, Inc. | 30,196 | IBERIABANK Corporation | 21,659 |

BankUnited, Inc. | 27,880 | TCF Financial Corporation | 21,441 |

Commerce Bancshares, Inc. | 25,641 | UMB Financial Corporation | 20,683 |

Umpqua Holdings Corporation | 24,813 | Washington Federal, Inc. | 14,888 |

*For comparison purposes, as of December 31, 2016, the Company’s assets were approximately $27,838 million.

Consideration of Last Year’s Advisory Stockholder Vote on Executive Compensation

At the 2016 Annual Meeting, approximately 97.1% of the votes cast were in favor of the advisory vote on the compensation of our Named Executive Officers for the period ended December 31, 2015, as discussed and disclosed in the 2016 proxy statement. In considering the results of the Company’s advisory vote on executive compensation, the Compensation Committee concluded that the results of the vote reflects favorable stockholder support of the compensation paid to our Named Executive Officers for the period ended December 31, 2015. In light of this support, the Compensation Committee retained the primary components of the compensation program, with an emphasis on short and long-term variable incentive compensation.

14

The Compensation Committee recognizes that executive pay practices and governance principles continue to evolve. Consequently, the Compensation Committee intends to continue paying close attention to the advice and counsel of its independent compensation advisors and will continue to take into account the opinion of stockholders as evidenced through the advisory vote.

Components of Our Executive Compensation Program

In 2016, the key elements of compensation for our Named Executive Officers generally consisted of base salary, annual cash bonuses and long-term equity incentives in the form of time-based and performance-based restricted stock units. We also maintain employment agreements with each of our Named Executive Officers that provide certain benefits as described below.

Annual Base Salaries

We pay base salaries to attract talented executives and to provide a fixed base of cash compensation. We also believe that base salaries should be reflective of our Named Executive Officers’ roles and responsibilities. The Compensation Committee reviews salaries for the Named Executive Officers on an annual basis, as well as at the time of a promotion or other change in responsibilities. In general, the Compensation Committee increases base salary based upon its subjective evaluation of such factors as prevailing changes in market rates for equivalent executive positions in the Peer Group, the individual’s level of responsibility, tenure with us and overall contribution to us. The Compensation Committee also takes into account Mr. Clements’ recommendations regarding salary increases for the other Named Executive Officers.

Based on that review, for 2016, the Compensation Committee approved annual merit base salary increases for the Named Executive Officers as described in the table below. The Compensation Committee believed the increases in base salary were appropriate based on the Company’s performance and each executive’s individual achievements in 2015. For 2016, neither Mr. Clements nor Mr. Wilson received a base salary increase. The base salary increases for each of Messrs. Surface, Fischer and Ervin were effective as of February 16, 2016.

Name | 2015 Base Salary | $ Amount of Increase | % Amount of Increase | 2016 Base Salary |

Mr. Clements | $775,000 | $— | —% | $775,000 |

Mr. Wilson | 675,000 | — | —% | 675,000 |

Mr. Surface | 400,000 | 15,000 | 3.75% | 415,000 |

Mr. Fischer | 400,000 | 15,000 | 3.75% | 415,000 |

Mr. Ervin | 325,000 | 12,000 | 3.69% | 337,000 |

Annual Cash Bonuses

Annual cash bonuses reward the Named Executive Officers for achieving short-term (annual) financial objectives. The Named Executive Officers participate in the Executive Cash Incentive Plan.

Messrs. Clements, Wilson, Surface and Fischer earn cash bonuses based solely on achievement of pre-established corporate performance goals. Mr. Ervin earns a cash bonus based on a combination of the achievement of pre-established corporate performance and individual performance goals (designated percentages of the basis for achievement of awards is indicated below). Mr. Ervin’s cash bonus is based on achievement of both corporate and individual performance goals because his effectiveness in the area of corporate services is not entirely reflected in the financial metrics on which the Company judges its overall performance.

The Compensation Committee established a target annual cash bonus expressed as a percentage of base salary for each Named Executive Officer, as set forth below. When calculating bonuses as a percentage of salary, the Company used the base salary of each Named Executive Officer as of December 31, 2016.

Named Executive Officers’ 2016 Target Bonus

Name | Target % of Base Salary Based on Corporate Performance | Target % of Base Salary Based on Individual Performance | Total Target Bonus (% of Base Salary) |

Mr. Clements | 150% | -% | 150% |

Mr. Wilson | 150% | -% | 150% |

Mr. Surface | 80% | -% | 80% |

Mr. Fischer | 80% | -% | 80% |

Mr. Ervin | 40% | 30% | 70% |

Corporate Performance Criteria for 2016 Annual Cash Bonuses

The 2016 annual bonus opportunity for our Named Executive Officers under the Executive Cash Incentive Plan was based on our achievement of adjusted ROE targets.

The Compensation Committee continues to believe such adjusted ROE is an appropriate performance goal for annual cash bonuses because this performance metric has meaningful bearing on long-term increases in stockholder value and the fundamental risk level and financial soundness of our business. In addition, the Compensation Committee believes that emphasizing adjusted ROE in 2016 was appropriate in light of

15

the economic uncertainty that was expected for 2016 and the continued high costs associated with the sweeping regulatory changes affecting us in 2016.

In order to align incentive payments with our overall corporate performance goals, the Compensation Committee established the following target ranges to measure absolute adjusted ROE:

Payout Grid | ||

Company Adjusted ROE Achievement | Payout %* | |

Maximum | 10.75% | 150% |

Target | 10.0% | 100% |

Threshold | 7.5% | 0% |

*Note: Amounts in between are interpolated

The Named Executive Officers do not receive an annual cash bonus payment (or in the case of Mr. Ervin, the portion of his annual cash bonus payment tied to corporate performance) if the adjusted ROE does not reach the threshold performance level of 7.5%. In addition, Mr. Ervin does not receive the portion of his annual cash bonus payment tied to individual performance if the adjusted ROE does not reach 6.5%.

The Compensation Committee retained certain positive and negative discretion to adjust results based on absolute ROE (up to +/- 15%) for significant achievement of specified performance factors, such as: (i) restructuring charge management; (ii) business optimizations; (iii) expense management; (iv) risk management compliance (downward adjustment only); and (v) market conditions.

2016 Actual Corporate Performance

In 2016, the Company achieved, for purposes of determining annual cash bonus payouts under the Executive Cash Incentive Plan, an adjusted ROE of 10.07%, as calculated below.

Calculation of Adjusted ROE for 2016

Net Income (thousands) | ROE (%) | |

GAAP Net Income Attributable to Common Shareholders and GAAP ROE | $134,806 | 7.72% |

Adjustment Items Approved by Compensation Committee: | ||

Transaction and start-up expenses | 5,952 | 0.34 |

Non-recurring regulatory-related expenses | (43) | (0.00) |

Impairment of mortgage servicing rights | 38,062 | 2.18 |

Increase in non-accretable discount relating to purchase of Bank of Florida assets | (193) | (0.01) |

Change in GAAP accounting principles (i.e., cumulative effect of GAAP changes) | (916) | (0.05) |

Non-recurring operating and non-operating income and/or expenses | (1,688) | (0.10) |

Total adjustment items, net of tax | 41,174 | 2.35 |

Adjusted Net Income Attributable to Common Shareholders and ROE | $175,980 | 10.07% |

Our adjusted ROE of 10.07% entitled Messrs. Clements, Wilson, Surface, Fischer and Ervin to bonuses of 104.67% of their respective target bonus awards pursuant to the ROE goals described above. The Committee did not apply any discretion, either positive or negative, to the adjusted ROE results.

2016 Individual Performance

The 2016 annual bonus opportunity for Mr. Ervin was based, in part, on our achievement of corporate performance goals and, in part, his individual performance. As our Chief Risk Officer, Mr. Ervin oversees enterprise risk management, enterprise quality control, and several enterprise-wide programs, including fraud management, model risk management, and corporate insurance. Mr. Ervin serves as Chairman of our Management Risk Committee. Mr. Ervin also serves as a key point of contact with the Risk Committee of the Board and our federal banking regulators.

To determine the payout based in part on individual performance, the Compensation Committee subjectively assessed the individual performance of Mr. Ervin in these areas after receiving input from the Chairperson of the Board Risk Committee and Messrs. Clements and Wilson, as appropriate. The Compensation Committee concluded that Mr. Ervin’s payout under the individual component of the Executive Cash Incentive Plan should be based principally on his continuing efforts to enhance our risk governance and compliance management functions.

Based on the foregoing, the Compensation Committee paid the following annual cash bonuses to the Named Executive Officers:

Name | 2016 Target Annual Cash Bonus ($) | Actual 2016 Annual Cash Bonus($) | Actual 2016 Bonuses as % Of Target Cash Bonus |

Mr. Clements | 1,162,500 | 1,216,750 | 104.67% |

Mr. Wilson | 1,012,500 | 1,059,750 | 104.67% |

Mr. Surface | 332,000 | 347,493 | 104.67% |

Mr. Fischer | 332,000 | 347,493 | 104.67% |

Mr. Ervin | 235,900 | 240,674 | 102.02% |

16

The 2016 annual cash bonuses received by our Named Executive Officers are also shown in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table below.

Long-Term Equity Incentives

We place great importance on equity as a form of compensation, and stock ownership is a key objective of the compensation program. Historically, equity awards have constituted a significant portion of the Named Executive Officers’ compensation. Management recommends and the Compensation Committee approves annual equity grants in the first quarter of each calendar year. The Compensation Committee retains discretion to grant equity awards at any time, including in connection with the promotion of an executive, to reward an executive, for retention purposes or in other circumstances recommended by Messrs. Clements or Wilson.

In 2016, each of the Named Executive Officers received an annual equity grant comprised of a mix of time-based restricted stock unit awards and performance-based restricted stock units.

Time-Based Restricted Stock Unit Awards

The Compensation Committee believes that restricted stock units are inherently performance-based because the value of restricted stock unit awards is tied to the price of a share of our common stock. The restricted stock unit cliff-vest at the end of the third anniversary of the date of grant provided that the executive is employed by us on such date. No dividends equivalents are paid on the restricted stock units.

The Compensation Committee believes that the retentive features and perceived value of restricted stock units are enhanced in a volatile stock market, which the financial services industry continues to experience. The Compensation Committee determined that the restricted stock units’ three-year vesting schedule is generally consistent with Peer Group practices.

Performance-Based Restricted Stock Unit Awards

In 2016, the Compensation Committee introduced performance-based restricted stock units to further align executive compensation to our performance over the next three years. These awards allow executives to earn between 0% and 200% of their target number of units based on the achievement of goals related to absolute total shareholder return over three rolling performance periods, with an opportunity for full vesting based on three-year performance. Specifically, 33% of the performance-based RSUs will be eligible to vest following the completion of the one-year performance period beginning on March 29, 2016 and ending on March 29, 2017, 33% will be eligible to vest following the completion of the two-year performance period beginning on March 29, 2016 and ending on March 29, 2018 and a number of performance-based RSUs will be eligible to vest following the completion of the three year performance period beginning on March 29, 2016 and ending on March 29, 2019, in each case based on the Company’s achievement of pre-established absolute total shareholder return goals. Any performance-based restricted stock units that do not vest in each of the first two performance periods will be eligible to vest following the completion of the third performance period, subject to a maximum of 200%. No dividends equivalents are paid on the performance-based restricted stock units.

2016 Long-Term Equity Incentive Awards

In determining the number of long-term equity incentives awarded to each Named Executive Officer, the Compensation Committee first approved the grant date value of long-term equity incentives for each Named Executive Officer after considering the long-term equity incentive values in the Peer Group, relative contributions by each executive and the equity awards received by the executive in prior years. The Compensation Committee determined the number of time-based restricted stock units granted by dividing one-half of the grant date value by the closing price of our common stock on the grant date, and then granted one performance-based restricted stock unit for each time-based restricted stock unit granted. Using this methodology, the Compensation Committee approved the grants of restricted stock units in 2016 identified below and disclosed later in the Grants of Plan-Based Awards Table.

Name | Time-Based Restricted Stock Units | Performance-Based Restricted Stock Units | Total Value 2016 Equity Awards | ||

Value(1) | # | Value(1) | # | ||

Mr. Clements | $650,000 | 45,968 | $199,041 | 45,968 | $849,041 |

Mr. Wilson | 600,000 | 42,432 | 183,730 | 42,432 | 783,730 |

Mr. Surface | 187,500 | 13,260 | 57,416 | 13,260 | 244,916 |

Mr. Fischer | 187,500 | 13,260 | 57,416 | 13,260 | 244,916 |

Mr. Ervin | 125,000 | 8,840 | 38,277 | 8,840 | 163,277 |

(1) | The dollar values in the above table, as determined in accordance with FASB ASC Topic 718, represent the grant date fair value of the time-based restricted stock units and performance-based restricted stock units, assuming achievement of target performance levels (100%). |

Other Benefits

Our Named Executive Officers participate in various health, life and disability plans that are generally made available to all salaried employees. These plans consist of the following:

17

Benefit | Description |

401(k) Plan | Our 401(k) Savings Plan, which in 2016 permitted employees to contribute up to 100% of their pre-tax compensation, up to certain IRS compensation deferral amount limits, with Company matching contributions of up to 4% of the employees’ eligible compensation contributions. |

Profit Sharing | Profit Sharing under the 401(k) Savings Plan. |

Medical/Life Benefits | A health care plan that provides medical and dental coverage for all eligible employees and life insurance coverage 1x salary up to $1 million and the option to purchase supplemental coverage up to $850,000. |

Welfare Benefits | Certain other welfare benefits (such as sick leave, vacation, etc.). |

In general, the benefits we provide our employees are designed to provide a safety net of protection against the financial catastrophes that can result from illness, disability or death, and to provide a reasonable level of retirement income based on years of service with us. These benefits help us to be competitive in attracting and retaining employees. Benefits also help to keep employees focused without distractions related to health care costs, adequate savings for retirement and similar issues. The Compensation Committee concluded that these employee benefit plans are consistent with industry standards. In 2016, we did not offer any additional retirement or deferred compensation plans or benefits to our Named Executive Officers. For additional detail on these benefits provided to the Named Executive Officers, please refer to footnote 5 to the Summary Compensation Table below.

The Company also provides our Named Executive Officers with certain limited perquisites and other personal benefits that the Company believes are reasonable and consistent with the Company’s overall compensation program to better enable the Company to attract and retain employees. Messrs. Clements and Wilson have access to use of the Company’s aircraft for personal use, but they are required to reimburse the Company for the incremental cost of such use.

Policies and Programs Related to Our Compensation and Governance Program

We maintain other policies and programs that provide meaningful value to members of Executive Management, including the Named Executive Officers, while at the same time promoting the retention of these highly valued executives and aligning their interests with those of the stockholders.

Stock Ownership Guidelines

We require our Named Executive Officers and all our Executive Vice Presidents to have a meaningful equity stake in the Company to further align their economic interests with those of our stockholders. Our Stock Ownership Guidelines are summarized in the following table:

Position | As a Multiple of Base Salary |

Chief Executive Officer | 5x Base Salary |

All Other Named Executive Officers | 3x Base Salary |

All Other Executive Vice Presidents | 2x Base Salary |

All shares held or controlled by a Named Executive Officer are considered in determining compliance with this ownership requirement, including, but not limited to, direct holdings and unvested restricted stock units. Each person subject to the Stock Ownership Guidelines is required to hold shares until he or she satisfies the Stock Ownership Guidelines; provided, however, that any such person is permitted, subject to the requirements in our Insider Trading Policy, to sell a sufficient amount of shares to pay the exercise price and related withholding taxes due in connection with the exercise or vesting of an equity award. Currently, each of the Named Executive Officers, other than Mr. Ervin, owns the requisite number of shares.